DOWNLOAD

DATE

Contact

The pandemic challenged many industries to rethink — and experiment with — their business models. This prompted the entertainment industry to explore new strategies, catalyzed by the need to recover film and program production costs. At times, major studios launched films directly to streaming services, sidestepping shuttered theaters. But studios and streaming platforms are still figuring out the best revenue models; in fact, some are swinging the pendulum back to traditional film release methods and models. What changes are still to come? What lessons did experimentation teach?

WHY EXPERIMENT?

Film studios and distributors were hard hit by the pandemic. Theaters were shuttered and film productions stalled. Homebound consumers remained hungry for entertainment, and studios were eager to meet their demands. To keep their businesses afloat, studios dusted off old ideas around theatrical exclusivity and embraced new ideas, like premium charging on streaming platforms. Ultimately, direct-to-consumer (D2C) strategies had to be deployed and adapted to suit shifting consumption habits.

Upon looking back at this period through present day, we decided to call it The Big Experiment. In this Viewpoint, we share background information about the economics of traditional theatrical releases, predict trends we expect to emerge, identify current changes that appear cemented, and discuss what it all means for the film industry going forward.

THE TRADITIONAL FLOW OF MONEY

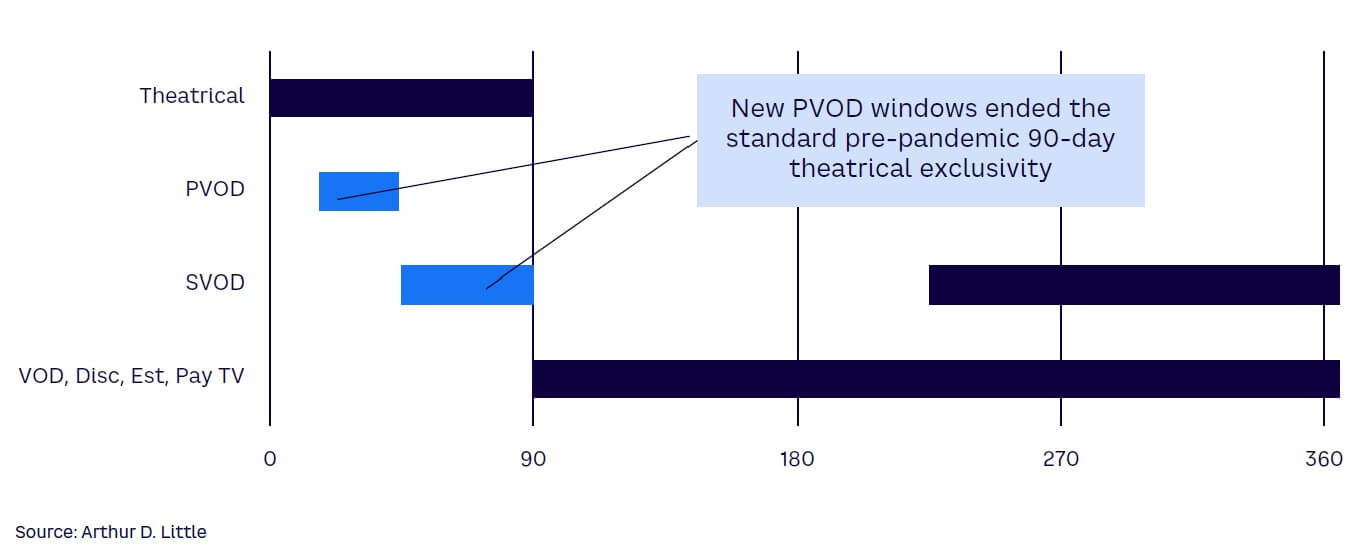

Studios are acutely aware of the importance of theatrical releases in generating income and contributing to a film’s profitability. The theatrical release window is the most important dynamic in movie distribution. Pre-pandemic, the theatrical release window was 90 days. This window provided movie theaters with exclusive rights to show a film before secondary platforms such as Netflix and Disney+.

We have seen experimentation with hybrid film release windows based on shorter theatrical exclusivity, including: day-and-date releases, which is when a film becomes available in theaters and on premium video on demand (PVOD) on the same day; day-and-date releases across subscription video on demand (SVOD); and PVOD releases within a 17- to 31-day window and SVOD with 30 to 45 days of theatrical exclusivity. Figure 1 illustrates the different windows and their time spans.

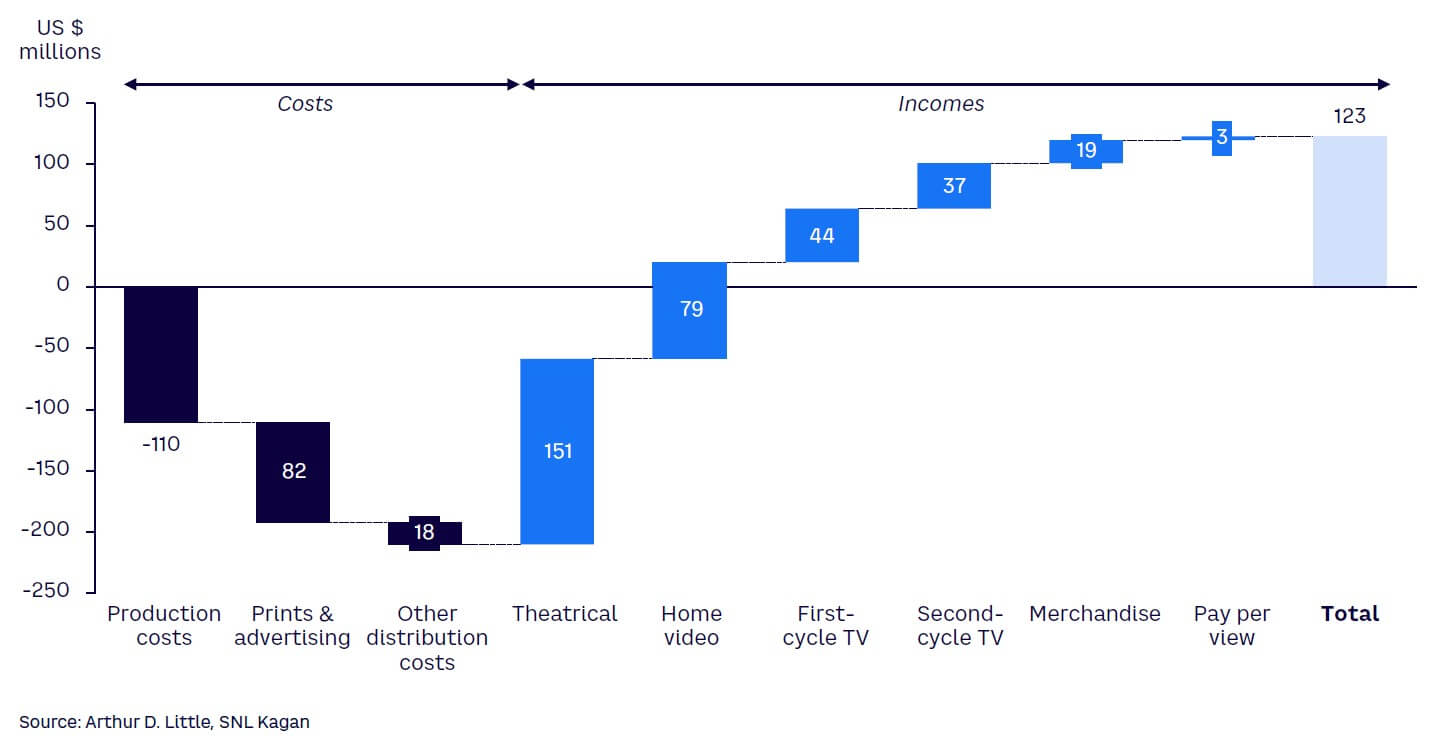

Figure 2 shows the costs and revenue associated with a big-budget film. Studios receive roughly half of total film revenues from the theatrical release window. When movie theaters closed during COVID lockdowns, studios had to adapt their strategies to generate revenues to cover production and prints and advertising (P&A) expenses.

THE THREE DIMENSIONS

The Big Experiment comprised three dimensions; the goal of each was to respond to pandemic-related shutdowns while meeting consumer demand for more in-home entertainment options. Studios implemented these strategies to recover money already spent and used unconventional ideas to generate revenue. Below we highlight these three dimensions in detail.

1. Reducing theatrical release windows; introducing day-and-date concept

Major studios swiftly adopted what were initially deemed short-term measures to stay in business. But these strategies became their daily realities. Studios reduced theater exclusivity windows, shifted releases, and tested title-by-title strategies that were anathema to executives before 2020. They also launched films directly to streaming platforms.

Studios tested four new windowing strategies for film distribution:

- Replacing the first window theatrical distribution with PVOD.

- Deploying PVOD and theatrical release windows sequentially.

- Offering movies with only a DTC option.

- Releasing films theatrically before making them available exclusively on homegrown DTC services.

Some major studios put their entire film slates for 2021 on day-and-date releases, much to the disquiet of movie theater owners.

2. Introducing PVOD; reexamining DTC models

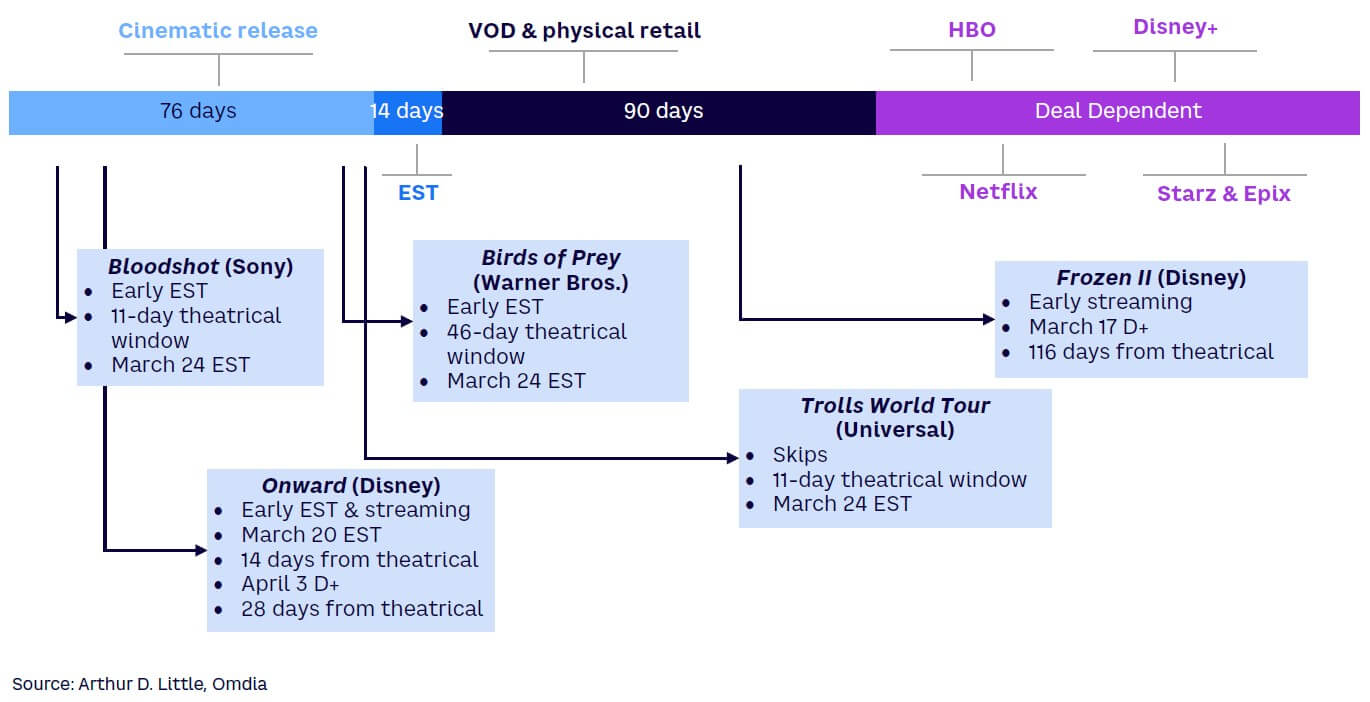

The PVOD window emerged as an alternative to the theatrical release window to provide studios direct access to the viewer. In March 2020, Universal released its first digital-only movie, Trolls World Tour, which generated US $100 million in PVOD revenue in its first three weeks. This success sparked a wave of experiments and alternative release strategies by all major studios. Figure 3 shows additional titles that moved toward experimental release strategies.

Two years later, we see studios and streaming platforms committing resources to navigate consumer behavioral data and spending patterns to help them select their distribution strategies and prioritize their film content spend.

3. Leveraging the power of movie theaters to keep streamers in check

Historically, movie theaters have played a significant role in attracting and retaining audiences as well as in helping studios build billion-dollar revenue franchises over time, including the Marvel Cinematic Universe, the James Bond films, and the Batman and Harry Potter franchises. (Note: Metacritic defines franchises as four or more films.)

The power and importance of movie theaters have kept streaming in check, limiting the number of day-and-date releases in 2022, with only a few exceptions like Peacock’s Marry Me and Marvel Entertainment’s Venom: Let There Be Carnage, which reached $500 million worldwide. Sony’s Spider-Man: No Way Home, Ghostbusters: Afterlife, and Uncharted all found solid financial success with domestic US audiences. The box office numbers justify Sony’s pledge to commit to exclusive theatrical releases as a key part of the post-pandemic box office–rebuilding process.

Reverting to the use of theatrical windows is important; as of August 2022, Screendollars reported that films shown on the big screen have achieved $5 billion in box office revenue, aided by huge worldwide marketing campaigns. For example, Spider-Man: No Way Home had an 88-day exclusive theatrical window at a time when other major studios have cut down their films’ windows to 45 days or less.

FROM DIMENSIONS TO TRENDS

We see five significant trends emerging from the three dimensions of The Big Experiment, outlined below.

1. Studios will behave more like retailers than wholesalers

Movie theaters stand between studios and audiences. We see studios becoming retailers instead of wholesalers by getting closer to their audiences and relying less on movie theaters to do this. A retail-inspired approach is not their natural habitat, as theaters and ticketing businesses previously built direct channels to moviegoers.

Thanks to streaming experiments, studios hold customer and viewing data. We think studios should build new capabilities, such as DTC marketing, using data analytics to guide them. They can factor in customer lifecycle management from acquisition to engagement and retention to churn. These are new skill sets for studios. In turn, leveraging data-driven insights can reduce risks in film development and financing, enabling better targeting for ad-supported services. The benefits are wide-reaching. Similarly, cross-selling opportunities arise: consumers who streamed a film are likely to subscribe to other services, such as music streaming and gaming, providing opportunities for studios to offer broader entertainment packages.

2. Data analytics will become key in making major films

The more interesting pattern is figuring out what types of films aren’t necessarily working theatrically but are working via streaming. A title that goes straight to ad-free or subscription streaming may be one that cannot perform in a 45-day theatrical window but is designed to accomplish other goals. For example, a DTC film may bring on new subscribers or attract a different audience demographic; HBO Max, for example, skews male, and executives want to bring in women over 40. What type of film can do that without sacrificing theatrical release revenue?

3. Studios will look beyond SVOD and PVOD to attract & retain audiences

A return to pre-pandemic activities and viewing habits has been followed by global cost-of-living increases. Consequently, we are witnessing SVOD numbers plateau and churn rates increase. Extrapolating data may help determine how new streaming models can work, including ad-tiered models.

Studios and streamers can read across consumer behavior data to identify top TV shows, and we think this could also apply to films. Netflix commissioned a series of teen romantic comedies, including The Kissing Booth and To All the Boys I’ve Loved Before, when other studios stopped releasing them in theaters. The following are among the most-watched movies on Netflix, as determined by hours: Bird Box (282 million hours), Extraction (231 million hours), The Irishman (215 million hours), and The Kissing Booth 2 (209 million hours). Significant consumer behavior data sits behind these numbers, waiting to be analyzed.

A recent Samba TV report shared data that showed significant front-loading of viewership for top-tier titles. The data highlighted that three in four viewers watch top shows within their first two weeks of availability. For example, Spiderhead saw 58% of its 15-day viewership in the first four days.

We think this data is a precursor for the future of an advertising video on demand (AVOD) model that creates windows for original content in SVOD for 15 to 30 days, before releasing it to ad-supported tiers. This blended approach could avoid impacting current subscribers who prefer to watch premiered content as soon as it becomes available. Netflix and Disney+ may want to consider a similar strategy as they prepare to launch advertising tiered services in November 2022 and December 2022, respectively.

4. M&As/partnerships will increase data acquisition

We see an acceleration by studios in building expertise in data analytics. Disney and Comcast are taking the lead. Comcast recently acquired data and advertising firms Beeswax and Freewheel. NBCUniversal-owned Fandango, one of the largest movie ticketing sites, merged with Vudu, a digital video store and streaming service, creating more opportunities for studios to reach a huge audience. Disney’s agreement with The Trade Desk, a media-buying platform, marks another key milestone in enabling greater audience activation and measurement.

5. Marketing spend will change in the streaming era

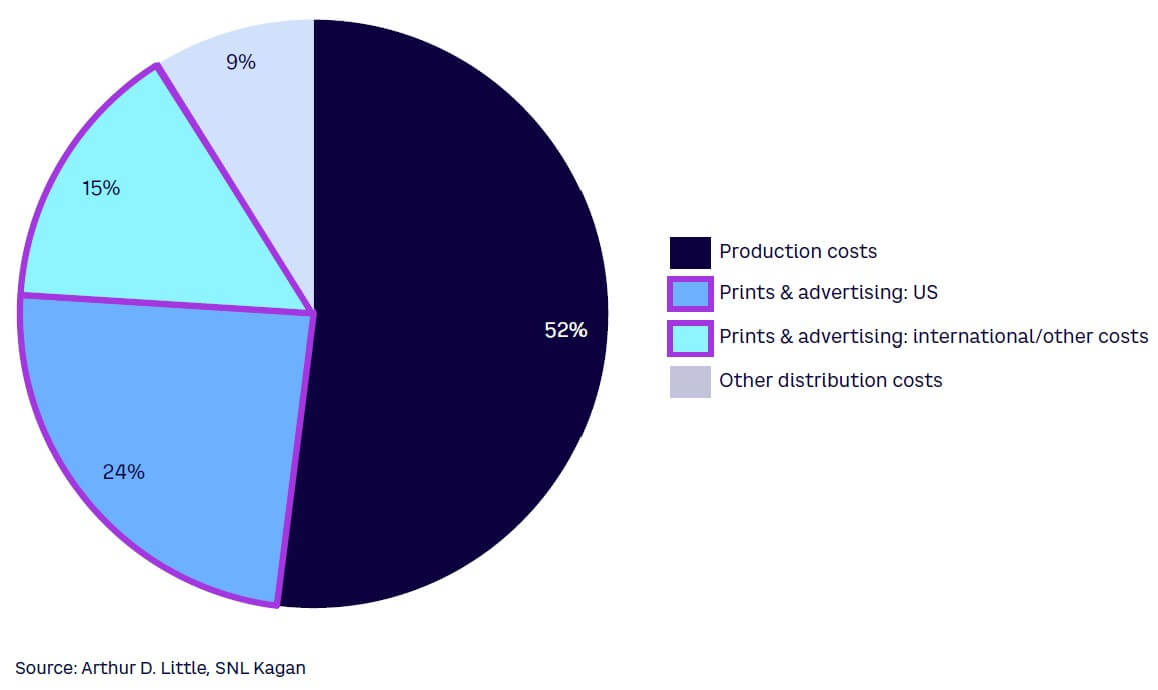

Despite the focus on revenue and viewing, film marketing costs, which typically account for about 40% of a major film’s budget, are rarely discussed in the context of the changing distribution environment. Direct access to consumers through their own streaming platforms equips studios with both the data and an additional marketing channel to build and support films.

Although many US movie theaters have reopened, average P&A spend per film has not returned to pre-pandemic levels. Globally, digital ad spending across the entertainment industry, of which P&A is one of the largest components, continues to rise, as shown by Figure 4. This indicates an increasing share of digital channels in P&A spend and shows the importance of creating digital VOD and AVOD ecosystems around film discovery, marketing, and sales.

CEMENTED CHANGES?

Upon considering the three dimensions and five trends that have surfaced in the movie industry, there is still much to be considered when examining whether The Big Experiment will create new business models or push business back toward the traditional path.

The power of movie theaters

Movie theaters have shown they still have a place in major film releases. They generate significant revenues for studios when they release major films exclusively to theaters. Sony’s Spider-Man: No Way Home, for instance, released exclusively to theaters in December 2021, generated $1.8 billion in global box office revenue (the sixth biggest in history), while No Time to Die grossed $770 million globally from its exclusive theatrical release, which is the third-best result of the James Bond franchise. MGM debuted No Time to Die on PVOD 31 days after its theatrical release.

Along with the runaway success of Spider-Man: No Way Home, Sony released Venom: Let There Be Carnage, which reached $500 million worldwide. The viewing numbers vindicate Sony’s pledge to commit to exclusive theatrical releases as part of the box office rebuilding process. Spider-Man: No Way Home had an 88-day theatrical exclusive window at a time when other major studios cut down the theatrical window for their films to 45 days or less. Despite the pandemic-era trends favoring streaming, movie theaters are not going away. Vue, Regal, and Cineworld restructured their businesses for this new era, rightsizing their models to suit moviegoers’ habits.

Measuring SVOD & PVOD success against box office returns

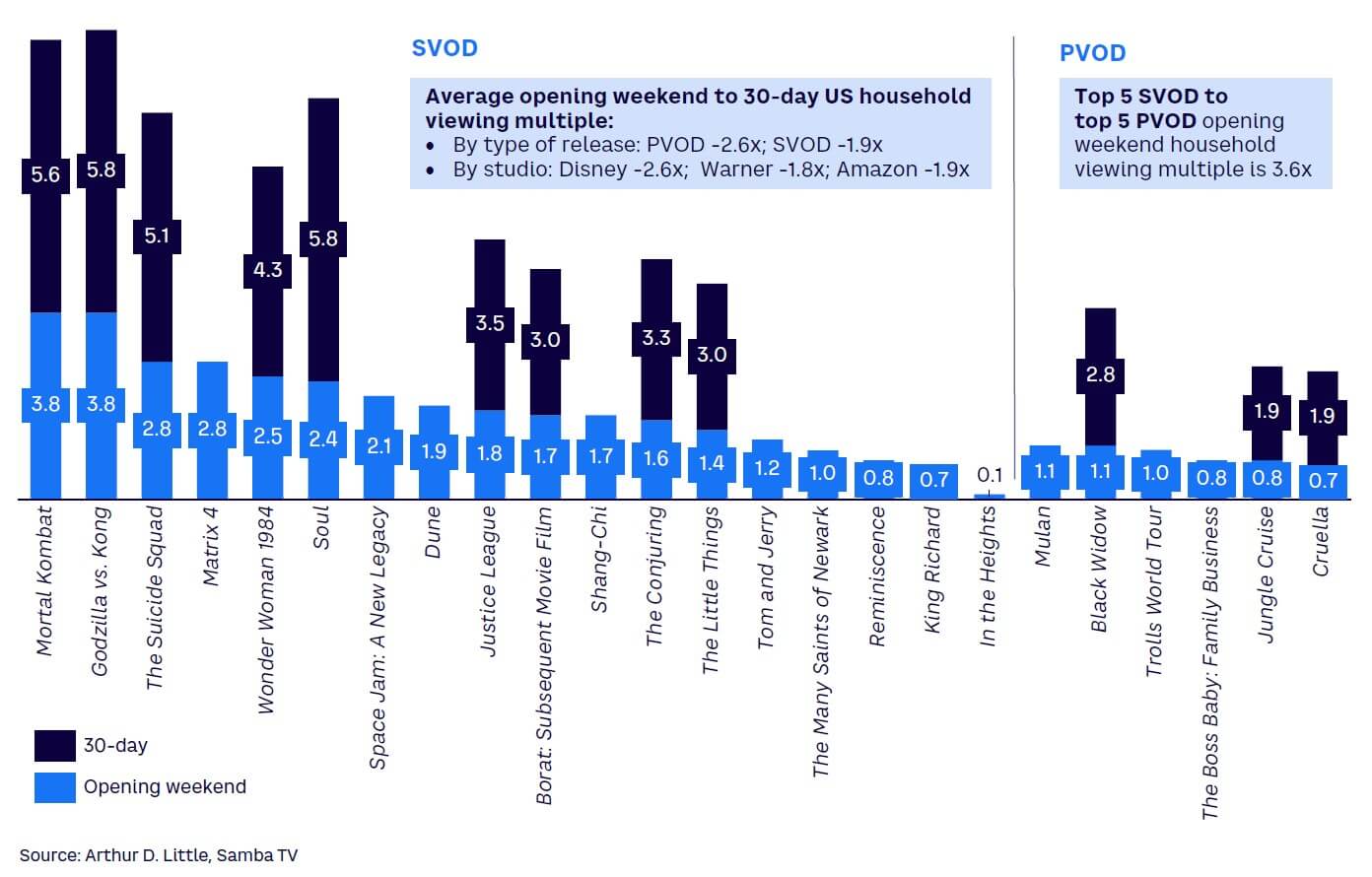

Measuring box office ticket sales against PVOD and SVOD revenues is not an apples-to-apples comparison. So Arthur D. Little (ADL) performed some analysis using data from Samba TV and also extrapolated data from a sample of films to determine a set of numbers equivalent to box office revenue. Figure 5 shows how PVOD and SVOP measure against each other during opening weekends.

Samba TV measures 46 million TV devices with a panel comprised of 3 million US households. We applied its household viewing numbers for Disney’s Mulan and Black Widow. Using the 2.6x metric for opening weekend to 30-day run and 2x US-to-global-revenue multiples in Figure 5, we can estimate the following:

- Top Disney+ films (Mulan and Black Widow), each with 1.1 million US opening weekend views, generated approximately $150 million on PVOD globally, the equivalent of $300 million in global box office gross revenues, assuming 50% of Disney’s theatrical rental rate is included. For comparison, $300 million would put them in 30th place on the list of top 2019 box office films. Not a home run, but certainly not a disappointment.

- Mulan was a PVOD exclusive; Black Widow was not. Black Widow generated $379 million in box office sales globally ($189 million in the US). So Black Widow’s theatrical and PVOD equivalent is about $679 million, making it number 14 on the 2019 top box office list.

- In the US, top performers generated about 4 million household views on opening weekend on SVOD. Mortal Kombat, released in January 2021, received 3.8 million views; Godzilla vs. Kong, released in May 2021, received 3.6 million views. The biggest US box office success of 2021 of day-and-date released titles earned $200 million: Godzilla vs. Kong.

We think these large revenue numbers generated through PVOD cannot be easily dismissed. However, these outcomes have not prevented studios from returning to theatrical releases in movie theaters as they reopened. Thus, we believe studios will continue to use a hybrid model for film releases.

The reversal of day-and-date releases

Warner Bros. sent shockwaves through the industry when it announced it would adopt a day-and-date release schedule for its 2021 film slate. They released the films simultaneously on HBO Max and in theaters. Other studios followed suit. Disney released Black Widow and Jungle Cruise in theaters and at a premium price on Disney+, while Universal released Halloween Kills, Boss Baby: Family Business, and Marry Me as day-and-date titles on Peacock and struck a deal to debut films on PVOD 17 days after theatrical release if they earned less than $50 million on opening weekend. Paramount took Mission: Impossible 7 and A Quiet Place Part II to Paramount+ 45 days after their big-screen releases.

The PVOD window has been much discussed, but never truly tested by the major studios before the pandemic. It proved an attractive revenue opportunity and, in many cases, an alternative to the theatrical release window.

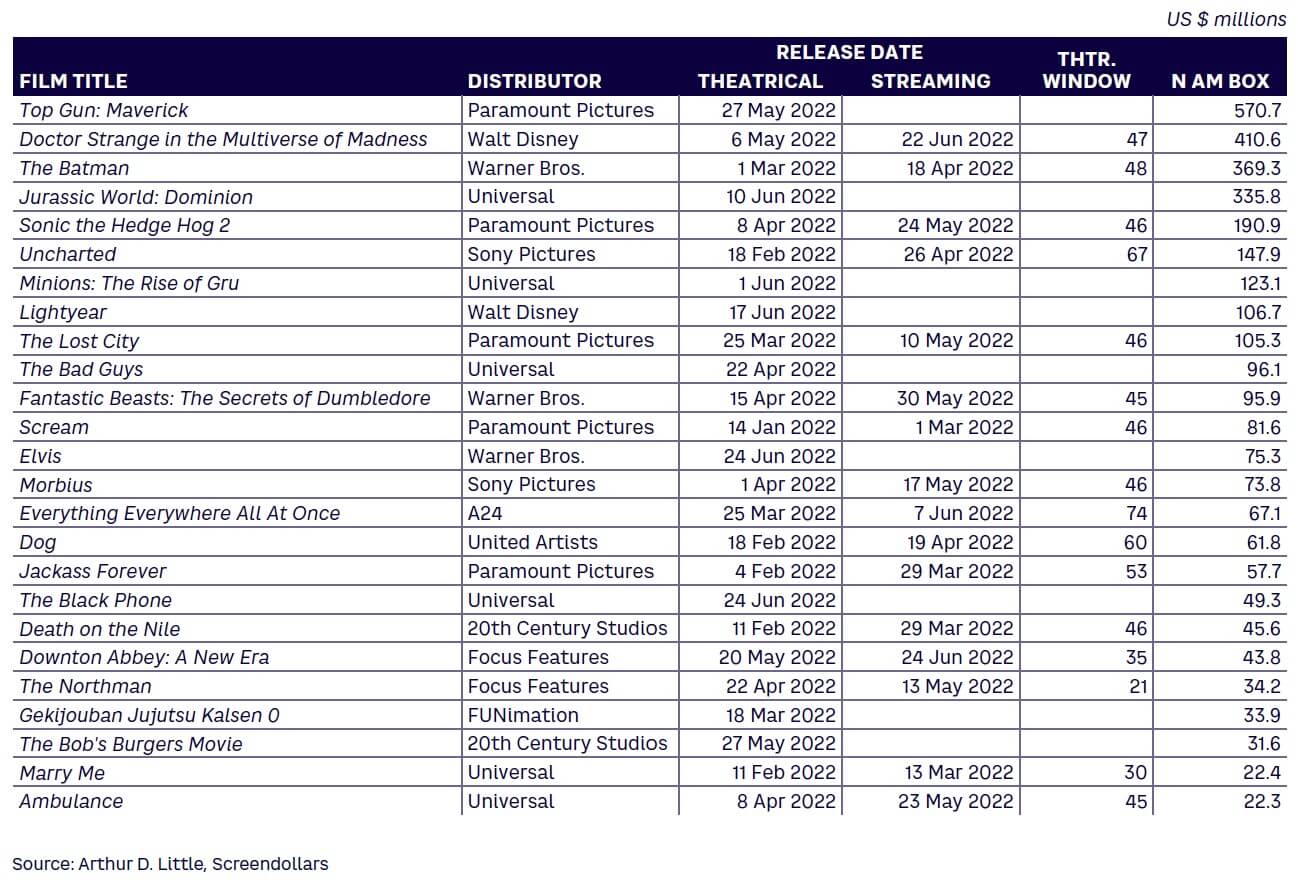

After one year, Warner reversed its day-and-date strategy and reached an agreement with Cineworld for a 45-day exclusive window for all theatrical films in 2022. Furthermore, Paramount announced the same window for top movies like Mission: Impossible 7. In 2022, we have seen other studios reverse strategies deployed in 2021 along with the reintroduction of film exclusive windows. Figure 6 shows release dates to both movie theaters and streaming services.

The marketing spend ROI will be a key criterion driving different release approaches by genre. Action (Maverick and Spider-Man: No Way Home) and comedy (Space Jam: A New Legacy) were the genres that on average recouped P&A spend from their theatrical runs only.

Conclusion

FUTURE CONSIDERATIONS

The pandemic hit the film industry hard; it also offered opportunities to challenge traditional ways of developing, distributing, and monetizing content. Hybrid models and experimentation will continue, providing data to studios while they figure out their marketing strategies. ADL believes studios can benefit by focusing on four key imperatives:

- Take a portfolio approach to film distribution; assess the economics of streaming against other release windows.

- Consider outcomes for customer acquisition, including engagement, retention, and churn; build tools to optimize marketing spend based on ROI.

- Develop digital marketing strategies and templates for streaming-only movies, hybrid releases, and theatricals releases; analyze audiences by film budgets, genres, and independent films versus blockbusters.

- Leverage data-driven insights to drive film development and financing.