DOWNLOAD

DATE

Contact

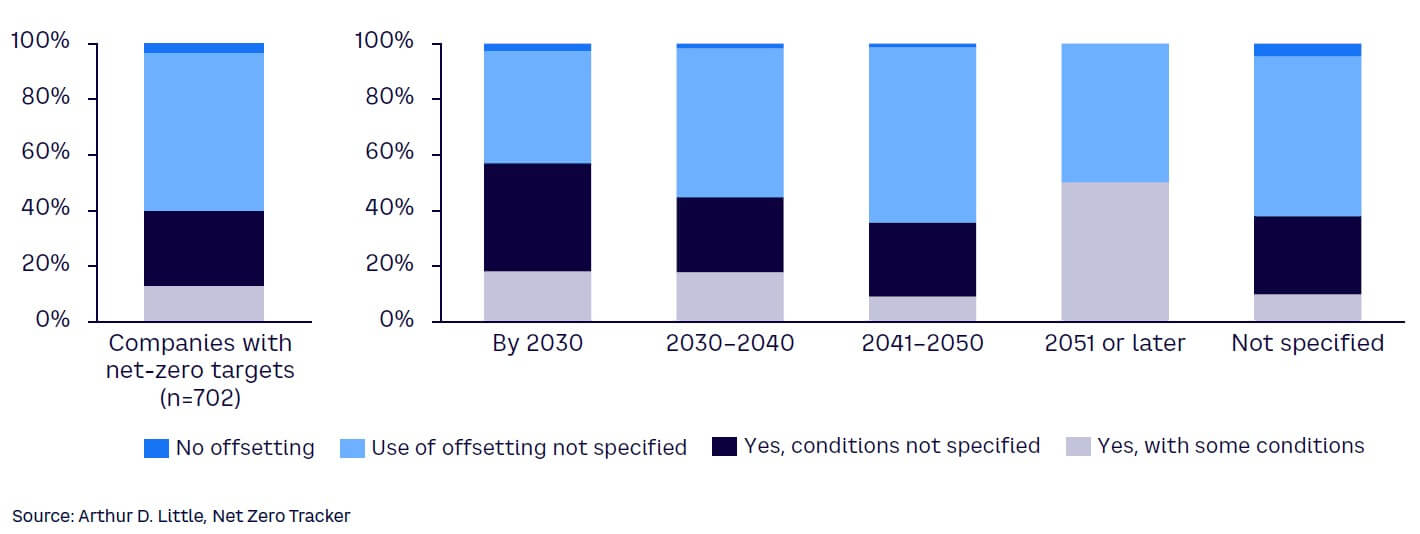

Of Forbes 2000 companies that have committed to achieving net zero emissions by 2030, a 2023 Net Zero Tracker study reports that 53% plan to use carbon credits, either to offset hard-to-eradicate emissions or to voluntarily advance their targets. However, the carbon offsetting market is still developing, and consumers, customers, and governments are scrutinizing the veracity of many claims. This Viewpoint provides guidance for companies that seek to incorporate carbon credits within their emissions strategies.

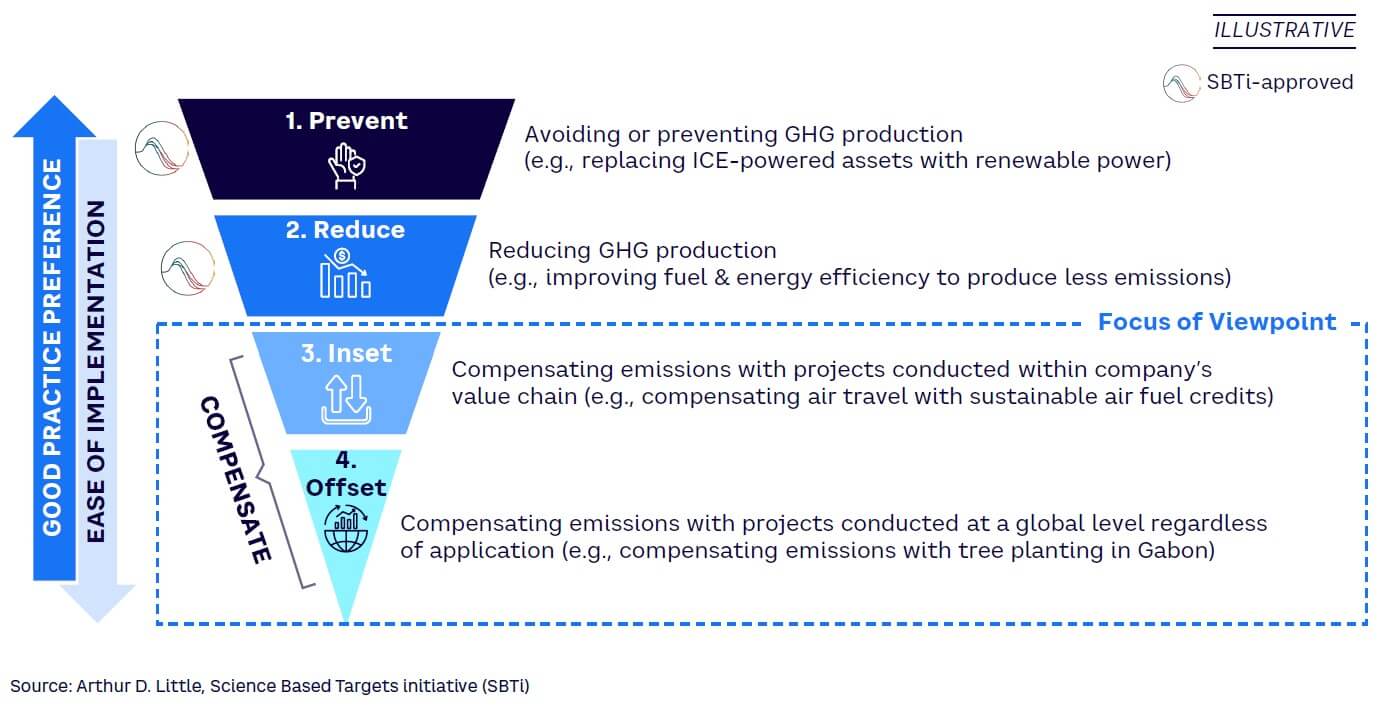

THE CARBON MANAGEMENT HIERARCHY

Companies face growing expectations and pressure to reduce their greenhouse gas (GHG) emissions now to achieve decarbonization. As a result, organizations have committed to meeting standards and publicly set deadlines for eradicating their emissions. For example, nearly half of the world’s largest publicly traded companies have committed to a voluntary net zero target, according to Net Zero Tracker.

To achieve GHG emissions targets, Arthur D. Little (ADL) suggests that organizations follow the carbon management hierarchy shown in Figure 1, focusing first on steps 1 and 2 and then using steps 3 and 4 to complete their full decarbonization strategy:

-

Prevent emissions by removing carbon-intensive operations, logistics, and raw materials.

-

Reduce and replace emissions by reducing material use, increasing energy efficiency, and changing existing operations to lower-carbon alternatives, such as using shipping for transport rather than air freight.

-

Use carbon insets, within the value chain, as described in this Viewpoint.

-

Use carbon offsets, outside their immediate value chain, as covered in this Viewpoint.

Additional hierarchies exist, depending on the quality of the inset/offset. We discuss the factors that contribute to quality in the “Understanding carbon management options” section below.

Achieving 100% decarbonization requires companies to overcome multiple challenges. This means that for some organizations and sectors, focusing solely on the first two steps in the carbon management hierarchy is not enough. Many are struggling to meet their obligations due to:

-

High costs and limited supplies of products, resources, and technologies (e.g., sustainable aviation fuel currently is around 2.5 times more expensive than normal kerosene)

-

Limited ability to monitor and control the activities of their supply chain, especially when it comes to Scope 3 emissions, such as emissions from the transportation of goods by third parties

-

Regulatory uncertainties and certification standards not yet in place, especially around certificates of origin for low/no-emission products, leading to consumer wariness about their adoption and slowing their rollout

-

Difficulties in removing some residual emissions with currently available technologies and processes

These factors mean that, after having done all that they are capable of in terms of avoiding and reducing emissions, companies are looking at options that either compensate for hard-to-abate emissions, bridge the gap until new emissions reduction technology is in place, voluntarily reduce emissions (such as from historic activities), or enable compliance with national regulatory schemes.

In some cases, companies are therefore turning to carbon credits in the form of insets and offsets as interim or longer-term solutions to reduce their hard-to-eradicate emissions, as shown in Figure 2. It is important to emphasize that carbon credits are not an alternative to reducing emissions through other means. They are only credible if an organization first has done its utmost to decrease current emissions.

THE DEVELOPING CARBON CREDIT MARKET

The carbon credit market is split into two groups of buyers:

-

Compliance — with governments using carbon credits to enforce greater sustainability. There are currently around 70 carbon-pricing initiatives (e.g., carbon tax, EU Emissions Trading System [ETS]) in place globally, covering 23% of 2022 global emissions. Many of these schemes, such as those in Japan, Korea, and China, allow the use of offsets (with specific limitations). Historically, the EU ETS allowed them as well, but they are no longer accepted in the fourth phase of the scheme (2021–2030).

-

Voluntary — driven by the private sector and used to reduce overall emissions for buyers or to compensate for historical emissions. For example:

-

Microsoft has committed to removing, by 2050, the equivalent of all its emissions since the company was founded in 1975. More than 85% of its carbon-removal portfolio in 2022 was made up of forest-based carbon credit initiatives. In 2023, the company announced it would purchase 2.7 million tons of carbon credits over the next decade generated from Ørsted's biomass-burning power plants; the carbon will then be buried under the North Sea.

-

Frontier, a consortium involving Alphabet, Meta, Stripe, and Shopify has announced a US $53 million deal with Charm Industrial to remove 112,000 tons of CO2 between 2024 and 2030 by converting agricultural waste into an oil that can be stored underground.

-

NextGen, a joint venture between Mitsubishi Corporation and carbon-removal project developer South Pole, plans to purchase over 1 million tons of carbon credits by 2025 and has already bought 200,000 tons.

-

Meta has agreed to purchase in advance almost 7 million tons of carbon credits from Aspiration, which will be delivered between 2027 and 2035. The credits will be from various carbon projects managed by Aspiration involving nature-based climate solutions, such as native reforestation, agroforestry, and sustainable agriculture practices.

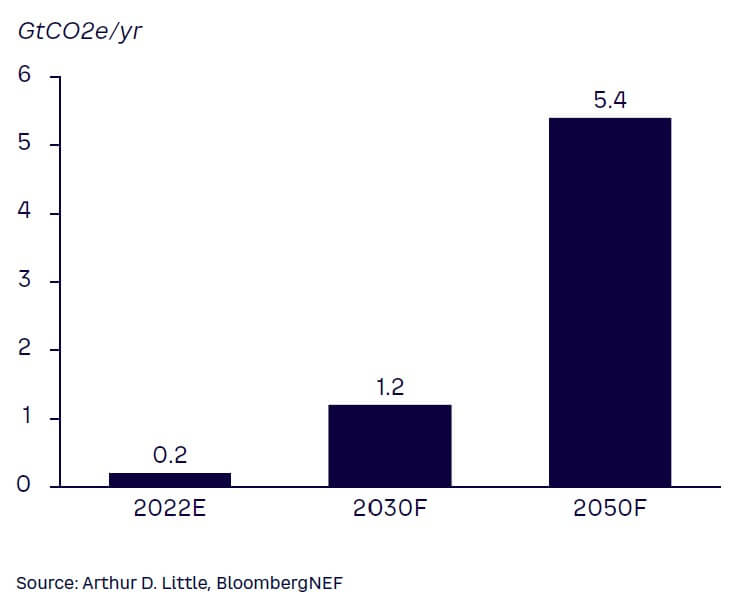

According to analysis by Trove Research and BloombergNEF, the voluntary carbon credits market is expected to grow around six-fold between 2022 and 2030, from approximately 0.2 gigatons of CO2 equivalent (GtCO2e) to around 1.2 GtCO2e, before reaching approximately 5.4 GtCO2e in 2050 (see Figure 3).

UNDERSTANDING CARBON MANAGEMENT OPTIONS

When setting their strategy for hard-to-abate or historic emissions, organizations must understand the differences between the two forms of carbon credits: offsets and insets.

-

A carbon offset is an activity that compensates for the emission of CO2 or other GHG by providing for an emission reduction elsewhere. For example, Disney has purchased carbon offsets in the form of REDD+ (reducing emissions from deforestation and forest degradation) projects in Peru.

-

A carbon inset involves emission-reduction activities implemented within a company’s value chain. For example, IKEA has bought carbon-reduction certificates for a fuel switch, using sustainable biofuel in a vessel that normally would have burned fossil fuel. This “insets” a portion of IKEA’s marine transport emissions.

While insets are typically more expensive per ton of CO2 equivalent (e.g., experts estimate ~$150 per ton of CO2 for marine biofuel insets versus ~$7 per ton of CO2 for REDD+ offsets), they are arguably more impactful as they are closely related to mitigating a company’s own emissions. Reductions take place in the company’s own value chain and contribute to transforming their own supply chain toward a more sustainable future. They therefore have increased credibility with stakeholders and consumers. However, there can be significant differences between the quality of credits in each of these categories, based on factors such as the type of technology/nature-based solutions involved and the co-benefits received.

CARBON CREDIT OPPORTUNITIES FOR ORGANIZATIONS

As demand for carbon credits increases globally, companies should consider what offsets can mean for them. These offsets can impact their business strategy in four key ways:

-

Buy credits to supplement their decarbonization programs and achieve their targets. Examples include:

-

Meeting regulatory requirements in hard-to-abate areas/sectors

-

Temporarily reducing current footprint until real abatement projects are implemented

-

Compensating for residual carbon footprint after emissions-reduction programs have been developed

-

Compensating for historic emissions since the organization was founded

-

-

Use carbon credits to finance sustainable activities. For example, an industrial company may invest in carbon-reduction equipment and then utilize it to capture/sequester more carbon than is needed for the company’s own compliance. The excess carbon captured can then be sold at attractive rates as high-quality carbon credits to partially finance the overall installation cost. Additionally, companies can take advantage of subsidies such as the US Code Section 45Q Credit for Carbon Oxide Sequestration. This enables companies to generate between $60-$180 per ton of CO2, depending on the type of activity. (We will explore using carbon credits for sustainable finance in more detail in a future Viewpoint.)

-

Sell credits as a key revenue stream by leveraging their existing capabilities. Today, many organizations possess the key assets and capabilities that are required to develop carbon credits, such as mid-scale project management expertise, access to land, access to resources, stakeholder management, and marketing capabilities. Harnessing these capabilities provides the opportunity to generate new income streams around carbon credits. For example, a partnership between oil and gas companies Wintershall Dea and Equinor has secured licenses to store carbon under the North Sea.

-

Develop new products and value propositions based on high-quality carbon credits. Many companies are already offering retail clients opportunities to offset their activities, including travel and hotel stays, ecommerce purchases, or energy companies offering green gas (a mixture of biogas and natural gas) combined with carbon credits at a higher price. In fact, 2023 research from Circana and New York University’s Stern Center for Sustainable Business found that sustainably marketed products are increasing their share in the US and are commanding price premiums.

CHALLENGES IN THE CARBON CREDITS MARKET

Whether they are buying or selling carbon credits, companies must understand and overcome a variety of challenges within the market, including:

-

Accusations of greenwashing. The practice of using credits to appear more sustainable but without changing underlying behavior or activities has led to skepticism around the market as a whole and whether specific schemes in fact offset emissions. For example, some projects that claim to be protecting forests have instead seen widespread deforestation, making the credits issued worthless, while some leading certification bodies have been accused of approving valueless offset schemes. Better monitoring, reporting, and verification as well as robust base scenarios are needed to rebuild confidence. Additionally, the recent emergence of independent rating agencies that quantify the likelihood that a benefit will be achieved will also increase transparency. At the same time, on the demand side, using credits is credible only if an organization has done its utmost to decrease emissions through other means. This is particularly important if carbon reduction is linked to compensation strategies, as there needs to be a clear case demonstrated for the use of credits.

-

Developing policies and ecosystems. The carbon credit market has existed for more than 30 years. However, its policies and ecosystems have developed progressively. Recent events, such as the inaugural auction on Malaysia’s carbon credit trading exchange, which saw limited interest with credits sold at minimum reserve price, highlight the market’s evolutionary journey. We anticipate gradual maturity and increased engagement as understanding and awareness of the market’s potential continue to grow. Depending on how developments evolve, the global voluntary carbon market may reach between $5-$50 billion by 2030, according to ADL analysis. On the other hand, the journey toward a sustainable future continues, and even though the recent COP28 conference has concluded without reaching a consensus on carbon trading rules, discussions remain ongoing, reflecting the commitment to finding a solution.

-

Quality credit realization, cost, and budget overruns. Project identification, development, approval, and execution can be challenging and time-intensive, especially in environments where carbon credit development is still a new topic. These challenges have been apparent with, for example, Shell removing mention of its $100 million/year carbon credit program from its recently updated strategy.

-

Changing regulations. Whether carbon credits can be used to meet emission-reduction targets differs among countries/regions. The credits that are eligible also change. For example, in the early phases of the ETS, using international credits was allowed, but this ended from phase 4 onward. More recently, the EU has banned the use of “climate neutral” claims based on carbon offsets. There is also a lack of unified regulations around the market, although this is being addressed through actions such as the recently published Core Carbon Principles (CCP) of the Integrity Council for the Voluntary Carbon Market (ICVCM), focusing on the supply side, and the newly issued guidelines of the Voluntary Carbon Market Integrity Initiative (VCMI), focusing on the demand side. In this respect, new reporting regulations (especially the EU’s Corporate Sustainability Reporting Directive and the International Sustainability Standards Board reporting standards S1 and S2) will further increase overall data transparency.

-

National climate goals. Countries increasingly understand the value of their natural resources to the carbon offset market and are introducing new regulations to both maximize the revenues these generate and to ensure they benefit their own, national decarbonization targets. For example, the Tanzania government reported a significant boost in its voluntary carbon market as more than 20 companies committed to investing over $20 billion in carbon offset credits, with the country already attracting over $1 billion in investments since it adopted legislation on carbon trading in 2022. Given that we are still not on the path of reaching the Paris Agreement targets, negative emissions will be required, and some of them will be supplied through voluntary carbon credits.

-

Lack of pricing transparency. Most current deals are over the counter, with the first carbon credit exchanges launching only recently. These exchanges (such as AirCarbon Exchange or Xpansiv CBL) have contributed to higher liquidity and price transparency.

KEY CONSIDERATIONS IN THE CARBON CREDIT MARKET

When developing their carbon offset strategies as part of their overall net zero targets, companies must understand and analyze eight key areas:

-

Regulatory changes. The regulatory regime around emissions currently varies around the world but is seeing a general tightening over time, especially in hard-to-abate areas. For example, in the EU, planned reforms to the ETS will require the installations it covers to reduce their carbon emissions by 62% from 2005 levels by 2030 — a 44% increase on the current target. Additionally, from 2026, the EU Carbon Border Adjustment Mechanism will see imports of steel, cement, fertilizers, aluminum, and electricity subject to a carbon tax. These reforms drive pricing of carbon credits and potentially impact requirements and companies’ strategies. In November 2022, the EU Commission released a proposal for an EU carbon-removal certification framework. This defines qualifying carbon removals as well as a process for verifying and monitoring projects. The regulation would cover projects including forest restoration; carbon capture, utilization, and storage (CCUS); and direct air capture (DAC). The Energy Transition Accelerator, announced at COP27 as a joint effort between the US Department of State, Bezos Earth Fund, and Rockefeller Foundation, is aiming to become a mechanism for climate finance and green development in developing economies. Companies looking to meet net zero and emissions-reductions targets would purchase carbon credits from emissions-reduction projects in the power sectors of qualified developing countries. Additionally, implementation of Article 6 of the Paris Climate Agreement would create a global set of standards with the potential to consolidate the highly fractured global market that exists today.

-

New and existing competitor activity. The expansion of the carbon credit market is attracting a range of players. For example, Shell has created its own voluntary carbon credit business, acting as a trader of credits from a portfolio of environmental projects around the world. In shipping, Maersk is providing sustainable biofuel alternatives to its customers as carbon insets. Financial services firm Rabobank has created a partner ecosystem, helping farmers store CO2 in the soil, determine and monitor impact, and sell generated carbon credits to its corporate clients, with farmers receiving 75% of the price. Companies should look to understand current market activity and also monitor the strategy and tactics of both new and existing competitors.

-

Role(s) in the carbon credit value chain. Companies need to decide where to play in the carbon credit value chain in terms of activities and opportunities. They might simply become a purchaser of credits or they can develop their own credits for internal use alone or also sell them on the open market. They must decide whether to source from individual project developers, invest in early-stage projects (pre-issue), buy from established registries and sources, or use emerging marketplaces and exchanges. Companies should determine which approach will deliver the greatest long-term value and enable them to meet their broader objectives.

-

Meeting effective standards. There is a range of standards and certifications available on the market, from international organizations such as Verra and Gold Standard, to country-specific ones such as the Thai T-VER credits and Australian Carbon Credit Units. Companies must choose which standards to adhere to for their own projects and to ensure that any investments they make are fully verifiable and audited. With the ICVCM and VCMI promising greater oversight of the sector, focusing on quality is vital to avoid accusations of greenwashing. Going forward, an overarching standard may be required to allow for global carbon trading and to ensure a high level of compliance in the market.

-

Size and scale of investment. Companies need to effectively plan the extent of their involvement in the carbon credit market, whether as a buyer, trader, or supplier. They should fully understand any constraints that will impact the limits of their ambition along with the factors to take into consideration when it comes to target volumes of credits.

-

Types of carbon credit. There is a wide selection of available carbon credits, including those for nature-based abatement solutions (e.g., reforestation projects), protecting ecosystems (e.g., preventing deforestation), and industrial removal (e.g., CCUS or DAC) or avoidance. Solutions based on technology tend to be more expensive. There are carbon credits with co-benefits that go beyond GHG removal and avoidance (e.g., meeting other United Nations Sustainable Development Goals). Local carbon credits are gaining popularity, but the volume potential in many countries is limited. Organizations should understand which are the best strategic fits for their needs and volumes and ensure that they complete sufficient due diligence so that projects provide good quality rather than phantom credits. To ensure such quality credits are effectively invested, a credible auditor is critical. While there are currently many auditors, it is likely that a relatively small number will be seen as credible as the market develops.

-

Partner selection. The carbon credit market is an emerging ecosystem where standards are not yet fully in place. That means it is vital to partner with responsible, high-quality companies to ensure verifiable results. Companies have the option of buying credits from brokers, exchange platforms, project developers, or even “codeveloping” them with project developers. Whichever channel they choose, companies must conduct the required due diligence to protect against potential fraud or greenwashing, and ensure that the right products are delivered on time and within budget.

-

Organizational capabilities and risk appetite. Depending on the role selected within the carbon credit market, organizations are likely to require new competencies and expertise. After deciding where to operate, companies should carry out a full review of existing skills and resources to understand the additional capabilities required to deliver success. Examples of skills that may be necessary include commercial deal making, technical due diligence, marketing, and carbon accounting. Risk appetite should include considerations of exposure to different projects, technologies, suppliers, evolving standards, and definitions of quality.

Conclusion

EMBRACING THE OPPORTUNITIES OF CARBON CREDITS

The use of carbon credits as part of wider emissions strategies is expected to increase due to greater regulation and ambitious company targets. To play in the market, businesses should:

-

Create a holistic decarbonization strategy (avoid and reduce) and roadmap that includes direct (Scope 1) and indirect (Scope 2 and Scope 3) emissions before investigating the potential role of carbon credits.

-

Actively consider the role that the company wants to take in this ecosystem — buyer, seller, or trader — and its contribution toward supporting overall growth and ecosystem integrity.

-

Move quickly to secure supply channels, resources, and to build necessary expertise.

-

Develop a strategy focused on business needs and strengthening competitive advantage, backed by verification and monitoring to avoid greenwashing risks, while ensuring it delivers on stated objectives.