19 min read • Energy, Utilities & Resources

Digital energy

How smart meters will contribute to changing the energy landscape?

Executive Summary

The majority of European countries have started the rollout process of smart metering in the electricity market, based on the outcome of the cost-benefit analysis (CBA) conducted according to the 2009 European Directive. Although some countries have not terminated the “first” rollout yet, a few, such as Italy, are already planning and deploying the rollout of a new generation of smart meters: the new metering system will serve as an enabler of smart services, which implies benefits for the system as a whole. In this paper, we will focus our analysis on:

- Our view of the European context (regulation and “state of the art” quality of the rollout),

- Challenges that power DSOs are facing or will have to face,

- How to succeed in the rollout of smart meters

- New services enabled (e.g., dynamic pricing, vehicle to grid, vehicle to home).

The success of the transition process will rely on the efficiency put in place by distributors, as well as a regulatory framework that will need to support the costs borne by the DSO and the innovative services/technologies that the deployment of the meter will enable.

Beyond the transition process, benefits from smart metering will reshape the value propositions of different market players, enabling integration with advanced systems based on new technologies and providing new value-added services to customers.

1

EU regulatory framework

EU policies

The European Union has supported the diffusion of advanced measurement systems over the last decade, with the aim of fostering the development of smart grids and intelligent measurement systems.

The first Directive, 2009/72, required Member States to perform CBAs for the massive rollout of smart meters and, in the case of a positive outcome, set the objective to reach a penetration rate of 80 percent by 2020.

Directive 2012/27 provided a new definition for smart-metering systems, underlining the importance of the timely availability of measuring data, in order to enhance consumers’ awareness of their consumption habits.

After the first two pieces of legislation, the Recommendation 2012/48 stated the minimum functional requirements for smart meters, and the Measuring Instruments Directive (MID) defined the technical and metrological requirements for measuring systems.

The “Clean Energy Package” presented by the EU in November 2016 pursued the objective, among others, of enhancing the transition towards smart grids, which would bring benefits in terms of information flows and cost efficiency for every actor in the energy landscape. In this context, smart meters, which were then regulated by the Directive 2019/944 (also called “Directive on common rules for the internal market for electricity” or “Electricity Directive”), play a key role. The Electricity Directive updates the common rules for generation, transmission, distribution, storage and supply of electricity, and makes specific provisions for smart metering.

According to the Directive, Member States or their designated national regulatory authorities (NRAs) shall prepare timetables with targets of up to 10 years for the deployment of smartmetering systems. The start of a deployment should follow a CBA that, if negative, has to be revised every four years. Even in case of a negative CBA, a Member State shall ensure the installation of smart meters upon request from the final customers, which have to bear the associated costs. On the other hand, if the CBA results are positive, at least 80 percent of final customers shall be equipped with smart meters within seven years from the date of the positive result, or by 2024 if the Member State has started the deployment before the entry into force of the Directive.

Each Member State has to publish the minimal functional and technical requirements for smart-metering systems, as well as ensure the interoperability of the systems and that they can provide output for consumer energy management systems. Smart-metering systems’ specifications have to comply with European standards and regulation, particularly on themes related to data management (the type of data provided to customers, data security, availability of data for final customers, and the communication to final customers prior to or at the time of the installation of the smart meter).

Member States’ implementation strategies

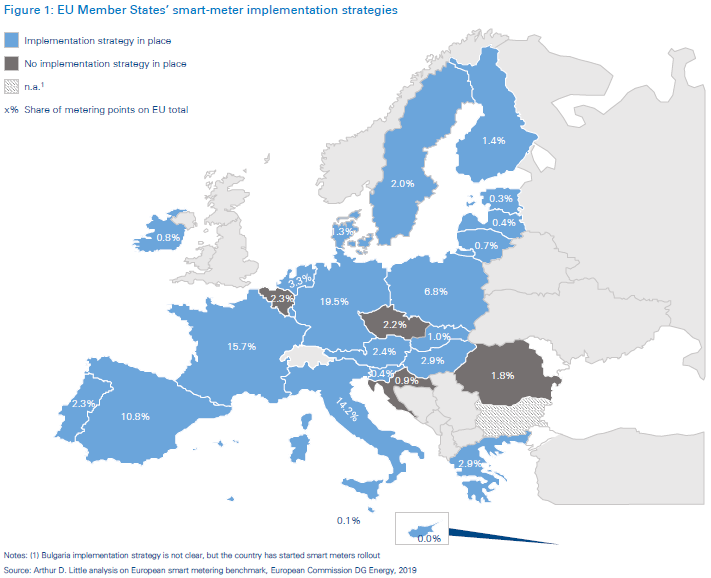

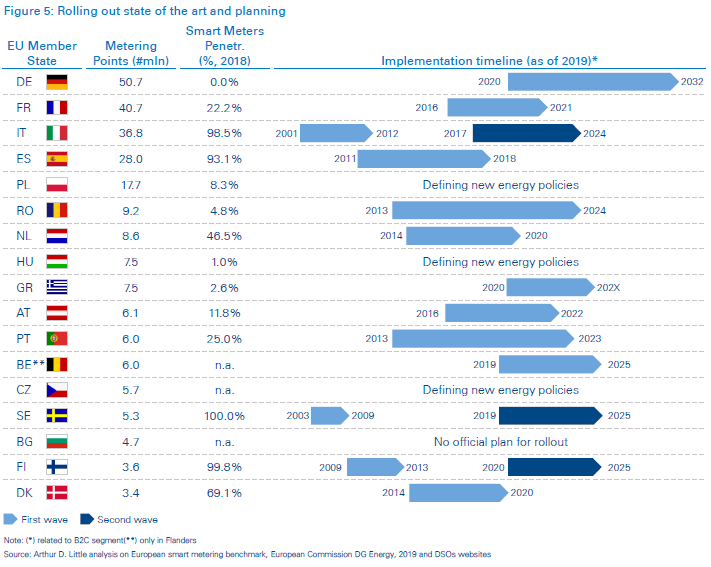

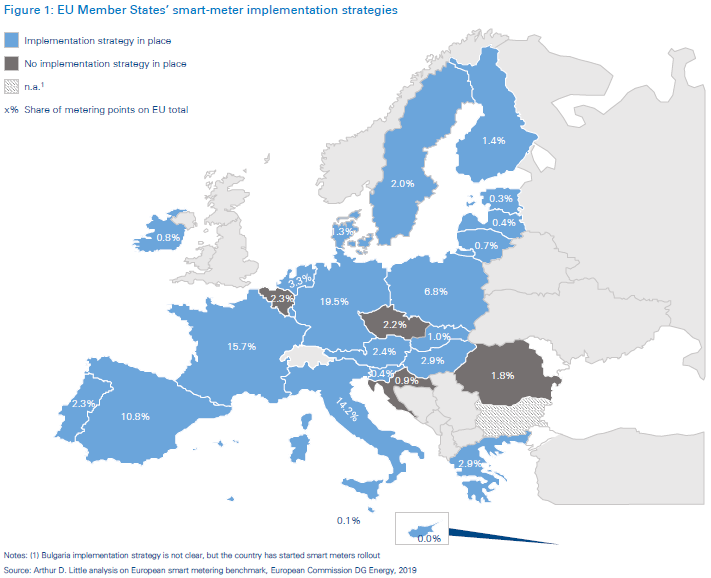

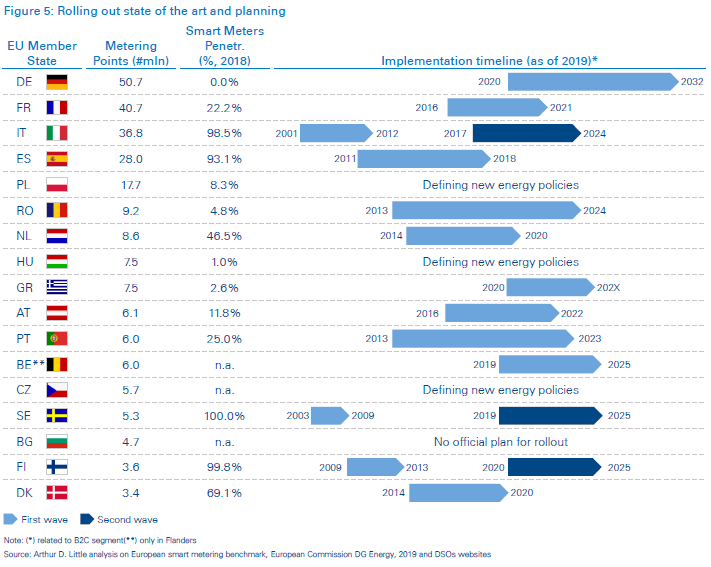

In EU countries there are approximately 260 million active metering points. Around 60 percent of European metering points are concentrated in four countries – Germany, France, Italy and Spain – with the remaining 40 percent divided among the other 23 countries.

About three-quarters of Member States have incorporated the Electricity Directive into national laws and defined their own implementation strategies, regulated by specific pieces of legislation for deployment of smart meters. Only four states (Belgium, Bulgaria, the Czech Republic and Croatia) have not defined implementation strategies yet.

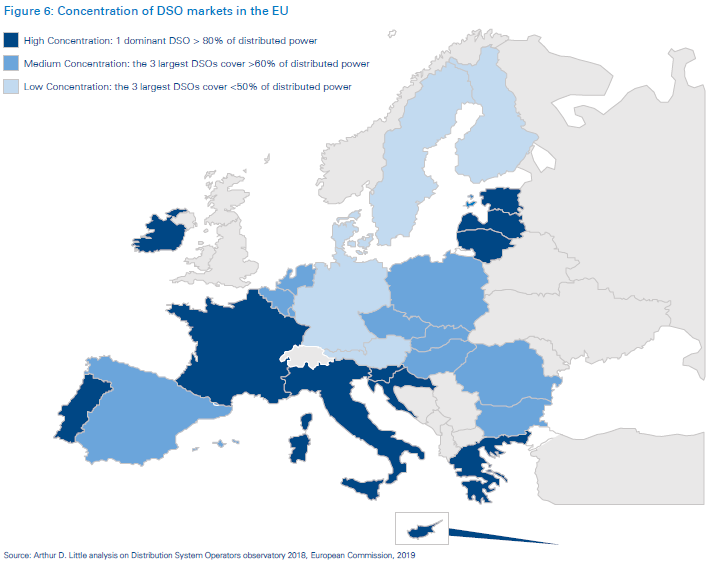

In most Member States, the implementation strategy defines the market actor that owns smart meters and is responsible for their installation. In most cases the ownership and installation of meters are the responsibility of the distribution system operator (DSO). In the few remaining Member States (such as France and Slovenia), local municipalities or the government own the smart meters and DSOs manage the metering services for concessions. The exception is Germany, where the activities can be the responsibility of the DSO or a third-party meter operator.

2

State-of-the-art smart metering

Cost-benefit analysis

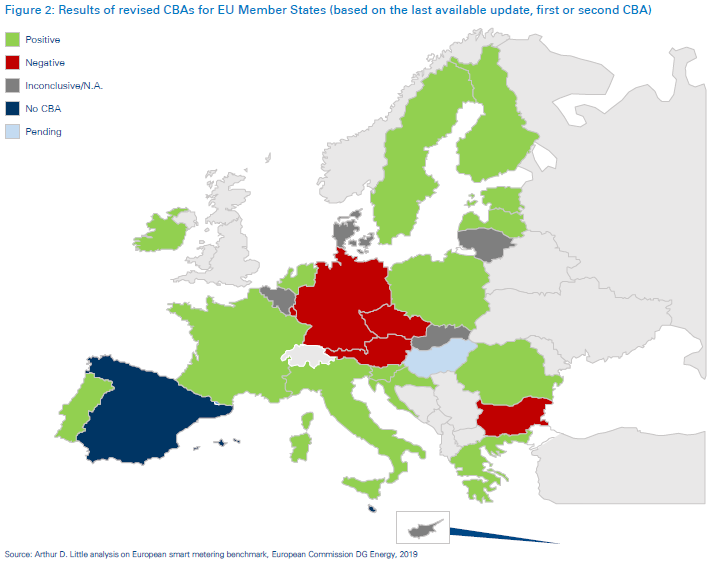

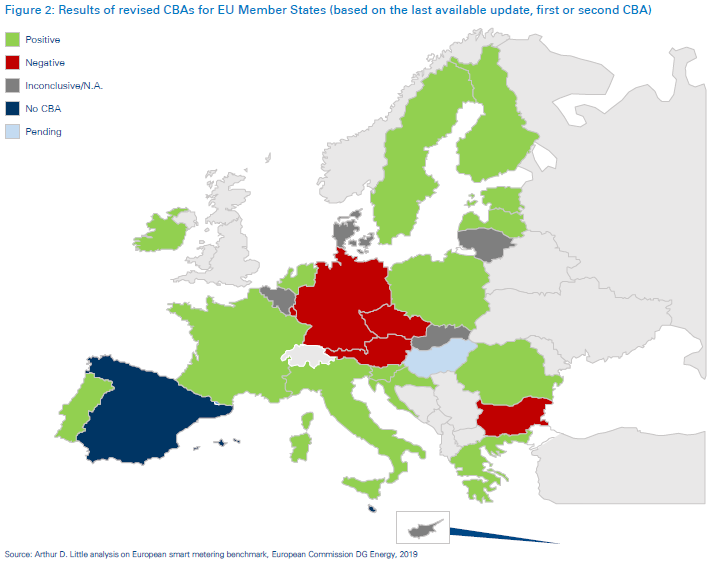

On the basis of the obligations set by Directive 2019/944, every Member State, except Spain and Malta, has completed at least one CBA. The initial CBAs were generally performed on the back of pilot projects, while the revised assessments targeted the actual scale and timing of the deployment. In many cases, when two CBAs were performed, the outcome of the first CBA (carried out in 2013) was confirmed. Only in a few cases were the CBA results changed from negative or inconclusive to positive (i.e., Latvia and Portugal).

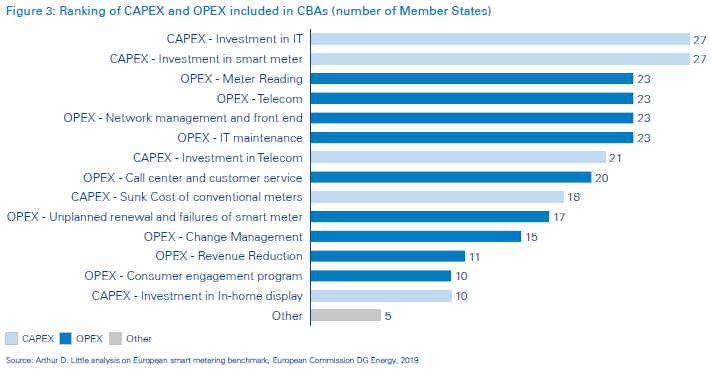

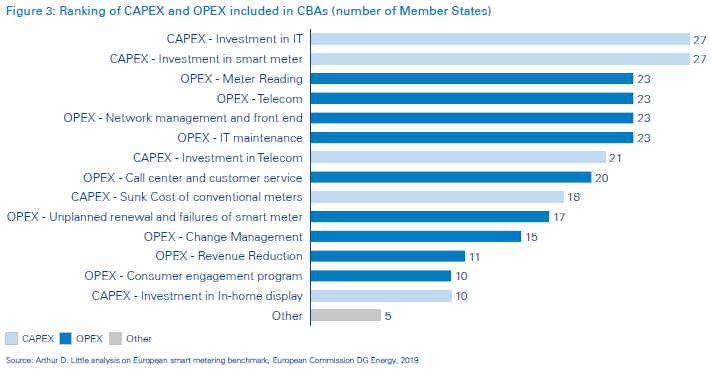

The CBA is structured according to a TOTEX approach, considering both OPEX and CAPEX. Despite each Member State adopting the same approach, the categories of costs and benefits included in the analysis differ across EU countries.

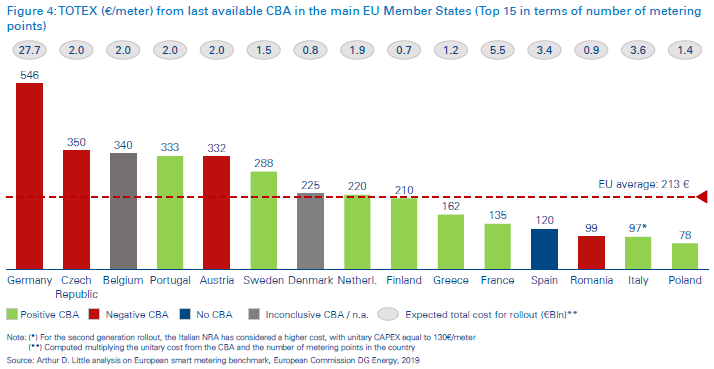

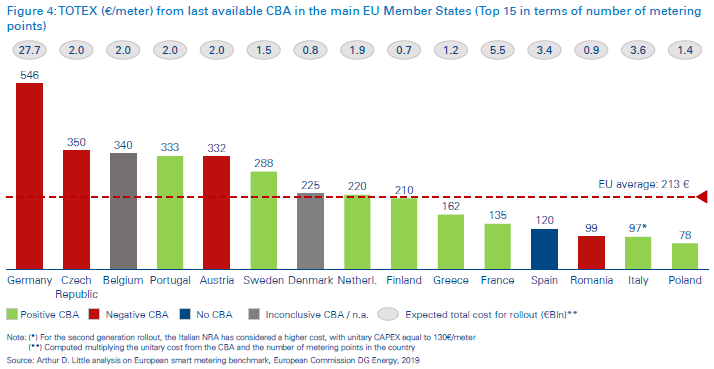

All Member States included investments in IT and smart meters in their assessments; OPEX for meter reading, telecom, network management, and front-end and IT maintenance were included in the CBAs of 23 EU Member States out of 27. Fewer countries included other costs in their assessments, with investments in in-home displays and OPEX for consumer engagement programs included by 10 EU countries. All the EU Members that performed CBAs quantified costs and benefits included in their CBAs, directly computing unitary indicators; the results of TOTEX computation have been highly variable, from 38.2 €/meter in Latvia to 546.0 €/meter in Germany, averaging 213.0 €/meter across all EU Member States.

Benefits considered by Member States in the CBA analysis varies significantly across countries, with a range between 19€/meter to 352€/meter. Main benefits are related to DSOs, such as operational savings due to remote meter readings and reduction of non-technical losses (e.g. administrative or fraud), as well as to consumer, considering the bill reduction given by increased energy efficiency.

The variability of unitary cost per meter resulting from a CBA is partially due to the different categories of CAPEX and OPEX included in the CBA. In fact, Sweden, Germany and France considered almost all cost categories in the assessment, while Spain, Italy and Poland considered lower numbers of costs in their CBAs.

Moreover, costs may vary according to the different types of systems adopted: as shown by the Italian market (see the section below), costs related to the new-generation smartmetering system are relatively higher than the ones related to the first wave. (The regulatory authority – ARERA – set a CAPEX cap for cost remuneration equal to 130 €/meter).

Rolling out state of the art

After a positive outcome from the CBA, Member States shall reach wide-scale rollout of smart meters (i.e., at least 80 percent of consumers) within seven years, or by 2024 if their positive results were prior to the implementation of Directive 2019/944.

While most countries have started and/or completed their first waves of smart-meter rollout, some have already started, or are about to start, the second wave – namely, Italy (analyzed in the following chapter), Finland and Sweden. In these countries, the smart meters related to the first wave are coming close to the end of their service lives (approximately 15 years) and will need to be replaced in the next years. This will bring additional benefits to operators and final customers in terms of monitoring of energy consumption.

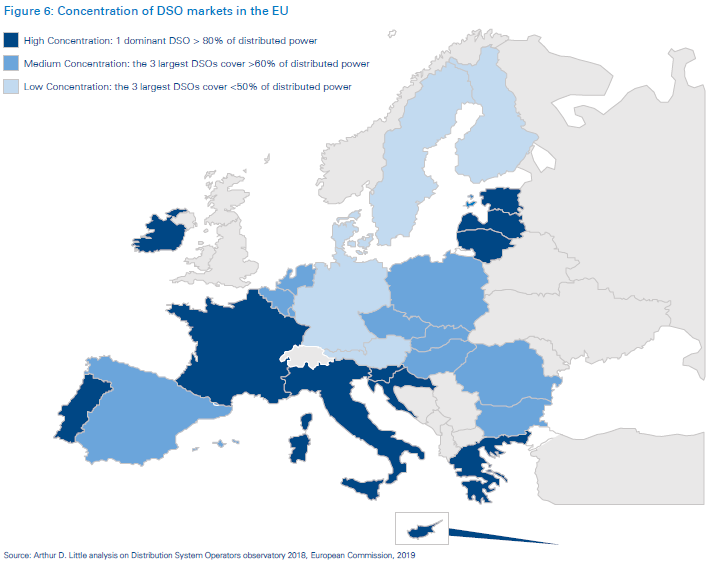

Germany is the Member State with the highest number of metering points (50.7M, 17.5 percent of the EU total), and has a low-concentrated market for DSOs, with 880 operators, of which 75 have more than 100,000 customers. Due to the negative outcome of its CBA, Germany decided to set up an independent, more gradual rollout strategy: the strategy requires DSOs to install smart meters for large consumers that have average annual consumptions above a determined threshold, which will be lowered over time (10,000 kWH from 2017, 6,000 kWH from 2020, etc.). Besides these consumption thresholds, generators with capacity above 7 kW, e-mobility drivers, and heat-pump and night-storage customers are targeted with the new smart meters. The gradual rollout is expected to be completed in 2032, while the pilot rollout will run from 2017 to 2020 (with a target penetration of 23 percent). The pilot rollout will allow operators to learn from the early adopters and mitigate or resolve any problems stemming from the initial phase of the rollout; this will result in a more efficient deployment

The DSO market in France is highly concentrated, with five DSOs covering more than 100,000 customers (158 in total), but one, Enedis (formerly EDF), covers more than 80 percent of the distributed power. The national rollout plan is expected to be completed in 2021, with a commitment of reaching a 95% penetration rate by the end of 2020 with a total of 28 million devices installed. So far, DSOs and manufacturers confirm that the rollout is on schedule

A unique case is represented by Spain, which did not perform any CBA analysis and does not have a national rollout plan for smart metering; nonetheless, the country reached a wide-scale rollout, and was among the six countries that reached the 80 percent penetration target. Five operators with more than 100,000 customers operate in the Spanish DSO market, with the largest three covering more than 60 percent of distributed power in the country.

Poland is the fifth EU Member State in terms of metering points (17.7M). Four DSOs (state-owned incumbent operators) account for 85 percent of the total market. The penetration rate of smart meters is 8.3 percent, mainly related to non-domestic customers: lack of legislation supporting EU directives on smart metering is holding the country back from a wide-scale rollout despite the positive result of the CBA.

Romania started an acceleration of smart-meter uptake in the past years as DSOs initiated significant deployments (8 percent penetration in 2019, and expectation to reach wide-scale rollout by 2024). The Romanian DSO market shows a medium level of concentration, and three DSOs cover most of the distributed power. In 2019, the national authority approved a decree that foresaw implementation of over 4 million smart meters by the end of 2028.

The Dutch DSO market has medium concentration, with the three largest covering more than 60 percent of distributed power in the country. In 2019 the Netherlands was more than halfway through the completion of a smart-meter rollout, with a penetration of 66.6 percent. (The completion of the rollout is expected to reach an 80 to 90 percent penetration by 2020.)

Hungary has not implemented an official national strategy for smart-meter rollout by DSOs, but has established a subsidiary of the national TSO to manage a national pilot project over the next years. The Hungarian DSO market has six operators, all with more than 100,000 customers, with the largest three covering more than 60 percent of distributed power in the country.

The DSO market in Greece is a monopoly, with HEDNO as the only player in the market. Greece had an official national strategy that expected the completion of the rollout by 2020, but it was put on hold. HEDNO is now expecting to start the rollout in 2020, without a clear indication about the completion date.

In Austria there are 138 DSOs, of which 13 have more than 100,000 customers, which shows low concentration in the market. The original implementation strategy was supposed to reach wide-scale deployment by 2019, as determined by the Federal Minister of Science, Research and Economy. As of 2019, the smart-meter penetration rate in Austria was 17 percent, which shows a delay in the original timeline, especially considering that DSOs forecasted that they would complete the rollout by 2022.

The Portuguese DSO market has 13 active players, of which three have more than 100,000 customers, and the largest, EDP Distribuçao, covers more than 80 percent of the market. As of 2018, the smart-meter penetration rate in Portugal was 25 percent, with EDP Distribuçao expecting to reach wide-scale rollout by 2023.

In Belgium operate four main DSOs (which aggregate smaller DSOs across the country), the largest three of which (Fluvius in Flanders, ORES in Wallonia, and Sibelga in the Brussels region) cover more than 60 percent of the distributed power in the country. This shows a medium level of market concentration. Despite the inconclusive result of the CBA, the smart-meter rollout in Flanders started in 2019, although in Brussels the DSO won’t proceed with large-scale rollout until 2023.

In the Czech Republic three DSOs cover the whole market, resulting in medium market concentration. Its CBA resulted in a negative outcome due to a negative business case. This is partly due to distributors’ reliance on “bulk remote control”, which allows basic on/off functionality at predefined times for certain types of appliances. A negative CBA resulted in a subsequent decision not to have a national smart-meter rollout plan; however, the Czech government is defining new energy policies that will likely include some provisions for smart metering.

Along with Italy and Finland, Sweden completed its firstgeneration rollout in 2009 and is starting the 2G rollout, which is expected to be completed by 2025. Like those of the other Nordic Member States, the Swedish DSO market is highly fragmented, with approximately 175 operators, of which only six have more than 100,000 customers.

Bulgaria does not plan a mandatory rollout, but the country’s four DSOs (three of which have more than 100,000 customers and cover almost the whole market) are gradually deploying smart meters to selected customers.

The Finland DSO market shows a low level of concentration, with seven operators covering more than 100,000 customers, and the largest three covering less than 50 percent of the country’s distributed power. It is one of the three Member States that completed its 1G smart-meter rollout and is about to start a second-generation deployment. The shift to 2G smart meters in Finland will allow the transition to a centralized information-exchange system for the electricity retail market, with the establishment of a centralized data hub to serve suppliers, DSOs and customers. The rollout is expected to start in 2020 and be completed in 2025, which will, among other things, allow it to move from one-hour to 15-minute intervals in electricity metering, further increasing the generation and transfers of metering and end-user data.

Denmark is the only country among the Nordics in the EU that has not completed its 1G rollout for smart meters. However, the country’s strategy is on track, with the announced timeline to be completed in 2020 and over an 80 percent household smart meter adoption rate, one of the highest in the EU. The Danish market for DSOs is fragmented, with a low level of concentration (approximately 50 DSOs).

3

Lessons learned from Italy

Italy has been at the forefront of smart-metering rollouts during both waves, having started its first-generation smart-meter rollout in the early 2000s (and completed it in 2012, with most smart meters installed in the first years). It was also the first EU country to start its rollout of the second generation of smart meters in 2017, following a deliberation by the Italian Regulatory Authority for Energy, Networks and Environment (ARERA) published in March 2016.

ARERA defined the fundamental technical and functional specifications that new-generation smart meters must have and set some rules in relation to cost recognition in tariffs, timing of the 2G rollout, and transparency of service plans provided by operators.

This section will offer a snapshot of i) regulation and tariffs, ii) technology, iii) benefits of the new smart-meter generation, and iv) the rollout plan.

Regulation and tariffs

The cost recognition related to smart metering is based on a TOTEX approach, which is applied to 2G smart metering only for capital expenditures. The level of CAPEX recognized is determined by ARERA on the basis of the business plan presented by the DSO. It also considers the cap of 130 €/meter. The CAPEX includes central system, concentrators and meters.

The expenditures recognition system is based on the following three main pillars:

- Business plan (PMS2): Companies submit 15-year rollout and implementation plans, defining the related costs and assuring the certainty of the connection between what operators plan to carry out and invest, as well as the benefits to be derived from it (output based). The regulation from ARERA states that once the business plan (PMS2) is submitted by a DSO, it has to be published for a public consultation phase, in which stakeholders may express their observations and any concern. After the consultation phase, DSOs can review the business plan according to the received observations, and then the final business plan is approved by ARERA.

- Incentive and penalty mechanism: Recognized costs depend on the relationship between costs included in the business plan, actual costs, and costs assumed by ARERA formalized in the Information Quality Incentive (IQI) matrix, to achieve:

- Correct measurement of operators’ expected costs,

- Minimization of total costs (ex ante approach plus long regulatory period),

- Specific outputs.

- Uncertainty mechanism: To transfer to the final customer some risks that are not under the control of operators (e.g., the possibility to update the business plan every three years).

Technology

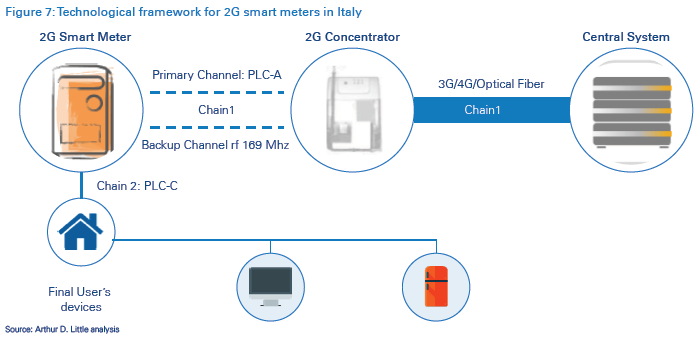

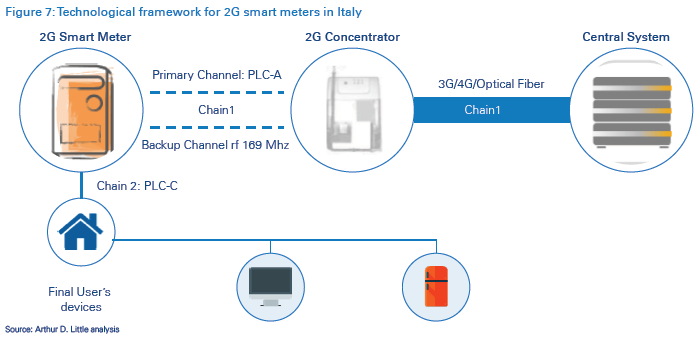

The Italian 2G smart-metering technological infrastructure is made up of three main components:

- Devices, which include 2G smart meters provided by the DSO, installation/communication sensors with meters and concentrators, and concentrators for the 2G system (equipped for communication with the central system) that can also use remote control on 1G meters (unless a transition is made by or to a different vendor with proprietary communication protocols).

- The central system, a remote management system with minimal functions required by the current regulation, compatible with 1G and 2G smart meters. Its main functions are remote reading, work-order management and a mobile app, and will eventually be comprehensive with a measurement data acquisition module (MDM), a software component related to the management of the measurement service as required by current legislation. The main functionalities of the MDM are measurement data management, measurement validation and estimation control, and provision and dispatch of data publication.

The system is comprised of two independent communication channels for the connection between the meter and the central system (“Chain 1”): the primary channel power line communication (PLC) in the A CENELEC band, and the backup channel in radio frequency (RF) Wireless Meter-Bus in the 169 MHz frequency band.

Direct access to information related to user consumption in real time will be enabled by communication through frequencies (PLC in the C CENELEC band) between the 2G meter and user device along “Chain 2”. In Italy, there is no application for Chain 2 yet, although a testing phase has been started by E-distribuzione (the DSO of Enel Group), with the aim of developing and selling in-home devices that allow management of final-user data coming from smart meters.

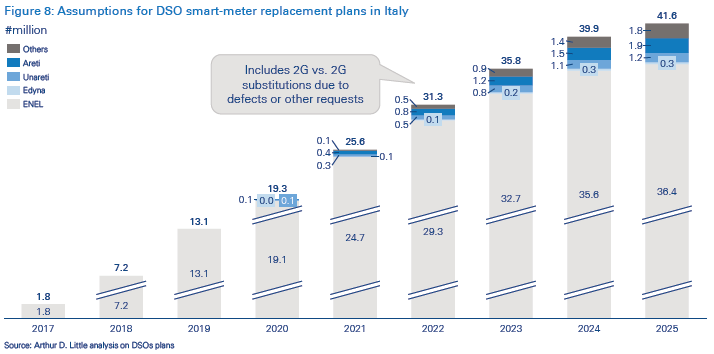

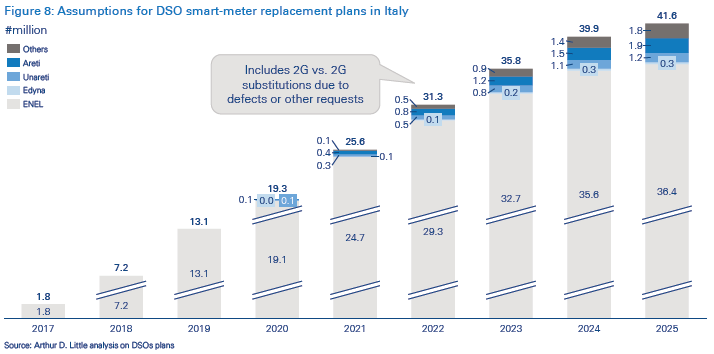

Rollout plan

E-distribuzione was the first company to submit the PMS2 and start the massive 2G rollout in 2017, followed by other DSOs (Areti, from ACEA Group; Unareti, from A2A Group; and Edyna). To avoid a “two-speed economy”, ARERA requires all DSOs with more than 100,000 delivery points to reach 95 percent coverage of the new-generation smart meters by 2026.

In Italy, six DSOs have not submitted their business plans, but are expected to do this in 2021 and 2022, in order to meet the deadlines of 2025 (90 percent) and 2026 (95 percent) for the rollout status set by ARERA. Assuming that half of the missing DSOs will submit their plans in 2020 and the other half in 2021 (which implies the start of their rollouts in 2021 and 2022, respectively), 41.6 million smart meters will be installed by 2025.

4

Benefits from smart meters and new services

The smart-metering rollout will be beneficial for all actors along the value chain (e.g., DSOs, retailers, and final customers). The main benefits can be summarized as follows:

- Remote reading and management: This represents the primary benefit for DSOs that are still managing the first wave of smart-meter rollout, as it allows them to significantly improve operational efficiency. For countries such as Italy and the Nordics, these benefits have been achieved: around 95 percent of smart meters installed are remotely read, and several activities can be remotely managed as the increase of available capacity. New smart meters installed in Sweden, for instance, can be upgraded remotely and have built-in switches for turning off the power supply (e.g., if the customer goes on vacation).

- Near-real-time reading: Every market player will benefit from accurate monitoring and forecasting of energy consumption, since this will enhance end users’ awareness (e.g., costs and the environmental impact of consumption habits), as well as anticipate potential disruption from market imbalances. Most European countries (including Italy and Germany) will provide 96 readings per day (one every quarter-hour), while Spain’s system will allow only one reading per hour.

- Dynamic pricing offers: The new system will likely allow retailers to differentiate tariffs based on individual customers’ consumption habits and give end customers access to dynamic pricing offers (e.g., an Italian retailer offering three hours per day of free energy for new customers). In Sweden, monthly variable price contracts that follow the spot market are the most common contract type, and hourly contracts have been available since late 2012.

- Smart-home offers/Chain 2: Smart meters will be able to communicate with users’ devices (Chain 2), allowing customers to optimize their consumption of energy throughout the day and extract additional value from smarthome devices. However, players (both energy companies and players from other industries) need to find new business models and develop innovative case studies to effectively enable customers so they can benefit from this new technology.

- From consumers to prosumers: The new system will facilitate the development of demand-response, energysharing systems and microgrids, helping individuals in the transition from consumers to prosumers in the market, as well as utilization of electric vehicles and home batteries that would be impacted by lower costs for charging. Possible applications enabled by microgrids are vehicle-to-grid and vehicle-to-home, in which electric vehicles’ batteries can interact with grids and homes, allowing stabilization and efficiency of power flows, as well as production of renewable energy. Cars can accumulate energy in lowconsumption moments and act as sources of energy in peak consumption hours.

In conclusion, benefits from smart metering will reshape the value propositions of different market players, enabling integration with advanced systems based on new technologies and providing new value-added services to the customers.

5

Key takeaways and recommendations

Smart metering represents one of the key strategic items towards smart-city development, thanks to the aforementioned benefits embedded throughout “electricity value chain”. Based on Italy’s experiences, DSOs and regulatory authorities that are planning new smart-meter roll-outs should address the following key challenges:

Regulation

- Moving towards output-based regulation for metering activities: The Italian regulation scheme represents a preliminary step towards an output-based approach, as it is focused on a CAPEX business plan, while OPEX continues to be remunerated according to a standard cost mechanism. The introduction of an output-based approach is highly recommended, in order to guarantee coverage of all additional expenditures required by smartmeter rollout and pursue efficiency targets at the same time. In this context, interaction between DSOs and the regulation authority is key to make the latter aware of the transformations of the business model (and the relative costs) that the rollout process implies, as well as to establish a regulatory framework that enhances an innovative digital transformation.

- Set up ad hoc regulation for some innovative activities enabled by smart meters (e.g., demand response, energy communities) to effectively boost the demand of these new energy services and enable the benefits estimated in CBAs.

Digital shift

-

The rollout process affects most of the processes related to measurement data management: therefore, deep knowledge and understanding of the organizational and IT structures are a key success factor to optimize the transition process and guarantee efficient deployment, while avoiding any shortfalls in operations.

- DSOs would then need to consider the rollout process an opportunity to review and reshape their ICT frameworks (central system, WFM, mobile app, etc.) with a view to moving towards a more digital approach.

Procurement

- Procurement of software and hardware related to the rollout process requires an in-depth make-or-buy analysis in order to address the right procurement procedures. Moreover, the market offering is broadening since several different providers (device manufactures and ICT services providers) are entering the market by offering various services according to the size and needs of the distributor.

Financials

- Elaboration on an accurate business plan is key for the financial stability of the DSO. The correct identification of capital expenditures, an installation-plan time frame, and emerging costs (such as the ones related for the reading and validation process) would assure that the DSO did not incur extra costs and penalties defined by the regulatory framework.

New business models

- Smart metering is affecting the entire electricity value chain and, hence, represents a key opportunity for market players to review and reengineer their business models. In fact, smart metering may:

- Foster, by enabling microgrids and demand-response, the development of renewable energy sources (such as solar and wind energy) and support the electricity system balance,

- Stimulate demand for more efficient power-based tools and services, such as batteries and smart-home devices,

- Broaden retailers’ offerings in terms of pricing and energy solutions,

- Create opportunities for non-energy players that may be interested in acquiring data related to customers’ habits.

DOWNLOAD THE FULL REPORT

19 min read • Energy, Utilities & Resources

Digital energy

How smart meters will contribute to changing the energy landscape?

DATE

Executive Summary

The majority of European countries have started the rollout process of smart metering in the electricity market, based on the outcome of the cost-benefit analysis (CBA) conducted according to the 2009 European Directive. Although some countries have not terminated the “first” rollout yet, a few, such as Italy, are already planning and deploying the rollout of a new generation of smart meters: the new metering system will serve as an enabler of smart services, which implies benefits for the system as a whole. In this paper, we will focus our analysis on:

- Our view of the European context (regulation and “state of the art” quality of the rollout),

- Challenges that power DSOs are facing or will have to face,

- How to succeed in the rollout of smart meters

- New services enabled (e.g., dynamic pricing, vehicle to grid, vehicle to home).

The success of the transition process will rely on the efficiency put in place by distributors, as well as a regulatory framework that will need to support the costs borne by the DSO and the innovative services/technologies that the deployment of the meter will enable.

Beyond the transition process, benefits from smart metering will reshape the value propositions of different market players, enabling integration with advanced systems based on new technologies and providing new value-added services to customers.

1

EU regulatory framework

EU policies

The European Union has supported the diffusion of advanced measurement systems over the last decade, with the aim of fostering the development of smart grids and intelligent measurement systems.

The first Directive, 2009/72, required Member States to perform CBAs for the massive rollout of smart meters and, in the case of a positive outcome, set the objective to reach a penetration rate of 80 percent by 2020.

Directive 2012/27 provided a new definition for smart-metering systems, underlining the importance of the timely availability of measuring data, in order to enhance consumers’ awareness of their consumption habits.

After the first two pieces of legislation, the Recommendation 2012/48 stated the minimum functional requirements for smart meters, and the Measuring Instruments Directive (MID) defined the technical and metrological requirements for measuring systems.

The “Clean Energy Package” presented by the EU in November 2016 pursued the objective, among others, of enhancing the transition towards smart grids, which would bring benefits in terms of information flows and cost efficiency for every actor in the energy landscape. In this context, smart meters, which were then regulated by the Directive 2019/944 (also called “Directive on common rules for the internal market for electricity” or “Electricity Directive”), play a key role. The Electricity Directive updates the common rules for generation, transmission, distribution, storage and supply of electricity, and makes specific provisions for smart metering.

According to the Directive, Member States or their designated national regulatory authorities (NRAs) shall prepare timetables with targets of up to 10 years for the deployment of smartmetering systems. The start of a deployment should follow a CBA that, if negative, has to be revised every four years. Even in case of a negative CBA, a Member State shall ensure the installation of smart meters upon request from the final customers, which have to bear the associated costs. On the other hand, if the CBA results are positive, at least 80 percent of final customers shall be equipped with smart meters within seven years from the date of the positive result, or by 2024 if the Member State has started the deployment before the entry into force of the Directive.

Each Member State has to publish the minimal functional and technical requirements for smart-metering systems, as well as ensure the interoperability of the systems and that they can provide output for consumer energy management systems. Smart-metering systems’ specifications have to comply with European standards and regulation, particularly on themes related to data management (the type of data provided to customers, data security, availability of data for final customers, and the communication to final customers prior to or at the time of the installation of the smart meter).

Member States’ implementation strategies

In EU countries there are approximately 260 million active metering points. Around 60 percent of European metering points are concentrated in four countries – Germany, France, Italy and Spain – with the remaining 40 percent divided among the other 23 countries.

About three-quarters of Member States have incorporated the Electricity Directive into national laws and defined their own implementation strategies, regulated by specific pieces of legislation for deployment of smart meters. Only four states (Belgium, Bulgaria, the Czech Republic and Croatia) have not defined implementation strategies yet.

In most Member States, the implementation strategy defines the market actor that owns smart meters and is responsible for their installation. In most cases the ownership and installation of meters are the responsibility of the distribution system operator (DSO). In the few remaining Member States (such as France and Slovenia), local municipalities or the government own the smart meters and DSOs manage the metering services for concessions. The exception is Germany, where the activities can be the responsibility of the DSO or a third-party meter operator.

2

State-of-the-art smart metering

Cost-benefit analysis

On the basis of the obligations set by Directive 2019/944, every Member State, except Spain and Malta, has completed at least one CBA. The initial CBAs were generally performed on the back of pilot projects, while the revised assessments targeted the actual scale and timing of the deployment. In many cases, when two CBAs were performed, the outcome of the first CBA (carried out in 2013) was confirmed. Only in a few cases were the CBA results changed from negative or inconclusive to positive (i.e., Latvia and Portugal).

The CBA is structured according to a TOTEX approach, considering both OPEX and CAPEX. Despite each Member State adopting the same approach, the categories of costs and benefits included in the analysis differ across EU countries.

All Member States included investments in IT and smart meters in their assessments; OPEX for meter reading, telecom, network management, and front-end and IT maintenance were included in the CBAs of 23 EU Member States out of 27. Fewer countries included other costs in their assessments, with investments in in-home displays and OPEX for consumer engagement programs included by 10 EU countries. All the EU Members that performed CBAs quantified costs and benefits included in their CBAs, directly computing unitary indicators; the results of TOTEX computation have been highly variable, from 38.2 €/meter in Latvia to 546.0 €/meter in Germany, averaging 213.0 €/meter across all EU Member States.

Benefits considered by Member States in the CBA analysis varies significantly across countries, with a range between 19€/meter to 352€/meter. Main benefits are related to DSOs, such as operational savings due to remote meter readings and reduction of non-technical losses (e.g. administrative or fraud), as well as to consumer, considering the bill reduction given by increased energy efficiency.

The variability of unitary cost per meter resulting from a CBA is partially due to the different categories of CAPEX and OPEX included in the CBA. In fact, Sweden, Germany and France considered almost all cost categories in the assessment, while Spain, Italy and Poland considered lower numbers of costs in their CBAs.

Moreover, costs may vary according to the different types of systems adopted: as shown by the Italian market (see the section below), costs related to the new-generation smartmetering system are relatively higher than the ones related to the first wave. (The regulatory authority – ARERA – set a CAPEX cap for cost remuneration equal to 130 €/meter).

Rolling out state of the art

After a positive outcome from the CBA, Member States shall reach wide-scale rollout of smart meters (i.e., at least 80 percent of consumers) within seven years, or by 2024 if their positive results were prior to the implementation of Directive 2019/944.

While most countries have started and/or completed their first waves of smart-meter rollout, some have already started, or are about to start, the second wave – namely, Italy (analyzed in the following chapter), Finland and Sweden. In these countries, the smart meters related to the first wave are coming close to the end of their service lives (approximately 15 years) and will need to be replaced in the next years. This will bring additional benefits to operators and final customers in terms of monitoring of energy consumption.

Germany is the Member State with the highest number of metering points (50.7M, 17.5 percent of the EU total), and has a low-concentrated market for DSOs, with 880 operators, of which 75 have more than 100,000 customers. Due to the negative outcome of its CBA, Germany decided to set up an independent, more gradual rollout strategy: the strategy requires DSOs to install smart meters for large consumers that have average annual consumptions above a determined threshold, which will be lowered over time (10,000 kWH from 2017, 6,000 kWH from 2020, etc.). Besides these consumption thresholds, generators with capacity above 7 kW, e-mobility drivers, and heat-pump and night-storage customers are targeted with the new smart meters. The gradual rollout is expected to be completed in 2032, while the pilot rollout will run from 2017 to 2020 (with a target penetration of 23 percent). The pilot rollout will allow operators to learn from the early adopters and mitigate or resolve any problems stemming from the initial phase of the rollout; this will result in a more efficient deployment

The DSO market in France is highly concentrated, with five DSOs covering more than 100,000 customers (158 in total), but one, Enedis (formerly EDF), covers more than 80 percent of the distributed power. The national rollout plan is expected to be completed in 2021, with a commitment of reaching a 95% penetration rate by the end of 2020 with a total of 28 million devices installed. So far, DSOs and manufacturers confirm that the rollout is on schedule

A unique case is represented by Spain, which did not perform any CBA analysis and does not have a national rollout plan for smart metering; nonetheless, the country reached a wide-scale rollout, and was among the six countries that reached the 80 percent penetration target. Five operators with more than 100,000 customers operate in the Spanish DSO market, with the largest three covering more than 60 percent of distributed power in the country.

Poland is the fifth EU Member State in terms of metering points (17.7M). Four DSOs (state-owned incumbent operators) account for 85 percent of the total market. The penetration rate of smart meters is 8.3 percent, mainly related to non-domestic customers: lack of legislation supporting EU directives on smart metering is holding the country back from a wide-scale rollout despite the positive result of the CBA.

Romania started an acceleration of smart-meter uptake in the past years as DSOs initiated significant deployments (8 percent penetration in 2019, and expectation to reach wide-scale rollout by 2024). The Romanian DSO market shows a medium level of concentration, and three DSOs cover most of the distributed power. In 2019, the national authority approved a decree that foresaw implementation of over 4 million smart meters by the end of 2028.

The Dutch DSO market has medium concentration, with the three largest covering more than 60 percent of distributed power in the country. In 2019 the Netherlands was more than halfway through the completion of a smart-meter rollout, with a penetration of 66.6 percent. (The completion of the rollout is expected to reach an 80 to 90 percent penetration by 2020.)

Hungary has not implemented an official national strategy for smart-meter rollout by DSOs, but has established a subsidiary of the national TSO to manage a national pilot project over the next years. The Hungarian DSO market has six operators, all with more than 100,000 customers, with the largest three covering more than 60 percent of distributed power in the country.

The DSO market in Greece is a monopoly, with HEDNO as the only player in the market. Greece had an official national strategy that expected the completion of the rollout by 2020, but it was put on hold. HEDNO is now expecting to start the rollout in 2020, without a clear indication about the completion date.

In Austria there are 138 DSOs, of which 13 have more than 100,000 customers, which shows low concentration in the market. The original implementation strategy was supposed to reach wide-scale deployment by 2019, as determined by the Federal Minister of Science, Research and Economy. As of 2019, the smart-meter penetration rate in Austria was 17 percent, which shows a delay in the original timeline, especially considering that DSOs forecasted that they would complete the rollout by 2022.

The Portuguese DSO market has 13 active players, of which three have more than 100,000 customers, and the largest, EDP Distribuçao, covers more than 80 percent of the market. As of 2018, the smart-meter penetration rate in Portugal was 25 percent, with EDP Distribuçao expecting to reach wide-scale rollout by 2023.

In Belgium operate four main DSOs (which aggregate smaller DSOs across the country), the largest three of which (Fluvius in Flanders, ORES in Wallonia, and Sibelga in the Brussels region) cover more than 60 percent of the distributed power in the country. This shows a medium level of market concentration. Despite the inconclusive result of the CBA, the smart-meter rollout in Flanders started in 2019, although in Brussels the DSO won’t proceed with large-scale rollout until 2023.

In the Czech Republic three DSOs cover the whole market, resulting in medium market concentration. Its CBA resulted in a negative outcome due to a negative business case. This is partly due to distributors’ reliance on “bulk remote control”, which allows basic on/off functionality at predefined times for certain types of appliances. A negative CBA resulted in a subsequent decision not to have a national smart-meter rollout plan; however, the Czech government is defining new energy policies that will likely include some provisions for smart metering.

Along with Italy and Finland, Sweden completed its firstgeneration rollout in 2009 and is starting the 2G rollout, which is expected to be completed by 2025. Like those of the other Nordic Member States, the Swedish DSO market is highly fragmented, with approximately 175 operators, of which only six have more than 100,000 customers.

Bulgaria does not plan a mandatory rollout, but the country’s four DSOs (three of which have more than 100,000 customers and cover almost the whole market) are gradually deploying smart meters to selected customers.

The Finland DSO market shows a low level of concentration, with seven operators covering more than 100,000 customers, and the largest three covering less than 50 percent of the country’s distributed power. It is one of the three Member States that completed its 1G smart-meter rollout and is about to start a second-generation deployment. The shift to 2G smart meters in Finland will allow the transition to a centralized information-exchange system for the electricity retail market, with the establishment of a centralized data hub to serve suppliers, DSOs and customers. The rollout is expected to start in 2020 and be completed in 2025, which will, among other things, allow it to move from one-hour to 15-minute intervals in electricity metering, further increasing the generation and transfers of metering and end-user data.

Denmark is the only country among the Nordics in the EU that has not completed its 1G rollout for smart meters. However, the country’s strategy is on track, with the announced timeline to be completed in 2020 and over an 80 percent household smart meter adoption rate, one of the highest in the EU. The Danish market for DSOs is fragmented, with a low level of concentration (approximately 50 DSOs).

3

Lessons learned from Italy

Italy has been at the forefront of smart-metering rollouts during both waves, having started its first-generation smart-meter rollout in the early 2000s (and completed it in 2012, with most smart meters installed in the first years). It was also the first EU country to start its rollout of the second generation of smart meters in 2017, following a deliberation by the Italian Regulatory Authority for Energy, Networks and Environment (ARERA) published in March 2016.

ARERA defined the fundamental technical and functional specifications that new-generation smart meters must have and set some rules in relation to cost recognition in tariffs, timing of the 2G rollout, and transparency of service plans provided by operators.

This section will offer a snapshot of i) regulation and tariffs, ii) technology, iii) benefits of the new smart-meter generation, and iv) the rollout plan.

Regulation and tariffs

The cost recognition related to smart metering is based on a TOTEX approach, which is applied to 2G smart metering only for capital expenditures. The level of CAPEX recognized is determined by ARERA on the basis of the business plan presented by the DSO. It also considers the cap of 130 €/meter. The CAPEX includes central system, concentrators and meters.

The expenditures recognition system is based on the following three main pillars:

- Business plan (PMS2): Companies submit 15-year rollout and implementation plans, defining the related costs and assuring the certainty of the connection between what operators plan to carry out and invest, as well as the benefits to be derived from it (output based). The regulation from ARERA states that once the business plan (PMS2) is submitted by a DSO, it has to be published for a public consultation phase, in which stakeholders may express their observations and any concern. After the consultation phase, DSOs can review the business plan according to the received observations, and then the final business plan is approved by ARERA.

- Incentive and penalty mechanism: Recognized costs depend on the relationship between costs included in the business plan, actual costs, and costs assumed by ARERA formalized in the Information Quality Incentive (IQI) matrix, to achieve:

- Correct measurement of operators’ expected costs,

- Minimization of total costs (ex ante approach plus long regulatory period),

- Specific outputs.

- Uncertainty mechanism: To transfer to the final customer some risks that are not under the control of operators (e.g., the possibility to update the business plan every three years).

Technology

The Italian 2G smart-metering technological infrastructure is made up of three main components:

- Devices, which include 2G smart meters provided by the DSO, installation/communication sensors with meters and concentrators, and concentrators for the 2G system (equipped for communication with the central system) that can also use remote control on 1G meters (unless a transition is made by or to a different vendor with proprietary communication protocols).

- The central system, a remote management system with minimal functions required by the current regulation, compatible with 1G and 2G smart meters. Its main functions are remote reading, work-order management and a mobile app, and will eventually be comprehensive with a measurement data acquisition module (MDM), a software component related to the management of the measurement service as required by current legislation. The main functionalities of the MDM are measurement data management, measurement validation and estimation control, and provision and dispatch of data publication.

The system is comprised of two independent communication channels for the connection between the meter and the central system (“Chain 1”): the primary channel power line communication (PLC) in the A CENELEC band, and the backup channel in radio frequency (RF) Wireless Meter-Bus in the 169 MHz frequency band.

Direct access to information related to user consumption in real time will be enabled by communication through frequencies (PLC in the C CENELEC band) between the 2G meter and user device along “Chain 2”. In Italy, there is no application for Chain 2 yet, although a testing phase has been started by E-distribuzione (the DSO of Enel Group), with the aim of developing and selling in-home devices that allow management of final-user data coming from smart meters.

Rollout plan

E-distribuzione was the first company to submit the PMS2 and start the massive 2G rollout in 2017, followed by other DSOs (Areti, from ACEA Group; Unareti, from A2A Group; and Edyna). To avoid a “two-speed economy”, ARERA requires all DSOs with more than 100,000 delivery points to reach 95 percent coverage of the new-generation smart meters by 2026.

In Italy, six DSOs have not submitted their business plans, but are expected to do this in 2021 and 2022, in order to meet the deadlines of 2025 (90 percent) and 2026 (95 percent) for the rollout status set by ARERA. Assuming that half of the missing DSOs will submit their plans in 2020 and the other half in 2021 (which implies the start of their rollouts in 2021 and 2022, respectively), 41.6 million smart meters will be installed by 2025.

4

Benefits from smart meters and new services

The smart-metering rollout will be beneficial for all actors along the value chain (e.g., DSOs, retailers, and final customers). The main benefits can be summarized as follows:

- Remote reading and management: This represents the primary benefit for DSOs that are still managing the first wave of smart-meter rollout, as it allows them to significantly improve operational efficiency. For countries such as Italy and the Nordics, these benefits have been achieved: around 95 percent of smart meters installed are remotely read, and several activities can be remotely managed as the increase of available capacity. New smart meters installed in Sweden, for instance, can be upgraded remotely and have built-in switches for turning off the power supply (e.g., if the customer goes on vacation).

- Near-real-time reading: Every market player will benefit from accurate monitoring and forecasting of energy consumption, since this will enhance end users’ awareness (e.g., costs and the environmental impact of consumption habits), as well as anticipate potential disruption from market imbalances. Most European countries (including Italy and Germany) will provide 96 readings per day (one every quarter-hour), while Spain’s system will allow only one reading per hour.

- Dynamic pricing offers: The new system will likely allow retailers to differentiate tariffs based on individual customers’ consumption habits and give end customers access to dynamic pricing offers (e.g., an Italian retailer offering three hours per day of free energy for new customers). In Sweden, monthly variable price contracts that follow the spot market are the most common contract type, and hourly contracts have been available since late 2012.

- Smart-home offers/Chain 2: Smart meters will be able to communicate with users’ devices (Chain 2), allowing customers to optimize their consumption of energy throughout the day and extract additional value from smarthome devices. However, players (both energy companies and players from other industries) need to find new business models and develop innovative case studies to effectively enable customers so they can benefit from this new technology.

- From consumers to prosumers: The new system will facilitate the development of demand-response, energysharing systems and microgrids, helping individuals in the transition from consumers to prosumers in the market, as well as utilization of electric vehicles and home batteries that would be impacted by lower costs for charging. Possible applications enabled by microgrids are vehicle-to-grid and vehicle-to-home, in which electric vehicles’ batteries can interact with grids and homes, allowing stabilization and efficiency of power flows, as well as production of renewable energy. Cars can accumulate energy in lowconsumption moments and act as sources of energy in peak consumption hours.

In conclusion, benefits from smart metering will reshape the value propositions of different market players, enabling integration with advanced systems based on new technologies and providing new value-added services to the customers.

5

Key takeaways and recommendations

Smart metering represents one of the key strategic items towards smart-city development, thanks to the aforementioned benefits embedded throughout “electricity value chain”. Based on Italy’s experiences, DSOs and regulatory authorities that are planning new smart-meter roll-outs should address the following key challenges:

Regulation

- Moving towards output-based regulation for metering activities: The Italian regulation scheme represents a preliminary step towards an output-based approach, as it is focused on a CAPEX business plan, while OPEX continues to be remunerated according to a standard cost mechanism. The introduction of an output-based approach is highly recommended, in order to guarantee coverage of all additional expenditures required by smartmeter rollout and pursue efficiency targets at the same time. In this context, interaction between DSOs and the regulation authority is key to make the latter aware of the transformations of the business model (and the relative costs) that the rollout process implies, as well as to establish a regulatory framework that enhances an innovative digital transformation.

- Set up ad hoc regulation for some innovative activities enabled by smart meters (e.g., demand response, energy communities) to effectively boost the demand of these new energy services and enable the benefits estimated in CBAs.

Digital shift

-

The rollout process affects most of the processes related to measurement data management: therefore, deep knowledge and understanding of the organizational and IT structures are a key success factor to optimize the transition process and guarantee efficient deployment, while avoiding any shortfalls in operations.

- DSOs would then need to consider the rollout process an opportunity to review and reshape their ICT frameworks (central system, WFM, mobile app, etc.) with a view to moving towards a more digital approach.

Procurement

- Procurement of software and hardware related to the rollout process requires an in-depth make-or-buy analysis in order to address the right procurement procedures. Moreover, the market offering is broadening since several different providers (device manufactures and ICT services providers) are entering the market by offering various services according to the size and needs of the distributor.

Financials

- Elaboration on an accurate business plan is key for the financial stability of the DSO. The correct identification of capital expenditures, an installation-plan time frame, and emerging costs (such as the ones related for the reading and validation process) would assure that the DSO did not incur extra costs and penalties defined by the regulatory framework.

New business models

- Smart metering is affecting the entire electricity value chain and, hence, represents a key opportunity for market players to review and reengineer their business models. In fact, smart metering may:

- Foster, by enabling microgrids and demand-response, the development of renewable energy sources (such as solar and wind energy) and support the electricity system balance,

- Stimulate demand for more efficient power-based tools and services, such as batteries and smart-home devices,

- Broaden retailers’ offerings in terms of pricing and energy solutions,

- Create opportunities for non-energy players that may be interested in acquiring data related to customers’ habits.

DOWNLOAD THE FULL REPORT