The future is no longer predictable. Businesses constantly face the challenge to interpret and plan for the impact of overarching trends, such as sustainability/climate change, geopolitical instability, resource scarcity, digitalization, and disruptive new technologies. Today’s CEOs must master resilience and growth in a world of uncertainty to ensure that they stay ahead of the curve. In this Viewpoint, we describe a systematic five-pillar approach to address this complexity.

Today’s businesses must ensure resilience in an unpredictable world driven by macro trends like geopolitical instability and sustainability, which can threaten supply chains or remove markets almost instantly. To remain competitive, management teams and boards must understand their landscape, acquire the right methods and tools, and take active decisions to stay ahead of the curve in their specific industries.

This adaptability requires new capabilities and mindsets — skills that many admit they lack. In fact, Arthur D. Little (ADL) analysis shows a clear correlation between business leaders’ digital skills and company performance, particularly as the importance of areas such as artificial intelligence (AI) accelerate. Yet, according to Amrop, 81% of boards have difficulties finding directors with digital capabilities to harness this transformation (based on analysis of 300 boards in Europe and US).

Staying ahead of the curve has never been more important — or more complex and urgent. Essentially, the modern CEO now must deal with an ever-changing market landscape, where the ecosystem space they operate in has expanded and time horizons have contracted dramatically, a scenario ADL first predicted in the Prism article, “The CEO — Lost in Space and Time?”:

-

The space where a company operates is continuously changing, industry lines are increasingly blurred, and cross-dependencies across fields are growing.

-

Time has contracted in the sense that it is no longer possible to clearly formulate a five- to 10-year strategic business plan. New disruptions occur continuously, demanding a huge acceleration in the pace of the business to adapt.

Building on that Prism piece, this Viewpoint looks at how to ensure continued success and business resilience in this new, disrupted reality. Senior leaders must be fully equipped with the capabilities and information required to create new adaptive business models, leverage new technologies, and digitalize their offerings.

This is a necessity to master the challenges of space and time.

This Viewpoint offers a five-pillar framework to deliver this leap forward, considering some crucial questions senior management should focus on, whatever their industry, including:

-

How do we keep pace with the latest business, technology, and regulatory trends?

-

How do we define and understand the implications of different scenarios for the future?

-

How does senior management work to evaluate and act on current trends and scenarios? What decisions and actions should it take based those trends?

5 CHALLENGES TO STAYING AHEAD OF THE CURVE

It is clear that all industries are impacted by today’s fast technology and business trend shifts. Figure 1 shows the companies that have entered and exited the S&P 500 stock market index over the past two years. While there are diverse companies on both sides, those that are thriving tend to have strong digital capabilities and are using those capabilities to drive disruptive change and build value, revenue streams, and market trust. They are proactively driving change rather than reactively being challenged by factors outside their control.

Staying ahead of the curve requires companies to master five specific challenges, as outlined below.

1. Operating in a fast-moving landscape

The world we live and work in is evolving rapidly, driven by macro trends such as demographic growth, urbanization, climate change, renewable energy, and geopolitical uncertainty. These trends are dynamic, interconnected, and unpredictable. As an example, few would have planned long-term for the far-reaching supply chain disruption caused by the war in Ukraine.

Alongside these macro trends, new business and technology innovations provide a mix of opportunities and challenges. Organizations need to master areas like the Internet of Things, AI, cybersecurity, robotics, and energy technology while simultaneously introducing innovative ways of operating along with new business models that are more sustainable and ecosystem-based. The need for innovation spans every sector; even traditional, slow-moving industries such as utilities now must harness technology to meet changing customer requirements and outperform new competitors.

2. Balancing short- & long-term trends

Business leaders have always understood the importance of longer-term business drivers and risks. However, the lack of immediate payoffs and uncertain time horizons can mean that they are not viewed as urgent or demanding of short-term focus. Now, however, time horizons are shrinking drastically. Businesses no longer have the luxury of focusing on either short- or long-term trends. Instead, they must cover both, particularly as the two often are fundamentally linked. For example, the only way to achieve on long-term sustainability goals is to deliver on short-/medium-term targets.

3. Misaligned incentives

Incentive structures often reinforce the bias toward short-term thinking. The need to demonstrate quarterly earnings growth to shareholders can easily outweigh commitments that deliver long-term payoffs.

Essentially, looking beyond the current curve delivers limited financial payback for executives and board members, especially if plans extend decades into the future. It is difficult to successfully communicate to distributed owners why an organization is taking a short-term loss now to position for larger benefits in the future.

4. Changing global regulations with far-reaching impacts

Across the globe, regulators are introducing and reinforcing legislation that can have immediate and significant effects on organizational business and operational models. These include:

-

Data privacy — for example, the EU’s General Data Protection Regulation (GDPR) and the US’s California Consumer Privacy Act (CCPA).

-

Sustainability — for example, the March 2022 US Securities and Exchange Commission (SEC) proposed ruling that all listed companies must describe climate-related risks to their business or proposed EU regulations regarding incentives and sustainability targets.

-

Increasing competition through regulation — particularly in digital “winner takes all” markets with legislation to better control the activities of those digital-first businesses that have grown rapidly and benefited from the switch to new technologies. For example, the US’s American Innovation and Choice Online Act, currently in the US Senate, aims to prevent large tech companies from boosting their own products and services over those of their rivals.

-

Geopolitical instability — responses such as sanctions, immediate tariff barriers, or forced divestments of particular assets due to the war in Ukraine.

Businesses must view all of this legislation as a driver and align themselves with its overall, long-term direction. To fully prepare, they must look beyond currently tabled proposals to future scenarios, such as those around recycling and circular business models.

5. Missing digital skills & competencies

A study of 2,000 companies by Peter Weill et al. from MIT Sloan School of Management found that just 7% were led by digitally competent teams, (i.e., where over half of senior management had digital skills). Unsurprisingly, those companies outperformed their peers by an average of over 48% in terms of both revenue growth and market valuation.

Over the last decade, boards have professionalized from a governance perspective, but digital competencies have not kept pace with requirements. That brings challenges for both current operations and future resilience, particularly as a lack of shared digital knowledge means there is no common language at the senior management level to discuss trends, technology, and risks.

APPLYING FRAMEWORK TO STAY AHEAD OF THE CURVE

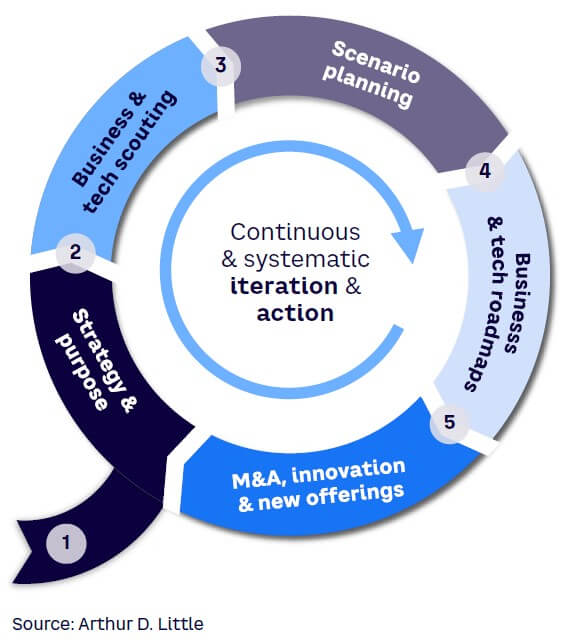

To deliver ongoing resilience to current and future operations, organizations must adopt a systematic approach that enables the right dialogue and decision making by both management and the board. To ensure maximum effectiveness, the key is to iterate and run the approach at a yearly cadence, continuously revisiting the five steps as a drumbeat throughout management. This framework covers five key areas, all of which must be continuously revisited (see Figure 2).

1. Company strategy & purpose

Begin by analyzing and understanding the organization’s purpose. Look at why your company exists and how the purpose is differentiated compared to competitors. What would disappear from the world if your company vanished? In a fast-moving environment, markets are hypercompetitive, and the precise purpose provides clarity and resilience in positioning and strategy. (This is explained in more detail in the ADL Viewpoint, “The WHY Strategy: There Is No Strategy Without Meaning.”)

Bringing management and the board together to define company purpose provides the opportunity to create a common understanding between stakeholders. This delivers a foundation for a clear strategy that outlines opportunities and directions for growth. It helps create a resilient strategy that anchors company purpose in customer needs.

2. Business & technology trends: Scouting & deciphering

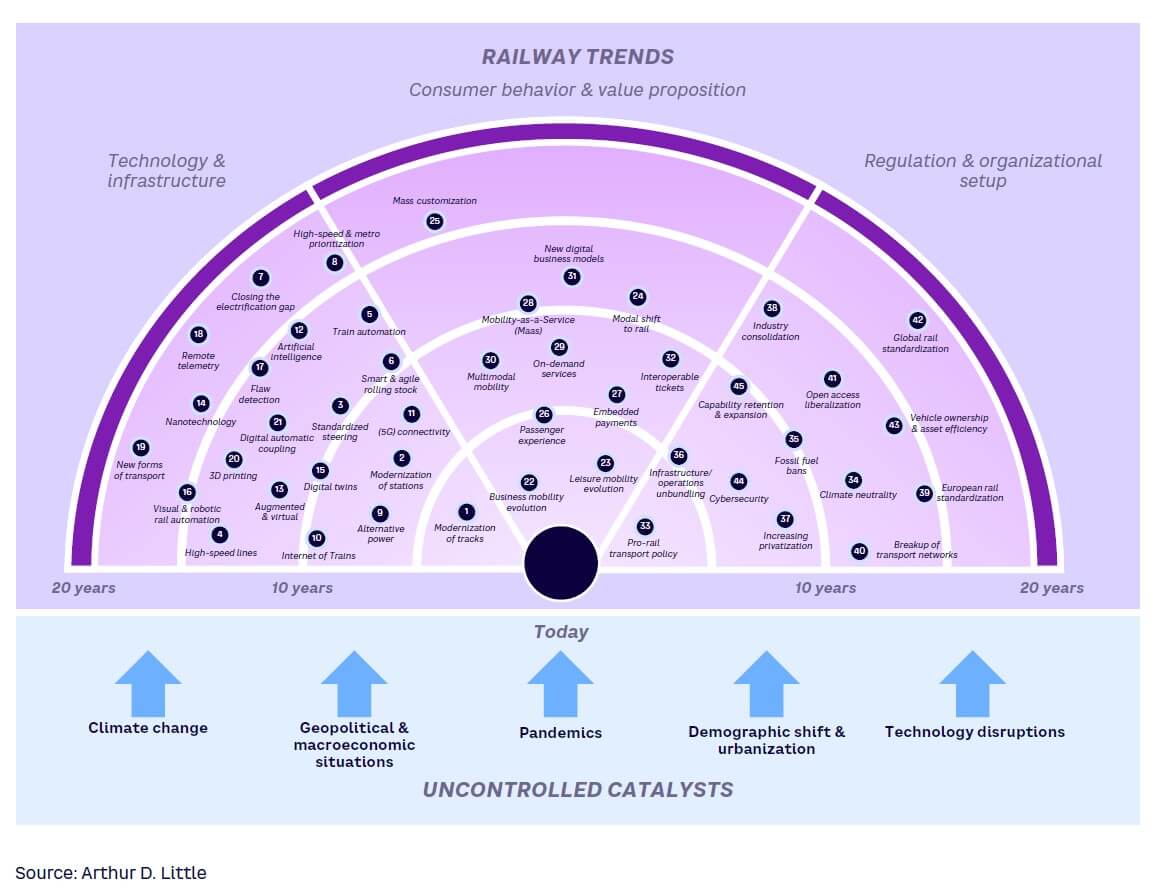

Organizations should strive to better understand the link between strategy, financial success, and business and technology trends. Adopting trend scouting through a trends radar brings senior management together and reinforces a common understanding — and provides a platform for informed discussion (for example, see Figure 3, a comprehensive trends radar of the rail industry, recently introduced in the ADL Report, “Rail 2040”).

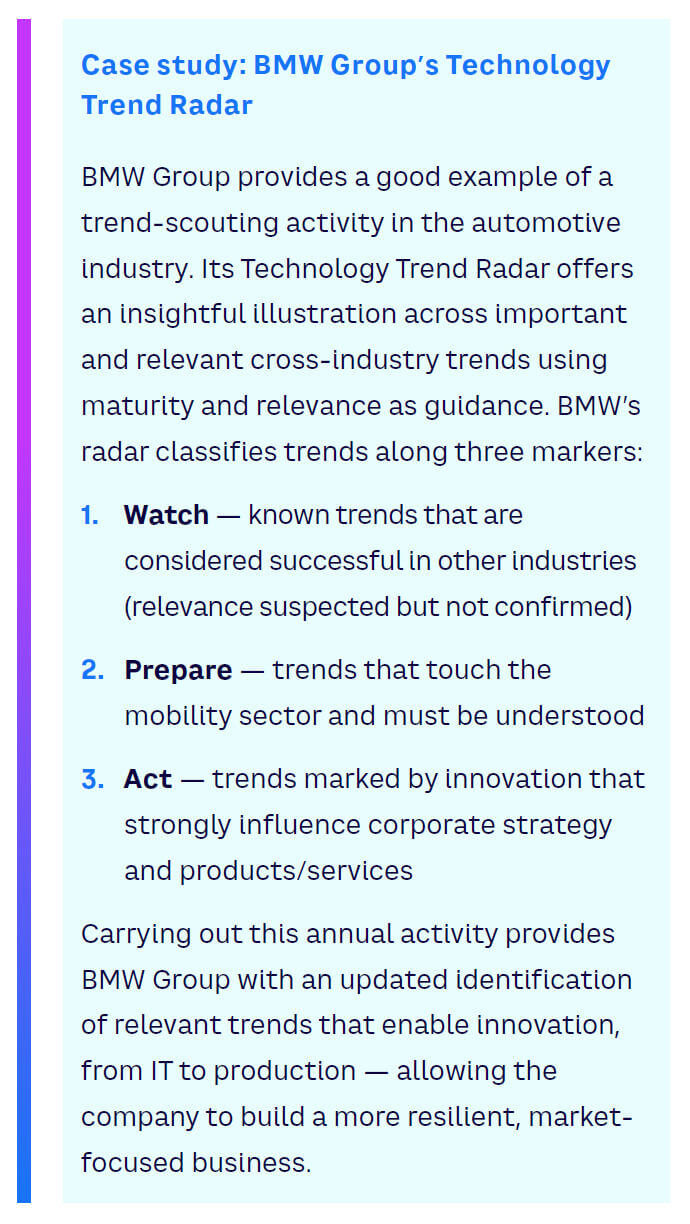

Trend scouting has internal benefits and can also be shared externally with the wider market and shareholders. This helps deliver an understanding of future strategy and areas of focus — helping to overcome shareholders’ potential short-term financial viewpoint (see sidebar “Case study: BMW Group’s Technology Trend Radar”).

3. Effective scenario planning

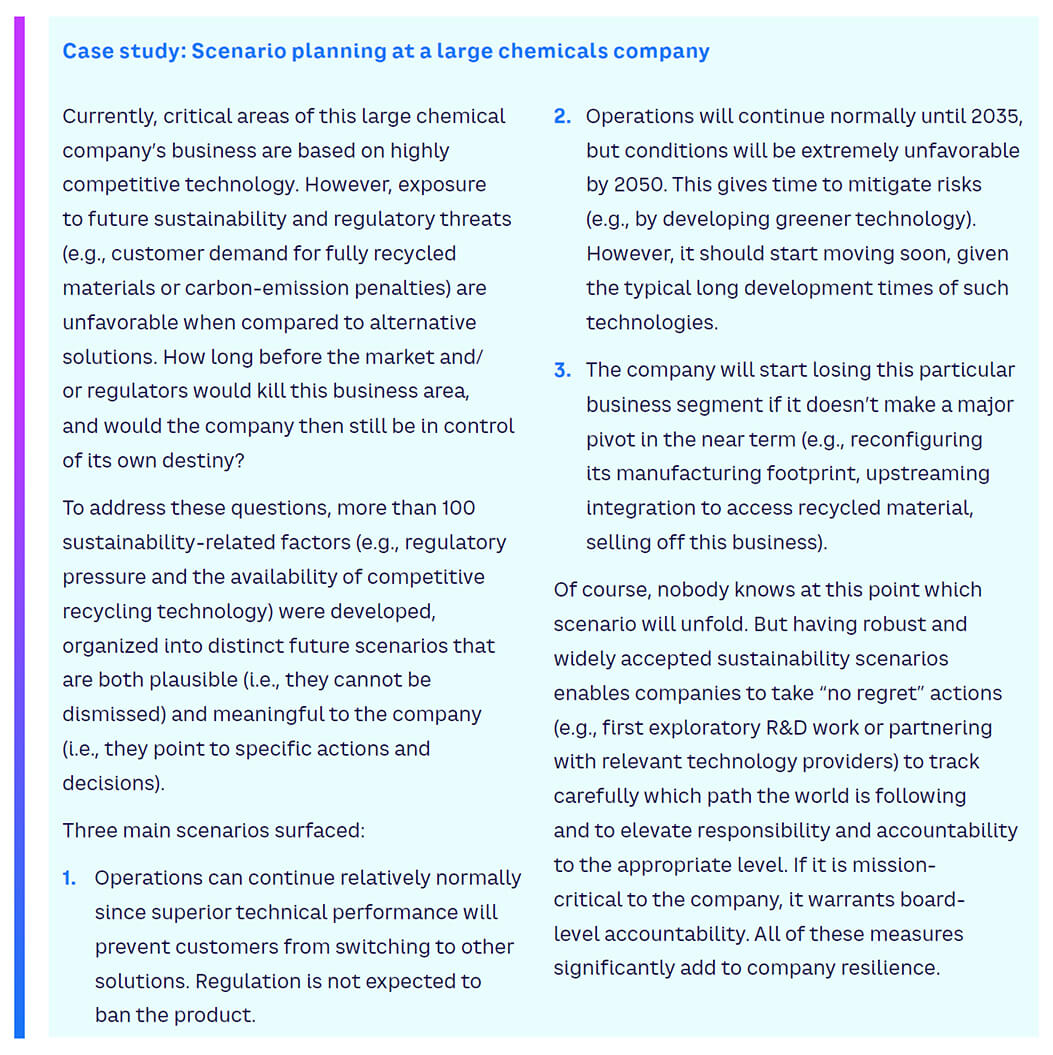

Turning trends into effective actions is difficult in an ever-changing and complex world. For many decades, scenario-based thinking and planning have been effective tools in capital-intensive industries such as oil and gas to try to predict the future (see sidebar “Case study: Scenario planning at a large chemicals company”). However, traditional scenario planning only goes so far, meaning these techniques require updates to meet modern requirements and to be extended to other sectors. Sustainability-related scenario planning, empowered by modern advanced analytics, will soon become best practice to manage companies for future resilience.

In a world of multiple what-ifs, scenario planning should be a core foundational element of the ambidextrous organization in order to deliver corporate agility and sustained performance. Such planning delivers resilience by highlighting uncertainties that are not only important but also require urgent attention. All too often, companies overestimate “time to impact” of longer-term developments (e.g., regulatory pressure or shifts in customer preferences) and underestimate the time needed to adapt effectively.

Nowhere is this more relevant than in sustainability risk. Organizations need to meet new customer demands and adhere to tighter regulations. When a large share of a company’s business portfolio is exposed to sustainability-related risks (e.g., future penalty on carbon emissions), it may take many years to make the company materially greener. In such a situation, which is common in many industries, a risk that may be 10 years away requires urgent attention and investment today.

The world is starting to take notice of sustainability risks. For example, the SEC proposed ruling mentioned earlier states that all listed companies must describe climate-related risks to their business states that:

“A registrant also would be required to describe any analytical tools, such as scenario analysis, that the registrant uses to assess the impact of climate-related risks on its business and consolidated financial statements, or to support the resilience of its strategy and business model in light of foreseeable climate-related risks.”

4. Continuous development: Capability & technology roadmaps

Once the organization has defined its purpose and strategy, analyzed market/technology trends, and run scenario planning exercises, it should move to create a capability and technology roadmap. The capability and technology roadmap should be both top-down and bottom-up driven:

-

Guided by vision and strategy (top-down). Here, the corporate vision statement acts as a guiding North Star principle driving subsequent strategic and solution promises. Key technologies and competencies are then decided on to fulfill solution promises, forming the basis of the capability need and roadmap design. This has a more open approach as a steering document, with the benefit of providing stakeholders with more autonomy when it comes to its execution.

-

Driven by products/services roadmap (bottom-up). In addition, the roadmap needs to have a clear link to the company-specific products and services roadmap (bottom-up). Incorporating technologies into the design of the capability and technology roadmap through this approach guarantees products and services can fulfill push and pull demand.

5. Informed decisions on M&A, innovation & new offerings

Upon outlining strategic bets in the capability and technology roadmap, executives need to make decisions regarding whether to develop the required capabilities in-house or to build them via M&A or alliances. These decisions will be impacted by wider factors, such as the availability of skills as well as potential targets and their price/availability.

One area that requires such decisions relates to organizations wanting to deliver responsible innovation. Responsible innovation plays a pivotal role in reaching sustainability targets and therefore building resilience into future operations. However, the level of financing applied must consider the sustainable innovation “bullwhip effect,” meaning that sustainable innovation decisions have a larger impact both upstream and downstream in value streams, while having a seemingly modest product and process effect at the R&D level.

This understanding should be factored into the level of financing applied to individual investments. Here, detecting market signals and analyzing impacts plays a central role in selecting relevant financing bets.

Conclusion

Where do we go from here?

Today’s CEOs need to master both time and space to enable resilience and growth. Carried out well, this exercise will deliver vital intelligence to help CEOs stay ahead of the curve. The key component of ensuring and safeguarding business resilience is to systematically incorporate ways of working with the aforementioned five framework pillars to:

-

Define a clear and differentiating purpose for increased strategy robustness.

-

Ensure continuous cadence for performing trend analysis (e.g., set up structures for relating key trends to business strategy).

-

Apply scenario planning to select the most viable path forward.

-

Establish methods for translating strategically significant trends into capabilities, incorporated in the internal capability and technology roadmap.

-

Ensure a robust and sustainable financing process that guides and supports decisions on whether to acquire or build the capability in-house or through external alliance(s).