DOWNLOAD

DATE

Contact

The global metals and mining industry faces a complex dilemma. Governments and other stakeholders want increases in the essential raw materials required for the energy transition while also pressuring companies to reduce their environmental footprint. In an increasingly volatile world, companies must balance these two aims while embracing opportunities and delivering business value.

CURRENT CHALLENGES

The metals and mining industry is responsible for approximately 8% of the world’s carbon footprint, with most emissions coming from metals refining and electrolysis, although mining also has large-scale environmental impacts. In addition to a need to reduce greenhouse gas (GHG) emissions, the sector faces growing pressure to lower its water use, improve its waste management, protect biodiversity and local communities, and ensure the safety and well-being of its workforce. This is reflected in increasing regulation across the globe.

Mining is essential to delivering the materials required for the green transition, including lithium, cobalt, and graphite for electric vehicle (EV) batteries. Copper demand is predicted to grow by 1.3x between 2023 and 2030, with nickel increasing by 1.8x, cobalt 1.9x, and lithium 4.3x. This is driving demand for stepped-up production and new mines, increasing the need for investment, despite long payback periods and uncertain future needs.

However, this predicted growth may not materialize and could be uneven in terms of regional requirements. For example, EV sales have slowed in the US, while battery makers are shifting away from expensive, hard-to-source metals like lithium to more common minerals, making future demands and profitability difficult to predict.

All this makes it hard to formulate effective sustainability plans. If you lag the market, your reputation and relationships with stakeholders will suffer, but if you are too far in front, you are at risk from requirements changes and market shifts. The metals and mining industry operates in a volatile, uncertain, complex, and ambiguous (VUCA) world, with fluctuating energy prices, uncertain regulation, resource nationalism, and climate change — all impacting decision-making.

To successfully navigate these challenges, companies must move beyond conventional management and leadership strategies in their daily operations. They must shift from seeing sustainability as a risk to embracing it as an opportunity, carefully selecting and prioritizing green initiatives that improve sustainability and positively impact shareholder value (see Figure 1).

Sustainability initiatives drive improved financial performance through factors such as improved risk management and greater innovation. Analysis shows this positive correlation between ESG (environmental, social, and governance) and financial performance metrics like return on investment (ROI), return on assets (ROA), and stock price in 58% of companies, according to New York University (NYU) Stern School of Business. Importantly, ESG disclosures alone do not drive financial performance; they must be accompanied by a well-articulated ESG strategy and detailed initiatives to demonstrate progress.

BALANCING SUSTAINABILITY WITH VALUE CREATION

To embrace emerging opportunities around sustainability, we recommend an end-to-end approach that focuses on value creation:

- Set goals. Assess potential, identify pain points/risks then set short-term, intermediate, and long-term goals.

- Develop and prioritize initiatives. Identify the right initiatives across all dimensions of sustainability (including water, GHG emissions, waste, and biodiversity) then manage a portfolio of initiatives that balance company value with ESG impact.

- Ensure effective implementation. Develop step-by-step, actionable plans (including roadmaps, KPIs, and budgets) and set up effective organizational structures to manage and drive sustainable development, backed by a project management office to ensure successful implementation.

1. Set goals

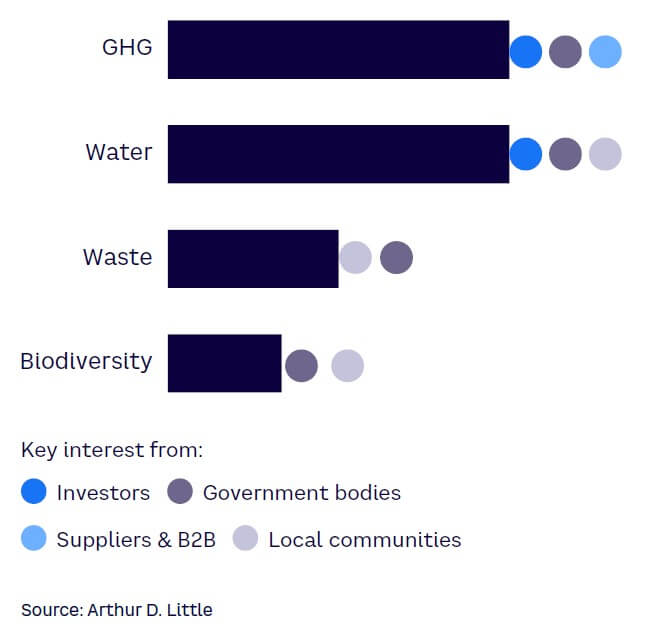

Strategic sustainability goals for metals and mining companies operating on a global scale should be diverse and holistic, focusing not just on decarbonization, but on other aspects to meet stakeholder priorities (see Figure 2).[1]

It is important to understand that sustainability elements vary in importance for stakeholders. For example, GHG abatement is a key concern for Western governments and global investors, as well as for clients and suppliers looking to track and reduce their own emissions. In contrast, local communities are focused on the direct impacts of mining operations on their lives, so they are much more concerned about water usage, pollution/waste, and threats to biodiversity. Failing to tackle this second group of topics can lead to disruption in daily operations at some mines, reputation damage, and/or a loss of operating licenses. Waste management failures can lead to groundwater contamination and even the collapse of tailings dams (which contain leftover materials from the processing of mined products), as in the Brumadinho, Brazil, dam disaster in 2019. That incident caused 270 deaths and led to a US $19 billion loss of market value for operator Vale, including $7 billion in fines and compensation.

Most major companies have already publicly communicated their sustainability goals and developed their overall strategy. Examples include:

- GHG abatement. Carbon neutrality by 2030 (De Beers) and by 2050 (Vale, Rio Tinto, BHP, AngloGold Ashanti).

- Water. “By 2030, we will reduce our water footprint by 50% and increase community access to water and sanitation.” (De Beers)

- Waste management. “Zero harm to people and the environment.” (AngloGold Ashanti)

- Biodiversity. “Recover and protect more than 500,000 hectares of forest areas beyond company fence line by 2030.” (Vale)

Here are two key recommendations for effective goal setting:

- Move beyond long-term goal setting to create interim objectives and initiatives that demonstrate progress in year one, not 2040. Stakeholders want to see concrete progress in specific areas within a short time frame (e.g., number of mining trucks converted to natural gas).

- Make goals more holistic, going beyond GHG emissions to include local and global perspectives.

2. Develop & prioritize initiatives

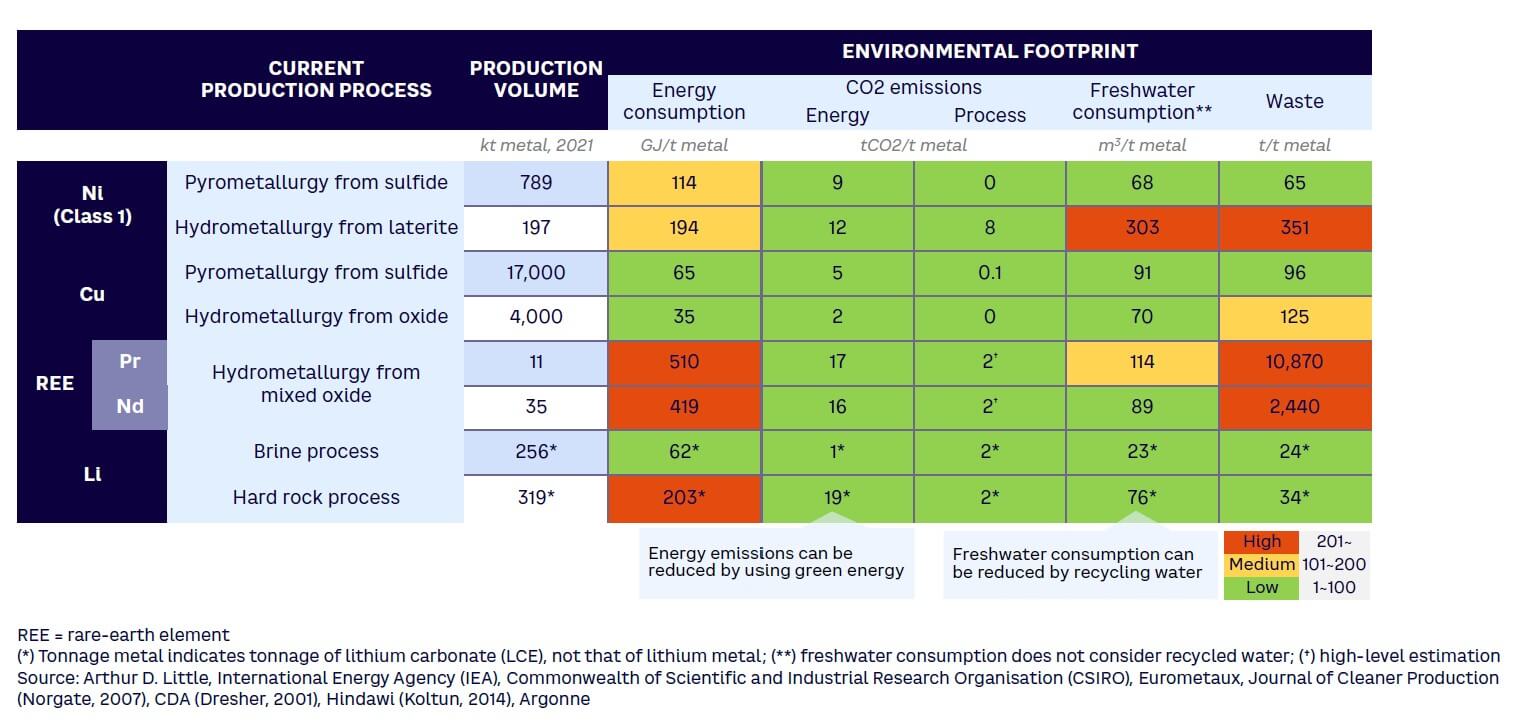

To balance compliance with opportunities, metals and mining companies should adopt a value-driven approach to sustainability, primarily concentrating on initiatives that enhance sustainability while contributing to the company’s bottom line, such as increasing shareholder value by improving access to funding, protecting revenue, reducing costs, and lowering risk exposure. The specifics will vary based on the minerals being extracted and the company’s overall environmental footprint (see Figure 3).

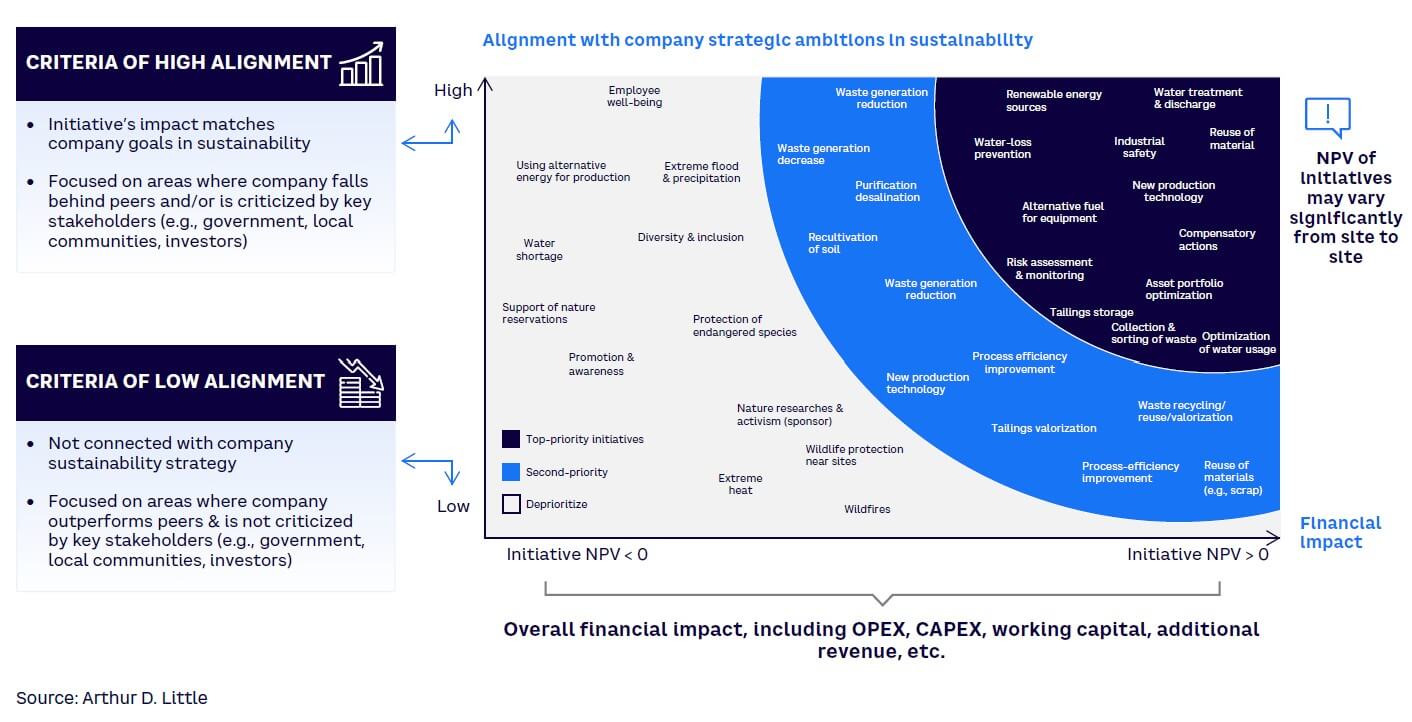

Sustainability initiatives should therefore be prioritized based on key factors, including their financial impact and alignment with the company’s strategic ambitions, as well as their current environmental footprint and potential effect (see Figure 4).

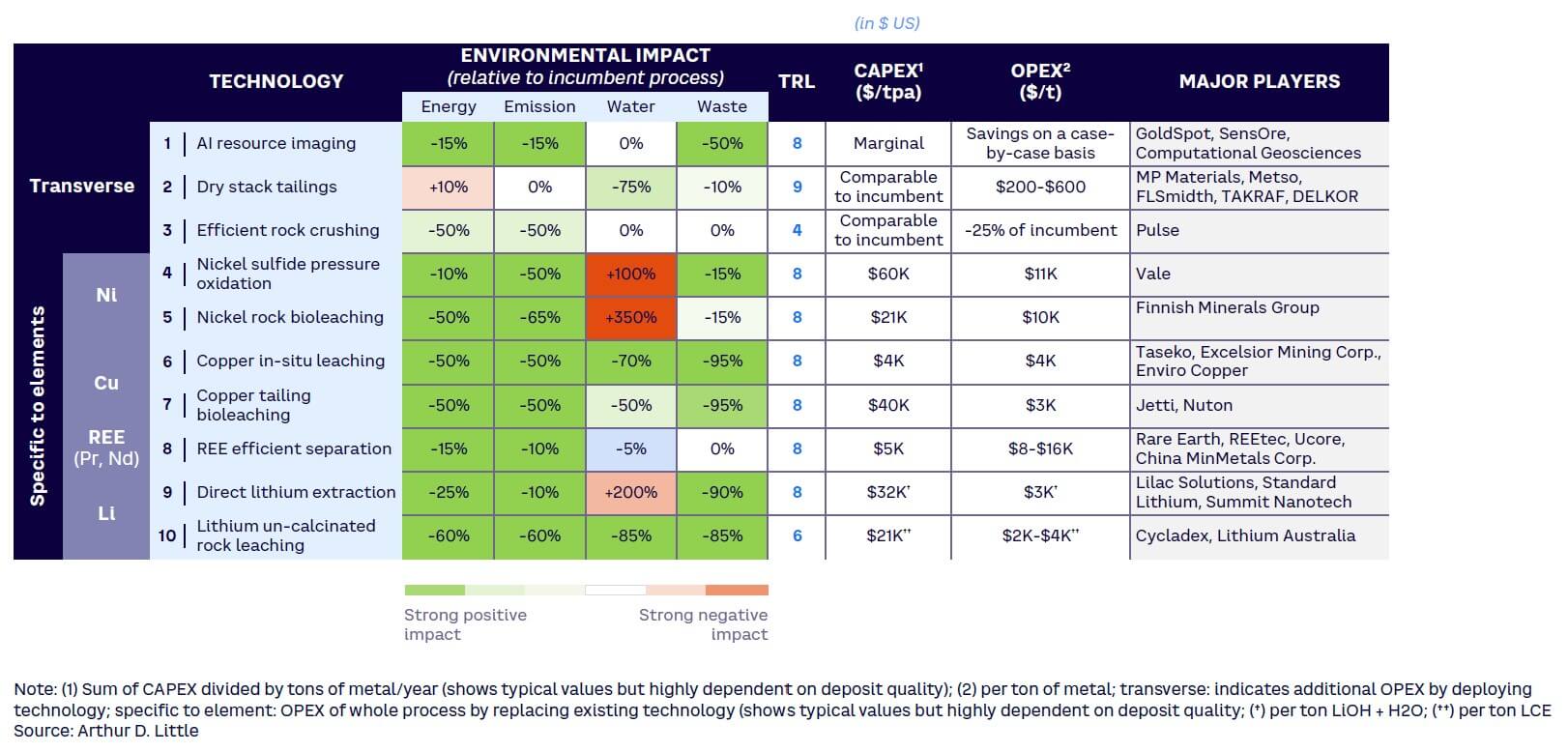

When deciding which technologies and processes to employ, companies should focus on embracing internal innovation while discovering and analyzing best practices from peers across the world. To assist in making the right choices, Arthur D. Little (ADL) has developed an extended library of relevant initiatives containing assessments, net present value (NPV) calculations, and implementation experiences. Examples of potential initiatives are shown in Figure 5. For example, nickel miners can cut their impact on water supplies in half by adopting nickel sulfide pressure oxidation, and direct lithium extraction reduces waste by 85%.

Initiatives to reduce GHG emissions

Nearly half of all mines are off-grid, meaning they mainly rely on fossil fuels to power operations. A significant share of vehicles still use diesel because large mining trucks are difficult to electrify due to their weight, and hydrogen vehicles aren’t widely available. Even on-grid mines tend to have limited options for power due to their remoteness.

To lower emissions, an increasing number of mines are reducing their dependence on fossil fuels and moving toward onsite power generation, with a focus on renewable energy.

Onshore wind and solar energy are relatively inexpensive to install and deliver a relatively high ratio of avoided emissions to CAPEX and OPEX. However, electricity from renewables has its own limitations, including reliance on the electricity grid, battery-charge limitations, and charging station availability.

Here are some ways mines are reducing reliance on fossil fuels:

- Exploration

- Use of EVs and drones for exploration activities and safety (Rio Tinto in Australia)

- Battery-powered core drilling rig for emission-free exploration (Epiroc’s SmartROC D65 BE)

- Energy generation

- Hybrid microgrid systems that combine renewable energy sources with storage solutions to deliver more continuous power supplies

- Onsite energy (AngloGold Ashanti’s 50 MW solar power plant at one of its South African mines)

- Battery storage (Glencore’s pilot of 150 MW system at Ernest Henry copper mine in Australia)

- Mineral extraction

- Use of battery electric vehicles (BEVs) and trolley-assist systems

- Use of electric-powered excavators and loaders (Caterpillar)

- Battery swapping (Rio Tinto for light mining vehicles in Australia)

- Use of alternative fuels (e.g., hydrogen cells)

- Processing

- Direct reduced iron process for steel industry

- Electric-arc furnaces for steel production, replacing emissions-heavy blast furnaces, especially with renewable power usage/hydrogen

- Energy-efficient furnace solutions (SMS Group’s ENVI-met technology)

- Increase in scrap usage/recycling

- Digital solutions to enhance energy efficiency (Siemens’ process control and optimization software)

- Treatment (beneficiation) plants

- Solar evaporation ponds, dewatering tailings, and dry-stacking technologies

- Energy-efficient technology solutions (Anglo American’s use of energy-efficient grinding/separation technologies and waste heat-recovery systems)

- Sensor-based processing optimization (BHP’s implementation of GE’s Predix platform to reduce energy consumption by 10%)

Initiatives to improve water treatment & management

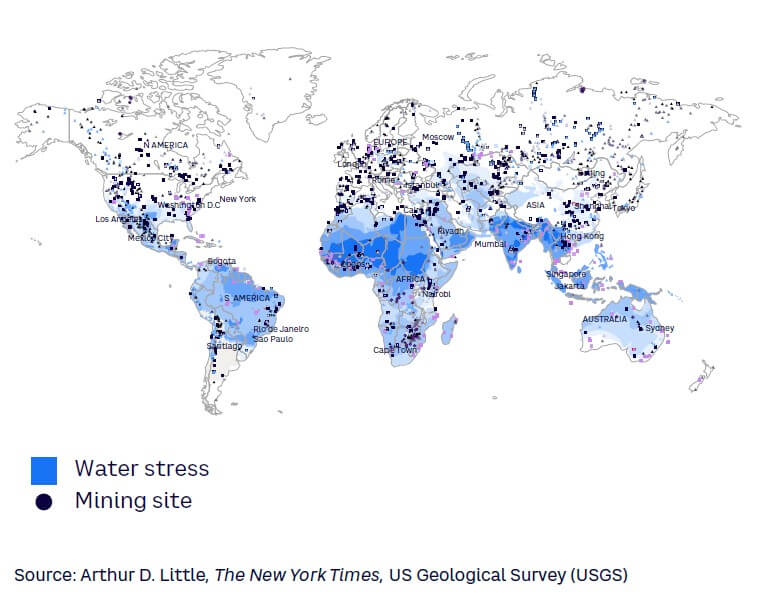

Many mining deposits are in water-stressed locations (see Figure 6), which increases risks for companies and may bring them into conflict with local communities that rely on scarce water resources. Sixteen percent of land-based critical mineral mines, deposits, and districts are located in areas with extreme water-stress levels.

Mining processes require large amounts of water. For example, ~90 cubic meters of water are needed to produce 1 ton of copper, and ~2,000 cubic meters of water are needed to create 1 ton of lithium. In some areas of Chile, lithium and copper extraction has reportedly consumed over 65% of the local water supply, depleting available water for indigenous farming communities in already water-scarce regions. Water contamination is an increasing issue, with communities in Chile and Argentina reporting that toxic waste from lithium operations has contaminated fresh water used for drinking, livestock, and agriculture.

Typical water initiatives focus on:

- Purification/desalination (e.g., reverse osmosis technology and solar-powered desalination)

- Water-loss prevention (e.g., Internet of Things sensors and real-time data analytics alongside improvements in pipe- and tank-sealing technologies)

- Water-use optimization through water recycling systems, smart water management software, and improved water treatment/discharge, including zero liquid discharge systems and bioremediation techniques

With further research and support for innovation, companies could do much more. Examples within the production process include:

- Exploration

- Using surfactants that reduce water consumption by increasing water-wetting characteristics and improving dedusting

- Leveraging air-cooling systems (e.g., vortex tubes) to cool drilling rigs and improve efficiency

- Mineral extraction

- Adopting sonic drilling to reduce water use and waste production by up to 80%

- Utilizing membrane filtration technology to produce more concentrated slurry

- Installing slurry pumps that can handle more highly concentrated slurry

- Processing

- Using dry tailing technology to achieve up to 93% water retention for recirculation

- Utilizing waterproofing technologies to limit losses due to evaporation and leakage

- Leveraging advanced water treatment technologies to remove contaminants before water discharge

- Treatment (beneficiation) plants

- Using inert anodes made to reduce the chance of acid rain formation

- Employing water-reuse regime in flotation to enhance water retention up to 34%

Initiatives to improve tailings management

Metals and mining companies are working hard to transform their approach to tailing management. They are moving from viewing waste as a risk to seeing it as an opportunity, particularly through circular economy approaches, and they are exploring new storage methods (e.g., condensed tails, paste styling, and dry storage).

Extraction technologies are now capable of reprocessing existing tailings to access valuable materials that could not be previously reached. This minimizes a company’s environmental impact (by avoiding new mining activities) and delivers economic benefits. Copper and gold tailings are especially valuable sources due to their low concentrations in normal ore. Gold miner Barrick began a tailings-reprocessing project in February 2022 at its Golden Sunlight mine in the US state of Montana, which had produced more than 3 million ounces of gold during its 40 years of operation. It is extracting further valuable materials from the tailing, material that was previously considered not economically feasible. Codelco and Sibanye Stillwater are also reprocessing their high-grade tailings to extract residual metals, including copper, platinum, and rare-earth elements. By transforming sand previously stored in tailings, Vale has created a new revenue stream while reducing the amount of waste material in its tailings.

Additional technologies being tested by mining companies include tailing-storage optimization, decreased waste generation, collection, sorting, and recycling. Tailing-dewatering technologies are also being adopted on a large scale to provide water to existing operations. The resulting thickened tailings can be mixed with cement and used in construction or as backfill in underground mines.

Initiatives to improve the local environment

Improved water use and waste management deliver clear benefits for the local environment and local communities. Metals and mining companies can further improve biodiversity through initiatives such as:

- Soil recultivation, including post-mining land restoration and the use of native species in reclamation projects

- Wildlife protection near sites (e.g., the creation of buffer zones, wildlife-monitoring programs, and human/wildlife conflict mitigation strategies)

- Protection of endangered species through habitat-restoration initiatives, species-specific protection plans, and collaboration with wildlife conservation bodies

- Support for nature reserves, including funding/management partnerships and community engagement and education

- Support for natural research projects and activism, including funding research and engagement and awareness programs

Examples of successful programs include:

- Vale has implemented a biodiversity conservation strategy that assesses sensitivity/risks to nature, prioritizes areas for mitigation, and creates plans to recover and offset activities. It has recorded 4,125 species in its operational area and has taken action to protect those that are endangered, as well as supporting 4,000 entrepreneurs working in the forest-related value chain.

- BHP has adopted a biodiversity approach based on three main levers: (1) valuation of natural capital, (2) innovation and collaboration, and (3) nature-related disclosure. Examples include assessing the natural capital of its Beenup site, which resulted in the protection and restoration of a threatened ecological community, and research to support coral reef resilience in Lau, Fiji.

Here are two key recommendations for developing and prioritizing projects:

- Combine internal ideas for improving sustainability with successful use cases from across the industry.

- Prioritize based on demonstrable impact against specific sustainability and business goals.

3. Ensure effective implementation

Once ESG initiatives have been selected, their implementation should be tracked against short- and mid-term milestones and connected with overall sustainability goals and ambitions. Relevant tools include:

- Projects and initiative tracking to provide detailed information to support long-term goals

- Sustainability reports to deliver detailed information on initiatives and performance

- ESG data workbook containing information about ESG performance

- Transparency and policy documents to provide insights into the policies guiding operations

- Risk management frameworks to outline and assess strategies for specific risks

- Milestones to help stakeholders understand achievements

This enables organizations to:

- Manage risks to comply with national and international regulations and frameworks.

- Create value by gaining higher multipliers and green premiums while attracting customers/employees. For example, studies show that ~70% of investors carry out a structured review of a company’s ESG strategy when making an investment decision, and 67% of employees prefer to work for companies that are responding positively to climate change.

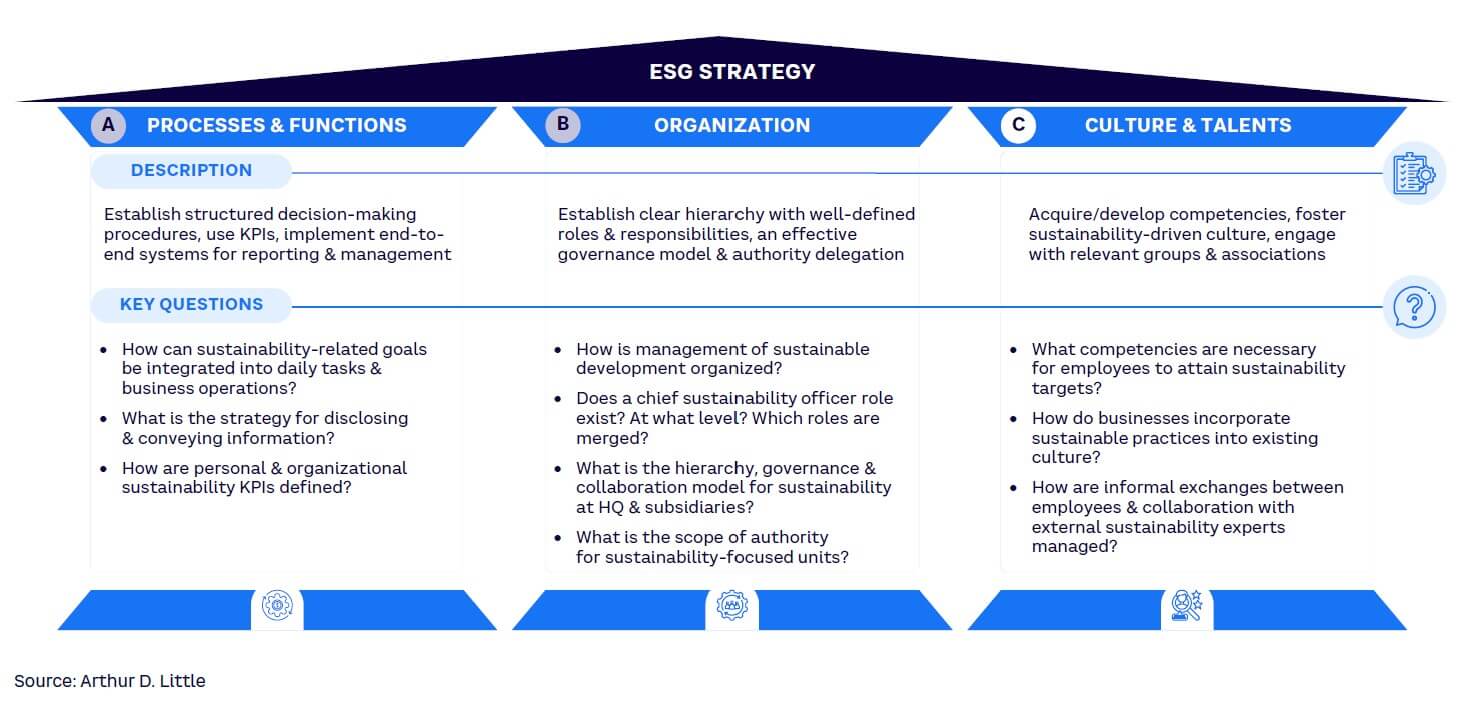

To ensure the successful implementation of sustainability initiatives, companies need to rethink their operating model, adopting an efficient sustainability approach that includes detailed processes, organization strategies, and plans to leverage culture and talent (see Figure 7).

Most metals and mining companies have chosen one of three models for their ESG organizational structure:

- Highly centralized. In this model, the competence center is responsible for developing the ESG strategy at the group level and putting top-level implementation plans in place at the business unit (BU) level. Ultimate responsibility is borne by the competence center, which sets KPIs for the BUs. The budget is generated at a group level and cascaded down to BUs. For example, Barrick dedicated a functional vertical responsible for sustainability from HQ down to the BU level.

- Moderately centralized. In this model, the competence center is responsible for developing the ESG strategy at the group level, but implementation plans can be developed by BUs (subject to endorsement at the group level). Responsibility for implementation is divided between the competence center and BU heads. The budget is generated at a group level and cascaded down to BUs. For example, Polys has a structure in which ESG responsibility rests mainly on the BU level.

- Decentralized. In this model, the competence center is responsible for developing the ESG strategy at the group level and business cases for implementation at the BU level. Ultimate responsibility is borne by BU heads, although the competence center can provide expert support during implementation. The budget is generated first at a group level, but each BU has its own budget. For example, Anglo American developed an ESG expertise center at the HQ level to support BUs in their implementation of the group sustainability strategy.

These are operating model archetypes; every company will create its own solution based on factors such as the level of operational independence of sites, availability of skills and competencies, and potential synergies between BUs in terms of ESG best practices.

Here are two key recommendations for ensuring effective implementation:

- Adopt an effective sustainability model, based on business needs and available capabilities.

- Put in place robust monitoring tools to ensure progress can be tracked and demonstrated.

Conclusion

ALIGNING SUSTAINABILITY WITH VALUE CREATION

The metals and mining sector faces conflicting goals: meeting demand for essential metals and minerals while reducing its carbon footprint and ensuring the green transition. Companies must adopt an approach that aligns sustainability initiatives with shareholder value creation via:

- Rigorous goal setting. Establish clear, achievable sustainability targets, including short- and medium-term goals that align with the company’s strategic ambitions and address stakeholder concerns. Go beyond reducing GHGs.

- Thorough prioritization. Base initiatives on financial impact and alignment with strategic goals, focusing on those that deliver both environmental benefits and shareholder value.

- Actionable implementation. Develop a robust operating model and tools to ensure the effective execution of prioritized sustainability initiatives.

Note

[1] There are other elements to ESG (e.g., safety and diversity), which are not covered in this Viewpoint due to space considerations.