DOWNLOAD

DATE

Contact

Current approaches and mechanisms are not sufficient to deliver on the European “Renovation Wave” ambitions. There needs to be a paradigm change to deliver value and leverage innovative private funding on top of sector subsidies. This Viewpoint puts the stakes and challenges in perspective and provides concrete recommendations to improve training, ecosystem development, sales approaches, innovation funding, and monitoring the results of individual homeowner choices, some of which can also be applicable to industrial and commercial segments.

THE NEED TO MOVE

According to the International Energy Agency (IEA) — in the pre-COVID environment — buildings were responsible for 39% of global energy-related carbon emissions, with 28% being from operational emissions like heating, cooling, and supplying power and 11% from materials and construction. This underscores the scale and urgency of the task at hand to transform Europe’s building stock and achieve ambitious emission-reduction targets.

The European Green Deal, in conjunction with the European Commission’s Recovery Plan, is propelling a dynamic shift toward building renovations throughout Europe. The Renovation Wave for Europe is at the forefront of this strategy; its comprehensive approach aims to (1) double annual renovation rates by 2030 to achieve a 55% reduction of greenhouse gases, and (2) reach carbon neutrality by 2050 with 100% net zero buildings. The strategy also seeks to enhance the quality of life for occupants of renovated buildings and fosters the creation of numerous green jobs in the construction sector. The Renovation Wave focuses on three areas: decarbonization, renovation, and tackling energy poverty and worst-performing buildings (see Figure 1).

The Buildings Performance Institute Europe (BPIE) estimates that there are 220 million building units within the EU, of which 75% are residential; 35 million buildings could be renovated between 2020 and 2030.

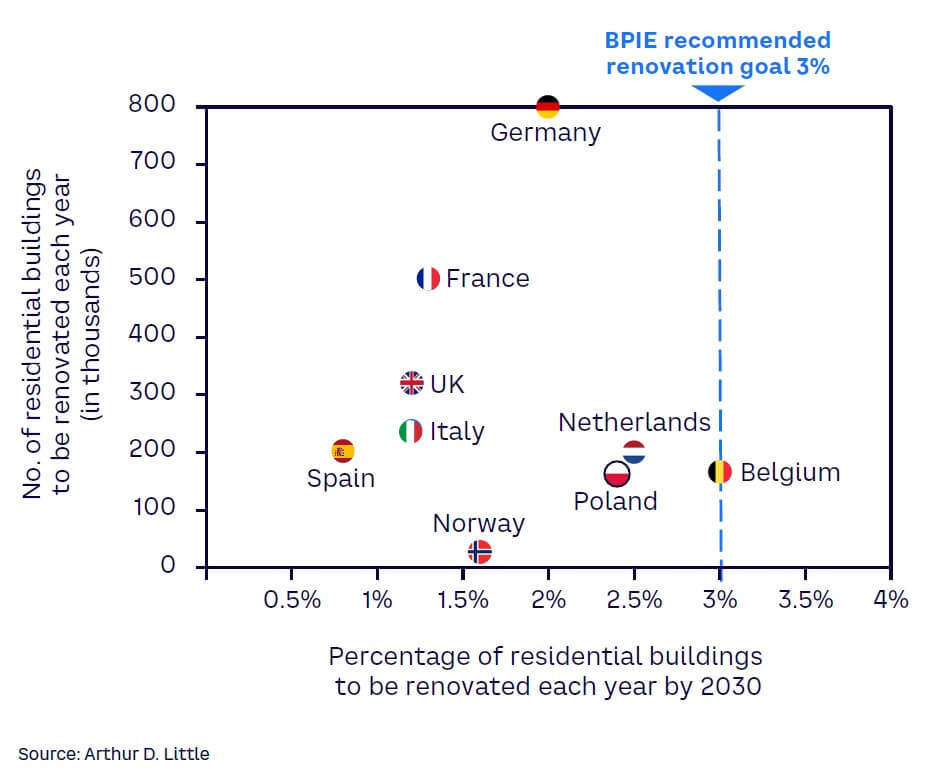

To meet this ambition, European countries must double, and in some cases triple, their planned renovation rates, with BPIE estimating that the annual renovation rate needs to reach 3% by 2030 to meet the climate target. At present, many countries are only planning to renovate 1%-2% of residential buildings by 2030.

An Arthur D. Little (ADL) sample of nine countries (representing more than 65% of Europe’s total residential building volume) revealed that the 3% annual recommended renovation rate needed to reach the 2030 goals is far from being met (see Figure 2). Moreover, there is a qualitative dimension to renovations. According to BPIE, deep renovations that effectively improve energy efficiency by at least 60% are only realized annually for 0.2% of the building stock. Meanwhile, carbon neutrality would require the renovation of 60%-80% of the building stock between 2030 and 2050.

As a result, some European countries have started implementing aggressive measures to meet the target, such as the renovation duty imposed in several countries (i.e., the Netherlands and Germany) or regions (i.e., Flanders in Belgium) that legally requires any residential building sold after a specific date to be renovated within a certain number of years if not in compliance with existing regulations. Countries can also be creative in finding other incentives like limitations imposed on rent indexation (i.e., France and Belgium). While policies differ from country to country, most have created local certification programs that recognize the expertise of professionals and companies in energy efficiency and environmental performance in building renovations.

Very often, these certifications are a prerequisite to access certain government subsidies and incentives related to energy efficiency in buildings. Next to this, the EU’s Energy Performance of Buildings Directive has been adapted, with minimum energy performance standards now an optional tool for residential buildings, and focus put on providing flexibility for each member state to reduce the average primary energy use of the residential building stock by 16% and 20%-22%, respectively, by 2030 and 2035.

Major trends are also strengthening the Renovation Wave, including the push for increased use of sustainable reclaimed and bio-sourced materials and a reduction in CO2 emissions during the construction and building management stages. Furthermore, there is an increased emphasis on enhancing productivity in the construction sector by leveraging advanced automation, lightweight materials, and digital technologies. This focus stems from the industry’s lack of a skilled workforce and the subsequent growing need to address the declining trend of output relative to time invested.

ADDRESSING THE CHALLENGES

To meet the 2030 target and maintain 2050 ambitions, five challenges must be addressed, as explored below.

1. Highly diverse technologies for building renovations

Accelerating the energy efficiency of buildings through renovation starts by understanding the available technologies. The broad array of solutions generates complexity, both for professional stakeholders (knowledge, experience, coordination) and for individual homeowners. The technology options can be grouped into two categories:

-

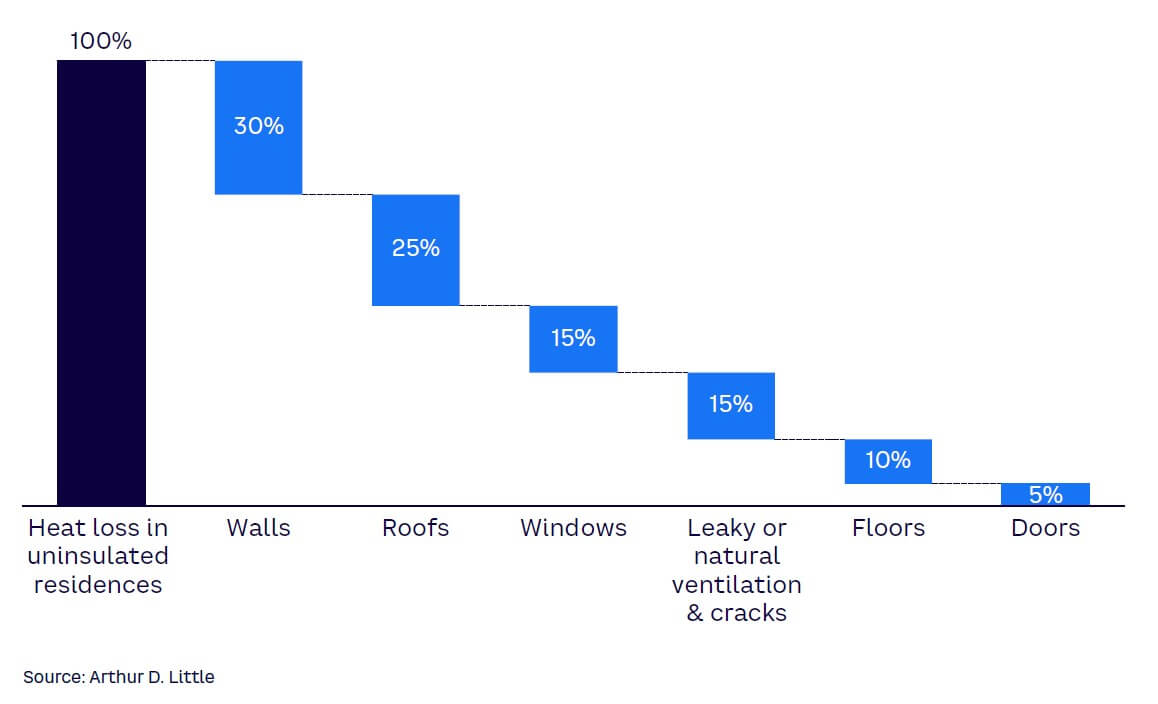

Technologies to reduce energy loss. While percentages vary slightly across literature, a typical uninsulated house loses around 30% of its heat through walls, 25% through roofs, 15% through windows, 15% through leaky or natural ventilation and cracks, 10% through the floor, and 5% through doors (see Figure 3). The energy loss in housing can be minimized by using modern technologies:

-

Walls, roofs, and floors. Insulation technologies are the most commonly used products to drive the renovation of buildings to net zero as they prevent unnecessary heat loss. Different materials (e.g., mineral wool, expanded or extruded polystyrene, polyurethane, or natural insulation materials such as wood fiber or hemp) are utilized; mineral wool is still the most common (although its use is slowly declining).

-

Windows and doors. Window and doorframes are mature products; only incremental improvements are being made with limited promising new window and door materials. The main materials used are unplasticized PVC (polyvinyl chloride), followed by aluminum and wood. Given market maturity, the share of respective technologies remains stable in the EU. Similarly, multiple glazing technologies for windows and glass doors are quite mature but growing progressively.

-

Ventilation. The choice of ventilation technologies is highly dependent on geographic location and the associated climate. In the northern region of Europe, heat-recovery ventilation systems dominate the market, whereas there is a wider usage of exhaust ventilation in the western region. Natural ventilation is prevalent in the east and south. The adoption of heat-recovery ventilation is growing but remains small, while exhaust ventilation adoption is gaining traction.

-

-

Technologies for greener energy

-

Heating systems. Current heating technologies will not support the realization of net zero goals, necessitating a shift. The current focus on natural gas condensation boilers must therefore move toward heat pumps, biomass boilers, and district heating technologies. The distribution of heat pump adoption within Europe is significantly different across countries. Scandinavian countries clearly lead, with Norway reaching a heat pump distribution of one per every three households. The presence of solar energy installations, which provide the required energy for electric heat pumps, is crucial to their successful use. However, heat pumps come with a steep investment cost; this is a barrier that must be addressed to meet the desired rate of adoption. Other factors should also be considered, such as the dimensioning of the building feed-in system, which may drive switching costs up. More generally, energy infrastructure may not be fully aligned with optimal heating technologies (it may be easier for countries like France, which are used to electric heating over gas heating), or even discourage photovoltaic installation as the grid cannot handle the load and/or meters do not run backwards.

-

Energy management software and platforms. These options include building energy management systems, energy monitoring and targeting software, demand-response platforms, energy analytics software, and energy procurement and management platforms. These platforms and software will increasingly support household energy performance by providing highly automated and efficient heating that can be monitored and optimized where relevant. Integrating home batteries (often connected to solar panels) is an energy management enabler, allowing energy to be produced, stored, and used most efficiently.

-

2. Insufficient support to building owners

To facilitate and accelerate the ongoing Renovation Wave, most EU governments have put in place dedicated platforms and services to support building owners, which assist with supplier selection, administrative paperwork, and funding. While these initiatives are welcome, they are often insufficient, given the volume of needs based on annual renovation targets and their accompanying high costs. Changes in subsidy policies may also impact the pace of change. A recent example is the reduction of subsidy amounts in Germany and Italy for heat pumps, which drastically reduced demand. Other examples may be linked to European-driven recommendations, such as the “Electricity market design” European directive, which encouraged EU countries to abandon photovoltaic compensation schemes by 2023. Increased budgets to scale up support and greater subsidize funding, combined with transparent and simplified mechanisms, are expected to progressively bridge this gap.

3. Unskilled & aging workforce

Skilled labor is required to install, maintain, and operate advanced insulation, heating, ventilation, and energy management technologies. According to Statista, over 30% of respondents to a survey on factors limiting construction activity consistently raised labor shortages as their biggest concern since mid-2021. These shortages simultaneously became the main concern of the EU construction industry, topping other key issues like insufficient demand and shortages of materials and/or equipment.

In particular, many countries face an aging skilled workforce and a decline in trainees. The “Employment and Social Developments in Europe 2023” report estimated labor shortages that are three times greater than 10 years ago.

A study commissioned by the International Trade Union Confederation (ITUC) and the European Federation of Building and Woodworkers (EFBWW) to assess direct and indirect employment effects of the Renovation Wave and its associated skill requirements estimated that the construction sector needs 1.5 million additional workers between 2020 and 2030. The report also estimates that 1.2 million workers are needed to replace aging ones leaving the workforce. The European Construction Industry Federation (FIEC) recently estimated that 25% of the construction industry’s overall workforce will need up-skilling and reskilling between 2022 and 2027 to address the skills mismatch.

4. High fragmentation of construction value chain

The construction sector is characterized by a significant number of siloed businesses located within highly fragmented value chains, which cannot sufficiently support the Renovation Wave. According to the European Centre for the Development of Vocational Training (CEDEFOP), the sector is dominated by small- and medium-sized enterprises, with an estimated 3.3 million construction firms in the EU employing fewer than 20 workers. These businesses are valuable to their communities for many reasons, but their small scale means they cannot always meet all their customers’ needs.

The diversity of Europe’s different needs (i.e., in terms of heating and cooling) and habits and local, country, regional, and city regulations also complicate the implementation of common approaches. All in all, this creates scaling and coordination challenges and slows down the adoption of integrated energy-efficient solutions. Building renovations often involve multiple stakeholders, including contractors, architects, engineers, suppliers, and building owners. A lack of collaboration and coordination among these parties can impede the renovation process.

5. Complexity of funding building renovation efforts in context of high(er) inflation & interest rates

Funding capacity of individual homeowners can be a barrier to the widespread adoption of energy-efficient technologies in building renovations. High interest rates on loans, insufficient subsidies or financial incentives, and the soaring prices of energy-efficient building materials have increased the up-front costs of renovations, making it financially challenging for homeowners to invest in energy-efficient technologies while often eroding margins.

Also, funding of financial incentives by national and regional governments is put under pressure as the European Commission estimates that an annual €275 billion of additional investment in building renovation is required to meet the 2030 renovation target, all the while sovereign debt servicing becomes more difficult. This is consistent with our estimates assuming an average unit renovation cost of €30,000 for residential buildings and €200,000 for nonresidential buildings.

OPPORTUNITIES TO RIDE THE WAVE

The Renovation Wave constitutes a major growth driver for the entire European construction industry. The sector will need exogenous support to effectively seize the existing opportunities, particularly regarding mechanisms for financing work and supporting future beneficiaries. Beyond outside measures, construction industry stakeholders must put in place a holistic plan to consistently activate multiple levers. Developing solutions, supporting individuals, recruiting a skilled workforce, deploying an ecosystem approach, and using innovative financing systems are all avenues for seizing market opportunities, as described below.

1. Adopt solutions that enhance replicability & scaling

-

Shift from a project-oriented model to a product-oriented one by deploying reproducible renovation solutions and making investments in advanced and more efficient factory prefabrication methods. Standardizing and modularizing technologies and solutions can streamline integration and interoperability. This could entail creating standardized interfaces, protocols, and components that seamlessly integrate into various building types and configurations.

-

Develop integrated product and service offerings to deliver comprehensive solutions that encompass various facets of building renovations. This could require combining different technologies and solutions into a unified offering that addresses a building’s overall energy performance rather than selling individual components separately. For example, packages that incorporate window upgrades, heat pump installations, and insulation improvements provide customers with a cohesive renovation solution. A model similar to software as a service (SaaS) also shows potential to reduce up-front investment requirements, in which a contractor installs the technology and provides ongoing service to optimize energy consumption and increase savings.

We expect such offerings to grow rapidly into the residential segment as they are already existing in the nonresident segment, with major companies such as Engie providing energy-savings-as-a-service (ESaaS) offerings to businesses, helping them overcome not only technical but also financial and behavioral barriers to energy consumption reduction.

- Push for certain product offerings that will better meet the Renovation Wave needs. For example, companies developing sustainable materials like wood are expected to experience higher growth, due to the product’s structural building performance, biodegradable properties, relatively low embodied energy, carbon sequestration properties, and branding benefits.

2. Strengthen support for individuals in context of renovation projects

- Modify budget allocations to local support programs designed to help homeowners navigate the process of energy-efficient renovation projects. This may help ensure sufficient recruitment of qualified personnel and/or facilitate accreditation conditions for companies that assist individuals with comprehensive or high-performance renovation projects. Local support programs exist in many countries, such as Accompagnateur Rénov in France or Energieberatung in Germany with varying degrees of support personalization and scale.

3. Address workforce concerns

-

Enhance the appeal of careers associated with building renovations and overall rehabilitation. This can be achieved by prioritizing professional certifications, increasing financial support for initial training, and fostering a more robust social dialogue at the relevant construction segment level to improve pay and working conditions.

-

Simplify the certification systems, recognizing the expertise of industry professionals and companies to meet growing demand, and support small renovation players in accessing local sustainability and energy-efficiency certifications, which are often required to access financial incentives from local authorities (e.g., RGE [Recognized Guarantor of the Environment] in France, KfW in Germany, CasaClima in Italy). This can be done through temporary measures. For example, RGE chantier par chantier in France, which until late 2023 encouraged RGE certification, allowed businesses with at least two years of activity to perform installations and/or renovations and be eligible to receive State support.

4. Reinforce the ecosystem

-

Encourage collaboration across business units or large groups by streamlining the coordination and integration of diverse technologies and solutions. Consistent communication, collaborative planning, and shared objectives are essential to approaching renovations comprehensively rather than on a standalone basis.

-

Facilitate the organization of the professional sector to enhance the efficient renovation of houses and small collective buildings by fostering collaboration between companies, establishing business groups, and enhancing networks. Cultivating long-term partnerships with other companies or organizations that provide complementary technologies and solutions allows for a more cohesive approach to building renovation. This could entail forming strategic alliances or collaborating with specialized companies (e.g., providers of windows, heat pumps, energy management) to collectively deliver comprehensive renovation solutions. These partnerships can present a unified value proposition to clients, promoting a coordinated and holistic approach to renovations and ultimately delivering a more integrated service.

5. Introduce innovative financing models

-

Simplify and stabilize the support mechanisms for energy-efficient building renovations to provide visibility to economic actors (businesses and individuals) through a multi-year programming initiative and direct these mechanisms toward comprehensive or high-performance energy renovation projects.

-

Encourage financial institutions or utility companies to develop more flexible financing options. The banking and insurance sectors could play a key role in financing energy refurbishment projects by offering increased financing flexibility to attract new clients. Other stakeholders, such as energy suppliers, could also benefit from offering leasing solutions, which could increase customer loyalty. Moreover, local public institutions could provide flexible financing options to sub-average-income homeowners to reduce financial constraints on energy-efficient renovation projects. For example, France offers options through its Renovation Advance Loan mechanism, which allows borrowers to obtain funds for carrying out renovation works and defer repayment of the principal and interest until the property is sold or transferred, and Germany’s KfW offers low-interest loans and grants; in some cases, they give repayment bonuses for achieving specific energy-efficiency standards.

Conclusion

DELIVERING ON THE RENOVATION WAVE REQUIRES INNOVATION & COORDINATION

With over 35 million buildings slated for renovation in this decade, the European residential renovation market is already massive and could accelerate, hereby creating opportunities for the construction sector. How quickly this acceleration materializes will depend on the speed to address the lingering challenges posed by labor shortages, incomplete industrial structuring, diversity of technologies used, weak financing, and fragile support. Efforts are required from stakeholders driving supply and demand to make the renovation wave a success:

-

Supply. The construction sector must rethink its structure, attractiveness, and offerings to provide a right-sized, comprehensive, high-performance, and self-financed renovation approach, as the Renovation Wave creates opportunities for bold actors to reshape the ecosystem.

-

Demand. The level of support to individuals must be maintained throughout the renovation process as it will shape demand; this requires regular evaluations of support mechanisms. Also, greater stability in the regulatory and financial framework will facilitate market development.