Broadcasters’ 5G evolvement within a hybrid environment

How can a broadcaster use 5G to trigger the necessary transformation to compete in a fast-changing and challenging media environment?

Executive Summary

Broadcasters compete in a fast-changing media environment, facing competition from new players and shifting consumption habits as well as technical requirements due to new technologies. We believe 5G has the potential to help broadcasters successfully undergo the required digital transformation and strengthen their market position in content production and distribution.

5G will combine a technology evolution (decreased latency, increased bandwidth and extended coverage) with a business model revolution (dynamically provided quality of service), fundamentally changing the range of exploitable mobile use cases in the following three production areas:

- Remote production – large-scale, high-profile news gathering; centralized and automated camera operations; remote production without outside broadcasting or signal-bundling vehicle

- Event densification – simplification of technology landscape by combining video, telemetry and microphones on one connectivity layer; increased number of special effect cameras; capitalizing on augmented reality/virtual reality recording

- Community platform building – live contribution at events, support in news gathering and crowd-based perspectives through user-generated content

5G is also expected to create a new distribution system able to effectively meet evolving user requirements for access to media services while allowing broadcasters to regain unconstrained access to audiences and audience data. The two major drivers for 5G FeMBMS include:

- Providing terrestrial distributors with a successor technology for DVB-T2 with high reliability and wide area coverage at relatively lower cost

- . Enabling increased competitiveness over terrestrial by gathering customer data via bidirectional unicast, increasing content quality due to high network capacity and reducing network congestion in mobile networks for parallel media consumption

Implementing these opportunities in a clear 5G strategy will not only lead to higher flexibility and quality, additional content and increasing customer loyalty, but also to an overall positive cost impact of 10-20 percent of the production cost while regaining competitiveness over terrestrial distribution.

5G will solve neither the challenge of competition nor of changing media consumption habits on its own, but the right strategy and prioritized use cases may help broadcasters reduce their costs for live productions, innovate their content, build stronger communities and get customer data access.

1

The broadcast industry disruption

Broadcasters are challenged by a changing media environment, competition from new players and changing consumption habits and technical requirements due to new technologies.

Streaming companies such as Netflix, Amazon, DAZN and Facebook are strongly challenging broadcasters in a battle for eyeballs (e.g., Amazon acquired the rights to show 20 English Premier League live games per season, and Netflix spent over US $15 billion on content in 2019).

At the same time, the media industry is dealing with profound changes in media consumption habits. Consumers gradually shifting from linear to non-linear viewing increase the necessity of using big data to develop a deep understanding of consumer habits and preferences in order to create increasingly tailored content. In parallel, a majority of consumers have moved from consuming media via TV to using a fully mobile environment, often with multiple mobile devices for media consumption. More and more users consume content anywhere and anytime. Some media companies as well as public and commercial broadcasters capitalize on these trends by offering their own streaming services like Disney+, Peacock, Joyn and BritBox. Most broadcasters, however, are not prepared to follow these trends without high investment in infrastructure.

In addition to a highly competitive market, higher complexity in consumer behavior and new consumer technologies such as augmented reality (AR)/virtual reality (VR) and 4K/8K videos bring additional challenges for the broadcasting industry, including: bandwidth requirements are increased for both production and distribution; the usage of public clouds to collect and use generated data is more frequent; and there is a need to adapt production assets for 4K/8K and to reinvent certain program concepts to integrate AR/VR.

Based on our conversations with media company CxOs and insights from our projects, we see three key capabilities that public and private broadcasters can capitalize on to strengthen their market position and fight back against Netflix and other tech giants:

- Create more local content to differentiate from the global players at a competitive cost level.

- Create more specialized (e.g., niche sport) and nextgeneration content (e.g., AR/VR, 8K, mobile) for a tailored audience by fast learning from individuals’ consumption habits

- Distribute content in an omni-channel approach (anytime and anywhere) to regain reach and relevance in young and fragmenting audiences.

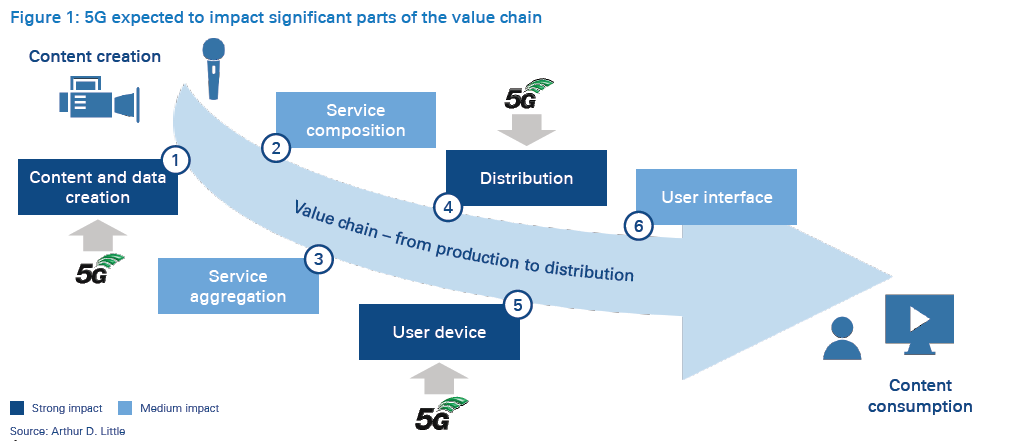

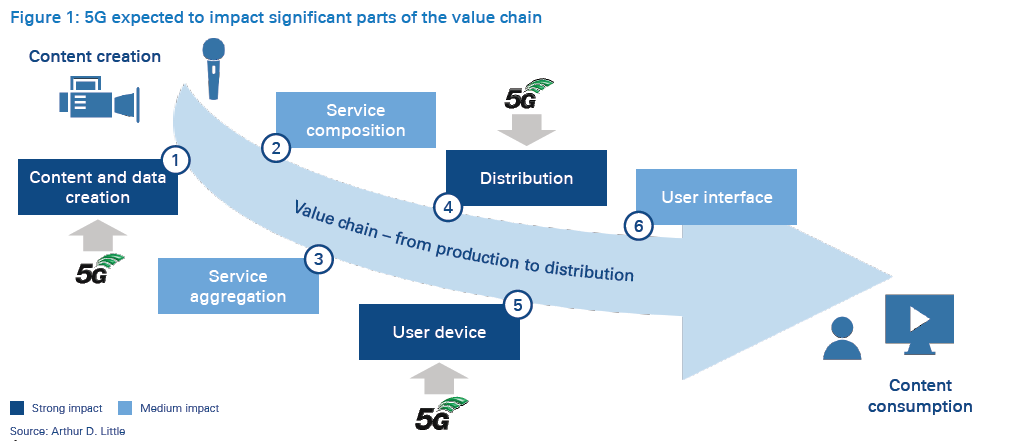

We believe 5G represents a stepping stone for broadcasting companies to successfully undergo the required digital transformation and strengthen their market position in content production and distribution (see Figure 1).

2

5G, a technical evolution & business model revolution

We believe 5G will combine a technology evolution with a business model revolution, fundamentally changing how broadcasting companies can leverage mobile technology in content production to implement real-life use cases, with exploitable potential outside of the existing limitations.

Technical evolution

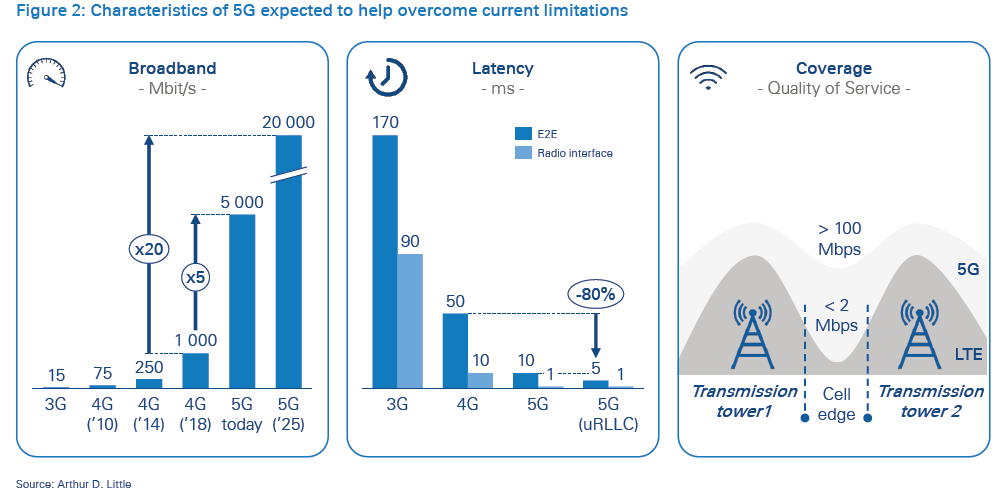

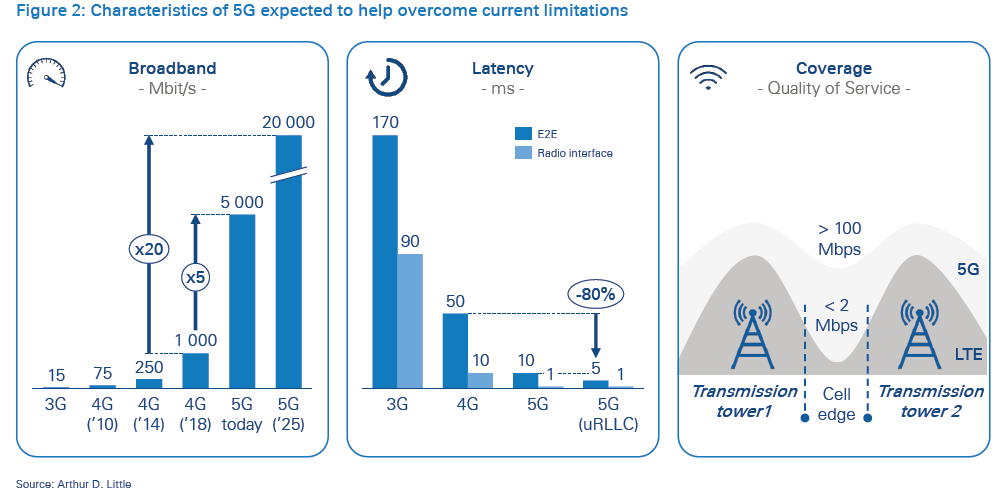

Broadcasters have already leveraged 4G mobile networks (e.g., LiveU, Mobile Viewpoint) for fast, flexible and cost-efficient news gathering and niche event production. However, they have encountered major technical limitations (e.g., in the number of cameras due to small bandwidths and in real-time combination of multiple sources due to high latency and low reliability resulting from the low quality of service [QoS] on cell edges). As we see in Figure 2, 5G can help overcome these limitations by providing: up to 20x higher overall bandwidth in the network (requires fiber backhaul to all sites and availability of all 5G spectrum bands, especially mid-band and mmWave); 90 percent lower latency; and continuous QoS even on cell edges, building the foundation for broad adoption of 5G-based content production beyond news gathering and niche events.

Business model revolution

In addition to breaking through technical barriers, 5G can provide enough network capacity for all without the obligation to buy guaranteed services and can therefore be seen as an important prerequisite for adopting mobile technology. 5G technology can even enable dedicated network slices, guaranteeing network capacity in an economically viable way, since there are none of the geographical and time-based limitations associated with specific demand. (Note: Economic viability depends on the regulator, the local mobile network operator [MNO] strategies and the competitive landscape.) Additionally, broadcasters would be able to build and operate their own 5G campus networks (nationally for event production, internationally with partners) with full quality control due to the new spectrum issued for 5G.

3

5G as door-opener for content production innovation

With 5G fulfilling the technical requirements of content production while guaranteeing high reliability, we see three major areas with multiple benefits for broadcasting companies:

- Remote production expansion

- Event densification

- Community platform building

5G enables remote production expansion

Broadcasters are already using a whole host of mobile solutions for news gathering and niche event production as well as for reducing the required satellite transmission of outside broadcasting (OB) vans. However, current technology requires expensive satellite-based solutions to support broadcast-grade HD or UHD event production and is barely able to keep pace with increasing quality and flexibility requirements due to shorter preparation times and high reliability needs.

We expect 5G to enhance the range of these existing solutions and enable (especially but not exclusively) mobile-based production solutions, including:

- High-profile news gathering with fast response times and low operation cost, either as a one-camera or smartphone remote production (e.g., for governmental announcements, crisis reports). Such solutions are already in place today, and large-scale implementation will likely follow upon 5G availability.

- Remote production of events with a pre-defined schedule and location and up to 10 cameras but neither an OB van, signal-bundling vehicle nor fixed-transmission line onsite. This can significantly reduce production costs (e.g., for smallscale sports events or church services). There are already existing pilots, but larger implementation is expected to materialize in the mid-term.

- Centralization of camera operators for remote and onsite production, with remote control of telemetry, pan-tilt-zoom (PTZ) and automated remote cameras enabled by low latencies of 5G (e.g., talk show, concert). There are a few early stage pilots, but frequent large-scale occurrences are unlikely to happen within the next few years.

These use cases can be implemented by using a dedicated network slice in the public 5G network of operators. Therefore, before implementing a 5G-based remote production strategy to exploit these above-mentioned potential solutions, broadcasters need to be aware of the 5G network rollout (part of MNO strategy and competitive landscape) in their home country and be certain that there is an option to obtain a slice.

5G increases event densification

5G is expected to provide broadcasting companies the opportunity to own and control geographically limited mobilebased networks for content production. Such networks may either be stationary campus networks for a company’s own production sites or mobile campus networks at big live event productions. Both network types will likely come with an extensive range of potential use cases due to the high reliability, high bandwidth and low latency of wireless onsite connectivity, providing some of the following outcomes:

- Simplifying the technology landscape onsite by combining several individual technologies used today (e.g., wireless camera video feeds and telemetry, additional microphones and intercom).

- Cutting set-up costs for events by significantly reducing cabling efforts onsite while allowing for increasingly flexible camera positioning; cameras can be deployed with a high share of wireless connections (e.g., moving cameras on motorcycles for biathlons, quick shifting of camera positions at ski races due to changes in weather conditions or stationary cameras on a Formula 1 track).

- Increasing the number of special effect cameras, which can be positioned at spots that are dangerous or difficult to reach for camera operators, giving directors maximum creative freedom for enhanced customer experience (e.g., inside a slalom pole of Kitzbühel, on the tennis net in Wimbledon or on the runway of the Eastbourne International Airshow).

- Capitalizing on new technologies like AR/VR, not only allowing new perspectives but also completely changing the type of customer experience in content production (e.g., live inserted player statistics of a soccer game via AR glasses or second-screen applications and multiple 360-degree perspectives of a football game individually chosen by each viewer).

All these use cases can be implemented by using a private 5G network fully controlled by the broadcaster or by a third party as a managed service. To give one implementation example, we can look at the German soccer club VfL Wolfsburg, which is already piloting a private 5G network in its stadium, enabling viewers to follow the game via their 5G smartphones and providing additional information like players’ running speeds or shooting accuracy. We expect a broader implementation of this use case in the top leagues around the world in the upcoming years.

Before broadcasters can start the implementation, they need to identify available options in terms of spectrum availability and slicing offers in order to choose the right implementation model – spectrum acquisition either with a partner or alone. If the spectrum situation is not yet defined by the regulator, broadcasters need to derive the overall value created from various use cases to use it as a basis for continuous lobbying to secure reserved 5G spectrum for broadcasting. Given the difference in use cases, different spectrum ranges need to be targeted (mmWave band for use cases that require extremely high data rates, mid-band for use cases that require capacity and coverage and low-band for spacious and deep indoor coverage) and vary depending on the local spectrum allocation plans of the regulator.

5G supports building or leveraging a community platform

Apart from expanding remote production and densifying content for event productions, 5G is expected to give broadcasters an enhanced tool to (re)start building a community or to strengthen existing community platforms. We believe that, with the increased availability of 5G networks with the described technical developments, it will be much easier for broadcasting companies to collect comparable, high-quality user-generated content (UGC). UGC has four major potential benefits:

- Helps engage the community by allowing it to contribute to content creation for live events (e.g., culture, sports), which is expected to lead to an increase in customer loyalty within the existing community (e.g., viewers contributing remotely to political debates).

- Supports news gathering and reduce response times of broadcasting initial first impressions; we believe this will increase the local relevance of the program (e.g., viewers contributing videos from disaster zones).

- Provides directors of events with additional, crowd-based perspectives, which can be incorporated into available professional feeds to create content that lets viewers assume the positions of visitors (e.g., a visitor of an event streams the event live).

- In the long run, UGC can be used to build a separate platform with (semi) curated live C2C content with a validating instance provided by the broadcaster (e.g., an application for editing and uploading videos from customers’ cell phones).

Overall, UGC has enormous potential to generate unlimited additional content nearly free of charge and can be leveraged in multiple ways. BBC, for example, capitalizes on UGC and builds a community around it. Its UGC hub collects content from users all around the world, bringing in new perspectives, especially for unexpected events. The effort to build up and maintain the hub and the resources needed for the verification process should not be underestimated. Main effort drivers are e.g., a wellfunctioning technical system, manpower for validation and legal checks as well as creative community engagers.

To evaluate the full potential of UGC, factors such as the legal situation of content rights, the restrictions in content distribution, the readiness of the editing processes as well as the penetration of 5G handsets need to be assessed on a country-by-county level.

4

5G, an up to 20 percent production cost saving potential

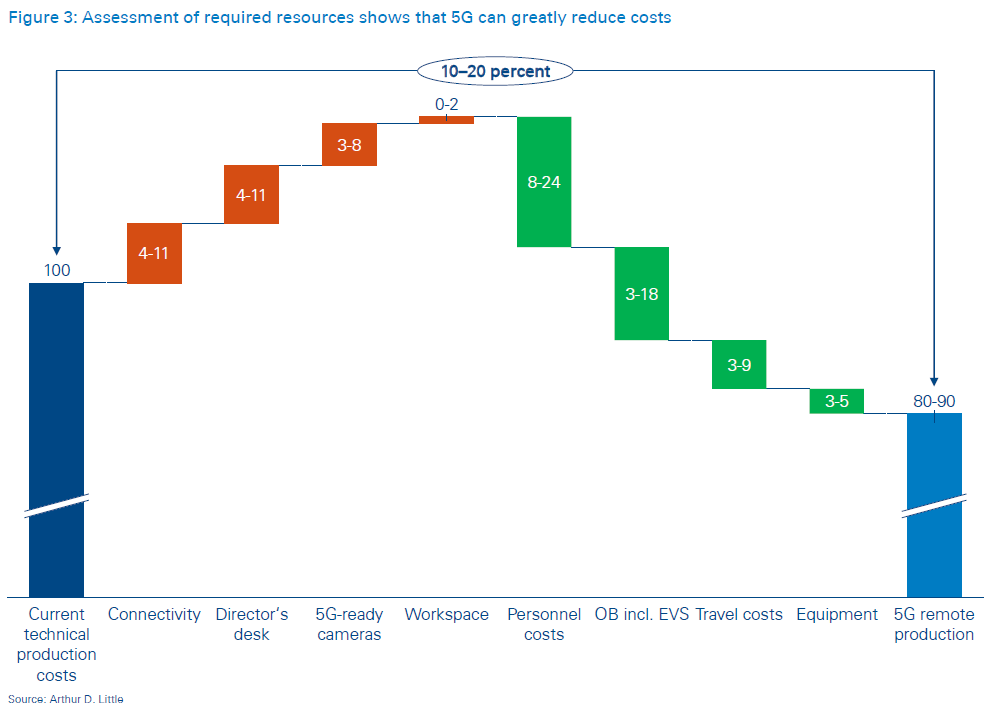

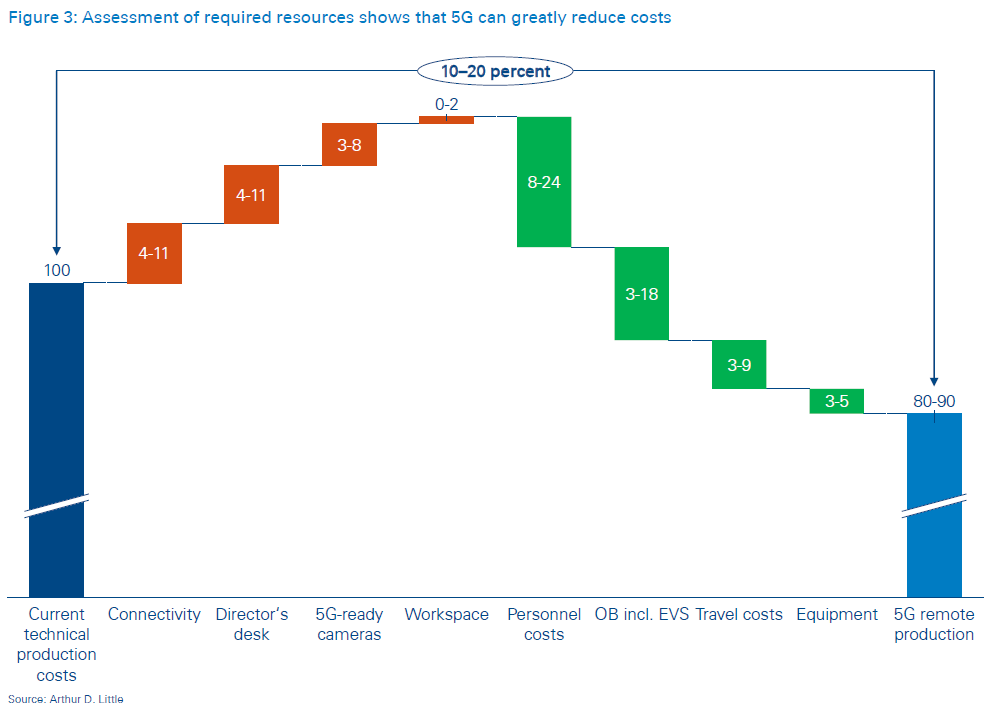

Implementing a clear 5G strategy will not only lead to higher flexibility and quality, additional content and increasing customer participation, but can also have an overall positive cost impact. We calculated the average technical cost savings for European broadcasters based on their live production portfolio, available capacity and market costs (see Figure 3). Those savings can be achieved in the short and mid-term with currently developed technologies. Long-term potential savings are expected to be significantly higher, although the exact magnitude is not yet assessable.

Our current assessment shows that 5G can significantly reduce the resources required for each type of production analyzed. We calculated average technical costs savings for a broad portfolio of live events (sports, culture, news, entertainment and religion). The four major drivers for cost savings are:

- Personnel costs – lower staff cost due to a reduction in dead time (remote production) and a reduction in overall FTEs (more efficient setups including wireless production)

- OB – reduced OB van requirements due to higher share of remote production including reduced electronic equipment (e.g., switchboards) due to unified and IP-based technology

- Travel costs – lower travel costs due to lower head count overall (wireless production); a smaller number of events with travelling requirements (remote production)

- Equipment – lower equipment costs due to lower technical complexity (only one common connectivity layer required, with a lower material cost [cabling])

However, broadcasting companies must be aware that a 5G strategy does not always mean there will be overall cost savings. There are four factors that need to be considered because they could potentially outweigh up to 40 percent of the potential savings:

- Director’s desk. Although the onsite staff can be reduced, the need for a centralized editor studio (e.g., HQ, national studio and separate editor center) could lead to increasing facility cost (cost level depends on free capacity in central studios).

- Workspace. A small share (approximately 10-20 percent) of remote productions is expected to require a small team to remain onsite for coordination or personal contact and would require a separate workplace.

- Connectivity. Connectivity cost is expected to increase, as a high share of productions can be transmitted directly via the 5G network, which can increase contracted bandwidth and QoS. (Note: this is based on current connectivity production cost [EUR/GB] plus premium for QoS).

- 5G-ready cameras, 5G-enabled I/O cluster and control room interfaces. Especially in the beginning, equipment supporting 5G is expected to be slightly more expensive than equipment for current technologies, although this cost difference is likely to decrease over time.

Although there are some additional costs associated with a clear 5G strategy, the overall business impact is expected to result in up to a 10-20 percent decrease in the technical cost of content production (see Figure 3).

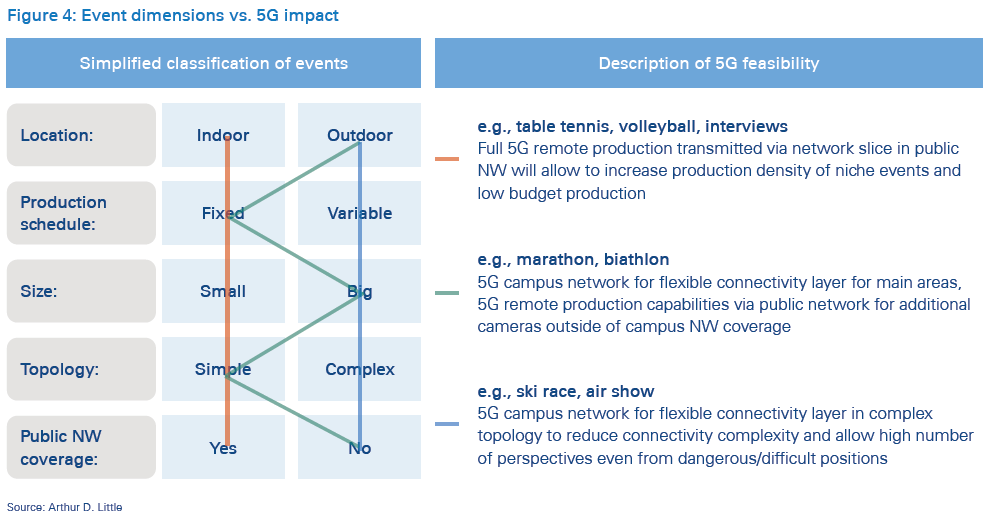

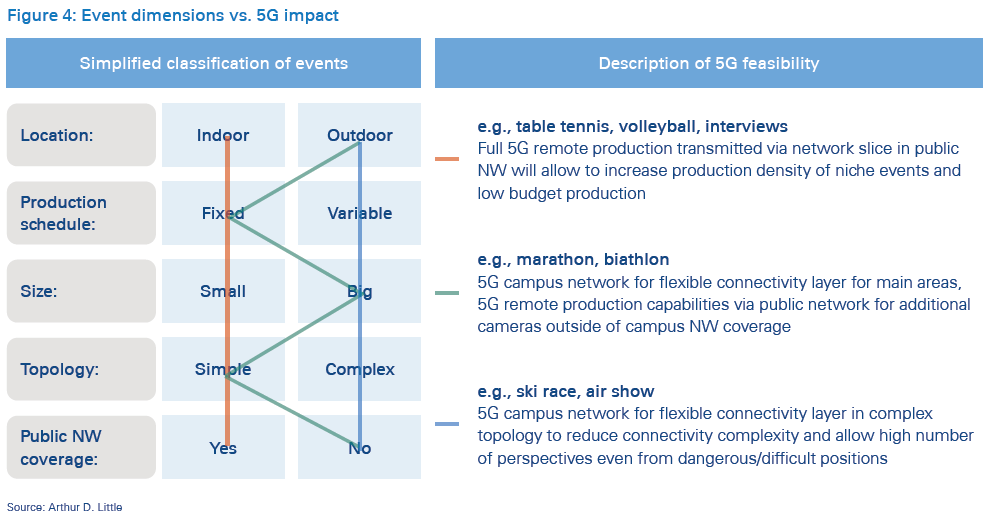

The precise effect of a tailored 5G strategy must be evaluated based on the prioritized use cases and the resulting crossdependency as well as the individual event portfolio as the applicability varies among these use cases (see Figure 4). Many use cases will reduce the cost (e.g., remote production operationalized as one camera, smartphone production or even 8K cameras with regions of interest that shoot different image sections from the same 8K sensor reducing the number of needed cameras and operators). On the other hand, several use cases will create new types of content and hence increase the cost, such as the opportunity for the viewer to change the perspective of the content (e.g., watching a soccer game from the opposite fan block).

5

5G as DVB-T2 successor for best-inclass distribution

The second major application for 5G in broadcasting is expected to be in content distribution. We believe 5G is necessary to create a delivery system able to effectively meet the evolving user requirements for access to media services (right content, right time, right place, right device, right quality and right price). At the same time, it is crucial to regain competitiveness with tech giants by gaining unconstrained access to the audience and audience data.

5G as successor of terrestrial distribution

Apart from satellite, cable and IPTV, broadcasting companies still rely on terrestrial technology as one of their major distribution channels in many countries (e.g., Italy, Spain), especially in rural areas with low next-generation access penetration. With DVB-T2 being the latest evolution of DTT, broadcasters are forced to find alternatives that can fill the emerging gap in distribution technology. 5G FeMBMS (further enhanced multimedia broadcast multicast service), a standard defined in 5G to allow broadcasting capabilities via the telecommunication standard, will allow broadcasters to fill this gap because it brings significant advantages compared to previous mobile-based broadcasting standards, including:

- FeMBMS standards offer a major enhancement by supporting the existing network of high-power high tower transmitters used for terrestrial broadcasting.

- The support of high-power high towers allows broadcasters to create a network that is able to offer the required coverage for broadcasting in a cost-effective way and still meet regulatory requirements (e.g., high and secured reach in times of disasters).

- Using a telecommunication standard for terrestrial broadcasting allows broadcasting companies to meet the customer behavior trend of using mobile devices extensively for media consumption, without huge additional infrastructure investments. 5G FeMBMS is expected to be supported by 5G antenna systems as well as handsets due to current lobbying efforts (one infrastructure for all device categories).

- 5G FeMBMS will allow use of 5G-related edge computing technology to enhance existing content delivery networks (CDNs), providing the most effective cost reducer in distribution.

To summarize, 5G FeMBMS should provide terrestrial distributors with a cost-efficient way to have a highly reliable, wide coverage network fulfilling regulatory requirements as well as expanding terrestrial reach to mobile devices. This can enable broadcasters to retain valuable spectrum by futureproofing the long-term relevance of terrestrial broadcasting. Therefore, some broadcasters (e.g., Bayerischer Rundfunk together with Telefónica) are already live testing 5G FeMBMS solutions. Wide availability, however, will depend on the spectrum available for broadcasters (e.g., sub-700MHz in Europe), the extent of broad support of FeMBMS and the spectrum range of handset and set-top-box manufacturers

5G as a driver of competitiveness

A successor for terrestrial broadcasting alone would likely not be enough to justify an investment in a new technology for broadcasters because most of them still face a lack of extensive customer data outside of the OTT world (terrestrial broadcasting usually only allows limited bidirectional communication [e.g., HbbTV]). This limited customer data bears a significant competitive disadvantage compared to big tech giants and streaming platforms, which know every detail about their customers’ media consumption habits and can use that data to optimize existing services, create personalized content for subsegments and tailor their business models to market demands. Therefore, it is imperative to form connections with customers based on mutual benefits and to get access to their data, revealing content and distribution preferences. 5G FeMBMS can not only help broadcasters find a successor for terrestrial broadcasting but may also come with new features to start closing the gap to other media players, including:

- Dynamic reallocation of downstream bandwidth between one-directional broadcast and bidirectional unicast, enabling broadcasting companies to gather customer data.

- A significant increase in the available capacity within the distribution network of broadcasters, competing above today’s widely adopted HD standard as well as UHD and 8K, while keeping the number of distributed channels unchanged.

- Content cache (capabilities combined with dynamic multicast/unicast switching) will allow broadcasters to dramatically reduce network congestion in mobile networks for parallel media consumption, either for their own ondemand service or as a service for MNO traffic offloading.

In sum, 5G FeMBMS will transform traditional terrestrial distribution into an innovative and converged linear and nonlinear media distribution environment.

6

5G: next-level content production and distribution

Concluding this report, we do not expect 5G to solve the challenge of increasing competition in the media sector from big tech giants nor the challenge of customers radically changing their media consumption habits. However, 5G equips broadcasters with a technology that we believe can help them to:

- Reach a highly competitive cost level for live production

- Produce innovative next-generation content to maximize customer experience

- Build a strong community by extensively including UGC in media strategy

- Re-strengthen terrestrial broadcasting competitiveness due to powerful DVB-T2 successor

- Access highly accurate data on customer consumption habits (through unicast/broadcast capabilities) to regain competitiveness

To be prepared for implementation as soon as use cases become possible on a large scale, broadcasters must proactively start to identify relevant use cases for themselves, evaluate the financial and qualitative impact of those use cases on their business and define a clear overall roadmap for 5G. They can kick-start this process immediately by beginning with use cases that are feasible with 4G, like one camera or smartphone production for spontaneous events or news gathering. To be successful with such pilots, companies need to educate their technical staff and reporters about the pilot to ensure a workable (technical) process, get the necessary equipment and the needed skills and encourage curiosity as well as an open-minded and forward-thinking environment. Assuming the first pilots deliver results, the organization will have a proof of concept and can scale it while trying out more complex use cases.

DOWNLOAD THE FULL REPORT

Broadcasters’ 5G evolvement within a hybrid environment

How can a broadcaster use 5G to trigger the necessary transformation to compete in a fast-changing and challenging media environment?

DATE

Executive Summary

Broadcasters compete in a fast-changing media environment, facing competition from new players and shifting consumption habits as well as technical requirements due to new technologies. We believe 5G has the potential to help broadcasters successfully undergo the required digital transformation and strengthen their market position in content production and distribution.

5G will combine a technology evolution (decreased latency, increased bandwidth and extended coverage) with a business model revolution (dynamically provided quality of service), fundamentally changing the range of exploitable mobile use cases in the following three production areas:

- Remote production – large-scale, high-profile news gathering; centralized and automated camera operations; remote production without outside broadcasting or signal-bundling vehicle

- Event densification – simplification of technology landscape by combining video, telemetry and microphones on one connectivity layer; increased number of special effect cameras; capitalizing on augmented reality/virtual reality recording

- Community platform building – live contribution at events, support in news gathering and crowd-based perspectives through user-generated content

5G is also expected to create a new distribution system able to effectively meet evolving user requirements for access to media services while allowing broadcasters to regain unconstrained access to audiences and audience data. The two major drivers for 5G FeMBMS include:

- Providing terrestrial distributors with a successor technology for DVB-T2 with high reliability and wide area coverage at relatively lower cost

- . Enabling increased competitiveness over terrestrial by gathering customer data via bidirectional unicast, increasing content quality due to high network capacity and reducing network congestion in mobile networks for parallel media consumption

Implementing these opportunities in a clear 5G strategy will not only lead to higher flexibility and quality, additional content and increasing customer loyalty, but also to an overall positive cost impact of 10-20 percent of the production cost while regaining competitiveness over terrestrial distribution.

5G will solve neither the challenge of competition nor of changing media consumption habits on its own, but the right strategy and prioritized use cases may help broadcasters reduce their costs for live productions, innovate their content, build stronger communities and get customer data access.

1

The broadcast industry disruption

Broadcasters are challenged by a changing media environment, competition from new players and changing consumption habits and technical requirements due to new technologies.

Streaming companies such as Netflix, Amazon, DAZN and Facebook are strongly challenging broadcasters in a battle for eyeballs (e.g., Amazon acquired the rights to show 20 English Premier League live games per season, and Netflix spent over US $15 billion on content in 2019).

At the same time, the media industry is dealing with profound changes in media consumption habits. Consumers gradually shifting from linear to non-linear viewing increase the necessity of using big data to develop a deep understanding of consumer habits and preferences in order to create increasingly tailored content. In parallel, a majority of consumers have moved from consuming media via TV to using a fully mobile environment, often with multiple mobile devices for media consumption. More and more users consume content anywhere and anytime. Some media companies as well as public and commercial broadcasters capitalize on these trends by offering their own streaming services like Disney+, Peacock, Joyn and BritBox. Most broadcasters, however, are not prepared to follow these trends without high investment in infrastructure.

In addition to a highly competitive market, higher complexity in consumer behavior and new consumer technologies such as augmented reality (AR)/virtual reality (VR) and 4K/8K videos bring additional challenges for the broadcasting industry, including: bandwidth requirements are increased for both production and distribution; the usage of public clouds to collect and use generated data is more frequent; and there is a need to adapt production assets for 4K/8K and to reinvent certain program concepts to integrate AR/VR.

Based on our conversations with media company CxOs and insights from our projects, we see three key capabilities that public and private broadcasters can capitalize on to strengthen their market position and fight back against Netflix and other tech giants:

- Create more local content to differentiate from the global players at a competitive cost level.

- Create more specialized (e.g., niche sport) and nextgeneration content (e.g., AR/VR, 8K, mobile) for a tailored audience by fast learning from individuals’ consumption habits

- Distribute content in an omni-channel approach (anytime and anywhere) to regain reach and relevance in young and fragmenting audiences.

We believe 5G represents a stepping stone for broadcasting companies to successfully undergo the required digital transformation and strengthen their market position in content production and distribution (see Figure 1).

2

5G, a technical evolution & business model revolution

We believe 5G will combine a technology evolution with a business model revolution, fundamentally changing how broadcasting companies can leverage mobile technology in content production to implement real-life use cases, with exploitable potential outside of the existing limitations.

Technical evolution

Broadcasters have already leveraged 4G mobile networks (e.g., LiveU, Mobile Viewpoint) for fast, flexible and cost-efficient news gathering and niche event production. However, they have encountered major technical limitations (e.g., in the number of cameras due to small bandwidths and in real-time combination of multiple sources due to high latency and low reliability resulting from the low quality of service [QoS] on cell edges). As we see in Figure 2, 5G can help overcome these limitations by providing: up to 20x higher overall bandwidth in the network (requires fiber backhaul to all sites and availability of all 5G spectrum bands, especially mid-band and mmWave); 90 percent lower latency; and continuous QoS even on cell edges, building the foundation for broad adoption of 5G-based content production beyond news gathering and niche events.

Business model revolution

In addition to breaking through technical barriers, 5G can provide enough network capacity for all without the obligation to buy guaranteed services and can therefore be seen as an important prerequisite for adopting mobile technology. 5G technology can even enable dedicated network slices, guaranteeing network capacity in an economically viable way, since there are none of the geographical and time-based limitations associated with specific demand. (Note: Economic viability depends on the regulator, the local mobile network operator [MNO] strategies and the competitive landscape.) Additionally, broadcasters would be able to build and operate their own 5G campus networks (nationally for event production, internationally with partners) with full quality control due to the new spectrum issued for 5G.

3

5G as door-opener for content production innovation

With 5G fulfilling the technical requirements of content production while guaranteeing high reliability, we see three major areas with multiple benefits for broadcasting companies:

- Remote production expansion

- Event densification

- Community platform building

5G enables remote production expansion

Broadcasters are already using a whole host of mobile solutions for news gathering and niche event production as well as for reducing the required satellite transmission of outside broadcasting (OB) vans. However, current technology requires expensive satellite-based solutions to support broadcast-grade HD or UHD event production and is barely able to keep pace with increasing quality and flexibility requirements due to shorter preparation times and high reliability needs.

We expect 5G to enhance the range of these existing solutions and enable (especially but not exclusively) mobile-based production solutions, including:

- High-profile news gathering with fast response times and low operation cost, either as a one-camera or smartphone remote production (e.g., for governmental announcements, crisis reports). Such solutions are already in place today, and large-scale implementation will likely follow upon 5G availability.

- Remote production of events with a pre-defined schedule and location and up to 10 cameras but neither an OB van, signal-bundling vehicle nor fixed-transmission line onsite. This can significantly reduce production costs (e.g., for smallscale sports events or church services). There are already existing pilots, but larger implementation is expected to materialize in the mid-term.

- Centralization of camera operators for remote and onsite production, with remote control of telemetry, pan-tilt-zoom (PTZ) and automated remote cameras enabled by low latencies of 5G (e.g., talk show, concert). There are a few early stage pilots, but frequent large-scale occurrences are unlikely to happen within the next few years.

These use cases can be implemented by using a dedicated network slice in the public 5G network of operators. Therefore, before implementing a 5G-based remote production strategy to exploit these above-mentioned potential solutions, broadcasters need to be aware of the 5G network rollout (part of MNO strategy and competitive landscape) in their home country and be certain that there is an option to obtain a slice.

5G increases event densification

5G is expected to provide broadcasting companies the opportunity to own and control geographically limited mobilebased networks for content production. Such networks may either be stationary campus networks for a company’s own production sites or mobile campus networks at big live event productions. Both network types will likely come with an extensive range of potential use cases due to the high reliability, high bandwidth and low latency of wireless onsite connectivity, providing some of the following outcomes:

- Simplifying the technology landscape onsite by combining several individual technologies used today (e.g., wireless camera video feeds and telemetry, additional microphones and intercom).

- Cutting set-up costs for events by significantly reducing cabling efforts onsite while allowing for increasingly flexible camera positioning; cameras can be deployed with a high share of wireless connections (e.g., moving cameras on motorcycles for biathlons, quick shifting of camera positions at ski races due to changes in weather conditions or stationary cameras on a Formula 1 track).

- Increasing the number of special effect cameras, which can be positioned at spots that are dangerous or difficult to reach for camera operators, giving directors maximum creative freedom for enhanced customer experience (e.g., inside a slalom pole of Kitzbühel, on the tennis net in Wimbledon or on the runway of the Eastbourne International Airshow).

- Capitalizing on new technologies like AR/VR, not only allowing new perspectives but also completely changing the type of customer experience in content production (e.g., live inserted player statistics of a soccer game via AR glasses or second-screen applications and multiple 360-degree perspectives of a football game individually chosen by each viewer).

All these use cases can be implemented by using a private 5G network fully controlled by the broadcaster or by a third party as a managed service. To give one implementation example, we can look at the German soccer club VfL Wolfsburg, which is already piloting a private 5G network in its stadium, enabling viewers to follow the game via their 5G smartphones and providing additional information like players’ running speeds or shooting accuracy. We expect a broader implementation of this use case in the top leagues around the world in the upcoming years.

Before broadcasters can start the implementation, they need to identify available options in terms of spectrum availability and slicing offers in order to choose the right implementation model – spectrum acquisition either with a partner or alone. If the spectrum situation is not yet defined by the regulator, broadcasters need to derive the overall value created from various use cases to use it as a basis for continuous lobbying to secure reserved 5G spectrum for broadcasting. Given the difference in use cases, different spectrum ranges need to be targeted (mmWave band for use cases that require extremely high data rates, mid-band for use cases that require capacity and coverage and low-band for spacious and deep indoor coverage) and vary depending on the local spectrum allocation plans of the regulator.

5G supports building or leveraging a community platform

Apart from expanding remote production and densifying content for event productions, 5G is expected to give broadcasters an enhanced tool to (re)start building a community or to strengthen existing community platforms. We believe that, with the increased availability of 5G networks with the described technical developments, it will be much easier for broadcasting companies to collect comparable, high-quality user-generated content (UGC). UGC has four major potential benefits:

- Helps engage the community by allowing it to contribute to content creation for live events (e.g., culture, sports), which is expected to lead to an increase in customer loyalty within the existing community (e.g., viewers contributing remotely to political debates).

- Supports news gathering and reduce response times of broadcasting initial first impressions; we believe this will increase the local relevance of the program (e.g., viewers contributing videos from disaster zones).

- Provides directors of events with additional, crowd-based perspectives, which can be incorporated into available professional feeds to create content that lets viewers assume the positions of visitors (e.g., a visitor of an event streams the event live).

- In the long run, UGC can be used to build a separate platform with (semi) curated live C2C content with a validating instance provided by the broadcaster (e.g., an application for editing and uploading videos from customers’ cell phones).

Overall, UGC has enormous potential to generate unlimited additional content nearly free of charge and can be leveraged in multiple ways. BBC, for example, capitalizes on UGC and builds a community around it. Its UGC hub collects content from users all around the world, bringing in new perspectives, especially for unexpected events. The effort to build up and maintain the hub and the resources needed for the verification process should not be underestimated. Main effort drivers are e.g., a wellfunctioning technical system, manpower for validation and legal checks as well as creative community engagers.

To evaluate the full potential of UGC, factors such as the legal situation of content rights, the restrictions in content distribution, the readiness of the editing processes as well as the penetration of 5G handsets need to be assessed on a country-by-county level.

4

5G, an up to 20 percent production cost saving potential

Implementing a clear 5G strategy will not only lead to higher flexibility and quality, additional content and increasing customer participation, but can also have an overall positive cost impact. We calculated the average technical cost savings for European broadcasters based on their live production portfolio, available capacity and market costs (see Figure 3). Those savings can be achieved in the short and mid-term with currently developed technologies. Long-term potential savings are expected to be significantly higher, although the exact magnitude is not yet assessable.

Our current assessment shows that 5G can significantly reduce the resources required for each type of production analyzed. We calculated average technical costs savings for a broad portfolio of live events (sports, culture, news, entertainment and religion). The four major drivers for cost savings are:

- Personnel costs – lower staff cost due to a reduction in dead time (remote production) and a reduction in overall FTEs (more efficient setups including wireless production)

- OB – reduced OB van requirements due to higher share of remote production including reduced electronic equipment (e.g., switchboards) due to unified and IP-based technology

- Travel costs – lower travel costs due to lower head count overall (wireless production); a smaller number of events with travelling requirements (remote production)

- Equipment – lower equipment costs due to lower technical complexity (only one common connectivity layer required, with a lower material cost [cabling])

However, broadcasting companies must be aware that a 5G strategy does not always mean there will be overall cost savings. There are four factors that need to be considered because they could potentially outweigh up to 40 percent of the potential savings:

- Director’s desk. Although the onsite staff can be reduced, the need for a centralized editor studio (e.g., HQ, national studio and separate editor center) could lead to increasing facility cost (cost level depends on free capacity in central studios).

- Workspace. A small share (approximately 10-20 percent) of remote productions is expected to require a small team to remain onsite for coordination or personal contact and would require a separate workplace.

- Connectivity. Connectivity cost is expected to increase, as a high share of productions can be transmitted directly via the 5G network, which can increase contracted bandwidth and QoS. (Note: this is based on current connectivity production cost [EUR/GB] plus premium for QoS).

- 5G-ready cameras, 5G-enabled I/O cluster and control room interfaces. Especially in the beginning, equipment supporting 5G is expected to be slightly more expensive than equipment for current technologies, although this cost difference is likely to decrease over time.

Although there are some additional costs associated with a clear 5G strategy, the overall business impact is expected to result in up to a 10-20 percent decrease in the technical cost of content production (see Figure 3).

The precise effect of a tailored 5G strategy must be evaluated based on the prioritized use cases and the resulting crossdependency as well as the individual event portfolio as the applicability varies among these use cases (see Figure 4). Many use cases will reduce the cost (e.g., remote production operationalized as one camera, smartphone production or even 8K cameras with regions of interest that shoot different image sections from the same 8K sensor reducing the number of needed cameras and operators). On the other hand, several use cases will create new types of content and hence increase the cost, such as the opportunity for the viewer to change the perspective of the content (e.g., watching a soccer game from the opposite fan block).

5

5G as DVB-T2 successor for best-inclass distribution

The second major application for 5G in broadcasting is expected to be in content distribution. We believe 5G is necessary to create a delivery system able to effectively meet the evolving user requirements for access to media services (right content, right time, right place, right device, right quality and right price). At the same time, it is crucial to regain competitiveness with tech giants by gaining unconstrained access to the audience and audience data.

5G as successor of terrestrial distribution

Apart from satellite, cable and IPTV, broadcasting companies still rely on terrestrial technology as one of their major distribution channels in many countries (e.g., Italy, Spain), especially in rural areas with low next-generation access penetration. With DVB-T2 being the latest evolution of DTT, broadcasters are forced to find alternatives that can fill the emerging gap in distribution technology. 5G FeMBMS (further enhanced multimedia broadcast multicast service), a standard defined in 5G to allow broadcasting capabilities via the telecommunication standard, will allow broadcasters to fill this gap because it brings significant advantages compared to previous mobile-based broadcasting standards, including:

- FeMBMS standards offer a major enhancement by supporting the existing network of high-power high tower transmitters used for terrestrial broadcasting.

- The support of high-power high towers allows broadcasters to create a network that is able to offer the required coverage for broadcasting in a cost-effective way and still meet regulatory requirements (e.g., high and secured reach in times of disasters).

- Using a telecommunication standard for terrestrial broadcasting allows broadcasting companies to meet the customer behavior trend of using mobile devices extensively for media consumption, without huge additional infrastructure investments. 5G FeMBMS is expected to be supported by 5G antenna systems as well as handsets due to current lobbying efforts (one infrastructure for all device categories).

- 5G FeMBMS will allow use of 5G-related edge computing technology to enhance existing content delivery networks (CDNs), providing the most effective cost reducer in distribution.

To summarize, 5G FeMBMS should provide terrestrial distributors with a cost-efficient way to have a highly reliable, wide coverage network fulfilling regulatory requirements as well as expanding terrestrial reach to mobile devices. This can enable broadcasters to retain valuable spectrum by futureproofing the long-term relevance of terrestrial broadcasting. Therefore, some broadcasters (e.g., Bayerischer Rundfunk together with Telefónica) are already live testing 5G FeMBMS solutions. Wide availability, however, will depend on the spectrum available for broadcasters (e.g., sub-700MHz in Europe), the extent of broad support of FeMBMS and the spectrum range of handset and set-top-box manufacturers

5G as a driver of competitiveness

A successor for terrestrial broadcasting alone would likely not be enough to justify an investment in a new technology for broadcasters because most of them still face a lack of extensive customer data outside of the OTT world (terrestrial broadcasting usually only allows limited bidirectional communication [e.g., HbbTV]). This limited customer data bears a significant competitive disadvantage compared to big tech giants and streaming platforms, which know every detail about their customers’ media consumption habits and can use that data to optimize existing services, create personalized content for subsegments and tailor their business models to market demands. Therefore, it is imperative to form connections with customers based on mutual benefits and to get access to their data, revealing content and distribution preferences. 5G FeMBMS can not only help broadcasters find a successor for terrestrial broadcasting but may also come with new features to start closing the gap to other media players, including:

- Dynamic reallocation of downstream bandwidth between one-directional broadcast and bidirectional unicast, enabling broadcasting companies to gather customer data.

- A significant increase in the available capacity within the distribution network of broadcasters, competing above today’s widely adopted HD standard as well as UHD and 8K, while keeping the number of distributed channels unchanged.

- Content cache (capabilities combined with dynamic multicast/unicast switching) will allow broadcasters to dramatically reduce network congestion in mobile networks for parallel media consumption, either for their own ondemand service or as a service for MNO traffic offloading.

In sum, 5G FeMBMS will transform traditional terrestrial distribution into an innovative and converged linear and nonlinear media distribution environment.

6

5G: next-level content production and distribution

Concluding this report, we do not expect 5G to solve the challenge of increasing competition in the media sector from big tech giants nor the challenge of customers radically changing their media consumption habits. However, 5G equips broadcasters with a technology that we believe can help them to:

- Reach a highly competitive cost level for live production

- Produce innovative next-generation content to maximize customer experience

- Build a strong community by extensively including UGC in media strategy

- Re-strengthen terrestrial broadcasting competitiveness due to powerful DVB-T2 successor

- Access highly accurate data on customer consumption habits (through unicast/broadcast capabilities) to regain competitiveness

To be prepared for implementation as soon as use cases become possible on a large scale, broadcasters must proactively start to identify relevant use cases for themselves, evaluate the financial and qualitative impact of those use cases on their business and define a clear overall roadmap for 5G. They can kick-start this process immediately by beginning with use cases that are feasible with 4G, like one camera or smartphone production for spontaneous events or news gathering. To be successful with such pilots, companies need to educate their technical staff and reporters about the pilot to ensure a workable (technical) process, get the necessary equipment and the needed skills and encourage curiosity as well as an open-minded and forward-thinking environment. Assuming the first pilots deliver results, the organization will have a proof of concept and can scale it while trying out more complex use cases.

DOWNLOAD THE FULL REPORT