DOWNLOAD

DATE

Contact

AI continues to evolve, and much like the software that came before, it “is eating the world.” AI has increasingly attracted attention from private equity (PE) investors seeking to capitalize on this burgeoning sector. However, the allure of high returns comes with significant risks obscured by AI technical complexity and hype. This Viewpoint enables informed investment decisions by identifying potential risks and critically evaluating opportunities in this challenging yet promising field.

In this comprehensive guide, we aim to outline (1) the importance of distinguishing between AI makers and AI users, (2) crucial ways to address the hype and the “fear of missing out” (or FOMO) versus AI’s real potential, (3) AI’s capabilities and inherent limitations, and (4) an examination of some practical tools and methodologies to assess the quality of AI assets effectively. These key points provide concrete ways to navigate AI investment decisions.

DIFFERENTIATING AI MAKERS FROM AI USERS

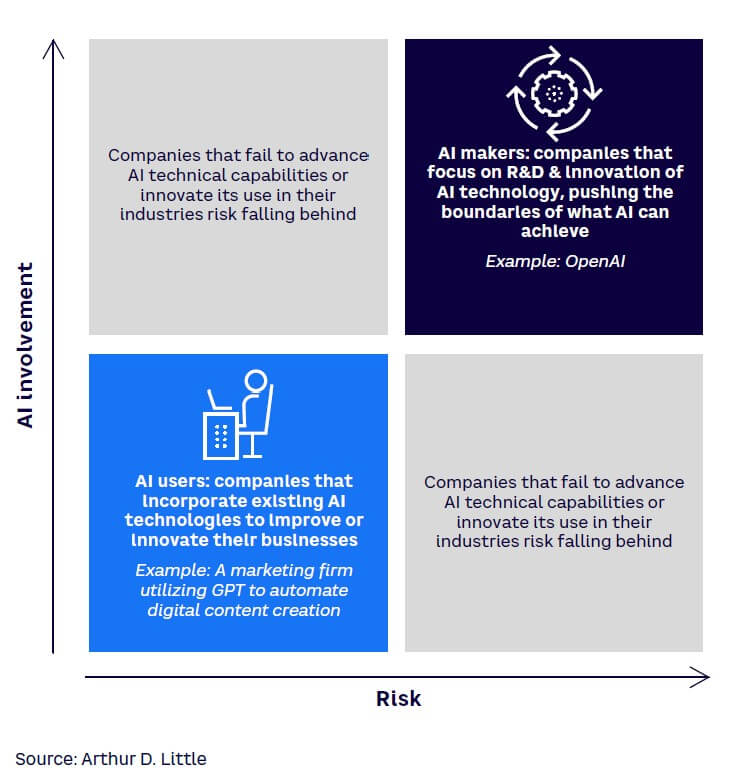

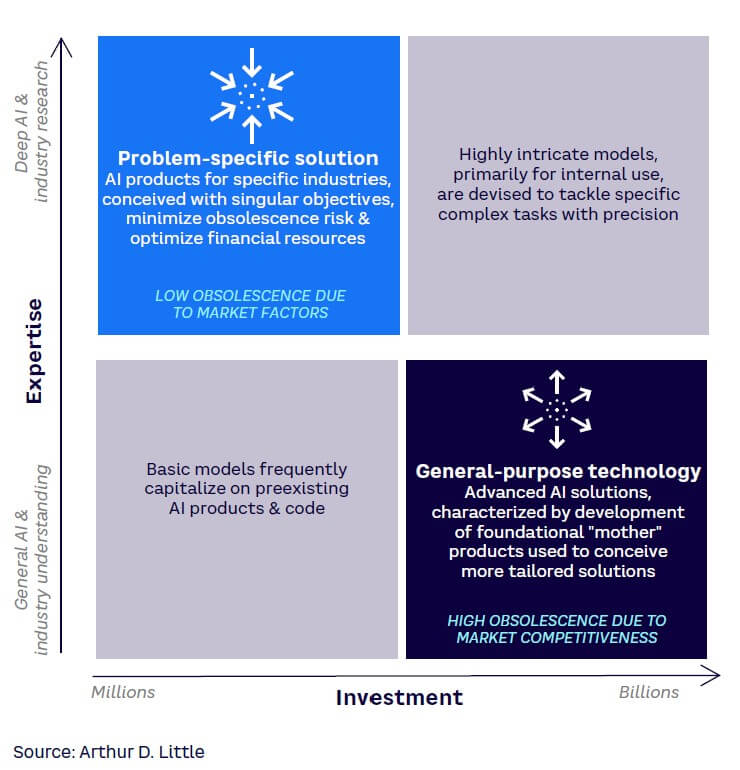

Distinguishing between companies that develop AI technologies (AI makers) and those utilizing AI to enhance their business processes or products (AI users) is crucial for investors, as it impacts the investment’s risk profile and potential returns (see Figure 1):

- AI makers — driving technology forward. Focusing on R&D and innovation of AI technology, AI makers drive the creation of new AI models and algorithms and push the boundaries of what AI can achieve.

For example, OpenAI, renowned for pioneering AI models like GPT (generative pre-trained transformer) that have set new standards for natural language processing (NLP), offers investment opportunities in cutting-edge AI R&D, carrying both higher risks and potentially higher rewards. The significant up-front costs required to develop and train foundational AI models could be nullified by competitors’ advancements, making investment a high-stakes endeavor. - AI users — leveraging existing AI for business enhancement. AI users are companies that incorporate existing AI technologies to improve or innovate their businesses, effectively applying these technologies in their industries without directly contributing to AI development. While this involves less investment and potentially lower risk of being outcompeted, it also limits the potential upside. Moreover, applying these technologies requires domain expertise, credibility in the market, and a specific configuration to address a customer’s unique problem. Consider, as an example, a marketing firm utilizing GPT to automate digital content creation (e.g., slide decks or blog posts). Rather than developing AI models, the firm integrates AI into its existing business model. Investments in such companies prioritize integrating and scaling AI tools within established business models, often resulting in more predictable, lower-risk returns.

Distinguishing between AI makers and AI users is essential for the following reasons:

- Risk assessment. Investing in AI makers involves a higher risk due to the inherent uncertainties in developing new technologies. In contrast, AI users typically present lower risks as they apply existing technologies.

- Growth potential. AI makers may offer explosive growth if their innovations succeed but face intense competition and high burn rates. AI users might not offer the same high growth potential but can provide steady gains by improving operational efficiencies.

- Expertise requirements. Investors in AI makers need a robust understanding of the underlying technology and its development landscape. Conversely, investments in AI users might require traditional industry knowledge, focusing on market penetration and scalability.

Understanding these distinctions (see Figure 2) enables PE investors to strategically tailor their investment approaches to match their risk appetite and target returns, leading to more informed capital investments in the AI sector.

HYPE/FOMO VS. REALITY IN AI INVESTMENTS

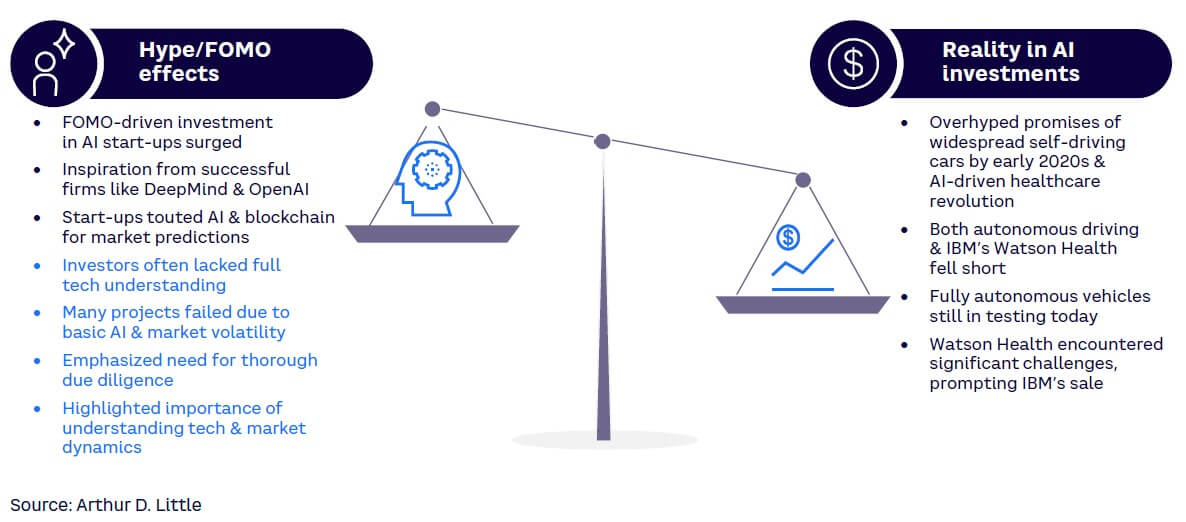

In the rapidly evolving field of AI, excitement and potential for transformational change often lead to significant hype. In particular, AI hype, often driven by exaggerated claims about capabilities, can mislead investors about the readiness of AI products and drive up valuations, creating bubbles that eventually burst when the technology fails to deliver as promised. FOMO can exacerbate the issue, as it compels investors to make decisions based on others’ actions rather than by a deep financial analysis and understanding of the technology (see Figure 3).

For PE investors, it is crucial to differentiate between genuine technological advancements and overinflated buzz. This section examines real-world examples to illustrate the distinction between hype and reality, providing insights on investment strategies.

As an example of hype, autonomous vehicles were projected to be a ubiquitous technology by the early 2020s. In fact, several high-profile companies touted fully self-driving capabilities to be just around the corner. The vision was a near future where personal vehicles would drive themselves, ride-hailing fleets would be fully autonomous, and logistics companies would employ driverless cars, ushering in an era of convenience and safety on the roads.

Despite the profound excitement, however, fully autonomous vehicles remain largely in the testing phase and are far from mainstream adoption as they face unpredictable real-world environments, regulatory frameworks, and slow development of public trust.

IBM’s Watson Health faced similar hurdles. The company promised a revolution in healthcare by applying AI to diagnose diseases, customize treatments, and optimize healthcare workflows. However, IBM’s AI was hampered by challenges in managing data complexity, scaling AI solutions, and inconsistent accuracy across diverse medical cases. In 2022, IBM sold Watson Health due to its struggles, highlighting the gap between the promises of AI in healthcare and the reality of its implementation.

For its part, FOMO has been a driving force behind the rapid investment in emerging technologies like AI, blockchain, and autonomous systems. Inspired by the successes of pioneering AI companies like DeepMind and OpenAI, as well as the rapid growth of sectors like cryptocurrency and blockchain, many investors flocked to fund start-ups with ambitious claims about the potential of these innovations. In some cases, these start-ups promised to harness AI and blockchain to solve complex problems or predict market trends, fueling a rush of investment from individuals and venture capitalists eager to capitalize on the next big thing. This fervor often led to investments without a full comprehension of the underlying technology, business models, or realistic potential outcomes.

While some companies have delivered significant advancements, many AI- and blockchain-driven start-ups have failed to meet expectations. For example, some AI-driven financial prediction start-ups claimed they could revolutionize trading through algorithmic predictions, but the high volatility of financial markets and the rudimentary application of AI in such complex, dynamic systems often meant that these solutions were not as reliable or innovative as advertised. Many projects have floundered or failed, costing investors large sums.

Strategies to counteract HYPE/FOMO

This wave of failed ventures highlights the need for due diligence and a deeper understanding of technology and market dynamics. To avoid the pitfalls of investing based on hype and FOMO, we suggest investors consider the following six strategies:

- Technical due diligence. Engage AI experts to critically assess current capabilities and development prospects, including algorithms, data quality, and real-world results. Ensure every investment is backed by a thorough analysis of the AI technology, the business model, and the leadership team, as well as the specific use case of AI and demand evidence of concept viability.

- Market validation. Invest in companies with proven AI deployments and paying customers rather than those with untested, hyped technologies. Focus on long-term potential rather than short-term trends. Consider whether the AI application has a sustainable market demand and how it fits within broader technological and economic trends.

- Regulatory and ethical considerations. Consider regulatory challenges and ethical implications, as they can impact AI adoption and scalability.

- Long-term potential versus short-term gains. Focus on companies with sustainable, long-term AI business models, not those chasing short-term hype.

- Risk management. Diversify investments to mitigate risks associated with any single emerging technology area. This is particularly important in AI, where the landscape is rapidly evolving, and many technologies are still in the experimental stage.

- Educate against hype. Promote a culture of learning and understanding within your investment team. Ensuring that decision makers are educated about AI and its realistic impacts can help prevent decisions driven purely by market excitement.

Understanding and incorporating these aspects into their investment analyses will allow PE investors to discern between substantial opportunities and those inflated by hype. This strategic approach mitigates risk and positions investors to capitalize on impactful AI advancements.

AI CAPABILITIES & INHERENT LIMITATIONS

Of course, before venturing into the AI landscape, it is crucial that companies understand AI’s capabilities and limitations. This knowledge ensures realistic expectations and strategic decisions. In this section, we delve into common misconceptions about AI, explore its actual capabilities, and discuss the importance of recognizing its limitations.

AI technologies, particularly those driven by machine learning (ML) and deep learning, have shown remarkable capabilities in various domains like NLP, image recognition, and predictive analytics. However, investors must distinguish AI’s current capabilities from aspirations.

While it is important to demystify the hype and misconceptions around AI, it is equally crucial to acknowledge its potential. AI is making a tangible impact across industries, including transformation in the following:

- Healthcare. AI-powered diagnostic tools enhance accuracy and speed, while predictive analytics optimize patient care and resource allocation.

- Finance. Algorithmic trading and fraud-detection systems are revolutionizing the financial sector, and AI-driven customer service chatbots like Klarna are improving user experiences.

- Retail and e-commerce. Personalized recommendations and demand forecasting are driving sales and customer satisfaction while supply chain optimization is reducing costs and improving logistics.

- Manufacturing. Predictive maintenance and quality-control algorithms are minimizing downtime and defects, leading to significant cost savings.

- Energy. AI is optimizing energy consumption, predicting equipment failures, and facilitating the integration of renewable energy sources.

PE firms are uniquely positioned to leverage AI’s capabilities, which can play a crucial role in:

- Due diligence. AI-powered tools can analyze vast amounts of data to identify potential risks and opportunities, enabling informed investment decisions.

- Portfolio management. AI can monitor portfolio companies’ performance, identify areas for improvement, and provide data-driven recommendations.

- Exit strategies. AI can analyze market trends and predict optimal exit timings, maximizing returns on investment.

While AI technology holds immense promise, it also faces inherent limitations that are often overlooked or misunderstood. Current AI capabilities are frequently overestimated, leading to misconceptions, such as the belief that AI can fully automate businesses or completely replace human judgment. These unrealistic expectations, coupled with a lack of awareness about AI’s fundamental constraints, risk overinvestment in immature technologies.

To make informed decisions, investors must carefully evaluate AI systems based on key performance metrics, including accuracy, reliability, error rates, and other indicators specific to the intended application. Equally critical is a thorough assessment of an AI system’s data foundation, as the quality, quantity, and management of data directly impact an the system’s performance and potential. By critically evaluating performance metrics, data practices, and AI limitations, investors can accurately gauge capabilities and make strategic decisions that balance potential with practical constraints.

Case studies: The transformational power of AI

At Arthur D. Little, we have seen firsthand how AI has revolutionized numerous industries; for example:

- Pharmaceutical companies struggle to plan and prioritize their clinical studies portfolio. A platform that uses AI/ML and event tree analysis enables companies to assess the impact of decision points on overall portfolio spend. Through a dynamic dashboard and probabilistic scenarios simulation, AI enables quick evaluation of the impact on the portfolio.

- A mass transit provider faced disruptions from falling trees on train tracks and inconsistent maintenance. A cutting-edge AI/ML solution predicts static and dynamic risks across track segments, leveraging climatological and geospatial data. This has resulted in a predictive maintenance system and improved tree and risk management.

- A European transmission system operator faced challenges with maintenance scheduling and hard-to-reach equipment locations. A generative AI solution simplifies standard operating procedures and manuals by building a graph network representation of locations and requirements and using graph intelligence to feed relevant documentation to large language models to generate step-by-step instructions for maintenance engineers. This has resulted in dynamic documentation that improves maintenance scheduling.

TOOLS & METHODOLOGIES FOR ANALYZING AI ASSETS

Evaluating AI assets accurately and effectively is crucial for PE investors, as it determines the investment’s potential success and sustainability. This section discusses various advanced tools and methodologies to analyze AI assets, emphasizing their practical application to provide a comprehensive framework for due diligence.

The tools and methodologies for analyzing AI assets include:

- Static code analysis for AI. Static code analysis involves examining the source code of AI systems to identify potential flaws or vulnerabilities without executing the program. This analysis is crucial for ensuring the robustness and security of AI software.

- Performance benchmarking. Performance benchmarking measures an AI system’s effectiveness against standardized tasks and comparisons with industry benchmarks or competing solutions.

- Data audits. Conducting data audits involves a thorough examination of the data sets used to train and test AI models. Audits assess the quality, diversity, representativeness, and ethical sourcing of data.

- Ethical and bias evaluation. Evaluating AI systems for ethical considerations and biases is increasingly important, especially in applications that impact human lives directly, such as in hiring, lending, and law enforcement.

- Financial/commercial metrics for AI companies. Financial evaluation remains a cornerstone of investment analysis, tailored to the specifics of AI companies.

- Advanced analytical methods. Investors can also employ more advanced analytical methods to gain deeper insights into the technical and business potential of AI investments.

- AI expert consultations. Incorporating insights from AI experts can provide an additional layer of depth to the analysis, offering perspectives that pure data might not reveal.

These approaches allow PE investors to analyze AI assets comprehensively and rigorously, ensuring better understanding of the technological and financial aspects of potential investments and the company’s identification with scalable and ethically sound AI solutions.

Conclusion

AI INVESTMENTS HOLD PROMISE, BUT INVESTORS MUST CHOOSE WISELY

While AI investment is challenging due to its complexity and rapid evolution, it remains a highly promising area for those well prepared to assess and embrace its nuances. By staying informed and vigilant, PE investors can thrive in the unfolding future that AI promises. As we have explored in this Viewpoint, key considerations for effective AI investment include:

- Differentiating AI users from AI makers. Understand the risk profiles and growth potentials of companies developing AI technologies (high risk, high reward) versus those using existing AI technologies (lower risk, steady returns).

- Addressing hype and FOMO. Recognize exaggerated claims and FOMO to make informed investment decisions, using strategies like comprehensive due diligence and long-term perspectives.

- Understanding AI capabilities and limitations. Distinguish between AI’s current achievements and its realistic limitations to avoid overinvesting in immature technologies while prioritizing data quality.

- Utilizing advanced tools and methods. Employ techniques like static code analysis, performance benchmarking, data audits, and ethical evaluations to thoroughly analyze AI assets.