DOWNLOAD

DATE

Contact

Fixed-mobile convergence has become a reality in Europe, driven by operators in markets with infrastructure-based competition and essentially adopted by customers for its discounts. Behind the nice take-up figures, there is a contrasting reality – the challenge being for operators to capture the value creation potential. Moving beyond discounting is critical to maintain differentiation and secure a positive incremental margin. Operators will need to deepen their understanding of how convergence affects customer segments and value contribution, and translate it into new go-tomarket strategies. The only way to unlock further growth opportunities within the digital home is to enhance customer experience and/or broaden the scope of services.

Insight for the Executive

- Fixed-mobile convergence (FMC) is accelerating and here to stay. It is mainly driven by operators that see an opportunity to get the upper hand via an asymmetrical game – i.e. leveraging an asset (a fixed or mobile network) that competitors do not have.

- In most markets fixed-mobile convergence implies infrastructure-based competition, putting substantial pressure on pure players, and therefore translates into a driver for consolidation and regulatory intervention.

- Value creation is at high risk if operators do not move quickly away from discounting. The name of the game is cross- and upselling/up-tiering. Given the current plans of most operators, awareness is high, but actual implementation is still very limited.

- It is therefore critical to understand the dynamics of the emerging convergent customer segments (or fishing ponds):

- What triggers the customer’s decision to opt for bundled/convergent offerings? Who in the household takes it? And what is the lowest barrier for the customer when selecting his single provider?

- How to seize the opportunity of capturing the additional SIM cards per household?

- How to develop tools to manage the value contribution of revenue-generating units?

- Convergence is much more than bundling, and a fundamental review of product development, strategic marketing and customer experience management will make the difference in the long run. Arthur D. Little’s experience in assisting operators to secure the key success factors of convergence has revealed the importance of a thorough review of the processes, management tools and IT systems across the company’s operating model.

- Finally, fixed-mobile convergence is the unique way to strengthen customer ownership, and therefore secure an option to drive the home-digital transformation and capture value from the future development of the smart-home/smart-life services.

Fixed-mobile convergence: a reality driven by operators

Over the last years, so-called fixed-mobile bundles have been gaining substantial traction in Europe. In the markets that were the first to adopt commercial offers bundling fixed and mobile telecom services, such as France, Spain, Belgium and Portugal, between 40 and 50%1 of households did subscribe to quad-play packages. The UK, Germany and Italy are still in an earlier stage of adoption, in a range of 5 to 10%. In all markets, once initiated, the move to fixed-mobile bundles is rapid.

Operators’ launch of fixed-mobile bundling results from two main strategic challenges:

- How to relaunch growth in distressed markets or markets with high price-based competition?

- How can incumbents reclaim the upper hand in markets where infrastructure-based competition has weakened their positions on fixed-NGA broadband services?

In markets which suffered from down-tiering and cancellation of subscriptions due to the economic downturn and/or in markets where price competition in the mobile market was intense, operators needed to find a way to further increase the discounts granted to end-users in order to remain competitive. Extending the scope of the discount to the combined offer enabled operators providing both fixed and mobile services to offer a higher face-value discount to the customer while creating an asymmetrical competitive advantage which could not be replicated by pure players (mobile or fixed).

Fixed infrastructure-based competition is also a major driver for fixed-mobile bundles. In several markets alternative operators have translated heavy investments in NGA infrastructure into commercial success (e.g. Belgium, the Netherlands, and parts of Spain). These markets are often characterized by the presence of strong cable operators that leveraged more progressive and success-driven investment roadmaps. Incumbents therefore pushed fixed-mobile convergence as a way to compensate for worsening attractiveness in the fixed-broadband market. Again, fixed-mobile bundling or convergence was used to create an asymmetrical advantage.

The driver of adoption by end users is the discount

The level of fixed-mobile bundling discount levels in the range of 25–40% tends to imply that customers have been adopting fixed-mobile bundles primarily for the saving and not for the other benefits of a combined fixed-mobile offer.

Interviews and surveys have repeatedly highlighted2 that the discount is currently customers’ main motivation to subscribe to converged offers. However, once fixed-mobile convergence is introduced, customers ask for the convenience of an overallsolution answer to the household’s digital life.

Fixed-mobile convergence generally starts with discounted bundling of several products. The discounts can be in the form of price discounts, (e.g. subscribing to a bundled offer of fixed broadband, TV, fixed voice and mobile will be less expensive than taking the different products individually) or volume discounts (e.g. subscribers receive more data, minutes, SMS, or even a single product for the overall same price).

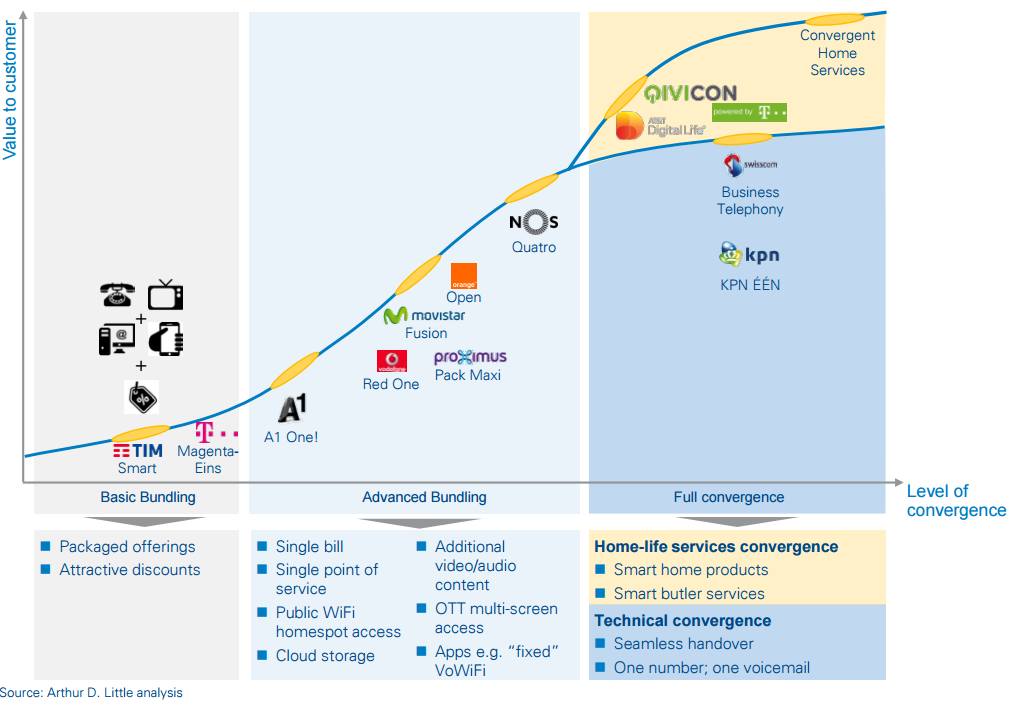

Slightly more advanced bundles add basic convenience services such as single-invoice and single-customer service, e.g. BT’s Starter pack. More advanced convergent offers, such as Orange Open, Proximus Maxi, BT Total Entertainment and NOS Quatro, include access to public WiFi homespots, additional video or audio content (e.g. additional channels, Spotify premium access), cloud storage, OTT multi-screen access or specific apps (e.g. NOS Telefone or Telenet Triiing to call with your fixed number from a WiFi hotspot).

Some operators have started moving to “full” convergence, with an integrated solution for communication taking the form of technical convergence in the more basic form or home-services convergence.

Figure 1: From fixed-mobile bundling to fixed-mobile convergence

Technical convergence leverages technology to seamlessly switch from fixed to mobile and vice-versa. It covers functionalities such as a single number for fixed and mobile, a single voicemail, and access to all video/audio content on all devices with the full range of features (start/stop/pause, record a program, view recordings…). Companies such as KPN and Swisscom already offer those services in their B2B offerings (KPN Eén and Swisscom Business Telephony), but do not yet include TV products.

Home services add another dimension to convergence, with a focus on addressing the verticals related to the household’s life. The basic version of smart-home portfolios usually limits itself to selling a few additional smart-home products (smart meters, monitoring devices, sensors …). Some operators have managed to set up ecosystems that will accept the widest-possible range of devices and associated services, e.g. Deutsche Telekom with the Qivicon platform, but do not systematically deliver and sell the services to the households themselves. AT&T goes even further with its Digital Life security and automation system, providing and billing a broad range of professional monitored services.

The more advanced convergent home services aim to provide end-to-end portfolios of home services to customers – i.e. the smart concierge, smart-butler concepts (e.g. PCCW has already made significant steps in that field).