12 min read • Healthcare & Life Sciences

Future health

How the industry will move from “one size fits all” to “ultra-targeted” care

Executive Summary

The shift from a one-size-fits-all model to more targeted and individualized care has a suite of implications. How will players across the ecosystem get ahead of these changes to avoid being left behind?

There is a new future for healthcare on the horizon. In this world, artificial organs will utilize a number of sensors to optimize the body’s chemical balance. Vaccines will exist for diseases that were thought to be incurable not too long ago. In fact, by 2030, the first CRISPR babies will enter their teenage years.

The healthcare ecosystem is always evolving, but the level of change we face in the next decade is unprecedented. Rapid technological developments in the areas of molecular biology, connectivity, artificial intelligence, digitalization and blockchain (to name a few) open entirely new doors and possibilities. These simultaneous developments create incredible potential for the future of healthcare as we move towards an age of “ultra-targeted” medicine: treatments, therapies, and care management targeted at improving the health of a smaller population of patients who are more likely to respond than they would be to traditional medicine.

At the same time, the burden of chronic diseases will continue to increase. The commercial implications will have to be managed, along with new drugs, devices, diagnostics, and health services. When we add economic pressure, political forces, and disruptive innovators such as Amazon, it becomes clear that traditional players across the healthcare system risk becoming obsolete. They must change how they operate in order to position themselves for success.

In this first installment of “Future health,” Arthur D. Little explores the scientific and technical developments that are dramatically changing the landscape and forcing payers, providers, and drug and device manufacturers to rethink their business, operating, and collaboration models.

Future health: How will healthcare adapt to “ultra-targeted” care?

Pharma, medtech, and care providers are evolving to create “Future health” business models, largely driven by precision medicine advances. From genomic treatments to curative medicine to Artificial Intelligence in diagnostics, the ecosystem is facing unprecedented change. Analysis from Arthur D. Little (ADL) highlights that all sectors of the industry must evolve their business and operating models in the coming decade.

Craig Wylie, Managing Partner of ADL in the United States and Head of the Global Pharmaceutical Competency Center, discusses the breadth of change and how healthcare companies in all corners of the industry will need to adapt.

1

Technological advances enable ultratargeted therapies

Thanks in large part to simultaneous advances in genomic sequencing, data science and analytics, and artificial intelligence/ machine learning, our ability to create biological data sets specific to individuals and small groups will provide us with incredible insight into patients’ biological make-ups (genes, cells, bio-markers, metabolic pathways, etc.).

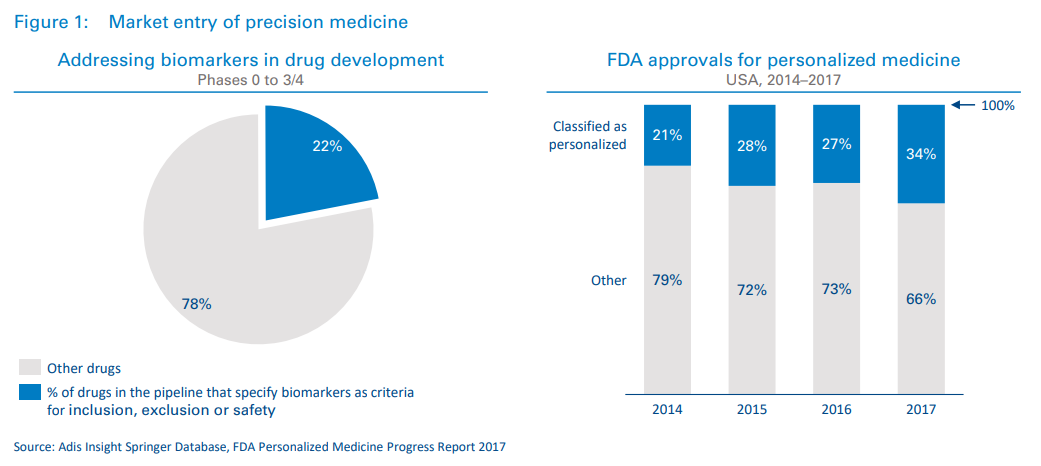

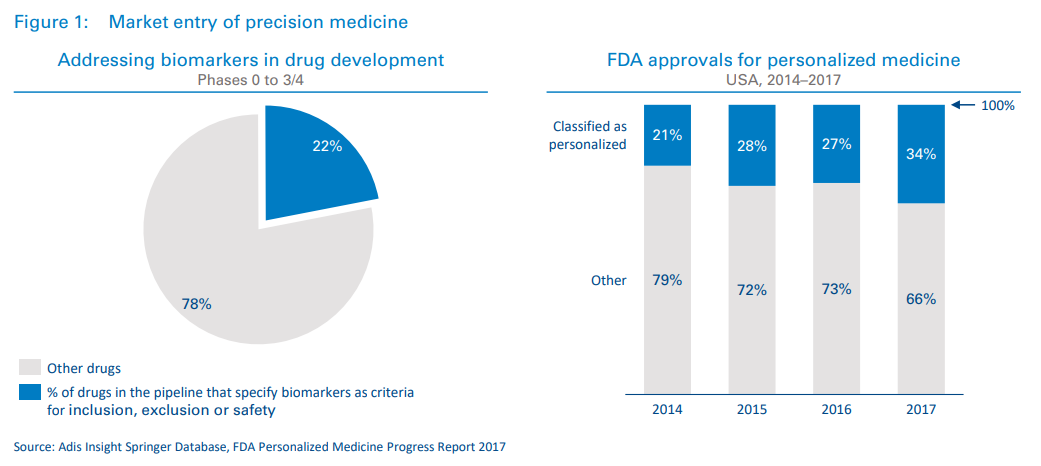

We have already seen several targeted treatments reach the market in areas such as oncology, and given the current trajectory of drugs in development, it is reasonable to expect a vast uptick in these treatments in the coming decades (see Figure 1). From 2014 to 2017, the percentage of US Food and Drug Administration (FDA) approvals classified as “personalized” increased from 21 to 34 percent.1 Additionally, 22 percent of drugs currently in development specify biomarkers as criteria for inclusion/exclusion and/or safety.2

One of the key drivers behind this is the expected volume of genomic data that will become available. Current projections for the global biobanking market show growth of around 10 percent year over year3 through 2021. ADL believes these projections are conservative, as consumer interest is high and companies such as Nebula Genomics and Luna DNA are offering patients financial rewards and individualized control of their data to incentivize genomic sequencing. In our paper, titled “The advent of consumer-owned genetic profiles,”4 we project the global consumer genetic testing market to be worth $50B by 2026. In the next 10 years it is highly possible that a large percentage of newborns will be assigned genetic “report cards.”

Consumer electronics have also become a new source of physiological and behavioral data. When integrated with medical records, this data could lead to powerful new approaches to addressing everything from prevention to diagnosis and treatment to outcome monitoring.

More important, and more challenging, than the collection of genomic and other biological data is the ability to understand and make use of that data. Recent advances in artificial intelligence and machine learning, however, vastly expand the breadth, speed, and accuracy with which data sets can be mined.

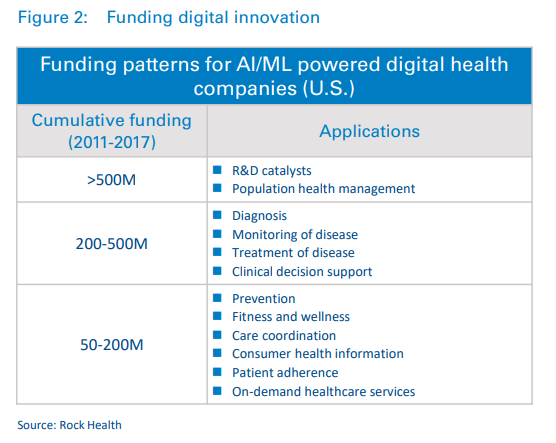

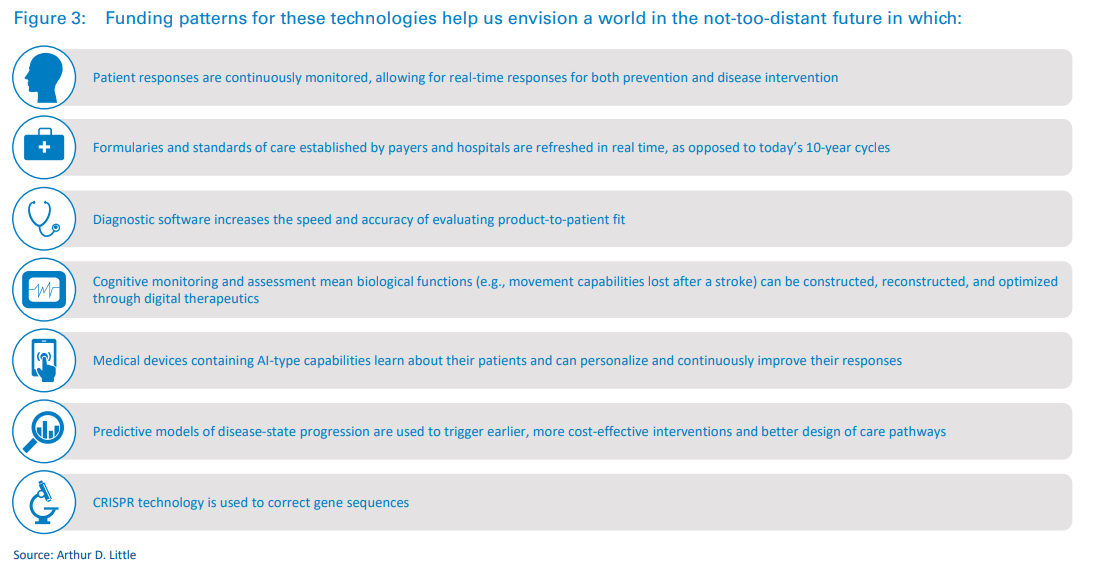

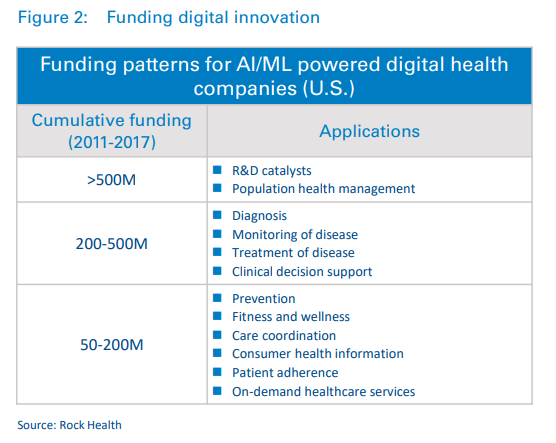

A look at funding patterns shows that investors have also taken note. Innovation is being funded through significant investments in digital health companies.

2

Precision healthcare: New outcomes, new industry

In the next five years, the number of traditional therapies being approved will likely be surpassed by new therapies based around molecular approaches. As this shift occurs (and therapies on the market lose their patent protection), we expect 60 percent of all patent-protected therapies in 2030 to be molecular in nature.

Consider how differently certain types of cancer are now being tackled. Recently, the FDA approved Vitrakvi (larotrectinib), the second drug to target tumors that carry a specific genetic change without regard to the tissue type of the cancer. The approval of Vitrakvi follows the 2017 approval of Keytruda (pembrolizumab), which was the first drug of this type. These therapies are part of a larger class of targeted cancer therapies: drugs that interfere with a specific molecular target involved in the growth and spread of cancer.

Other examples of precision products include several first-inclass drugs. Chimeric antigen receptor T-cell (CAR-T) therapies have received significant publicity due to their unprecedented efficacy with previously untreatable cancers. In these therapies, a gene targeting a specific cancer epitope is inserted into the patient’s own T-cells, which are then reintroduced to circulation, where they mount an immune response against the cancer.

Drug companies are actively pursuing CAR-Ts directed at solid tumors as well, and there are even signs that one day an off-theshelf solution will be available. This would result in a significant reduction in cost and open treatment up to more patients.

As of May 2018, there were 753 cancer cell therapies in the global development pipeline, with 375 in clinical development and 350 new cancer cell therapies entering the pipeline since September 2017.

While oncology has been at the epicenter of advances in precision medicine, there has been significant progress in other areas as well. In late 2017, the FDA approved the first gene therapy to treat children and adult patients with an inherited form of vision loss, and Bluebird Bio recently received marketing approval by the European Medicines Agency for its LentiGlobin gene therapy for treatment of transfusion-dependent ß-thalassemia (TDT). Several other companies are working on similar approaches to this disease – taking a new look at how gene therapy can be used to correct a mutation present from birth. And genome-editing technologies such as CRISPR will likely enable a tidal wave of advances within a broad range of indication areas.

In addition, sequencing and biomarker technologies will allow companies to develop companion diagnostics. A diagnostics or predictive biomarker assay is the critical link between drug and patient and an essential piece of the precision medicine puzzle. The ability to check treatment progression in real time will enable faster and more accurate clinical decisions.

Successfully rolling out a precision medicine approach will require significant industry-wide investment in enabling diagnostics and devices. Development of new, high-throughput sequencing platforms, for example, has made possible the sequencing of entire genomes that can then be used to understand the phenomenon of exceptional responders and how to leverage those findings for treatments. Foundation Medicine (recently acquired by Roche), for example, is using its clinical multiplex gene testing and its large, anonymized patient records database to help accelerate new biomarker-driven treatments.

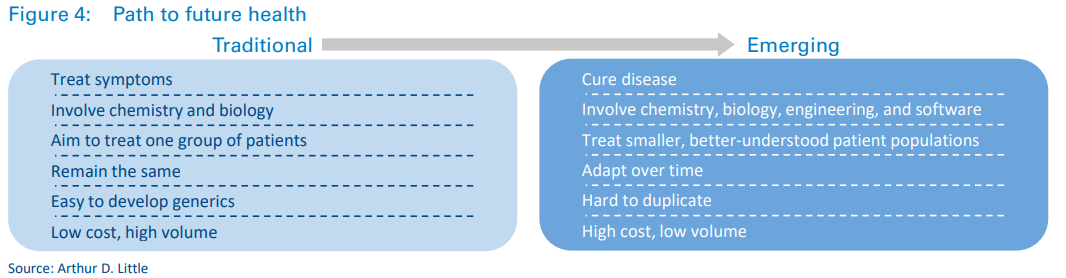

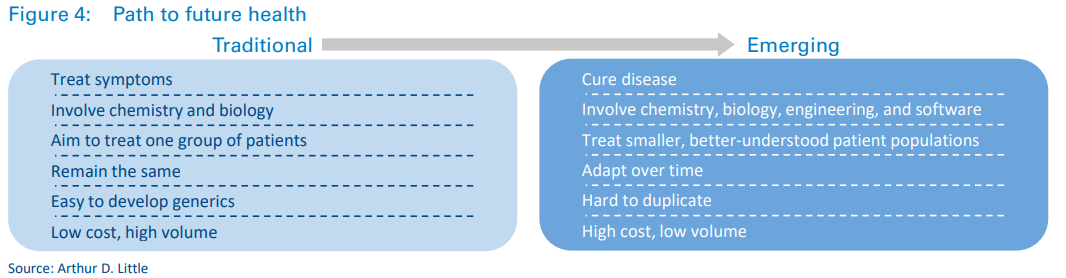

These new waves of products will have a profound effect on healthcare as we know it, with several fundamental differences between emerging and traditional treatments.

3

Treating disease in more precise patient populations

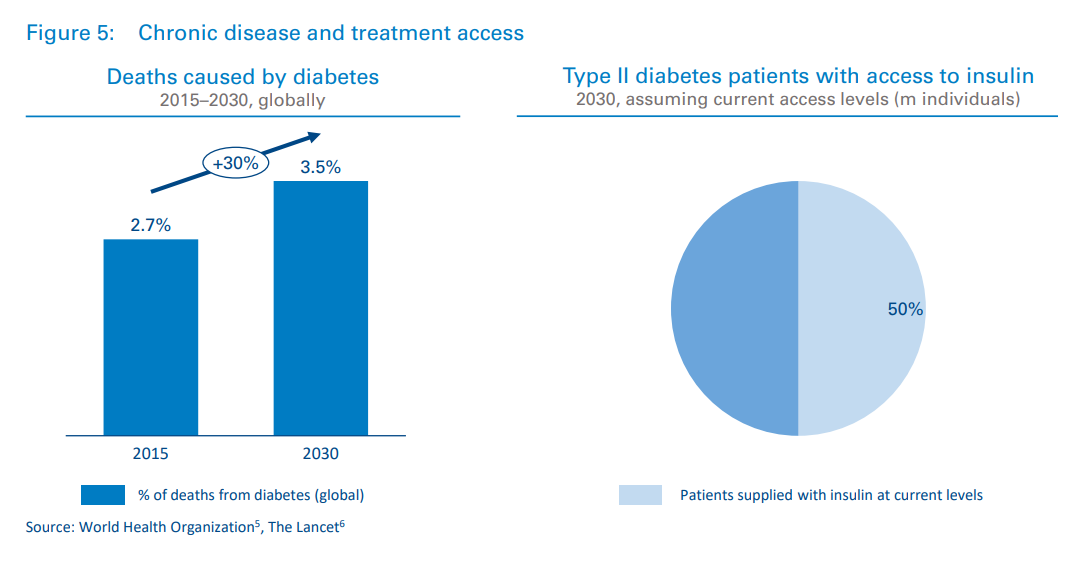

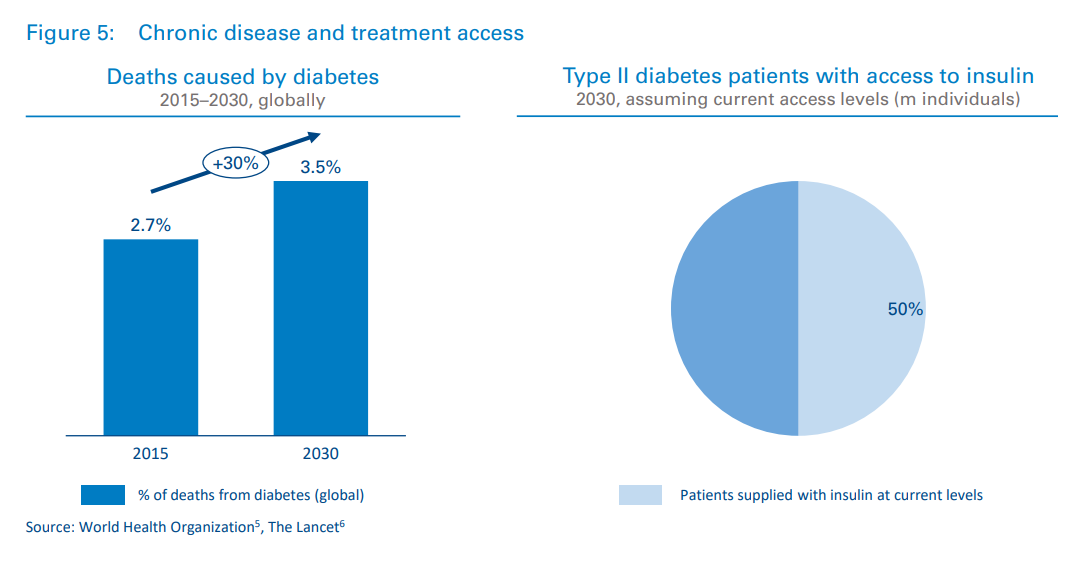

Some chronic diseases will become treatable, but not all. With an aging population and rates of obesity increasing around the world, diseases of affluence will continue to dominate financial, clinical, and social burdens. Heart disease is responsible for one in every seven deaths, and the percentage of deaths due to diabetes will increase by almost 30 percent from 2015 to 2030.51 And of all the people globally that will require insulin in 2030, only half will have access to it, according to a recent study6 2 by Stanford University (see Figure 5).

Meeting the needs of an increasing population of chronic care patients is still an issue to be solved, and finding novel ways to manage chronic conditions will be key to opening up the capacity of health systems. If we don’t find effective ways to manage chronic conditions, the financing available for ultratargeted treatments will be limited.

3.1 New patient population fragmentation

The development of ultra-targeted treatments will lead to a wave of patient population fragmentation characterized by an increased number of marketed treatments and a smaller number of patients targeted per treatment. This will have consequences for drug developers, payers, and providers.

One basic but non-trivial requirement will be to build a clear understanding of disease prevalence in a more specific manner to identify patients. With smaller numbers of patients, each individual becomes more valuable. Drug and device companies may choose to sponsor patient registries or establish patient recruitment partnerships with large hospital networks. In cases for which specific diagnostics are required, drug companies will need strategies for making diagnostics available and relieving bottlenecks that may occur due to limited testing infrastructure.

However, advances in consumer genomics may also pave the way for new methods of patient recruitment. Traditional healthcare companies may partner with consumer genomics companies to promote awareness of the connection between disease risk and genotype, as well as to provide resources for consumers that fit certain criteria. Companies will also likely partner differently with providers and payers to leverage AIenabled EMR analysis to automatically flag patients.

In the precision healthcare world, patients will have more data and better control of it, but they will also need to be more proactive. The cost pressure on the system could drive socioeconomic stratification in which savvy and engaged patients (who are also likely to be the most affluent) would receive the most advanced treatments, while less affluent patients would remain on traditional treatment pathways.

4

New business models and approaches will emerge

To unlock the potential benefits that science and technology advances can bring to healthcare, it is imperative for the entire healthcare ecosystem to not only take action, but to think more like a collaborative industry than ever before. The right partnerships and creative thinking will lead to faster, smarter adaptation to the new environment.

4.1 Care providers

Executives today are focused on the road towards Smart Hospitals, with the objective of achieving better clinical outcomes, efficiency in supply chain, and enhancement of patient experience. This momentum can help executives drive the structural and operational changes needed for precision healthcare. Hospitals catering to surgical procedures and longterm chronic care will see curative therapies force a change from surgical to physician-led therapies. Hospitals will need to assess their infrastructure and how they will adapt to a change in indication prevalence.

Moreover, hospitals must consider the potential for on-site device and drug manufacturing. The need for integrated healthcare systems will also become more critical, particularly to support adaptive trials.

4.2 (Bio)pharmaceuticals

Although pharmaceutical companies are investing in R&D to capitalize on this new world, the traditional commercial models will need to change as well. As currently configured, the way treatments are covered financially would not sustainably support ultra-targeted products. If left unchanged, this will harm both patients and pharma companies.

Commercial model innovation and patient engagement will be as important as scientific development. Creative payment models are a step in the right direction. In the case of its CAR-T treatment, Kymriah, Novartis is taking an outcomesbased approach through contingent reimbursement in the U.S. Bluebird, meanwhile, recently proposed a five-year payment plan for LentiGlobin, which would be the first arrangement of this kind.7

(Bio)pharma companies must also transition from passive to adaptive clinical trials; focus on providing an unassailable user experience to patients through seamless integration of 7 With Likely Approvals on the Way, Bluebird Bio Offers up Pricing Strategy for GeneTherapy, MarkTerry, Biospace, January 9, 2019 companion diagnostics; and develop a targeted, localized supply chain close to the patient.

4.3 Medtech

Device companies are already seeing the need to transition from providing electromechanical solutions to identifying ways in which they can collect meaningful data, but more needs to happen.

Breakthrough predictive analytics technologies will help clinicians make proactive decisions in critical situations, but monetizing these software-based solutions remains a key challenge. As device companies undergo this transition, acquiring a new set of competencies – either internally or through collaboration – will be a key success factor

Successful medtech companies will also shift their business models to compete with or supplement pharmaceutical drugs through therapeutic devices.

Lastly, in an industry that has become accustomed to lengthy product life cycles, medtech organizations will have to become much more agile in order to efficiently respond to rapidly changing market demands and incorporate technological innovations from adjacent industries. The nimblest organizations will win in the future.

4.4 Diagnostics

The role of diagnostics will change drastically in the next decade. While the industry has previously taken more of a “backseat” role and stayed in the lab, diagnostics will be at the forefront of innovation moving forward.

The way in which products are introduced to market will have to change. Diagnostics firms will put more emphasis on codevelopment and co-licensing with pharma companies, as well as collaborating with care providers to provide tests that will fit within ever-changing workflows.

Payment models will also need to evolve as consumer-financed options (for the growing volume of consumer-facing products) become more prevalent. And as the science becomes more exact in determining not only diagnoses, but also optimal treatment pathways, how will manufacturers capture returns for the added value they are providing?

Conclusion

Change is already upon us. Advances in genomics are leading to more precise targeting, treatments are shifting from symptomatic to curative, and digital advances and AI allow for real-time monitoring of patient health.

These and other leaps forward demand a rapid evolution. Hospitals are examining their approach to care, staffing, and facilities. Drug developers are experimenting with new commercial models.

In short, the path is being cleared for “Future health,” and the industry is likely to see new leaders emerge as:

- Drug and device manufacturers bring more innovative products to market.

- The shape, speed, and precision of clinical trials changes.

- Patients use the resources at their disposal to take control of their health.

- Policy makers understand that the shift to targeted and specific treatments changes every aspect of the provision and reimbursement of care.

- Hospitals review their capacity and capabilities around chronic care and become agile in a world that is changing faster than ever.

In the future healthcare paradigm, collaboration is critical. The most successful organizations across all segments of the healthcare ecosystem will be those that adapt their business models and operations and place an emphasis on strategic partnerships.

In future ADL Viewpoints, we will explore how each healthcare sub-sector can adapt to the new environment.

DOWNLOAD THE FULL REPORT

12 min read • Healthcare & Life Sciences

Future health

How the industry will move from “one size fits all” to “ultra-targeted” care

DATE

Executive Summary

The shift from a one-size-fits-all model to more targeted and individualized care has a suite of implications. How will players across the ecosystem get ahead of these changes to avoid being left behind?

There is a new future for healthcare on the horizon. In this world, artificial organs will utilize a number of sensors to optimize the body’s chemical balance. Vaccines will exist for diseases that were thought to be incurable not too long ago. In fact, by 2030, the first CRISPR babies will enter their teenage years.

The healthcare ecosystem is always evolving, but the level of change we face in the next decade is unprecedented. Rapid technological developments in the areas of molecular biology, connectivity, artificial intelligence, digitalization and blockchain (to name a few) open entirely new doors and possibilities. These simultaneous developments create incredible potential for the future of healthcare as we move towards an age of “ultra-targeted” medicine: treatments, therapies, and care management targeted at improving the health of a smaller population of patients who are more likely to respond than they would be to traditional medicine.

At the same time, the burden of chronic diseases will continue to increase. The commercial implications will have to be managed, along with new drugs, devices, diagnostics, and health services. When we add economic pressure, political forces, and disruptive innovators such as Amazon, it becomes clear that traditional players across the healthcare system risk becoming obsolete. They must change how they operate in order to position themselves for success.

In this first installment of “Future health,” Arthur D. Little explores the scientific and technical developments that are dramatically changing the landscape and forcing payers, providers, and drug and device manufacturers to rethink their business, operating, and collaboration models.

Future health: How will healthcare adapt to “ultra-targeted” care?

Pharma, medtech, and care providers are evolving to create “Future health” business models, largely driven by precision medicine advances. From genomic treatments to curative medicine to Artificial Intelligence in diagnostics, the ecosystem is facing unprecedented change. Analysis from Arthur D. Little (ADL) highlights that all sectors of the industry must evolve their business and operating models in the coming decade.

Craig Wylie, Managing Partner of ADL in the United States and Head of the Global Pharmaceutical Competency Center, discusses the breadth of change and how healthcare companies in all corners of the industry will need to adapt.

1

Technological advances enable ultratargeted therapies

Thanks in large part to simultaneous advances in genomic sequencing, data science and analytics, and artificial intelligence/ machine learning, our ability to create biological data sets specific to individuals and small groups will provide us with incredible insight into patients’ biological make-ups (genes, cells, bio-markers, metabolic pathways, etc.).

We have already seen several targeted treatments reach the market in areas such as oncology, and given the current trajectory of drugs in development, it is reasonable to expect a vast uptick in these treatments in the coming decades (see Figure 1). From 2014 to 2017, the percentage of US Food and Drug Administration (FDA) approvals classified as “personalized” increased from 21 to 34 percent.1 Additionally, 22 percent of drugs currently in development specify biomarkers as criteria for inclusion/exclusion and/or safety.2

One of the key drivers behind this is the expected volume of genomic data that will become available. Current projections for the global biobanking market show growth of around 10 percent year over year3 through 2021. ADL believes these projections are conservative, as consumer interest is high and companies such as Nebula Genomics and Luna DNA are offering patients financial rewards and individualized control of their data to incentivize genomic sequencing. In our paper, titled “The advent of consumer-owned genetic profiles,”4 we project the global consumer genetic testing market to be worth $50B by 2026. In the next 10 years it is highly possible that a large percentage of newborns will be assigned genetic “report cards.”

Consumer electronics have also become a new source of physiological and behavioral data. When integrated with medical records, this data could lead to powerful new approaches to addressing everything from prevention to diagnosis and treatment to outcome monitoring.

More important, and more challenging, than the collection of genomic and other biological data is the ability to understand and make use of that data. Recent advances in artificial intelligence and machine learning, however, vastly expand the breadth, speed, and accuracy with which data sets can be mined.

A look at funding patterns shows that investors have also taken note. Innovation is being funded through significant investments in digital health companies.

2

Precision healthcare: New outcomes, new industry

In the next five years, the number of traditional therapies being approved will likely be surpassed by new therapies based around molecular approaches. As this shift occurs (and therapies on the market lose their patent protection), we expect 60 percent of all patent-protected therapies in 2030 to be molecular in nature.

Consider how differently certain types of cancer are now being tackled. Recently, the FDA approved Vitrakvi (larotrectinib), the second drug to target tumors that carry a specific genetic change without regard to the tissue type of the cancer. The approval of Vitrakvi follows the 2017 approval of Keytruda (pembrolizumab), which was the first drug of this type. These therapies are part of a larger class of targeted cancer therapies: drugs that interfere with a specific molecular target involved in the growth and spread of cancer.

Other examples of precision products include several first-inclass drugs. Chimeric antigen receptor T-cell (CAR-T) therapies have received significant publicity due to their unprecedented efficacy with previously untreatable cancers. In these therapies, a gene targeting a specific cancer epitope is inserted into the patient’s own T-cells, which are then reintroduced to circulation, where they mount an immune response against the cancer.

Drug companies are actively pursuing CAR-Ts directed at solid tumors as well, and there are even signs that one day an off-theshelf solution will be available. This would result in a significant reduction in cost and open treatment up to more patients.

As of May 2018, there were 753 cancer cell therapies in the global development pipeline, with 375 in clinical development and 350 new cancer cell therapies entering the pipeline since September 2017.

While oncology has been at the epicenter of advances in precision medicine, there has been significant progress in other areas as well. In late 2017, the FDA approved the first gene therapy to treat children and adult patients with an inherited form of vision loss, and Bluebird Bio recently received marketing approval by the European Medicines Agency for its LentiGlobin gene therapy for treatment of transfusion-dependent ß-thalassemia (TDT). Several other companies are working on similar approaches to this disease – taking a new look at how gene therapy can be used to correct a mutation present from birth. And genome-editing technologies such as CRISPR will likely enable a tidal wave of advances within a broad range of indication areas.

In addition, sequencing and biomarker technologies will allow companies to develop companion diagnostics. A diagnostics or predictive biomarker assay is the critical link between drug and patient and an essential piece of the precision medicine puzzle. The ability to check treatment progression in real time will enable faster and more accurate clinical decisions.

Successfully rolling out a precision medicine approach will require significant industry-wide investment in enabling diagnostics and devices. Development of new, high-throughput sequencing platforms, for example, has made possible the sequencing of entire genomes that can then be used to understand the phenomenon of exceptional responders and how to leverage those findings for treatments. Foundation Medicine (recently acquired by Roche), for example, is using its clinical multiplex gene testing and its large, anonymized patient records database to help accelerate new biomarker-driven treatments.

These new waves of products will have a profound effect on healthcare as we know it, with several fundamental differences between emerging and traditional treatments.

3

Treating disease in more precise patient populations

Some chronic diseases will become treatable, but not all. With an aging population and rates of obesity increasing around the world, diseases of affluence will continue to dominate financial, clinical, and social burdens. Heart disease is responsible for one in every seven deaths, and the percentage of deaths due to diabetes will increase by almost 30 percent from 2015 to 2030.51 And of all the people globally that will require insulin in 2030, only half will have access to it, according to a recent study6 2 by Stanford University (see Figure 5).

Meeting the needs of an increasing population of chronic care patients is still an issue to be solved, and finding novel ways to manage chronic conditions will be key to opening up the capacity of health systems. If we don’t find effective ways to manage chronic conditions, the financing available for ultratargeted treatments will be limited.

3.1 New patient population fragmentation

The development of ultra-targeted treatments will lead to a wave of patient population fragmentation characterized by an increased number of marketed treatments and a smaller number of patients targeted per treatment. This will have consequences for drug developers, payers, and providers.

One basic but non-trivial requirement will be to build a clear understanding of disease prevalence in a more specific manner to identify patients. With smaller numbers of patients, each individual becomes more valuable. Drug and device companies may choose to sponsor patient registries or establish patient recruitment partnerships with large hospital networks. In cases for which specific diagnostics are required, drug companies will need strategies for making diagnostics available and relieving bottlenecks that may occur due to limited testing infrastructure.

However, advances in consumer genomics may also pave the way for new methods of patient recruitment. Traditional healthcare companies may partner with consumer genomics companies to promote awareness of the connection between disease risk and genotype, as well as to provide resources for consumers that fit certain criteria. Companies will also likely partner differently with providers and payers to leverage AIenabled EMR analysis to automatically flag patients.

In the precision healthcare world, patients will have more data and better control of it, but they will also need to be more proactive. The cost pressure on the system could drive socioeconomic stratification in which savvy and engaged patients (who are also likely to be the most affluent) would receive the most advanced treatments, while less affluent patients would remain on traditional treatment pathways.

4

New business models and approaches will emerge

To unlock the potential benefits that science and technology advances can bring to healthcare, it is imperative for the entire healthcare ecosystem to not only take action, but to think more like a collaborative industry than ever before. The right partnerships and creative thinking will lead to faster, smarter adaptation to the new environment.

4.1 Care providers

Executives today are focused on the road towards Smart Hospitals, with the objective of achieving better clinical outcomes, efficiency in supply chain, and enhancement of patient experience. This momentum can help executives drive the structural and operational changes needed for precision healthcare. Hospitals catering to surgical procedures and longterm chronic care will see curative therapies force a change from surgical to physician-led therapies. Hospitals will need to assess their infrastructure and how they will adapt to a change in indication prevalence.

Moreover, hospitals must consider the potential for on-site device and drug manufacturing. The need for integrated healthcare systems will also become more critical, particularly to support adaptive trials.

4.2 (Bio)pharmaceuticals

Although pharmaceutical companies are investing in R&D to capitalize on this new world, the traditional commercial models will need to change as well. As currently configured, the way treatments are covered financially would not sustainably support ultra-targeted products. If left unchanged, this will harm both patients and pharma companies.

Commercial model innovation and patient engagement will be as important as scientific development. Creative payment models are a step in the right direction. In the case of its CAR-T treatment, Kymriah, Novartis is taking an outcomesbased approach through contingent reimbursement in the U.S. Bluebird, meanwhile, recently proposed a five-year payment plan for LentiGlobin, which would be the first arrangement of this kind.7

(Bio)pharma companies must also transition from passive to adaptive clinical trials; focus on providing an unassailable user experience to patients through seamless integration of 7 With Likely Approvals on the Way, Bluebird Bio Offers up Pricing Strategy for GeneTherapy, MarkTerry, Biospace, January 9, 2019 companion diagnostics; and develop a targeted, localized supply chain close to the patient.

4.3 Medtech

Device companies are already seeing the need to transition from providing electromechanical solutions to identifying ways in which they can collect meaningful data, but more needs to happen.

Breakthrough predictive analytics technologies will help clinicians make proactive decisions in critical situations, but monetizing these software-based solutions remains a key challenge. As device companies undergo this transition, acquiring a new set of competencies – either internally or through collaboration – will be a key success factor

Successful medtech companies will also shift their business models to compete with or supplement pharmaceutical drugs through therapeutic devices.

Lastly, in an industry that has become accustomed to lengthy product life cycles, medtech organizations will have to become much more agile in order to efficiently respond to rapidly changing market demands and incorporate technological innovations from adjacent industries. The nimblest organizations will win in the future.

4.4 Diagnostics

The role of diagnostics will change drastically in the next decade. While the industry has previously taken more of a “backseat” role and stayed in the lab, diagnostics will be at the forefront of innovation moving forward.

The way in which products are introduced to market will have to change. Diagnostics firms will put more emphasis on codevelopment and co-licensing with pharma companies, as well as collaborating with care providers to provide tests that will fit within ever-changing workflows.

Payment models will also need to evolve as consumer-financed options (for the growing volume of consumer-facing products) become more prevalent. And as the science becomes more exact in determining not only diagnoses, but also optimal treatment pathways, how will manufacturers capture returns for the added value they are providing?

Conclusion

Change is already upon us. Advances in genomics are leading to more precise targeting, treatments are shifting from symptomatic to curative, and digital advances and AI allow for real-time monitoring of patient health.

These and other leaps forward demand a rapid evolution. Hospitals are examining their approach to care, staffing, and facilities. Drug developers are experimenting with new commercial models.

In short, the path is being cleared for “Future health,” and the industry is likely to see new leaders emerge as:

- Drug and device manufacturers bring more innovative products to market.

- The shape, speed, and precision of clinical trials changes.

- Patients use the resources at their disposal to take control of their health.

- Policy makers understand that the shift to targeted and specific treatments changes every aspect of the provision and reimbursement of care.

- Hospitals review their capacity and capabilities around chronic care and become agile in a world that is changing faster than ever.

In the future healthcare paradigm, collaboration is critical. The most successful organizations across all segments of the healthcare ecosystem will be those that adapt their business models and operations and place an emphasis on strategic partnerships.

In future ADL Viewpoints, we will explore how each healthcare sub-sector can adapt to the new environment.

DOWNLOAD THE FULL REPORT