DOWNLOAD

DATE

Contact

The enterprise business segment has long been viewed as the context where mobile network operators (MNOs) realize significant returns in deploying 5G technology. Of particular interest is the deployment of mobile private networks (MPNs), dedicated to a particular enterprise and in effect serving as its local area network (LAN). MPNs unlock the potential of 5G for advanced connectivity, security, and enterprise autonomy. This Viewpoint examines MPN development and analyzes its drivers of success, exploring MPNs’ commercial potential and devising a generic go-to-market approach for MNOs to succeed by reaching scale in the MPN business with tangible business results beyond proof-of-concept deployments.

MPN IMPLEMENTATIONS GAIN SPEED GLOBALLY

Enterprise spectrum liberalization accelerates global MPN deployments

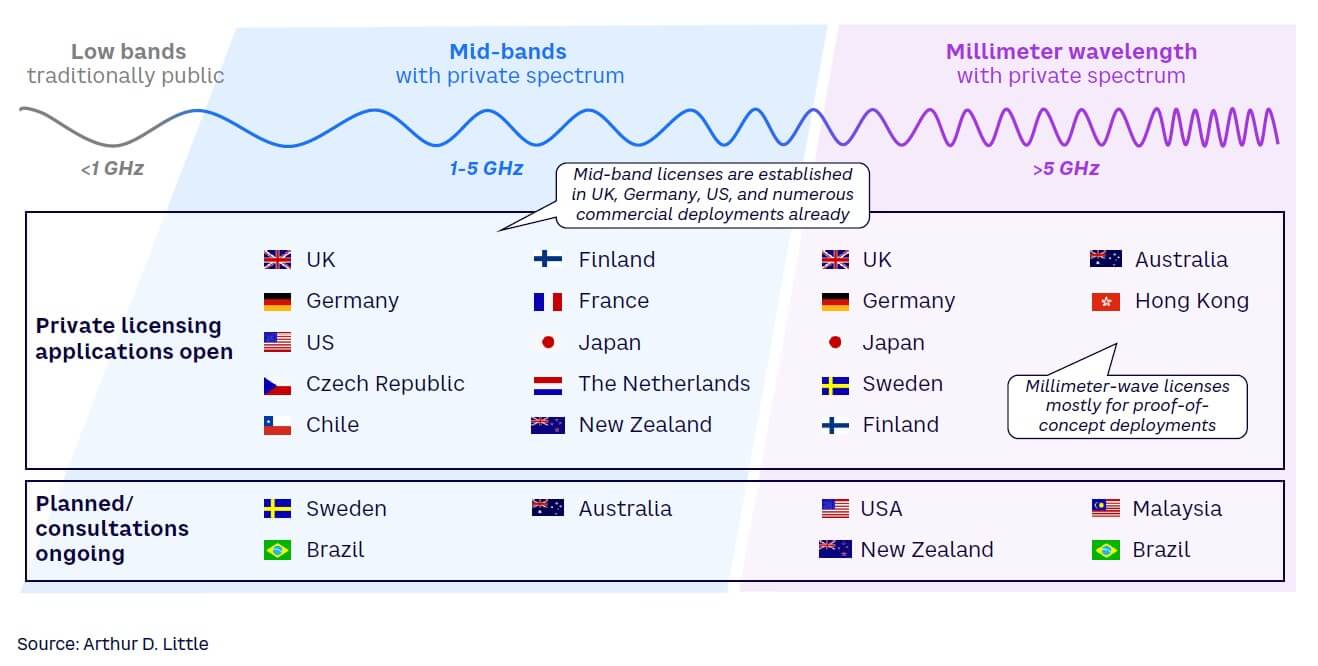

Globally, the growth of private networks is often driven by the liberalization of spectrum. The increase in spectrum directly accessible to enterprises drives initial experimental deployments, raising awareness among potential customers to the benefits of a cellular solution in a local context. This in turn leads to a number of productive MPN deployments and supports market growth.

Today, to foster digitalization, a range of developed economies have already granted spectrum for private use, primarily in the mid-bands of 3.6-4 GHz (see Figure 1). Within the European context, spectrum liberalization is increasingly prevalent. France, as an example, has granted 100 MHz of spectrum in the 3.8- 4 GHz band, and many other countries are experimenting with millimeter-wavelength private spectrum, enabling further development of 5G features. Further to this, as of March 2022, Germany had granted more than 200 local 5G network applications in the 3.7-3.8 GHz band and 10 in the 26 GHz band. Fundamentally, liberalization has enabled new, non-MNO players to enter the MPN market — shifting market dynamics for the present and future.

Globally, three main options prevail for MPN sourcing: (1) end-to-end service via MNOs, (2) own-sourced spectrum with MNO-operated network, and (3) full private operated MPN — however end-to-end MNO operation has remained the dominant method. Inherently, spectrum holding remains a key question for global MPN developments — with implications for MNOs varying based on the degree of liberalization within the market:

-

Liberalized market — MNOs must adopt strategies that put them in the driver’s seat.

-

Closed market — MNOs must decide whether to serve customers out of their current network or dedicate spectrum specifically to B2B clients (current trends highlight a preference for public network slices over spectrum dedication).

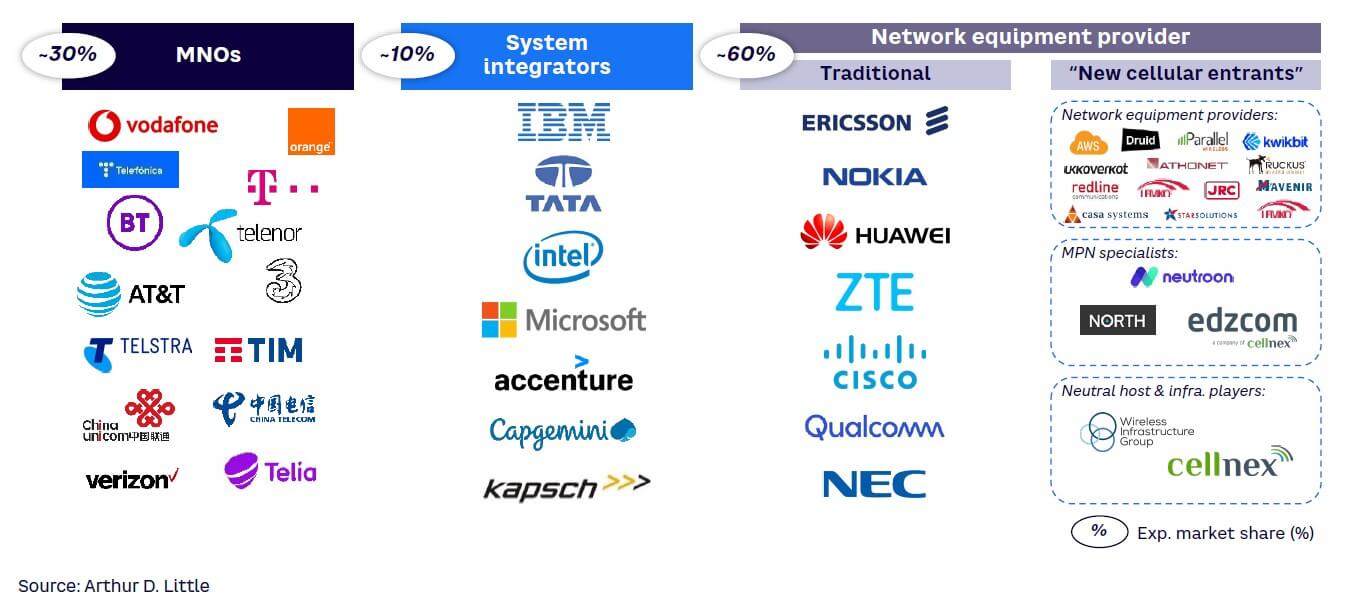

Local MNOs hold attractive starting positions, with competitive pressure increasing

Mobile operators have often perceived the MPN opportunity as a natural addition to their B2B portfolio, similar to other growth areas where competition is limited to three to four local operators. Recent market dynamics, however, reveal a diverging trend. While MNOs are well positioned with their ability to deploy their own spectrum and their extensive capabilities in running cellular networks locally, other players are showing interest in entering the MPN space:

-

International MNOs often develop MPN capabilities at a group level in an effort to deploy them both regionally and globally (e.g., BT, Deutsche Telekom, Orange, Telefónica, Vodafone).

-

System integrators (SIs) build pre-integrated solutions of software-based MPN vendors and deploy at a lower price point (e.g., various providers in Germany, including becon and CONGIV).

-

Traditional network equipment providers (NEPs) target large corporate customers and multisite deployments over direct channels (e.g., Nokia, Ericsson).

-

New cellular entrants (network equipment vendors, specialists, neutral hosts, and infrastructure players) develop scalable solutions and team up with software providers to offer connectivity solutions that can partially run on commercial off-the-shelf hardware, enabling cost efficiency (e.g., AWS with Affirmed, Microsoft, Neutroon, Cellnex).

At present (see Figure 2), NEPs yield the largest share of the MPN market (~60%) relative to MNOs (~30%) and SIs (~10%), as a result of driving current POCs (proofs of concept). However, this is expected to change considerably in the future.

As M&A activity intensifies, competitive landscape shifts

There has been a considerable shift in the competitive landscape of private networks, with the positioning of players changing as they acquire adjacent players and expand. Microsoft has been at the forefront of M&A activity in the MPN space, with its 2020 acquisition of Metaswitch Networks for its IP Multimedia Subsystem (IMS) and Affirmed Networks for its packet core solution. Traditional NEPs have also finalized recent acquisitions.

For instance, Cradlepoint (owned by Ericsson) acquired private network software company Quortus in December 2021. Additionally, Spanish wireless telecommunications infrastructure provider Cellnex acquired the edge connectivity solution provider EDZCOM in 2020, while Airspan Networks Inc. merged with the special-purpose acquisition company New Beginnings Acquisition Corporation and started trading on the New York Stock Exchange under the ticker “MIMO” in 2021. Further market diversification is also expected via the potential formation of consortiums between hyperscalers, SIs, and MNOs — following the example of Cegeka’s 2020 acquisition of Gridmax and of a majority stake in Citymesh — highlighting the dynamic nature of the MPN market.

4 DISTINCT PRIVATE NETWORK BUYER GROUPS IDENTIFIED

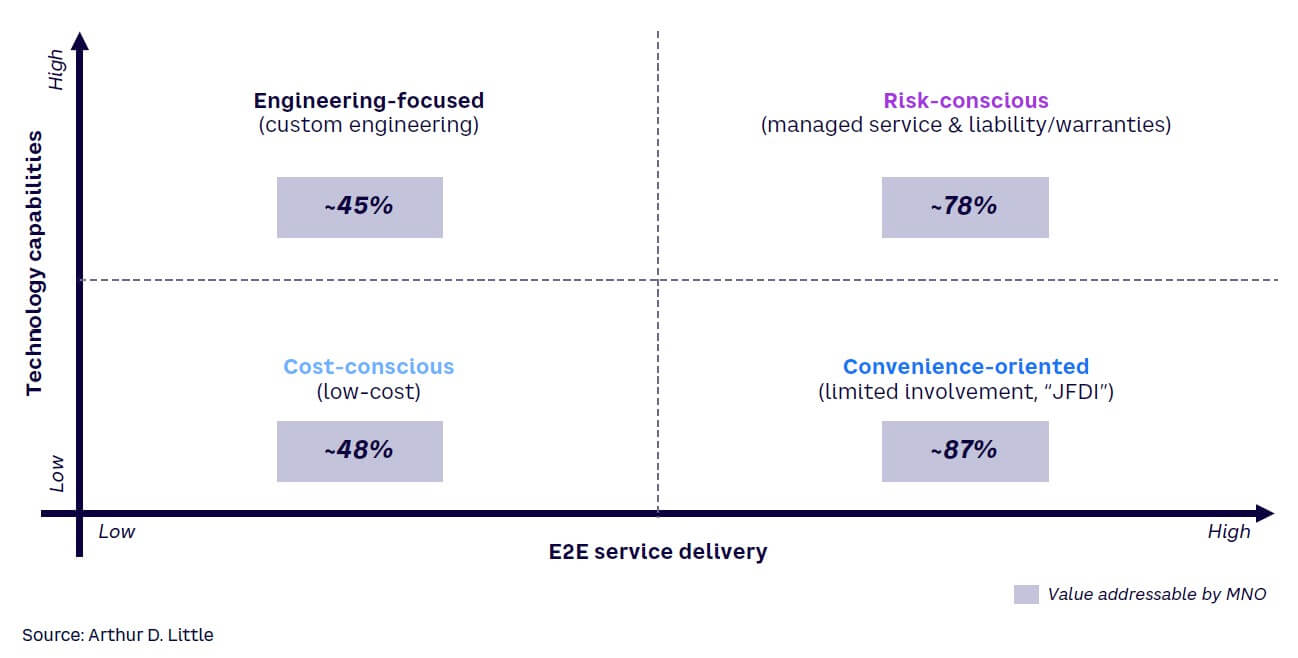

Across the MPN market, players are targeting different customer segments, with these segments categorized by buyer types. Arthur D. Little (ADL) analysis of over 45 global MPN tenders highlights that buyers differ along two key vectors: (1) how advanced their technical requirements are and (2) how important end-to-end service delivery is to them. As a result, we have defined four distinct buyer types:

-

Cost-conscious — buyers are focused on solutions with the lowest possible cost, with generally low performance requirements.

-

Convenience-oriented — buyer’s main priority is that the MPN solution works, with overall limited involvement.

-

Risk-conscious — buyer concern is risk avoidance, providing input where relevant to mitigate risk.

-

Engineering-focused — buyers are highly technical, engaging in both engineering/requirement specification.

Engineering-focused clients largely require a component-only solution, while cost-conscious clients prefer mainly pre-integrated components, both of which result in a lower value share for MNOs to capture (due to the limited requirement for managed services). In contrast, the managed services required for cost- and risk-conscious buyers generate a greater value share for MNOs. Thus, to address the full marketplace, MNOs must tailor their offerings via different value propositions, with no single product able to operate successfully across the entire market. Consequently, operators need to find an effective approach to address these four buyer types by defining key questions (e.g., who connects your assets?), verticals (e.g., manufacturing), and use cases (e.g., digital vision and artificial intelligence [AI] video analytics) for each segment.

Currently, MNOs focus largely on engineering-focused buyers, with the majority of POCs being within this segment (see Figure 3). Although this remains an important stepping stone to enter the MPN market, this segment is expected to yield decreased future importance, as the share of value for MNOs is low and specialists will most likely take over provisioning. Alternatively, risk-conscious and convenience-oriented buyer groups are identified as key segments, providing the necessary scale needed for profitability. Furthermore, MNOs are naturally well-positioned to service these customer groups, with buyers’ focus being on the outsourced operation of the network. In contrast, cost-conscious buyers will prefer to source individual components on the market and therefore will be difficult for MNOs to penetrate.

SOLUTION VS. PRODUCT: 2 MPN VALUE PROPOSITION APPROACHES

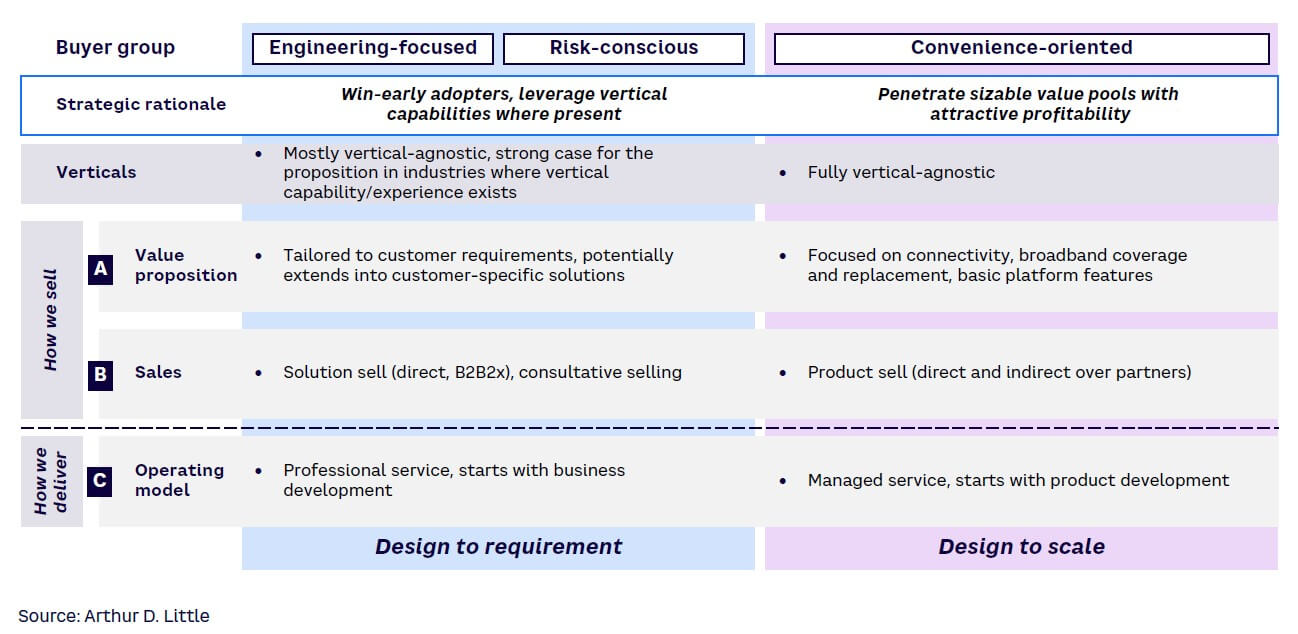

To be successful in MPN and address the largely different profile/requirements of the enterprises buying them, MNOs must offer two largely different value propositions (see Figure 4):

-

Design to requirement is the value proposition for a more complex MPN with integrated end-to-end solutions and is highly tailored to specific customer requirements (i.e., “project-based” business).

-

Design to scale is the value proposition for a plain-vanilla MPN that is focused on standardization of the deployment, so that private connectivity can be offered at low effort for the provider and low cost for the buying enterprise (i.e., “productization”).

In addition, the two value propositions require different sales and operating model approaches. The design-to-requirement proposition leverages a consultative sales approach, focused on business development, and is run based on a professional service — with the goal to achieve client centricity and agility. The design-to-scale proposition, on the other hand, is product-based, with product development and managed service at the center of its proposition and efficiency as the leading principle for organization.

NEW NETWORK ARCHITECTURE MODELS NEEDED

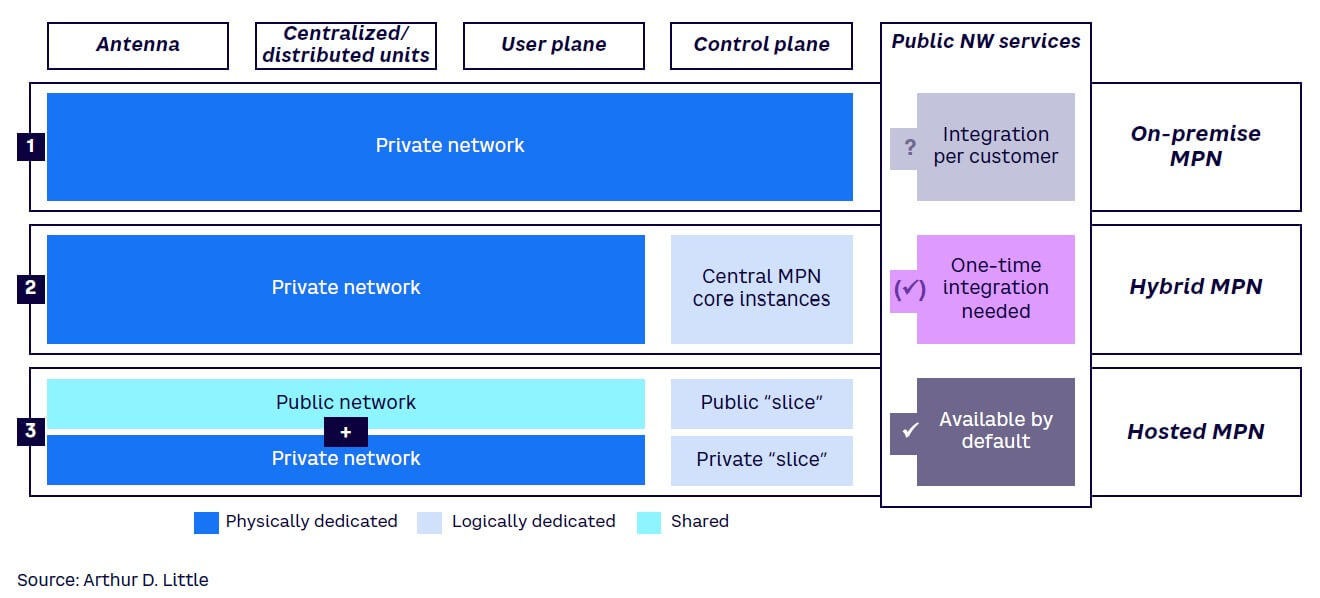

To support the requirements of these two value propositions, MNOs must augment their network architectures to be able to deploy and run multiple (and eventually hundreds of) customer-owned networks in a local context — a relatively new challenge for most MNOs. Facing the tradeoff of scalability versus flexibility, MNOs must also develop new technology architectures, often outside of the well-known public network domain. Overall, three key architectural models for MPNs have emerged, with each yielding varying levels of success: (1) on-premise, (2) hybrid, and (3) hosted (see Figure 5).

On-premise MPNs deliver high flexibility, at higher costs

An on-premise MPN architecture is meaningful when use case requirements are specific and data security/local site resilience requirements are high. The benefit of the architecture is a very high level of flexibility in terms of individual use case requirements and site autonomy. Also, utilizing a virtual orchestration platform can be a meaningful way to reduce the management and deployment complexity of single MPN sites.

However, this “island”-like architecture has two clear weaknesses: (1) to enable access to the public network for users of the MPN, either a costly integration between the two is needed or a dual-SIM solution that enables network switching; and (2) with expected future growth of deployed instances, managed service provisioning across a high number of local networks can be inefficient for MNOs.

From a cost perspective, the key benefit of the on-premise architecture is that it can be delivered by “new cellular entrant” vendors, with pricing well below industrial and carrier grade kits. Despite this, we expect on-premise MPNs to underperform in overall cost-efficiency when compared to a setup that utilizes existing public network infrastructure at scale. Success with use of such private network architecture is exemplified by Athonet’s offering of 5G-SA and CBRS private network starter kits, which include all key components such as mobile core, radio, and SIM/eSIM.

Hybrid MPNs are best suited for multisite deployments

A hybrid architecture is well suited for multisite MPN deployments since it is based on provisioning an already-integrated platform with a synergetic control and management plane. It belongs in the operator’s domain and is based on sharing a control plane (i.e., for authentication, signaling, configuration across deployments), with fully centralized or regionally shared instances possible. A multi-tenant deployment integration engine is used for standardized, low-effort addition of new sites. This architecture can also extend to the use of an on-premise core and macro radio (e.g., MOCN).

The key benefit is the cost efficiency of sharing a control plane across sites. Currently, this archetype can be enabled primarily by established NEPs, although this architecture can be challenging to deploy and run for MNOs due its technical setup and associated operational requirements. The main limitations of this setup, however, are that complexity increases with the number of deployments and the central MPN core yields performance limits. Success with use of such private network architecture is exemplified by Nokia’s Digital Automation Cloud offering — with applications across a range of private connectivity use cases, including smart city, factory automation, and video processing.

Hosted MPNs offer high synergies, but with lower flexibility

Hosted MPN solutions leverage and reutilize the existing public radio access networks and mobile core capabilities of the public mobile network. Clear benefits of this archetype are: (1) out-of-the-box integration with the public network (e.g., public number ranges and other services) and (2) a very high level of scalability and cost efficiency due to synergies with the public network. However, a possible downside is that coverage or capacity challenges in any part of the public network may trigger the need for complex and costly infrastructure extensions. Also, autonomy of the individual sites is lower by design due to a lack of dedicated infrastructure on various levels.

Additional challenges associated with this architecture include the difficulty of managing and prioritizing B2C/B2B operations within a single limited resource platform (from an MNO perspective). Further to this, the architecture is underpinned by some roadmap elements of 5G architecture such as network slicing, with this currently at an early stage of development. Success with use of such private network architecture is exemplified by Deutsche Telekom and Ericsson’s deployment of a dual-slice campus network for BMW, enabling both private and public connectivity.

CHOOSING THE WINNING GO-TO-MARKET STRATEGY

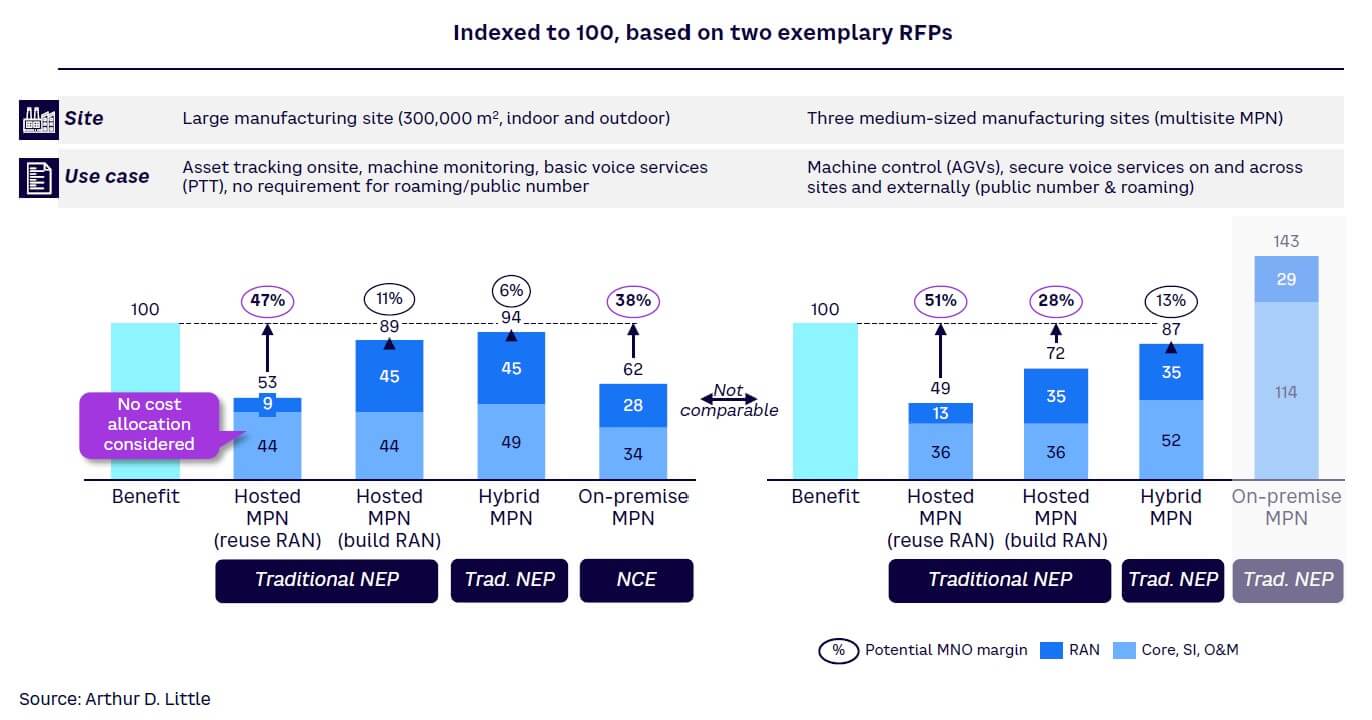

To win in the market, operators need to find the combination of value proposition and technical deployment model that best suits them. Choosing the winning combination is highly dependent on the enterprise’s situation in terms of use cases, their benefits/requirements, physical site specifics, and the provider’s unique selling position.

Two mobile private network sourcing examples showcase the success of different propositions:

-

Four provider offers are analyzed in a stand-alone, one-site MPN deployment, with relatively low technological requirements (see left side of Figure 6). Two combinations provide a “right-to-win,” with a price tag sufficiently below the expected benefit of the MPN — one in which the MNO can reuse parts of the public network to provide coverage and one in which a “new cellular entrant” vendor provides an on-premise solution. The cost for deploying a “traditional NEP” solution with fully owned infrastructure outweighs the expected benefits.

-

In a more complex deployment case (see Figure 6) of a multisite MPN with public network integration requirements, analysis shows that only a “hosted” solution that reuses the public network has a “right-to-win,” especially favoring MNOs with existing network coverage.

With any innovative and complex product like an MPN, a single winning go-to-market proposition does not exist. To be positioned to win, providers need to: (1) produce a value proposition with scalable sales and delivery channels and (2) expand their technology ecosystem to enable flexible deployment architectures. In this context, agility is fundamental to ensuring success, combined with a regular review of strategy and data-driven insight based on commercial viability.

Conclusion

The future of MPN

The potential for 5G in the private networking space is massive, but so are the challenges for organizations to realize its full potential. The 5G landscape has a complex, multi-partner ecosystem — with investment in 5G requiring organizations to work with a provider that yields a rich partner ecosystem, to support complex global deployments. In addition, as the number of connected devices increases, so does the number of security threats. As a result, organizations must develop security protocols for a more holistic strategy across the entire (private) network to protect operations, data, and devices from internal and external attacks. Thus, the level of change and innovation required to deliver on the 5G promise in the LAN will bring significant challenges, complexity, and need for investment, as customers increasingly want to ensure that new investments are 5G-ready.

Many organizations, however, lack the expertise necessary to grapple with this new technology and to provide an effective journey and deliver the right business value to reap the benefits of 5G.

Beyond connectivity, the business case for 5G needs to center around business value and aligning to customers’ needs, addressing key requirements for productivity and efficiency gains, safety, and sustainability. A common starting point, for example, involves requirements for Wi-Fi solutions (including its replacement/enhancement), which can begin the conversation around 5G, which in some scenarios offers a better TCO than Wi-Fi. Such a business strategy relies on four pillars:

-

Solutions — with best-in-class connectivity and security, through co-creation and co-innovation.

-

Ecosystem — including partnerships on various levels of engagement to develop a rich ecosystem that enriches propositions for customers in line with their requirements.

-

Customers — ensuring a strong understanding of buying types and their respective needs/decision-making processes.

-

Expertise — leveraging knowledge and experience in public 5G deployment and design across the wider portfolio, as well as vertical-focused solution/sales specialists.

5G must be a core component of a broader proposition and will rely heavily on the capability to deliver end-to-end on a global scale. Ultimately, innovation in the partner ecosystems will bring the private 5G proposition to life.