With maturity and fierce competition across the insurance landscape, partnerships with massive distributors — in bancassurance and beyond (e.g., utilities, retail, telecommunications) — have emerged as an increasingly popular alternative to achieve growth targets. Competition to sign an agreement with a relevant partner is intense and costly, and once an insurer achieves that milestone, failing to capture the expected value emerges as a worst nightmare. This Viewpoint provides a practical guide to achieving an agile partnership launch that will drive credibility from day one and establish the foundations for a successful alliance.

SETTING THE STAGE

Insurance is a well-established, highly competitive market, characterized by a mature business model and recurrent, predictable revenues, with growth occurring primarily with the addition of new customers. As players consolidate their positions, however, growing the business becomes more and more difficult and costly. As a result, insurers increasingly have turned to partnerships to achieve growth goals, as they provide a new stream of potential customers. Partnerships also allow insurers to leverage customer interactions to initiate conversations around insurance products, enabling insurers to offer the right products at the right time (e.g., offering car insurance when the customer buys the car), which is key for driving better sales conversion ratios.

Although each deal has its own particularities, Arthur D. Little (ADL) has identified four fundamental steps to ensure successful implementation during the first six to 12 months after agreement signoff:

- Define and align the short-term partnership vision.

- Develop the Alliance Implementation Plan (AIP).

- Set up joint working teams.

- Launch the governance model for alliance implementation.

Define & align short-term partnership vision

Alliance agreements tend to be at a very high level and do not usually include a detailed view on fundamental topics regarding partnership setup and management, leaving plenty of gray areas that can be a source of discrepancies and, therefore, negatively impact partnership implementation (e.g., misunderstandings between partners, reworking, longer partnership implementation deadlines).

After signing the partnership agreement, it is essential to ensure full alignment between the partners on the short-term milestones and the vision of the alliance during its first year. This agreement and alignment should be built around five key pillars:

-

Roadmap of distribution channels — which channels to develop during the first months and definition of specific readiness dates.

-

Value proposition to be developed — which products to launch, level of customization, and launch dates.

-

Operational features for launch — definition of main features of end-to-end operational model (e.g., customer onboarding, claims and complaints processes, customer communications, product approval by both insurer and partner, service control, service-level agreements [SLAs], and measured KPIs).

-

Working teams and resources devoted to alliance setup — the teams needed to execute the implementation and the amount of resources that each party will dedicate.

-

Governance and coordination model for joint work — defining the forums through which the short-term vision implementation will be coordinated and their main characteristics (responsibilities, participants, periodicity).

This alignment exercise is critical, regardless of whether the above-mentioned points have been previously detailed in the signed partnership agreement or the depth to which they have been agreed. In the case where these points have been included in the agreement, determining the work to be done serves as a confirmation that the points remain valid.

The success and credibility of the partnership are at stake during these first months, so it is important that set milestones are achieved within agreed timelines. A pragmatic approach is needed while defining the key pillars, balancing ambition and feasibility of implementation.

To ensure such a balance, main stakeholders and alliance sponsors (including C-level executives from both the insurer and the partner) must be actively involved in discussions and decision making. It is also essential to name a person at each organization to be an alliance manager who will be responsible for the alliance’s success — ensuring the partnership reaches its financial performance targets, driving prioritization of the alliance at the alliance manager’s organization, managing the relationship with the partner, and so on — including on-time implementation of the defined short-term partnership vision.

Alliance managers also must be involved in conversations around definitions to ensure that their perspective regarding goals and timelines is captured, thus signing off on the vision agreed by other relevant stakeholders and alliance sponsors, and committing to implement it within set time frames.

Additionally, although the defined plan is specific to an alliance, alliance managers must guarantee that it is synchronized with the involved parties’ overall strategic vision (e.g., IT development plans, customer targeting preferences, target financial KPIs evolution). For this purpose, alliance managers need to be continuously in touch with key stakeholders at their organizations.

Develop Alliance Implementation Plan

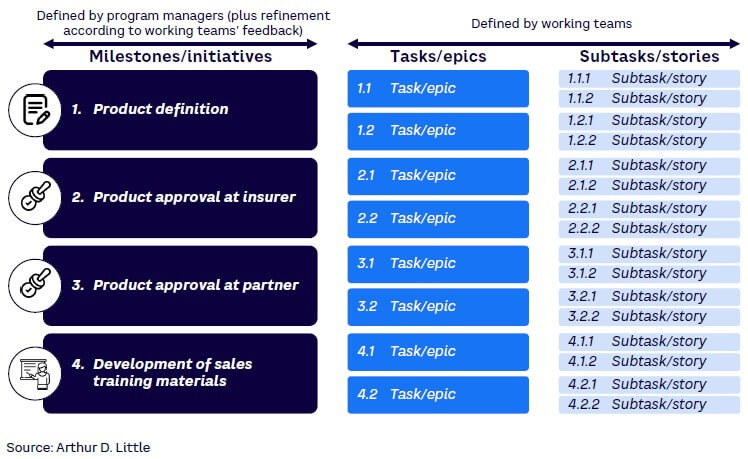

After reaching an alignment on the short-term partnership vision, the parties must develop the plan — the Alliance Implementation Plan (AIP) — to build it. Program managers from the insurer and the partner will be responsible for detailing and aligning around a first high-level version of this plan, which will include main milestones/initiatives to be reached within the coming months. It is essential that each milestone/initiative contains the following items:

- Owner and applicable working team (out of the ones defined during previous stages).

- Start and end date.

- Dependencies with other milestones/initiatives.

It is possible that after drafting the AIP, alliance managers will realize that it is necessary to adjust the working teams (i.e., create new working team(s) or merge any of them). If this is the case, they will raise it to relevant stakeholders at their organizations to receive approval for the allocation of additional FTEs, if needed.

Before making the decision to set up a new working team, alliance managers must assess and be certain that the additional working team is essential for successful implementation (i.e., assigned goals cannot be effectively achieved by one of the already-agreed working teams at the short-term partnership vision definition stage). It is a best practice to rely on the lowest number of working teams possible, since it will significantly simplify program coordination.

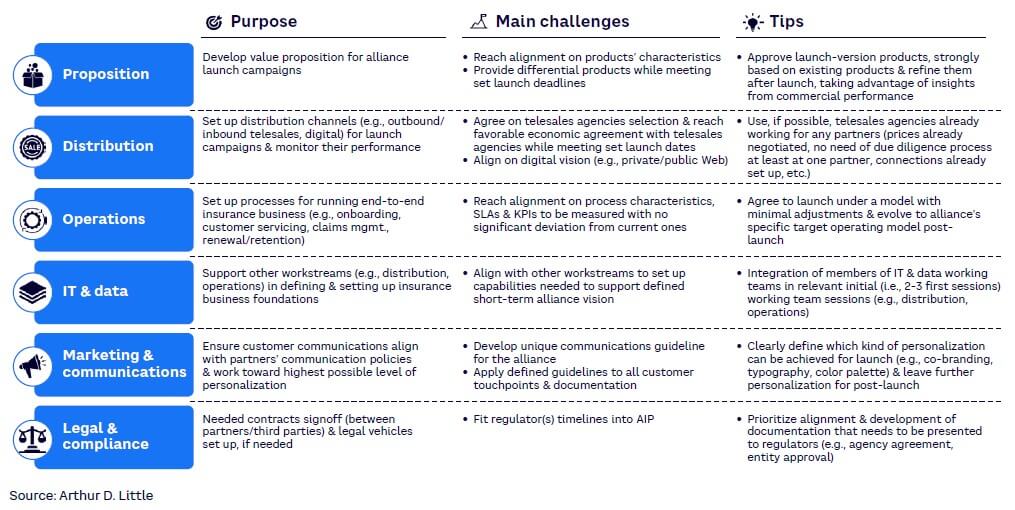

Based on our experience, the following six workstreams are sufficient to successfully implement a partnership (see Figure 1):

- Proposition

- Distribution

- Operations

- IT & data

- Marketing & communications

- Legal & compliance

Nevertheless, since each deal has its own particularities, this structure should be taken only as a reference. Partners must carry out a specific assessment to define which working teams are needed to develop the agreed short-term partnership vision.

Following AIP alignment between alliance managers, the plan must be shared with working teams’ leads to refine (if necessary) and validate it. It is a good practice to allow teams to have at least a couple of days to review the shared plan and then hold a meeting to answer any questions that might arise, amend the AIP if necessary, and reach final alignment around the plan.

Based on our experience, a typical mistake is to transfer the AIP development exercise directly to the teams (i.e., not drafting an initial high-level plan that they then validate). This usually results in significantly longer time frames to build it and reach an alignment among involved parties.

Another mistake we have observed is when alliance managers put too much detail into the AIP and fail to give working teams sufficient autonomy. This can also end in long discussions and the failure of working teams to internalize the AIP as their own, thus lowering the level of engagement, commitment, and alignment with set milestones and deadlines.

A proper AIP should cover the high-level main milestones/initiatives, leaving no doubt to teams about the goals that need to be reached but also allowing working teams to decide and detail needed tasks/epics and subtasks/stories to reach those goals. At the end of the day, working teams’ leads will be held responsible to execute that plan on time, so they need to be comfortable with it.

Alliance managers review program progress only at the milestone/initiative level and make their progress-level status presentations to main stakeholders at this level. It is the working teams, as described in the next section, that keep track of task and subtask levels so they are always sure their teams are on track for meeting milestones/initiatives’ agreed deadlines (see Figure 2). In the case of an expected or potential deviation to a deadline, teams must bring the issue to the attention of an alliance manager so together they can assess potential solutions and minimize impact on implementation performance (e.g., deadlines, costs, quality/capabilities developed).

Set up joint working teams

Once the AIP is fully aligned, it is time to set up the working teams to execute it. These teams must represent both insurer and partner, involving members from both companies to ensure alignment between the two parties. The teams should comprise:

-

Two team leads (one each from insurer and partner) — responsible for meeting set milestones within agreed deadlines.

-

Team members — fully dedicated to the program to guarantee superior performance (for example, it is better to have a team of two dedicated full-time members than a team of four part-time members).

Working teams’ cross-company nature allows the alliance to distance itself from the client-supplier working model, establishing strong partnerships and collaboration dynamics that will result in greater agility in implementation and alliance management. Similarly, the collaboration will allow companies to better know and understand each other, enabling higher transparency and making it easier to reach alignment.

Working teams must work autonomously, with alliance managers intervening only in the case of a roadblock, dependency with other workstreams, or if an issue needs to be escalated to key program stakeholders to be solved.

To further enable this autonomous working dynamic, working teams’ leads will organize and lead, at a minimum, a weekly progress review session, including a draft of the meeting minutes. Since it is inefficient for alliance managers to regularly join these review meetings (instead joining only when there is a critical issue), they will remain apprised of working teams’ progress by the updates provided from the internal weekly meeting by the working teams’ leads.

Additionally, particularly in cases where workstream members are not fully allocated to the alliance, it is a best practice to establish a project management office (PMO) team whose goal is to facilitate decision making and boost required deliverables development. Having this PMO team in place significantly increases the chances of implementation success.

Launch program governance

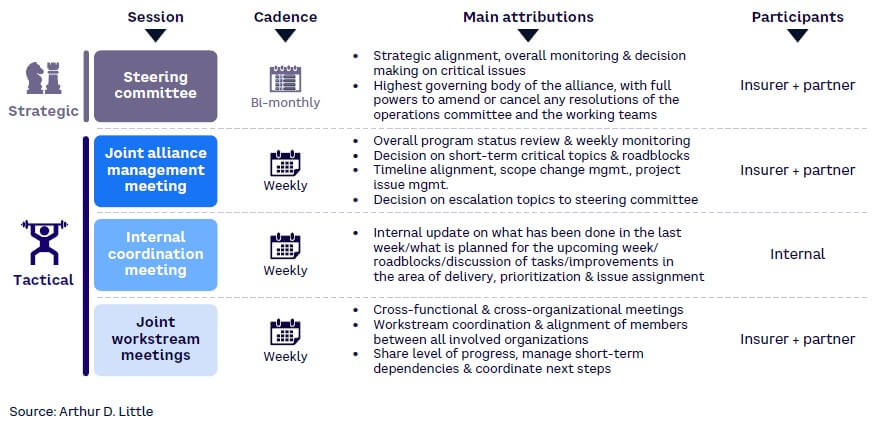

Once parties have fully aligned the program plan and established working teams, it is time to launch the program governance to coordinate execution. Based on our experience, it is ideal to establish two levels of governance (see Figure 3):

-

Strategic level — comprised of sessions in which the main stakeholders and alliance sponsors from the parties are involved for decision making on critical issues for the alliance.

-

Tactical level — including people responsible for day-to-day alliance management, these sessions are focused on making decisions impacting the alliance in the short term.

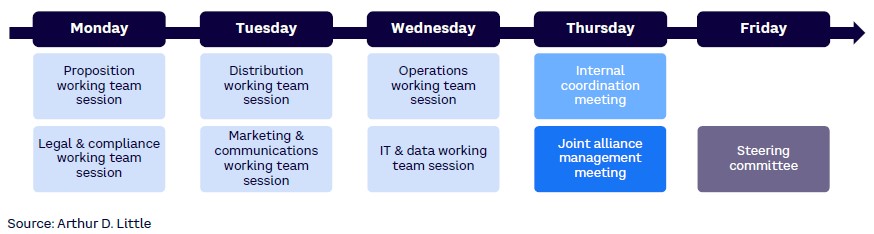

A typical week during the implementation of the alliance would look like that shown in Figure 4. We strongly encourage the following schedule:

- Working teams’ meetings are scheduled by their leads at their best convenience. The only rules they need to follow are:

- They are held on a weekly basis between Monday and Wednesday.

- They do not overlap with each other.

- Alliance managers are invited to all of them (thus the need for no overlap).

- The internal coordination meeting is held on Thursday morning. It is led internally by the alliance manager, and working teams’ leads present their progress from the week, together with next steps and potential roadblocks/dependencies.

- On Thursday afternoon, the joint alliance management meeting is held. Alliance managers from both the insurer and the partner lead this meeting and it is aimed at decision making on short-term roadblocks and issues raised by working teams’ leads (using a list of topics to be discussed that is aligned beforehand by alliance managers).

- Although not as critical as the meetings described above, it is good to schedule the steering committee meeting at the end of the week to avoid overlap with other sessions. Scheduling will depend on C-level executives’ agendas.

The focus will shift from tactical to strategic as the implementation progresses (and will require a lower frequency of meetings at the tactical level), switching to business-as-usual stage after the implementation.

After short-term vision implementation, the focus will be on launching remaining products and channels, running the business, and evolving toward higher levels of integration between partners (e.g., value proposals, ad hoc processes and SLAs, personalized communications, development of joint data models).

Conclusion

ENSURING ALLIANCE SUCCESS

Alliances between insurers and massive distributors have become a hot topic, and proper implementation is key to capture expected value. As we have explored in this Viewpoint, some key points to consider to ensure successful implementation include:

- Ensure full alignment between the partners on the short-term milestones and the vision of the alliance during its first six to 12 months.

- Take a pragmatic approach to defining short-term milestones, balancing ambition and feasibility of implementation.

- Name an alliance manager at each organization who will be responsible for alliance success, including on-time implementation of the defined short-term partnership vision.

- Implement alliance via cross-company working teams from the outset, enabling strong partnership and collaboration dynamics.

- Establish or coordinate strategic and tactical levels of governance for alliance implementation, including both internal and joint meetings.