DOWNLOAD

14 min read •

Demystifying the charging challenge

A driver for convergence and new business opportunities

The combination of a growing need for electric vehicle charging and an energy industry increasingly reliant on renewable generation has led to many prophesizing power cuts and blackouts as current infrastructure struggles to cope. However, this charging challenge will instead open up new opportunities for the energy and automotive industries as the two converge. We explore how this will transform both sectors.

There is a widely held view that the combination of rising energy demand from electric vehicles (EVs) and the shift to fluctuating renewable power generation will lead to inevitable blackouts and power cuts. However, given the rapidly developing technologies and emerging business models in energy and mobility provision, how likely is this to happen in practice? In this article we provide an optimistic view of the future, in which we see the charging challenge as more of an opportunity than a threat for those mobility and energy players that can best exploit the new business prospects offered by the convergence of these two domains.

The charging challenge: Will EVs and renewables put energy grids under pressure?

The charging challenge: Will EVs and renewables put energy grids under pressure?

In recent years, zero-emission transport and renewable energy have left their niches and become mainstream market drivers.

In 2017, we passed the first remarkable milestone in the EV market, when global EV sales passed the 1 million mark 1 . Since then the EV market has been gaining further momentum, driven by greater consumer acceptance, greater availability of infrastructure and favorable regulatory change. Countries across the world have set deadlines for ending sales of petroleum- and diesel-engine vehicles – for example, Norway in 2025, Sweden in 2030, and the UK, China and France in 2040. Consequently, automotive manufacturers have been focusing on a zero-emission future, boldly shifting investments towards vehicle electrification. Volkswagen Group, the world’s largest automobile maker in terms of sales, plans to invest €44 billion by 2023 in electric vehicles and related digital services2 .

At the same time, renewables are becoming central to energy supply. Germany produced enough renewable energy in the first half of 2018 to power every household in the country for a year. In 2019, more than half of the UK’s power has come from renewable sources. As of 2020, California will be the first US state to make solar panels on new buildings mandatory, which will support its goal to be CO2-neutral by 2045 3 . To meet climate change targets, legislators are looking to decrease harmful emissions from fossil fuel power generation, amid ambitious targets to reduce CO2 levels.

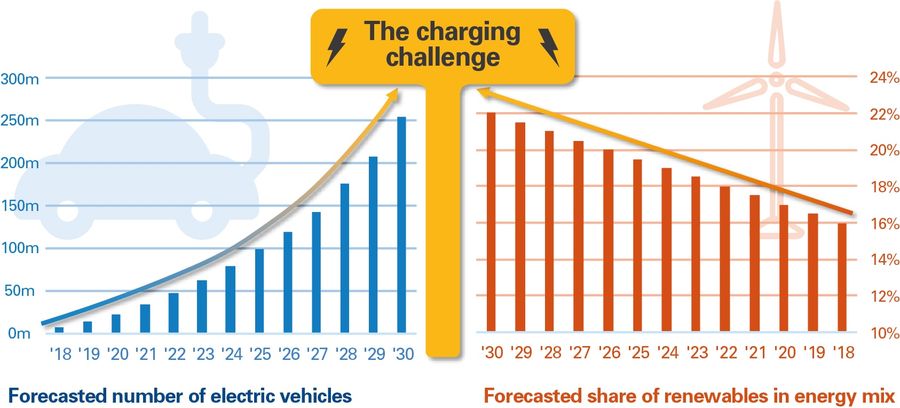

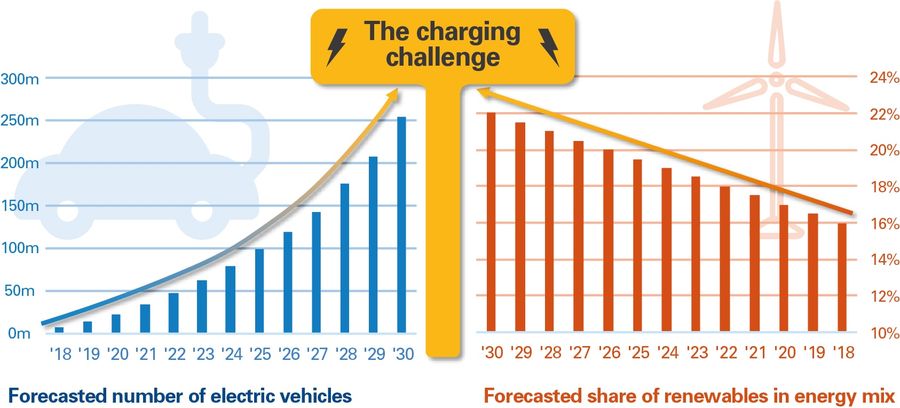

The automotive and energy industries have grown and developed independently of each other over the last decades. Each has faced its own separate opportunities and challenges. However, now, thanks to EV and renewables trends, they have begun to substantially affect each other. On the positive side, the electrification of cars and the shift from conventional to renewable energy generation have led to improved air quality by decreasing emissions. At the same time, they also put traditional energy networks under pressure – electric vehicles on the demand side and renewable energies on the supply side, as shown Figure 1.

Increased volatility: Coping when the wind doesn’t blow or the sun doesn’t shine

Increasing energy generation from renewable sources threatens the stability of grids due to their time- and location- dependent availability. Wind is hardly predictable, and shows high fluctuations in power generation due to varying weather. Solar power may be more predictable, but is still volatile and only available during the daytime. It is also localized – in the case of Germany, most wind energy stems from the North of the country, while solar power is predominantly generated in Southern areas. Given that the German government has set a target of renewable energies meeting 65 percent of German power demand by 2030, this will lead to a supply-side challenge for electricity grids 5 . Similar grid challenges will arise in other countries, such as China, the world’s biggest energy consumer. The government there has increased its original renewables target from 20 to 35 percent by 2030, which will lead to enormous expansion of fossil-free energy generation6 .

From a demand-side perspective, vehicle electrification will substantially increase electricity requirements. The combination of greater consumer acceptance, regulatory targets and more affordable vehicles will lead to growing market uptake, especially in Europe. From a cost perspective, by 2022 EVs will be on par with, or even drop below, the costs of internal combustion engine (ICE) vehicles in Europe, according to a recent study by Bloomberg New Energy Finance. This decrease in cost is mainly driven by the drop in battery prices. In just a few years this will make choosing an electric car over its ICE equivalent a matter of taste, not one of cost 7 . By 2040, 54 percent of new-car sales and 33 percent of the global car fleet are forecast to be electric, with China, the US and Europe making up over 60 percent of the global EV market 8 . Consequently, consumers’ electricity demand will be significantly changed, in terms of not only electricity volume, but also charging power.

These two trends contribute to the same critical challenge – putting the electricity grid under pressure. They are often seen as leading to a potentially bleak outlook for maintaining a secure power supply.

The threat of electricity blackouts

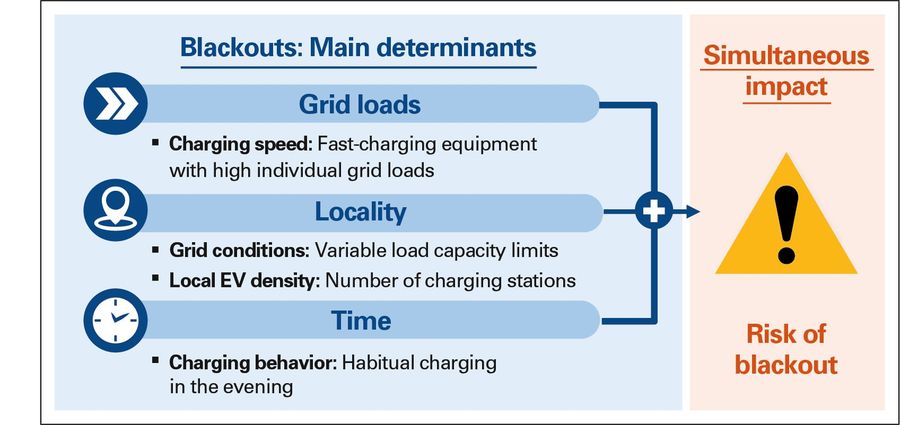

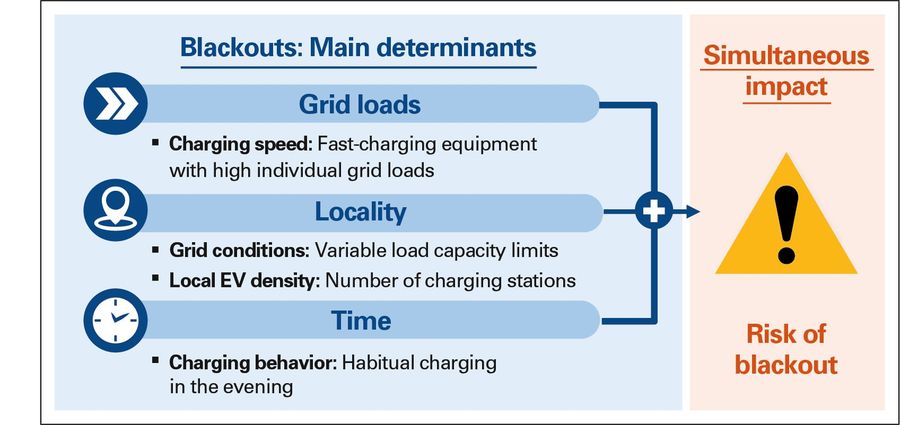

So how real is the threat of local blackouts as energy networks are pushed beyond their maximum capacity? First of all, it is important to realize that this would not be a continuous problem: with EVs accounting for less than 10 percent of total electricity demand by 2030, the challenge is more around the time and local impact of charging. What happens if more fast chargers with higher load capacities are installed? What happens when every EV owner in a suburban residential neighborhood charges their vehicle at exactly the same time? Figure 2 illustrates the main determinants of potential blackouts: grid loads, locality and time.

Many studies have discussed this threat and forecast nightmare scenarios that range from short-term local power outages to nationwide blackouts. The often-repeated message is that electricity grids cannot cope with forecasted vehicle electrification and renewable energy development at the same time. And it is very true that if grid infrastructure remains in its current state, blackouts and energy shortages will become a reality even before 2030.

However, in our analysis, this scenario will only be valid if energy and mobility providers follow the same patterns and business models that predominate today. In practice, we believe this is unlikely, as mobility and energy players have strong drivers to evolve their business models, and ample time to respond to the new opportunities afforded by technological convergence of electric vehicles and renewable energy applications.

Why the charging challenge will be overcome

The key reason for optimism is that all market players still have some time to adapt to changing requirements and transform their operations. EV penetration is an evolutionary, rather than revolutionary, process. Although electricity demand for charging EVs is expected to double by 2022, this still accounts for less than 1 percent of total electricity generation. Given that the major uptake of EVs, and therefore greater electricity demand, is only expected from 2025 onwards, providers have time to prepare.

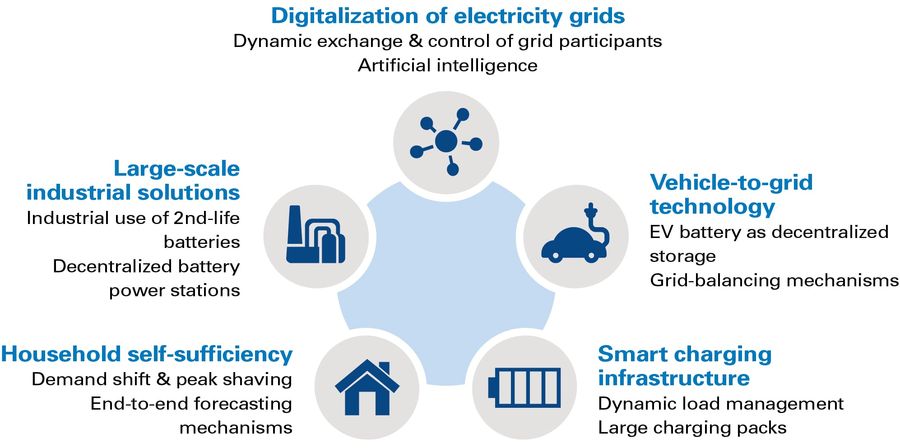

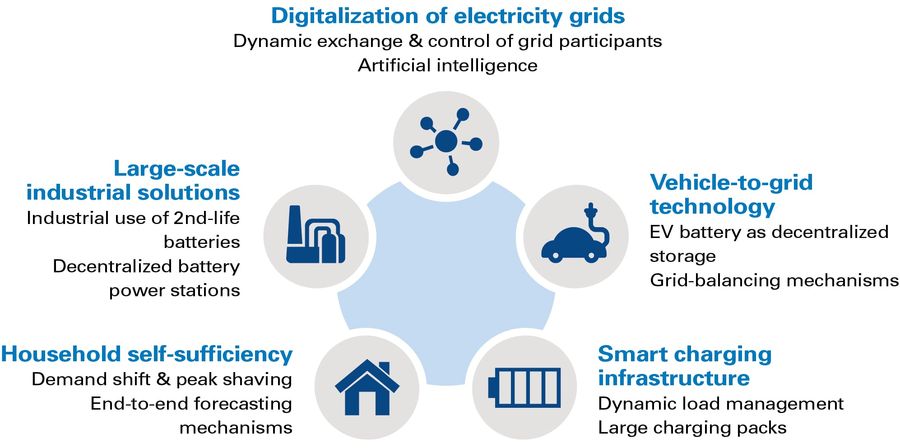

Five key technologies and trends will support their transformation:

1. Digitalization of electricity grids

Energy providers are increasingly investing in intelligent networks that will help to prevent grid instability and blackouts. Smart grids, which enable the exchange of information between different players within the network, are key to balancing electricity supply and demand. For example, the Trans-European Network for Energy facilitates transport of electricity over long distances across Europe, which lowers the risk of electricity blackouts. Current technology developments such as artificial intelligence, vehicle-to-grid/- home and dynamic load management will further support the development of intelligent and stable grids. Today, the building blocks for smart grids are already being put in place. In multiple countries, smart meters are becoming mandatory for businesses and end consumers with high electricity demand. In addition, electricity network providers are investing in intelligent transformer stations that contain metering and control functionalities. By making it possible to constantly monitor and steer voltage, current and frequency, these intelligent transformers also allow bidirectional flow of energy.

2. Vehicle-to-grid technology

Expensive infrastructure updates can be avoided with vehicle- to-grid technology that uses the batteries of EVs as a storage mechanism, which stabilizes the grid. If there is a surplus of electricity, EV batteries can be charged and serve as local storage. In case of electricity shortages, they can then feed energy into the grid or, alternatively, reduce their charging rates to keep the grid stable. The essential vehicle-to-grid technology to deliver these capabilities is still in its infancy and requires further development, but it is the focus of cross-sector research and studies that are building the pillars to exploit this new technology. Different players, including network operators, energy service providers and automobile manufacturers, are launching joint pilot projects. For example, Renault has begun piloting the first large-scale vehicle-to-grid charging project with electric vehicles in the Netherlands and Portugal. In the UK a consortium of players with different expertise, such as Nissan Motor Manufacturing UK, Energy Systems Catapult and National Grid ESO, are exploring both near-term and large-scale opportunities for vehicle-to-grid to play a role in a flexible energy system 9 .

3. Smart charging infrastructure

The nightmare scenario of all EV owners plugging in their vehicles at once should be mitigated through the installation of smart charging infrastructure. Communication features and in-built load management will allow energy providers or charging infrastructure owners to flexibly control the charging process at one or more connected charge points, which will smooth electricity demand peaks. For example, even if every EV owner begins charging their vehicle at the same time every evening, the process doesn’t need to be simultaneous. Dynamic load management enables the charging volumes to be distributed across the entire night, which will significantly reduce grid load.

Today, there is already a lot of smart charging infrastructure installed, which allows for communication and load management. In this major area of focus, we expect rapid maturing and expansion of more sophisticated load management systems, in both private and public charging infrastructure.

In addition to private households, larger energy consumers such as charging parks and other business facilities can benefit significantly from intelligent steering of charging processes, as it allows them to reduce demand peaks and thus avoid cost-intensive infrastructure expansion.

4. Household self-sufficiency

In 2018 there was a record number of installed photovoltaic (PV) solar panels combined with home battery storage, and this is predicted to grow in the future 10 . These households with battery storage have the potential to reduce grid loads and provide flexibility by shifting demand and lowering the need for electricity supply to their properties (and vehicles). Smart management of these electricity sources and consumer needs will provide an endless range of new applications and business models. For example, AI algorithms could evaluate driver profiles, weather forecasts and electricity consumption patterns to flexibly connect individual electricity sources to consumers, which will minimize energy cost, ensure high customer satisfaction, and limit the impact on local grids. In fact, home batteries are already being used to balance grid volatility due to the rise of renewable energy.

5. Large-scale industrial solutions

Advances in battery technology and rapidly decreasing kilowatt hour prices will provide larger-scale solutions to help with grid stability. Stand-alone battery power stations will be installed as significant local power resources, while smaller energy storage systems can ensure distribution grid stability. The growth in availability of dedicated power station batteries, as well as the increasing reuse of EV batteries, will feed this trend. For example, the second-life EV battery 11 market is expected to grow to $4.2 billion by 2025, with 70 percent of the market value originating in China and 16 percent in South Korea 12 .

Audi has recently installed stationary energy storage with capacity of 1.9 MWh in Berlin. Fortum, as well, is piloting different second-life battery solutions, testing new business models. In India, for example, Fortum is developing a leasing model in which auto rickshaw owners can give back their used batteries for recharging and receive full batteries in return 13 .

Taking them together, we expect these trends to enable grids to cope with the charging challenge despite rising vehicle electrification and renewable energy use. Batteries and smart charging infrastructure will provide flexibility, while intelligent networks and connectivity allow for decentralized energy management. Finally, monetary incentives across all applications will ensure market attractiveness. Some utilities have already started to introduce such tariffs, especially for B2B customers, while reduced grid connection costs for interruptible consumers such as EVs allow for short power cuts in case of grid instability.

Both utilities and e-mobility providers have explicit interest in supporting these developments, to prevent unnecessary costs for grid extensions and ensure a flawless customer experience for EV users. Other players, too, are entering the market; often these are mobility service providers emerging from the start-up landscape with strong digital focus. In these rapidly converging industries, we expect a new competitive landscape to quickly develop on the base of new business models.

Incumbents, challengers and new business models – Which will win the battle?

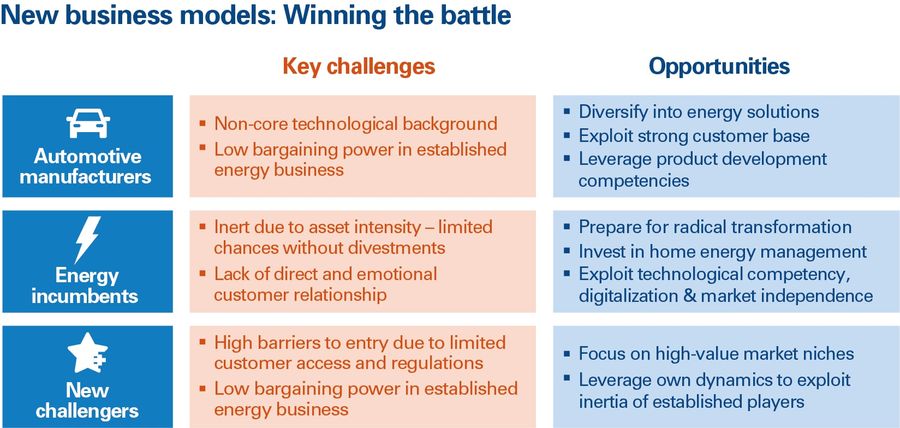

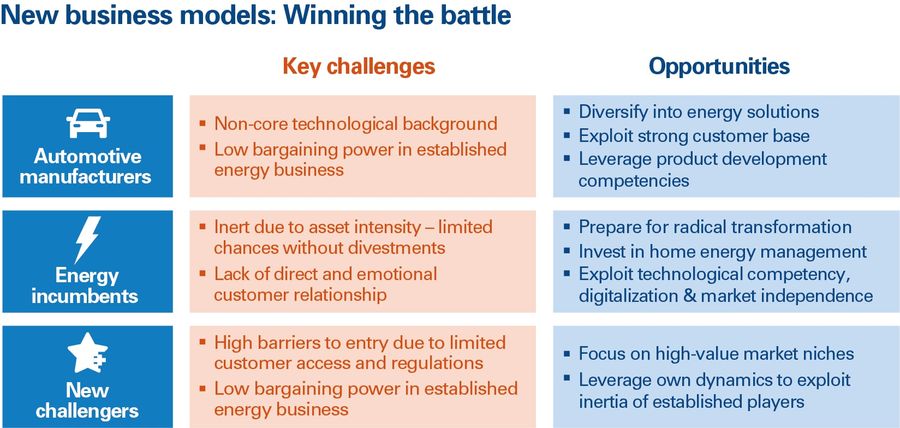

Potential new business models will arise from the charging challenge, for both established energy market incumbents and challengers such as automotive manufacturers and mobility service providers. Energy companies will heavily invest in public charging infrastructure to provide viable alternatives to home charging, while e-mobility players extend their offerings to support grid-stabilizing mechanisms. Each of these players brings different core competencies to the table:

- Automotive manufacturers have global retail and brand experience at their disposal.

- Energy incumbents build on vast energy technology and regulatory expertise.

- Smaller mobility players are able to take on specific niches at high speed and with advanced digital skill sets.

When it comes to successfully introducing new business models, all these strengths can be crucial. Which players will emerge as the winners? Three aspects are likely to be important: margins, customer access and technological capabilities.

- Automotive manufacturers, with well-established B2C and B2B customer bases, as well as command of vehicles, will enter the charging challenge from a position of strength and are likely to have the initial advantage in generating enough margins. Clearly, their products are focused on the vehicle, with little or no reach into customers’ households. They do, however, hold the advantage in terms of their experience in emotionally charging products and building brands. We therefore expect manufacturers to extend their offerings towards the “energy solutions” business by making use of their EVs, brands, and market access. For example, Volkswagen Group founded Elli, an energy and charging solutions provider, in 2018. Elli aims to offer a seamless and holistic energy and charging experience for electric car drivers and fleet managers.

- Energy incumbents have a greater challenge due to their traditional focus on energy provision as asset- heavy and cost-driven Enterprises. However, those players that are able to move away from central generation, transform their infrastructure, digitalize their businesses and refocus on the consumer 14 have good chances of success. This trend is already well under way, as shown by, for example, the splitting of E.ON into E.ON and Uniper, and RWE into RWE and Innogy. Continuous investment from Engie in customer energy management and demand response players is another example. Smart home appliances allow energy players to gain access to customers’ homes. They can also use their independence from automotive brands as a unique selling point, especially with corporate customers. In addition, existing energy players will have networks of installers, which will provide an advantage when it comes to deploying relevant hardware.

- New challengers, such as mobility and energy service providers, pose a serious challenge, given their speed, strong focus on the customer, and digital capabilities. While many corporates make use of internal incubators to create these capabilities, start-ups with technology focus are likely acquisition targets. For example, Shell has been investing heavily in energy and mobility service start-ups such as Sonnen and NewMotion. Amazon is leading a $700 million round of investment in Rivian, a potential rival to EV manufacturer Tesla, as well as investing heavily in customer energy management providers 15 . Well-known automotive players, similarly, are investing in high-potential e-mobility companies such as Rimac. This Croatian company develops EVs with advanced battery and control technology, and was able to attract investments from Porsche, Hyundai and Kia 16 . These challengers will address specific “high value” spots in the value chain where they are likely to have the upper hand over the industry giants, at least initially.

Figure 4 summarizes the positioning of players entering the charging challenge and opportunities for new business models.

Insight for the executive

The competition has begun around future energy business models. The charging challenge is unlikely to lead to blackouts or instability, given the strong drivers for new business models, the potential of converging technologies, and the availability of sufficient time for key players to adapt. On the contrary, the rise of EVs will very much prove to be an opportunity. In converging industries, the charging challenge will enable new business models, which will see established and new players competing. We expect energy and automotive incumbents, as well as new challengers – often smaller mobility players and energy service providers – to open up these new areas.

Today, these players start from different positions with their individual sets of capabilities. With smaller players as likely acquisition targets, both of the giant industry environments of energy and mobility promise to drive consolidation as competencies converge. This can be seen in the automotive industry, as alliances have become increasingly popular to fund the significant investments required for new e-mobility capabilities. In the meantime, energy players themselves have been consolidating, and will be further driven to demerge asset-heavy and cost-intensive electricity generation businesses.

Realizing margins within these new business models is based heavily on gaining substantial market shares, which means we expect a “volume-driven game” to emerge in these areas. Currently, automotive manufacturers seem best equipped to succeed in this competition, but the challenge requires all players to change and adapt if they are to drive long-term success.

14 min read •

Demystifying the charging challenge

A driver for convergence and new business opportunities

The combination of a growing need for electric vehicle charging and an energy industry increasingly reliant on renewable generation has led to many prophesizing power cuts and blackouts as current infrastructure struggles to cope. However, this charging challenge will instead open up new opportunities for the energy and automotive industries as the two converge. We explore how this will transform both sectors.

There is a widely held view that the combination of rising energy demand from electric vehicles (EVs) and the shift to fluctuating renewable power generation will lead to inevitable blackouts and power cuts. However, given the rapidly developing technologies and emerging business models in energy and mobility provision, how likely is this to happen in practice? In this article we provide an optimistic view of the future, in which we see the charging challenge as more of an opportunity than a threat for those mobility and energy players that can best exploit the new business prospects offered by the convergence of these two domains.

The charging challenge: Will EVs and renewables put energy grids under pressure?

The charging challenge: Will EVs and renewables put energy grids under pressure?

In recent years, zero-emission transport and renewable energy have left their niches and become mainstream market drivers.

In 2017, we passed the first remarkable milestone in the EV market, when global EV sales passed the 1 million mark 1 . Since then the EV market has been gaining further momentum, driven by greater consumer acceptance, greater availability of infrastructure and favorable regulatory change. Countries across the world have set deadlines for ending sales of petroleum- and diesel-engine vehicles – for example, Norway in 2025, Sweden in 2030, and the UK, China and France in 2040. Consequently, automotive manufacturers have been focusing on a zero-emission future, boldly shifting investments towards vehicle electrification. Volkswagen Group, the world’s largest automobile maker in terms of sales, plans to invest €44 billion by 2023 in electric vehicles and related digital services2 .

At the same time, renewables are becoming central to energy supply. Germany produced enough renewable energy in the first half of 2018 to power every household in the country for a year. In 2019, more than half of the UK’s power has come from renewable sources. As of 2020, California will be the first US state to make solar panels on new buildings mandatory, which will support its goal to be CO2-neutral by 2045 3 . To meet climate change targets, legislators are looking to decrease harmful emissions from fossil fuel power generation, amid ambitious targets to reduce CO2 levels.

The automotive and energy industries have grown and developed independently of each other over the last decades. Each has faced its own separate opportunities and challenges. However, now, thanks to EV and renewables trends, they have begun to substantially affect each other. On the positive side, the electrification of cars and the shift from conventional to renewable energy generation have led to improved air quality by decreasing emissions. At the same time, they also put traditional energy networks under pressure – electric vehicles on the demand side and renewable energies on the supply side, as shown Figure 1.

Increased volatility: Coping when the wind doesn’t blow or the sun doesn’t shine

Increasing energy generation from renewable sources threatens the stability of grids due to their time- and location- dependent availability. Wind is hardly predictable, and shows high fluctuations in power generation due to varying weather. Solar power may be more predictable, but is still volatile and only available during the daytime. It is also localized – in the case of Germany, most wind energy stems from the North of the country, while solar power is predominantly generated in Southern areas. Given that the German government has set a target of renewable energies meeting 65 percent of German power demand by 2030, this will lead to a supply-side challenge for electricity grids 5 . Similar grid challenges will arise in other countries, such as China, the world’s biggest energy consumer. The government there has increased its original renewables target from 20 to 35 percent by 2030, which will lead to enormous expansion of fossil-free energy generation6 .

From a demand-side perspective, vehicle electrification will substantially increase electricity requirements. The combination of greater consumer acceptance, regulatory targets and more affordable vehicles will lead to growing market uptake, especially in Europe. From a cost perspective, by 2022 EVs will be on par with, or even drop below, the costs of internal combustion engine (ICE) vehicles in Europe, according to a recent study by Bloomberg New Energy Finance. This decrease in cost is mainly driven by the drop in battery prices. In just a few years this will make choosing an electric car over its ICE equivalent a matter of taste, not one of cost 7 . By 2040, 54 percent of new-car sales and 33 percent of the global car fleet are forecast to be electric, with China, the US and Europe making up over 60 percent of the global EV market 8 . Consequently, consumers’ electricity demand will be significantly changed, in terms of not only electricity volume, but also charging power.

These two trends contribute to the same critical challenge – putting the electricity grid under pressure. They are often seen as leading to a potentially bleak outlook for maintaining a secure power supply.

The threat of electricity blackouts

So how real is the threat of local blackouts as energy networks are pushed beyond their maximum capacity? First of all, it is important to realize that this would not be a continuous problem: with EVs accounting for less than 10 percent of total electricity demand by 2030, the challenge is more around the time and local impact of charging. What happens if more fast chargers with higher load capacities are installed? What happens when every EV owner in a suburban residential neighborhood charges their vehicle at exactly the same time? Figure 2 illustrates the main determinants of potential blackouts: grid loads, locality and time.

Many studies have discussed this threat and forecast nightmare scenarios that range from short-term local power outages to nationwide blackouts. The often-repeated message is that electricity grids cannot cope with forecasted vehicle electrification and renewable energy development at the same time. And it is very true that if grid infrastructure remains in its current state, blackouts and energy shortages will become a reality even before 2030.

However, in our analysis, this scenario will only be valid if energy and mobility providers follow the same patterns and business models that predominate today. In practice, we believe this is unlikely, as mobility and energy players have strong drivers to evolve their business models, and ample time to respond to the new opportunities afforded by technological convergence of electric vehicles and renewable energy applications.

Why the charging challenge will be overcome

The key reason for optimism is that all market players still have some time to adapt to changing requirements and transform their operations. EV penetration is an evolutionary, rather than revolutionary, process. Although electricity demand for charging EVs is expected to double by 2022, this still accounts for less than 1 percent of total electricity generation. Given that the major uptake of EVs, and therefore greater electricity demand, is only expected from 2025 onwards, providers have time to prepare.

Five key technologies and trends will support their transformation:

1. Digitalization of electricity grids

Energy providers are increasingly investing in intelligent networks that will help to prevent grid instability and blackouts. Smart grids, which enable the exchange of information between different players within the network, are key to balancing electricity supply and demand. For example, the Trans-European Network for Energy facilitates transport of electricity over long distances across Europe, which lowers the risk of electricity blackouts. Current technology developments such as artificial intelligence, vehicle-to-grid/- home and dynamic load management will further support the development of intelligent and stable grids. Today, the building blocks for smart grids are already being put in place. In multiple countries, smart meters are becoming mandatory for businesses and end consumers with high electricity demand. In addition, electricity network providers are investing in intelligent transformer stations that contain metering and control functionalities. By making it possible to constantly monitor and steer voltage, current and frequency, these intelligent transformers also allow bidirectional flow of energy.

2. Vehicle-to-grid technology

Expensive infrastructure updates can be avoided with vehicle- to-grid technology that uses the batteries of EVs as a storage mechanism, which stabilizes the grid. If there is a surplus of electricity, EV batteries can be charged and serve as local storage. In case of electricity shortages, they can then feed energy into the grid or, alternatively, reduce their charging rates to keep the grid stable. The essential vehicle-to-grid technology to deliver these capabilities is still in its infancy and requires further development, but it is the focus of cross-sector research and studies that are building the pillars to exploit this new technology. Different players, including network operators, energy service providers and automobile manufacturers, are launching joint pilot projects. For example, Renault has begun piloting the first large-scale vehicle-to-grid charging project with electric vehicles in the Netherlands and Portugal. In the UK a consortium of players with different expertise, such as Nissan Motor Manufacturing UK, Energy Systems Catapult and National Grid ESO, are exploring both near-term and large-scale opportunities for vehicle-to-grid to play a role in a flexible energy system 9 .

3. Smart charging infrastructure

The nightmare scenario of all EV owners plugging in their vehicles at once should be mitigated through the installation of smart charging infrastructure. Communication features and in-built load management will allow energy providers or charging infrastructure owners to flexibly control the charging process at one or more connected charge points, which will smooth electricity demand peaks. For example, even if every EV owner begins charging their vehicle at the same time every evening, the process doesn’t need to be simultaneous. Dynamic load management enables the charging volumes to be distributed across the entire night, which will significantly reduce grid load.

Today, there is already a lot of smart charging infrastructure installed, which allows for communication and load management. In this major area of focus, we expect rapid maturing and expansion of more sophisticated load management systems, in both private and public charging infrastructure.

In addition to private households, larger energy consumers such as charging parks and other business facilities can benefit significantly from intelligent steering of charging processes, as it allows them to reduce demand peaks and thus avoid cost-intensive infrastructure expansion.

4. Household self-sufficiency

In 2018 there was a record number of installed photovoltaic (PV) solar panels combined with home battery storage, and this is predicted to grow in the future 10 . These households with battery storage have the potential to reduce grid loads and provide flexibility by shifting demand and lowering the need for electricity supply to their properties (and vehicles). Smart management of these electricity sources and consumer needs will provide an endless range of new applications and business models. For example, AI algorithms could evaluate driver profiles, weather forecasts and electricity consumption patterns to flexibly connect individual electricity sources to consumers, which will minimize energy cost, ensure high customer satisfaction, and limit the impact on local grids. In fact, home batteries are already being used to balance grid volatility due to the rise of renewable energy.

5. Large-scale industrial solutions

Advances in battery technology and rapidly decreasing kilowatt hour prices will provide larger-scale solutions to help with grid stability. Stand-alone battery power stations will be installed as significant local power resources, while smaller energy storage systems can ensure distribution grid stability. The growth in availability of dedicated power station batteries, as well as the increasing reuse of EV batteries, will feed this trend. For example, the second-life EV battery 11 market is expected to grow to $4.2 billion by 2025, with 70 percent of the market value originating in China and 16 percent in South Korea 12 .

Audi has recently installed stationary energy storage with capacity of 1.9 MWh in Berlin. Fortum, as well, is piloting different second-life battery solutions, testing new business models. In India, for example, Fortum is developing a leasing model in which auto rickshaw owners can give back their used batteries for recharging and receive full batteries in return 13 .

Taking them together, we expect these trends to enable grids to cope with the charging challenge despite rising vehicle electrification and renewable energy use. Batteries and smart charging infrastructure will provide flexibility, while intelligent networks and connectivity allow for decentralized energy management. Finally, monetary incentives across all applications will ensure market attractiveness. Some utilities have already started to introduce such tariffs, especially for B2B customers, while reduced grid connection costs for interruptible consumers such as EVs allow for short power cuts in case of grid instability.

Both utilities and e-mobility providers have explicit interest in supporting these developments, to prevent unnecessary costs for grid extensions and ensure a flawless customer experience for EV users. Other players, too, are entering the market; often these are mobility service providers emerging from the start-up landscape with strong digital focus. In these rapidly converging industries, we expect a new competitive landscape to quickly develop on the base of new business models.

Incumbents, challengers and new business models – Which will win the battle?

Potential new business models will arise from the charging challenge, for both established energy market incumbents and challengers such as automotive manufacturers and mobility service providers. Energy companies will heavily invest in public charging infrastructure to provide viable alternatives to home charging, while e-mobility players extend their offerings to support grid-stabilizing mechanisms. Each of these players brings different core competencies to the table:

- Automotive manufacturers have global retail and brand experience at their disposal.

- Energy incumbents build on vast energy technology and regulatory expertise.

- Smaller mobility players are able to take on specific niches at high speed and with advanced digital skill sets.

When it comes to successfully introducing new business models, all these strengths can be crucial. Which players will emerge as the winners? Three aspects are likely to be important: margins, customer access and technological capabilities.

- Automotive manufacturers, with well-established B2C and B2B customer bases, as well as command of vehicles, will enter the charging challenge from a position of strength and are likely to have the initial advantage in generating enough margins. Clearly, their products are focused on the vehicle, with little or no reach into customers’ households. They do, however, hold the advantage in terms of their experience in emotionally charging products and building brands. We therefore expect manufacturers to extend their offerings towards the “energy solutions” business by making use of their EVs, brands, and market access. For example, Volkswagen Group founded Elli, an energy and charging solutions provider, in 2018. Elli aims to offer a seamless and holistic energy and charging experience for electric car drivers and fleet managers.

- Energy incumbents have a greater challenge due to their traditional focus on energy provision as asset- heavy and cost-driven Enterprises. However, those players that are able to move away from central generation, transform their infrastructure, digitalize their businesses and refocus on the consumer 14 have good chances of success. This trend is already well under way, as shown by, for example, the splitting of E.ON into E.ON and Uniper, and RWE into RWE and Innogy. Continuous investment from Engie in customer energy management and demand response players is another example. Smart home appliances allow energy players to gain access to customers’ homes. They can also use their independence from automotive brands as a unique selling point, especially with corporate customers. In addition, existing energy players will have networks of installers, which will provide an advantage when it comes to deploying relevant hardware.

- New challengers, such as mobility and energy service providers, pose a serious challenge, given their speed, strong focus on the customer, and digital capabilities. While many corporates make use of internal incubators to create these capabilities, start-ups with technology focus are likely acquisition targets. For example, Shell has been investing heavily in energy and mobility service start-ups such as Sonnen and NewMotion. Amazon is leading a $700 million round of investment in Rivian, a potential rival to EV manufacturer Tesla, as well as investing heavily in customer energy management providers 15 . Well-known automotive players, similarly, are investing in high-potential e-mobility companies such as Rimac. This Croatian company develops EVs with advanced battery and control technology, and was able to attract investments from Porsche, Hyundai and Kia 16 . These challengers will address specific “high value” spots in the value chain where they are likely to have the upper hand over the industry giants, at least initially.

Figure 4 summarizes the positioning of players entering the charging challenge and opportunities for new business models.

Insight for the executive

The competition has begun around future energy business models. The charging challenge is unlikely to lead to blackouts or instability, given the strong drivers for new business models, the potential of converging technologies, and the availability of sufficient time for key players to adapt. On the contrary, the rise of EVs will very much prove to be an opportunity. In converging industries, the charging challenge will enable new business models, which will see established and new players competing. We expect energy and automotive incumbents, as well as new challengers – often smaller mobility players and energy service providers – to open up these new areas.

Today, these players start from different positions with their individual sets of capabilities. With smaller players as likely acquisition targets, both of the giant industry environments of energy and mobility promise to drive consolidation as competencies converge. This can be seen in the automotive industry, as alliances have become increasingly popular to fund the significant investments required for new e-mobility capabilities. In the meantime, energy players themselves have been consolidating, and will be further driven to demerge asset-heavy and cost-intensive electricity generation businesses.

Realizing margins within these new business models is based heavily on gaining substantial market shares, which means we expect a “volume-driven game” to emerge in these areas. Currently, automotive manufacturers seem best equipped to succeed in this competition, but the challenge requires all players to change and adapt if they are to drive long-term success.