B2B “buy now, pay later” (BNPL) is emerging as a flexible method for businesses to obtain financing at the point of sale, better manage liquidity, and create an enhanced customer experience. In this Viewpoint, we dive into the benefits and considerations surrounding B2B BNPL, including how it differs from trade credit and factoring as well as its market potential. We also examine competitive dynamics and explore strategic options for banks responding to the opportunity.

BNPL: A FLEXIBLE, UNDERUSED STRATEGY

BNPL is a type of short-term financing that allows customers to purchase goods and services but pay for them in full later, or over time in installments. BNPL offers convenience and flexibility and drives affordability, making it a popular short-term financing option for retail consumers shopping in both e-commerce and brick-and-mortar modes. However, BNPL is not only relevant for B2C; it is even more important for B2B, where the well-known and much-used trade credit has been firmly established as a deferred payment solution.

In principle, B2B BNPL works in the same manner as B2C BNPL, but the end customer is a company instead of an individual. It is offered by individual suppliers or through marketplaces. Individual suppliers are companies that supply other businesses with their products, such as machinery, office furniture, and so forth. These companies can be found across many industries and in different sizes, from micro-, small-, and medium-sized enterprises (MSMEs) to large corporates. They typically require multichannel BNPL solutions to cover in-person and online sales.

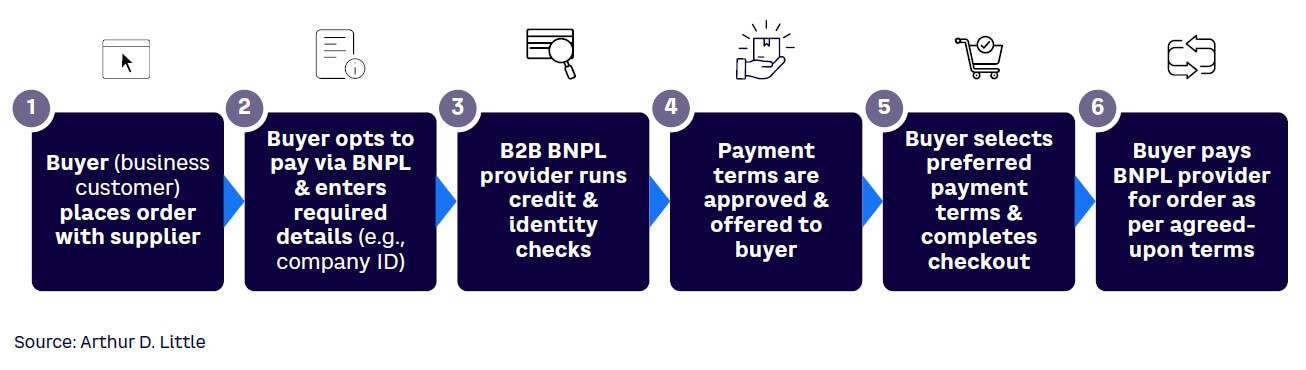

Marketplaces are platforms that connect buyers and sellers of goods or services, typically in a specific industry or across several industries. Their number has grown significantly in the last decade — and because they are digital in nature — they are especially inclined to use digital BNPL solutions. The B2B BNPL process differs depending on the B2B BNPL provider, but it essentially follows the steps outlined in Figure 1.

In principle, suppliers can extend BNPL directly to business customers, especially if a limited number of them are mostly recurring. In many cases, suppliers already do this via trade credit. However, when suppliers have a diverse set of customers, including many first-time buyers, in-house BNPL solutions reach their limits because of suppliers’ balance sheet size, underwriting capabilities, and operational capacity. Given that suppliers should aim to achieve BNPL approval rates of 80% and higher, they may find themselves stretched too thin.

This is where specialized B2B BNPL providers enter the game.

MAXIMIZING BENEFITS, MANAGING RISKS

B2B BNPL deserves serious attention and consideration as it addresses two major challenges in the B2B environment:

- Providing financing to businesses at the point of sale helps reduce the MSME funding gap at the point of need and increases purchasing power.

- More importantly, it allows businesses to manage their liquidity through the flexible payment terms offered.

B2B BNPL also outshines its sister offering, B2C BNPL, in several ways:

- The market is substantially bigger. The B2B market size is roughly five times bigger than the B2C market.

- The transaction volume is higher than average. B2B transactions are notably larger than B2C transactions, boosting BNPL providers’ revenues.

- The propensity for repeat business is greater. Long-term buyer-supplier relationships mean frequent purchases from the same supplier, creating greater opportunities for BNPL.

- It caters to a vastly underserved market. B2B BNPL solves critical working capital and liquidity challenges for small businesses.

- There are opportunities to go global. B2B BNPL can simplify international trade, tackling currency and cross-border payment hurdles through more standardized credit terms.

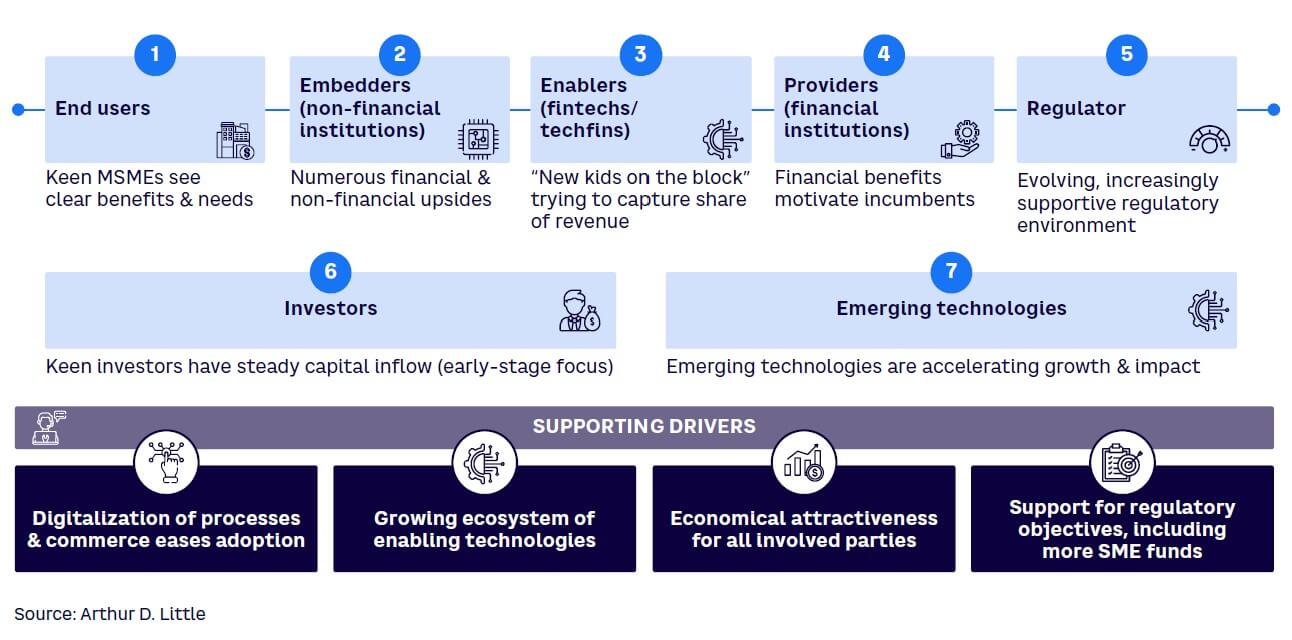

Figure 2 summarizes the key growth drivers of B2B BNPL. It shows that various players, including end users, fintechs, regulators, and investors contribute to a fruitful environment for innovation and adoption of B2B BNPL solutions.

While the benefits are evident, it is also important to highlight three main considerations around B2B BNPL that should be addressed by the provider and the embedding supplier: (1) debt burden, (2) transparency, and (3) adverse selection.

Debt burden

Customers may overuse BNPL and overspend. Unlike B2C, B2B customers are professionals who are generally better equipped to make financing decisions. However, providers should minimize the risk of overspending by employing clear communication, education, and controls so that customers enjoy the value of B2B BNPL without making risky financial decisions.

Transparency

Customers may discover fees later in the process that they were not aware of initially (e.g., late payment fees). Providers should be very transparent about conditions and fee structures; this protects their customers and prevents negative experiences that impact customer satisfaction and lead to churn.

Adverse selection

From the provider perspective, there is concern that BNPL may attract low-quality borrowers. Thorough credit checks are crucial. Moreover, while this concern may be particularly warranted in B2C BNPL, there is reason to believe that business customers primarily use BNPL for liquidity management rather than to enable purchases they could otherwise not afford.

THE DIFFERENCES

It is important to point out the differences between B2B BNPL and related supply chain–financing methods. The pay-later version of B2B BNPL is most similar to the well-known legacy trade credit where suppliers offer deferred payment to business customers. However, looking closer, the two methods differ significantly:

- With BNPL, the credit risk and the underwriting are taken over by the BNPL providers who should be more thorough in their assessment.

- Credit decisions, including those for first-time buyers, occur on the spot. For buyers, this also minimizes paperwork, and the credit decisions and terms are much more codified and structured rather than based on relationships.

- BNPL is typically facilitated by a third party and not the supplier directly.

- The supplier gets paid up front by the BNPL provider (minus fees), and efforts around administration and collections are shifted to the BNPL provider.

- BNPL frequently has more flexible and tailorable terms.

While B2B BNPL is typically organized as factoring in the background, it also differs from classic factoring:

- In BNPL, the buyer requests BNPL; the supplier does not decide to sell the claim. Therefore, it is more similar to reverse factoring where the buyer decides to refinance the supplies. However, BNPL is initiated at the point of sale, while reverse factoring happens later (with risk of decline).

- In some factoring arrangements, businesses need to give up control of their customer relationship; in BNPL, that’s not required.

- With factoring, the businesses sell their accounts receivable at a discount; in BNPL, the discount is typically lower.

A HUGE OPPORTUNITY

B2B BNPL’s potential is huge, as it taps into the vast B2B commerce space, which was worth approximately US $120 trillion in 2022 across offline and online channels, according to Activant Capital. Moreover, while B2B sales have trailed B2C in terms of e-commerce share (the area where BNPL is particularly strong), B2B has been catching up and will continue outgrowing the other channels.

Arthur D. Little (ADL) estimates that B2B BNPL will enjoy a high double-digit annual growth rate over the coming years and will capture 15%-20% of the payments in B2B commerce by 2030. Considering the overall growth of B2B commerce in the coming years, this would equal approximately $25-$30 trillion BNPL volume and, assuming average BNPL fees of 3%-4% per transaction, a total addressable market between $700 billion and $1.3 trillion. Thus, it is fair to call B2B BNPL a “trillion-dollar opportunity” by 2030.

To make these numbers more tangible, let’s look closely at a major economy: Germany. According to ECC KÖLN, the B2B market size in that country was $7.3 billion in 2022. B2B BNPL is particularly strong in the online channel. After excluding sales made via electronic data interchange and sectors where B2B BNPL is less relevant (e.g., construction or defense), the B2B sales by producers and wholesalers via online shops and marketplaces were estimated at $467 billion in 2022. This amount represents 6.4% of the whole B2B volume and is around five times the size of Germany’s B2C online market (estimated at $92.3 billion in 2022).

Germany’s numbers demonstrate the large market size of B2B and the related potential for BNPL providers globally. B2C BNPL has proven successful; however, the sheer potential of B2B is exponentially larger. Business customers, for instance, are already using flexible payment terms like trade credit, which, according to Atradius, takes up 30%-50% of B2B sales, depending on the year of observation.

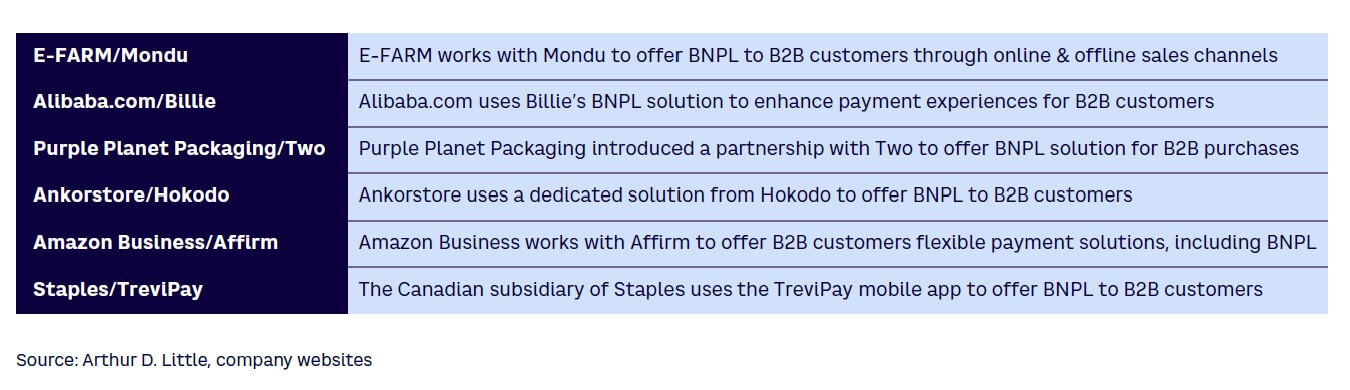

Figure 3 shows some selected examples of partnerships between merchants and B2B BNPL providers, demonstrating how various industries have adopted the solution.

AN EMERGING MARKET

There is little doubt that B2B BNPL is in high demand, the addressable market is considerable, and the players are capable, so it’s surprising that B2B BNPL is not yet mainstream. There are two key contributing reasons for this:

- The B2B sector generally trails B2C in terms of the adoption speed of new solutions. Typically, new solutions appear in the B2C sector first and enjoy widespread adoption there. Over time and with certain delay, business customers increasingly demand the same experience they have become used to as private individuals.

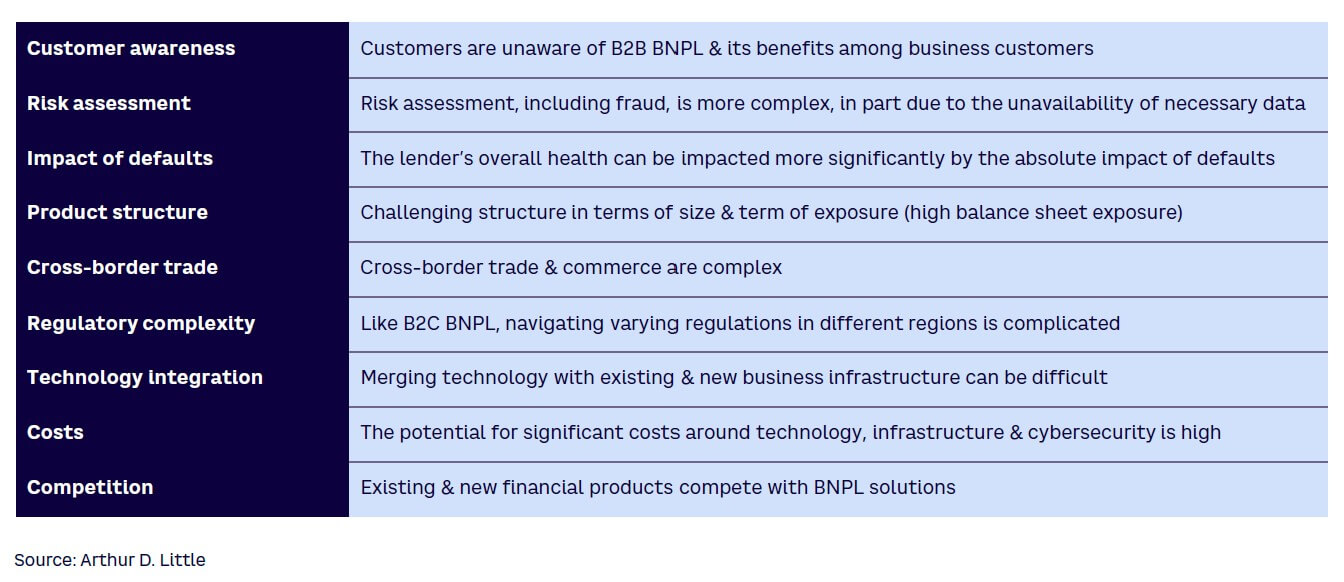

- Several challenges at an industry level are blocking the full potential of B2B BNPL. In many cases, the challenges arise from the more complex nature of B2B lending due to higher credit limits and the accompanying risk, more complex underwriting decision models, and longer, more diverse payment terms. Figure 4 provides a summary of these challenges.

Providers that can navigate hurdles while offering valuable, secure, and tailored solutions will likely emerge as winners in this rapidly evolving market.

FINTECHS & FIRST INCUMBENTS ENTERING MARKET

Though still in the nascent stage, the competitive landscape of B2B BNPL is growing rapidly. In addition to fintechs, two incumbent banks in Europe have especially recognized the vast potential and have started offering B2B BNPL:

- Spain-based Banco Santander has launched its B2B BNPL solution in partnership with B2B BNPL fintech Two and leading insurer Allianz SE. Santander finances the up-front payments, Allianz insures the value chain against non-payment risk, and Two acts as the BNPL tech provider. It is a one-stop solution with single API integration and multicurrency support.

- BNP Paribas and B2B BNPL fintech Hokodo have partnered to launch a new B2B BNPL solution for businesses, which can be easily integrated into existing checkout systems, providing instant buyer approval using real-time credit decision-making.

In addition, there are also embedded lending fintechs, such as credi2, that use a white label approach to provide banks with the technical capabilities to launch such propositions. Fintechs have also partnered with other fintechs to offer B2B BNPL solutions. For example, the fintech and payment platform Adyen partnered with payment fintech Billie to offer B2B BNPL across Europe. Overall, B2B BNPL has become a competitive and dynamic market where fintechs and banks are collaborating as well as competing to offer the best solution to customers.

From conversations about the market, we know that many incumbent banks are considering entering the field, as they enjoy strong advantages that make the case compelling. Incumbent banks have a strong brand, trust, an established customer base, a license and balance sheet, underwriting capabilities, and market knowledge. Fintechs, on the other hand, often have the required innovative spirit, technology, and agility, along with the connectivity capabilities required to take part in this business.

HOW CAN BANKS RESPOND TO THIS OPPORTUNITY?

Banks can seize the B2B BNPL opportunity in several ways; the best response will depend on their strategic objectives and capabilities. Below, we summarize some possible ways banks can participate in this attractive market (this is a non-exhaustive list, and banks may pursue multiple strategies simultaneously):

- Develop in-house capabilities, potentially working with infrastructure fintech providers. This option grants a bank more control over the solution that can be intricately integrated and tailored within its operations. However, it will require the highest in-house effort, needs the most time to go-to-market, and carries a significant implementation risk due to the development of new capabilities from scratch.

- Partner with existing B2B BNPL players. The nature of these partnerships can vary based on market conditions, target customer type, and so on. This option requires less effort and investment than building in-house capabilities. Furthermore, it enables the bank to tap into its partner’s specialized knowledge and technology, resulting in a solution that aligns with the bank’s specific requirements. However, it also brings about fee sharing and a greater reliance on the external partner, causing potential complications should the partnership dissolve.

- Introduce a banking-as-a-service (BaaS) offering — which may encompass financial infrastructure, risk management capabilities, license, and balance sheet — to the established BNPL players in the market. This option allows banks to leverage their existing infrastructure and expertise.

- Acquire ready-to-use solutions from B2B BNPL start-ups to gain a foothold and technology capabilities. This option will minimize implementation risk and time to market. However, it will require considerable investment, and the solution may not fully fit the bank’s specific needs.

Banks may also want to consider introducing a convergence between existing products and BNPL features. For example, they could integrate BNPL as a feature of revenue-based lending products instead of traditional interest payments. Whatever option the bank chooses, it is becoming increasingly obvious that they cannot ignore the vast opportunities and growth in this sector; otherwise, they will be late to the game as they were in the B2C BNPL sector but this time in a remarkably larger market.

Conclusion

TRILLION-DOLLAR POTENTIAL

In the coming years, the B2B BNPL market is expected to enjoy high double-digit annual growth. By 2030, it is estimated that B2B BNPL will be a trillion-dollar opportunity, capturing 15%-20% of the B2B payments market. There is no doubt that B2B BNPL represents an exceptional opportunity in the embedded finance sector. Its potential to transform B2B transactions and fulfill the unmet needs of millions of MSME players makes it a trend worth watching and participating in for banks and businesses in other sectors pursuing an embedded finance strategy. The time to act is now.