The recent economic turmoil surrounding the COVID-19 pandemic and the Russian invasion of Ukraine have exposed the vulnerabilities of today’s complex supply chain networks, challenging many industries across the globe. Companies have learned the hard lessons of underestimating supply and demand volatility risks, raising questions around control, transparency, and regionalization. Supply chain resilience has risen to the top of the executive agenda, and it is now time to transfer lessons learned into action to prepare businesses for future disruptions.

SUPPLY CHAIN VULNERABILITIES EXPOSED

The economic turmoil across the globe has exposed significant vulnerabilities in supply chains. Companies’ networks have never been more complex or more susceptible to world economy dynamics. They have been tested both by supply and demand volatility as well as the digitalization of an increasing number of industries, which has driven demand for scarce components and raw materials. A lack of resilience has been made apparent, igniting a call for action to businesses worldwide to prepare for future disruptions.

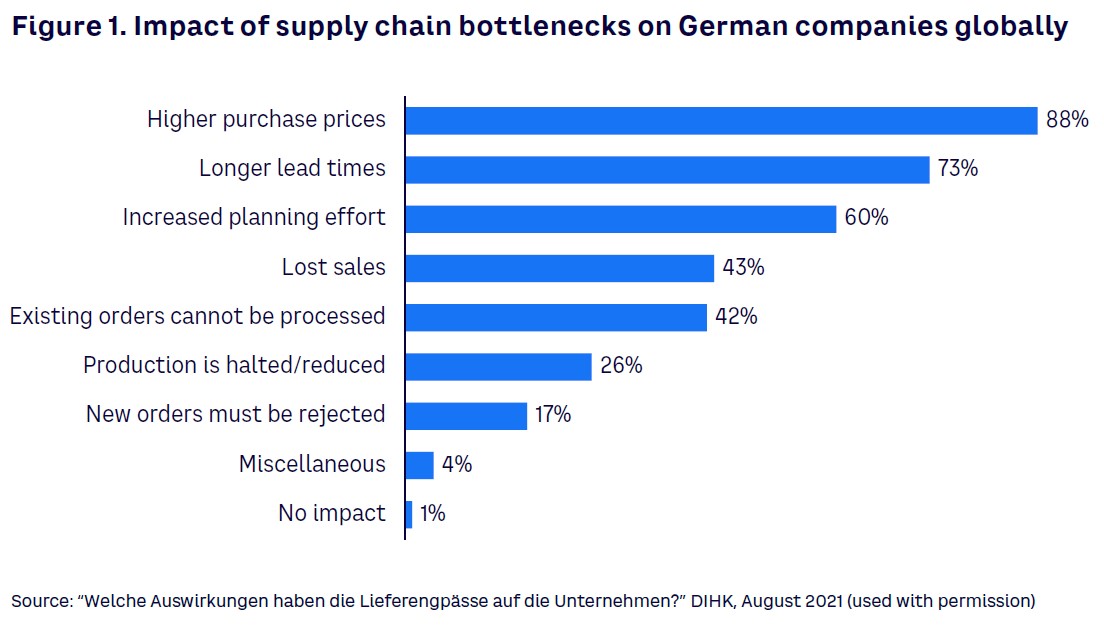

In the pursuit of cost efficiency and just-in-time logistics, companies have built networks to deliver at just the required service levels — at times underestimating risk. For example, a 2021 survey by the German Chamber of Industry and Commerce (DIHK) shows that supply chain bottlenecks have had a significant impact on German companies domestically and abroad, with higher purchase prices, longer lead times, and lost sales (see Figure 1). As a result, a majority of surveyed companies are looking to, or have already, reorganized their supply chains. This is particularly true among industrial and construction companies, with 67% expressing a need to diversify their networks.

Other recent events, such as semiconductor shortages costing the automotive industry hundreds of billions of dollars in 2021, the Suez Canal blockage (estimated by Allianz to have cost US $6-$10 billion per week) and impacts of the US-China trade conflict, remind us of the fragility of our global supply chains.

While many of these issues and broader imbalances are fueled by recent events, challenges stemming from reliance on offshore production have been aggregated over a long time and, perhaps more importantly, will remain well after the effect of Russia’s invasion of Ukraine and the pandemic-driven crunch begin to subside. There are three key reasons issues around supply chain will continue:

- Increasing importance of environmental, social, and corporate governance (ESG).

- Need for transparency and control.

- A shifting balance, strengthening reshoring over offshoring.

THE PRESSURE IS ON

Increasingly, customers (both B2C and B2B) are placing greater value on knowing origin, product contents, and the conditions under which products were produced and transported. As an example, a 2021 sustainability study by GreenPrint found that 77% of Americans are concerned about the environmental impact of products they purchase. To mitigate that concern, customers require information that enables them to make educated choices.

At the same time, businesses face expanding legislation and regulatory requirements as well as pressure from the media and NGOs, posing a significant reputational risk for those that do not comply. Companies not only have to ensure that their supply chain meets increasing ESG demands, but they must also be knowledgeable enough to communicate key metrics externally.

A company’s supply chains are no longer used solely to provide cost advantages. Now they must also support efficient operations during turbulent times while also fully aligning with a company’s strategic vision and target brand statement. Many industry networks have been developed based on heritage and inorganic growth, often resulting in suboptimal flows between many locations. Current networks often are neither a reflection of the company’s strategy nor resilient to changes, nor the most holistically cost/benefit-efficient.

TRANSPARENCY REQUIRED

Understanding and acting on vulnerabilities and meeting increasing demands on information require supply chain transparency. However, this is no easy feat for many businesses. Supply chains were not designed to be transparent. In fact, many suppliers see mystery as integral to their competitiveness. However, Arthur D. Little (ADL) argues that there is very little to gain, and much to lose, in keeping it hidden.

On top of this desire for secrecy, supply chains are challenging to analyze because they constitute a considerable number of stakeholders, often holding data in different formats and varying quality. This data is often difficult to merge, analyze, and draw conclusions from. For instance, in a survey conducted by Resilinc in early 2021 following a COVID-19 outbreak in China, 70% of 300 company respondents said they were in a supply chain data collection and evaluation phase, manually attempting to identify which of their suppliers in China would be impacted by lockdowns.

Automotive OEMs, for their part, are approaching the task of increasing transparency from a multidimensional perspective. Several automotive partnerships have been established to advance environmental practices throughout the supply chain, such as the Suppliers Partnership for the Environment (SP) and Drive Sustainability. These partnerships work toward establishing harmonized measurement approaches and KPIs, enabling improved control and transparency throughout the entire value chain. Automotive suppliers increasingly are expected to take ownership of their networks’ environmental performance. For example, an SP guidance document calls for suppliers to lead and coach their supplier base in environmental sustainability and establish a reporting cycle for collecting and evaluating suppliers’ CO2 data.

Technology investments in supply chain transparency are also on the rise. Blockchain technology can enable tamper-proof visibility through multiple levels and data sharing between manufacturers and retailers. For example, BMW Group initiated its PartChain project, based on cloud technology and blockchain solutions, to ensure components’ seamless traceability. Volvo Cars, for its part, has invested in Circulor blockchain for cobalt tracing in EV batteries. And Porsche is working with blockchain plastic traceability with startup Circularise, while Rio Tinto has focused on traceability of aluminum.

SHIFT IN GEOGRAPHICAL BALANCE

The time has come for firms to question some of the principles of operations they have previously taken for granted. One example is the assumption that speed and proximity of production always equate to higher total cost. In evaluating their manufacturing and supplier footprints, companies may find that the relative benefits of offshore production and sourcing are shrinking, bolstering the concept of reshoring (also referred to as backshoring or inshoring, or the opposite of offshoring).

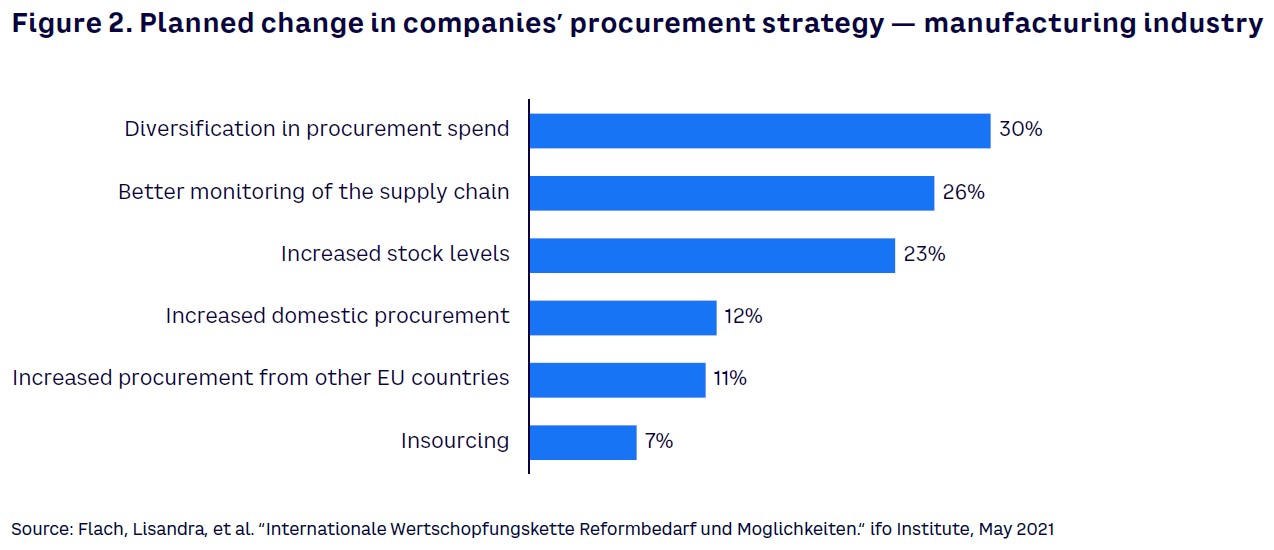

Companies are clearly looking to their procurement strategies to strengthen the supply chain. In the US alone, recent analytics from Thomasnet have tracked a fivefold increase in requests for quotes for new supply sourcing since 2018. And in a survey of the German manufacturing industry by Ifo Institute for Economic Research, close to a third of respondents say they will look to diversify their sourcing, and around a quarter say that they will improve the monitoring and control of the supply chain (see Figure 2). What stands out in this research, however, is the 12% of respondents that report they will increase domestic sourcing and the 11% that will look to increase spend with EU suppliers.

While offshoring has grown steadily over the past decades, it is now in decline. An increasing number of firms are not only sourcing closer to home but also investing in factories in Europe and the US to cater to local markets. Especially in establishing new factories and supply chain hubs, the benefits can be significant. The shift to localized production is driven by a number of factors, including:

- Market and regulatory supply chain transparency and sustainability demands.

- Increasing need for green and affordable energy.

- Lead times and speed of time to market of new products.

- Industry 4.0 and automation of the workforce — lower dependency on cost of manual labor at the same time wages are rising in emerging markets.

- Growth of protectionism and trade barriers, specifically surrounding critical industries.

- Political tensions.

- Investment incentives, grants, and tax subsidies.

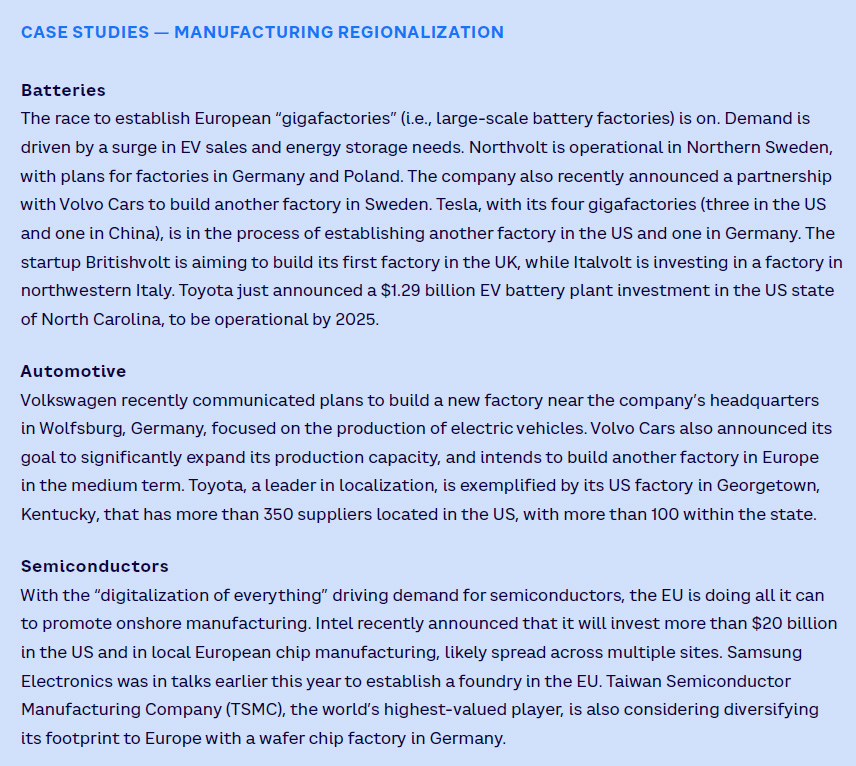

This will be a gradual journey, as most supply chains do not have the capacity to immediately shift production nor can they motivate investments in the near term. However, we anticipate an increasingly local manufacturing strategy. In the meantime, we expect to see geographical risk dispersion through increased local inventories and technological optimization support, such as in the examples shown in case studies below.

REEVALUATING SUPPLY CHAIN SUCCESS

Alongside working to improve transparency and supply chain performance, companies should reevaluate how to determine network success. In such an evaluation, ADL suggests four key areas to consider:

- Strategic fit. The supply chain must align with the company’s vision and values, as well as correspond to the target brand statement and desired reputation, enabling the company to reach its objectives and target state.

- Risk. The supply chain must offer resilience and control, supporting company operations in a dynamic and unpredictable environment, and enabling the company to make accurate and timely decisions.

- Sustainability. The supply chain must align with the company’s sustainability policy and the ESG demands of the market — both as an enabler of higher market caps and valuation and an imperative in doing business. In fact, a recent survey by ADL and Invest Europe highlights the increasingly embedded nature of ESG factors in investment practices and funds. Close to 90% of the 100 limited partners and 95% of the 150 general partners surveyed across geographies expect to increase attention on ESG in future capital allocation.

- Efficiency. The supply chain must enable resource-efficient operations, minimizing cost while maximizing speed and emphasizing proximity to demand and operational excellence. As global supply chains become more local/regional, higher costs and prices and lower economic growth may be the result. Therefore, improving productivity levels is critical to remain competitive.

Conclusion

THE TIME FOR ACTION IS NOW

Companies worldwide have experienced business disruption resulting from vulnerabilities of their complex networks. While triggered by recent events, the need to future-proof the supply chain has been aggregated over time. We see several drivers for this, including:

- Today’s supply chains need not only be cost-efficient and meet increasing ESG demands but also align with the company’s strategic vision. Most companies have suboptimal networks based on legacy.

- Transparency will be a critical success factor on both the demand and supply side in many industries but is difficult to establish.

- The relative benefits of offshoring are shrinking, shifting the focus to reshoring and regionalization.

Recalibrating the supply chain is no short-term measure and requires a holistic long-term perspective. Fortunately, there are clear steps to take, enabling companies to create an action plan and stepwise implementation levers.