Profitable growth is a key topic for all insurers in all geographies. Traditionally, insurers have focused on maximizing new sales: new products, channels, segments, incentives, and so on. But over the years, market leaders have discovered that profitable growth requires not only increasing new sales but also successfully retaining customers to increase the total lifetime value of their portfolios. In this Viewpoint, we describe a comprehensive framework to design a successful retention model and share some of the best practices from leading insurers.

Customer retention is a key measure of how a company satisfies its existing customers and is a pillar for growth. This applies both to mature companies with a solid customer base and to companies focused on growth and acquiring new customers. Offering a customer-oriented product through the appropriate communication channel — together with an efficient cross-functional structure ready to give the best experience and monitor, prevent, and react — is key to increase customer lifetime value. However, even under the best circumstances, some customer churn is unavoidable. Thus, successful insurers need to define a robust retention model.

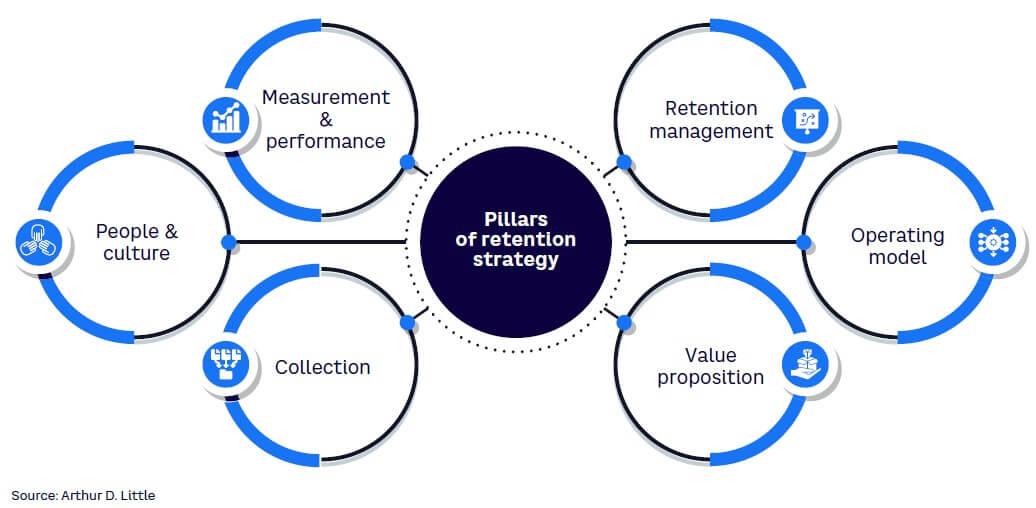

In our experience, a comprehensive framework to design a successful retention model includes six elements (see Figure 1):

- Retention management

- Operating model

- Value proposition

- Collection

- People and culture

- Measurement and performance

RETENTION MANAGEMENT

Executing a good retention strategy relies on the insurer to focus on customer centricity and coordinating specific capabilities in multiple areas. To do so requires a unified customer view instead of the usual policy-centered focus, utilizing a solid governance structure that enables it, and having a deep understanding of the core elements to be addressed, internally or externally:

-

Unified customer view. Insurers today have the advantage of data availability. Internal data can provide insights into how a customer interacts, their transaction history, and their profile. Together with external data sources that enable the insurer to understand behaviors and preferences, there is sufficient information to micro-segment the customer base accordingly. Companies must combine these sources to build a unified view of the customer to understand the overall profitability and define segmented (or personalized) retention actions. As an example, high-value customers will get more advantageous offers and higher priority for the retention team or agents, whereas those receiving a negative value will not receive a retention offer.

-

Cross-functional coordination. Teams within a company tend to work in silos, each team taking care of its own functions and maximizing its performance. This approach should shift to a coordinated effort aimed at engaging the customer throughout the journey. Coordination usually involves product development, marketing, customer service, underwriting, claims, finance, and retention units. All these functions, working together, can create a shared view of what happens to customers, imparting important lessons and actions to improve overall customer satisfaction.

-

Governance. The best way to guarantee the proper development of a retention strategy is by establishing a governance structure that generates the necessary integration and communication between the different areas. Customer engagement decisions need to have a broad view of the journey, taking into account the different elements that affect customers. Insurers should establish periodic cross-functional committees that review the different customer interactions throughout their journey along with the relevant performance indicators. This allows companies to identify concrete areas of opportunities and responsibility so they can take appropriate action (e.g., if customers are constantly leaving for better offers, there is a concrete opportunity for product and underwriting to improve the offer).

-

Externalization vs. internalization. Companies do not have to do everything internally; instead, they must be able to externalize certain services when necessary. Best-in-class companies do not favor one or the other, instead periodically analyzing whether they should change how are they doing things, taking advantage of their core skills and leveraging third parties for additional services.

OPERATING MODEL

When a customer is poised to leave, the company must have elements in place to take appropriate retention actions at the right time. This means being able to segment and prioritize customers to respond to them appropriately, having the tools and the relevant information to take appropriate data-based actions, and reducing friction by giving autonomy when needed. Companies must commit to enhancing their operating models — combining digital and operational capabilities — and providing the right tools at the right time.

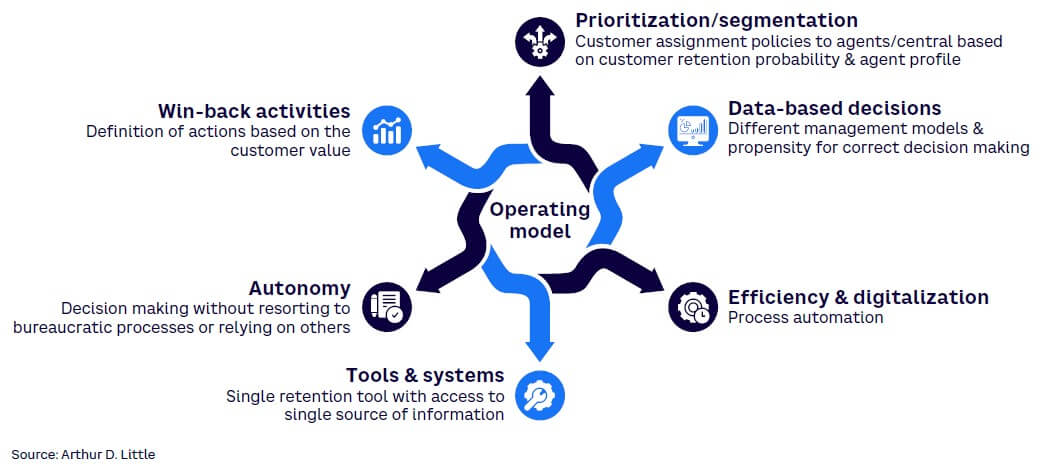

This shift in the operating model includes reviewing and enhancing six key elements (see Figure 2):

Prioritization/segmentation

Success in profitable customer retention is based on segmenting customers and creating segmented capabilities. For instance, high-value customers can first be retained by their agents and then redirected to a VIP retention call center with exclusive offers. Typical examples of segmented capabilities in insurance include:

-

Sales executives retention. Agents can have access to the first level of retention offer to convince customers on the spot to prevent them from leaving. Every utilized retention offer should also be tracked to prevent misuse.

-

Digital channel retention. This capability is employed particularly with digital players or products/customers where the communication is primarily digital. The digital channel can act as baseline retention, when the customer does not renew or wants to cancel. Digital can be used as well for low-value customers that do not accept the retention offer from sales agents or do not pay their premiums.

-

Dedicated retention team. Usually on the call center, agents are in place primarily to save high-value customers with higher-value retention offers, having multiple offers at its disposal depending on the profitability of the customers (and potentially other criteria, such as key strategic customer, long-term relationship, etc.). This team should have the technological support necessary to know whether prior retention offers were unsuccessful, ideally with reasons for refusal — and to prepare an offer the customer will not be able to resist.

Best-in-class insurers are optimizing their retention ratio by using tools as predictable models to match the agents’ profiles (experience and characteristics) and customer characteristics.

Data-based decisions

The efficiency of the operating model depends on the ability to leverage data. Many insurers are already reducing churn by creating propension models to anticipate customer actions. These models may include different actions along the whole customer journey, such as targeted communication and offering different products or even discounts.

Digitization

Leveraging technology to reduce manual work will reduce costs and improve customer experience. Every insurer must rethink how it can digitalize customer interactions, favoring self-service or generating personalized responses while engaging the customer. One of the key elements of digitization is enabling a seamless online interaction. Around 70% of customers prefer to use self-service options instead of speaking with a company representative. Nowadays, there are plenty of tasks that can be done directly by the customers without any human interaction, reducing friction by providing immediate responses and avoiding possible churn.

Tools & systems

Companies tend to have different systems (with legacy systems being a major problem when aiming at enhancing or changing certain processes) with a variety of information sources. This is a major source of problems, both in terms of cost and in the efficiency that an agent can have while trying to retain a customer. What differentiates top-performing companies from the rest in customer retention is the integration of information within a single centralized system.

The best option is to maintain all customer information in a single system (e.g., data lake). This allows the agent to solve a variety of problems and avoid unnecessary questions or delays. This is also a core element to understanding a customer’s real value, since looking at a single product or even a single transaction may give an incomplete or inaccurate picture of the customer.

In a single system, companies could also integrate preventive and reactive action triggers based on events detected by data processing in current tools, avoiding improvisation, asynchronous manual tasks, and handover. By incorporating these actions and decisions into the system, agents can improve their retention rates.

Autonomy

Giving the agents the necessary autonomy for making decisions will enable a quicker and frictionless process. The agents should be able to make certain decisions that are already preapproved, avoiding the need to involve superiors or other areas. Best-in-class companies apply a set of rules and policies that allow agents to make decisions by themselves in more than 90% of cases.

Win-back activities

Finally, companies shouldn’t neglect the “win-back” opportunity to reengage former customers. This opportunity is especially relevant in non-life insurance with regular contracts and known duration of contracts, and is especially powerful when the company has lost a customer but still has the contacts and consent to reach out with win-back offers.

Modern customer relationship campaign management tools can fully automate the win-back process. Based on product and/or customer value, a customer can be automatically scheduled for a win-back campaign when they drop out, with offer conditions that can automatically match the customer’s value.

Depending on the customer’s previous contact preferences and channel usage, the former customer can be contacted either through digital channels, by the customer’s previous advisor, or by a specialized team in the contact center that is equipped with an overview of the market as well as arguments for the insurer’s offer as well as potential sweeteners (e.g., additional coverage, discounts). Such campaigns may not convert the entire lost portfolio into a live one, but with relatively minimal effort these campaigns can win back 5%-20% of the lost customers.

VALUE PROPOSITION

One of the core elements of an enhanced customer experience is to generate a clear link between what the customer is searching for and what the company is able to offer. This starts by understanding how much a customer is worth, determining the alternatives to retaining that value with respect to the net result, and combining that information with the customer profile or micro-segment to trigger the right action. The main goal of the value proposition is to define how the company will build the right set of products, price flexibility, communication channels, and retention scripts:

-

Communication. Customer expectations have changed dramatically over the last few years. Immediate, personalized responses are now expected, so companies must be able to generate personalized communication. Having an automatic response that identifies the customer or an agent that has all the relevant information about the customer ensures a clear goal of treating each customer according to their preferences and behavior.

-

Product portfolio. Companies that have specific tailored-made retention products see much lower churn rates. These offers can comprise simpler and less expensive products for customers who are going through financial distress or more evolved and complete packages, including multi-line products. Depending on the complexity of the products, retention offers can be designed in multiple ways, the impacts of which must be tested to determine changes to profitability and attractiveness to the customer. Common actions include changes to the insurance products (e.g., coverages, limits, copayments) or using riders/freebies on top of product (the customer received some additional bonus). These options can have different perceived value, depending on the product and the customer.

-

Price flexibility. Dynamic pricing, with the ability to provide personalized discounts and change prices for certain customers, is a core element of a successful retention strategy. Since most of the churning customers leave due to economics, providing profitable discounts or reduced prices (even for a limited period) can greatly improve retention rates. In refined, sophisticated companies, both the product profitability and customer profitability will affect the levels of retention offers the customer receives. To quickly set up basic retention segmentation, it is usually faster to start with product-based profitability and then calculate discounts, keeping profitable products at the same premium. With more advanced analytics, companies can move to customer-based profitability, increasing the scope of discounts.

-

Retention scripts. To assist retention teams, scripts must be updated regularly and incorporate elements that are specific to each customer or customer segment. Personalized scripts allow teams to address customers properly, making customers feel special and allow for more efficiently addressing their needs.

COLLECTION

Payment collection is one of the major challenges companies face in addressing churn. In some studies, Arthur D. Little (ADL) has found that more than 50% of the cancellations on certain products were because of a payment problem, lack of funds, or issues with a payment method.

Companies must address several elements to maximize the chances of collecting payments:

-

Collection process. In the past, companies often had one set and rigid collection process, in which payment periods were inflexible and every customer/product was standardized. Today, personalized processes are the norm, where according to customer segment rules, the process may vary, setting alternative dates or number of times a charge is attempted.

-

Payment methods. Providing alternative payment methods and making these alternatives seamless, as well as eliminating unnecessary bureaucracy, could help prevent involuntary churn, which, according to ProfitWell, is about 20%-40% of the total churn. Another element that has proven beneficial (even in non-financial companies) is the ability to provide financing to certain customers. This financing may come as delayed payment terms or as reduced premiums.

-

Non-paying customers. Dealing with customers that do not pay is a complicated and lengthy process. To optimize this process, there should be automatic triggers and actions to generate a payment. When unsuccessful, third parties that are specialized in collecting payments must be engaged.

PEOPLE & CULTURE

A company’s strategy is nothing without a culture to back it up, and pursuit of flawless customer service is one of its foundations. In fact, a 2022 Gallup poll reports that engaged employees can drive up to 21% in profitability and 10% in customer satisfaction, but to achieve such results requires clear goals and objectives, constant training to keep employees up to date, and selecting the right people with the right skills for each job. Also, there must be clear alignment between incentives and the company’s strategy as well as well-defined career paths for employees who aspire for more.

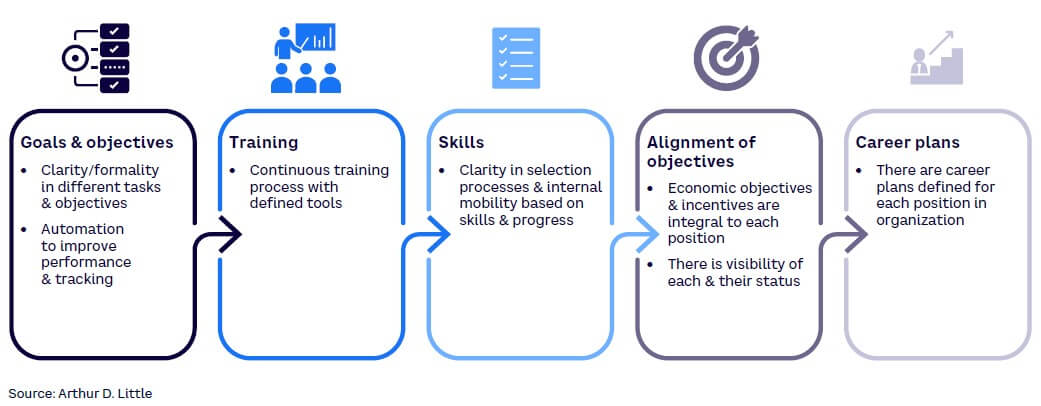

There are five elements to building a successful culture around retention (see Figure 3):

-

Goals and objectives. Building a customer-centric organization requires clear goals and aspirations that permeate all levels of the company. Generating these common goals is the first step; the second is to translate them into well-defined objectives. These objectives must be an integral part of the customer engagement process, with clear visibility and automation when needed.

-

Training. Learning never stops, and there should be a clear focus on keeping the whole organization up to date in the necessary skills and trends. By designing different training plans for specific areas, people not only can perform better but their motivation to improve professionally rises considerably.

-

Skills. Having the right people for the right job means identifying the right skills for each position and selecting people with those skills. Recruitment processes have evolved considerably, enabling some automation of this function and detailed searches based on skills. It is also important to allow movement within the company to ensure the best allocation of people based on their progress and skills.

-

Alignment with strategy. Financial incentives are one of the most powerful tools organizations have to generate impact (motivation, transformation, and execution). Aligning these incentives with the customer-centric vision and the objectives aimed at enhancing customer engagement is key.

-

Career path. Focusing on employees’ career development can boost performance within an organization. In fact, according to a Pew Research Center survey, the main reasons employees cited for quitting a job in 2021 were low pay (63%) and no opportunities for advancement (63%). By addressing career development, companies can unlock employee potential and increase internal loyalty, increasing performance as well as employee and organization marketability. This, in turn, can lead to better treatment of customers.

MEASUREMENT & PERFORMANCE

Effective performance management is one of the building blocks of a successful business. Having the right metrics and communicating them effectively according to the different levels of the organization increases the probability that resources and efforts are aligned to the strategic roadmap.

Customer retention is a key performance indicator, so companies need to align their objectives to the different metrics related to this issue. There must be clear control panels to ensure control over the key indicators, consistent quality checks, and structured governance to lead and make decisions.

-

Control panels. Three main areas require a specific control panel to measure and track the relevant indicators and status:

-

Customer view — to measure customer satisfaction, complaints, and churn throughout the customer journey.

-

Operations view — to control claims management and process efficiency.

-

Financials view — to understand the profitability of each customer segment and to be able to control the different costs related to retention (CAPEX and OPEX).

More advanced insurers add a retention management view as well to follow the effectiveness of retention activity. For example:

-

Ensuring agents, which often do not use retention offers or do not know they exist, utilize offers.

-

Instituting effective mechanisms to prevent overuse and/or misuse of retention offers (e.g., given to customers who are not really considering leaving), such as approval by manager, overuse/fraud analytics, discount/retention budgets, and so on.

-

Evaluating the effectiveness of retention offers, analyzing how customers react to the retention offers and the evolution of the retention offers’ cost and impact in the overall churn at the company (i.e., showing the overall retention impact on profit and loss).

-

Assigning and evaluating retention budget allocation based on churn levels (regionally or on the level of individual sales units), enabling the regular evaluation of budget utilization and associated decrease of customer churn.

-

-

-

Quality check. Measuring the quality of sales and complaints management is necessary to generate a virtuous circle of feedback and prevent churn. Companies with dedicated teams to review this and generate the appropriate metrics have a considerable advantage over those without.

-

Committee structure. To ensure customer retention, it is necessary to periodically engage committees that are involved in the customer-related areas of the company. These committees must guide the whole organization on this topic and use an ROI-based steering approach, measuring the impact of the different actions and levers without depending solely on budget constraints.

Conclusion

PUTTING THE CUSTOMER FIRST

Companies that continually review and redefine their retention models using tools that exploit opportunity in an agile way and consider best market practices will have the greatest chance of retaining customers. As we have explored in this Viewpoint, some key points to consider when developing a customer retention strategy include:

- The strategy applies during the whole customer journey and all its interactions.

- It affects the entire company and must be a joint effort among the different areas, avoiding silos. Creating optimal and relevant customer experiences requires a cross-functional vision.

- Maximizing customer lifetime value requires a unified customer view that incorporates both internal and external information.

- Companies must take advantage of the increased availability of data to generate a data-based decision-making culture.

- Shifting to a cross-retention strategy is paramount, increasing automation and the use of modern tools.