Growing global mega challenges and rising competition mean that generating a steady stream of breakthrough innovations is central to organizational success. However, traditional corporate structures and capabilities are geared toward supporting incremental innovation programs, which require unique processes and skills. Yet what we need today is a new way of industrializing breakthrough innovations to create a portfolio of successes that support corporate growth objectives — the Breakthrough Innovation Factory (BIF).

THE PRESSING NEED FOR BREAKTHROUGH INNOVATION

The opportunities and challenges for organizations across all sectors have never been greater. Transformative technology creates radical possibilities for new products, services, and ways of working while rising competition is increasing threats to revenues, even in previously safe markets. At the same time, challenges in areas such as sustainability and decarbonization can only be solved through innovation and new thinking. Incremental innovation alone is not enough in today’s world — breakthrough innovation must be central to how organizations innovate and operate.

However, deploying a system for managing a portfolio of breakthrough innovation projects while still pursuing incremental innovation requires companies to overcome challenges around organization, culture, and strategy:

-

Operating model. The models to manage and encourage incremental innovations are well established, featuring clear, stage-gate processes associated with predefined deliverables for each step. By contrast, breakthrough innovation requires companies to manage uncertainties, notably in terms of technology and market fit, requiring a completely different process and project organization.

-

Combining incremental and breakthrough innovation. Organizations cannot afford to neglect either incremental or breakthrough innovation. Combining these aims and structures in the same organization is challenging in terms of allocating resources, capabilities, and support.

-

Risk-averse cultures. Many large organizations (and some employees) are risk-averse. Incremental innovation programs are considered low risk and fit comfortably into existing company cultures. It is much more difficult to predict and manage the risks around breakthrough innovation, requiring a cultural change to create the right balance between the risk of failure and potential value creation.

-

Collective biases. Linked to culture, many corporations suffer from a (misplaced) collective belief that they cannot harness breakthrough innovation due to their size and maturity. Employees feel they are not creative enough to drive breakthroughs, instead leaving it to start-ups to bring radical innovations to market.

-

The innovation dilemma. By developing breakthrough innovations, a company can potentially threaten its existing business and revenues — the classic innovation dilemma. This is not the case with incremental innovations, leading to this approach being prioritized as safer by the business.

Due to these challenges, many companies have essentially outsourced their breakthrough innovation programs. For example, they have created corporate venture funds (CVFs) or incubators that invest in and support start-ups to assess and provide access to new opportunities or technologies. While widespread, this model has limits. There is restricted strategic impact from the investment due to the complexity of the relationship with the start-ups themselves, and it is difficult to maintain alignment between stakeholders (i.e., start-up founders, corporates, and other investors).

These limitations mean that while this approach is clearly attractive when scouting a new market, testing a technology, gathering market intelligence, or sometimes facilitating an acquisition, it is rarely sufficient to develop a real impactful breakthrough innovation strategy.

3 DEVELOPMENT MODELS

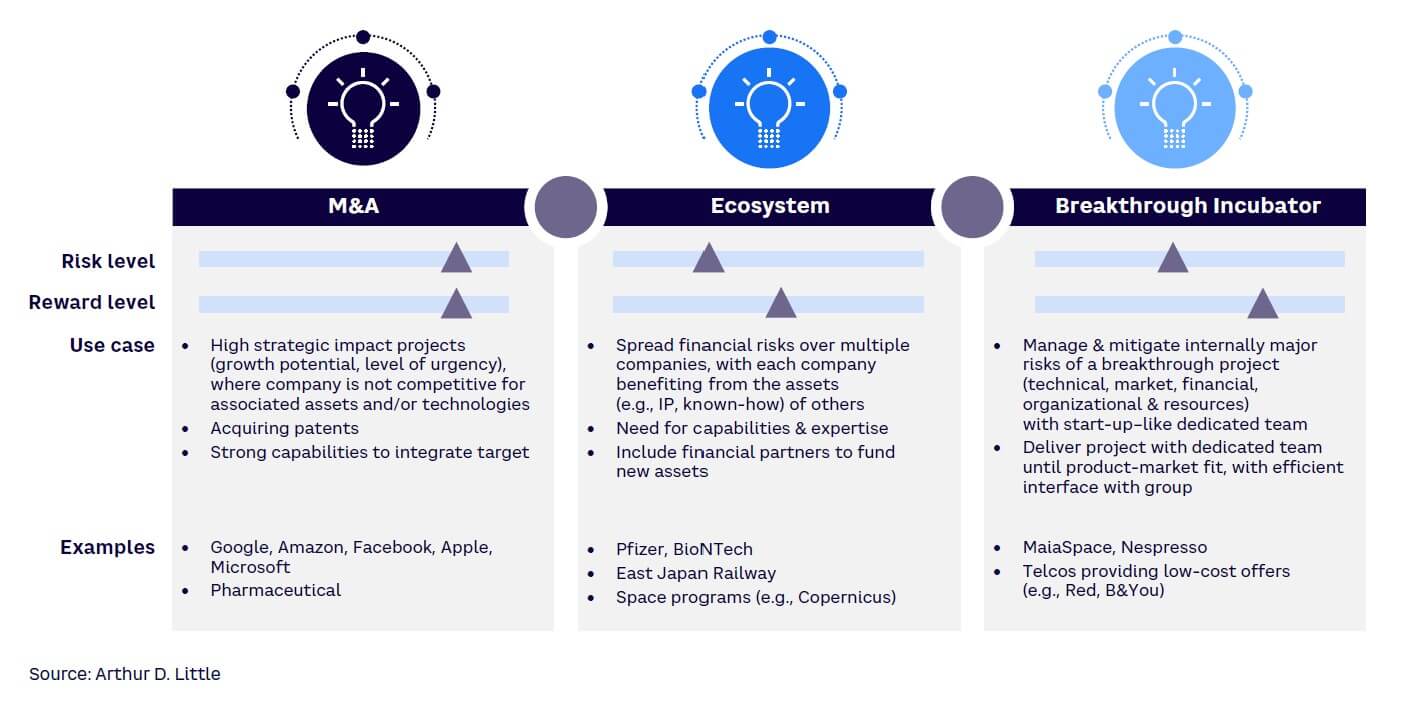

To meet the challenge of systematically and proactively delivering breakthrough projects, companies can consider three main development model possibilities to maximize the chances of success (see Figure 1).

1. M&A

New breakthrough innovations can be bought, an approach especially relevant when it comes to areas where the company is not competitive but where innovation can deliver high strategic impact. The key success factor is the organization’s ability to successfully integrate the acquisition without destroying its value. Digital players such as Amazon or Google excel at this model; it is also a tried and tested approach in pharmaceuticals, with large players acquiring start-ups whose drugs have successfully completed Phase 1 trials.

2. Ecosystem (strategic partnership)

Working together across an ecosystem pools risks and delivers shared benefits in terms of intellectual property (IP) and technology. The key success factor is how the ecosystem’s governance rules are structured and applied to ensure an equitable return for all parties. An example of this approach is the collaboration between Pfizer and BioNTech on their COVID-19 vaccine, which brought together disruptive technology from the start-up with regulatory and operational capabilities from the corporation. Strategic partnerships can also include financial partners to fund new assets, reducing risk for other players.

3. Breakthrough Incubator

In this model, as described in the Arthur D. Little (ADL) Viewpoint “The Breakthrough Incubator: A Proven Approach,” the company is much more proactive and autonomous when it comes to internally managing and mitigating the major risks of a breakthrough project. It creates a dedicated team with a start-up–like operating model and an efficient interface with the parent organization. The resulting projects can then either remain within the company or be incorporated into a NewCo hosting the resources, at least during development and potentially after commercialization.

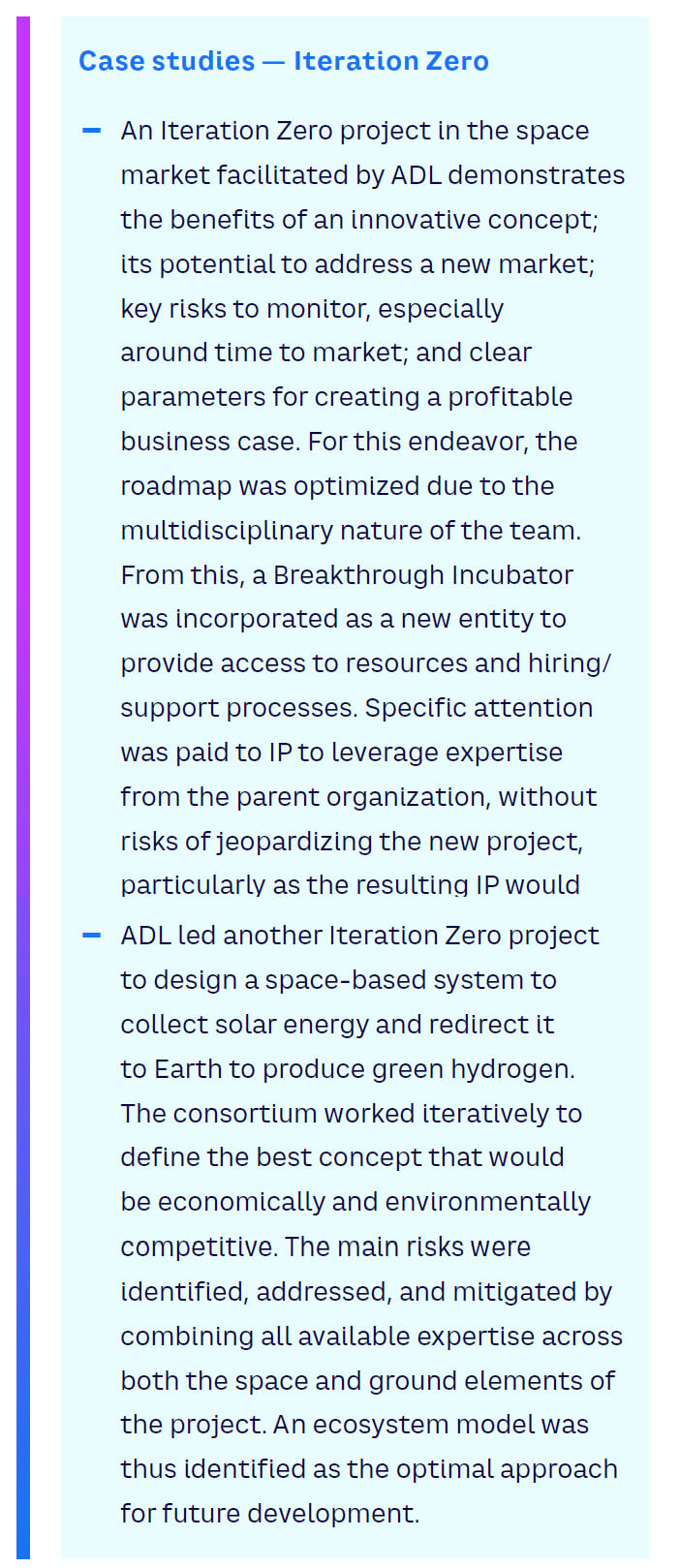

ITERATION ZERO TO SELECT RIGHT MODEL FOR EACH PROJECT

All three models leverage some organizational assets. Selecting the right level of assets to leverage, how to manage them, and the right model itself can be challenging, particularly as choices depend on multiple factors that are not clear at the ideation stage and are specific to the project itself. A proven way to overcome these uncertainties is by using an “Iteration Zero” approach, as described in the ADL Prism article “Combining Strength and Agility,” harnessing these elements:

-

A multidisciplinary team of six to eight people covering all key functions, ideally all totally (or at least substantially) dedicated to the project for the Iteration Zero phase.

-

A program of three sprints, each typically lasting three to six weeks, depending on complexity.

-

This then qualifies and mitigates all potential technological, financial, market, and resource risks.

-

This leads to a recommendation on the best development mode and roadmap.

This approach has been proven across multiple projects and markets. It provides senior management with clear outputs to base their go/no-go decision, particularly by delivering a more in-depth view of risks, how to mitigate them, and the necessary conditions to build a viable business model.

THE BREAKTHROUGH INNOVATION FACTORY

Organizations must industrialize the rate and volume of breakthrough innovation projects they deliver to multiply the opportunities of increasing growth and margins. As such, they must move from working on a single breakthrough during a year to handling two to five projects simultaneously. This requires a shift from single Breakthrough Incubators or partnerships to the creation of the BIF, which aims to support the development and growth phases of a technology/idea/patent and/or a start-up to establish a new stand-alone business at scale. The corporate side supports the process by providing its resources (finance and managerial/industrial knowledge) and runs a rigorous Iteration Zero process to ensure the correct approach for each initiative before being developed further.

The BIF acts as an essential bridge to overcome the often-ignored gaps in proving and scaling new ideas to create significant value:

-

It can foster business model innovation. New technologies for new markets can support or lead business model innovation, not just technology-led innovation, necessitating independence and the ability to experiment.

-

It proves demand by commercializing technology research. Research projects are not fully fledged businesses, so it is key to prove demand and generate real revenue trajectory before handing off to a business owner.

-

It achieves required time to market through a dedicated focus. Critical projects tied to the innovation agenda need deliberate resourcing and funding to meet the market opportunity in time.

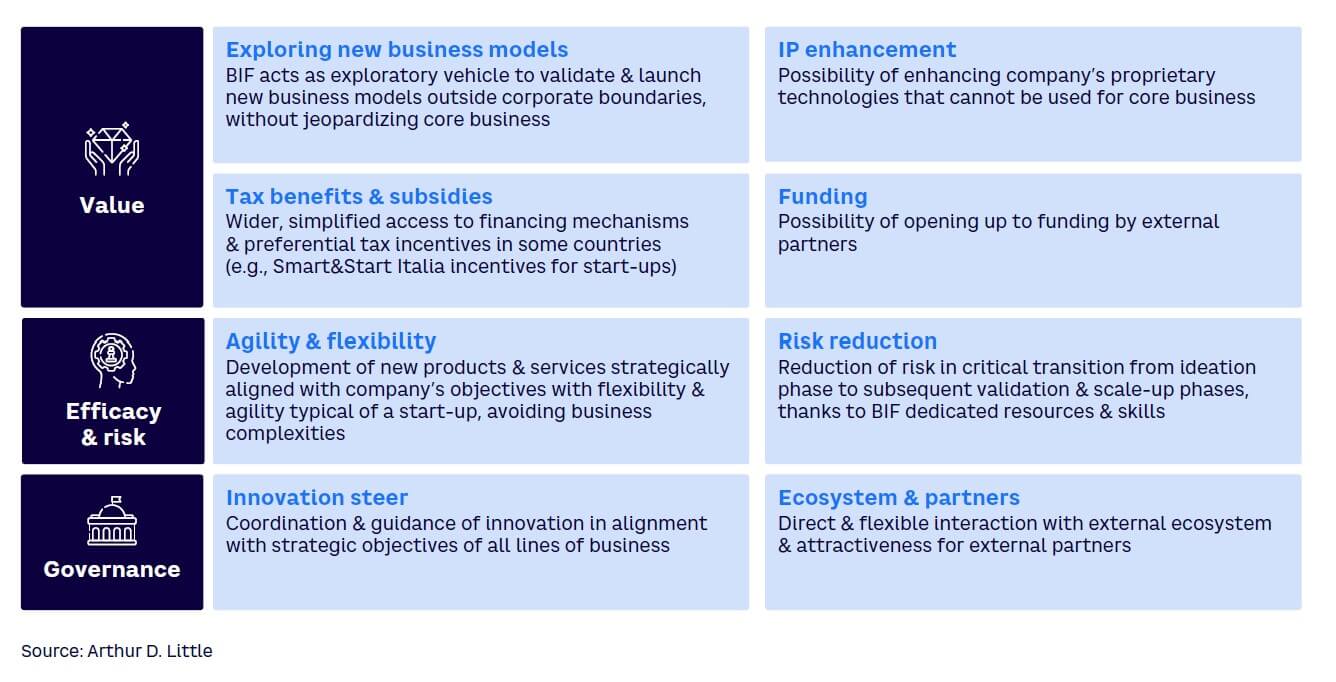

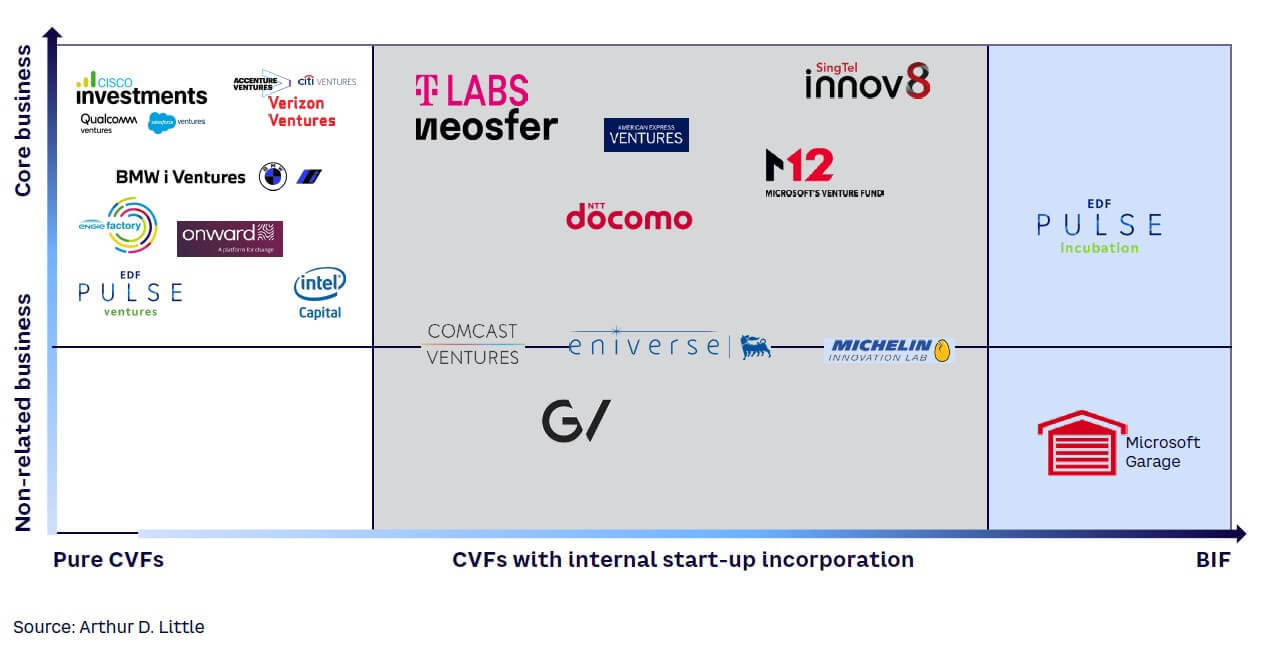

Sometimes there is confusion between CVFs (or corporate venture capital) and BIFs. The main differences are that venture funds typically involve direct investments in external start-ups or ventures that provide the innovative idea, while BIFs focus on internally initiating and building new businesses. BIF entities operate independently, leveraging the parent company’s resources, assets, and knowledge to create innovative products and services, whereas venture funds primarily involve financial investments in external entities. Figure 2 summarizes the main benefits of the BIF approach.

How BIFs fit into the innovation environment

Looking at innovation leaders across different sectors shows the range of models in scaling breakthrough innovation. While most initiatives are related to venture funds investing in core/adjacent businesses, a range of other options, including BIFs, is now emerging. Some have a specific focus related to the core business, while others do not have any constraints on the target market, as shown in Figure 3. For example:

-

Microsoft Garage. Microsoft launched an internal open innovation hub 15 years ago. Employees from all divisions of the company are free to take part in Microsoft Garage activities and small-scale innovation projects — not necessarily connected to their primary function or related to Microsoft’s core markets. More than 75 successful projects have been launched, such as FarmBeats (data-driven farming to increase crop yields) and Health Bot Service (a software-as-a-service AI that empowers healthcare organizations to provide users with health information).

-

EDF Pulse Incubation. Part of EDF Group’s Pulse innovation ecosystem, this strand is dedicated to internal technology market development. It promotes new businesses in the energy transition through intrapreneurship, complementing other EDF entities that oversee investment in start-ups (EDF Pulse Ventures), training (EDF Pulse Factory), and open innovation (EDF Pulse Connect). As of June 2024, seven major businesses have been created and are now EDF subsidiaries, including Perfesco (financing energy-efficiency projects of industrial and tertiary buildings), Sowee (housing management), and Hynamics (hydrogen production).

-

Michelin Innovation Lab (MIL). MIL focuses on supporting new in-house projects in strategic, adjacent areas for the tire manufacturer (high-tech materials, services and solutions, and experience) as part of Michelin’s objective to generate a third of its business from outside the tire sector in 2030. Nine projects have already been launched, including Wàtea (electric mobility solutions for commercial vehicles), WISAMO (a wind propulsion solution for the maritime sector), and ResiCare (a high-performance resin adhesive for industrial applications).

HOW TO DESIGN A BIF

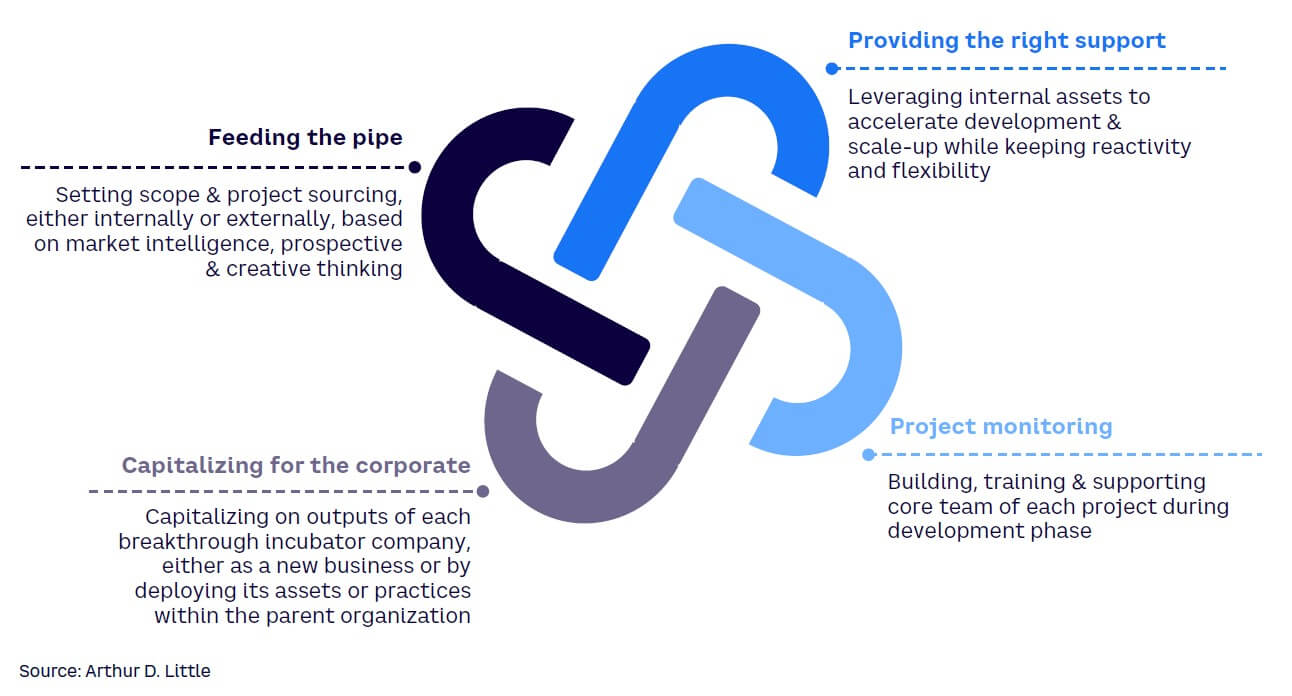

A successful BIF must be led by a strong, dedicated team that pioneers fast, flexible innovation development within the company; fosters an innovation-driven culture; and possesses an entrepreneurial mindset to drive new business creation. Figure 4 outlines the four key roles of a central BIF entity. Achieving this requires processes that cover these four areas.

1. Feeding the pipe

Organizations need to set the scope and focus for the BIF, determining whether it should concentrate solely on adjacent business areas or be empowered to develop new ventures that potentially cannibalize current products and services. The examples seen in the rise of Netflix and the fall of Blockbuster in film rental highlight the dangers of not embracing disruption.

Businesses should also set the level of ambition, target value, and time horizon. A good practice is to set ambitious goals to create momentum and avoid a focus on incremental innovations or limited growth opportunities.

For example, IBM launched its Emerging Business Opportunities process, establishing a set of criteria to select new growth businesses: opportunities must align with and support the wider IBM strategy, provide cross-IBM leverage, offer a new source of customer value, promise revenues of US $1 billion within a five-year time frame, enable IBM to be the market leader, and provide sustained profit without being commoditized.

As part of the objective process, organizations should set the balance between the strategic and financial returns expected from their BIFs. BIFs are typically designed to drive major revenue growth by embracing disruptive innovations. However, they can also deliver strategic benefits, such as understanding and mastering new business models, processes, or market areas.

Finally, BIFs need to fill their pipeline with potential projects. A best practice is to look widely for potential innovative concepts from business unit inputs, market stimuli, and externally from partners/shareholders and research organizations, such as universities. This requires creative thinking, market visioning, and patent scouting of third-party technologies and IP.

2. Project monitoring

Companies often begin breakthrough programs with a single project and then look to scale to create a full BIF that operates at a corporate level. Once the breakthrough funnel grows, organizations should retain agility by creating specific BIFs on a business unit or thematic level, an approach embraced by Amazon and Microsoft, for example.

BIF governance should take inspiration from private equity and start-up models, with two levels of management:

-

Breakthrough innovation committee — comprising the BIF’s key managers. This should focus on BIF operations and processes to manage ideation/design and development.

-

Innovation strategy committee — involving key corporate executives. This should focus more strategically, ensuring the selection of the right ideas for the project portfolio, monitoring the funnel, deciding the best development model for each idea, and validating the benefits of each project.

The BIF team should be staffed with ambidextrous, skilled people, enhanced by a pool of experts. Each breakthrough project team should bring together the optimal blend of skills, mixing internal and external key experts, mentored by the BIF team.

3. Providing the right support

Leveraging internal assets is key to accelerating the development (or scale-up phase) of BIF projects. These assets cover three segments:

-

Intangible (brand, IP and know-how, generated and collected data). Some companies prefer to create a new brand for breakthrough projects to avoid any customer confusion or conflicts with competitors.

-

Tangible (factory and production processes, systems and software, geographic footprint). In a breakthrough project, it is vital to be as autonomous as possible, enabling a test-and-learn approach. Providing specific production facilities can be key, with technologies such as 3D printing accelerating development. However, tangible tools from the business can often add value and should therefore be shared flexibly.

-

Relationships (customer database and user community, value chain position, third-party relationships). This includes intangible assets, but these must be leveraged carefully as projects involve external parties, and it is vital not to put the existing business at risk.

4. Capitalizing for the corporate

Whether the breakthrough project has been successful or not, it is crucial for the parent organization to capitalize on its assets and close the loop after the commercial launch. This can involve benefits received in terms of intangible, tangible, and relationships assets, but also in two further areas:

-

Taking care of staff from the project, who are likely to have developed and deepened more ambidextrous skills. They should be managed carefully to ensure they remain in the company, as they can play a key role in spreading an entrepreneurial spirit more widely.

-

Feedback from the project. This should be systematic, detailed, factual, and constructive, involving all stakeholders. Companies can normally learn more from failures than successes. While it can be painful to “replay the game,” it is critical to develop the company’s capabilities around delivering breakthrough projects at scale.

Conclusion

MASTERING BREAKTHROUGH INNOVATION AT SCALE

Companies face a pressing need to deliver multiple breakthrough innovations at a faster pace and on a wider scale than ever before. That requires a systematic Breakthrough Innovation Factory approach built on:

-

Strategic alignment with the organization’s strategic goals and existing knowledge to create value and drive growth

-

Aligning initiatives with short-, medium-, and long-term time frames while supporting different types of innovation (processes, products, or business models)

-

Autonomy, while being able to leverage the parent company’s resources and connections

-

A culture of agility and flexibility, enabling rapid adaptation to market changes and emerging opportunities, with a fast decision-making process

-

A core team of staff with ambidextrous skills, able to take a transversal view to accelerate project design and delivery