DOWNLOAD

DATE

Contact

Providing voice services is among the core functions of telcos. It may seem counterintuitive but outsourcing international voice services has the potential to create value and enhance service quality. In this Viewpoint, we summarize the options available for stand-alone telcos and small telco groups to manage the decline in international voice business and illuminate benefits they can gain from outsourcing international voice. We also highlight the outsourcing process and strategies to mitigate common challenges.

THE INTERNATIONAL VOICE BUSINESS: AN OVERVIEW

A telco’s international wholesale business typically does not command much attention from management; international voice is just one of several categories within international wholesale whose performance must be analyzed by expert eyes only.

We begin with the basics of how international voice works before moving on to the complexities in helping to develop a clear case in favor of outsourcing. A telco’s international voice business is tasked with terminating international direct dialing calls on other telcos’ networks (outbound calls) and terminating international calls coming into its own network (inbound calls). The telco receives payments for the inbound calls and has a revenue line linked to them. The telco must pay the other parties for outbound calls, and therefore, has a cost line linked to those (revenue and margins related to outbound international calls typically fall under retail, not wholesale). To enable termination, the telco has to negotiate rates with each of its international partners.

The telco also maintains the infrastructure, including points of presence (PoPs) in multiple locations and interconnects to other global operators. It also retains staff that are either fully or partially responsible for commercial and technical activities for the international voice business.

RISING CHALLENGES FOR MANAGEMENT

The international voice business has presented management with an increasingly complicated series of problems, including those outlined below:

-

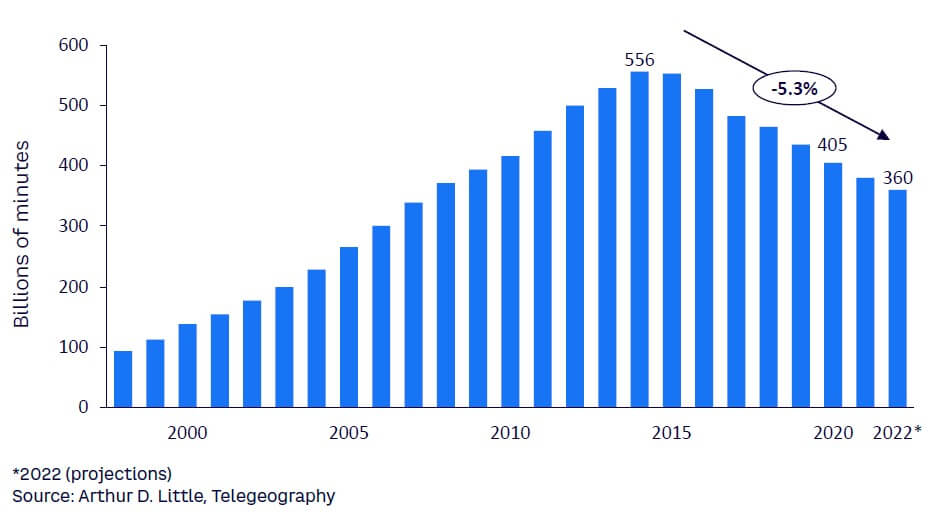

Volume decline. The international voice business began declining significantly for telcos around 2015–2016. Voice traffic peaked at 556 billion minutes in 2014, but by 2020 had declined to 405 billion minutes and was predicted to drop to 360 billion minutes in 2022, an annual decline of 5.3% (see Figure 1). Although overall international voice traffic is increasing by about 13% annually, telcos’ share of it is declining. This is primarily due to the rise of free or low-cost voice apps (e.g., Skype, Viber, WhatsApp). It was initially thought that the pandemic would relieve pressure on telcos to address international voice, but it only accelerated the decline thanks to much of the global population becoming comfortable with Zoom, Microsoft Teams, and similar video-calling applications. Despite declining revenues, telcos still must maintain large asset bases and cover operational costs to support international voice, which is fundamentally unsustainable based on low volumes, which continue to fall.

-

Upside-down economics. Stand-alone telcos and small telco groups are watching their inbound revenues sink yet cannot lower their outbound termination costs. Termination rates are linked to volumes, and declining volumes weaken the position of smaller telcos at the negotiating table. This imbalance causes their net position in the international voice business to decline year-on-year, by nearly 30% as we observed at one small telco group.

-

Volume volatility. The voice business is volatile, especially for a telco engaged in the transit business (i.e., carrying international voice calls between two other telcos). Traffic patterns are largely dependent on retail offers within the originating country. Furthermore, transit traffic is unpredictable, as calls are dynamically routed following the least-cost-routing method. Therefore, international voice revenues and margins cannot be easily foreseen and budgeted — and could cause fluctuations in company revenue that are not easy to explain to board or investors.

-

Damaging fraud. The international voice business is prone to fraud. Several players in the market terminate traffic through illegal routes known as “grey routes,” which causes the terminating telco to lose its rightful revenue from the inbound traffic. Many fraud mechanisms exist, requiring telcos to constantly trace and block such routes, but it is nearly impossible for telcos to find and block all grey routes. Therefore, the fraud leads to significant revenue leakage, sometimes even exceeding 50% of potential revenues.

-

Costly interventions. A telco may attempt to inflate its revenues by “tromboning” traffic. Tromboning occurs when two or more telcos agree to reroute their own traffic via the other telco’s network, enabling both to recognize higher termination revenues. While this may temporarily fix the revenue line, it dilutes overall earnings before interest, taxes, depreciation, and amortization (EBITDA) margins.

-

Unexpected costs. The international voice business has become increasingly risky. The growth of fraudulent traffic has compelled regulators in some countries to adopt origin-based rating policies, which impose surcharges on illegal traffic. A simple error in routing may incur unexpected costs, which are potentially devastating from a business case point of view.

In summary, the international voice business is declining, volatile, and prone to fraud, potentially impacting overall revenues and earnings of telcos. Beyond these daunting economic dynamics, however, quality management is another side to the problem that many telco industry executives fail to recognize. Superior call quality is the primary (or only) value proposition telcos can currently offer over their competition with the software giants that offer free international voice. Telcos are inadvertently giving up this quality advantage in their quest to lower costs by moving (voluntarily in some cases) to suboptimal and/or grey routes. Calls terminated via grey routes are low quality and typically do not have calling line identification (CLI). Therefore, the customer experience is negatively impacted, leading the customer to spend less time on international calls and forgo calls with an unknown CLI. The impacted customer then permanently migrates to an over-the-top platform, causing a downward spiral for the telco’s international voice business. This has become so widespread that telcos sometimes do not realize that their calls are being carried through grey routes, despite paying for the highest-quality route. As a result, telcos are inflicting major reputational damage on their most mature product and themselves. In practice, a telco might lose between 8% and 30% of its international voice traffic due to low quality. In one case, the lower quality not only impacted a telco’s international voice traffic volume, but also its retail market share.

STRATEGIC OPTIONS: OPTIMIZE, CONSOLIDATE, OR OUTSOURCE?

How can telcos overcome the problem of managing a declining business plagued by costly fraud and other challenges? Three options emerge (one of which poses the greatest benefit and smallest risk to telcos).

1. Optimize existing business

A large telco may attempt to optimize its existing international voice business by shedding low-margin routes to improve its margin percentage, though the absolute margins would decline. If the telco is still using time-division multiplexing instead of IP (Internet protocol), it can also attempt to optimize its technology infrastructure. But historically, this optimization provides minimal gains. The telco will not build the necessary critical mass to stabilize pricing and prevent fraud. Therefore, optimization is not an attractive option for most telcos.

2. Consolidate international voice across operations

Consolidation comes into play by merging the international voice business across a telco group’s operating companies — and approaching the market as a single entity. This strategy has been executed by many large telco groups. In fact, many top international voice carriers started by consolidating the international voice business within their group, which prepared them to attract third-party business.

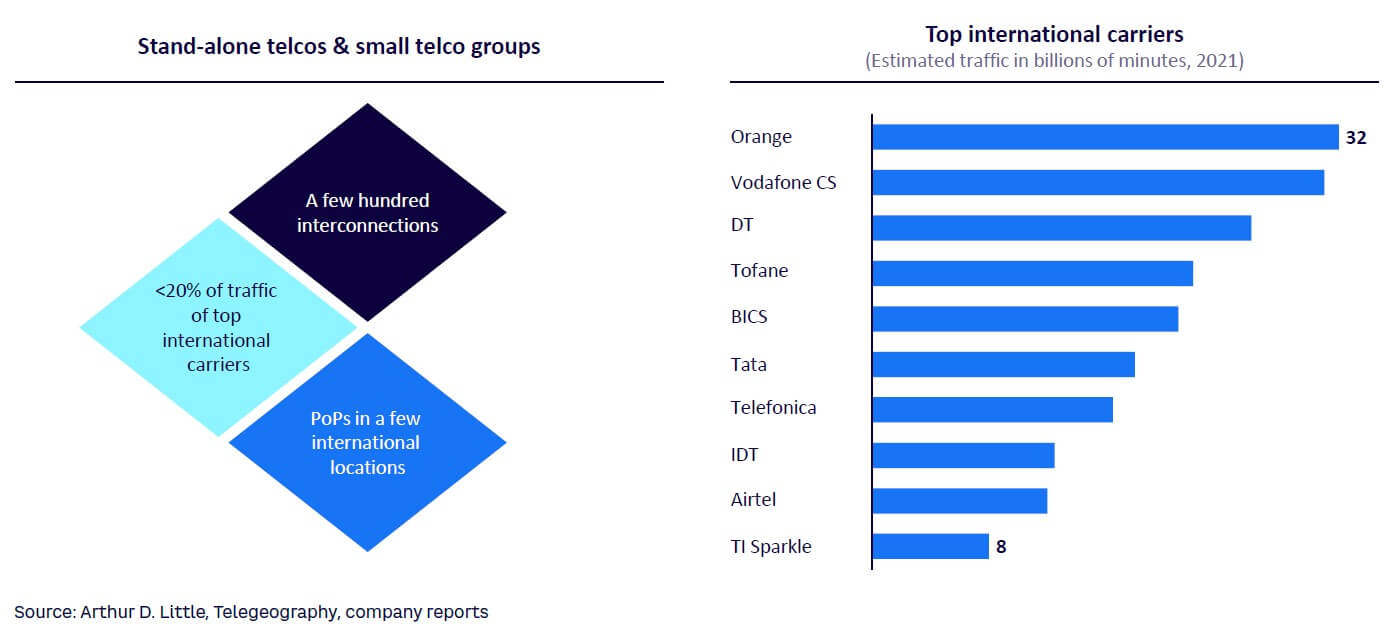

A small telco group, however, may find it too ambitious to use this method to increase its influence at the negotiating table. This is illustrated by the top international voice carriers, which carry 8-32 billion minutes per year each, while a stand-alone telco’s business volumes hover around a few billion minutes, maximum. Further, a small telco group’s scale may be too limited to develop and deploy state-of-the-art fraud prevention tools, even after consolidation. While it is possible to reap cost savings through technology optimization, depending on the existing configuration, the implementation cost of centralizing the platforms must be considered (see Figure 2).

3. Outsource to a specialist international carrier

Outsourcing refers to routing all voice traffic through the hub of an international carrier. The carrier manages the telco’s entire international voice business, including commercial negotiations with other telcos. It also deploys and operates interconnects and voice platforms. The telco and the carrier coordinate fraud prevention efforts and jointly assure call quality.

Outsourcing offers telcos multiple potential benefits:

-

Negotiating power. Handling large volumes positions the carrier to negotiate lower costs for outbound termination, even after charging its margin to the telco.

-

Fraud detection. The carrier’s footprint and large volumes provide the scale and capability to analyze traffic patterns and detect fraud. Therefore, the carrier can support the telco by identifying grey routes and assuring revenues.

-

Revenue generation. The carrier possesses a large number of interconnects, which can also increase the revenues from higher traffic through direct interconnects to the telco.

-

Risk mitigation. Financially, the telco benefits from transferring bad-debt risks (on payments from other telcos for inbound traffic) to the carrier. The carrier will be responsible for collection of payments from originating telcos and can manage it effectively through the settlement of payments between inbound and outbound traffic.

-

Cost reduction. On the technical front, the telco would need interconnects only to the carrier (one main, one redundant). Therefore, it can avoid the cost of adding additional interconnects; established interconnects can be used for other purposes. The telco can avoid the need for further investments in its voice platforms as well, as it will be using the carrier’s platforms. There is hardly any implementation cost.

-

Quality improvement. The carrier offers direct interconnects to most other telcos, paired with advanced fraud prevention abilities. The end user receives service with significantly improved quality.

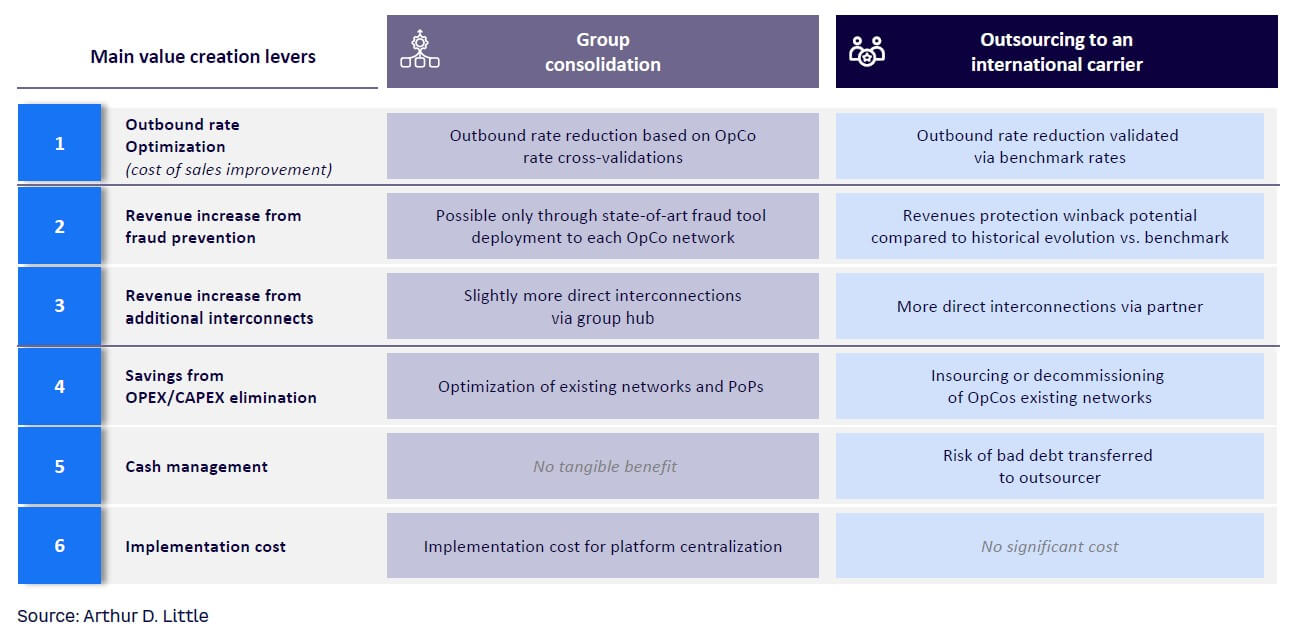

Through our experience with leading global telcos, we have observed that outsourcing offers three times more value than consolidation, through the multiple value creation levers shown in Figure 3. The primary downside of outsourcing is that it prevents the telco from pursuing the transit business, as it would have ceded its voice business and platforms. From our perspective, however, the telco is not forgoing a significant opportunity, as the transit business has low margins and is in decline.

In summary, there is very little potential in optimizing existing business. Consolidation, which many large telco groups have already enacted, can help, but it offers limited benefits and may not suit players of all sizes. Outsourcing has proven itself the most attractive option for stand-alone telcos and small-to-medium-sized telco groups. Indeed, outsourcing is an emerging trend and shows promise as the best way forward. Many telcos have already chosen outsourcing; indeed, the international voice market share of the top 10 carriers has increased by 11% between 2016 and 2019 in an overall declining market environment.

IDENTIFYING & MITIGATING CHALLENGES TO OUTSOURCING

The primary challenges to outsourcing international voice stem from within the telco:

-

Legacy voice team cooperation. Outsourcing can generate insecurity among members of an existing voice team. However, the outsourcing partner needs their support to understand and improve the existing business. For this reason, it is important that reducing staff cost is not the primary goal. Ideally, the initiative should originate with the upper echelons of management, as it is in a better position than the wholesale team.

-

Profit and loss visibility. A clear P&L view of international voice business hardly exists in any telco. Prospective outsourcing partners should be offered a complete and transparent view of performance over recent years to help them propose an informed offer. Similarly, a reasonable projection of the business for the next few years is required for a fruitful discussion with the outsourcing partner. The telco may consider inflating its projections to obtain a better value, but this tactic may only result in prolonged discussions.

-

Governance and collaboration. Both parties must trust each other and negotiate in good faith. Appropriate governance mechanisms give guidance to both parties so they can agree on critical elements, such as financial commitments, quality commitments, and so on.

INTERNATIONAL VOICE OUTSOURCING: SUCCESS FACTORS

When a telco decides to outsource its international voice business, it must clearly define commercial terms and operational principles with its outsourcing partner. Some key considerations include:

Commercial terms

-

Inbound voice. Select the appropriate model for inbound revenues, including send-or-pay model, fixed price per minute, target-based, value sharing, and so on.

-

Outbound voice. Select the method to determine outbound costs, including cost-plus, send-or-pay, or other models; determine the mechanisms to ensure competitiveness of outbound costs.

-

Transit/off-net business. Agree on compensation for the transit or off-net business, which will transfer to the outsourcing partner.

Operating principles

-

Operations. Identify and align the simplification and rationalization process post-handover; align the usage, cost, and implementation responsibility of the fraud platforms.

-

Human resources. Agree on how to migrate existing international voice staff after outsourcing.

-

Governance. Define the outsourcing contract structure and its governance; define quality metrics, service levels, and their governance.

The above may seem daunting, but different models have been tested in the market and deemed successful. These models offer opportunities for relevant learning and application. With support from a neutral advisor, a telco could be well placed to make the appropriate choices and outsource its international voice business.

IMPLEMENTATION IMPERATIVES

Telco leaders should deal with this pebble in their shoe before it turns into a stone around their necks. CEOs and CFOs are typically in the best position to set a voice outsourcing initiative in motion. A review of the telco’s existing business and operations is required to help evaluate the existing business; the findings can be used to prepare a short investment document for potential outsourcing partners. A request for information (RFI) would be issued to those potential partners, followed by workshops and discussions to tune the responses to cover all the requirements of the telco. After subsequent discussions and clarifications, the partner candidates submit their final offers, which telco leadership reviews before selecting the most suitable partner(s).

CONCLUSION

Next steps

Telco CEOs and CFOs must acknowledge the urgency created by the steady decline of their international voice business and be willing to act on an outsourcing plan. Stand-alone telcos and small telco groups, in particular, have limited time to protect their international voice businesses, but initiating the process can:

-

Stem revenue decline.

-

Reduce volatility.

-

Improve service quality and customer experience.

-

Shift management focus to more critical matters.

Support from neutral advisors and industry experts can help a telco create the conditions it needs to make decisions that will result in successful outsourcing while managing risk effectively.