Mergers and acquisitions (M&As) have become an optimal way for insurers to expand or increase profits. However, dealmaking is time-intensive and costly, so failing to deliver on expected value is not an option. In this Viewpoint, we examine all the required elements to ensure business continuity and create synergies that make the combined entity more than the sum of its parts.

CAPTURING VALUE

Insurance is a highly competitive market characterized by a mature business model and recurrent, predictable revenues. With growth occurring primarily through new customer acquisition, insurers are increasingly turning to M&As to consolidate their positions. We expect this trend to accelerate in the next few years.

Successfully completing an M&A takes considerable time and financial resources — but it is only the first step. Once the deal is set, both companies must immediately pivot to focus on post-merger integration. Without successful integration, the companies will fail to capture the deal’s expected value.

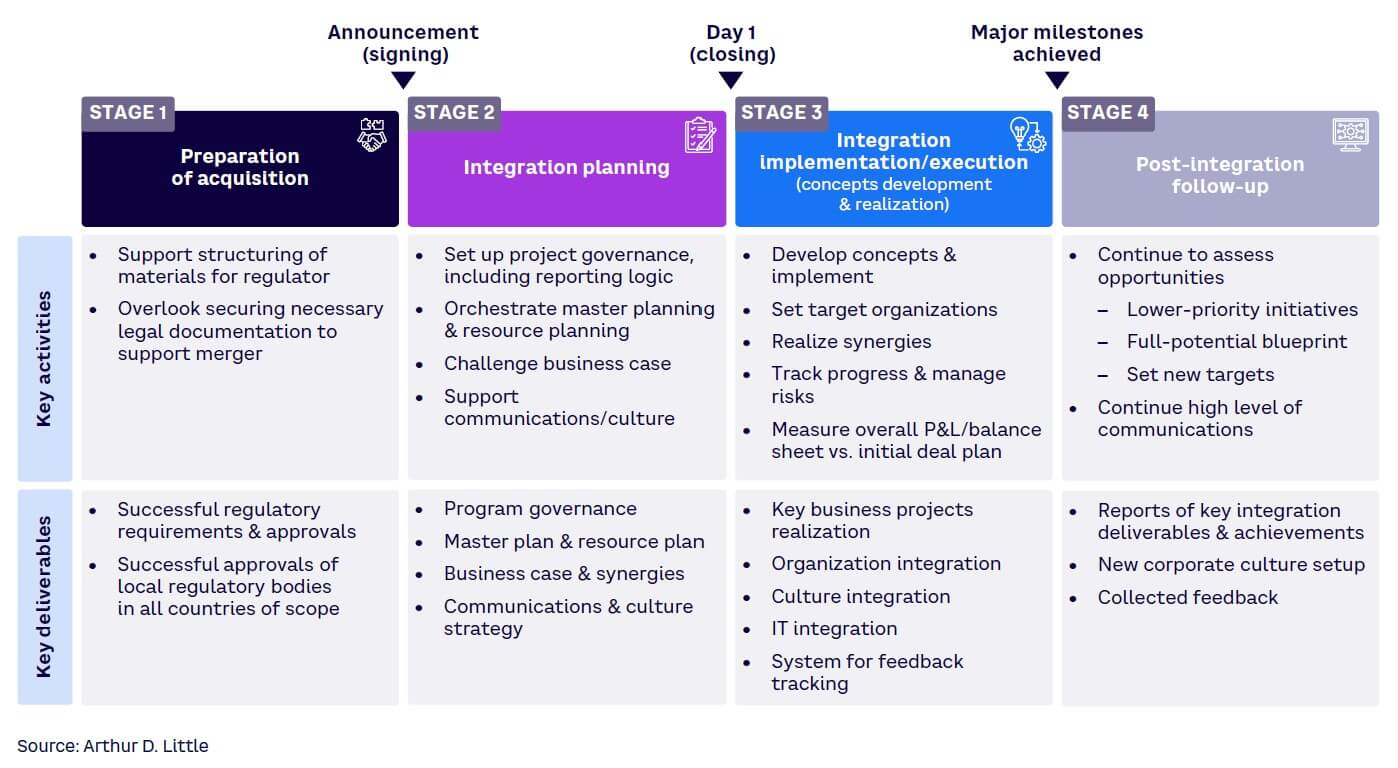

As shown in Figure 1, post-merger integration begins with acquisition preparation and ends with post-integration follow-up:

-

Preparation. Conduct due diligence and secure the necessary legal documentation to support the merger or acquisition.

-

Integration planning. Upon agreeing on the deal, create a plan, set up project governance, and develop detailed target business cases and desired synergies.

-

Integration implementation. Immediately after closing, execute the integration plan, including progress tracking and risk management.

-

Post-integration follow-up. Monitor integration success or issues, assess new integration opportunities, and set additional targets.

Success of the integration depends on the correct execution of each stage, so it is important to dedicate significant attention and resources to each. In our experience, using a “SMART PMO” (project management office) that includes a few senior resources with full-time dedication to drive the project can yield significant value.

Establishing a successful integration that builds a solid foundation for continuous growth of the combined entity stands across four pillars:

-

Planning ahead. Smooth integration and growth targets can only be achieved with in-depth, agile planning. This takes time and a collective effort, so a substantial planning phase is needed to ensure all dimensions have been examined from beginning to end.

-

Aligning each stakeholder. One of the main operational challenges during post-merger integration is ensuring that every stakeholder aligns on each integration aspect. For example, employees must be frequently updated about all changes brought about by the integration, while stakeholders such as sales channels should be kept informed about news related to the integration along with progress being made.

-

Efficiently integrating systems. A wide variety of technical issues must be addressed during integration, including access to production screens for all sales channels, data warehouse integration, and system and tool access for employees of both companies. Perhaps the most crucial aspect of system integration is product portfolio finalization, which includes stopping new product issuance from the phased-out platform and renewing existing policies in the target production system, with the ultimate goal of unifying all transactions on a single platform.

-

Closely monitoring synergies. To achieve the main goal of creating an integrated entity that is more than the sum of its parts, consistent synergy tracking must occur for both sales and operations.

The SMART PMO is responsible for ensuring that all business units (BUs) are directly involved with the execution of each main pillar.

PLANNING AHEAD

The first step in the planning phase is creating a roadmap for each BU with a detailed set of actions and deadlines. This requires a series of meetings with all BUs to develop an understanding of the activities to be completed and the required amount of time needed for each. The SMART PMO consolidates this information to prepare project charters with a key set of actions, their respective deadlines, and an estimate of the time required for each. Project charters are extremely useful because they help each value stream detail its key goals, activities, and deliverables, giving the SMART PMO a complete list of needed integration activities across all BUs, including their potential dependencies.

As the integration progresses, weekly status meetings with department heads can help track progress, resolve interdependencies, and identify risks and possible mitigations. Weekly status meetings also help create an atmosphere of co-creation and co-responsibility for the integration.

Ensure business continuity

The next step involves continuity activities performed in the first few days after the closing. Every merger or takeover encompasses a period of uncertainty in which detailed planning and risk anticipation are key success factors. Topics to consider include:

-

Definition of an agile governance model, with clear attributions and responsibilities from day one, allowing control of the acquired company without affecting daily operations

-

Definition of the legal roadmap, identifying the requirements and deadlines for transaction approval by various regulatory bodies

-

Specification and validation of the perimeter included in the transaction (e.g., real estate, people, know-how, systems, brand)

-

Definition of a customer-retention plan to preserve the value of the business being acquired

-

A review and update of the existing business plan, encouraging commercial actions from day one and considering the initial capture of synergies and other value-creation levers

-

Definition of a change management strategy based on an understanding of cultural differences, C-suite involvement, and employee engagement to ensure a smooth transition

-

Definition of a customized, detailed (hourly) communications plan for day one and the next several days for the main external and internal stakeholders (shareholders, regulators, employees, and customers), highlighting the main benefits of the integration with the goal of ensuring business continuity

-

Identification of key employees and definition of a talent-retention plan for the combined entity to avoid the loss of critical personnel

-

Placement of a plan to ensure operational continuity and control of critical financial functions (e.g., joint treasury management)

The integration manager plays a key role in this phase of the process, a time when managerial responsibility is assumed by the new leadership team. He or she must have sufficient seniority and strong-enough leadership skills to ensure timely decision-making, conflict resolution, resource management, and team mobilization. The integration manager can help define essential actions for all value streams and business-as-usual functions to ensure a successful takeover while guaranteeing business continuity.

ALIGNING STAKEHOLDERS

During the integration process, it’s important to keep all stakeholders fully informed about key decisions made, integration achievements, and next steps. Sales channels are one of the most crucial stakeholders in the post-merger phase — they must quickly be assured that their partnership with the integrated firm will continue and that relationships will be preserved to the greatest possible extent. Sales teams, including top management, should proactively visit every sales channel branch to better understand their needs and answer their questions regarding new ways of doing business.

Employees are the next priority when it comes to communication. Welcoming messages such as a CEO email or “town hall speech” should be part of a comprehensive welcome package. Long-time employees may be assigned to work with newcomers to add a personal, helping generate an atmosphere of trust in the new work environment.

“Key to a successful integration is continuously communicating with each and every stakeholder, most importantly new-coming employees.” — Yavuz Ölken, CEO of AXA Turkey

EFFICIENTLY INTEGRATING SYSTEMS

Product screens and core system adjustments, data transfer to achieve a consolidated view, and employee access to systems are all needed to ensure a smooth operational, technical, and commercial integration.

Product screens & core system adjustments

As two companies begin operating as one, it’s vital to handle technology integration carefully. For example, there may be sales channel branches that have never worked with the client company’s screen for underwriting.

Similarly, agents must quickly stop using the secondary company’s sales production system. Each scenario requires a specific set of actions. The first step in enabling all sales channel branches to operate from a single company screen is to prepare a target product portfolio. This involves setting specific closing dates for new business and policy renewals, as some products might close in alignment with target portfolio specifications. The SMART PMO, in cooperation with product teams, must continuously track each major product line. Key parameters include closing dates for new business, renewals, and the addition of products based on product mapping and data/technology requirements.

System duplication must also be addressed. For each application, there should be meetings with BUs to define a closing plan or develop an approach for continuing the application’s use. (These meetings are a valuable way to conduct IT security checks to ensure all departments are complying with regulations.) Maintaining duplicate applications is expensive, so closing plans are key to helping IT correctly allocate budget and personnel and prioritize systems that must be kept running to ensure continuous operation.

Data transfer realization with a consolidated view

Conversion is the process of transferring all policies with related information to the target system and is essential to enabling automatic policy updates. However, conversion requires long-term dedication, along with major financial and operational support. Some companies are opting for a leaner approach using summary reports. These are prepared in the acquired company’s data warehouse to reflect the acquirer company’s data-tracking guidelines. The acquirer company’s daily operation-tracking reports are created in the acquired company’s systems; those reports are then combined with the reports of the acquiring companies to reflect the combined company’s financials.

Employee access to systems

From a morale perspective, and to ensure employee coordination across departments, newcomers must quickly connect to the acquiring company’s network. If needed, network access can be provided by a virtual private network on a point-to-point leased line. Call center connections and email management should also be prioritized, with an email transfer program to forward workers’ previous emails to their new inboxes.

CLOSELY MONITORING SYNERGIES

When two companies create synergies, whether in client services, sales, or expenses, they become an entity that is more than the sum of its parts. There are three primary areas to consider:

-

Avoiding client disruption. Each BU’s gross written premium amount should be tracked monthly (daily or weekly for the first few weeks). To avoid significant sales drops, renewals should be carefully examined (products that initially appear to match may have slightly different features), and sales leaders should ensure that everyone on their team is using the most current sales pitch and understands new incentives.

-

Focusing on increasing sales for target lines. High-volume product lines should be a focal point for achieving synergies, as higher sales automatically yield better traction and more sustainable growth.

-

Planning and tracking cost synergies. Cost synergies can be found in various areas, including evaluating contracts to see if lower rates and cost optimization can be achieved through system closings.

“Each contract, each initiative, every possible opportunity must be evaluated in detail to ensure the synergies are realized at their full potential for the growth & future ambitions.” — Yavuz Ölken

COMMON PITFALLS

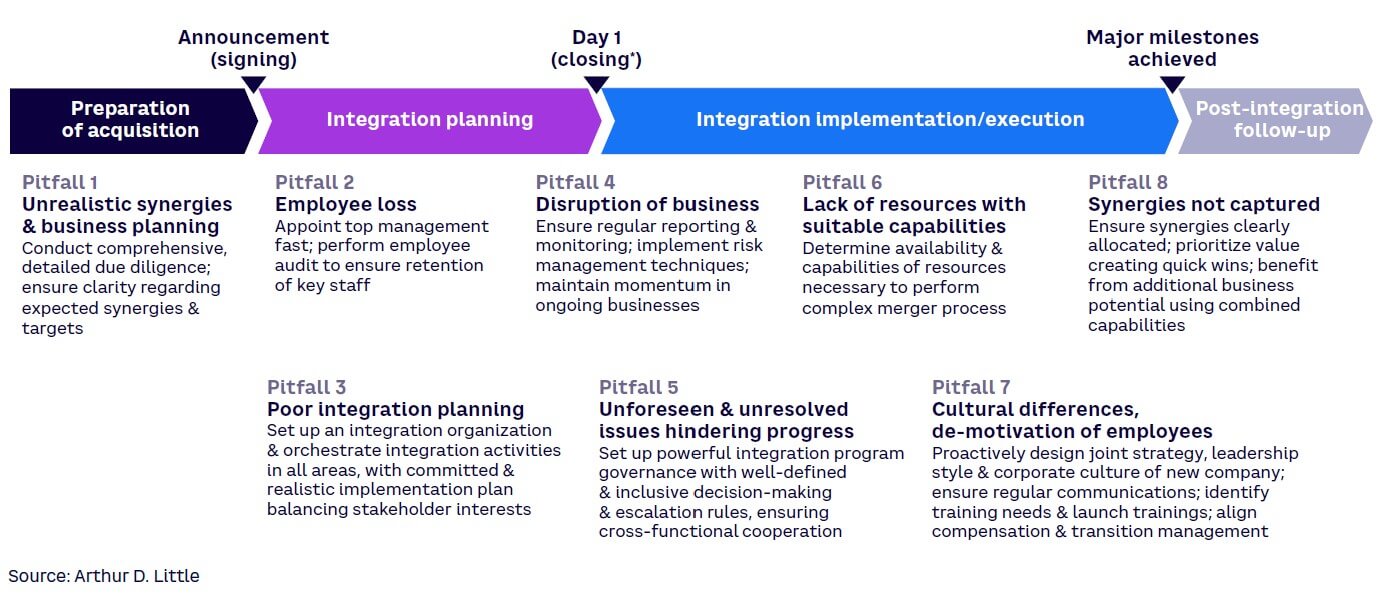

Figure 2 shows eight of the most common post-merger pitfalls. Avoiding these bolsters the integration process, ensuring the merger achieves the anticipated value-add.

POST-MERGER INTEGRATIONS TOOLBOX

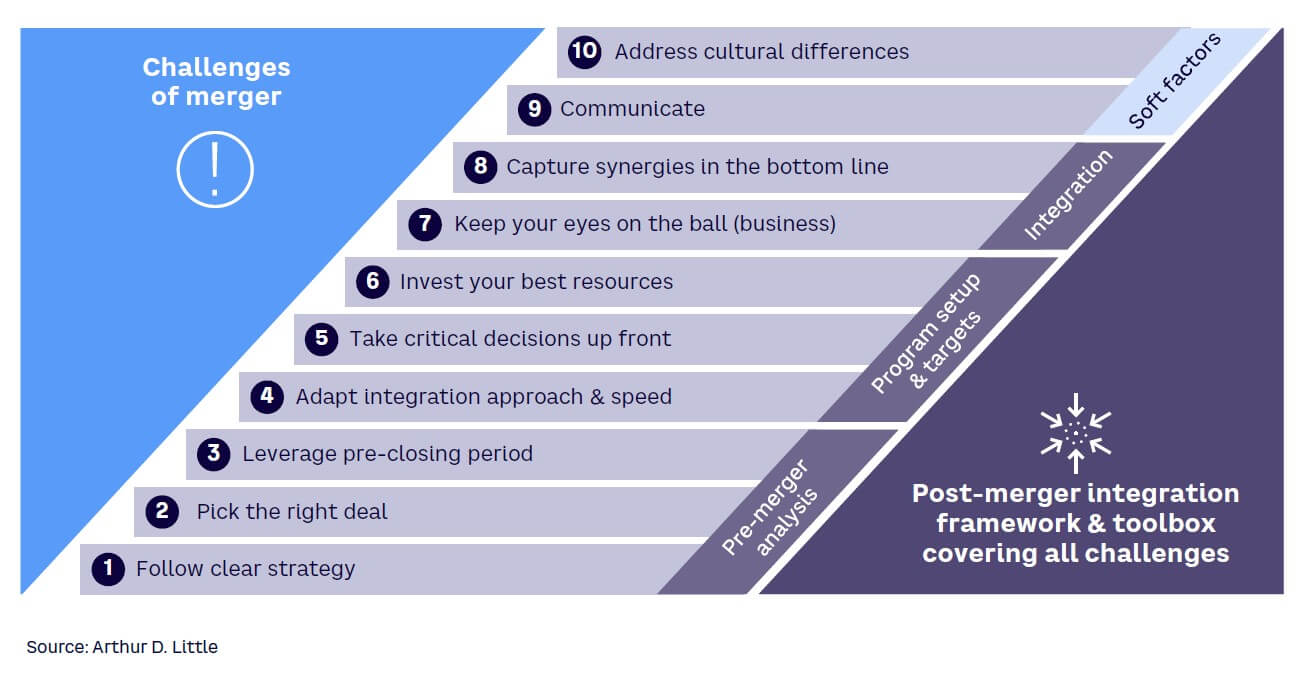

As post-merger integrations become ever more important to growth, insurers may want to develop their own post-merger integration capabilities, including a customized framework and toolbox (see Figure 3).

The framework should summarize the knowledge and learnings generated from previous integrations, helping the organization learn from experience and leverage available best practices. The methodology and related toolbox should not be static; rather, they should be frequently reviewed to incorporate new ways to optimize future integrations.

“We must ensure seamless integration throughout the whole organization, and working with the right partner is one of the keys.” — Yavuz Ölken

Conclusion

Proper post-merger integration requires a broader focus

M&A activity in the insurance sector is increasing, and proper post-merger integration is fundamental to capturing expected synergies. We recommend post-merger integration that includes planning ahead, aligning each stakeholder, efficiently integrating systems, and closely monitoring synergies. Although a structured approach is an important crucial aspect of post-merger integration, as the project progresses, the SMART PMO will need to look beyond the product portfolio, technology issues, and the org chart to focus on cultural differences, urgent communication requests, stakeholder engagement, and agile problem-solving.