The Middle Eastern (ME) banking sector is experiencing a profound transformation, driven by technological advancements, regulatory shifts, and evolving consumer expectations. As the region diversifies its economies and seeks to reduce reliance on oil, banks are at the forefront of this change. This Viewpoint looks at some best practice examples of ME bank transformation and draws comparisons with the vibrant Southeast Asia (SEA) banking market, highlighting some key lessons for accelerating progress.

Across the world, the traditional banking model is being fundamentally disrupted by digital technology, a changing marketplace, and the growth of a new ecosystem of financial players. The Middle East is no exception, and most ME banks are taking steps to adapt to the new landscape by embracing digital innovations, fostering strategic partnerships, enhancing regulatory frameworks, and cultivating a culture of continuous improvement.

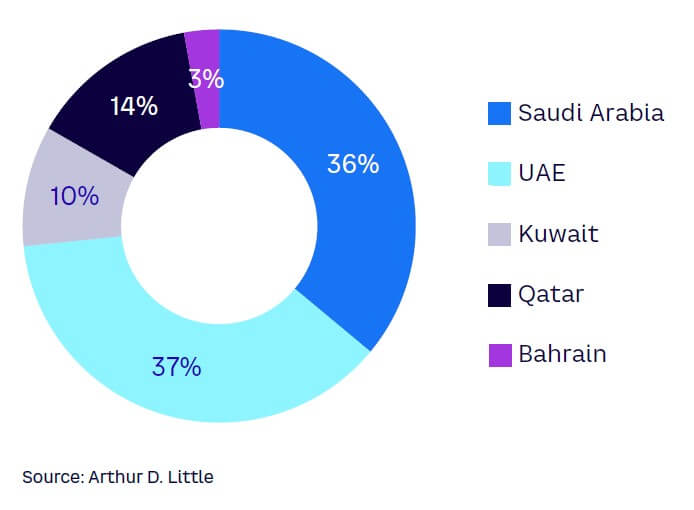

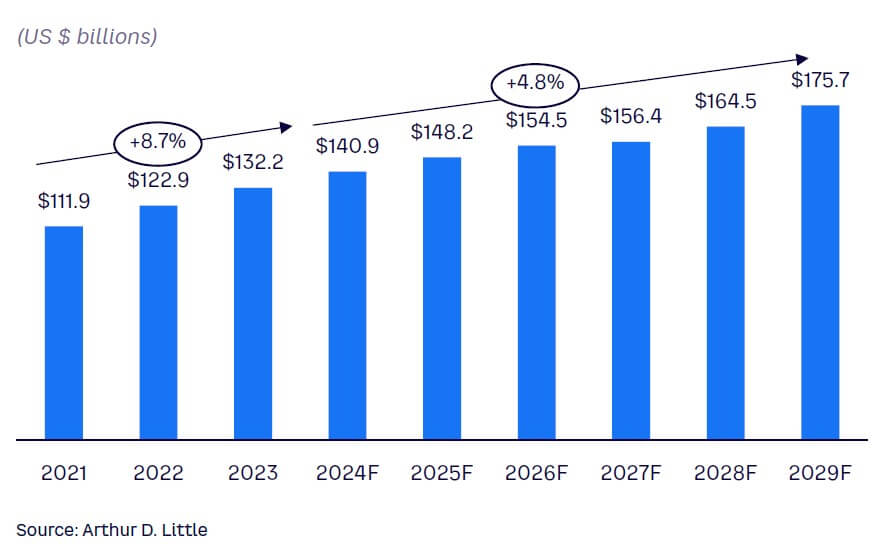

The ME banking sector has performed well since the pandemic. The sector recorded revenues of $140.9 billion in 2023, with the total assets of the top 25 banks across major ME economies reaching an impressive $3.2 trillion. Saudi Arabia and UAE dominate the landscape, accounting for nearly three-quarters of the total assets (see Figure 1).

Digital banking in the region has also experienced robust growth, with a CAGR of 8.7% between 2021 and 2023 (see Figure 2); it is expected to grow to $175.7 billion at a CAGR of 4.8% from 2024 to 2029.

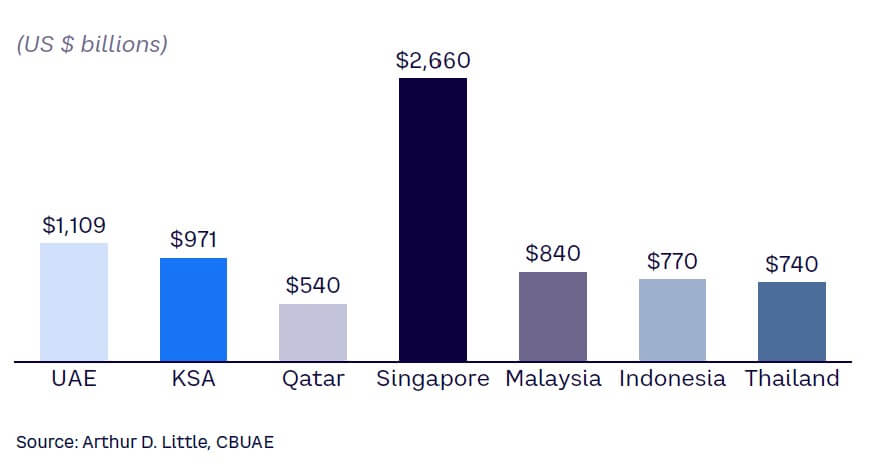

According to the Central Bank of the United Arab Emirates (CBUAE) 2023 Annual Report, the total assets of banks operating in the United Arab Emirates (UAE) reached US $1,109 billion. Similarly, Saudi banks reported a 9.5% growth in total assets, amounting to $971 billion. As reported by Qatar Central Bank, the total assets of the country’s commercial banks increased to over $540 billion.

However, there is room for further improvement and acceleration of the transformation effort. Many SEA banks, for example, especially in Singapore, have demonstrated even better financial performance (see Figure 3).

Total assets of Singaporean banks grew by 8.1% in 2023, reaching $2,660 trillion, and a similar trend has been observed for the rest of the SEA region. Malaysian commercial banks reported total assets of $840 billion while Indonesia and Thailand banks reported $770 billion and $740 billion, respectively.

The remainder of this Viewpoint looks at the four key pillars of banking transformation in the ME region, highlighting best practice examples and lessons learned from Singapore’s banking industry. These key pillars include digital technology adoption, enhancing the regulatory climate, achieving true customer centricity, and developing new talent and culture.

DIGITAL TECHNOLOGY ADOPTION

A recent Arthur D. Little (ADL) study revealed that a substantial majority of regional ME banks, reaching 80%, are prioritizing digital transformation to enhance customer experience and streamline operations. This widespread shift is underscored by the adoption of a diverse array of advanced technologies, including blockchain, cloud computing, and AI/ML (machine learning).

Blockchain technology

Blockchain has emerged as a transformative force within the banking industry. Historically, the banking sector has grappled with challenges such as slow transaction-processing times, high costs associated with cross-border payments, and counterparty risk. By recording transactions across multiple computers, blockchain ensures transparency, security, and immutability, streamlining operations, reducing friction, and enhancing trust.

Best practice use cases

- Cross-border payments. Blockchain can significantly streamline international money transfers by reducing intermediaries, enhancing speed, and lowering costs. Smart contracts can automate compliance checks, ensuring faster and more secure transactions. Examples: JPMorgan Chase has developed its own blockchain platform, JPM Coin, for cross-border payments, reducing transaction times and costs. In the Middle East, Emirates NBD has pioneered blockchain adoption, focusing on cross-border payments and trade finance.

- Trade finance. Blockchain can digitize trade documents, improve supply chain visibility, and reduce fraud risks. Letters of credit, bills of lading, and other trade-related documents can be securely shared and verified on a blockchain platform. Examples: HSBC has partnered with multiple banks to utilize blockchain for trade finance, streamlining processes and reducing documentation. In the Middle East, banks like Abu Dhabi Commercial Bank (ADCB) and Qatar National Bank (QNB) have been actively exploring blockchain solutions for trade finance.

- Know your customer (KYC). By creating a shared, immutable record of customer due diligence, blockchain can streamline KYC processes, reduce operational costs, and enhance compliance. Examples: Standard Chartered has implemented a blockchain-based KYC platform to share customer information securely and efficiently. In the Middle East, banks in the fintech hub Bahrain have been at the forefront of KYC blockchain initiatives.

- Securities settlement. Blockchain can automate the settlement process, reducing operational risks and improving efficiency. Smart contracts can ensure accurate and timely settlement of securities transactions. Examples: The US Depository Trust & Clearing Corporation (DTCC) has explored blockchain for post-trade processing, aiming to reduce settlement risks and improve efficiency. While the Middle East is still catching up in this area, some exchanges and securities depositories are exploring blockchain potential.

- Loans and lending. Blockchain can enable peer-to-peer lending platforms, facilitate loan origination, and provide transparent tracking of loan performance. Examples: Banco Santander has invested in blockchain-based lending platforms to expand its customer base and improve lending efficiency. In the Middle East, Islamic finance institutions are exploring blockchain for Sharia-compliant lending and financing.

- Regulatory compliance. Blockchain can help banks meet regulatory requirements by providing an auditable and tamper-proof record of transactions. Examples: Many banks are exploring blockchain for anti-money-laundering (AML) and counterterrorism-financing compliance, as it can improve data sharing and analysis. Central banks in the Middle East, such as CBUAE, have been supportive of blockchain initiatives to enhance regulatory compliance.

By embracing blockchain, ME banks (e.g., Emirates NBD, ADCB, QNB) and Bahrain-based institutions have demonstrated a strong commitment to innovation and digital transformation. As the region continues to invest in technology and infrastructure, the potential for blockchain to reshape the banking landscape is immense.

Cloud computing

Traditionally, ME banks, like many financial institutions globally, faced challenges such as high IT infrastructure costs, limited scalability, and slow innovation cycles. Cloud computing empowers organizations to scale operations flexibly, reduce operational costs, and enhance agility. By leveraging cloud services, banks can optimize resource allocation, accelerate time to market for new products, and improve overall operational efficiency. Applications include: infrastructure as a service (IaaS), which can help reduce IT infrastructure costs, improve scalability, and enhance disaster recovery; platform as a service (PaaS), which offers a development platform for building and deploying applications, accelerating time to market for new products and services; and software as a service (SaaS), which can reduce up-front software development costs and maintenance efforts, enabling banks to focus on core competencies.

Best practice use cases

- Core banking systems. Migrating core banking systems to the cloud can enhance scalability, improve system performance, and reduce operational costs. Example: JPMorgan Chase has migrated its core banking platform to the cloud, enabling faster time to market for new products and services.

- Data analytics and business intelligence. Cloud-based analytics platforms provide the processing power and storage required for handling vast amounts of data, enabling banks to derive valuable insights. Example: HSBC utilizes cloud-based analytics to identify customer trends, optimize marketing campaigns, and manage risk effectively.

- Customer relationship management (CRM). Cloud-based CRM solutions offer a unified view of customers, improving customer service and enabling personalized interactions. Example: Emirates NBD has implemented a cloud-based CRM system to enhance customer engagement and drive sales growth.

- Fraud prevention. Cloud-based fraud-detection tools leverage advanced analytics and ML to identify suspicious activities in real time. Example: QNB has adopted cloud-based fraud prevention solutions to protect customer accounts and mitigate financial losses.

- Disaster recovery and business continuity. Cloud-based disaster-recovery solutions provide robust protection against data loss and system failures, ensuring business continuity. Example: Saudi National Bank (SNB) has implemented a cloud-based disaster-recovery plan to safeguard critical systems and data.

By embracing cloud computing, banks in the Middle East (e.g., JPMorgan Chase, HSBC, Emirates NBD, QNB, and SNB) have demonstrated the potential to gain a competitive advantage, improve customer experience, and build trust in the financial system. As the region continues to adopt digital technologies, cloud computing will play an increasingly vital role in shaping the future of ME banking.

AI & ML

The convergence of AI & ML is reshaping the banking industry, addressing longstanding challenges and creating new opportunities.

Best practice use cases

- Customer experience. ME banks have traditionally faced challenges in delivering personalized customer experiences. AI-powered chatbots and virtual assistants can provide instant responses to customer inquiries, improving satisfaction and efficiency. Example: Emirates NBD has successfully deployed AI-powered chatbots to handle routine customer queries, freeing up human agents for more complex issues.

- Fraud prevention. The Middle East has experienced a rise in financial crimes. AI-driven fraud-detection systems can analyze vast amounts of transaction data to identify suspicious patterns in real time. Example: QNB has implemented ML-based fraud-prevention solutions to protect customers and the bank from financial losses.

- Credit risk assessment. Traditionally, credit-scoring models in the Middle East have relied on limited data. AI-powered credit assessment can analyze a wider range of data points, including alternative data, to improve risk assessment accuracy. Example: ADCB has adopted AI-driven credit-scoring models to expand access to credit for underserved segments of the population.

- AML. Compliance with AML regulations is a complex and costly process. AI-powered systems can analyze large volumes of transaction data to identify suspicious activities more efficiently. Example: Dubai Islamic Bank has implemented AI-driven AML solutions to streamline compliance processes and reduce false positives.

- Operational efficiency. ME banks often grapple with manual processes and inefficiencies. AI-powered automation can streamline back-office operations and reduce costs. Example: SNB has adopted AI-powered robotic process automation to automate repetitive tasks, improving efficiency and accuracy.

- Personalized banking. AI-powered analytics can provide deep insights into customer behavior, enabling banks to offer tailored products and services.

- Wealth management. AI-driven investment advisory platforms can provide personalized wealth management solutions.

- Digital onboarding. AI can streamline customer-onboarding processes, reducing time and costs.

- Process optimization. AI can identify inefficiencies in banking operations and suggest improvements.

By embracing AI and ML, ME banks can enhance customer experiences, improve operational efficiency, mitigate risks, and gain a competitive edge. As the region continues its digital transformation journey, these technologies will play a pivotal role in shaping the future of banking.

The need for a holistic approach

Digital transformation in banking demands a holistic approach that extends beyond technology adoption to encompass fundamental shifts in business models and processes.

While continued investment in AI, blockchain, and cloud computing remains crucial, banks must also explore emerging technologies like quantum computing and edge computing to maintain a competitive edge. Open banking is a pivotal strategy in this landscape; it fosters innovation, enhances customer experiences, and strengthens security. This ecosystem empowers customers with a wider range of financial services and products. However, the digital frontier is fraught with cybersecurity risks. Robust protection is imperative. Banks like Saudi Arabia’s National Commercial Bank (NCB) exemplify the need for advanced cybersecurity measures to safeguard digital assets and customer data.

Insights from SEA banks

SEA has emerged as a dynamic hub for digital banking, with institutions across the region investing heavily in mobile banking, digital payments, and fintech partnerships. A tech-savvy population and supportive regulatory environments have accelerated this transformation. Singapore, in particular, has been instrumental in fostering a thriving digital ecosystem, with government initiatives like “SMEs Go Digital” driving widespread technology adoption.

DBS Bank exemplifies the region’s digital leadership. By strategically investing in AI, blockchain, and cloud technologies, the bank has achieved substantial growth, marked by a 26% increase in net profit in 2023. AI-powered chatbots handle over 80% of customer inquiries, while blockchain has revolutionized cross-border payments. The bank’s cloud migration has enhanced operational efficiency and enabled personalized banking experiences.

Singapore’s collaborative approach to innovation is evident in the creation of Partior, a blockchain-based platform developed by Temasek, DBS Bank, JPMorgan Chase, and Standard Chartered. This initiative demonstrates the power of public-private partnerships in driving digital transformation and enhancing the efficiency and security of global payments.

ENHANCING REGULATION

The ME regulatory landscape is undergoing rapid transformation, driven by a heightened focus on financial stability and consumer protection. Governments across the region are implementing increasingly stringent measures to safeguard the banking sector. For example, the UAE Central Bank Digital Currency (CBDC) initiative and Saudi Arabia’s Vision 2030 financial sector development program exemplify the region’s commitment to building a robust and resilient financial ecosystem. To thrive in this evolving environment, financial institutions must proactively engage with regulators to shape policies and ensure compliance with emerging regulations.

UAE CBDC

CBUAE is at the forefront of digital currency innovation through its CBDC initiative. By introducing a digital form of the national currency, the central bank aims to modernize the payment landscape, enhance efficiency, reduce transaction costs, and expand financial inclusion. To ensure a seamless transition, CBUAE conducts pilot programs in collaboration with commercial banks and fintech firms. These initiatives are instrumental in assessing the technical feasibility, operational efficiency, and potential regulatory implications of a CBDC.

Vision 2030 & financial sector development

Vision 2030 places a strong emphasis on transforming the financial sector into a global leader. By prioritizing digital payments, cybersecurity, and innovation, KSA aims to enhance efficiency, competitiveness, and financial inclusion. The Saudi Arabian Monetary Authority (SAMA) has been instrumental in driving this transformation through supportive policies, fostering collaboration between traditional banks and fintech firms, and nurturing a thriving fintech ecosystem.

RegTech

Banks are responding to increasing regulatory scrutiny and the complexity of compliance mandates by investing in regulatory technology (RegTech). ME are leveraging RegTech solutions to streamline operations, mitigate risks, and ensure adherence to local and international regulations. By automating compliance processes and utilizing advanced technologies like AI and blockchain, these institutions are building robust compliance frameworks. For example, the National Bank of Kuwait (NBK) has successfully implemented an AI-powered RegTech solution to enhance AML surveillance and overall regulatory compliance.

Insights from SEA banks

SEA presents a diverse regulatory landscape for the financial industry. While Singapore has emerged as a regional fintech hub with progressive policies like the FinTech Regulatory Sandbox, other countries in the region are still developing their regulatory frameworks.

According to its financial statements from 2022–2023, the Monetary Authority of Singapore (MAS) has played a pivotal role in fostering innovation by creating a conducive environment for fintech experimentation. Success stories such as GrabPay and TradeTrust exemplify the impact of the sandbox in accelerating the development of digital financial services. The MAS FinTech Festival further solidifies Singapore’s position as a global fintech leader. In contrast, certain SEA countries face challenges in balancing financial stability with innovation. Harmonizing regulatory standards across the region would facilitate cross-border financial services and level the playing field for fintech firms. A similar harmonization of regulation across the Middle East would also have a beneficial impact on the banking sector.

ACHIEVING CUSTOMER CENTRICITY

Globally, banks are undergoing a paradigm shift toward customer centricity, prioritizing seamless and personalized banking experiences. To achieve this, institutions are heavily investing in omnichannel strategies that seamlessly integrate digital and physical touchpoints. By offering consistent and tailored interactions across various channels, banks aim to enhance customer satisfaction, foster loyalty, and drive long-term engagement.

Omnichannel excellence

Omnichannel banking is a cornerstone of modern customer experience. By integrating mobile, online, and physical branches, financial institutions aim to create seamless and personalized customer journeys. Mashreq Bank exemplifies this approach with its comprehensive omnichannel platform, including innovative self-service kiosks. Emirates NBD’s humanoid robot “Pepper” further pushes the boundaries of customer interaction.

However, a successful omnichannel strategy requires meticulous execution. Consistency in branding, messaging, and service delivery across all channels is paramount. QNB has recognized this and implemented a holistic omnichannel strategy to deliver a unified customer experience. To maximize the benefits of omnichannel banking, institutions must leverage data analytics to gain insights into customer behavior and preferences. This information can be used to personalize offerings, improve service delivery, and identify opportunities for cross-selling and upselling.

Personalization & partnerships

Leveraging advanced analytics and AI, banks are delving deeper into customer preferences to deliver highly personalized experiences. For instance, QNB’s use of AI to offer tailored investment recommendations exemplifies this trend.

The competitive landscape is rapidly evolving due to the rise of fintech firms. To maintain relevance, traditional banks are forging strategic alliances. These collaborations, marked by the integration of fintech innovations, are essential for meeting the demands of tech-savvy consumers. For example, the partnership between Saudi Awwal Bank (SAB) and HyperPay has expanded payment options. By collaborating with fintech firms, technology providers, and other industry stakeholders, banks can access new markets, develop innovative products, and enhance operational efficiency. Such partnerships are crucial for future growth and success.

Insights from SEA banks

SEA banks have also prioritized customer centricity, leveraging advanced analytics to gain deep insights into customer behavior. This data-driven approach has enabled banks like Indonesia’s Bank Central Asia (BCA) to deliver highly personalized banking experiences, resulting in increased customer satisfaction and retention.

Singapore’s leading banks (DBS Bank, UOB, OCBC, and Standard Chartered) have been pioneers in customer centricity. Their commitment to data-driven insights, coupled with a strong focus on customer journey optimization, has culminated in the creation of flagship products like OCBC 360 Account, UOB One Account, DBS Multiplier, and Standard Chartered’s Bonus$aver. These offerings exemplify the region’s leadership in delivering value-added, personalized banking solutions.

TALENT & ORGANIZATIONAL CULTURE

The success of organizational transformation in banking hinges on talent and culture. Large banks must overcome several challenges, such as attracting and retaining talent in competition with global tech companies and fintech start-ups, closing skills gaps in areas such as data science and cybersecurity, and overcoming barriers resulting from traditional hierarchical structures and risk-averse mindsets. Closing skills gaps in digital technologies and cultivating a culture of agility and continuous learning are imperative for adapting to the dynamic market landscape.

Talent development

ME banks increasingly recognize the importance of talent development in driving digital transformation. By investing in upskilling and re-skilling programs, these banks aim to equip employees with the necessary competencies to thrive in a digital-first environment. Key priorities include digital skills, innovation capabilities, and promoting agility. Examples of successful initiatives in the ME region include the Emirates NBD digital academy, SNB’s leadership development program, First Abu Dhabi Bank (FAB)’s Digital Innovation Hub, and QNB’s talent academy.

Cultural transformation

Cultural transformation is one of the most critical components of successful digital transformation in the banking sector. The basic principles of transformation are well-known, and banking is no different from other industries. A multifaceted approach is needed including leadership buy-in, employee engagement, training and development, recognition and reward, collaboration and partnership, and encouraging experimentation. Resistance to change needs to be addressed proactively, requiring open communication, empathy and understanding, support in adapting to change, and recognition of successes achieved.

There are some good examples of successful cultural transformation in the ME: DBS Bank, which has implemented programs such as hackathons, design thinking workshops, and employee-recognition programs to foster creativity and collaboration; JPMorgan Chase, which has focused on creating a culture of innovation and risk-taking through initiatives like its Innovation Lab and employee development programs; FAB, which has implemented innovation labs, hackathons, and employee engagement programs to foster a culture of innovation and collaboration; Emirates NBD, which has focused on creating a customer-centric culture through design thinking workshops and employee empowerment programs; and SNB, which has invested in training programs to develop digital skills and promote a culture of innovation among its employees.

Insights from SEA banks

SEA banks have demonstrated a strong commitment to talent development and innovation, often surpassing their ME counterparts in certain areas. Frameworks such as Singapore’s SkillsFuture have played a pivotal role in nurturing digital skills and fostering a culture of innovation within the region’s financial sector. This government-led program provides financial support for lifelong learning, enabling individuals to acquire new skills and enhance their employability. Techstars (Singapore) is a government-backed initiative that supports technology start-ups and fosters innovation within the financial sector. The Association of Southeast Asian Nations (ASEAN) Fintech Hub (Singapore) is a platform that facilitates collaboration between fintech start-ups, banks, and regulators in the ASEAN region. Indonesia’s Digital Economy Blueprint is a government-led plan to transform Indonesia into a digital economy, with a focus on developing digital skills and promoting innovation.

Steps ME banks can take to prepare for large-scale transformation

Successfully executing a large-scale transformation requires meticulous planning and strategic foresight. ADL recommends the following eight steps:

- Conduct a comprehensive assessment of current operations, technologies, and processes. Identify key areas for improvement and potential challenges during the transformation. This should include a benchmarking analysis against industry best practices and competitors. Many banks in KSA conduct assessments of their digital capabilities to identify areas for improvement and benchmark against leading global banks.

- Define a clear customer-focused vision and set specific, measurable objectives. Align objectives with the overall business strategy and ensure that all stakeholders are aware of and committed to achieving them. Emirates NBD’s digital transformation strategy, which focuses on enhancing customer experience and operational efficiency, provides a clear reference for defining and aligning transformation objectives.

- Develop a robust change management strategy. A strong strategy includes communicating the vision and objectives to employees, providing training and support, and fostering a culture of openness and adaptability. Mashreq Bank has implemented a comprehensive change management strategy that includes employee training programs and regular communication to ensure alignment with the transformation objectives.

- Engage with key stakeholders to gain their support and input. Effective stakeholder engagement can help mitigate risks and ensure that the transformation aligns with regulatory requirements and market expectations. NBK has been actively engaging with regulators and other stakeholders to ensure alignment with regulatory frameworks and gain support for its transformation initiatives.

- Invest in upgrading the technology infrastructure. This includes adopting scalable and flexible technology solutions, enhancing cybersecurity, and integrating new technologies such as AI and blockchain. SAB’s investment in cloud computing and blockchain to enhance operational efficiency and security is a prime example of how to upgrade technology.

- Implement pilot programs to test new processes and technologies. Pilot programs allow for the identification and resolution of potential issues, ensuring a smoother large-scale implementation. QNB has successfully implemented pilot programs to test new digital banking solutions before full-scale deployment.

- Establish a framework for continuous monitoring and evaluation. Use key performance indicators (KPIs) to track achievements against objectives and make necessary adjustments to the strategy as needed. Emirates NBD’s use of KPIs to monitor the progress of its digital transformation initiatives and make data-driven decisions is an excellent example of continuous monitoring and evaluation.

-

Ensure adequate allocation of resources. This includes securing buy-in from senior leadership and ensuring sufficient funding and expertise to drive the initiative. Many banks in KSA have been securing significant investments from senior leadership to fund digital transformation initiatives and ensure the availability of necessary resources.

Conclusion

KEY LESSONS FROM SEA FOR ME BANKS

ME banks have made significant strides in transformation in terms of digitalization, customer centricity, partnerships, capabilities, and culture. However, SEA banks are still further advanced along the journey. There are four key lessons:

- Digital transformation. SEA banks have been at the forefront of digital transformation. This has been enabled by extensive public-private partnerships and government support of new technologies. Greater adoption of such approaches could accelerate digital transformation.

- Regulatory support. Many SEA countries have implemented effective supportive regulatory frameworks that encourage innovation and competition. ME countries could establish regulatory sandboxes similar to those in SEA to allow banks and start-ups to experiment and try innovative solutions. They could also focus on harmonizing regulation across the GCC to encourage cross-border transactions and growth.

- Fintech partnerships. SEA banks have been more proactive in forming strong partnerships with fintech start-ups, as opposed to viewing them as competitive threats. ME banks should establish joint innovation labs with fintech start-ups to foster collaboration within the financial ecosystem.

- Talent and culture. The SEA region has successfully attracted the best talent, largely through its strong universities and vibrant start-up ecosystems. The ME region has also been active in increasing its attractiveness for highly qualified individuals, but much more is needed.