Network sharing in the 5G era

Choosing the right sharing model to maximize efficiency of 5G rollout

Executive Summary

5G has triggered a new wave of interest in network sharing. Similar to the previous wave of network sharing seen during the 4G rollout years (2010-2014), operators aim for similar highlevel objectives to maximize rollout, minimize CAPEX and TCO and improve overall network quality.

However, 5G-based network sharing brings along with it a new set of challenges that telecom operators need to resolve in their overall network-sharing strategies:

- 5G rollout tied with 4G, as the so-called non-standalone 5G, is the deployment method for established telcos as they seek a soft transition to future 5G, both in terms of network rollout and end-user traffic migration. Hence, any 5G network-sharing strategy automatically also implies 4G sharing.

- Sunsetting of legacy technologies like 2G/3G is high on the agenda of telecom operators as they closely monitor cost per unit of throughput. This gives rise to the dilemma of whether legacy technologies should be left as-is or be shared with a potential partner along with 4G/5G sharing.

- Non-telecom entities are increasingly interested in rolling out and operating 5G (or at least parts of the telecommunication infrastructure). Railway companies, city authorities or large industrial players could be considered viable candidates for network-sharing partnerships by MNOs.

- Regulatory requirements are being eased for active network sharing. As a result, regulators are allowing nationwide sharing (excluding the top few dense urban areas), even with spectrum pooling, for new 5G spectrum bands like 3.5 GHz. Operators should make use of this window of regulatory leniency to forge new network-sharing agreements.

Other network-sharing levers like choosing the right financial model and defining the right governance structure still are key elements in ensuring long-term sustainable partnerships. Objective and technology-centric analysis needs to be balanced with soft skills such as compromise to ensure a successful network-sharing agreement.

Selecting the right network-sharing model is a fine balance of determining the right strategic considerations of your future 5G network while ensuring favorable financial economics. Arthur D. Little has already supported numerous players in exploring or concluding network-sharing deals throughout different technology generations (including 5G). In this report, we share our most recent learning and expertise to assist telecom operators to conceptualize and detail their respective 5G-driven network-sharing strategies.

1

Network sharing is widespread in most telecom markets

While network sharing is a common practice in almost every telecom market in the world, the range of options for network sharing are diverse, and there is no one-size-fits-all model. Sharing of the passive infrastructure only (tower sharing, for example) happens quite often, even on an ad hoc basis with regular infrastructure wholesale agreements.

The best time to begin network sharing is just before rolling out a new technology (e.g., currently 5G), since the main driver of synergies is not just cost optimization but also avoiding redundant future CAPEX

Active network sharing became popular with the advent of 4G rollout in the decade after 2010. In many markets (especially in developing markets in Asia, Africa, Middle East, Latin America and some markets in Europe), spectrum pooling is not allowed, hence MORAN-based sharing is a popular model (O2 and Vodafone in the UK, Orange and Vodafone in Spain and SFR and Bouygues Telecom in France).

In markets where spectrum pooling is not prohibited by regulation (e.g., North America, some European markets, AsiaPacific), we also see MOCN-based active network sharing with spectrum pooling (e.g., Net4Mobility, a joint venture in Sweden between Telenor and Tele2; Telia and Telenor in Denmark; and Orange and T-Mobile in Poland).

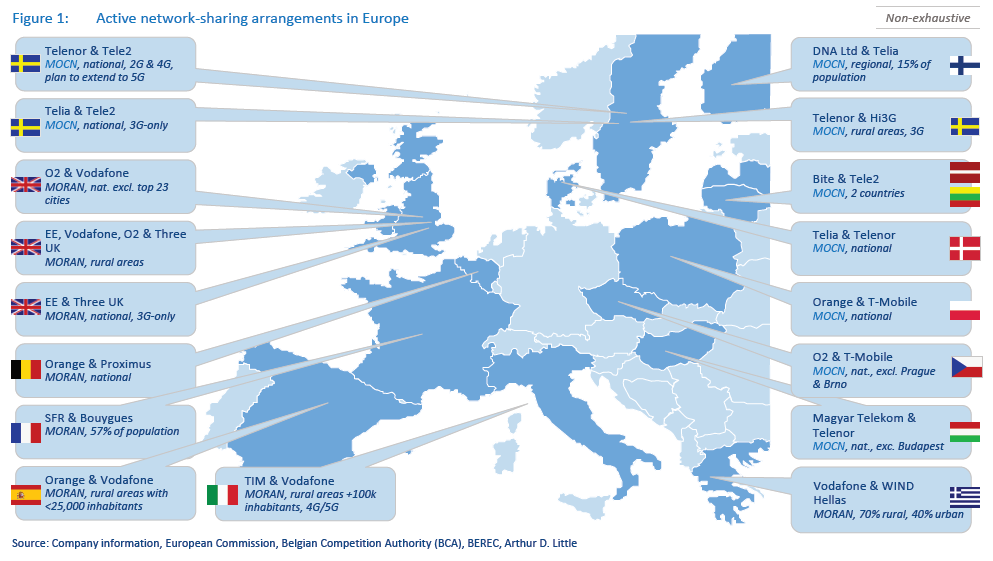

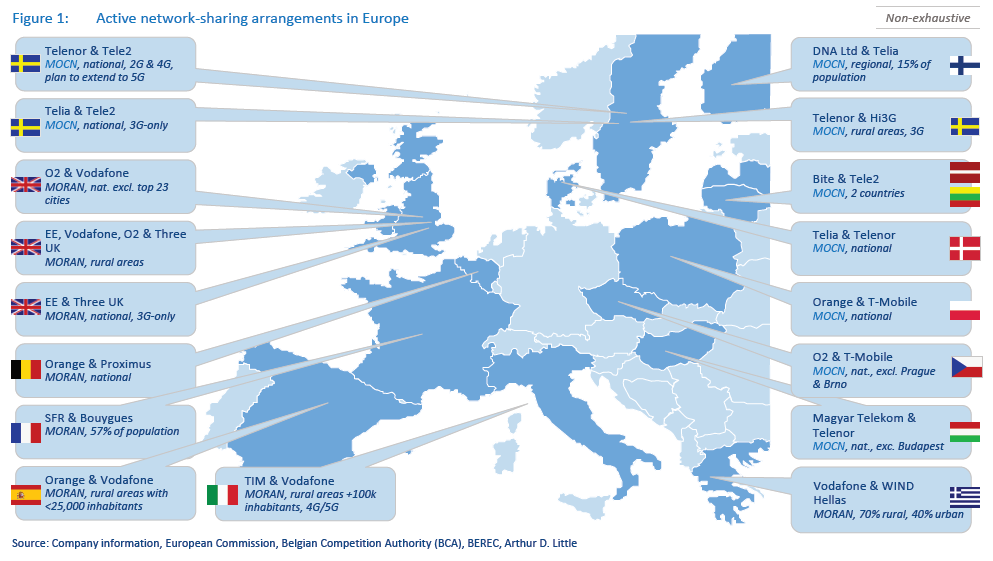

In the majority of markets in Europe, network sharing clearly extends to the active layer of the network (see Figure 1).

2

5G is triggering a new wave of interest in active network sharing

The advent of 5G has triggered a new wave of interest in network sharing in markets and operators that have not yet been involved in such ventures. 5G demands high investment in the radio access network and transmission network, due to the following:

- High spectrum costs in several new bands (700-800 MHz, 3.5-3.7 GHz, 20-26 GHz).

- Grid densification for C-band (3.5-3.7 GHz) of 1.6-1.8 times more sites and up to 10 times more small cell sites than macro/microsites for mmWave bands (20-26 GHz).

- Fiber optic backhaul to most sites (70-80 percent) for transport capacity of n x 10 Gbps per site (n = number of sectors/active antenna units [AAUs]).

- 5G sites with AAUs and massive MIMO (e.g., 64x64 in urban areas).

These investments are in areas with existing network overbuild, where typically 3-4 MNOs already have overlapping networks, which creates a strong potential for optimization of future infrastructure deployment with network sharing.

Operators with existing 4G MORAN/MOCN agreements are working towards incrementally extending the scope of their cooperation to include 5G as well (Vodafone/O2 in the UK, Vodafone/Orange in Spain and Orange/T-Mobile in Poland). A recent, greenfield network-sharing agreement in Belgium between Proximus and Orange also plans all-technologies MORAN sharing, including 5G (both MNOs have already set up a JV – MWingz – to facilitate joint network planning and operations).

Most MNOs in the world deploy 5G by incrementally upgrading their 4G networks (non-standalone), creating a tight coupling between the existing 4G layer and the future 5G layer (using the same core and spectrum anchoring). Incumbent vendors also encourage this path, as it eases the transition to 5G infrastructure, allowing early access to 5G network capacity even while the majority of devices are still not 5G-ready.

Early cases are showing promising results in applying this model. As an example, in June 2020, South Korea reported the highest number of 5G mobile subscribers in the world (>6 million subscribers handled between the three MNOs). The MNOs actively switch between 4G and 5G networks to achieve the right balance between speed, latency and battery life and offer >1 Gbps speeds at retail prices of US $60-70 per month, with an estimated 24 percent of data already handled by 5G in Q1 2020.

We have observed that legacy 2G/3G technologies do not have the same importance as 4G in evolution towards 5G. Operators are considering leaving legacy 2G/3G out of their 5G-focused network-sharing agreements, with the aim to retire and eventually decommission legacy technologies and re-farm this spectrum for 4G/5G deployment.

3

4G/5G Network sharing allows decoupling from legacy 2G/3G

In the past, most active network-sharing JVs have either focused exclusively on 4G (e.g., Net4Mobility in Sweden, and EE and Three in the UK) or primarily facilitated rolling out 4G along with sharing of the underlying 2G/3G (e.g., Orange and T-Mobile in Poland, O2 and Vodafone in the UK and Orange and Vodafone in Spain).

The new wave of 5G network-sharing agreements continue to be more selective, typically focusing on 4G/5G and excluding legacy 2G/3G from the scope of sharing. For example, the network sharing by T-Mobile and Sprint in the US focuses on sharing the company’s 4G and 5G (MOCN) networks. In May 2020, they successfully demonstrated gigabit+ speeds using 40 MHz of Sprint’s 2,500 MHz band, 20 MHz of T-Mobile’s 2,500 MHz and 1,700 MHz bands using an LTE and 5G aggregation model.

Another example is in South Korea between KT Corp, SK Telecom and LG Uplus, which reportedly partnered with an additional 17 local municipalities/governments to roll out active network sharing based on 4G and 5G (on both 3.5 GHz and 28 GHz spectrum bands).

Arthur D. Little has also been involved in facilitating several network-sharing agreements, with a focus exclusively on 4G/5G sharing leaving out legacy technologies:

- In 2019 and 2020, Arthur D. Little supported several operators in different markets to develop their 4G/5Gonly MORAN/MOCN sharing partnerships (with some remaining at a concept phase and others proceeding to implementation). A couple of these cases excluded 2G/3G from the scope of sharing. One reason 2G/3G was excluded was to avoid MORAN/MOCN transformation costs of legacy technologies. Another reason was due to asymmetries in the existing legacy technology network between the operators (e.g., one operator had only national roaming agreements for 2G).

- Arthur D. Little supported a new MNO entrant on a pure 5G network that was interested in 5G-only network sharing with 4G roaming until 5G devices become mass market. For this player, being lean, efficient and competitive on network QoS and TCO were key KPIs that were viewed as more important than backward compatibility with legacy technologies.

- In 2019 we also worked with a European cable company that acquired a 3.5 GHz spectrum to extend its footprint with 5G-based FWA. 5G-based MOCN sharing is being evaluated to sell excess capacity on the network in areas where the company does not intend to extend its fixed footprint.

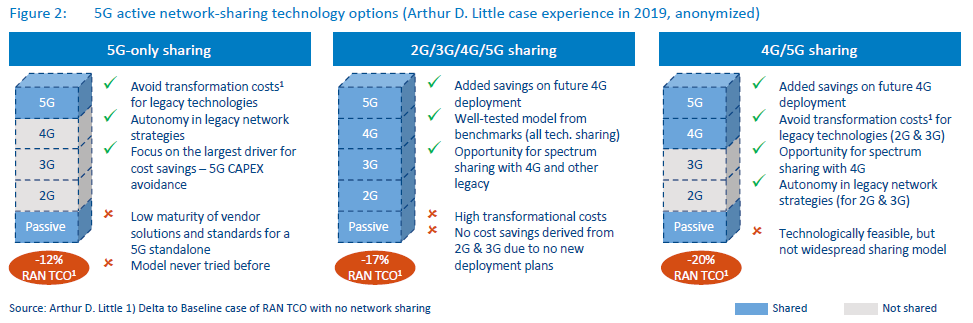

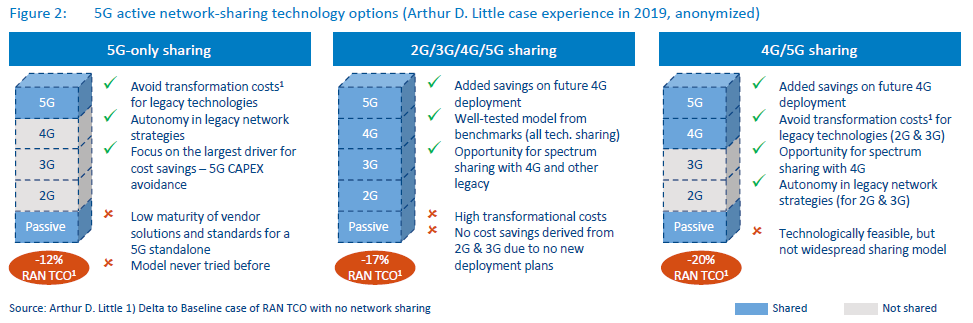

Some operators also consider sharing only their future 5G networks. However, due to lack of commercial, stand-alone 5G infrastructure and low penetration of mass market 5G devices, such 5G-only active network-sharing models are not yet gaining traction (see Figure 2).

The key questions to ask in order to choose the right technology model are:

- What has the largest impact (e.g., 5G, 4G, grid optimization) on our savings potential?

- Which parts of the network should be upgraded/ transformed to MORAN/MOCN?

- Do the partners have asymmetries (especially sunset plans) in their technology roadmaps?

- What new vendor options do I have for 5G? Do I have any attractive legacy vendor agreements to preserve?

- How do my network-sharing plans impact the commercial takeup of 5G?

- What degree of complexity of transformation/optimization and of continuous operations (given an attractive business case) can each operator tolerate in their network?

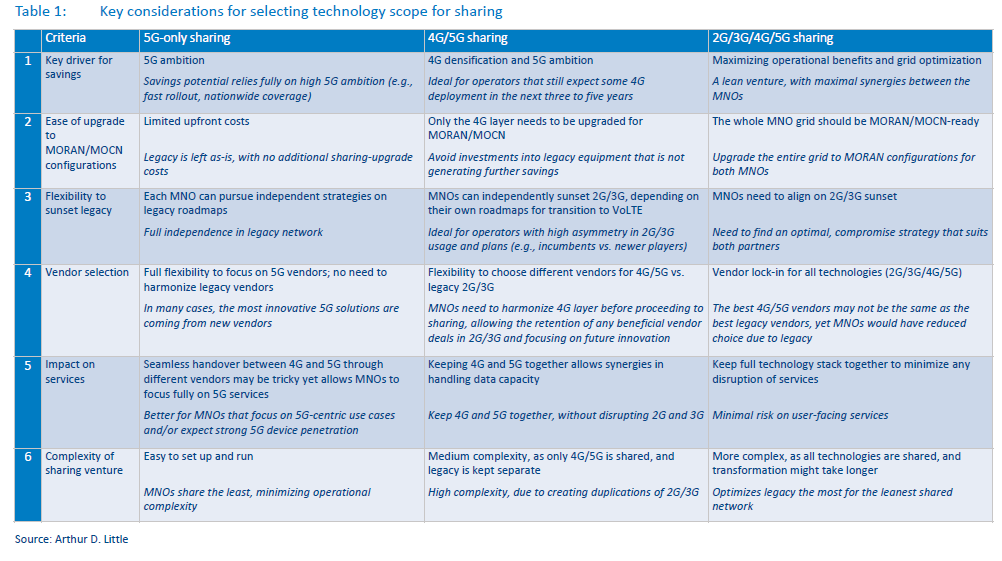

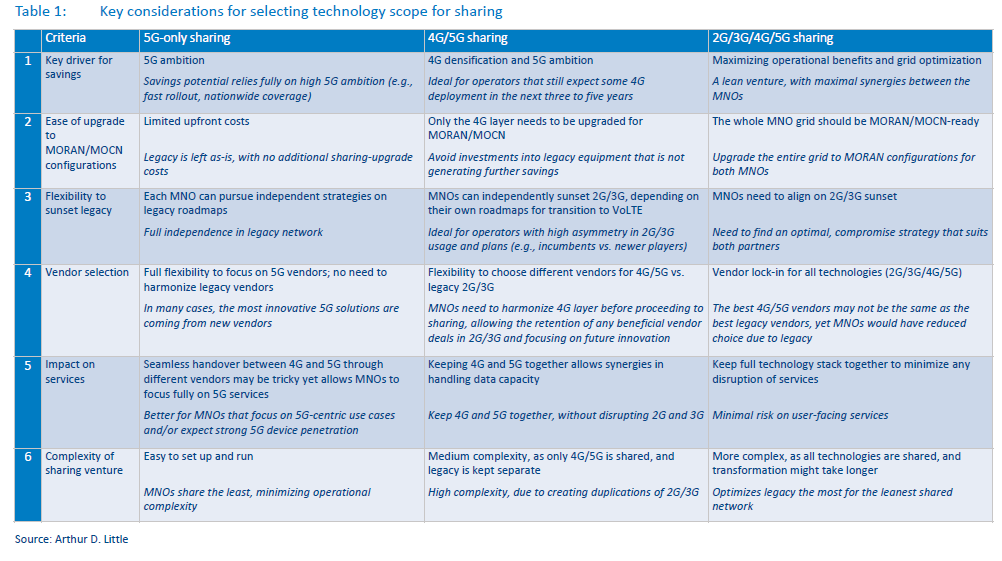

In Table 1, we highlight how each of these questions leads to a preference for a particular technology model. The decision the operator makes today will effectively bind them to that decision for the entire 5G deployment cycle for the next decade, hence operators should take due care in ensuring that the technologysharing model reflects their long-term network strategy

4

New, non-telco entrants are showing interest in 5G rollout and sharing

In recent years, numerous non-telcos have gained access to 5G spectrum in industry-specific or regional license blocks allotted through national auctions (e.g., part of 3.5 GHz in Germany has been kept aside for regional campus deployment). One of the main motivations for this segmentation is to build private mobile campus networks that have sufficient dimension to fit the quality, security, reliability and cost parameters of the given industry (typically manufacturing, mining, venues, logistics and travel).

Entities with distributed geographical infrastructure (e.g., railway, utility and public transport) are becoming increasingly receptive to the idea of deploying their own 5G networks for internal use as well as to sell excess capacity via wholesale to other players. Such networks would provide wholesale services to MNOs, especially to support them in their rollout plans for 4G/5G where critical civil infrastructure is involved, which may produce some unattractive standalone commercial economics if the MNO were to deploy such a network on its own.

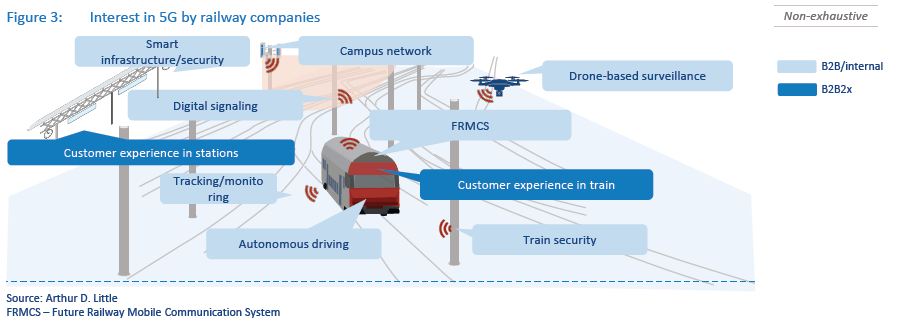

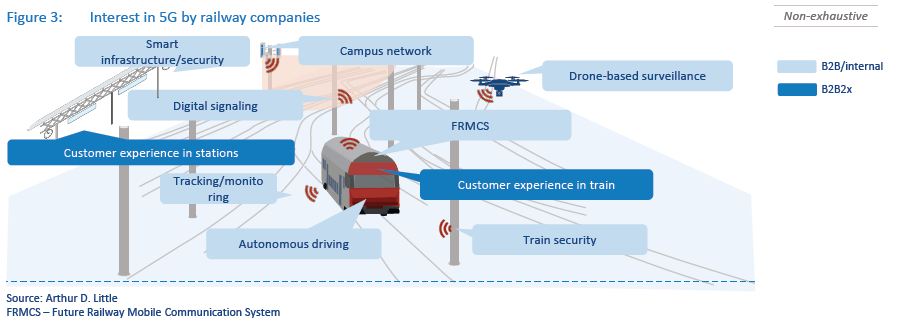

As an example, Arthur D. Little is currently assisting several railway companies in Europe to define their 5G strategies. One key area they are considering is improving their own communications requirements and achieving efficiency in core operations using connectivity use cases (e.g., autonomous driving and improved digital signalling). At the same time, they aim to unlock new revenue opportunities and improve customer experience in their trains and stations. A key solution to operationalize such a strategy involves 5G network sharing with other telecom operators.

In the past, leveraging non-telecom infrastructure (poles, real estate, ducts or optical fiber) was a proven operating model for railway companies to monetize their infrastructure (see Figure 3). With a 5G network, a railway company can provide neutral host services or wholesale data services to MNOs on a pay-peruse basis, requiring minimal upfront investment by the MNOs.

Under a MORAN model (shared RAN, separate spectrum), non-telco players can allow MNOs to significantly minimize deployment costs, especially by sharing expensive 5G base station equipment and AAUs. Additionally, infrastructure players with their own spectrum can further share the RAN for their own use cases.

In MOCN (shared RAN, pooled spectrum), operators of infrastructure in areas with sparse usage can provide further benefits to operators by allowing them to leverage the differences during busy and peak times as well as other asymmetries in spectrum holdings to optimize capacity. Additionally, players that do not fully utilize their spectrum can further monetize it by allowing MNOs to use this spectrum to fulfil capacity requirements in other parts of the country.

These new models (for non-ICT players) of active RAN sharing can be perceived as the next step in MNOs relying increasingly on optimized, shared infrastructure and focusing on their core competencies of service operations and commercialization, as they leave the infrastructure pieces to entities with greater assets.

5

European regulators are warming up to active network sharing

Regulators are becoming increasingly open to the idea that expanding our nationwide cost-efficient 5G networks will require sharing of some sort, such as active network sharing and spectrum sharing. A 2018 Body of European Regulators for Electronic Communications (BEREC) report indicates that regulatory bodies in Europe are seeking to develop a common European position on sharing, especially given the wave of 5G rollout expected and the challenges associated with 5G rollout (increased site fiberization, 10x new microsites/small cells, indoor coverage and high band and mm wavelength deployment).

In 5G spectrum auctions in Europe, multiple regulators have indicated the possibility of active network sharing under certain conditions, including by non-telco entities. For example, in a 2019 3.5 GHz spectrum auction, the Austrian Regulatory Authority for Broadcasting and Telecommunications indicated that active network sharing (including spectrum sharing) could be permitted under certain conditions (in general, sharing could be potentially permitted everywhere except in the three largest cities). However, explicit regulatory permission would be required before implementing an active network-sharing agreement. German regulator Bundesnetzagentur also allows active network sharing under certain conditions (regional/rural sharing) but does not yet allow spectrum pooling. Some other markets like Denmark and Sweden allow active network sharing with spectrum pooling on a national level, as long as it does not distort retail market competition.

On the other hand, competition agencies are taking tougher positions when the incumbent is involved in network sharing. In 2019, Proximus and Orange Belgium announced a MORAN all-technology network-sharing agreement, which was under regulatory review by the Belgian Competition Authority, with work towards the agreement resumed as of 18 March 2020. The European Commission is also investigating the networksharing agreement between O2/CETIN and T-Mobile in the Czech Republic to ensure competition is not restricted. In all these cases, the main argument brought forward by the competition agencies is that the sharing covered more than 70-80 percent of the population coverage and harms the competitiveness of the market, as it leaves the third player out of the network-sharing arrangement.

Many 5G network-sharing agreements specifically mention that the focus will be on rural network sharing, and the most dense urban cities will be left out of the arrangement. For example, an active network-sharing deal between TIM and Vodafone Italy announced in 2019 mentions that it only covers cities and towns with a population of fewer than 100,000 inhabitants.

6

Governance models must be tailored to each party’s objectives

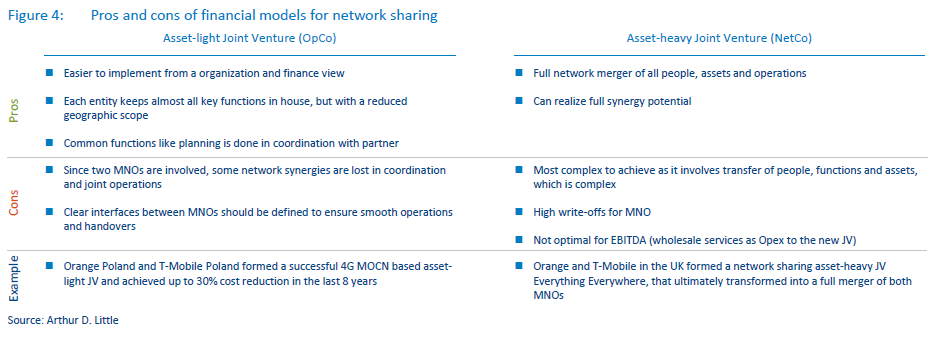

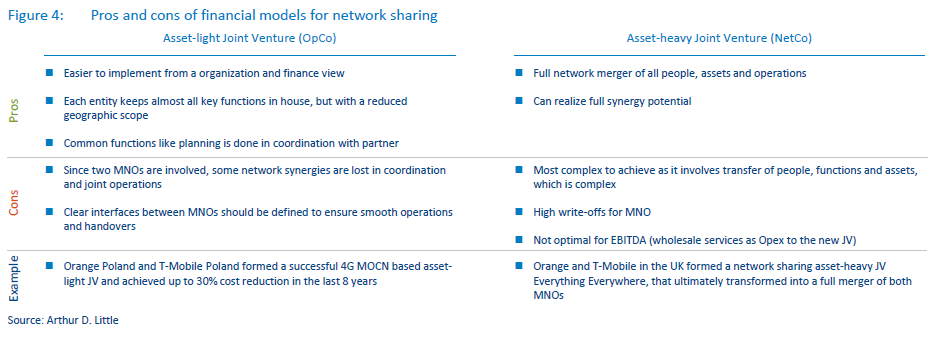

The key question in terms of the governance model is what vehicle to use (see Figure 4):

- An asset-heavy JV, carving the assets into a legally independent JV

- An asset-light JV (or no JV; only using contractual agreement), handling joint planning and a few other key functions (no asset transfer).

And, once the model is chosen, parties must determine how investment, risk and reward are to be shared fairly. Both models need to be aligned more with the strategy of the shareholder/ owner than the MNOs themselves, as the shareholder’s/ owner’s strategy will determine what the MNO’s financial statements (e.g., EBITDA, balance sheet) will look like in the long run.

In theory, either financial model can help operators achieve their network-sharing objectives, albeit with different (typically operational) constraints.

Asset-heavy JVs are typically better structured to drive consolidation and joint rollout synergies in network sharing, as the overall network is owned and operated by one neutral JV.

Yet, carving out assets, people and functions can be complex and take time, especially considering the additional write-off and tax implications and reorganization of the telcos’ D/E structure that is needed. Furthermore, the valuation of the assets themselves can be a point of intense negotiation between the operators. On the other hand, when the two MNOs have a shared infrastructure investment vehicle, it can be further used to onboard future financial partners (e.g., infrastructure PE funds) to monetize the infrastructure and generate cash for the MNOs. Arthur D. Little has worked with two MNOs in a CEE market that successfully carved out their RAN (2G, 3G and 4G) and backhaul networks, along with the associated functions, staff and processes, to form a MOCN-based, asset-heavy JV.

Asset-light JVs (or agreements only) avoid the complexity of carve outs and thus are easier (faster) to implement; hence increasing the likelihood of a successful agreement and speeding up implementation. Yet, a key risk with this model is the operational complexity, especially if the deal takes the share of an agreement without formation of a JV. However, examples from the UK (Cornerstone and MBNL) and Poland (NetWorkS!) show how asset-light JVs can transition into their own infrastructure service companies.

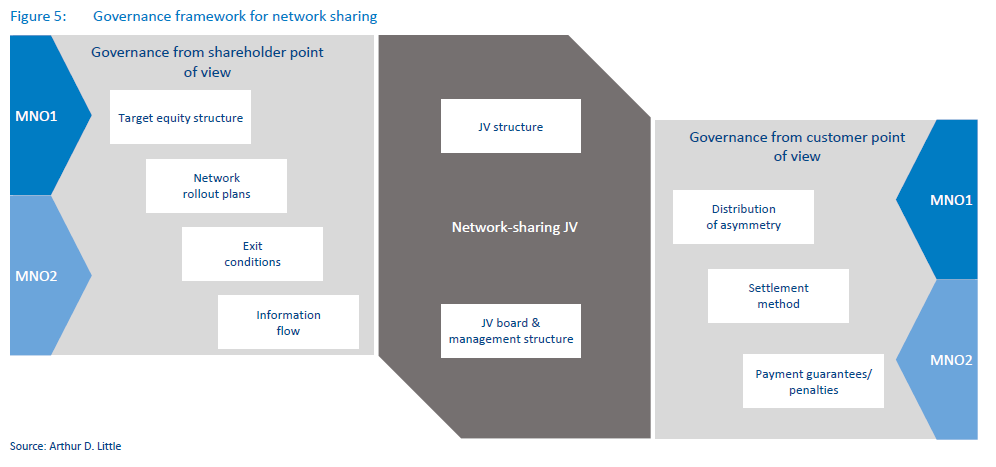

Regardless of the sharing model, a core set of governance principles need to be aligned to ensure fair sharing of investment risk and reward. The model should also allow for fair acknowledgement and settlement of asymmetries (e.g., differences in sites contributed, capacities contributed, and in decommissioning of sites).

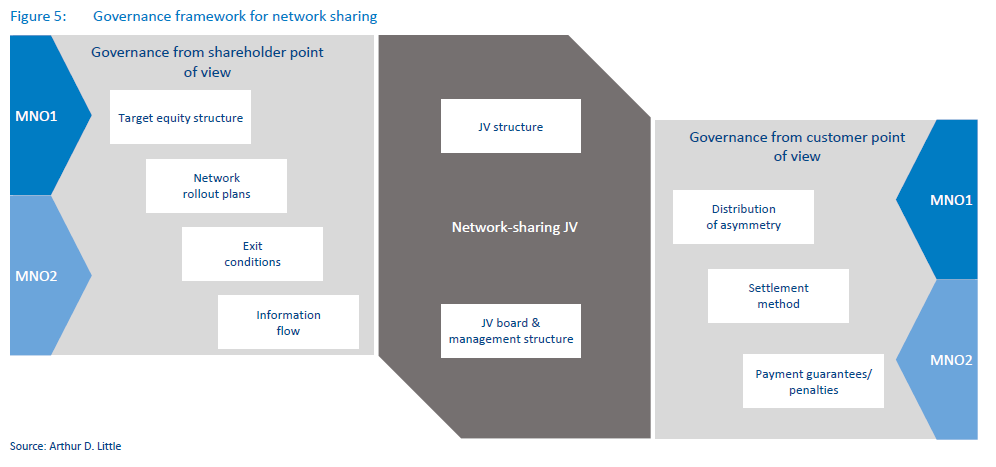

Arthur D. Little has developed a governance framework that has enabled us to successfully conceptualize and detail the elements of governance feeding into the term sheet and other legal documents (see Figure 5). Detailed insights into choosing the right financial model and governance model can be found in our previous report on network sharing, “Network Cooperation: Making It Work and Creating Value,” which can assist your understanding of each key governance lever and enable each party to frame their respective position on each of these levers.

7

Network sharing as a stepping-stone for overall company strategy

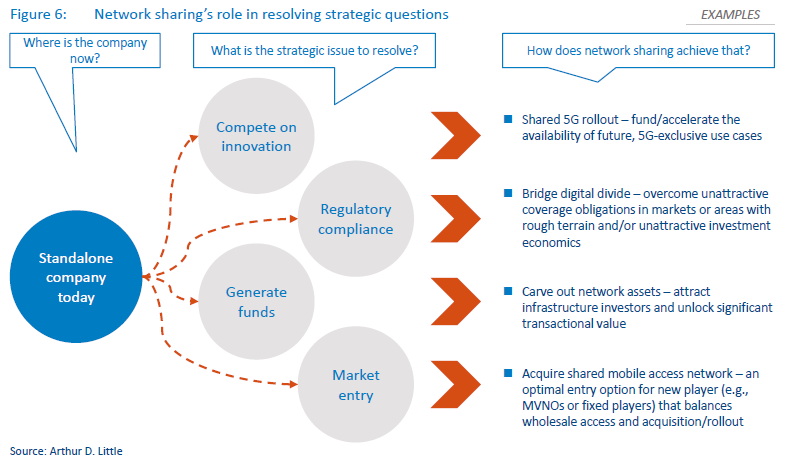

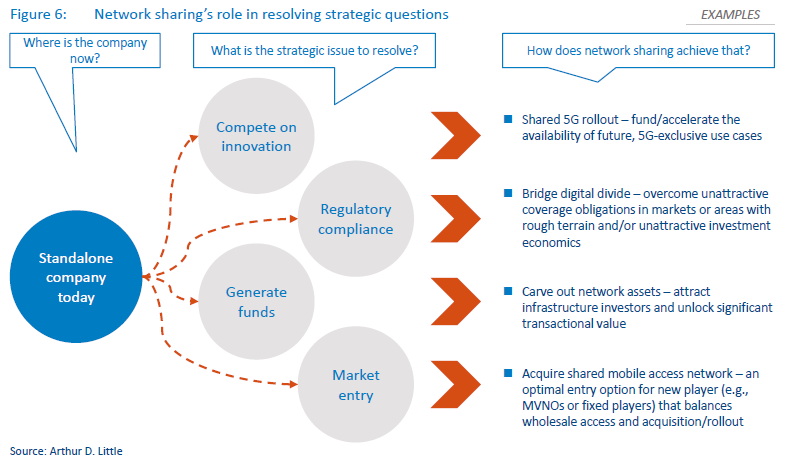

Network sharing cannot be adopted as a standalone, costoptimization exercise and should be linked with the overall corporate strategy of the MNO because it has long-lasting implications in terms of both strategic benefits and constraints on the ability of the MNO to deliver its commercial strategy. The exercise should be aligned on several layers balancing financial, operational, strategic and regulatory objectives before the MNO commits to sharing network assets with a competing MNO.

In our experience at Arthur D. Little, we have seen cases where network sharing has been seen as a necessity to facilitate technology evolution (even during 4G introduction), a response to unattractive economics of coverage obligations (mountainous, sparsely populated areas), a tool for investors to create (carve out of asset-heavy, pure-infrastructure JV) and as market entry (see Figure 6).

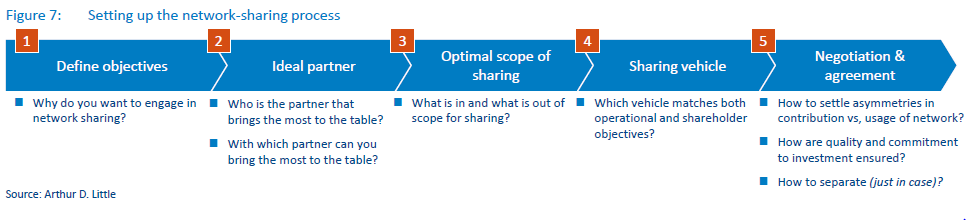

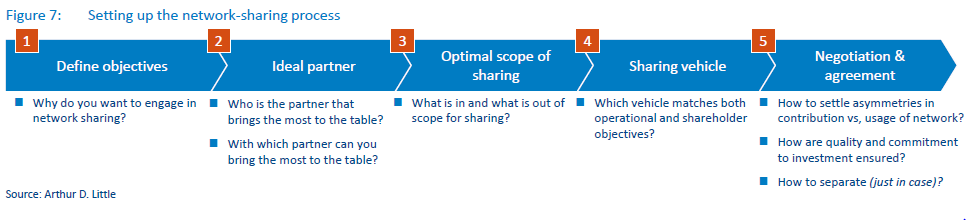

Network sharing is a long journey that can take between one and two years solely to set up an agreement and three to five years to fully implement and achieve a new “normal” for the shared network. Throughout this process, both partners should retain sight of the link between sharing and corporate strategy. A structured approach is necessary at all times to keep this link and to guide operators through the key questions, ensuring that vital steps are not skipped and that decisions are not taken prematurely. Here and in Figure 7, we share a perspective on the typical process an operator (or investor or any other interested entity) needs to undertake to steer their network-sharing strategy

- Define objective(s): why does this initiative need to take place?

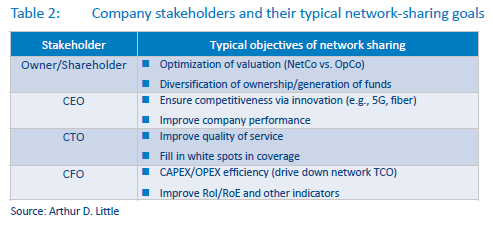

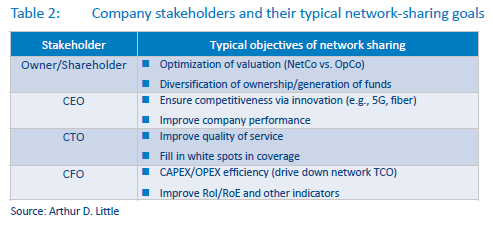

Clarity on the reasons for network sharing ensures stakeholder buy-in throughout the whole process and serves as the guidance in all decision making throughout the long process. Yet, it requires balance and compromise between numerous decision-making stakeholders – CEO, CTO, CFO and the shareholder(s). The goals, as shown in Table 2, may often be contradictory or mutually exclusive as well, such as:

- Do you maximize performance or optimize costs?

- Do you optimizing EBITDA or minimize CAPEX?

- Is it the valuation of the current company or valuation of the to-be JV?

- Ideal partner: with whom to share a network?

Give consideration to what each potential partner brings to the table – access to fiber, access to better (exclusive?)

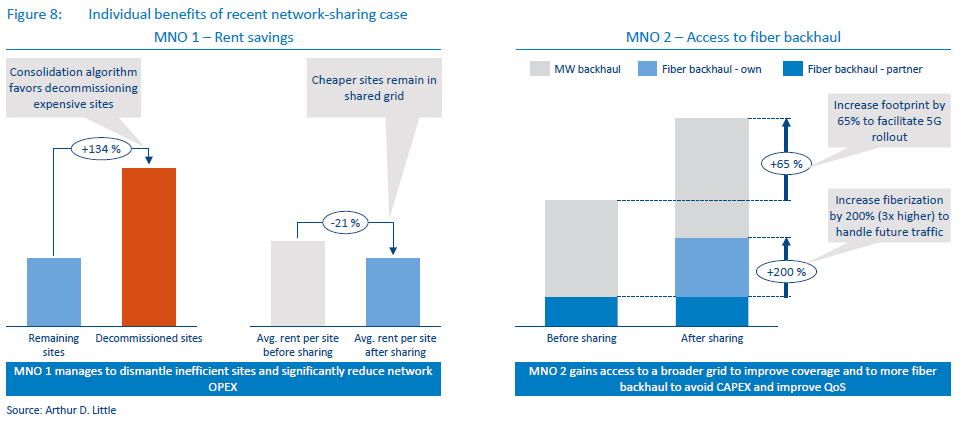

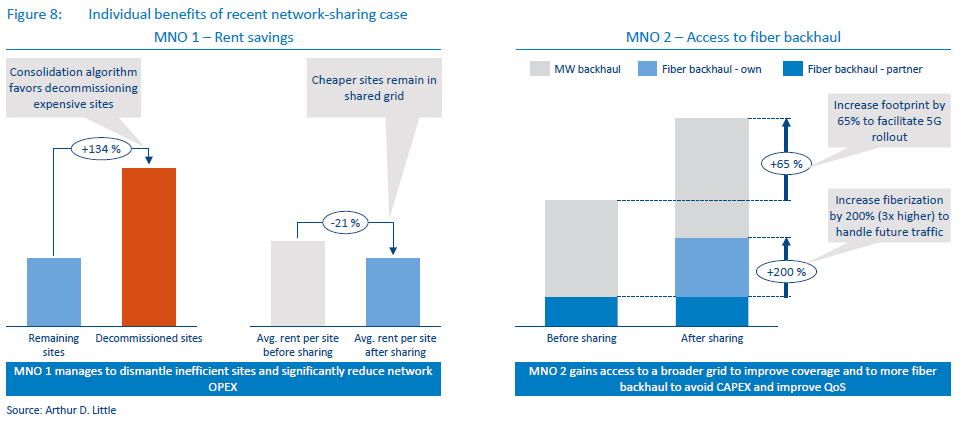

site locations, complementary coverage or opportunities for coverage densification. Inversely, an operator must be aware of the benefits and value proposition they bring in as network partners to ensure a mutually beneficial relationship. The example in Figure 8 shows how partners can complement each other in terms of footprint, fiber backhaul access and operating efficiency of the network.

And, as we have already mentioned, the search need not be limited only to other MNOs. A broader scope of potential partners must be considered in the context of 5G, where the ecosystem of infrastructure owners can be much more diverse than with traditional operators.

- Optimal scope of sharing: what is to be shared?

Operators must determine the scope of sharing, which would optimally fulfil the selected objectives of sharing:

- Assets. These include towers, backhaul, antennas, baseband, spectrum and core network and backbone.

- Technologies. While a major part of partnerships include all mobile generations, future-focused cooperation (e.g., 4G or 5G) is also possible, especially in cases of asymmetries between the partners on legacy (current status or future plans).

- Geographies. Identify the parts (e.g., rural, urban or selected areas) of the country that drive achievement of the objectives. Here, regulators and competition authorities often play a role in limiting the scope of cooperation with a focus on rural and underserved areas over urban and denseurban areas.

- Processes. Agree on the degree of joint network operations: planning, deployment, field operations or even procurement have been shared in network-sharing deals.

- Sharing vehicle: how to make network sharing happen?

Network sharing will determine the shape of the MNO’s most important asset for the next decade. Once implemented, exit is difficult and costly to execute. In this long-term commitment, the vision of the company’s leadership plays a key role in driving the operationalization of the network-sharing strategy.

It is vital that operators decide whether to carve out or keep assets within the current legal entity. Network-sharing assetheavy JVs can be a stepping-stone to further carve outs or opening up networks to third parties or investors. Vehicles with lighter asset ownership may be used to retain a higher degree of control over networks and can be a good way to overcome initial partner mistrust.

- Negotiation and implementation: time to act

After all the plans have been laid out, next is implementation, which is a long journey on its own with up to two years to setup the agreement and up to three to five years to fully execute consolidation/transformation plans.

Throughout the whole process, negotiations and compromise are key to facilitate results. Determining which impasses can be placed on pause until other issues are resolved can be a good way to manage this process. Not everything needs to be clear and resolved from Day 1.

During the implementation phase, capable, neutral consultants can provide the necessary objectivity and expertise to facilitate agreement. Operators must also retain a mindset of trust and partnership that will allow them to make network sharing viable in the long run.

In conclusion, in this report, we hope to have provided a perspective for MNOs and other entities rolling out 5G networks to consider network sharing as a valid strategy to operationalize their respective 5G networks. We have also highlighted the key areas in which 5G-based network sharing is different from earlier 4G-based network sharing.

There are numerous factors to watch from the start (e.g., regulatory approval, asymmetries and operational complexities). However, it is also important to note that many of these factors remain fluid to some degree throughout the negotiation process, and many roadblocks can be resolved when both parties keep the end objective in sight, whether it’s having the best network, obtaining the most synergy savings or another goal.

Each network-sharing deal is uniquely designed to fit the strategic requirements of that particular founding partner and must be tailor-made based on the technology, financial, regulatory and governance constraints of the particular entities that wish to share their networks.

DOWNLOAD THE FULL REPORT

Network sharing in the 5G era

Choosing the right sharing model to maximize efficiency of 5G rollout

DATE

Executive Summary

5G has triggered a new wave of interest in network sharing. Similar to the previous wave of network sharing seen during the 4G rollout years (2010-2014), operators aim for similar highlevel objectives to maximize rollout, minimize CAPEX and TCO and improve overall network quality.

However, 5G-based network sharing brings along with it a new set of challenges that telecom operators need to resolve in their overall network-sharing strategies:

- 5G rollout tied with 4G, as the so-called non-standalone 5G, is the deployment method for established telcos as they seek a soft transition to future 5G, both in terms of network rollout and end-user traffic migration. Hence, any 5G network-sharing strategy automatically also implies 4G sharing.

- Sunsetting of legacy technologies like 2G/3G is high on the agenda of telecom operators as they closely monitor cost per unit of throughput. This gives rise to the dilemma of whether legacy technologies should be left as-is or be shared with a potential partner along with 4G/5G sharing.

- Non-telecom entities are increasingly interested in rolling out and operating 5G (or at least parts of the telecommunication infrastructure). Railway companies, city authorities or large industrial players could be considered viable candidates for network-sharing partnerships by MNOs.

- Regulatory requirements are being eased for active network sharing. As a result, regulators are allowing nationwide sharing (excluding the top few dense urban areas), even with spectrum pooling, for new 5G spectrum bands like 3.5 GHz. Operators should make use of this window of regulatory leniency to forge new network-sharing agreements.

Other network-sharing levers like choosing the right financial model and defining the right governance structure still are key elements in ensuring long-term sustainable partnerships. Objective and technology-centric analysis needs to be balanced with soft skills such as compromise to ensure a successful network-sharing agreement.

Selecting the right network-sharing model is a fine balance of determining the right strategic considerations of your future 5G network while ensuring favorable financial economics. Arthur D. Little has already supported numerous players in exploring or concluding network-sharing deals throughout different technology generations (including 5G). In this report, we share our most recent learning and expertise to assist telecom operators to conceptualize and detail their respective 5G-driven network-sharing strategies.

1

Network sharing is widespread in most telecom markets

While network sharing is a common practice in almost every telecom market in the world, the range of options for network sharing are diverse, and there is no one-size-fits-all model. Sharing of the passive infrastructure only (tower sharing, for example) happens quite often, even on an ad hoc basis with regular infrastructure wholesale agreements.

The best time to begin network sharing is just before rolling out a new technology (e.g., currently 5G), since the main driver of synergies is not just cost optimization but also avoiding redundant future CAPEX

Active network sharing became popular with the advent of 4G rollout in the decade after 2010. In many markets (especially in developing markets in Asia, Africa, Middle East, Latin America and some markets in Europe), spectrum pooling is not allowed, hence MORAN-based sharing is a popular model (O2 and Vodafone in the UK, Orange and Vodafone in Spain and SFR and Bouygues Telecom in France).

In markets where spectrum pooling is not prohibited by regulation (e.g., North America, some European markets, AsiaPacific), we also see MOCN-based active network sharing with spectrum pooling (e.g., Net4Mobility, a joint venture in Sweden between Telenor and Tele2; Telia and Telenor in Denmark; and Orange and T-Mobile in Poland).

In the majority of markets in Europe, network sharing clearly extends to the active layer of the network (see Figure 1).

2

5G is triggering a new wave of interest in active network sharing

The advent of 5G has triggered a new wave of interest in network sharing in markets and operators that have not yet been involved in such ventures. 5G demands high investment in the radio access network and transmission network, due to the following:

- High spectrum costs in several new bands (700-800 MHz, 3.5-3.7 GHz, 20-26 GHz).

- Grid densification for C-band (3.5-3.7 GHz) of 1.6-1.8 times more sites and up to 10 times more small cell sites than macro/microsites for mmWave bands (20-26 GHz).

- Fiber optic backhaul to most sites (70-80 percent) for transport capacity of n x 10 Gbps per site (n = number of sectors/active antenna units [AAUs]).

- 5G sites with AAUs and massive MIMO (e.g., 64x64 in urban areas).

These investments are in areas with existing network overbuild, where typically 3-4 MNOs already have overlapping networks, which creates a strong potential for optimization of future infrastructure deployment with network sharing.

Operators with existing 4G MORAN/MOCN agreements are working towards incrementally extending the scope of their cooperation to include 5G as well (Vodafone/O2 in the UK, Vodafone/Orange in Spain and Orange/T-Mobile in Poland). A recent, greenfield network-sharing agreement in Belgium between Proximus and Orange also plans all-technologies MORAN sharing, including 5G (both MNOs have already set up a JV – MWingz – to facilitate joint network planning and operations).

Most MNOs in the world deploy 5G by incrementally upgrading their 4G networks (non-standalone), creating a tight coupling between the existing 4G layer and the future 5G layer (using the same core and spectrum anchoring). Incumbent vendors also encourage this path, as it eases the transition to 5G infrastructure, allowing early access to 5G network capacity even while the majority of devices are still not 5G-ready.

Early cases are showing promising results in applying this model. As an example, in June 2020, South Korea reported the highest number of 5G mobile subscribers in the world (>6 million subscribers handled between the three MNOs). The MNOs actively switch between 4G and 5G networks to achieve the right balance between speed, latency and battery life and offer >1 Gbps speeds at retail prices of US $60-70 per month, with an estimated 24 percent of data already handled by 5G in Q1 2020.

We have observed that legacy 2G/3G technologies do not have the same importance as 4G in evolution towards 5G. Operators are considering leaving legacy 2G/3G out of their 5G-focused network-sharing agreements, with the aim to retire and eventually decommission legacy technologies and re-farm this spectrum for 4G/5G deployment.

3

4G/5G Network sharing allows decoupling from legacy 2G/3G

In the past, most active network-sharing JVs have either focused exclusively on 4G (e.g., Net4Mobility in Sweden, and EE and Three in the UK) or primarily facilitated rolling out 4G along with sharing of the underlying 2G/3G (e.g., Orange and T-Mobile in Poland, O2 and Vodafone in the UK and Orange and Vodafone in Spain).

The new wave of 5G network-sharing agreements continue to be more selective, typically focusing on 4G/5G and excluding legacy 2G/3G from the scope of sharing. For example, the network sharing by T-Mobile and Sprint in the US focuses on sharing the company’s 4G and 5G (MOCN) networks. In May 2020, they successfully demonstrated gigabit+ speeds using 40 MHz of Sprint’s 2,500 MHz band, 20 MHz of T-Mobile’s 2,500 MHz and 1,700 MHz bands using an LTE and 5G aggregation model.

Another example is in South Korea between KT Corp, SK Telecom and LG Uplus, which reportedly partnered with an additional 17 local municipalities/governments to roll out active network sharing based on 4G and 5G (on both 3.5 GHz and 28 GHz spectrum bands).

Arthur D. Little has also been involved in facilitating several network-sharing agreements, with a focus exclusively on 4G/5G sharing leaving out legacy technologies:

- In 2019 and 2020, Arthur D. Little supported several operators in different markets to develop their 4G/5Gonly MORAN/MOCN sharing partnerships (with some remaining at a concept phase and others proceeding to implementation). A couple of these cases excluded 2G/3G from the scope of sharing. One reason 2G/3G was excluded was to avoid MORAN/MOCN transformation costs of legacy technologies. Another reason was due to asymmetries in the existing legacy technology network between the operators (e.g., one operator had only national roaming agreements for 2G).

- Arthur D. Little supported a new MNO entrant on a pure 5G network that was interested in 5G-only network sharing with 4G roaming until 5G devices become mass market. For this player, being lean, efficient and competitive on network QoS and TCO were key KPIs that were viewed as more important than backward compatibility with legacy technologies.

- In 2019 we also worked with a European cable company that acquired a 3.5 GHz spectrum to extend its footprint with 5G-based FWA. 5G-based MOCN sharing is being evaluated to sell excess capacity on the network in areas where the company does not intend to extend its fixed footprint.

Some operators also consider sharing only their future 5G networks. However, due to lack of commercial, stand-alone 5G infrastructure and low penetration of mass market 5G devices, such 5G-only active network-sharing models are not yet gaining traction (see Figure 2).

The key questions to ask in order to choose the right technology model are:

- What has the largest impact (e.g., 5G, 4G, grid optimization) on our savings potential?

- Which parts of the network should be upgraded/ transformed to MORAN/MOCN?

- Do the partners have asymmetries (especially sunset plans) in their technology roadmaps?

- What new vendor options do I have for 5G? Do I have any attractive legacy vendor agreements to preserve?

- How do my network-sharing plans impact the commercial takeup of 5G?

- What degree of complexity of transformation/optimization and of continuous operations (given an attractive business case) can each operator tolerate in their network?

In Table 1, we highlight how each of these questions leads to a preference for a particular technology model. The decision the operator makes today will effectively bind them to that decision for the entire 5G deployment cycle for the next decade, hence operators should take due care in ensuring that the technologysharing model reflects their long-term network strategy

4

New, non-telco entrants are showing interest in 5G rollout and sharing

In recent years, numerous non-telcos have gained access to 5G spectrum in industry-specific or regional license blocks allotted through national auctions (e.g., part of 3.5 GHz in Germany has been kept aside for regional campus deployment). One of the main motivations for this segmentation is to build private mobile campus networks that have sufficient dimension to fit the quality, security, reliability and cost parameters of the given industry (typically manufacturing, mining, venues, logistics and travel).

Entities with distributed geographical infrastructure (e.g., railway, utility and public transport) are becoming increasingly receptive to the idea of deploying their own 5G networks for internal use as well as to sell excess capacity via wholesale to other players. Such networks would provide wholesale services to MNOs, especially to support them in their rollout plans for 4G/5G where critical civil infrastructure is involved, which may produce some unattractive standalone commercial economics if the MNO were to deploy such a network on its own.

As an example, Arthur D. Little is currently assisting several railway companies in Europe to define their 5G strategies. One key area they are considering is improving their own communications requirements and achieving efficiency in core operations using connectivity use cases (e.g., autonomous driving and improved digital signalling). At the same time, they aim to unlock new revenue opportunities and improve customer experience in their trains and stations. A key solution to operationalize such a strategy involves 5G network sharing with other telecom operators.

In the past, leveraging non-telecom infrastructure (poles, real estate, ducts or optical fiber) was a proven operating model for railway companies to monetize their infrastructure (see Figure 3). With a 5G network, a railway company can provide neutral host services or wholesale data services to MNOs on a pay-peruse basis, requiring minimal upfront investment by the MNOs.

Under a MORAN model (shared RAN, separate spectrum), non-telco players can allow MNOs to significantly minimize deployment costs, especially by sharing expensive 5G base station equipment and AAUs. Additionally, infrastructure players with their own spectrum can further share the RAN for their own use cases.

In MOCN (shared RAN, pooled spectrum), operators of infrastructure in areas with sparse usage can provide further benefits to operators by allowing them to leverage the differences during busy and peak times as well as other asymmetries in spectrum holdings to optimize capacity. Additionally, players that do not fully utilize their spectrum can further monetize it by allowing MNOs to use this spectrum to fulfil capacity requirements in other parts of the country.

These new models (for non-ICT players) of active RAN sharing can be perceived as the next step in MNOs relying increasingly on optimized, shared infrastructure and focusing on their core competencies of service operations and commercialization, as they leave the infrastructure pieces to entities with greater assets.

5

European regulators are warming up to active network sharing

Regulators are becoming increasingly open to the idea that expanding our nationwide cost-efficient 5G networks will require sharing of some sort, such as active network sharing and spectrum sharing. A 2018 Body of European Regulators for Electronic Communications (BEREC) report indicates that regulatory bodies in Europe are seeking to develop a common European position on sharing, especially given the wave of 5G rollout expected and the challenges associated with 5G rollout (increased site fiberization, 10x new microsites/small cells, indoor coverage and high band and mm wavelength deployment).

In 5G spectrum auctions in Europe, multiple regulators have indicated the possibility of active network sharing under certain conditions, including by non-telco entities. For example, in a 2019 3.5 GHz spectrum auction, the Austrian Regulatory Authority for Broadcasting and Telecommunications indicated that active network sharing (including spectrum sharing) could be permitted under certain conditions (in general, sharing could be potentially permitted everywhere except in the three largest cities). However, explicit regulatory permission would be required before implementing an active network-sharing agreement. German regulator Bundesnetzagentur also allows active network sharing under certain conditions (regional/rural sharing) but does not yet allow spectrum pooling. Some other markets like Denmark and Sweden allow active network sharing with spectrum pooling on a national level, as long as it does not distort retail market competition.

On the other hand, competition agencies are taking tougher positions when the incumbent is involved in network sharing. In 2019, Proximus and Orange Belgium announced a MORAN all-technology network-sharing agreement, which was under regulatory review by the Belgian Competition Authority, with work towards the agreement resumed as of 18 March 2020. The European Commission is also investigating the networksharing agreement between O2/CETIN and T-Mobile in the Czech Republic to ensure competition is not restricted. In all these cases, the main argument brought forward by the competition agencies is that the sharing covered more than 70-80 percent of the population coverage and harms the competitiveness of the market, as it leaves the third player out of the network-sharing arrangement.

Many 5G network-sharing agreements specifically mention that the focus will be on rural network sharing, and the most dense urban cities will be left out of the arrangement. For example, an active network-sharing deal between TIM and Vodafone Italy announced in 2019 mentions that it only covers cities and towns with a population of fewer than 100,000 inhabitants.

6

Governance models must be tailored to each party’s objectives

The key question in terms of the governance model is what vehicle to use (see Figure 4):

- An asset-heavy JV, carving the assets into a legally independent JV

- An asset-light JV (or no JV; only using contractual agreement), handling joint planning and a few other key functions (no asset transfer).

And, once the model is chosen, parties must determine how investment, risk and reward are to be shared fairly. Both models need to be aligned more with the strategy of the shareholder/ owner than the MNOs themselves, as the shareholder’s/ owner’s strategy will determine what the MNO’s financial statements (e.g., EBITDA, balance sheet) will look like in the long run.

In theory, either financial model can help operators achieve their network-sharing objectives, albeit with different (typically operational) constraints.

Asset-heavy JVs are typically better structured to drive consolidation and joint rollout synergies in network sharing, as the overall network is owned and operated by one neutral JV.

Yet, carving out assets, people and functions can be complex and take time, especially considering the additional write-off and tax implications and reorganization of the telcos’ D/E structure that is needed. Furthermore, the valuation of the assets themselves can be a point of intense negotiation between the operators. On the other hand, when the two MNOs have a shared infrastructure investment vehicle, it can be further used to onboard future financial partners (e.g., infrastructure PE funds) to monetize the infrastructure and generate cash for the MNOs. Arthur D. Little has worked with two MNOs in a CEE market that successfully carved out their RAN (2G, 3G and 4G) and backhaul networks, along with the associated functions, staff and processes, to form a MOCN-based, asset-heavy JV.

Asset-light JVs (or agreements only) avoid the complexity of carve outs and thus are easier (faster) to implement; hence increasing the likelihood of a successful agreement and speeding up implementation. Yet, a key risk with this model is the operational complexity, especially if the deal takes the share of an agreement without formation of a JV. However, examples from the UK (Cornerstone and MBNL) and Poland (NetWorkS!) show how asset-light JVs can transition into their own infrastructure service companies.

Regardless of the sharing model, a core set of governance principles need to be aligned to ensure fair sharing of investment risk and reward. The model should also allow for fair acknowledgement and settlement of asymmetries (e.g., differences in sites contributed, capacities contributed, and in decommissioning of sites).

Arthur D. Little has developed a governance framework that has enabled us to successfully conceptualize and detail the elements of governance feeding into the term sheet and other legal documents (see Figure 5). Detailed insights into choosing the right financial model and governance model can be found in our previous report on network sharing, “Network Cooperation: Making It Work and Creating Value,” which can assist your understanding of each key governance lever and enable each party to frame their respective position on each of these levers.

7

Network sharing as a stepping-stone for overall company strategy

Network sharing cannot be adopted as a standalone, costoptimization exercise and should be linked with the overall corporate strategy of the MNO because it has long-lasting implications in terms of both strategic benefits and constraints on the ability of the MNO to deliver its commercial strategy. The exercise should be aligned on several layers balancing financial, operational, strategic and regulatory objectives before the MNO commits to sharing network assets with a competing MNO.

In our experience at Arthur D. Little, we have seen cases where network sharing has been seen as a necessity to facilitate technology evolution (even during 4G introduction), a response to unattractive economics of coverage obligations (mountainous, sparsely populated areas), a tool for investors to create (carve out of asset-heavy, pure-infrastructure JV) and as market entry (see Figure 6).

Network sharing is a long journey that can take between one and two years solely to set up an agreement and three to five years to fully implement and achieve a new “normal” for the shared network. Throughout this process, both partners should retain sight of the link between sharing and corporate strategy. A structured approach is necessary at all times to keep this link and to guide operators through the key questions, ensuring that vital steps are not skipped and that decisions are not taken prematurely. Here and in Figure 7, we share a perspective on the typical process an operator (or investor or any other interested entity) needs to undertake to steer their network-sharing strategy

- Define objective(s): why does this initiative need to take place?

Clarity on the reasons for network sharing ensures stakeholder buy-in throughout the whole process and serves as the guidance in all decision making throughout the long process. Yet, it requires balance and compromise between numerous decision-making stakeholders – CEO, CTO, CFO and the shareholder(s). The goals, as shown in Table 2, may often be contradictory or mutually exclusive as well, such as:

- Do you maximize performance or optimize costs?

- Do you optimizing EBITDA or minimize CAPEX?

- Is it the valuation of the current company or valuation of the to-be JV?

- Ideal partner: with whom to share a network?

Give consideration to what each potential partner brings to the table – access to fiber, access to better (exclusive?)

site locations, complementary coverage or opportunities for coverage densification. Inversely, an operator must be aware of the benefits and value proposition they bring in as network partners to ensure a mutually beneficial relationship. The example in Figure 8 shows how partners can complement each other in terms of footprint, fiber backhaul access and operating efficiency of the network.

And, as we have already mentioned, the search need not be limited only to other MNOs. A broader scope of potential partners must be considered in the context of 5G, where the ecosystem of infrastructure owners can be much more diverse than with traditional operators.

- Optimal scope of sharing: what is to be shared?

Operators must determine the scope of sharing, which would optimally fulfil the selected objectives of sharing:

- Assets. These include towers, backhaul, antennas, baseband, spectrum and core network and backbone.

- Technologies. While a major part of partnerships include all mobile generations, future-focused cooperation (e.g., 4G or 5G) is also possible, especially in cases of asymmetries between the partners on legacy (current status or future plans).

- Geographies. Identify the parts (e.g., rural, urban or selected areas) of the country that drive achievement of the objectives. Here, regulators and competition authorities often play a role in limiting the scope of cooperation with a focus on rural and underserved areas over urban and denseurban areas.

- Processes. Agree on the degree of joint network operations: planning, deployment, field operations or even procurement have been shared in network-sharing deals.

- Sharing vehicle: how to make network sharing happen?

Network sharing will determine the shape of the MNO’s most important asset for the next decade. Once implemented, exit is difficult and costly to execute. In this long-term commitment, the vision of the company’s leadership plays a key role in driving the operationalization of the network-sharing strategy.

It is vital that operators decide whether to carve out or keep assets within the current legal entity. Network-sharing assetheavy JVs can be a stepping-stone to further carve outs or opening up networks to third parties or investors. Vehicles with lighter asset ownership may be used to retain a higher degree of control over networks and can be a good way to overcome initial partner mistrust.

- Negotiation and implementation: time to act

After all the plans have been laid out, next is implementation, which is a long journey on its own with up to two years to setup the agreement and up to three to five years to fully execute consolidation/transformation plans.

Throughout the whole process, negotiations and compromise are key to facilitate results. Determining which impasses can be placed on pause until other issues are resolved can be a good way to manage this process. Not everything needs to be clear and resolved from Day 1.

During the implementation phase, capable, neutral consultants can provide the necessary objectivity and expertise to facilitate agreement. Operators must also retain a mindset of trust and partnership that will allow them to make network sharing viable in the long run.

In conclusion, in this report, we hope to have provided a perspective for MNOs and other entities rolling out 5G networks to consider network sharing as a valid strategy to operationalize their respective 5G networks. We have also highlighted the key areas in which 5G-based network sharing is different from earlier 4G-based network sharing.

There are numerous factors to watch from the start (e.g., regulatory approval, asymmetries and operational complexities). However, it is also important to note that many of these factors remain fluid to some degree throughout the negotiation process, and many roadblocks can be resolved when both parties keep the end objective in sight, whether it’s having the best network, obtaining the most synergy savings or another goal.

Each network-sharing deal is uniquely designed to fit the strategic requirements of that particular founding partner and must be tailor-made based on the technology, financial, regulatory and governance constraints of the particular entities that wish to share their networks.

DOWNLOAD THE FULL REPORT