Public-private partnerships (PPPs) are an essential tool to satisfy and advance infrastructure needs worldwide. If planned, designed and implemented properly, PPPs can contribute to national development and growth across all socioeconomic sectors, benefiting private- and public-sector players. Creating high-performing and effective PPPs entails the consideration of specific requirements at the different stages of planning, structuring and implementation of such projects, at sector and country levels and across four main levers of the ecosystem: governance, strategy, transaction process and implementation/monitoring.

Private-sector participation approaches and PPPs

Infrastructure is critical for the world’s economic and social development, but there has been a growing gap between infrastructure spending and needs. To mitigate that gap and cope with spending limitations, governments often involve the private sector, which can offer financial support and introduce more efficiency, quality, know-how, timely delivery and optimal sharing of project risks with the public sector, creating long-term value for invested money. The private sector can also infuse and spur innovation, as seen mainly in Europe and Latin and Central America and illustrated by the Finnish Digital Cluster PPP ecosystem (DIMECC).

Multiple approaches to private-sector participation in the economy are distinguished by the degree of risk private parties assume. PPPs are one in a continuum of approaches involving, through a long-term contractual relationship, the private sector in public-service delivery and investment. Particular to PPPs is the significant sharing of risk between the public and private sectors in three main areas: financing, ownership and revenue.

PPPs can unlock significant financial and non-financial resources to foster the procurement of infrastructures and services in a way that is convenient for both the private and the public sector. This Viewpoint shares insights on establishing an effective ecosystem for governments and public entities to successfully deliver PPPs.

PPPs in infrastructure

While largely viewed as powerful tools, PPPs contribute to less than five percent of public infrastructure investments, leaving room for improvements to meet the expected rise in global public infrastructure financial needs. Adoption of PPPs has been limited for several reasons:

- High complexity, due to the interaction of several public and private players, potentially from different countries.

- High costs, requiring extensive legal expertise and monitoring due to the complex interaction of parties and the indexed nature of public repayments.

- Need for an enabling environment that can properly structure deals and monitor the work of the private parties and their remuneration.

- Availability of bankable projects to attract private parties and justify the transfer of risk.

Despite efforts to enable private-sector participation, countries often struggle to implement PPPs and structure projects properly. They face four key challenges:

- Striking the right balance between empowering sectors and maintaining quality.

- Ensuring the project pipeline is suitable and strong.

- Ensuring the project is structured in the right manner, protecting both public and private sectors.

- Optimizing implementation to maximize success of PPPs.

In the following sections, we share insights from our engagements in optimizing countries’ PPP ecosystems. Note that municipality-scale PPP projects may follow a different path.

1. Enabling success through effective governance

Empowering sector ministries

In any PPP ecosystem, the sector ministry should hold project ownership as the party ultimately responsible for implementing these projects and managing related contracts for the full project term (~30 years). The ministry’s buy-in and leadership of the full procurement effort, from project preparation to structuring and tendering, is essential to prevent future project failure.

Streamlining the approval authorities

Clearly defining stakeholders’ roles and responsibilities, streamlining decision-making, minimizing approval layers and ensuring the PPP unit is playing the right support role for line ministries to avoid paralyzing progress is key. It is also important to ensure:

- The highest level of approval is reached prior to tendering to ensure relevant comments are incorporated in due time.

- Delegation principles are used to ease the workload on the higher authorities while maintaining adequate levels of control.

The Ministry of Finance (MoF) is often tasked with steering the country’s PPP ecosystem and procurement process as gatekeeper of the country’s budget. The MoF is often the highest level of approval authority, except where an asset sale is included as part of the PPP process, which requires involving a higher decision-making body.

Creating “PPP catalyzers”

The role of PPP units can vary greatly depending on the country’s PPP ecosystem maturity:

- With strong ministerial capabilities running PPP projects, the PPP unit may take a backseat approach, focusing on guidance and support, and supporting the MoF in performing comprehensive control and checks across different sectors on key performance parameters.

- When ministries lack the capabilities to run PPP projects, the PPP unit assumes the role of sharing knowledge, building capabilities and actively supporting sectors in creating their project pipelines and assessing and ensuring end-to-end procurement of PPP projects.

While it is possible to execute a project without one, a PPP unit helps ensure consistency across sectors in approaching the private sector, overcoming the complexity of PPP processes and construing a solid framework (technical, legal and financial) through which to procure and execute projects. PPP units are vital in prioritizing projects according to need and in maintaining a good hold on project progress to avoid calling on contingent liabilities that could severely affect a country’s budget.

2. Building a strong project pipeline

Defining a private-sector participation plan

Sectors must prepare a private-sector participation plan aligned with overall strategic objectives and targets to eliminate roadblocks in private-sector participation and define a healthy pipeline of projects that can be procured through PPPs. Such a project pipeline should be constructed on a rolling basis and should consider the time to procure PPP projects (typically several years). Sectors also must increase their readiness, including but not limited to the governance, operational activities and resources required for effective strategy execution.

Conducting a thorough needs assessment analysis

Sectors should identify and select projects to satisfy their objectives and qualify for PPP, understand risks and develop a pre-feasibility analysis for each. A needs assessment is essential to understand the project’s importance and criticality, whether the project is needed (and at the size indicated), if costs are reasonable and if technical requirements are right. This can be validated within the PPP unit itself or outside if the country has a body that manages capital spending efficiency. A needs assessment is vital to ensure the right amount is spent on the right project, to provide a good basis for project approvals and to streamline the PPP procurement process by securing reassurance to the sector before fully detailing the business case, which is where costs start piling up.

Selecting PPP projects that matter

Due to the costly and time-consuming procurement process (about two years from preparation of business case through financial close), PPP agreements are more suitable for large, expensive projects. This is even more relevant for countries that are new to PPP procurement. One way to ensure economic viability for PPP procurement is to establish thresholds of eligibility. In this approach, a minimum threshold is needed to:

- From a public-sector view – justify procurement cost incurred and maintain value for money.

- From a private-sector view – secure project financing; typically, this is not economical for banks/borrowers below certain amounts, and bidders would have to give full recourse to raise financing/justify transaction costs incurred by bidder.

Once these initial sizeable projects are successfully delivered and a library of standardized procurement documents that would lower procurement costs is created, eligibility thresholds can be revisited and lowered, or removed, as necessary.

Another way to ensure economic viability is to bundle several similar smaller projects that would otherwise not be eligible for PPP procurement as standalone projects into one larger program that can use standardized procedures with minimal adjustments

3. Initiating transaction advisory on solid ground

Performing option analysis

Multiple PPP models and labels exist, which can be confusing for countries seeking the best solution for their projects. More important than the name of the model selected is the allocation of roles and risks among the parties along ownership, financing and revenue. Commonly, governments try to pass on most of the risks from the public sector to the private sector, even when the private sector has no control over that risk. A good philosophy is to have risks borne by the party most eligible to manage those risks, and at the least cost, optimizing overall project costs to obtain higher return and facilitate financing.

Each country/project has particularities that guide and shape the optimal structure. As such, an analysis that ranks options according to pre-agreed objectives (relative and absolute) will allow the selection of the most appropriate model, avoiding money and time spent on a suboptimal solution. Sample objectives include degree of risk transfer, project cost or time to execute. For complex projects such as in the transport sector, consider dividing the projects into sub-components if these entail completely different PPP models or if some parts will not consider a PPP model at all.

Performing soft market sounding for pathfinder projects

Soft market sounding might be perceived as giving competitive advantage to a few players, but if well construed with only necessary information, it should always be included in the initial phase of the PPP procurement to:

- Inform governments early on if there is enough market/ investor appetite, capacity and capability for this particular project.

- Allow you to gain valuable insights into private sector working practices, requirements, concerns and priorities as well as validate certain assumptions taken in the option assessment.

- Offer a potentially revised list of available and validated PPP contracting model options.

Market sounding will generally be an ongoing exercise conducted throughout the process up to the conclusion of the business case.

Protecting all interests

There are many examples of unsuccessful PPPs worldwide due to inflated numbers in the business cases, which can lead to potential project bankruptcies. These accuracy issues are not due only to transaction advisors inflating numbers to make a project look more attractive but are also due to ministries themselves that are biased towards rapid execution of an infrastructure that is required urgently.

The MoF or PPP unit can mitigate these risks by incorporating “duty of care,” which can incentivize the right behavior from advisors and protect the public party against unfair consultations. Duty of care should be applied towards the contracting entity as well as to the MoF or PPP unit to ensure impartial and unbiased advice. Private parties may also consider subscribing to insurance policies when project success is linked tightly with demand assumptions.

4. Ensuring success beyond financial close

Finally, a PPP project financial closure is not the end of the project. Several years of implementation and operation lie ahead, and the contracting entity must stay on top of progress. Monitoring PPP KPIs as well as associated contingent liabilities is often neglected while represents a vital part of the lifecycle of the project.

Performance data must be made available from the sector to the PPP unit to ensure close follow up on the initiative’s impact and controlling quality delivered in order to compensate appropriate performance levels per the contract. Often, PPP units complain they cannot track real performance of the project to confirm it has delivered the VFM per the signed contract. Monitoring is also useful to apply timely corrective actions when needed. In addition, through its PPP unit, the government should:

- Monitor contingent liabilities to timely flag contractor risks and avoid situations where contingent liabilities materialize.

- Monitor the project’s performance to manage risk of realization and exact amount to be disbursed.

The contract should also include clauses to ensure the private sector and the ministry report on the project’s performance.

Lastly, the government should carefully plan and actively monitor the country’s exposure to contingent and committed liabilities related to the PPP portfolio. This can be performed within the PPP unit or at the MoF level, following potential indexation mechanisms, the government’s net payment position and the performance of all PPP companies, safeguarding public balances against poor private-sector performance and hostile economic conditions.

Conclusion

Private-sector participation is essential to bridge the investment gap and satisfy infrastructure needs worldwide. PPPs are one of many arrangements to consider; but due to their complex, timely and costly procurement, governments often struggle to apply and leverage them. Governments can put in place mechanisms to nurture their PPPs and infuse efficiency and performance throughout their maturity journey. These mechanisms should be carefully crafted and ensure that actors are clear on their role and are empowered to execute it; that projects are suitable, structured in the right manner and optimally leverage public- and private-sector capabilities; and that implementation is monitored and guided to ensure success.

How Arthur D. Little can help

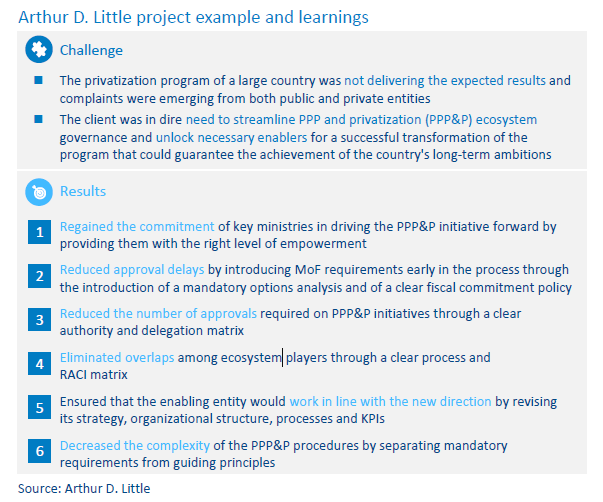

Arthur D. Little’s team of PPP strategy, governance and transaction advisory experts can help in all aspects of a country’s PPP programs (see figure below). We can help governments:

- Develop ecosystem governance to catalyze PPP programs.

- Equip and empower a unit to guide PPP efforts, aligning their role and responsibilities (including strategy, governance, processes and KPIs) to national objectives and the related ecosystem governance.

- Streamline and increase quality of PPP procurement processes and methodologies through the development of PPP policy, manual and guidance notes.

- Develop a MoF fiscal commitment policy to effectively govern PPP opportunities, ensuring alignment with PPP procurement process

- Advise transactions and provide support throughout the PPP procurement process, using our network of experts with extensive on-the-ground practical experience.