NOW IS THE RIGHT TIME TO PUT GROWTH ON AGENDA

As the global vaccination campaign continues, companies are preparing for the post-COVID-19 economic rebound to rebuild their financial strength and recover ground that they have lost during the COVID recession. Simultaneously, they must also respond to drivers and trends that the pandemic has either induced or significantly accelerated. They must balance the demand surge and digitalization tailwind against supply shortages.

There will be clear winners and losers in this recovery, as has been the case with preceding historic global crises. Winners will take stock of the successes and failures of their business models, which were illuminated during the “stress test” of COVID, rebuild their growth capabilities, and invest in business model transformation to position themselves for systemic shifts. Losers, conversely, will miss the opportunity to learn and improve from the pandemic, and plan for a gradual business return in the expectation that things will recover back to the “old normal.”

To prepare for a post-COVID and VUCA world, companies must review their growth agendas to maximize total shareholder value and reach their full potential. They must reassess their growth ambitions and potential sources of growth. Concurrently, companies ought to acknowledge that increasing shareholder value may not suffice, as the line between shareholder and stakeholder value is becoming increasingly blurred.

“Growth and comfort do not coexist.” — Ginni Rometty, former President and CEO, IBM

Environmental, social, and governance (ESG) issues have in the past primarily been viewed as a stakeholder interest. Yet in the last decade, governments, organizations, and institutional and private investors have increasingly recognized their importance. Sustainability (i.e., ESG) has moved from the periphery, becoming a central business factor to boost shareholder value. The COVID-19 pandemic has, moreover, augmented sustainability’s importance, as it has been acknowledged to contribute to more resilient investments and societies.

Looking at the stock markets, it is evident that ESG funds have made significant traction since the onset of COVID-19. Data from Morningstar shows that the net inflow to sustainable European funds increased by roughly 343% between Q1 2020 and Q1 2021. While sustainable US funds lag behind their European counterparts in total levels, their net inflow rose by 106% between Q1 2020 and Q2 2021 and increased fivefold since Q1 2019. Furthermore, the total assets of sustainable funds grew by approximately 137% Q1 2020 to Q1 2021, reaching 1,984 billion USD globally.

In short, 2,000 billion USD are going for green growth. Impact investments are on everyone’s lips. New issues and opportunities will arise with sustainability’s intensification and growing momentum.

The pandemic also showed the importance of digital transformation, as companies that had embraced it were better able to manage the crisis. The Big Five (Facebook, Apple, Amazon, Microsoft, and Google), for example, have all accelerated growth through the COVID crisis and demonstrated the power of the digital revolution. All companies must be proactive and adaptive to address both sustainability and technological developments to ensure full potential growth in today’s VUCA world.

POINT OF DEPARTURE: FPGA 4.0

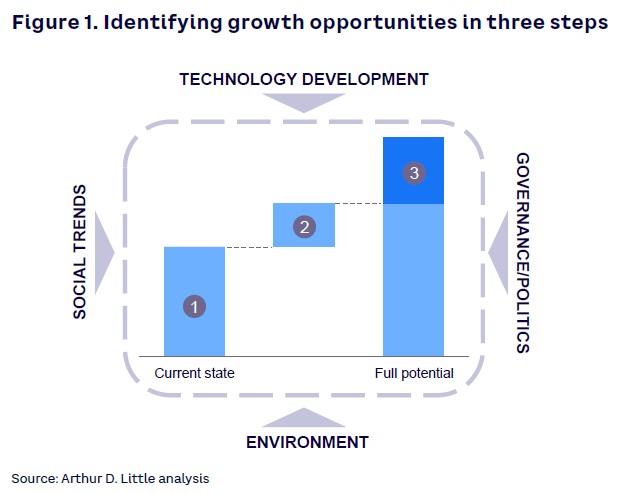

Arthur D. Little’s FPGA 4.0 framework offers a systematic lens for companies to assess their full potential growth strategy. The framework is designed to facilitate the identification of growth opportunities within core business, adjacencies, and new spaces through a three-step methodology, integrating sustainability

and technology reviews in each step (see Figure 1):

- Step 1. Cement a clear, sustainable growth ambition.

- Step 2. Augment organic growth, rethinking core business.

- Step 3. Engage in M&A to find the right growth opportunities.

By formulating a clear growth ambition, Step 1 of the FPGA framework sets the direction, while Steps 2 and 3 ensure the trajectory toward that direction. The latter steps are strategic pillars that facilitate growth (i.e., organic growth driven by core business momentum and inorganic growth driven by M&A).

Companies in the current age also need to manage a number of trends and enablers to maximize shareholder value. External trends, and the risks and opportunities they entail, must be examined when setting the growth ambition.

Underlying sustainability targets should be consequently formulated in Step 1 of the framework and subsequently integrated in Steps 2 and 3. Technology is similarly embedded in the framework, as it is an important growth enabler when reviewing core, adjacencies, and M&A possibilities.

Step 1: Cement a clear, sustainable growth ambition

"My destination is no longer a place, rather a new way of seeing.” — Marcel Proust, French novelist

Setting a growth ambition is nothing new. It is, nevertheless, crucial for companies to be aware of the trajectory of their growth journey in today’s VUCA environment. Therefore, a clear growth ambition is essential, and it should act as a moon-shot target for companies, setting the foundation for strategic development.

A company must formulate what it aims to become as well as successfully manage to take into consideration challenges and trends, small or large, that may have an impact on future growth. A clearly articulated growth ambition with daring goals is a vital cornerstone in achieving full potential growth. The process of articulating the ambition is, however, equally important. Companies must be bold and forward-looking, while being capable of adopting an open-minded approach in order to be receptive to potential sources of growth.

The growth ambition must include factors affecting shareholder and stakeholder value alike, since both affect long-term growth and value. Including the important aspect of sustainability in the growth ambition is essential, since financial and operational factors alone are not enough to ensure robust and sustainable growth heading forward.

Step 2: Augment organic growth, rethinking core business

In today’s climate, it does not suffice to launch new products, diversify current offerings, or attempt to increase market share by cutting prices. To achieve full potential organic growth, companies must reexamine and look beyond current core practices and market space boundaries. They must rethink how they can create new business solutions, expand existing core offerings with additional services and improved functionality, and ensure additional value for both current and future customers.

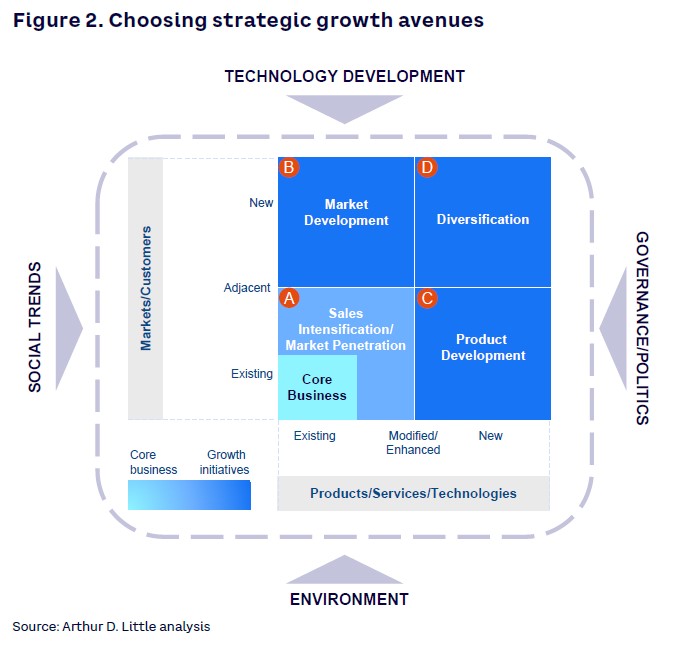

Based on the growth ambition in Step 1, companies need to review the strategic growth avenues they can follow. Once chosen, companies must decide how they are to reach the targeted growth avenues, while simultaneously being aware of any potential challenges. It is important that they are conscious at an early stage of the complexity of their industry, any entrenched biases, or the lack of new perspectives, innovation, and responsiveness to change.

Working with the strategic growth avenues is an iterative process in which avenues are selected, followed, revised, and then reselected based on the revision. The strategic growth avenues to select from are (see Figure 2):

- Sales intensification/market penetration. Protect and increase your company’s turnover of existing product and services within the existing customer base.

- Market development. Broaden customer base and develop in underrepresented and new market segments.

- Product development. Define your market segment-specific future products and innovation pipeline to fulfill current and emerging customer needs.

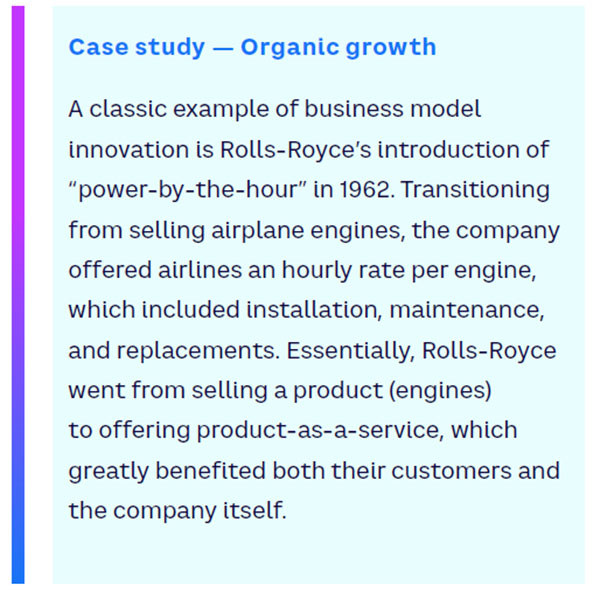

- Diversification. Identify attractive growth opportunities in new target markets and product segments beyond your current scope, leveraging existing competencies and capabilities (see case study).

Sustainability and technology considerations ought to be integrated throughout the process. New sustainability trends and technology drivers will affect market conditions and change business landscapes. For example, in growth avenue A, the increasingly service-oriented nature of products will see a continued momentum going forward. Products will gain add-on services and/or become services themselves, the latter contributing to a more circular economy. Similarly, market and customers can be micro- segmented thanks to the right technology in growth avenue B, as new customers and markets can be identified more efficiently.

Step 3: Boost the growth journey with the right M&A

To meet ambitious growth targets, which are often in terms of doubling or tripling in size within just a few years, M&A activities might be required to boost growth. M&As are also becoming increasingly important for the purpose of technology and competence acquisition, as companies have smaller windows to develop their own tech capabilities in the face of rapidly evolving technology development. Thus, M&A activities are often crucial to gain the technology needed to sustain growth.

Choosing the right growth avenue, as mentioned in Step 2, is equally important for M&A activities. Where a company’s own capabilities, resources, or footprint do not suffice, M&A can be the best option to reach the desired growth avenue. As a part of selecting the growth avenue, companies must be aware of their M&A profile and the archetype that best suits them. There are three archetypes that most M&A programs fall under. Depending on the category, the way the company works with M&A can differ significantly. Archetypes include:

- Big deals — at least one transformational deal (e.g., Chevron).

- Volume deals — high-volume program to reinforce current portfolio or to incubate new footholds

- Particular deals — well-selected deals with low frequency.

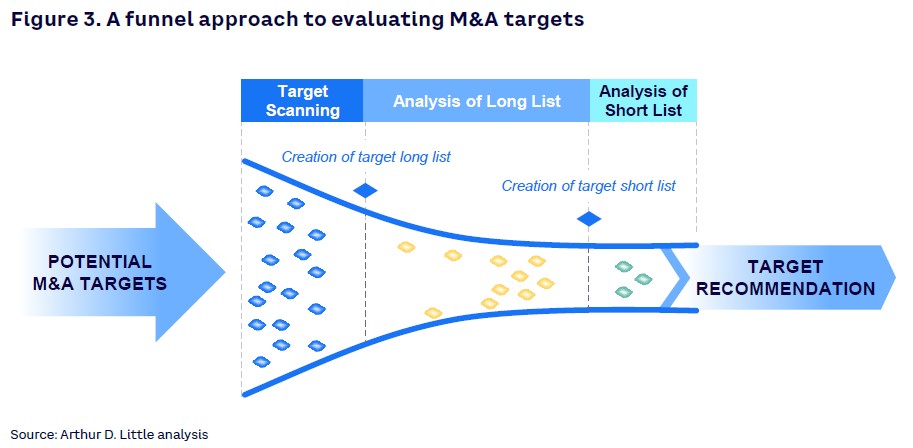

Examining inorganic growth opportunities, a funnel approach is useful to evaluate potential M&A targets (see Figure 3). It Is important to have the defined growth ambition and sustainability targets in mind when developing a long list and a short list of targets for deeper assessment in a due diligence process.

One of the largest challenges to companies, regardless of the M&A category, is the post-merger integration. It is important to start integration planning early on and to have a strong plan for integration communication and culture sharing.

HOW TO ACTUALLY SUCCEED: THE CHECKLIST

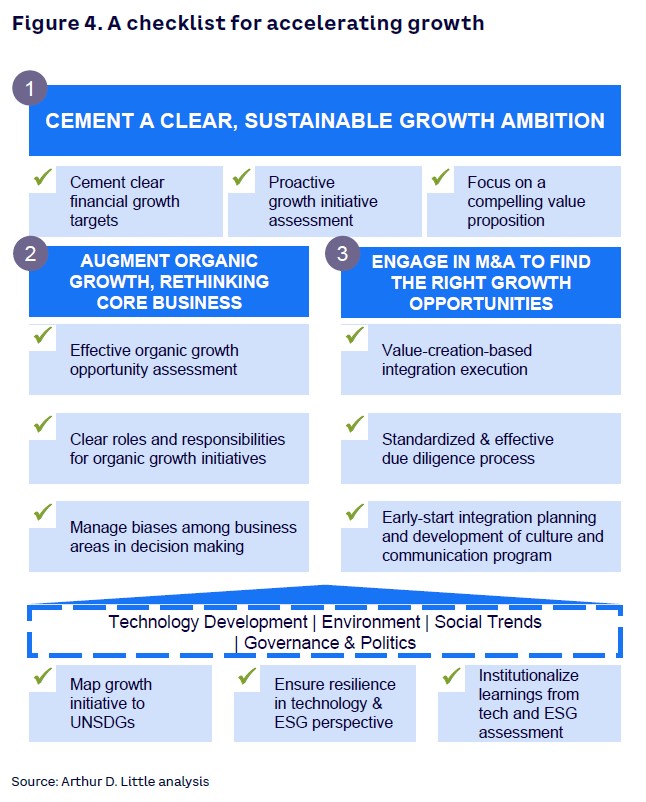

To build a successful growth engine, one must not only follow the steps presented in the FPGA framework, but also consider a number of success factors as shown in the checklist in Figure 4.

To succeed in Step 1 of FPGA, the growth strategy must be aligned with corporate strategy and with proactive growth opportunity identification based on the organization’s strengths.

Organic expansion can be challenging for the organization, as it requires redirecting and shuffling internal processes and setups. In Step 2, the organization must have an effective, standardized growth opportunity assessment process, regardless of whether it assesses a product, service, or customer type of expansion initiative. There should be clear roles and responsibilities within the organization in terms of what division or business owns the initiative, with leadership in place that is prepared to manage uncertainties and biases in decision making.

For inorganic expansion (Step 3), it is equally important to have a standardized and effective assessment process and always to have a value-creation focus, highlighting how M&A activities will generate value for the company, both in

the assessment process and in the integration execution. The planning for integration and communication should start early on, again with a focus on value creation.

Furthermore, technology and sustainability considerations must permeate all activities. A good practice is always to assess and map growth initiatives against the United Nations Sustainable Development Goals and highlight the impact of those goals on targets and indicators. Similarly, technology and sustainability perspectives should be confirmed to be resilient and future-proof. To establish a truly sustainable growth initiative, the initiative must be assessed not only based on today’s world, but also from the perspective of the next 10 years. This exercise is challenging, emphasizing the need for leveraging and institutionalizing learnings. Adding this perspective to the growth initiative assessment might be seen as a recommendation today but will be proven to be a requirement tomorrow.

“We are products of our past, but we don’t have to be prisoners of it.” — Rick Warren, American author

CONCLUSION

KEY CONSIDERATIONS

- Now is the right time to reexamine growth, as COVID-19 has upturned the old and paved way for the new.

- Aiming to maximize total shareholder value does not suffice in the post-COVID world; Stakeholder value must also be considered for full potential growth, given the rising importance of sustainability.

- The FPGA 4.0 framework provides concrete first steps for realizing full potential and green growth going forward.

- Set a clear growth ambition and let it act as a guiding light throughout the growth and strategy development. Let the ambition inspire organic and inorganic growth activities with daring targets.

- Rethink which strategic growth avenues to follow given the new growth ambition and acknowledge the best-suited M&A profile.

- Sustainability and technology considerations must be integrated at an early stage and should be aligned with the growth ambition. The COVID-19 pandemic showed that digital and technological capabilities were critical to succeed. Similarly, the role of sustainability will continue to grow and be central in creating resilience to future crises.