The evolution of data growth in Europe

Evaluating the trends fueling data consumption in European markets

Executive Summary

HIGH DATA INTENSITY WILL DRIVE DATA CONSUMPTION GROWTH

Average household data consumption over telecommunication networks has steadily grown across Europe. Measured in gigabytes (GB) per month per user (GB/month), consumption has increased from approximately 5 GB/month in 2018 to 15 GB/month in 2022, for a growth rate of 25%. We expect Europe’s mobile data consumption per user to continue growing in the coming years, increasing from the 2022 level of approximately 15 GB/month to 75 GB/month by 2030, creating an annual growth rate of 25%. And we expect fixed data consumption per household to grow from the 2022 level of 225 GB/month to 900 GB/month by 2030, for an annual growth rate of 20%.

Overall monthly data consumption in gigabytes is determined by multiplying the amount of time spent online per day (measured in hours) by the data usage intensity of the applications used during that time (measured in GB/hour). The amount of time spent online appears to plateau at three to four hours a day for mobile (per individual) and six to 10 hours a day for fixed (per home). However, the data intensity of applications like videos and social networks is continuously increasing, which in turn drives up the hourly, and ultimately, the monthly data consumption.

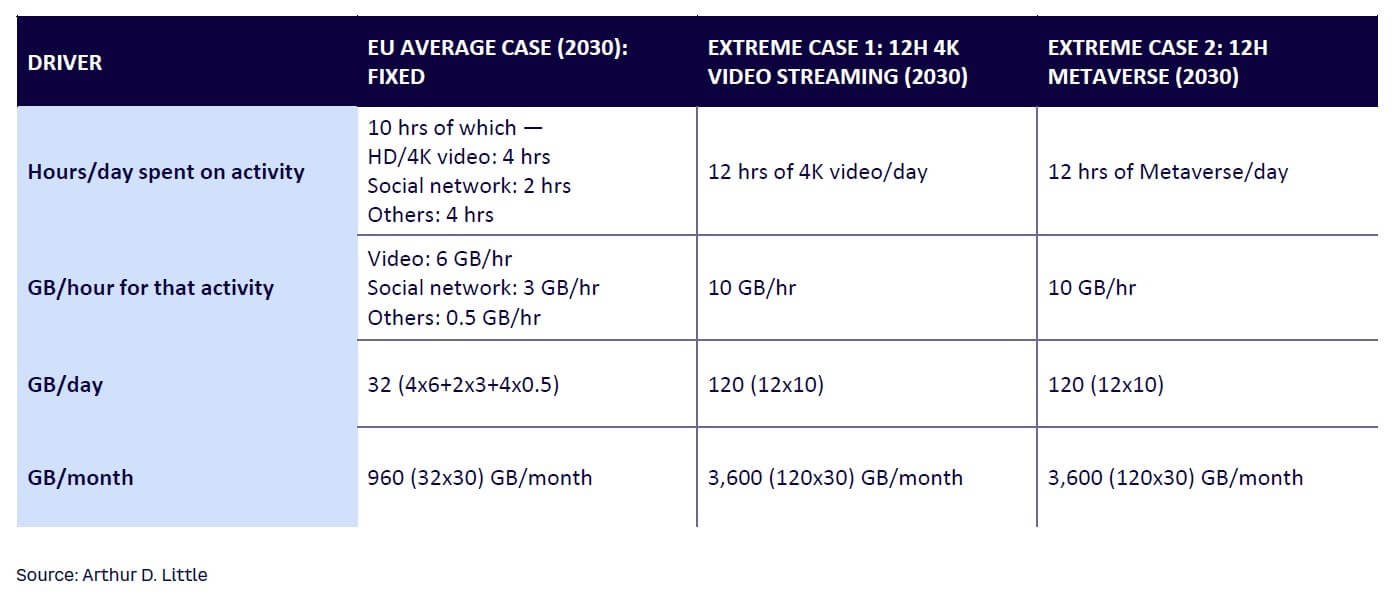

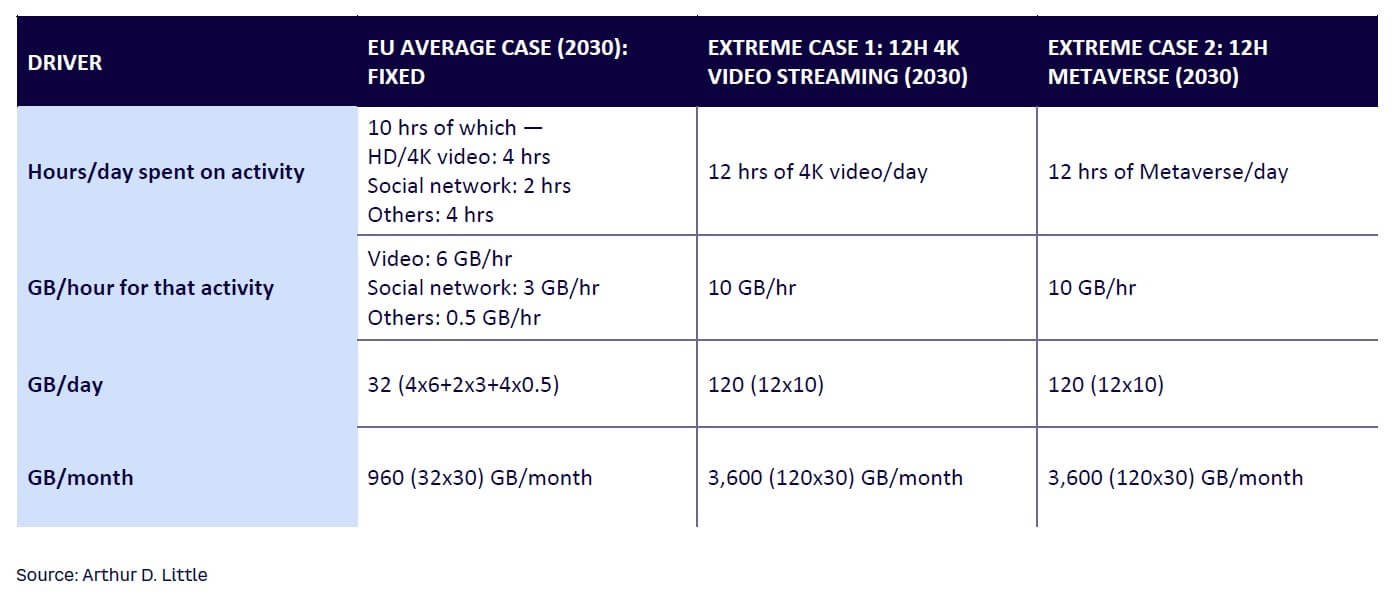

Our data consumption forecast already includes all these expected trends. However, pushing the boundary of time spent per day using the most data-intensive applications could lead to extreme scenarios. For example, a household consuming 4K content for 12 hours a day would use 3,600 GB in one month. This scenario illustrates how technical leapfrogging of device capabilities and data hunger of applications may generate faster, more excessive data growth, which would affect underlying network investment requirements and their ability to ensure value and enable full experiences.

In the future, a number of trends will contribute to the data intensity of some use cases, boosting overall data consumption:

-

Improved video resolution from standard definition (SD) to high definition (HD).

-

High-definition 4K and 8K.

-

Higher consumption of HD live sports, especially on mobile handsets.

-

Increased use of short-form video on social networks.

-

The “metaversization” of use cases — watching videos, meeting people, attending concerts, and shopping.

-

The use of augmented reality (AR) and virtual reality VR).

-

Artificial intelligence (AI)-generated content.

Many publications report periodically on the growth of average data consumption (mostly focused on mobile), analyzing the differences between high-growth and low-growth markets. These reports provide a clear snapshot of the current state of data consumption and short- to medium-term forecasts. However, in this Report we delve deeper, analyzing the underlying demand-side factors that constitute actual data consumption as well as the supply-side factors that either constrain or fuel data consumption. We review both the mobile and the fixed side of these phenomena in order to forecast average data consumption between now and 2030.

1

SPECIFIC USE CASES WILL FUEL HIGH GROWTH TRAJECTORY

Telecommunication data consumption, measured in GB per month per user (“user” is defined as per SIM for mobile or per home or household for fixed) has continuously evolved over the last two decades. The growing average data consumption is an indicator of the constant digitalization of society as more services (watching videos, playing games, communicating with others) are consumed digitally and more activities are transacted online (e-commerce, Web browsing, cloud services). Average data consumption is an important key performance indicator (KPI) measured by telecom operators in conjunction with busy hour throughput and latency to support future infrastructure investment planning.

In 2020, pandemic-induced behavioral changes precipitated a spike in usage; fixed GB/month increased between 50% and 100%, while mobile GB/month was muted due to multiple lockdowns. However, fixed growth showed a dip in 2021 to pre-pandemic levels of around 20% by 2022, while mobile growth sprang back to pre-pandemic levels of 25% as soon as lockdowns were lifted. These permanent step increases in post-pandemic average data consumption are strong indicators of permanent changes in user behavior, namely greater consumption of digital services.

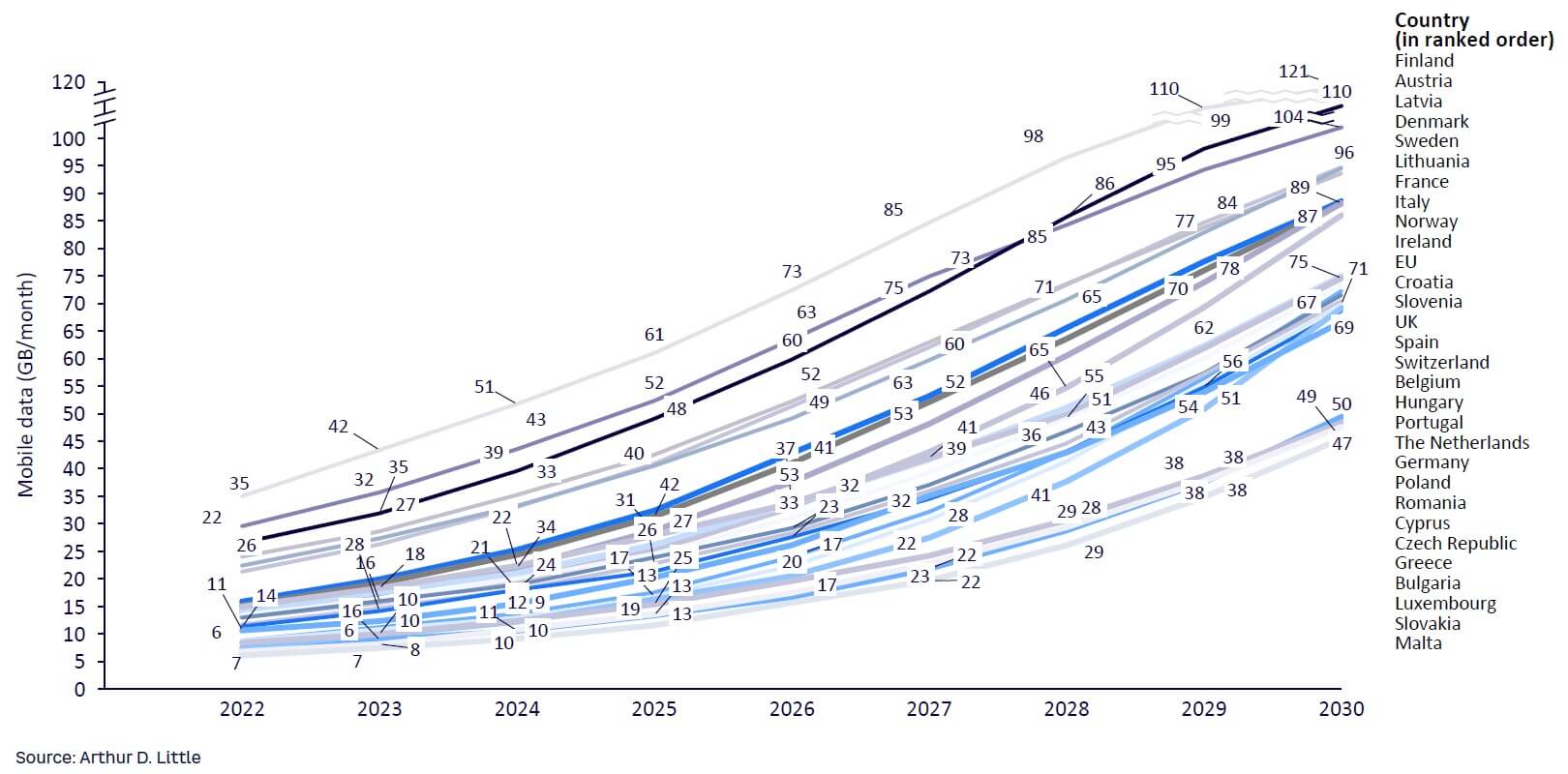

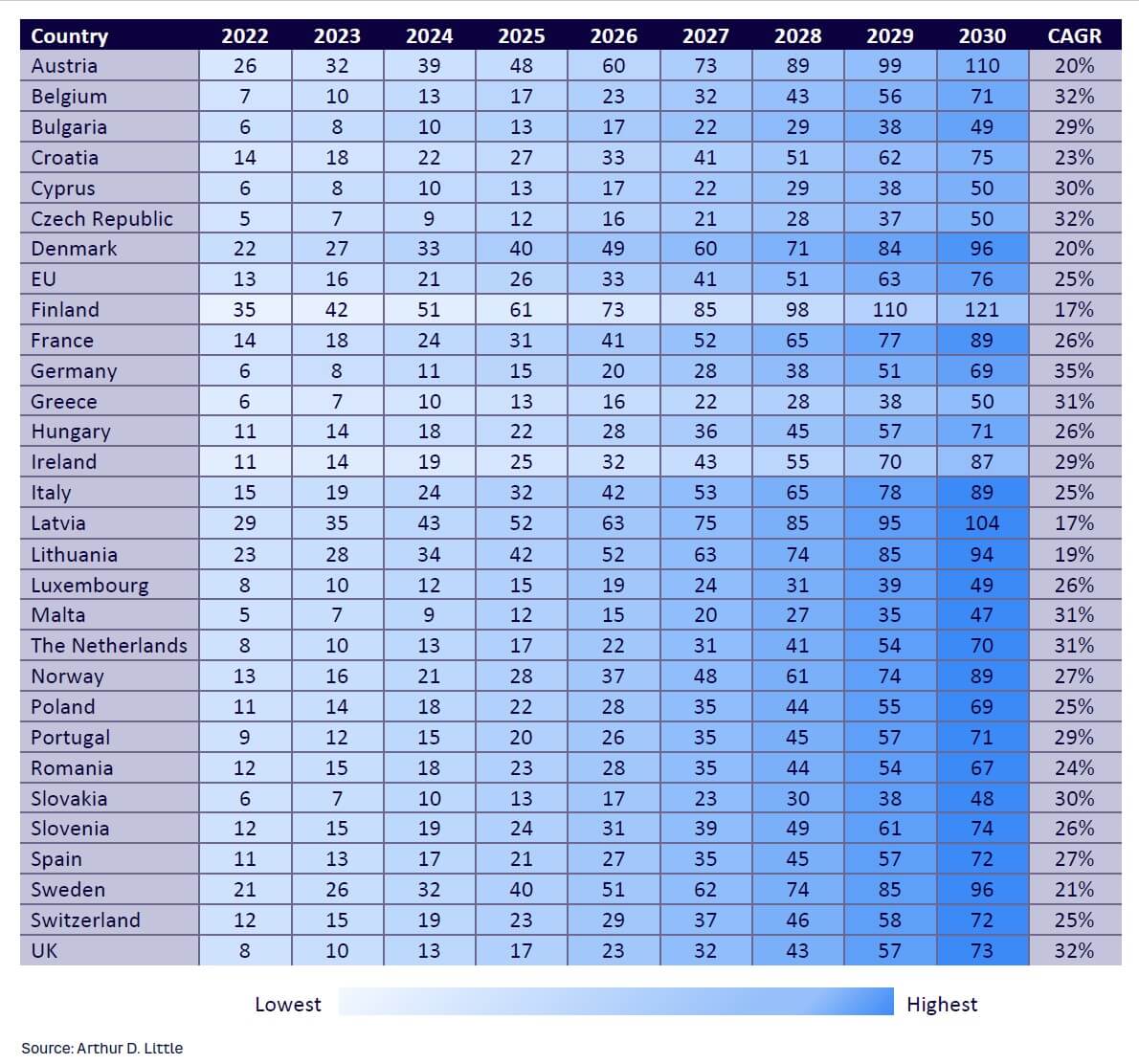

There are large variations in mobile data usage among European countries. Markets like Austria, Finland, Latvia, Lithuania, Sweden, and Denmark already exhibit usage of 20 or more GB/month, due to multiple factors including the availability of relatively low-priced high-volume data bundles, faster 5G rollout, a lack of nationwide FTTP (fiber to the premise) networks, and behavioral demand factors like mobile consumption of video and social network content. Other markets still show usage below 10 GB/month.

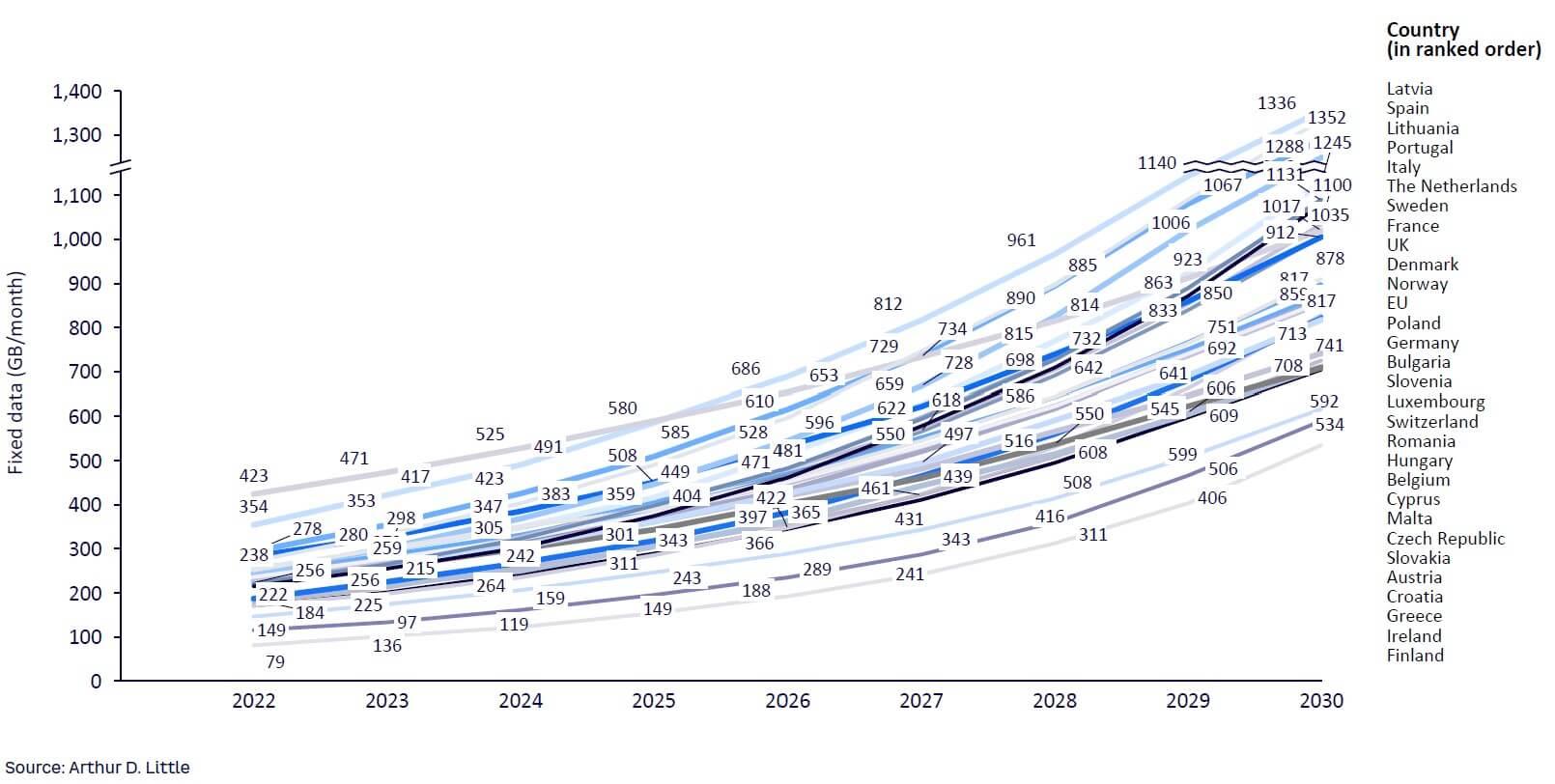

Fixed data consumption among countries in Europe also varies. Markets like Spain, Portugal, Latvia, and Lithuania, with high FTTP coverage, also exhibit higher fixed data consumption. Factors like the rollout of FTTP and the availability of higher-speed bundles will continue to drive growth of fixed data in their respective markets. Behavioral demand factors, such as the widespread use of streaming video services in markets like the UK, induce higher data consumption.

2

DEMAND DRIVERS — VIDEO, SOCIAL NETWORKING & LIVE SPORTS

MAINSTREAM USE CASES

Video and social networking continue to drive data consumption due to increased penetration of higher-resolution content and the move toward live sports streaming. We scanned a broad range of publications to identify the most popular mobile and fixed use cases and the average time spent on them. We then assessed the underlying data-intensity requirements for those activities to estimate the overall GB/month, broken down by fixed and mobile, and further broken down by each activity.

The most popular use cases for both mobile and fixed are:

-

Video consumption

-

Social networks, including short-form video

-

Gaming

-

E-commerce

-

Web browsing

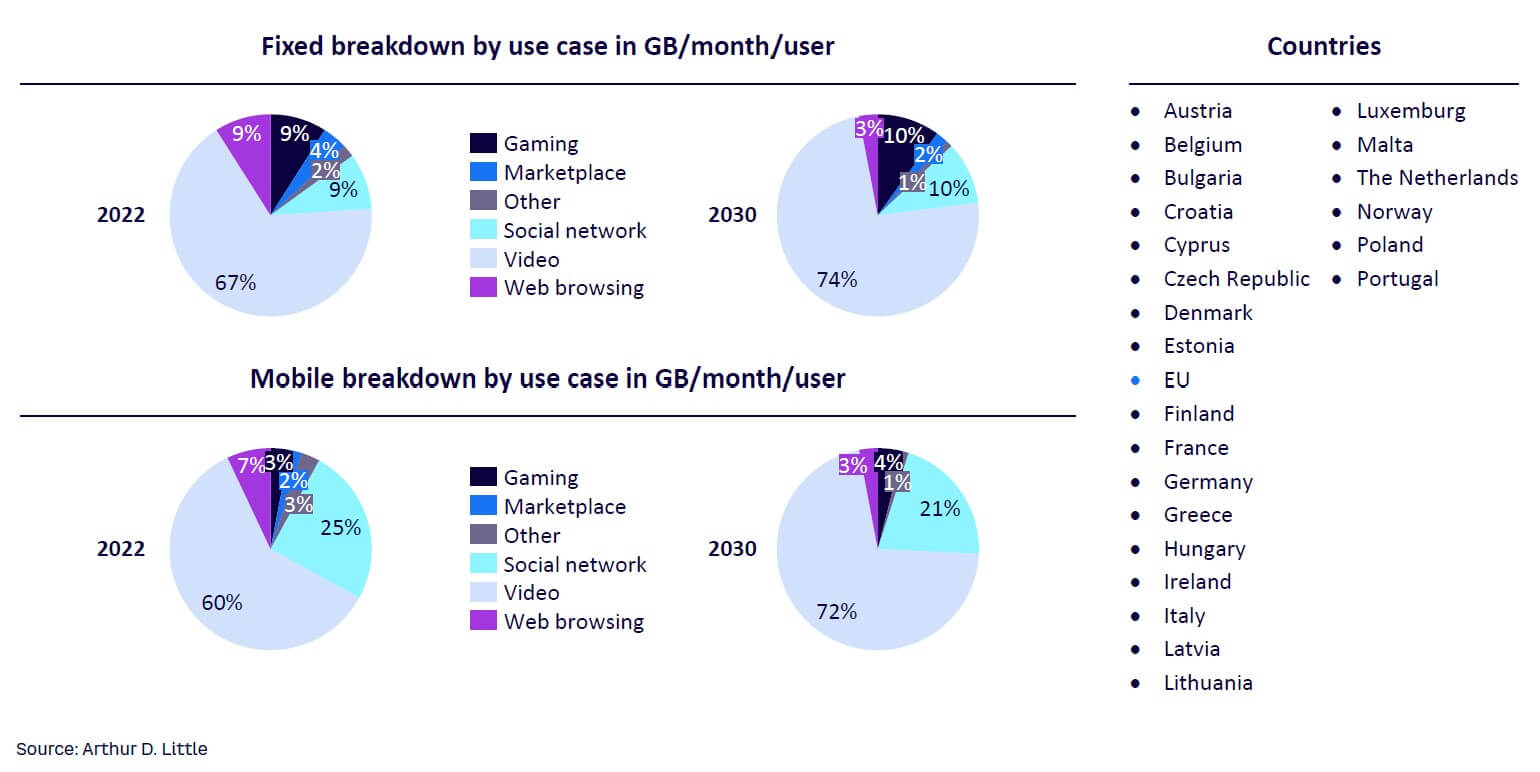

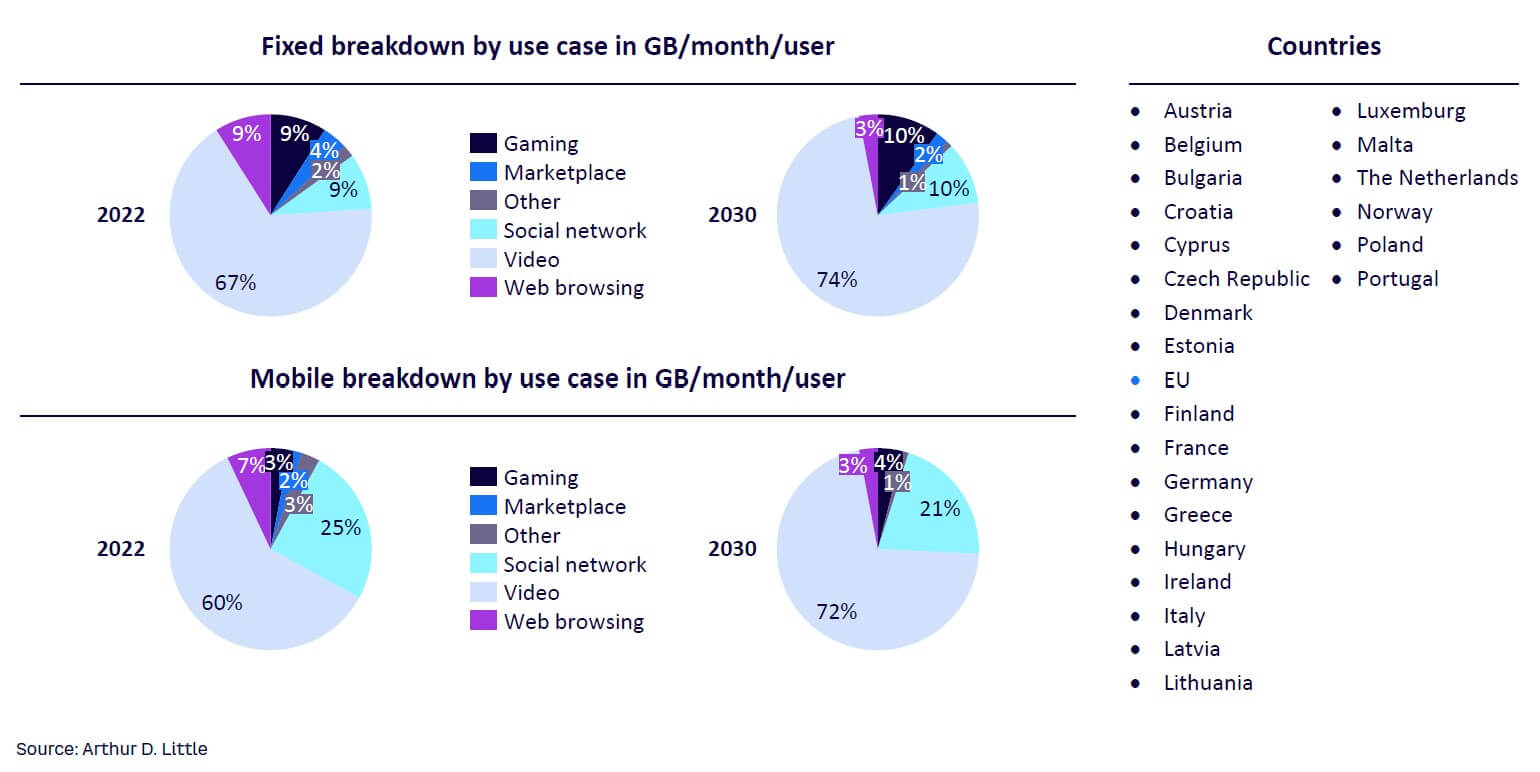

Figure 1 shows additional details of the distribution of the above use cases in 2022 and 2030 and includes expected changes to overall composition, as well as the share of both time and data a user spends on each of these activities.

Video viewing

Video continues to be the main driver of data consumption, currently comprising approximately 60%-65% of total data consumption in Europe. We expect it to grow its share to 70%-75% by 2030, due to more penetration of higher-resolution content and the move toward live sports streaming. The average European spends approximately three to four hours a day watching videos, with most of those hours spent at home using a television, a tablet, or another large-screen device. Approximately one hour a day is also spent watching videos on mobile handsets while outside the home. Popular video service providers such as YouTube and Netflix are used, as well as the over-the-top (OTT) platforms of traditional and pay-TV operators. The availability of live sports via OTT players is a popular recent development.

We believe time spent watching videos will plateau at four to five hours per day. The data intensity (GB/hour) consumed increases constantly irrespective of which of the above video services are engaged. Our data-growth scenario includes the ongoing move from broadcast TV to Internet protocol TV (IPTV). Almost all users view videos in the default auto-quality mode, which implies that the video service provider automatically adjusts the quality, usually to the highest resolution possible, based on the user’s available bandwidth.

Currently, most videos are viewed in HD, requiring 1-3 GB/hour, and we expect this to increase to 8-10 GB/hour as the average quality improves from HD to 4K by 2030. Although higher quality, like 8K, is already available, we believe this will be a niche in the same period. Substantial 8K content and mass-market adoption of suitable viewing devices, like 8K TVs, are not widely available. We believe video consumption will evolve from HD to 4K by 2030, and most content available will be 4K by then. The mix of content in terms of resolution at the end of the time horizon as assumed in our model is 70% HD, 25% 4K, and 5% 8K.

Simultaneous viewing of live sports via OTT applications has a limited impact on overall monthly data consumption, as it simply serves as a substitute for other types of video content, though it has relevant impacts on other KPIs, such as the busy hour throughput of telecom operator networks.

Social networking

Coming in second to video in terms of data intensity, social networking takes the highest share of time on mobile, currently contributing the maximum time spent per day per user in the range of one to two hours a day. Over the long term, we believe the time spent by users on social networks will expand to three to four hours daily, as social networks continue to serve as substitutes for real-world interactions. At the same time, social networks are becoming more data-intensive.

The activities that comprise social networks have evolved from messaging a decade ago (e.g., over Facebook, Orkut, Google+), to posting images five years ago (e.g., Instagram), to posting short-form videos (e.g., TikTok) and multimedia-rich stories today. Soon, we anticipate an even larger share of higher-quality videos, and perhaps a Metaverse-enabled social experience in the future, which effectively requires multiple streams of simultaneous video and images in order to create an immersive experience.

In addition, these video- and image-rich apps are assumed to be guided by AI algorithms to pre-download content, which keep the user firmly engaged in an infinite scrolling experience without the need to pause and load the latest content. This process in turn increases the underlying data consumption.

These factors lead us to believe that the GB/hour required for social networks will increase from less than 1 GB/hour today to 1-3 GB/hour in the period until 2030.

Gaming

Gaming consumes both significant time and data, but penetration is limited to a small proportion of heavy gamers, contributing to approximately 10% of Europe’s total data consumption. But there are large differences between homes with heavy gamers and homes with no gamers. Game-like video usually consumes one HD stream of video, which usually currently requires 1-2 GB/hour of data and is expected to grow to 4-8 GB/hour as video-stream quality increases from HD to 4K.

The amount of time spent gaming can be as high as 8-10 hours a day for homes with active gamers, but accounts for less than an hour a day on average in a typical European home. As gaming moves to the cloud, factors such as latency, more multiplayer gaming, and broadcasting games via apps like Twitch, YouTube, and Facebook, will play a more significant role than data consumption.

The section on the Metaverse below discusses the implications of latency on telecom operators.

E-commerce

Internet transactions received a big boost related to the COVID-19 pandemic; some reports estimated that the volume more than doubled in the period between 2019–2021. We believe e-commerce is here to stay, and users will continue to spend time online, currently estimated at a half-hour a day, exploring products, reading reviews, and eventually making purchases. Product reviews in online marketplaces have also evolved from a few lines of text to image-rich reviews. Short video reviews of products are predicted for the future, which in turn will cause higher data consumption.

Nonetheless, we expect this consumption category to remain at a level below 1 GB/hour for mobile in the period until 2030. However, it could rise to 4-8 GB/hour for fixed, as some e-commerce activities have the potential to be carried out in the Metaverse.

Web browsing

Web browsing was one of the first use cases when the Internet gained mass-market acceptance in the 1990s, and we believe users will continue to spend time, estimated at a half-hour per day, browsing websites, despite competition from apps and other forms of digital experiences. Data intensity will increase with a move toward richer HTML5-based content.

Websites are constantly evolving as well, from early, plain HTML text websites to more image-rich websites, to HTML5-type websites displaying high-resolution images and videos and featuring smooth, continuous scrolling. This, in turn, will raise the amount of data required per hour, reaching levels of 1 GB/hour by 2030.

Other services

Cloud services, music streaming, background-operating system updates, and so on, constitute the remaining longtail of use cases, which consumes data but on a much lower scale than the use cases mentioned above. We estimated usage around 1 GB/hour in our analysis.

Differences between fixed & mobile

Video dominates data consumption on both fixed and mobile, but social networking captures the largest time-share in mobile. In our analysis, we modify the time (hours) and data intensity (GB/hour) requirements to account for differences in using an application based on whether it uses mobile data or a fixed connection. For example, users spend the most time on social networking activities on their mobile devices; on a fixed connection the maximum time is spent watching videos. Additionally, the quality, and hence the data intensity, is higher on fixed networks for activities like video and social networking due to devices like TV, tablets, and laptops, whose larger screens allow higher resolutions.

ADDITIONAL GROWTH DRIVERS & EMERGING USE CASES

We evaluated additional drivers and technologies influencing the data intensity of some of the use cases elaborated on in the previous section.

Device mix

The device mix determines data intensity and will differ for fixed networks and mobile networks. Fixed data consumption of video grows faster than mobile thanks to the greater presence of higher-resolution devices with large screens. We assume the primary device used to consume video is a TV with HD, with future upgrades to 4K and partially 8K occurring within the time horizon. Secondary devices for video consumption are assumed to be a second TV or a tablet that can handle HD. For e-commerce, Web browsing, and cloud activities, we assume a PC/laptop/tablet is the primary device at home versus a mobile handset for mobile. We also assume longer time spent (including background usage) on activities like cloud, music streaming, and so on, adjusted appropriately between fixed (PC/laptop/tablet) and mobile (handset).

AR & VR

These will increase data intensity and will modify some of the consumption behavior in existing use cases. We assume AR will primarily alter mobile use cases, as users will probably experience AR over their mobile devices. We believe AR will require data consumption rates equivalent to two times today’s HD video data throughputs (one for upstream, and one for downstream), but more importantly, AR will affect KPIs like latency and throughput to a greater extent. We assume VR will primarily be experienced via fixed networks, as it requires the user to wear a headset and be in a safe, enclosed space. The data requirements of VR are projected to require the equivalent of consuming three to six simultaneous video streams to account for the constantly changing user perspectives.

The Metaverse

Data-intensity changes provoked by the Metaverse will be similar to AR and VR. But the real challenge will be improving latency, which calls for an overhaul of existing telecom network architectures. While the Metaverse has received a fair share of attention in the recent past, especially after the rebranding of Facebook to Meta in 2021, the actual number of Metaverse use cases and the share of active Metaverse users (i.e., engaging at least once a week) is estimated to be low (in the range of tens of millions). Although many publications claim the Metaverse has hundreds of millions of users, we think they are mostly one-time users, so far.

We accounted for a fair share of metaversization of our core use cases, reviewing video consumption, social networking, gaming, and e-commerce that use Metaverse-type applications. We expect a portion of each use case to be consumed by the Metaverse in the future. Gaming is the most likely starting point, as Metaverse versions of games are already available from providers like Roblox, followed by video consumption (e.g., watching a live concert in the Metaverse), social networking (e.g., meeting friends in a virtual café or participating in Metaverse discussions), and e-commerce (e.g., shopping the multiple brands that have already launched Metaverse stores so shoppers can virtually experience a product before purchasing).

In terms of data, we assume Metaverse activities will be similar to VR and consume the equivalent of three to six simultaneous HD video streams. We assume up to one hour of use cases per day will be conducted using AR, VR, or Metaverse applications per day by 2030 and adjusted the data intensity of those use cases accordingly.

Some publications have taken a more aggressive view of the data consumption of Metaverse applications, such as a recent Nokia study that distinguished early VR, entry VR, advanced VR, and extreme VR, with the latter achieving 8K+8K resolution, 120 FPS, and maximum throughputs of 1,000-2,350 Mbps. As the VR market is still in a nascent stage, the impact on data consumption is hard to predict. Hardware availability and applications are still limited but are expected to grow considerably, propelled by Apple and its launch of a mixed reality headset later this year. While we are skeptical of extreme views of Metaverse-driven data consumption, there is no doubt that VR, AR, and extended reality (XR) environments and applications will require existing broadband networks to adapt in the future.

We believe AR and VR will expand from a niche to a sizable minority, but will not reach mass-market penetration in the period to 2030; nor will it command multiple hours of engagement per day, due to factors including limited availability of nonintrusive VR and Metaverse equipment (would you wear a VR headset for more than an hour a day?); low availability of nonintrusive AR equipment (would you wear a “Google Glass” device for more than an hour a day?); battery-life challenges for AR equipment; limited availability of AR,VR, and Metaverse applications; and slow evolution of required legislation. For example, allowing video recording for AR in public places would call for policy changes. Social and cultural norms would frown upon people spending multiple hours a day immersed in the Metaverse, while ignoring real contact with human beings in their immediate physical vicinity.

Given the small form factor of Metaverse headsets (meant to sit on a person’s head with a small built-in screen), it is unlikely to render high video resolutions. The most expensive VR headsets available today have resolutions equivalent to high-end mobile devices (HD, or 2K HD) but cost three times more than a high-end mobile device. Some telecom operators indicated that the Metaverse will require low latency and 10-times-higher throughputs than today (i.e., speeds of at least a few hundred Mbps) to deliver a good user experience.

Decreasing latency would probably require a complete overhaul of telecommunication architecture, to reduce the number of hops and nodes between the end user and the service provider. This implies that the access network and the transmission, backbone, and core network would probably need to be redesigned. Additionally, depending on the nature of the AR, VR, or Metaverse application, specific requirements in the network would have to be considered. For example, a Metaverse application to view videos is probably easy to configure as it does not require low latency, but a Metaverse application enabling interaction between two people in two different corners of the world would require end-to-end low latency spanning the networks of multiple telecom operators.

Defining the problem statement for Metaverse throughput and latency requirements for a telecom operator is not straightforward, as it depends on specific use cases. Envisaging suitable solutions requires close collaboration between the service provider and the telecom operator, with appropriate adjustments made to network architecture and unavoidable new investments in specific telecom infrastructure areas.

The coming years will bring more clarity, as providers like Meta have already begun actively engaging with telecom operators to launch preliminary Metaverse use cases. A recently published Arthur D. Little (ADL) report, “The Metaverse: What’s in It for Telcos?” contains additional details of developments in the Metaverse.

AI

AI has received a solid boost with the recent success of ChatGPT, while the real-world impact of AI is already being felt in our daily lives. Well-known examples are Netflix’s “recommendation” feature, TikTok’s “infinite scroll” feature, and the launch of Tesla’s Full Self-Driving (FSD) feature, but AI’s actual impact on data consumption is uncertain.

We believe AI will continue to disrupt many activities and use cases. On one hand, AI could result in an explosion of user-generated video content (e.g., TikTok and Snapchat filters) as well as remotely searched or generated AI videos based on user inputs (e.g., searching for a video using descriptions of a scene, rather than meta text of the video), resulting in even higher consumption of video and other data-intensive services. However, to a large extent this time would be a substitute for time spent by the user on other activities, in favor of AI-related content searching, creating, and consuming, ultimately resulting in limited overall impact on total data consumption.

On the other hand, the impact on data consumption could be muted because most heavy AI algorithms are data-collected, trained, iterated, bug-fixed, and finalized within private data centers, private clouds, and private networks without using public Internet and public telecommunication networks. The end user eventually obtains just a paragraph of text from an AI service provider (as ChatGPT does) or a stream of images or videos (Netflix’s recommendations or TikTok’s continuous video feed). Eventually, the data consumption implication of these use cases might not be unlike watching videos or visiting social networks and their respective evolution in terms of data consumption, which we already incorporated in our calculations.

B2B, IoT & M2M

Most telecom operators stated that overall data consumption patterns, for both mobile and fixed, are driven primarily by the consumer segment. B2B has a limited role in shaping consumption patterns and driving overall traffic growth and is not the main driver of consumer data growth.

B2B end users usually fall in one of two categories. People in the first category use their employer-provided B2B SIM card as their primary card, exhibiting a consumption pattern like any other average consumer. The second category of B2B end users use their employer-provided B2B SIM card exclusively for work-related communication, and use less data, usually in the low single-digit GB/month range.

Similarly, Internet of Things (IoT) does not significantly shape overall consumption patterns, accounting for only a small share of overall traffic. An upcoming chapter on IoT and machine to machine (M2M) provides additional details. Private networks and project-based B2B telecommunication services are not in scope of this assessment, as they are bilaterally negotiated between the service provider (usually a telco) and the end customer (usually an industrial enterprise). Client-specific solutions are designed and client-exclusive infrastructure is rolled out, which is outside the purview of public telecommunication networks.

Web3

In terms of data consumption, Web3 (aka Web 3.0 or Web 3) will most likely increase the need for individual nodes on the network to communicate with each other, as computing and storage are distributed. Web3 is the next generation of the Internet, characterized by the use of blockchain technology, decentralized applications, and smart contracts. It effectively decentralizes the Internet, where individual users take on greater responsibilities for computing, storage, and communication, as opposed to servers owned by large providers doing the bulk of computing and storage.

We are not certain who will play a key role in a decentralized architecture: ordinary end users or a limited number of larger formal players, similar to today’s Bitcoin miners. Arguments supporting both increased and decreased end-user data consumption exist, and the outcome will ultimately depend on the final architecture of Web3 and its user uptake.

Blockchain-based Web requires data storage across multiple nodes and maintaining a digital copy of the entire blockchain, which can increase data consumption. However, Web3 technologies can also enable more efficient data processing and communication through the use of distributed computing and compression algorithms, which can ultimately decrease data consumption.

In the past, ordinary end users played an important role in decentralized sharing and storage. Remember the P2P torrent file-sharing phase in the early 2000s? Continuous storing and sharing of media by end users had a clear impact on monthly data consumption, so much so that telecom operators introduced “midnight tariffs” in an attempt to move this traffic to off-peak hours. Web3 may or may not have a similar impact on ordinary end users. In any case, if ordinary end users play a greater role in Web3 developments, the requirements on computing, storage, and energy will be much higher than the requirements for communication. Hence, the impact on data consumption will be lower than the impact on computation, energy, and storage.

Holographic video projection

Holographic video projection is a method of projecting 3D images or videos that appear to be floating in space and can be viewed without special glasses or headsets. This method is mostly used during outdoor public-viewing events and is not considered a method for consumer video consumption. Currently, holographic video projection is in its early stages, and resolutions are similar to HD-quality videos, at best. As this technology matures, more content may become available at higher resolutions, accompanied by greater penetration of videos using this method. Its effect on data consumption is uncertain.

3. SUPPLY DRIVERS — ATTRACTIVELY PRICED DATA BUNDLES, FTTP COVERAGE & 5G COVERAGE

The availability of attractively priced data bundles and increased FTTP and 5G coverage support higher data consumption. For each of the 30 European markets, we analyzed in detail more than 100 supply KPIs across the spectrum of fixed and mobile coverage; share of the respective technology coverage; evolution of ARPUs (average revenue per user), which were broken down by technology and segment; specific bundles availability; and overall competitive environment. The telco KPIs were obtained from sites like Eurostat, Organization for Economic Cooperation and Development, and International Telecommunications Union and publications like GlobalData, Tefficient, and FTTH Council.

First, we conducted a correlation analysis between the average fixed and mobile data consumption (GB/month) and each of the 100-plus supply KPIs for each of the 30 focus markets and selected the top dozen KPIs based on their correlation and significance parameters (R2, p value, and statistical significance) to data consumption.

Next, we passed the short-listed input KPIs through multiple rounds of random forest decision tree classification algorithms to identify which KPIs influenced data consumption the most and short-listed the resulting KPIs for the next step of analysis.

Finally, we identified the most important variables impacting data consumption. We accomplished this by applying algorithms, including k-means clustering, to multiple rounds of clustering analysis that used various combinations of the short-listed input factors, scaling input parameters, modifying the number of target clusters, and changing the underlying clustering algorithm itself. We also assessed which of the supply factors were constraining conditions, or alternatively, encouraging conditions, to overall growth in data consumption and adjusted the data consumption growth in those markets accordingly.

The analysis revealed the following influential drivers:

-

Attractively priced mobile bundles

-

Fixed FTTP coverage

-

5G penetration (low impact)

-

Fixed wireless access (FWA) penetration (low impact)

The findings showed no direct impact on data consumption for the following drivers:

-

Mobile ARPU (i.e., increased consumption does not correlate with increased revenues)

-

Mobile and fixed speeds

-

Penetration of 100 Mbps fixed bundles

In the next section, we evaluate selected supply drivers and describe their effect on the overall data consumption in their respective markets.

ATTRACTIVELY PRICED MOBILE BUNDLES INFLUENCE DATA CONSUMPTION

The relative price of a large mobile bundle, determined by the ratio of a larger mobile bundle price to the average mobile ARPU in a given market, showed three clusters:

-

Markets where 20 GB mobile bundles seem to be the norm demonstrate some of the highest mobile data usage in Europe.

-

Other markets with a premium price for a 20 GB bundle show low mobile data consumption.

-

Other markets with relatively low-priced 20 GB packages can still have low mobile data consumption, indicating that other factors constrain data consumption.

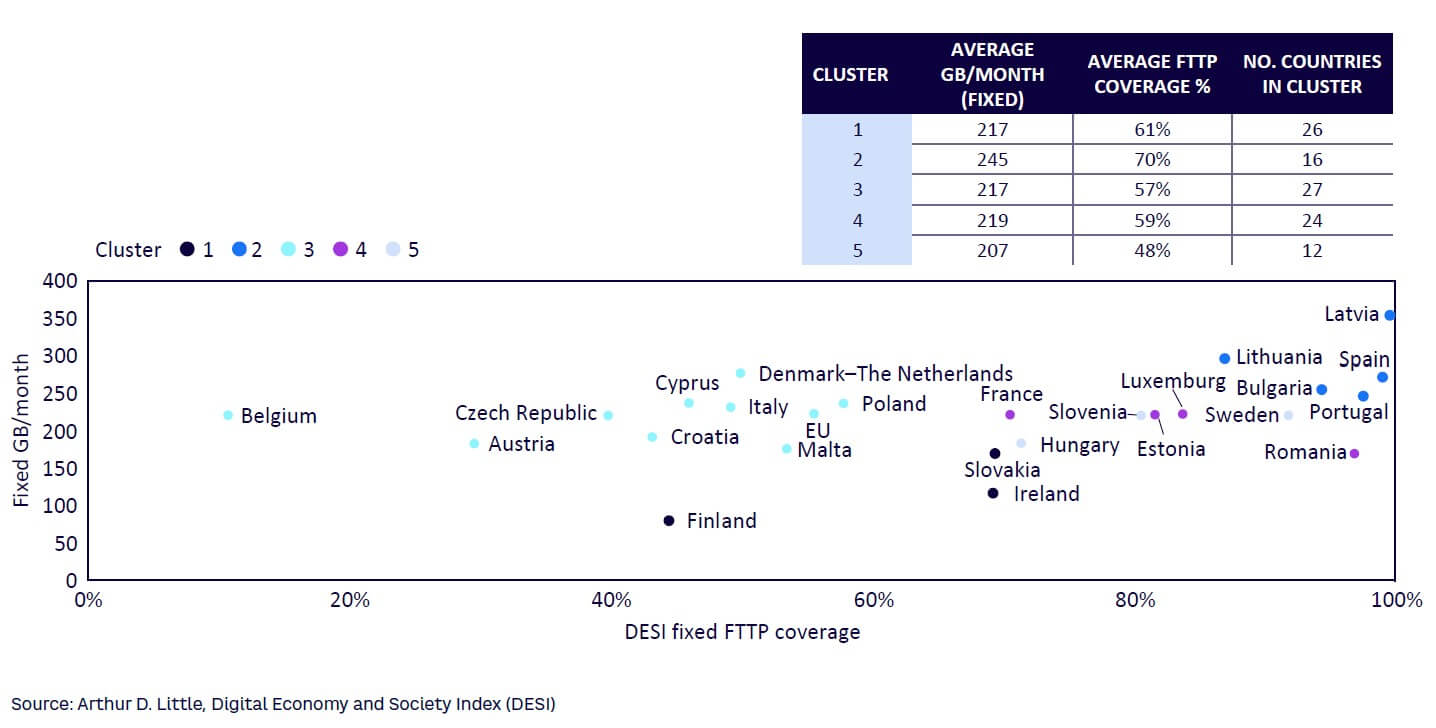

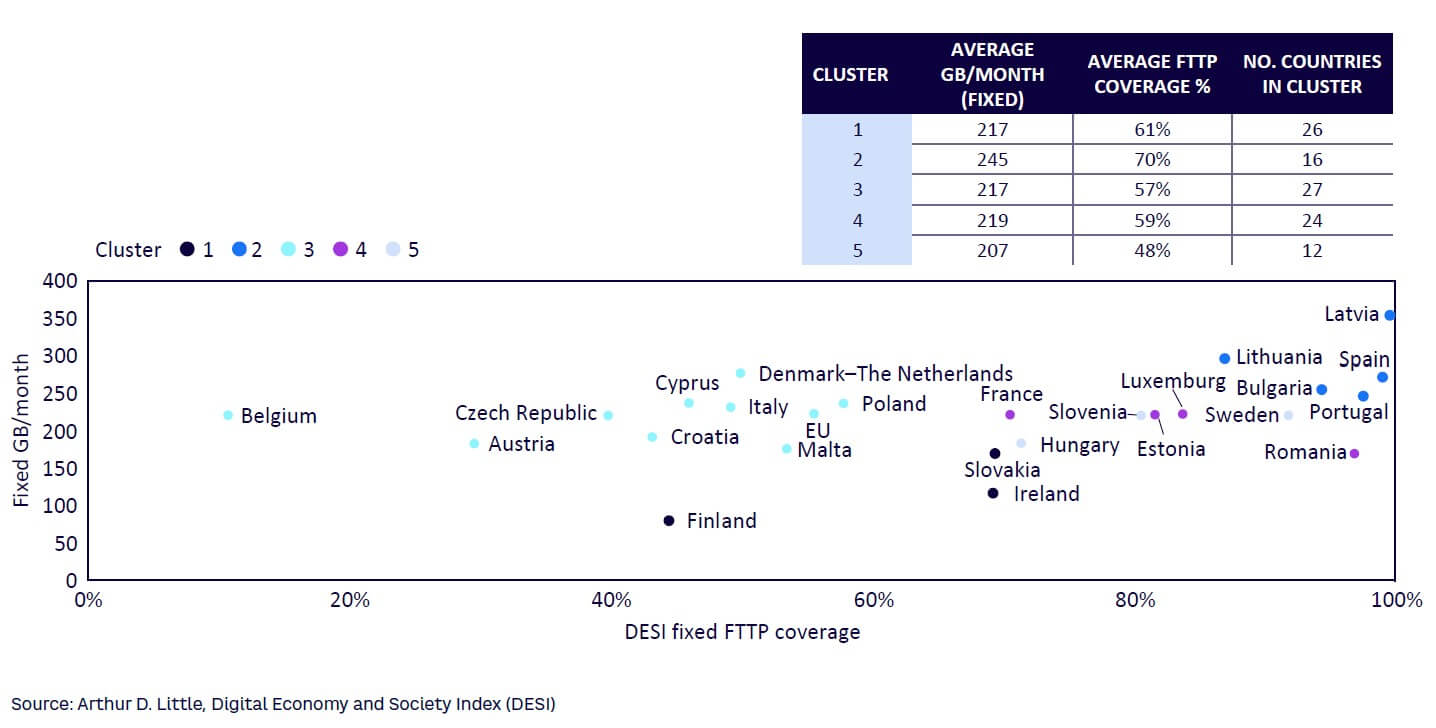

HIGHER FTTP COVERAGE INDICATES HIGHER DATA CONSUMPTION

FTTH networks offer higher speeds than legacy networks; higher coverage shows a trend toward higher fixed data consumption. Countries with more than 80% FTTP coverage (Spain, Portugal, Latvia, Lithuania, Bulgaria) are also in the top quartile of high FTTP penetration and overall high fixed GB/month. Belgium and Denmark, which have high cable coverage, also behave like FTTP countries based on high fixed data consumption. Conversely, countries with low FTTP tend to show lower fixed data consumption.

Almost all the telecom operators we spoke to observed two clear trends with regard to FTTP. Because FTTP facilitates higher average speeds than xDSL services, consumers tend to use more data-intensive services like video streaming, or their existing video service providers automatically scale their videos to higher resolutions, resulting in higher overall data consumption. The resulting average data consumption increases by a factor of 2x when a customer is upgraded from xDSL to FTTP.

We believe strong FTTP networks are the backbone of telecom infrastructure and will drive growth in data consumption in the future. As the share of FTTP coverage increases, we expect the rate of data consumption to also increase (previous ADL publications, “Open Access Fiber” and “The Race to Gigabit Fiber,” cover these topics in-depth). Figure 2 shows the output of the k-means clustering algorithm (FTTP coverage versus fixed data).

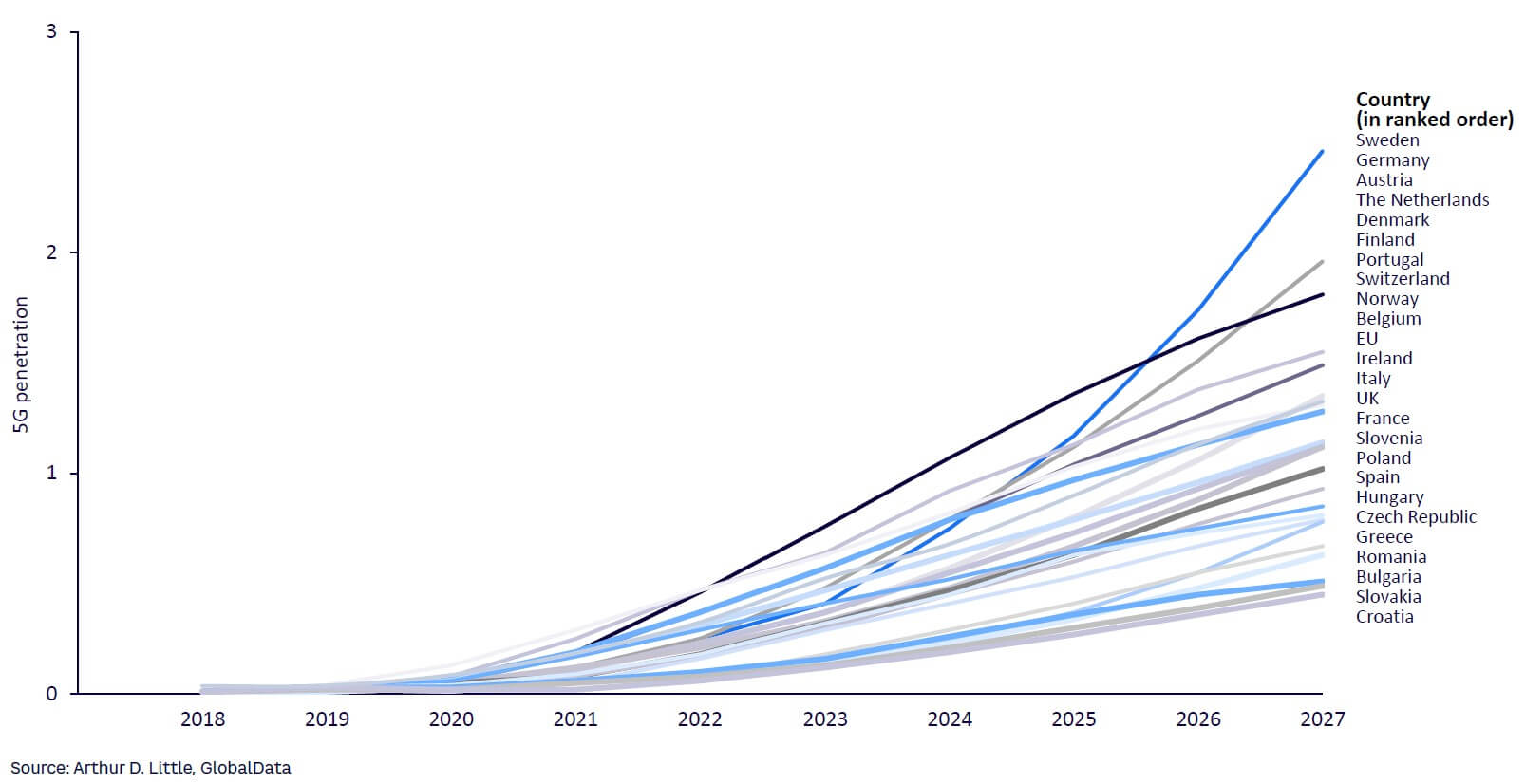

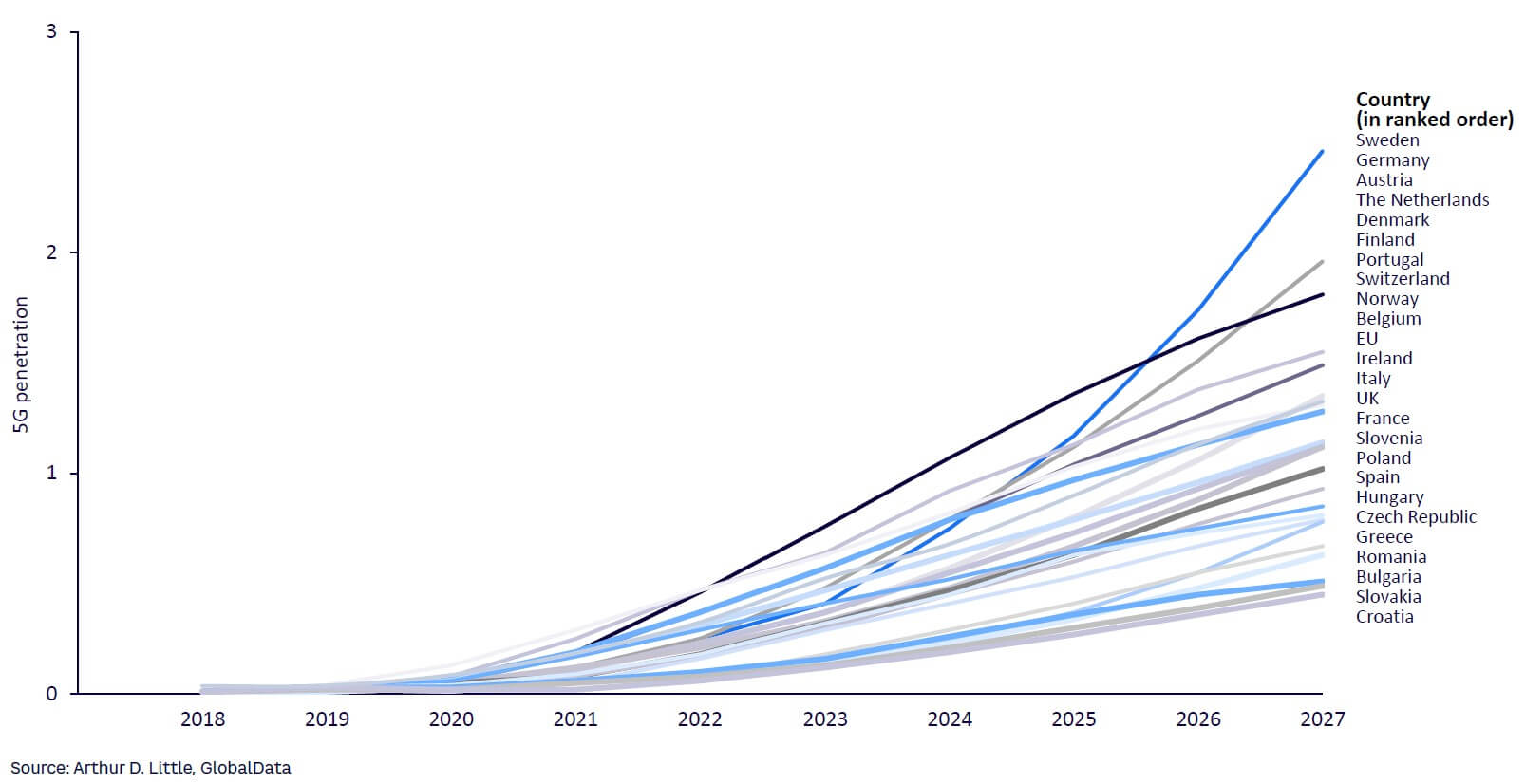

THE EFFECT OF 5G PENETRATION

5G penetration appears to modestly increase data consumption, likely because the first adopters are sophisticated users who consume more data. To determine the role of faster 5G uptake in accelerating overall data consumption, we looked at the current status of 5G rollouts in different European markets and projections of when the number of 5G subscribers will overtake 4G subscribers, as reported by GlobalData and other publications. Early initial results from some advanced 5G markets like South Korea report that their 5G customers use two to three times more data per month than their average 4G customers. However, recent reports indicate that the data consumption of 5G customers in 2023 is more modest, accounting for 20%-25% higher consumption than average 4G customers.

We spoke to European telecom operators who noticed an increase (usually around 20%) in data consumption by their 5G customers versus their 4G customers. Two underlying factors are behind this observation:

-

The type of customers who initially upgrade to 5G are more sophisticated users, who already exhibit above-average data consumption. Their upgrade to 5G simply continues their existing higher-than-usual data consumption.

-

Telecom operators describe upgrading to 5G as a gradual organic process, usually beginning with a thin 5G coverage layer. An upgrade of specific congestion sites to 5G follows, using capacity frequencies like C-Band (3.5 GHz, 3.7 GHz), which is followed by upgrades of other potential congestion sites to 5G, while backhaul or transmission networks undergo constant upgrades to fiber.

As a result, the capacity of 5G networks increases at the same rate as end-user data consumption, thus avoiding consumption-specific spikes attributable to an initial end-user upgrade to 5G. Figure 3 shows the expected growth of 5G penetration in Europe, as forecasted by GlobalData.

FIXED WIRELESS ACCESS FUELS FIXED DATA CONSUMPTION

FWA is gaining some traction in specific segments in Europe as an effective solution for high-speed fixed broadband delivery, but it is happening at a slower pace than FTTP networks. Markets where C-Band (3.5 GHz/3.7 GHz) and 26 GHz/28 GHz have been auctioned (e.g., Italy, Austria, Germany, France, Spain, UK) are already seeing high FWA deployment. Larger markets like Italy and Spain already have multiple millions of homes connected via FWA, while markets such as Germany, France, Spain, and the UK, reportedly reached over one million FWA subscribers. In Austria and Norway, FWA is increasingly being positioned as an alternative to high-speed fixed broadband.

Operators reported that their FWA subscribers already consume over 100 GB/month of data (versus over 300 GB/month for FTTP). They see FWA as a stable, medium-term alternative for fixed connectivity, especially in regions where FTTP and cable rollout are not economically viable. However, FWA is not considered a viable solution in dense urban areas due to limited capacity, although in Austria, FWA is a fairly popular solution even in its urban areas. In our model, we consider FWA part of the fixed ecosystem, contributing toward total market growth in data consumption.

Mobile ARPU does not influence data consumption, indicating that basic affordability may not be a constraining factor. High-ARPU markets and low-ARPU markets both appear to have low data consumption. One notable cluster comprised of Finland, Austria, Sweden, and Denmark showed high data consumption and moderate ARPUs, indicating that low ARPU is not necessarily required for high data consumption.

Extending this analysis to GDP per capita, with and without purchasing power parity (PPP), also resulted in no insightful clustering of consumption. This suggests that a country’s level of wealth does not necessarily result in higher or lower data consumption, which was also confirmed from expert interviews.

THE EFFECT OF MOBILE SPEEDS & FIXED SPEEDS

According to a report by Ookla, a country’s overall average mobile speeds, broken down by region, do not seem to result in insightful clusters of data consumption, implying that mobile speeds likely do not influence mobile data consumption. India, which is not part of our analysis, helps explain this apparent anomaly: India’s mobile speeds are among the lowest in the world (25 Mbps versus 150+ Mbps for global leaders) but its mobile data consumption levels are among the highest (25-30 GB/month versus 10-15 GB/month global average).

A similar effect is also seen in the 30 markets, namely that the average speeds available to the user do not materially impact overall data consumption, indicating that current speeds, which according to Ookla is a minimum of 40 Mbps for most European mobile markets, are sufficient to fuel the data consumption of users without becoming a constraining condition. Telecom operators we spoke to shared that mobile speeds offered to their customers are sufficient for most of their requirements and do not seem to constrain their data usage. The only exception is during live sport events coinciding with the busy hour, which cause busy hour congestion. Additional details on the busy hour and its influence on data consumption are shared in later sections.

Fixed speeds for the overall country, broken down by regions, as reported by Ookla, also do not seem to have a noticeable impact on overall fixed data consumption. This indicates that current speeds, which is a minimum of 50 Mbps for almost all markets in fixed according to Ookla, are adequate for the data consumption that the user needs without becoming a constraining condition.

EXISTING FIXED SPEEDS MAY SUFFICE FOR MOST USERS

For now, penetration of 100 Mbps fixed bundles does not influence fixed data consumption, indicating that existing fixed speeds (identified as 60 Mbps by Ookla in February 2023) are probably sufficient for most user requirements. We observe no clear clustering when assessing penetration of 100 Mbps fixed penetration with fixed data consumption. This indicates that existing sub-100 Mbps speeds that are the norm for home broadband users are enough to meet all their existing fixed data requirements. This is also what we heard from interviews with telecom operators, who stated that although high data-speed bundles are available in most of their markets, customers with low-speed bundles do not appear to feel disadvantaged in terms of overall quality of experience.

In the near future, perhaps 100 Mbps speed availability will be a constraining factor, as data-throughput requirements increase when users consume multiple 4K streams or Metaverse use cases require multiple simultaneous video streams. But for now, the availability of 100 Mbps packages does not seem to be a constraining factor.

4

MOBILE CONSUMPTION WILL ACCELERATE UNTIL 2030

DOUBLE-DIGIT GROWTH EXPECTED IN ALL EUROPEAN MARKETS

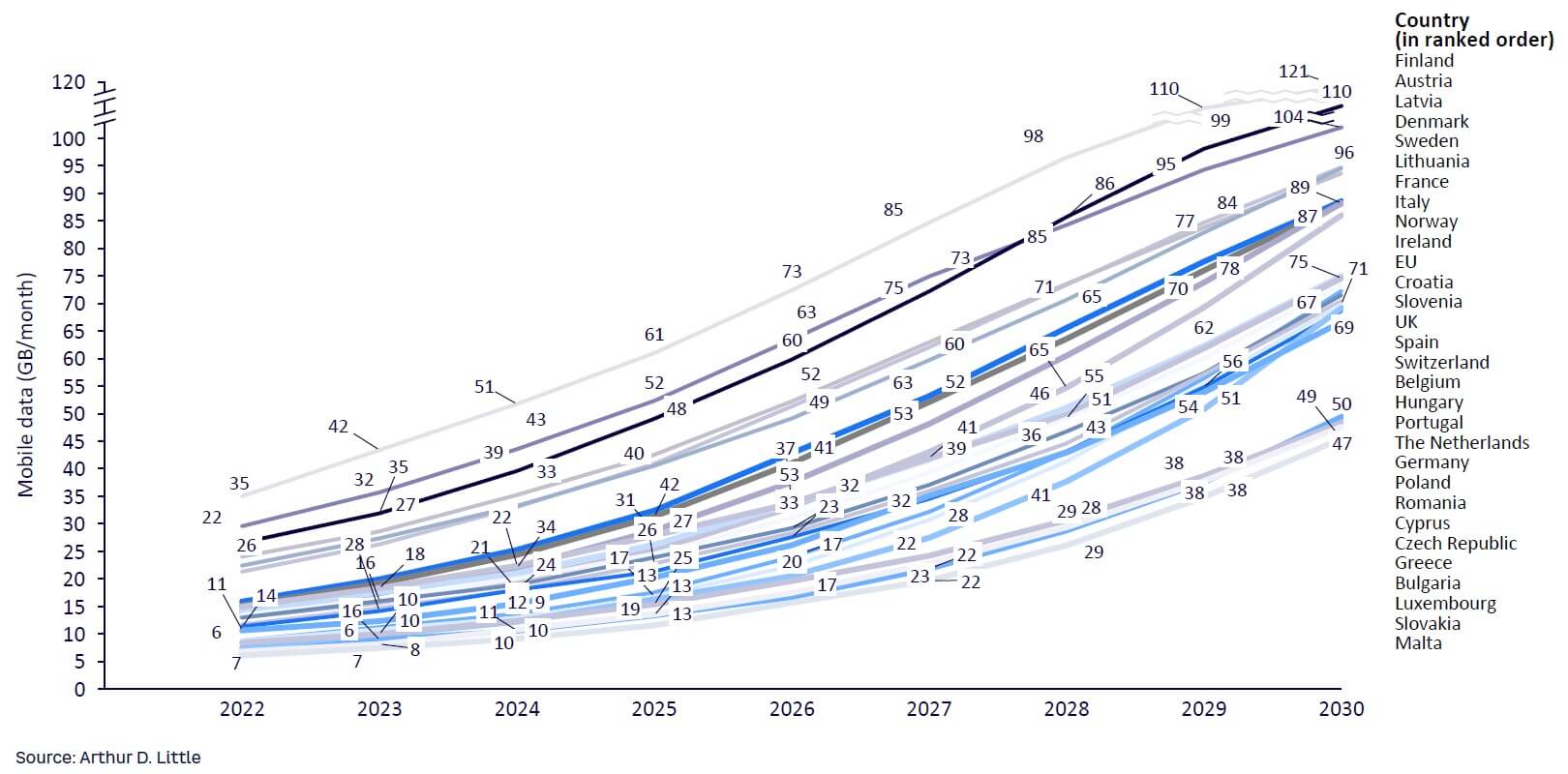

Driven by video and social networks, we anticipate average mobile data consumption to continue growing rapidly from approximately 15 GB/month in 2022 to 75-80 GB/month by 2030. This creates an overall annual growth rate of 25%. Video will continue to lead overall growth, accounting for 60% of the share in 2022, and will grow to 70% by 2030. Figure 4 shows line charts of the evolution of mobile data consumption for each market.

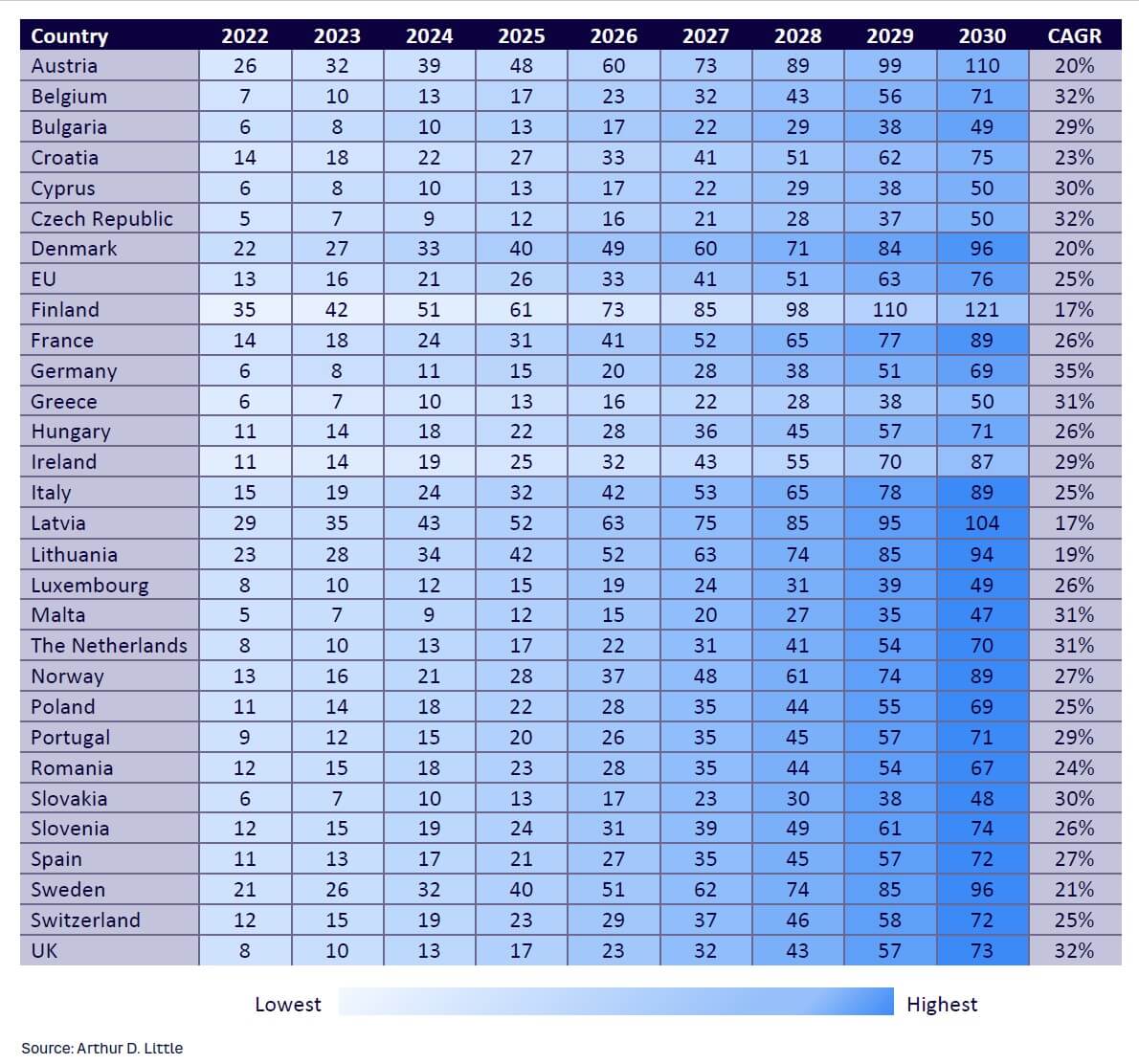

EARLY 5G ROLLOUTS HELP LEADING MARKETS OUTPACE OTHERS

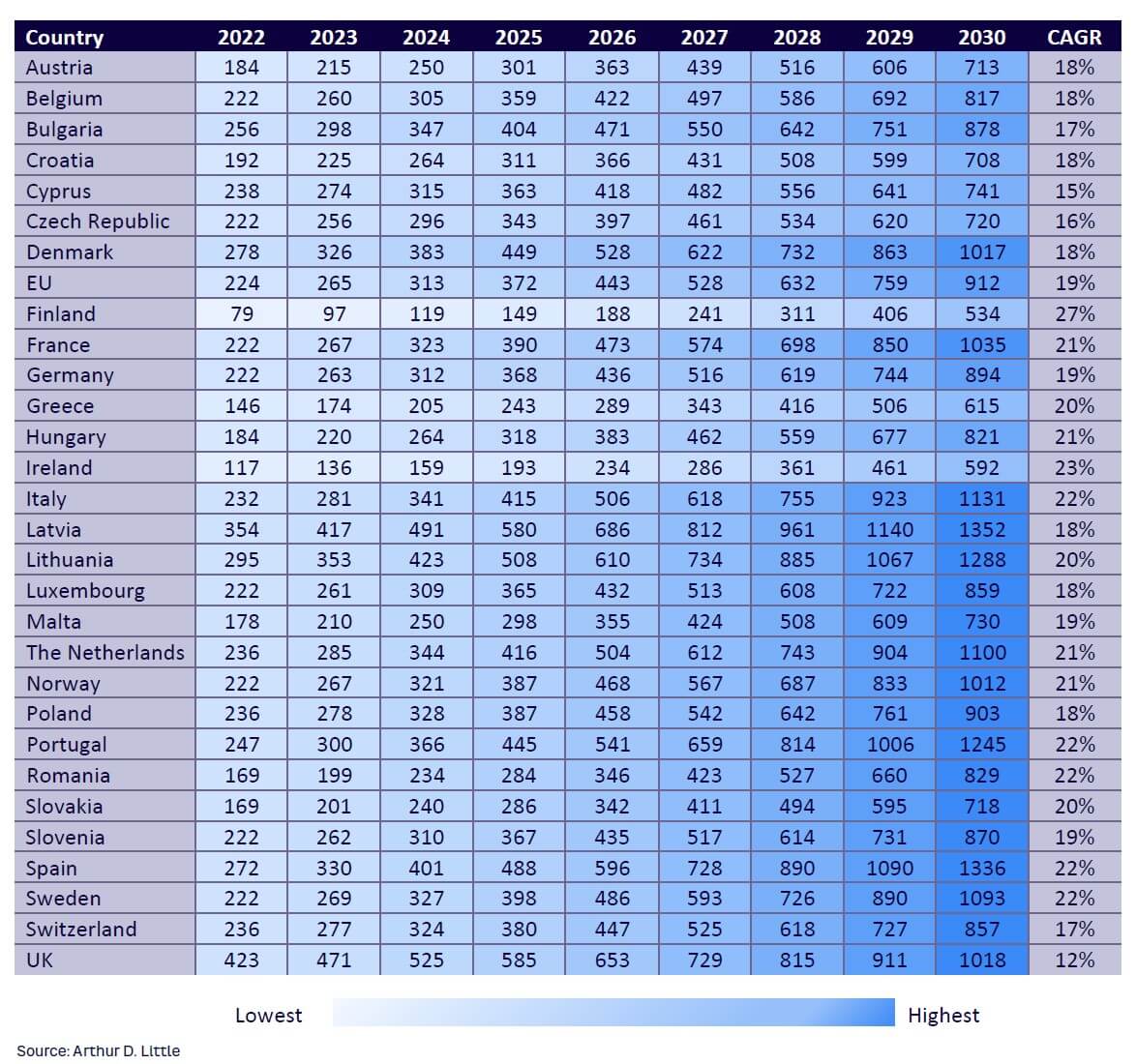

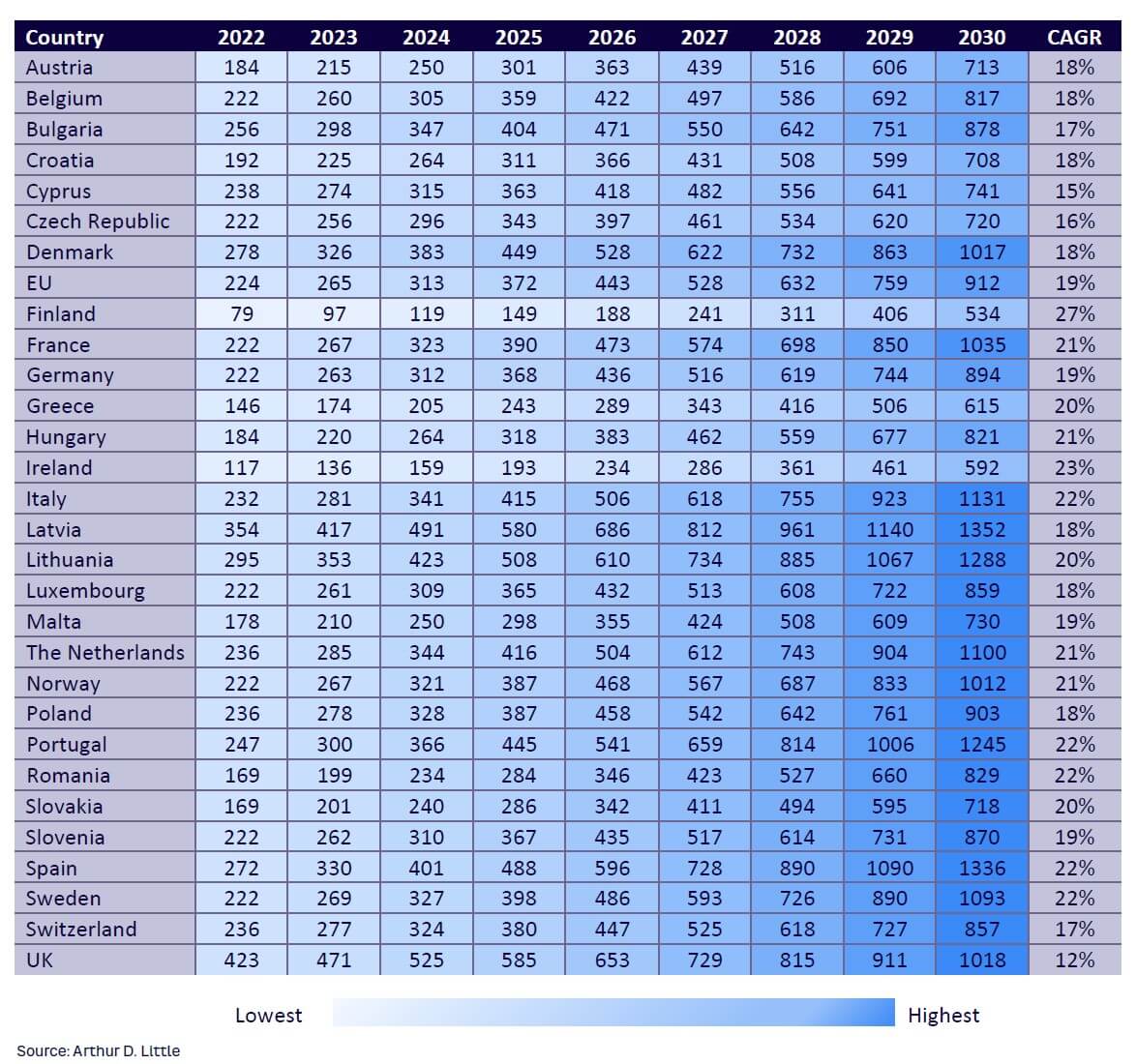

Leading markets continue to outpace others thanks to earlier 5G rollouts, the availability of relatively inexpensive, high-volume data packages, and in some cases, mobile-fixed substitution. Examples of these markets include Finland, Austria, Latvia, Lithuania, Estonia, and Denmark. Finland and Austria exhibit higher-than-average mobile data consumption, primarily because of the absence of FTTP and cable fixed networks, which points to a higher level of fixed mobile substitution. In general, Latvia and Lithuania exhibit higher data consumption for both fixed and mobile. Scandinavian markets, including Denmark, Sweden, and Norway, also exhibit higher-than-average data consumption overall and are expected to continue to lead, supported by sufficient infrastructure that includes the fiberization of radio access network (RAN) and the availability of affordable, high-volume mobile bundles. Table 1 shows a detailed breakdown of the evolution of mobile data consumption for each market.

LAGGING MARKETS CHARACTERIZED BY SLOWER 5G ROLLOUT & OTHER CONSTRAINTS

In general, markets that have been slow to kick-start the 5G rollout also demonstrate below-average mobile data consumption. These markets also tend to exhibit lower levels of site backhaul fiberization, slower deployment of 5G capacity frequencies like C-band, and less availability of high-volume data bundles, which in turn limit their networks’ overall data consumption potential. Multiple countries in Europe lack nationwide FTTP rollout programs and are expected to have below-average in overall fixed data consumption.

5

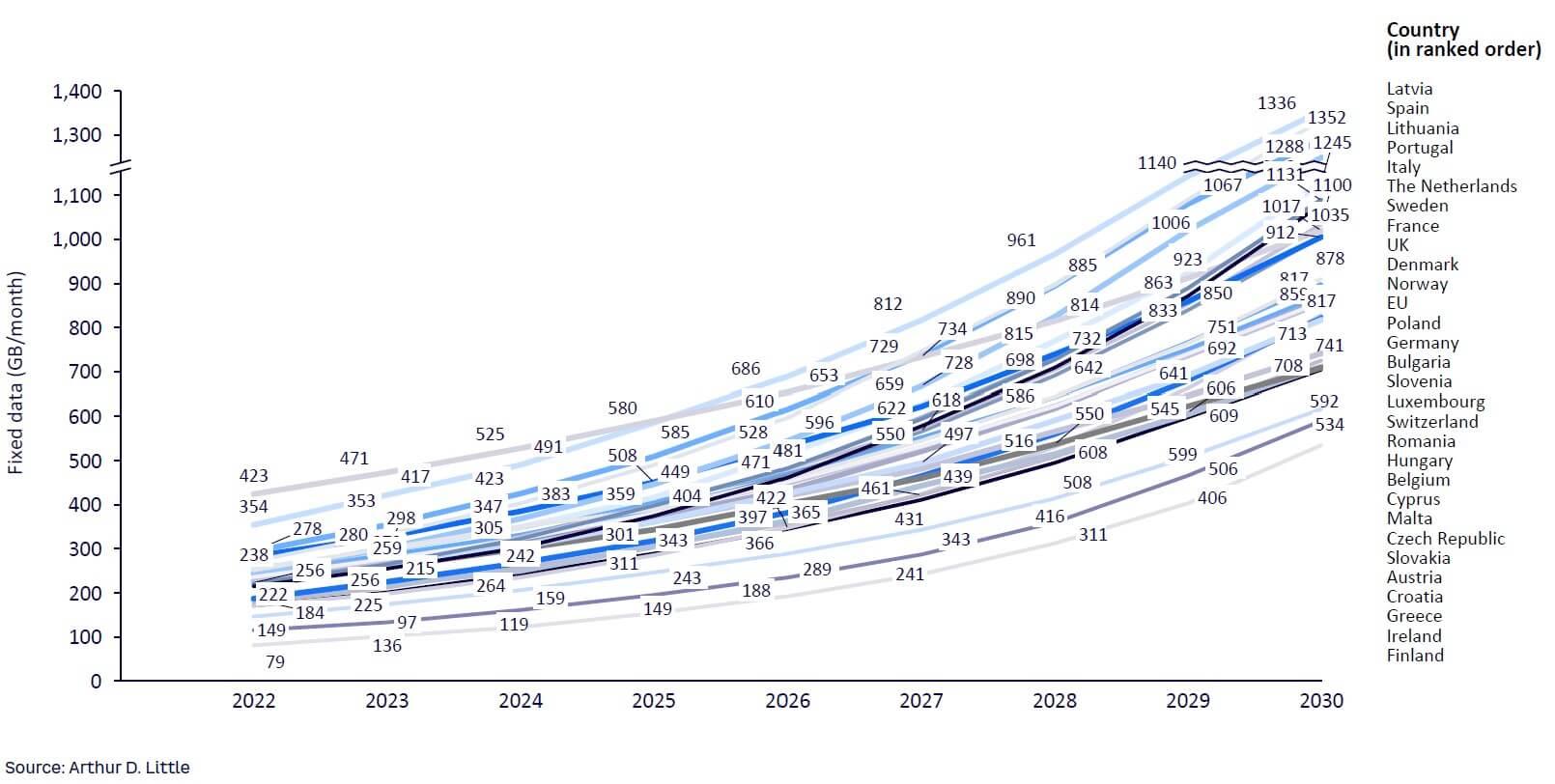

FIXED CONSUMPTION TO GROW UNTIL 2030

DOUBLE-DIGIT GROWTH EXPECTED IN ALL EUROPEAN MARKETS

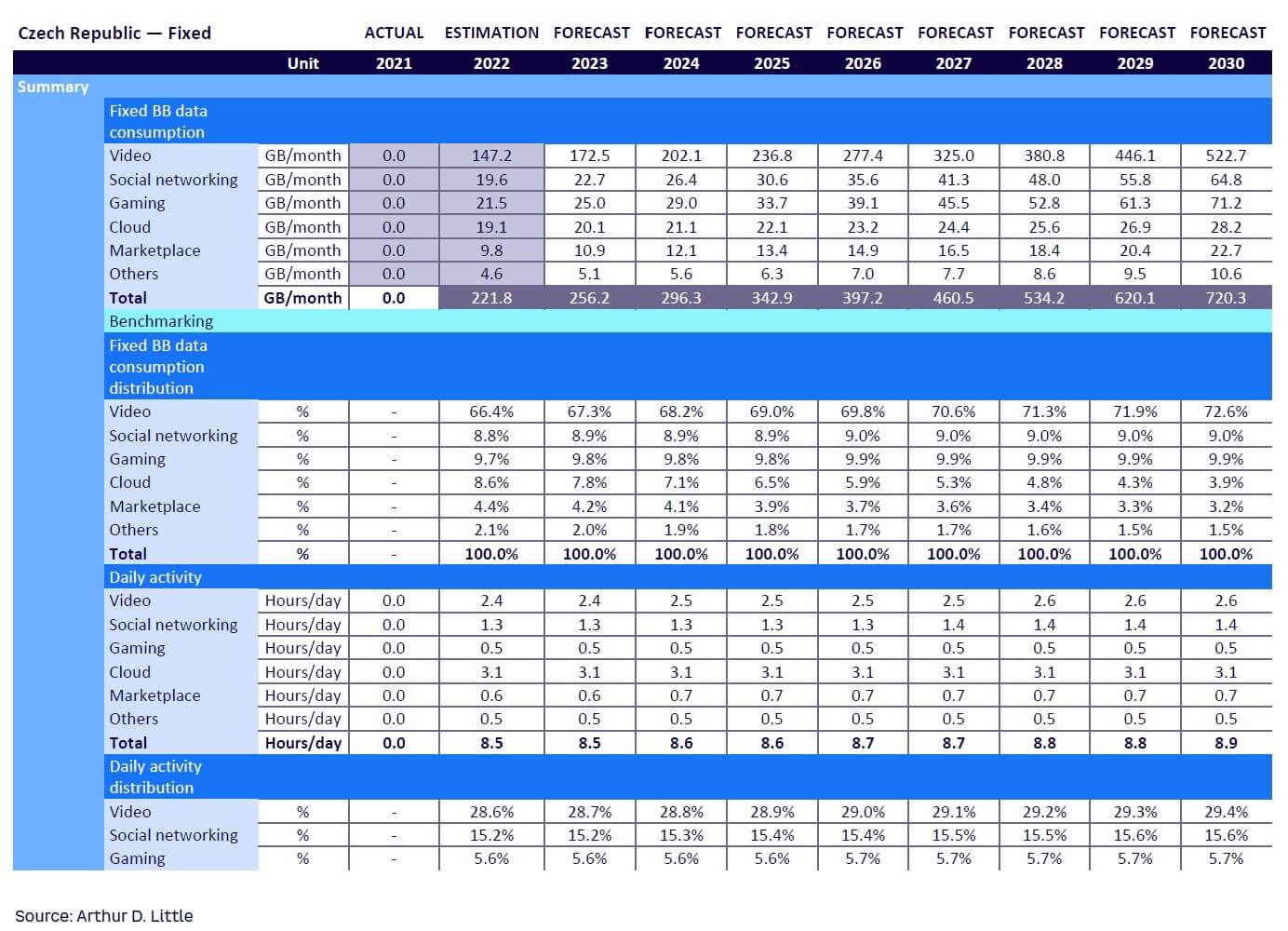

We expect average fixed data consumption to grow from approximately 225 GB/month in 2022 to 900 GB/month per home by 2030, accounting for an overall annual growth rate of 20%, similar to past elevated levels. Video will continue to lead overall growth in fixed as well, accounting for 65% share in 2022 and increasing to 75% in 2030. Figure 5 shows line charts of the evolution of fixed data consumption for each market.

HIGH OR GROWING FTTP COVERAGE CHARACTERIZES LEADING MARKETS

Spain, Portugal, Latvia, and Lithuania will continue to lead overall fixed data consumption, driven by underlying higher rates of FTTP coverage and growing rates of 100 Mbps and 1 Gbps penetration. Some markets, such as the UK, currently exhibit above-average data consumption, but we believe this will fall a bit toward the European average due to the slower pace of FTTP rollout in the UK versus the leading FTTP European markets.

Some studies, including one from Ofcom, contemplate linear extrapolation for higher future growth rates (42% for an average fixed broadband consumer), recognizing the uncertainty in future demand projections. Markets like Denmark, Italy, The Netherlands, and Germany, which have recently accelerated FTTP or cable rollout, will exceed European average data consumption levels. A detailed breakdown of the evolution of mobile data consumption for each market is shown in Table 2.

EXTREME FORECAST CASES REQUIRE DRASTIC CHANGES IN USER BEHAVIOR

To assess the reasonableness (or alternatively, conservativeness or aggressiveness) of the data consumption levels that we forecast by 2030, we put forth a theoretical alternative “extreme” scenario below to evaluate what could be extreme cases for monthly data consumption. We see two such use cases that could drive monthly data consumption to an extreme by 2030.

Extreme case 1: Watching 4K videos 12 hours/day, 30 days/month

Assuming watching 4K videos 12 hours a day (per home), a 4K video stream would need approximately 8-10 GB/hour. Multiplying 10 GB/hour times 12 hours a day times 30 days a month results in 3,600 GB/month.

Extreme case 2: Using Metaverse services 12 hours/day, 30 days/month

This case assumes using Metaverse services 12 hours day (not only spending most of one’s awake time in the Metaverse, but also minimizing actual real contact with other humans in one’s close vicinity, while wearing a Metaverse headset for such extended periods of time). We believe the data required in this Metaverse use case is three to six simultaneous HD video streams, effectively requiring 8-10 GB/hour. Multiplying 10 GB/hour by 12 hours a day by 30 days a month results in 3,600 GB/month.

We believe these extreme scenarios are implausible for two reasons. First, it is culturally unlikely that human beings would drastically change their behavior by replacing social contact with real people with digital content or immersion in Metaverse worlds for prolonged periods of time. Secondly, the underlying data consumption requirements of the Metaverse are not so different from the data consumption requirements of watching high-quality video, hence increased use of Metaverse does not necessarily imply higher data consumption than watching high-quality video content.

In Table 3, we contrast the average fixed projection in the EU derived from our forecast model with the two extreme scenario cases described above. We believe our forecasts are reasonable and are neither too aggressive nor too conservative.

Widespread availability of 8K videos or accelerated use of the Metaverse (to several hours a day), with hardware solutions to project 4K or 8K videos in a small form factor such as a headset worn over the eyes, could result in a more aggressive data consumption pattern than what we have forecasted. But in the absence of such technological and drastic cultural changes, we believe data consumption will grow at the elevated growth rates shared in this Report.

Several other factors could impact forecasted data consumption, including potential health-related lockdowns and higher levels of home-office acceptance, implying higher work-related data consumption from homes (e.g., cloud and communication related), as well as factors such as new technology adoption, the availability of high-resolution viewing devices (especially headsets), and government policies allowing for AR applications in public places. The interplay of technological and infrastructural changes, user behavior changes, and policy changes will ultimately determine the trajectory of data consumption.

6

CONCLUSION — DATA CONSUMPTION TO CONTINUE AT ELEVATED LEVELS

MOBILE DATA CONSUMPTION INCREASES WITH DATA INTENSITY OF VIDEO & SOCIAL NETWORKS

We expect growth in mobile data consumption to continue to grow at the elevated annual rate of 25%. Demand shocks (spikes in mobile data consumption like those seen during the recent pandemic) could further accelerate consumption, but it is inherently dampened by supply factors such as busy hour throughput. For example, when there is high demand for video (e.g., during a FIFA World Cup match), video is automatically downscaled to lower resolutions to fit the overall available bandwidth in mobile networks, thus limiting any short-term explosions in overall data consumption.

Earlier-than-expected adoption of AR could drive up mobile data consumption, but other factors like data throughput and latency will play more important roles. AR adoption will also require drastic changes to cultural patterns, like widespread use of glasses that superimpose digital images as an overlay over reality. A massive overhaul of current data-privacy legislation may be in order as well, which we do not expect in the period between now and 2030.

Telecom operators continue to constantly and incrementally invest in upgrading their networks, spending on average 20% of revenues (in spite of single-digit growth in revenues and flat EBITDAs) to sustain high growth rates in data traffic. Consequently, they are able to sustain double-digit elevated rates of growth in data consumption.

FIXED DATA CONSUMPTION INCREASES AS USERS CONSUME HIGH-QUALITY CONTENT THROUGH MULTIPLE CHANNELS

Fixed data consumption continues to grow as data intensity of video and other use cases increase with availability of higher-quality content through multiple channels. We expect growth in fixed data consumption to remain at the elevated annual rate of 20%. Short-term accelerations in data consumption may occur in some markets, where FTTP rollout is expected to noticeably increase data consumption in those areas.

As telecom operators upgrade their networks, countries with FTTP programs could see gigabit-speed packages becoming available in this time horizon. Telecom operators report that today, even low-priced bundles offering speeds of under 100 Mbps are sufficient for most daily activities and do not constrain user experience or overall data consumption.

APPENDIX A — METHODOLOGY

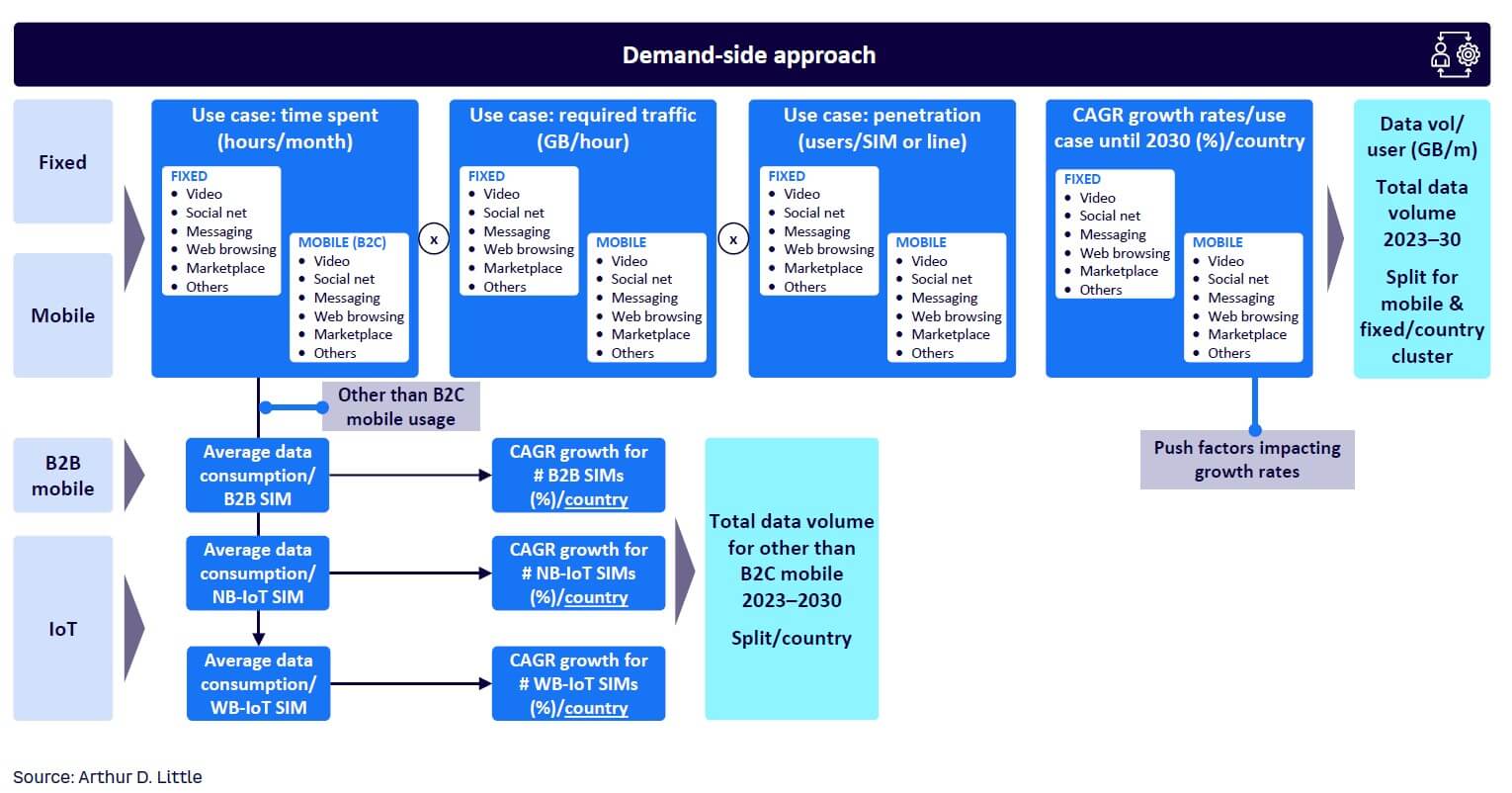

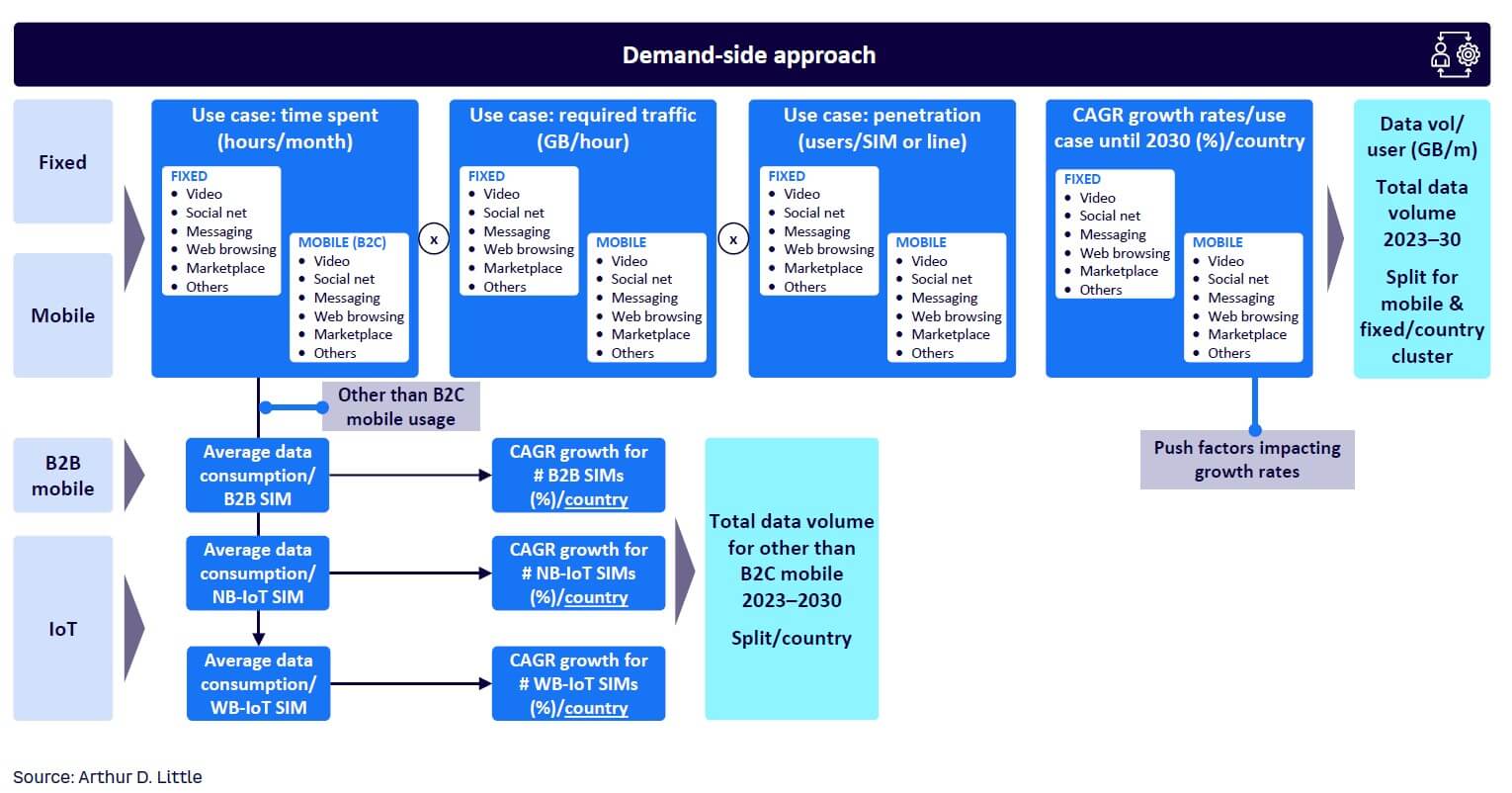

We followed a two-step approach to estimate expected fixed and mobile data consumption (GB/month) between 2022 and 2030:

-

Bottom-up, demand-driven methodology.

-

Supply drivers that influence demand.

BOTTOM-UP DEMAND-DRIVEN METHODOLOGY

Our demand-driven methodology for estimating Internet usage is based on estimating the data consumption requirements of the top five (or more) consumer use cases for both fixed and mobile Internet.

For both fixed and mobile, we assessed these use cases and evaluated the time spent by a typical user on each, as well as the data intensity of that particular use case. We then forecast the time spent by the user on the use case and the evolution of data intensity, subject to the underlying primary drivers, including:

-

Substitution of one use case with another (more video in fixed versus more social networks in mobile).

-

Change in user behavior in that use case (e.g., metaversization of video, social networks).

-

Evolution in data intensity of use cases (upgrade to higher and higher resolutions when watching video).

-

Use of devices that influences the data intensity (4K-capable TVs versus HD-capable mobile handsets).

-

Engagement of multiple simultaneous streams (watching video on a TV, while other household members watch other videos on a secondary TV, tablet, or laptop).

-

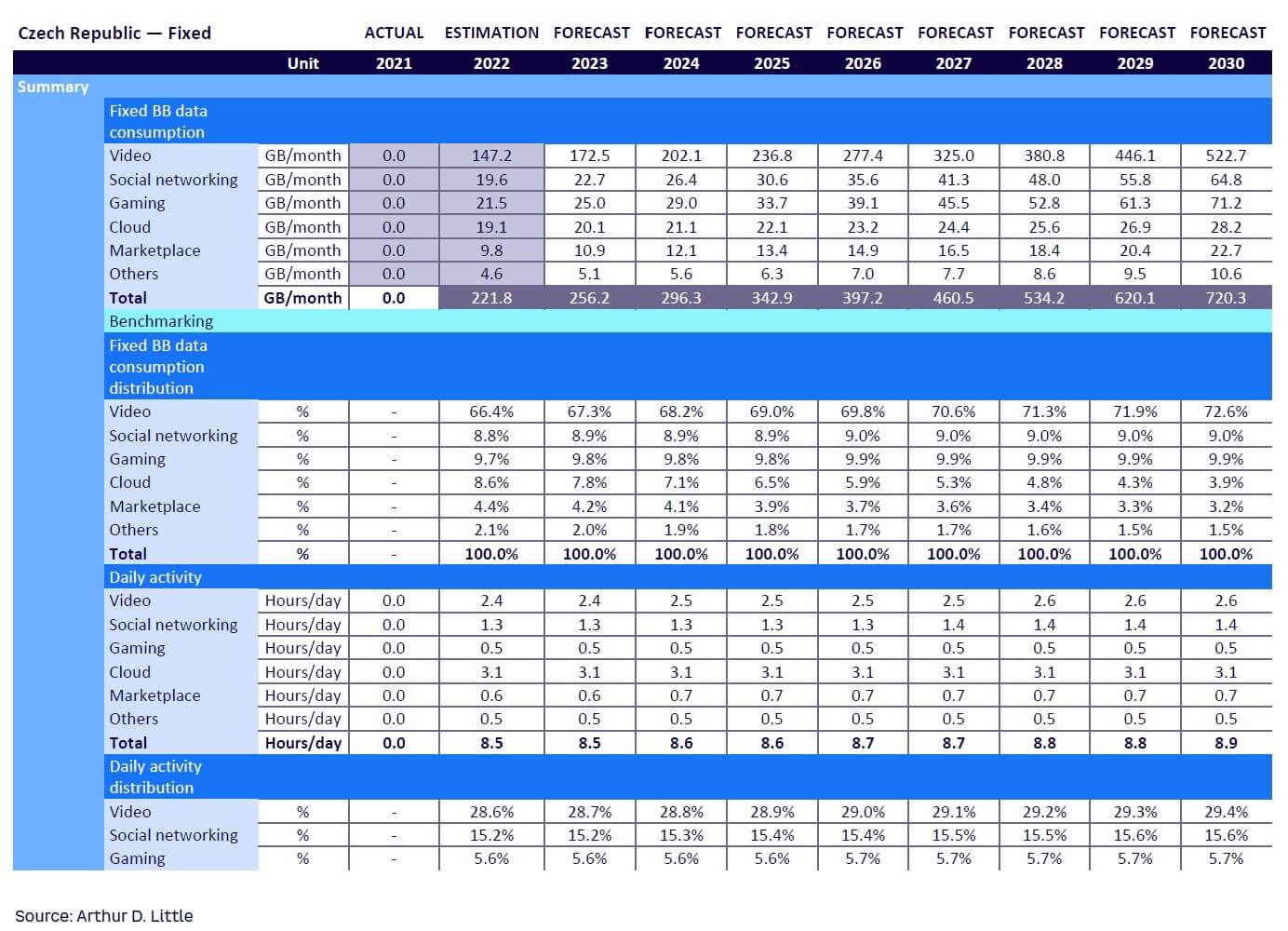

Use of mobile handsets outside the home (using mobile broadband) versus use of mobile handsets inside the home (using fixed broadband).

We calculated the GB/hour for each use case and multiplied it by the average number of hours per day spent on that use case. Next, we extrapolated this value, to the monthly level, to get the average GB/month for that use case making appropriate adjustments for weekend behavior. We then summed up the different use cases (including “other”) to get the average GB/user for both fixed and mobile. Thus, we arrived at the data consumption, per country, per fixed/mobile, per use case, for the period 2022–2030. Table 4 provides a snapshot of the bottom-up model used in this analysis.

SUPPLY DRIVERS THAT INFLUENCE DEMAND

The supply drivers that influenced demand were evaluated using a three-step process:

-

Assess the key telecom KPIs per market that potentially impact data consumption. We collected over 100 key telecom KPIs for each of the 30 markets in our scope. The data cleaning, data standardization, and KPI inspection were done in Microsoft Power BI.

-

Create a short list of the top five to 10 KPIs via correlation-significance analysis. The results of the bottom-up, demand-driven market were fed into a matrix, along with the long list of telco KPIs in order to run a correlation analysis. The correlation analysis, per fixed/mobile (2x), per country (30x), per KPI (100+x), for the time period 2018–2022 (5x), with more than 30,000 data points, was performed in Alteryx to identify the top five to 10 KPIs potentially influencing data consumption, via their R2, p-value, significance, and t-value parameters. The short-listed KPIs were then fed into multiple random forest decision tree models to identify the most important and most sensitive input variables impacting data consumption. Thus, the list of telecom KPIs were further short-listed before transferring them to clustering algorithms.

-

Perform cluster analysis to zoom in on the handful of core KPIs influencing data consumption, as either a constraining factor or as a growth enabler. We then performed multiple rounds of clustering analysis on fixed and mobile data consumption and on the short list of telecom KPIs for each market, modifying in each iteration the selection of input KPIs, whether or not the input KPIs were standardized (linear or standard), the number of clusters (three to five in most cases), and the underlying clustering algorithm itself (k-means or k-medians). We also subjectively evaluated if the clustering output made sense, given our view on each market, and the underlying market conditions influencing (or alternatively constraining) data growth in those markets.

When necessary, we iterated back to the bottom-up demand-driven model to modify the parameters influencing data consumption for one or more use cases and reran both demand and supply modules until the results made enough sense in terms of the clusters and in terms of our subjective expectation and were aligned with the feedback obtained by telecom operators and market experts.

The end result is presented as an output in this Report. Figure 6 shows the use cases, organized using a demand-side approach.

APPENDIX B — ADDITIONAL CONSIDERATIONS

FACTORS AFFECTING BUSY HOUR THROUGHPUT

We spoke to telecom operators who reported that busy hour throughput is impacted by events like football matches (e.g., league matches on Sunday nights), new episodes of streaming series (e.g., Monday night Netflix launches), or special sporting events like the recent 2022 FIFA World Cup in Qatar.

When the busy hour occurs during working hours, between 8 am and 8 pm, operators reported that their mobile networks exhibit a clear spike in usage, indicating that mobile consumption is higher than usual, as end users consume this (mostly sporting) content on their mobile devices. Improved mobile coverage of public transport networks further enables the ability of end users to consume videos on their phones while traveling to and from work, which further adds to video consumption in the evening hours.

Often, the busy hour occurs after 8 pm, so mobile networks do not exhibit corresponding spikes in usage versus the previous scenario, indicating that most of this data consumption happens on fixed networks. Telecom operators report that their fixed networks are generally equipped to handle heavy video traffic. While consumers with less expensive lower-speed packages might be unable to access high-resolution videos in the busy hour, consumers with pricier higher-speed packages usually do not notice a degradation in quality.

Telecom operators have always astutely managed their busy hour throughputs, as this need directly influences the amount of CAPEX required to upgrade the underlying infrastructure. In the past, telecom operators launched “off-peak bundles” and “midnight bundles” to encourage users to shift their data-intensive applications to off-peak hours. However, with the advent of live sports streaming and a greater share of users viewing live sports via streaming applications, telecom operators are no longer in a position to influence busy hour usage by attempting to shift end-user behavior.

Telecom operators reported that they would need to explore solutions with streaming video-service providers in order to find sustainable solutions. Some potential options would be to use broadcast or multicast technologies, instead of the current OTT unicast streaming. But this would require the telecom operator to be an integral part of the service providers’ solution via some type of business to business to any end user (B2B2x) solution.

THE CRITICAL ROLE OF LATENCY

Latency, the delay between the transmission and reception of data, is another critical KPI monitored by telecom operators in addition to data consumption and throughput. In the future, latency could play a critical role in delivering smooth Metaverse, AR, and VR experiences and may require an overhaul of telecom network architecture. Latency can significantly impact user experience, especially in AR and Metaverse applications, as low latency is key to delivering an immersive, real-time user experience.

Reducing the number of hops from the end user to the application server lies at the core of reducing latency. In order to implement this, telecom operators may need to replace large parts of their RAN, backhaul network, transmission network, and core networks with direct point-to-point connections, in order to reduce the number of hops.

Another option is replacing slower legacy links with modern, faster links (e.g., fiber optic links) and reducing the number of hops in a given link. Edge data centers offer an additional alternative to service data traffic; unlike centralized servers, these are located physically closer to end users. These solutions are neither prescriptive nor exhaustive and simply serve to highlight the complexity that telecom operators will need to manage to reduce latency.

Lowering latency is far from easy for telecom operators, and in many cases achieving it might require a complete overhaul of the telecom’s infrastructure. We believe these operators will need to work closely with application and service providers to jointly come up with solutions to reduce latency, most likely through some form of B2B2x partnership model. In addition, we envisage service providers collocating their servers within the access infrastructure of the telco, while telecom operators modify their network architecture to reduce latency between end users and an application provider’s servers.

IOT & M2M: MORE VOLUME, BUT SMALL IMPACT ON DATA CONSUMPTION

Within the field of IoT and M2M connections, Europe has seen a surge in volume though IoT SIM cards, but not at the rate operators anticipated. According to OECD, M2M connections in the studied European countries reached around 186 million by 2021. However, actual data consumption by IoT SIM cards is quite low, in the range of a few tens of MB/month.

NB-IoT (Narrowband Internet of Things) and WB-IoT (Wideband Internet of Things) are two distinct technologies used for IoT connectivity.

NB-IOT: A NEGLIGIBLE IMPACT ON DATA CONSUMPTION

NB-IoT is a low-power, wide-area (LPWA) technology designed to give reliable, low-cost connectivity to a wide range of IoT devices. It is designed for devices with long battery life that need to send smaller amounts of data over long distances, making it ideal for applications such as smart meters, remote sensors, and other devices that only need to transmit data intermittently. Additional applications include smart cities, smart agriculture, and smart logistics. Average monthly data consumption may be significantly lower than what is used by mass-market offerings, measured in low megabytes per month.

WB-IOT: BELOW-AVERAGE CONSUMER DATA CONSUMPTION

WB-IoT is designed for applications requiring higher bandwidth and faster data transfer rates. It supports high-speed applications such as video streaming, VR, and AR. It is also made to support devices that need to transmit larger amounts of data frequently. WB-IoT is used for applications that require high-speed data transfer rates, such as connected cars, industrial automation, and smart homes.

Some of the technologies included in WB-IoT are:

-

Long-term evolution for machines (LTE-M) — an LPWA technology that achieves higher data transfer rates than NB-IoT.

-

5G — the next generation of cellular technology that promises higher bandwidth, faster data transfer rates, and lower latency than 4G.

-

Wi-Fi 6 — a new Wi-Fi standard that offers faster data transfer rates and more reliable connections than previous versions.

-

Bluetooth 5 — the latest version of the Bluetooth standard that offers longer ranges, higher data transfer rates, and better connectivity than previous versions.

-

Zigbee — a low-power wireless technology that is designed for home automation and other low-bandwidth applications.

Actual data consumption of an IoT SIM in a WB-IoT network can vary widely depending on the specific application and usage scenario. Some WB-IoT applications may require a few megabytes of data per month, while others may need significantly more. High-bandwidth applications, like video monitoring or industrial automation, will need significantly more, potentially several gigabytes per month.

NB-IOT: THE LION’S SHARE OF IOT

The majority (up to 95%) of IoT traffic has been and still is satisfied by NB-IoT networks, thus data traffic generated from NB-IoT connections will have a negligible impact on overall data consumption levels.

While WB-IoT also continues to grow, its share is expected to be less than 5% of the overall IoT volume. Monthly data consumption is expected to be far lower than the average consumer mobile data consumption, due to use of local storage, local processing, and efficient compression techniques, which preserve battery life and reduce unnecessary data processing.

According to telecom operators, certain types of IoT applications result in temporary spikes in data usage. One example is the rollout of software updates for automotive IoT; however, activities like this can be planned to the reduce impact on overall consumer network requirements.

In summary, we believe the consumer sector will continue to drive data consumption, and IoT will continue to have a limited impact on shaping data consumption trends.

DOWNLOAD THE FULL REPORT

The evolution of data growth in Europe

Evaluating the trends fueling data consumption in European markets

DATE

Executive Summary

HIGH DATA INTENSITY WILL DRIVE DATA CONSUMPTION GROWTH

Average household data consumption over telecommunication networks has steadily grown across Europe. Measured in gigabytes (GB) per month per user (GB/month), consumption has increased from approximately 5 GB/month in 2018 to 15 GB/month in 2022, for a growth rate of 25%. We expect Europe’s mobile data consumption per user to continue growing in the coming years, increasing from the 2022 level of approximately 15 GB/month to 75 GB/month by 2030, creating an annual growth rate of 25%. And we expect fixed data consumption per household to grow from the 2022 level of 225 GB/month to 900 GB/month by 2030, for an annual growth rate of 20%.

Overall monthly data consumption in gigabytes is determined by multiplying the amount of time spent online per day (measured in hours) by the data usage intensity of the applications used during that time (measured in GB/hour). The amount of time spent online appears to plateau at three to four hours a day for mobile (per individual) and six to 10 hours a day for fixed (per home). However, the data intensity of applications like videos and social networks is continuously increasing, which in turn drives up the hourly, and ultimately, the monthly data consumption.

Our data consumption forecast already includes all these expected trends. However, pushing the boundary of time spent per day using the most data-intensive applications could lead to extreme scenarios. For example, a household consuming 4K content for 12 hours a day would use 3,600 GB in one month. This scenario illustrates how technical leapfrogging of device capabilities and data hunger of applications may generate faster, more excessive data growth, which would affect underlying network investment requirements and their ability to ensure value and enable full experiences.

In the future, a number of trends will contribute to the data intensity of some use cases, boosting overall data consumption:

-

Improved video resolution from standard definition (SD) to high definition (HD).

-

High-definition 4K and 8K.

-

Higher consumption of HD live sports, especially on mobile handsets.

-

Increased use of short-form video on social networks.

-

The “metaversization” of use cases — watching videos, meeting people, attending concerts, and shopping.

-

The use of augmented reality (AR) and virtual reality VR).

-

Artificial intelligence (AI)-generated content.

Many publications report periodically on the growth of average data consumption (mostly focused on mobile), analyzing the differences between high-growth and low-growth markets. These reports provide a clear snapshot of the current state of data consumption and short- to medium-term forecasts. However, in this Report we delve deeper, analyzing the underlying demand-side factors that constitute actual data consumption as well as the supply-side factors that either constrain or fuel data consumption. We review both the mobile and the fixed side of these phenomena in order to forecast average data consumption between now and 2030.

1

SPECIFIC USE CASES WILL FUEL HIGH GROWTH TRAJECTORY

Telecommunication data consumption, measured in GB per month per user (“user” is defined as per SIM for mobile or per home or household for fixed) has continuously evolved over the last two decades. The growing average data consumption is an indicator of the constant digitalization of society as more services (watching videos, playing games, communicating with others) are consumed digitally and more activities are transacted online (e-commerce, Web browsing, cloud services). Average data consumption is an important key performance indicator (KPI) measured by telecom operators in conjunction with busy hour throughput and latency to support future infrastructure investment planning.

In 2020, pandemic-induced behavioral changes precipitated a spike in usage; fixed GB/month increased between 50% and 100%, while mobile GB/month was muted due to multiple lockdowns. However, fixed growth showed a dip in 2021 to pre-pandemic levels of around 20% by 2022, while mobile growth sprang back to pre-pandemic levels of 25% as soon as lockdowns were lifted. These permanent step increases in post-pandemic average data consumption are strong indicators of permanent changes in user behavior, namely greater consumption of digital services.

There are large variations in mobile data usage among European countries. Markets like Austria, Finland, Latvia, Lithuania, Sweden, and Denmark already exhibit usage of 20 or more GB/month, due to multiple factors including the availability of relatively low-priced high-volume data bundles, faster 5G rollout, a lack of nationwide FTTP (fiber to the premise) networks, and behavioral demand factors like mobile consumption of video and social network content. Other markets still show usage below 10 GB/month.

Fixed data consumption among countries in Europe also varies. Markets like Spain, Portugal, Latvia, and Lithuania, with high FTTP coverage, also exhibit higher fixed data consumption. Factors like the rollout of FTTP and the availability of higher-speed bundles will continue to drive growth of fixed data in their respective markets. Behavioral demand factors, such as the widespread use of streaming video services in markets like the UK, induce higher data consumption.

2

DEMAND DRIVERS — VIDEO, SOCIAL NETWORKING & LIVE SPORTS

MAINSTREAM USE CASES

Video and social networking continue to drive data consumption due to increased penetration of higher-resolution content and the move toward live sports streaming. We scanned a broad range of publications to identify the most popular mobile and fixed use cases and the average time spent on them. We then assessed the underlying data-intensity requirements for those activities to estimate the overall GB/month, broken down by fixed and mobile, and further broken down by each activity.

The most popular use cases for both mobile and fixed are:

-

Video consumption

-

Social networks, including short-form video

-

Gaming

-

E-commerce

-

Web browsing

Figure 1 shows additional details of the distribution of the above use cases in 2022 and 2030 and includes expected changes to overall composition, as well as the share of both time and data a user spends on each of these activities.

Video viewing

Video continues to be the main driver of data consumption, currently comprising approximately 60%-65% of total data consumption in Europe. We expect it to grow its share to 70%-75% by 2030, due to more penetration of higher-resolution content and the move toward live sports streaming. The average European spends approximately three to four hours a day watching videos, with most of those hours spent at home using a television, a tablet, or another large-screen device. Approximately one hour a day is also spent watching videos on mobile handsets while outside the home. Popular video service providers such as YouTube and Netflix are used, as well as the over-the-top (OTT) platforms of traditional and pay-TV operators. The availability of live sports via OTT players is a popular recent development.

We believe time spent watching videos will plateau at four to five hours per day. The data intensity (GB/hour) consumed increases constantly irrespective of which of the above video services are engaged. Our data-growth scenario includes the ongoing move from broadcast TV to Internet protocol TV (IPTV). Almost all users view videos in the default auto-quality mode, which implies that the video service provider automatically adjusts the quality, usually to the highest resolution possible, based on the user’s available bandwidth.

Currently, most videos are viewed in HD, requiring 1-3 GB/hour, and we expect this to increase to 8-10 GB/hour as the average quality improves from HD to 4K by 2030. Although higher quality, like 8K, is already available, we believe this will be a niche in the same period. Substantial 8K content and mass-market adoption of suitable viewing devices, like 8K TVs, are not widely available. We believe video consumption will evolve from HD to 4K by 2030, and most content available will be 4K by then. The mix of content in terms of resolution at the end of the time horizon as assumed in our model is 70% HD, 25% 4K, and 5% 8K.

Simultaneous viewing of live sports via OTT applications has a limited impact on overall monthly data consumption, as it simply serves as a substitute for other types of video content, though it has relevant impacts on other KPIs, such as the busy hour throughput of telecom operator networks.

Social networking

Coming in second to video in terms of data intensity, social networking takes the highest share of time on mobile, currently contributing the maximum time spent per day per user in the range of one to two hours a day. Over the long term, we believe the time spent by users on social networks will expand to three to four hours daily, as social networks continue to serve as substitutes for real-world interactions. At the same time, social networks are becoming more data-intensive.

The activities that comprise social networks have evolved from messaging a decade ago (e.g., over Facebook, Orkut, Google+), to posting images five years ago (e.g., Instagram), to posting short-form videos (e.g., TikTok) and multimedia-rich stories today. Soon, we anticipate an even larger share of higher-quality videos, and perhaps a Metaverse-enabled social experience in the future, which effectively requires multiple streams of simultaneous video and images in order to create an immersive experience.

In addition, these video- and image-rich apps are assumed to be guided by AI algorithms to pre-download content, which keep the user firmly engaged in an infinite scrolling experience without the need to pause and load the latest content. This process in turn increases the underlying data consumption.

These factors lead us to believe that the GB/hour required for social networks will increase from less than 1 GB/hour today to 1-3 GB/hour in the period until 2030.

Gaming

Gaming consumes both significant time and data, but penetration is limited to a small proportion of heavy gamers, contributing to approximately 10% of Europe’s total data consumption. But there are large differences between homes with heavy gamers and homes with no gamers. Game-like video usually consumes one HD stream of video, which usually currently requires 1-2 GB/hour of data and is expected to grow to 4-8 GB/hour as video-stream quality increases from HD to 4K.

The amount of time spent gaming can be as high as 8-10 hours a day for homes with active gamers, but accounts for less than an hour a day on average in a typical European home. As gaming moves to the cloud, factors such as latency, more multiplayer gaming, and broadcasting games via apps like Twitch, YouTube, and Facebook, will play a more significant role than data consumption.

The section on the Metaverse below discusses the implications of latency on telecom operators.

E-commerce

Internet transactions received a big boost related to the COVID-19 pandemic; some reports estimated that the volume more than doubled in the period between 2019–2021. We believe e-commerce is here to stay, and users will continue to spend time online, currently estimated at a half-hour a day, exploring products, reading reviews, and eventually making purchases. Product reviews in online marketplaces have also evolved from a few lines of text to image-rich reviews. Short video reviews of products are predicted for the future, which in turn will cause higher data consumption.

Nonetheless, we expect this consumption category to remain at a level below 1 GB/hour for mobile in the period until 2030. However, it could rise to 4-8 GB/hour for fixed, as some e-commerce activities have the potential to be carried out in the Metaverse.

Web browsing

Web browsing was one of the first use cases when the Internet gained mass-market acceptance in the 1990s, and we believe users will continue to spend time, estimated at a half-hour per day, browsing websites, despite competition from apps and other forms of digital experiences. Data intensity will increase with a move toward richer HTML5-based content.

Websites are constantly evolving as well, from early, plain HTML text websites to more image-rich websites, to HTML5-type websites displaying high-resolution images and videos and featuring smooth, continuous scrolling. This, in turn, will raise the amount of data required per hour, reaching levels of 1 GB/hour by 2030.

Other services

Cloud services, music streaming, background-operating system updates, and so on, constitute the remaining longtail of use cases, which consumes data but on a much lower scale than the use cases mentioned above. We estimated usage around 1 GB/hour in our analysis.

Differences between fixed & mobile

Video dominates data consumption on both fixed and mobile, but social networking captures the largest time-share in mobile. In our analysis, we modify the time (hours) and data intensity (GB/hour) requirements to account for differences in using an application based on whether it uses mobile data or a fixed connection. For example, users spend the most time on social networking activities on their mobile devices; on a fixed connection the maximum time is spent watching videos. Additionally, the quality, and hence the data intensity, is higher on fixed networks for activities like video and social networking due to devices like TV, tablets, and laptops, whose larger screens allow higher resolutions.

ADDITIONAL GROWTH DRIVERS & EMERGING USE CASES

We evaluated additional drivers and technologies influencing the data intensity of some of the use cases elaborated on in the previous section.

Device mix

The device mix determines data intensity and will differ for fixed networks and mobile networks. Fixed data consumption of video grows faster than mobile thanks to the greater presence of higher-resolution devices with large screens. We assume the primary device used to consume video is a TV with HD, with future upgrades to 4K and partially 8K occurring within the time horizon. Secondary devices for video consumption are assumed to be a second TV or a tablet that can handle HD. For e-commerce, Web browsing, and cloud activities, we assume a PC/laptop/tablet is the primary device at home versus a mobile handset for mobile. We also assume longer time spent (including background usage) on activities like cloud, music streaming, and so on, adjusted appropriately between fixed (PC/laptop/tablet) and mobile (handset).

AR & VR

These will increase data intensity and will modify some of the consumption behavior in existing use cases. We assume AR will primarily alter mobile use cases, as users will probably experience AR over their mobile devices. We believe AR will require data consumption rates equivalent to two times today’s HD video data throughputs (one for upstream, and one for downstream), but more importantly, AR will affect KPIs like latency and throughput to a greater extent. We assume VR will primarily be experienced via fixed networks, as it requires the user to wear a headset and be in a safe, enclosed space. The data requirements of VR are projected to require the equivalent of consuming three to six simultaneous video streams to account for the constantly changing user perspectives.

The Metaverse

Data-intensity changes provoked by the Metaverse will be similar to AR and VR. But the real challenge will be improving latency, which calls for an overhaul of existing telecom network architectures. While the Metaverse has received a fair share of attention in the recent past, especially after the rebranding of Facebook to Meta in 2021, the actual number of Metaverse use cases and the share of active Metaverse users (i.e., engaging at least once a week) is estimated to be low (in the range of tens of millions). Although many publications claim the Metaverse has hundreds of millions of users, we think they are mostly one-time users, so far.

We accounted for a fair share of metaversization of our core use cases, reviewing video consumption, social networking, gaming, and e-commerce that use Metaverse-type applications. We expect a portion of each use case to be consumed by the Metaverse in the future. Gaming is the most likely starting point, as Metaverse versions of games are already available from providers like Roblox, followed by video consumption (e.g., watching a live concert in the Metaverse), social networking (e.g., meeting friends in a virtual café or participating in Metaverse discussions), and e-commerce (e.g., shopping the multiple brands that have already launched Metaverse stores so shoppers can virtually experience a product before purchasing).

In terms of data, we assume Metaverse activities will be similar to VR and consume the equivalent of three to six simultaneous HD video streams. We assume up to one hour of use cases per day will be conducted using AR, VR, or Metaverse applications per day by 2030 and adjusted the data intensity of those use cases accordingly.