DOWNLOAD

9 min read

Petroleum: Surviving in the post-COVID-19 era

Traditional oil & gas companies can only succeed in the decarbonizing energy ecosystem of the future through substantial portfolio realignment

The pandemic has created a perfect storm for the global petroleum industry, combining oversupply with a dramatic fall in demand – all at a time when ongoing requirements to decarbonize economies are gathering pace. We look at potential scenarios for the future, analyzing the impact on different market players over both the short and long term.

A perfect storm for the petroleum industry

The global lockdown triggered by the COVID-19 pandemic has pushed a transforming industry into a state of major crisis. Progressive weakening of global oil demand during early 2020 was exacerbated by growing structural oversupply caused by a struggle for market share between Russia and OPEC. These two factors together sent oil prices to a 20-year low. Although OPEC, Russia and other producers later agreed on some production cuts, these price-support efforts have had a relatively modest impact at the time of writing.

The global lockdown triggered by the COVID-19 pandemic has pushed a transforming industry into a state of major crisis. Progressive weakening of global oil demand during early 2020 was exacerbated by growing structural oversupply caused by a struggle for market share between Russia and OPEC. These two factors together sent oil prices to a 20-year low. Although OPEC, Russia and other producers later agreed on some production cuts, these price-support efforts have had a relatively modest impact at the time of writing.

This article visualizes different future scenarios for the industry, given the effect of COVID-19 on demand and the likely persistence of structural oversupply. We analyze each scenario and its expected impact on each type of industry player, given expected medium-term oil prices. Looking into the future, we outline how the crisis will impact the current carbon transition and provide insights on the strategies oil & gas executives will require to survive and win in the future industry ecosystem.

The COVID-19 crisis will transform the structure of the industry

With the oil & gas industry currently locked into a cycle of oversupply, low prices and volatility, the economic downturn created by the COVID-19 crisis is likely to deal a major blow to many companies. Investors have found the sector increasingly unattractive over the past 10 years. Any further, prolonged period of low oil prices is likely to see them divert their capital elsewhere as the traditional oil & gas business model becomes even riskier and less commercially attractive.

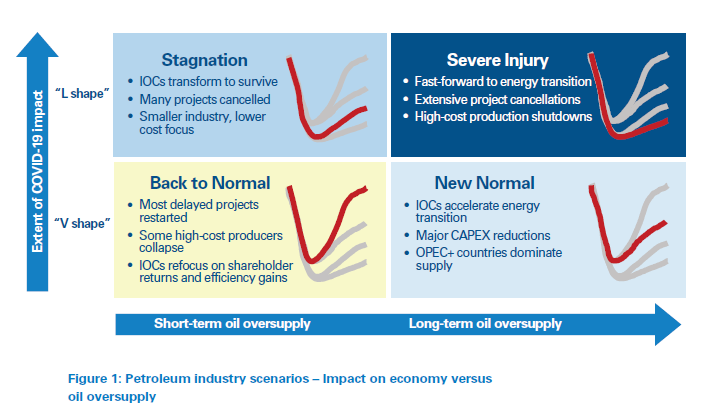

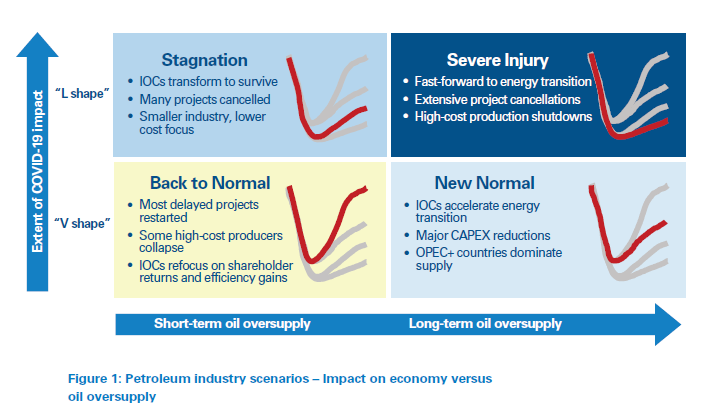

Although the global economy will eventually recover, it is unlikely that it will return soon (if at all) to its pre-COVID-19 “business as usual” state. Instead, the oil & gas industry is likely to be faced with prolonged substantially reduced demand, thanks to lower economic activity and growing pressures to use greener energy sources. Similarly, the industry must also grapple with oversupply issues, whether due to burgeoning oil volumes from US shale, or the struggle for market share between OPEC and Russia. Figure 1 outlines four potential scenarios based on these factors.

A “Back to Normal” scenario depends on an early, “V-shaped” bounce-back of the global economy, combined with failure to progress the climate-change/renewables agenda. At the same time, it requires major oil producers to agree production cuts that are sufficiently rapid and deep that current oversupply is reduced. Achieving these conditions seems unlikely.

The “Stagnation” scenario, in which the global economic rebound and oil-demand impact is “L-shaped”, seems much more probable. In this case weak demand recovery is held back by continued adoption of renewables and low-carbon energy forms. Nevertheless, in this scenario producers are gradually able to reduce oversupply to support modest prices that ensure the viability of many new projects.

The worst potential scenario is undoubtedly “Severe Injury”. In this case, a slow, “L-shaped” economic recovery, perhaps blended with accelerating demand destruction driven by the renewables transition, combines with persistent oversupply, due to major producers’ repeated failures to agree to sufficiently deep production cuts. On the positive side, any lasting demand drop would provide OPEC and other major producers with strong political and financial motivation to adjust supply to an adequate price level. This makes this scenario less likely than Stagnation.

Accordingly, the level of injury inflicted on both individual players and the wider industry will largely depend on whether OPEC (and/or Russia) can commit to supporting prices in this way, perhaps at the expense of market share.

Given these factors, another likely outcome is the “New Normal” scenario. In this case, if the economy bounces back after a few months (with a “U-shaped” recovery), coupled with relatively slow demand erosion due to tightening of climate-change policies, oil prices should strengthen. This will be the case even if OPEC and other producers fail to curb supply as much as in the past.

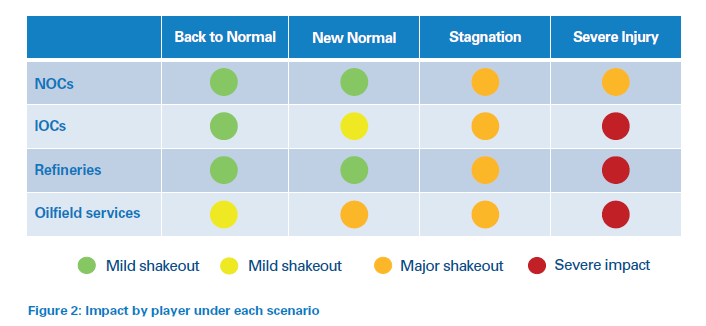

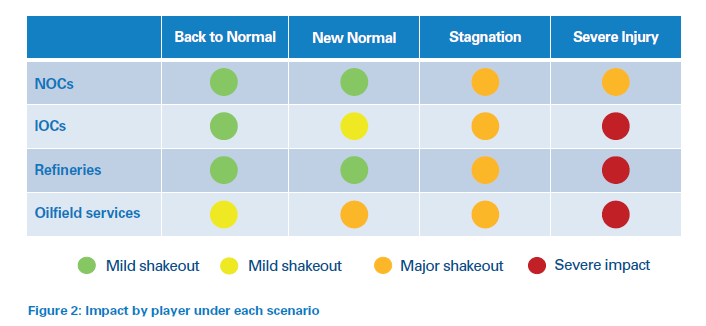

Impact will vary across industry segments

A closer examination of sub-sectors within the industry reveals the degree to which each will be affected:

- International oil companies (IOCs) will find it increasingly difficult to grow organically, with certain high-cost and stranded assets being written off. However, there will be more M&A opportunities as smaller players struggle to compete.

- National oil companies (NOCs) with large, low-cost reserve positions will push to accelerate production, but those with higher cost structures will struggle. Due to reduced oil & gas revenue, lower national budgets will intensify debate about prioritization between oil reinvestment and social needs. Some governments may use the crisis to spur support for energy transition programs.

- Refiners will face low margins and returns for many years due to structural overcapacity, heterogenous demand evolution and stricter product-quality standards. Accordingly, some small-scale plants will not even be able to recover their operating and maintenance cash costs.

- Oilfield services players face very low asset utilization because of project cancellations or deferrals and production shutdowns. Severe capacity cutbacks and massive employee layoffs are likely to continue in this segment.

Emerging models for the “oil company of the future”

Under almost any scenario, the post-COVID-19 world will see the oil & gas industry accelerate its transition towards cleaner energy sources, products and service offerings, and away from its traditional business models. The pandemic has created a perfect storm that, along with an ongoing need to reduce CO2 emissions, will transform the industry. The future survival and success of many players depends not only on their achieving greater focus on renewable energy, but also upon an ability to deliver still-lower-cost solutions.

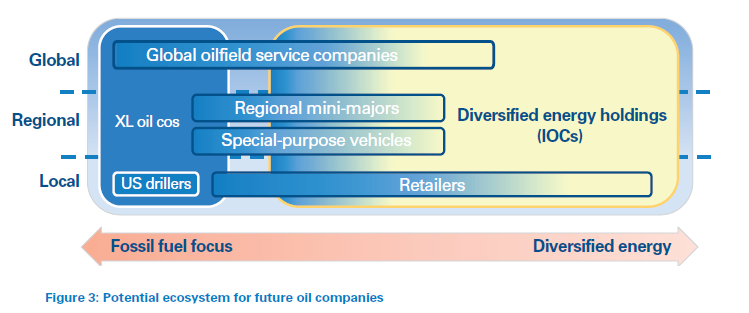

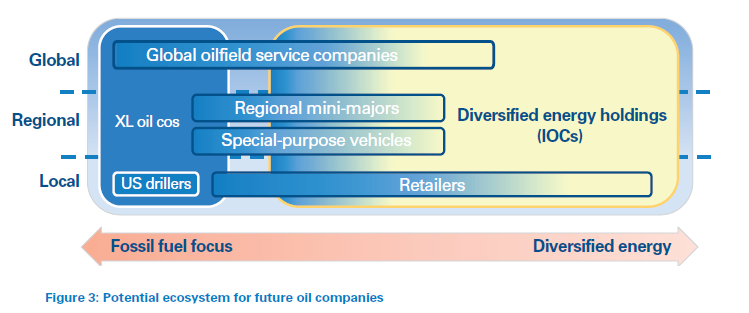

We expect the following seven hydrocarbon business models to co-exist in the future, as illustrated in Figure 3, with a player’s chance of success depending largely on its ability to transform after the crisis:

- Diversified energy holdings: IOCs will respond to the twin challenges of low prices and decarbonization by moving rapidly away from their increasingly unattractive traditional business models, becoming energy-holding companies with more diverse interests. They already foresee that oil demand will peak, and after COVID-19 they will increasingly grow organically beyond hydrocarbons. They will transform their global oil & gas operations into truly diversified energy holdings that are robust in a world that is evolving towards cleaner energy sources. IOCs will also look to strengthen their naturalgas value chains and integration into petrochemicals.

- XL oil companies: Low-cost production and a large reserve base will underpin the predominance of the XL model, which is already being adopted by some IOCs and the large national oil companies. This model prioritizes scale in monetizing existing, ultra-low-cost oil & gas resources. The largest and most competitive NOCs may therefore emerge as major winners from this crisis.

- Regional “mini-majors”: Most regional players will leverage their geopolitical, cultural, logistical and commercial advantages to transform their businesses into regionally tailored, integrated and diversified models. They may become diversified “mini-IOCs”, or perhaps be more strongly oil & gas focused.

- Special-purpose vehicles (SPVs): Oil & gas companies will increasingly create SPVs to provide greater financial flexibility within their portfolio-restructuring strategies.

- US drillers: These companies have been most damaged by the COVID-19 oversupply crisis. They need to manage their portfolios in a highly dynamic way, maintaining free cashflow while trying to keep opportunities alive for immediate rebound in the event of price recovery. They face shrinkage and a significant challenge for medium-term survival.

- Global oilfield service companies: This business sector underwent major efficiency gains in 2015, leaving little room for further improvement. Their business models will be extremely challenged by much lower levels of drilling activity. If they are to maintain growth, they need to pivot into energy transition support through rapid innovation and development of new solutions for energy producers and consumers.

- Retailers: Fossil-fuel demand will take time to recover and, even if gross retail margins are not impacted in the long term, this segment will need to prioritize investment in non-fossil energy and other related customer-service areas to ensure viable returns.

Although there isn’t one single business model that will enable future success, the journey towards the “oil company of the future” requires companies to adopt transformation strategies now that will prepare them for an uncertain and changing world. They need to think carefully about their long-term survival paths, identify growth options, and take deliberate, meaningful and strategic actions to protect themselves against what is now the very real risk of early obsolescence.

Companies need to improve capital returns in their traditional business segments, while exploring options for future growth into renewables through a combination of acquisitions and new-venture pilots. They also need to undergo deep transformation of their cultures, skills and capabilities if they are to survive and create long-term, sustainable competitive positions. The challenges are huge, and not all of today’s oil companies are likely to succeed.

Insight for the executive

All sectors of the industry are affected by the COVID-19 crisis, with some companies at risk of bankruptcy and many more unlikely to survive in their current forms if oil prices and margins remain at depressed levels. Companies dominated by high-cost assets, led by weak management teams, or carrying high debt burdens will face increasingly severe challenges, with many such companies disappearing or being acquired. Most oil companies have already reduced their planned short-term capital spend, but need to also undergo strategic rebalancing of their portfolios to give them the bestpossible chance of weathering the COVID-19 storm and emerging fitter and more secure in the long term.

In this transformation, they should not only divest highcost upstream developments, including shale or tar sands, concentrating instead on low-cost assets, but also curtail high-risk exploration. They should cancel or carefully review new construction of refining projects or plant upgrades, considering the very limited time window to secure returns from such investments. They will need to rebalance their businesses through stronger positions in the natural-gas value chain and petrochemicals, while delivering more robust emissions-efficiency initiatives.

All oil & gas companies should also now develop expansion opportunities in the energy transition, electricity and renewables space, pushing harder in this direction, and investing further into decarbonization and renewables as such projects become more sustainable and attractive.

These changes certainly apply to international and regional oil companies, as well as to American drillers, but global oilfield service companies will need to make the most urgent and profound responses to the COVID-19 pandemic. As they are the most severely impacted by the drop in global oil-sector activity, they will need to rapidly pivot towards renewablessector support, as many have already done. All players will also need to accelerate their automation and digitalization initiatives to gain new levels of operational efficiency.

Such transformations are the only way to ensure the longterm viability of the petroleum sector. Participants need to completely rethink their roles in the future industry ecosystem as traditional business models become progressively untenable.

9 min read

Petroleum: Surviving in the post-COVID-19 era

Traditional oil & gas companies can only succeed in the decarbonizing energy ecosystem of the future through substantial portfolio realignment

The pandemic has created a perfect storm for the global petroleum industry, combining oversupply with a dramatic fall in demand – all at a time when ongoing requirements to decarbonize economies are gathering pace. We look at potential scenarios for the future, analyzing the impact on different market players over both the short and long term.

A perfect storm for the petroleum industry

The global lockdown triggered by the COVID-19 pandemic has pushed a transforming industry into a state of major crisis. Progressive weakening of global oil demand during early 2020 was exacerbated by growing structural oversupply caused by a struggle for market share between Russia and OPEC. These two factors together sent oil prices to a 20-year low. Although OPEC, Russia and other producers later agreed on some production cuts, these price-support efforts have had a relatively modest impact at the time of writing.

The global lockdown triggered by the COVID-19 pandemic has pushed a transforming industry into a state of major crisis. Progressive weakening of global oil demand during early 2020 was exacerbated by growing structural oversupply caused by a struggle for market share between Russia and OPEC. These two factors together sent oil prices to a 20-year low. Although OPEC, Russia and other producers later agreed on some production cuts, these price-support efforts have had a relatively modest impact at the time of writing.

This article visualizes different future scenarios for the industry, given the effect of COVID-19 on demand and the likely persistence of structural oversupply. We analyze each scenario and its expected impact on each type of industry player, given expected medium-term oil prices. Looking into the future, we outline how the crisis will impact the current carbon transition and provide insights on the strategies oil & gas executives will require to survive and win in the future industry ecosystem.

The COVID-19 crisis will transform the structure of the industry

With the oil & gas industry currently locked into a cycle of oversupply, low prices and volatility, the economic downturn created by the COVID-19 crisis is likely to deal a major blow to many companies. Investors have found the sector increasingly unattractive over the past 10 years. Any further, prolonged period of low oil prices is likely to see them divert their capital elsewhere as the traditional oil & gas business model becomes even riskier and less commercially attractive.

Although the global economy will eventually recover, it is unlikely that it will return soon (if at all) to its pre-COVID-19 “business as usual” state. Instead, the oil & gas industry is likely to be faced with prolonged substantially reduced demand, thanks to lower economic activity and growing pressures to use greener energy sources. Similarly, the industry must also grapple with oversupply issues, whether due to burgeoning oil volumes from US shale, or the struggle for market share between OPEC and Russia. Figure 1 outlines four potential scenarios based on these factors.

A “Back to Normal” scenario depends on an early, “V-shaped” bounce-back of the global economy, combined with failure to progress the climate-change/renewables agenda. At the same time, it requires major oil producers to agree production cuts that are sufficiently rapid and deep that current oversupply is reduced. Achieving these conditions seems unlikely.

The “Stagnation” scenario, in which the global economic rebound and oil-demand impact is “L-shaped”, seems much more probable. In this case weak demand recovery is held back by continued adoption of renewables and low-carbon energy forms. Nevertheless, in this scenario producers are gradually able to reduce oversupply to support modest prices that ensure the viability of many new projects.

The worst potential scenario is undoubtedly “Severe Injury”. In this case, a slow, “L-shaped” economic recovery, perhaps blended with accelerating demand destruction driven by the renewables transition, combines with persistent oversupply, due to major producers’ repeated failures to agree to sufficiently deep production cuts. On the positive side, any lasting demand drop would provide OPEC and other major producers with strong political and financial motivation to adjust supply to an adequate price level. This makes this scenario less likely than Stagnation.

Accordingly, the level of injury inflicted on both individual players and the wider industry will largely depend on whether OPEC (and/or Russia) can commit to supporting prices in this way, perhaps at the expense of market share.

Given these factors, another likely outcome is the “New Normal” scenario. In this case, if the economy bounces back after a few months (with a “U-shaped” recovery), coupled with relatively slow demand erosion due to tightening of climate-change policies, oil prices should strengthen. This will be the case even if OPEC and other producers fail to curb supply as much as in the past.

Impact will vary across industry segments

A closer examination of sub-sectors within the industry reveals the degree to which each will be affected:

- International oil companies (IOCs) will find it increasingly difficult to grow organically, with certain high-cost and stranded assets being written off. However, there will be more M&A opportunities as smaller players struggle to compete.

- National oil companies (NOCs) with large, low-cost reserve positions will push to accelerate production, but those with higher cost structures will struggle. Due to reduced oil & gas revenue, lower national budgets will intensify debate about prioritization between oil reinvestment and social needs. Some governments may use the crisis to spur support for energy transition programs.

- Refiners will face low margins and returns for many years due to structural overcapacity, heterogenous demand evolution and stricter product-quality standards. Accordingly, some small-scale plants will not even be able to recover their operating and maintenance cash costs.

- Oilfield services players face very low asset utilization because of project cancellations or deferrals and production shutdowns. Severe capacity cutbacks and massive employee layoffs are likely to continue in this segment.

Emerging models for the “oil company of the future”

Under almost any scenario, the post-COVID-19 world will see the oil & gas industry accelerate its transition towards cleaner energy sources, products and service offerings, and away from its traditional business models. The pandemic has created a perfect storm that, along with an ongoing need to reduce CO2 emissions, will transform the industry. The future survival and success of many players depends not only on their achieving greater focus on renewable energy, but also upon an ability to deliver still-lower-cost solutions.

We expect the following seven hydrocarbon business models to co-exist in the future, as illustrated in Figure 3, with a player’s chance of success depending largely on its ability to transform after the crisis:

- Diversified energy holdings: IOCs will respond to the twin challenges of low prices and decarbonization by moving rapidly away from their increasingly unattractive traditional business models, becoming energy-holding companies with more diverse interests. They already foresee that oil demand will peak, and after COVID-19 they will increasingly grow organically beyond hydrocarbons. They will transform their global oil & gas operations into truly diversified energy holdings that are robust in a world that is evolving towards cleaner energy sources. IOCs will also look to strengthen their naturalgas value chains and integration into petrochemicals.

- XL oil companies: Low-cost production and a large reserve base will underpin the predominance of the XL model, which is already being adopted by some IOCs and the large national oil companies. This model prioritizes scale in monetizing existing, ultra-low-cost oil & gas resources. The largest and most competitive NOCs may therefore emerge as major winners from this crisis.

- Regional “mini-majors”: Most regional players will leverage their geopolitical, cultural, logistical and commercial advantages to transform their businesses into regionally tailored, integrated and diversified models. They may become diversified “mini-IOCs”, or perhaps be more strongly oil & gas focused.

- Special-purpose vehicles (SPVs): Oil & gas companies will increasingly create SPVs to provide greater financial flexibility within their portfolio-restructuring strategies.

- US drillers: These companies have been most damaged by the COVID-19 oversupply crisis. They need to manage their portfolios in a highly dynamic way, maintaining free cashflow while trying to keep opportunities alive for immediate rebound in the event of price recovery. They face shrinkage and a significant challenge for medium-term survival.

- Global oilfield service companies: This business sector underwent major efficiency gains in 2015, leaving little room for further improvement. Their business models will be extremely challenged by much lower levels of drilling activity. If they are to maintain growth, they need to pivot into energy transition support through rapid innovation and development of new solutions for energy producers and consumers.

- Retailers: Fossil-fuel demand will take time to recover and, even if gross retail margins are not impacted in the long term, this segment will need to prioritize investment in non-fossil energy and other related customer-service areas to ensure viable returns.

Although there isn’t one single business model that will enable future success, the journey towards the “oil company of the future” requires companies to adopt transformation strategies now that will prepare them for an uncertain and changing world. They need to think carefully about their long-term survival paths, identify growth options, and take deliberate, meaningful and strategic actions to protect themselves against what is now the very real risk of early obsolescence.

Companies need to improve capital returns in their traditional business segments, while exploring options for future growth into renewables through a combination of acquisitions and new-venture pilots. They also need to undergo deep transformation of their cultures, skills and capabilities if they are to survive and create long-term, sustainable competitive positions. The challenges are huge, and not all of today’s oil companies are likely to succeed.

Insight for the executive

All sectors of the industry are affected by the COVID-19 crisis, with some companies at risk of bankruptcy and many more unlikely to survive in their current forms if oil prices and margins remain at depressed levels. Companies dominated by high-cost assets, led by weak management teams, or carrying high debt burdens will face increasingly severe challenges, with many such companies disappearing or being acquired. Most oil companies have already reduced their planned short-term capital spend, but need to also undergo strategic rebalancing of their portfolios to give them the bestpossible chance of weathering the COVID-19 storm and emerging fitter and more secure in the long term.

In this transformation, they should not only divest highcost upstream developments, including shale or tar sands, concentrating instead on low-cost assets, but also curtail high-risk exploration. They should cancel or carefully review new construction of refining projects or plant upgrades, considering the very limited time window to secure returns from such investments. They will need to rebalance their businesses through stronger positions in the natural-gas value chain and petrochemicals, while delivering more robust emissions-efficiency initiatives.

All oil & gas companies should also now develop expansion opportunities in the energy transition, electricity and renewables space, pushing harder in this direction, and investing further into decarbonization and renewables as such projects become more sustainable and attractive.

These changes certainly apply to international and regional oil companies, as well as to American drillers, but global oilfield service companies will need to make the most urgent and profound responses to the COVID-19 pandemic. As they are the most severely impacted by the drop in global oil-sector activity, they will need to rapidly pivot towards renewablessector support, as many have already done. All players will also need to accelerate their automation and digitalization initiatives to gain new levels of operational efficiency.

Such transformations are the only way to ensure the longterm viability of the petroleum sector. Participants need to completely rethink their roles in the future industry ecosystem as traditional business models become progressively untenable.