DOWNLOAD

DATE

Contact

Companies play a major part in mitigating the impacts of climate change by reducing both their own emissions and those along their supply chains. Controlling emissions along the value chain — Scope 3 emissions — is a strategic priority, especially as environmental regulations tighten. As we outline in this Viewpoint, procurement organizations will become a key player in creating supply chain emissions transparency — helping companies define their strategies and balance commercial requirements against sustainability measures.

URGENCY TO ACT ON GLOBAL WARMING

The urgent need to reduce greenhouse gas (GHG) emissions to meet the 1.5-degree goal set out in the Paris Agreement is making sustainability a strategic priority — especially given the growing market demand for sustainable goods and services. In response, industries are increasing their efforts to diminish their carbon footprint. More than 4,500 companies globally have aligned their sustainability targets with the Paris Agreement. Among them are Amazon, Mercedes, IBM, and Heineken, all of which plan to achieve net zero carbon emissions by 2040. Companies including Unilever, IKEA, Microsoft, and Telia are championing net zero emission initiatives through networks like the Exponential Roadmap and the SME Climate Hub.

Fighting against climate change is of strategic and societal importance for all companies, urging them to prepare their business models and strategies for a climate-neutral economy. In addition, regulatory pressure to act on global warming is on the rise, and there are growing calls for mandatory reporting of sustainability risks and GHG emissions along the entire supply chain, such as the US Securities and Exchange Commission (SEC) International Financial Reporting System (IFRS) S1 and S2, the European Corporate Sustainability Reporting Directive (CSRD) (mandatory from 2024), the European Sustainability Reporting Standards (ESRS), and the Carbon Border Adjustment Mechanism (CBAM).

UNDERSTANDING SCOPE 3

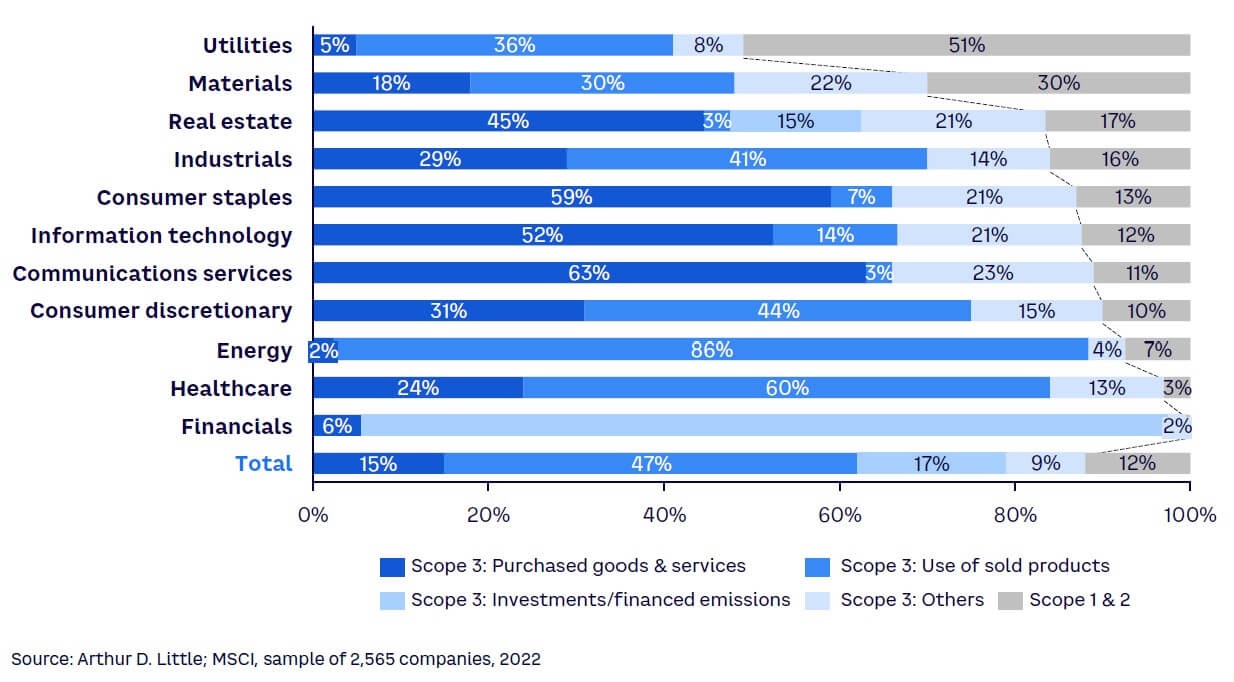

These measures will have a significant impact on enterprises with extensive value chains since they involve addressing GHG emissions beyond the organization’s direct operational control. Scope 3 includes emissions from suppliers, customers, and end users (see Figure 1). Although Scope 3 emissions can originate outside a company's direct sphere of influence, most companies should prioritize controlling Scope 3 emissions, as these constitute up to 90% of a company's carbon footprint. Particularly in asset-intensive industries like manufacturing and communications services, upstream emissions can make up the majority of total emissions according to MSCI (see Figure 2). For example, in 2022, 98% of all emissions of telco operator Telekom were Scope 3 emissions, and 77% were generated upstream.

TRANSPARENCY OF EMISSIONS HOTSPOTS

The challenge of controlling Scope 3 emissions will fall largely on procurement professionals — their choice of suppliers and production locations will have the power to reshape the supply chain. For instance, emphasizing circular practices in an area like raw material extraction and processing (rather than looking to reduce transport emissions that often make up only a fraction of a company’s overall carbon footprint) will have wide-ranging implications.

As procurement takes on greater strategic importance, the first step will be to identify emissions hot spots and create a framework for reducing emissions. Procurement organizations should work closely with suppliers to increase transparency and reduce emissions along the supply chain.

This will not be an easy task. Whenever sustainability measures conflict with commercial aspects of the business such as product price, quality, and production cost, stakeholder interests are likely to slow (or inhibit) their rollout. Gathering data from suppliers may also be difficult, as there are no established industry standards yet for tracking and reporting emission reduction.

This results in inconsistent information coming from different vendors, complicated by the fact that many suppliers lack comprehensive, high-quality data about their operations. Average-data and spend-based methods offer convenience because they use third-party data from organizations such as the International Energy Agency, the Intergovernmental Panel on Climate Change (IPCC), and the International Aluminum Institute (IAI). However, they are less precise than supplier-specific emissions data, which is based on in-depth lifecycle assessments of the entire carbon footprint of a product but is harder to produce. For many companies, the most sensible approach is to use the average-data method as a starting point and gradually create a more accurate emission picture by introducing supplier-specific data as it becomes available.

Scope 3 calculation methods

The Greenhouse Gas Protocol provides four main ways to calculate Scope 3 emissions, each with pros and cons:

-

Spend-based. The amount spent on particular products and services is multiplied by an emission factor.

-

Average data. The quantities of goods and services purchased are multiplied by emission factors using secondary data sources that reflect average industry metrics and standards.

-

Supplier-specific. The quantities of goods and services purchased are multiplied by an emission factor based on product-level, end-to-end GHG inventory data provided by suppliers (this could be obtained from material passports).

-

Hybrid. A combination of supplier-specific data about Scope 1 and 2 emissions, plus secondary calculations on Scope 3 emissions based on industry averages.

TAKING STRATEGIC PROCUREMENT TO THE NEXT LEVEL

A continuous search for greater resilience and innovation has changed the nature of supply chains significantly over the last few years. The need to decarbonize will further accelerate this change, requiring many organizations to take a more strategic approach. In the face of scarce resources and market shifts, many companies have already lost their historic authority to make demands of suppliers, which was what underpinned traditional category management. They must now switch to a sustainable sourcing model in which all players along the supply chain have the same goal, even if their priorities are different. This requires true collaboration based on honest, open relationships that welcome supplier input (and listen to it with respect) and ensure their concerns are addressed. It goes far beyond relationships labeled as collaborative but, in reality, are anything but.

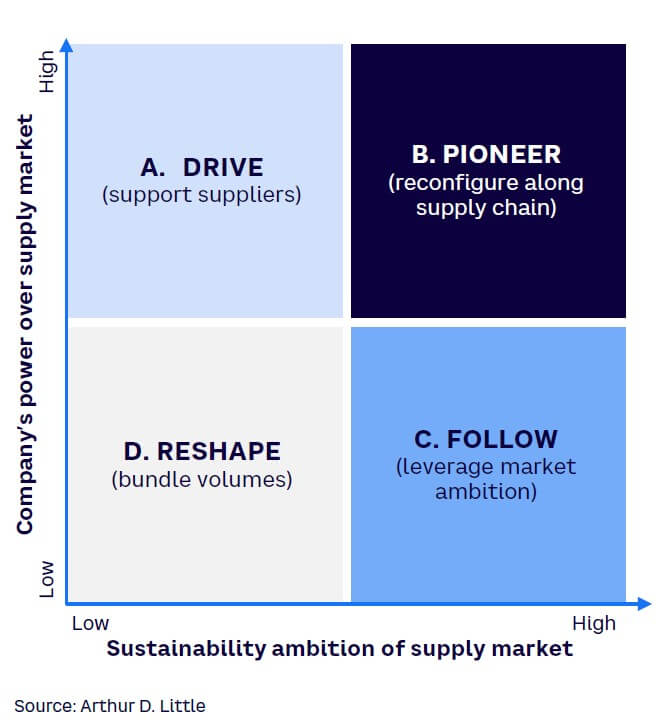

How companies position themselves in this new reality will depend on their power to influence the marketplace, the sustainability ambitions of their Tier 1 and Tier 2 (and potentially Tier n) suppliers, the effect of legislation, and the maturity of low-carbon or carbon-neutral technologies that impact their industry. Figure 3 illustrates four sustainability strategies an organization can pursue based on its relative power in the market (shown on the vertical axis) and the sustainability ambitions of its suppliers (shown on the horizontal axis).

In Quadrant A (drive), companies wield significant power over a weak supply market, which means they can drive through sustainability initiatives and change the supply market to align with their goals. This may involve collaborating with suppliers in R&D to foster innovation and/or promoting sustainability by including sustainability goals in contracts, exchanging lessons learned with others, and/or insourcing production.

In Quadrant B (pioneer), both the company at hand and its supply market exhibit strength. The choices here are to align with prevailing market trends or to pioneer sustainability initiatives (e.g., establishing new industry standards and influencing suppliers to adopt more sustainable practices).

Quadrant C (follow) occurs when companies lack significant power to influence a supply market already strongly focused on sustainability. Here, the optimal strategy may be to follow existing market trends. Companies can align themselves with the supply market’s ambitions by offering long-term contracts or taking on responsibilities that would previously have fallen on suppliers. The key here is to be adaptable and to find ways to better fit with the supply market.

In Quadrant D (reshape), both companies and their supply market lack strength and sustainability ambitions. Here, companies can try to reduce their demand or look for ways to enhance their positioning, (e.g., through product bundling or redesign) so they can be disassembled, and their components recycled to reduce their overall environmental impact. At the same time, suppliers can strengthen their competitive position by exploring more ambitious markets. In other words, there is potential for both customers and suppliers to transform themselves to become more sustainable.

THE SUSTAINABILITY BALANCING ACT

Sustainability has only recently become a supply chain management (SCM) goal, and there are obvious tensions between it and the other three classic SCM goals (cost, quality, and reliability), necessitating trade-offs to maintain balance (see Figure 4). Sustainable alternatives can be more expensive, so although using greener raw materials or products may be better for the environment, this can come with a price premium or may require an investment in expensive new technologies (e.g., hydrogen energy or electric arc furnaces for steel production). Companies must decide whether the CO2 savings potential justifies the cost of greener options. For example, how large must the savings be for recycled steel to be the preference over primary steel or for bio-PET (polyethylene terephthalate) to take the place of conventional PET?

Furthermore, we cannot assume that green alternatives always provide comparable quality and can be applied interchangeably. Although products such as pozzolanic-based green cement are coming onto the market as replacements for commonly used Portland cement, they must be tested and thoroughly evaluated to ensure they are suitable for each use case. A lower-specification green product may be acceptable in some instances and not in others. For example, flat glass cannot be produced from recycled glass, and certain cable types can only be manufactured using virgin copper.

Another challenge to balancing the different SCM goals is the reliable supply of green materials. With growing demand for green materials, supply for them can be scarce and thus inhibit reliability. For instance, many clothing manufacturers would like to use organic cotton in their products because CO2 emissions from its cultivation are 40%-46% lower than conventionally grown crops. However, only 1% of the cotton grown globally is organic, so demand far outstrips supply, according to the Soil Association. Similarly, although there is a strong demand for recycled metal, scrap takes a long time to come onto the market. According to the World Steel Association, steel products have an average lifespan of 40 years, and three-quarters of all the aluminum ever produced is still in use (according to the European Recycling Industries’ Confederation [EuRIC]). The situation is not helped by suboptimal recycling rates; EuRIC also reports that only 44% of EU copper demand is currently met from recycled sources. Only through an emphasis on creating and scaling circular economies will this figure rise in the future.

Resolving trade-offs between sustainability and other SCM goals requires: (1) a clearly defined governance and purchasing strategy aligned with an overall procurement and sustainability strategy and (2) open and effective communication with suppliers. It may also entail coordination with other internal and external stakeholders (e.g., product development, engineering, or sub-suppliers further down the value chain) to redesign products, change technical specifications, or adapt production steps to reduce their overall environmental impact.

There are, however, also synergies between SCM goals in various cases. For example, it is less costly to make glass products from recycled materials than from virgin materials, according to the World Economic Forum. New regulations for imported raw materials (e.g., the EU’s proposed CBAM) should encourage further use of recycled materials. Implementing closed-loop supply chains that reuse materials and end-of-life products can further reduce waste and improve reliability while also reducing costs.

Although cost is always a consideration when determining CO2-reducing measures, one solution is to accept some additional costs if they do not cause significant financial burden and bring long-term environmental benefits. Note that even when sustainable alternatives are initially more expensive, there may be cost savings over time from reduced waste, improved efficiency, and enhanced brand reputation, particularly when adopting eco-friendly measures early on.

Conclusion

TRUE COLLABORATION FOR SUSTAINABLE SOURCING

To make decisions that are both economically and environmentally sustainable, companies will need to strike a balance between the competing goals of SCM: cost, quality, reliability, and sustainability. By working closely with suppliers, evaluating costs and risks, and prioritizing sustainability initiatives, procurement leaders can play a vital role in helping organizations meet their short- and long-term sustainability goals. In sum, here are five takeaways:

-

To successfully reduce Scope 3 emissions, organizations must collaborate all along their supply chains.

-

New legislation will encourage greater transparency along supply chains, helping companies and their suppliers adopt a common approach to sustainability and reducing Scope 3 emissions.

-

Because identifying and managing Scope 3 emissions is highly complex, companies must take a pragmatic, flexible approach to controlling and optimizing them.

-

By acting early, pioneering organizations can reshape their supply chains in ways that give them a competitive advantage.

-

Procurement departments will play a key role in driving emission reduction, but to be as effective as possible, they will need to define a strategic roadmap and work closely with suppliers on concrete sustainability initiatives.