The Italian gas distribution sector

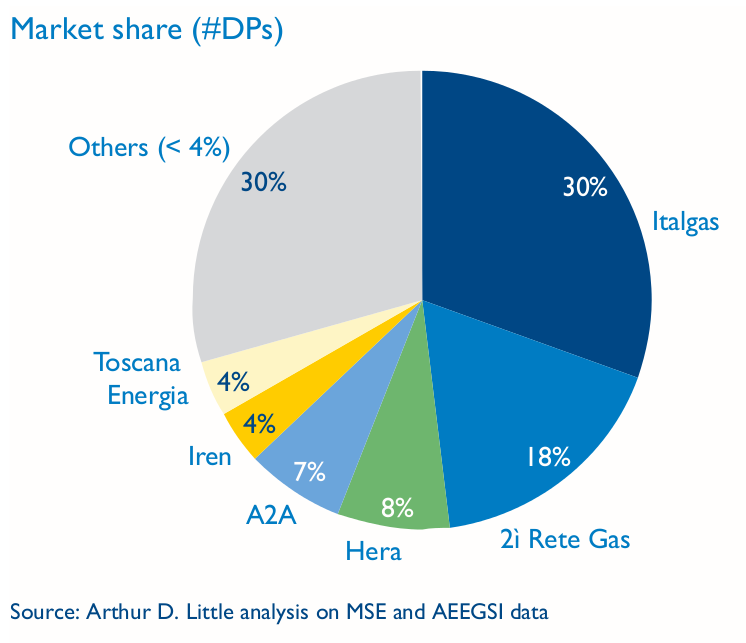

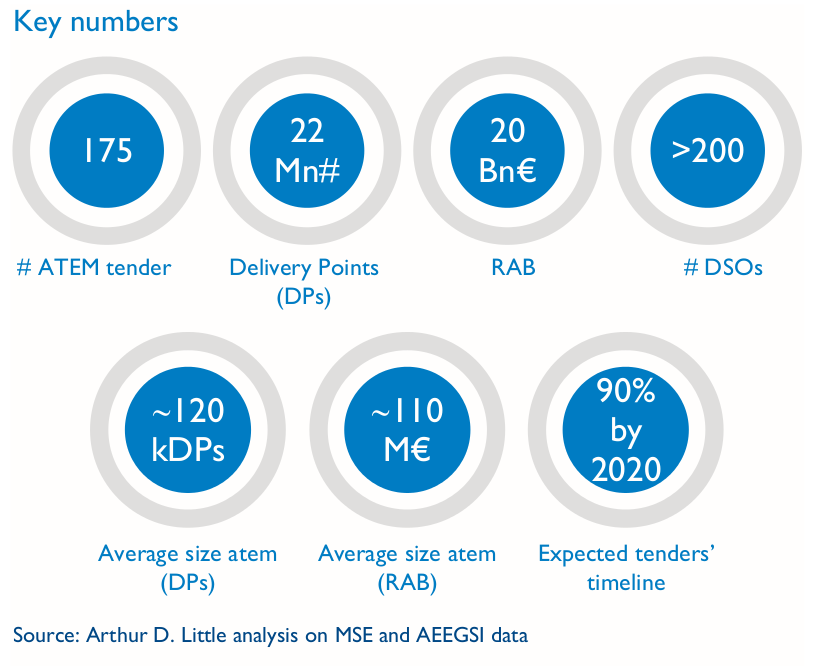

The Italian gas distribution sector is highly fragmented: the top six DSOs represent ~70% of the existing 22 million delivery points (DPs), while the remaining 30% is split among more than 200 players.

In order to increase companies’ efficiency and improve the quality of service delivered, the government decided that consolidation of the sector was required. It introduced the ATEM concept: ministerial decree 226/2011 divided the Italian territory into 175 ATEMs (“minimum concession area”) for the next tenders and defined an ATEM tender calendar.

The size of an average ATEM is around 120,000 DPs, 20% more than DSOs’ average size (~100,000 DPs).

Few operators are likely to have all of the technical and financial capabilities to be competitive in the upcoming ATEM tenders. (E.g., bidders should manage at least 50% of ATEM DPs to participate to the tender.)

On the other hand, in the majority of ATEMs (~70%), the first DSO (“incumbent”) manages more than 50% of DPs. Market share represents one of the main entry barriers for future tenders: the greater the incumbent’s capabilities and willingness to retain the ATEM, the lower the ATEM’s contestability.

The total value of the Regulatory Asset Base (RAB) that will be renegotiated through ATEM tenders is estimated at around €20 billion (about €110 million per ATEM).

This scenario will impact the market in two main ways:

- The number of active operators is expected to decrease sharply after the next round of tenders.

- Several operators will be looking for financial and industrial partners to increase their likelihood of success.