DOWNLOAD

DATE

Contact

WHAT ARE NETWORK APIs? WHY DO THEY MATTER?

Emerging use cases like Industry 4.0, drones, connected mobility, and more are fueling the demand for a new set of network application programming interfaces (APIs). Communication service providers (CSPs) need to act now to capture value — collaboration will be critical to prevent slow market take-up and a marginalized role for CSPs.

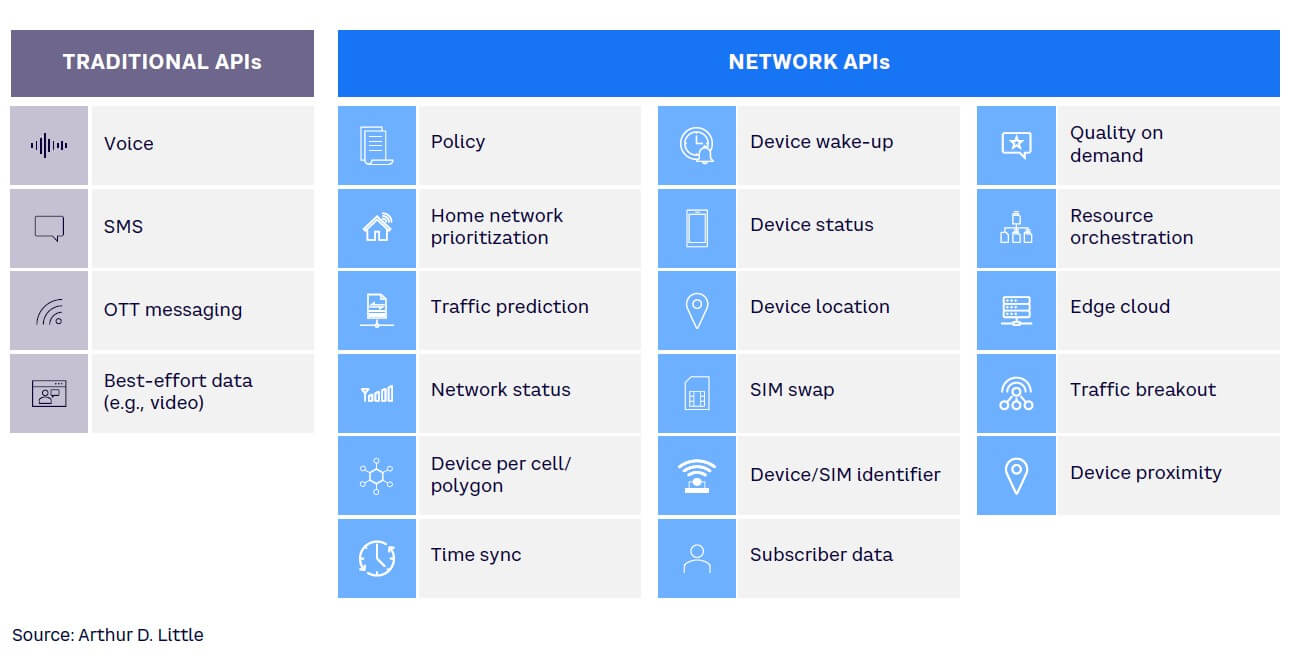

Traditional APIs have been built around core telecom services (e.g., voice, SMS, and video), allowing enterprises to access functionality like SMS-based one-time passcodes or over-the-top (OTT) messaging services. This ecosystem simplified the way enterprises sourced and used network connectivity. With the adoption of 4G and 5G networks, along with the virtualization of network functions exposing new areas of the network, next-generation APIs are now available.

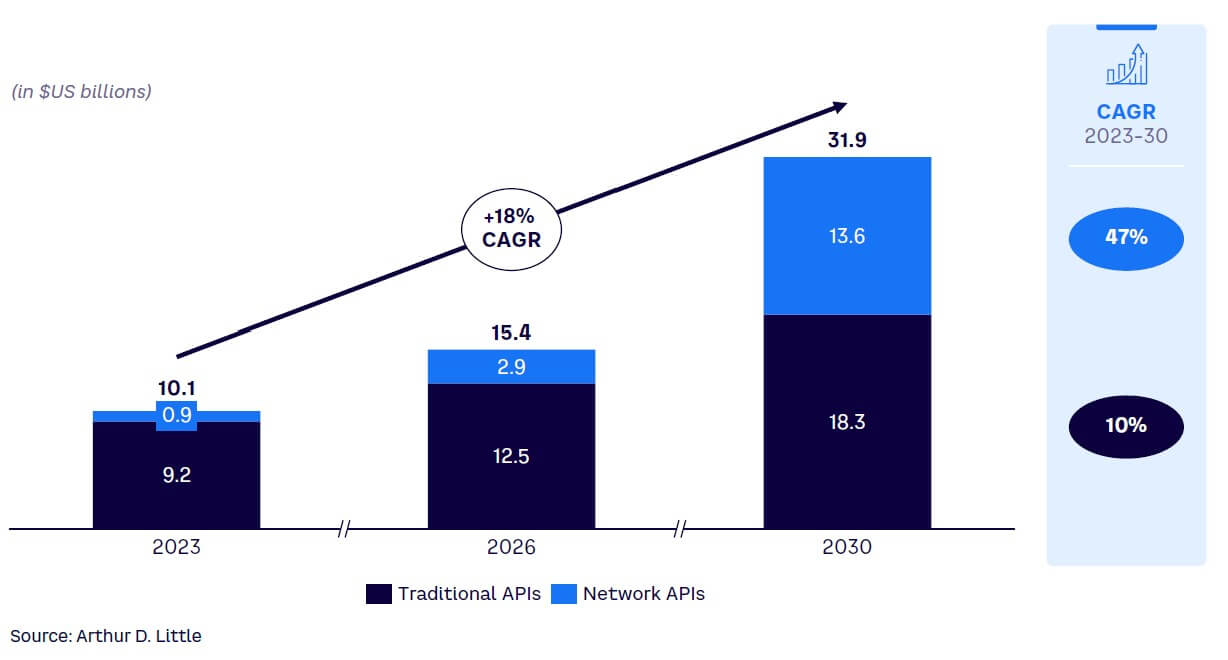

These APIs enable more sophisticated use cases, including guaranteed quality of service, resource orchestration, and edge cloud computing. The use cases offer potential revenue for CSPs, which is important to monetizing their large network investments over the past several years. The network API market is expected to grow by a CAGR of 47% between 2023 and 2030 (from about US $1 billion to $13.5 billion), and communication APIs overall (including SMS, video, and voice) are expected to grow at an CAGR of 18% (to a total value of about $32 billion by 2030). It will be crucial for CSPs to react rapidly to reap the rewards of this growing market and deliver attractive ROIs on spent network CAPEX (see Figure 1).

Network APIs let external software applications interact with and use the capabilities of a CSP’s network. Network APIs operate across three layers:

- Layer 1 — the underlying network, including direct interconnections and SIP trunks

- Layer 2 — the communications solution, which considers the value of “pure play” APIs (APIs aggregated but not enhanced with documentation and SDKs) as well as “wrapped” APIs (pure-play, consumer-ready APIs, such as documentation, SDKs, and sample code)

- Layer 3 — the process solution layer, which considers the value of enhanced APIs or solutions built using a combination of Layer 2 APIs

(Layer 4 is a complete solution that sits outside the network API market considered in this Insight.)

Network API use cases

Network APIs promise to let businesses access advanced network capabilities, such as ultra-low latency and precise location services (see Figure 2), which can enable various use cases in the industry.

Example use cases include:

- Guaranteed stream quality. “Quality on demand” APIs guarantee a certain level of network performance for a specified time (e.g., a live-streaming event). For example, Netflix could use this to ensure uninterrupted service during a film premiere.

- Precision vehicle connectivity. Location-based services APIs provide precise geolocation targeting, enabling use cases such as connected vehicles. For example, ports and other private facilities could operate autonomous, fully connected vehicle networks.

- SIM-based authentication. APIs using SIM-swap technology can gather information about the latest SIM swap date of a mobile line. This can be used for number verification for frictionless, secure authentication services for B2C and B2B purposes. Telcos such as Orange and Telefonica have already deployed this technology.

Network API core customers

We believe CSPs that successfully engage with the network API market will generate revenues from four core customer groups purchasing API-driven connectivity:

- Aggregators. These companies connect enterprises with multiple telecom operators, making APIs easier to use (e.g., Twilio, Vonage, Sinch, and Infobip).

- Hyperscalers. These large cloud providers will use APIs to enhance services for their own needs or to sell to enterprises (e.g., Microsoft, AWS, Google, Oracle).

- Independent software vendors. These solution developers integrate APIs into their applications to offer enhanced services to their enterprise clients (e.g., Cisco, SAP, Salesforce).

- Enterprises. These large companies have sufficient scale to use APIs directly in their applications (e.g., Netflix, Uber, and Temu).

Although the market potential for network APIs is large, some obstacles must be overcome to unlock its promised value. First, a common CSP approach toward APIs is critical to create a compelling alternative to hyperscaler and aggregator offerings (e.g., Twilio, Sinch, and Megaport) and accelerate overall take-up of high-quality network APIs. Second, industry-wide initiatives (e.g., CAMARA, Open Gateway, and TM Forum) already exist, although given the complexity of network APIs, an additional layer of cooperation in the form of a joint company is necessary to enable seamless API aggregation for developers to easily leverage their solutions.

CSPs will need to: (1) ensure their APIs are standardized across as many other CSPs as possible; (2) build a global network in their standardization efforts; and (3) provide a single, aggregated API to decrease integration costs and attract as many downstream users as possible.

NETWORK API JOINT VEHICLE ADDRESSES CHALLENGES

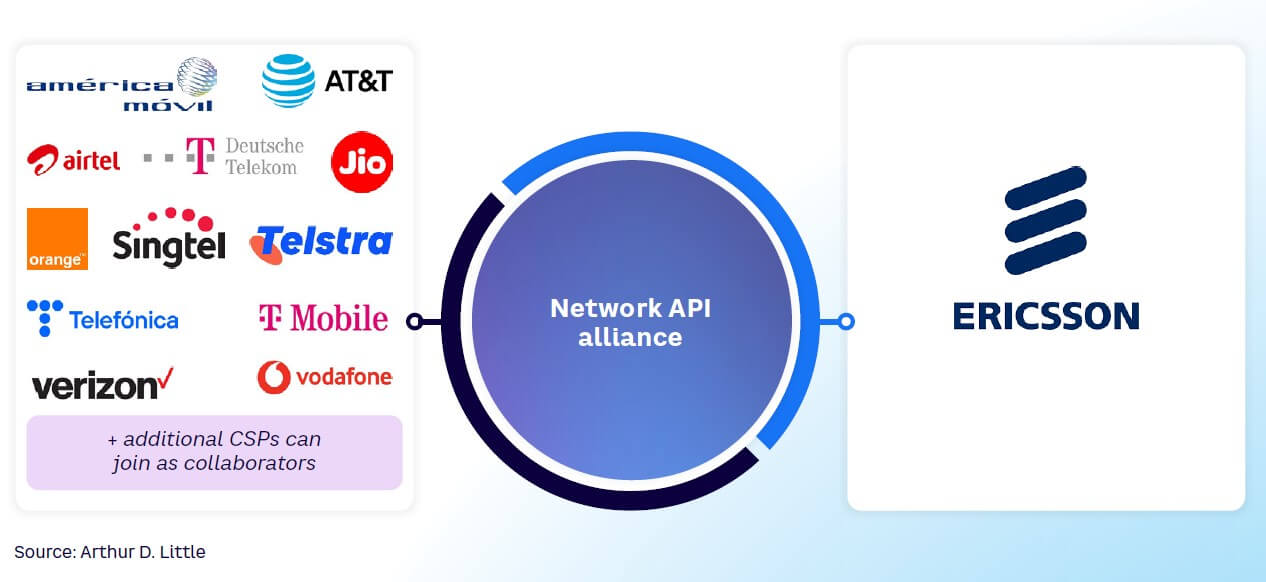

Arthur D. Little has supported CSPs over the past 24 months in conceptualizing and implementing an industry-wide collaboration that will address the challenges mentioned above and help accelerate the network API market for CSPs worldwide. In September 2024, Ericsson and 12 leading CSPs[1] announced a joint company establishing a collaborative ecosystem for APIs (see Figure 3). A CSP collaboration done quickly and decisively gives a first-mover advantage and allows CSPs to have a future network API “category builder” role, as is the case with Open Gateway.

The goal is to develop and aggregate a standardized set of APIs based on CAMARA’s principles. These APIs will be available across multiple networks, making it easier for developers to build new services on top of them. These APIs and the use cases they enable offer significant revenue-generating potential for participating CSPs. A joint company of this nature facilitates API standardization, making APIs accessible to a broad audience of developers and customers to use in their applications. The global coverage of aggregated APIs will encourage the development of use cases that require extensive reach to be commercially viable for developers, unlocking revenue potential.

MOVING FORWARD

Network APIs represent a powerful opportunity for CSPs to monetize their networks and become central to the digital economy. CSPs, whether members of the company or not, have a clear “right to win” in this market given their:

- Ability to manage quality of service

- Native access to customer/device information

- Strong enterprise go-to-market (G2M)/access

- Excellence in consumption-based business models

- Fundamental carrier economics

It’s clear that CSPs need to respond to the rise of network APIs to thrive in the changing telecom market. We recommend the following:

- Collaborate now. Work closely with other CSPs to: (1) identify the most compelling use cases and associated APIs; and (2) co-create product roadmaps to address these (while respecting regulatory and competition restrictions across geographies). Projects such as the Network API alliance can help open up a CSP’s network to standardized APIs.

- Educate the market. CSPs must prove the potential of network APIs to their customers. Through hackathons, pilots, and early deployments, players can demonstrate the real-world impact of network APIs, build confidence in the market, and attract API consumers to further develop them.

- Deploy G2M capabilities. Operators should leverage their enterprise sales capabilities to sell network API-enabled solutions to seize market opportunity. This can take the form of direct sales or through partnerships with aggregators and hyperscalers.

We would like to acknowledge all those who contributed to this Insight, especially Bela Virag, Maximilian Scherr, and Pierre Peladeau.

Note

[1] The full joint company comprises Ericsson, América Móvil, AT&T, Bharti Airtel, Deutsche Telekom, Jio, Orange, Singtel, Telstra, Telefónica, T-Mobile, Verizon, and Vodafone.