74 min read • Energy, Utilities & Resources, Waste, Water & Circularity

Disruption is now

How decarbonization, decentralization, and digitalization transform the energy and resources sector

Foreword

Dear readers,

In this 2022 energy flagship report from Arthur D. Little (ADL), we explore the trends that are currently shaping the energy industry as it transitions with great ambitions toward net zero. This transition has a disruptive impact, be it carbon regulation, new technologies, emergence of new market players, as well as convergence of industry verticals. However, timing and speed vary by region and market. Also, political events influence direction and speed of the transition.

Our ADL community, with 200 enthusiastic energy consultants and knowledge experts, started working on this report prior to the ongoing Ukraine crisis. Before, as a society, we were used to power and gas being available uninterrupted 365 days a year. The current conflict in Europe at the doorstep of many of our colleagues — as well as conflicts in the last century, like the oil crisis of the 1970s and the Gulf War in the 1980s — remind us how fragile energy supply can be.

Regardless of how and when the conflict between Russia and Ukraine will end, the event will have long-lasting global implications on geopolitics and the energy sector at large.

If the EU and countries like the US wish or need to reduce their reliance on Russian oil and gas even faster, there are several options, but probably not without significant tradeoffs.

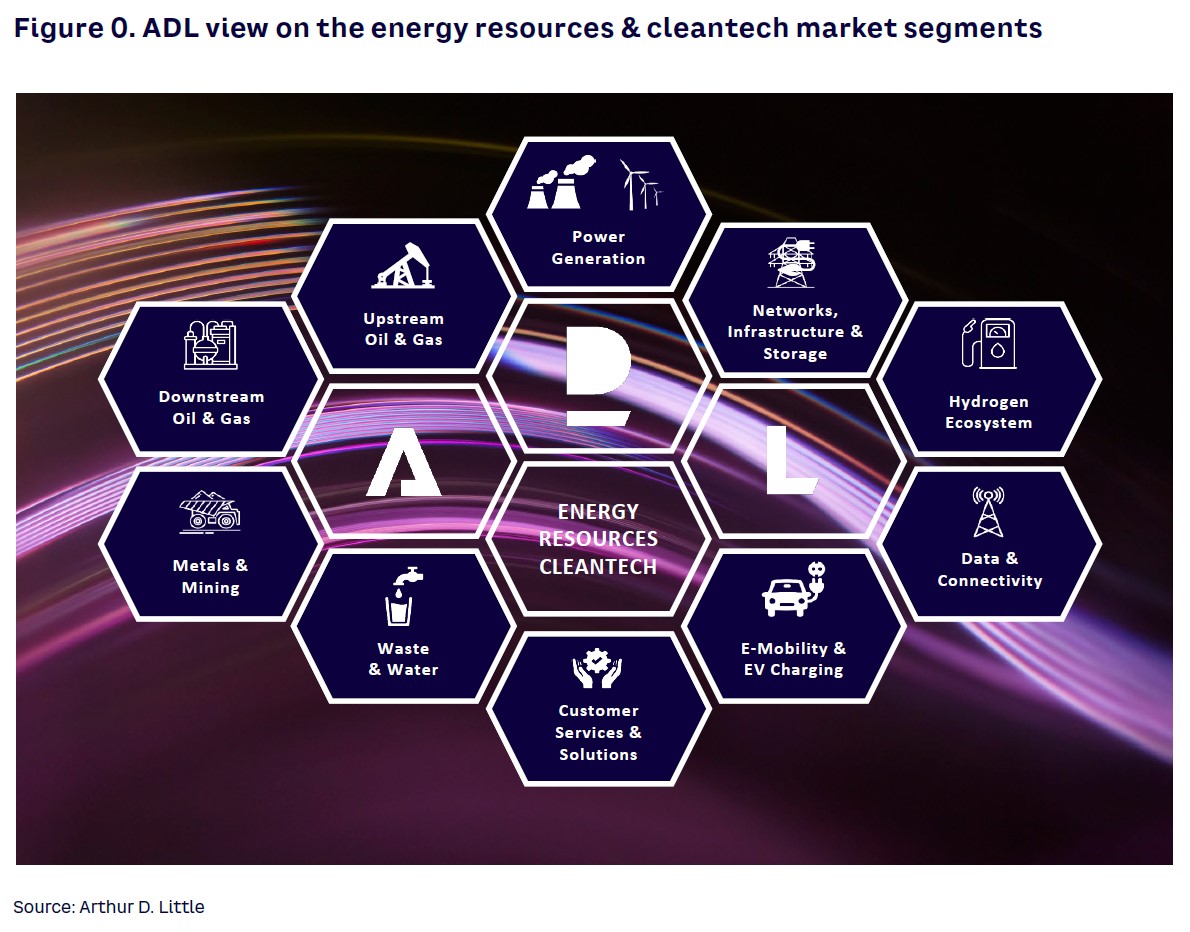

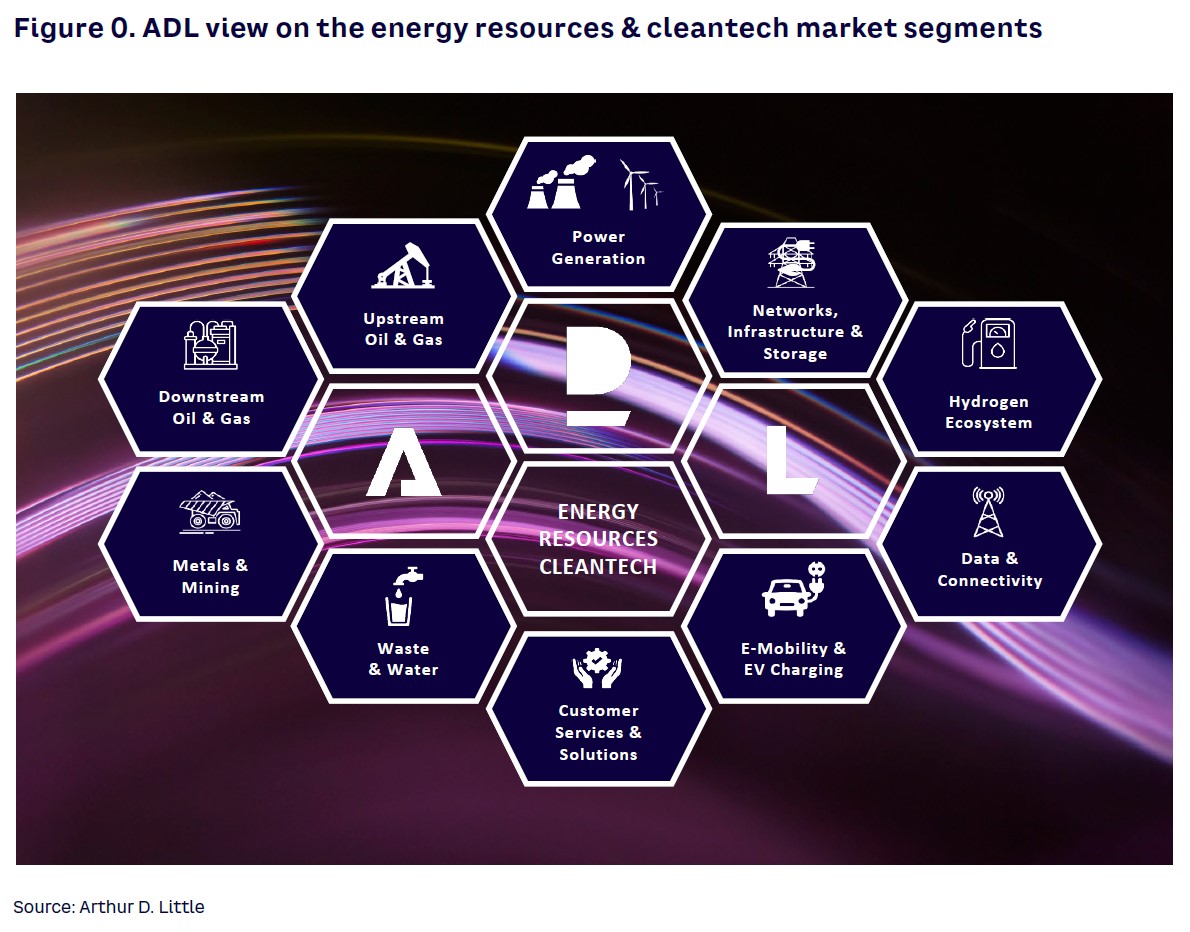

In this report, we look at the energy and resources sector from the various market segments, shown in Figure 0, and dive deeper into the specific trends and strategic moves in each segment.

As ever, the report encapsulates our own research into global energy resources and cleantech and the many insights gathered from the companies we have worked with over the last 12 months. These together give us a sense of what progress is being made toward a decarbonized future, which challenges still lie ahead, and the impacts on energy and utility players all along the value chain.

As part of our analysis, we have reviewed in detail the investments being made by traditional companies across many different sectors, including both upstream and downstream oil and gas (O&G), power generation, networks and infrastructure, customer services and solutions, waste, water, and metals and mining.

While each of these sectors is responding in its own way to the energy transition, it is important to recognize that the boundaries between them are increasingly dissolving as different industries are drawn together by similarities, synergies, and new technologies that enable disruptive “incomers” to jump much more easily between them. Such “convergence” is now one of the biggest drivers of marketplace change, creating not just new revenue streams, but also potential threats to established players.

These changes are leading to the evolution of an ever-expanding ecosystem of players, something that is not just accelerating the speed of innovation but also leading to the development of increasingly integrated offerings that better meet the growing customer demand for more sustainable products and services.

Of course, decarbonization — net zero — is the most important overarching trend for all sectors and the world in general. And this is what now increasingly underpins the economic policies of many countries. Inevitably, decarbonization is having a fundamental impact on the strategic thinking and future investment decisions of companies in all sectors.

Another major trend of the moment, again across sectors, is the need to digitize operations to meet the needs of marketplaces that are driven ever more by transparency, seamlessness, and speed of delivery.

There is one further trend that is particularly relevant to the energy and utilities sectors: decentralization — the movement to a far more localized solution to the delivery of a service rather than a reliance on a much wider national or regional infrastructure. This is evidenced, for instance, by siting wind farms close to urban areas or using micro-generation, such as photovoltaic (PV) rooftop panels on new housing developments and encouraging users of power to take greater responsibility for how they consume it.

All these elements are feeding into new business models that are focused on much greater sustainability, a thread that runs increasingly through every component of society. This includes industries such as energy and utilities, where the introduction of carbon capture and other cleantech is now central to both day-to-day operations as well as strategic decision making, given the growing significance of environmental, social, and governance standards on corporate thinking.

In the following chapters of this report, my Partner and Principal colleagues of ADL’s Energy & Utilities Practice present their observations, experience, and insights of how disruption and convergence are already happening in their markets and industry segments and which fundamental strategic moves should be considered accordingly.

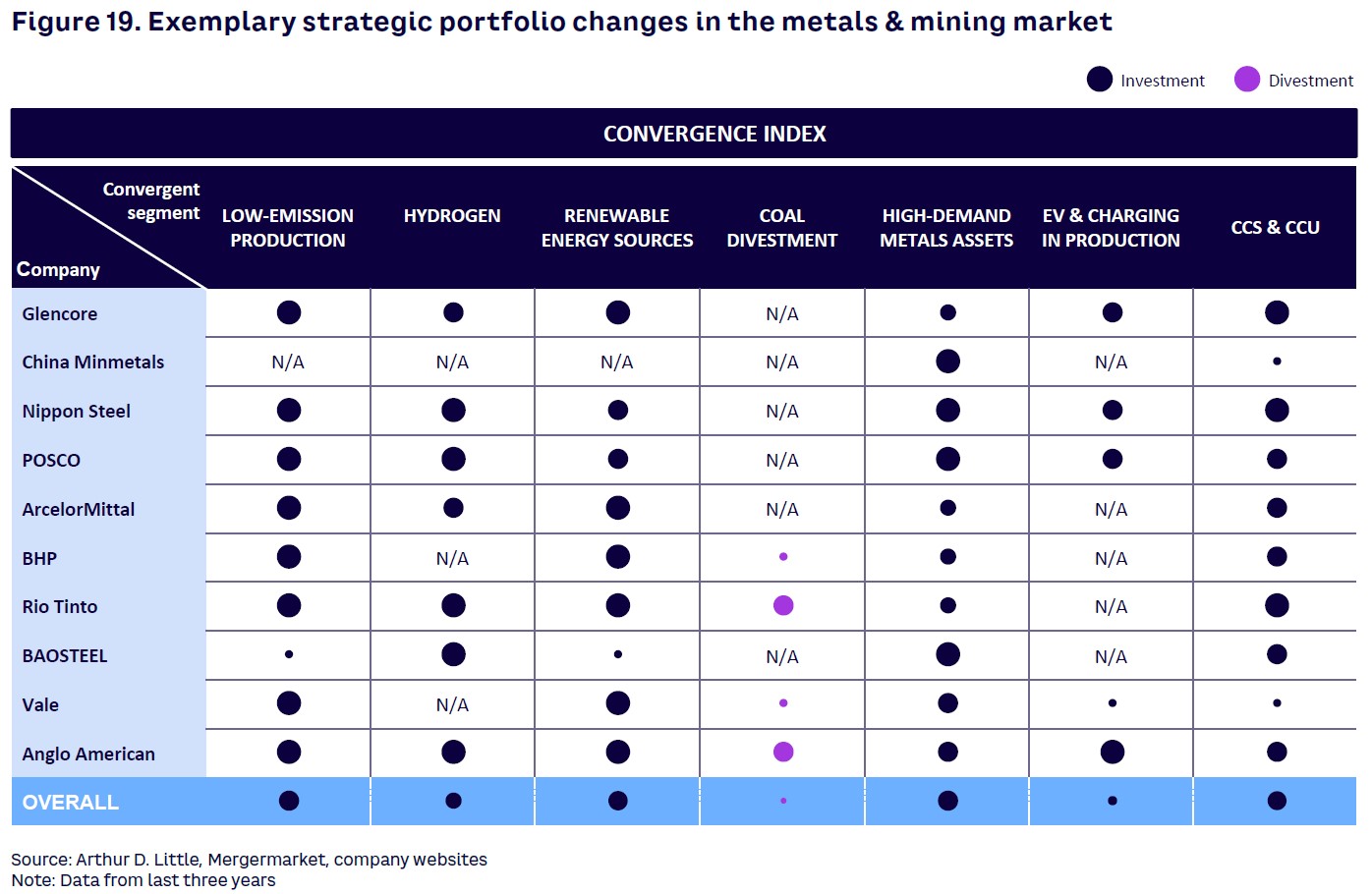

On behalf of our Practice, I wish you an insightful reflection about the energy transition.

Michael Kruse

Global Leader, Energy & Utilities Practice

1

Customer Services & Solutions: Creating a Better Customer Experience

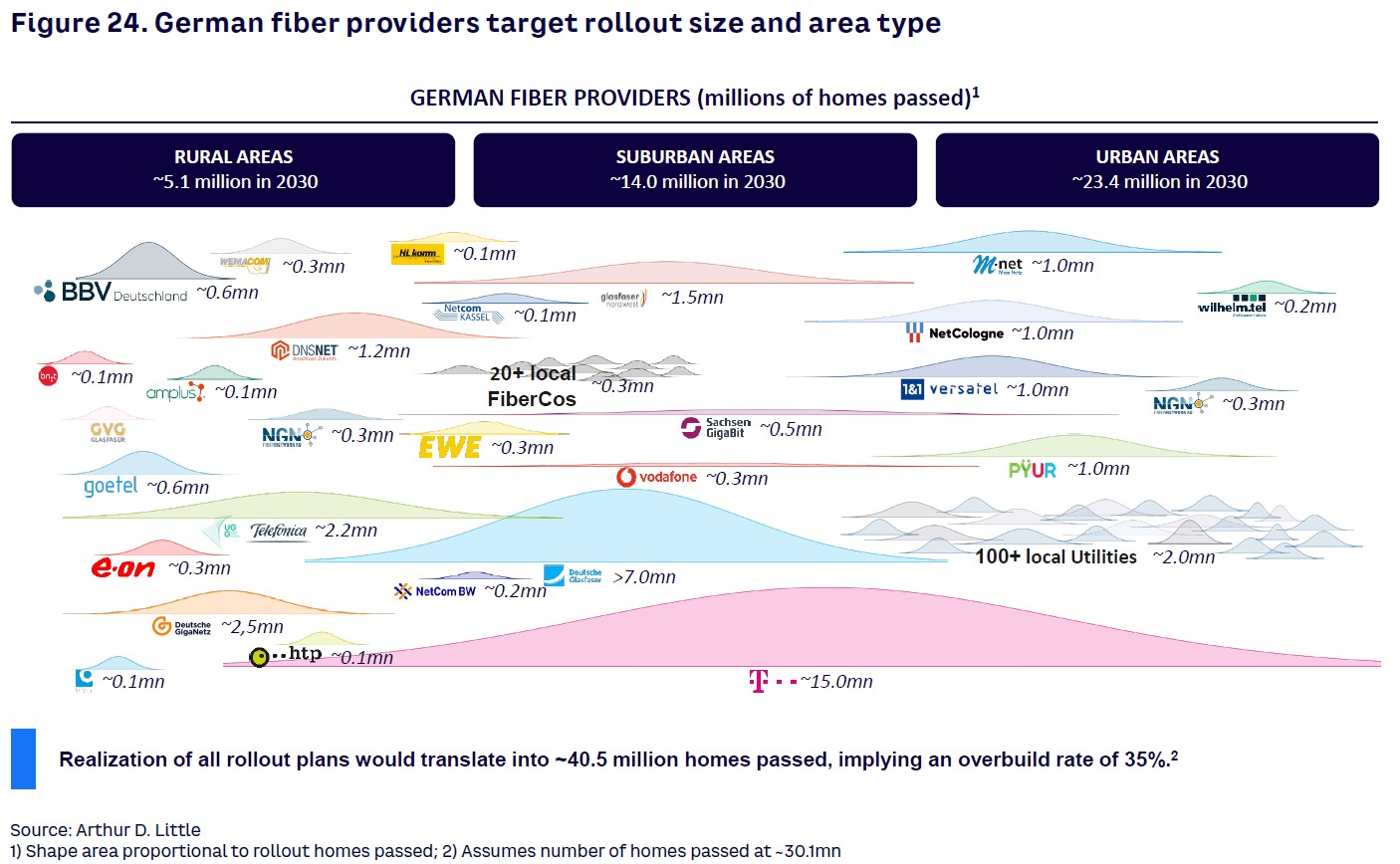

by Florence Carlot

It should be no surprise to anyone that the retail energy business is becoming ever more challenging, with every player faced with a litany of pressures: high volatility of prices (certainly during the second half of 2021), thinner margins, higher costs to serve, increasing expenditure on customer acquisition and retention, disruptive emerging technologies, greater competition from hyper-agile players offering a superior customer experience, and more “alternative aware” customers ready to shift their loyalty.

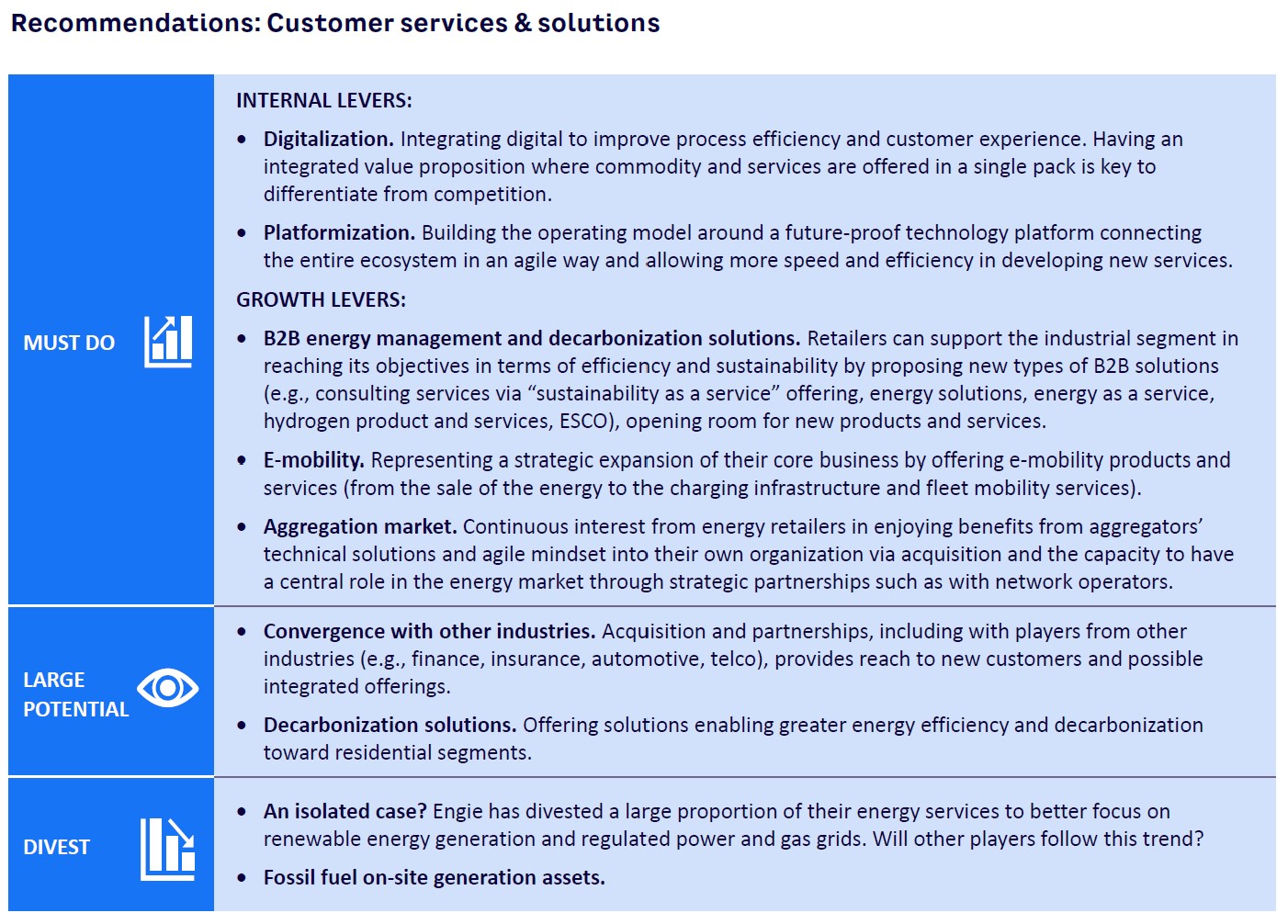

In such an environment, all players need to consider what they must do to adapt over the next five to 10 years. This will not be easy as it will almost certainly require the complete reinvention of their traditional business model and widespread changes to their operations. For instance, incumbent players in the energy sector itself will have no choice but to move away from the commoditized selling of power and gas and diversify into more profitable and sustainable revenue streams.

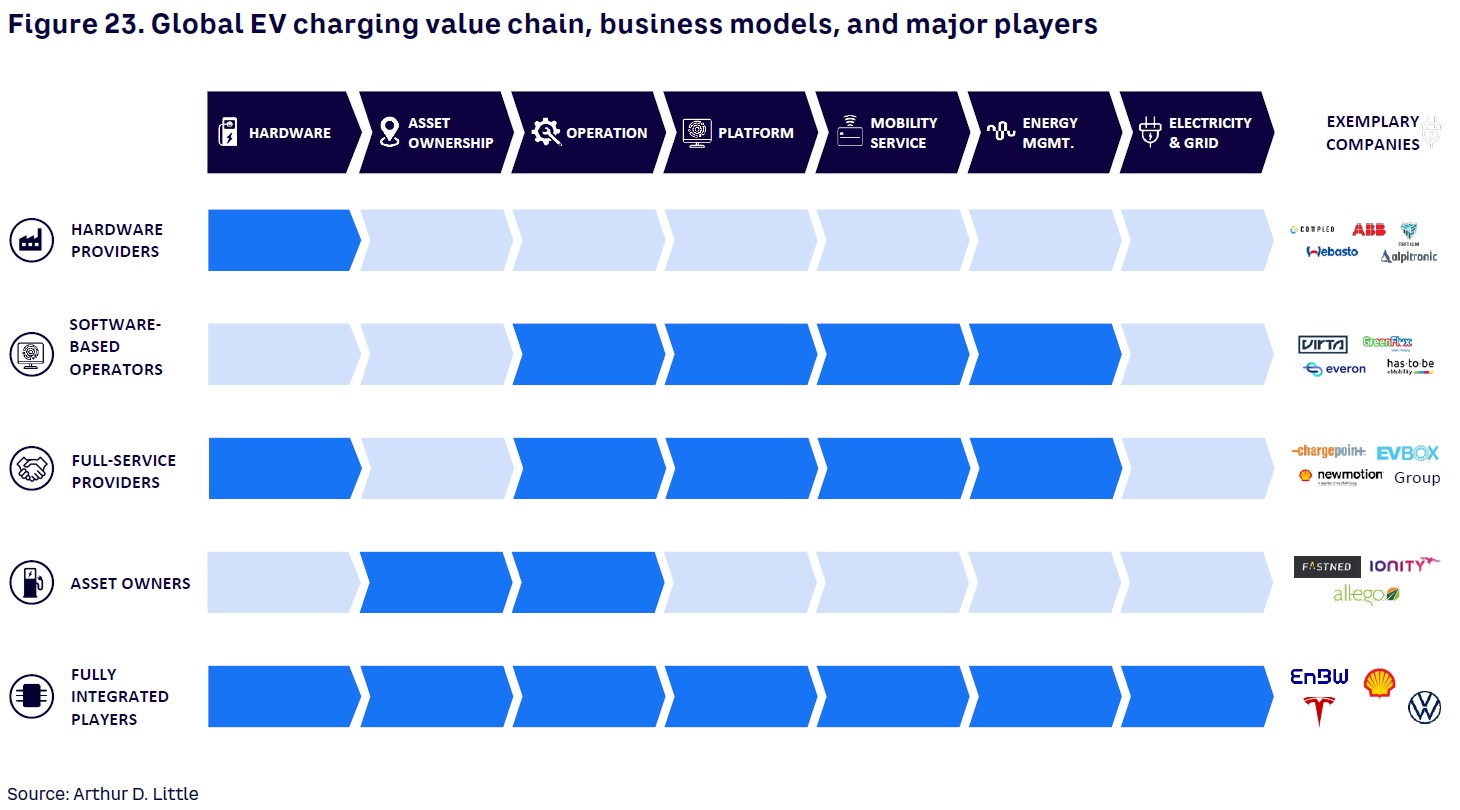

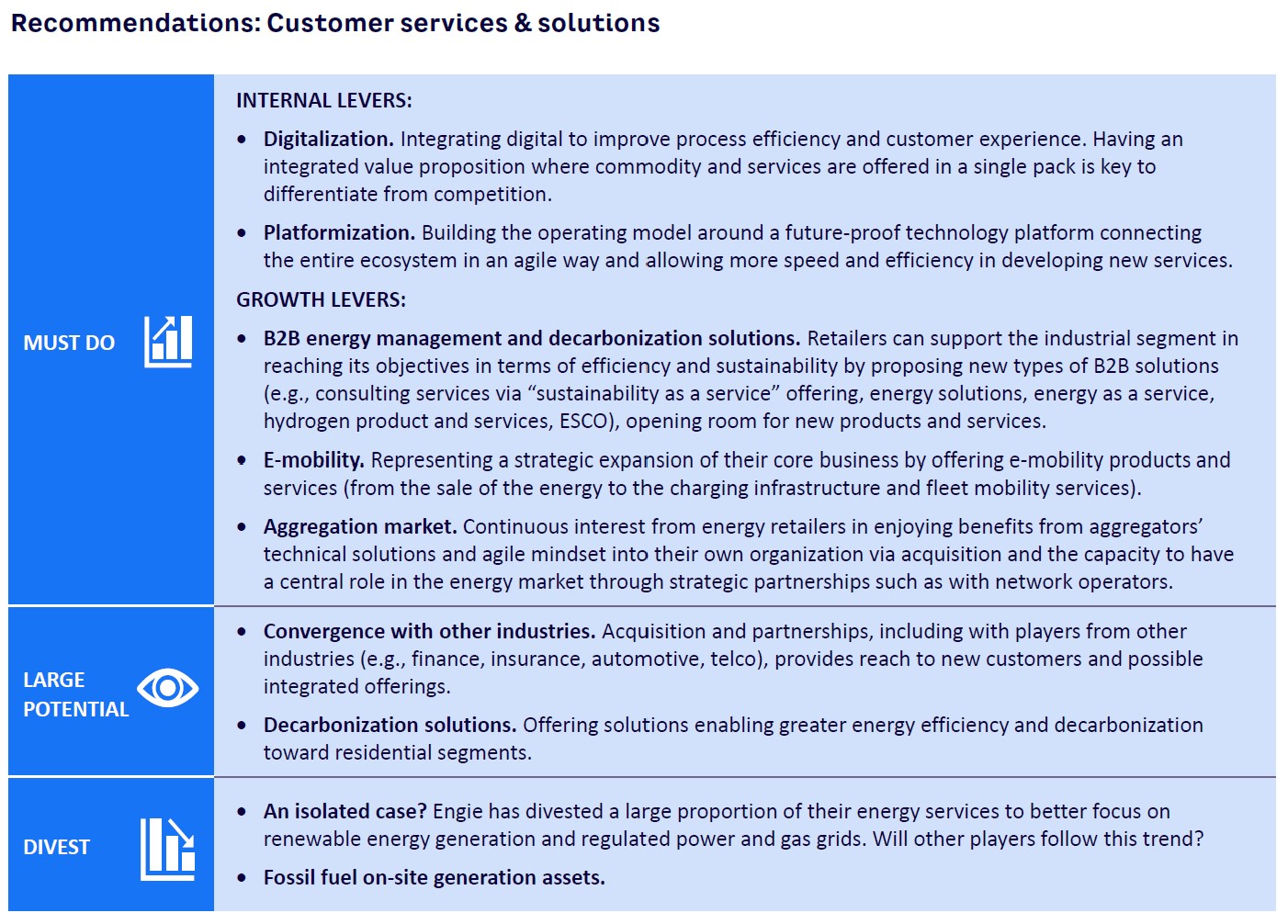

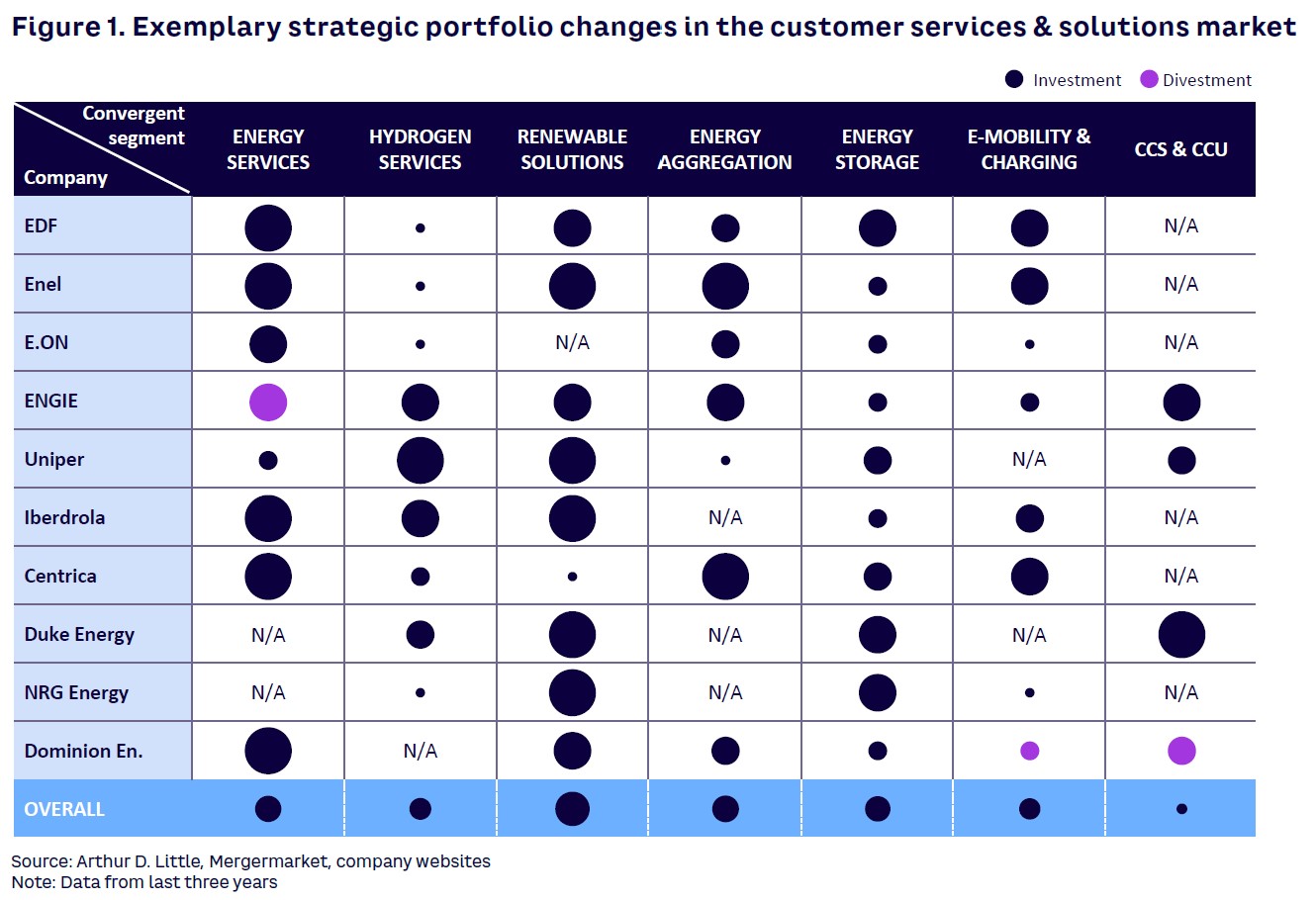

Energy companies are investing or divesting among convergent segments (see Figure 1). While some in the energy sector, like grid operators, are intensifying their investments in just a few areas, the underlying characteristic in the customer services and solutions segment is diversification. With technological developments happening in parallel across the marketplace, companies must ensure they have a broadly based offering, so they are not left exposed.

Get digitalization right for superior efficiency and customer experience

Digitalization is central to improving efficiency and enhancing customer experience across every sector. It also has a major role to play in stimulating innovative ideas and ensuring they are turned as quickly as possible into real-life solutions for customers.

Many energy retailers have already embarked on the digital journey, though not all have chosen the same path. So, while many have opted for the incremental digitalization of their operations by addressing their challenges one by one and building on previous investment, others that we can call “digital native challengers” have developed their operating model around the future-proof technology platform approach. Here, the platform acts as a digital broker between the energy retailer, its subsidiaries, its clients, and the broader energy ecosystem. This broker aims at improving, securing, and developing new, more agile, services. If well designed, each new wave of initiatives is lighter, shorter in terms of length of implementation, more profitable, and brings with it incremental benefits. The digital platform is the enabler that boosts innovation, ensuring ideas can quickly be transformed into actual customer solutions. Building such a platform is more than a technology journey and requires an extended commitment to identify open business models, revamp core business processes, and align the organization.

UK’s Octopus Energy, for instance, has created a digital platform, the “Kraken platform,” where an energy retailer, its subsidiaries, and clients can establish an “energy ecosystem” of better, faster, and more agile products and services.

In addition to improving customers’ energy efficiency, ADL believes that offering a tailored digital experience through apps, service portals, and marketplaces will be increasingly important for energy retailers and fundamental to their transformation.

With industry setting ever more ambitious cost and sustainability goals, and residential consumers becoming more proactive in managing their contracts, energy retailers must ensure they are offering an optimal mix of energy services to both segments.

To do this, they need to create what are truly value-driven solutions based on multiple service and product offerings. This could mean, for instance, integrating EV fleet management with solar panel installation and the negotiation of corporate power purchase agreements (PPAs).

Unfortunately, legacy systems and traditional business structures don’t lend themselves easily to this integrated approach, although some have overcome such challenges. Enel, for instance, because it laid “digital foundations” back in 2016, has been able to progress to its current integrated approach that involves collaboration with third parties and delivery through a platform-based business model.

Alongside a user-friendly platform, powerful data analytics is another essential component for improving the customer experience. Information from CRM and billing systems, as well external sources such as mortgage applications, can provide invaluable insights into customer behaviors that can influence strategic decisions, lead to the development of new solutions and partnerships, as well as improve interactions with customers at every touchpoint.

Distributed assets and their aggregation

Because many markets have incentivized the development and adoption of customer-side distributed assets, the number of dedicated tariffs and generation solutions being offered by retailers in the US and Europe has grown. Most of these involve small-scale distributed electricity generation typically using PV systems, energy storage systems (ESS) that optimize consumption and export electricity to the grid, or load management solutions that adapt consumption to grid events. Next to those assets, electric mobility represents another opportunity for energy players to diversify their revenues through the installation of charging infrastructure at end consumers’ place. And finally, heat pumps are expected to experience a steep increase in use, as they are considered a decarbonizing technology of choice due to their high efficiency and use of renewable power.

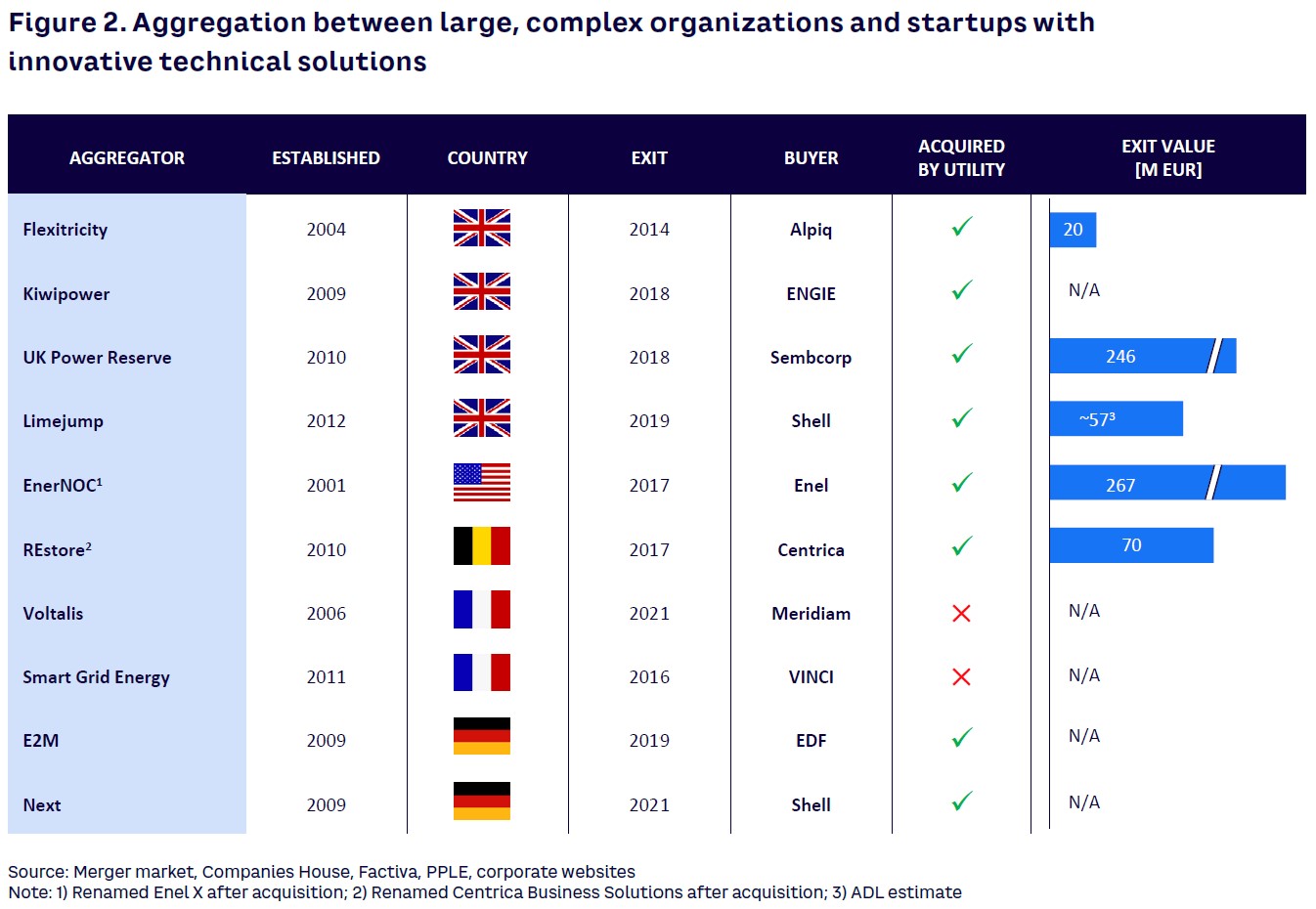

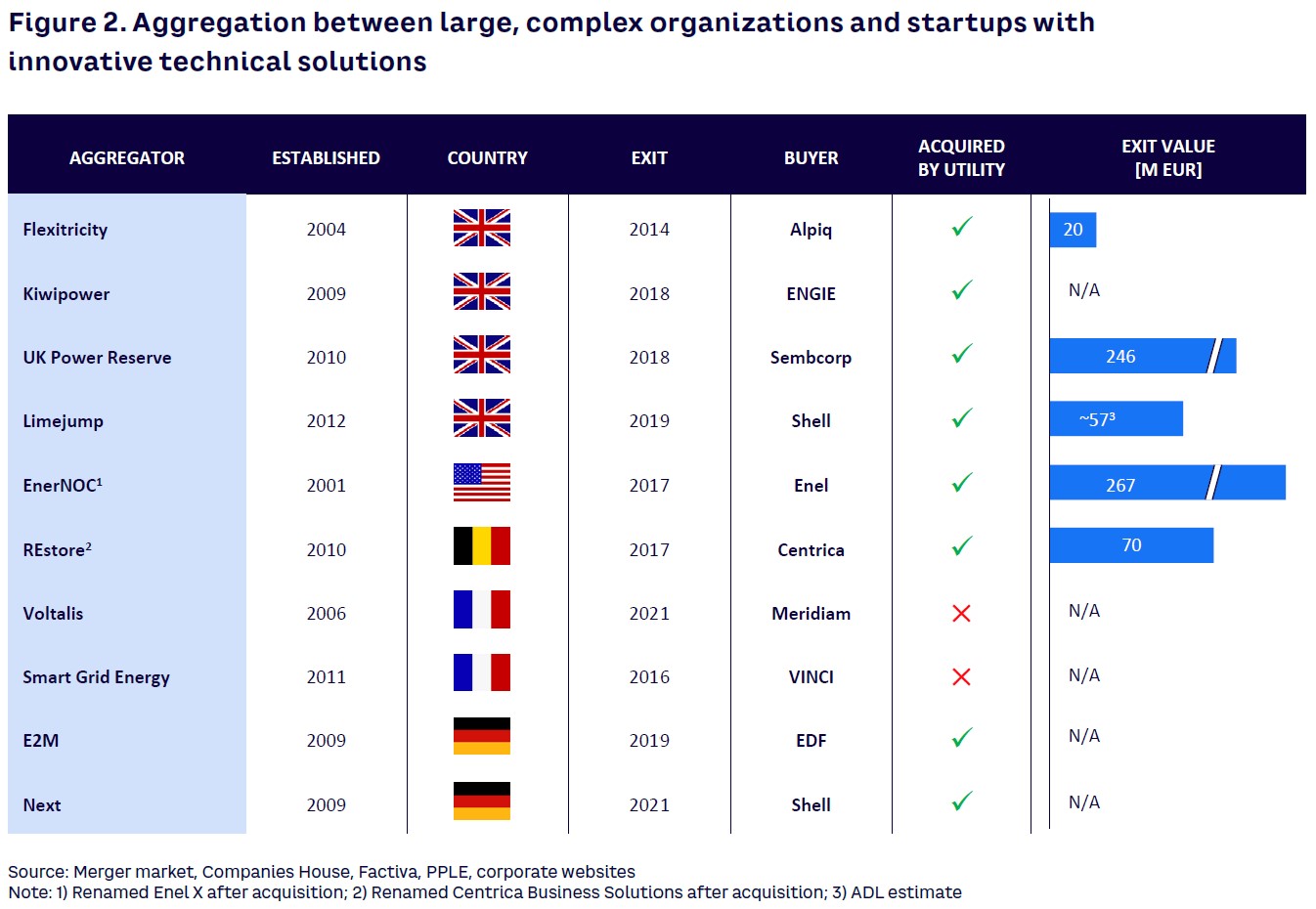

In this context, as well as providing these essential distributed assets to customers, retailers are also seeing the value of aggregating them and supporting network operators in their supply-and-demand balance role. Consequently, the aggregation business has seen real interest from retailers (particularly three to five years ago), leading to a significant consolidation with major investments by utilities and private equity firms. And while the pace of this M&A activity may have slowed, it’s still ongoing. In Europe, for instance, Shell acquired Limejump in 2019 as well as Next Kraftwerke at the start of 2021 (see Figure 2).

Creating an optimal mix of energy services

Given the increasing number of new players and convergence of industries within the energy value chain, in this new ecosystem of interconnected actors, retailers are facing existential questions about where and how to position themselves to provide their own parts of the solution. Retailers now understand they will not win through single products, services, or solutions but rather by providing a range of solutions, supported by the right capabilities that will unlock a new pool of value that was inaccessible in the past, given the challenge to invest in so many capabilities.

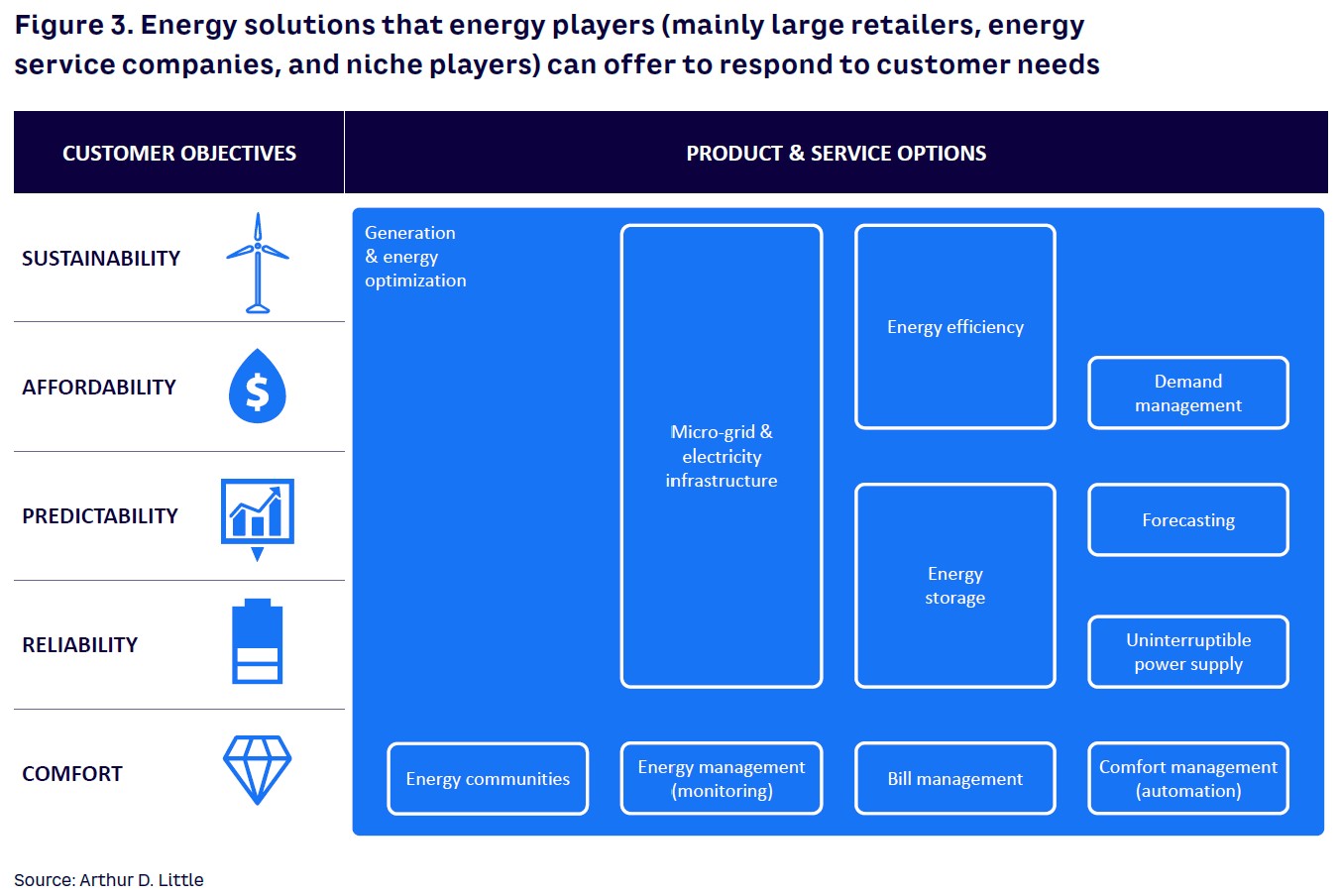

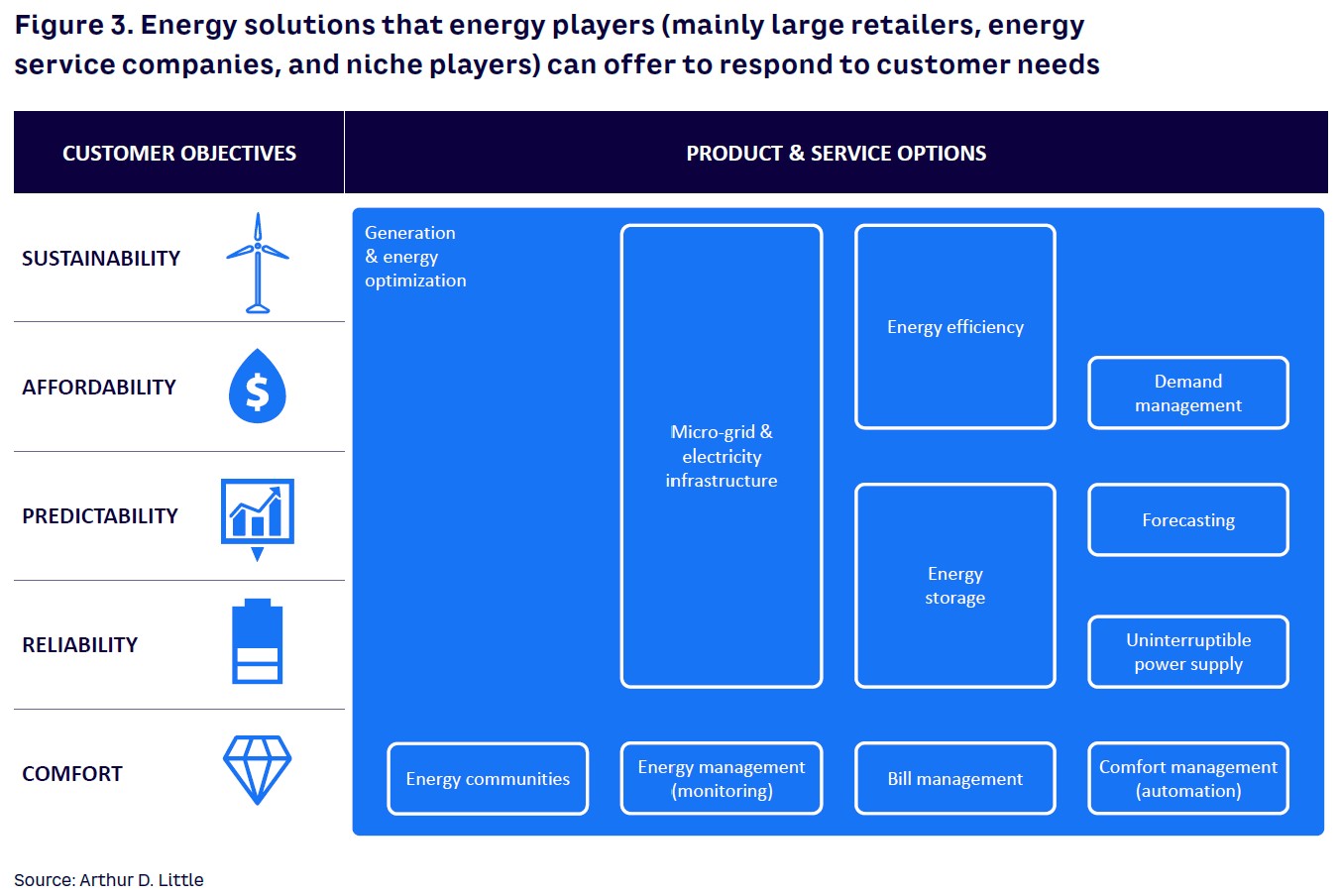

Those solutions will need to respond to the ambitions of end customers, more specifically industrials, which are increasingly challenging energy management decisions due to their own sustainability ambitions and concerns for energy costs (see Figure 3).

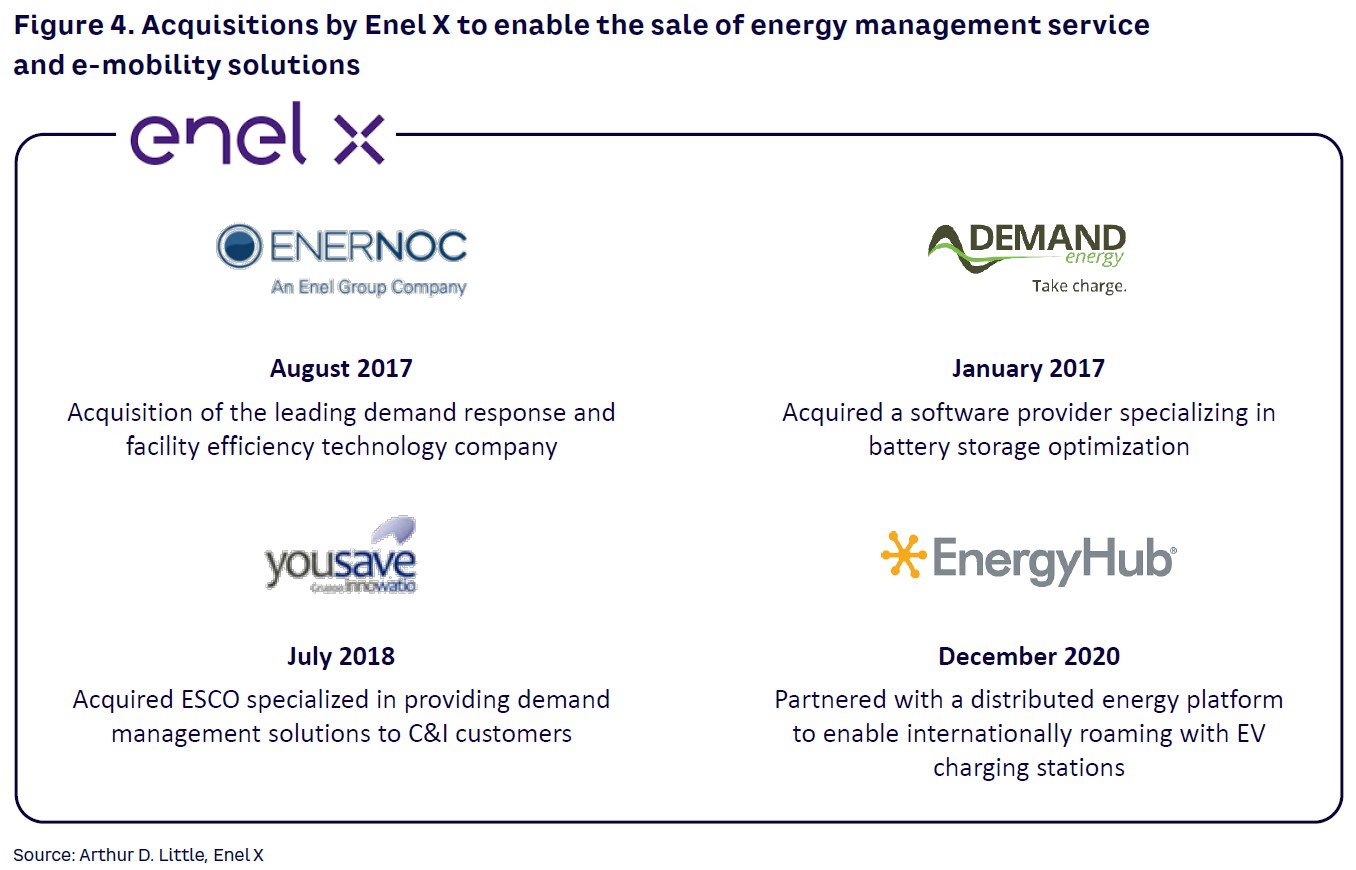

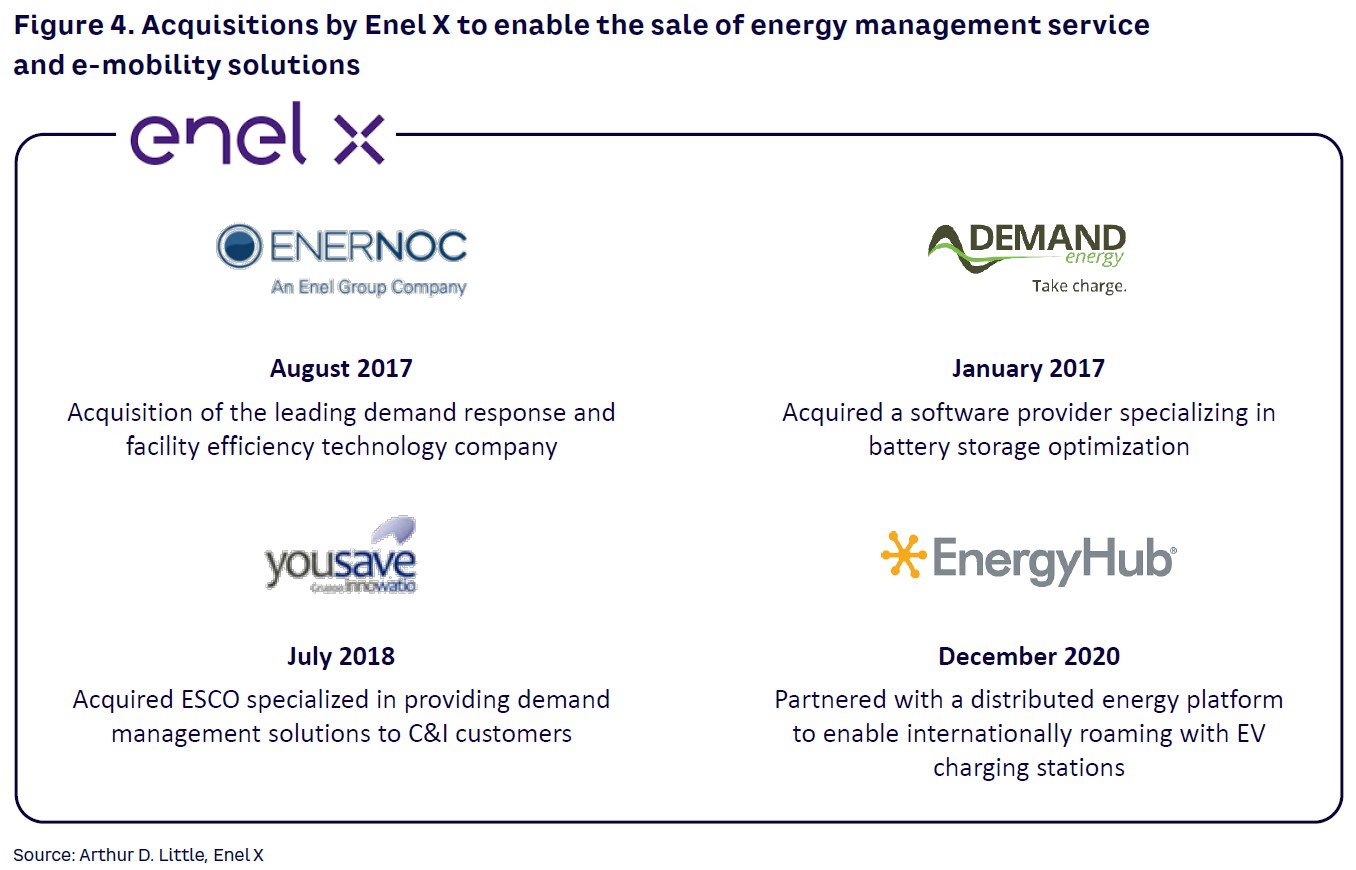

With many companies extending their offering of energy services, in some geographies we are seeing a mixed market, with many smaller local specialists focused on specific areas sitting alongside larger players that through acquisitions and partnerships can position themselves as one-stop-shop service providers. This is the case with Enel X, for example (as illustrated in Figure 4), which has made a series of acquisitions in energy services, addressing primarily the B2B segment. We expect those investments to target the residential segment soon.

Definitely time for investment, but a need for growing focus

For retail businesses, increasing end consumers’ average basket value (i.e., the average value of a purchase) is critical. Essentially, this increase will happen through new offerings such as solar, storage, heat, and CHP (combined heat and power) assets, electric mobility infrastructure and related services, as well as energy efficiency and decarbonization services (especially important when emitting carbon will increasingly impact your cost base). But providing these services requires high CAPEX, which may exclude smaller players. Partnerships with financing parties and convergent industry players (e.g., automotive) are therefore essential for these businesses.

Larger players, which in parallel with their retail business have to invest in new types of generation assets such as hydrogen production or nuclear plants, are also constrained by increasing CAPEX. Some, like ENGIE, have decided to divest a part of their services portfolio (e.g., Equans was acquired by Bouygues in Q4 2021), to better focus on renewable energy generation and regulated power and gas grids. Others need to accept a deceleration or plateauing of new businesses because of having to wait for the result of political elections, decisions about regional nuclear strategy, and/or the raising of funds.

Leveraging energy and convergent industries ecosystem is key for success

For several years, it has been clear that using acquisitions and partnerships to enter other industries has been a way to accelerate the development of new services, reach different types of customers, and boost revenues. Retailers that have expanded their ecosystem have also been able to innovate faster and improve their efficiency and customer experience through digitalization. At the same time, they have also benefited from an injection of know-how from convergent industries and co-financing of CAPEX-intensive projects and investments.

2

Networks, Infrastructure & Storage: The New Role of Energy Networks

by Kurt Baes and Irene Macchiarelli

Whether they are power, gas, or heat, grids work within a highly regulated market that effectively constitutes a natural monopoly.

The biggest challenge for energy networks relates to energy transition: dealing with new energy flows triggered by a growing number of renewable energy sources and having to handle new energy carriers in the energy system at large.

The critical role and position of grid companies is widely agreed to put them at the very heart of this energy transition. While the energy network companies today continue to be the matchmaker between energy suppliers and clients/consumers end-to-end, many are upping their game through new initiatives that are taking them to the next level.

This is seeing some grid companies diversify into new areas, sometimes outside of the energy field, in search of growth and synergies (see Chapters 7, 11, and 12 on diversification of network companies in water, e-mobility, and data & connectivity).

The critical importance of grids

Transmission and distribution system operators (TSOs and DSOs) are tasked with delivering overarching initiatives like the EU’s Green Deal and the national plans that underpin them. And what is being asked of TSOs and DSOs is far from insignificant. The European Commission, for instance, is proposing to raise the EU’s renewable energy target from 32% to 40% by 2030, according to WindEurope. This would see wind power capacity increase from today’s 180 GW to 451 GW, which would require new wind farms to be constructed and launched at a rate of 30 GW every year. So, today’s wind energy expansion of 15 GW per year until 2025 would need to double.

The mission then for energy grid firms is to create future-proofed energy infrastructures that can accommodate a wide range of technologies such as intermittent and decentralized generation, and also deal with energy storage, demand response, EV charging, and new energy carriers like hydrogen and molecules such as CO2.

The decisions these operators make will not only have massive investment implications but political ones, too. The long-standing “nuclear power debate” in Belgium, is an obvious example.

Some of these system transformation challenges mainly relate to TSOs, such as in Germany, where additional power lines are being installed to bring power from huge offshore and onshore wind farms in the North to the large industrial hubs (steel, chemicals) in the South.

For DSOs, the system transformation challenges typically relate more to changes in technology and consumer behavior. One example is the growth of EVs, which is triggering the need for grid changes to enable better charging. In many instances, demand might be better served by decentralized power generation using localized PV arrays and batteries.

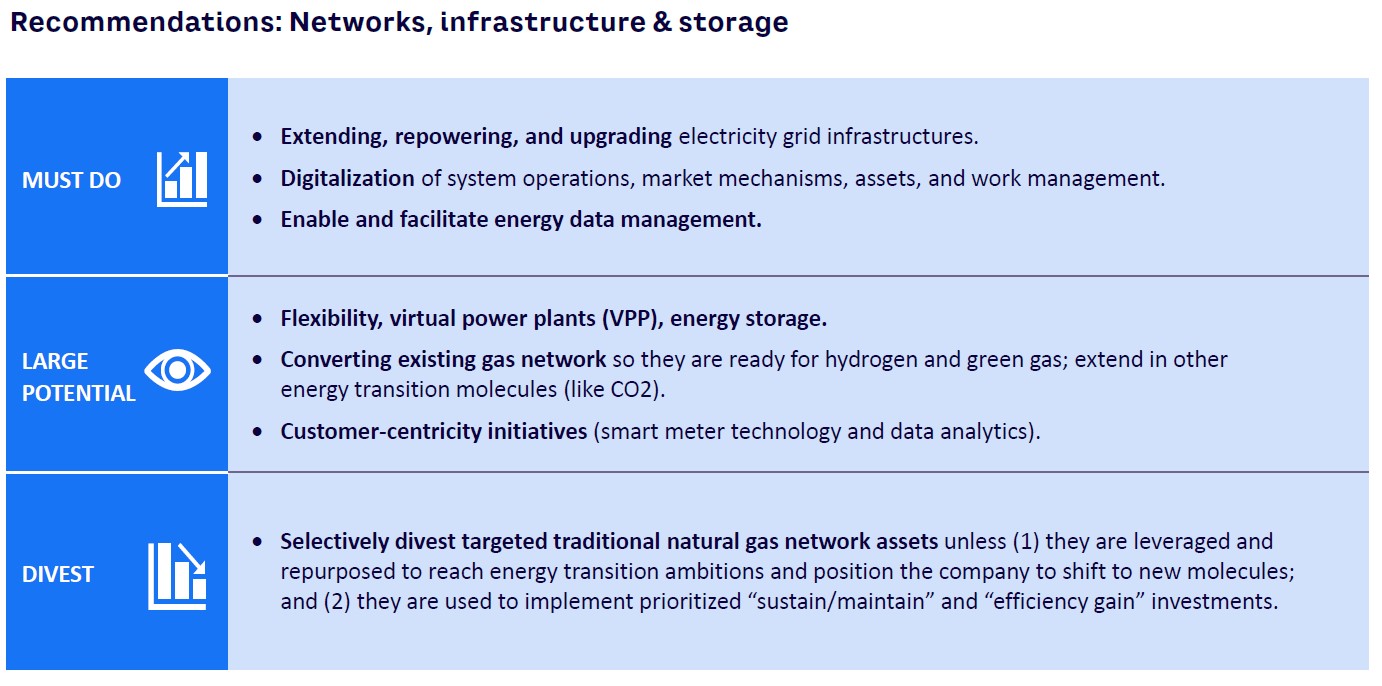

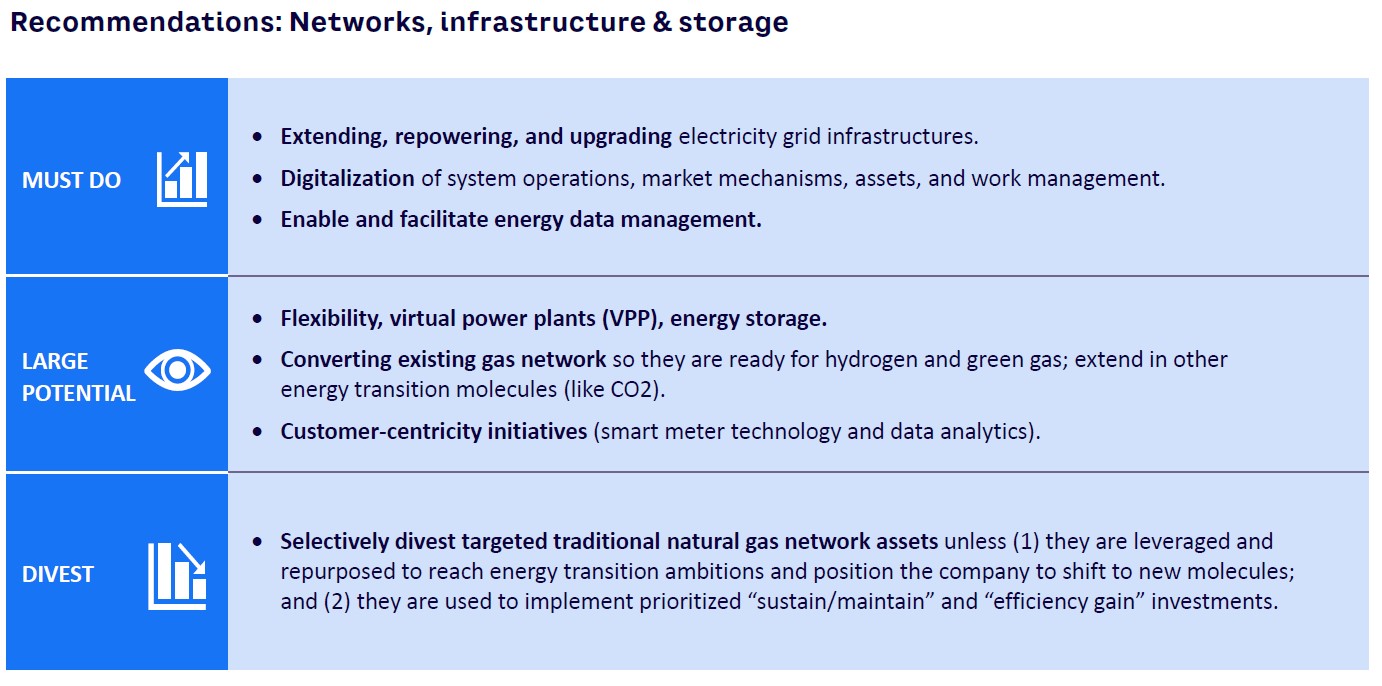

Investment and disinvestment landscape

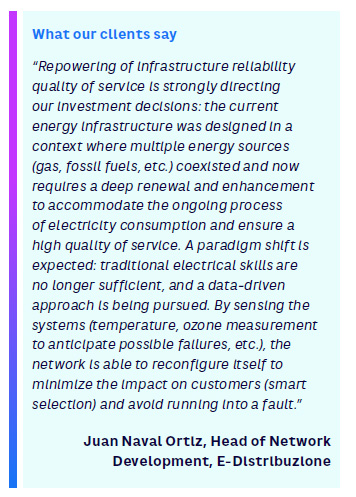

Considering the current investment priorities of TSOs and DSOs, we can see clearly that a key emphasis for most will be the integration of renewable energy (extensions to integrate offshore wind, reinforcements, and renewals) into the existing grid, followed by the digitization of operations and asset base. This digital transformation will need to be pushed through at all levels (e.g., system operation, infrastructure, and asset management) to enable the creation of a more flexible infrastructure capable of dealing with greater supply and demand volatility. Customer centricity will be a core driver of this digital wave.

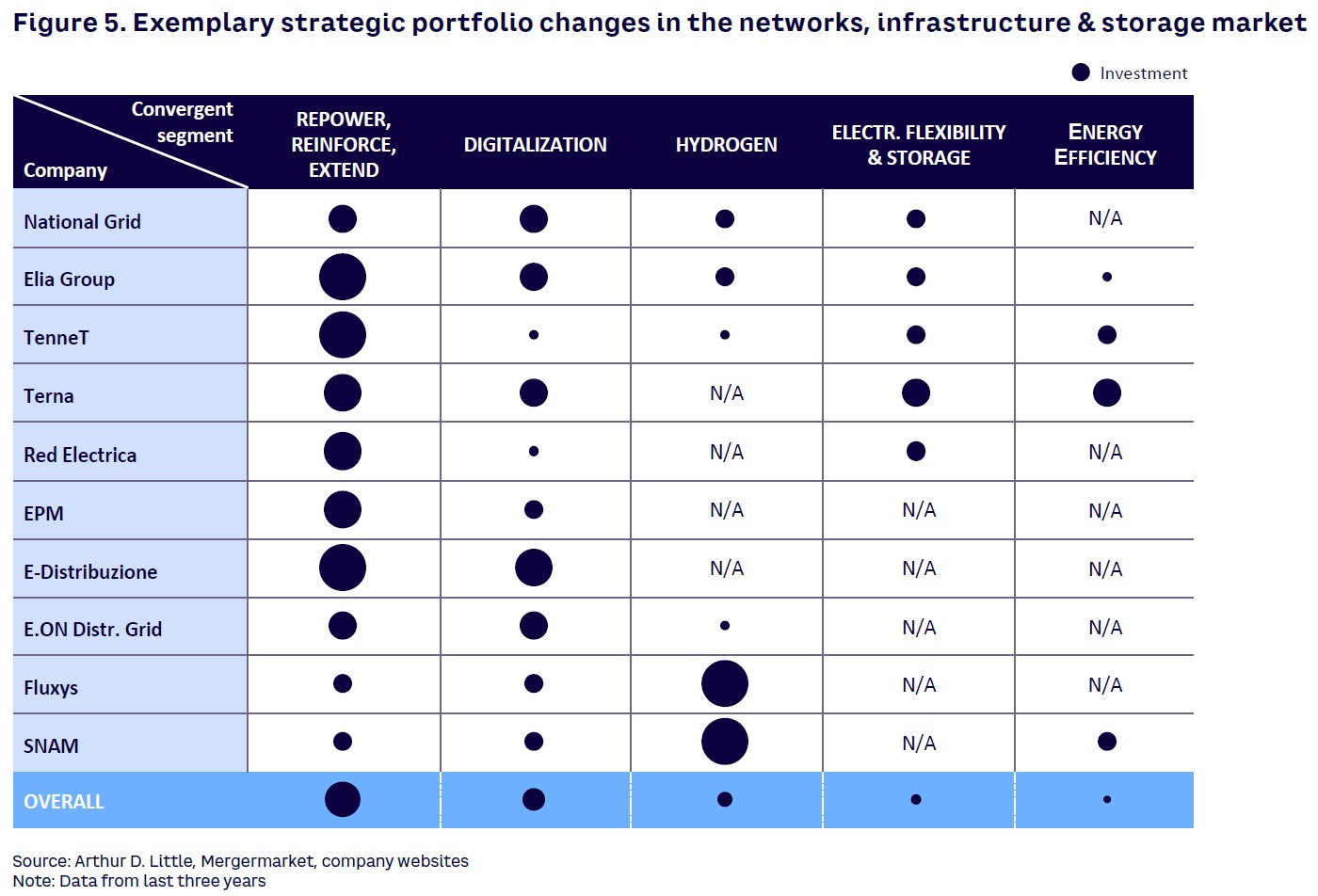

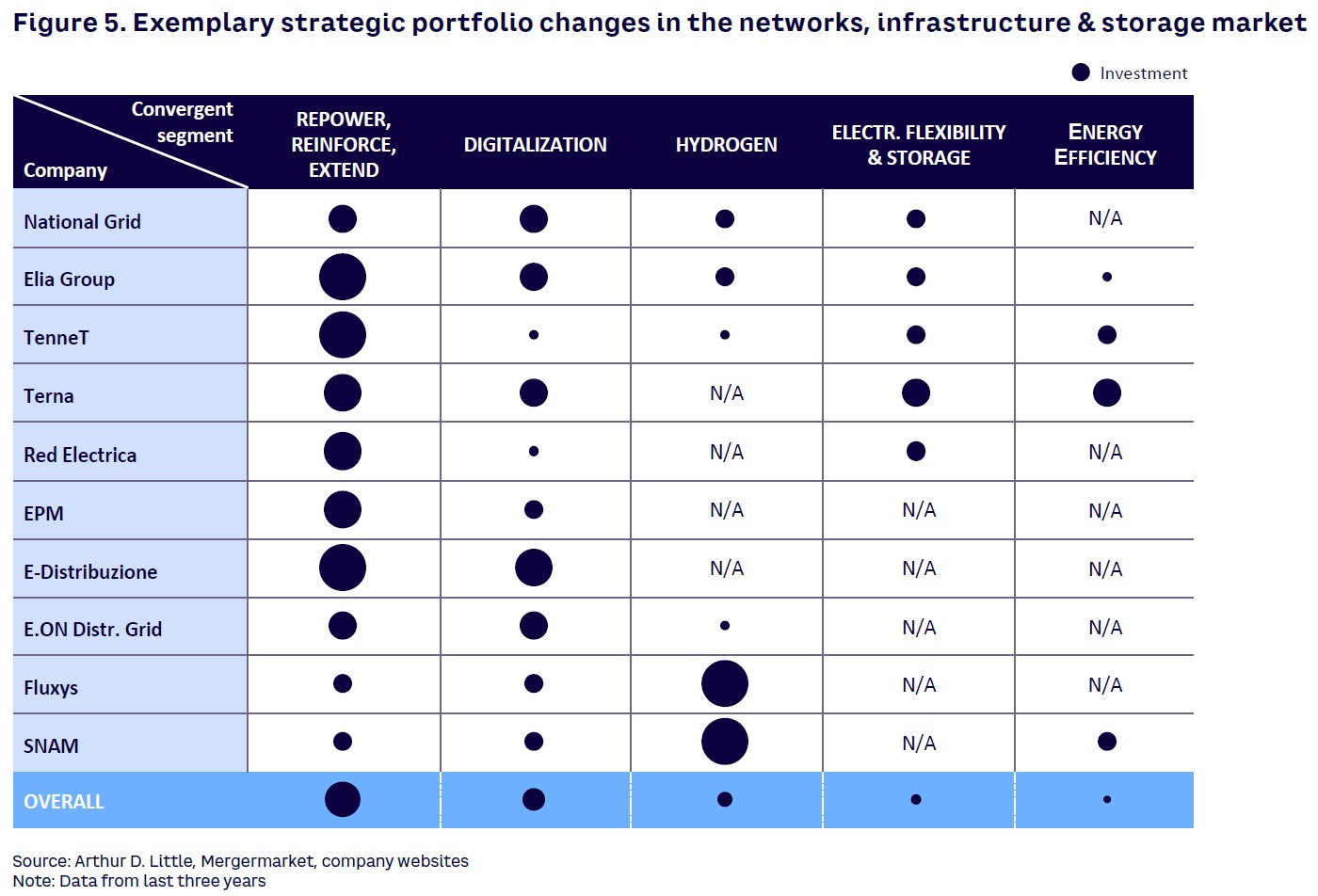

For power grids, extending (e.g., offshore), reinforcing, and renewing aging electricity networks continue to absorb the bulk of capital expenditures. While gas grid companies, in particular, have an additional investment need to prepare for new energy carriers such as hydrogen (including related products like ammonia) and CO2. Figure 5 illustrates the investment focus of a selection of grid companies (TSO/DSO, electricity/gas). Besides massive investments in the grid itself (“repowering”), the increasing digitization of operations and flexibility dominate investments.

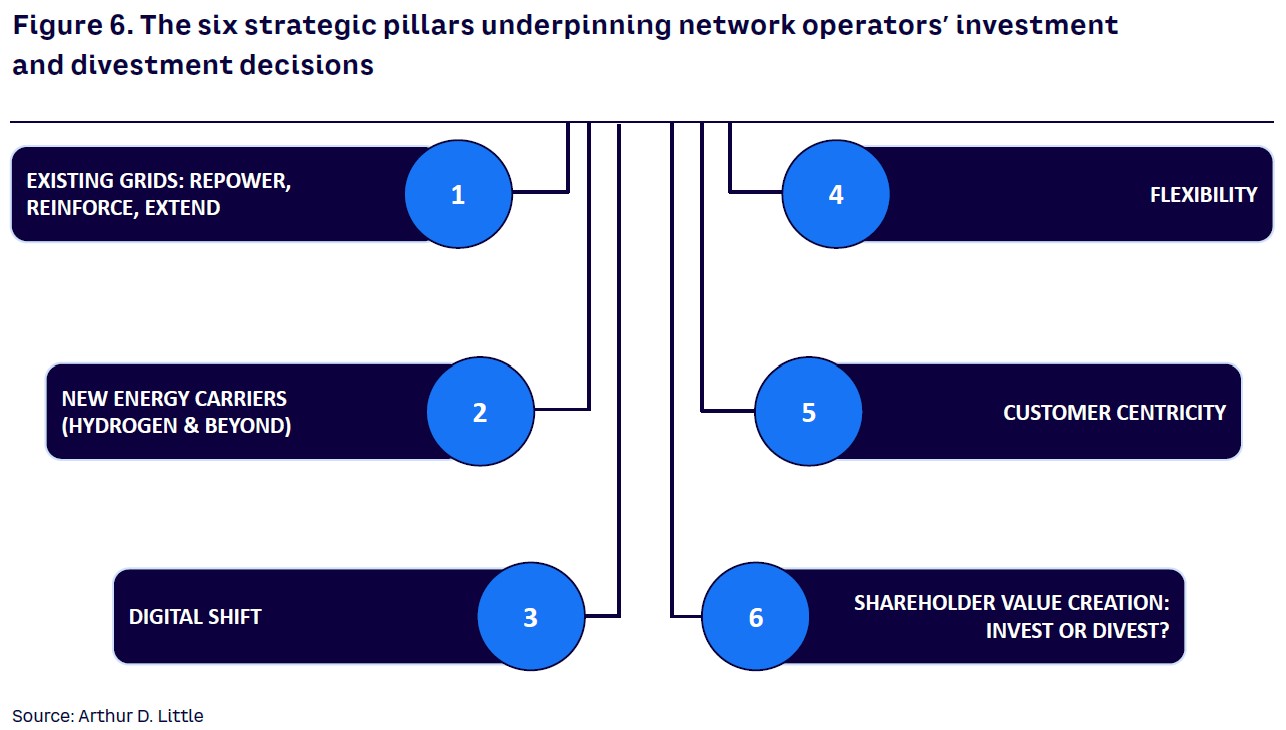

Six strategic pillars for grid operators

Because grid companies can operate in both regulated and deregulated markets, having to create value for shareholders and external capital providers on the one hand, as well as providing users with a high-quality and efficient service compliant with requirements of regulators and energy authorities can be quite complex.

Some TSOs and DSOs have started to operate in specific niches of deregulated markets to boost energy transition. For example, Snam has done some direct investment in hydrogen technologies while Terna has invested in energy efficiency and storage. However, these will remain just a small part of each companies’ total investment plan.

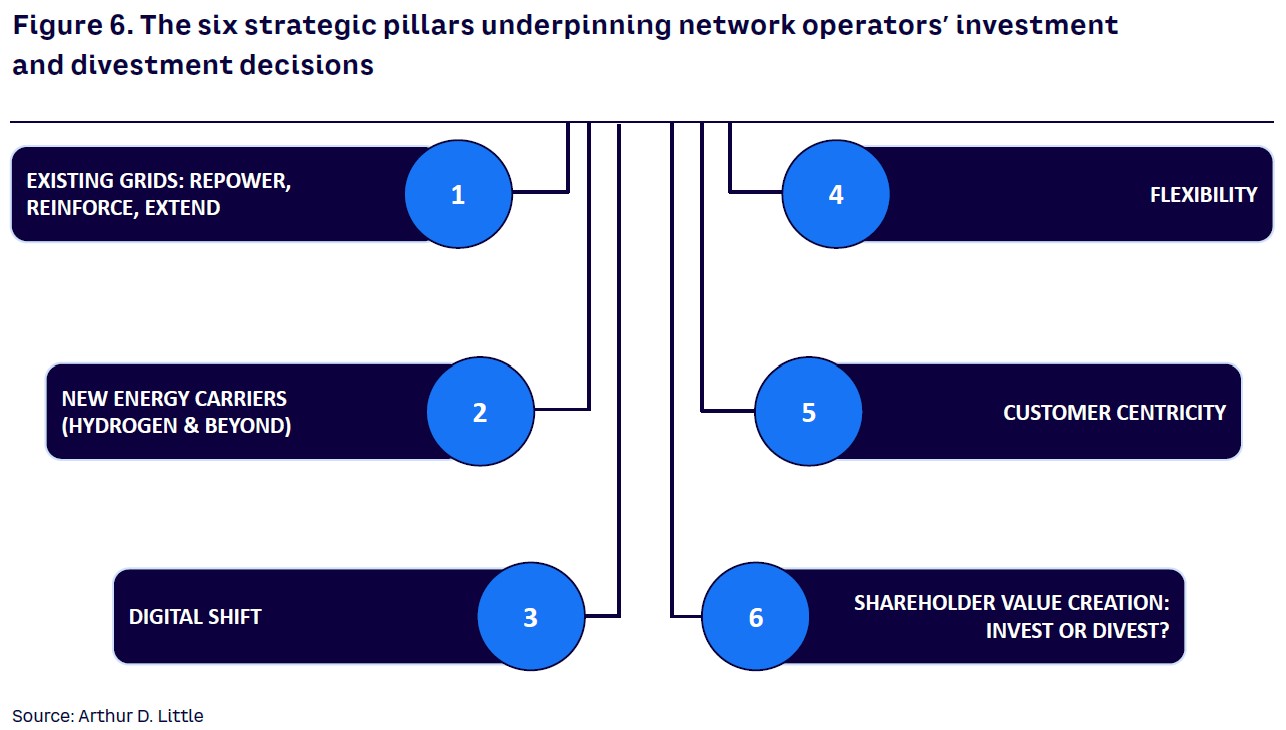

When we dissect the “regulated” investment and divestment priorities, we find they rest on six primary pillars, as shown in Figure 6.

Pillar 1 — Existing grids: extend, repower, reinforce

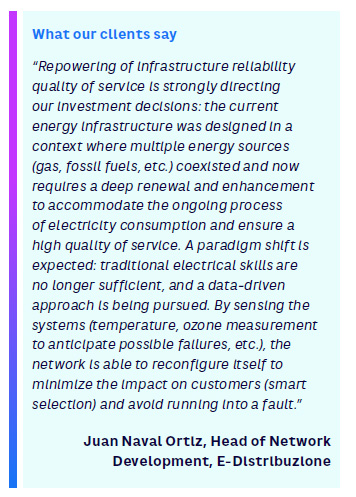

Current energy infrastructures are designed around centralized non-intermittent generation, but this no longer works well when consumers are switching to EV and heat pumps and renewable energy generation is increasing. So, if they are to remain strong and resilient, networks must redirect their investments (which many are already doing).

Italy DSO e-distribuzione, for example, is repowering and renewing its existing infrastructure in a major investment program that will see it spend €8.2 billion between 2021-2023 (+50% up on the previous outlook for 2020-2022). They are not alone, with many DSOs more than doubling their CAPEX in their new strategic plans.

In Germany, electricity TSOs Amprion, 50Hertz, TenneT, and TransnetBW are building DC transmission lines north to south and south to east to transport power from the North Sea and Baltic coasts, which is where 1,500 of the country’s offshore wind turbines are located, to the country’s industrial manufacturing hubs in the south. As part of Germany’s “mission-crucial” shift to green energy, TenneT is also building two separate storage centers for energy at either end of the country. These will form part of a “virtual power line” that will increase flexibility at times of grid congestion or in case of an emergency.

Pillar 2 — New energy carriers (hydrogen and beyond)

Following an initial focus on renewable electricity generation, there is now growing interest in new energy carriers like hydrogen and biomethane produced from biomass digested in purification plants.

Gas is already a strategic pillar of the transition toward a low-carbon economy given its flexibility, the fact that it can be delivered through existing pipeline infrastructure, and the ability of gas-fired power plants to easily support intermittent renewable generation. However, in a future decarbonized energy system, green hydrogen, biomethane, and synthetic gas (syngas) will create an additional growth opportunity space for gas TSOs and DSOs.

Hydrogen that’s electrolyzed from water using power-to-gas systems employing wind or PV energy can be transported by gas grid companies to points of consumption as part of the development of a hydrogen pipeline infrastructure.

A good example is Fluxys and Gasunie’s green hydrogen hub on the North Sea coast of the Netherlands and Belgium, which when complete will include 1 GW of electrolyzers. Similarly, in Italy, Snam is looking to transport decarbonized gas — hydrogen as well as biomethane — through a clean energy hub in Northern Europe. Half of Snam’s €7.4 billion investment will go into replacing and developing hydrogen-compatible assets.

In a joint venture, the German federal government, Thyssengas, and Dutch electricity and gas TSOs have set up 20 “real laboratories” to look at doubling the level of hydrogen that can be carried through the existing gas network from 5% to 10%. Hydrogen is a major change vector in Europe’s clean energy package, and grid companies will play a key role in enabling it.

Pillar 3 — Digital shift

Due to the increasing stress being placed on energy grids and growing pressure from regulators looking for efficiency gains and new technologies, power and gas operators must digitize faster than ever if they are to become more efficient and resilient during times of crisis.

New DSO and TSO roles will require more data exchange between them, so there is a compelling need to create new platforms and to focus on leveraging information and communications technology to the maximum. Accordingly, they will need to become much more data-centric to meet the needs both of their clients and markets as well as their internal systems operations and asset management. So, we can see initiatives like the “digital substation” being rolled out everywhere among electricity grid firms though it will require much greater integration and understanding of data and analytics to leverage their full potential.

Leading European power TSOs, like RTE, Fingrid, Elia, National Grid, and Statnett are developing in-house R&D teams to work on digital technologies, and there are many third-party service providers in the marketplace. These include big names like IBM, OSIsoft, Siemens, and GE, as well as many startups and smaller hardware and software providers such as N-SIDE, which offers artificial intelligence (AI) solutions to improve grid balancing, outage management, and RES forecasting.

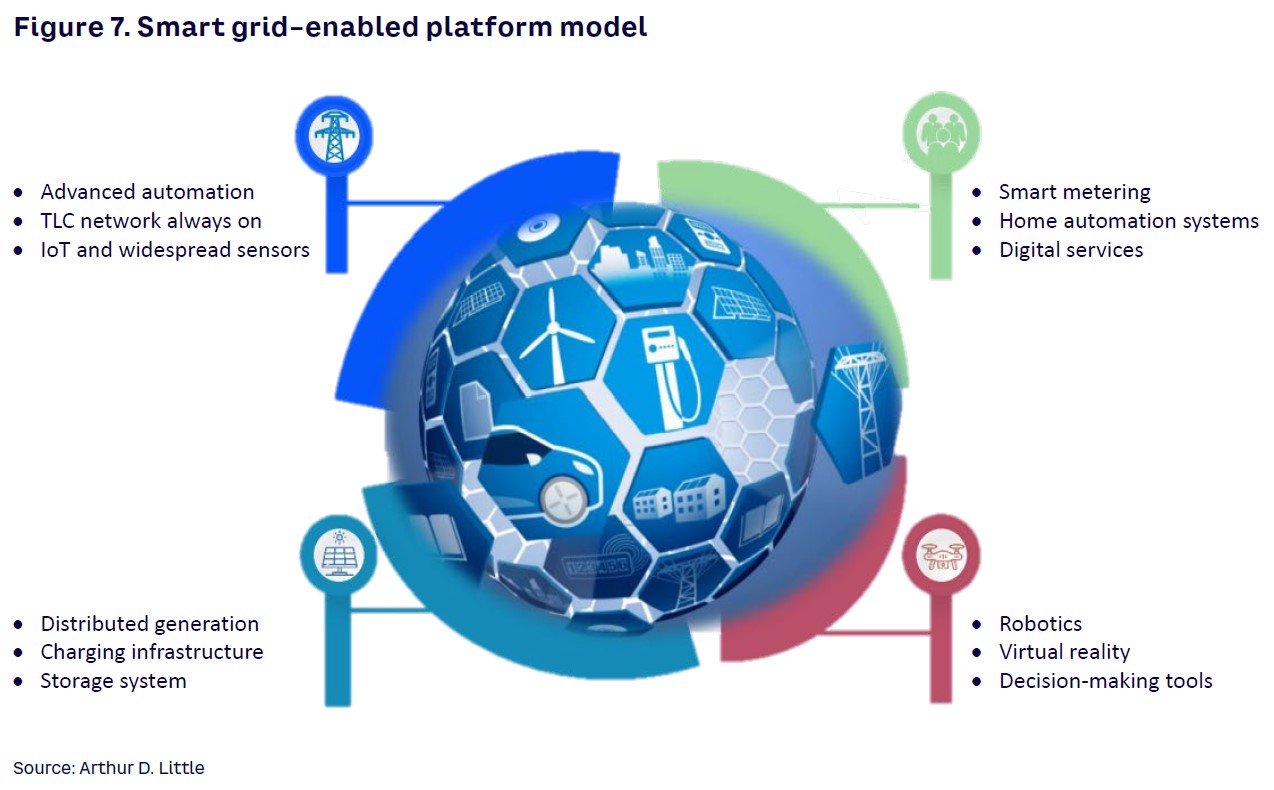

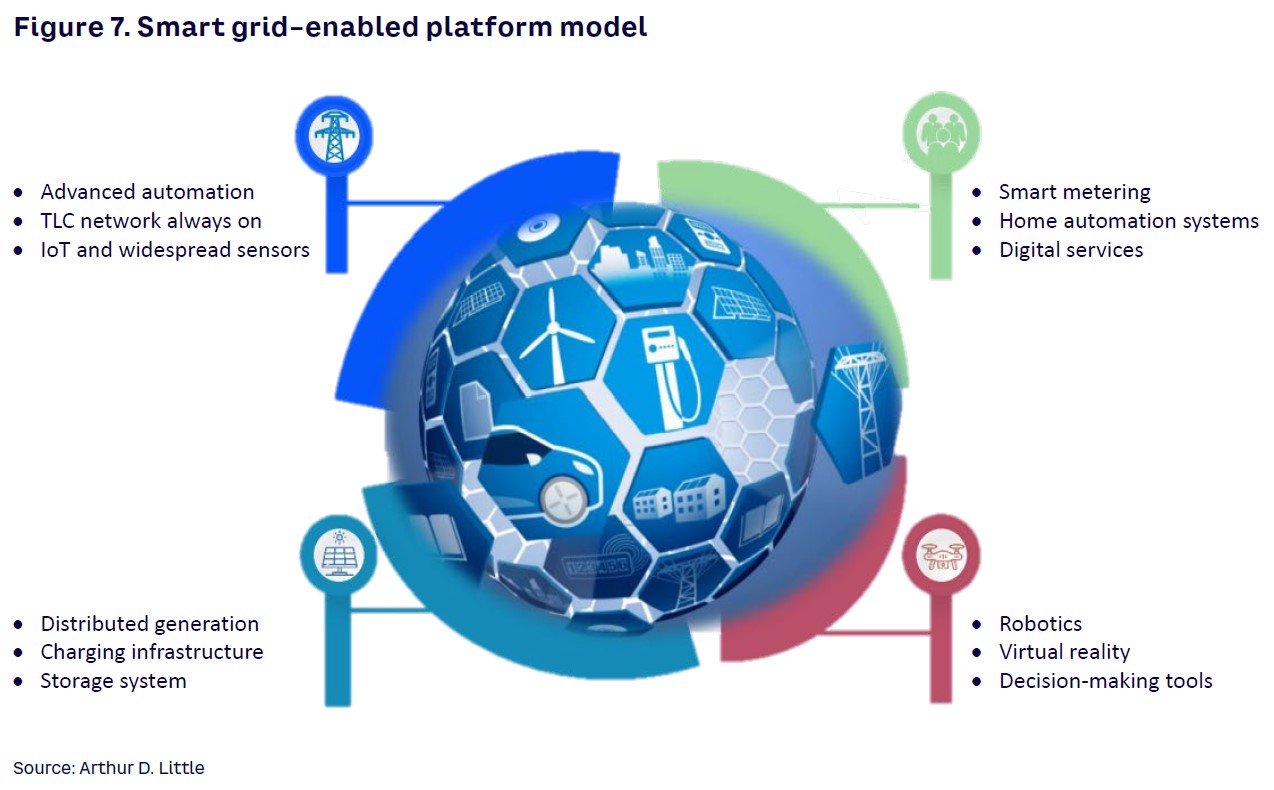

The speed with which companies need to digitize varies between regions and companies, but the industry as a whole must consistently move faster toward a multi-layered “smart grid” that includes advanced automation, distributed generation, smart metering, and robotics (see Figure 7).

Pillar 4 — Flexibility

Given the growing need for energy flexibility globally — the International Energy Agency expects a 300% increase in flexibility use in China and 600% in India by 2040 — grid operators can create value by helping network operators balance their real-time energy requirements. But rather than frantically investing in copper power-grid assets, budgets should be allocated to creating a smarter energy system with demand-response programs that better manage capacity and variable supplies from renewables.

The Yukon Energy Corporation (YEC) in Canada, for instance, is looking to reduce the territory’s dependence on thermal generation using demand response technology to manage the increasing number of electrical grid peaks. So, as part of a three-year-long project, YEC has fitted remotely controllable devices into about 400 of its customers’ homes, enabling YEC to shift the load when demand surges.

In the US, Oregon electricity and gas grid utility Portland General Electric (PGE) is researching the benefits of concentrating battery assets at a single substation. In a pilot scheme, PGE has installed 525 residential energy storage batteries that in aggregate create a 4 MW virtual power plant (VPP). The utility encourages participation in the scheme by discounting the upfront cost of batteries and adding US $20 or $40 credits to monthly bills.

Elsewhere, one of the UK’s largest distribution network operators, UK Power Networks (UKPN), entered a €15m contract in June 2020 to provide 123 MW of flexible power, which will come from distributed generation and batteries, VPPs aggregating heat pumps, household batteries, and EVs.

Pillar 5 — Customer centricity

Given the sheer numbers involved, any customer-centric initiative is likely to be an area of major investment for any energy grid firm.

While installing smart meters to promote energy efficiency by increasing awareness of consumption is an immense exercise, the wealth of data generated is so valuable that it is often labeled as the energy sector’s “new gold.” Despite its value, smart meter rollout is still very patchy, so while some countries already roll out second-generation units, others have barely begun installing their first wave.

This uneven take-up can be attributed to regulators’ involvement. In the EU, for instance, regulators tend to allocate key market facilitation roles to grid companies, which means that data management and governance is assigned to TSOs and DSOs who drive it forward. For example, in the Netherlands, the combined power and gas TSOs and DSOs have collaborated closely with all stakeholders in the energy market to establish a customer-centric data management and governance framework sector-wide.

Looking forward, we can see that smart meters will be just part of a much wider ecosystem, an “Internet of Energy” (IO.Energy) like the one put forward by Belgian electricity operators Elia, Fluvius, ORES, Resa, and Sibelga.

And in France, ENGIE has launched a community-based solar energy sharing project — five households generate electricity from PV roof panels, which is then passed on to 23 homes in the neighborhood. Smart software developed by ENGIE controls the distribution while smart meters in each home inform consumers how much power they are using. Any electricity not immediately consumed is stored in a communal battery or hot water tanks for later use.

Pillar 6 — Shareholder value creation: Invest or divest?

While investment strategies must consider the needs of shareholders and capital markets, doing so can be a problem for some energy network firms because it raises questions about what exactly “value” is and how it is created. So, while grid companies, for instance, are constrained by regulators in some markets, at the same time their shareholders, which could be municipalities, public authorities, and external capital providers, are pushing them to find value creation opportunities outside their regulated business.

Again, this can result in a continually changing investment landscape with strategic shifts into new “favorite” asset types and away from others, such as those to do with fossil fuels, which in turn can have an impact on national energy networks. In the UK, for instance, where electricity demand is forecast to double by 2050, Reuters reported that National Grid, the country’s largest electricity network operator, has communicated plans to sell its majority stakes in National Grid Gas, the gas transmission operator.

The need to think differently about future investment is leading to creative setups by some energy providers. In Germany, for instance, E.ON wants to turn electricity pylons into radio masts that will serve the 4G and 5G mobile network. With over 100,000 high- and medium-voltage pylons across Germany that could be used, the network could be extended farther and faster, since no permission is needed to convert the pylons.

Finally, energy grids have an essential “market facilitation” role that consists of kick-starting new energy transition initiatives, even if this implies supporting non-regulated business activities. This was done in the early stages of new value chains such as battery storage, flexibility markets, and hydrogen. It confirms the spearhead role that network firms have in accelerating the transition to green.

3

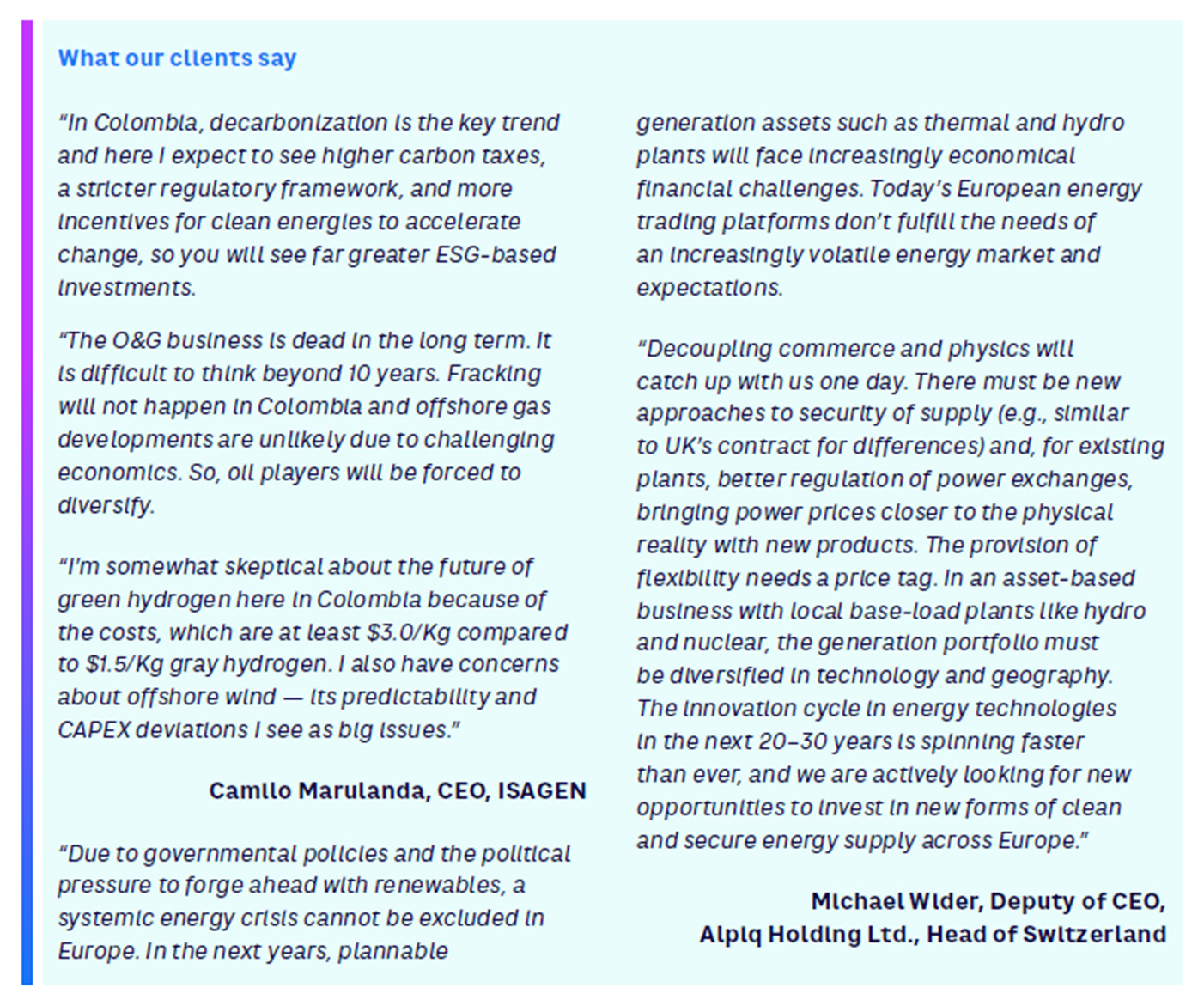

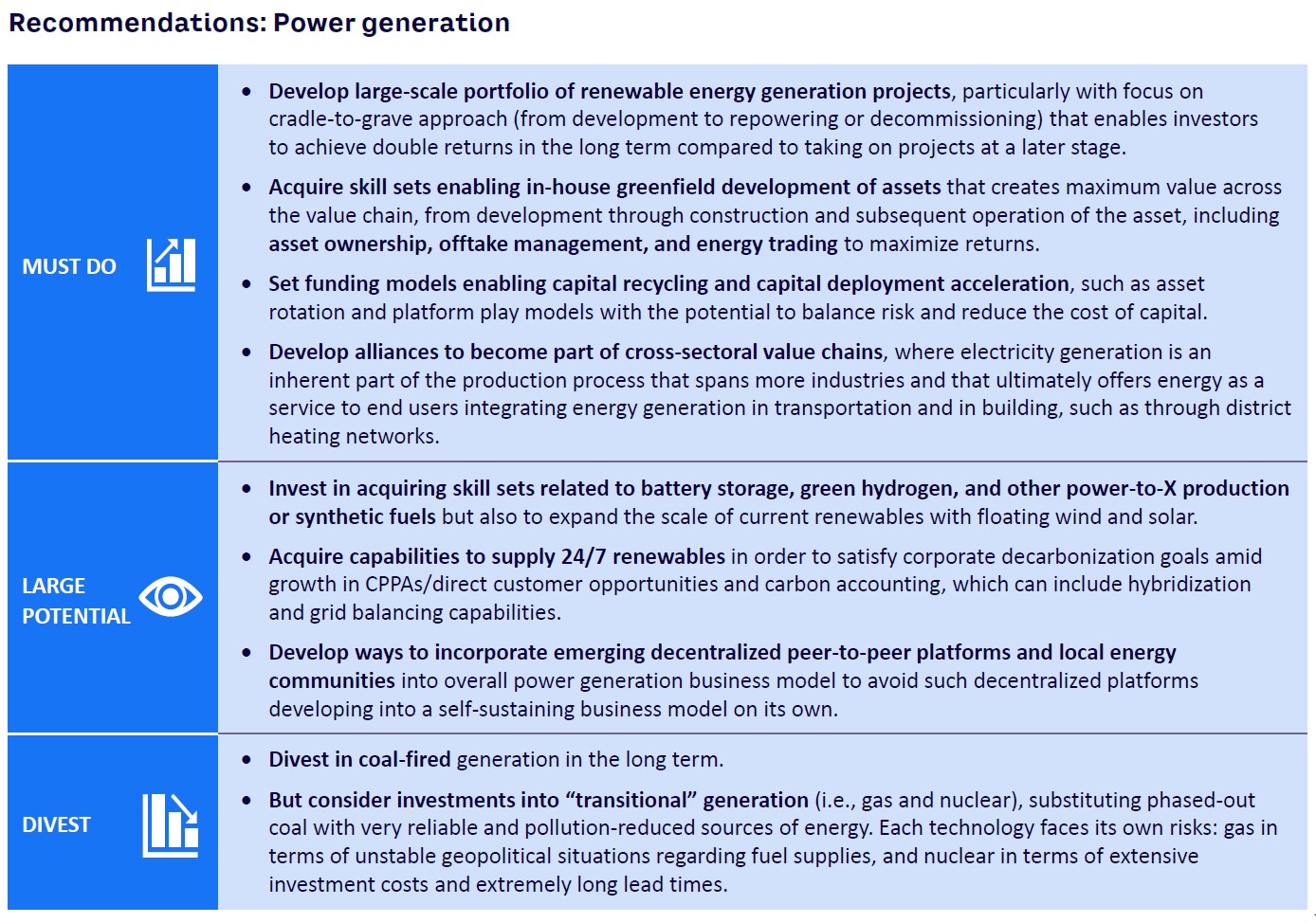

Power Generation: An Industry Reshaped

by Robert Clover and Tomas Dzurilla

The power-generation industry has undergone major changes in recent years driven in large part by new technologies and a growing emphasis on sustainability. These changes have forced incumbents to rethink their previously long-established business model of centralized production.

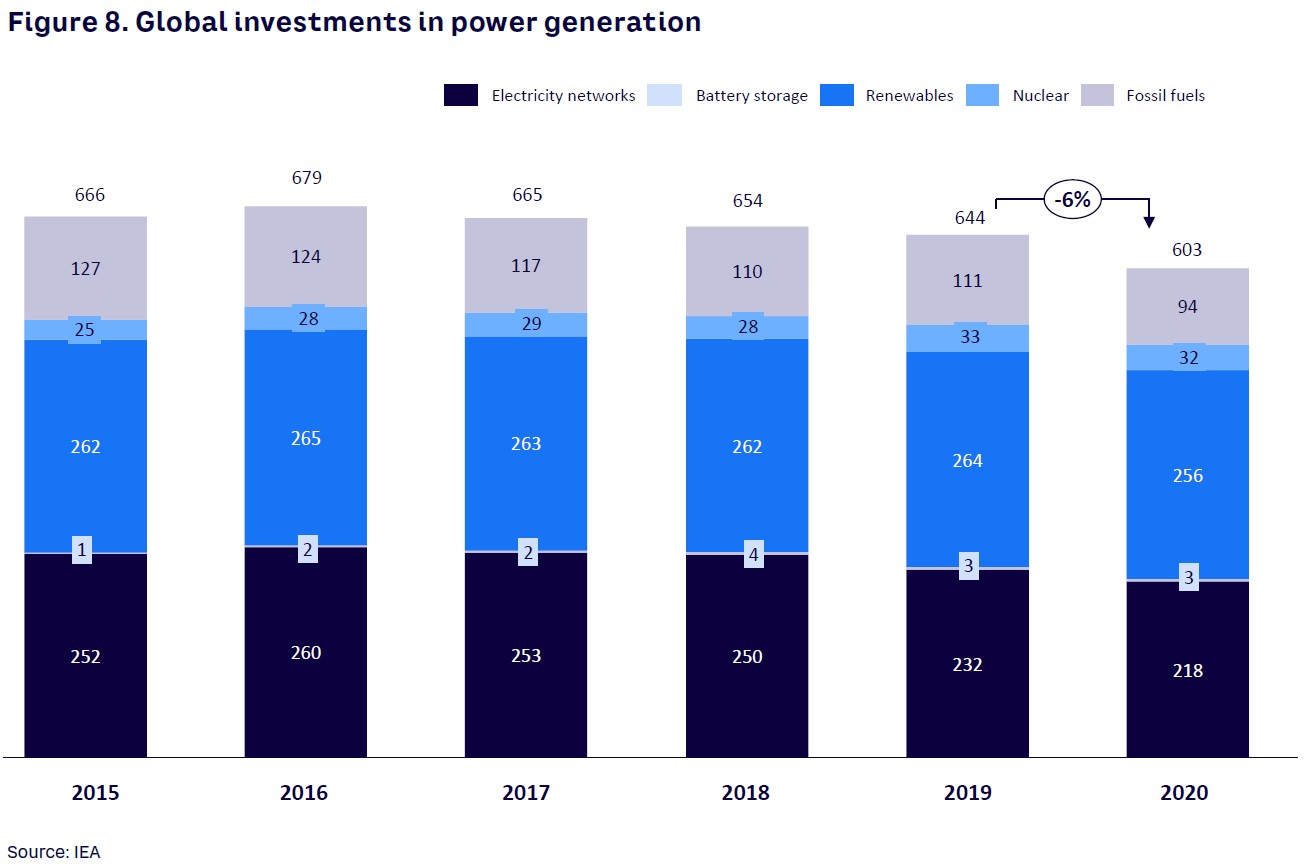

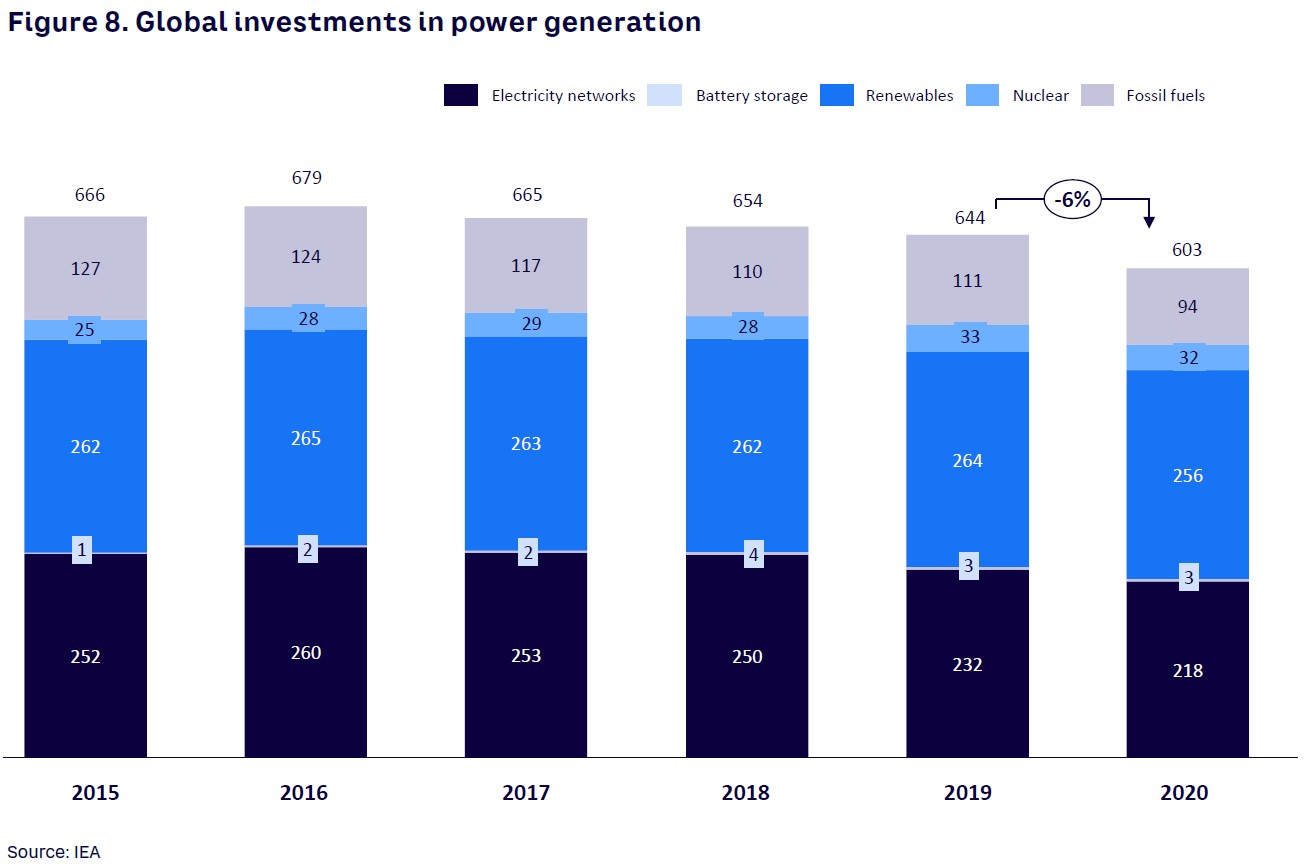

The COVID-19 pandemic has caused a further spasm, with lockdowns leading to a fall in global energy demand. The International Energy Agency (IEA) reports oil to be down by 9%, coal 7%, and electricity 3% — though these figures are projected to climb back to pre-pandemic levels by 2025.

Not surprisingly, this has had a consequent effect on power generation investment globally. So, while in 2019, IEA reported major energy agencies forecasting a slight increase in capital expenditure for the following year, capital flows actually dropped by 20%, the largest fall ever recorded (see Figure 8).

Asset consolidation

In a weak market, energy companies have historically looked to scale up their earnings by vertically integrating the value chain through M&A; this is the reason there have been so many deals around the world since 2016.

And though M&A activity in the energy and utilities sector fell 7% compared to 2019 according to Mergermarket, we do not anticipate the underlying wave to fade away; in fact, we expect quite the opposite. Even if COVID-19 persists for longer than expected, high capital mobility, the ability to take on debt at low rates, and a push from global decarbonization initiatives supported by pledges of carbon neutrality by 2050 by 110 countries will maintain the impetus.

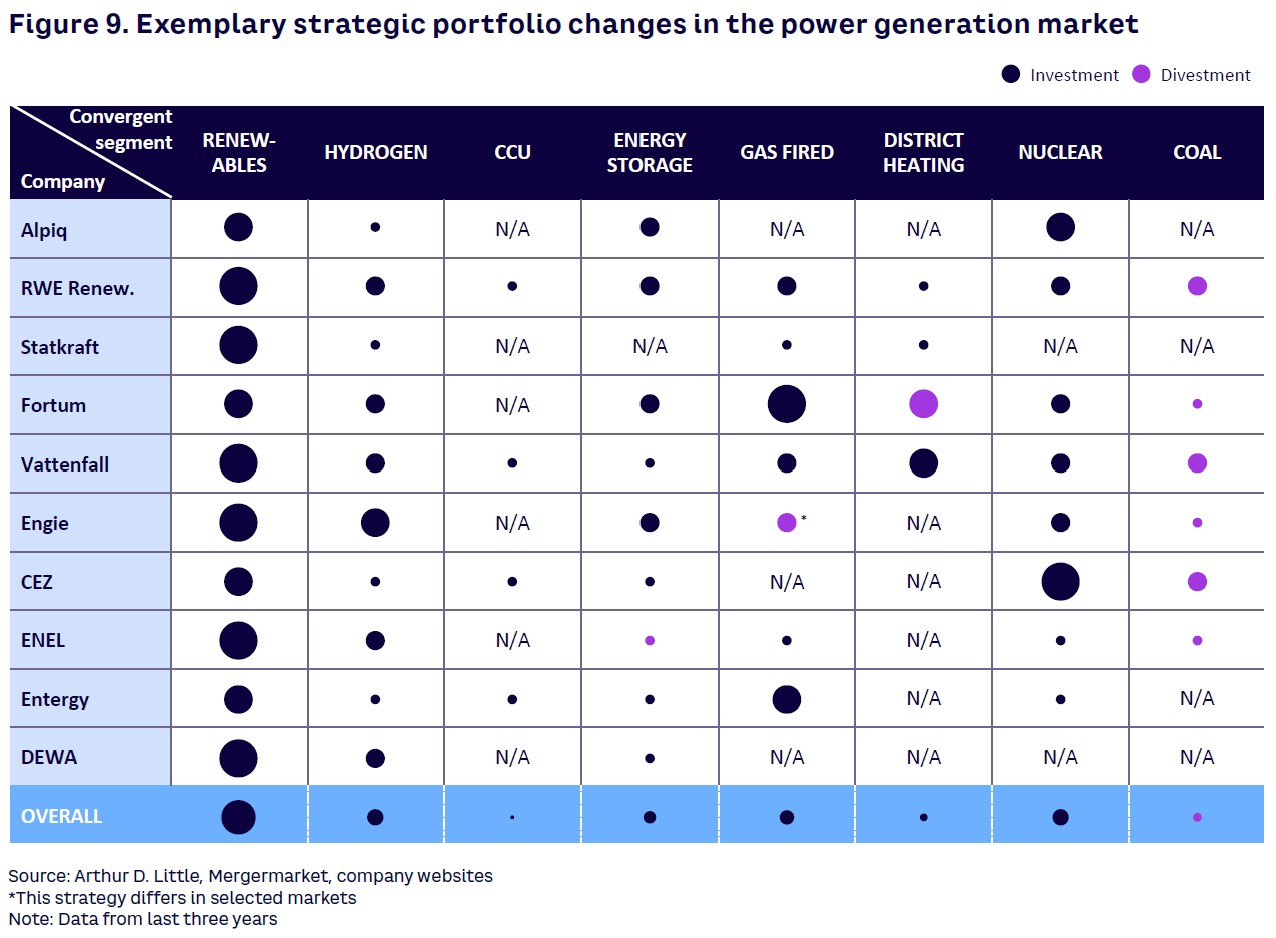

Renewables in the ascendent

Since power production is responsible for over half of global greenhouse gas emissions, regulators and governments are trying to accelerate the sector’s transition to renewable energy production through tariffs and subsidies. So, it is those regulators and governments, along with consumers who increasingly consider sustainability important, that are leading the reshaping of the industry rather than companies themselves. Investors are also playing a strong role, with Bloomberg Green estimating the inflow of funds into ESG funds and green stocks at $350 billion, in other words, doubling over the last two years.

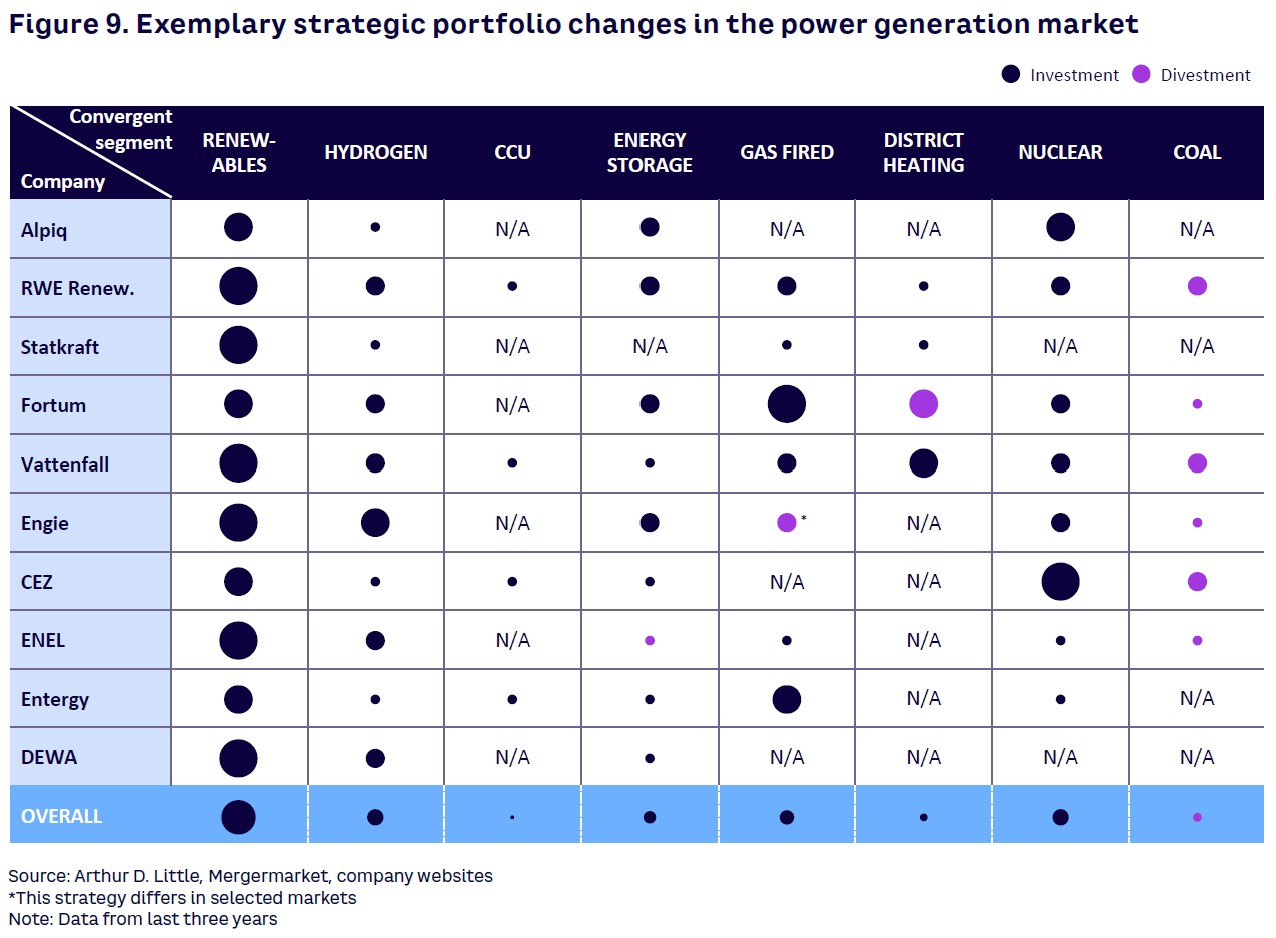

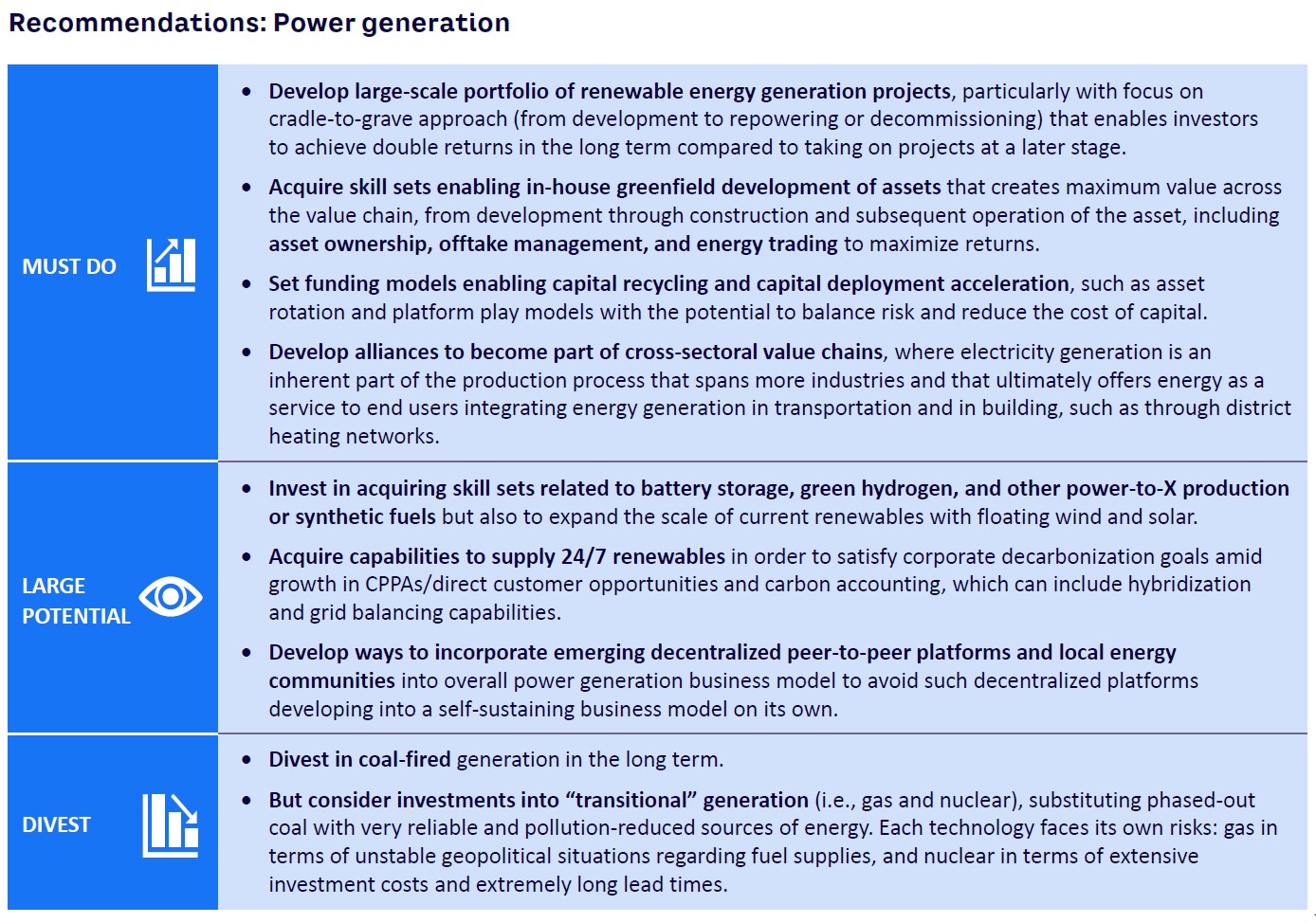

This changing landscape obviously impacts the investment decisions of power-generating companies. The investment focus of some power-generation companies, as illustrated in Figure 9, is on renewables and technologies needed for a stable decarbonized power supply. It is now evident that if they wish to maximize value from an asset across its lifetime, they must take a “cradle to the grave” approach focused on greenfield development if they want to achieve double-digit returns. Taking on projects at a later stage means facing greater competition resulting in lower internal rates of return of just 5%-7%.

Of course, such development is not without its issues, not least of which is the time to delivery — up to 10 years for offshore, at least five for onshore wind, and three for solar PV. There is also the issue of energy storage and the ability to release energy when needed to meet fluctuating demand, an essential component of any reliable green power generation system, particularly when small-scale solar and wind is involved. This is why energy storage technologies are increasingly significant for power generation companies because they give them not just supply flexibility but also the opportunity to diversify into new products like demand response management and microgrids, which then can be offered as “energy as a service.”

Transitional generation sources

To meet the goal of fossil-free power generation, energy companies are investing heavily in solar, wind, and hydro while simultaneously largely divesting themselves of coal-fired power plants. However, this is not a like-for-like substitution given the large upfront costs of renewables and the inconsistency of their power generation.

So, rather than switching completely to renewables, transitional generation sources like gas and nuclear can have a part to play, as they significantly reduce pollution while being a large and reliable source of energy. We see them as the go-to option in the short and medium term and so expect continuing investment in both until at least 2030.

Changing risk profiles

The expansion of clean energy into generation companies’ portfolios is affecting their risk profiles. Their previous commitment to large power plants and stable generation meant spending was skewed heavily toward operating costs but the transition to renewables has shifted this toward capital expenditure, exposing companies to more risk, not just in terms of delivery but also by putting more pressure on balance sheets and forcing them into new areas where they lack specialist skills.

The growing dependency on less reliable renewable energy sources also creates the potential for outages. This all makes the power generation sector a riskier short-term investment, although with a more positive long-term outlook.

A new business model required

The energy production industry’s established business model presumes that increasing demand will generate sufficient revenues to cover operational expenses as well as new investment. However, changing market conditions and priority dispatch (transmission system operators’ obligation to use energy from renewables over that from other sources) show “going green” is the way forward.

Energy without sustainability is now just a commodity, which is why companies must work ever harder to inject a green element to capture the attention of consumers and investors.

And as new technologies evolve and regulators increasingly push a climate change agenda, incumbent players will need to develop alternative business models. That imperative will become even greater as consumers look to optimize their energy consumption. For some companies, this will entail becoming part of a local “energy community,” where neighbors both produce and share energy, the very opposite of the centralized, capital-intensive model in which power generators and utilities have traditionally invested. New peer-to-peer models are now also emerging using blockchain-powered trading platforms, a business opportunity for those utilities willing and able to become part of them.

Extending the boundaries

So, if they are to stay relevant, electricity generators need to adopt a progressive mindset by acquiring, probably through M&As or partnerships, the specialist skills and competencies needed to capitalize on new opportunities in areas such as “power-to-X.” Here, generated energy is converted into an “energy carrier,” such as hydrogen, methane, or ammonia for distribution and then converted back at its destination.

Electricity generators must also recognize they are now part of an ever-expanding value chain that stretches across industries. The Carbon2ProductAustria project announced between Verbund, Lafarge, OMV, and Borealis to create renewable-based plastics with fuel as a side product is just one example.

4

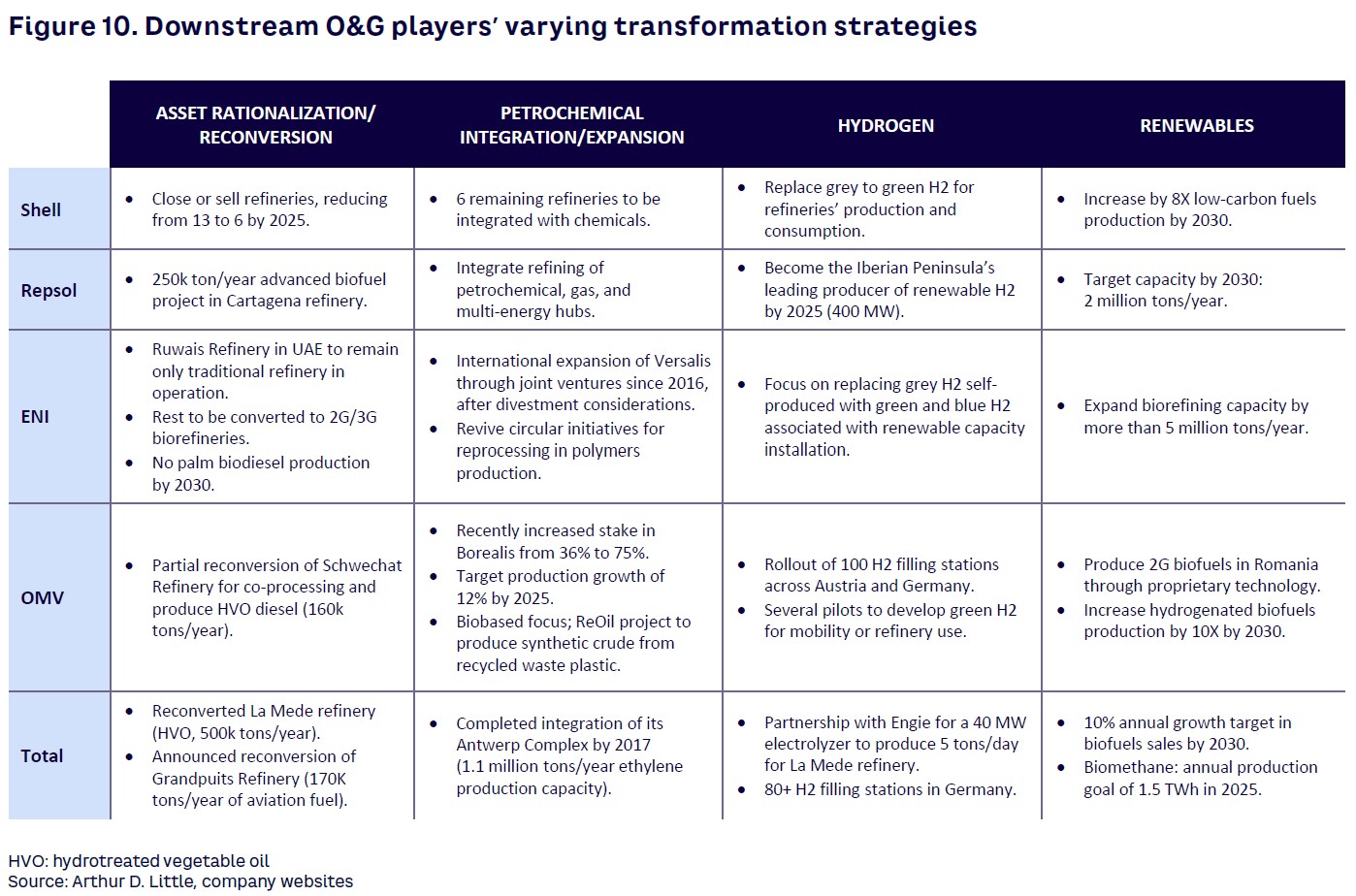

Downstream Oil & Gas: Time to Find a New Way Forward

by Daniel Monzon

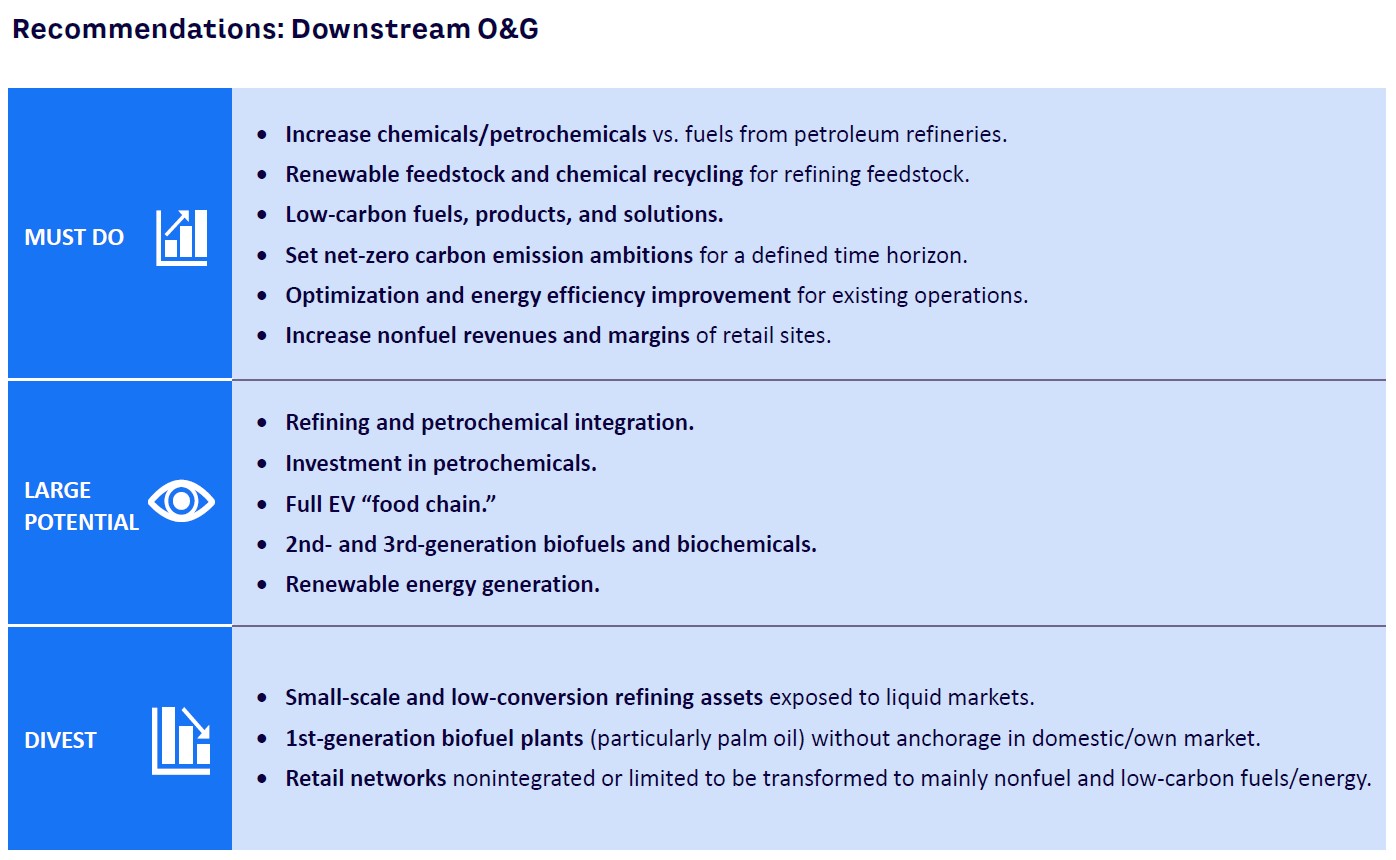

With over 700 refineries and more than 1 million fuel retail sites, the downstream petroleum industry is a highly fragmented and heterogeneous sector in terms of ownership, scale, configuration, and the quality of fuels produced.

Over the last decade, the sector has been challenged by increasingly stringent regulations covering industrial operations and fuel quality. Changes in the quality of available feedstock has also been an issue, as has increasing competition from new energy and feedstock providers, which has led to the loss of some small-scale, low-conversion, and poor-quality refining capacity. With margins historically volatile and highly affected by small changes in worldwide supply and demand balance, new refineries that can produce an even greater percentage of petrochemicals (over 60%) will further increase the challenges for small-scale and poorly configured facilities.

This commercial stress makes it impossible to sustain investment in such operations long term and especially so in a global market where demand for traditional fuels continues to decelerate because of improved engine efficiency and decarbonization regulations arising from greater social awareness about environmental issues and climate change. So, consumer habits and preferences are changing, with more customers wanting lower-emission vehicles and home appliances, for which they are even willing to pay a premium. At the same time is the increase in working from home due to COVID-19, which has fundamentally changed the patterns of domestic energy use.

All of this, of course, is underpinned by the Paris Agreement, which established new targets for emissions and the use of renewable energies, set limits for first-generation biofuels, impacted the sale of ICE vehicles, and restricted crude oil processing.

This context has driven technological innovation that enables, for instance, the manufacture of alternative powertrains and more energy-dense batteries.

At the same time, the market for renewable fuels is growing, with a new generation of biofuels now taking a greater percentage of subsidies. With that said, the uptake of traditional biodiesel and bioethanol, for instance, has been limited by regulations to protect land for food production as well as the unwillingness of governments to sustain high subsidies indefinitely. Currently, the limited availability of appropriate technology also means that only a relatively low percentage of bio feedstocks can be processed at petroleum refineries.

Traditional downstream industry, for its part, has sought to maintain a competitive position by scaling up and by changing its product mix more to heavy-to-light conversion, upgrading the quality of fuels produced, and increasing the percentage of chemicals and petrochemicals being manufactured. Given such a backdrop, downstream companies are faced with the prospect of having underutilized assets like refineries, terminals, and pipelines on their hands. To add to their woes, they also have a retail network that’s now too large and inefficiently configured, while lower barriers to entry allow those from other sectors to supply what was historically downstream companies’ transport market.

In a market where oversupply, tight margins, lower demand from transport and industry, and tighter environmental regulation are the new norm, what once worked for downstream players now no longer does and promises only to deliver diminishing returns. In fact, the increasing cost of capital for “dirty” projects and those that increase carbon emissions means that the return on capital employed, or ROCE, for traditional industrial and fuel distribution assets and other investments may now be very low or even negative.

What’s next?

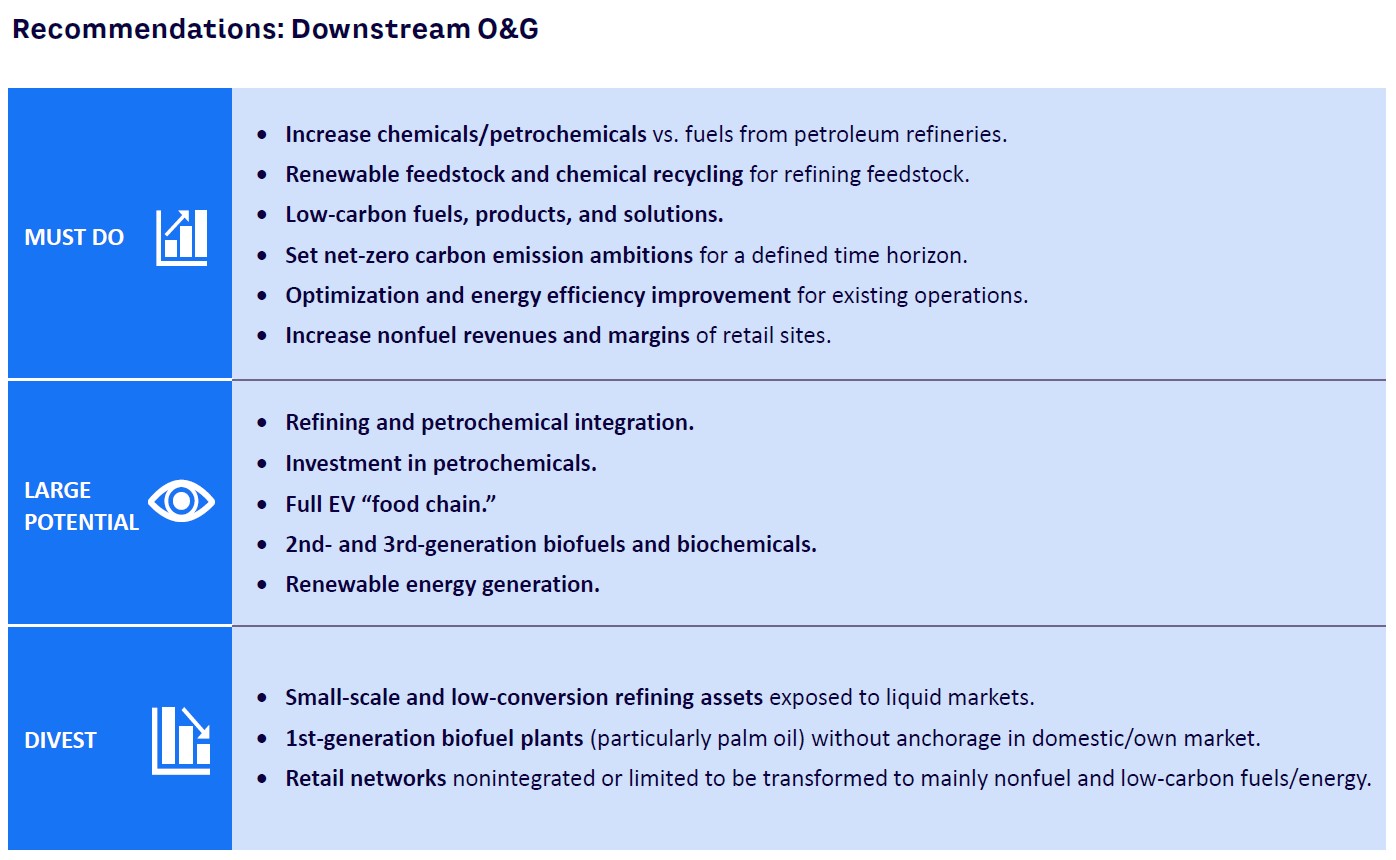

All this means that traditional downstream players must set a realistic time frame for making the investments necessary to improve their asset base and for creating an optimal mix of low-carbon fuels and other petrochemical products.

This will in part require them to make judgments about when certain assets are likely to become stranded and whether it is possible to defend their downstream share of transportation sector energy demand and how this might be done. Questions are also likely to emerge around how to capture value from the EV and alternative fuels value chain, what future model for service stations would allow an organization to maintain its share of driver spend, and who might be potential partners to help to access opportunities and develop a more competitive position during the energy transition.

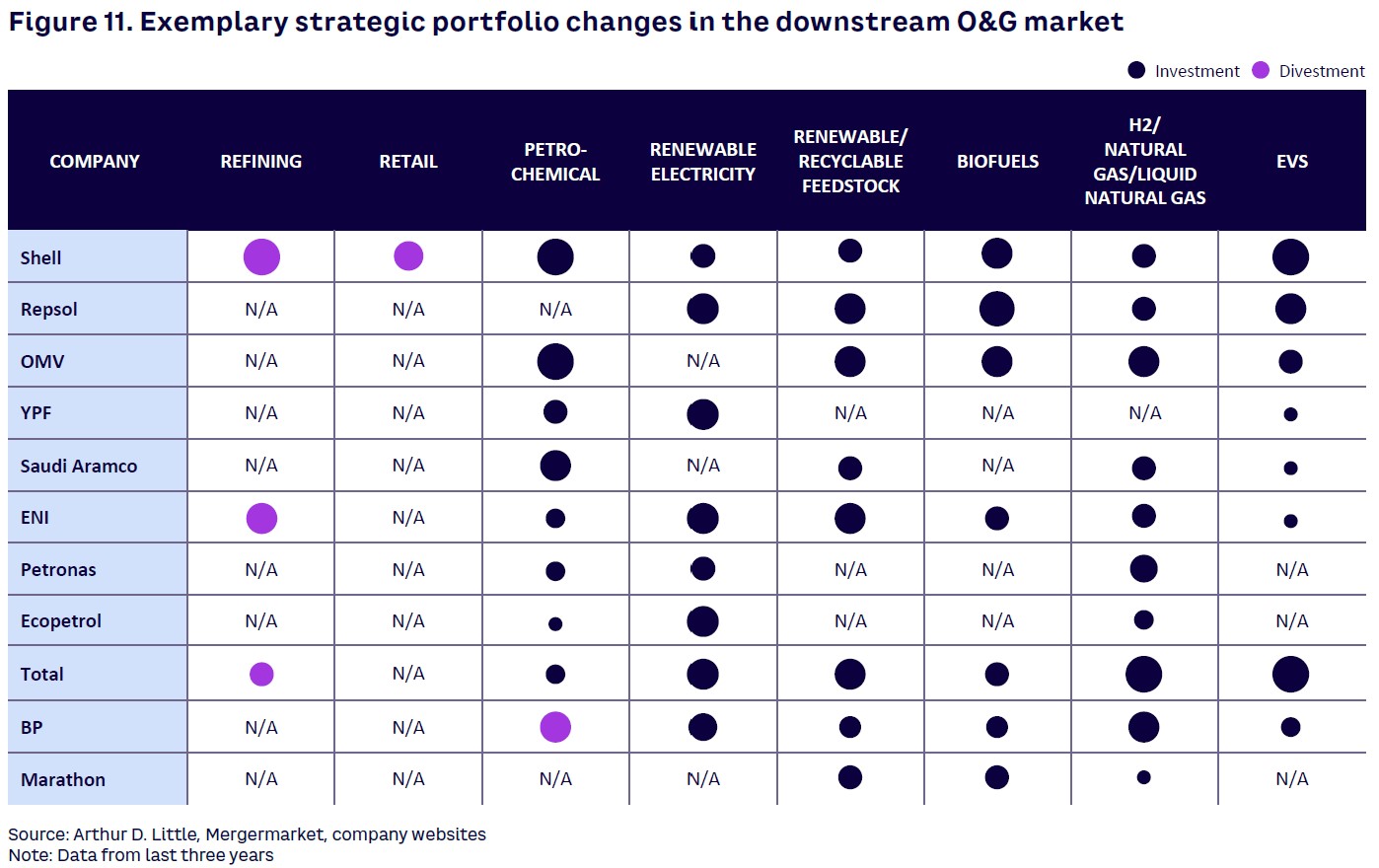

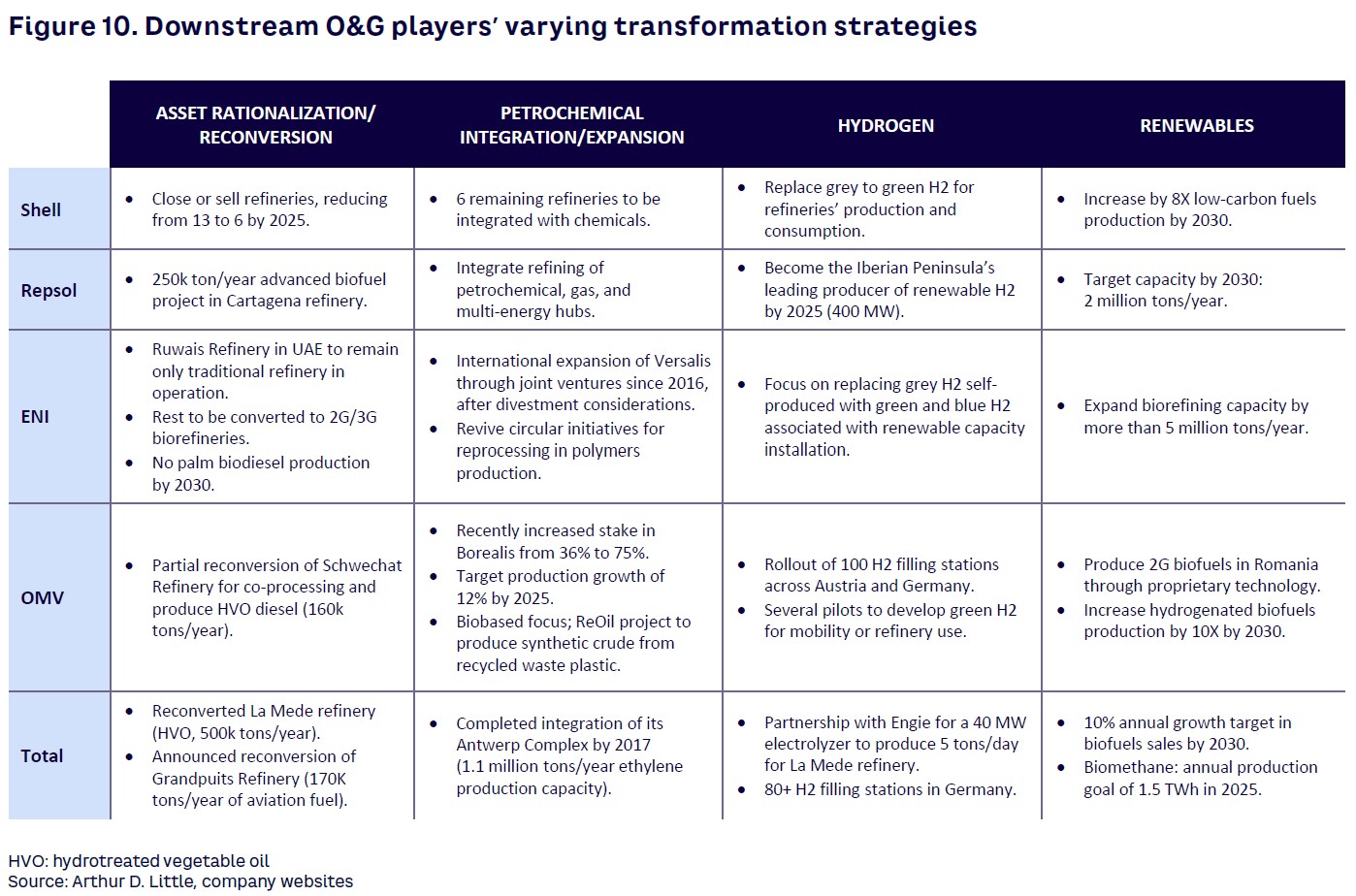

Irrespective of their specific answers to such questions, O&G companies will be faced with a variety of broad options. Accordingly, the major downstream players, as shown in Figure 10, have already begun to adopt different transformation strategies based upon their unique characteristics and what they see as the sector’s future point of arrival.

The best way forward

Which route an O&G company takes will depend on further factors, such as the competitiveness and configuration of their existing downstream assets.

Access to feedstock and resources will also have an impact. For instance, whether a company can benefit from cheap crude oil sourcing or gain privileged access to bio-based feedstocks and renewable resources will be a key determinant of the potential future path.

The size of the inland market and degree to which this can be protected must also be considered, as doing so may require a level of investment that is deemed unacceptable.

The regulatory environment and “green awareness” within different markets will also have a bearing. A “hot” regulatory environment will mean that the transition must be much faster than in a geography where there is less pressure to relinquish hydrocarbon-based fuels.

Companies should also consider the cost of capital since this is a major factor in dictating the profitably of utility-scale renewable business. Developing market operations where the cost of capital might exceed achievable internal rates of return is obviously not a sensible move even if there is good access to natural resources.

The degree of upstream and downstream integration is another possible factor. Possessing refining assets, for instance, might provide some kind of anchor for crude oil assets at risk of being stranded, while midstream and retail assets might give better protection to those exposed to liquid markets and stagnant or declining demand. Similarly, having an existing retail presence is a natural springboard for developing an EV ecosystem, which would in turn lead to better customer data acquisition that could then create further opportunities.

National energy policies and the presence of national oil companies (NOCs) will, of course, exert a considerable influence on the local regulatory landscapes and consequently the pace of energy transition.

And finally, a company’s size will also determine what it should do. Large companies, most notably the majors, will need to make a relatively greater effort to maintain their current consumers’ share-of-wallet. While smaller independent refiners — the mini-majors and niche players that can achieve operational excellence through specialization, for instance — might be able to sustain profitability even under the most aggressive transition scenarios.

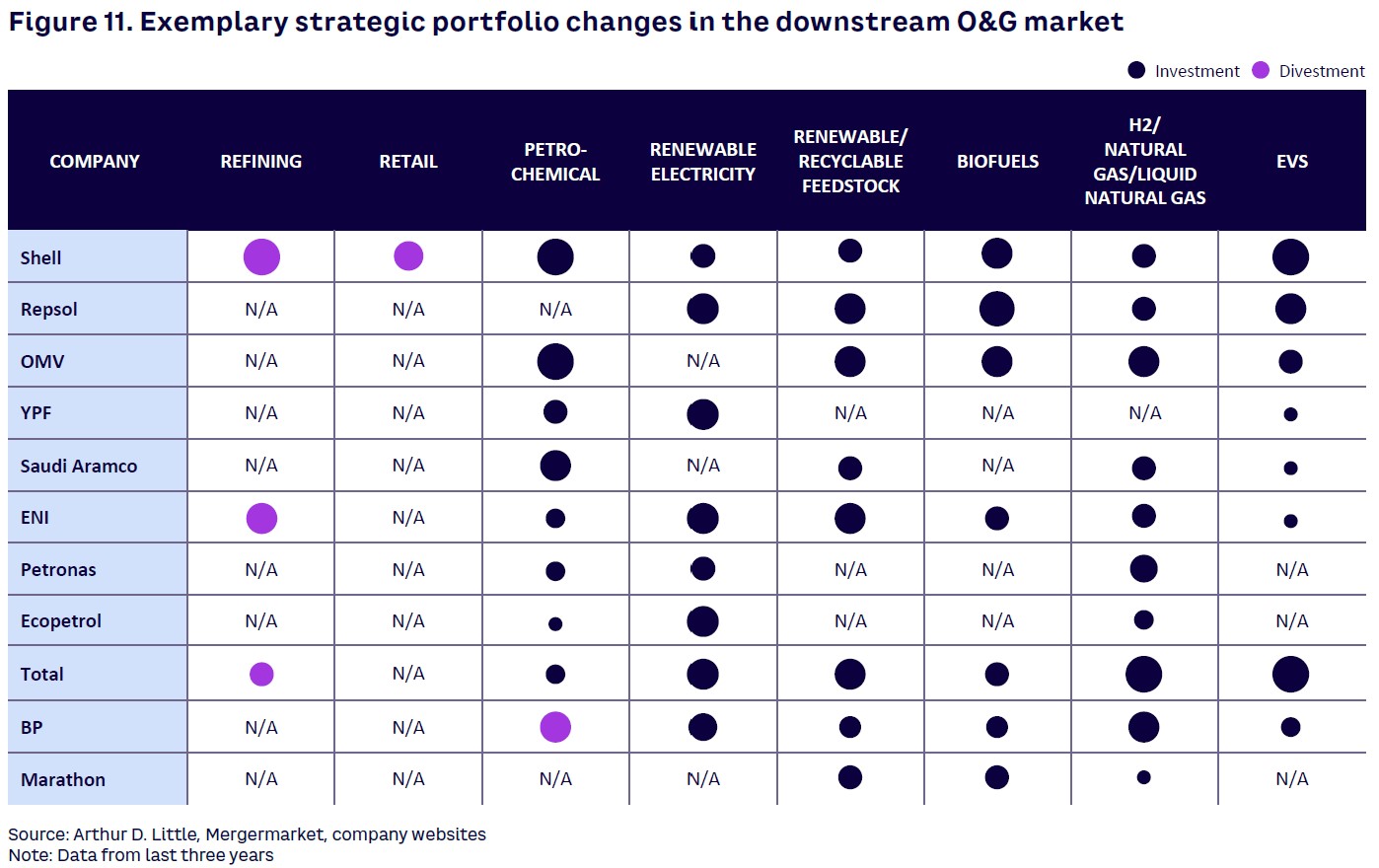

Figure 11 provides an overview of how the factors described above are leading to significant differences in the operational plays of major companies.

Planning a successful reconversion strategy

Doing nothing is not an option for any company wanting to stay relevant in the medium to long term, but timing your move will be the key to success in any reconversion strategy. Overreacting and going too early, for instance, carries the risk of destroying significant value. There is also the fact that embarking on any radical reconversion that in the short term delivers low returns is likely to burn through capital, hit cashflow, and potentially limit access to low-cost capital.

For those companies with a global footprint, the challenge is even greater since they must have in place multiple strategies tailored to the pace of transformation in different regions and business segments. This means a company could be divesting non-competitive European refineries, holding onto resilient assets in the US Gulf Coast (USGC), partially reconverting to biorefineries in California to benefit from state subsidies, while investing in highly competitive petrochemical integrated assets in the Middle East and increasing conversion capacity in Latin American — all at the same time. Navigating such potential complexity requires very sound portfolio assessment, great capital discipline, and a deep understanding of regional markets.

Though refining technology has undergone what can only be called a moderate evolution over the last century, several emerging technologies (particularly those relating to bio-feedstock processing and biofuels production as well as crude oil to chemicals) could soon have a substantial impact on reconversion strategies. So, too, will the increasing digitalization of operations, for which many companies are still struggling to prove the business case.

While the petroleum upstream sector has long used partnerships to mitigate risk and gain access to assets and know-how, this is not something that’s generally part of the downstream mindset. This perspective needs to change because partners will be needed to exploit emerging opportunities. For instance, if biofuels partnered with agri-based players, municipalities, or waste utilities, they would gain access to feedstock access, while an ecosystem of utilities, licensors, traders, transportation, and industrial players will certainly be needed to develop big green and blue hydrogen projects. As for EVs, that will require OEMs, integrators, and mobility services companies to join forces. Even new petrochemical integration initiatives will most likely only happen through partnerships.

5

Upstream Oil & Gas: Finding a Way to the Net-Zero Future

by Trung Ghi, Rodolfo Guzman, and Prakasa Mulyo

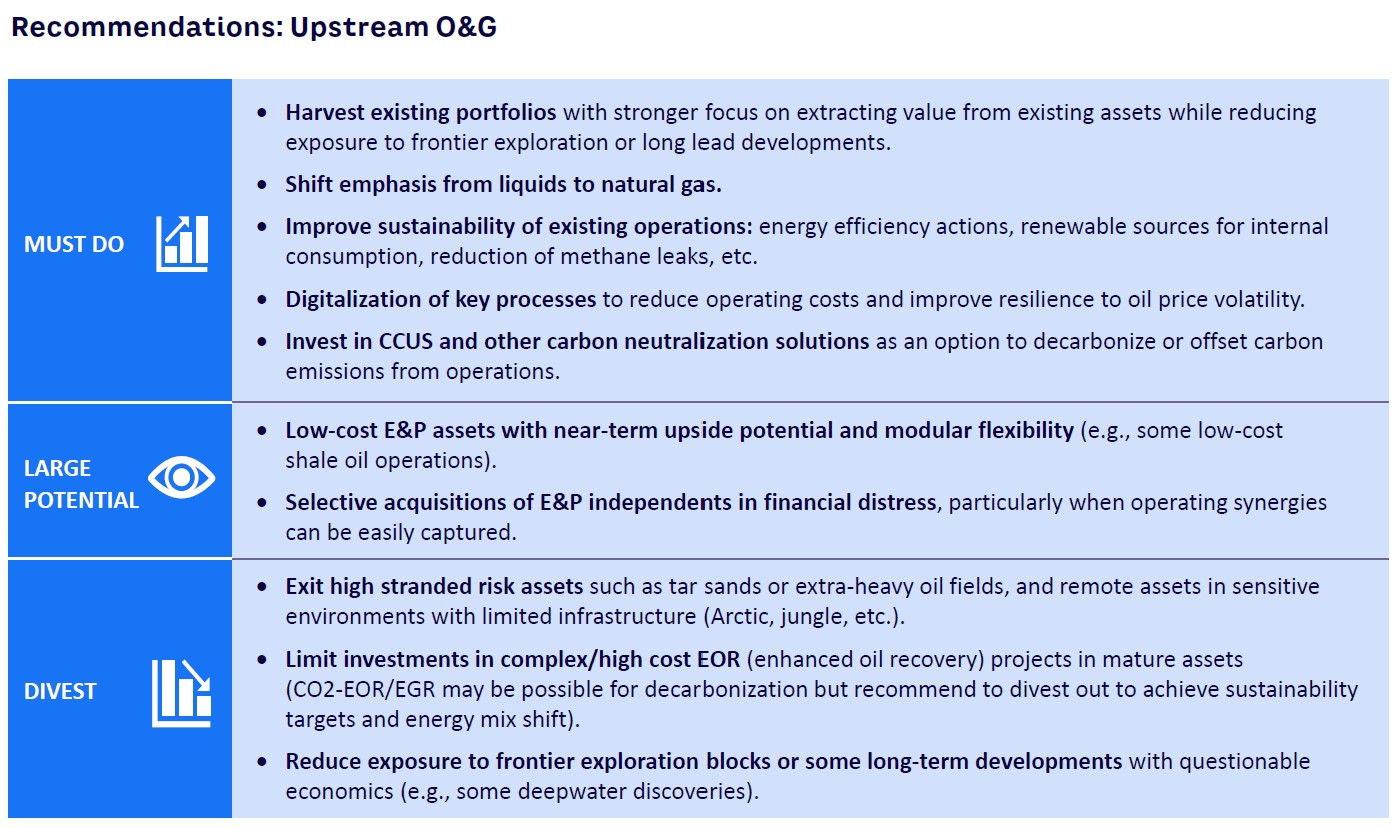

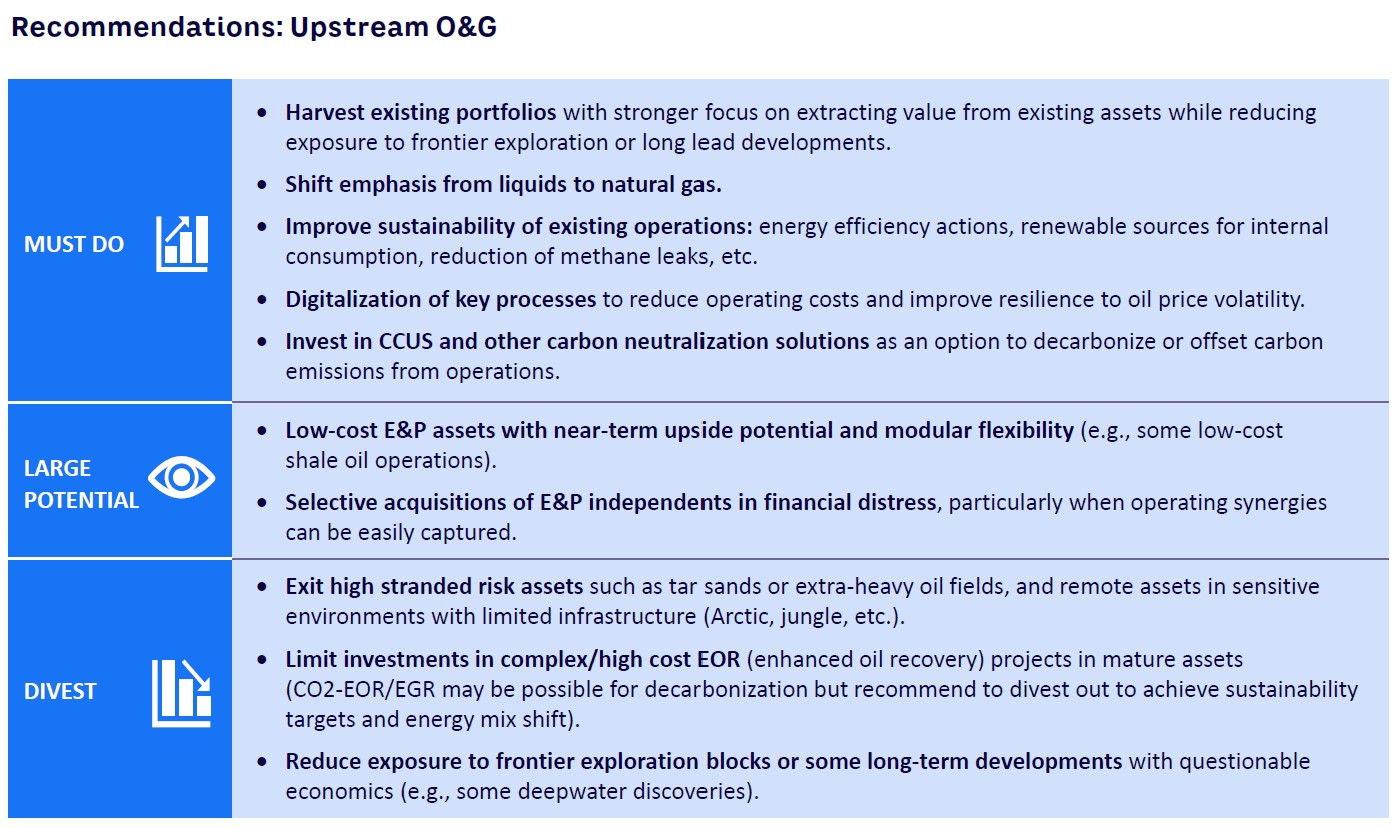

As more and more countries set net-zero targets, the upstream O&G sector will be increasingly impacted by the accelerating pace of energy transition. This will particularly affect those in high carbon-intensive production that will either have to change and conform or risk being left behind.

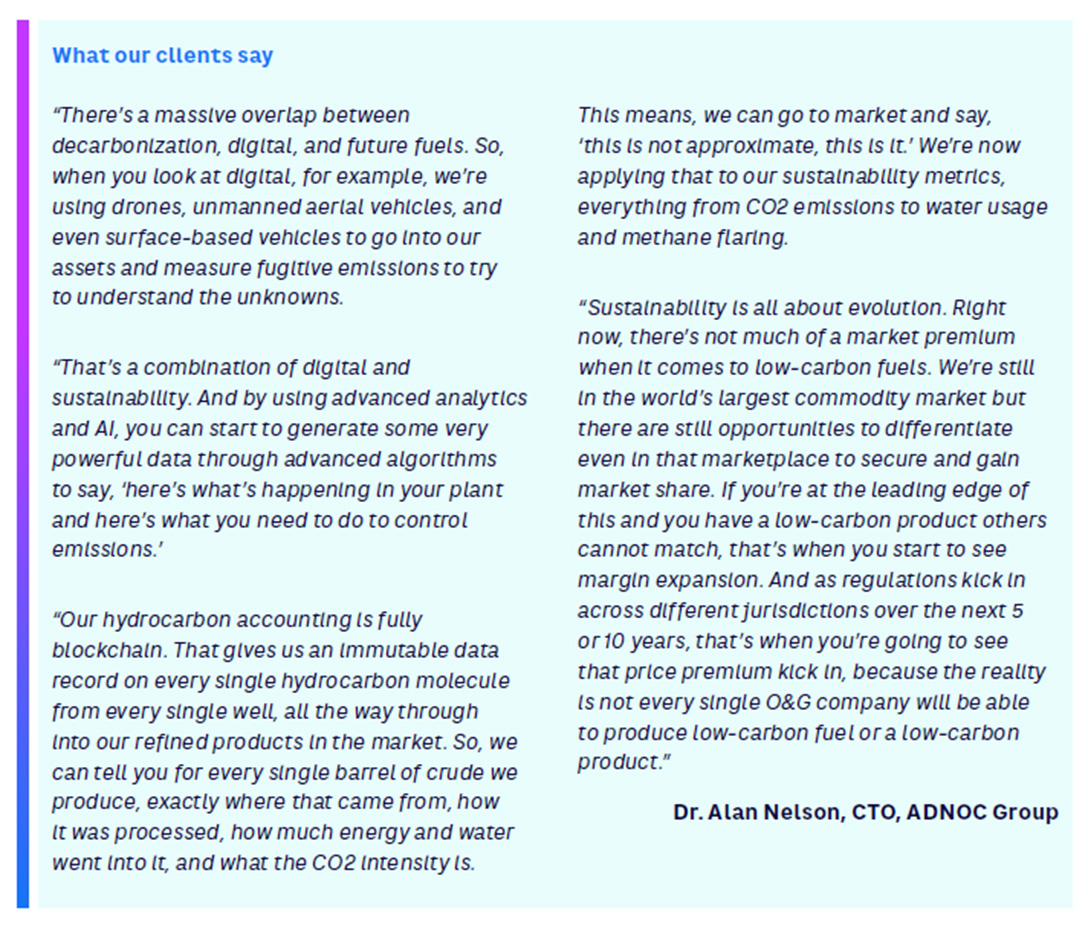

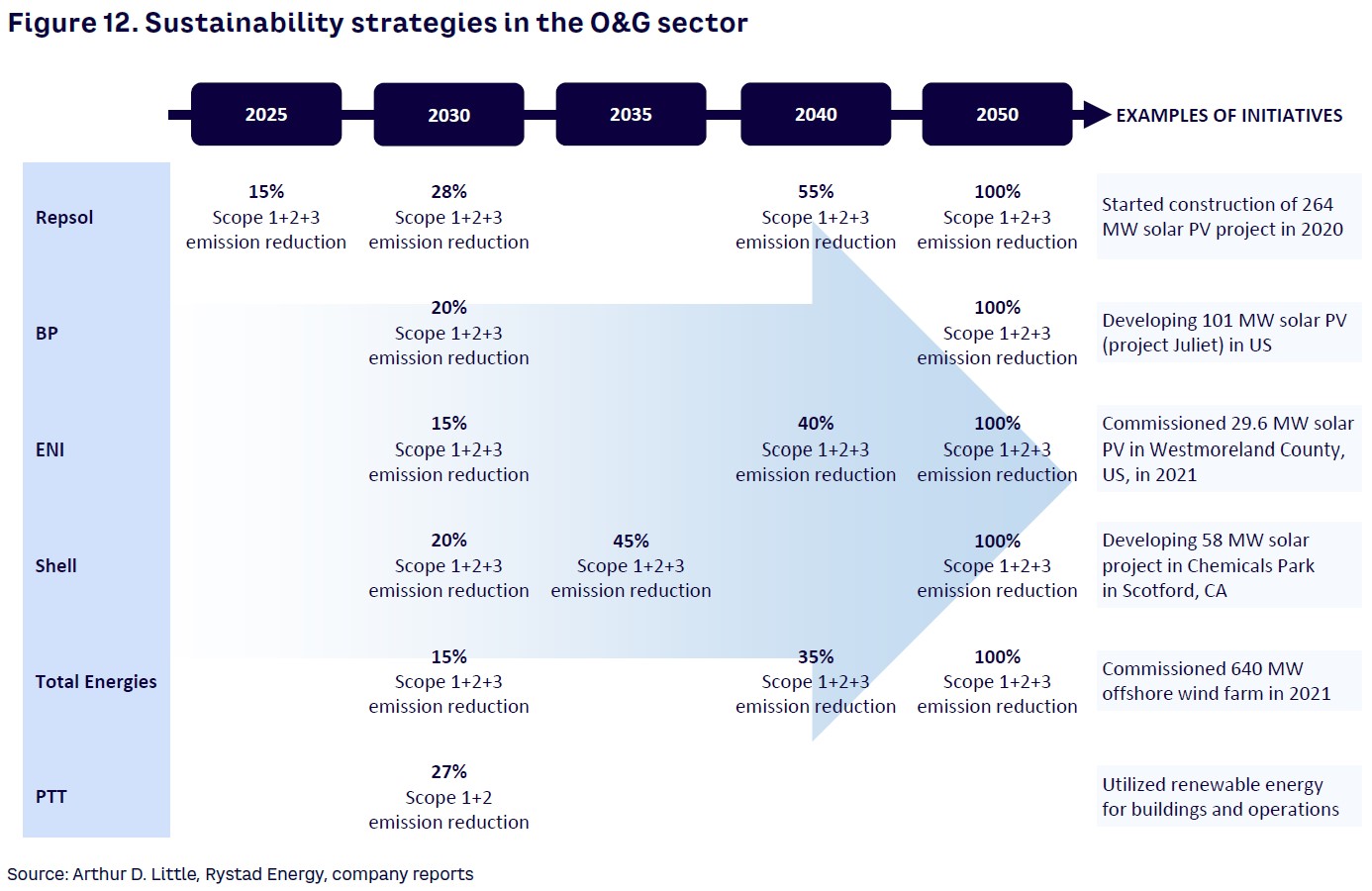

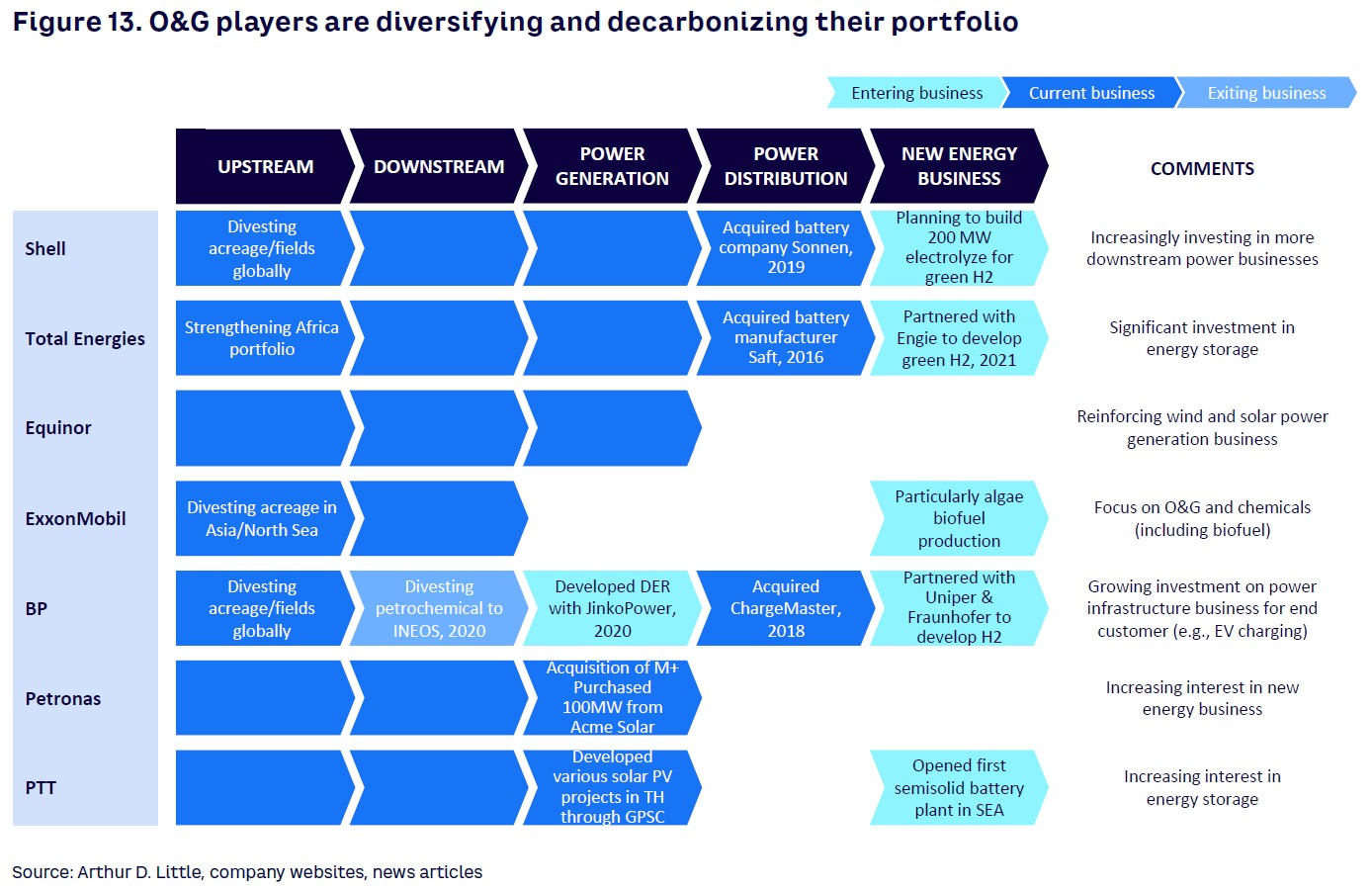

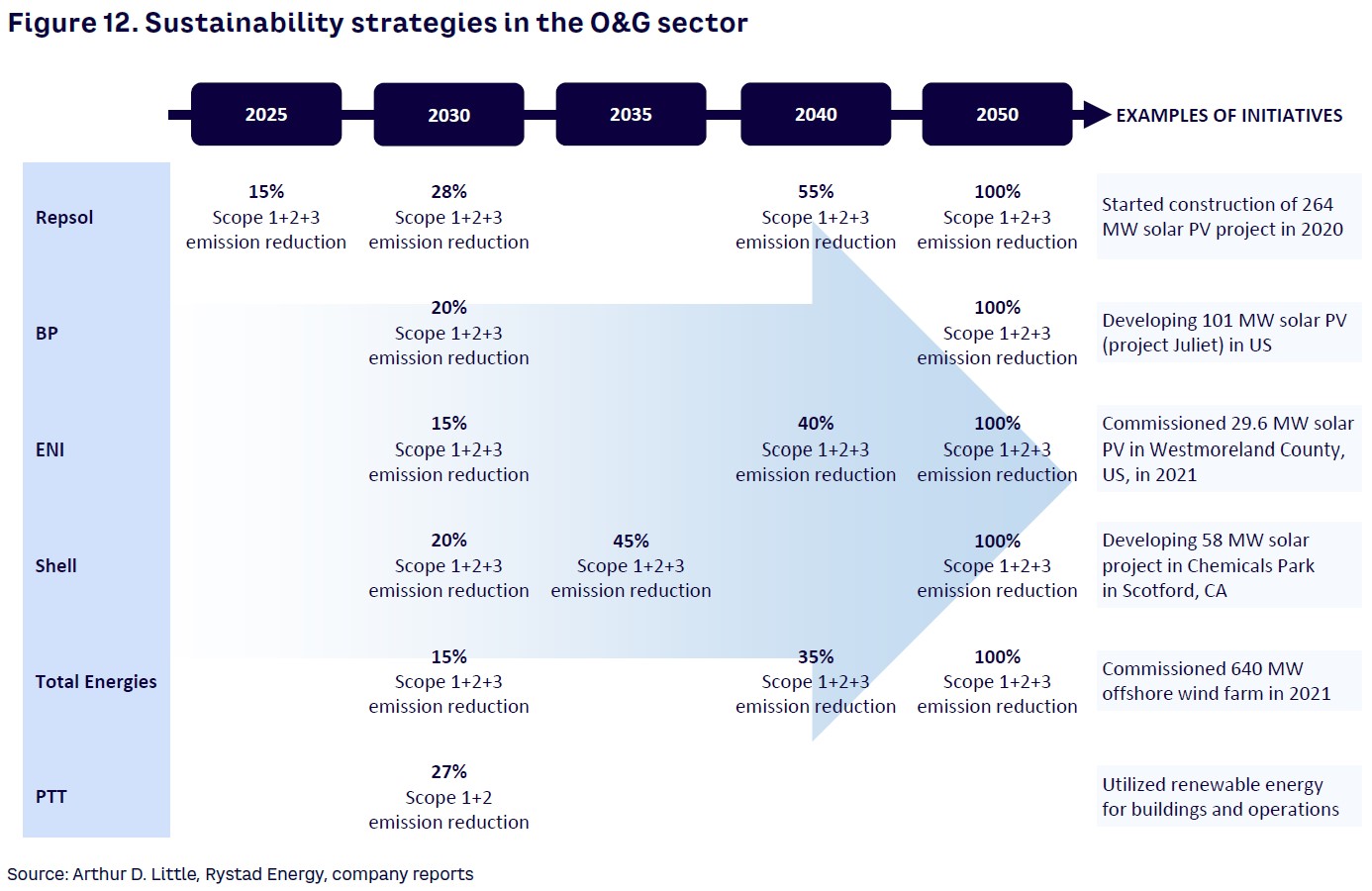

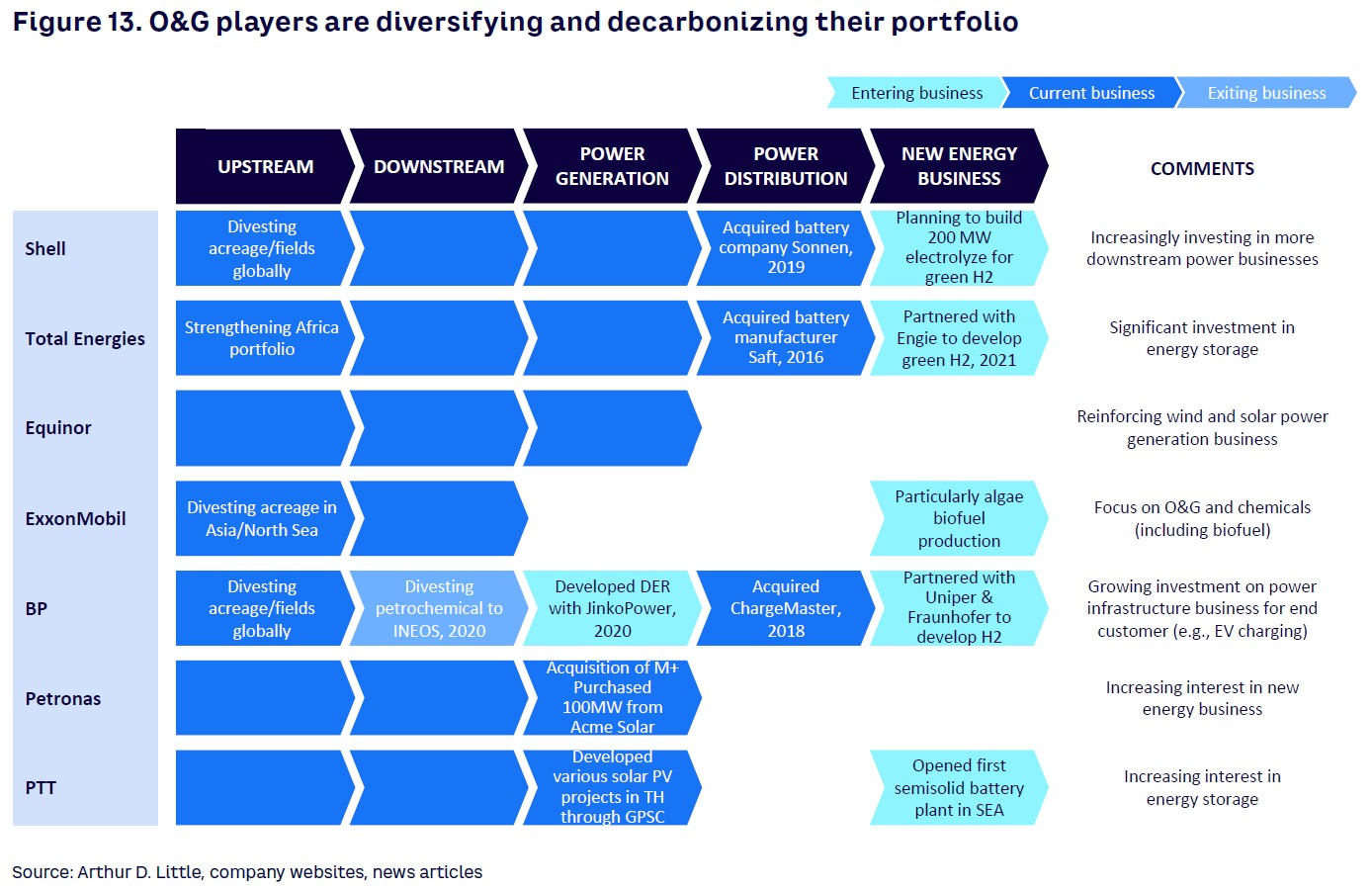

Many O&G companies now regard oil as their least favored portfolio play and consequently are shifting their investment to a more focused gas play and venturing into renewable energy generation, hydrogen, and other alternative energy, as well as EVs (see Figure 12).

Some O&G companies are moving much more aggressively away from hydrocarbons and divesting from countries, regions, and portfolio plays to fund their transition into cleaner and greener energy. BP, for example, is moving out of Oman and Algeria; Exxon plans to exit Malaysia, Europe, and Equatorial Guinea; while Shell is saying goodbye to Mexico, Malaysia, and Egypt.

But others are taking a more gradual approach, maintaining their core production but refocusing on a combination of gas play and carbon capture, use, and storage (CCUS) technologies as seen in companies like Oxy. Those who haven’t yet pursued this route are sure to come under increasing pressure to decarbonize from shareholders who are increasingly losing patience with the sector’s slowness to do so. The value of energy companies on the S&P 500, for instance, is now less than 5% of the total index, well below its 11% of a decade ago.

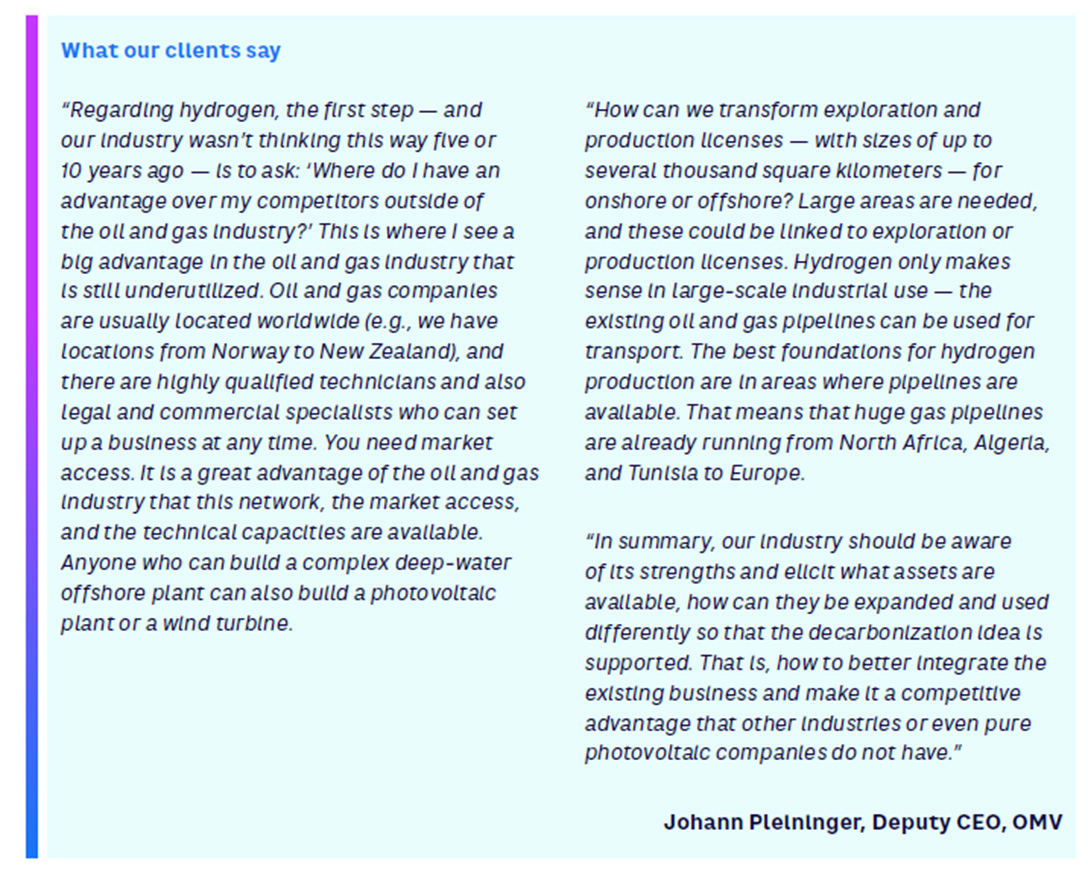

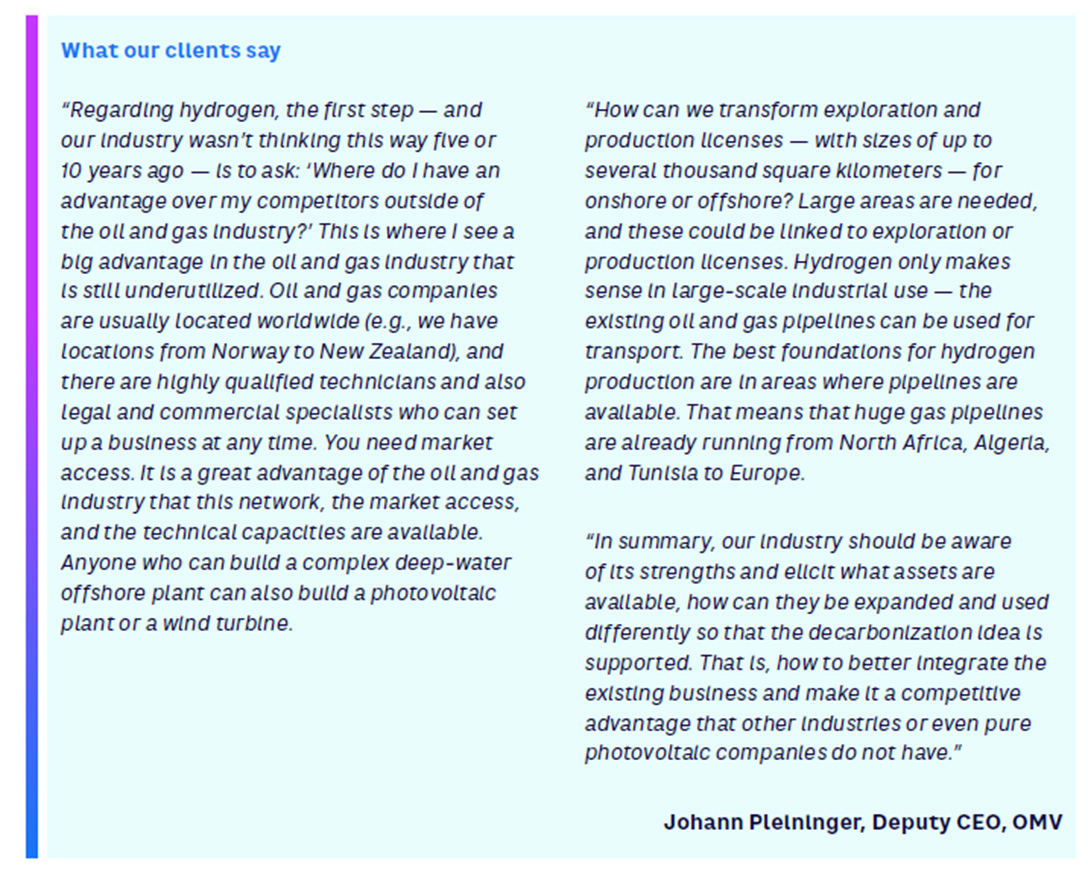

The O&G service sector is quickly adapting to sectoral shifts with players pushing the competitive boundaries in technologies, processes, and know-how. But to be among the success stories of this transformation, those in the service sector along with the O&G companies will need to work more closely than before, leveraging new partnerships and business models to ensure their survival. Looking forward, non-traditional partners will be required, which means anticipating new trends and identifying innovative models. As the industry converges, unlikely partnerships will develop.

Who’s moving?

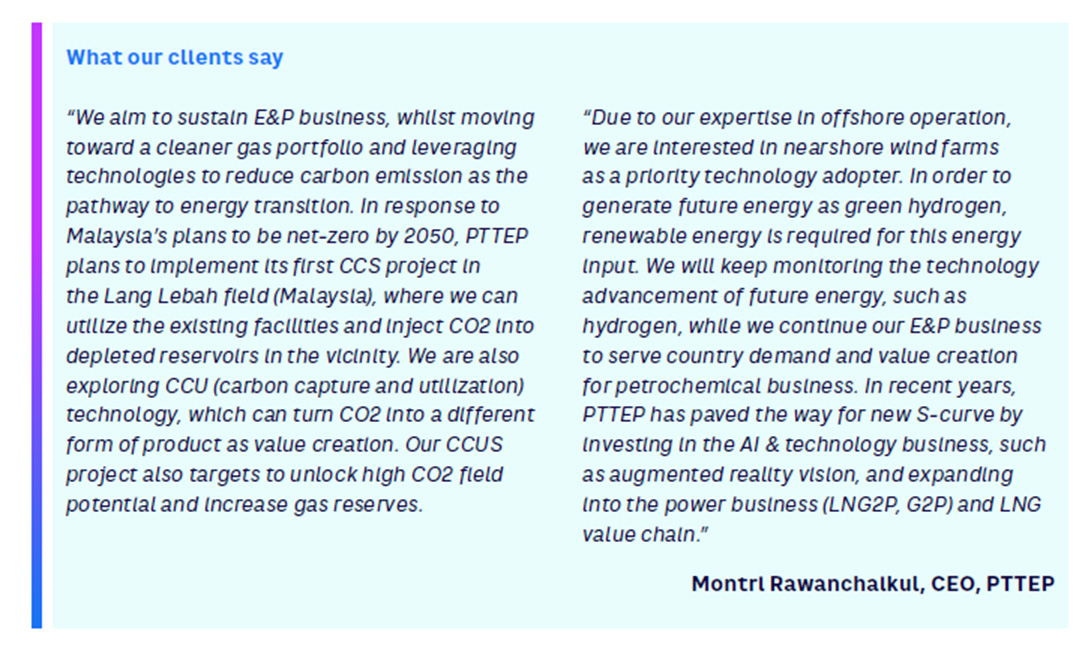

While the majors have the capacity to pursue a net-zero strategy more proactively, the pace of change for NOCs and Independents is determined more by shareholders, governmental agendas, and the need to meet national energy demands (see Figure 13).

Following on from the 2021 UN Climate Change Conference (COP26), many O&G companies are taking steps to accelerate their decarbonization strategy as well as diversifying into clean energy driven by regulators making changes to sustainability goals and targets. So we will see O&G companies adopting distinct decarbonization strategies.

Typically, NOCs and Independents (e.g., Oxy, ConocoPhillips) are focusing more on reducing the carbon footprint of O&G exploration and production operations through initiatives such as carbon capture solutions and integrating renewable energy as part of O&G exploration and production operations. Majors, on the other hand, are putting more attention into diversifying into power generation and expanding new energy businesses.

We are also witnessing the INOCs (international NOCs) taking a broader stance that involves protecting the national agenda of producing O&G with low-carbon techniques and venturing into new energy businesses.

Lockdowns in response to the COVID-19 pandemic significantly reduced demand for oil and gas and led to a reevaluation of exploration and production activity. However, as local demand for oil and gas recovers, this should benefit the upstream sector. M&A activity in Q2 2021, for instance, surpassed 2020 by 70% and has been at the highest level for three years. In fact, about 56% of the deals made in 2021 were in gas portfolios (Source: S&P Global).

Maintaining core business

Given that they are still the major energy source used globally and are relatively cheap, O&G will remain important in the short to medium term for O&G companies as a means to generate cash to fund decarbonization initiatives and provide stability.

Even for those strongly committed to emissions reduction, maintaining core business will be key to strategy with O&G companies focusing on core regions to improve cash flow and limit risk related to hydrocarbon price volatility.

So, while O&G companies will increase investment in decarbonization, oil and gas exploration and production will continue for the next decade. Equinor, for example, which aims to make low-carbon solutions 50% of gross CAPEX, has recently declared its Bay du Nord oil field offshore of Newfoundland as a “key project.” Other O&G companies will continue to review and update their core portfolios to ensure their relevancy to company goals.

As in the power generation sector, O&G companies will implement innovative and digital decarbonization techniques while simultaneously moving their core business forward at a slower pace. But the core business will remain a “cash generator” for the next few decades, especially if they can introduce new operational efficiencies.

Major O&G companies are starting to put low-carbon CAPEX plans in place. During 2020, independent oil companies like Total and Repsol signaled their global net-zero ambitions by increasing their CAPEX on low-carbon initiatives to 5%, according to company reports. But while O&G companies like them will need to revisit their portfolios to fund such moves, it doesn’t mean that they will be abandoning their core business in the pursuit of net-zero any time soon.

6

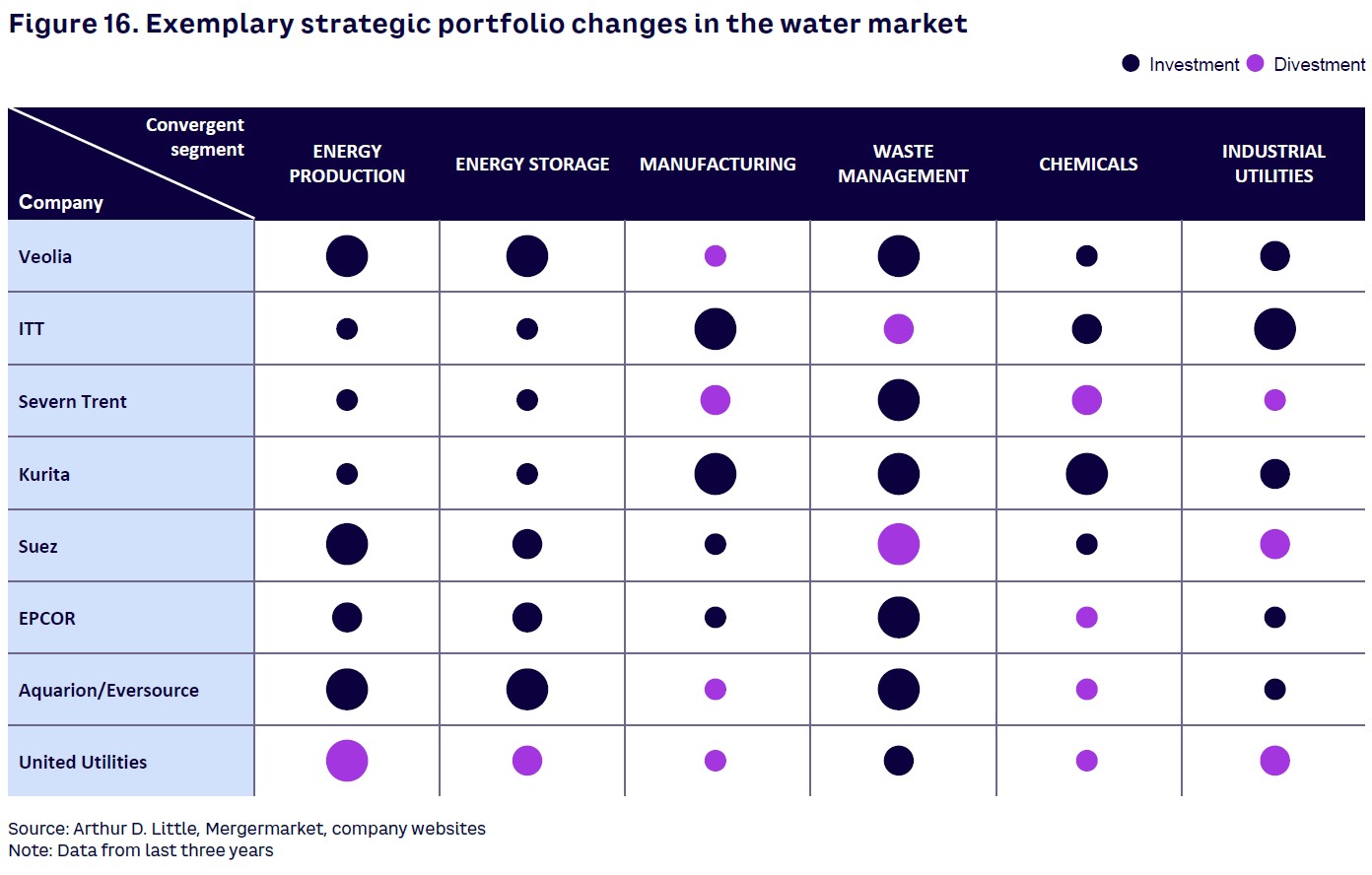

Waste: Opportunities Too Good to Waste

by Carlo Stella, Chiara Loreti, Martijn Eikelenboom, Louay Saleh, Yves Takchi, and Sally Menassa

The world is producing more waste than ever before. The World Bank estimates we will be generating 2.6 billion tons of municipal solid waste a year by 2030, and 3.4 billion tons two decades later.

This vast mountain of material must be properly managed and disposed of to minimize not just the leakage of toxins from it, but also the emission of greenhouse gases. These are significant as they account for more than 80% of what the Amazonian rainforest can absorb in a year, according to IEA.

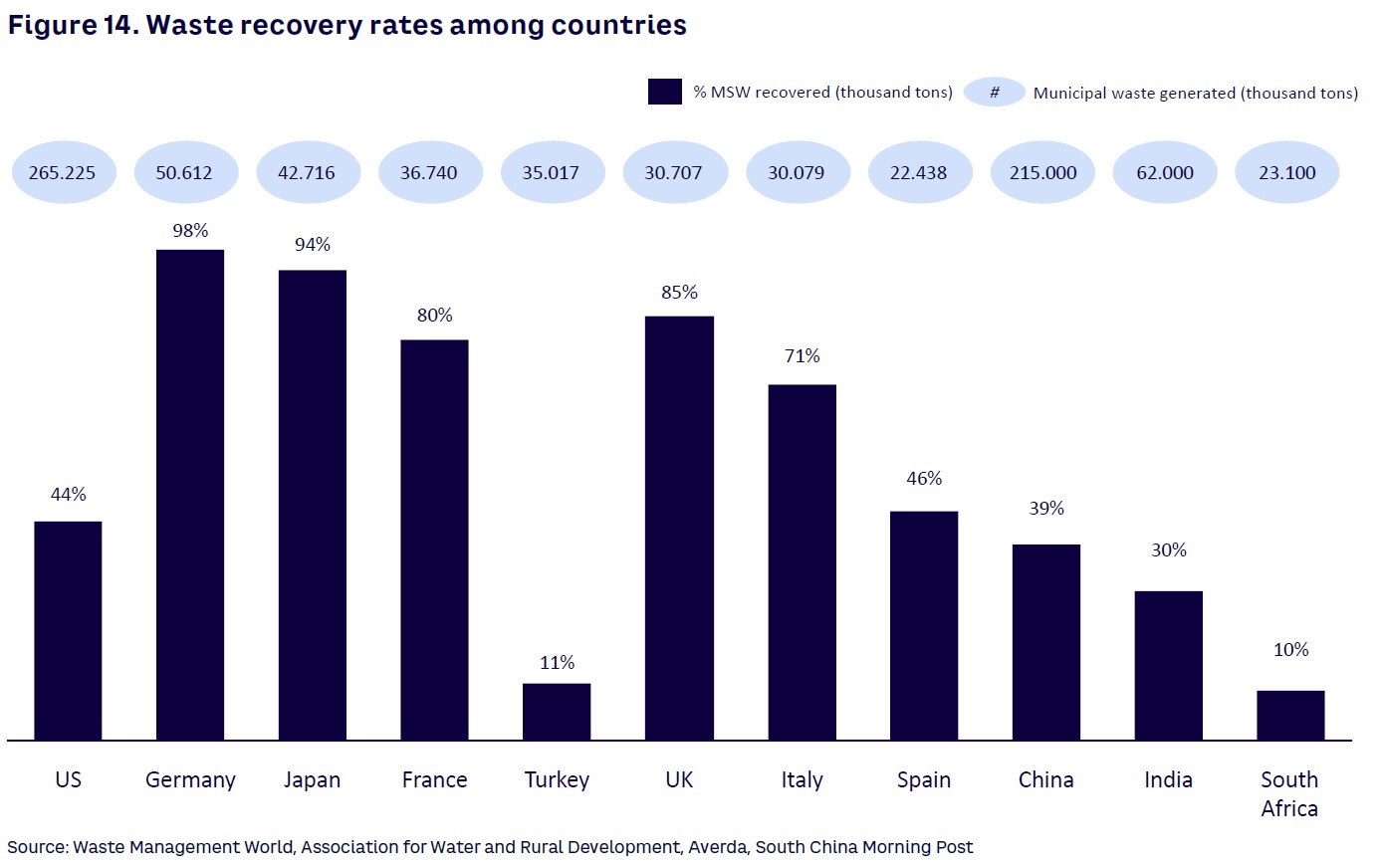

Continuing economic growth and unsound disposal methods will only lead to an increase of CO2 equivalent emissions. This means that to meet the Paris Agreement’s ambition of curbing emissions by 7.6% a year through to 2030, the global waste sector must collectively develop and adopt ever more sustainable practices and innovative technologies. Inevitably, some countries are making better progress than others.

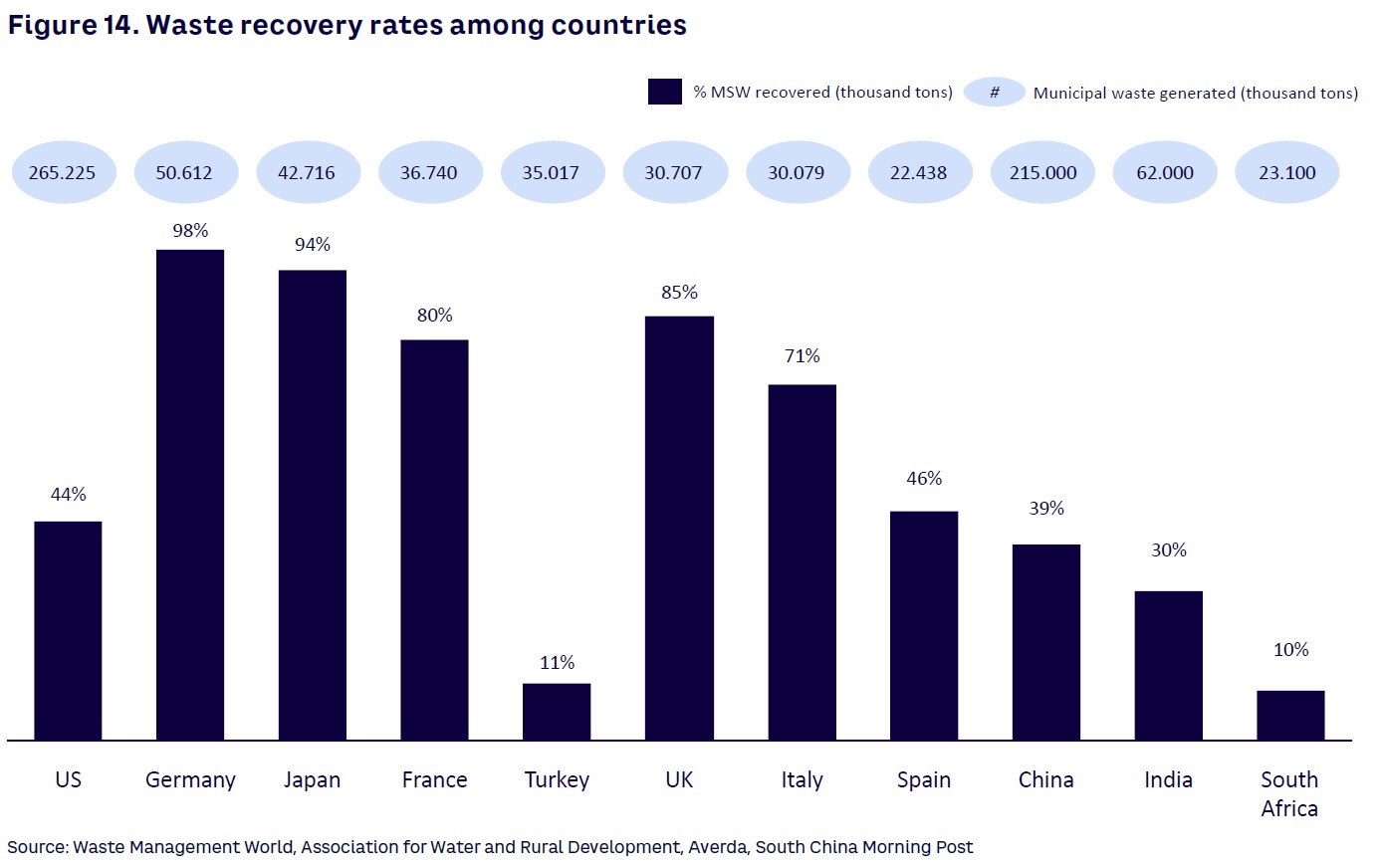

So, while some Organisation for Economic Co-operation and Development (OECD) countries have managed to recover or divert from landfill 94% or more of their waste, others, like China, India, and South Africa, are far from such a figure. Even the US, one of the world’s richest countries in terms of GDP, is failing to make significant inroads into the effective management of its waste.

As shown in Figure 14, there is a wide variation in waste recovery rates among countries. Better-performing nations tend to use a wide range of recovery methods and have a far greater number of recycling, waste treatment, and waste-to-energy (WtE) plants in relation to the size of the country and its population.

Putting the circular economy at the center of things

Encouraging a “circular economy” where existing materials and products are reused, refurbished, repaired, and recycled to extend their life as much as possible in line with the waste hierarchy, requires the creation of effective enablers.

Financial mechanisms such as deposit refund systems, financial grants, tax cuts, and discounts have all been successful in changing people’s “waste behavior” in line with the “polluter pays” concept, which passes the cost of managing waste on to those who generate it.

Extended producer responsibility (EPR) schemes that place the onus on producers and importers to ensure the safe and effective final disposal of what they introduce into the markets, have become popular and have been applied to a wide range of products. In Europe, for example, this concept has been mandated in the context of the Waste from Electrical and Electronic Equipment, Batteries, End of Life Vehicles directives and indirectly in the Packaging Directive. Additional waste streams are dealt with under an EPR scheme within the European Union or in some of its member states. Items covered under such schemes include tires, waste oil, paper and card, construction and demolition waste, farm plastics, medicines and medical waste, plastic bags, photo-chemicals and chemicals, newspapers, refrigerants, pesticides and herbicides, and lamps, light bulbs, and electrical fittings.

Greening waste collection

While waste management is key to reducing overall carbon emissions, finding ways to diminish the impact of the activities themselves along the value chain is becoming increasingly important. The pursuit of new solutions is leading to more technological innovation, such as “electrification as a service,” which is being offered to waste haulers in the US.

We are also seeing a widespread switch to more cleantech vehicles. At the start of 2021, the City of London Corporation and Veolia unveiled their electric Refuse Collection Vehicle (eRCV). Powered by recyclable lithium-ion batteries, these vehicles are the first step in the creation of a zero-emission fleet. Similarly in the Middle East, UAE-based waste management company Bee’ah has ordered 50 Tesla Semis, all-electric trucks it will use for waste and recovered material transportation.

In Germany, the city of Freiburg expects about two-thirds of its waste collection fleet will be hydrogen powered by 2023, according to TheMayor.EU.

Also, Wuppertal in Germany is generating green hydrogen by using electricity from municipal waste incineration plant to power a fleet of fuel cell electric buses (FCEBs), while in Japan, a waste-to-hydrogen facility has opened in Tokyo.

This is part of a growing interest in hydrogen by the waste sector.

New technology helps push recycling’s boundaries

Waste management companies are also looking to digitalize their operations using Internet of Things (IoT) technology and GPS connectivity. In Prague, for instance, municipal services are piloting smart technology that will automate the collection of waste from 130,000 bins in the city. And Australia has a real-time waste monitoring system where bins send an alert when they are full that tells an autonomous truck to come and empty them.

Robotics and AI are also being employed to sort and recycle waste as with the AI-powered ZenRobotics Recycler, which can pick wood, stone, and metal from the construction waste stream, and the AMP Robotics’ Dual-Robot Recycling System that plucks plastics, paper, cartons, electronics waste, and mixed metals from municipal waste.

On UK landfill sites, SUEZ waste management is also now using drones to collect data, much faster and safer than sending staff to do time-consuming on-site surveys. And in Australia and the UAE, capped landfill sites are also being seen as good places for solar installations, transforming what would otherwise be unusable ground into a significant source of power generation.

Turning waste into a usable resource often depends on new technology. So, while it makes sense to recycle plastic because this uses significantly less energy than making from new, traditional reprocessing methods generally can’t create complex consumer plastics that could contain over 20 different resins. However, innovative systems like SUEZ’s Plast’lab now make it possible to manufacture bespoke recycled plastics to meet the market’s needs for specific characteristics like heat and impact resistance.

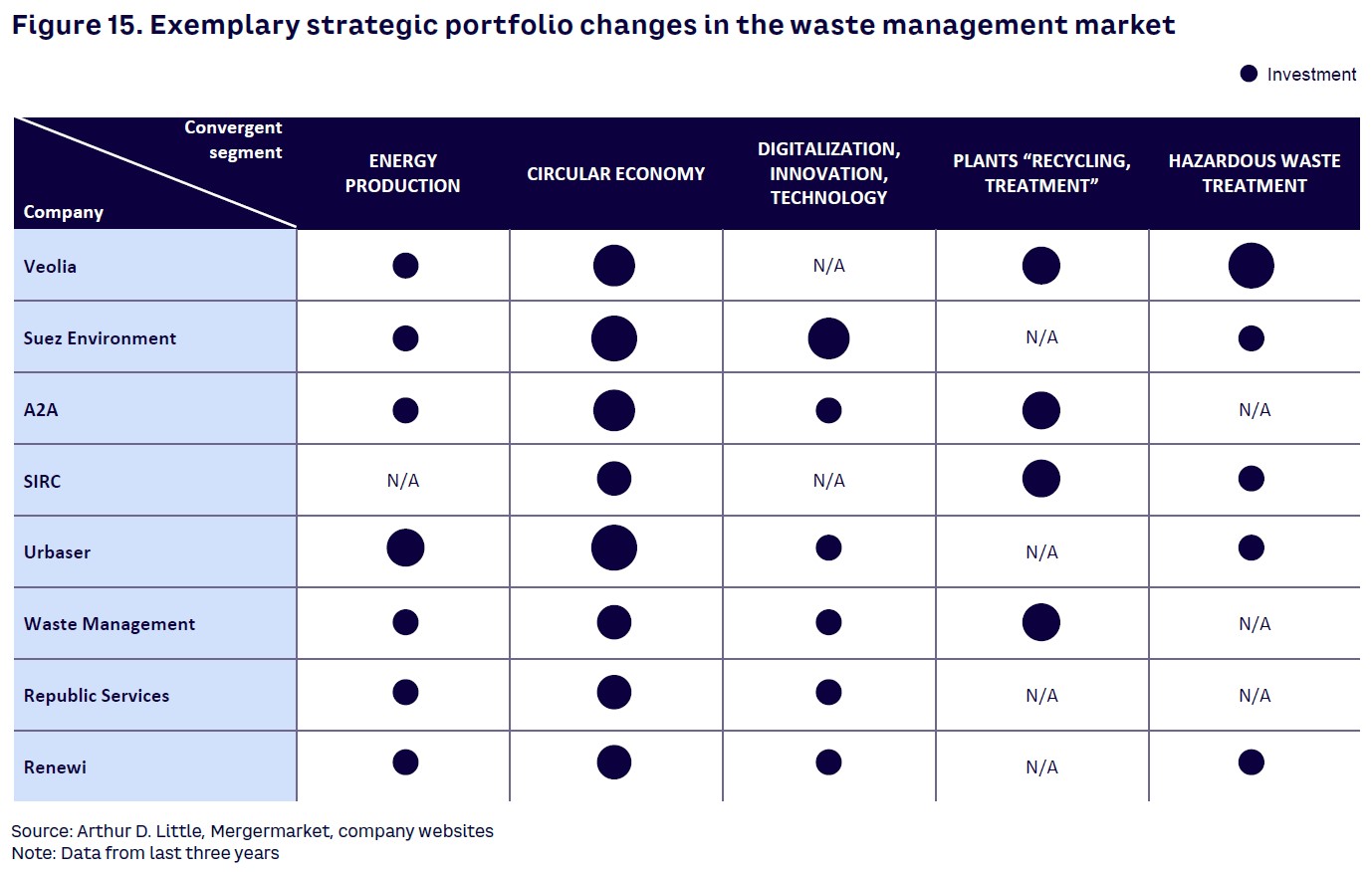

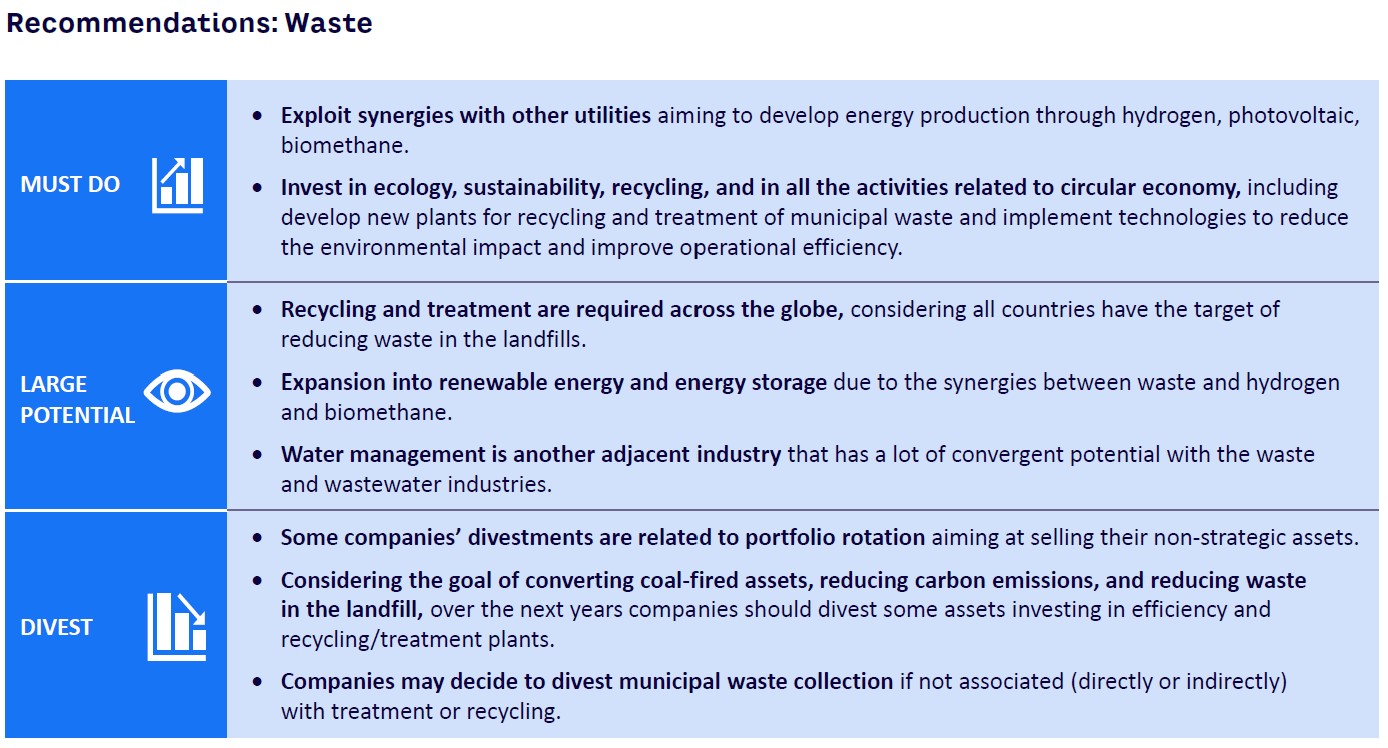

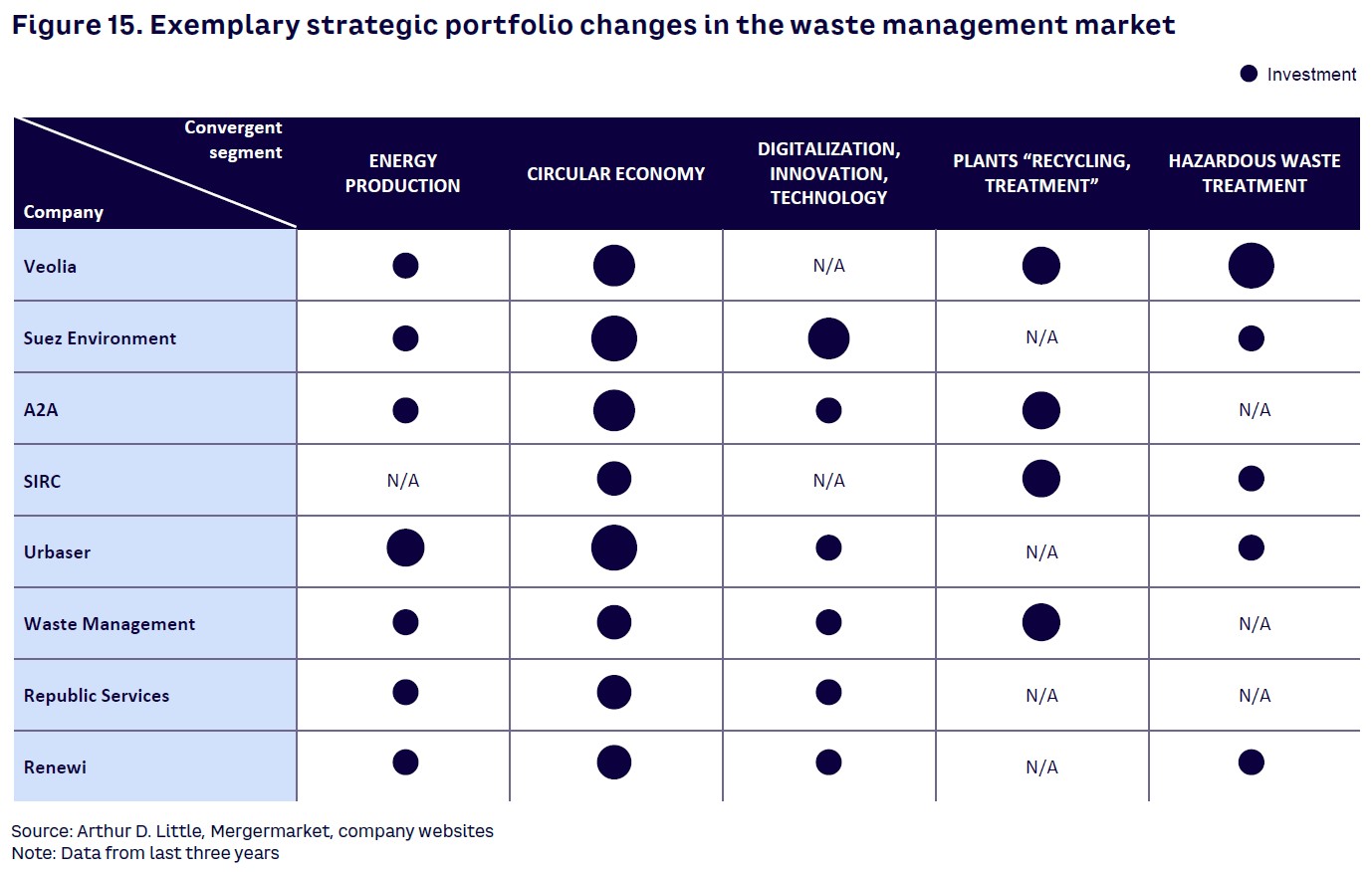

As illustrated in Figure 15, waste management companies are heavily investing in the creation of assets and services that promote and enable the adoption of circular economy concepts as SUEZ did with the creation of CircularChain, which brings together secure information storage and transmission technology to provide better reporting on all wastewater treatment plant transactions. This means it’s possible to follow the organic matter value chain (from production to when it returns to the soil), ensuring full transparency across the industry.

Energy production is another area that has seen intense investment. One example of the valorization of the calorific value embedded in the waste is Urbaser’s recent 15-year €265 million contract to construct and operate the Maldives waste-to-energy plant, which has the capacity to manage 500 tons of waste per day and a 13 MW electricity production facility. Other investment areas in the industry cover the need for increased recycling treatment capacity in line with country-level renewed objectives for resource preservation, more attention toward the treatment of hazardous waste, and the overarching acquisition of new capabilities around digitalization and innovation to stay abreast of very fast-moving client demands and competition.

The way forward

The waste sector is experiencing revived interest as stakeholders increasingly appreciate the importance of protecting the environment and limiting the consumption of precious resources through a circular economy approach. Here the waste sector is a key enabler but it will need to adapt to the challenges ahead. To do so, waste management players will need to embrace technology and innovation and create ecosystems that can stimulate the creativity needed to further improve how we reduce, reuse, and recycle materials. With this objective in mind, we need to encourage waste players and governments to start creating an ecosystem of “wastetech” startups to ensure there is sufficient focus, scalability, and access to capital and capabilities.

7

Water: Making the Most of a Precious Resource

by Carlo Stella, Chiara Loreti, Dan Scholz, India Nelson, and Katey Hayes

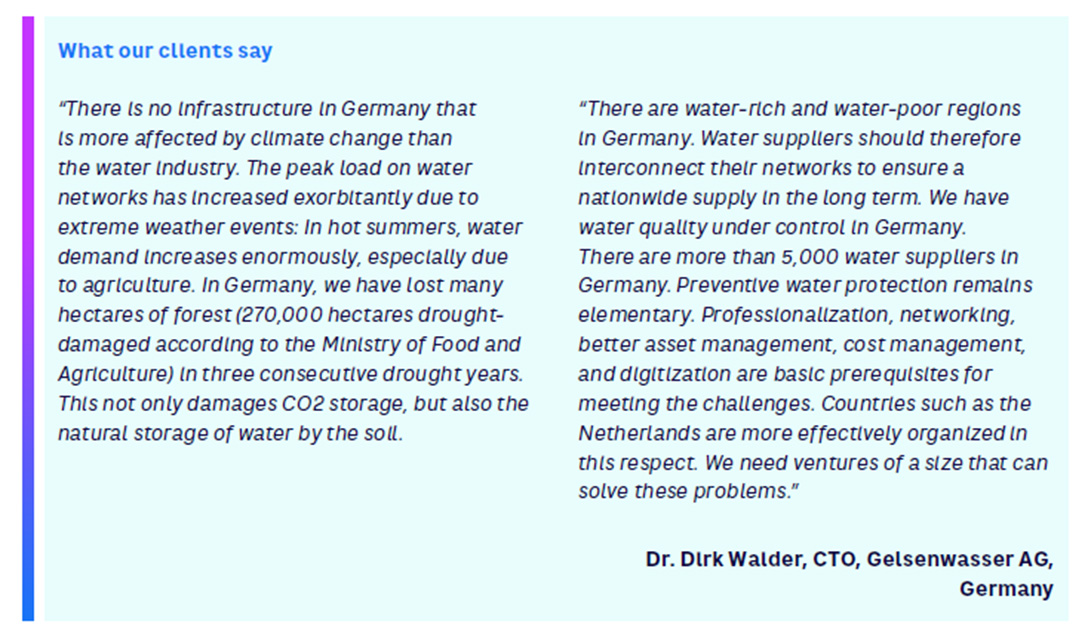

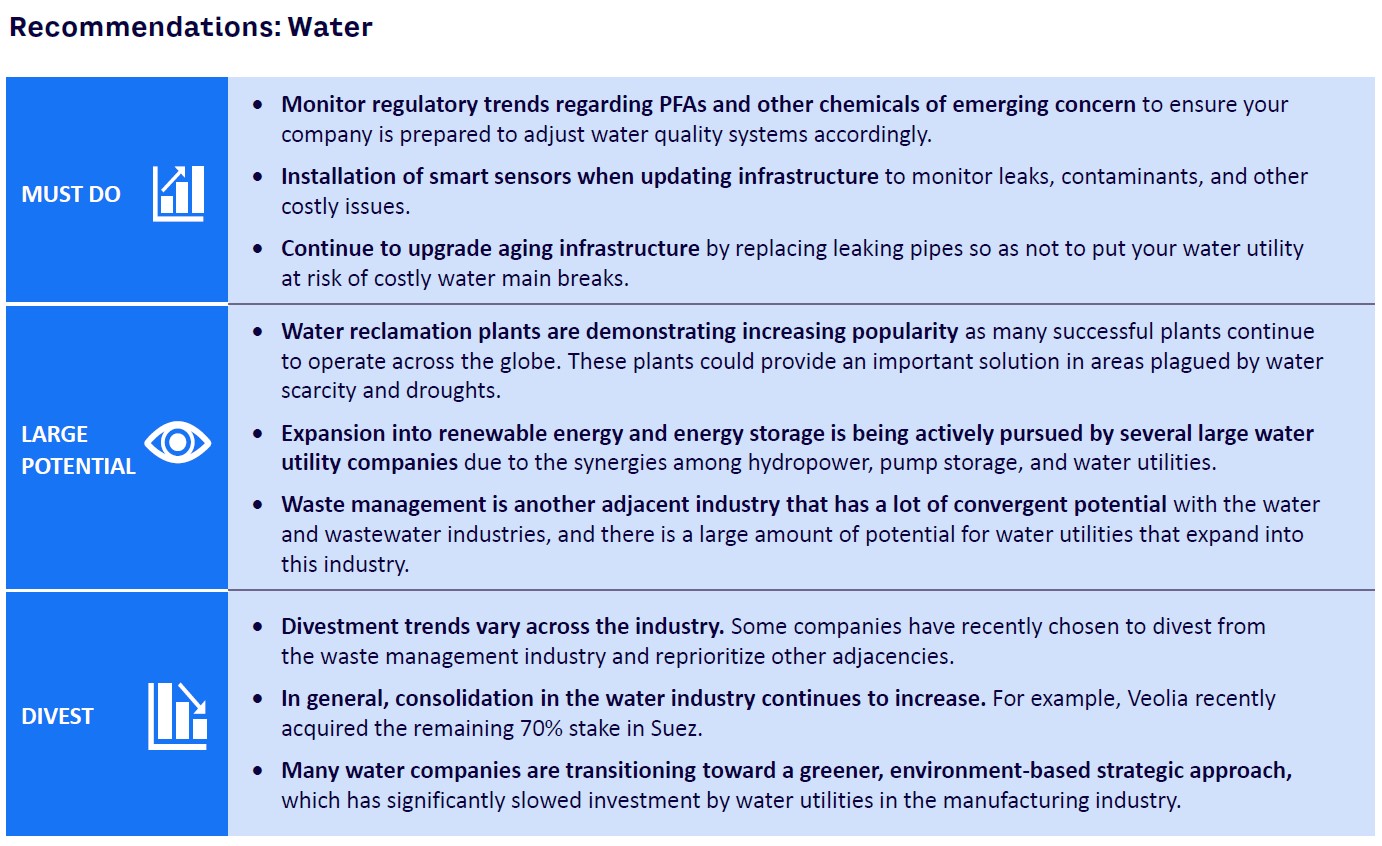

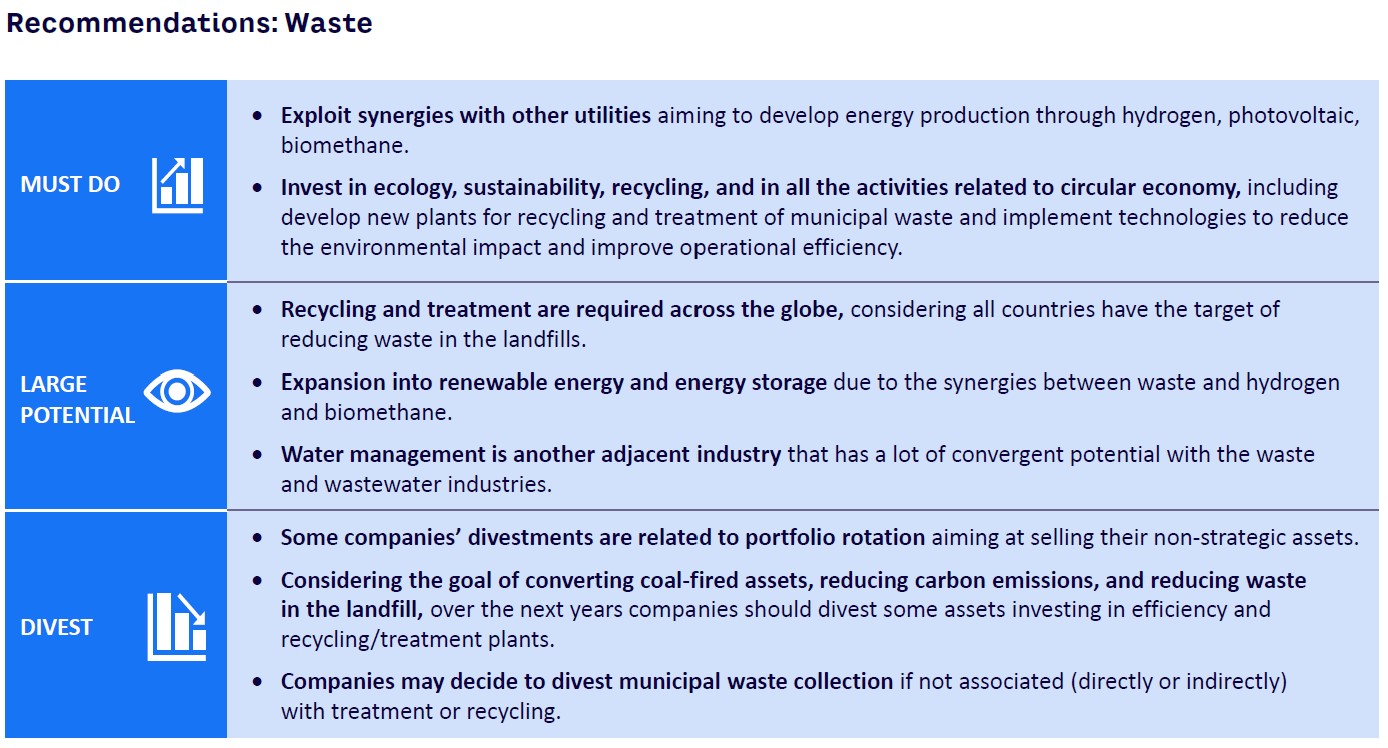

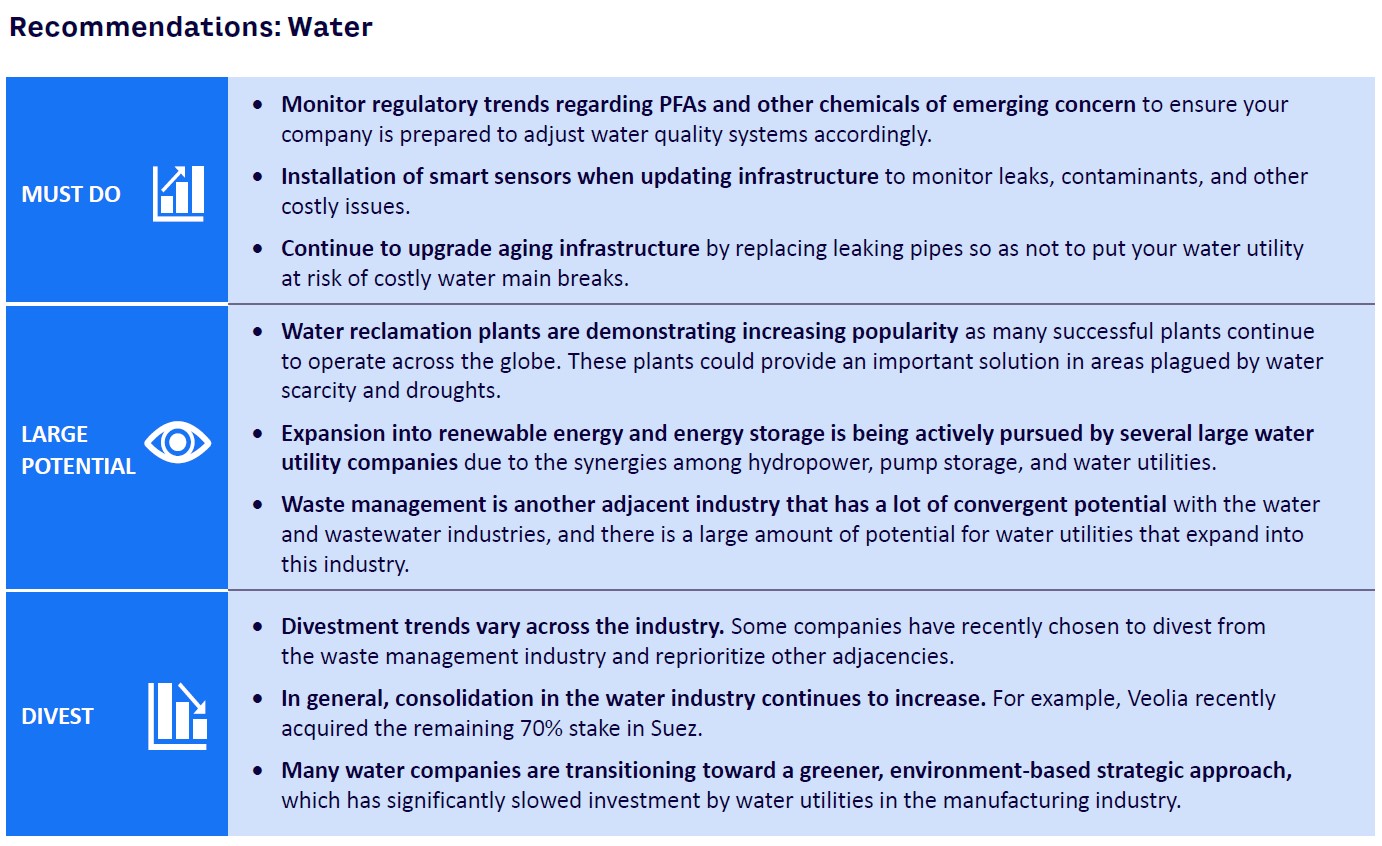

Players in the water sector face two persistent challenges in provisioning water to customers: water scarcity and water quality. Fortunately, increasing innovation in utility infrastructure provides water companies with opportunities to cut costs, expand into new areas, and improve their services. Larger water utility companies will seek to expand beyond their core business through ongoing M&A as segments converge.

Water quality

Ensuring water quality is an ongoing challenge for every player in the sector. While policy measures to prevent contamination from industrial and agricultural pollutants, such as DDT, PCBs, and chlorinated dioxins have been highly successful, these represent only a fraction of the pollutants released that can significantly impact health and do environmental damage.

ADL research suggests that those related to pharmaceuticals and personal care products (PPCPs) and per- and polyfluoroalkyl substances (PFAS) are of particular concern.

Some research groups, like the Product Stewardship Institute, advocate EPR legislation to ensure manufacturers safely dispose of such products at the end of their life. This would require them to alter their products’ chemistry and adopt new production methods.

Though regulations regarding PFAS concentrations vary among countries, tolerance of their usage is declining. For instance, they are no longer made in the US and some states have outlawed their use in food packaging, a ban that the US Food and Drug Administration is under pressure to impose nationwide. Elsewhere, several EU member states have set limits for PFAS in drinking water.

By continuously monitoring water quality at fixed locations, regulatory agencies can ensure compliance with national standards, a task made easier by laboratory information management systems that automate data collection and analysis of contaminant concentrations. If contaminants are present, utility companies can use filtering and purification methods, such as enacted carbon treatments, ion exchange resins, high-pressure nanofiltration, and reverse osmosis to remove PPCPs and PFAS.

Tackling water scarcity

While maintaining water quality is an essential task for utility companies, so too is ensuring supply, something that is increasingly difficult to do. According to the World Wildlife Foundation, water shortages will be a potential problem for two-thirds of the world’s population by 2025.

A major contributor to water shortages is groundwater depletion — the long-term decline in underlying water levels because of pumping from wells, streams, and lakes — which reduces both quantity and the quality of what remains. Adding to future water uncertainty is the growing threat of drought that accompanies climate change and associated changing weather patterns.

Further contributing to the decline in water availability is the generally poor condition of water infrastructure worldwide, much of which was built over a century ago and is now corroding. The loss of water from resultant leaks contributes to shortages, increases pumping costs, and allows diseases and toxins to contaminate drinking water, impacting peoples’ health.

Unfortunately, replacing this aging infrastructure is difficult and extremely expensive. The American Water Works Association estimates the cost of replacing and extending the water network as necessary across the US could be as much as $1 trillion over the next few decades.

How to improve water efficiency

The continued deterioration of water infrastructures and persistent consequences of climate change will likely prompt regulatory action. New technological solutions will surely emerge in response to rules around domestic water use. BCC Research estimates that the global market for leak-detecting sensors, for instance, might top $1.5 billion by 2023.

Domestically, smart water meters and shutoffs can help households track water consumption and alert them to leaks.

The advent of the IoT and 5G also enables the development of wireless solutions to monitor soil moisture, something that could reduce water consumption by farm irrigation systems up to 30%. Since less than 2% of agricultural land worldwide is equipped with soil-moisture measurement, according to estimates by Advanced Science News, this presents a vast untapped market.

Another way to reduce scarcity is to reclaim “good water” from low-quality sources. This can then be reused for irrigation and groundwater replenishment. Singapore’s NEWater brand, for example, contains highly treated reclaimed wastewater that already meets around 30% of the island’s total water demand, a figure that is expected to rise to 55% by 2060, according to Singapore’s Public Utilities Board. While Namibia can boast the longest-running potable reuse facility in the world, which provides about 35% of the total drinking water for the city of Windhoek. But the initial investment such facilities require will limit their widespread adoption.

Convergence in the water sector

In addition to helping water companies cut costs and improve services, new technology can also help them expand into other sectors, such as hydropower and pump storage (using low-cost solar energy to lift water from a low to a high reservoir and then releasing it to flow through power-generating turbines). However, local topography must be appropriate to enable the building of reservoirs at different heights, again restricting their use. In the US, for example, the Department of Energy reports that pumped hydro storage produces just 6.7% of the country’s power generation capacity, though there are plans to double this capacity through potential projects in California and Tennessee.

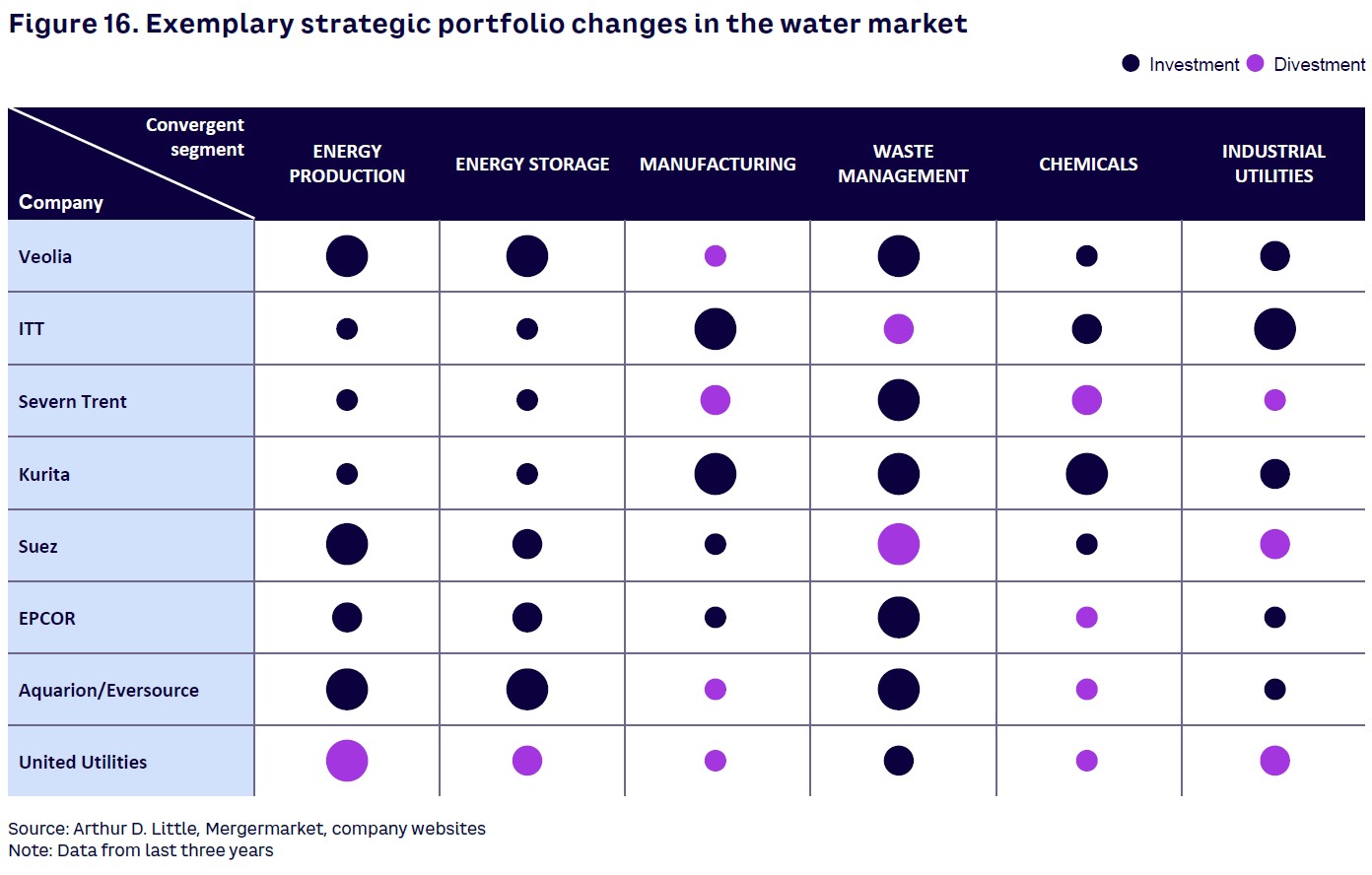

Veolia is one water utility interested in this space. It recently bought a controlling stake in a Slovakia-based electrical power generation company, as well as a Czech Republic-based electricity producer and distributor.

Manufacturing offers opportunities for water utilities because of similarities in their infrastructure needs. For that reason, Veolia acquired a France-based company specializing in the installation and maintenance of compressed air and nitrogen systems in February 2021. ITT also bought a German pump maker as well as a US manufacturer of precision components for the aerospace and defense industries.

Another sector where there are synergies for water companies is waste management. Here again, Veolia has been active, acquiring in 2020 not only a company collecting, processing, and recycling municipal waste in Russia but also a UK recycling service. And, two years earlier, Severn Trent bought a UK-based waste management company.

Chemicals could also be of interest to water companies. In 2019, Kurita Water Industries bought a US-based manufacturer of reverse osmosis chemicals, which are used primarily for water treatment.

M&A in the water sector

As larger water utility companies seek to expand beyond their core business, we are likely to see more M&A activity (see Figure 16). Municipally owned utilities are an attractive proposition given that they are such a large market. In 2020, they made up 85% of the water utility systems in the US, for instance (Source: S&P Global 2020). Now, many of these utilities are struggling due to COVID-19-induced financial constraints and their high capital needs, which force them to compete against other municipal services for financing. With public officials unwilling to raise taxes in support, and their own lack of expertise in meeting tougher water quality standards, they make easy targets.

And, with US earnings growth already fueling corporations’ capital expenditure programs, more funds will be poured into water by pension funds and private equity funds looking for new climate-prioritized investment.

Big tech and critical infrastructure firms won’t be far behind. In fact, we can already see changes in focus. For example, software firm Autodesk paid $1 billion for Innovyze, a predictive analytics firm, in the hope of successfully combining civil engineering with water modeling. Similarly, Essential Utilities, one of the largest publicly traded water, wastewater, and natural gas providers in the US, acquired the Delaware County Regional Water Quality Control Authority for $276.5 million, adding it to several acquisitions already finalized and planned in water and wastewater systems investments.

8

Metals & Mining: Learning Lessons from Underground

by Pavel Lubuzh

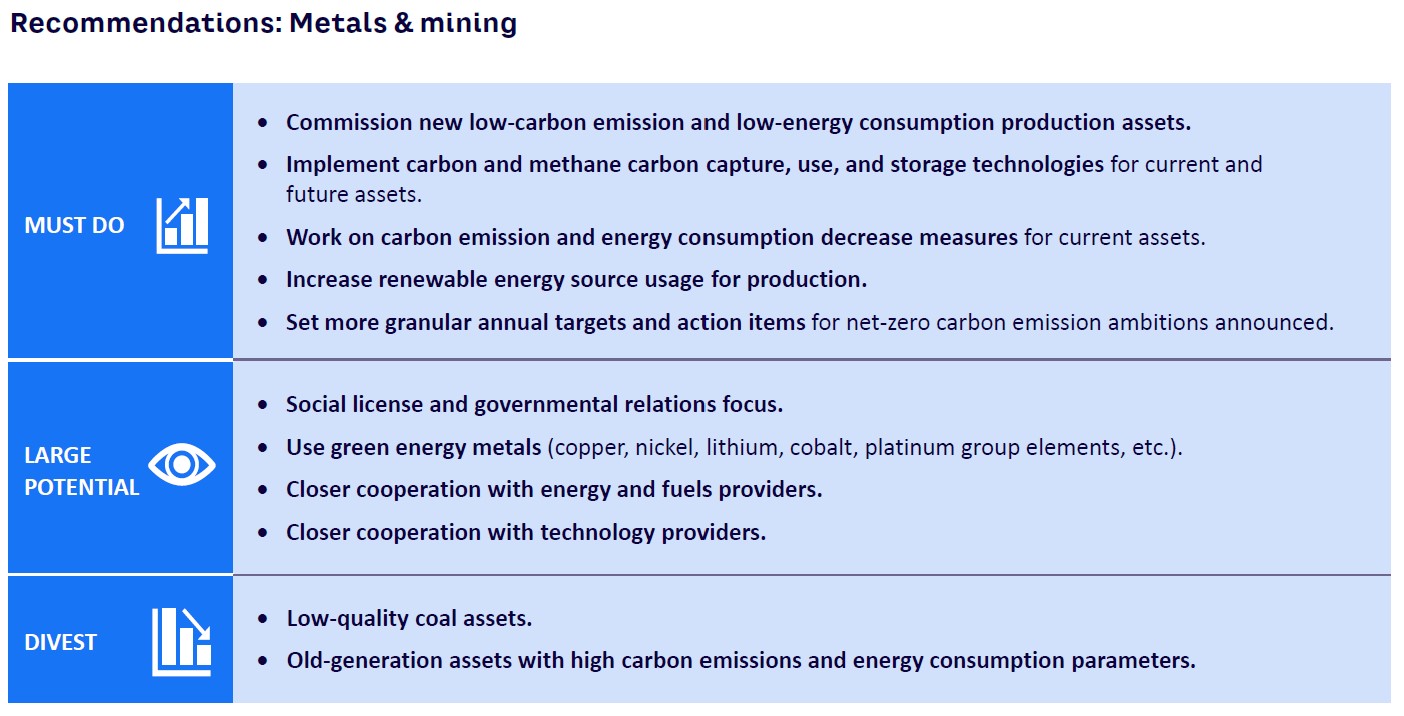

Energy transition in other sectors directly impacts the metals and mining sector. So, while traditional products like steel, non-ferrous metals, and non-metal minerals will remain the focus of the metals and mining sector, a wider movement to a low-carbon economy means there is a growing demand for copper, nickel, lithium, cobalt, and platinum, the materials that are critical to the manufacture of batteries, EVs, and solar and wind generation equipment.

In its own right, metals and mining as an industry is a major energy consumer — energy expenses of our metals and mining clients make up approximately 20% of total operating costs, according to Trinomics — so, it accounts for over 29% of IEA’s estimated total global industrial energy consumption. Metals and mining consumes more than half of global coal consumption, so it is also a major CO2 emitter, producing more than 11% of global carbon emissions and more than 32% of global industrial emissions (Source: Global Efficiency Intelligence 2019, IEA 2018).

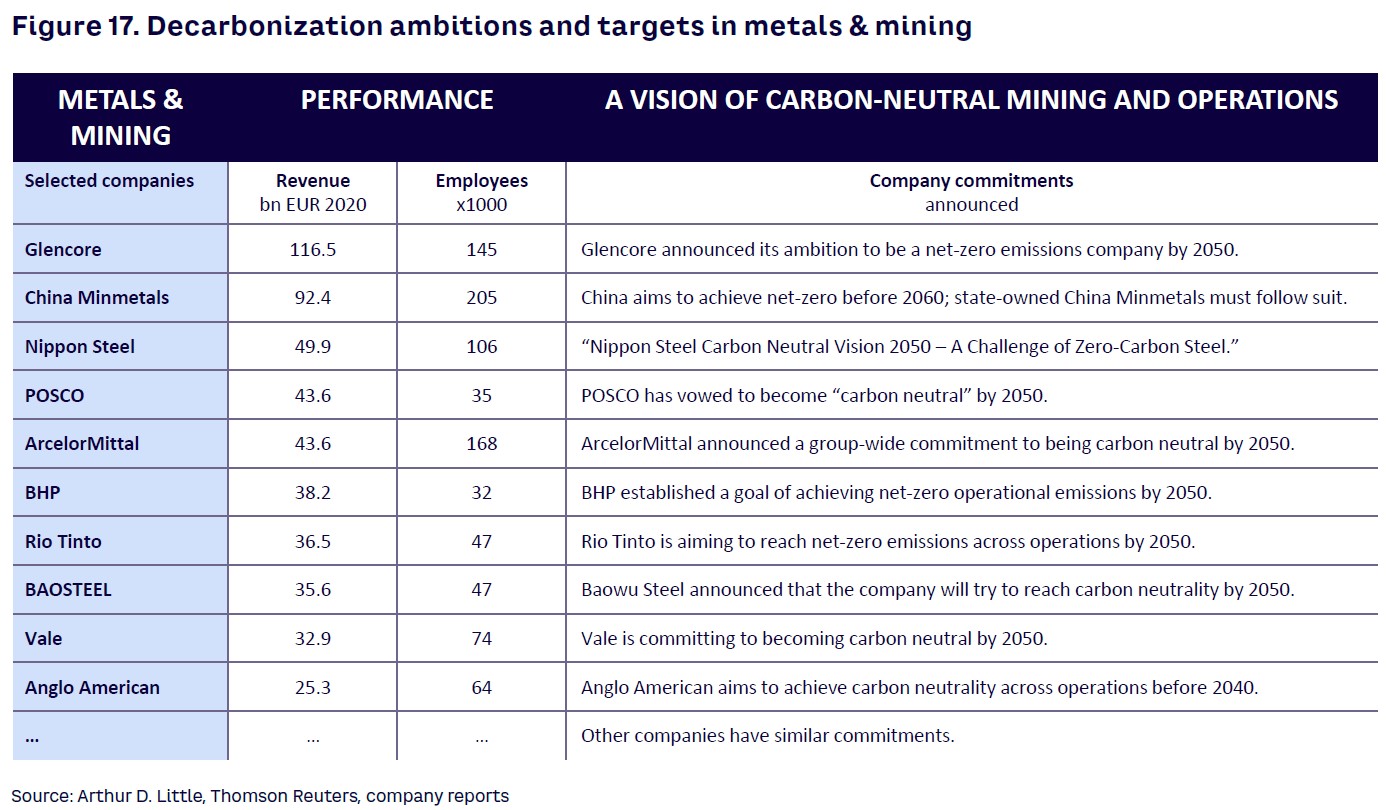

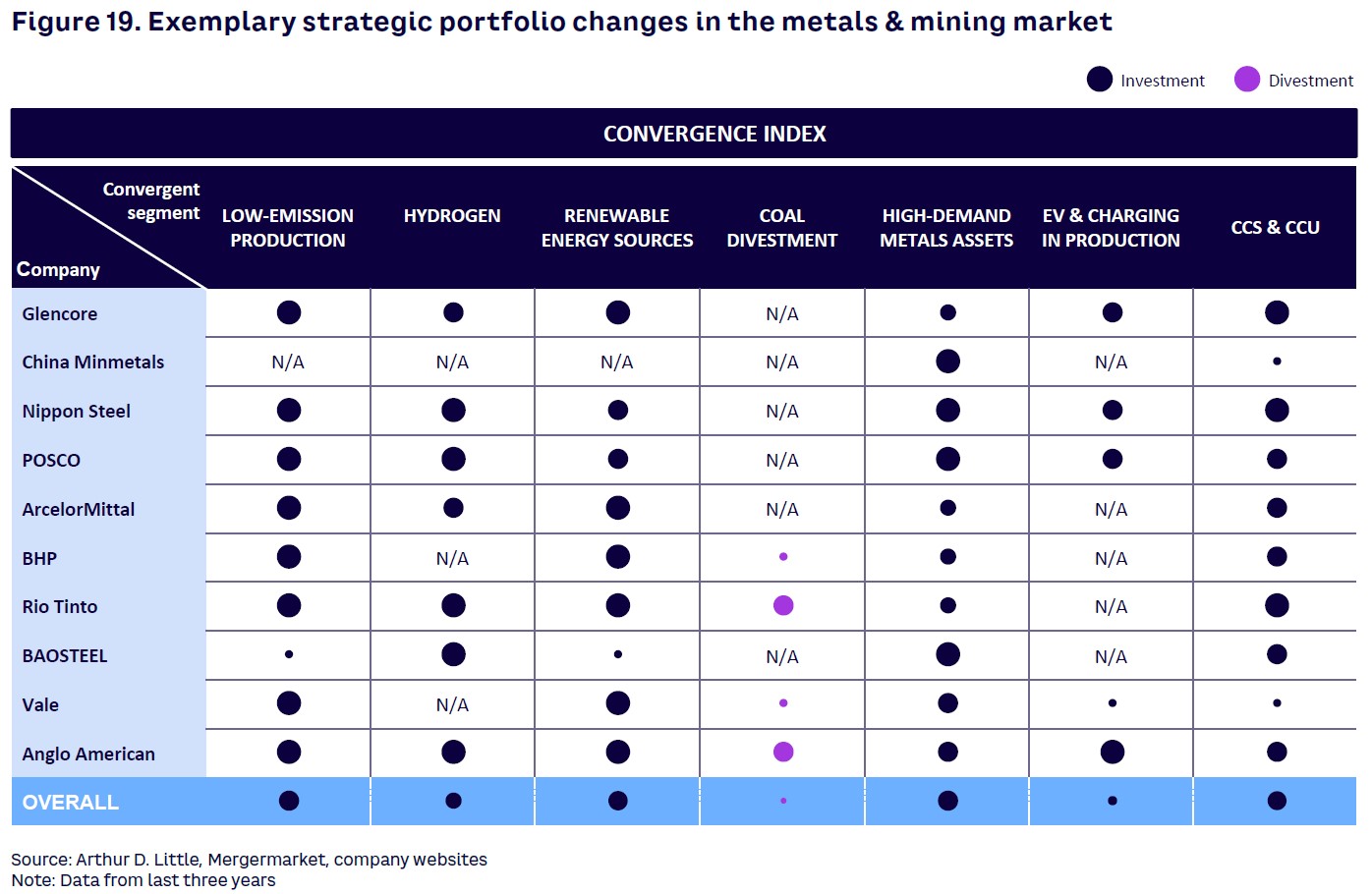

Consequently, the industry is under growing pressure from governments, regulators, investors, clients, end consumers, and the wider society to transition to cleaner sources of energy.

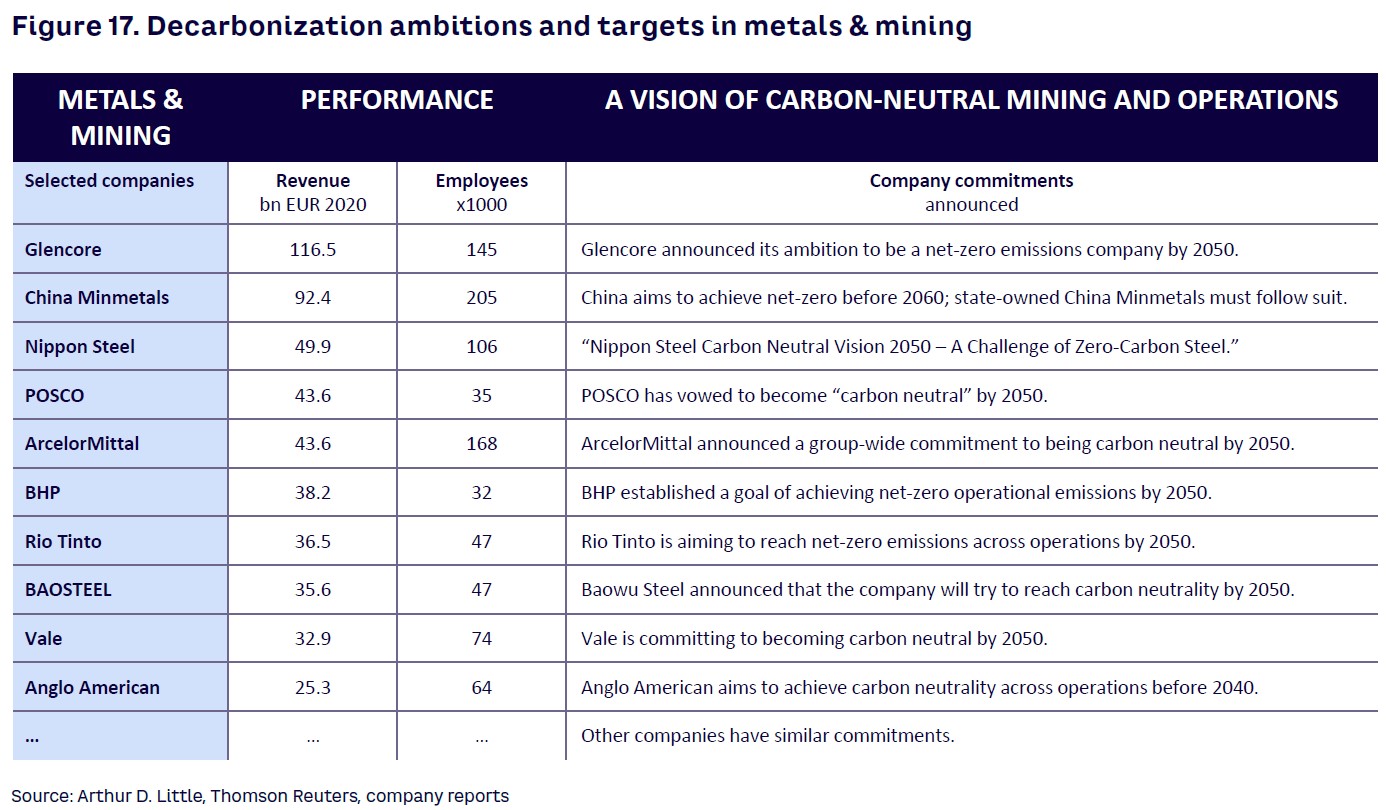

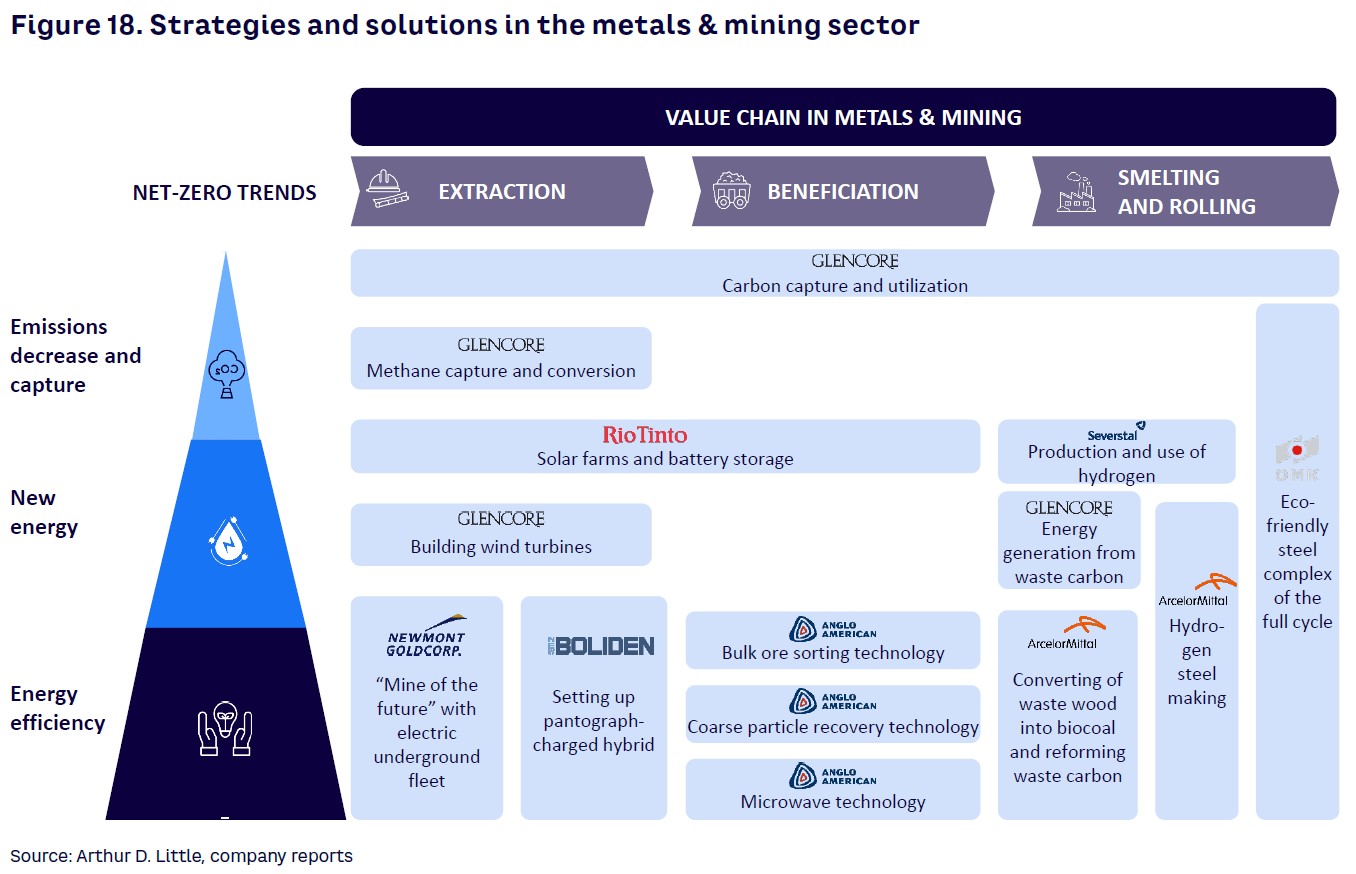

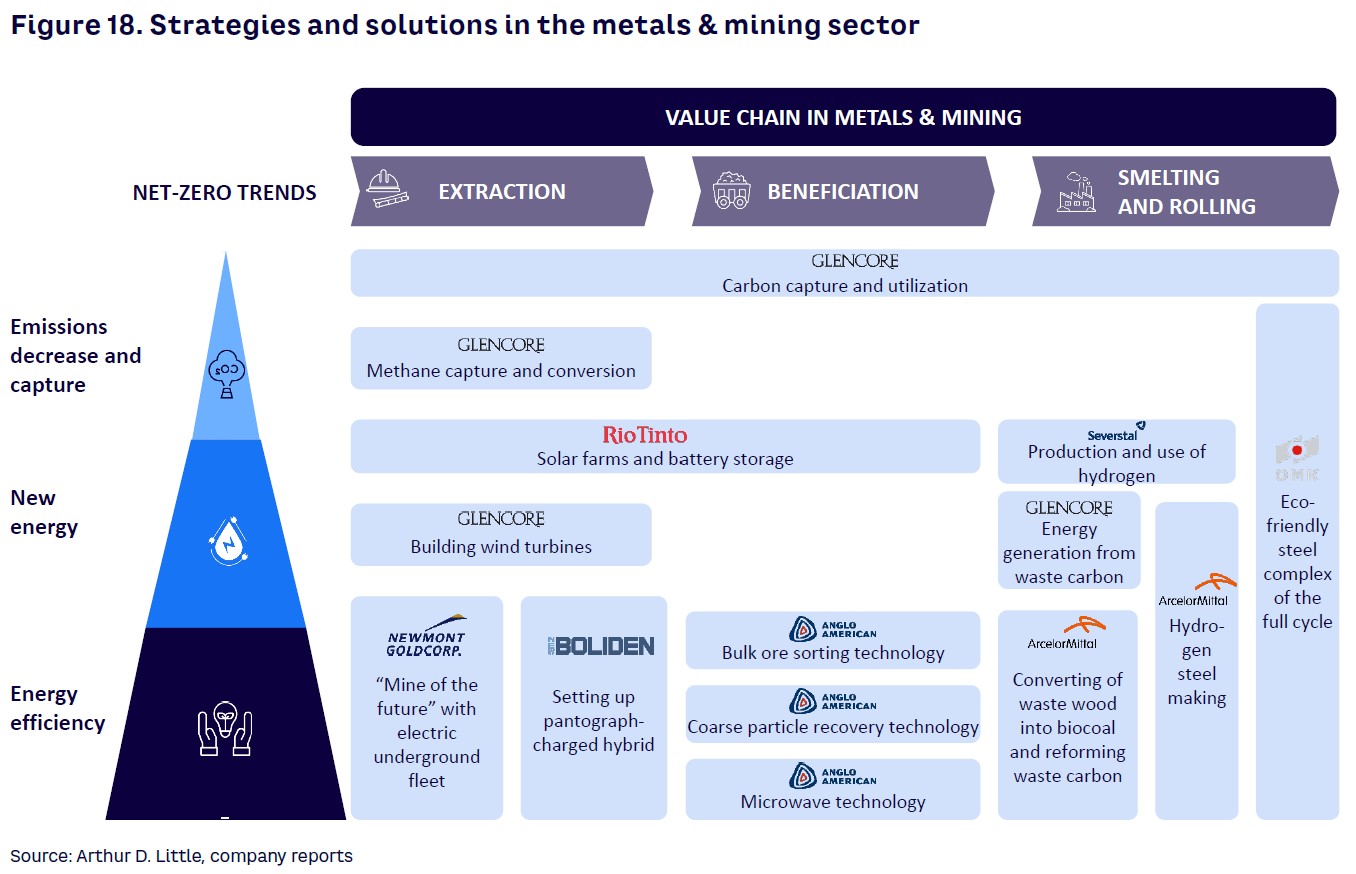

Capturing carbon and methane emissions

Most key regional and global players are now taking practical steps to meet their previously announced net-zero commitments by doing more to capture their carbon and methane emissions through switching to new energy sources, improving their own energy efficiency, and adopting CCUS, which the International Energy Agency believes is a “key technology” in the transition to a global low-carbon economy (see Figure 17).

Glencore is one company that is using CCUS technology to reduce its emissions from fossil fuels and is doing so on an industrial scale at its Carbon Transport and Storage Company (CTSCo) Project in Queensland, Australia. This is Australia’s most advanced onshore CCUS project, where CO2 is being captured from a coal-fired power station at Millmerran and then permanently held deep underground in the Surat Basin. The project offers the opportunity to assess how safely and effectively emissions from multiple coal generators and other industries such as gas, hydrogen, cement, and chemicals can be stored long term.

Over the last decade, Glencore has also been capturing methane from Australian coal mines that would otherwise have been flared off, abating 28 Mt CO2 equivalent in the process.

In Russia, steel company OMK has invested in direct reduced iron (DRI) technology at its large, full-cycle steel complex to remove oxygen from iron-bearing materials before they are melted in the blast furnace. The carbon monoxide and hydrogen, used as reducing agents, come from reformed natural gas, syngas, or coal.

While the DRI technology significantly reduces CO2 emissions and cuts electricity consumption to 140 kWh/t, the OMK project is also notable for using a single closed-circuit water cycle, according to reports by Kommersant Daily. This collects surface water that is then used to recharge closed water-carrying cycles. The steel furnace will have the best gas-cleaning system in Russia, holding 99.9% of solid substances thanks to an automatic system that controls air purity. It will also generate 24 MW of electrical energy from the heat of the off-gas.

As a major consumer of energy and producer of CO2 pollutants, the metals and mining sector has declared its commitment to move to net zero. Accordingly, players in the industry are adopting a wide range of strategies and technological solutions as they attempt to increase their energy efficiency and decrease emissions (see Figure 18). Doing so will take time and trillions of dollars, given the industry’s scale and the capital-intensive nature of projects that are often in very remote areas.

Switching to new energy

Given that metals and mining is such a high energy use sector, it is unsurprising that companies are highly proactive in trying to find new ways to generate the power they need in a cleaner way.

In Western Australia, Rio Tinto has built its first solar plant to power an iron ore mine. The plant will, at peak solar power–generating times, supply the Gudai-Darri mine with all its electricity needs and meet 65% of them, on average. The solar plant, when used in conjunction with a new lithium-ion battery energy storage system, should reduce CO2 emissions by about 90,000 tons a year compared to conventional gas-powered generation. In other words, the equivalent of taking some 28,000 cars off the road, by company estimates.

In 2018, Glencore completed the construction of two wind turbines at its Raglan Mine in Arctic Canada, where diesel fuel had been the only source of energy. The company estimates the offset of the mine’s diesel dependence at 10%. If there was a displacement of 4.4 million liters of diesel at the mine annually, this would reduce greenhouse gas emissions by about 12,000 tons — the equivalent of taking 2,700 vehicles off the road.

And at Glencore’s ferroalloys Boshoek Smelter in South Africa, as part of an energy and carbon reduction project, the company hopes to generate electricity by combusting waste carbon monoxide collected from its smelters.

In Russia, steel company Severstal has entered a joint venture with Novatek, Russia’s largest independent natural gas producer, to develop hydrogen, alternative energy, and greenhouse gas emissions reduction technologies. Pilot production will begin at the Severstal site at Cherepovets by 2023. The project develops other green technologies, utilizing CO2 in the production of blue hydrogen from methane and its use in steel production as well as technologies for storage and transportation of hydrogen. Eventually, Severstal aims to replace coal with hydrogen in the smelting production chain.

ArcelorMittal has launched a €40 million demonstration project in Belgium to convert waste wood into biocoal for use in iron ore reduction instead of fossil fuels. This has the potential to work across a variety of waste streams. In France, the company runs another project that uses IGAR technology (Injection de Gaz Réformé) to capture CO2 from blast furnaces, which it converts into syngas that can be reinjected into the blast furnace to reduce iron ore rather than using fossil fuels, further cutting CO2 emissions.

And at its Hamburg site in Germany, ArcelorMittal is looking at the first industrial-scale production and use of DRI, which uses hydrogen as the only reductant. The project will begin with gray hydrogen generated from gas separation using a process known as “pressure swing absorption” to make hydrogen with a purity of over 97% from the existing plant’s waste gas.

The “mine of the future”

O&G companies are also looking at how they clean up their supporting infrastructure. In Canada, for instance, Newmont Goldcorp has its Borden Gold Project “mine of the future,” where, along with digital mining technologies, it is running a fleet of low-carbon energy vehicles. These not only help reduce energy costs and are better for the environment but also protect employees’ health because they have lower greenhouse gas emissions, which eliminates the buildup of polluting diesel particulates underground.

At Aitik in the Arctic Circle, Sweden’s largest open-pit copper mine, Boliden, is assessing the potential of using electrified trucks to move 70 million tons of rock from an open pit each year. If the trial is successful, this could save about 830 m3 of diesel annually, which would enable Boliden to cut its greenhouse gas emissions by as much as 80% along those routes where this technology is used.

Using cutting-edge mining technology is another way that companies can improve their energy use and CO2 footprint. For instance, to extract minerals with optimal efficiency, Anglo American uses a combination of bulk ore sorting (BOS) technology, coarse particle recovery (CPR), and microwave technology to pre-condition rock.

The main benefit of the BOS system is that it removes waste and unwanted material early in the production process, which helps increase the grade of ore and reduces the volume of rock needing to be taken to the processing plant or concentrator. By using composition-sensing technology to detect elements of interest, BOS can cut costs per ton produced, decrease wet tailings volumes, and lower water and energy use.

BOS pilot plants are already running or being commissioned at Barro Alto in Brazil, Mogalakwena in South Africa, and in Chile at Los Bronces and the El Soldado copper mine, where trials suggest that using BOS alone could potentially deliver 10% energy savings and mean 40% less processing of waste.