Insurers spent years developing a deep understanding of each risk type and creating precise business models to optimize their earnings, including operating models for each line of business. Unfortunately, this model is not conducive to serving today’s customers, who desire the seamless, digital-based service they experience in their other transactions. In this Viewpoint, we outline the best way for insurers to shift from a traditional model to a customer-centric one.

Today’s customers have high expectations. Right from their smartphone, they can purchase any item quickly, access their bank accounts, arrange transportation, and book a healthcare visit. They expect the same from their insurance company but are often disappointed. Customers want to use their phone to purchase insurance and also have the ability to file a claim and modify their policy from that device. In fact, they desire seamless communications with their insurer via all digital channels, including email, voice calls, chat, and social media.

Agents and brokers are another key set of stakeholders for many insurers. They are the ones with more intimacy and knowledge related to customers and thus play a vital role in personalizing the insurer experience. Agents and brokers are increasingly asking for more options and tools to provide customer-centric service (e.g., to improve advisory capabilities or to provide specific discounts in cross-sell policies and more involvement in renewal-price calculations and claims processing).

Finally, insurers are willing to increase the size and profitability of their portfolios. The rising price war in mature markets and lines of business such as automotive and the ever increase of the combined ratio are putting more pressure on their business models. Customer centricity, which allows insurers to focus on more profitable, loyal, and better-protected customers, offers a unique opportunity for profitable growth. Nevertheless, insurers face significant challenges, including technology platforms designed with policy-centric processes, siloed customer data hindering personalization and cross-selling, independent communications channels that impede omnichannel relationships, and limited coordination and differing strategies within their organizations (mostly between sales, technical, and operations teams). Usually, this comes from varied understandings/views of the customers across different teams. Insurers also struggle to measure their baseline in customer centricity (i.e., how they compare with their peers and how to measure improvement over time).

START WITH CUSTOMER SEGMENTATION

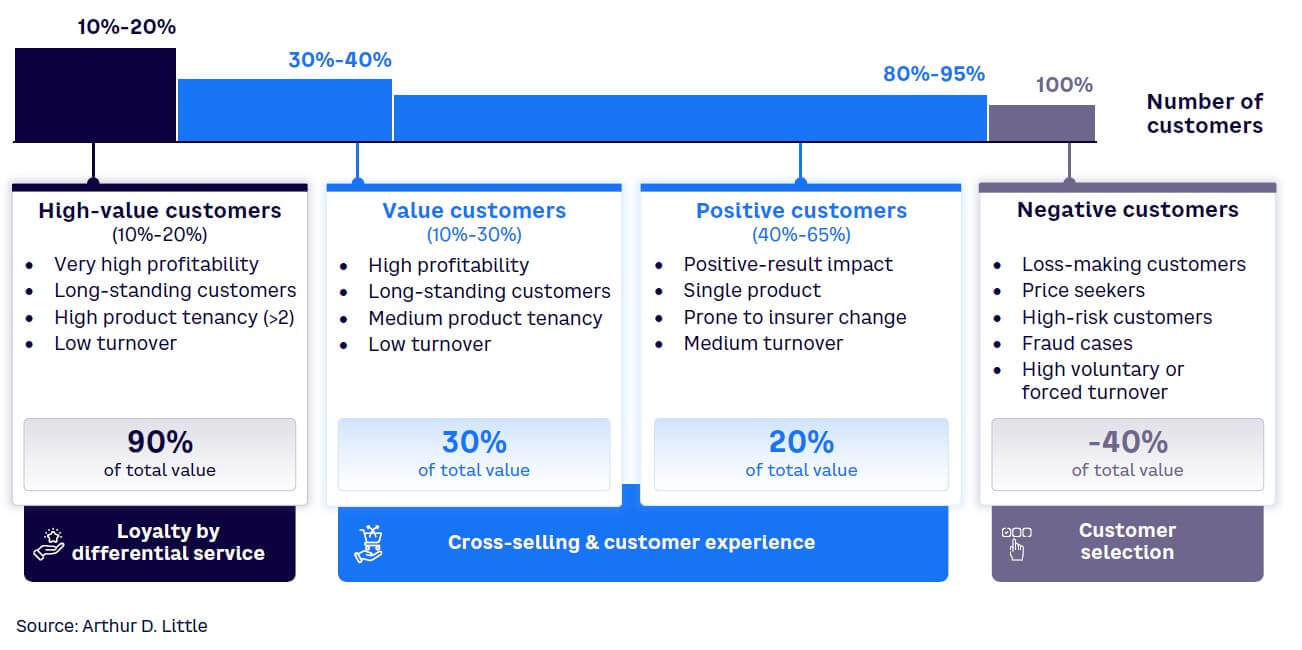

Insurers should start understanding how to segment the customer. The value that insurance customers bring is by no means equal. In our experience, 10%-20% of customers constitute 90% of a business’s value, while 5%-20% destroy up to 40% of total value (see Figure 1). This leads to a significant opportunity: segment customers, gain a comprehensive understanding of each segment’s behavior, and use those insights to manage your business. In other words, create a business model that helps you focus your resources on the most profitable customers while developing initiatives to identify and convert high-potential customers.

The segmentation should be clear, easy to understand, and enable a customized value proposition tailored to specific customer needs. A first approach might be based on product tenancy and incorporating behavioral elements when the organization is ready. Product configuration can be tailored to customer segments or include flexibility to leverage new sales initiatives, portfolio defense assured sums, exclusions, or underwriting rules. Agents should be able to focus on specific segments to improve both the advice they give to customers and the overall customer experience.

BUILD A CUSTOMER-CENTRIC VISION

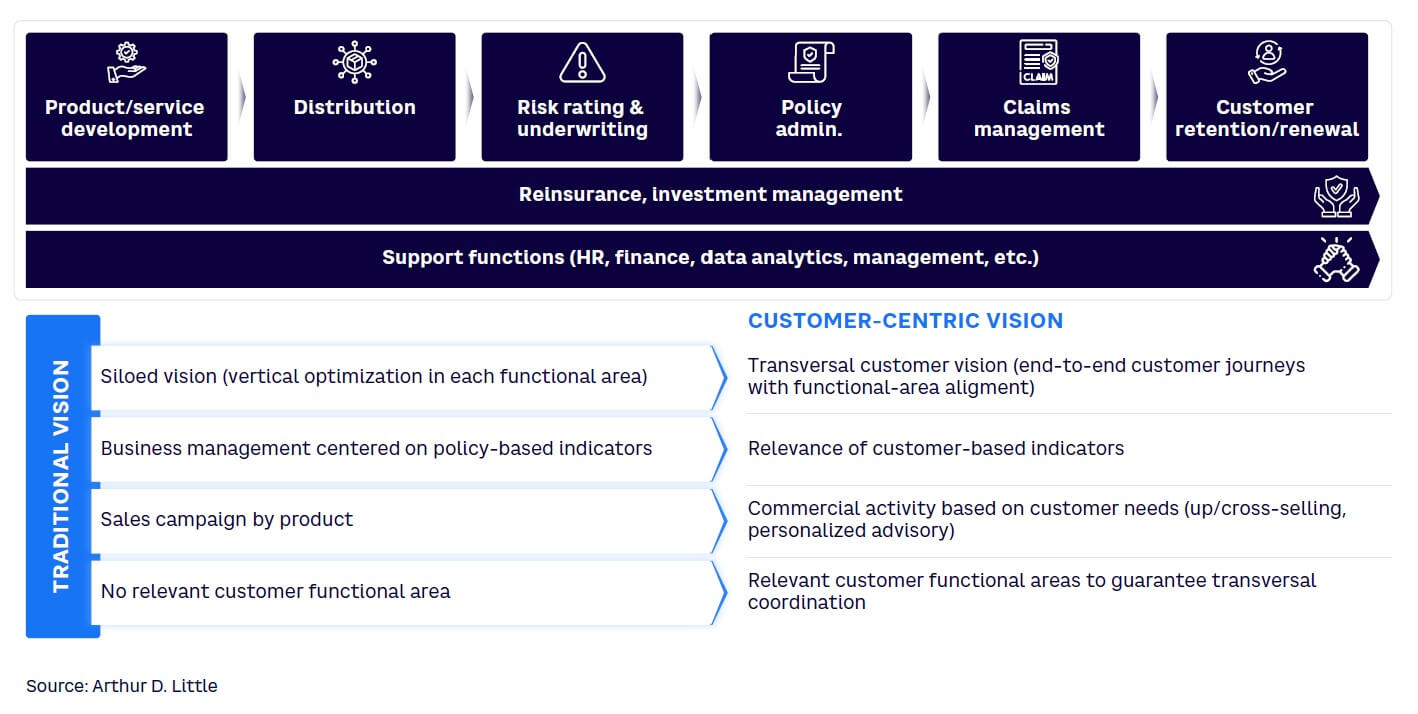

Insurers must change the way they work by evolving from product-oriented organizations into customer-centric businesses.

Figure 2 highlights six elements insurers need to make that transition successfully.

1. Design a distinctive, shared, customer-centric strategy

More advanced customer-centric insurers stand out due to their shared strategy. They go well beyond the classical insurance product value proposition to build an ecosystem approach where the customer also accesses complementary services (e.g., Vitality in the UK and Helvetia in Switzerland). The value proposition also incentivizes cross-selling (e.g., with personalized prices for cross-sell products or better service commitments). Another trend in value proposition is including prevention services so the insurer is no longer just a claims payer but evolves into a risk management partner.

Distribution and servicing channels are also affected by a customer-centric strategy. Traditional agents and broker channels are mostly impacted by digitalization that supports a more personalized advisory, captures customer data (that otherwise would be only available for the distributor), and enables personalized cross-selling (e.g., via propensity models or the use of Microsoft or Google videoconferencing tools). Remote channels, which started with the traditional call center, now include new digital channels (e.g., apps and Web) and social networks (e.g., WhatsApp and Telegram) that allow for more customer interaction. All these channels require personalization. Advanced customer-centric insurers excel in their ability to use customer data to personalize the entire value chain.

2. Drive cross-functional collaboration

To successfully shift to a customer-centric business model, organizations must ensure the relevance of the customer vision to all departments. We recommend a cross-functional steering committee dedicated to creating a common vision of the client and a detailed customer-centricity plan that includes objectives, resource allocation, and an action plan. Leaders must drive this customer-centric vision by aligning team incentives, creating cross-functional project visibility, and building awareness through internal reporting.

Customer leadership can be under the tutelage of a functional leader reporting to the executive committee or reporting directly to the CEO as a self-contained function. The first option requires coordination with the functional leader to develop the customer vision. The second option conveys greater relevance of the customer-centric approach to the organization and allows for greater impact of initiatives.

Client initiatives are mostly transversal to the organization, so they require alignment and teamwork. Thus, leading insurers develop a cross-direction operating model where different organizations work together. These operating models ensure that key employees can dedicate their time to client projects and that incentives align (e.g., employees with long-term assignment to client projects might receive specific KPIs for their annual bonuses), provide visibility over transversal projects to ensure a smooth implementation, and build awareness through internal reporting to all stakeholders.

3. Engage employees, agents & external partners

Customer centricity calls for personalization and excellence during all touchpoints of the customer experience. This is why customer service employees (e.g., claims adjusters or phone representatives), agents, and sometimes external partners (e.g., repair shop employees) must be engaged in customer-centricity initiatives.

To engage employees and agents, the first step is to clearly communicate the relevance of the customer vision, with a consistent storyline shared by all executives, middle managers, and key influencers. Then, they need specific training, including formal training (reskilling) and on-the-job training (e.g., participating in cross-functional projects or with job role rotation programs). One of the most difficult levers to apply is adapting internal policies to foster customer centricity, including HR policies (using client KPIs in the bonus calculation or in evaluating career development) and agent management policies (e.g., extra commissions based on customer KPIs) and incorporating customer-experience KPIs in day-to-day reports and processes.

To engage with external partners, client-based KPIs are more commonly used in contracts and reporting. Leading insurers go the extra mile by developing client-centric action plans with their partners, which might be co-financed, and by significantly linking a partner’s compensation to the implementation of the client vision.

4. Manage interactions with customers, agents & brokers

Traditionally, customer interaction management has taken place in silos. Each team for a given insurer would optimize its part of the value chain, thus creating suboptimal experiences (see Figure 3). Agents and brokers also usually have misaligned incentives (e.g., performance KPIs linked to policies/premiums and not including customer KPIs).

More advanced insurers can break those silos to build an integrated value chain around the customer. Different teams collaborate to understand customer pain points and create end-to-end customer journeys that balance the different trade-offs between teams (e.g., pricing, customer purchasing power, under insurance). Next, they move toward providing omnichannel, consistent, and personalized customer experiences.

5. Test, measure & improve

Another challenge in customer centricity is the measurement of baseline, improvements, and benchmarking. Basic measurement KPIs, already widespread, are net promoter score (NPS — transactional NPS for a given touchpoint and relational NPS for the overall client relationship). Also widespread are quality KPIs (e.g., average time to pick up a phone call or to complete a claim). These provide part of the answer to measurement.

Surveys often complement KPIs. These include customer surveys (broken down by segment, geography, line of business, product tenancy, etc.) and agent, broker, employee, and partner company surveys. More advanced insurers use other customer research techniques as well, such as online panels, focus groups, and “day in the life of” profiles, along with enabling the sharing of information from quality teams (e.g., claims and customer support), fraud control, and the internal audit team. Each of these alternatives provides additional information toward a comprehensive measurement of each insurer’s situation.

Action, of course, must complement measurement. The first tool to identify root causes and solutions is a “close the loop” call, where insurers actively ask customers for more information about their experiences and expectations. A more advanced trend is the evolution toward the “test and learn” approach, with an increasing use of pilots to test improvements before including them in processes. This enables faster improvement. These approaches are usually complemented by co-creation methodologies, which include the customer and agents in the development of solutions (e.g., via online panels, advisory committees, or design thinking tools). Other sources for improvement ideas could come from external players; for example, by observing best practices of competitors and collaborating with insurtechs and start-ups that have more disruptive approaches.

6. Personalize the experience using customer analytics

The personalization of services and products requires a massive exploitation of customer data. This brings two challenges: (1) developing the required analytics capabilities and (2) deploying the analytics capabilities in the business processes.

-

Developing the required analytics capabilities starts with identifying and prioritizing personalization use cases in an implementation roadmap (usually by economic/customer impact and by implementation complexity). Then, working backward, you can:

-

Identify required and available customer data. The usual challenges here are missing information (e.g., information not provided by agents) and unconnected data silos (e.g., industry/product).

-

Define the legal model to support personalization under a specific regulation (e.g., with GDPR, two key concepts are privacy policy and processing under legitimate interest and/or consent).

-

Create an analytical team able to prepare the models. The team should incorporate diverse skills (e.g., data engineer, scientist, translator).

-

Develop the analytical platform with the required functionalities.

-

-

Deploying the analytics capabilities in the business process usually requires solving the integration problems of different core systems (e.g., life, non-life/savings platforms, retail, and corporate platforms) and the lack of functionality (usually in the sales domain of customer relationship management as insurers are usually intermediated).

Conclusion

DRIVING CHANGE

As customers’ expectations increase, insurers must successfully turn business verticals into a fully integrated value chain focused on customer segments. To drive real change, organizations should integrate a customer-centric vision and adapt processes, tools, and governance to ensure consistency and implementation. This Viewpoint presented six elements that insurers should focus on as they transition to a customer-centric model:

-

Design a distinctive, shared, customer-centric strategy.

-

Drive cross-functional collaboration and customer leadership in the organizational structure.

-

Engage employees, agents, and external partners.

-

Manage interactions with customers, agents, and brokers.

-

Test, measure, and improve, focusing on relevant customer interactions.

-

Personalize the experience using customer analytics.