After record-breaking transaction years in 2020 and 2021, markets cooled down significantly, and transactions came to an almost standstill. While 2023 and 2024 started seeing a rebound, it was largely driven by strategic acquirers taking advantage of private equity (PE) and venture capital’s (VC’s) limited ability to compete. At the same time, healthcare life sciences (HCLS) PE fundraising activity has remained strong, limited partners (LPs) remain interested in HCLS, and there is a lot of capital in the market ready for investment. So where should investors look next?

STILL A SLOW CURRENT MARKET

With high (although decreasing) interest rates across markets as well as macroeconomic and geopolitical uncertainty, global PE markets have slowed down since their peak in 2021 when deal volumes and fundraising were at historical highs. Investments in the HCLS sector are no exception. According to a healthcare funds report by Pitchbook, global PE deal volume has decreased by 35% and 27%, respectively, between 2021–2022 and 2022–2023. The largest decrease has been in Europe, with a -48% CAGR in investments in 2021–2023, in contrast to North America (-29%) and the rest of the world (-16%). While the US began seeing some recovery in 2023, it has taken until 2024 for Europe to start picking up again.

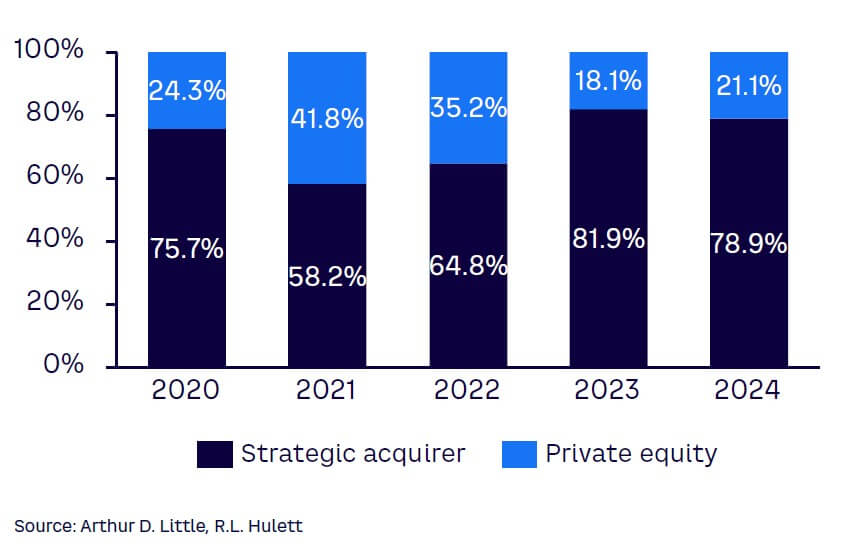

According to a report by R.L. Hulett, PE’s share of total capital invested in healthcare M&A deals decreased significantly in 2023 to 18.1%, down from 41.8% in 2021 (see Figure 1). Strategic acquirers, on the other hand, have completed several large deals in 2023, particularly in the US. The largest deal was Pfizer’s acquisition of Seagen, a leader in antibody-drug conjugates (ADCs, a class of biopharmaceutical drugs typically used as targeted therapy for cancer treatment) technology, for approximately US $43 billion.

Other notable acquisitions were Amgen’s $28 billion purchase of Horizon Therapeutics (focused on rare, autoimmune, and severe inflammatory disease medicines) and Merck & Co.’s acquisition of Prometheus Biosciences (a maker of autoimmune drugs) for $10.8 billion.

In Europe, there have been very few HCLS companies for sale overall, but the available companies have been sold at very high multiples (up to nearly 25x) EBITDA. Some have been sold to bigger funds exploring consolidation plays, while industry players have acquired others. For example, British PE company Permira’s acquisition of Ergomed was valued at approximately 24x its adjusted EBITDA for FY22. Industry player Danaher’s acquisition of Abcam at a $24/share price was ~21.5x its expected EBITDA for 2024.

“It is mainly industrial buyers who bought to high multiples, as they find it easier to get financing. They see immediate industrial synergies that are worth paying for.”

— Head of healthcare investments, investment bank

Arthur D. Little’s (ADL’s) interviews with investment managers at PE and VC funds have confirmed that the current funding landscape has made them more cautious in making new deals and, in general, prompting them to perform more rigorous analyses and due diligence before making new investments. Also, more investments are being directed toward already existing portfolio companies as this entails less risk. Consequently, early-stage biopharma companies (those publicly listed as well as companies seeking VC backing) are having a difficult time getting capital, whereas later-stage and more stable holdings are managing despite the tougher market climate.

Strong underlying fundamentals

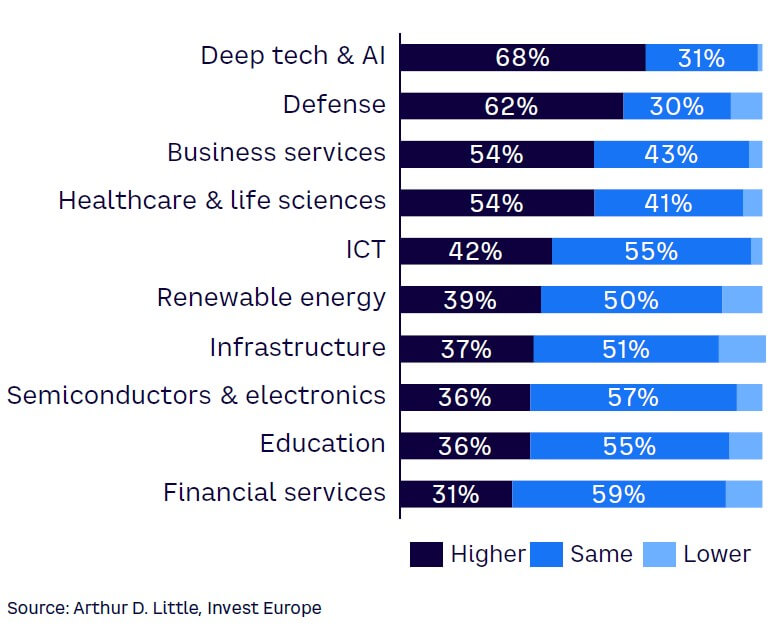

Overall, investors are aligned in viewing the underlying fundamentals for HCLS as strong and the long-term outlook as positive. GPs continue to focus on healthcare and life sciences (see Figure 2), and a 2023 Coller Capital survey found that 87% of LPs believe that healthcare and pharmaceuticals are strong potential areas for PE investment in the coming two years — making it the most appealing sector for investments. Biotech (biologics and new treatment modalities) is slightly less attractive, with 63% viewing it as a good area going forward. This is likely an effect of lower investments from VCs and fewer biotech companies maturing into the PE space.

“As long as there are better and better drugs being developed, there will always be investors who are interested.”

— VC partner and board member

Dry powder & impending exits

A near-term change is expected in the healthcare PE market, driven by both a large amount of dry powder and upcoming exits that need to be realized. Looking at Europe and North America, healthcare specialized funds have raised significant amounts of capital in the last couple of years. In 2023, although the total number of funds closed was almost half of totals in 2021 and 2022, capital raised reached an all-time high of $18.3 billion closed by end of the year. Pitchbook’s “Healthcare Funds Report H2 2023” estimates the total dry powder caches for healthcare deals at around $162.4 billion and around $39.7 billion for life sciences VC deals. Moreover, many funds are currently delaying exits as they wait for the market to improve. In the near term, funds will need to realize value to their investors, which means companies held back in 2022 and 2023 will soon enter the market.

“We have been able to exit portfolio companies with strong fundamentals even though the market has been challenging, but we do have a number of assets that we have needed to roll over into a new fund, and while LPs understand that, they are also increasingly asking questions about our ability to exist.”

— PE investment manager

PROMISING INVESTMENT AREAS GOING FORWARD

While both private and public markets have been slow for HCLS investments, progress in the industry has not slowed down. We have continued to see strong scientific development and continued growth of new modalities. While it will take a while for many of these new modalities to get out of the VC investment space, they give rise to investment opportunities in adjacent fields.

Driven by continued technological advancements with a high speed of innovation, several emerging areas related to so-called pharma/biotech enabling services, tools, and technologies should attract investors going forward. In contrast to the drug development field, which involves high development and medical risk, companies operating in these pharma/biotech-enabling areas have more stable cash flows and allow for a less risky path into the sector for investors.

Pharma services

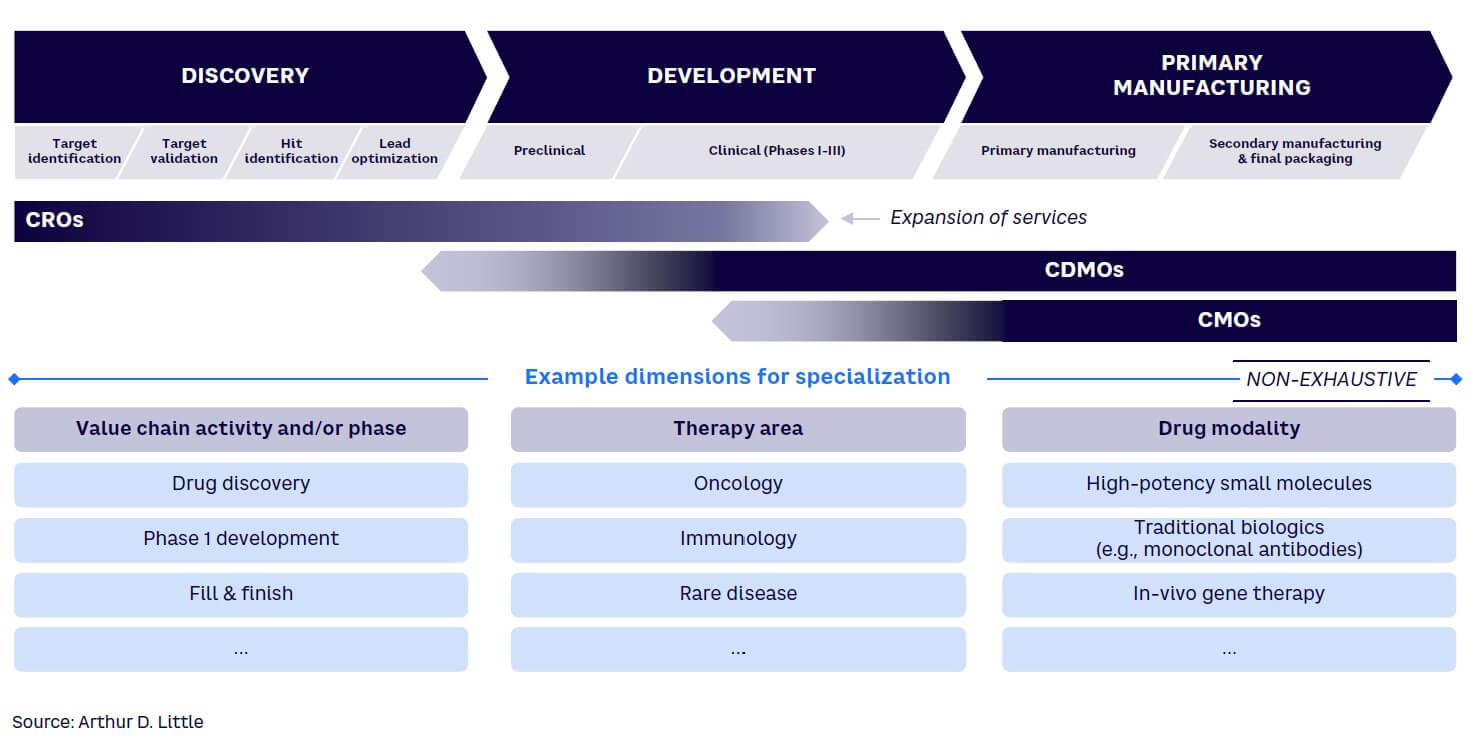

Over the last year, the pharmaceutical industry has witnessed a significant shift toward more complex treatment modalities, cell and gene therapies, ADCs, radiopharmaceuticals, and bispecific antibodies. These advanced therapies are challenging to develop/manufacture and navigate a less mature regulatory landscape. As this complexity calls for specialized capabilities, pharma companies of all sizes increasingly rely on outsourcing for both development and manufacturing (see Figure 3).

Despite the strong M&A and investment appetite within the contract research organization (CRO) and contract development and manufacturing organization (CDMO) sectors in recent years, new, highly specialized players continue to appear. These organizations carve niches for themselves by focusing on specific modalities and/or aspects of the pharmaceutical development process, thereby offering significant opportunities for investors. Examples of such specialized players with significant growth over the last years include Belgian Exothera, a specialized CDMO delivering preclinical to commercial manufacturing services for viral vector and RNA-based therapeutics and vaccines; UK-based RoslinCT, a cell therapy-focused CDMO with expertise in process development, analytical testing, and clinical and commercial manufacturing for induced pluripotent stem cell (iPSC)-based therapies; and Finish FinVector, a CDMO focused on viral-based gene therapy products.

Tools

Recent technological advancements have significantly enhanced the sensitivity, speed, and resolution of various analytical assays and tests, expanding research opportunities in fields such as proteomics. Once an area of interest only for academic research, proteomics is increasingly being leveraged by pharma companies and CROs as they expand their service offerings.

Researchers are currently investigating a range of other “omics” as well (e.g., metabolomics, lipidomics, and glycomics). Though these areas of research remain relatively immature, attention to these fields is expected to increase, potentially seeing a similar development as for genomics and proteomics.

Although various techniques can be used for proteomics and other “omics” analysis, mass spectrometry–based techniques such as liquid chromatography-mass spectrometry (LC-MS) currently receive the strongest attention from the market across research and drug-discovery applications. This has resulted in increased growth and interest in companies providing instrumentation and consumables for these analyses.

One such example is the Australian company IonOpticks, which provides nanoflow columns, a form of consumables used for LC-MS proteomics analyses. Despite its relatively small size, the company has managed quickly to become renowned within the research community for its high-performance columns. The success story eventually sparked PE attention, as the company was recently acquired.

Technologies

The demand for sensitivity is prominent in diagnostic applications. Driven by technological advancements, higher-sensitivity assays now enable biomarkers to be detectable at much lower concentrations, which allows for biomarkers to be identified from smaller and/or less invasive samples as well as for the identification of completely new biomarkers.

An example of such a technology is Swedish company Cavidi’s Binding Oligo Ladder Detection (BOLD) technology, which amplifies traditional immunoassay signals by up to 100x, thereby significantly increasing the level of sensitivity. This is but one example of the rapid development we are seeing in this field.

Conclusion

MARKET REBOUND, BUT FUNDAMENTALS MATTER

With significant capital ready for investment and declining interest rates, we expect the market to recover in 2025, though with more conservative valuations. Investments will likely continue to focus on companies with clear and defensible business models minimally exposed to external risks, including technical, development, and political risks. These high-quality targets should see above-average valuations.

For the most attractive targets, PE funds should anticipate continued fierce competition from both industrial investors and other PE firms. With strong competition for mature PE targets, identifying companies with solid combinations of strong proprietary technology, deep scientific knowledge, and attractive business models early in their growth cycle — and starting to build trust and relationships — can be a valuable long-term approach. In the coming years, we expect more mid-size PEs to acquire high-potential targets while they are still relatively immature, using these initial acquisitions as platforms to establish positions in clearly defined spaces through complementary M&As.