27 min read • Travel & transportation

Sharing in success

How car sharing can deliver on its potential in an ecosystem play

Executive Summary

Car sharing’s origins date back to 1948 in Switzerland, with faster growth starting in the 1970s. The market has expanded further in the last two decades, driven by restrictions on city center private car use, advanced digital technologies, and shifting consumer attitudes around car ownership. However, it remains a relatively small market, accounting for less than 5% of the US $100 billion global shared mobility market.

Car-sharing schemes have faced a number of challenges, both for operators looking to build economically viable, scalable businesses as well as for authorities tasked with regulating them within the overall mobility system. Looking ahead, car sharing has a key role to play in the integrated mobility system, in large part driven by increasing demand for sustainability and convenience. This Report explores the benefits and pitfalls of car sharing and describes strategies for success for both regulators and operators.

BENEFITS & PITFALLS

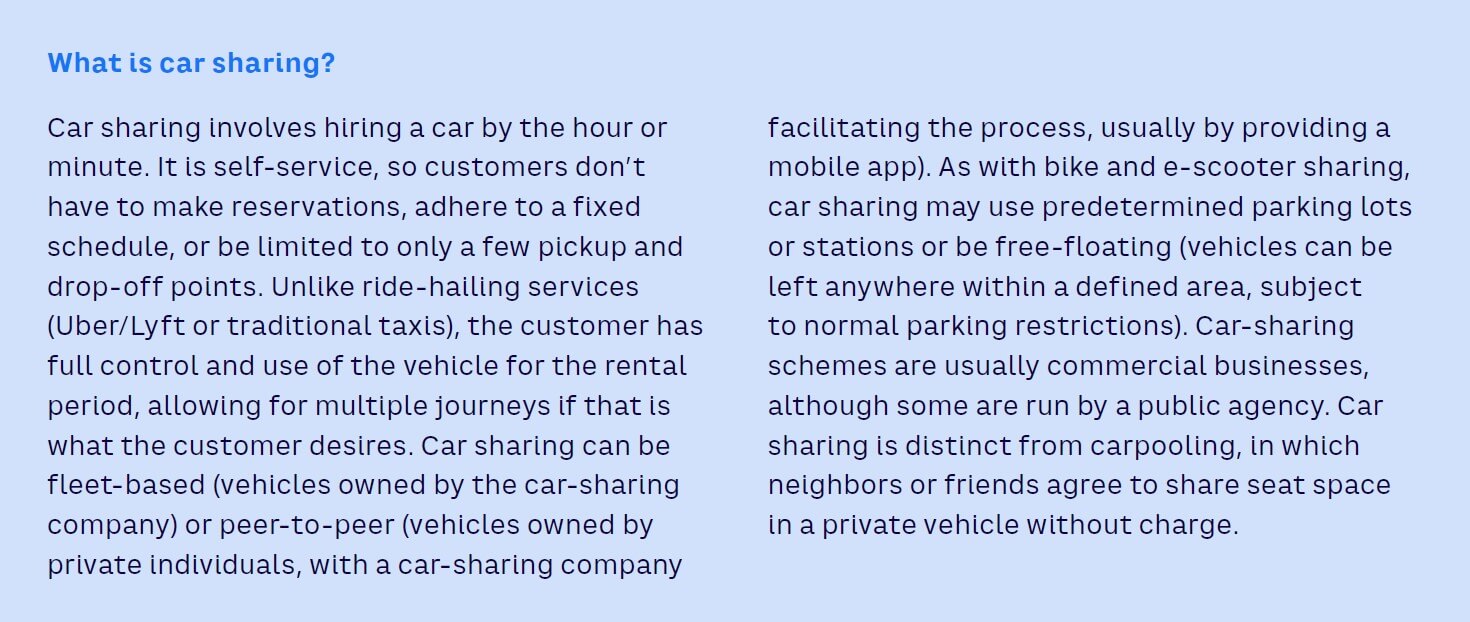

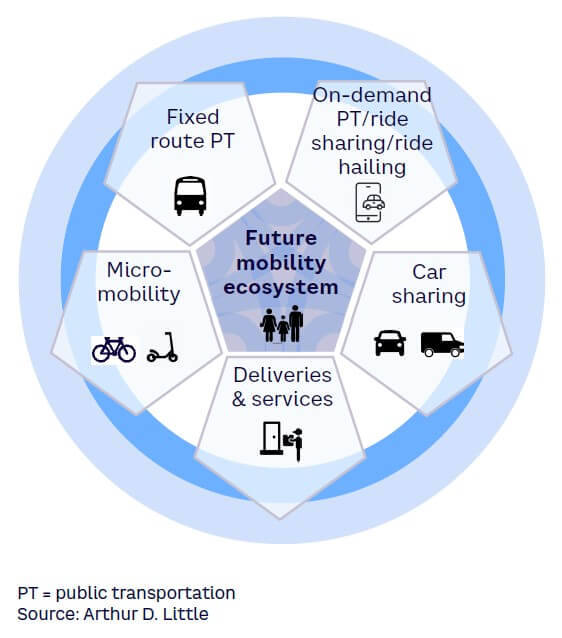

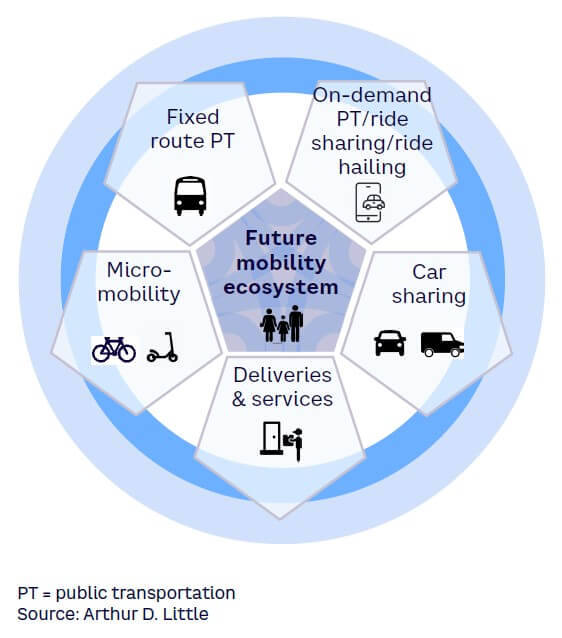

Car sharing has the potential to come into its own as a critical part of future mobility systems, alongside fixed route public transport (buses, trains, metros), on-demand public transport (ride hailing, ride sharing), micromobility (bikes and scooters), and deliveries and services (logistics, couriers). Indeed, a properly framed car-sharing scheme offers three main benefits. First, it improves the overall performance of the mobility system by enhancing connectivity, increasing access, and increasing system capacity. Second, it contributes to better sustainability and safety by significantly reducing the number of privately owned cars. Third, it offers the convenience of a private vehicle for users picking up goods, trip chaining,[1] or traveling out of town.

However, when car sharing is not properly framed into the overall mobility system, there are some pitfalls. For example, free-floating schemes (those without fixed parking stations) may encourage users to choose cars over mass-transport modes. There may also be cleanliness/condition issues from improperly maintained vehicles and some stationary vehicle nuisance issues (although less so than bikes and scooters).

IMPLEMENTATION CHALLENGES

Cities and transport authorities have struggled to regulate car sharing for two main reasons. First, regulation has often been overly restrictive, focused on limiting the scheme’s impact, rather than collaborating with operators to maximize overall mobility system benefits. In some cases (e.g., Car2Go in Toronto), limitations on area access and parking led to operators exiting the market altogether. Second, inadequate coordination between authorities across jurisdictional boundaries has often led to inconsistencies that confuse users.

The key challenge for operators is the business model. Many struggled to achieve profitability due to high operating costs, poor coordination with competitors, narrow focus (e.g., premium niches or B2B customers requiring costly customization), unfavorable revenue-sharing models with municipalities, and/or lack of collaboration with vehicle OEMs. Finally, inadequate parking arrangements with authorities have depressed customer uptake, as have delays in essential upgrades for operators relying entirely on third parties for their digital platforms.

STRATEGIES FOR SUCCESS

Success in this market requires evolving car-sharing schemes beyond the traditional and OEM-led models. Future schemes must integrate better with the broader shared-mobility system and place services in locations where they add the most value.

We refer to this as the “ecosystem player stage.” Key features include designing the system around simplifying mobility for the user, using car sharing as a complement to the public transport backbone in both city centers and outskirts (including possibly providing subsidies for trips that are less profitable but benefit the overall system), and designing the system to suit as many consumers as possible (low/middle rather than premium).

For city authorities, this translates into seven imperatives:

-

Find the right balance between “framing” (i.e., regulations aimed at exercising control over service and performance levels) and “enabling” (i.e. taking actions that set the right conditions, incentives, and governance to encourage development of car-sharing services benefiting the mobility systems as a whole).

-

Regulate to manage demand. This could be done by subsidizing particular car-sharing routes, instituting parking charge exemptions, and/or congestion charging.

-

Integrate physical infrastructure. This could transpire by colocating car-sharing stations with train, bus, and/or metro stations.

-

Foster innovation, collaboration, and standardization. This can occur through collaboration forums; setting minimum requirements for data sharing; establishing suitable IT infrastructure standards; and encouraging product standardization, system integration, and accessibility.

-

Exploit synergies with electric vehicle (EV) growth. This includes integrating car sharing into EV charging infrastructure provision plans.

-

Consider public/private partnerships. This is especially helpful with regard to overall system integration and demand management.

-

Adopt a test-and-learn approach to regulation. Trials and pilots, provided they are not too short, are a good way to shape requirements and create a more balanced market with a diverse set of players.

For operators, we identify five imperatives:

-

Be customer-centric and act local, creating tailored schemes driven by customer needs.

-

Be willing to collaborate and share data. Data sharing is critically important to integrated mobility ecosystems. Operators should be prepared to accept “win-win” data-sharing solutions that benefit multiple partners.

-

Innovate continuously. Constantly search for opportunities to grow scale and margin, including partnerships.

-

Focus on the broadest customer population. Careful customer segmentation and profiling are essential to creating customer-centric offerings.

-

Adopt a system-wide perspective. Operators must look beyond their piece of the market and seek opportunities to become an integral part of the overall mobility system.

As the shift away from car ownership continues and new mobility models become better integrated into the overall mobility system, car sharing has the potential to deliver major benefits to both customers and transport authorities. Looking further ahead, as autonomous vehicles (AVs) and robotaxis become more mainstream, we can expect car sharing to converge with ride sharing.

1

CAR SHARING: A POSITIVE CONTRIBUTION TO MOBILITY SYSTEMS?

Car sharing is a component of the mobility offering in many major cities today, with a global market of about $3 billion and a predicted forecast of 20% CAGR over the next decade. More than 250 operators provide services in around 3,000 cities, about 30% of the world’s total. It’s nevertheless a relatively small part of the approximately $100 billion overall shared mobility market: less than 5% of the total.

The first recorded implementation of a car-sharing scheme was in Zürich in 1948 (known as the Selbstfahrergenossenschaft scheme). Further development of cooperative schemes took place in the 1970s and 1980s, mainly in Switzerland and Germany, although also in other countries on a smaller scale. Growth has accelerated in the last two decades, driven by rising traffic congestion, restrictions on private cars in city centers, digital technologies like mobile apps, and a gradual shift away from a desire for individual car ownership, especially among younger adults.

As post-pandemic pressure to develop and improve urban mobility systems continues, car sharing has a vital role to play, both in reducing private car journeys and as a complement to public transport systems. However, integrating car sharing within the mobility system has proven challenging for cities and transport authorities.

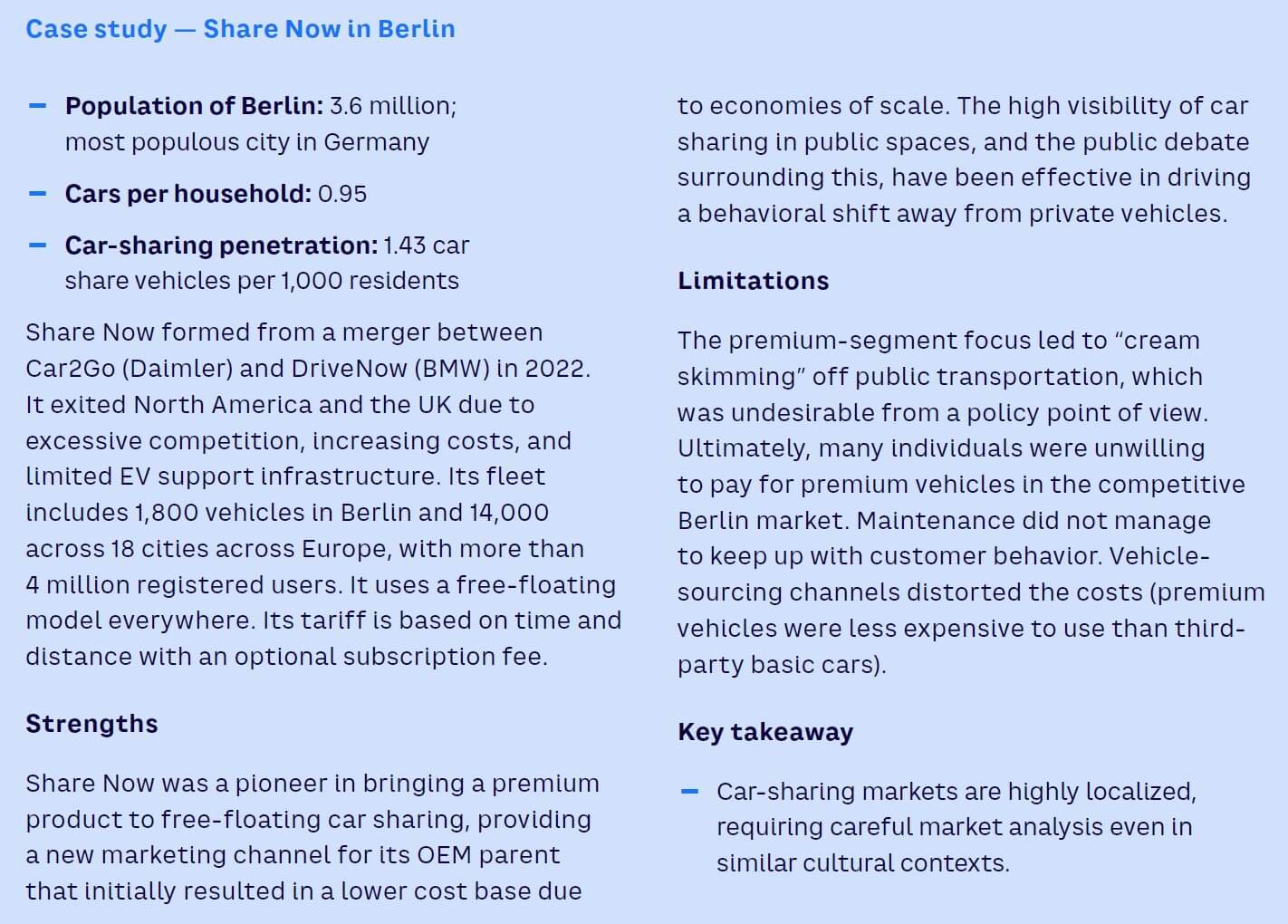

From an operator’s perspective, car sharing has not been without its hurdles. Although analysts expect double-digit market growth per annum in the coming years (driven by increased consumer willingness to use shared modes and a regulatory push to steer people away from private cars), the financial business case for traditional (i.e., asset-heavy) car sharing is uncertain. Many new ventures struggled for profitability, including Share Now, a 2019 joint venture between Daimler and BMW that combined their car-sharing services (Car2Go and DriveNow, respectively). Following the formation of the joint venture, Share Now pulled out of North American and British markets. Three years later, after losing €123 million in 2020 and €70 million in 2021, Daimler and BMW pulled out altogether, selling the business to Stellantis, operator of Free2move.

This Report explores the drivers, benefits, pitfalls, and strategies for success for car sharing, drawing on lessons learned from across the world. We draw conclusions for both transport authorities and operators on how, using the right ecosystem-based approach, car sharing can achieve its full potential as an essential part of the mobility system.

THE SHIFT AWAY FROM CAR OWNERSHIP

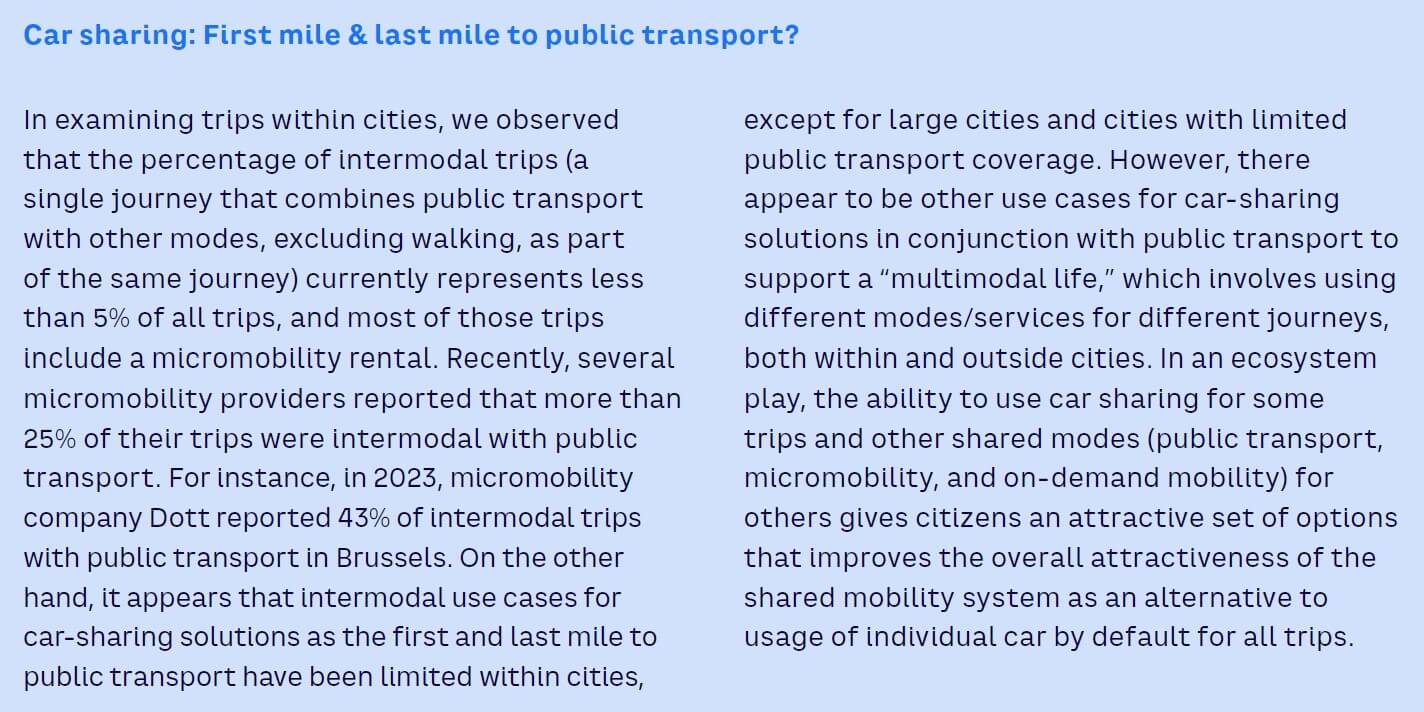

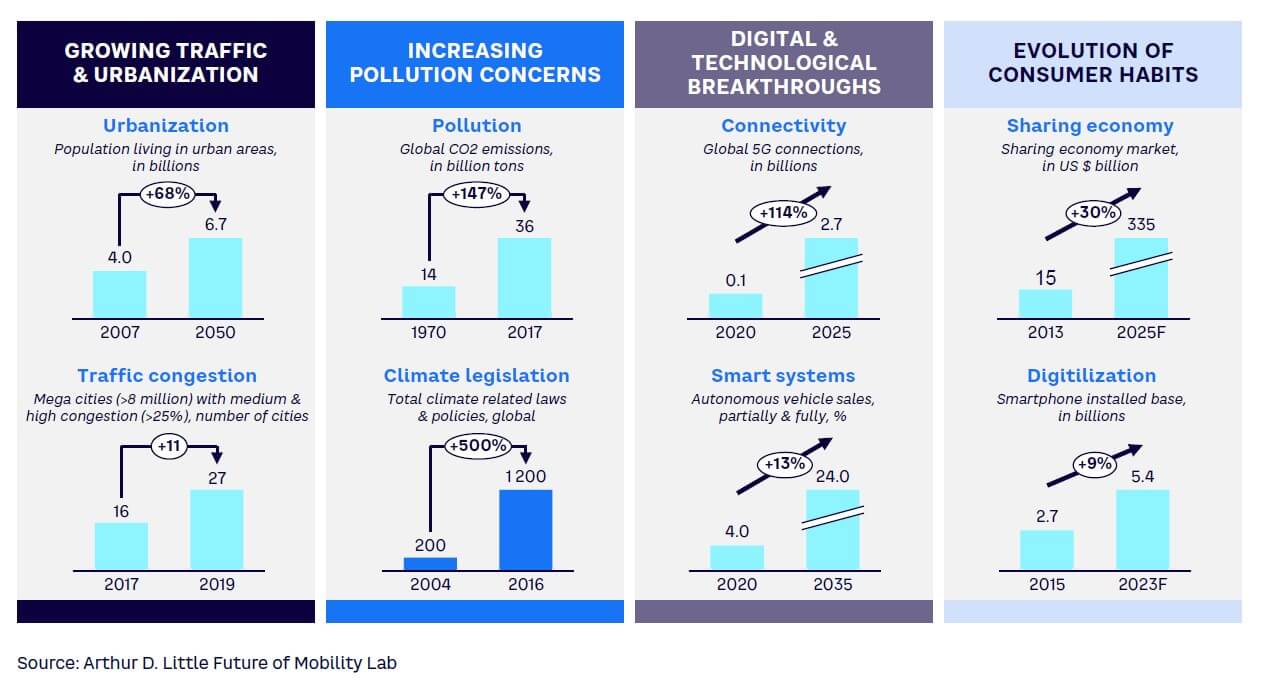

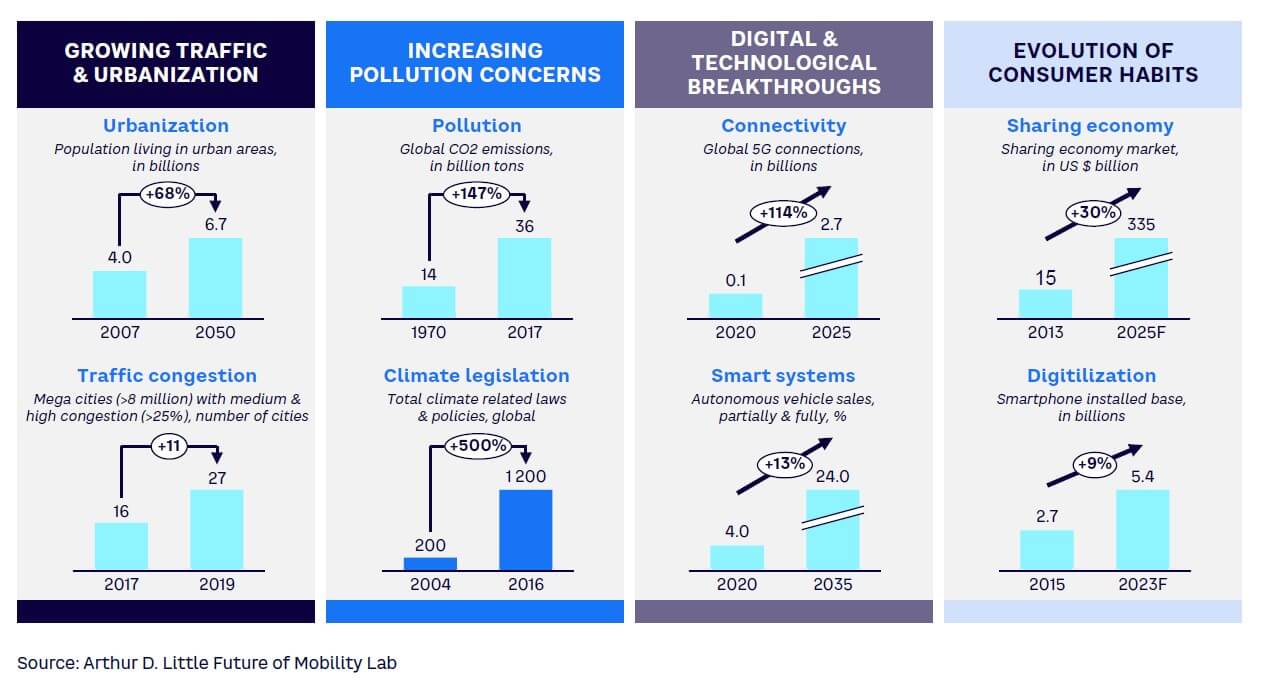

Several trends are shifting users away from private car ownership toward use-based mobility models such as car sharing; these are likely to increase over the coming years (see Figure 1).

We see from Figure 1 that urbanization is expected to increase significantly in the next few decades, bringing with it increased traffic congestion in the absence of improved urban mobility strategies and policies. Environmental pollution therefore has become an existential threat, causing many users to shift to EVs or avoid car ownership altogether. Digitalization will continue to change the way we interact as human beings, both socially and in a business context. Although we can envisage increased use of virtual and augmented reality for leisure, social, and commercial activities, it is unclear to what extent virtualization will affect mobility demand in the long term. What’s clear is that increased connectivity and usability of digital technology acts as a strong driver toward participating in the sharing economy, including shared mobility solutions.

We can predict with some confidence that the range and flexibility of mobility offers will grow in the coming years, with increasing degrees of convergence between them. Leasing rates are likely to rise, converging with car-rental and car-subscription models as short-term leases become more available. Car subscription, in which a car is provided for a month or several months with all costs and services included except fuel, is a rapidly growing model. Traditional car rentals (less than a month) will continue, but some of this market share will start to move to car subscription and car sharing. Car sharing and car subscription are increasingly converging into “car-as-a-service” (CaaS) offerings that center on flexibility and choice in terms of contract type and duration, vehicle model, and vehicle availability.

Although they have encountered more barriers and difficulties than envisaged five to 10 years ago, as illustrated by the 2023 Cruise-based robotaxi deployment in San Francisco and Dubai, AVs will also impact the future of car sharing. They will be deployed initially in urban areas as robotaxis or on specific routes, such as to and from airports, but will eventually accelerate a mindset shift away from car ownership by stimulating demand for car-sharing models, including nonautonomous conventional vehicles.

BENEFITS OF CAR SHARING

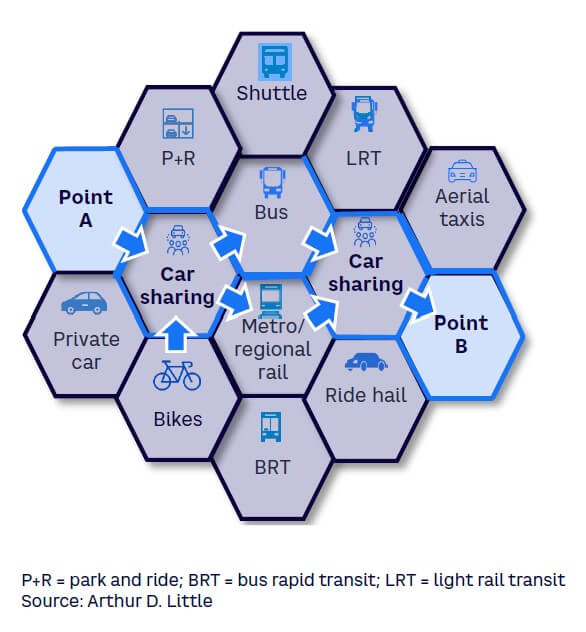

Car sharing is part of the future mobility system, alongside fixed route public transport, on-demand public transport, small vehicle sharing (bikes), and deliveries and services (see Figure 2). Potential benefits of car sharing fall into three categories:

-

Improving performance of mobility system

-

Contributing to better sustainability and safety

-

Simplifying customers’ lives

Improving performance of mobility system

Properly regulated, operated, and integrated with the wider mobility system, car sharing has the potential to deliver a range of performance benefits to cities and transportation authorities:

-

Better land use. Car sharing reduces the number of cars in city centers by reducing the number of privately owned cars by as much as 20x.[2] This frees up urban space for things like green spaces, residential units, and commercial properties.

-

Improved access. Car sharing contributes to improving accessibility to areas of cities not well served by public transport. In 2021, the UK Car Club reported that 55% of car-sharing members said membership provided access to places that wouldn’t be otherwise accessible.

-

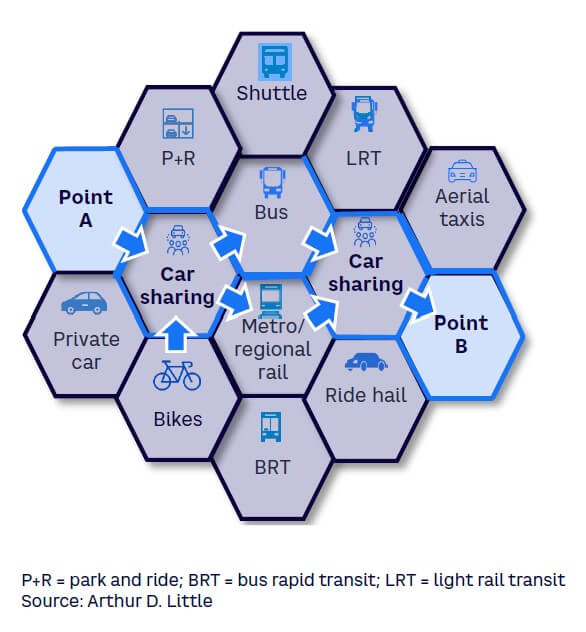

Better mobility flows. Alongside other offerings, car sharing can help optimize mobility flows across the system, improving access to public transport hubs. This is especially true when mobility data is shared with the broader mobility system (see Figure 3).

-

Increased system capacity. Car sharing helps cities accommodate mobility demand increases without adding to congestion.

Contributing to better sustainability & safety

Car sharing provides several safety and environmental benefits:

-

Reduced emissions, noise, and road surface use. By reducing overall number of cars, car sharing lowers tailpipe emissions and road noise. Studies suggest that one shared car can replace up to 20 private vehicles parked on city streets.[3] Currently, shared cars are more often electric than privately owned cars.

-

Reduced environmental impact from new car manufacture. Fewer cars means less environmental impact from new car manufacture.

-

More sustainable vehicles. Car-sharing schemes are increasingly based on electric, hybrid, and other more sustainable vehicles, providing an advantage over private cars. Moreover, car-sharing vehicles are, on average, much newer than privately owned vehicles (most are less than five years old). In 2021 in the UK, car-sharing vehicles averaged 27% less emissions than privately held vehicles.

-

Better safety and health. Fewer cars translates into lower adverse health effects on residents from vehicle emissions, as well as better road safety. Newer vehicles have better safety features than older vehicles.

Simplifying customers’ lives

-

Lower cost versus car ownership for some. For some people,[4] car sharing is less expensive than car ownership. Typical annual tax, fuel, and insurance costs for a non-hybrid car range from $2,000 to $2,500. Lease payments are usually an additional $3,000 to $5,000, for a total of $5,000 to $7,500. Typical car share rates are $2 to $10 per hour and $75 to $120 per day. For users who live in city centers, do not incur high annual mileage (i.e., between 6,000-10,000 km per year), and who would have additional ownership costs such as parking, car sharing can be less expensive than owning. In the 2021 UK Car Club survey, 73% of members reported savings versus private car ownership. Of course, this may not be the case for users outside city centers.

-

More convenient than other public mobility modes. Car-sharing schemes offer users the convenience of short-term car rental without the need to prebook or fill out forms. Pickup and drop-off locations are typically flexible to better suit user needs. Car sharing is more private than ride sharing, eliminates user dependence on another driver, and gives users control over the combination of trips and tasks they wish to complete. Car sharing is also more convenient than both public transport and ride sharing for users who need to pick up bulky items and/or make multiple trips.

CAR-SHARING PITFALLS

Notwithstanding the significant potential benefits, if car sharing is not properly framed and integrated into the overall mobility system, it can have unintended consequences that detract from overall system performance. These include:

-

Reduced mass transit use. In some city centers, car sharing encourages car usage over mass transport choices like metro, trams, and buses. This phenomenon has mainly been observed in free-floating car-sharing systems. The pandemic reduced mass transport ridership in many cities. Despite partial recovery since then, many public transport systems are experiencing funding difficulties that car sharing could contribute to.

-

Stationary vehicle nuisance. Unused and parked car share vehicles, together with other mobility devices such as bikes and scooters, can cause a nuisance if not well managed. For example, in free-floating schemes, they may be left in clusters that take up large blocks of parking space or end up in unsafe or restricted areas, especially in neighborhoods with limited parking spaces. In general, cars are generally less likely to cause a nuisance than micromobility devices (e-bikes and scooters).

-

Cleanliness and user behavior issues. Car share vehicles may be treated with less care by users than private vehicles would be by their owners, leading to cleanliness issues if the vehicles are not frequently inspected and maintained. Drivers may not be used to the control and operation of the car they receive, which could lead to driving errors.

2

STRATEGIES FOR SUCCESS

3 STAGES OF EVOLUTION

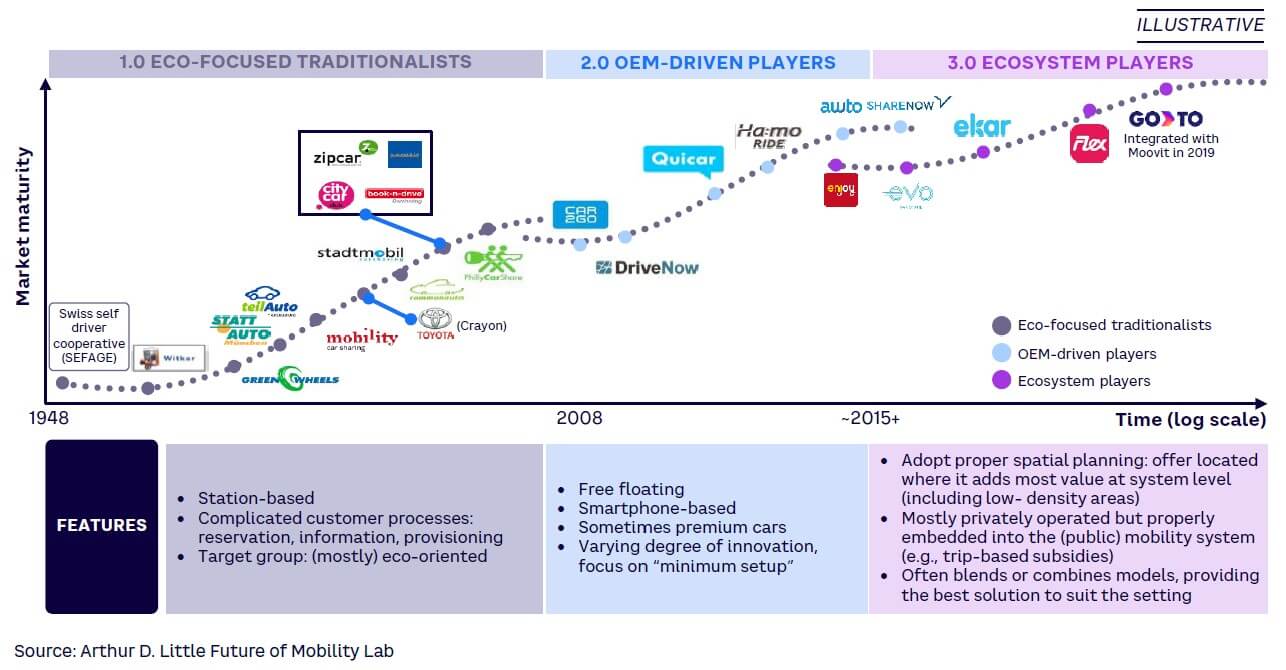

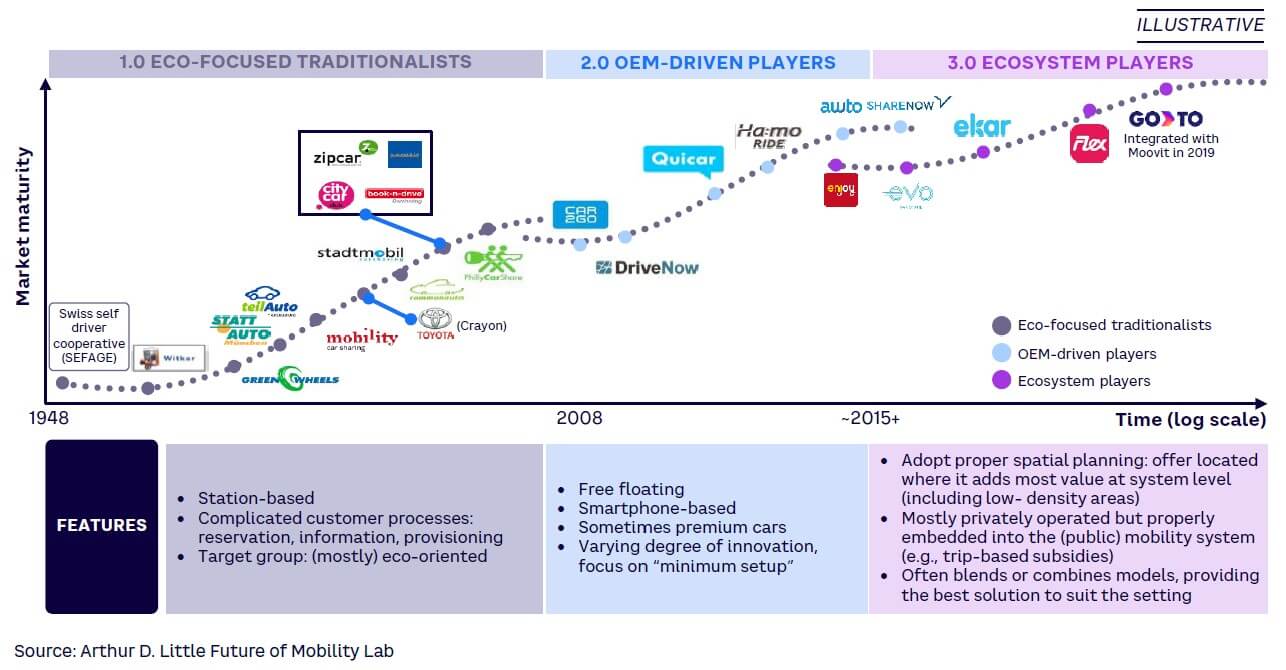

In 2014, Arthur D. Little (ADL) and the International Association of Public Transport (UITP) published “The Future of Urban Mobility 2.0” study, which described three stages of evolution: eco-focused traditionalists, OEM-driven players, and a third stage in which car sharing became a mass-market offering within an integrated mobility system.[5] Today, we can now be more certain and specific about the third stage, which we now refer to as “ecosystem players” (see Figure 4). There are existing operators in all three stages:

-

Eco-focused traditionalists. These are often the earliest operators. They usually operate a station-based service, and target customers are often driven by an interest in sustainability. For example, Greenwheels focuses on reducing the number of cars on the street, energy efficiency, and safety. Zipcar is another large provider in this category. Generally, customer-facing processes are less sophisticated in this category.

-

OEM-driven players. These represent the next stage of evolution and usually operate free-floating services with user-friendly mobile apps that demonstrate varying degrees of innovation. Prominent examples include Car2Go and DriveNow.

-

Ecosystem players. These are characterized by being well integrated with the broader shared mobility system — car-sharing services are offered in locations and contributing to use cases where they add the most value. Services may be privately operated, but subsidies are applied where they benefit the mobility system as a whole. Operators may blend or combine models based on user needs and locations. This model has the greatest potential to reap the benefits of car sharing.

The next two sections look closely at the limitations of current models and explore how ecosystem players can overcome them.

CURRENT MODEL LIMITATIONS

Regulation challenges

The struggles cities and transport authorities face in regulating car sharing fall into two main categories: (1) overly restrictive regulation and (2) lack of coordination across jurisdictional boundaries.

1. Overly restrictive regulation

Regulators sometimes view car sharing as a for-profit industry that provides additional mobility mode for users but is not a fully integrated part of the mobility ecosystem. As such, regulation focuses on restricting its impact, rather than encouraging its development and implementation in a way that maximizes overall mobility system benefits.

For example, in San Francisco, restrictive parking regulations forced BMW’s DriveNow to pull out of the city. Similarly, Car2Go’s 2018 car-sharing pilot was banned in 95% of Toronto’s residential areas. Local councils, which were responsible for the remaining 5% of residential areas, were allowed to ban Car2Go if they desired. Late in 2018, Car2Go, which claimed 80,000 users at the time, exited the market, citing parking fees and restrictions that made its service “inoperable.” Car sharing is still at an early stage in Singapore, but so far, car-sharing players face significant challenges, including high taxes on vehicle ownership, insufficient visible public-parking locations allocated for car sharing, insufficient promotion, and lack of integration with public transport.

Governments tend to set restrictions in a top-down fashion without adequate consultation with mobility service providers, users, or potentially affected businesses, leading to misunderstandings about how car-sharing schemes work. In Toronto, regulations were changed to shift from allocated parking lots to free-floating lots without adjusting for additional parking demand. This led to Car2Go racking up more than CAD $730,000 in parking fines.

2. Lack of coordination across jurisdictional boundaries

Inadequate standards coordination between stakeholders in the mobility ecosystem can impact the overall effectiveness of car-sharing schemes. For example, there has long been a problem with lack of coordination between London boroughs around car sharing, leading to inconsistencies in rules regarding free-floating parking. This negatively impacted user experiences and caused difficulties for service providers operating across the city.

Operational shortcomings

There are several common problems faced by car-sharing operators, including: (1) unsustainable business models, (2) unfavorable parking arrangements, and (3) lack of control over technology.

1. Unsustainable business models

The main reasons car-sharing operators have struggled to achieve profitability are:

-

Lack of product/customer fit. Often, demand issues are due to a lack of accessibility driven by an insufficient number of vehicles deployed. Some operators focused too heavily on specific niches (e.g., premium vehicles) before building sufficient volume, leading to low utilization rates.

-

Low-yield models. Low vehicle-utilization rates and low prices (reflecting current users’ willingness to pay, which is not much higher than for micromobility) mean many car-sharing operations can only generate low yields given the high operational costs involved (e.g., maintenance, insurance, parking).

-

Fractured market. Too many competitors with comparable products have operated in parallel silos in direct competition, without cross-usability or consideration of the mutual benefits of network effects. This has led to lower-than-planned use levels and difficulties scaling up.

-

Unsustainable revenue-share model with municipalities. Some municipalities have a revenue-share model for car-sharing services, increasing pressure on profitability.

-

Labor-intensive B2B model. Some operators developed a B2B business model that focused heavily on labor-intensive customization, driving up costs.

-

Failure to successfully partner with OEMs. Most car-sharing operators have not found a way to collaborate with OEMs. Partnership agreements between car-sharing operators and OEMs could yield mutual benefits and create a more profitable ecosystem.

There are examples of profitable car-sharing operations. Often, these are local solutions limited in size and driven by differentiated use cases and/or business models. It is also worth mentioning asset-light models such as peer-to-peer, business-to-employee, and business-to-tenant models in which vehicles are owned by individuals or employers, as well as schemes subsidized by local/regional authorities (e.g., Citiz in France).

2. Unfavorable parking arrangements

Adequate parking arrangements are critical to car-sharing schemes. Some countries or regions don’t allow free-floating car sharing, and suitable parking policies have not been defined in others. Several operators faced challenges due to limitations placed on their free-floating models; others experienced arbitrary bans to unclear regulations. Successful operations depend on making adequate parking arrangements with relevant authorities.

3. Lack of control over technology

Operators must be digitally enabled from the start to have a viable car-sharing operation. Operators wholly reliant on third parties for system development encounter delays in making important changes to operating models as they learn more about the market. With the broader availability of third-party car-sharing operating software, the choice of provider is critical to the ability to scale the business across regions (e.g., to form interregional or multinational alliances).

EMERGENCE OF THE ECOSYSTEM PLAY

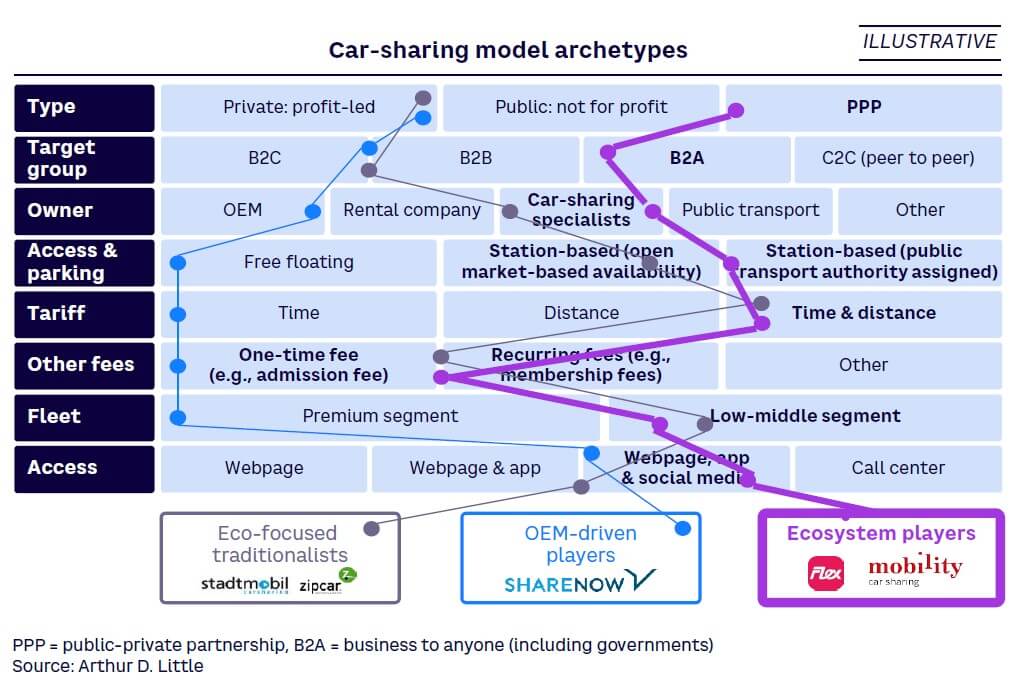

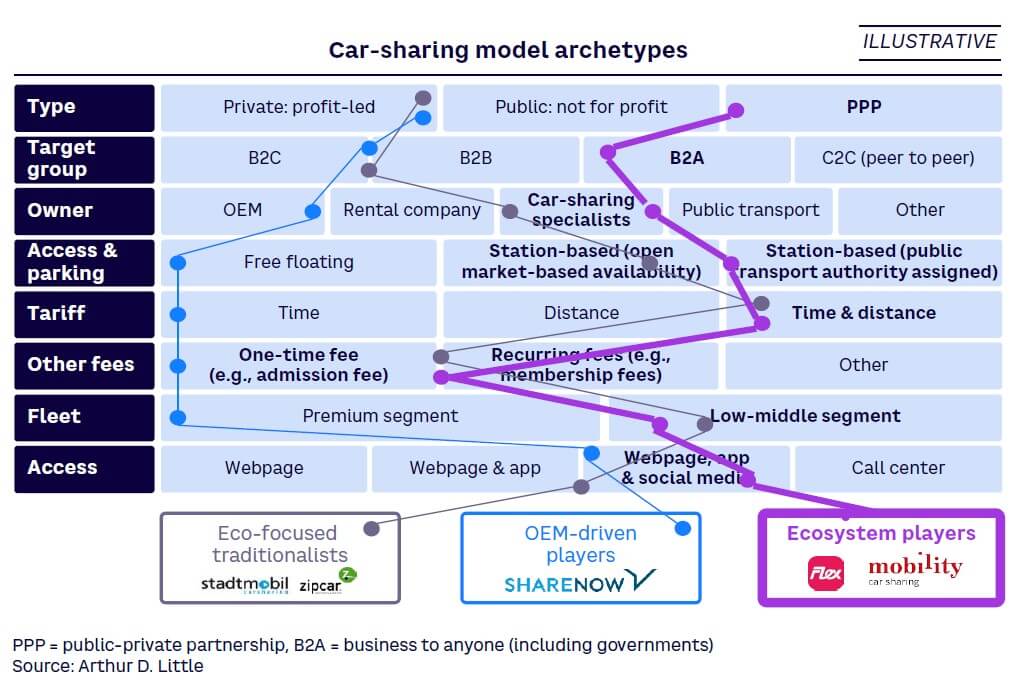

The ecosystem approach is the most evolved car-sharing model. In Figure 5, we see how its primary features compare to other models. In the ecosystem approach, car sharing is fully integrated with, and a contributor to, the overall mobility system. It’s designed to be user-centric and integrate with public transport via these key features:

-

Designed to simplify user mobility. The ecosystem model centers the mobility system around the user. For example, public transport may meet the needs of a work commute while micromobility is used for short distances around town, and car-sharing facilitates picking up larger items, doing multiple errands in two or more neighborhoods, and/or heading out of town with friends.

-

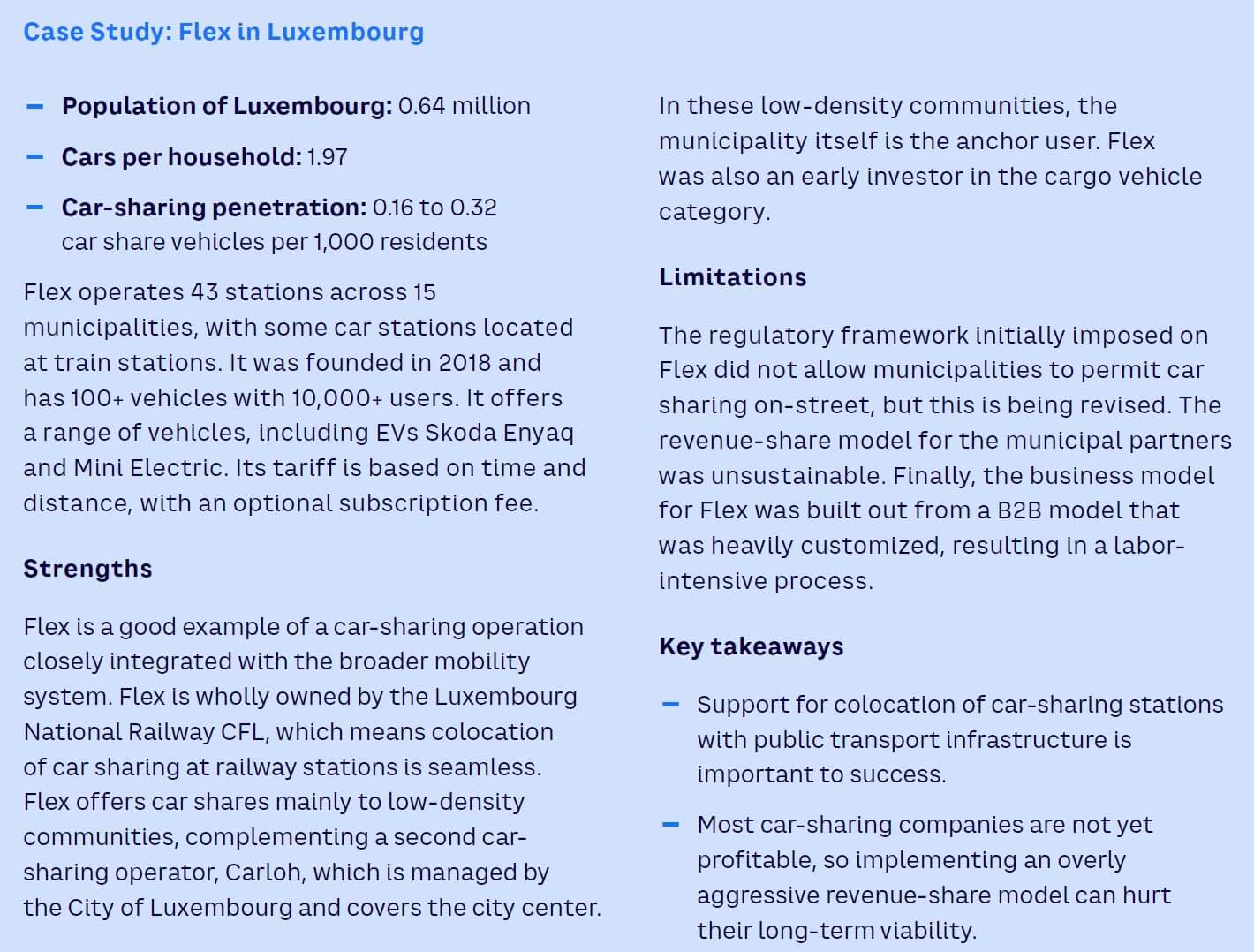

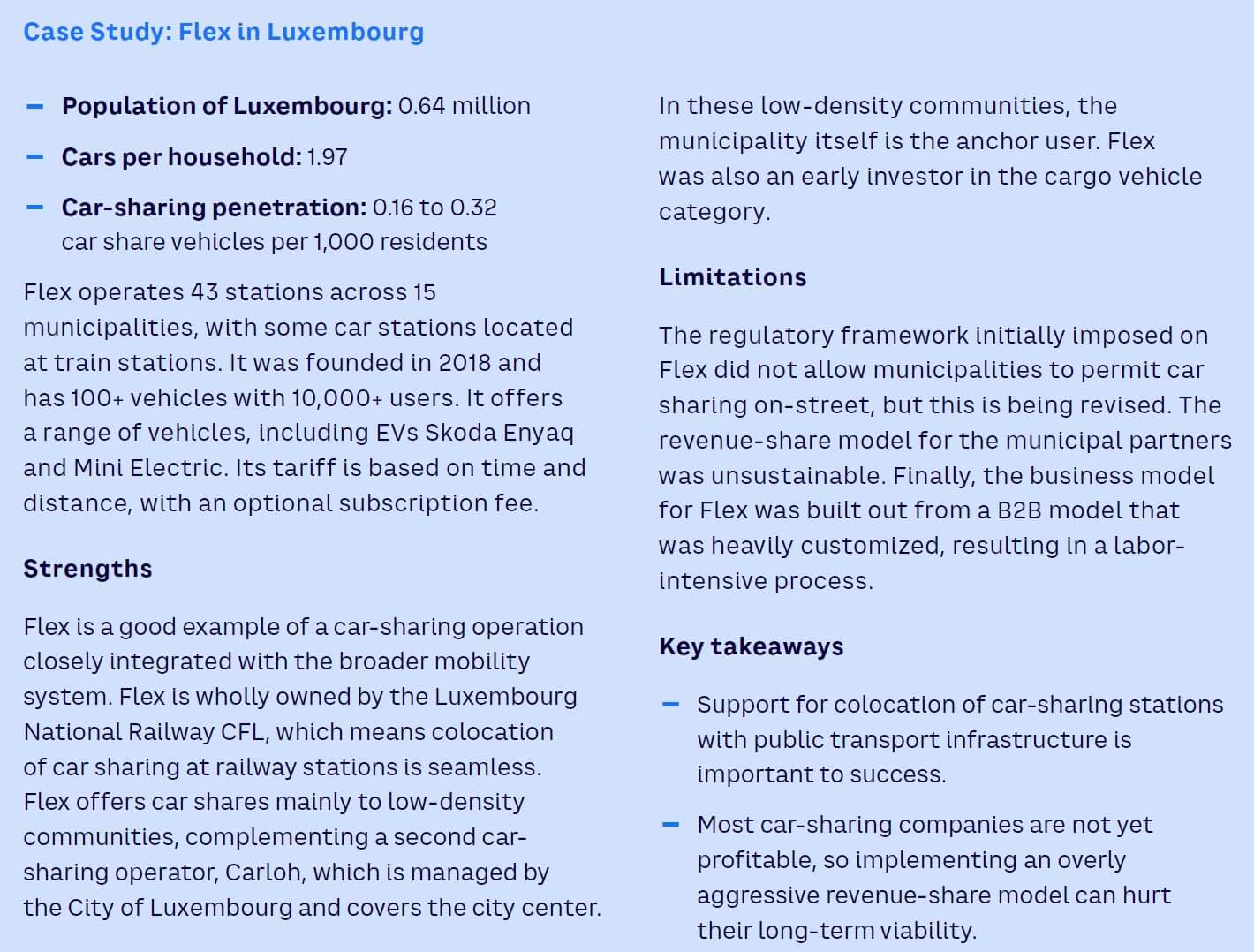

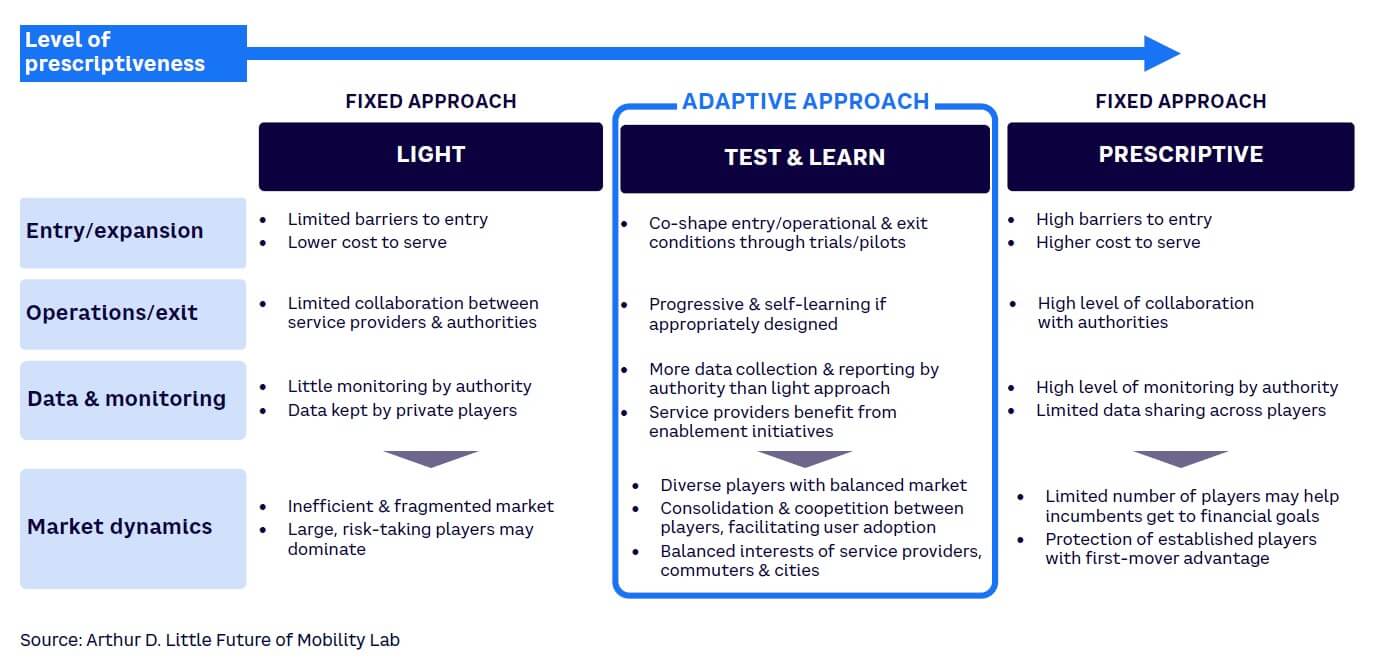

City center feed to mass transit hubs. For trips within large city centers, car sharing can (alongside other shared individual mobility modes such as micromobility and on-demand) act as a complement or feeder to the public transport backbone rather than a substitute for it. Examples include Flex in Luxembourg, where car-sharing stations are colocated with railway stations (see case study “Flex in Luxembourg”).

-

For city outskirts and rural areas. For trips outside city centers, car sharing can be an effective complement to public transport. City outskirts and rural areas have lower population densities and are less well served by public transport, so new mobility modes like car sharing improve individual convenience. Because car-sharing vehicles are more highly utilized than private vehicles, they still deliver a sustainability advantage. Furthermore, promoting car-sharing solutions for trips in rural areas can deliver a positive business case for regional authorities. This is not about generating profitable revenue streams from the car-sharing operation, it’s about cost savings if better accessibility can be provided than with public transport at a lower cost.

-

Selective public funding. When car sharing is properly integrated as part of the mobility system, public funding can have a place alongside private funding. For example, the system as a whole can benefit from car sharing on the outskirts, rather than in city centers where public transport is already in place. However, trips in these areas are often less commercially attractive for the operator than city center trips. Subsidization of such trips, together with suitable policies to regulate city center trip volumes, can help car sharing benefit the mobility system as a whole.

-

Low/middle segment fleet offer. From an overall system viewpoint, car sharing should be accessible to as many passengers as possible. Thus, the offer should focus on low/middle and utility segments rather than the premium segment.

In essence, the ecosystem approach seeks to align car sharing such that it improves mobility system performance and sustainability while enabling viable commercial operation. Below, we look at what this means for authorities and operators.

8 IMPERATIVES FOR CITY AUTHORITIES

To create an ecosystem model that supports car sharing, city authorities and regulators should consider eight regulatory imperatives.

1. Find the right balance between framing & enabling

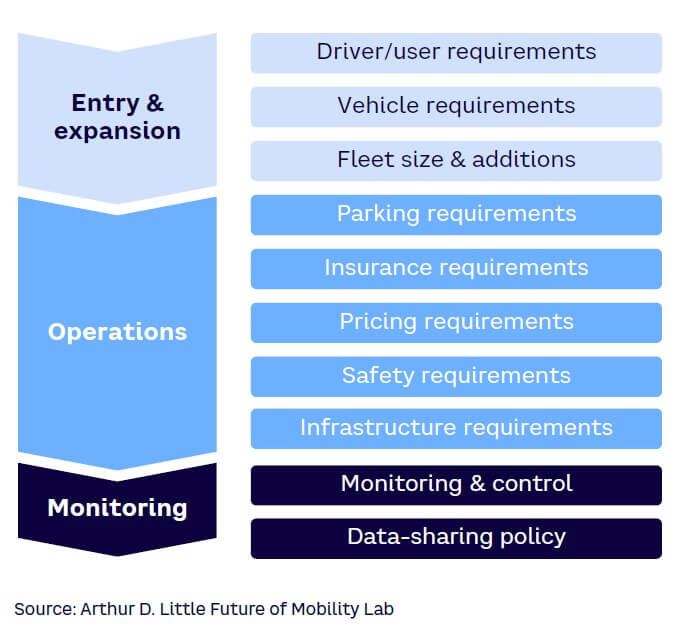

Cites and transport authorities have a wide range of parameters to consider in regulating car sharing (see Figure 6).

These parameters can be split conveniently into three categories:

-

Entry and expansion. This involves setting basic requirements operators must meet regarding vehicles, fleet size, and provisions for drivers/users. This should be based on the overarching objectives of the city, avoiding overly restrictive rules wherever possible.

-

Operations. This is the most complex category, covering issues such as parking, pricing (e.g., guidance on equitable access to low-income users), safety, and infrastructure. How these issues are addressed can have a profound impact on the viability of the car-sharing operation. As with entry and expansion requirements, overly restrictive rules should be avoided.

-

Monitoring. This involves setting requirements for how operations will be monitored and controlled, including what data must be reported for regulatory purposes and how it should be shared for effective mobility system management, including other ecosystem players and authorities. It should be incented using suitable KPIs.

Transport authorities should strike the right balance between "framing" and "enabling":

-

Framing — develop the right regulations aimed at exercising control over car-sharing schemes (e.g., service and performance levels, safety, resilience and environmental requirements, pricing).

-

Enabling — consider regulatory as well as non-regulatory actions that set the right conditions, incentives, and governance to encourage development of car-sharing services benefiting the mobility systems as a whole.

Inevitably, there are trade-offs between the various parameters and measures. For example, when setting parking requirements for car sharing, safety, security, environmental, and land-use concerns must be balanced with the financial viability of mobility operators and spin-off impacts for commercial businesses. All this must be done while remembering that a level playing field needs to be created to encourage competition. In general, cities and transport authorities have focused more on framing than enabling, and an ecosystem-based approach requires more attention to the latter. In striking a regulatory balance, the needs of the user/customer must be at the heart of all considerations.

2. Regulate to manage car-sharing demand

Mobility demand management measures for car sharing are important for optimizing the performance of the mobility system as a whole. As mentioned, when properly designed, car-sharing schemes can be a great complement to other mobility offerings in city centers and improve connectivity in city outskirts and rural areas, improving the overall attractiveness on the shared mobility system and providing an alternative to the use of private cars by default. Subsidies may be necessary to make servicing low-density areas commercially viable for the operator. Conversely, in some city centers, there may be a need to limit car sharing to avoid encouraging congestion and displacing mass transit ridership.

Demand management can also take the form of exemptions from parking, congestion, and/or toll charges (or discounts), helping to make car sharing more appealing than individual ownership.

3. Integrate physical infrastructure

Infrastructure can help improve integration of various mobility solutions. For example, it can facilitate car-sharing stations being colocated with train, bus, or metro stations (refer back to case study “Flex in Luxembourg”). This is an excellent way to maximize car-sharing benefits.

4. Foster innovation, collaboration & standardization

Fostering close collaboration between new mobility service providers and public transport operators and authorities is important to help car share operations add value at the mobility system level. Authorities can help foster collaboration and innovation at the mobility system level through a range of measures:

-

Sponsoring and facilitating collaboration forums, such as topic-based workshops, physical collaboration spaces, or best-practice sharing meetings. This can include promotion of better product localization to meet specific stakeholder needs.

-

Setting minimum requirements for data sharing across system partners. Data sharing is the essential “fuel” for running a integrated mobility system, and car sharing should be no exception.

-

Establishing suitable common IT infrastructure, processes, and standards to enable practical data sharing.

-

Imposing a base level of product standardization, system integration, and accessibility.

5. Avoid overly restrictive regulation

Car-sharing schemes must achieve scale to be financially viable. Authorities and regulators should avoid restrictive regulations that dampen demand to the point that scaling becomes impossible.

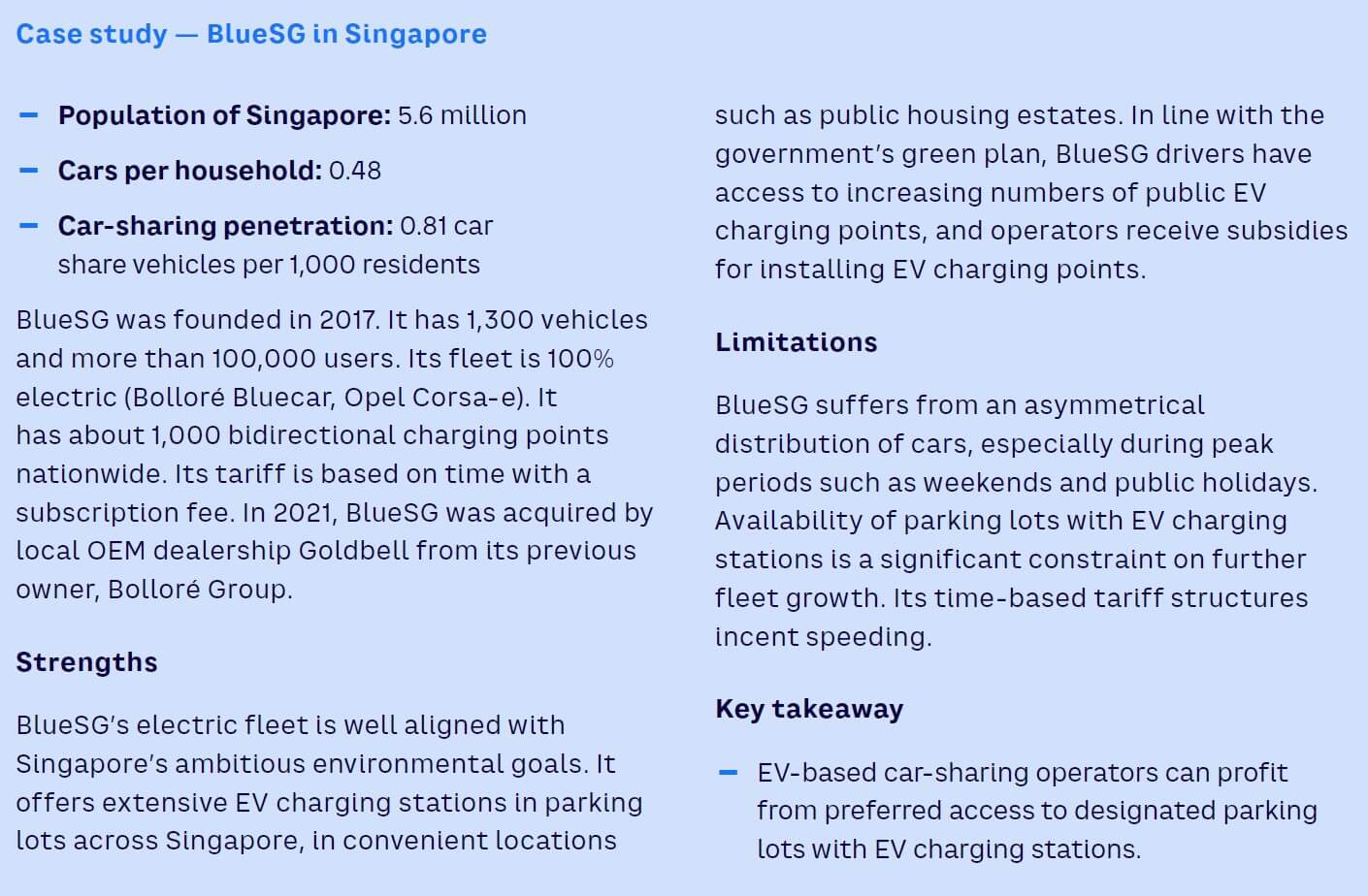

6. Exploit synergies with EV growth

Authorities should integrate the needs of car-sharing schemes into strategies for boosting penetration and adoption of EVs, especially provision of EV charging infrastructure, which is typically the primary bottleneck for the electrification of car sharing.

7. Consider public/private partnerships

Whether primarily backed by public or private capital, car-sharing schemes can benefit from the involvement of public parties such as cities and transport authorities. This involvement can ensure good integration of the overall mobility system, especially when it comes to demand management. This includes evaluating direct or indirect forms of subsidies (e.g., access to parking, financial contribution according to metrics such as trip length, start/end in specific neighborhoods at specific times), especially taking into consideration that in many economies, the most heavily subsidized mode of transport, considered holistically, is the privately owned car.

8. Adopt a test-and-learn approach

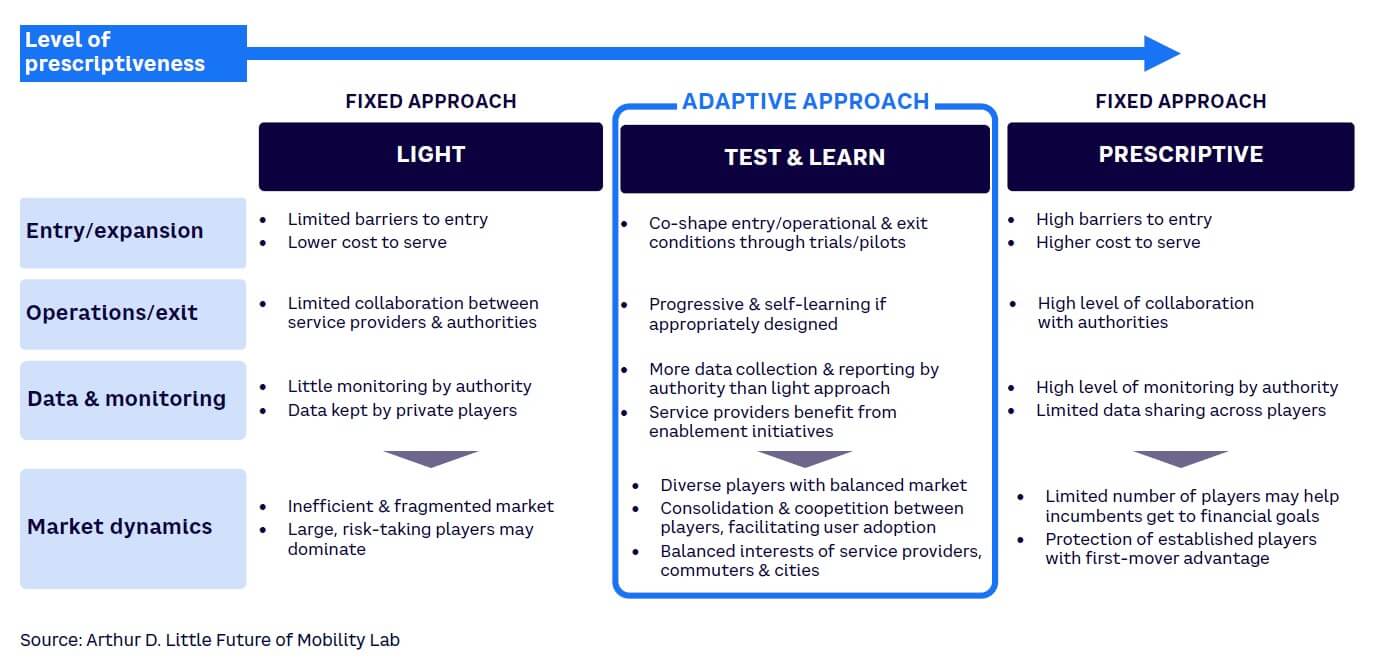

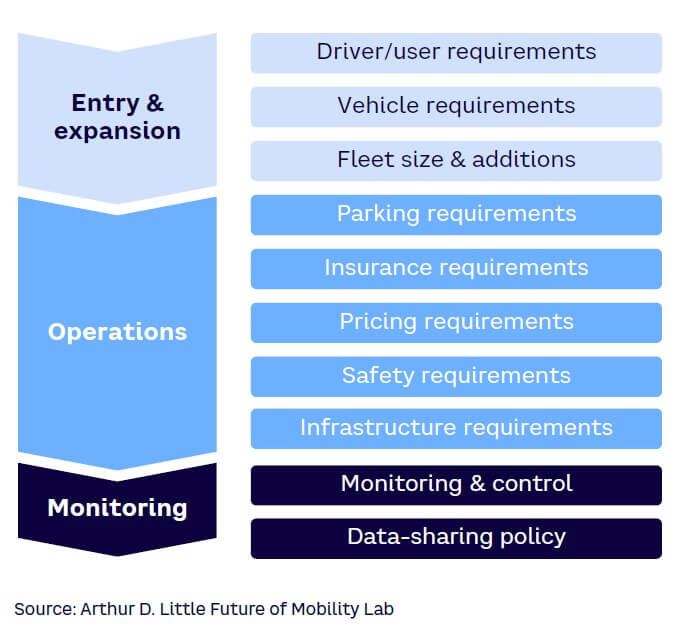

Experience shows that the most effective regulation follows a test-and-learn approach (see Figure 7).

Fixed approaches to regulation, whether light or prescriptive, have drawbacks. Light approaches can lead to a mobility market that is not as efficient as it could be and is difficult to control due to lack of data and effective enforcement levers. This often leads to market domination by larger players, who can absorb the most risk. Prescriptive approaches tend to have higher barriers to entry, high operating costs, less competition, and less innovation, although they protect the incumbents.

In between these extremes, a test-and-learn approach can deliver multiple benefits. Trials and pilots are an effective way to shape requirements in terms of entry, expansion, operations, and exit. However, short trials (less than three years) tend to be impractical due to the capital investment needed. Ideally, regulators should set conditions to encourage self-learning. In return for sharing more data, operators can benefit from the enabling measures described above.

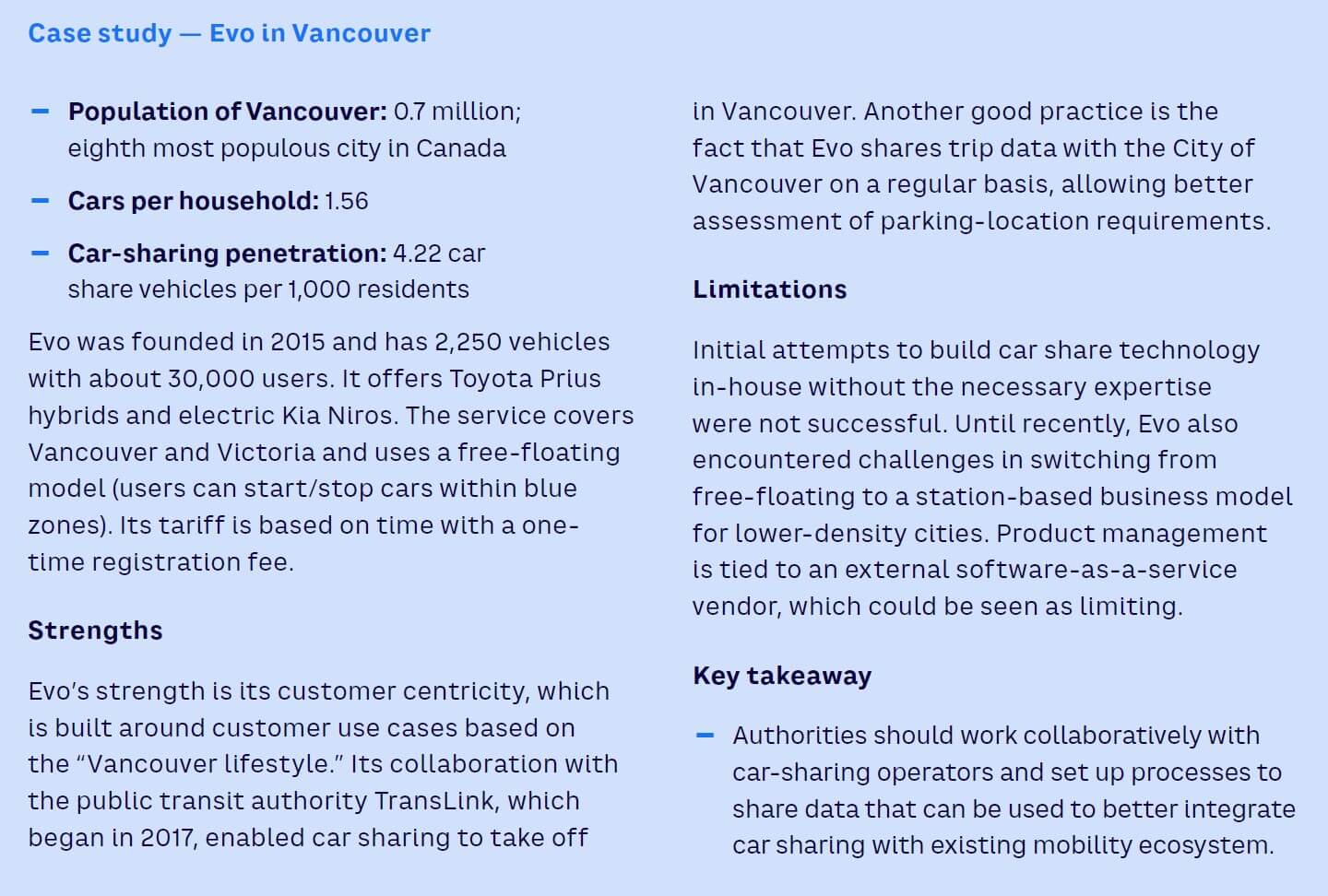

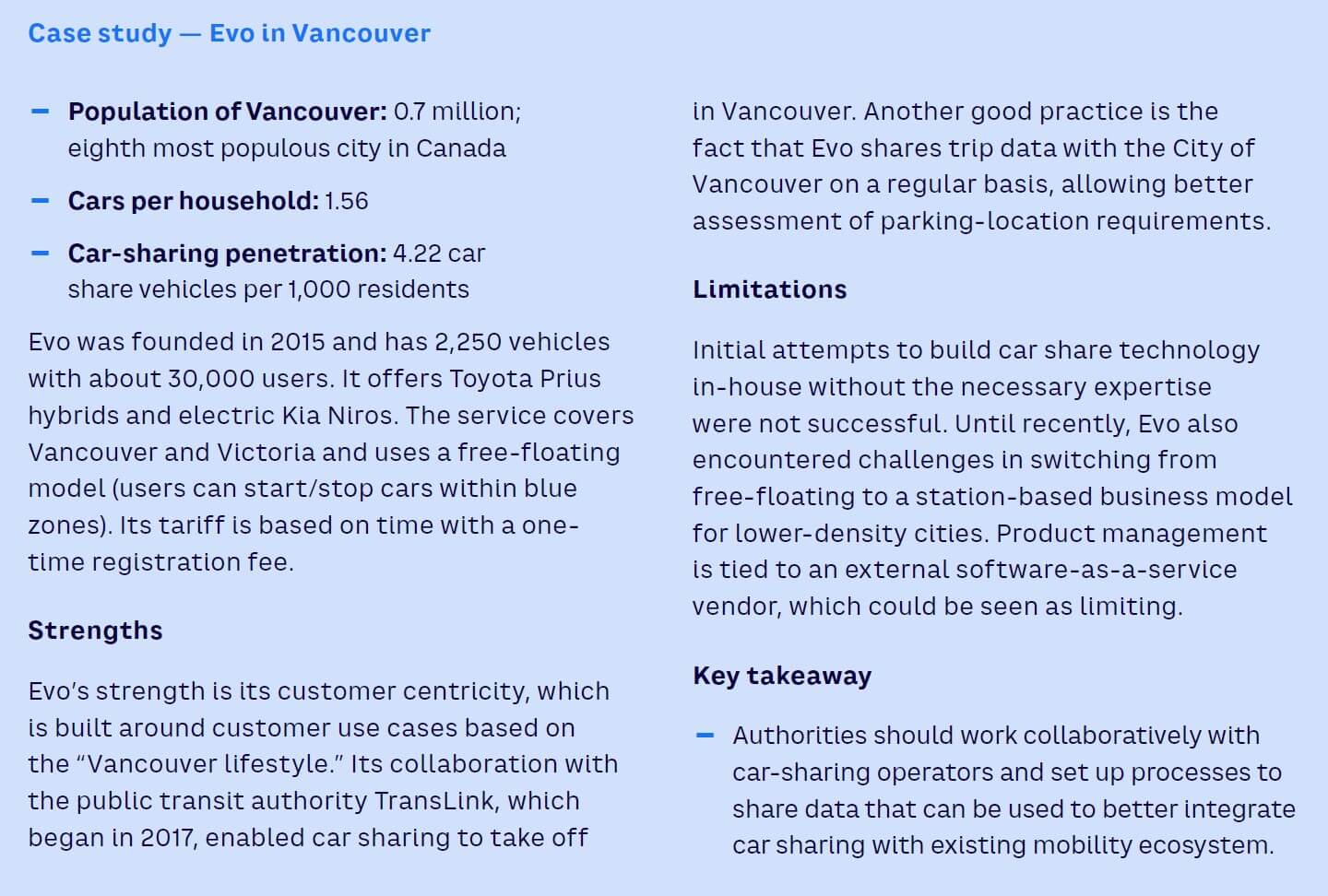

Done correctly, a test-and-learn approach leads to a more balanced market with a diverse set of players that balances the interests of all the actors in the system. Cooperation between players leads to closer integration and even consolidation, in most cases improving the attractiveness of the mobility offer and facilitating user adoption. This ideally results in predefined, close, consistent feedback loops and activities between regulators and operators. A good example of this approach is the way Vancouver cooperated with mobility operator Evo to help build an attractive, customer-centric offer (see case study “Evo in Vancouver”).

5 IMPERATIVES FOR CAR-SHARING OPERATORS

We can similarly identify a series of five key imperatives for success from an operator perspective.

1. Be customer-centric & act local

With the active support of authorities, operators need to create customer-centric car-sharing schemes. This means avoiding a one-size-fits-all approach in favor of tailoring offerings to suit a variety of customer segments and behaviors. Customer needs differ greatly from city to city and from neighborhood to neighborhood within the same city, requiring careful analysis. Operators should carefully research the most attractive customer use cases and build communities of customers around these, as did Evo in Vancouver (see, again, case study “Evo in Vancouver”).

2. Be willing to collaborate & share data

Collaboration with partners in the mobility ecosystem, especially authorities, is critical for achieving an outcome with mutual benefits. One of the most important considerations is data sharing, without which running an integrated mobility ecosystem is impossible. Although authorities have a key role in setting data-sharing standards and safeguards and providing suitable infrastructure, operators must cooperate and actively look for solutions that benefit multiple partners. Operators should work with authorities to help shape regulation, including being open to public/private partnerships.

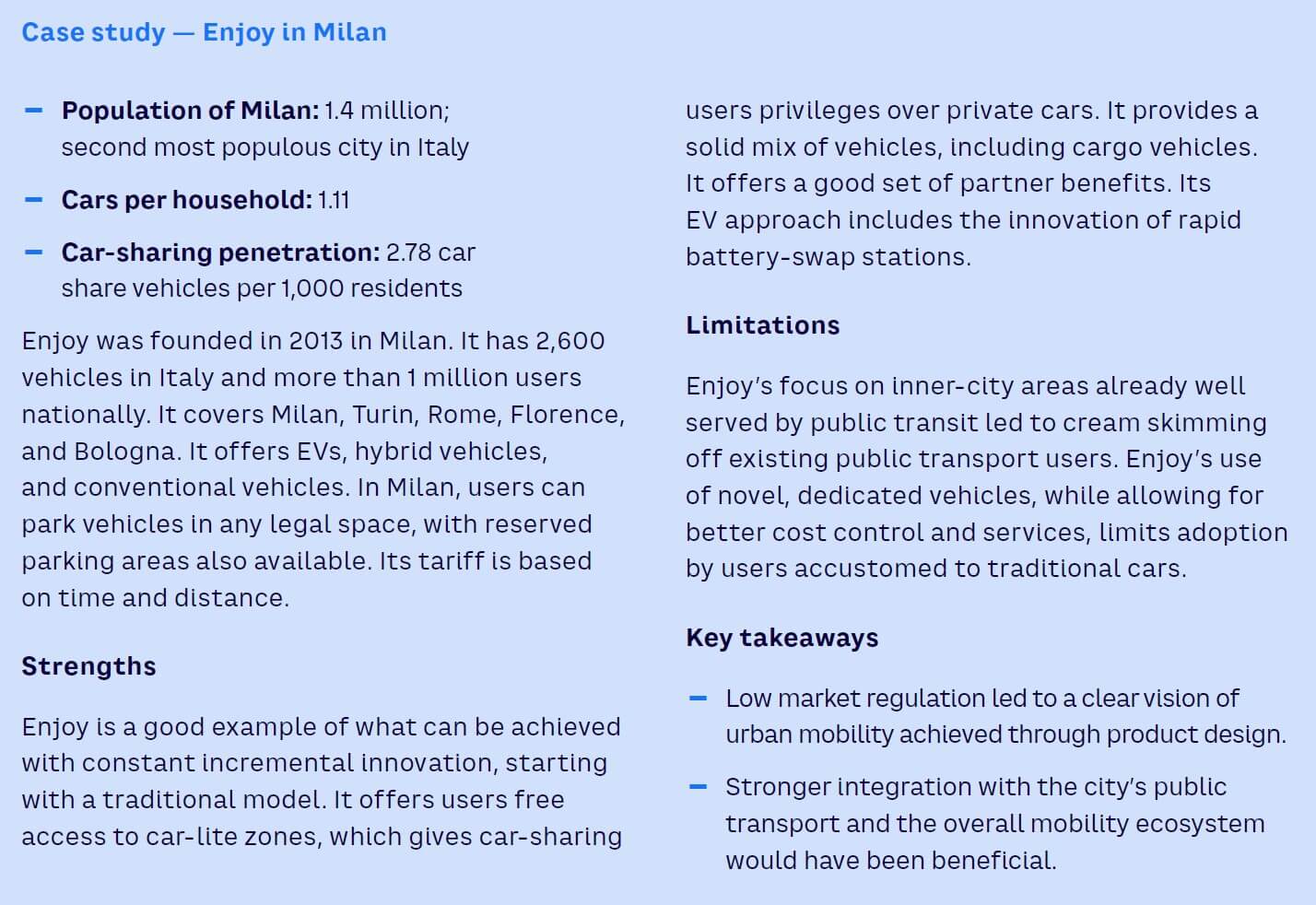

3. Innovate continuously

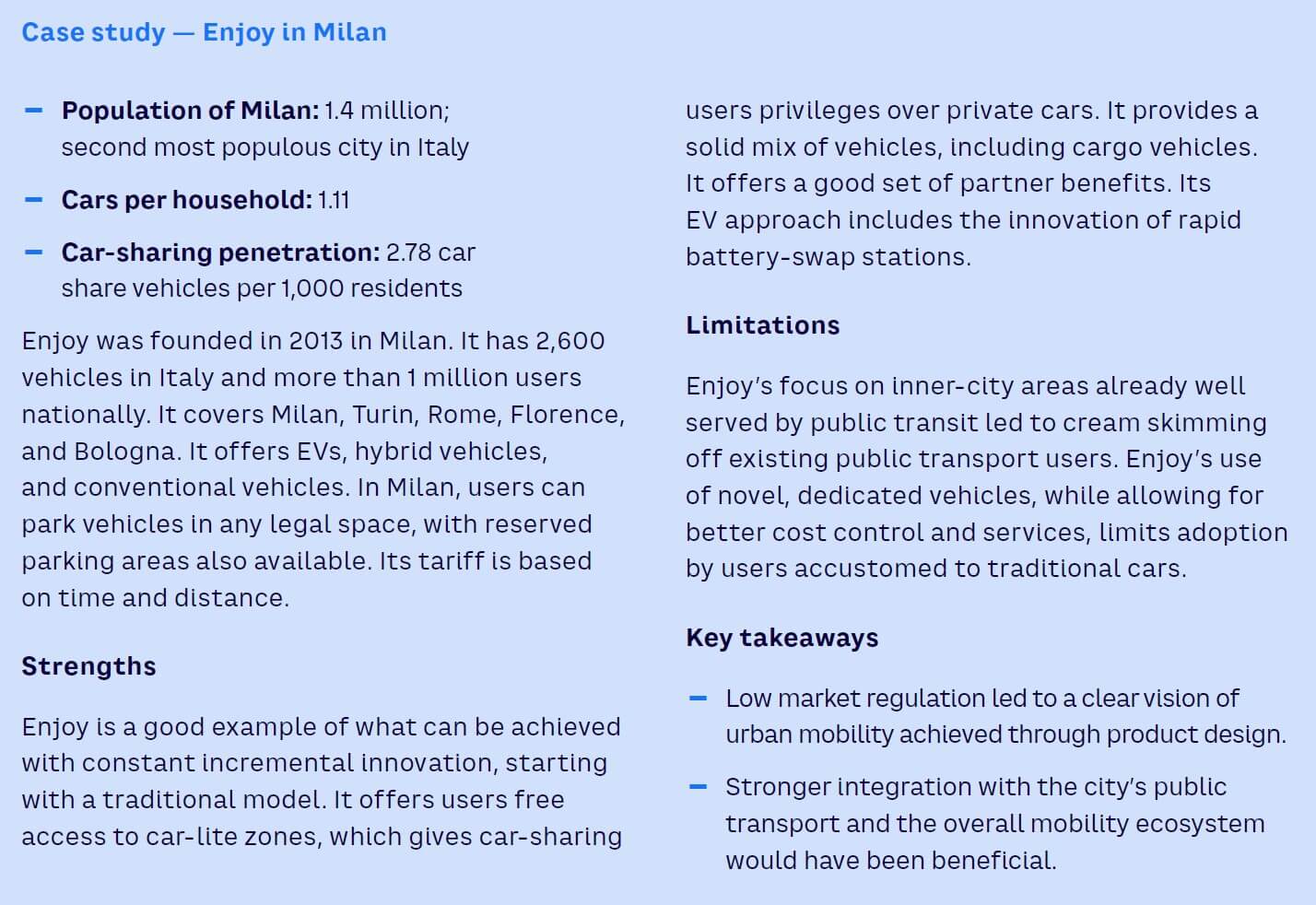

Operators must adopt a mindset of continuous innovation to grow scale and profit margin. Enjoy in Milan, which started with a traditional model, is a good example of what can be achieved with constant incremental innovation (see case study “Enjoy in Milan”). It offers users free access to car-lite zones, giving car-sharing users privileges over private cars, and it provides a solid mix of vehicles, including cargo vehicles. It also offers a good set of partner benefits and rapid battery-swap stations for EVs.

4. Focus on the broadest possible customer population

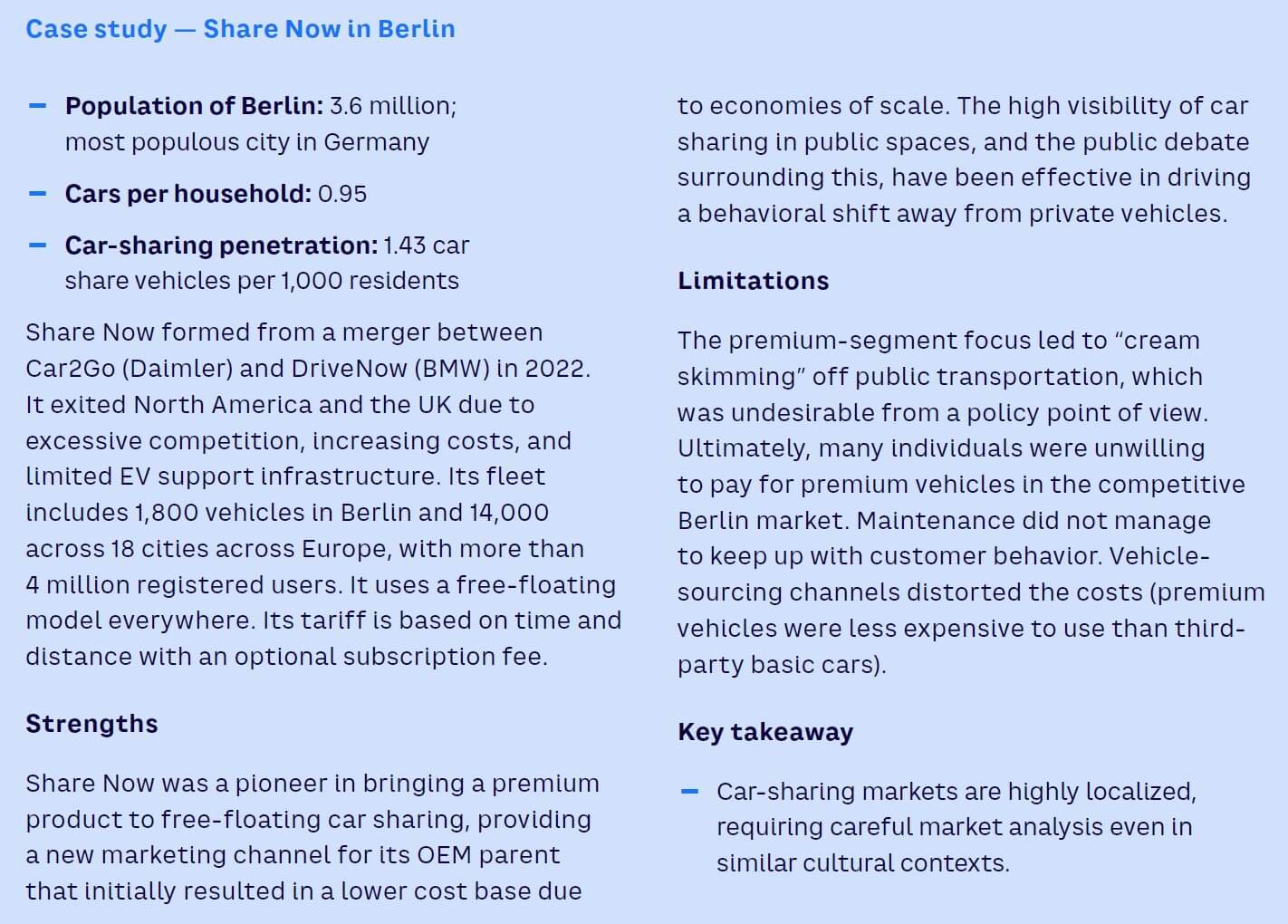

Car-sharing businesses that only focus on one segment tend to be more difficult to scale and may not be commercially viable (see case study “Share Now in Berlin”). From an overall ecosystem perspective, such schemes are usually suboptimal because they are hard to integrate with other mobility modes. Scalability requires aiming at the broadest possible customer population (whether consumer, business, or government) with careful customer segmentation and profiling to ensure customer-centric offerings.

5. Adopt a system-wide perspective

Car-sharing operators must consider the overall mobility system, rather than focusing solely on the performance of their operation. Indeed, an ecosystem-based approach is much more likely to lead to sustainable operations in the long run, as the greater overall value provided to consumers is matched with a higher willingness to pay for the service.

CONCLUSION

Car sharing has a checkered history in many cities, with a few successes and some notable failures. But as the shift away from “car ownership by default” continues and new mobility offers become better integrated into the overall mobility system, car sharing has the potential to come into its own and deliver major benefits to both customers and transit authorities. Car sharing is even more attractive as an individual mobility solution when paired with the shift to EVs, and as AVs and robotaxis become mainstream, we may see car sharing increasingly converge with ride sharing.

The key to success for all stakeholders (transit authorities, operators, investors, and suppliers) is adopting an ecosystem-based approach. Car sharing benefits from being fully integrated with, and contributes to, the overall mobility system, especially public transport; this also benefits citizens.

For city and transport authorities, this means finding the right balance between framing and enabling regulations and actions, actively managing car-sharing demand for the benefit of the overall system, setting conditions that enable close collaboration between players, enabling data sharing, fostering innovation, and integrating physical infrastructure. In many places, subsidies can be justified by the resulting reduction in privately owned cars.

Operators must become and remain customer-centric, acting local, target the broadest possible customer population, be willing to collaborate and share data with others, take a broad system perspective, and constantly innovate.

With this approach, car sharing has the potential to become a key part of a sustainable mobility future for our cities and regions.

Notes

[1] Trip chaining is a travel pattern involving multiple small, interconnected trips.

[2] “Car Club Annual Report: United Kingdom.” CoMoUK, 2021.

[3] Nicholas, Michael, and Marie Rajon Bernard. “Success Factors for Electric Carsharing.” International Council on Clean Transportation (ICCT), Working Paper 2021-30, August 2021.

[4] In addition to varying between user types, the economics of car sharing versus ownership vary between markets, based on issues such as taxes and incentives.

[5] Van Audenhove, François-Joseph, et al. “The Future of Urban Mobility 2.0 – Imperatives to Shape Extended Mobility Ecosystems of Tomorrow.” Arthur D. Little/UITP, January 2014.

DOWNLOAD THE FULL REPORT

27 min read • Travel & transportation

Sharing in success

How car sharing can deliver on its potential in an ecosystem play

DATE

Executive Summary

Car sharing’s origins date back to 1948 in Switzerland, with faster growth starting in the 1970s. The market has expanded further in the last two decades, driven by restrictions on city center private car use, advanced digital technologies, and shifting consumer attitudes around car ownership. However, it remains a relatively small market, accounting for less than 5% of the US $100 billion global shared mobility market.

Car-sharing schemes have faced a number of challenges, both for operators looking to build economically viable, scalable businesses as well as for authorities tasked with regulating them within the overall mobility system. Looking ahead, car sharing has a key role to play in the integrated mobility system, in large part driven by increasing demand for sustainability and convenience. This Report explores the benefits and pitfalls of car sharing and describes strategies for success for both regulators and operators.

BENEFITS & PITFALLS

Car sharing has the potential to come into its own as a critical part of future mobility systems, alongside fixed route public transport (buses, trains, metros), on-demand public transport (ride hailing, ride sharing), micromobility (bikes and scooters), and deliveries and services (logistics, couriers). Indeed, a properly framed car-sharing scheme offers three main benefits. First, it improves the overall performance of the mobility system by enhancing connectivity, increasing access, and increasing system capacity. Second, it contributes to better sustainability and safety by significantly reducing the number of privately owned cars. Third, it offers the convenience of a private vehicle for users picking up goods, trip chaining,[1] or traveling out of town.

However, when car sharing is not properly framed into the overall mobility system, there are some pitfalls. For example, free-floating schemes (those without fixed parking stations) may encourage users to choose cars over mass-transport modes. There may also be cleanliness/condition issues from improperly maintained vehicles and some stationary vehicle nuisance issues (although less so than bikes and scooters).

IMPLEMENTATION CHALLENGES

Cities and transport authorities have struggled to regulate car sharing for two main reasons. First, regulation has often been overly restrictive, focused on limiting the scheme’s impact, rather than collaborating with operators to maximize overall mobility system benefits. In some cases (e.g., Car2Go in Toronto), limitations on area access and parking led to operators exiting the market altogether. Second, inadequate coordination between authorities across jurisdictional boundaries has often led to inconsistencies that confuse users.

The key challenge for operators is the business model. Many struggled to achieve profitability due to high operating costs, poor coordination with competitors, narrow focus (e.g., premium niches or B2B customers requiring costly customization), unfavorable revenue-sharing models with municipalities, and/or lack of collaboration with vehicle OEMs. Finally, inadequate parking arrangements with authorities have depressed customer uptake, as have delays in essential upgrades for operators relying entirely on third parties for their digital platforms.

STRATEGIES FOR SUCCESS

Success in this market requires evolving car-sharing schemes beyond the traditional and OEM-led models. Future schemes must integrate better with the broader shared-mobility system and place services in locations where they add the most value.

We refer to this as the “ecosystem player stage.” Key features include designing the system around simplifying mobility for the user, using car sharing as a complement to the public transport backbone in both city centers and outskirts (including possibly providing subsidies for trips that are less profitable but benefit the overall system), and designing the system to suit as many consumers as possible (low/middle rather than premium).

For city authorities, this translates into seven imperatives:

-

Find the right balance between “framing” (i.e., regulations aimed at exercising control over service and performance levels) and “enabling” (i.e. taking actions that set the right conditions, incentives, and governance to encourage development of car-sharing services benefiting the mobility systems as a whole).

-

Regulate to manage demand. This could be done by subsidizing particular car-sharing routes, instituting parking charge exemptions, and/or congestion charging.

-

Integrate physical infrastructure. This could transpire by colocating car-sharing stations with train, bus, and/or metro stations.

-

Foster innovation, collaboration, and standardization. This can occur through collaboration forums; setting minimum requirements for data sharing; establishing suitable IT infrastructure standards; and encouraging product standardization, system integration, and accessibility.

-

Exploit synergies with electric vehicle (EV) growth. This includes integrating car sharing into EV charging infrastructure provision plans.

-

Consider public/private partnerships. This is especially helpful with regard to overall system integration and demand management.

-

Adopt a test-and-learn approach to regulation. Trials and pilots, provided they are not too short, are a good way to shape requirements and create a more balanced market with a diverse set of players.

For operators, we identify five imperatives:

-

Be customer-centric and act local, creating tailored schemes driven by customer needs.

-

Be willing to collaborate and share data. Data sharing is critically important to integrated mobility ecosystems. Operators should be prepared to accept “win-win” data-sharing solutions that benefit multiple partners.

-

Innovate continuously. Constantly search for opportunities to grow scale and margin, including partnerships.

-

Focus on the broadest customer population. Careful customer segmentation and profiling are essential to creating customer-centric offerings.

-

Adopt a system-wide perspective. Operators must look beyond their piece of the market and seek opportunities to become an integral part of the overall mobility system.

As the shift away from car ownership continues and new mobility models become better integrated into the overall mobility system, car sharing has the potential to deliver major benefits to both customers and transport authorities. Looking further ahead, as autonomous vehicles (AVs) and robotaxis become more mainstream, we can expect car sharing to converge with ride sharing.

1

CAR SHARING: A POSITIVE CONTRIBUTION TO MOBILITY SYSTEMS?

Car sharing is a component of the mobility offering in many major cities today, with a global market of about $3 billion and a predicted forecast of 20% CAGR over the next decade. More than 250 operators provide services in around 3,000 cities, about 30% of the world’s total. It’s nevertheless a relatively small part of the approximately $100 billion overall shared mobility market: less than 5% of the total.

The first recorded implementation of a car-sharing scheme was in Zürich in 1948 (known as the Selbstfahrergenossenschaft scheme). Further development of cooperative schemes took place in the 1970s and 1980s, mainly in Switzerland and Germany, although also in other countries on a smaller scale. Growth has accelerated in the last two decades, driven by rising traffic congestion, restrictions on private cars in city centers, digital technologies like mobile apps, and a gradual shift away from a desire for individual car ownership, especially among younger adults.

As post-pandemic pressure to develop and improve urban mobility systems continues, car sharing has a vital role to play, both in reducing private car journeys and as a complement to public transport systems. However, integrating car sharing within the mobility system has proven challenging for cities and transport authorities.

From an operator’s perspective, car sharing has not been without its hurdles. Although analysts expect double-digit market growth per annum in the coming years (driven by increased consumer willingness to use shared modes and a regulatory push to steer people away from private cars), the financial business case for traditional (i.e., asset-heavy) car sharing is uncertain. Many new ventures struggled for profitability, including Share Now, a 2019 joint venture between Daimler and BMW that combined their car-sharing services (Car2Go and DriveNow, respectively). Following the formation of the joint venture, Share Now pulled out of North American and British markets. Three years later, after losing €123 million in 2020 and €70 million in 2021, Daimler and BMW pulled out altogether, selling the business to Stellantis, operator of Free2move.

This Report explores the drivers, benefits, pitfalls, and strategies for success for car sharing, drawing on lessons learned from across the world. We draw conclusions for both transport authorities and operators on how, using the right ecosystem-based approach, car sharing can achieve its full potential as an essential part of the mobility system.

THE SHIFT AWAY FROM CAR OWNERSHIP

Several trends are shifting users away from private car ownership toward use-based mobility models such as car sharing; these are likely to increase over the coming years (see Figure 1).

We see from Figure 1 that urbanization is expected to increase significantly in the next few decades, bringing with it increased traffic congestion in the absence of improved urban mobility strategies and policies. Environmental pollution therefore has become an existential threat, causing many users to shift to EVs or avoid car ownership altogether. Digitalization will continue to change the way we interact as human beings, both socially and in a business context. Although we can envisage increased use of virtual and augmented reality for leisure, social, and commercial activities, it is unclear to what extent virtualization will affect mobility demand in the long term. What’s clear is that increased connectivity and usability of digital technology acts as a strong driver toward participating in the sharing economy, including shared mobility solutions.

We can predict with some confidence that the range and flexibility of mobility offers will grow in the coming years, with increasing degrees of convergence between them. Leasing rates are likely to rise, converging with car-rental and car-subscription models as short-term leases become more available. Car subscription, in which a car is provided for a month or several months with all costs and services included except fuel, is a rapidly growing model. Traditional car rentals (less than a month) will continue, but some of this market share will start to move to car subscription and car sharing. Car sharing and car subscription are increasingly converging into “car-as-a-service” (CaaS) offerings that center on flexibility and choice in terms of contract type and duration, vehicle model, and vehicle availability.

Although they have encountered more barriers and difficulties than envisaged five to 10 years ago, as illustrated by the 2023 Cruise-based robotaxi deployment in San Francisco and Dubai, AVs will also impact the future of car sharing. They will be deployed initially in urban areas as robotaxis or on specific routes, such as to and from airports, but will eventually accelerate a mindset shift away from car ownership by stimulating demand for car-sharing models, including nonautonomous conventional vehicles.

BENEFITS OF CAR SHARING

Car sharing is part of the future mobility system, alongside fixed route public transport, on-demand public transport, small vehicle sharing (bikes), and deliveries and services (see Figure 2). Potential benefits of car sharing fall into three categories:

-

Improving performance of mobility system

-

Contributing to better sustainability and safety

-

Simplifying customers’ lives

Improving performance of mobility system

Properly regulated, operated, and integrated with the wider mobility system, car sharing has the potential to deliver a range of performance benefits to cities and transportation authorities:

-

Better land use. Car sharing reduces the number of cars in city centers by reducing the number of privately owned cars by as much as 20x.[2] This frees up urban space for things like green spaces, residential units, and commercial properties.

-

Improved access. Car sharing contributes to improving accessibility to areas of cities not well served by public transport. In 2021, the UK Car Club reported that 55% of car-sharing members said membership provided access to places that wouldn’t be otherwise accessible.

-

Better mobility flows. Alongside other offerings, car sharing can help optimize mobility flows across the system, improving access to public transport hubs. This is especially true when mobility data is shared with the broader mobility system (see Figure 3).

-

Increased system capacity. Car sharing helps cities accommodate mobility demand increases without adding to congestion.

Contributing to better sustainability & safety

Car sharing provides several safety and environmental benefits:

-

Reduced emissions, noise, and road surface use. By reducing overall number of cars, car sharing lowers tailpipe emissions and road noise. Studies suggest that one shared car can replace up to 20 private vehicles parked on city streets.[3] Currently, shared cars are more often electric than privately owned cars.

-

Reduced environmental impact from new car manufacture. Fewer cars means less environmental impact from new car manufacture.

-

More sustainable vehicles. Car-sharing schemes are increasingly based on electric, hybrid, and other more sustainable vehicles, providing an advantage over private cars. Moreover, car-sharing vehicles are, on average, much newer than privately owned vehicles (most are less than five years old). In 2021 in the UK, car-sharing vehicles averaged 27% less emissions than privately held vehicles.

-

Better safety and health. Fewer cars translates into lower adverse health effects on residents from vehicle emissions, as well as better road safety. Newer vehicles have better safety features than older vehicles.

Simplifying customers’ lives

-

Lower cost versus car ownership for some. For some people,[4] car sharing is less expensive than car ownership. Typical annual tax, fuel, and insurance costs for a non-hybrid car range from $2,000 to $2,500. Lease payments are usually an additional $3,000 to $5,000, for a total of $5,000 to $7,500. Typical car share rates are $2 to $10 per hour and $75 to $120 per day. For users who live in city centers, do not incur high annual mileage (i.e., between 6,000-10,000 km per year), and who would have additional ownership costs such as parking, car sharing can be less expensive than owning. In the 2021 UK Car Club survey, 73% of members reported savings versus private car ownership. Of course, this may not be the case for users outside city centers.

-

More convenient than other public mobility modes. Car-sharing schemes offer users the convenience of short-term car rental without the need to prebook or fill out forms. Pickup and drop-off locations are typically flexible to better suit user needs. Car sharing is more private than ride sharing, eliminates user dependence on another driver, and gives users control over the combination of trips and tasks they wish to complete. Car sharing is also more convenient than both public transport and ride sharing for users who need to pick up bulky items and/or make multiple trips.

CAR-SHARING PITFALLS

Notwithstanding the significant potential benefits, if car sharing is not properly framed and integrated into the overall mobility system, it can have unintended consequences that detract from overall system performance. These include:

-

Reduced mass transit use. In some city centers, car sharing encourages car usage over mass transport choices like metro, trams, and buses. This phenomenon has mainly been observed in free-floating car-sharing systems. The pandemic reduced mass transport ridership in many cities. Despite partial recovery since then, many public transport systems are experiencing funding difficulties that car sharing could contribute to.

-

Stationary vehicle nuisance. Unused and parked car share vehicles, together with other mobility devices such as bikes and scooters, can cause a nuisance if not well managed. For example, in free-floating schemes, they may be left in clusters that take up large blocks of parking space or end up in unsafe or restricted areas, especially in neighborhoods with limited parking spaces. In general, cars are generally less likely to cause a nuisance than micromobility devices (e-bikes and scooters).

-

Cleanliness and user behavior issues. Car share vehicles may be treated with less care by users than private vehicles would be by their owners, leading to cleanliness issues if the vehicles are not frequently inspected and maintained. Drivers may not be used to the control and operation of the car they receive, which could lead to driving errors.

2

STRATEGIES FOR SUCCESS

3 STAGES OF EVOLUTION

In 2014, Arthur D. Little (ADL) and the International Association of Public Transport (UITP) published “The Future of Urban Mobility 2.0” study, which described three stages of evolution: eco-focused traditionalists, OEM-driven players, and a third stage in which car sharing became a mass-market offering within an integrated mobility system.[5] Today, we can now be more certain and specific about the third stage, which we now refer to as “ecosystem players” (see Figure 4). There are existing operators in all three stages:

-

Eco-focused traditionalists. These are often the earliest operators. They usually operate a station-based service, and target customers are often driven by an interest in sustainability. For example, Greenwheels focuses on reducing the number of cars on the street, energy efficiency, and safety. Zipcar is another large provider in this category. Generally, customer-facing processes are less sophisticated in this category.

-

OEM-driven players. These represent the next stage of evolution and usually operate free-floating services with user-friendly mobile apps that demonstrate varying degrees of innovation. Prominent examples include Car2Go and DriveNow.

-

Ecosystem players. These are characterized by being well integrated with the broader shared mobility system — car-sharing services are offered in locations and contributing to use cases where they add the most value. Services may be privately operated, but subsidies are applied where they benefit the mobility system as a whole. Operators may blend or combine models based on user needs and locations. This model has the greatest potential to reap the benefits of car sharing.

The next two sections look closely at the limitations of current models and explore how ecosystem players can overcome them.

CURRENT MODEL LIMITATIONS

Regulation challenges

The struggles cities and transport authorities face in regulating car sharing fall into two main categories: (1) overly restrictive regulation and (2) lack of coordination across jurisdictional boundaries.

1. Overly restrictive regulation

Regulators sometimes view car sharing as a for-profit industry that provides additional mobility mode for users but is not a fully integrated part of the mobility ecosystem. As such, regulation focuses on restricting its impact, rather than encouraging its development and implementation in a way that maximizes overall mobility system benefits.

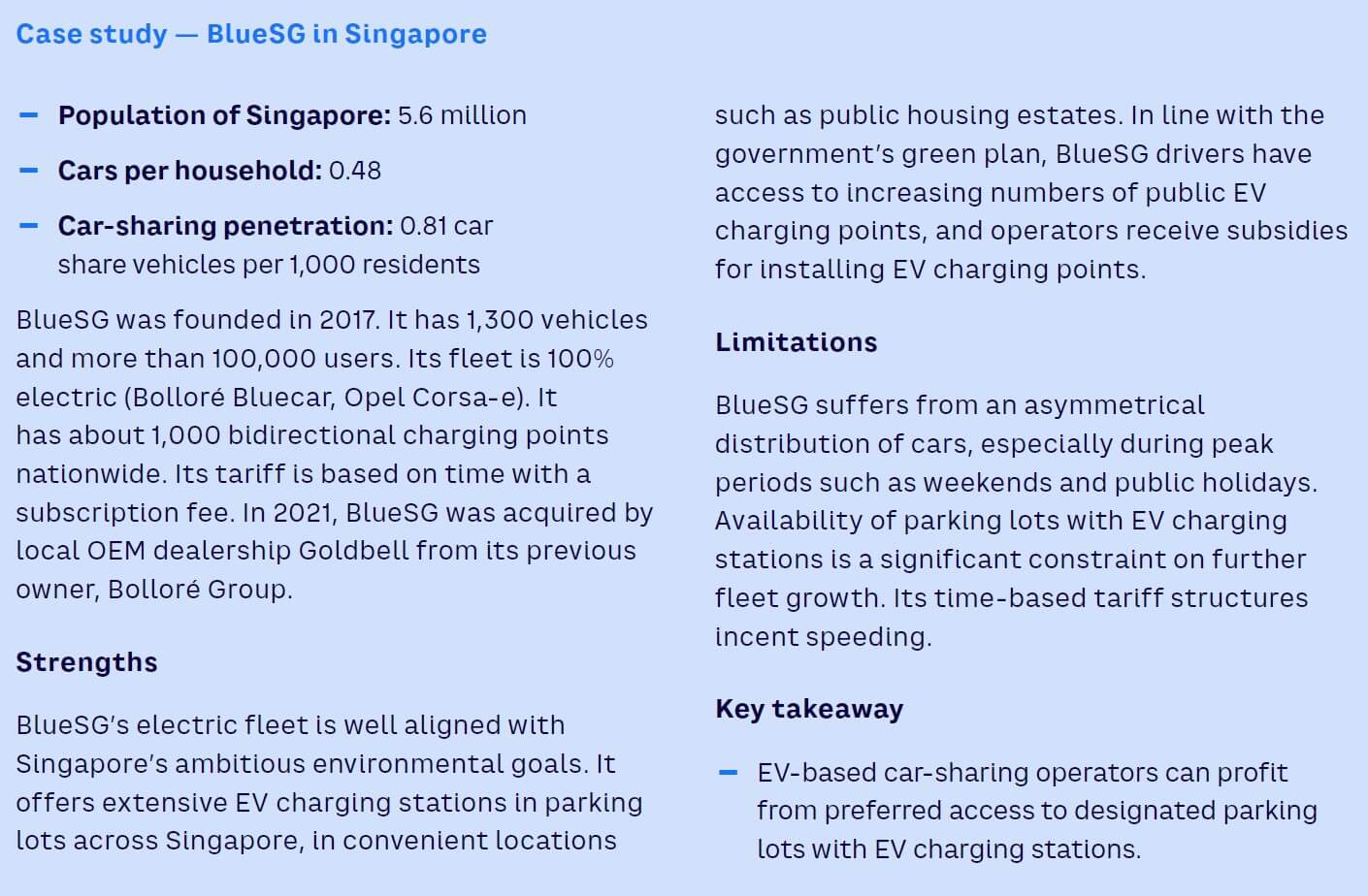

For example, in San Francisco, restrictive parking regulations forced BMW’s DriveNow to pull out of the city. Similarly, Car2Go’s 2018 car-sharing pilot was banned in 95% of Toronto’s residential areas. Local councils, which were responsible for the remaining 5% of residential areas, were allowed to ban Car2Go if they desired. Late in 2018, Car2Go, which claimed 80,000 users at the time, exited the market, citing parking fees and restrictions that made its service “inoperable.” Car sharing is still at an early stage in Singapore, but so far, car-sharing players face significant challenges, including high taxes on vehicle ownership, insufficient visible public-parking locations allocated for car sharing, insufficient promotion, and lack of integration with public transport.

Governments tend to set restrictions in a top-down fashion without adequate consultation with mobility service providers, users, or potentially affected businesses, leading to misunderstandings about how car-sharing schemes work. In Toronto, regulations were changed to shift from allocated parking lots to free-floating lots without adjusting for additional parking demand. This led to Car2Go racking up more than CAD $730,000 in parking fines.

2. Lack of coordination across jurisdictional boundaries

Inadequate standards coordination between stakeholders in the mobility ecosystem can impact the overall effectiveness of car-sharing schemes. For example, there has long been a problem with lack of coordination between London boroughs around car sharing, leading to inconsistencies in rules regarding free-floating parking. This negatively impacted user experiences and caused difficulties for service providers operating across the city.

Operational shortcomings

There are several common problems faced by car-sharing operators, including: (1) unsustainable business models, (2) unfavorable parking arrangements, and (3) lack of control over technology.

1. Unsustainable business models

The main reasons car-sharing operators have struggled to achieve profitability are:

-

Lack of product/customer fit. Often, demand issues are due to a lack of accessibility driven by an insufficient number of vehicles deployed. Some operators focused too heavily on specific niches (e.g., premium vehicles) before building sufficient volume, leading to low utilization rates.

-

Low-yield models. Low vehicle-utilization rates and low prices (reflecting current users’ willingness to pay, which is not much higher than for micromobility) mean many car-sharing operations can only generate low yields given the high operational costs involved (e.g., maintenance, insurance, parking).

-

Fractured market. Too many competitors with comparable products have operated in parallel silos in direct competition, without cross-usability or consideration of the mutual benefits of network effects. This has led to lower-than-planned use levels and difficulties scaling up.

-

Unsustainable revenue-share model with municipalities. Some municipalities have a revenue-share model for car-sharing services, increasing pressure on profitability.

-

Labor-intensive B2B model. Some operators developed a B2B business model that focused heavily on labor-intensive customization, driving up costs.

-

Failure to successfully partner with OEMs. Most car-sharing operators have not found a way to collaborate with OEMs. Partnership agreements between car-sharing operators and OEMs could yield mutual benefits and create a more profitable ecosystem.

There are examples of profitable car-sharing operations. Often, these are local solutions limited in size and driven by differentiated use cases and/or business models. It is also worth mentioning asset-light models such as peer-to-peer, business-to-employee, and business-to-tenant models in which vehicles are owned by individuals or employers, as well as schemes subsidized by local/regional authorities (e.g., Citiz in France).

2. Unfavorable parking arrangements

Adequate parking arrangements are critical to car-sharing schemes. Some countries or regions don’t allow free-floating car sharing, and suitable parking policies have not been defined in others. Several operators faced challenges due to limitations placed on their free-floating models; others experienced arbitrary bans to unclear regulations. Successful operations depend on making adequate parking arrangements with relevant authorities.

3. Lack of control over technology

Operators must be digitally enabled from the start to have a viable car-sharing operation. Operators wholly reliant on third parties for system development encounter delays in making important changes to operating models as they learn more about the market. With the broader availability of third-party car-sharing operating software, the choice of provider is critical to the ability to scale the business across regions (e.g., to form interregional or multinational alliances).

EMERGENCE OF THE ECOSYSTEM PLAY

The ecosystem approach is the most evolved car-sharing model. In Figure 5, we see how its primary features compare to other models. In the ecosystem approach, car sharing is fully integrated with, and a contributor to, the overall mobility system. It’s designed to be user-centric and integrate with public transport via these key features:

-

Designed to simplify user mobility. The ecosystem model centers the mobility system around the user. For example, public transport may meet the needs of a work commute while micromobility is used for short distances around town, and car-sharing facilitates picking up larger items, doing multiple errands in two or more neighborhoods, and/or heading out of town with friends.

-

City center feed to mass transit hubs. For trips within large city centers, car sharing can (alongside other shared individual mobility modes such as micromobility and on-demand) act as a complement or feeder to the public transport backbone rather than a substitute for it. Examples include Flex in Luxembourg, where car-sharing stations are colocated with railway stations (see case study “Flex in Luxembourg”).

-

For city outskirts and rural areas. For trips outside city centers, car sharing can be an effective complement to public transport. City outskirts and rural areas have lower population densities and are less well served by public transport, so new mobility modes like car sharing improve individual convenience. Because car-sharing vehicles are more highly utilized than private vehicles, they still deliver a sustainability advantage. Furthermore, promoting car-sharing solutions for trips in rural areas can deliver a positive business case for regional authorities. This is not about generating profitable revenue streams from the car-sharing operation, it’s about cost savings if better accessibility can be provided than with public transport at a lower cost.

-

Selective public funding. When car sharing is properly integrated as part of the mobility system, public funding can have a place alongside private funding. For example, the system as a whole can benefit from car sharing on the outskirts, rather than in city centers where public transport is already in place. However, trips in these areas are often less commercially attractive for the operator than city center trips. Subsidization of such trips, together with suitable policies to regulate city center trip volumes, can help car sharing benefit the mobility system as a whole.

-

Low/middle segment fleet offer. From an overall system viewpoint, car sharing should be accessible to as many passengers as possible. Thus, the offer should focus on low/middle and utility segments rather than the premium segment.

In essence, the ecosystem approach seeks to align car sharing such that it improves mobility system performance and sustainability while enabling viable commercial operation. Below, we look at what this means for authorities and operators.

8 IMPERATIVES FOR CITY AUTHORITIES

To create an ecosystem model that supports car sharing, city authorities and regulators should consider eight regulatory imperatives.

1. Find the right balance between framing & enabling

Cites and transport authorities have a wide range of parameters to consider in regulating car sharing (see Figure 6).

These parameters can be split conveniently into three categories:

-

Entry and expansion. This involves setting basic requirements operators must meet regarding vehicles, fleet size, and provisions for drivers/users. This should be based on the overarching objectives of the city, avoiding overly restrictive rules wherever possible.

-

Operations. This is the most complex category, covering issues such as parking, pricing (e.g., guidance on equitable access to low-income users), safety, and infrastructure. How these issues are addressed can have a profound impact on the viability of the car-sharing operation. As with entry and expansion requirements, overly restrictive rules should be avoided.

-

Monitoring. This involves setting requirements for how operations will be monitored and controlled, including what data must be reported for regulatory purposes and how it should be shared for effective mobility system management, including other ecosystem players and authorities. It should be incented using suitable KPIs.

Transport authorities should strike the right balance between "framing" and "enabling":

-

Framing — develop the right regulations aimed at exercising control over car-sharing schemes (e.g., service and performance levels, safety, resilience and environmental requirements, pricing).

-

Enabling — consider regulatory as well as non-regulatory actions that set the right conditions, incentives, and governance to encourage development of car-sharing services benefiting the mobility systems as a whole.

Inevitably, there are trade-offs between the various parameters and measures. For example, when setting parking requirements for car sharing, safety, security, environmental, and land-use concerns must be balanced with the financial viability of mobility operators and spin-off impacts for commercial businesses. All this must be done while remembering that a level playing field needs to be created to encourage competition. In general, cities and transport authorities have focused more on framing than enabling, and an ecosystem-based approach requires more attention to the latter. In striking a regulatory balance, the needs of the user/customer must be at the heart of all considerations.

2. Regulate to manage car-sharing demand

Mobility demand management measures for car sharing are important for optimizing the performance of the mobility system as a whole. As mentioned, when properly designed, car-sharing schemes can be a great complement to other mobility offerings in city centers and improve connectivity in city outskirts and rural areas, improving the overall attractiveness on the shared mobility system and providing an alternative to the use of private cars by default. Subsidies may be necessary to make servicing low-density areas commercially viable for the operator. Conversely, in some city centers, there may be a need to limit car sharing to avoid encouraging congestion and displacing mass transit ridership.

Demand management can also take the form of exemptions from parking, congestion, and/or toll charges (or discounts), helping to make car sharing more appealing than individual ownership.

3. Integrate physical infrastructure

Infrastructure can help improve integration of various mobility solutions. For example, it can facilitate car-sharing stations being colocated with train, bus, or metro stations (refer back to case study “Flex in Luxembourg”). This is an excellent way to maximize car-sharing benefits.

4. Foster innovation, collaboration & standardization

Fostering close collaboration between new mobility service providers and public transport operators and authorities is important to help car share operations add value at the mobility system level. Authorities can help foster collaboration and innovation at the mobility system level through a range of measures:

-

Sponsoring and facilitating collaboration forums, such as topic-based workshops, physical collaboration spaces, or best-practice sharing meetings. This can include promotion of better product localization to meet specific stakeholder needs.

-

Setting minimum requirements for data sharing across system partners. Data sharing is the essential “fuel” for running a integrated mobility system, and car sharing should be no exception.

-

Establishing suitable common IT infrastructure, processes, and standards to enable practical data sharing.

-

Imposing a base level of product standardization, system integration, and accessibility.

5. Avoid overly restrictive regulation

Car-sharing schemes must achieve scale to be financially viable. Authorities and regulators should avoid restrictive regulations that dampen demand to the point that scaling becomes impossible.

6. Exploit synergies with EV growth

Authorities should integrate the needs of car-sharing schemes into strategies for boosting penetration and adoption of EVs, especially provision of EV charging infrastructure, which is typically the primary bottleneck for the electrification of car sharing.

7. Consider public/private partnerships

Whether primarily backed by public or private capital, car-sharing schemes can benefit from the involvement of public parties such as cities and transport authorities. This involvement can ensure good integration of the overall mobility system, especially when it comes to demand management. This includes evaluating direct or indirect forms of subsidies (e.g., access to parking, financial contribution according to metrics such as trip length, start/end in specific neighborhoods at specific times), especially taking into consideration that in many economies, the most heavily subsidized mode of transport, considered holistically, is the privately owned car.

8. Adopt a test-and-learn approach

Experience shows that the most effective regulation follows a test-and-learn approach (see Figure 7).

Fixed approaches to regulation, whether light or prescriptive, have drawbacks. Light approaches can lead to a mobility market that is not as efficient as it could be and is difficult to control due to lack of data and effective enforcement levers. This often leads to market domination by larger players, who can absorb the most risk. Prescriptive approaches tend to have higher barriers to entry, high operating costs, less competition, and less innovation, although they protect the incumbents.

In between these extremes, a test-and-learn approach can deliver multiple benefits. Trials and pilots are an effective way to shape requirements in terms of entry, expansion, operations, and exit. However, short trials (less than three years) tend to be impractical due to the capital investment needed. Ideally, regulators should set conditions to encourage self-learning. In return for sharing more data, operators can benefit from the enabling measures described above.

Done correctly, a test-and-learn approach leads to a more balanced market with a diverse set of players that balances the interests of all the actors in the system. Cooperation between players leads to closer integration and even consolidation, in most cases improving the attractiveness of the mobility offer and facilitating user adoption. This ideally results in predefined, close, consistent feedback loops and activities between regulators and operators. A good example of this approach is the way Vancouver cooperated with mobility operator Evo to help build an attractive, customer-centric offer (see case study “Evo in Vancouver”).

5 IMPERATIVES FOR CAR-SHARING OPERATORS

We can similarly identify a series of five key imperatives for success from an operator perspective.

1. Be customer-centric & act local

With the active support of authorities, operators need to create customer-centric car-sharing schemes. This means avoiding a one-size-fits-all approach in favor of tailoring offerings to suit a variety of customer segments and behaviors. Customer needs differ greatly from city to city and from neighborhood to neighborhood within the same city, requiring careful analysis. Operators should carefully research the most attractive customer use cases and build communities of customers around these, as did Evo in Vancouver (see, again, case study “Evo in Vancouver”).

2. Be willing to collaborate & share data