As utilities are exposed to bigger risks of supply-and-demand imbalance fueled by unpredictable, intermittent generation sources, they are searching for flexibility solutions to offset their open positions. In this market context, energy aggregators have emerged, and are taking an increasingly important role in optimizing electricity generation and demand volatility by providing the needed flexibility. Meanwhile, multiple traditional (integrated) utilities have developed similar demandside response (DSR) solutions and even acquired aggregators altogether. Catching the inherent value in these services is becoming part of the core business of utilities. However, being in this game requires speed, skills, agility and differentiators. The key question is how utilities can make this happen.

While it could seem counterintuitive at first, multiple factors are pushing utilities to become active providers of flexibility services, which is outside of the traditional comfort zone of the energy commodity. We distinguish three main reasons traditional utilities are adding flexibility services to their commercial offerings.

Benefit 1: Additional source of stable revenues within the rapidly growing flexible-capacity market

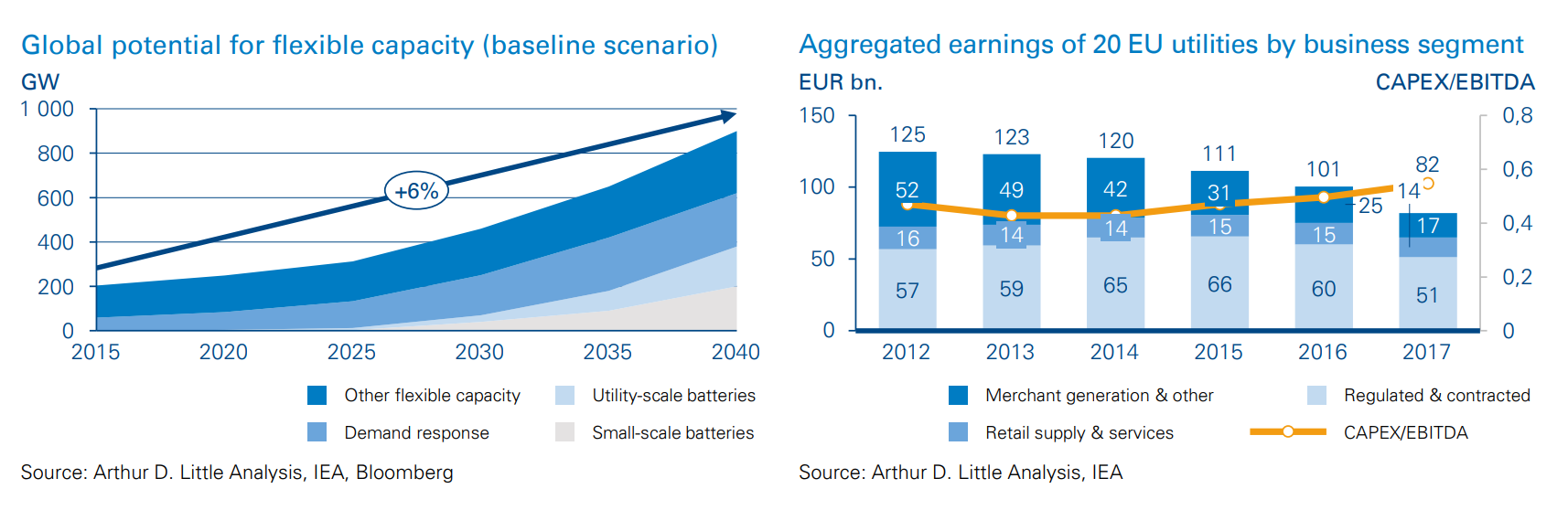

Underlying market drivers for flexibility (the rise of intermittent generation, the expected shutdown of conventional generation assets) are gaining strength. Consequently, the global market for flexible capacity is expected to experience significant growth, at a CAGR of 6 percent over the next two decades, to reach 900 GW by 2040. However, there are important differences in the forecasted growth rates of the different types of flexible capacity under consideration.

First, the share of DSR within the flexible capacity mix is expected to remain stable at ≈27 percent. Second, the share of utility-scale and small-scale batteries is expected to grow at a CAGR of ≈23 percent, resulting in a combined share of ≈42 percent of the total flexible capacity in 2040. Finally, the relative share of other flexible resources, such as open-cycle gas plants and gas peakers, is expected to drop from ≈71 percent in 2015 to ≈31 percent in 2040, at a lower-than-average CAGR of ≈3 percent. These growth figures present welcome compensation for some industry players, such as the European utilities whose earnings from traditional activities are either stagnating (in the case of retail & supply services) or significantly dropping (in the case of merchant generation), as can be seen from above figure. Utility earnings now stem from segments offering more stable cash flows, such as networks and generation based on contracted/regulated pricing models such as ancillary services or PPAs.

On top of that, flexibility usage can represent an additional and cheaper way to prevent utility imbalance, and therefore avoid paying penalties.

Benefit 2: Strengthen the relationship with prosumers

Unlike aggregators, utilities have access to portfolios of existing customers (B2B/B2C), with insight into their current energy consumption (patterns). Flexibility service offerings would provide utilities with the opportunity to strengthen their relationships and increase customer retention.

On the one hand, utilities can use flexibility services to help customers save money by lowering their energy bills, as well as to monetize their newly acquired assets such as residential batteries (plus provide related subscription-based services such as maintenance contracts). This can be achieved by changing customer consumption behavior (e.g., shifting consumption away from peak periods), or even optimizing asset use of prosumers (e.g., releasing energy from residential batteries when it is the most valuable). On the other hand, the utility can leverage the flexible capacity provided by consumers to optimize its own operations across the value chain. The utility can then improve its asset management by, e.g., choosing to (de-)activate a virtual power plant (VPP, flexibility from the customers) instead of using a traditional generation asset.