RELATIONSHIP MANAGEMENT AT THE CORE

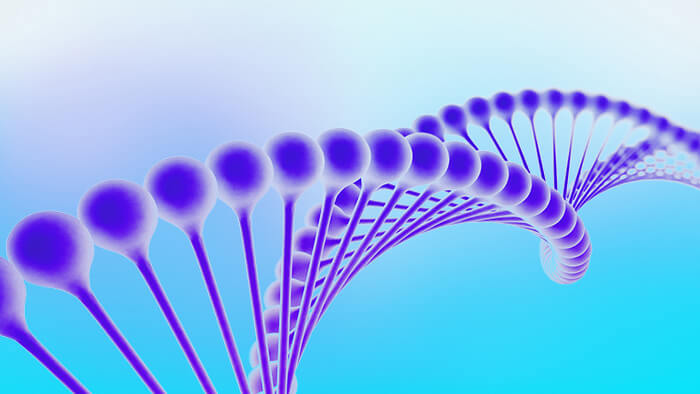

Digitization in service businesses has become the de facto standard, where the focus centers on creating operating models without staff involvement in sales and service processes. The same is true for banks. Under their digitization programs, banks have been attempting to cut costs of traditional sales channels (e.g., branch network, sales staff) by minimizing sales force size and diverting sales and services to digital channels.

This approach works well in retail banking. A mobile app can easily replace (or even outperform) the services of a relationship manager (RM) or operations specialist — and often in a much simpler, more scalable way. This is why native-born fintech/neo-banks are challenging traditional banks in the retail segment.

However, in business banking, understanding the client’s needs and offering solutions tailored to those specific requirements often calls for creativity and a human touch. That is why digitization in business banking requires rethinking the digital operating model for all business segments, from micro businesses to large enterprises (see Figure 1).

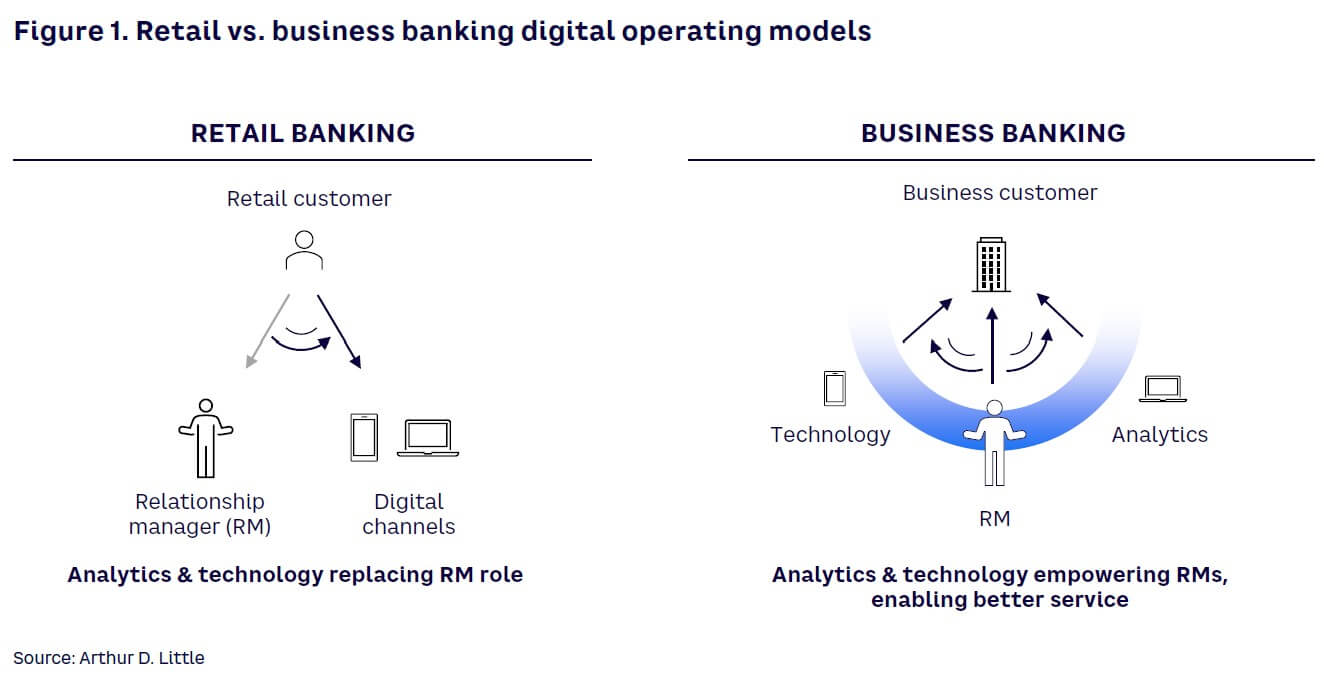

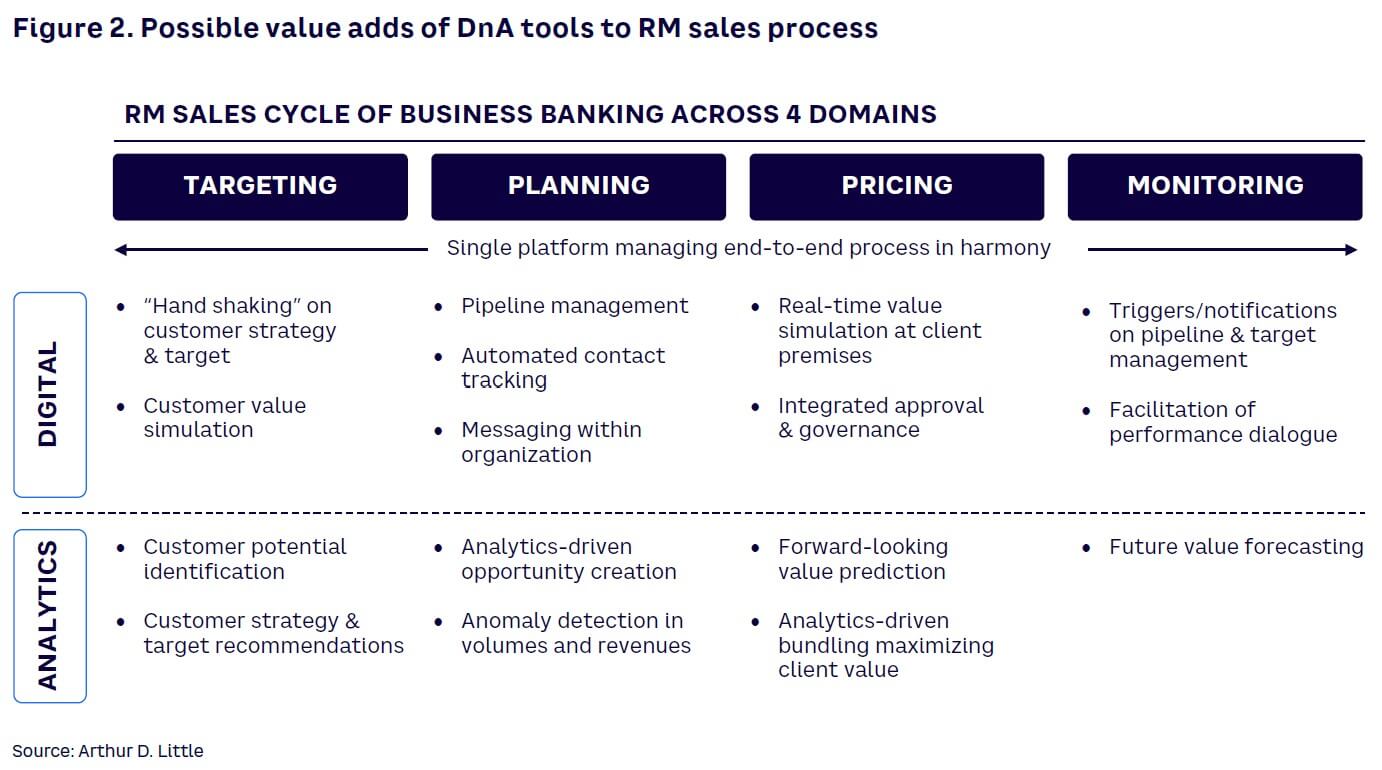

The essence of this new digital operating model is about respecting and valuing the RM role at the core of the interaction between client and bank. Rather than merely replacing the RM role with digital and analytics (DnA) tools, banks should find ways to support and empower RMs with DnA technology. There are many areas where modern analytics and its technology can help (Figure 2 summarizes some potential use cases). The end result is a sales force that can dedicate more time on client interaction and sales, resulting in higher productivity. In fact, based on evidence from banks that have implemented similar solutions, banks can achieve 30% higher productivity by setting up an RM-centric digital operating model.

While transforming business banking into this new digital operating model, banks must begin by redesigning their sales processes. They must thoroughly scan every stage of the RM sales cycle and find ways to cleverly embed DnA tools within it. At every step, banks can find various areas where DnA tools can add sizable value, while remaining aligned with the basics of business banking practices. Banks that successfully embed these solutions in the daily sales cycles of RMs can improve business performance by 20%-30%, which can come either from higher volumes or higher productivity/profitability (see Figure 3).

THE APPROACH

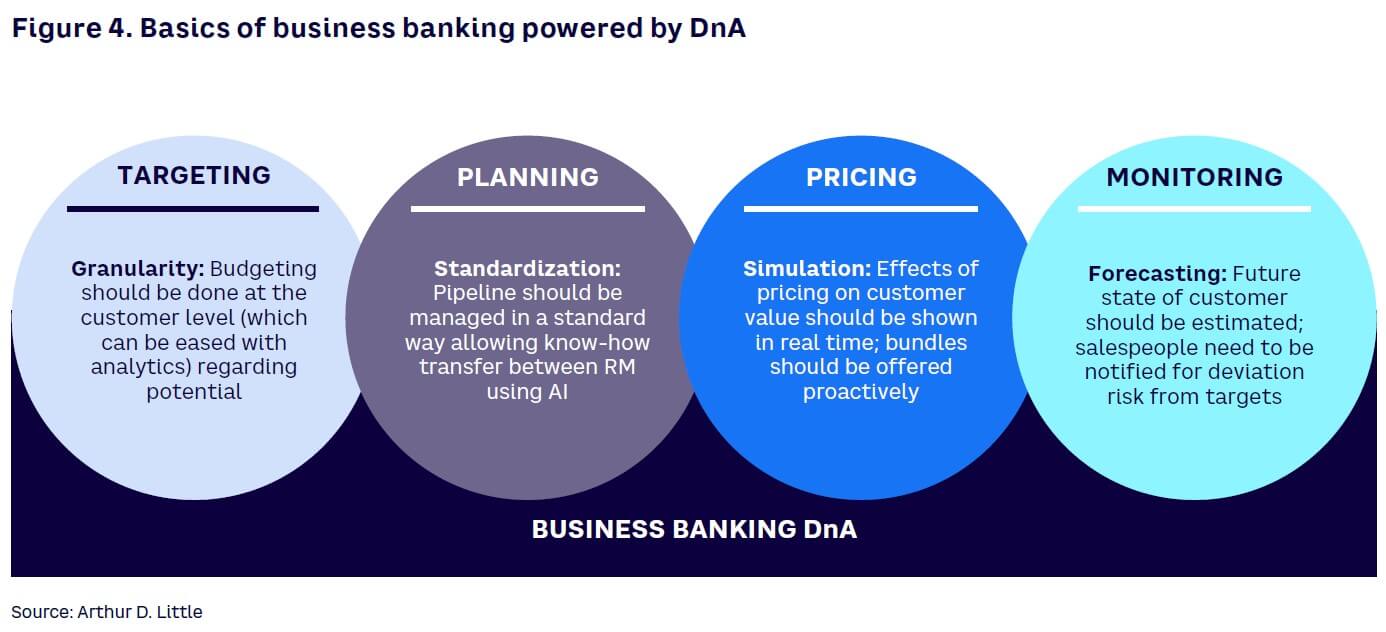

The first step in embedding DnA into business banking sales is reframing the entire sales process. From a general perspective, we can classify activities in the sales process under four domains (see Figure 4):

- Targeting

- Planning

- Pricing

- Monitoring

Although every step in the process has its way of interacting with DnA tools, banks need to keep in mind that the core value-add of digitization lies in the seamless integration of these steps with each other (again, with the help of DnA tools).

Targeting

Targeting in most banks is synonymous with budgeting. Indeed, most banks do not partake in client-level targeting (or they do so only for a few corporate enterprises they serve). Typically, RMs are given portfolio-level targets and then are left on their own to set strategies and quantitative targets for each client in the portfolio.

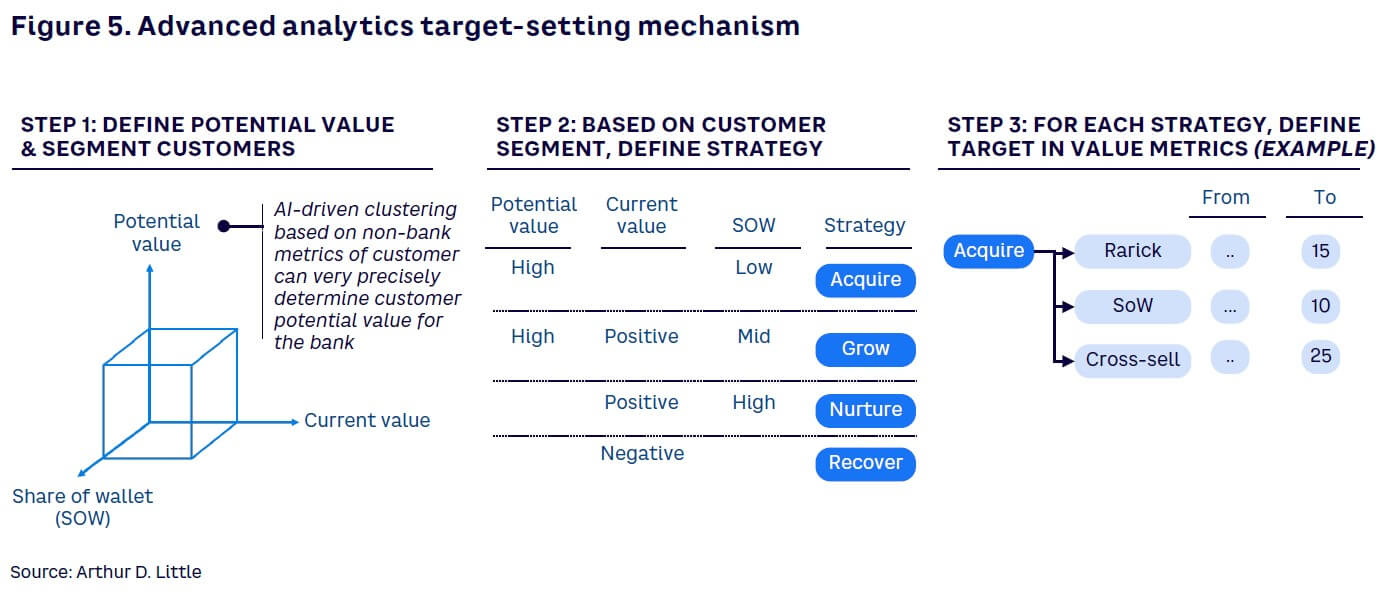

Modern analytical tools can assist in setting these targets (see Figure 5). Advanced analytics–driven clustering, for instance, can precisely determine a client’s potential value. This can help set a strategy for each client using a three-dimensional segmentation model with the client’s current value, the share of wallet, and potential value. Then, an automated target-setting mechanism can set quantitative targets based on these strategies.

A side benefit of this approach is that it makes the budgeting process a bottom-up plan. Since every client has a target, the RM’s target in his or her scorecard becomes simply a sum of clients’ targets in the RM’s portfolio.

Planning

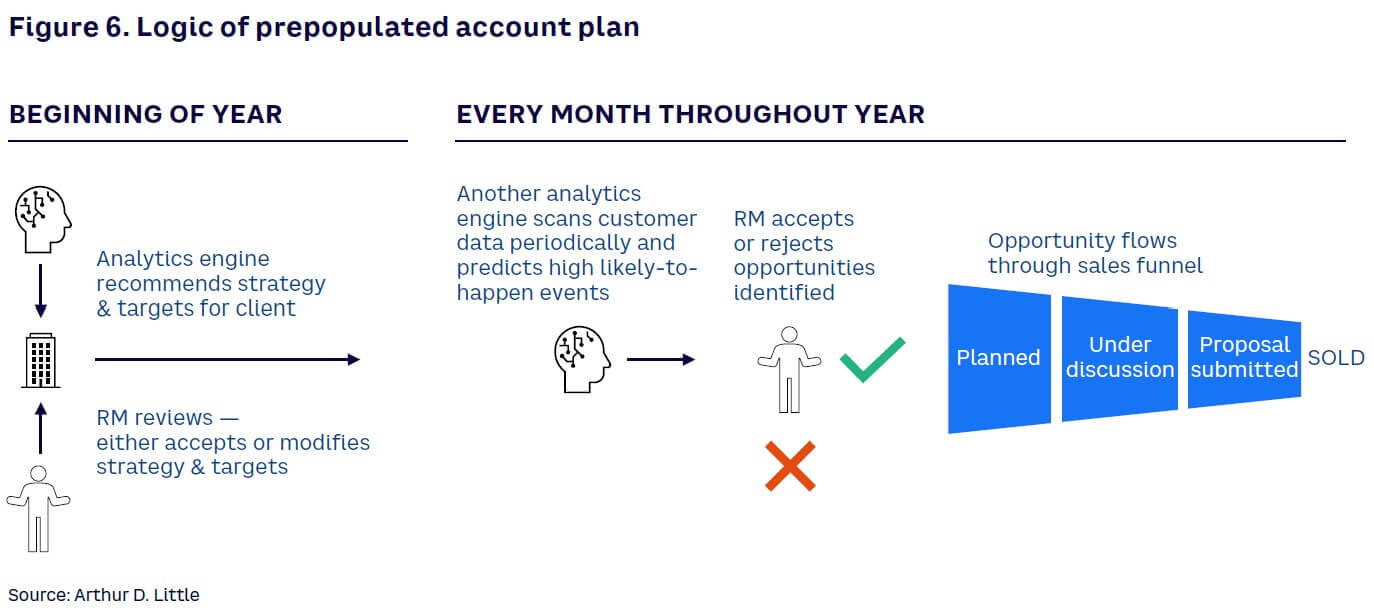

Creating a structured account plan is an important element of proper relationship management (see Figure 6). RMs need to handle two key tasks to create a proper client-level account plan:

- Review client strategies and targets. The RM needs to review the output of the targeting stage and, if there is an edge case, the RM should be able to adjust the client’s targets and strategies. Contrary to common thinking, giving RMs freedom to modify strategies and targets is not bad practice. These reviews trigger the RM’s thinking process about the customer, and any modifications proposed by the RM can improve the accuracy and reliability of targeting (together with proper approval and governance mechanisms).

- Develop a potential list of actions (or client opportunities). Advanced analytics–based propensity-to-buy models are a game-changer for banks. Modern analytics tools can extract valuable insights from historic data (whether it be at the customer, product, or transaction level). As an example, an analytics engine can be built to periodically scan customer data to identify “likely to happen” opportunities for each customer. These opportunities can be in the form of cross-selling (offering the client a new product), volume growth (offering more of the selected product), margin correction (offering renewed pricing on an existing product), or communication (e.g., visiting the client).

It is important not to position analytics as an assertion tool in identifying opportunities. Rather, identified opportunities should be positioned as possible options, and RMs, as the owners of interaction between client and bank, should be able to accept or reject any opportunity the analytics engine proposes. This approach significantly improves RM engagement, and machine learning algorithms can be configured in a way that learns from RM responses. Thus, a feedback engine can be developed to fine-tune the algorithms based on RM responses (acceptions/rejections).

With an action plan in place, account planning becomes an easy-to-use tool as well as a one-stop area for client information and to-dos. The power of DnA prepopulates the account plan, then RMs can modify the actions or push them through the sales funnel. If this approach is coupled with an intuitive user interface, the account planning tool can become the most-used screen of a bank’s sales force management tool.

Pricing

Pricing in banking is a combination of art and science. When it comes to business banking, the norm is to always think about client value-based pricing, which encourages maximizing overall client value rather than a single product or transaction value.

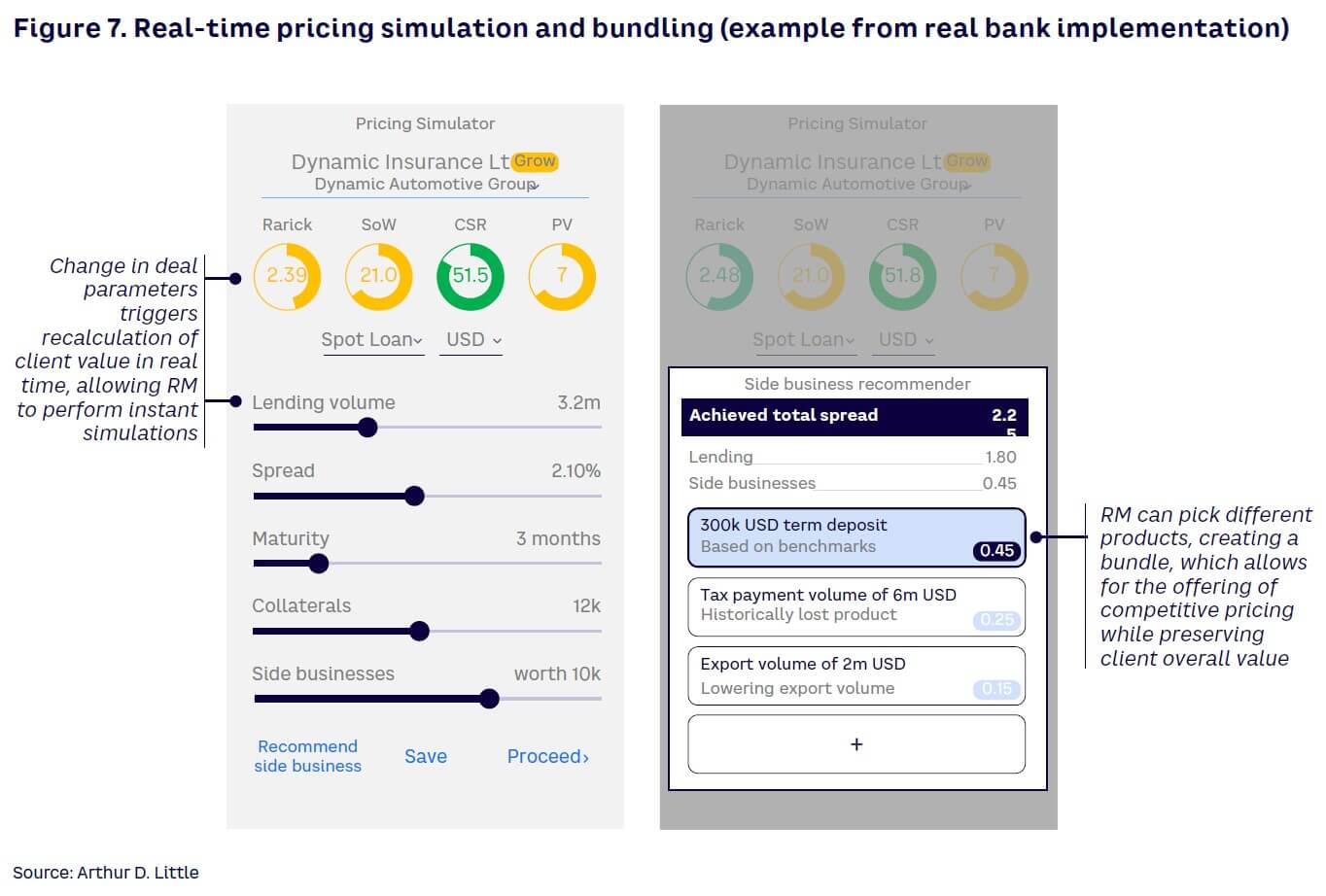

Analytical support in value-based pricing comes in the form of client value simulation (see Figure 7). Banks need to provide real-time simulation tools to predict a client’s future value under different deal configurations. Two key benefits arise from this approach:

- Ensuring the deal is always priced in the direction of targets set (and aligned) at the account plan.

- Allowing real-time bunding of different products. For example, instead of selling a single loan for a 2.5% margin, the RM can sell the loan with a 1.5% margin and secure a term deposit contract, bringing higher total value for the bank. Here, an artificial intelligence engine can be developed to offer the optimum and most appealing deal configuration for the client.

If this pricing simulator can run on a mobile device (phone or tablet), all pricing and deal configuration efforts can take place on the client’s premises, with the RM acting as a financial consultant.

Monitoring

Almost all banks adopt client performance-monitoring systems to track client value metrics. A key issue of commonly adopted techniques is their backward-looking nature. Most banks report “revenues year to date,” “volumes as of today,” and so on, which are completely reactive. DnA converts reactive monitoring to proactive monitoring in the following ways:

- Automatically identifies and notifies anomalies in client metrics in real time. For example, a sizable decline in current account volumes can signify a client’s value churn. Modern analytical techniques can automatically track time series data and create notifications, enabling immediate actions for these types of changes.

- Making periodic predictions for future cash flows and recalculating client value metrics to determine whether progress aligns with account plan targets. In the case of significant variance (either positive or negative), RMs can be warned, allowing them to fix possible issues. In line with a historic view of deals with the client, these predictions also enable monitoring of the client’s previous commitments (especially in pricing lending products).

THE TOOLS

When designing the new DnA-embedded processes, banks face the problem of which tool to use for sales force management. The basic answer is to pick the tool that best aligns with the bank’s IT stack. In today’s environment, any customer relationship management tool supported by a modern analytics platform can handle all the functionalities required. A bank should keep in mind that it’s not the tool that will bring success. Rather, success comes from the bank’s approach to the sales process and how it embeds the tool into the process.

While designing the tool that will power RMs, banks need to define the target state, addressing four core principles:

- Incorporate best-in-class business logic.

- Leverage DnA at greatest extent possible.

- Be digitally fun and easy to use.

- Encourage collaboration.

Best-in-class business logic

The tool’s ultimate objective is to empower the sales process, so it needs to enable managing the sales process end to end through a single platform. This means it should integrate targeting, planning, pricing, and monitoring domains using DnA. The platform should also facilitate client potential calculation, strategic direction assessment, and objections management for client-level targets.

Among the most important elements to include is the value-based pricing simulator. User experience and mobility need to be considered with the ability for the RM to do instant pricing on customer premises during conversations with clients.

While integrating these processes, the question may arise concerning whether a bank should have separate systems for different segments. The answer: it should have the same back end but a differentiated front end for different segments. Because the system will be live for years and evolve over time, developing independent systems for different segments would be extremely costly. However, daily routines of RMs in different segments vary, and the tool’s user interfaces should respect these diverse needs.

DnA at the core

As we have shown, there are many areas of the sales process where DnA can help RMs. Beginning with the fundamentals involved in the first steps of the sales funnel, DnA can assist with the prepopulation of an account plan with advanced analytics–driven potential identification and opportunities pushed by the analytics engine. Generating smart recommendations for bundling at the time of pricing can also bring forth an immediate impact for the bank.

Another area where analytics can play a valuable role is with customer-interaction reminders. Typically, an RM manages 100+ clients in the portfolio, and it is very common for the RM to deprioritize interaction with several clients. A smart reminder engine can define interaction frequency, monitor client interaction from different sources (e.g., call detail records, emails), and create notifications for interactions and/or specific tasks for the RMs.

In addition to banks’ specific use cases, DnA can also provide services support for RMs, including document scanning, geoanalytics, and speech recognition on a mobile platform to significantly simplify a RM’s work.

Digitally fun to use

The tool should be positioned on a mobile platform to maximize flexibility. Mobile platforms are not only easy to use but also provide an array of digital technologies that can assist RMs in their daily responsibilities. For example, RMs can use location-aware customer searches to immediately open the correct account plan based on location. And when they visit a customer, RMs can use the tool to easily create a plan to visit other clients within the same area.

Moreover, speech recognition can make it very easy for RMs to navigate between client account plans. When an RM visits a customer or makes a call with a customer, the RM can easily take notes via speech that is directly translated to text and added to the visit/call report.

Document-scanning functionalities can also help trigger back-end processes in the case of complex/new product sales (e.g., invoice scanning for factoring sales).

The more the digital capabilities are fully embedded into the tool, the more likely RMs will use the tools; therefore, digital functionalities are a must for successful tool adoption.

Collaborative

The tool should also encourage collaboration within the organization and reflect the dynamics of organizational hierarchy. For example, the branch manager should be able to see and do what the RM can see and do.

Another important area of collaboration is integrating client-related communications within the tool. The system should directly connect to email servers and provide direct access to client-related emails (which can be flagged with text-mining technologies). In addition, RMs, branch managers, and staff at headquarters should be able to send and receive messages directly on the platform to facilitate communication within the bank about the client.

Given the competitive nature of sales, gamification can also be an important motivator. An example of a socially engaging tool may include the creation of tournaments between RMs in which their progress is monitored using audio and visual feedback.

Conclusion

WHERE TO START

Digitizing business banking is not a one-time exercise; rather, it is a long journey. Banks need to follow a step-by-step approach:

- The bank should rethink the sales process in detail and define the bank’s ambition. By involving all key stakeholders (sales, finance, risk, and technology people, at a minimum), the bank can outline a clear picture of short- and medium-term goals in business banking digitization. This is generally called the business design phase.

- The business design phase should be followed by an agile analytics and technology development step, where rapid prototyping of certain functionalities is critical to keep the excitement level high in the sales network. To ensure this level of enthusiasm, sales teams should be part of the development effort, too.

- As soon as a minimum viable product (MVP) is ready (at least in selected functionalities), the bank should begin piloting in a real-world environment. Piloting and fine-tuning the process for a few weeks should be followed by a capability building and rollout exercise. The tools and logic developed should trigger a change management process in the network. Series of classroom trainings explaining the approach coupled with on-the-job training by coaches are must-haves for efficiency and adaptation of the sales network to the new approach.

Although the journey is long and can sometimes be arduous, a bank can immediately begin receiving benefits from such a digital transformation within a few quarters. While embarking on this transformation, banks should keep in mind the first principle: the main driver of success in digitizing business banking is embracing the expertise and sales skills of the RMs and supporting them where and whenever possible with DnA tools.