The Global Financial Crisis of 2008 revealed deep interconnections between financial institutions and real estate markets. In today’s globalized economy, these interconnections continue to hold relevance, as property market issues spill over to financial institutions and vice versa. This Viewpoint explores the complex relationship between these sectors, examining how challenging market environments characterized by rising interest rates affect real estate markets and how financial institutions can protect against looming consequences.

FINANCIAL SERVICES & REAL ESTATE: A COMPLEX RELATIONSHIP

In the book “Towers of Capital: Office Markets and International Financial Services,” University of Cambridge Emeritus Professor Colin Lizieri eloquently summarized the connection between financial institutions and real estate: “Firms that occupy space are the same firms that acquire office spaces as an investment asset (directly and indirectly) and who provide finance and funding for the creation of new office space. This interlocking creates greater potential volatility in office markets, increasing the amplitude of upswings and downswings.” Put differently, there exists a tight interdependence between the two industries because of the financial services sector’s strong involvement in both the supply and demand sides of real estate markets, thereby amplifying risks and exposures thereof.

Supply

Real estate is a capital-intensive industry that relies heavily on financial institutions to provide funding. This includes financing for single-family homes as well as large-scale infrastructure projects, such as Hudson Yards, a 28-acre waterfront development in New York City. The project, currently priced at US $25 billion, was financed by a consortium of banks, including Wells Fargo, Bank of America, and JPMorgan Chase. Because real estate projects have high capital requirements, property developers often find their internal funds are insufficient, or not the most profitable financing option. As a result, a diverse range of individuals and institutions depends on external funding from financial institutions. Moreover, in the euro area, residential and commercial mortgages account for almost 40% of total bank loans.

Financial institutions offer a variety of real estate financing options to meet this demand. Mortgages are the most prominent product, with multiple types available to address a diverse range of situations, including:

-

Blanket mortgages — cover multiple properties

-

Wraparound mortgages — a second mortgage encompasses an existing one

-

Balloon mortgages — characterized by large final payments

-

Participation mortgages — where the lender shares profits of the property

Refinancing is another common practice among sophisticated real estate market participants, especially in environments with rapidly changing interest rates. Financial institutions also influence real estate supply through land loans for developers that plan to build in the future and construction loans, which are typically disbursed in stages as a project progresses. These lending activities establish financial institutions as an important cornerstone of property development and real estate supply, but they expose lenders to risks in fluctuating real estate markets, such as defaults of developers due to rising material costs.

Demand

On the demand side, financial institutions are involved through both direct property ownership and indirect holdings via capital market investments in real estate–linked companies and financial products. Like other assets, real estate offers a regular cash flow stream through rental income, as well as the potential for capital appreciation. Additionally, real estate is often considered a good inflation hedge, particularly when there is an upward-only rent-review clause or if the rental income is directly linked to inflation.

In the long run, there is evidence that capital market investments in real estate–linked companies and financial products offer returns linked to the value of the underlying properties, but in the short run they expose investors to additional risks and return opportunities through capital market movements. For example, herding behavior and sentiment in stock markets can impact the return of real estate investment trusts (REITs) and mortgage-backed securities (MBSs).

Also worth noting, financial institutions are frequently among the industries occupying office buildings in some of the world’s most prestigious locations, either through outright ownership, renting office spaces, or more innovative alternatives, such as coworking spaces. The future of the office, however, is being fiercely debated in this post-COVID-19 world, with employees increasingly requesting opportunities to work from home (WFH). Studies indicate that WFH will become increasingly common, but only in industries where physical absence from a workplace does not harm corporate performance. Regardless of the effects of WFH on financial services companies, physical office occupation will likely continue to offer myriad benefits, including better infrastructure and proximity to clients and coworkers.

Corporate performance reflects the general state of the economy; thus, demand for office space is further affected by the business cycle. Additional factors influencing demand include:

-

Economic prosperity. Businesses typically expand and require more office space when economic growth and security are high, while weakening economic prosperity often results in downsizing and decreased space requirements.

-

Demographic changes. Urbanization and variations in population density over time further affect demand for office space in certain locations. For example, areas with high population density or strong transportation infrastructure may be more desirable for businesses.

-

Generational preferences. Younger, more educated workers tend to prefer open, collaborative workspaces, while older workers may prefer more traditional office layouts.

-

Advancing technology. The rise of cloud computing and digital storage reduces the need for physical storage and, consequently, office space.

Overall, buying, renting, and investing in office space further links the balance sheet of financial institutions to real estate market developments.

THE CURRENT MARKET ENVIRONMENT

2023 was characterized by contractionary monetary policy. The European Central Bank (ECB) raised interest rates from 2.5% at the beginning of the year to around 4.5% in September 2023. Similarly, the US Federal Reserve raised rates from 4.25%-4.5% at the beginning of the year to 5.25%-5.5% in July 2023. When interest rates rise, a multitude of consequences ensues. Below, we shed light on the challenges posed from the currently rising interest rate environment on real estate markets.

Rising interest rates & real estate markets

Elevated interest rates can influence real estate markets and subsequently impact financial institutions. Household disposable income suffers, as rising interest rates result in higher financing costs. A reduction in disposable income diminishes the overall demand for property, creating a domino effect on the real estate market. Construction and supply for real estate are unable to adapt instantaneously to the decrease in demand for residential real estate (RRE), which leads to higher vacancy rates. Higher vacancy rates exert a downward pressure on rents and subsequently on real estate prices.

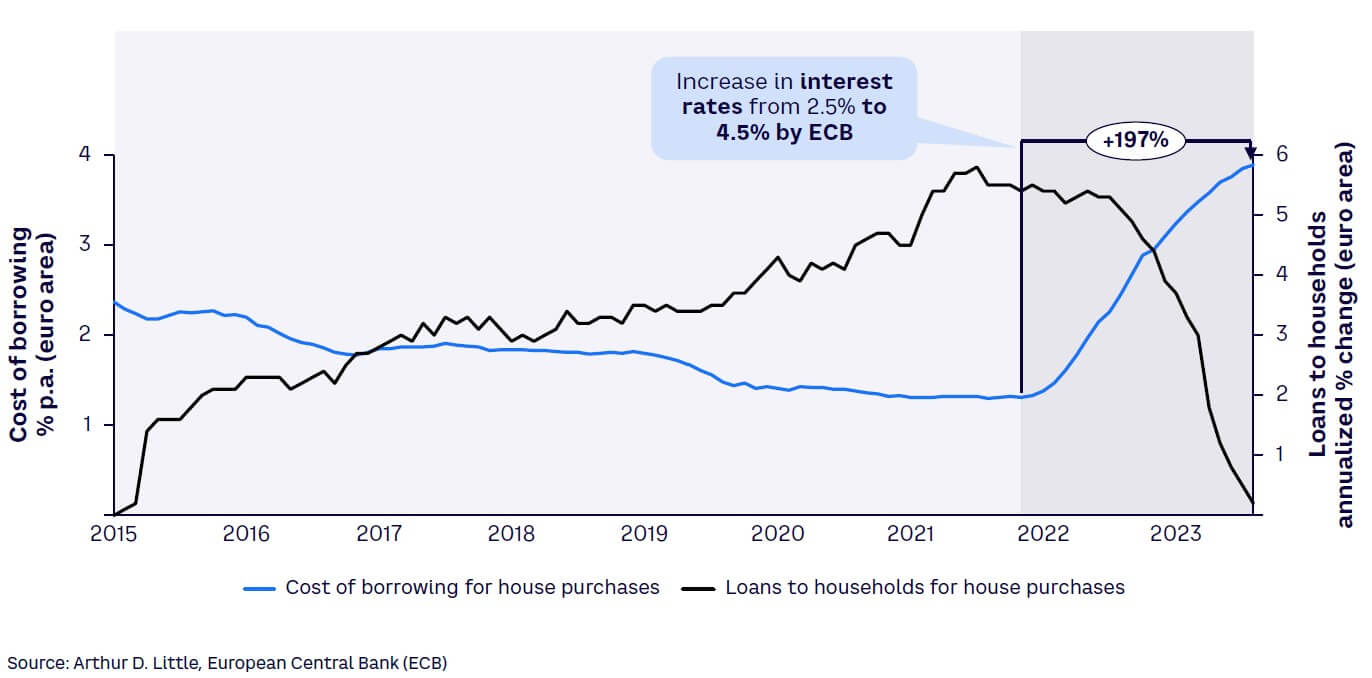

Figure 1 shows the sharp decline in the growth rate of loans to households for house purchases issued by financial institutions, represented by the black line. The blue line shows the increase in the cost of borrowing for house purchases within the euro area during 2022–2023. Notice how the increase in borrowing costs for RRE and the reduction in loans for RRE (i.e., the exposure of financial institutions to RRE lending) coincide with the recent rate hikes by ECB. This follows a period of low interest rates that occurred after the 2008 crisis, which provided real estate market participants with cheap financing and increased the financial institutions’ exposure to the market (as indicated by the black line between 2015 and 2022).

A slowdown in overall economic activity and increased financing costs are expected to cause a further decline in demand for commercial real estate (CRE), leading to additional downward pressure on real estate prices. Because of reduced demand under contractionary monetary policy, financial institutions’ exposure of both CRE and RRE is expected to decline. According to an ECB study, the current environment places greater pressure on banks’ CRE exposures. However, exposures are less systemically important than the banks’ RRE portfolios; although residential and commercial mortgages account for almost 40% of total bank loans in the euro area, 75% of mortgages stem from RRE lending. Thus, it is less likely that the CRE portfolios of financial institutions will lead to a systemic financial crisis. However, the exposure of financial institutions to CRE has increased in recent years, and falling CRE prices can amplify a financial crisis.

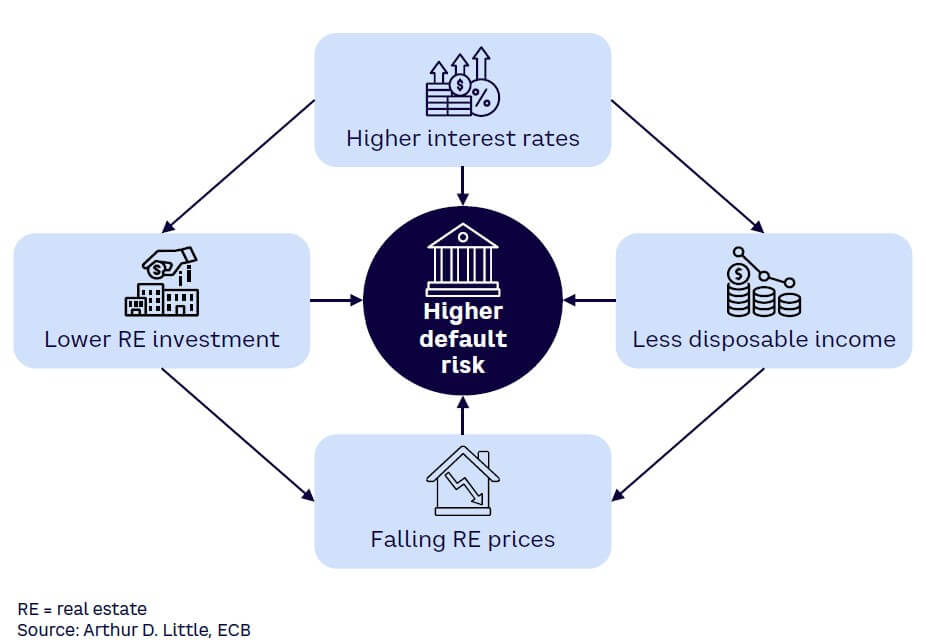

An increase in interest rates negatively impacts the ability to pay and amplifies default risks, especially for leveraged borrowers with high current debt-to-income (DTI), as well as borrowers exposed to variable interest rates. According to a study by Fitch Ratings, residential mortgages in Australia, Spain, and the UK are among the most exposed to the risks associated with rising interest rates. While UK residential mortgages have higher DTI exposure, variable rate lending is particularly common in Spain and Australia. The study estimates that a 3% rate rise increases the DTI ratio in Australia, the UK, and Spain by 8.7%, 5.2%, and 5.1%, respectively. Figure 2 shows different channels and how higher interest rates influence default risk.

Higher interest rates also make fixed-income investments more attractive, leading to an investment shift toward bonds and other fixed-income securities. Moreover, investors requiring higher yields to compensate for the increased risk of real estate assets put downward pressure on the value of REITs and real estate mutual funds, further depressing the demand for real estate–linked capital market assets. The current market environment has a twofold effect on the discounted cash flow (DCF) valuations of real estate assets. On the one hand, declining demand reduces rental forecasts and future income streams. On the other hand, higher interest rates increase the discount factor in DCF models. Both forces put downward pressure on the net present value of real estate assets and reduce investments. Rising interest rates can also make it more expensive for REITs and real estate companies to finance new development projects or acquire existing properties. This may slow down growth and expansion plans, potentially impacting overall performance. As a result of fewer (or later) development completions, the real estate assets may not (or only at a later point in time) reach the state where they can produce cash flows through sales and rents. This delay can have a significant impact on the profitability of development projects and the overall real estate market.

REAL ESTATE RESTRUCTURING

Financial institutions ought to reevaluate their real estate strategies and seriously consider restructuring options in light of current economic developments. Real estate restructuring involves reorganizing or modifying the financial and operational aspects of real estate assets and portfolios to enhance performance, safeguard against financial challenges, and adapt to changing market environments. Here, we focus on restructuring financing and investment, the areas where financial institutions and real estate connect most.

Real estate financing

Financial institutions need to assess and optimize real estate financing because of rising interest rates and the increasing probability of mortgage default. Restructuring real estate financing requires financial institutions to consider the following:

-

Portfolio analysis and risk assessment. In recessionary periods, reviewing the mortgage portfolio will identify loans with a higher risk of default, and conducting a thorough risk assessment will identify the factors contributing to the increased probability of mortgage defaults. The process may involve analyzing loan-to-value ratios, DTI ratios, credit scores, and payment histories. Financial institutions also need to assess whether their portfolio aligns with market developments like e-commerce, which can affect the performance of certain mortgages (e.g., those linked to retail stores). Furthermore, they need to analyze borrower profiles, macroeconomic indicators, and regional trends (e.g., higher exposures to variable rate lending).

-

Loss-mitigation strategies. Developing and implementing loss-mitigation strategies helps minimize the impact of potential defaults. These strategies may include loan modifications, forbearance agreements, or deed in lieu of foreclosure arrangements. Securitization and pooling mortgages to create MBSs, which are subsequently sold to investors, can also transfer risks associated with mortgages to investors that are better prepared to take them on and free up capital within financial institutions.

-

Enhanced monitoring. High-risk loans require frequent, in-depth monitoring. This may involve consistent communication with borrowers, closer tracking of payment histories, and greater scrutiny of financial documentation.

-

Enhanced monitoring and strengthened underwriting standards. Reviewing underwriting standards and adjusting them as needed is one approach to reducing the likelihood of future defaults. Revisions focus on tightening credit score requirements, increasing down payment requirements, or implementing more stringent income-verification processes. Increasingly, changes to underwriting standards now include environmental, social, and governance risks, such as the physical climate risks of properties located close to waterways. (Munich Re estimates that natural disasters led to inflation-adjusted losses of $210 billion in 2020.)

-

Stakeholder communication. Maintaining open lines of communication with stakeholders can help identify borrowers at an earlier stage who may be at risk of default. Offering assistance and guidance on available options, such as refinancing or loan-modification programs, are important subsequent steps to avoid default.

-

Contingency planning. Developing a contingency plan can help effectively address the potential impact of a significant increase in mortgage defaults on the financial institution’s operations, capital, and liquidity. This may involve stress testing, scenario analysis, debt/equity raising, and capital planning.

-

Regulatory compliance. In a tense market environment, staying current with regulatory changes related to mortgage lending and default management is crucial. This step can be particularly important in market downturns, considering that regulators often pass new laws during these time periods.

Real estate investment

Rising interest rates also pose challenges to real estate investment activities. Financial institutions can tackle these challenges more effectively by taking the following steps:

-

Portfolio analysis and risk assessment. Conducting a thorough examination can identify underperforming assets, assess the level of risk associated with each property, and determine the potential impact of market downturns on property values and cash flows. Moreover, financial institutions ought to assess market trends that can affect future income and ensure their real estate investments comply with industry standards, such as energy codes and standards (e.g., the ASHRAE Standard 90.1 in the US, which sets minimum energy-efficiency rates for most buildings).

-

Lease restructuring and tenant retention. If financial institutions own property, renegotiating lease terms with existing tenants to improve occupancy rates and rental income levels can avoid topline deterioriation during market downturns. Offering rent concessions, modifying lease durations, or adjusting other provisions to accommodate tenants’ needs during recessions are additional possible actions.

-

Asset repositioning and diversification. Repositioning underperforming assets to better align with market demand can enhance asset values, particularly if changes in demand are long-term. This may involve changing a property’s use or purpose (e.g., converting unused office space to residential space) or investing in property improvements to transform vacant properties into income-generating assets. Additionally, diversifying the portfolio across different property types and geographic locations may reduce risk exposure in any market environment. As described above, higher interest rates can put downward pressure on real estate–linked capital market investments, such as REITs. In recessionary periods, financial institutions may want to focus on investments in REITs and real estate mutual funds with strong balance sheets, low levels of debt, and stable cash flows. These companies are better positioned to withstand the impact of higher interest rates and maintain their dividend payouts.

Although it is vital for financial institutions to reassess and potentially adapt their real estate strategies, some factors suggest that a global financial crisis is less likely to occur because of the current real estate market environment. In the euro area, in particular, housing development has recently dropped below historic averages, which mitigates the reduction in real estate prices because of supply shortages. Following the previous financial crisis, most banks became better capitalized after the establishment of stringent financial regulations, such as Basel III. Banks are also less exposed to real estate risk compared to some US banks during the buildup to 2008 due to practices like NINJA (no income, no job, no assets) lending. Nonetheless, the current market environment remains very tense, with trends and developments in property markets requiring financial institutions to reevaluate their real estate strategy to create competitive advantages.

Conclusion

THE NEED TO ACT NOW

The interconnection between financial institutions and real estate markets has led to substantial risk exposures, with mortgages granted based on optimistic outlooks during past low-interest-rate environments. Changing market environments in 2023 significantly shook the status quo, especially in the euro area. In light of these changes, this Viewpoint identified three key takeaways for financial institutions:

-

Contractionary monetary policy and economic slowdowns have created challenges to real estate markets, strongly impacting financial institutions and necessitating restructuring activities.

-

Banks should prepare for market changes to minimize potential negative impacts on their businesses and the economy by reassessing their portfolios, strengthening risk management practices, and exploring alternative financing options.

-

Given the consequences, a proactive approach is necessary to mitigate possible financial losses.