Challenging mobility cases in cities

Addressing the challenges of increased emissions and traffic congestion, and creating attractive cities where people want to live and visit, requires a reduction in the number of cars. For politicians to act on these topics, however, requires access to relevant and affordable mobility substitutes to the private car. Public transport currently is not enough to meet citizens’ demand for convenience and flexibility. According to Arthur D. Little (ADL) research, the factors consumers cite most often for giving up their private cars and moving to new mobility services are increased availability (45%) and lower costs (42%).

In multiple use cases, public transport authorities and operators have reported having difficulties resolving last-mile mobility in suburban areas. Passengers tend to select their private car when the nearest public transportation station is found more than 650 meters away or when there is more than 15-30 minutes between locations, resulting in many large buses being poorly utilized and operated with empty seats. In the future, experts suggest that the units transporting people will be smaller and more flexible, with capacities of up to 10 individuals.

The “daily commute between home and work” mobility use case that includes passenger cars currently dominates the mobility mix in many cities. In urban and suburban areas, drivers experience traffic congestion and difficulties finding parking during peak hours, leading to increased travel time and inconvenience. Robotaxis introduce a mobility-on-demand solution for travelers with the possibility to share AVs. Robotaxis offer an affordable alternative to commuting, and the increased travel time for individual commuters due to sharing a vehicle can be offset by reduced congestion and issues involving parking.

Robotaxis have the potential to revolutionize urban and suburban mobility use cases with a convenient, safe, and affordable option that can replace the need of private car ownership.

Potential s-curve adoption

Several industry reports published at the end of the 2010s concluded a consensus on the potential of robotaxis and predicted disruptive growth figures by 2030. More recently, these aggressive growth predictions have been adjusted down dramatically, possibly due to changing perceptions of the maturity of the autonomous drive (AD) technology and its short-term potential to become commercially viable in mixed environments with pedestrians and other vehicles.

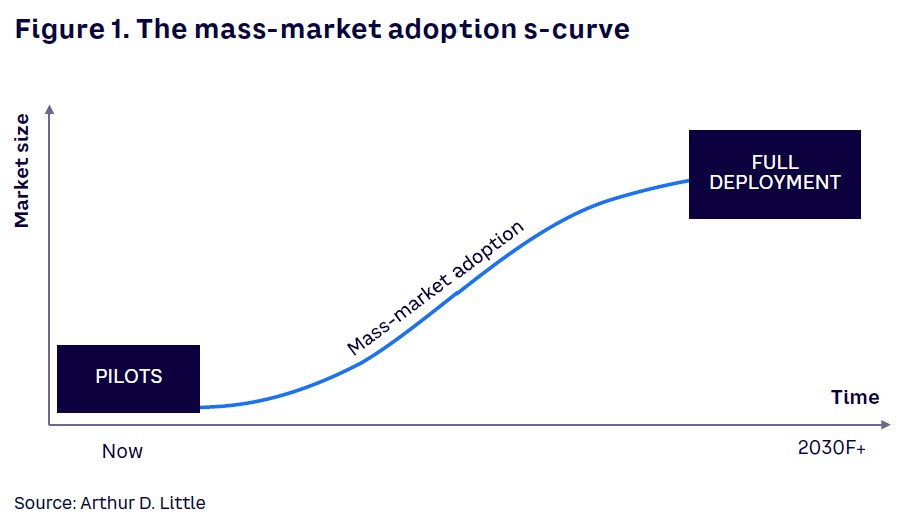

ADL analysis indicates that the robotaxi market has the potential to follow an attractive and positive s-curve adoption (see Figure 1). There are several drivers and question marks that will affect both when the adaptation will take off and how large the market will be after full deployment.

Key determinants for mass-market adoption

For the robotaxi market to be adopted by the mass market, three determinants will need to reach a certain level of maturity (see Figure 2):

- Shared solutions.

- Autonomous drive.

- Electric mobility (e-mobility).

Among these determinants, sharing concepts (e.g., car and ride sharing) are becoming commercially viable and e-mobility has already reached a more mature status. AD, however, is still in the pilot stage.

Shared solutions

The key growth drivers for shared solutions are primarily the goal to decrease fleet size and the ability to split costs among passengers. Shared solutions can be ride sharing, car sharing, or hailing.

Decrease traffic congestion

The UN reports that 56% of today’s world population live in urban areas, which is expected to increase to 68% by 2050 (84% in Europe, 89% in North America, and 66% in Asia).

According to industry experts, privately owned cars are used only about 3%-4% of the time, representing an extremely low degree of utilization. By comparison, sharing concepts increase the utilization degree, a prerequisite for reducing the overall car fleet.

To decrease traffic congestion in urban areas, politicians in many prominent cities are already taking measures to ban private cars in inner cities by adding taxes and making changes in infrastructure that favor bike lanes and shared modes of transportation. For example, Oslo, which was appointed European Green Capital 2019, set a goal of reducing car use by a third by 2030. And in October 2021, Paris announced plans of becoming 100% cyclable by adding 180 kilometers of bike lanes and increasing bike parking spots by more than triple by 2026, according to Bloomberg. Hence, adoption may be realized more rapidly in cities that use regulations to move away from privately owned cars.

Ride-sharing concepts can result in earlier and larger customer adoption if passengers:

- Accept the potential increase in travel time.

- Feel comfortable and safe sharing the ride with other unknown individuals.

- Change perceptions of car ownership (owning a car, in addition to being convenient, is often a symbol of status).

Sharing concepts decrease the cost per passenger by splitting costs among participants. However, the substantial cost of the driver for ride sharing still inhibits mass-market deployment.

The main limitations in shifting from car ownership to public transport, in addition to the convenience aspects mentioned above, include limited available capacity and long build cycles for subways. These constraints make autonomous driving (especially robotaxis) a potential game changer for new urban mobility and sustainability.

Autonomous drive

The key growth drivers for AVs are the potential increase in traffic safety, major cost advantages in removing drivers, and speed of technology readiness. According to the Thales Group, robotaxis can reduce travel time by up to 40% by eliminating waves of stop-and-go traffic and removing the need to find parking. In a renowned ADL study based on a micro simulation of urban traffic, we found that pure and optimized autonomous driving could lead to a dramatically increased capacity (by as much as five to seven times) and thus reduced travel times.

Increase traffic safety

AD can significantly improve the level of traffic safety overall. The US Department of Transportation reports that human error is involved in 94% of today’s traffic accidents in the US, taking 1.3 million lives every year. The World Health Organization (WHO) reports traffic accidents as the leading cause of death for children and young adults aged 5-29 years. By implementing AD in all vehicles, hundreds of thousands of lives can be saved each year, in line with global goals from the UN to reduce the number of traffic-related deaths and injuries by 50% by 2030.

According to WHO studies, introducing AD would directly prevent some of the most prominent risk factors, including:

- Speeding. Speed is related directly both to likelihood and severity of a crash, with a 1% increase in mean speed leading to a 4% increase in fatal crash risk. AD would ensure constant levels of speeds in line with traffic design.

- Driving under the influence of alcohol, drugs, or psychoactive substances. Impaired driving is likely to increase the risk of dying in a car crash by more than a factor of 10. Removing the necessity for a human to drive the vehicle would significantly reduce this risk.

- Distracted driving. Drivers using mobile phones are four times more likely to be involved in a crash because of reduced reaction times. Removing the human dependency to drive the vehicle would significantly reduce this risk.

Thus, once AD technology reaches a level where it is safer than human driving by a factor of as much as 10 to 100, it becomes an ethical imperative to cease human driving.

Removing the safety driver

Until AD technology is developed well enough to handle all traffic situations without any human intervention, automated driving features will require remote safety operators as a fallback solution. Currently, at least in the developed world, the driver is one of the largest operational costs for commercial mobility solutions. Removing the driver may enable opportunities to offer inexpensive mobility alternatives.

Technological readiness

Features at Society of Automotive Engineers (SAE) Level 2, such as adaptive cruise control and lane centering, are already widely adopted in the mass market, with SAE Level 3 becoming available. However, to reach desired levels of technological readiness within AD (SAE Levels 4 and 5), the vehicle must operate completely independently without a human driver. Level 4 would allow the robotaxi to be completely driverless during limited conditions, such as when confined to geofenced areas and unless affected by severe weather conditions where human intervention might be needed. Level 5 automation would not be limited by these conditions.

Although skeptical perspectives on the technical maturity of AD exist, progressive AD suppliers in Asia, Europe, and North America are planning for commercial use from 2023 and onward, meaning that according to the roadmaps and pilots, technological readiness is quickly on the rise. Today, there are already commercial ride-hailing projects without a driver in mixed operational driving domains and with permits becoming easier to obtain, the number of projects as well as actors are steadily increasing.

Waymo launched its fully driverless commercial taxi in Phoenix, Arizona, US, in 2020 and, according to Autonomous Vehicle International, AutoX now offers a commercial driverless ride-hailing service in Shenzhen, China, after receiving the first ever license to operate fully driverless on public roads in that country. CNBC reports that Baidu received a permit to collect fares from its robotaxi services in Beijing in late 2021. Cruise has recently commercially deployed its first routes. Apple has also recently announced that the company is aiming to launch an autonomous electric vehicle (EV) by 2025, potentially accelerating the adoption of these technologies. In addition, larger OEMs are looking positively to AV development, with Volkswagen aiming to launch a self-driving electric van in 2025 and Volvo forecasting 1 million vehicles sold with Level 4 AD by 2025.

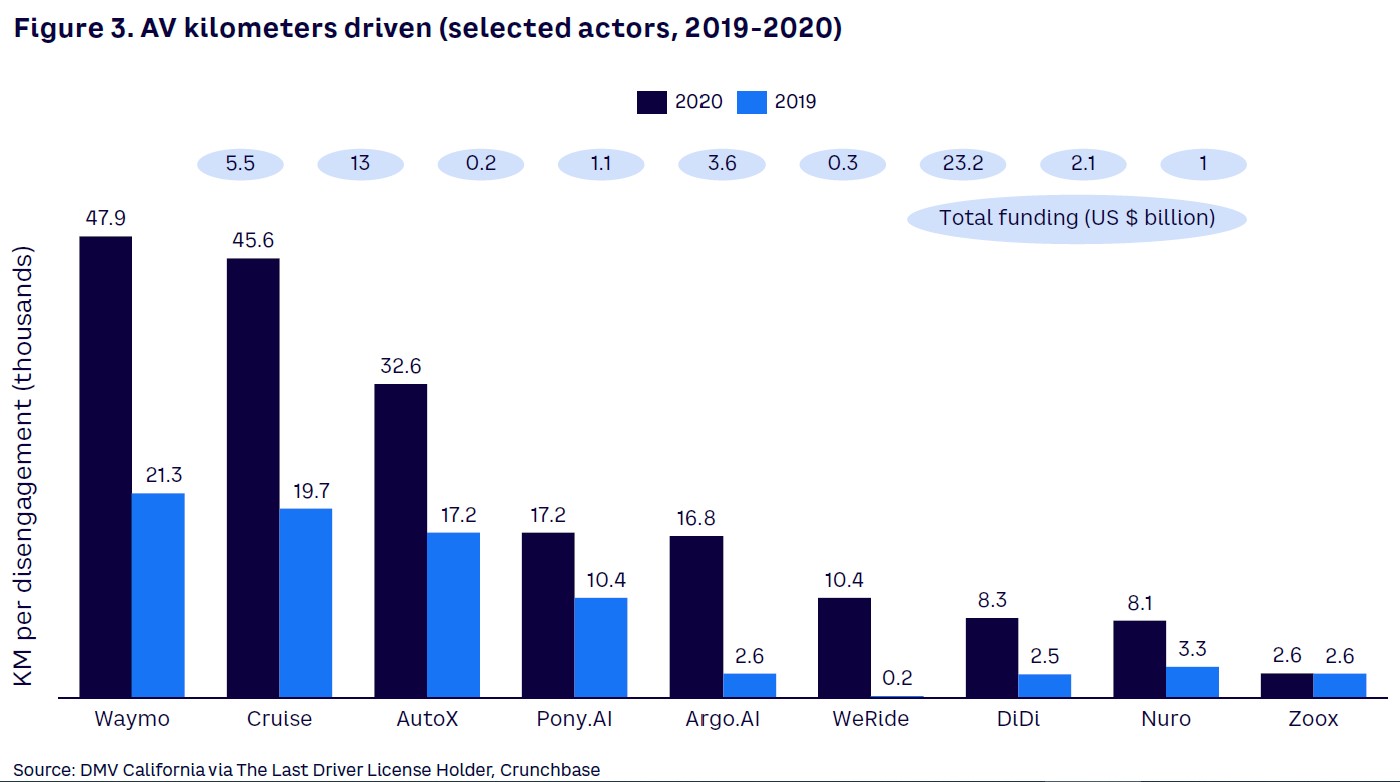

In 2019-2020, many prominent actors saw a rapid increase in the number of kilometers driven without the need for human involvement, further supporting the technological readiness of AD (see Figure 3). Waymo and Cruise both passed an average of 40,000 kilometers per disengagement. Continuous market development of AD sensors is expected to further push technological advancement, with the AD sensor market forecast to move from approximately US $13 billion to over $40 billion by 2030, according to ADL research.

Market development will to a significant extent be pushed by actors that are best able to learn from the generated data. With this insight, many of the AV actors at the forefront have been founded by, are owned by, or are collaborating with the largest tech actors (e.g., Waymo by Alphabet, Cruise with Microsoft, and Zoox by Amazon).

Vehicle price & capacity

Currently, vehicle/computer processing units are too expensive for commercial large-scale production and consume a lot of energy, which negatively affects the range of battery-powered cars. The units must become more effective and efficient to reduce cost and energy usage before large-scale production of long-range AVs is viable. Large investments will be needed to achieve this goal. With increasing funding of both EV and AD companies, we consider the future scale-up potential to be promising.

The AD can result in earlier and larger customer adoption if:

- The general perception changes and AV is perceived as safe for pedestrians and passengers.

- AD technology is proven reliable in mixed environments in accordance with national regulations.

- AD technology costs are reduced to reasonable levels (this must begin with commercial applications such as robotaxis or trucks).

E-mobility

The key growth drivers for e-mobility are primarily increased focus on sustainability and decarbonization, driven by regulations and the maturity of EVs.

Focus on sustainability & decarbonization

Last year in Europe, there were close to 200 low-emission zones, with a large share of European cities restricting vehicles with internal combustion engines (ICEs) to some extent. Low-emission zones have already seen considerable success, with London´s first implemented zone in 2017 reducing emissions by 44%. In October 2021, London’s Ultra Low Emission Zone was increased by a factor of 18. The zone now covers 3.8 million people, improving air quality for a population at elevated risk from pollution in the atmosphere.

There are pressures and incentives for both OEMs and end consumers. OEMs are pressured to reduce fleet emissions to avoid massive penalties, where the European Commission has enacted an excess emission premium of €95 per g/km CO2 when a manufacturer exceeds emission targets. Notably, end consumers often can receive subsidies or tax reductions when purchasing EVs.

EVs have the potential to reach zero-emission targets if units are powered by clean and renewable energy. This supports science-based targets and the shift driven by potential legislation that will forbid new combustion engines by 2035 within the EU. Horizon Europe, EU’s key funding program, has focused €15.1 billion on climate, energy, and mobility to support the development of future mobility solutions to achieve the UN’s Sustainable Development Goals and boost the EU’s competitiveness.

More regulations against ICE vehicles provide further tailwind for electric robotaxis with increased restriction of access to inner-city areas. As an example, Ruter reports that the city of Oslo is investigating the potential to prohibit all fossil-fueled cars as early as 2026, with a reduction of cars by one third by 2030. The city is lobbying for low-emission zones to improve the inner-city environment. Low-emission zones generate a push for change toward non-private-owned transport and/or EVs, creating a window of opportunity for electric robotaxis.

Today, issues remain with the charging infrastructure, concerning, for example, uneven loads on the electricity grid. Through the implementation of electric and shared AVs, the need for parking spaces with charging posts declines, since the fueling can be planned in advance for an entire car fleet as well as conducted outside of the city center. By facilitating the charging planning of the vehicle fleet, a more regular load will be achieved for the electricity grid, since the units do not require charging within the same time frame (i.e., at night or during morning office hours).

Maturity of EVs & investments

EV sales have boomed following an increased focus on sustainability as well as technological development that has increased the current capabilities of electric-driven transport modes. Several EV barriers are decreasing, further supporting adoption and attractiveness of e-mobility solutions. Cost reductions, increased battery range, and decreased charging times all support electric robotaxis operations and deployment:

- By 2030, ADL and other researchers estimate that close to 70% of new registered vehicles will be electric, with decreasing lithium-ion battery pack prices and increasing energy density, making EVs both more affordable and versatile for the end consumer.

- Prices are expected to decrease from $150/kWh in 2020 to below $100/kWh in the next two years.

- Battery capacity for a midsized vehicle is predicted to increase from between 60-100 kWh to 80-150 kWh in 2025, increasing the driving range from 400-500 kilometers to 600-900 kilometers.

- Decreasing average charging times from six to nine minutes to two to four minutes (direct current) in 2025 for 100-kilometer driving range.

The e-mobility transition can result in earlier and larger customer adoption if more cities implement regulations that affect ICE cars, such as emission bans or increased gasoline prices, which would force the mass market to seek new mobility options. EVs would still be 30%-40% of all traffic, while public transport would make up around 20%, and the remaining would be biking and walking.

As soon as political forces realize that electric robotaxis are the real game changer in immediate impacts to sustainability and at the same time increase convenience and enable affordable mobility options for everyone, the adoption rate will increase.

Conclusion

Positive outlook for robotaxis

ADL has found that electric, shared, and AVs, such as robotaxis or autonomous shuttles, can be a feasible solution to the mobility challenges of many cities. Thus, ADL forecasts a positive outlook for robotaxis with scalable commercial services from 2024. From there on, early mass-market adoption is possible. This potential disruption will have an impact on actors in the mobility system, such as car OEMs, suppliers, retailers, public transport authorities, and transport operators. Regardless of the role, all will be affected by the inevitable reshaping of the mobility industry and should consider betting on robotaxis.