The digitalization of the economy is profoundly changing trade. Traditional retailers must transform to survive reduced foot traffic and sales. Postal operators that have not yet outsourced their branches face the same problems as retailers, amplified by the progressive disappearance of mail, the growth of virtual banking, and the digitalization of a substantial proportion of counter operations. A deep transformation is necessary. In this Viewpoint, we share how retail networks, once transformed, could represent major assets for postal operators by differentiating their value proposition in e-commerce and taking advantage of the increasing constraints of urban logistics.

RETAIL’S PROFOUND TRANSFORMATION

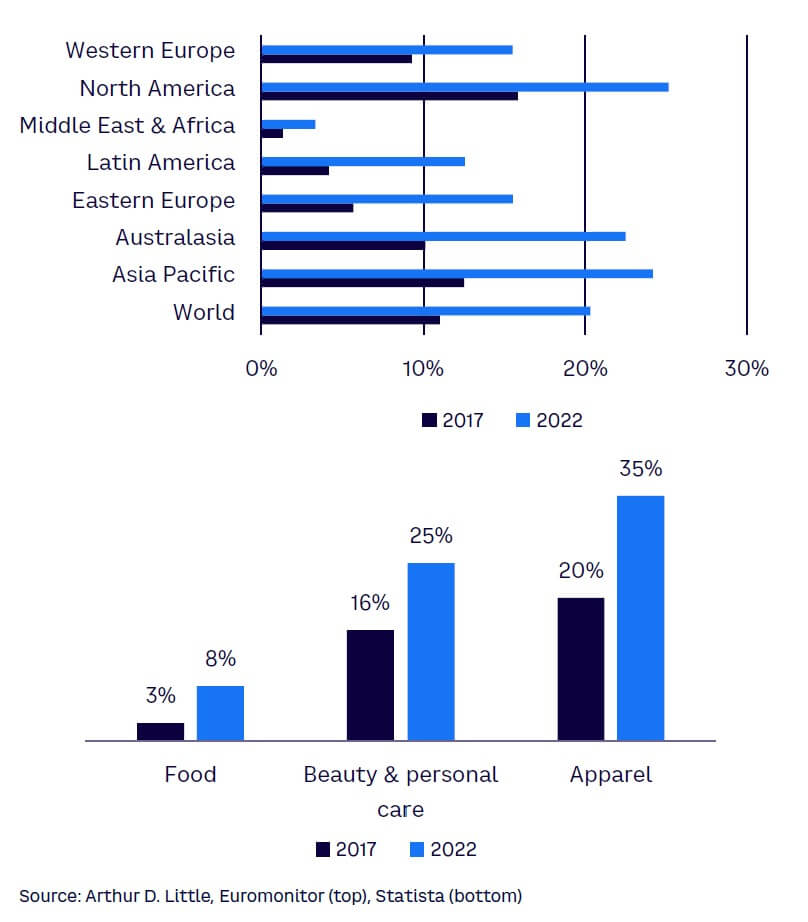

The weight of e-commerce is increasing rapidly across the globe, covering all types of categories, and soon may reach remarkably high levels (see Figure 1). This is dramatically shifting the retail sector. Indeed, the penetration rate of e-commerce could rapidly exceed 25%-30% in all regions. Euromonitor cites South Korea as a prime example, where the penetration rate in 2021 surpassed 40%.

Challenges to traditional retail come from two different fronts:

-

Economic models based on high fixed distribution costs, including real estate and sales staff, with fewer sales in stores.

-

Little opportunity for price increases of goods due to the price transparency that e-commerce has brought.

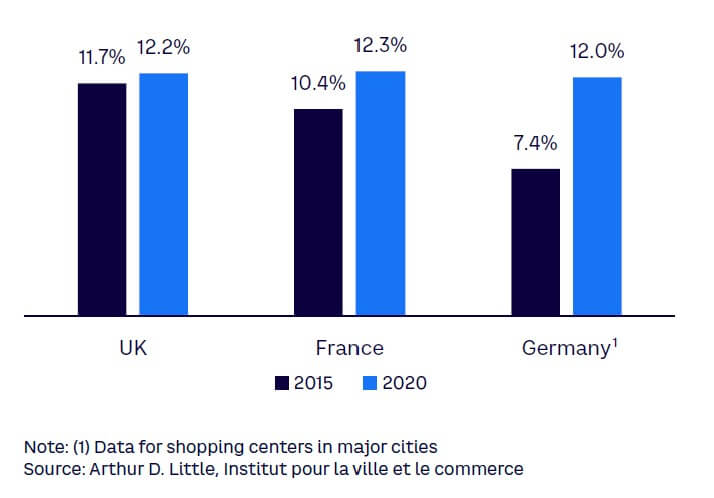

As a consequence, the average level of retailer margins has fallen in recent years and remains low, leading to both a growing number of failures/closures of physical stores and a steadily increasing commercial vacancy rate, especially in low GDP growth countries (see Figure 2).

REINVENT OR DISAPPEAR

Traditional retailers do not have many options. They have expanded their sales channels by combining physical commerce and e-commerce into a coherent whole. Now, physical stores are evolving beyond these diversified sales channels by offering several initiatives aimed at incrementing their purposes or functions. These evolutions fall into three notable categories:

-

Logistics. Traditional points of sale are no longer solely distribution points for products; they also function as logistics points for e-commerce with multiple functions: click and collect, pick up/drop off (PUDO) locations, shipping from store, and returns.

-

Format. The shift of sales toward online transactions has led to smaller store formats. However, the physical nature and formats of stores are evolving into showrooms that integrate brand corners, offer ephemeral or seasonal sales, etc.

-

Customer experience. These evolutions aim to take advantage of the physical world to support in-store traffic and develop customer loyalty. The emphasis can be on product experience (e.g., testing at Boulanger), product customization (e.g., Nike), or trainings (e.g., makeup courses at Sephora), for instance.

These new features are producing positive results on their own but using them in combination can create even better results, as there is no single “magic recipe.”

EVEN TRUER FOR POSTAL NETWORKS …

As a specialized retail network, post offices are even more exposed to the changing demand for traditional services since (1) demand for mail is rapidly declining and (2) remote banking applications are eliminating the need for some branches to fulfill banking services. Also, part of the non-postal diversification services that some postal operators have developed, such as over-the-counter bill payment and government or administrative services, are being replaced by digital services as well.

The main exception to the substitution trend is the increase in parcels stemming from the growth of e-commerce. Both purchases and returns create an additional workload for post offices, which can generate revenue and provide lower costs than home delivery.

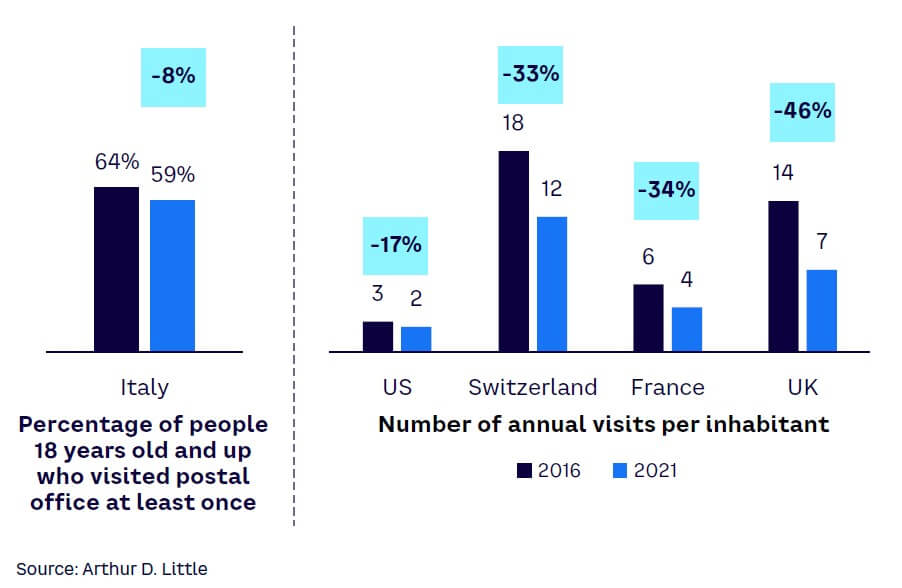

Notwithstanding the impact of parcels in the branches, the overall traffic in post offices is declining quickly (see Figure 3). This change raises crucial questions about the economic model and usefulness of these networks.

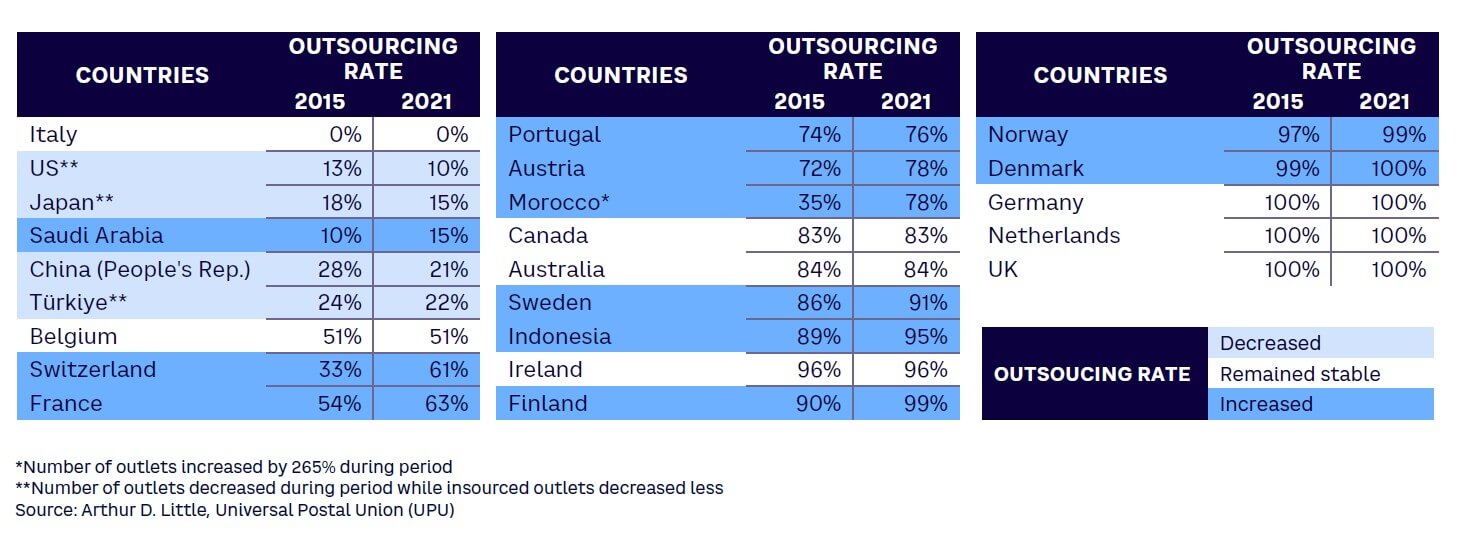

To cope with these trends, some postal operators have outsourced their retail activities to third parties. This move allows them to suppress high fixed costs and make the cost of sales and consumer contact points more variable. Postal operators mainly engaged in logistics activities, including mail, parcels, express, and warehousing, have made the most use of this type of outsourcing. Outsourcing is ongoing, recently (see Table 1).

In parallel with the outsourcing movement, postal operators that have maintained their own retail network have sought to diversify their activities. There has been a great deal of trial and error. Three new services, unrelated to banking, have successfully emerged:

-

Telecommunications, mainly in the form of mobile virtual network operators (MVNOs). Developments have shown that a “call for partners” approach has been particularly effective in this kind of business.

-

Activities on behalf of governments or utilities to facilitate local services (e.g., bill payment, identity or official document delivery, document certification, medical file management).

-

New services, notably for the public sector, such as organizing theoretical driving license exams in France or providing Internet access in African or Middle Eastern countries.

POST OFFICES AT THE CROSSROADS

Unfortunately, multiple developments have not made a sufficient enough contribution to address the decline in traffic and network revenues. Postal operators therefore face a dilemma: make the most of their consumer network or drastically lower their costs by reducing their footprint and/or outsourcing their networks. But if they aim to enhance their networks, they must implement new recipes.

OPTIMIZING NETWORKS THROUGH OUTSOURCING

Continuing to execute and intensify postal outlet outsourcing is one option. This was widely implemented by postal operators during the 2000s, notably by those whose business portfolio was mainly logistics. Note, however, that managing an outsourced network is costly (especially due to instability of business and a high number of failures). It is also interesting to observe the current trend of post offices increasing their points of contact, even when outsourced, driven by the need to increase territorial-presence density (particularly for B2C, out-of-home parcel delivery to PUDOs or lockers).

DIFFERENTIATING AT THE FIRST & LAST MILE

However, postal operators should also consider leveraging their retail networks to improve their value proposition in e-commerce (e.g., for parcel delivery) and create a decisive advantage. In fact, the role of post offices can evolve and enrich itself via new activities that leverage their footprint and proximity in logistics, especially in urban areas. In this context, proximity refers to the density of these postal networks; generally, due to Universal Service Obligations, 90%-95% of the total population have access to a post office within 10 minutes of their residence.

There are opportunities today to diversify the use of these networks (or parts of the networks), particularly in the core business of postal services, by better using available resources and networks in a universal way and developing new value propositions that incorporate proximity as an advantage.

Three courses of action appear particularly relevant:

-

Develop logistics operations in branches (like mail and parcel delivery in close vicinity of offices), leveraging periods of low counter activity.

-

Develop new service offerings in logistics that leverage proximity and thus contribute to improved value propositions.

-

Capture value from higher volumes of business — by selectively offering retail network access to third-party logistics providers; this can happen without threatening the competitiveness of internal solutions.

These developments and changes to the core business do not exclude other relevant ways of maximizing commercial space. For example, post offices have already identified opportunities to share office space, host new activities (e.g., brand corners, ephemeral stores), or develop new commercial activities, mainly through calls for partners (which several post offices have already done in the MVNO field).

EXTENDING the OPERATIONAL PERIMETER

Integrating more postal operations within post offices is both feasible and relevant:

-

The pace of the workload at the counter during the day leads to underuse and allots more time to staff for other activities during lulls (which may occur twice a day and range from two to three hours).

-

Preparing delivery tours is usually automated and performed remotely, making it possible to pre-organize mail bags or parcels by order of delivery. It is therefore feasible to delegate mail and parcel-delivery operations to counter staff for nearby areas. Delegating is opportune, as it uses spare time while improving the economics of distribution; unproductive route time between the distribution center and delivery locations is greatly reduced due to better proximity.

-

Mail and parcel deliveries can be made on foot or by cargo bike within a designated radius around the post office, which has favorable effects on pollution and congestion in cities.

-

Mobilizing more post office staff during periods of high activity, particularly during the end-of-year peak period, makes it also possible to mitigate peak loads.

Multiple activities can be assigned to the retail network, including:

-

Servicing as PUDOs (with or without lockers), provided there are sufficient opening hours.

-

Using offices as departure points for postal workers delivering presorted mail and parcels and using counter staff to deliver these items during periods of low traffic.

-

Subcontracting parcel distribution to the post offices during peak periods.

IMPROVING VALUE PROPOSITION THROUGH PROXIMITY

Extending the operational perimeter of post offices also makes it possible to improve service through proximity. The post office can play the role of micro-hub by providing intermediate product storage for deliveries, which can optimize convenience for recipients and contribute to customer satisfaction. Services could include:

-

On-demand delivery of parcels or registered letters (similar to the services French start- up Tousfacteurs offers from Mondial Relay PUDOs).

-

Home delivery or parcel collection during specific time slots, with micro-tours operated by post office staff during low-traffic periods or subcontracted to local courier companies.

-

Implementation of a drive function (pedestrian or car) associated with PUDOs to improve service and differentiate the out-of-home delivery offer from competitors thanks to reduced waiting times. Such service is already provided by major US retailers as “curbside pickup” for their online sales. The customers use a geolocation app when picking up their purchased goods, enabling the store to prepare the product in advance and deliver it (to them in person or to their car trunk) upon arrival.

The location of a post office relative to its delivery areas also makes it possible for same-day delivery services when orders are shipped from stores or from regional warehouses.

Services can also cover diversification into new logistics market segments, such as reverse logistics for products to recycle, reuse, or repair, by making this activity convenient for individuals and affordable for recycling companies. This type of service also can be applied to any type of activity that requires precise delivery and working within tight time slots (e.g., meal delivery or food product e-commerce). Offering refrigerated pickup points for orders or home deliveries from these proximity points replicates what Italian postal operator Poste Italiane and its subsidiary MLK Deliveries have developed with their partner Mazzocco.

MAKE SELECTIVE OFFERINGS TO COMPETITORS

The activities performed by postal retail networks traditionally are reserved for their own postal operations — to function as a point of contact for their customers and their various postal business unit needs, including mail, banking, and insurance services. However, these services could be offered to competitors, provided the competitors do not gain a decisive advantage or that services are limited to operators positioned on flows of a different nature (e.g., courier companies).

This kind of approach is already implemented by Post Office in the UK (note that Post Office is independent of Royal Mail). Post Office has been acting as PUDO for DPD out-of-home delivery parcels since 2021, which enables DPD parcel recipients to pick up their packages from Post Office branches (and the service is expected to expand in late 2023 to include drop-off options). Parcel-delivery service Evri also partnered with Post Office at the end of 2022 to do a trial of in-branch sales and parcel PUDOs as it looks to provide a safe, stable and convenient location for customers to send, collect, and return parcels.

Postal retail networks are interested in leveraging their proximity, better amortizing their fixed costs, and capturing a share of the value on parcels that are not currently handled by the postal operator. For consumers, this means more convenience in receiving their parcels. For local authorities, this could result in a significant reduction in pollution from emissions and urban congestion. For competitors, this could lead to significant savings for the collection of their parcels, or the redistribution of failed deliveries. Thus, there are multiple benefits to considering collaborations between competitors.

Operations carried out on behalf of competitors need not be limited to operations done in the post offices. For example, e-commerce returns can occur in the post office, but the postal operator can also offer the service to concentrating and making available flows in regional logistics platforms or injecting them into the competitors’ agencies, which brings additional economies of scale.

To sum up, the following operations/services to competitors may be considered partially or in totality:

-

Collection points for failed shipments (those that were not delivered to the appropriate home), including the possibility of redelivery at the recipient’s request

-

Standard PUDOs for out-of-home delivery

-

Collection and concentration of return flows

-

Micro-hubs with delivery organized on demand or during a time slot chosen by the recipient

-

B2B relay points for mobile professionals (e.g., for maintenance activities, point-of-sale advertising, home services)

These logistic diversifications do not apply identically to all post offices and can be complemented by additional country-specific services. They are highly dependent on existing infrastructures and may lead postal operators to consider different network formats for different zones or within zones. In all cases, logistic diversification and careful change management must be part of all transformation projects. While the actions are of a high-stakes nature, they are vital for those who have maintained large retail networks and plan to use them as key assets for future development.

Conclusion

FROM COST HANDICAPS TO COMPETITIVE ADVANTAGES

In a previous Viewpoint (see “Postal Operators: The Need for Transformation and Corresponding Strategic Moves”), we discussed challenges faced by postal operators from the decline in their historical activities (particularly mail) and shared three strategic priorities:

-

Evolve the business model to defend and maintain profitability.

-

Capture growth from e-commerce and increase profits by building upon mail and retail assets.

-

Diversify the portfolio by leveraging mail and retail assets and entering attractive markets, especially in logistics.

These priorities naturally apply to the postal operators’ retail strategy. Improving profitability may require more emphasis on outsourcing. But postal branches also can be leveraged to differentiate their value proposition in both the last mile of e-commerce and in logistics. There’s an inherent need for a good balance between outsourcing and insourcing new business; what was once considered a burden is now likely to create a decisive competitive advantage for postal operators, especially in a context where urban logistics constraints are rising.