Innovation is at the core of the most successful companies, but as budgets are squeezed by short-term priorities, competition from nontraditional players, and market challenges, corporations must be judicious with their funds. While corporate venturing has historically been a less well-defined path to strategic value creation, its investment structure, nimble nature, and financial profile make it an attractive option if structured properly. In this Viewpoint, we explore the benefits of corporate venture capital (CVC) investments to remain competitive in a rapidly evolving market and ensure long-term strategic value creation.

DESPITE BENEFITS OF INVESTMENT, PRESSURE TO REDUCE SPEND

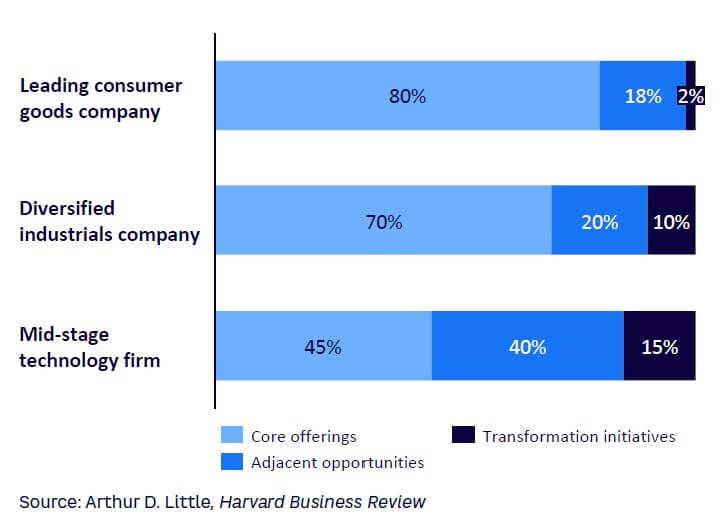

Benchmarks show that companies can benefit greatly from investing more in adjacent and transformational opportunities. A study by Harvard Business Review of companies in the industrial, technology, and consumer goods sectors looked at whether any particular allocation of resources across core, adjacent, and transformational initiatives correlated with significantly higher share price performance. The analysis reveals that a 70% allocation of innovation resources to enhancements of core offerings, 20% to adjacent opportunities, and 10% to transformational initiatives (70-20-10) correlated to meaningfully higher share price performance. For most companies, this breakdown is a good starting point for discussion and supports a balance between short-term growth and long-term bets, although, individual firms may deviate from that ratio for sound strategic reasons. See Figure 1 for three allocations we have seen that made sense for firms in various circumstances.

Allocation is based on a cross-industry and cross-geography analysis, with the average being 70-20-10 and the optimal distribution for companies varying due to several factors, including industry.

According to our industry-by-industry analysis, industrial manufacturers are closest to the proposed 70-20-10 allocation compared to consumer goods and technology companies. Other factors are competitive position and stage of development. A lagging company might want to pursue more transformational innovation aimed at disruptive innovation that results in accelerated growth. Similarly, newly founded companies may need to invest a higher share in transformational innovation to attract attention from investors and customers.

Despite all of the compelling evidence for investing in innovation, companies instead are cutting innovation budgets due to uncertainties in the world economy, rising energy costs, and other post-pandemic inflationary pressures. However, all indicators are signaling that higher spending levels are needed to compete with new mega players that are entering traditional manufacturing markets (e.g., Google, Apple, and Tesla). Reducing investments now may temporarily improve cash flow but will have dire consequences in the longer term.

In the remainder of this Viewpoint, we explore how successful CVC investments can help plug the innovation gap and deliver both financial and strategic value.

KEY QUESTIONS REGARDING CVC

Corporate venturing is challenging and requires each company to reflect on several factors prior to engaging in investments in disruptive companies. It is of utmost importance for companies to find a fit between the current innovation strategy and the new ventures’ contribution in order to thrive in the future. To achieve this, there are three key questions companies should consider:

-

Can CVC fill the transformational innovation gap while maintaining attractive financials?

-

What role should corporate venturing play within our broader strategy?

-

How should CVC be organized to maximize the desired financial and strategic returns?

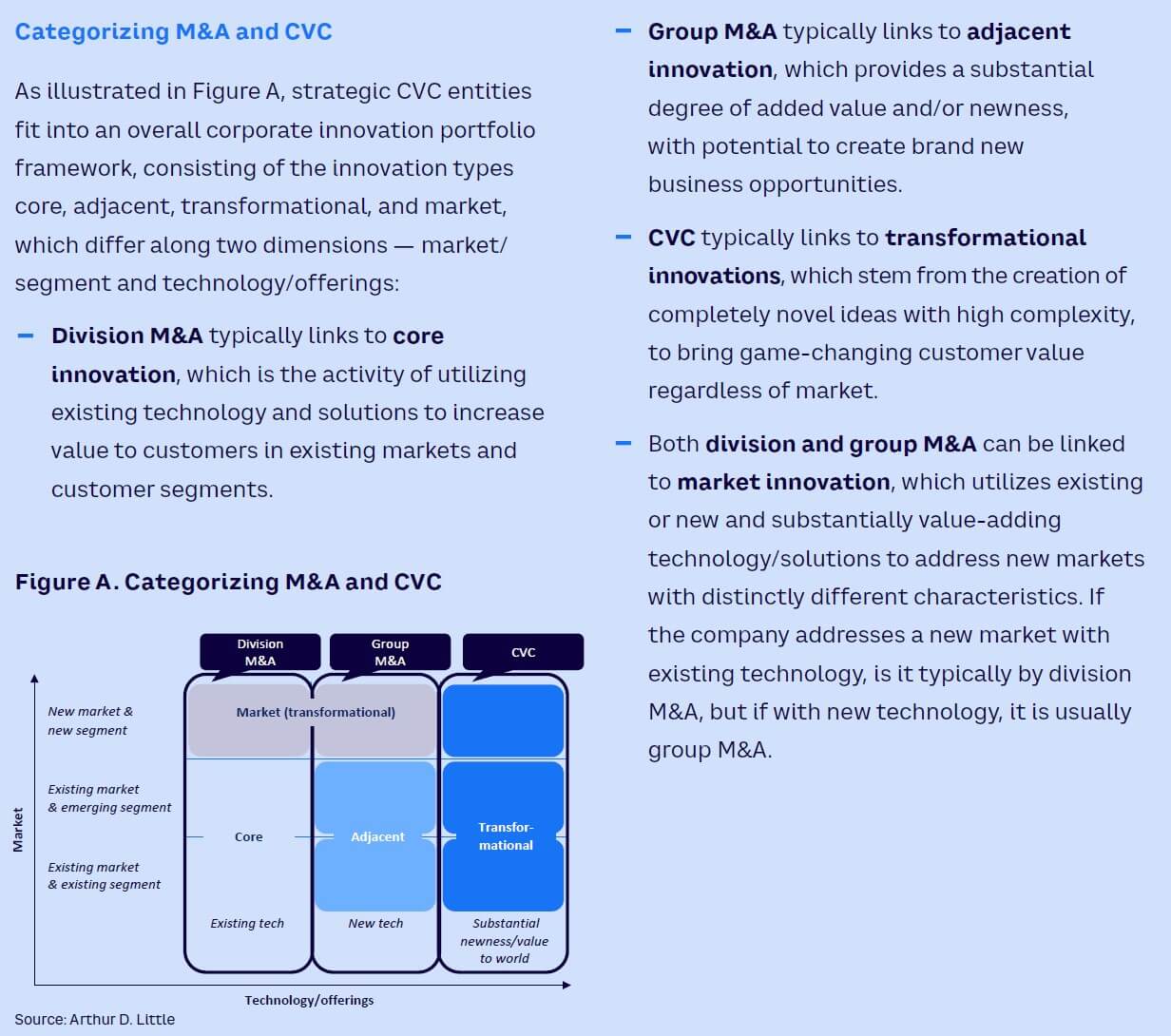

CVC FILLS TRANSFORMATIONAL INNOVATION GAP

CVC is one of many corporate development levers available to drive innovation and results, but it differs from traditional M&A both in terms of goals and investment focus. While the goal of corporate venturing is often to enhance the innovation portfolio outside of core business, traditional M&A is typically related more to the existing business plan and core business (e.g., as geographical or product portfolio expansion). Corporate venturing’s investment focus has a longer-term perspective by making technology bets in start-up or scale-up companies with innovative technology that potentially could become core business in the future. In comparison, traditional M&A is focused to a greater degree on making acquisitions that have positive contribution to financials in the short term.

In our CVC benchmarking, we see corporate venturing across this spectrum of strategic versus financial objectives. A strategic investment has the primary aim to drive innovation and learnings both in technology and business models, with the longer-term goal of driving sales and profits in the corporation’s core business. In these cases, the investing company is seeking to supplement and/or replace traditional R&D and M&A and create a mutually beneficial relationship between itself and the new venture. On the other side, financial return-focused CVCs’ aim is purely on driving attractive returns for the parent company. Financial CVC competes more directly with traditional venture capital (VC) investors by bringing brand, technology, channel, customers, and market knowledge to investments in addition to the cash investment.

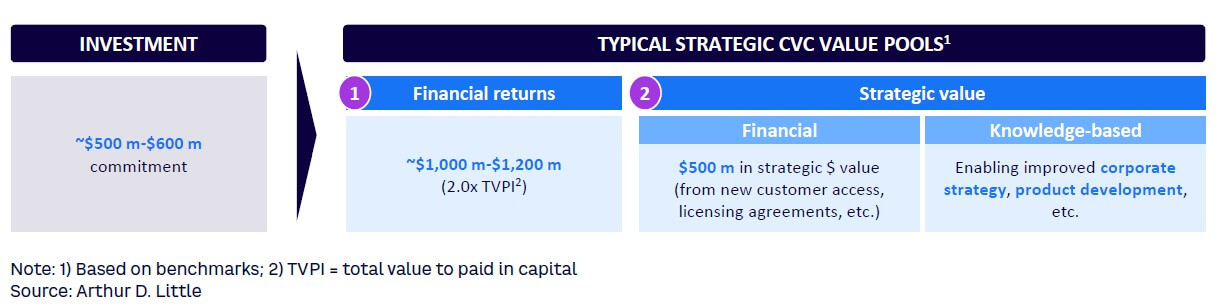

More recently, as corporate innovation budgets are squeezed by other priorities, competition from nontraditional players, and broader market challenges, we have seen a marked shift toward strategic-weighted CVCs. While they may not have the highest financial returns, our benchmarks suggest top strategic CVCs expect financial returns of 2x cash and 15% IRR on a 10-year investment horizon with an additional 100% return in strategic value gain (see Figure 2). In other words, a top strategic CVC can turn a US $500 million cash investment into more than $1 billion cash plus $500 million in strategic value.

DESIGNING STRATEGIC CVC FUNDS FOR SPECIFIC NEEDS

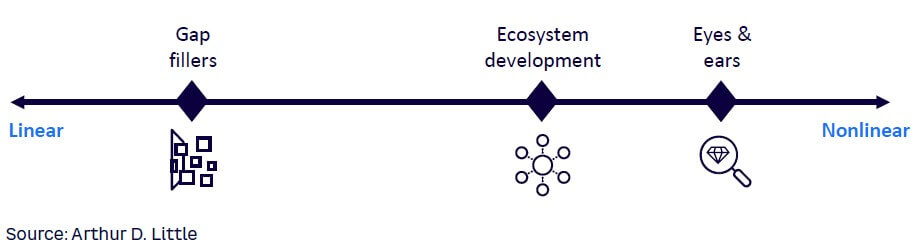

Strategic value-creating CVC can be further segmented based on different focus areas, depending on the corporate goals (see Figure 3). Our experience shows that there are three archetypes of strategic CVC connected to these varying priorities:

-

Gap fillers. Investments in companies that fit into the corporate’s short- to mid-term product roadmap, which are expected to lead to future revenue generation, portfolio completeness, and relative investment cost benefits. The knowledge-based value creation of gap-filler investments is generally limited (e.g., Cisco’s acquisition of Piston Cloud Computing [portfolio company of Cisco investments] for Cisco Intercloud).

-

Ecosystem development. Investments focused on forward and backward value chain integration and linkage, resulting in revenue development or new supplier/partner relationships. Ecosystem development investments supports firms in gaining additional capabilities in prioritized areas (e.g., Intel Capital’s investments in WiMAX [Worldwide Interoperability for Microwave Access] & Wi-Fi start-ups to drive usage of Intel’s processors).

-

Eyes and ears. Investments in emerging technologies of future relevance. These do not immediately lead to financial gains but set firms up for potential future edge and competitiveness through access to knowledge-based value, intellectual property, and R&D collaborations (e.g., Microsoft M12’s investment in Authomize, an AI-based authorization management automation solution).

CVC ORGANIZATIONAL STRUCTURE

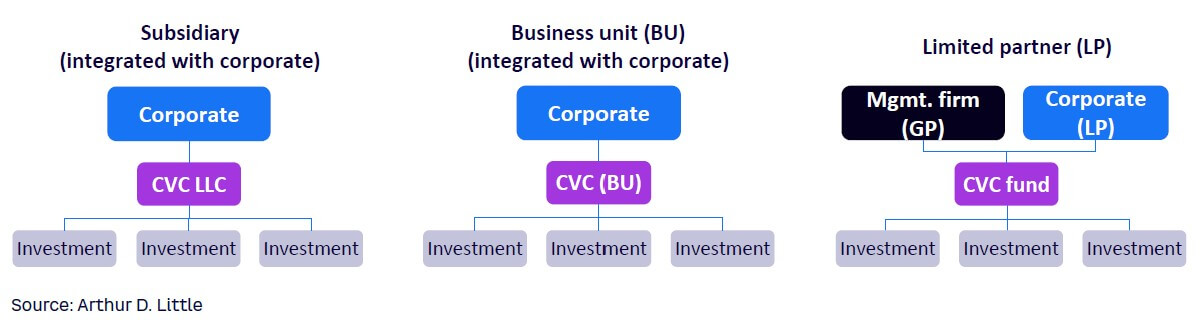

There are several ways to organize for CVC, which can be categorized in three structures (see Figure 4): subsidiary, business unit (BU), and limited partner (LP). While the subsidiary and BU structures are quite similar, the LP structure differs significantly in terms of structure and CVC independence.

-

Subsidiary:

-

Structured as a wholly owned subsidiary with overall reporting to a corporate nominee (typically CEO/CSO, corporate development, etc.).

-

CVC independence is moderately higher than in the BU structure.

-

-

BU:

-

Structured as a BU within the corporate organization, with overall reporting to a corporate nominee (typically CEO/CSO, corporate development, etc.).

-

Typically results in greater corporate influence on CVC operations.

-

-

LP:

-

Standard VC structure wherein the corporation acts as a limited partner, general partners typically report to an advisory LP council consisting of CEO/CSO, etc.

-

Allows for high operational independence for the CVC.

-

Examples of corporate venturing among manufacturing companies illustrate all three structures (see case studies in next section). It is therefore important for companies interested in exploring corporate venturing to evaluate which setup is most suitable to their situation. The examples below illustrate how manufacturing companies organize for transformational innovation via CVC entities while other M&A activities for core and adjacent innovation are carried out at the group and/or division level.

CVC in manufacturing: Case studies

GM subsidiary

GM Ventures, established in 2010, invests in start-ups that share General Motors’s (GM’s) vision of a world of zero emissions, zero crashes, and zero congestion. GM Ventures focuses on key technologies that can be implemented in GM’s vehicles, manufacturing facilities, and operating businesses. GM Ventures LLC is a limited company owned by GM and is not one of the company’s business units.

Saab subsidiary

Saab Ventures was set up in 2001 to build new independent companies that can be “spun out” from the Saab Group within a four- to seven-year horizon based on abundant engineering expertise in the Group. Saab Ventures uses technologies that are constantly being created within Saab that might be developed for one particular market but have the potential to be applied to other markets, too. Saab Ventures AB is a limited company owned by SAAB AB and is not one of the company’s business units.

Volvo Group subsidiary

Transformational innovation is supported by Volvo Group Venture Capital, which was founded in 1997. When analyzing opportunities, Volvo Group Venture Capital looks at a company’s potential and the possibility to combine assets of the company with the capabilities of the Volvo Group through minority investments. The group performs evaluation in collaboration with the group’s commercial and engineering teams. The CVC team works closely with the group strategy team and CFO. M&A activities for adjacent and core innovation are, on the other hand, handled by Volvo Group and its divisions, respectively. Volvo Group Venture Capital AB is a limited company owned by AB Volvo and is not one of the company’s business units.

Airbus LP

Airbus Ventures targets extraordinary start-ups that work to redefine the aerospace industry and leverages the networks and supply chain of Airbus as well as the wider ecosystem of limited partners. Airbus Ventures invests in autonomous mobility, electrification, and low-carbon economy teams and technologies, alongside advanced materials and manufacturing systems, next-generation computing, sensing, security, and beyond. Its latest fund, Airbus Ventures Fund III, was established in 2020 and has an LP structure.

BMW LP

The aim of BMW i Ventures is to make financially attractive investments that create strategic value add for the BMW Group. It has invested in more than 50 companies, including several that have gone or are planning to go public. Its focus is on early to mid-stage start-up companies, many of them based in Silicon Valley, working on vehicle and manufacturing automation, data, and connectivity, as well as in companies involved in efforts to reduce carbon emissions. Its second fund, BMW i Ventures II, was established in 2021 and has an LP structure.

Bosch LP

Robert Bosch Venture Capital invests in technology start-ups with disruptive innovations. Earning potential is a factor, but the primary goal is to secure Bosch’s innovation leadership. Robert Bosch Venture Capital GmbH is a limited company that manages several funds, the latest being Robert Bosch Venture Capital V in 2022, with $266 million in LP structure.

Scania LP

Scania Growth Capital invests in high-growth companies with strategic relevance that discover disruptive, transformational technologies and business models in the automotive and transport industries. Scania is the majority owner in the Scania Growth Capital AB fund, while its investment team retains a minority stake in the fund through a separate advisory company, East Hill Equity. This setup aims to attract a broad range of entrepreneurs, combining the strength of Scania’s ecosystem with the experienced venture capitalist minority owners.

Conclusion

CVC PATH TO INNOVATION

Considering the importance of transformational innovation and the benefits that corporate venturing brings, we believe that more industrial companies should explore the opportunity for CVC investments. Some key considerations include:

-

Although current events and market transformation are challenging the ratio, a 70-20-10 breakdown in allocation of innovation resources is a good starting point for discussion and supports a balance between short-term growth and long-term bets.

-

Corporate venturing can enhance the innovation portfolio outside of core business through transformational innovations that stem from the creation of highly complex, novel ideas and bring game-changing customer value regardless of market.

-

Depending on the goals of the parent organization, CVC funds can be designed to incentivize the activities and investments that provide the most value in terms of strategy and knowledge.

-

There are several ways to organize for CVC, and for companies exploring this field, it is important to evaluate each structure for the specific case.