Public electric vehicle (EV) charging is still nascent, as reflected by subpar customer charging experiences. Arthur D. Little (ADL) recently took a deep dive into the public EV charging customer journey, surveying and conducting comprehensive interviews with EV drivers in North America to understand their key pain points. From these challenges arose significant opportunities that players across the ecosystem can seize to improve financial performance and create competitive advantage.

THE EV CUSTOMER JOURNEY

The public EV charging experience has a long road ahead. It must compete against the unremarkable yet consistent process that customers have grown to expect at the gas pump — and must address a range of complications causing negative experiences for customers. The decentralization of charging providers has hindered the driver’s discovery of and routing to a charger, impacting ease of use and customer experience (CX). In fact, a recent University of California, Berkeley study found that more than 25% of non-Tesla direct current fast chargers (DCFC) in the San Francisco Bay Area were not functional. An ADL analysis of session data from a leading charge point operator (CPO) found only 85% of initiated sessions led to a successful charge. Common issues faced by customers include payment gateway failures; inability to initiate a charge; broken hoses, connectors, or plugs; broken screens; and a host of other malfunctions. The root cause of these problems could be attributed to various ecosystem participants, from auto manufacturers, EV charging hardware providers, network system operators, telecom providers, and payment processors to the CPOs that own and operate these assets.

These pitfalls must be overcome, both to further widen EV adoption and enable better financial outcomes (e.g., market share, revenue growth, profitability) for all players involved.

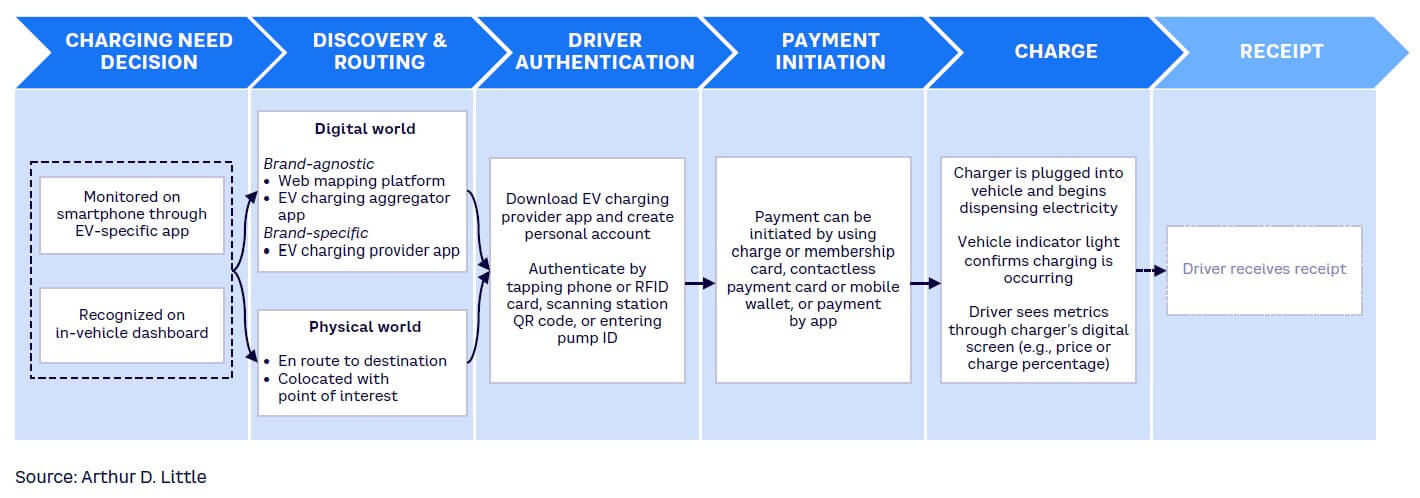

To better understand the challenges of EV charging from the customer perspective, ADL launched a survey of more than 750 EV drivers across the US and conducted several in-depth interviews with them, enabling us to build a foundational understanding of the customer journey (see Figure 1) and analyze how stakeholders across the ecosystem can create a “right to win” in their segment while driving both top- and bottom-line improvements.

CX CHALLENGES

Inconsistency creates lack of customer loyalty

The public EV charging CX can best be described as inconsistent, despite how foundational it is to EV ownership. Unlike the standardization found at a gas station, EV charging can vary in plug type, location type, payment availability, and membership requirements. Most CPOs require drivers to download an app and create a user account before using their stations, causing additional friction in the process.

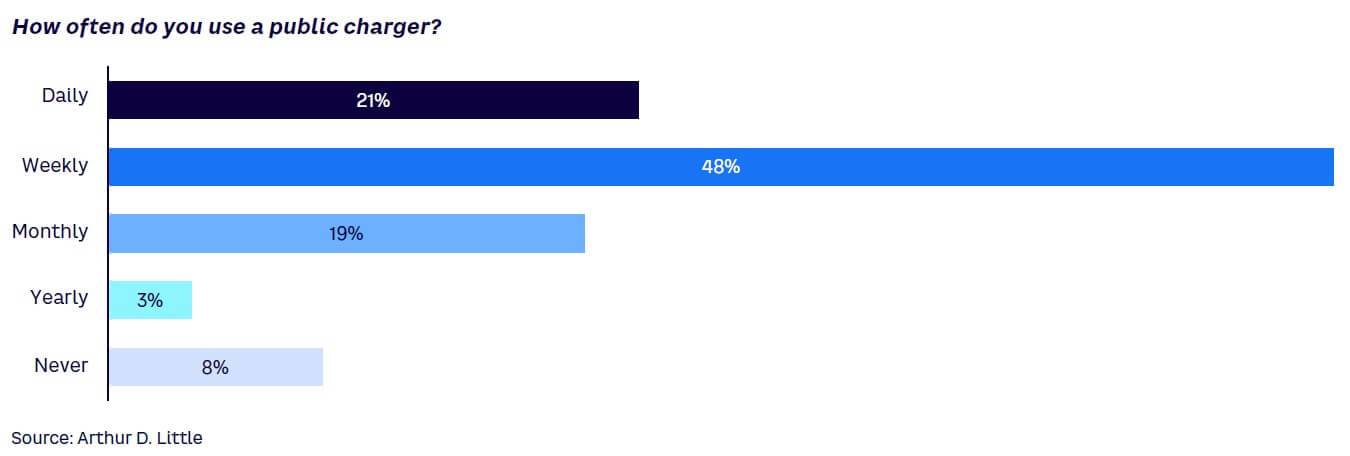

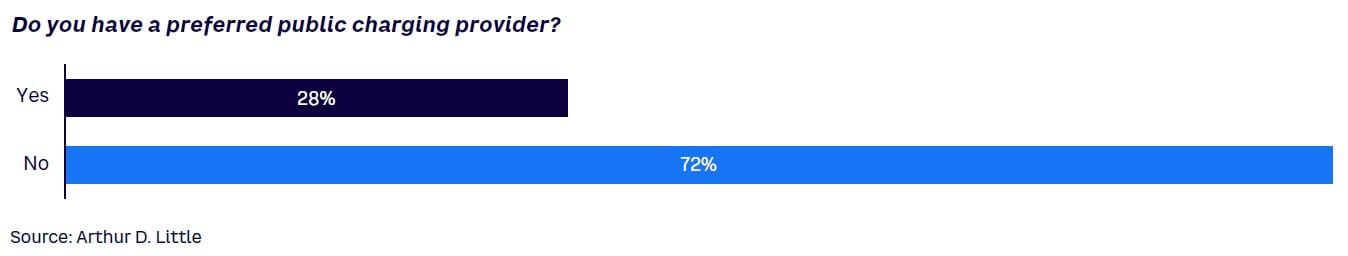

A recent California Air and Resource Board survey found that over 62% of respondents had between two and five network memberships. However, CPOs have not been able to turn these memberships into loyalty. According to ADL’s survey, nearly 70% of participants use public charging relatively frequently (daily or weekly), as shown in Figure 2. However, the vast majority of EV drivers surveyed (72%) do not have a preferred public charging provider (see Figure 3).

Pain points in the customer journey

Every customer who uses a public charger starts their journey by recognizing that they need to charge their EV, and ends, it is hoped, with a successful charge. However, customers have the potential to experience significant pain points at every step along the way, and they often do. Consider some examples below:

- Charging needs and “range anxiety.” The driver realizes the vehicle needs a charge, either from the car’s dashboard or smartphone app. The decision to address this need initiates the quest for a public charging station. Compared to traditional internal combustion engine (ICE) vehicles, with longer ranges and ubiquitous fueling availability, EVs require drivers to plan trips more thoughtfully, especially long-distance ones. Depending on the EV model, the in-vehicle display attempts to help drivers manage charge planning by providing remaining battery capacity and how this translates to miles left in the tank. However, speed, topography, and adverse driving conditions can lead to faster-than-anticipated battery use. If the driver is confronted by a sudden and unanticipated need for charging, this can be an annoyance at best and a risk to the journey at worst. Either way, access to a charging station becomes all the more important.

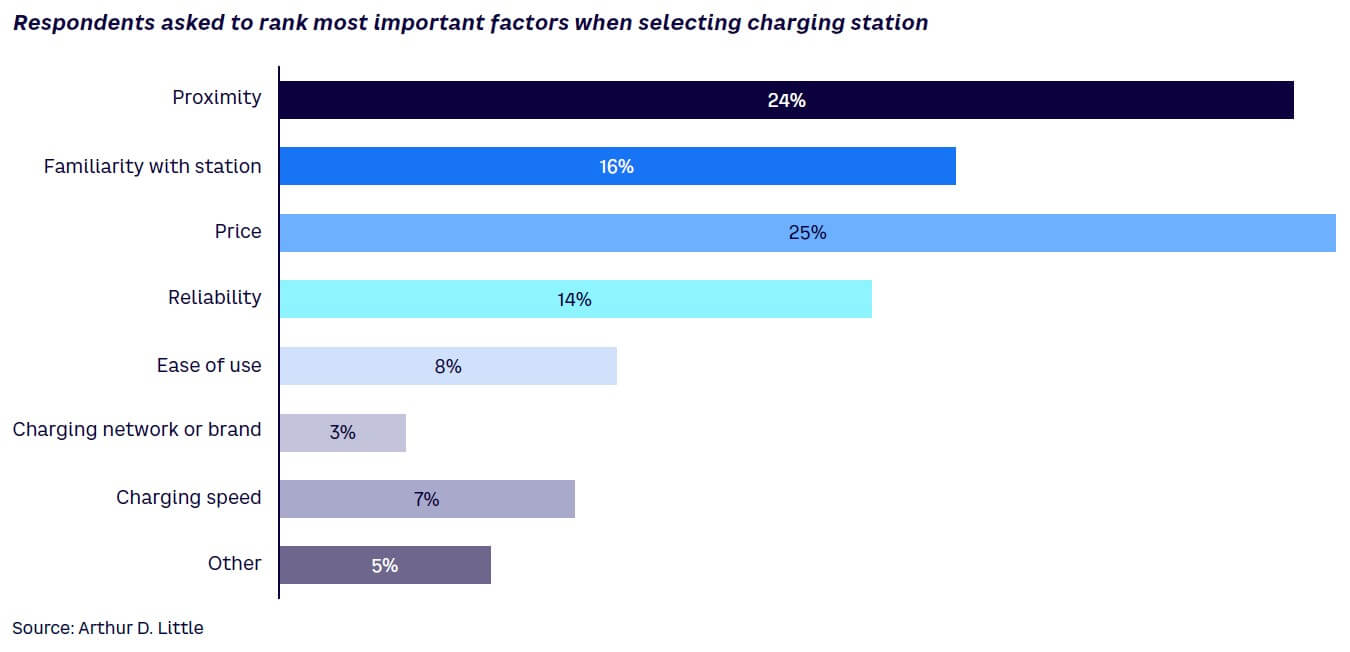

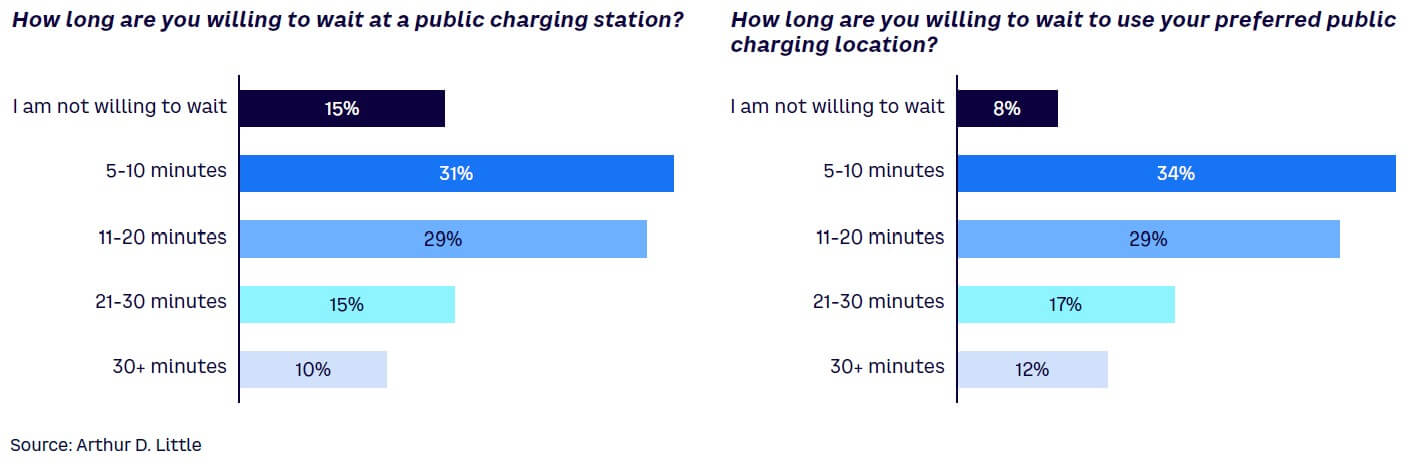

- Finding the “right” charging station. The driver locates and navigates to a public charging station, likely using a smartphone app or the vehicle’s infotainment system, if they haven’t previously visited this station. Having a number of preferred charging locations is natural if you’re close to home. According to our survey, 61% of customers have a preferred public charging location, noting that their most important criteria are price, proximity, familiarity, and reliability. Figure 4 shows what drivers look for in a charging station. However, if the driver is a new owner or in an unfamiliar place, locating a suitable public charging station (e.g., car-compatible, charges at an acceptable speed) can be a challenge. Public charging availability, particularly for fast charging, varies significantly depending on location. Therefore, the driver must sometimes utilize multiple tools (e.g., in-vehicle displays, proprietary CPO apps, Google Maps, PlugShare) to develop a view of options in the local area. Once the driver decides on a location, a new set of challenges may arise. Respondents reported inconveniences ranging from glitchy navigation apps leading nowhere to physical blockades like snowdrifts preventing access to a given charging point. The most common grievance is that charging apps may not update charge-point availability in real time. Half the drivers who arrived at a station and left without charging their vehicle cited long wait times. Fifteen percent of respondents reported an unwillingness to wait at all for a charging station to free up; 31% will wait five to 10 minutes. Figure 5 provides additional details related to customers and their willingness to wait for a charge. Public charging providers should view customers lost due to these preventable causes as money left on the table.

- Complicated driver authentication. Stations within a public charging network require a user authentication step to identify/verify the driver’s profile and connect to their billing and payment systems. The driver can authenticate via a radio frequency identification (RFID) card, a smartphone app, or by plugging in the car, which is a feature currently exclusive to Tesla. If the driver arrives at a station and is not already a member of that charging network, then the driver is frequently required to download the provider’s app (often relying on cellular connectivity), create an account, and enter vehicle and payment information before being able to charge the vehicle. As a result, excluding Tesla drivers, between 50% and 75% of survey respondents have not downloaded or very seldom use proprietary apps from major CPOs. Once the driver has joined the network, the process of authentication is intended to be simple. However, network issues can often occur and stop the authentication process from moving forward, thus making it difficult to impossible for the driver to receive a charge.

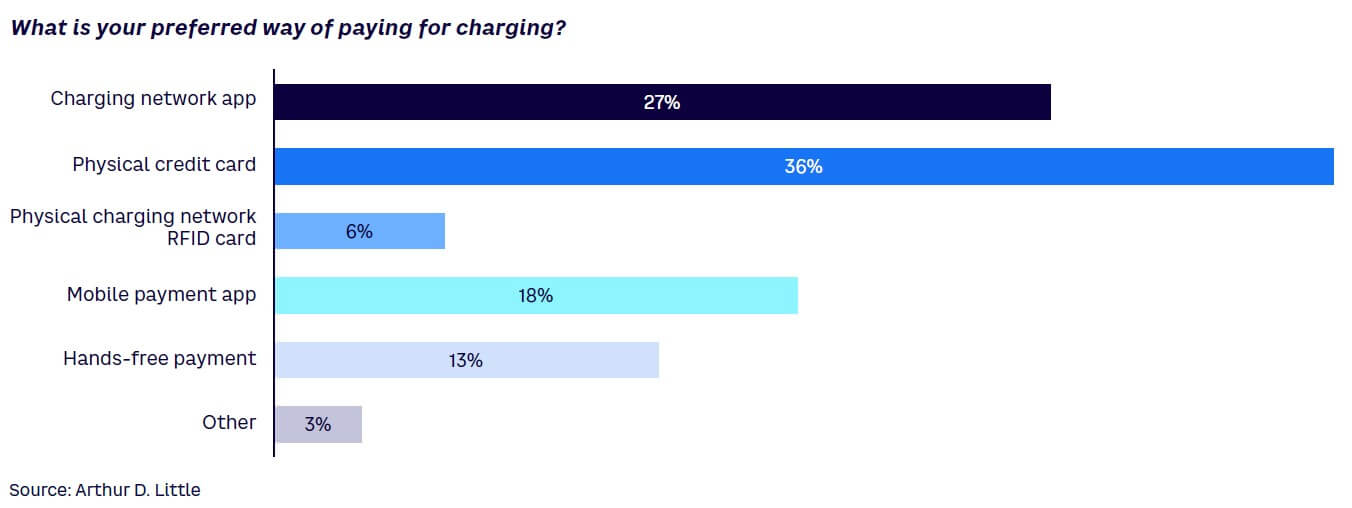

- Payment initiation problems. Depending on the station and provider, drivers can pay for charging by using the charging network’s app, mobile payments (e.g., Apple Pay), or credit cards. Currently, more than half of respondents prefer to pay using traditional credit cards or mobile payments. Figure 6 shows payment methods and customer preferences. More than a quarter like to pay through a charging network app, like ChargePoint or Electrify America. Hands-free “plug-and-charge” payments are lightly adopted but increasingly attractive to customers, with some vehicle OEMs, such as GM and EVgo, collaborating with CPOs to enable this functionality. The majority of respondents (37%) opt to pay by credit card but may encounter issues with the card reader, typically a third-party component that consistently causes issues, requiring the driver to call the CPO’s customer contact number. Of those who call, only about half are “satisfied” with the service.

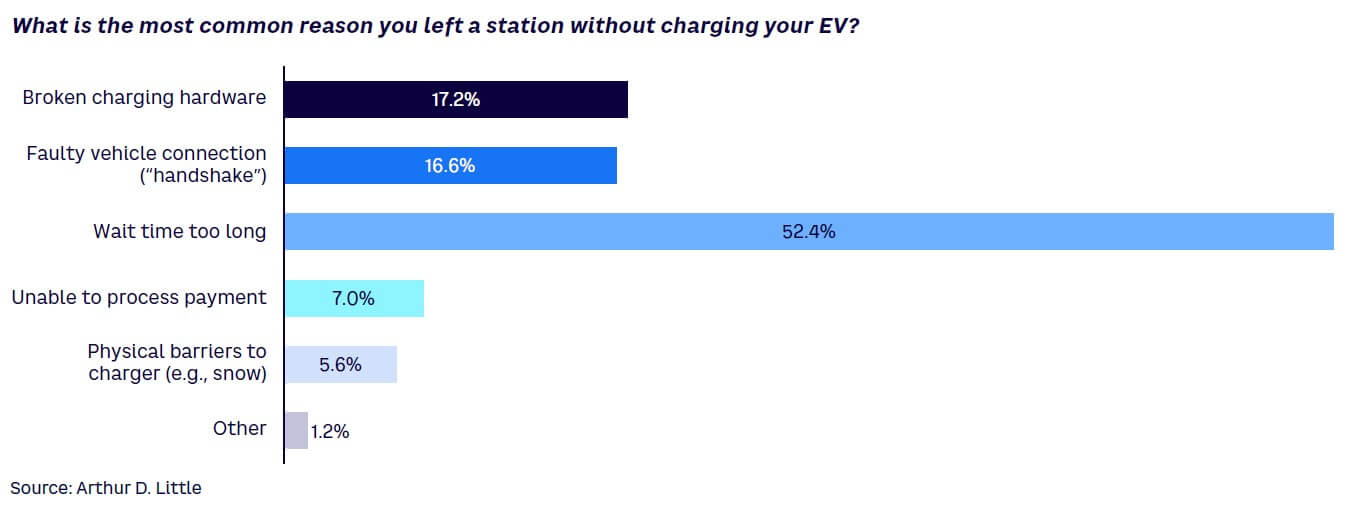

- Charging challenges. The charger delivers electricity to the vehicle’s battery. The vehicle will indicate that it is charging, along with metrics that may include charging speed, expected remaining time until complete, electricity price, and total cost. Before charging, customers may find cumbersome plugs, lack of weather protection, or remote areas with little to no choice of activities to do during charging. Chargers may be ambiguously labeled in terms of their speed and can still be throttled due to hardware issues or CPO-imposed limits. Speed is an important factor, as 55% of respondents rank charging speed as “very important” and are willing to go out of their way for faster charging — expecting to charge at a fully rated 150 kW charger; only getting half or less of that energy throughput adds significant time and breeds disappointment. Common reasons for leaving a station without charging are shown in Figure 7. The more severe charging issue regards the “handshake” between the vehicle and charger, which refers to the connection that allows electricity to flow. Handshake problems can take several forms: the charger may indicate its readiness to charge but never initiates the charge; the charge may initiate but is interrupted before completion; or the vehicle and plug may never connect at all. A failed handshake results in a failed charge. In fact, a third of survey respondents cited either an unsuccessful handshake or broken charging hardware as the primary reason for leaving a charging station without charge.

BETTER CX CREATES MEASURABLE VALUE

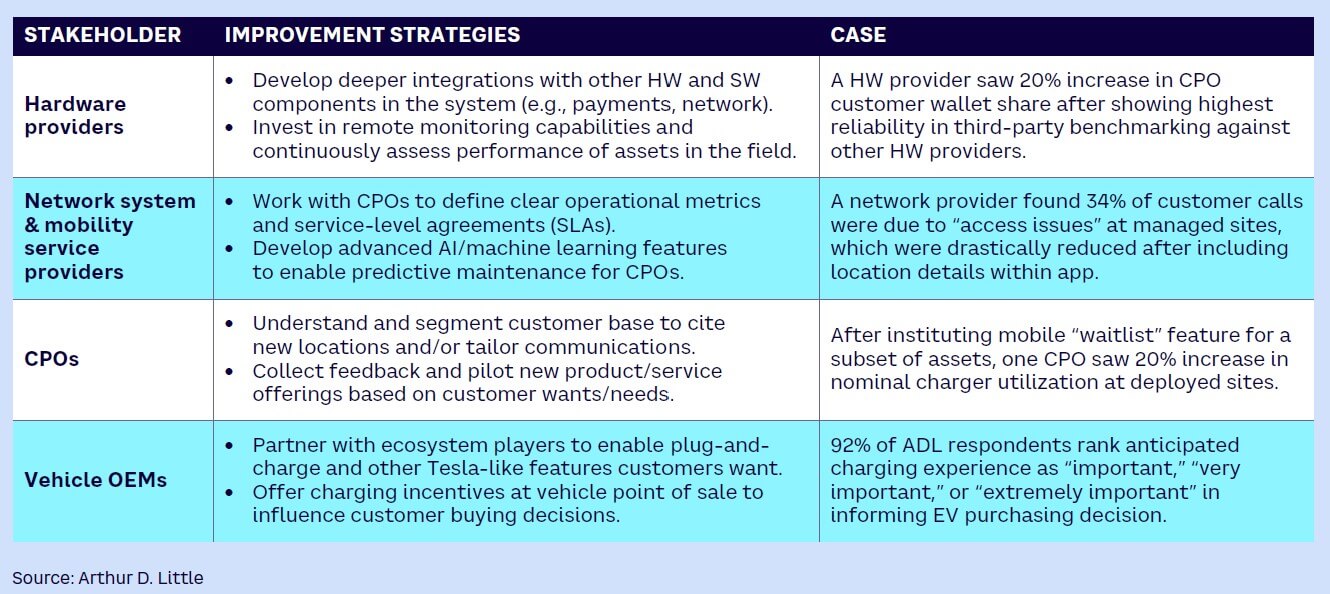

Brands with the best CX make significantly more revenue than lagging competitors. We see evidence of this in other industries as well: Credit Karma in the personal finance space, IKEA in the furniture industry, Roku in streaming services, Warby Parker in consumer retail, and the list goes on. Like these companies, stakeholders across the EV charging ecosystem need an intimate understanding of customer behavior and unmet needs. The knowledge gained will show them how to build frictionless experiences that will set them apart in a hot and growing market. Table 1 presents a selection of strategies and benefits to improve CX.

Conclusion

Seizing opportunities

The EV ecosystem for stakeholders presents some clear investment direction toward CX improvements. The ADL survey, in particular, provides an overview of the preferences and pain points of EV customers. From these challenges, there are significant opportunities that players across the ecosystem can seize to improve financial performance and create competitive advantage. Some critical issues offer a place to start:

- Today’s public EV charging customer faces several potential challenges when attempting to charge a vehicle.

- Delighting customers starts with understanding the pain points at each part of the journey.

- The public EV charging ecosystem is complex and requires collaboration across a wide range of players to enable the seamless experience that customers expect.

- The anticipated charging experience is an important customer criteria for deciding which EV model to purchase.

- There is currently very little brand loyalty in public EV charging — most customers do not have a preferred charging provider.

- Customers cite price, proximity, and station familiarity as the most important factors when choosing a public EV station; these should be the top priorities for CPOs.

- Customers are experiencing “app fatigue” from multiple EV charging networks.