37 min read • Travel & transportation

Rail 2040

Scenarios and CEO agenda

Executive Summary

The demand for energy-efficient mobility is growing significantly, and transportation must meet these rising needs. Rail transport has clear advantages to meet these challenges over other modes of transportation. The coming years are essential for all stakeholders: public authorities, rail incumbents, and potential new entrants. Each one faces a strong growth perspective and uncertainty about how the rail market will evolve. Public authorities need to make informed decisions around regulations and public funding. To make the most of the decarbonizing power of rail, incumbents must continue to prioritize strategic choices to maintain their leadership, improve their profitability, and expand into new territories. New entrants must make careful choices to become relevant in the sector.

In this Report, we first explore key trends that will reshape the industry and assess the general market environment for railway services. Next, we develop a scheme that puts regulation and operation into a comprehensive framework to show options for setting up different rail systems today and tomorrow. We follow with case studies of the railway markets in eight countries, examining the potential for competition, regulatory impacts, and performance statistics. Finally, we share our outlook to inform the agendas of CEOs and other rail company decision makers.

1

ORGANIZING & MANAGING RAILWAY SYSTEMS FOR MAXIMUM IMPACT

The next 10 years have the potential to be the “Rail Decade.” Compared to other sectors, the rail sector’s technological development and growth rates have historically been modest. However, today, we see global trends with great potential to reshape the industry: accelerated green transitions, technological breakthroughs, shorter technology cycles, growing public involvement, and increased regulation. And within the industry, the demand for moving passengers and goods is expanding. The growth of passenger-kilometers (pkm) and tonne-kilometers (tkm) is expected to be 200% by 2050 (ITF/OECD, base year 2019).

The above trends and developments showcase a new global paradigm shift and must be managed through a triangle of increased sustainability (energy efficiency and inclusion), efficiency, and resilience.

In the context of rapid change, higher demand, and sustainability, rail has clear advantages over other transport sectors:

-

A developed railway system can support the general pattern of integration of transport modes by serving as a natural backbone for shared mobility systems, which are created by mass transit and supplemented by active, shared, and micro-mobility options for a journey’s first and last miles.

-

The individual car is no longer the preferred or default option for optimal transport experiences and mobility patterns, indicating a growing customer preference for rail. A car is no longer a “status symbol,” according to a number of empirical studies (see, for example, the Arthur D. Little [ADL] Report “The Future of Mobility Post-COVID-19 — Turning a Crisis into an Opportunity” with analyses of mobility trends and the evolution of mobility patterns).

-

Government and public transport authorities (PTAs) must make careful decisions to address three important issues in order to maximize and exploit these opportunities:

-

What is the best regulatory scheme to frame the market as a good platform to grow modern mobility services?

-

What is the best funding mechanism and how can both public and private investment stimulate growth and innovation?

-

How can multi-stakeholder ecosystems, which are key for integrated mobility systems, be encouraged?

-

-

Public transport operators (PTOs) must determine how to use new regulatory settings (especially regarding liberalization, public well-being, and pricing) as they strive to provide their best and competitive customer services.

2

KEY TRENDS RESHAPING THE INDUSTRY

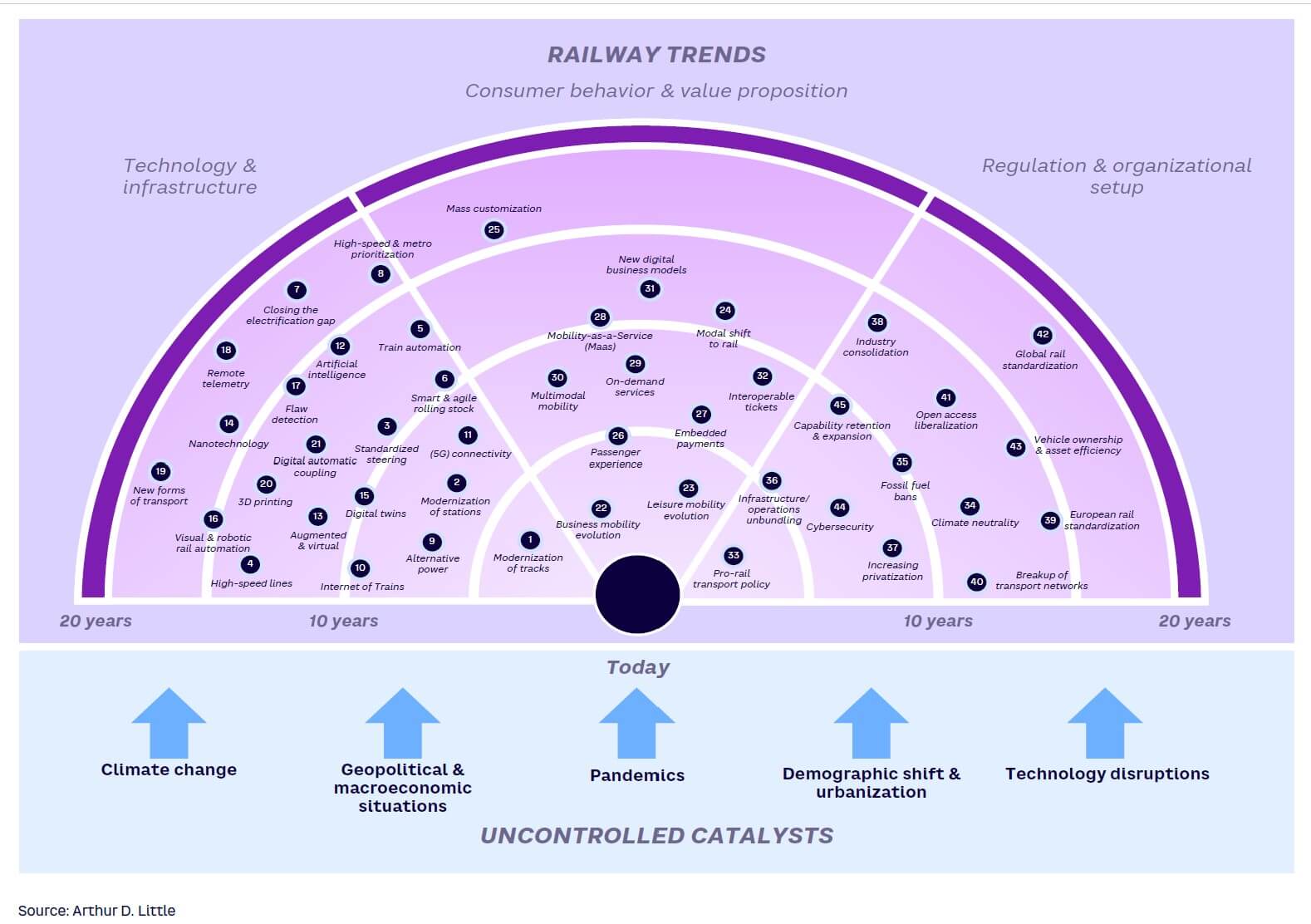

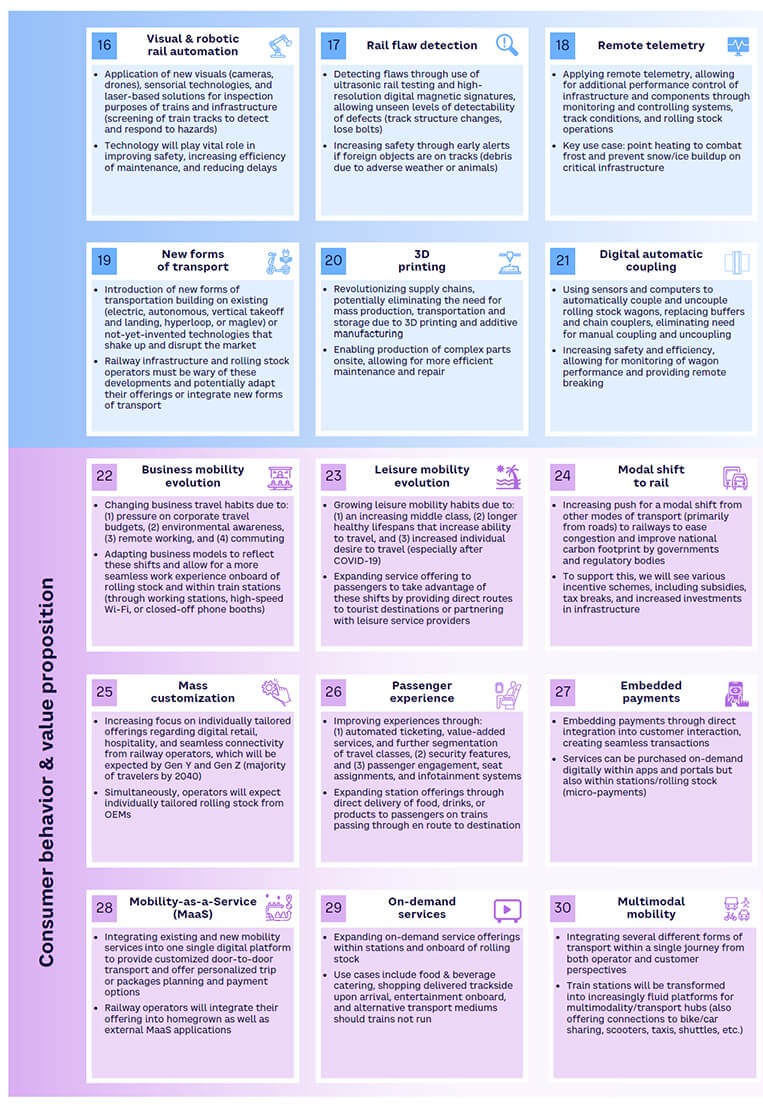

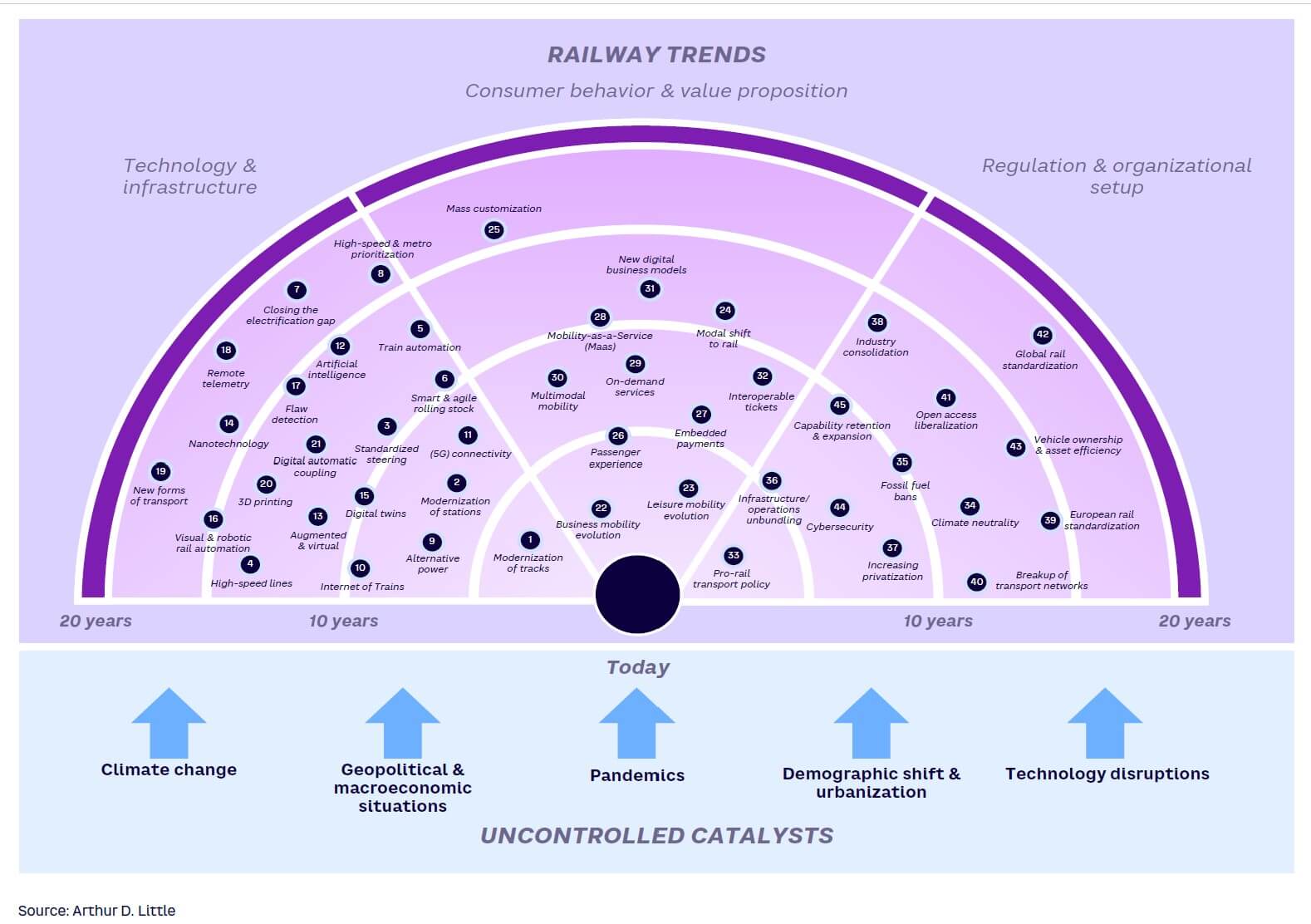

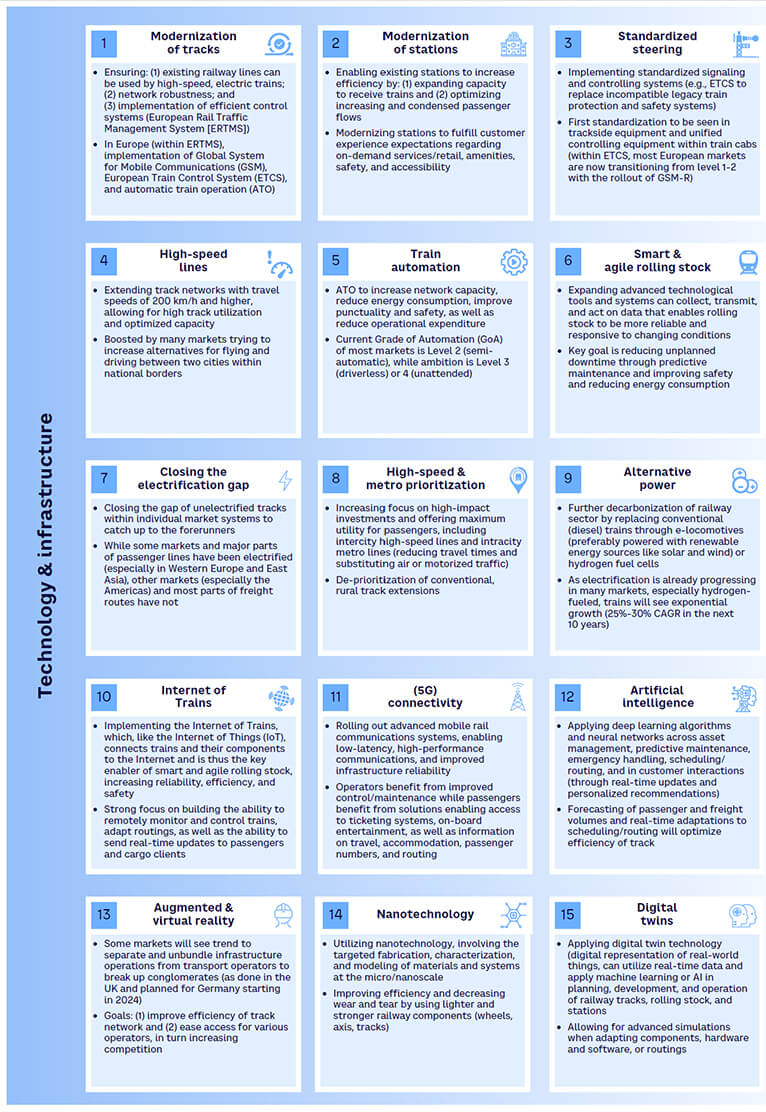

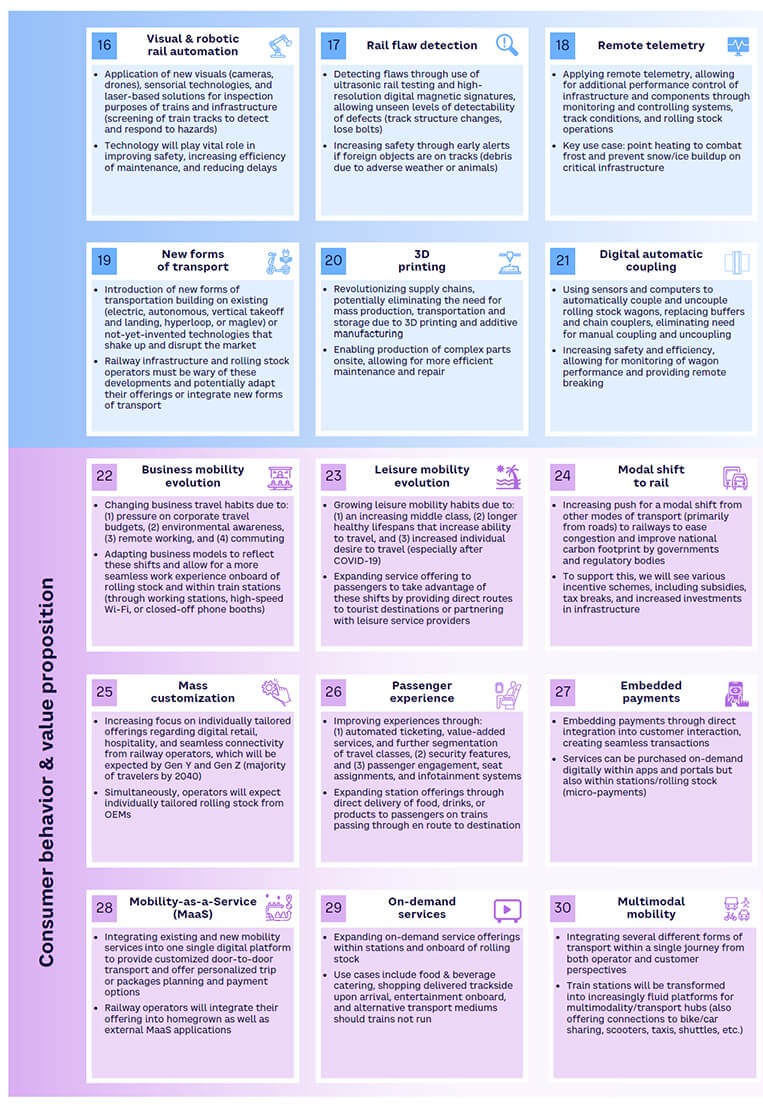

ADL has a long record of advising railway systems around the world. Our approach involves systematically monitoring trend analyses on a global scale and building a synthesis with direct insights from our experience with railway clients. There are 45 trends that will be crucial to reshaping the industry within the next 20 years. These trends fall into three classes: (1) technology and infrastructure, (2) consumer behavior and value proposition, and (3) regulation and organizational setup (see Figure 1).

Each category can be directly or indirectly managed within the big picture, which is determined by uncontrolled catalysts: climate change, geopolitical and macroeconomic situations, pandemics, demographic shifts and urbanization, and technology disruptions.

UNCONTROLLABLE CATALYSTS & THEIR POSSIBLE IMPACTS

In the coming years, the rail ecosystem may undergo unprecedented changes that profoundly transform the structure of its value chain, its size, and its profitability in established railway markets. These changes are driven by five uncontrollable catalysts:

- Climate change. Transportation is responsible for about a quarter of CO2 emissions. The goal to reduce Europe’s emissions from 8 tons per capita to 2 tons per capita requires a significant modal shift to more sustainable transport modes, with rail (national and intercity) and urban mass transit as natural backbones. In this context, rail is a particularly important option that is increasingly favored by both the population and public authorities. Beyond its status as an essentially electric mode of transport, passenger rail is also very energy efficient (3-4 kWh per 100 km for France’s TGV against 15-20 kWh for an electric car). The outcome is similar for freight rail transport, with an electric consumption of 8 kWh/ton per 100 km for the rail against 15 kWh/ton per 100 km for an electric truck.

- Geopolitical and macroeconomic situations. The return of inflation could cause major difficulties for the railway sector, and the threat is aimed at multiple dimensions. The decrease in purchasing power and the increase in transportation costs could significantly reduce the number of passengers taking leisure trips. A slowdown in the economy would mechanically slow the recovery of business travel to pre-COVID-19 levels. Higher electricity costs could multiply costs for rail operators by a factor of 2 to 4. Similarly, the cost of materials directly impacts maintenance, prices of rolling stock, and the ability of infrastructure managers to maintain and improve the network within the same expenditure package.

- Pandemics. Rail ridership was strongly impacted by the COVID-19 crisis. During the past few years, passengers and freight volumes have been at historically low levels while costs remained stable, which limited the railways’ ability to invest and innovate. Since mid-2022, the volume of business traffic has rebounded in many countries but continues to suffer in terms of value (fewer one-day trips and less willingness to pay for fully flexible fares), while leisure traffic is peaking in many European countries (notably supported by the trend of “revenge travel”). COVID had a limited impact on rail freight transport, with pre-crisis traffic recovering in 2021.

- Demographic shifts and urbanization. Population and mobility per capita continue to grow in Europe and throughout the world. In the EU, mobility measured in pkm/per capita has increased by 27% over the last 25 years according to a 2020 Eurostat report. Mobility growth rates for the next 10 years could be even higher. In this growth scenario, the railway system has a competitive advantage: the transport capacity of a train is unrivaled. A high-speed line has a transport capacity twice as large as a bidirectional three-lane highway with lower land consumption (a 15-meter-wide railway against 25-meter-wide highway).

- Technology disruptions. The speed of innovation is increasing. Over the last few years, we have seen a significant number of disruptive technologies solutions that improve network efficiency, rolling stock utilization, distribution, and on-board experience. They include train automation, Internet of Trains, digital twins, and many other solutions that have already passed the PoC (proof-of-concept) stage.

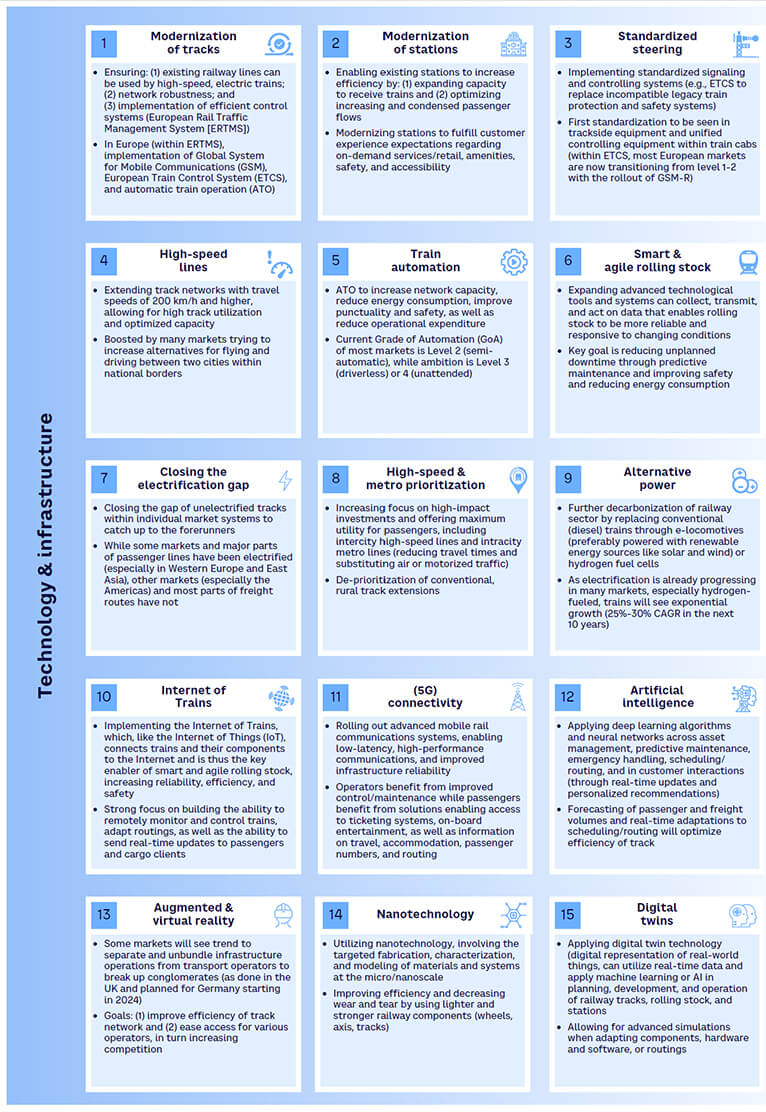

RAILWAY TRENDS

Table 1 explains the 45 trends represented by Figure 1, color-coded by class: blue for technology and infrastructure, purple for consumer behavior and value proposition, and gray for regulation and organizational setup. Railway companies currently monitor each trend, placing them at the top of their management agendas; each company defines its own strategic positioning to approach the spectrum.

3

THE GENERAL MARKET ENVIRONMENT FOR RAILWAY SERVICES

Two major uncertainties affect the general growth dynamic for railway transport: overall mobility growth and the share of rail in the modal split.

-

The growth of overall mobility depends on macroeconomic factors:

-

Uncertainties about the evolution of household consumption in a context of inflation will directly affect leisure mobility.

-

Uncertainties about the evolution of growth in the eurozone will have a direct impact on business mobility.

-

The growth of inland freight volumes is directly linked to economic growth, and the implementation of new logic for more local logistics and nearshoring affects the growth of inland freight volumes.

-

-

The share of rail in the modal split depends on several factors related to the ecological transition:

-

Travelers. This refers to a modal shift to rail at the individual level and willingness to consider the ecological impact in their choice of transport. In 2020, it was estimated that two-thirds of Europeans took ecological impact into account, but only 5% have considered it during their last trip, according to the 2020 Kantar mobility study. The evolution of this figure, which reflects the actual ability of users to move from desire to an actual change of travel preferences, is an important uncertainty that will affect the share of rail.

-

Authorities. Pro-rail transport policy in a carbon-neutral context (concrete regulatory decisions such as banning short-haul air travel) and public investment (in infrastructure and rolling stock) are two essential pillars that favor rail. But market share gains for rail are hard to achieve. When rail is the most efficient transport offer (city center to center with high-speed services of under four hours), its market share is often very high (for example, 60% on Paris-Milan and 65% on Paris-Lyon). But this is not sufficient. To gain a strong modal share, rail must also progress in areas where it is less relevant today:

-

Long distance and very long distance with the building of new high speed lines, the development of multi-modal with rail-air and railroad facilitations, the setting up of cross-border corridors, and the development of longer and longer train services, including the return of night trains.

-

Short distance with increasing density of regional networks.

-

Connections and multimodality from routes outside city center to city center routes.

-

Public investments and policies to develop medium-term rail freight flows.

-

-

Operators. In addition to public authorities, rail operators have a role in proposing breakthrough offers to the positioning of rail:

-

Ecological positioning by strengthening sustainability levers (e.g., removal of diesel locomotives, battery train technology, hydrogen, purchase or direct production of green energy).

-

Improving price attractiveness by reducing operating and maintenance costs: low-cost model (e.g., Lumo, Ouigo, Avlo) and new technologies lowering costs (automation, predictive maintenance).

-

Proposing new business models adapted to new markets such as the very long distance (positioning startups like Midnight Trains and European Sleeper) and regional high-speed transport (e.g., Le Train, Kevin Speed).

-

-

Improved integration with urban mass transit solutions (metro, tramways, buses) as well as new mobility solutions (active, shared, and micromobility modes to complement mass transit for the first and last miles) increases the attractiveness of the shared mobility system as an alternative to individual car travel by default. This physical integration can be further enhanced through Mobility-as-a-Service (MaaS) as explained in the ADL Report “How to Realize the Promise of Mobility-as-as-Service.”

These efforts to increase attractiveness for travelers will have positive effects on volume. This growth impulse must be supplemented by efforts to increase and improve the physical capacity (infrastructure and vehicles), which is one of the main bottlenecks in many rail systems (see Figure 2).

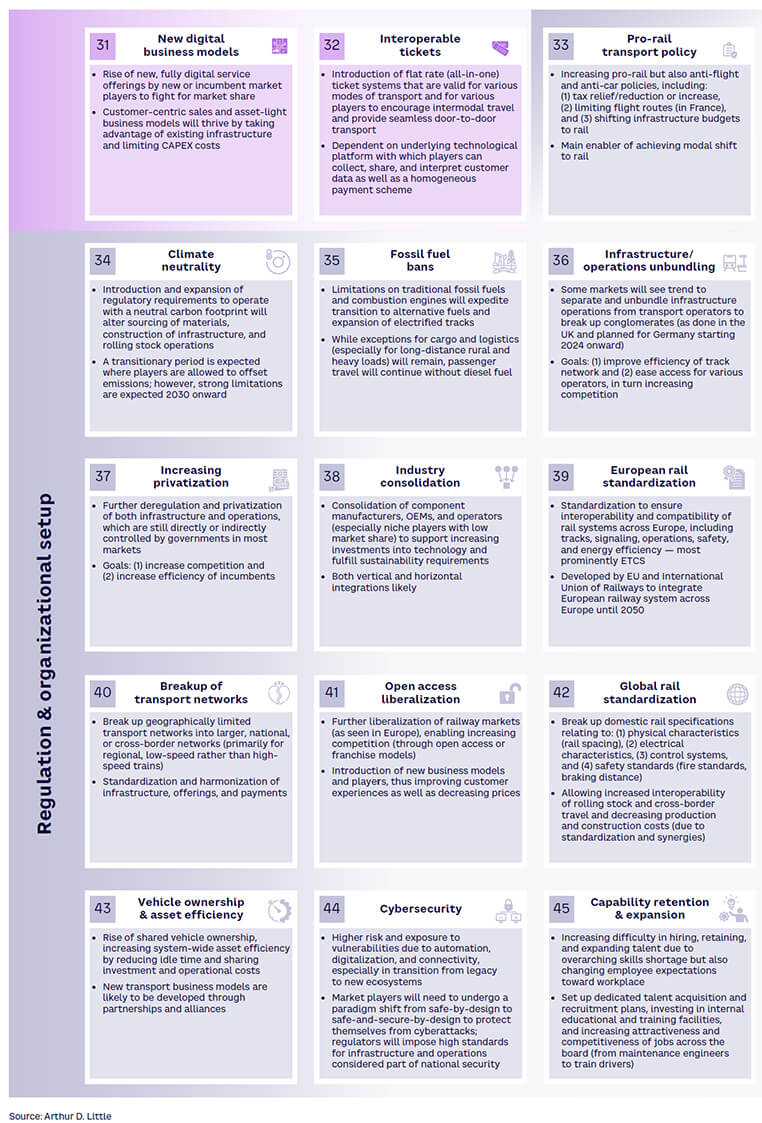

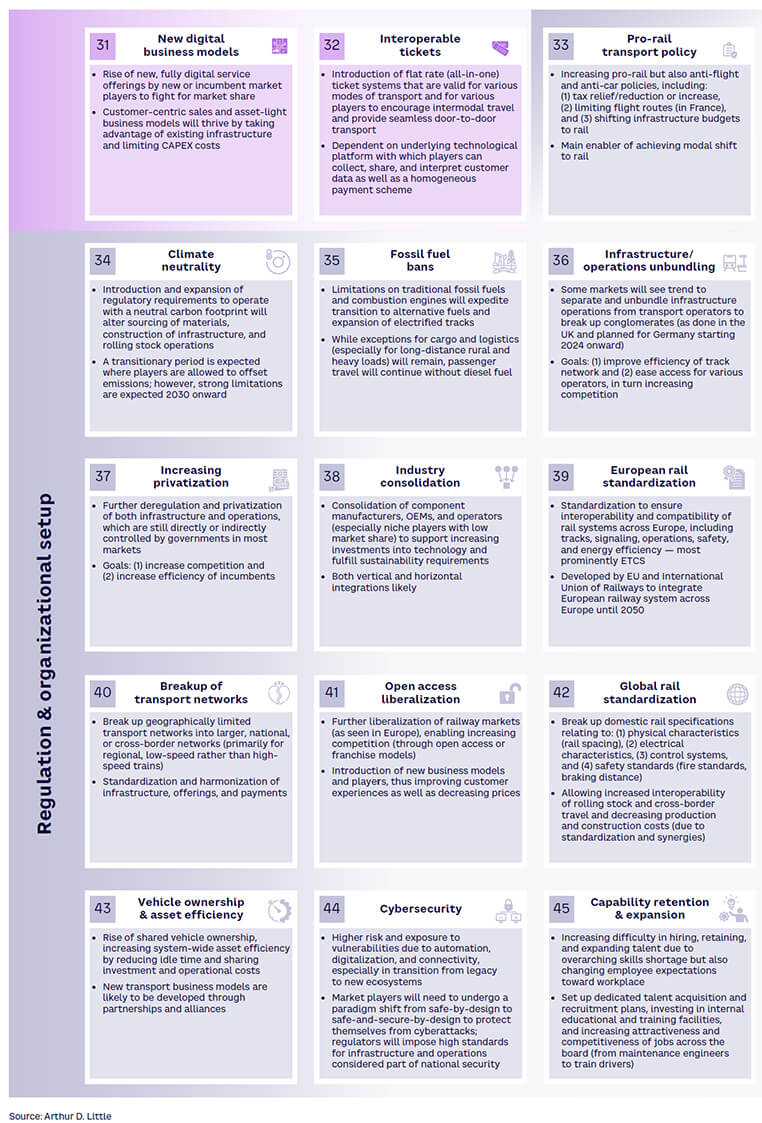

Two competing scenarios of rail demand growth are possible:

-

Stagnation (low case) with mobility growth of +0.5% per year (CAGR 2019–2040, Europe, in millions pkm) and freight growth of +1.0% per year (CAGR 2019–2040, Europe, millions tkm).

-

Economic growth scenario (high case) with mobility growth of +1.5% per year (CAGR 2019–2040, Europe, in millions pkm) and freight growth of +2.0% per year (CAGR 2019–2040, Europe, millions tkm).

What would this mean?

Stagnation (low case):

-

Slow progress in a constrained economic context and in a slower ecological transition.

-

Mobility growth around 0.5% per year constrained by stagflation.

-

A market share of 8% for passenger rail and 20% for freight limited by road/air habits and limited investments in rail infrastructure.

Economic growth scenario (high case):

-

The tripling or quadrupling of rail by 2035–2040 to serve the massive and rapid ecological transition in a context of growing mobility.

-

A growth in mobility that remains supported by a buoyant economic context, with rail’s market share rising to 10% (passenger) and 25% (freight), driven by public investments and the switch of users and innovations brought by the ecosystem.

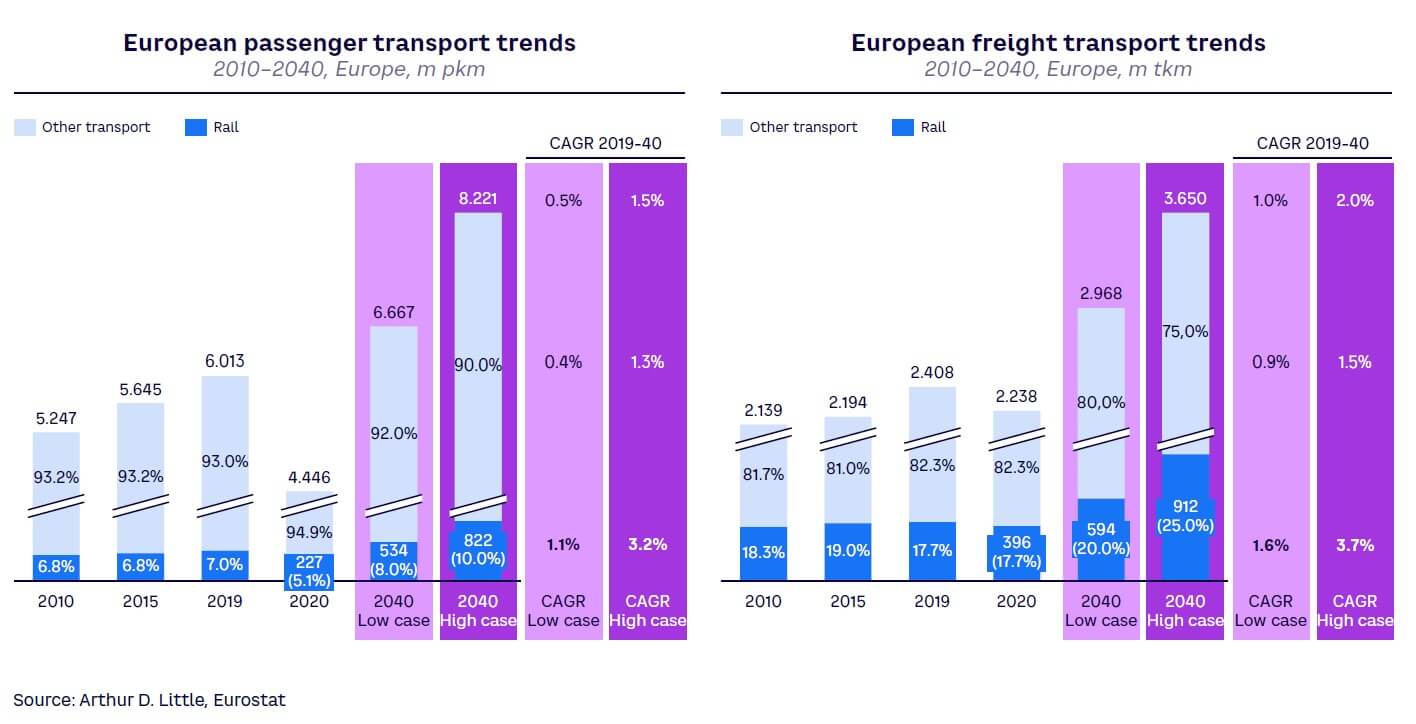

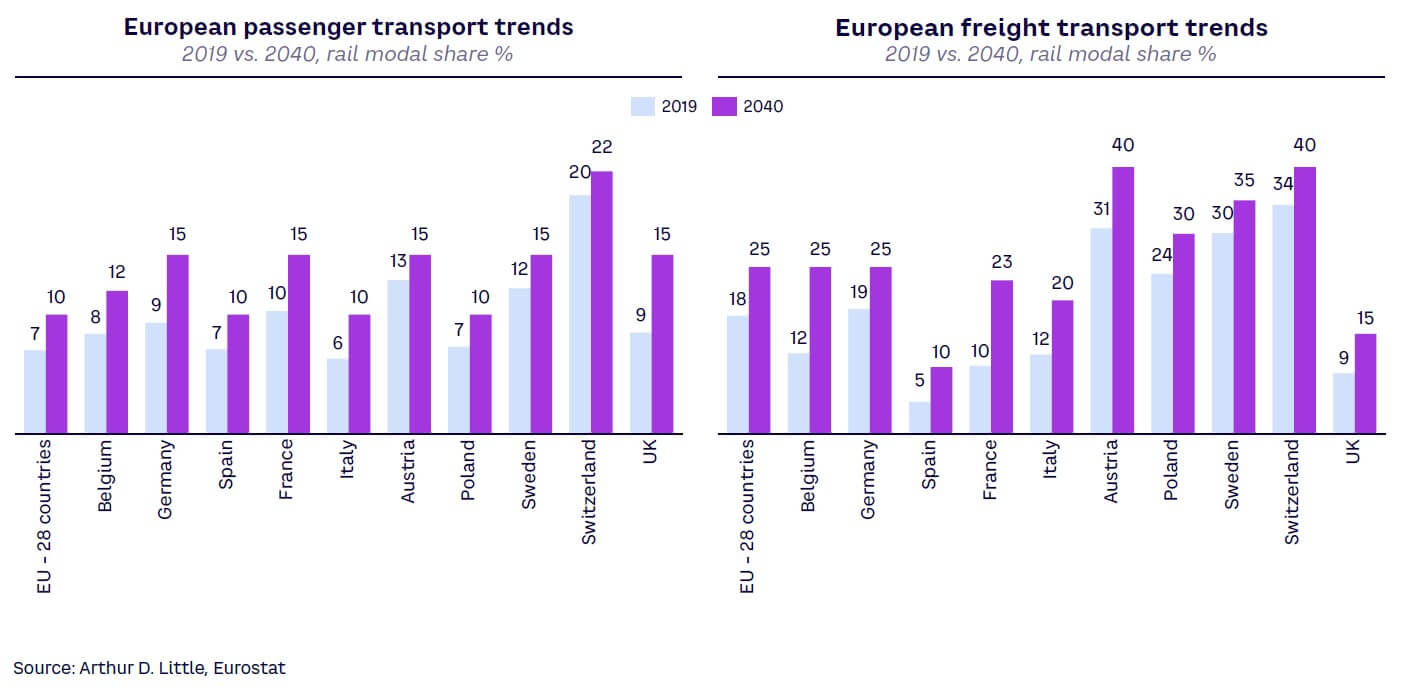

All European countries have major ambitions to develop rail for freight transport, passenger transport, or both (see Figure 3). There are numerous investment plans, whether for the current network, the development of new lines, or to support operators.

4

MARKET SCENARIOS BY COUNTRY

In this section, we assess current national rail market systems of regulations and operations and develop a scheme that organizes these dimensions into a comprehensive framework. Leaders and key stakeholders of railway companies and systems may use this framework to evaluate their current positioning and readjust their strategic direction if needed.

AN OVERVIEW OF THE SCENARIO CANVAS

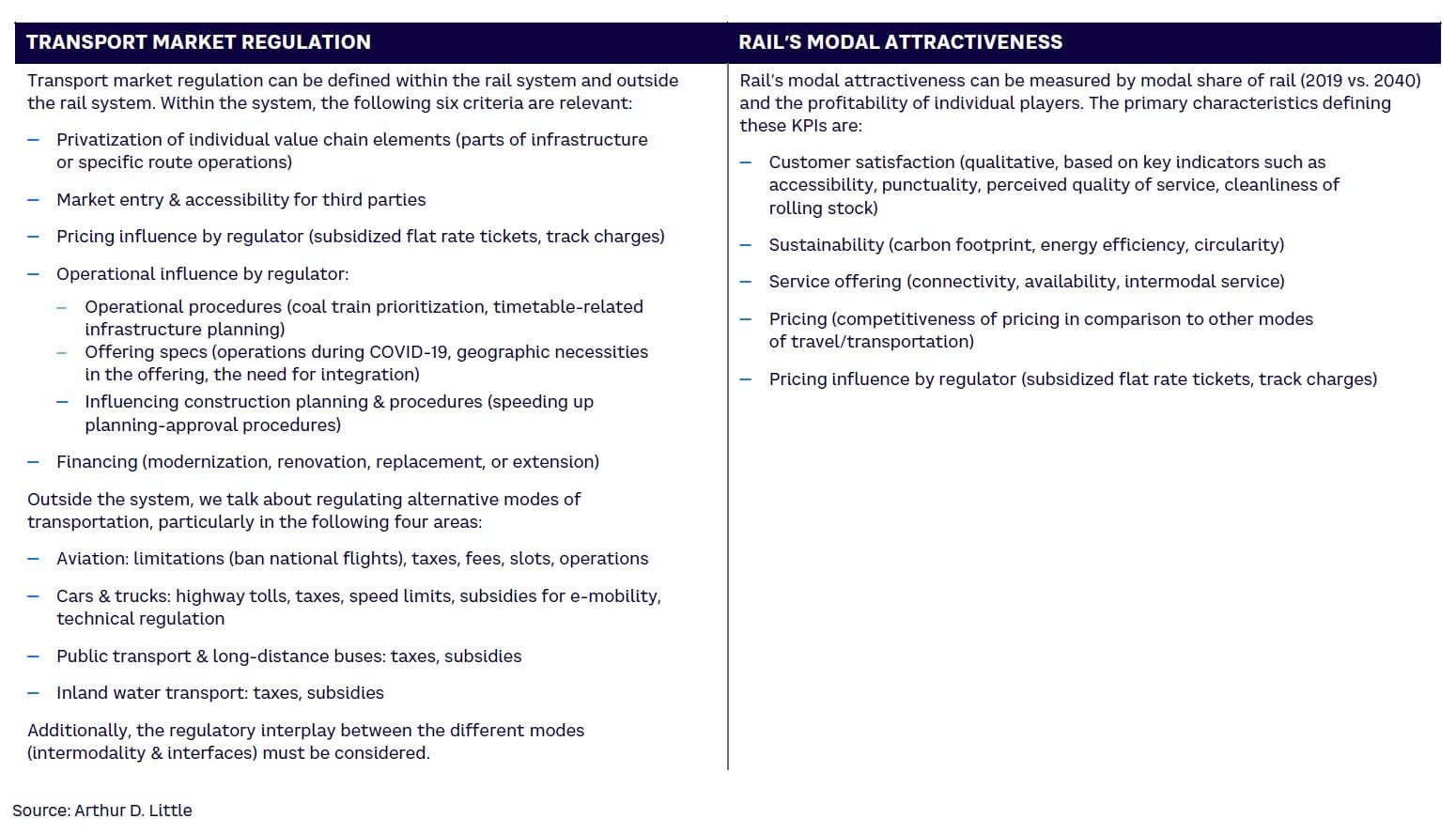

Railways typically serve a national market, with country-specific characteristics. They can be described by two main criteria:

-

Variations in transport market regulations. France and Germany are highly regulated, whereas the US and UK have looser regulations.

-

Rail’s modal attractiveness. In some markets, modal attractiveness of rail is seen as very favorable, while other markets show stronger customer preferences for other mobility types, like aviation or private car.

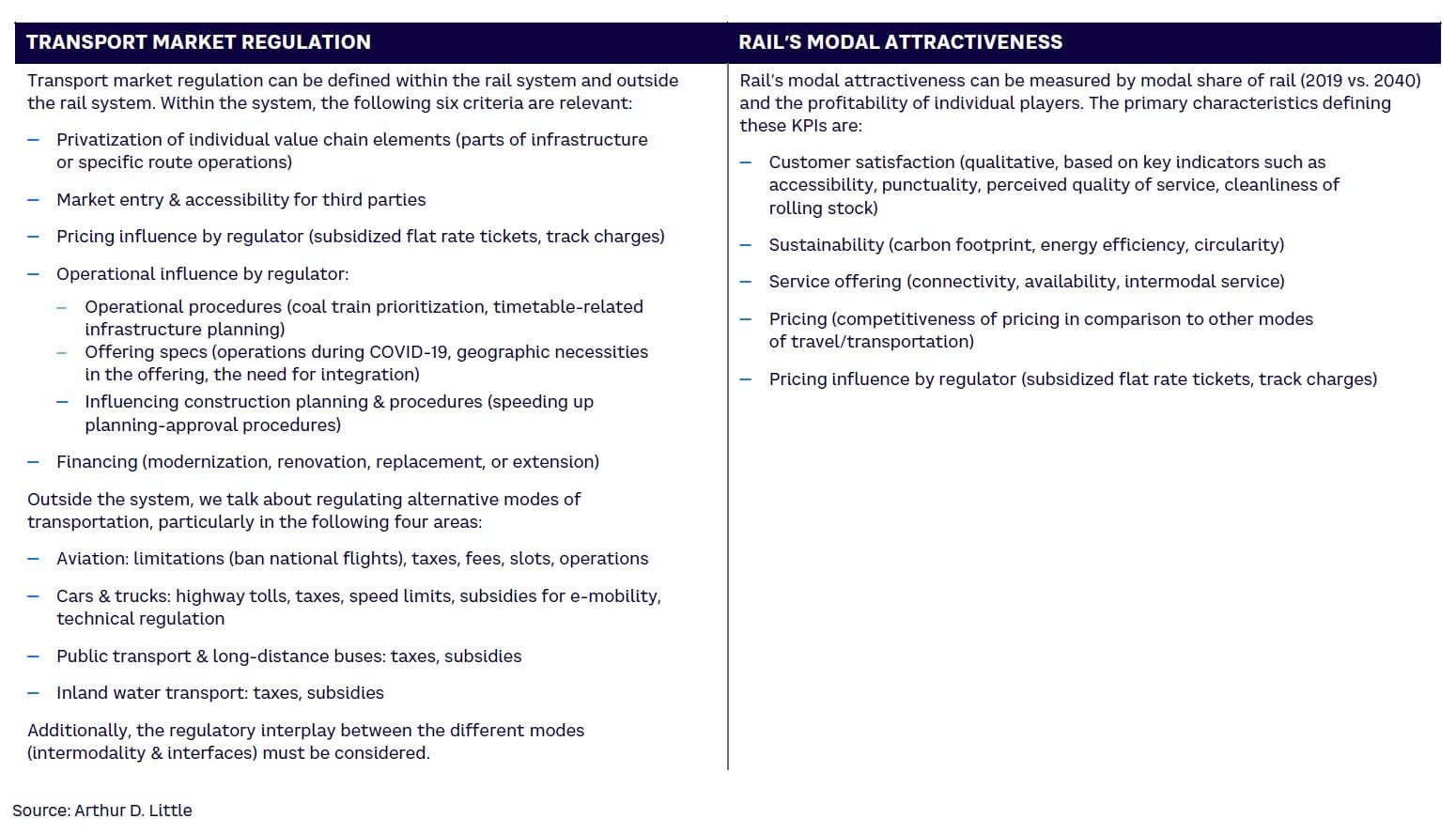

Table 2 specifies the sub-criteria that define transport market regulations and rail’s modal attractiveness.

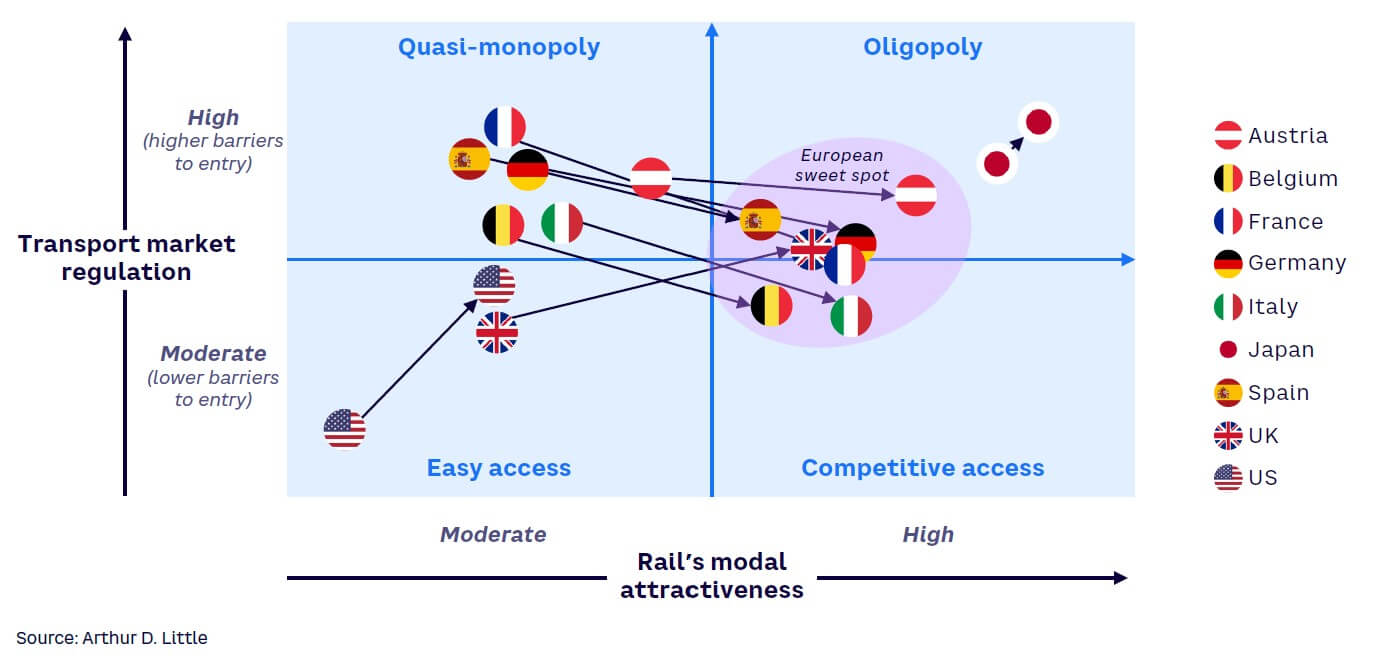

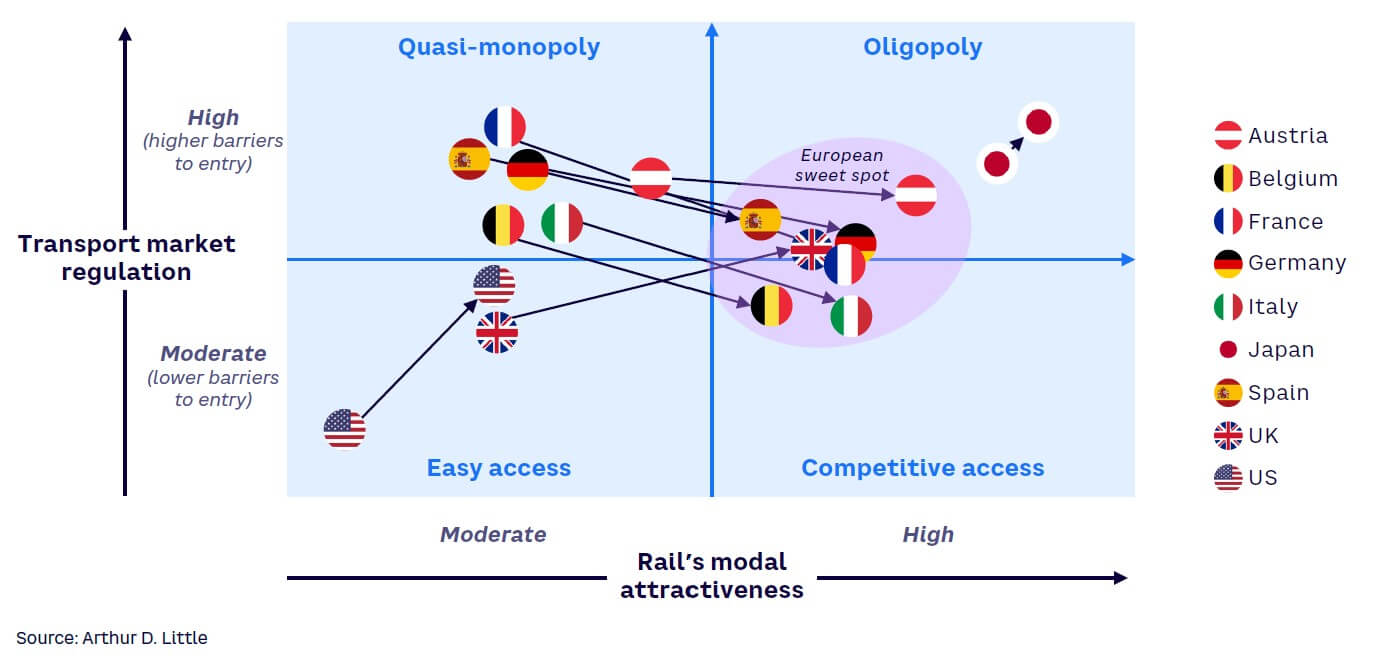

We have identified four different market types (see Figure 4), based on these two dimensions: transport market regulation and rail modal attractiveness:

-

Quasi-monopoly. Markets are dominated by an incumbent and a few competitors. A typical example is Germany, where Deutsche Bahn AG operates the infrastructure and dominates the market for both long-distance and regional travel.

-

Oligopoly. Markets feature a small group of strong players. The Netherlands provides a typical example, where only a few other players have significant market shares besides Nederlandse Spoorwegen (NS).

-

Easy access. Markets follow a strict liberalization policy with weak or weakening incumbents. Typical examples are the US and UK; the UK has embarked on a course of regrouping various railway players into Great British Railways (GBR).

-

Competitive access. Markets are highly attractive and allow true competition. At present, none of the global railway markets qualify for this category.

It is important to note that all quadrants have their pros and cons, and it is not necessarily better to move from left to right or bottom to top. Every quadrant is a potential target, depending on the point of view (e.g., operator, customer, regulator) and the overall maturity of the transport system within the market.

Every country’s rail market has unique characteristics and corresponding national macroeconomic factors. Individual assessments were conducted to create thorough reports for each market. We selected and examined eight markets, taking a deep look at market regulation, the attractiveness of rail, and the strategic direction that each market is following to further develop its systems.

France

France’s passenger rail market is Europe’s second largest after Germany; its freight rail market is the third largest after Germany and Poland. Thanks to rail market liberalization, freight transport’s 12% EBITDA margin in 2022 was better, relative to other European countries. The margin of B2C long-distance passenger activity back to pre-COVID levels, with a 2022 EBITDA margin of 17%, up from 15% in 2019. The 2022 margin demonstrates the profitability potential of the French long-distance market. In 2022, the EBITDA margin for B2G (business to government) regional train activity was 6%, down from 7% in 2019. It is worth noting that the steep toll increases announced by SNCF Réseau for 2023 and 2024 are likely to seriously impact profitability of all activities.

Development prospects will remain important over the next 10-15 years, thanks to ambitions to double passenger and freight traffic. Reaching this goal will necessitate a significant increase in the modal share of rail, from 10% in 2019 to 15% in 2040 for passenger transport and from 10% to 23% for freight. Debates are underway over public policy pertaining to rail financing. Policy issues include funding to build new high-speed lines, developing regional train networks around 10 of France’s major cities, investing in modernizing the network, and generating public support for freight rail development.

In terms of competition, France’s freight market was privatized in 2004 with two major consequences: SNCF, the state-owned national rail company, now represents only about 70% of market share, of which approximately 20% is through SNCF subsidiaries and 50% is through Fret SNCF. This share will fall by at least a further 10 pts by 2024, in response to the demands of the European Competition Authority. The value chain has been strongly divided from development of rolling stock companies (ROSCOs) and development of maintenance for third parties.

The French passenger market opened up to competition for open access operators on high-speed long-distance routes in 2021 and by tender on regional transport. Several competitors have entered or are currently entering the market, including Trenitalia and Renfe. Over the long term, SNCF could lose between 10%-15% of its market share to competition in both regional and long-distance transport. The value chain is also changing: LISEA wants to offer maintenance capacity, Getlink wants to set up a ROSCO to focus on cross-channel rolling stock, and the Caisse des Dépôts is considering a ROSCO for regional rolling stock. SNCF may be able to monetize some of these activities in the future.

In summary, France’s market is attractive because it is growing (up 3% per year on passengers, assuming the market doubles by 2040, and up 6% per year on freight, assuming the market triples by 2040). The market has significant potential to improve profitability (the cost weight of tolls and rolling stock are still high in France), and regulation is decreasing as the market opens in either open access or via tender. These conditions offer opportunities to foreign rail operators (Renfe, Trenitalia), start-ups (Le Train, Kevin Speed), and private equity (PE) firms investing in rail assets (CDPQ, DWS). The expected growth in traffic should also allow SNCF to grow its national market by expanding its high-speed low-cost service Ouigo, defending its regional trains’ market share, and launching new activities in the value chain.

UK

Thanks to the UK’s commitment to reach net zero by 2050, the modal share of rail will increase substantially from 2022 levels for both passenger and freight traffic. Increased regulations on carbon emissions and urban air quality will support the modal shift to rail.

Rail travel offers a more sustainable option than traveling by car or plane. A rise in passengers transported by rail is anticipated, as conventionally fueled vehicles are gradually phased out and more sustainable transport modes gain popularity. In 2019, there was a 3% increase of passengers using rail transportation; by 2040, rail passenger traffic is projected to increase by 50% due to more environmentally conscious customers. Following the opening of London’s Elizabeth line, billions of dollars have been invested in High Speed 2 (HS2) and the Transpennine Route Upgrade (TRU), which will increase passenger capacity and free up former passenger capacity for increased freight flows.

Great progress has already been made toward greening the UK’s rail network. To date, 42% of the network is electrified, and a combination of battery and clean fuels will eliminate all diesel rolling stock at the remote ends of the network. By 2040, we expect to see 100% rail electrification. The rail sector, which suffered fragmentation during the mid-1990s, is being restored by a unified, innovative national railway offering increasing levels of customer experience, driven by private sector operators of regional contracts.

Several large passenger operators, including National Express and NS, have left the market. By 2040, it is expected that the network will remain state-owned, with multiple private sector organizations operating under tightly specified contracts to deliver high-quality passenger services. The freight sector remains dominated by four private sector operators who actively compete to deliver freight transport services to support other sectors of the UK economy.

Data from the UK’s national regulator reveals the country has maintained its position as the safest global railway, with passenger-satisfaction levels similar to other consumer sectors. Post-pandemic, the sector transitioned from a system designed to carry large volumes of weekday season ticket holders to urban centers into one where a similar service is provided seven days per week, removing historical distinctions between commuting and leisure travel.

The investment in UK rolling stock design, development, and manufacturing, which began earlier in this decade, created a world-class train-supply industry. The country is the test bed for new rolling stock, prior to launching global exports to exploit the UK’s proximity to the EU and negotiate free-trade deals with major rail markets. In 2019, the total income for the UK rail industry was £21 billion (roughly US $27 billion), an increase of 0.5% from the previous year. Should this continue to increase steadily, by 2040 we will see a 9% increase in income with passenger rail as the largest contributor.

Germany

Germany is the largest railway market in Europe, with over 100 million pkm in 2019, and 38,394 km of tracks. While the COVID-19 pandemic severely impacted the railway system (down 50% in long-distance pkm, 40% in regional and local rail pkm, and 4% tkm in freight), it has recovered well, with more than 10% CAGR in the last two years, which is expected to stay stable until 2027. The modal split does not yet fully showcase this development.

Over the past five years, rail freight transport has remained stable with an 18.7% modal split of transport modes. Passenger rail peaked at 9.3% in 2019 (dropping to 6.3% in 2020, primarily due to the increase in motorized individual transport). This share is increasing again (primarily due to improved options for affordable ticketing, such as subsidized monthly tickets, and increasing sustainability consciousness) but not as quickly as the absolute numbers because of parallel increases in other modal transportation.

Even though the German market was partially opened to competition through its reform in 1994, it is still highly concentrated. The country’s market is dominated by the federally owned Deutsche Bahn (DB), which controls the entire infrastructure and the majority of personal transport (from subsidiaries DB Long-Distance and DB Regional). This picture, however, differs for long distance and regional distance. For long-distance travel, DB Fernverkehr has held a stable 98% monopolistic market share. For regional travel, DB Regio has been losing market share in recent years, now holding at 60%. For freight transport, DB Cargo holds an even smaller market share (45%).

The goal of the German government is to double the number of rail customers and increase the modal split of rail freight to 25% by 2030. To achieve this goal, the German railway system will undergo significant changes. Foremost, a new setup and steering logic for the infrastructure division will be launched beginning in 2024. There will be a paradigm shift from profit orientation to common welfare orientation, which will further foster fairness and competition in the market with regard to access to infrastructure and fair pricing.

Investments and funding for the railway sector have increased significantly due to increasing road congestion, changes in customer preferences, and environmental pressure. In Germany, the per capita investment in rail has lagged for years, never placing in the top 10 for European investment. In 2021, this changed with a year-on-year investment increase of 40% (€124 EUR per capita, now ranking eighth). In upcoming years, investment amounts will increase even further. In 2022, for the first time ever, the German government invested more money in railway than road transport (€8.9 billion EUR versus €8.3 billion EUR), which foreshadowed the prioritization shift for the coming decades. Thanks to public preferences, we expect this trend to continue regardless of the political party in charge. The increase and modernization of infrastructure (e.g., increasing the number of electrified tracks from 53% to 75% by 2030, fully rolling out the European Train Control System [ETCS] by 2035, and improving capacity and modernization of stations) are primary concerns.

As global best practices prove, the real shift toward a modal split only happens if regulation works on both sides: increasing attractiveness of rail while decreasing the attractiveness of individual modes of transport. This can be accomplished by decreasing road lanes and parking spaces in cities and increasing the relative tax burden, which can include raising vehicle taxes, implementing intercity tolling, and imposing strict emission class regulations and limitations.

We see two clear paths for the German market: a push for more competition in the rail system and an increase in modal attractiveness. Thus, we expect a modal share of 15% for passenger transport until 2040. The shift in absolute terms will seem rather small compared to other markets because of the country’s unique starting point, but the impact by the relative change will be undeniable.

Italy

The structure of the Italian national railway network is characterized by a separation between railway infrastructure management and railway service performance, which corresponds to the corporate separation within Ferrovie dello Stato Italiane S.p.A. (FS Italiane) and between state-owned Rete Ferroviaria Italiana (RFI) and Trenitalia.

The Italian railway market is highly concentrated, even if its degree of openness to competition is among the most advanced in Europe; in fact, once it has implemented the relevant EU regulations, any railway company in Italy can freely operate domestic passenger services. Out of 20,000 km of rail infrastructure, only about 16,000 km are managed directly by RFI as of 31 December 2021, while about 3,000 km, of which about 1,500 km are interconnected with the national infrastructure, are managed by other private or public entities.

For rail passenger transport, the service is divided into local public transport (LPT) and long-distance transport. Italy’s long-distance options are managed by four railway companies:

-

Trenitalia, which provides the majority of national and international service.

-

Italo, which operates a national premium service.

-

Trenord long distance, which provides international service.

-

SNCF, which operates international services.

Most long-distance services are provided on the high-speed rail network, which, in the years prior to 2020, recorded an increase in volume and a rise in the frequency of services. The remaining national offer has not undergone major changes in the quantity of trains, but rather in the commercial stops planned and the rolling stock used. The international market is also stable.

For rail freight transport, the market share of rail cargo in Italy is 13%, below the European average of 19%-20%. It is clear that if Italy wants to reach the 30% threshold by 2030, as required by the EU, it will need to push goods toward the railways by making freight trains more competitive. Overcoming bottlenecks, like those at the Alpine passes, and improving last-mile connections between the railway network and the ports, which can hinder a full development, are necessities.

We see two clear trends for the Italian railway market over the next decade: greater commitments to sustainability and a modal shift toward high-speed travel. In Italy, the liberalization of the high-speed market has led to a significant increase in passengers, especially on the Milan-Rome route. Italo began operating in April 2012 and its competition with Le Frecce, Trenitalia’s high-speed service, led to a significant price reduction, which also affected air travel. In fact, traveling by train became more convenient economically, with comparable timescales to air travel. Thus, we saw high-speed travel go from 36% in 2008 to 58% in 2012 and to 73% in 2016. Conversely, air travel dropped from 50% in 2008 to 32% in 2012 and 18% in 2016. This trend will probably continue during the next decade, and we see high market opportunity for high-speed rail system development, particularly in Italy’s south.

To meet decarbonization goals, FS Italiane intends to become carbon neutral by 2040, with respect both to the energy it buys and the energy produced by the group’s companies, including the energy used to power both rail and road vehicles and energy used in fixed facilities (e.g., workshops, stations, offices, tunnels, roads).

Hydrogen-innovation projects are gaining momentum for decarbonizing fleets of trains currently powered by diesel in order to make travel greener within the 28% of the national territory not yet electrified. FS Italiane and gas transport group Snam will set up a working group to evaluate possible pilot projects involving the replacement of fossil fuels with hydrogen. One objective of this collaboration is to create infrastructures to rapidly convert diesel-powered trains to hydrogen and thus acquire technological leadership that can be capitalized on at the international level.

Austria

Austria’s rail market plays an exceptionally important role in the mobility mix relative to its European neighbors, with a modal split share of 9.1% in 2020. Only Switzerland (15.5%) has a higher share, while other EU countries such as the Czech Republic (7.8%), France (7.8%), and Germany (6.3%) are significantly behind. The COVID-19 pandemic resulted in a significant decline in public transport, and the rail’s 2019 share in the modal split of 12.9% could not be maintained. However, in 2021 the rail had gradually returned to its regular schedule, and as a result, passenger numbers also climbed back up to 218.7 million, an increase of nearly 14% compared to 2020’s 192.2 million.

The economic recovery was noticeable in the freight sector, where the 2021 indicators showed positive developments primarily due to the easing of COVID-related restrictions that affected the economy. Though the share of rail transport remained stable throughout the pandemic (roughly 30%), both volume and transport performance (net tkm, gross tkm) did not reach pre-COVID levels until 2021.

The Austrian passenger and rail freight market is dominated by ÖBB, the federally owned railway company. While ÖBB’s market share in passenger transport is 86%, representing a quasi-monopoly, its biggest competitor, WESTbahn, operates on Austria’s most profitable route (Vienna-Linz-Salzburg-Innsbruck) and recently expanded its services to Munich. This significantly increases price pressure. Rail freight transport in Austria is more fragmented than passenger transport. ÖBB’s subsidiary Rail Cargo Austria has a market share of 62.7%, while the smaller providers each have a market share of less than 6%. Competition is most pronounced on the Brenner and western axes, where companies outside the ÖBB Group already have a market share of above 50%.

To achieve Austria’s climate goals, the government is aiming for a 43% share of public transport (e.g., train, bus, tram) by 2040. To attain this, rail will have to double its share in the modal split. An equally ambitious target has been set for freight transport, aiming for a 40% share of all rail transport by 2040. The measures are, on the one hand, necessitating substantial investments in infrastructure and, on the other hand, increasing the attractiveness of the railway by implementing new policies. The Austrian government guaranteed a €19 billion EUR investment (roughly US $21 billion) in a modern rail network between 2023 and 2028 and introduced a new nationwide travel ticket (KlimaTicket or “climate ticket”) to promote public transport. However, according to experts, meeting the 2040 target is questionable since the rail network will reach its limits by 2030, even if expansion measures are implemented. Increased frequency, new trains, and enhanced automation are not expected to sufficiently address capacity constraints.

In closing, we see three main challenges for Austria’s railway system:

-

The attractiveness of the southern line must be further increased, which has already been initiated with the start of the construction of the Semmering Base Tunnel and the Koralm Tunnel. The travel time is not competitive enough to be a viable alternative for cars and trucks.

-

Capacity constraints need to be addressed, and infrastructure projects need to be expanded and accelerated to achieve the ambitious goals for 2040. The deciding factor will be how the political sentiment on decarbonizing transport evolves.

-

To compete with new players in the future, the focus must be on intermodal transport (passenger and freight) and offering a real end-to-end journey.

Belgium

Belgium has one of the densest national rail networks in the world (15 billion pkm in 2019 and 4,000 km of tracks). The network is primarily used for passenger transport. In 2018, passenger trains accounted for 86.9% of train kilometers traveled.

A breakdown of passenger transport in Belgium shows that 97.9% of pkm traveled is national transport and 2.1% is international transport. The total share of rail in passenger transport was 8.4% in 2019. The modal share of national transport has been stable since 2012. Internationally, the share increased overall from 2012–2019, but it collapsed in 2020, with only 3.3 train kilometers compared to 6.0 train kilometers in 2019, a drop of 44.6%. Until 2020, only the international passenger transport segment faced effective competition. The COVID-19 crisis allowed SNCB to strengthen its market share (98%) because it maintained its offer and international rail transport fell sharply.

Belgium has a strategic position to transport freight via rail from the ports of Antwerp and Zeebrugge to other European destinations. The total rail modal share in Belgium for freight is 10.5%. COVID-19 led to a 20% decrease in demand in April 2020, but it is expected to recover fully this year. Between 2020–2025, the rail freight market is expected to grow by 3.2% per year, driven by intermodal transport and linked to a rise in container throughput at relevant ports, including Antwerp and Zeebrugge.

SNCB’s freight business was privatized in 2011 after several years of financial difficulties. In 2016 and 2017, growth rebounded when the company underwent rebranding as Lineas. Now, 12 railway undertakings are active in the Belgian rail freight market. Lineas is the incumbent and has around a 67% market share. Its market share decreased again in recent years due to high competition. Its main competitors are CFL cargo, an incumbent in Luxembourg with a 10% market share; Railtraxx, a subsidiary of SNCF with a 7% market share; and Crossrail Benelux, a subsidiary of Swiss BLS Cargo AG with a 5% market share.

In its Railway Vision 2040, Belgium’s federal government is clear about its long-term ambitions: by 2040, the modal share of trains should increase from its current 8% to 15% of domestic passenger transport, and by 2030, the freight volume should double. In concrete terms, this means smoother, more reliable, and numerous connections; the identification of Brussels as an international hub connected to European capitals; the upgrading of freight infrastructure, but also a strengthening of supply (a train every 15 minutes in major cities and every 30 minutes on the rest of the network); and better accessibility or even, attractive, and simplified pricing.

Spain

Spain has a well-developed railway system, with over 4,500 trains running daily and a total of 15,200 km of track. The state-owned railway company Renfe dominates the passenger segment, which operates both high-speed and regional trains. Infrastructure is managed by the state-owned Administrador de Infraestructuras Ferroviarias (ADIF), which manages 80% of all tracks, of which two-thirds are electrified.

With 3,200 km, Spain’s high-speed network is the second largest in the world after China. Since 2021, interest has grown in liberalizing the country’s railway system, mainly to increase traffic on its high-speed network. A 2018 report from the National Commission for Markets and Competition (CNMC) indicated that 76% of the network’s capacity is virtually inactive.

ADIF, the network manager, opened three routes in 2021 (Madrid-Barcelona, Madrid-Valencia, and Madrid-Málaga) to new operators under three different traffic packages. SNCF was awarded one package and operates in Spain under the low-cost brand Ouigo. Trenitalia and Ilsa (under the brand Iryo) were awarded the second package and public operator Renfe the third, as it required more resources for significant traffic. As of 2021, Renfe retained a market share of 64% in these lines, showing that Spanish policy did not want to kill the national operator.

Opening the market to competition led to the introduction of train equipment from three different manufacturers: Talgo (Renfe), Alstom (Ouigo SNCF), and Hitachi Rail (Ilsa/Trenitalia). Spain became the first country to have trains from such a wide variety of manufacturers. This model of liberalization is atypical; it is conditioned by the three traffic packages. While the historical operator is still the market leader, and ADIF, the infrastructure manager, is a state-owned company.

Before switching to the standard gauge in 1992, Spanish rail infrastructure was built with an assortment of gauges, primarily the Iberian gauge, which was interoperable with Portugal but not the rest of Europe. As a result, even today, large portions of track still cannot be linked to the rest of Europe. Rectifying this is a major endeavor that is currently being tackled.

In 2019, the railway sector in Spain transported over 500 million passengers and 34 million tons of freight. COVID-19 had a huge impact on the railway sector. In Q4 2020, there were 81 million fewer rail passengers than in Q4 2019 (down 49%). In long-distance travel, the decrease was even greater due to precautionary measures, as non-essential trips were discouraged. In fact, in Q4 2020, Spain was ranked fifth among European countries with the largest decrease in pkm (-65%).

Spain’s rail freight traffic had showed a steady decline since the year 2000 (pre-liberalization) when it peaked at 12 million net tkm. This decline was accentuated by the COVID-19 pandemic, dropping 10% in 2020. However, in 2021, the recovery resulted in 9.7 million net tkm, close to 2019 levels.

Comparing a quarter in one year to the same quarter in another year can yield more recovery-related data. For example, in Q3 2022, the railway sector in Spain transported around 128 million passengers, less than the 140 million from Q3 2019. In Q3 2022, 5.5 million tons of freight were transported in Spain, which was less than the 6.1 million tons of freight from the same quarter in 2019. Spain’s railway sector hasn’t yet fully recovered from the pandemic.

The Spanish government set ambitious goals to increase the use of rail transportation. Its main objective is to increase the share of rail in land freight transport from 5% to 10% by 2030 and to raise passenger transport from 7% to 20%. Achieving this goal is expected through a combination of infrastructure investments, improvements to existing rail lines, and the development of high-speed rail networks. The Freight 30 bill has set aside €8 billion EUR (US $8.7 billion) for these undertakings. There are several long-term priorities, including the expansion of rail freight transport in northwest Spain, with a target to triple its current numbers of 7 million tons annually.

In addition, the ongoing expansion of the high-speed train network is important, with new lines being built and existing lines being upgraded. The Renfa AVE, Avlo, Ouigo, and Iryo lines will benefit from the creation of 10 new routes from the current 24, for an increase of approximately 40%.

In addition, €900 million EUR (approximately US $977 million) will be provided to support operators with the installation of the European Rail Traffic Management System (ERTMS) to purchase and renew wagons and locomotives and to construct, adapt, and improve the rail network and terminals. To meet the goal of ensuring decarbonization, Spain has been investing in electric and hybrid trains. Targets have been set to only source new trains and run 100% electric trains, creating an opportunity for investment and improvement.

In conclusion, Spain’s market offers great opportunities. The projected revenue for 2025 from intercity passenger rail transport in Spain will reach approximately €2.7 million EUR (approximately US $3 million), whereas for the freight transport is estimated to reach around €344 million EUR (approximately US $375 million). The government has set clear objectives for the next several years, which will make this market more profitable overall. These objectives focus on two main purposes: (1) to increase rail use for transportation passengers (20%) and freight (10%) and (2) to embrace the inclination toward decarbonization by increasing the production of electric tracks, aiming to reduce emissions by 7 million tons of CO2 by 2030. The Spanish high-speed and long-distance segments also offer significant potential. There is ample existing rail and more is under construction. This segment can be very appealing for investors.

Japan

Japan’s railway is one of the country’s most fundamental social infrastructures, which determines people’s way of living and characterizes its cities. The national average of railway share in all traffic is approximately 17%, which is even higher in central Tokyo, with a 50% share. The country’s densely developed rail network provides people with frequent and reliable transportation for commuting and daily life activities. Travel time by train from the metropolitan center and the distance from the train station nearby define the value of land. Social and living functions are centered around train stations, forming the structure of the city.

From a historical perspective, the railway network has been developed through a close collaboration between public and private sectors since Japan’s first railway started operating in 1872. Although the government initiated the development of long-distance railroads, the leading force of the development soon shifted to newly established private companies, due to the government’s financial difficulties from civil wars during the early Meiji era in the 1880s. Even after long-distance rails were nationalized, rails serving urban and interurban routes were mostly developed by private companies. Those private rail companies evolved early, as conglomerates with diversified businesses were formed to get a foothold in city development, city management, housing and land development, real estate management, department stores, hotels, and so on.

The Japanese National Railways (JNR), which operated long-distance and regional lines, was privatized in 1987 and split into six regional passenger rail companies and one freight service company. Thus, current railways in Japan, with the exception of some local third-sector lines, are mostly managed and operated by private companies. Its rail service operations are still highly regulated in terms of safety requirements, pricing, and opening and abandoning routes, as they are closely linked to people’s quality of life and social survivorship.

Although Japan’s railways benefited from its densely populated demographics and the society’s heavy reliance on rail transportation, the trends of declining population and more motorization in rural areas have created revenue problems for Japan Railways (JR) and local district railway companies. According to a 2019 survey by the Ministry of Land, Infrastructure, Transport and Tourism (MLIT), 79% of Japan’s 95 regional railway companies were suffering from financial deficits.

Furthermore, COVID-19 accelerated flexible working styles that do not require commuting. This fundamental social change has led to rail companies experiencing severe declines in revenue and therefore profits. On the other hand, expectations and social pressure on rail transportation are still high. The aging population has highlighted the issue of transportation access for the elderly, especially in rural areas. In addition, social and political support for decarbonization has shed light on the ecological value of rail transportation. Thus, railways in Japan are transforming in two ways: as a modal infrastructure with redesigned and redefined regional mobility functions for an enhanced value with economic rationality and as a management body with established diversified income sources that are less dependent on train fare revenue.

Given the recent challenges, major railway companies in Japan aspire to establish their new roles in society. As fundamental mobility service providers, they seek to transform their rail service into integrated regional mobility solutions, combining multimodal transport that augments networks with value enhancement of points of interest and destinations. In the pursuit of these mobility service innovations, some railway companies have started to build a cross-industry service ecosystem by bringing in other mobility providers as well as destination service providers, technology developers, and entities that can assist. One notable example, JR East, established the Mobility Innovation Consortium (MIC), comprising over 120 companies and academic institutions. MIC advocates for a future mobility vision, which includes not only a new mobility concept but also serves to enrich people’s lives in regions and cities.

The government also supports railway companies’ pursuit of regional mobility transformation. In January 2023, MLIT declared that the government’s efforts to redesign regional public transports is one of the most important agendas of the year. Within these efforts, budgetary support for regional transportation is expected to be reinforced, while collaboration among various stakeholders in the region is encouraged.

Furthermore, some leading railway companies are aspiring to bold transformations of themselves. By leveraging a wide range of assets and operational capabilities, which have been developed through integrated management of rail infrastructure and operations as well as historically diversified transportation-related peripheral services, the companies aspire to expand their roles to wider social infrastructure management, including vital services such as energy, water, security, wellness, and financial services. In a decade or two, railway companies may evolve into fundamental social platform providers that undertake comprehensive social functions that form the foundation of people’s lives.

SUMMARIZING MARKET DEVELOPMENT SCENARIOS

Going through our case studies and reflecting on national developments in light of the market scenario canvas helped us derive three insights that capture the overall development of the global railway system:

-

There is an overall and long-term trend of railway systems that started as national state-owned companies to standardize the individual ecosystems across national borders. Europe in particular has seen a strong push to harmonize regulation, especially with respect to liberalization, safety, interoperability, sustainability, technology (e.g., through ETCS, usage of the standard gauge), and sales (e.g., through cross-national ticketing). At the same time, significant parts of the infrastructure have aged and require renovation, modernization, replacement, or extension in order to fully function today and into the future. The increased volume and traffic on existing infrastructure have exponentially grown in complexity and raise the potential for incidents. A wide application of incident management, particularly around punctuality and safety (see ADL’s Viewpoint “Comprehensive Machine-Augmented Assurance”), has been used to minimize the effect on customers, but the infrastructure systems still show large deficits.

-

We see the efforts of railway companies to expand services, provide higher service levels, and improve quality, driven by growing customer expectations that grew from the discovery of railway systems as natural backbones for integrated mobility systems. In addition, the openness and transparency of railway services are continuously increasing.

-

With regards to the market scenario canvas, we envision all European railway systems gravitating toward a sweet spot. This sweet spot, found in the lower right quadrant of Figure 4, is characterized by more liberalization and higher service attractiveness. Driven by early 1990s European railway reform, the common role model for railway organization is characterized by more standardization and harmonization (e.g., ETCS), modernization of the infrastructure (i.e., networks and stations), sustainability initiatives, and greater but fair competition between national and private operators across borders, based on national infrastructure that is accessible to all.

Single markets, on the other hand, will move on a different trajectory. Japan and the US are two good examples. Japan, with its already strong service level, will aim to further perfect both infrastructure and customer offerings. The US lies at the other end of the spectrum, having work to do in both regulation and attractiveness.

Overall, these developments send a good message to rail customers because they signal larger, differentiated product offerings and prices, as well as higher overall quality levels. This provides a push for intermodality and integration of mobility solutions through the progressive setup of MaaS ecosystems, leading to increased accessibility as well as increased sustainability. To fulfill these demands, railway companies will also invest heavily in employee capabilities and increase their staff retention efforts.

5

IMPLICATIONS FOR CEO AGENDAS

The insights we collected from different rail systems lead us to expect that railway management strategies and management agendas will have dedicated and explicit policies that respond to the issues below. The questions differ and depend on the individual or organization’s role within the ecosystem (e.g., public authority, OEM, supplier, operator, infrastructure provider, private and public investors, other private and public mobility solution providers, enterprises, and citizens).

Standardization

-

Regulation. How can key points of railway regulation, such as equipment and vehicle certification, be further streamlined?

-

Technology and innovation. What is on my technological roadmap?

-

Technology for the network (digital twins, telemetry).

-

Technology for maintenance (inspection on the move, remote telemetry, visual and robotic rail automation).

-

Technology for rolling stock (train automation, smart and agile rolling stock, hydrogen).

-

Technology for distribution (MaaS, customization).

-

-

Harmonization. Which efforts should be undertaken to further eliminate national approaches and “dialects” for a common infrastructure technology (ETCS) and rolling stock technology (interoperability)?

-

Sales. How can ticketing systems be harmonized and simplified? How can ticketing-related transparency be improved?

Integration

-

What are the new paradigms and operating models to integrate railway backbone and core services with adjacent mobility service offerings, which include on-demand services, taxi services, micro-mobility, luggage services, and so on.

-

How can we collaborate with potential key partners like airports and bus operators to configure a truly intermodal service platform?

Liberalization and service attractiveness

-

The traditional strategy of gaining a competitive advantage over other players will be replaced by a competitive access approach to fair and cooperative ecosystem play:

-

How can a railway company become a real ecosystem partner?

-

What are the rail company’s priorities and positioning in terms of the business model?

-

Expanding services depends on demand evolution (long-distance, regional, freight) and profitability.

-

Customer experience adaptations should consider individualization and/or mass compatibility.

-

Consider breakthrough business models to gain in competitiveness (low-cost, asset-light businesses and code-sharing trains).

-

Consider developing markets in new countries.

-

-

What are the appropriate organization, operating model, and shareholder structures?

-

Long-term, foreseeable financing.

-

Evaluating pros and cons and anticipating regulatory requirements for integration and disintegration.

-

Cross-border expansion and renewed focus on mergers and acquisitions and mobility diversification.

-

Outsourcing unprofitable maintenance operations.

-

Opportunities for diversification from MaaS and hydrogen production and distribution.

-

-

DOWNLOAD THE FULL REPORT

DATE

Executive Summary

The demand for energy-efficient mobility is growing significantly, and transportation must meet these rising needs. Rail transport has clear advantages to meet these challenges over other modes of transportation. The coming years are essential for all stakeholders: public authorities, rail incumbents, and potential new entrants. Each one faces a strong growth perspective and uncertainty about how the rail market will evolve. Public authorities need to make informed decisions around regulations and public funding. To make the most of the decarbonizing power of rail, incumbents must continue to prioritize strategic choices to maintain their leadership, improve their profitability, and expand into new territories. New entrants must make careful choices to become relevant in the sector.

In this Report, we first explore key trends that will reshape the industry and assess the general market environment for railway services. Next, we develop a scheme that puts regulation and operation into a comprehensive framework to show options for setting up different rail systems today and tomorrow. We follow with case studies of the railway markets in eight countries, examining the potential for competition, regulatory impacts, and performance statistics. Finally, we share our outlook to inform the agendas of CEOs and other rail company decision makers.

1

ORGANIZING & MANAGING RAILWAY SYSTEMS FOR MAXIMUM IMPACT

The next 10 years have the potential to be the “Rail Decade.” Compared to other sectors, the rail sector’s technological development and growth rates have historically been modest. However, today, we see global trends with great potential to reshape the industry: accelerated green transitions, technological breakthroughs, shorter technology cycles, growing public involvement, and increased regulation. And within the industry, the demand for moving passengers and goods is expanding. The growth of passenger-kilometers (pkm) and tonne-kilometers (tkm) is expected to be 200% by 2050 (ITF/OECD, base year 2019).

The above trends and developments showcase a new global paradigm shift and must be managed through a triangle of increased sustainability (energy efficiency and inclusion), efficiency, and resilience.

In the context of rapid change, higher demand, and sustainability, rail has clear advantages over other transport sectors:

-

A developed railway system can support the general pattern of integration of transport modes by serving as a natural backbone for shared mobility systems, which are created by mass transit and supplemented by active, shared, and micro-mobility options for a journey’s first and last miles.

-

The individual car is no longer the preferred or default option for optimal transport experiences and mobility patterns, indicating a growing customer preference for rail. A car is no longer a “status symbol,” according to a number of empirical studies (see, for example, the Arthur D. Little [ADL] Report “The Future of Mobility Post-COVID-19 — Turning a Crisis into an Opportunity” with analyses of mobility trends and the evolution of mobility patterns).

-

Government and public transport authorities (PTAs) must make careful decisions to address three important issues in order to maximize and exploit these opportunities:

-

What is the best regulatory scheme to frame the market as a good platform to grow modern mobility services?

-

What is the best funding mechanism and how can both public and private investment stimulate growth and innovation?

-

How can multi-stakeholder ecosystems, which are key for integrated mobility systems, be encouraged?

-

-

Public transport operators (PTOs) must determine how to use new regulatory settings (especially regarding liberalization, public well-being, and pricing) as they strive to provide their best and competitive customer services.

2

KEY TRENDS RESHAPING THE INDUSTRY

ADL has a long record of advising railway systems around the world. Our approach involves systematically monitoring trend analyses on a global scale and building a synthesis with direct insights from our experience with railway clients. There are 45 trends that will be crucial to reshaping the industry within the next 20 years. These trends fall into three classes: (1) technology and infrastructure, (2) consumer behavior and value proposition, and (3) regulation and organizational setup (see Figure 1).

Each category can be directly or indirectly managed within the big picture, which is determined by uncontrolled catalysts: climate change, geopolitical and macroeconomic situations, pandemics, demographic shifts and urbanization, and technology disruptions.

UNCONTROLLABLE CATALYSTS & THEIR POSSIBLE IMPACTS

In the coming years, the rail ecosystem may undergo unprecedented changes that profoundly transform the structure of its value chain, its size, and its profitability in established railway markets. These changes are driven by five uncontrollable catalysts:

- Climate change. Transportation is responsible for about a quarter of CO2 emissions. The goal to reduce Europe’s emissions from 8 tons per capita to 2 tons per capita requires a significant modal shift to more sustainable transport modes, with rail (national and intercity) and urban mass transit as natural backbones. In this context, rail is a particularly important option that is increasingly favored by both the population and public authorities. Beyond its status as an essentially electric mode of transport, passenger rail is also very energy efficient (3-4 kWh per 100 km for France’s TGV against 15-20 kWh for an electric car). The outcome is similar for freight rail transport, with an electric consumption of 8 kWh/ton per 100 km for the rail against 15 kWh/ton per 100 km for an electric truck.

- Geopolitical and macroeconomic situations. The return of inflation could cause major difficulties for the railway sector, and the threat is aimed at multiple dimensions. The decrease in purchasing power and the increase in transportation costs could significantly reduce the number of passengers taking leisure trips. A slowdown in the economy would mechanically slow the recovery of business travel to pre-COVID-19 levels. Higher electricity costs could multiply costs for rail operators by a factor of 2 to 4. Similarly, the cost of materials directly impacts maintenance, prices of rolling stock, and the ability of infrastructure managers to maintain and improve the network within the same expenditure package.

- Pandemics. Rail ridership was strongly impacted by the COVID-19 crisis. During the past few years, passengers and freight volumes have been at historically low levels while costs remained stable, which limited the railways’ ability to invest and innovate. Since mid-2022, the volume of business traffic has rebounded in many countries but continues to suffer in terms of value (fewer one-day trips and less willingness to pay for fully flexible fares), while leisure traffic is peaking in many European countries (notably supported by the trend of “revenge travel”). COVID had a limited impact on rail freight transport, with pre-crisis traffic recovering in 2021.

- Demographic shifts and urbanization. Population and mobility per capita continue to grow in Europe and throughout the world. In the EU, mobility measured in pkm/per capita has increased by 27% over the last 25 years according to a 2020 Eurostat report. Mobility growth rates for the next 10 years could be even higher. In this growth scenario, the railway system has a competitive advantage: the transport capacity of a train is unrivaled. A high-speed line has a transport capacity twice as large as a bidirectional three-lane highway with lower land consumption (a 15-meter-wide railway against 25-meter-wide highway).

- Technology disruptions. The speed of innovation is increasing. Over the last few years, we have seen a significant number of disruptive technologies solutions that improve network efficiency, rolling stock utilization, distribution, and on-board experience. They include train automation, Internet of Trains, digital twins, and many other solutions that have already passed the PoC (proof-of-concept) stage.

RAILWAY TRENDS

Table 1 explains the 45 trends represented by Figure 1, color-coded by class: blue for technology and infrastructure, purple for consumer behavior and value proposition, and gray for regulation and organizational setup. Railway companies currently monitor each trend, placing them at the top of their management agendas; each company defines its own strategic positioning to approach the spectrum.

3

THE GENERAL MARKET ENVIRONMENT FOR RAILWAY SERVICES

Two major uncertainties affect the general growth dynamic for railway transport: overall mobility growth and the share of rail in the modal split.

-

The growth of overall mobility depends on macroeconomic factors:

-

Uncertainties about the evolution of household consumption in a context of inflation will directly affect leisure mobility.

-

Uncertainties about the evolution of growth in the eurozone will have a direct impact on business mobility.

-

The growth of inland freight volumes is directly linked to economic growth, and the implementation of new logic for more local logistics and nearshoring affects the growth of inland freight volumes.

-

-

The share of rail in the modal split depends on several factors related to the ecological transition:

-

Travelers. This refers to a modal shift to rail at the individual level and willingness to consider the ecological impact in their choice of transport. In 2020, it was estimated that two-thirds of Europeans took ecological impact into account, but only 5% have considered it during their last trip, according to the 2020 Kantar mobility study. The evolution of this figure, which reflects the actual ability of users to move from desire to an actual change of travel preferences, is an important uncertainty that will affect the share of rail.

-

Authorities. Pro-rail transport policy in a carbon-neutral context (concrete regulatory decisions such as banning short-haul air travel) and public investment (in infrastructure and rolling stock) are two essential pillars that favor rail. But market share gains for rail are hard to achieve. When rail is the most efficient transport offer (city center to center with high-speed services of under four hours), its market share is often very high (for example, 60% on Paris-Milan and 65% on Paris-Lyon). But this is not sufficient. To gain a strong modal share, rail must also progress in areas where it is less relevant today:

-

Long distance and very long distance with the building of new high speed lines, the development of multi-modal with rail-air and railroad facilitations, the setting up of cross-border corridors, and the development of longer and longer train services, including the return of night trains.

-

Short distance with increasing density of regional networks.

-

Connections and multimodality from routes outside city center to city center routes.

-

Public investments and policies to develop medium-term rail freight flows.

-

-

Operators. In addition to public authorities, rail operators have a role in proposing breakthrough offers to the positioning of rail:

-

Ecological positioning by strengthening sustainability levers (e.g., removal of diesel locomotives, battery train technology, hydrogen, purchase or direct production of green energy).

-

Improving price attractiveness by reducing operating and maintenance costs: low-cost model (e.g., Lumo, Ouigo, Avlo) and new technologies lowering costs (automation, predictive maintenance).

-

Proposing new business models adapted to new markets such as the very long distance (positioning startups like Midnight Trains and European Sleeper) and regional high-speed transport (e.g., Le Train, Kevin Speed).

-

-

Improved integration with urban mass transit solutions (metro, tramways, buses) as well as new mobility solutions (active, shared, and micromobility modes to complement mass transit for the first and last miles) increases the attractiveness of the shared mobility system as an alternative to individual car travel by default. This physical integration can be further enhanced through Mobility-as-a-Service (MaaS) as explained in the ADL Report “How to Realize the Promise of Mobility-as-as-Service.”

These efforts to increase attractiveness for travelers will have positive effects on volume. This growth impulse must be supplemented by efforts to increase and improve the physical capacity (infrastructure and vehicles), which is one of the main bottlenecks in many rail systems (see Figure 2).

Two competing scenarios of rail demand growth are possible:

-

Stagnation (low case) with mobility growth of +0.5% per year (CAGR 2019–2040, Europe, in millions pkm) and freight growth of +1.0% per year (CAGR 2019–2040, Europe, millions tkm).

-

Economic growth scenario (high case) with mobility growth of +1.5% per year (CAGR 2019–2040, Europe, in millions pkm) and freight growth of +2.0% per year (CAGR 2019–2040, Europe, millions tkm).

What would this mean?

Stagnation (low case):

-

Slow progress in a constrained economic context and in a slower ecological transition.

-

Mobility growth around 0.5% per year constrained by stagflation.

-

A market share of 8% for passenger rail and 20% for freight limited by road/air habits and limited investments in rail infrastructure.

Economic growth scenario (high case):

-

The tripling or quadrupling of rail by 2035–2040 to serve the massive and rapid ecological transition in a context of growing mobility.

-

A growth in mobility that remains supported by a buoyant economic context, with rail’s market share rising to 10% (passenger) and 25% (freight), driven by public investments and the switch of users and innovations brought by the ecosystem.

All European countries have major ambitions to develop rail for freight transport, passenger transport, or both (see Figure 3). There are numerous investment plans, whether for the current network, the development of new lines, or to support operators.

4

MARKET SCENARIOS BY COUNTRY

In this section, we assess current national rail market systems of regulations and operations and develop a scheme that organizes these dimensions into a comprehensive framework. Leaders and key stakeholders of railway companies and systems may use this framework to evaluate their current positioning and readjust their strategic direction if needed.

AN OVERVIEW OF THE SCENARIO CANVAS

Railways typically serve a national market, with country-specific characteristics. They can be described by two main criteria:

-

Variations in transport market regulations. France and Germany are highly regulated, whereas the US and UK have looser regulations.

-

Rail’s modal attractiveness. In some markets, modal attractiveness of rail is seen as very favorable, while other markets show stronger customer preferences for other mobility types, like aviation or private car.

Table 2 specifies the sub-criteria that define transport market regulations and rail’s modal attractiveness.

We have identified four different market types (see Figure 4), based on these two dimensions: transport market regulation and rail modal attractiveness:

-

Quasi-monopoly. Markets are dominated by an incumbent and a few competitors. A typical example is Germany, where Deutsche Bahn AG operates the infrastructure and dominates the market for both long-distance and regional travel.

-

Oligopoly. Markets feature a small group of strong players. The Netherlands provides a typical example, where only a few other players have significant market shares besides Nederlandse Spoorwegen (NS).

-

Easy access. Markets follow a strict liberalization policy with weak or weakening incumbents. Typical examples are the US and UK; the UK has embarked on a course of regrouping various railway players into Great British Railways (GBR).

-

Competitive access. Markets are highly attractive and allow true competition. At present, none of the global railway markets qualify for this category.

It is important to note that all quadrants have their pros and cons, and it is not necessarily better to move from left to right or bottom to top. Every quadrant is a potential target, depending on the point of view (e.g., operator, customer, regulator) and the overall maturity of the transport system within the market.

Every country’s rail market has unique characteristics and corresponding national macroeconomic factors. Individual assessments were conducted to create thorough reports for each market. We selected and examined eight markets, taking a deep look at market regulation, the attractiveness of rail, and the strategic direction that each market is following to further develop its systems.

France

France’s passenger rail market is Europe’s second largest after Germany; its freight rail market is the third largest after Germany and Poland. Thanks to rail market liberalization, freight transport’s 12% EBITDA margin in 2022 was better, relative to other European countries. The margin of B2C long-distance passenger activity back to pre-COVID levels, with a 2022 EBITDA margin of 17%, up from 15% in 2019. The 2022 margin demonstrates the profitability potential of the French long-distance market. In 2022, the EBITDA margin for B2G (business to government) regional train activity was 6%, down from 7% in 2019. It is worth noting that the steep toll increases announced by SNCF Réseau for 2023 and 2024 are likely to seriously impact profitability of all activities.

Development prospects will remain important over the next 10-15 years, thanks to ambitions to double passenger and freight traffic. Reaching this goal will necessitate a significant increase in the modal share of rail, from 10% in 2019 to 15% in 2040 for passenger transport and from 10% to 23% for freight. Debates are underway over public policy pertaining to rail financing. Policy issues include funding to build new high-speed lines, developing regional train networks around 10 of France’s major cities, investing in modernizing the network, and generating public support for freight rail development.

In terms of competition, France’s freight market was privatized in 2004 with two major consequences: SNCF, the state-owned national rail company, now represents only about 70% of market share, of which approximately 20% is through SNCF subsidiaries and 50% is through Fret SNCF. This share will fall by at least a further 10 pts by 2024, in response to the demands of the European Competition Authority. The value chain has been strongly divided from development of rolling stock companies (ROSCOs) and development of maintenance for third parties.

The French passenger market opened up to competition for open access operators on high-speed long-distance routes in 2021 and by tender on regional transport. Several competitors have entered or are currently entering the market, including Trenitalia and Renfe. Over the long term, SNCF could lose between 10%-15% of its market share to competition in both regional and long-distance transport. The value chain is also changing: LISEA wants to offer maintenance capacity, Getlink wants to set up a ROSCO to focus on cross-channel rolling stock, and the Caisse des Dépôts is considering a ROSCO for regional rolling stock. SNCF may be able to monetize some of these activities in the future.

In summary, France’s market is attractive because it is growing (up 3% per year on passengers, assuming the market doubles by 2040, and up 6% per year on freight, assuming the market triples by 2040). The market has significant potential to improve profitability (the cost weight of tolls and rolling stock are still high in France), and regulation is decreasing as the market opens in either open access or via tender. These conditions offer opportunities to foreign rail operators (Renfe, Trenitalia), start-ups (Le Train, Kevin Speed), and private equity (PE) firms investing in rail assets (CDPQ, DWS). The expected growth in traffic should also allow SNCF to grow its national market by expanding its high-speed low-cost service Ouigo, defending its regional trains’ market share, and launching new activities in the value chain.

UK

Thanks to the UK’s commitment to reach net zero by 2050, the modal share of rail will increase substantially from 2022 levels for both passenger and freight traffic. Increased regulations on carbon emissions and urban air quality will support the modal shift to rail.

Rail travel offers a more sustainable option than traveling by car or plane. A rise in passengers transported by rail is anticipated, as conventionally fueled vehicles are gradually phased out and more sustainable transport modes gain popularity. In 2019, there was a 3% increase of passengers using rail transportation; by 2040, rail passenger traffic is projected to increase by 50% due to more environmentally conscious customers. Following the opening of London’s Elizabeth line, billions of dollars have been invested in High Speed 2 (HS2) and the Transpennine Route Upgrade (TRU), which will increase passenger capacity and free up former passenger capacity for increased freight flows.

Great progress has already been made toward greening the UK’s rail network. To date, 42% of the network is electrified, and a combination of battery and clean fuels will eliminate all diesel rolling stock at the remote ends of the network. By 2040, we expect to see 100% rail electrification. The rail sector, which suffered fragmentation during the mid-1990s, is being restored by a unified, innovative national railway offering increasing levels of customer experience, driven by private sector operators of regional contracts.

Several large passenger operators, including National Express and NS, have left the market. By 2040, it is expected that the network will remain state-owned, with multiple private sector organizations operating under tightly specified contracts to deliver high-quality passenger services. The freight sector remains dominated by four private sector operators who actively compete to deliver freight transport services to support other sectors of the UK economy.