26 min read • Travel & transportation

Autonomous mobility journal, edition IV

Latest developments worldwide

Foreword

Dear reader,

In response to the interest generated by the previous three editions of our journal, and in the spirit of our perpetual efforts to bring to you the latest developments and breakthroughs pertaining to the global autonomous mobility sector, we are excited to share the 4th edition of our Autonomous Mobility Journal.

In the wake of COVID-19, we have come to realize that even though the pandemic has had disruptive effects on the global mobility and automotive sectors, it has simultaneously accelerated our move into a “new normal,” where consumers tend to favor home-based living and working, leading to a growing requirement for more frequent, fast, and cost-effective movement of goods and people within our cities and beyond.

In today’s context, for mobility industry players to innovate and cater to shifting consumer preferences, we foresee a growing interest in the research, development, and imminent rollout of autonomous mobility solutions across the transport value chain. This includes private consumer autonomous vehicles (private vehicle ownership) and public transit, as well as logistics and freight transport.

It is of paramount importance for industry players (public and private sector) to recognize the transformational phase that the mobility sector is undergoing. Mobility players must position themselves favorably to explore the promise of autonomous mobility, reap its benefits as they arise, and minimize its future impacts on their business models. In that spirit, over the past year we have been working closely with mobility stakeholders across the globe, identifying trends, opportunities, and challenges to draw implications for the sector and push the boundaries of thought leadership.

While the development of autonomous mobility solutions globally remains experiential, industry players are clearly on the lookout for technological and business model innovation to unlock value-creating use cases. In this journal, we provide our insight into recent developments and industry dynamics. In addition, we highlight the key considerations and existing challenges that stand in the way of full-scale autonomous mobility solution rollout. We hope that you enjoy reading, and we look forward to hearing your ideas, thoughts, and queries.

— Joseph Salem, Partner, Travel & Transportation, Arthur D. Little

1

INDUSTRY DYNAMICS

After a long period of hype during the last decade, autonomous mobility has met the harsh reality of the market. Limited global implementation of the technology in high-volume use cases, crises driven by the COVID-19 pandemic, and supply shortages have shifted attention toward more critical technologies such as longer-range batteries for electric vehicles (EVs). Moreover, recent stock exchange listings of mobility start-ups have also stirred some controversy. Most of these listings happened through special-purpose acquisition companies (SPACs), and nearly all of them have lost significant value since their introduction. However, amid these troubled times, the growing focus of large global original equipment manufacturers (OEMs) on accelerating the adoption of new technologies in the industry, including by growing their EV offerings, represents a positive prospect for autonomous mobility in the mid to long term. We explore these dimensions in this section.

Looking for the silver lining

Autonomous mobility led the new mobility hype during the 2010 decade, but it appears to have suffered from both internal limitations and external risks in recent years. While the technology exists and has proven to be fully functional and usable both in testing grounds and in real-life conditions, the lack of suitable infrastructure and insufficient cost-effectiveness seem to have limited use cases to select innovation-driven models and brands.

The COVID-19 pandemic and its impact on economies and consumer behavior were also not of much help in spreading autonomous mobility to larger-scale use cases. Moreover, the lasting global semiconductor chip shortage and greater supply crisis have shifted automaker attentions toward the installation of more critical functions in their vehicles.

However, promising silver linings are starting to appear. First, while autonomous mobility is still not accessible or even available to most users on the roads globally, companies operating in this space have continued their work in the background to advance the technology. Second, the growth of other mobility-related technologies and use cases is expected to pave the way and facilitate the uptake of autonomous mobility. According to the International Energy Agency (IEA), EV sales reached 2 million units in the first quarter of 2022, representing a 75% increase compared to the same period in 2021. Compared to traditional internal combustion engines (ICEs), EV hardware and software are significantly more suited to accommodate autonomous-driving features, and autonomous-driving technology is more prevalent across EVs than ICE vehicles.

SPACs: The vehicle of choice

One of the characteristics that differentiates the autonomous mobility landscape from more mature or advanced sectors is the appeal of SPACs, as a significant number of start-ups in this space are going public through SPACs rather than more conventional initial public offerings (IPOs). SPACs are companies without a commercial purpose, established specifically to raise capital through an IPO. Once the IPO is completed, the SPAC’s management team has up to 24 months to identify a suitable target to acquire or with which to merge. Hence, SPACs act as publicly traded shell companies that allow a business to be listed on the stock exchange, either directly by merging with the SPAC or indirectly as the sole asset in a SPAC’s portfolio. This solution provides an alternative path to access the stock market for companies that do not want to (or cannot) go through the traditional IPO process and fulfill requirements in terms of revenues and financial documentation.

In recent years, SPACs have become increasingly prevalent, allowing start-ups, tech companies, and nontraditional businesses to be publicly listed and receive significant cash inflows with less complexity and fewer requirements from the market regulator. The smart mobility ecosystem has been particularly prone to SPACs, with more than 40 deals announced in 2021 alone, mostly focused on autonomous mobility, EVs, and air mobility companies. Embark Trucks, an autonomous trucking software company, went public in 2021 through a SPAC formation with a valuation of around US $5 billion. In the same year, the autonomous trucking and ride-hailing company, Aurora, listed through a SPAC with a starting valuation of $13 billion. Electric Last Mile Solutions (ELMS), another player in this segment, also went public with a valuation of $1.4 billion. These are just a few of the many examples in the autonomous and EV space.

Amid the crisis, what’s the future hold in the mid-term?

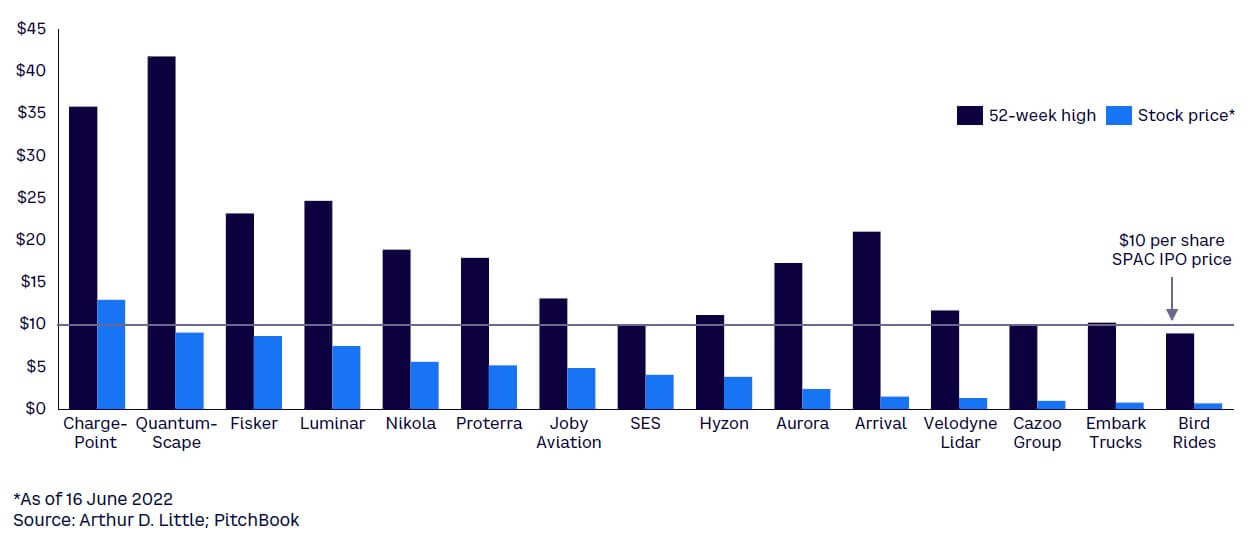

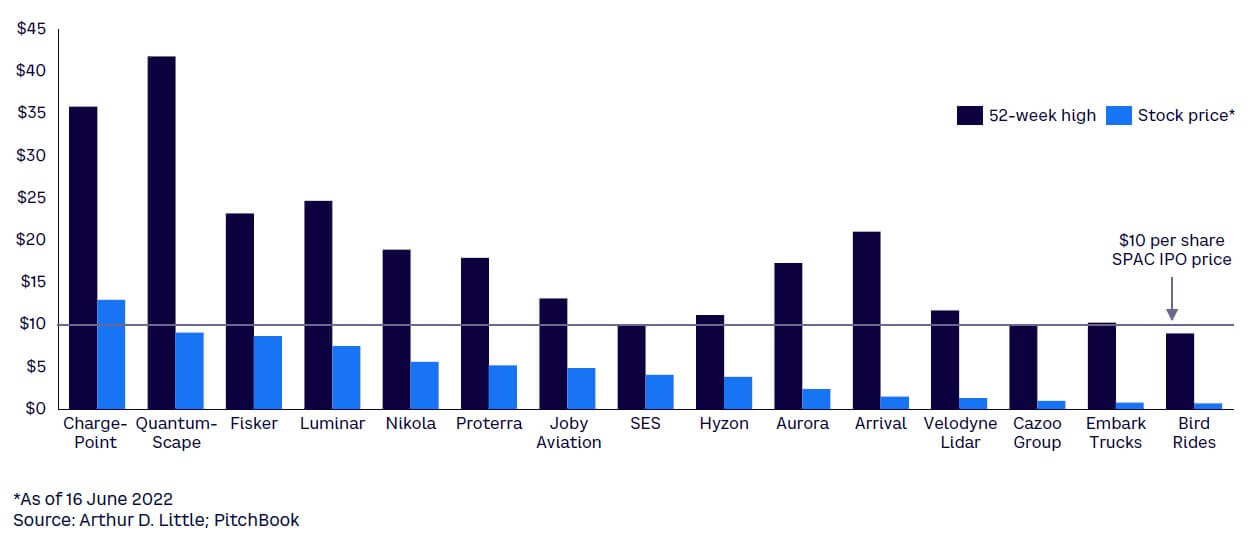

Over the last two years, mobility SPACs have rapidly increased in number. However, they have also shown fragility and lack of resilience in a difficult market context. Valued at $1.4 billion at the time of its SPAC in 2021, for example, ELMS filed for bankruptcy just one year later, and many other mobility SPACs seem to be on a similar path. According to data collected by PitchBook (see Figure 1), nearly all mobility SPACs have been trading below their IPO price of $10 per share. In fact, 43 out of a total of around 60 companies analyzed by PitchBook have been trading below $5 per share, while 15 companies have registered a 90% loss on their share price compared to their 52-week high at the close of the second quarter of 2022.

Even more troubling, only four out of the 60+ companies considered have been trading over their IPO share price, with ChargePoint, Blue Bird, Enovix, and Verra Mobility valued between $11 and $16, but still far from all-time highs after their IPOs. The broader tech sector has also been suffering from a difficult market context since 2020, with the NASDAQ-100 Technology Sector Index losing close to 40% between November 2021 and November 2022. Mobility SPAC performance over the period appears to be below sector average, with certain players having lost a significant share of their valuation.

However, if the short-term future appears relatively clouded for some autonomous mobility SPACs, a silver lining can be seen, driven by more conventional legacy players. While smaller mobility start-ups have been leading innovation in their specific verticals in recent years, large OEMs have taken their time to adjust their strategies, R&D focus, supply chains, and production capacity. As a result, legacy OEMs are progressively gaining traction in the innovative mobility space, including autonomous mobility.

This shift appears to be driven by advancements in autonomous mobility technologies and, more importantly, by EV sales growth. Given their powertrain as well as their heavier reliance on software, EVs are more suited to accommodate autonomous mobility than traditional ICEs. As such, rapidly growing EV sales driven by their normalization in OEM model lineups and the development of more efficient charging networks are likely to present the positive outlook autonomous mobility was waiting for.

With OEMs focusing more and more on EVs and innovative technologies, autonomous mobility’s mid-term future appears to be more promising than its recent past. Now it is up to smaller mobility players, including weakened SPACs, to take advantage of this traction and develop the marketable products and services, both for B2B and B2C, that will allow them to remain relevant in the mobility space.

2

USE CASE OF THE SEMESTER

Focus on robotaxis

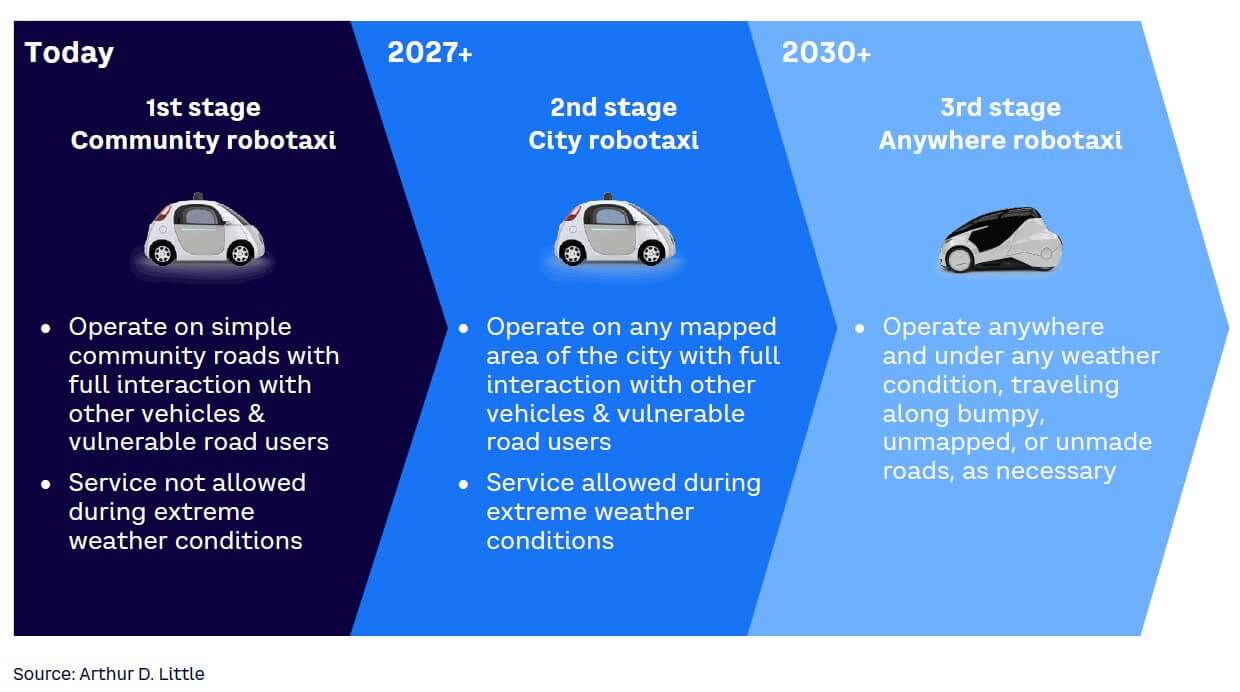

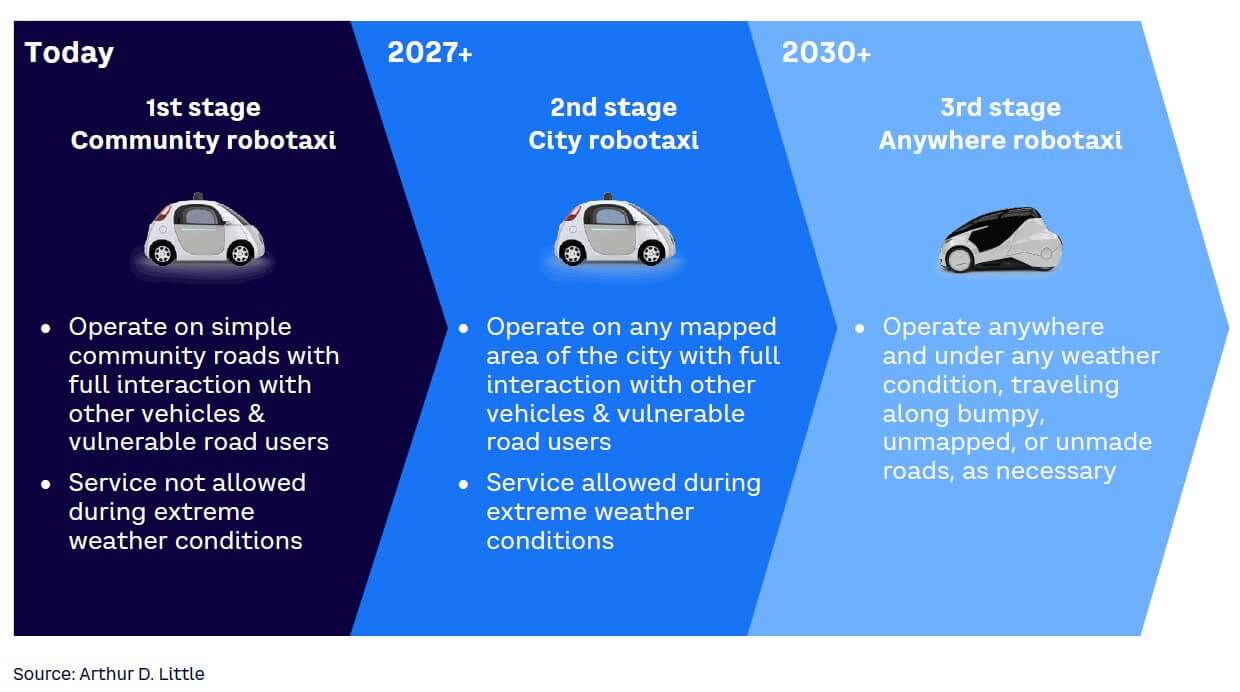

Robotaxis, also known as autonomous taxis, are an important mode of transportation in autonomous mobility with enormous potential for a robust business case for service providers and car manufacturers from commercialization of the service. Today, robotaxis operate as “community robotaxis,” providing commercial services using simple community roads under restricted operating environments (see Figure 2). We foresee the evolution of robotaxis into “city robotaxis” by 2027, where they would operate in any mapped area of a city as well as under extreme weather conditions. We further anticipate the development of “anywhere robotaxis” by 2030, which would operate anywhere and under any weather conditions, traveling along bumpy, unmapped, or unmade roads.

Introduction to robotaxis

Robotaxis offer many benefits for the transportation industry, such as increased efficiency by operating 24/7 without the need for breaks or human drivers, reduced costs, and increased safety through the use of advanced sensors and navigation systems. They are also convenient to use, providing on-demand service and improved mobility for people who have difficulty driving or lack access to personal vehicles. Additionally, they can optimize traffic by taking the most efficient routes and reduce emissions by running on electric power. Therefore, we believe that robotaxis have the potential to revolutionize urban and suburban mobility use cases, serving as a convenient, safe, and affordable option. Today, robotaxis have hit a major milestone as companies are able to finally commercialize driverless ride-hailing services for the public in different cities around the world.

However, despite these initial deployments, robotaxis still remain in the development stage and will have to evolve through the three stages described above in their quest for full autonomy. These stages have distinctive characteristics when it comes to the potential operating environment, journeys provided, and service availability.

Community robotaxis — Today

Community robotaxis are already technically feasible and have been implemented in different cities around the world. Many of these early experiments do not have a robust business case, but they are of upmost importance, primarily because they provide companies with the possibility to cover many miles and develop the experience they need to guide further robotaxi development.

The typical operating environment for this use case is quite limited and represented mainly by city communities, where robotaxis can operate on simple community roads with full interaction with other vehicles and vulnerable road users, such as pedestrians and cyclists.

Due to restrictions in the operating environment, the typical service profile is first-/last-mile service, including pickup and drop-off of passengers traveling between their homes and public transportation stops within their community or short-trip service, which allows pickup and drop-off of passengers traveling between their homes and work or leisure venues.

The restricted operating environment is not the only constraint for this type of use case. Most of these deployments also are prohibited by regulation to operate during extreme weather conditions, such as heavy rain or sandstorms.

As mentioned, community robotaxis are currently in use in several cities, and companies such as Waymo and Cruise have been charging customers for their robotaxi services for quite some time. Below, we present some of the early deployments of community robotaxis, highlighting their main characteristics:

-

In October 2020, Waymo finally opened up a truly driverless ride-hailing service. Existing Waymo One members were provided access to the service in a 50-square-mile area in the US city of Phoenix, Arizona. In August 2022, Waymo extended the driverless autonomous taxi service to downtown Phoenix. Currently, only people accepted onto Waymo’s “Trusted Tester” shuttle program are eligible to hail these rides.

-

In June 2022, the California Public Utilities Commission also gave a green flag to Cruise to launch a paid, driverless ride-hailing taxi service. The service initially will be limited to 30 electric cars transporting passengers in less congested parts of San Francisco during late-night hours (10 pm to 6 am). The driverless service will not be allowed to operate in bad weather conditions, such as heavy rain or fog.

-

In August 2022, the Chinese Internet giant Baidu secured permits to launch a fully driverless commercial autonomous taxi service in Chongqing and Wuhan in China. In Wuhan, Baidu’s service will operate from 9 am to 5 pm and cover a 13-square-kilometer area in the city’s Economic and Technological Development Zone, which is known as China’s “Auto City.” In Chongqing, the service will run from 9:30 am to 4:30 pm in a 30-square-kilometer area in Yongchuan District. Each city will have a fleet of five Apollo fifth-generation autonomous taxis. Both cities have been testing hubs for autonomous vehicles (AVs) and provide the right technology and infrastructure for launching the ride-hailing service. Baidu plans to expand its commercial ride-hailing service to 65 cities by 2025 and to 100 cities by 2030.

City robotaxis — 2027

Based on the technology roadmaps of the main robotaxi OEMs, we anticipate that, in the next five years, robotaxis will enter the second stage of development, and city robotaxi use cases will be successfully implemented in various cities around the world, such as Dubai, San Francisco, Paris, and Beijing, among others.

Compared to community robotaxis, city robotaxis will be able to operate in much more complex operating environments. Indeed, they will be capable of operating in automated mode in any mapped area of a city, and to circulate on any type of road, regardless of the level of complexity and interaction with mixed traffic. In addition, restrictions related to service availability will be relaxed as technology advances and public acceptance increase, allowing these deployments to operate even during extreme weather conditions.

As a result, city robotaxis will offer a more robust business case to companies, enabling them to fully monetize the provided services.

Anywhere robotaxis — 2030 and beyond

Anywhere robotaxis represent the last development stage for robotaxis and will require a true leap in technology development since anywhere robotaxis will be able to operate anywhere and under any weather conditions.

Indeed, stage three will enable a robotaxi to pick customers up from their homes and drive them into another city (or vice versa), traveling along bumpy, unmapped, or unmade roads, as necessary. Operation will be possible under any weather conditions, including snow, hail, and heavy rain.

3

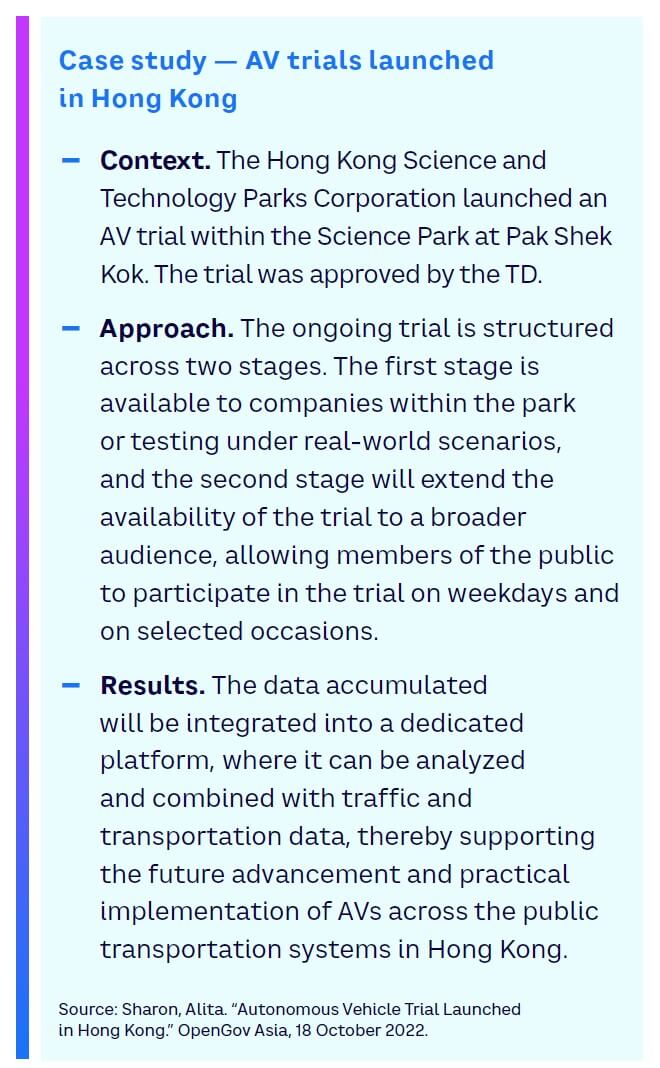

CITY OF THE SEMESTER: HONG KONG

AVs are intended to reshape the future of the transport sector across all travel modes. Pioneering countries and cities are preparing for this transformation journey by building momentum to unlock early advantages from this trend. Hong Kong, as an example, has set a clear target to enable the AV ecosystem from different angles, including setting a strategic direction that acts as an overarching umbrella to lead public and private sector efforts, upgrading the existing infrastructure to enable relevant technologies, and developing the necessary framework that allows for fast adoptions in response to market updates. Hong Kong’s relative success in enabling the deployment of AVs can be attributed to its focus on setting a clear strategic direction, developing enabling regulations, encouraging stakeholder engagement, and strengthening the underlying infrastructure.

Setting a clear strategic direction

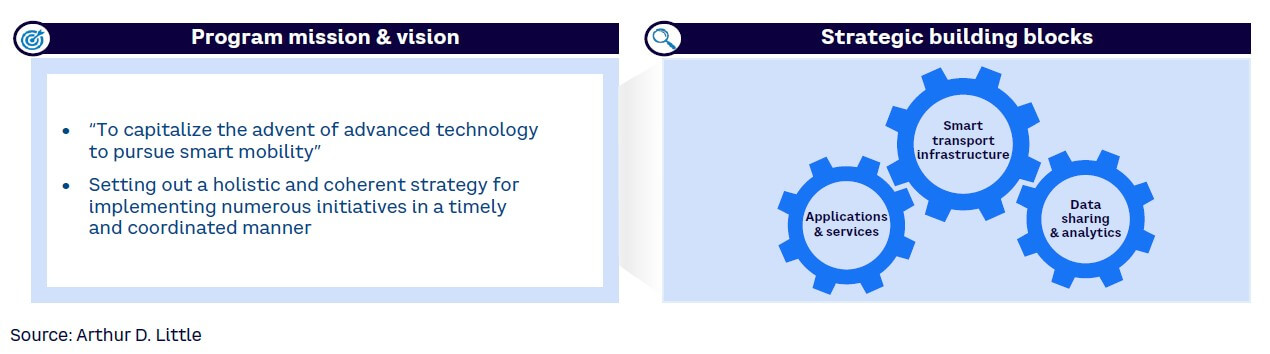

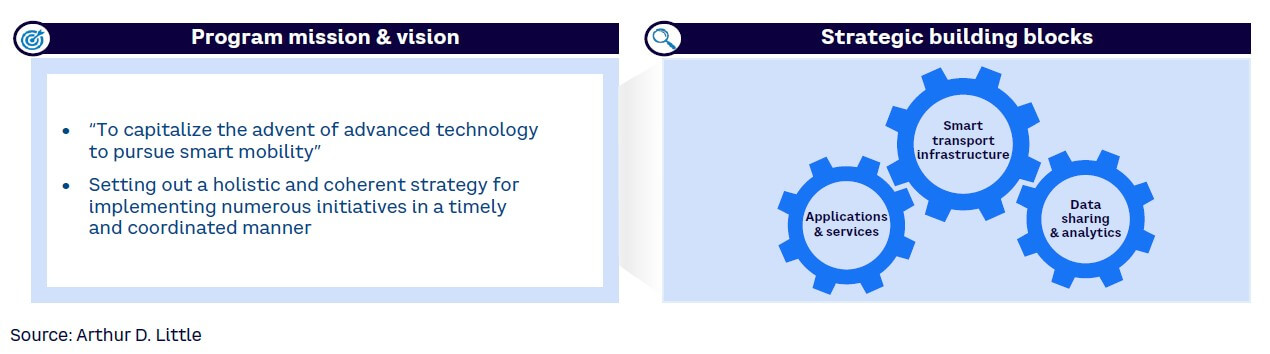

Hong Kong’s Transport Department (TD) has initiated a proactive strategy to progress on numerous smart mobility initiatives that focus on four key elements: (1) autonomous mobility, (2) smart mobility infrastructure, (3) mobility services digitalization, and (4) improving current traditional services. The overarching program, encompassing autonomous mobility as a key focus, has a clear vision to capitalize on the advent of advanced technology to pursue smart mobility. The strategy consists of three building blocks to guide efforts toward advancing a smart and autonomous mobility ecosystem for Hong Kong (see Figure 3):

-

Smart transport infrastructure — sensing and analytic technology and onboard and vehicle technology.

-

Data sharing and analytics — data-sharing and data analytics technologies.

-

Applications and services — new data sharing, new-generation parking meters, and smart public transport infrastructure.

As part of the strategy, the Hong Kong government has facilitated the achievement of technology advancement and industry development in vehicle-to-everything (V2X), AVs, and ultimately introducing AVs with integrated Internet access. However, its primary strategic focus is enabling the overarching ecosystem for such advancements through these three blocks.

Developing enabling regulations

In 2017, the Hong Kong TD issued “A Guide on Application for Movement Permit for Test, Trial and/or Demonstration of Autonomous Vehicles on Roads Within Designated Sites in Hong Kong,” opening the door for AVs and marking the TD as a worldwide pioneering regulatory entity in testing and enabling the relevant technologies. The move also allowed the TD to proactively expand regulatory maturity and competitiveness from the early stages.

At the end of 2020, the TD issued updated guidelines (“Guidance Notes on the Trials of Autonomous Vehicles”), establishing a clear yet flexible mechanism to facilitate applications for movement permits to conduct more advanced AV trials (including tests and demonstrations) while ensuring safety. Although Hong Kong lacks a comprehensive framework or laws governing and regulating the AV ecosystem, these guiding notes are currently used to clarify key elements for AV trials, including:

-

Application procedures for movement permits. The notes guide applicants through the licensing process and required applications to conduct AV trials. Each application is assessed on a case-by-case basis depending on its own merit.

-

General requirements. The guidance lists all major requirements (e.g., AVs shall be roadworthy and in good/serviceable condition) and provides notes on trial proposals with information on the relevant stakeholders and intended results as well as safety management plans.

-

Vehicle requirements. Included in the notes is a list of obligations relating to vehicle fitness that applicants seeking on-road trial permits must fulfill. For example:

-

The AV, through its sensors or control by the driver/operator, will need to respond appropriately to all types of road users, hazards, and scenarios (TD representatives may attend and witness the pretrial tests, if required).

-

The applicant should start with in-house trials to gather experience and evidence to substantiate the satisfactory functioning of the AV and its components.

-

The transition function between autonomous mode and manual mode must first be proven in in-house trials or trials within a confined area before advancing to trials on temporarily closed and open roads.

-

-

Driver/operator requirements. During the road trials of AVs, there must be a driver/operator to monitor the operation of the AV and take over operation of the AV if necessary.

Encouraging stakeholder engagement

Hong Kong’s ability to position itself as a leader in the smart mobility and AV ecosystem is contingent on the coordinated efforts of stakeholders, which are categorized as smart mobility leading entities and smart mobility contributors. Smart mobility leading entities primarily include government entities that drive the overall strategic-direction definition. Smart mobility contributors, on the other hand, are public and private entities that provide inputs to support defining of the direction, as well as a private sector–focused advisory panel that channels market views. In the case of Hong Kong, all collaboration efforts are built on a concept of effective data exchange and transparency among three categories of stakeholders:

-

Leading entities. Smart mobility, particularly autonomous mobility, is a key focus area for the Hong Kong government, and the TD is the leading entity developing all policies and attracting private sector players.

-

Contributors. Contributors are predominantly private sector entities operating within the smart mobility ecosystem, formalized via the recent establishment of the Smart Mobility Consortium, an advisory panel established to provide input to the TD on regulatory direction.

-

Dedicated unit. In addition, the TD leads the overall strategic direction for autonomous mobility in Hong Kong and has created a dedicated unit focused on enabling the deployment of autonomous mobility. The Smart Mobility Division unit spearheads regulatory adjustments and acts as the main interface with the private sector and third parties in areas related to smart mobility, including autonomous mobility.

Overall, Hong Kong has identified autonomous mobility as a strategic focus area, as illustrated via its governance. The dedicated unit within the TD, supported by a formalized private sector advisory panel, serves as a key enabler to attract overseas companies, investors, and international expertise to assist in developing the smart mobility and autonomous mobility ecosystem.

Strengthening the underlying infrastructure

A key prerequisite for autonomous mobility is the development of a robust physical and digital infrastructural layer that effectively connects the vehicles. Hong Kong has ambitious plans to be among the first to roll out 5G communications capabilities to enable these connections and has structured a program across three goals:

-

Connected. Hong Kong is driving connectivity by widening and increasing connectivity coverage and enhancing connectivity speed. In terms of coverage, Hong Kong has launched a Wi-Fi-connected city program, Wi-Fi.HK, which connects more than 36,000 hot spots across the city. In parallel, the city has put in place a program to launch a total spectrum of 4,500 MHz for 5G services and has assigned spectrums in the 26 GHz and 28 GHz bands.

-

Autonomous. Hong Kong’s focus is on the development of test beds to conduct trials, with the potential to focus on dedicated AV corridors or temporary testing in the future. The city is conducting AV trials for 5G research purposes and is testing infrastructure for vehicle identification of pedestrian lanes, including vehicles’ ability to slow down in front of pedestrians and react to a moving object.

-

Shared. Given Hong Kong’s urban landscape and crowded nature, the city’s plans are focusing on potential dedicated lanes for different modes. Currently, dedicated lanes exist for bicycles, although those that exist are primarily restricted to new territories and parks.

Hong Kong has understood the importance of infrastructure as a key prerequisite and enabling pillar for its autonomous mobility journey. It has initiated efforts related to increasing connectivity and rolling out 5G, and it should continue focusing on trials with AV-dedicated lanes and on growing shared mobility opportunities within the transportation ecosystem.

Summary

Hong Kong is positioning itself as a leader in the autonomous mobility ecosystem. Its efforts have been particularly successful due to coordinated efforts across the following key elements:

-

Strategy — developing a central vision and direction that unifies all stakeholder efforts, drives partnerships, and enables private sector participation.

-

Regulations — reviewing existing conservative regulations to define a clear regulatory framework across liability and insurance, registration, data privacy, and testing and deployment.

-

Stakeholder integration — following a multitiered approach led by a dedicated unit within the transport authority. The unit leads all smart mobility/autonomous mobility efforts and is supported by effective engagement with the private sector, formalized via the Smart Mobility Consortium.

-

Infrastructure — enhancing connectivity through 5G rollout to allow for higher peak speeds along with flexibility and lower latency.

-

Technology — maintaining a clear focus on infrastructure connectivity and investing in expanding 5G connectivity.

4

INTERVIEW OF THE SEMESTER

Interview with Prof. Omaimah Bamasag, Deputy of Transport Enablement at the Transport General Authority of the Kingdom of Saudi Arabia (KSA)

The Transport General Authority (TGA) was established in 2012 by the Council of Ministers Resolution No. 373 to regulate the railway, maritime, and land transport industry in the KSA. TGA maintains high standards of quality and safety in the transport sector and uses data and technology to create a safe and efficient transport environment promoting investment opportunities to meet the Kingdom’s Vision 2030 socioeconomic goals. We had the pleasure of conducting an e-interview with Prof. Omaimah Bamasag, Deputy of Transport Enablement at TGA.

Q: What outlook do you foresee for autonomous mobility in the future?

A: There is no doubt that AV technologies are progressing and growing significantly, especially in recent years with the development of computer capabilities and the emergence of the artificial intelligence revolution, the concept of big data, and 5G. It is well known that the ultimate global goal in AV is to bring them to Full Autonomy (Level 5, according to the Society of Automotive Engineers [SAE] International) in a commercial form, and it seems to me that we have a tricky road ahead to reach that level, especially in light of the challenges related to the security and privacy of data and risk of cybersecurity attacks. Therefore, I expect that in the coming years we will see an increase in spending on R&D and technology advancement by OEMs, start-ups, and tech giants for the development of AVs.

We will also notice high developments in the areas of V2X, especially between vehicles and means of micromobility, to reduce the rate of accidents in this regard, besides the development of new business models for insurance companies to accelerate the commercial operation. This will definitely lead us to see more licensing of AVs around the world and their commercial operation on public streets.

I also expect to see AVs commercially soon in the applications of shared mobility by buses and taxis, and perhaps trucks and robots, due to the controllability of their applications and scope, as they often have predetermined origins, destinations, and paths. Besides that, there are many global efforts ongoing to define their technical and operational requirements. And with the emergence of the concept of mobility as a service (MaaS) and the proof of its effectiveness, it is expected that there will be a greater trend toward the concept of autonomous MaaS based on AVs to serve the first and last mile, and pilots have begun in some countries around the world. In the end, I may agree with the global forecast that commercial operation of AVs at SAE Level 4 and Level 5 will become a reality around 2038.

Q: What is KSA’s vision toward autonomous mobility?

A: The Kingdom’s goals for AV transport are very ambitious and can be seen from the giant projects based on autonomy, such as the Neom and Red Sea projects in the economic zone. These smart cities are designed to be sustainable through the introduction of new transport systems for passengers and goods based entirely on autonomous mobility, such as volocopters, autonomous pods, robotaxis, etc. On the other hand, there are several mega projects in a number of cities in the Kingdom aimed at catering AVs to passengers, such as the King Salman Park project in Riyadh and the King Abdullah University of Science and Technology in Thuwal.

Looking at the National Transport and Logistics Strategy (NTLS), we find it was supportive of adopting new mobility systems for the transport of people and logistics sectors. This was reinforced by the sectoral strategy for land transport by TGA, with targets that aspire to convert approximately 15% of public transport vehicles into AVs and 25% of goods transport vehicles into AVs by 2030.

Q: What role would TGA play in achieving KSA’s vision?

A: The regulatory position of TGA on the passenger and goods transport sectors in the Kingdom makes its role essential in achieving the Kingdom’s vision. TGA is working on two tracks. The first revolves around promoting and adopting new modes and means of transportation through piloting and testing, R&D, and establishing relationships with governmental and private entities, universities, and research bodies to reach recommendations that formulate the necessary regulations and legislation for these technologies. In the second track, TGA prepares economic, social, and environmental feasibility studies through which it determines the stages of imposing certain regulations on operators and providers of public transport services and goods transport through which the goals of the Kingdom’s Vision 2030 are achieved. In short, imposing regulations by TGA is very easy, but the most important thing is to verify the adverse effects that may result from imposing such regulations because some effects may deviate from the Kingdom’s desired vision.

Q: Are there any other stakeholders involved? How do you coordinate with each other?

A: With the nature of AV technologies, interagency collaboration is critical to achieving rapid maturity and development. TGA is very keen to work with all concerned governmental, private, local, and international bodies, or even research bodies, each according to its specialization. On the governmental level, we are aligned with the Ministry of Transport and Logistic Services on AV projects, and with the Ministry of Municipal and Rural Affairs and Housing, including the municipalities and royal and development authorities of the regions, for their competence in infrastructure and city intelligence. We are also working with the Ministry of Communications and Information Technology and the Saudi Authority for Data and Artificial Intelligence to improve the readiness of the necessary communications infrastructure for these technologies, such as 5G, data privacy, and security.

Meanwhile, we seek to discuss with some enforcement bodies, like the General Traffic Department and Public Security, about the improvement of traffic control units, smart usage of surveillance cameras, and fine approaches, etc. As for research bodies, cooperation is based on exchanging data obtained from tests for research purposes, localizing some operational tasks of autonomous mobility, and opening new horizons in development and innovation. Cooperation also extends to raising community awareness through holding local seminars, hosting international conferences specialized in autonomous mobility, and organizing competitions and hackathons.

Q: What is the status of AV regulations in KSA?

A: The Kingdom is still in the early stages of regulating AVs, but this does not mean that we are not interested; on the contrary, it is the first concern and target of all parties of the transport ecosystem. At all levels, the authorities are working very hard to regulate and legislate AV in the Kingdom through piloting different technologies, conducting studies, and meeting with the competent local and global authorities in the field to determine their technical, operational, and legislative requirements. Saudi Arabia’s desire to build one of the largest sandboxes for new mobility may be strong support for advancing the growth of AVs in the Kingdom and is a great accelerator for the development of its regulations and legislation.

It is worth noting that the Saudi Central Bank (SAMA) recently announced its approval of a new insurance product, the first of its kind designed to provide coverage for AVs and related risks. The bank indicated that the product provides insurance coverage for AVs that can drive themselves from a start point to a pre-set destination in “autopilot” mode using various in-vehicle technologies and sensors. These include adaptive control, active steering, anti-lock braking systems, GPS navigation technology, lasers, and radar. Coverage is only valid for vehicles that are driven and operated in licensed areas and areas designated for AVs.

Q: Are you collaborating with international authorities for regulatory standardization?

A: Unfortunately, TGA does not have any collaboration thus far with international bodies to standardize the regulation, but we will definitely do so soon. In fact, it is an important step to unify and integrate efforts and advance the development toward the commercial operation of AVs.

Q: What roadblocks do you foresee for AV market ramp-up in KSA?

A: In terms of roadblocks, there are many, and perhaps the most important of them is the readiness of the infrastructure for AVs, particularly if the aim is to achieve commercial operation at SAE Level 4 and Level 5 for AVs. What I mean by readiness here is the readiness of technologies and other necessary requirements in the infrastructure for achieving safe operation and protection of privacy and data. Also, one of the important roadblocks, assuming that the infrastructure in the Kingdom is ready, is the delay in formulating the necessary regulations for these vehicles. Public acceptance may be another roadblock to increasing AVs in the Kingdom, especially if privacy and security issues are not well addressed.

Q: How are you looking to tackle these roadblocks?

A: It is important to note that addressing roadblocks should be participatory work between all stakeholders. We are working with many ministries and agencies, like the Ministry of Transport and Logistic Services; the Ministry of Municipal and Rural Affairs and Housing; the Ministry of Communications and Information Technology; the Saudi Data and Artificial Intelligence Authority; the National Cybersecurity Authority; the royal and development authorities of regions; municipalities; and some other local and international private sectors to improve the readiness of the infrastructure in the Kingdom and formulate the necessary regulations for AVs. We work also with many research bodies, universities, and organizations to set up programs and competitions and develop educational curricula that contribute to raising community awareness and educating the community about what is new in technology.

Q: Most AV players foresee large-scale commercialization of the service by 2024. Do you believe this target is achievable?

A: Yes, it is achievable, but only to a certain extent. Levels 4 and 5 of personal AV may require more study and research to be commercially ready. But if we look around the world, we see that there are other AV technologies that are currently operating in a kind of commercial manner, like the autonomous pod, e-commerce robot, and all other technologies built similarly on the concept of shared mobility. These are what I expect to be commercially operational by 2024 because many organizations and governments have made extensive efforts to develop their requirements and legislation. It is important to note that the readiness of the infrastructure and regulation play an important role in achieving the commercialization of AVs.

Q: Going forward, what will be the next steps for TGA to ensure effective collaboration with the private sector on AVs?

A: The private sector is one of the most important arms in the development and growth of AVs. They possess technical and operational knowledge and have global experiences by the nature of their presence in several countries around the world, and their role with TGA comes through transferring their global knowledge. What I see in our collaboration is that they can strengthen TGA in establishing proof-of-concept piloting and support TGA in drafting the necessary regulation for technologies. Meanwhile, the role of TGA is to create investment opportunities for them and pave the way for new horizons in the local market for AVs. This is what the Public Authority for Investment and Competitiveness at TGA is targeting.

DOWNLOAD THE FULL REPORT

26 min read • Travel & transportation

Autonomous mobility journal, edition IV

Latest developments worldwide

DATE

Foreword

Dear reader,

In response to the interest generated by the previous three editions of our journal, and in the spirit of our perpetual efforts to bring to you the latest developments and breakthroughs pertaining to the global autonomous mobility sector, we are excited to share the 4th edition of our Autonomous Mobility Journal.

In the wake of COVID-19, we have come to realize that even though the pandemic has had disruptive effects on the global mobility and automotive sectors, it has simultaneously accelerated our move into a “new normal,” where consumers tend to favor home-based living and working, leading to a growing requirement for more frequent, fast, and cost-effective movement of goods and people within our cities and beyond.

In today’s context, for mobility industry players to innovate and cater to shifting consumer preferences, we foresee a growing interest in the research, development, and imminent rollout of autonomous mobility solutions across the transport value chain. This includes private consumer autonomous vehicles (private vehicle ownership) and public transit, as well as logistics and freight transport.

It is of paramount importance for industry players (public and private sector) to recognize the transformational phase that the mobility sector is undergoing. Mobility players must position themselves favorably to explore the promise of autonomous mobility, reap its benefits as they arise, and minimize its future impacts on their business models. In that spirit, over the past year we have been working closely with mobility stakeholders across the globe, identifying trends, opportunities, and challenges to draw implications for the sector and push the boundaries of thought leadership.

While the development of autonomous mobility solutions globally remains experiential, industry players are clearly on the lookout for technological and business model innovation to unlock value-creating use cases. In this journal, we provide our insight into recent developments and industry dynamics. In addition, we highlight the key considerations and existing challenges that stand in the way of full-scale autonomous mobility solution rollout. We hope that you enjoy reading, and we look forward to hearing your ideas, thoughts, and queries.

— Joseph Salem, Partner, Travel & Transportation, Arthur D. Little

1

INDUSTRY DYNAMICS

After a long period of hype during the last decade, autonomous mobility has met the harsh reality of the market. Limited global implementation of the technology in high-volume use cases, crises driven by the COVID-19 pandemic, and supply shortages have shifted attention toward more critical technologies such as longer-range batteries for electric vehicles (EVs). Moreover, recent stock exchange listings of mobility start-ups have also stirred some controversy. Most of these listings happened through special-purpose acquisition companies (SPACs), and nearly all of them have lost significant value since their introduction. However, amid these troubled times, the growing focus of large global original equipment manufacturers (OEMs) on accelerating the adoption of new technologies in the industry, including by growing their EV offerings, represents a positive prospect for autonomous mobility in the mid to long term. We explore these dimensions in this section.

Looking for the silver lining

Autonomous mobility led the new mobility hype during the 2010 decade, but it appears to have suffered from both internal limitations and external risks in recent years. While the technology exists and has proven to be fully functional and usable both in testing grounds and in real-life conditions, the lack of suitable infrastructure and insufficient cost-effectiveness seem to have limited use cases to select innovation-driven models and brands.

The COVID-19 pandemic and its impact on economies and consumer behavior were also not of much help in spreading autonomous mobility to larger-scale use cases. Moreover, the lasting global semiconductor chip shortage and greater supply crisis have shifted automaker attentions toward the installation of more critical functions in their vehicles.

However, promising silver linings are starting to appear. First, while autonomous mobility is still not accessible or even available to most users on the roads globally, companies operating in this space have continued their work in the background to advance the technology. Second, the growth of other mobility-related technologies and use cases is expected to pave the way and facilitate the uptake of autonomous mobility. According to the International Energy Agency (IEA), EV sales reached 2 million units in the first quarter of 2022, representing a 75% increase compared to the same period in 2021. Compared to traditional internal combustion engines (ICEs), EV hardware and software are significantly more suited to accommodate autonomous-driving features, and autonomous-driving technology is more prevalent across EVs than ICE vehicles.

SPACs: The vehicle of choice

One of the characteristics that differentiates the autonomous mobility landscape from more mature or advanced sectors is the appeal of SPACs, as a significant number of start-ups in this space are going public through SPACs rather than more conventional initial public offerings (IPOs). SPACs are companies without a commercial purpose, established specifically to raise capital through an IPO. Once the IPO is completed, the SPAC’s management team has up to 24 months to identify a suitable target to acquire or with which to merge. Hence, SPACs act as publicly traded shell companies that allow a business to be listed on the stock exchange, either directly by merging with the SPAC or indirectly as the sole asset in a SPAC’s portfolio. This solution provides an alternative path to access the stock market for companies that do not want to (or cannot) go through the traditional IPO process and fulfill requirements in terms of revenues and financial documentation.

In recent years, SPACs have become increasingly prevalent, allowing start-ups, tech companies, and nontraditional businesses to be publicly listed and receive significant cash inflows with less complexity and fewer requirements from the market regulator. The smart mobility ecosystem has been particularly prone to SPACs, with more than 40 deals announced in 2021 alone, mostly focused on autonomous mobility, EVs, and air mobility companies. Embark Trucks, an autonomous trucking software company, went public in 2021 through a SPAC formation with a valuation of around US $5 billion. In the same year, the autonomous trucking and ride-hailing company, Aurora, listed through a SPAC with a starting valuation of $13 billion. Electric Last Mile Solutions (ELMS), another player in this segment, also went public with a valuation of $1.4 billion. These are just a few of the many examples in the autonomous and EV space.

Amid the crisis, what’s the future hold in the mid-term?

Over the last two years, mobility SPACs have rapidly increased in number. However, they have also shown fragility and lack of resilience in a difficult market context. Valued at $1.4 billion at the time of its SPAC in 2021, for example, ELMS filed for bankruptcy just one year later, and many other mobility SPACs seem to be on a similar path. According to data collected by PitchBook (see Figure 1), nearly all mobility SPACs have been trading below their IPO price of $10 per share. In fact, 43 out of a total of around 60 companies analyzed by PitchBook have been trading below $5 per share, while 15 companies have registered a 90% loss on their share price compared to their 52-week high at the close of the second quarter of 2022.

Even more troubling, only four out of the 60+ companies considered have been trading over their IPO share price, with ChargePoint, Blue Bird, Enovix, and Verra Mobility valued between $11 and $16, but still far from all-time highs after their IPOs. The broader tech sector has also been suffering from a difficult market context since 2020, with the NASDAQ-100 Technology Sector Index losing close to 40% between November 2021 and November 2022. Mobility SPAC performance over the period appears to be below sector average, with certain players having lost a significant share of their valuation.

However, if the short-term future appears relatively clouded for some autonomous mobility SPACs, a silver lining can be seen, driven by more conventional legacy players. While smaller mobility start-ups have been leading innovation in their specific verticals in recent years, large OEMs have taken their time to adjust their strategies, R&D focus, supply chains, and production capacity. As a result, legacy OEMs are progressively gaining traction in the innovative mobility space, including autonomous mobility.

This shift appears to be driven by advancements in autonomous mobility technologies and, more importantly, by EV sales growth. Given their powertrain as well as their heavier reliance on software, EVs are more suited to accommodate autonomous mobility than traditional ICEs. As such, rapidly growing EV sales driven by their normalization in OEM model lineups and the development of more efficient charging networks are likely to present the positive outlook autonomous mobility was waiting for.

With OEMs focusing more and more on EVs and innovative technologies, autonomous mobility’s mid-term future appears to be more promising than its recent past. Now it is up to smaller mobility players, including weakened SPACs, to take advantage of this traction and develop the marketable products and services, both for B2B and B2C, that will allow them to remain relevant in the mobility space.

2

USE CASE OF THE SEMESTER

Focus on robotaxis

Robotaxis, also known as autonomous taxis, are an important mode of transportation in autonomous mobility with enormous potential for a robust business case for service providers and car manufacturers from commercialization of the service. Today, robotaxis operate as “community robotaxis,” providing commercial services using simple community roads under restricted operating environments (see Figure 2). We foresee the evolution of robotaxis into “city robotaxis” by 2027, where they would operate in any mapped area of a city as well as under extreme weather conditions. We further anticipate the development of “anywhere robotaxis” by 2030, which would operate anywhere and under any weather conditions, traveling along bumpy, unmapped, or unmade roads.

Introduction to robotaxis

Robotaxis offer many benefits for the transportation industry, such as increased efficiency by operating 24/7 without the need for breaks or human drivers, reduced costs, and increased safety through the use of advanced sensors and navigation systems. They are also convenient to use, providing on-demand service and improved mobility for people who have difficulty driving or lack access to personal vehicles. Additionally, they can optimize traffic by taking the most efficient routes and reduce emissions by running on electric power. Therefore, we believe that robotaxis have the potential to revolutionize urban and suburban mobility use cases, serving as a convenient, safe, and affordable option. Today, robotaxis have hit a major milestone as companies are able to finally commercialize driverless ride-hailing services for the public in different cities around the world.

However, despite these initial deployments, robotaxis still remain in the development stage and will have to evolve through the three stages described above in their quest for full autonomy. These stages have distinctive characteristics when it comes to the potential operating environment, journeys provided, and service availability.

Community robotaxis — Today

Community robotaxis are already technically feasible and have been implemented in different cities around the world. Many of these early experiments do not have a robust business case, but they are of upmost importance, primarily because they provide companies with the possibility to cover many miles and develop the experience they need to guide further robotaxi development.

The typical operating environment for this use case is quite limited and represented mainly by city communities, where robotaxis can operate on simple community roads with full interaction with other vehicles and vulnerable road users, such as pedestrians and cyclists.

Due to restrictions in the operating environment, the typical service profile is first-/last-mile service, including pickup and drop-off of passengers traveling between their homes and public transportation stops within their community or short-trip service, which allows pickup and drop-off of passengers traveling between their homes and work or leisure venues.

The restricted operating environment is not the only constraint for this type of use case. Most of these deployments also are prohibited by regulation to operate during extreme weather conditions, such as heavy rain or sandstorms.

As mentioned, community robotaxis are currently in use in several cities, and companies such as Waymo and Cruise have been charging customers for their robotaxi services for quite some time. Below, we present some of the early deployments of community robotaxis, highlighting their main characteristics:

-

In October 2020, Waymo finally opened up a truly driverless ride-hailing service. Existing Waymo One members were provided access to the service in a 50-square-mile area in the US city of Phoenix, Arizona. In August 2022, Waymo extended the driverless autonomous taxi service to downtown Phoenix. Currently, only people accepted onto Waymo’s “Trusted Tester” shuttle program are eligible to hail these rides.

-

In June 2022, the California Public Utilities Commission also gave a green flag to Cruise to launch a paid, driverless ride-hailing taxi service. The service initially will be limited to 30 electric cars transporting passengers in less congested parts of San Francisco during late-night hours (10 pm to 6 am). The driverless service will not be allowed to operate in bad weather conditions, such as heavy rain or fog.

-

In August 2022, the Chinese Internet giant Baidu secured permits to launch a fully driverless commercial autonomous taxi service in Chongqing and Wuhan in China. In Wuhan, Baidu’s service will operate from 9 am to 5 pm and cover a 13-square-kilometer area in the city’s Economic and Technological Development Zone, which is known as China’s “Auto City.” In Chongqing, the service will run from 9:30 am to 4:30 pm in a 30-square-kilometer area in Yongchuan District. Each city will have a fleet of five Apollo fifth-generation autonomous taxis. Both cities have been testing hubs for autonomous vehicles (AVs) and provide the right technology and infrastructure for launching the ride-hailing service. Baidu plans to expand its commercial ride-hailing service to 65 cities by 2025 and to 100 cities by 2030.

City robotaxis — 2027

Based on the technology roadmaps of the main robotaxi OEMs, we anticipate that, in the next five years, robotaxis will enter the second stage of development, and city robotaxi use cases will be successfully implemented in various cities around the world, such as Dubai, San Francisco, Paris, and Beijing, among others.

Compared to community robotaxis, city robotaxis will be able to operate in much more complex operating environments. Indeed, they will be capable of operating in automated mode in any mapped area of a city, and to circulate on any type of road, regardless of the level of complexity and interaction with mixed traffic. In addition, restrictions related to service availability will be relaxed as technology advances and public acceptance increase, allowing these deployments to operate even during extreme weather conditions.

As a result, city robotaxis will offer a more robust business case to companies, enabling them to fully monetize the provided services.

Anywhere robotaxis — 2030 and beyond

Anywhere robotaxis represent the last development stage for robotaxis and will require a true leap in technology development since anywhere robotaxis will be able to operate anywhere and under any weather conditions.

Indeed, stage three will enable a robotaxi to pick customers up from their homes and drive them into another city (or vice versa), traveling along bumpy, unmapped, or unmade roads, as necessary. Operation will be possible under any weather conditions, including snow, hail, and heavy rain.

3

CITY OF THE SEMESTER: HONG KONG

AVs are intended to reshape the future of the transport sector across all travel modes. Pioneering countries and cities are preparing for this transformation journey by building momentum to unlock early advantages from this trend. Hong Kong, as an example, has set a clear target to enable the AV ecosystem from different angles, including setting a strategic direction that acts as an overarching umbrella to lead public and private sector efforts, upgrading the existing infrastructure to enable relevant technologies, and developing the necessary framework that allows for fast adoptions in response to market updates. Hong Kong’s relative success in enabling the deployment of AVs can be attributed to its focus on setting a clear strategic direction, developing enabling regulations, encouraging stakeholder engagement, and strengthening the underlying infrastructure.

Setting a clear strategic direction

Hong Kong’s Transport Department (TD) has initiated a proactive strategy to progress on numerous smart mobility initiatives that focus on four key elements: (1) autonomous mobility, (2) smart mobility infrastructure, (3) mobility services digitalization, and (4) improving current traditional services. The overarching program, encompassing autonomous mobility as a key focus, has a clear vision to capitalize on the advent of advanced technology to pursue smart mobility. The strategy consists of three building blocks to guide efforts toward advancing a smart and autonomous mobility ecosystem for Hong Kong (see Figure 3):

-

Smart transport infrastructure — sensing and analytic technology and onboard and vehicle technology.

-

Data sharing and analytics — data-sharing and data analytics technologies.

-

Applications and services — new data sharing, new-generation parking meters, and smart public transport infrastructure.

As part of the strategy, the Hong Kong government has facilitated the achievement of technology advancement and industry development in vehicle-to-everything (V2X), AVs, and ultimately introducing AVs with integrated Internet access. However, its primary strategic focus is enabling the overarching ecosystem for such advancements through these three blocks.

Developing enabling regulations

In 2017, the Hong Kong TD issued “A Guide on Application for Movement Permit for Test, Trial and/or Demonstration of Autonomous Vehicles on Roads Within Designated Sites in Hong Kong,” opening the door for AVs and marking the TD as a worldwide pioneering regulatory entity in testing and enabling the relevant technologies. The move also allowed the TD to proactively expand regulatory maturity and competitiveness from the early stages.

At the end of 2020, the TD issued updated guidelines (“Guidance Notes on the Trials of Autonomous Vehicles”), establishing a clear yet flexible mechanism to facilitate applications for movement permits to conduct more advanced AV trials (including tests and demonstrations) while ensuring safety. Although Hong Kong lacks a comprehensive framework or laws governing and regulating the AV ecosystem, these guiding notes are currently used to clarify key elements for AV trials, including:

-

Application procedures for movement permits. The notes guide applicants through the licensing process and required applications to conduct AV trials. Each application is assessed on a case-by-case basis depending on its own merit.

-

General requirements. The guidance lists all major requirements (e.g., AVs shall be roadworthy and in good/serviceable condition) and provides notes on trial proposals with information on the relevant stakeholders and intended results as well as safety management plans.

-

Vehicle requirements. Included in the notes is a list of obligations relating to vehicle fitness that applicants seeking on-road trial permits must fulfill. For example:

-

The AV, through its sensors or control by the driver/operator, will need to respond appropriately to all types of road users, hazards, and scenarios (TD representatives may attend and witness the pretrial tests, if required).

-

The applicant should start with in-house trials to gather experience and evidence to substantiate the satisfactory functioning of the AV and its components.

-

The transition function between autonomous mode and manual mode must first be proven in in-house trials or trials within a confined area before advancing to trials on temporarily closed and open roads.

-

-

Driver/operator requirements. During the road trials of AVs, there must be a driver/operator to monitor the operation of the AV and take over operation of the AV if necessary.

Encouraging stakeholder engagement

Hong Kong’s ability to position itself as a leader in the smart mobility and AV ecosystem is contingent on the coordinated efforts of stakeholders, which are categorized as smart mobility leading entities and smart mobility contributors. Smart mobility leading entities primarily include government entities that drive the overall strategic-direction definition. Smart mobility contributors, on the other hand, are public and private entities that provide inputs to support defining of the direction, as well as a private sector–focused advisory panel that channels market views. In the case of Hong Kong, all collaboration efforts are built on a concept of effective data exchange and transparency among three categories of stakeholders:

-

Leading entities. Smart mobility, particularly autonomous mobility, is a key focus area for the Hong Kong government, and the TD is the leading entity developing all policies and attracting private sector players.

-

Contributors. Contributors are predominantly private sector entities operating within the smart mobility ecosystem, formalized via the recent establishment of the Smart Mobility Consortium, an advisory panel established to provide input to the TD on regulatory direction.

-

Dedicated unit. In addition, the TD leads the overall strategic direction for autonomous mobility in Hong Kong and has created a dedicated unit focused on enabling the deployment of autonomous mobility. The Smart Mobility Division unit spearheads regulatory adjustments and acts as the main interface with the private sector and third parties in areas related to smart mobility, including autonomous mobility.

Overall, Hong Kong has identified autonomous mobility as a strategic focus area, as illustrated via its governance. The dedicated unit within the TD, supported by a formalized private sector advisory panel, serves as a key enabler to attract overseas companies, investors, and international expertise to assist in developing the smart mobility and autonomous mobility ecosystem.

Strengthening the underlying infrastructure

A key prerequisite for autonomous mobility is the development of a robust physical and digital infrastructural layer that effectively connects the vehicles. Hong Kong has ambitious plans to be among the first to roll out 5G communications capabilities to enable these connections and has structured a program across three goals:

-

Connected. Hong Kong is driving connectivity by widening and increasing connectivity coverage and enhancing connectivity speed. In terms of coverage, Hong Kong has launched a Wi-Fi-connected city program, Wi-Fi.HK, which connects more than 36,000 hot spots across the city. In parallel, the city has put in place a program to launch a total spectrum of 4,500 MHz for 5G services and has assigned spectrums in the 26 GHz and 28 GHz bands.

-

Autonomous. Hong Kong’s focus is on the development of test beds to conduct trials, with the potential to focus on dedicated AV corridors or temporary testing in the future. The city is conducting AV trials for 5G research purposes and is testing infrastructure for vehicle identification of pedestrian lanes, including vehicles’ ability to slow down in front of pedestrians and react to a moving object.

-

Shared. Given Hong Kong’s urban landscape and crowded nature, the city’s plans are focusing on potential dedicated lanes for different modes. Currently, dedicated lanes exist for bicycles, although those that exist are primarily restricted to new territories and parks.

Hong Kong has understood the importance of infrastructure as a key prerequisite and enabling pillar for its autonomous mobility journey. It has initiated efforts related to increasing connectivity and rolling out 5G, and it should continue focusing on trials with AV-dedicated lanes and on growing shared mobility opportunities within the transportation ecosystem.

Summary

Hong Kong is positioning itself as a leader in the autonomous mobility ecosystem. Its efforts have been particularly successful due to coordinated efforts across the following key elements:

-

Strategy — developing a central vision and direction that unifies all stakeholder efforts, drives partnerships, and enables private sector participation.

-

Regulations — reviewing existing conservative regulations to define a clear regulatory framework across liability and insurance, registration, data privacy, and testing and deployment.

-

Stakeholder integration — following a multitiered approach led by a dedicated unit within the transport authority. The unit leads all smart mobility/autonomous mobility efforts and is supported by effective engagement with the private sector, formalized via the Smart Mobility Consortium.

-

Infrastructure — enhancing connectivity through 5G rollout to allow for higher peak speeds along with flexibility and lower latency.

-

Technology — maintaining a clear focus on infrastructure connectivity and investing in expanding 5G connectivity.

4

INTERVIEW OF THE SEMESTER

Interview with Prof. Omaimah Bamasag, Deputy of Transport Enablement at the Transport General Authority of the Kingdom of Saudi Arabia (KSA)

The Transport General Authority (TGA) was established in 2012 by the Council of Ministers Resolution No. 373 to regulate the railway, maritime, and land transport industry in the KSA. TGA maintains high standards of quality and safety in the transport sector and uses data and technology to create a safe and efficient transport environment promoting investment opportunities to meet the Kingdom’s Vision 2030 socioeconomic goals. We had the pleasure of conducting an e-interview with Prof. Omaimah Bamasag, Deputy of Transport Enablement at TGA.

Q: What outlook do you foresee for autonomous mobility in the future?

A: There is no doubt that AV technologies are progressing and growing significantly, especially in recent years with the development of computer capabilities and the emergence of the artificial intelligence revolution, the concept of big data, and 5G. It is well known that the ultimate global goal in AV is to bring them to Full Autonomy (Level 5, according to the Society of Automotive Engineers [SAE] International) in a commercial form, and it seems to me that we have a tricky road ahead to reach that level, especially in light of the challenges related to the security and privacy of data and risk of cybersecurity attacks. Therefore, I expect that in the coming years we will see an increase in spending on R&D and technology advancement by OEMs, start-ups, and tech giants for the development of AVs.

We will also notice high developments in the areas of V2X, especially between vehicles and means of micromobility, to reduce the rate of accidents in this regard, besides the development of new business models for insurance companies to accelerate the commercial operation. This will definitely lead us to see more licensing of AVs around the world and their commercial operation on public streets.

I also expect to see AVs commercially soon in the applications of shared mobility by buses and taxis, and perhaps trucks and robots, due to the controllability of their applications and scope, as they often have predetermined origins, destinations, and paths. Besides that, there are many global efforts ongoing to define their technical and operational requirements. And with the emergence of the concept of mobility as a service (MaaS) and the proof of its effectiveness, it is expected that there will be a greater trend toward the concept of autonomous MaaS based on AVs to serve the first and last mile, and pilots have begun in some countries around the world. In the end, I may agree with the global forecast that commercial operation of AVs at SAE Level 4 and Level 5 will become a reality around 2038.

Q: What is KSA’s vision toward autonomous mobility?

A: The Kingdom’s goals for AV transport are very ambitious and can be seen from the giant projects based on autonomy, such as the Neom and Red Sea projects in the economic zone. These smart cities are designed to be sustainable through the introduction of new transport systems for passengers and goods based entirely on autonomous mobility, such as volocopters, autonomous pods, robotaxis, etc. On the other hand, there are several mega projects in a number of cities in the Kingdom aimed at catering AVs to passengers, such as the King Salman Park project in Riyadh and the King Abdullah University of Science and Technology in Thuwal.

Looking at the National Transport and Logistics Strategy (NTLS), we find it was supportive of adopting new mobility systems for the transport of people and logistics sectors. This was reinforced by the sectoral strategy for land transport by TGA, with targets that aspire to convert approximately 15% of public transport vehicles into AVs and 25% of goods transport vehicles into AVs by 2030.

Q: What role would TGA play in achieving KSA’s vision?

A: The regulatory position of TGA on the passenger and goods transport sectors in the Kingdom makes its role essential in achieving the Kingdom’s vision. TGA is working on two tracks. The first revolves around promoting and adopting new modes and means of transportation through piloting and testing, R&D, and establishing relationships with governmental and private entities, universities, and research bodies to reach recommendations that formulate the necessary regulations and legislation for these technologies. In the second track, TGA prepares economic, social, and environmental feasibility studies through which it determines the stages of imposing certain regulations on operators and providers of public transport services and goods transport through which the goals of the Kingdom’s Vision 2030 are achieved. In short, imposing regulations by TGA is very easy, but the most important thing is to verify the adverse effects that may result from imposing such regulations because some effects may deviate from the Kingdom’s desired vision.

Q: Are there any other stakeholders involved? How do you coordinate with each other?

A: With the nature of AV technologies, interagency collaboration is critical to achieving rapid maturity and development. TGA is very keen to work with all concerned governmental, private, local, and international bodies, or even research bodies, each according to its specialization. On the governmental level, we are aligned with the Ministry of Transport and Logistic Services on AV projects, and with the Ministry of Municipal and Rural Affairs and Housing, including the municipalities and royal and development authorities of the regions, for their competence in infrastructure and city intelligence. We are also working with the Ministry of Communications and Information Technology and the Saudi Authority for Data and Artificial Intelligence to improve the readiness of the necessary communications infrastructure for these technologies, such as 5G, data privacy, and security.

Meanwhile, we seek to discuss with some enforcement bodies, like the General Traffic Department and Public Security, about the improvement of traffic control units, smart usage of surveillance cameras, and fine approaches, etc. As for research bodies, cooperation is based on exchanging data obtained from tests for research purposes, localizing some operational tasks of autonomous mobility, and opening new horizons in development and innovation. Cooperation also extends to raising community awareness through holding local seminars, hosting international conferences specialized in autonomous mobility, and organizing competitions and hackathons.

Q: What is the status of AV regulations in KSA?

A: The Kingdom is still in the early stages of regulating AVs, but this does not mean that we are not interested; on the contrary, it is the first concern and target of all parties of the transport ecosystem. At all levels, the authorities are working very hard to regulate and legislate AV in the Kingdom through piloting different technologies, conducting studies, and meeting with the competent local and global authorities in the field to determine their technical, operational, and legislative requirements. Saudi Arabia’s desire to build one of the largest sandboxes for new mobility may be strong support for advancing the growth of AVs in the Kingdom and is a great accelerator for the development of its regulations and legislation.

It is worth noting that the Saudi Central Bank (SAMA) recently announced its approval of a new insurance product, the first of its kind designed to provide coverage for AVs and related risks. The bank indicated that the product provides insurance coverage for AVs that can drive themselves from a start point to a pre-set destination in “autopilot” mode using various in-vehicle technologies and sensors. These include adaptive control, active steering, anti-lock braking systems, GPS navigation technology, lasers, and radar. Coverage is only valid for vehicles that are driven and operated in licensed areas and areas designated for AVs.

Q: Are you collaborating with international authorities for regulatory standardization?

A: Unfortunately, TGA does not have any collaboration thus far with international bodies to standardize the regulation, but we will definitely do so soon. In fact, it is an important step to unify and integrate efforts and advance the development toward the commercial operation of AVs.

Q: What roadblocks do you foresee for AV market ramp-up in KSA?

A: In terms of roadblocks, there are many, and perhaps the most important of them is the readiness of the infrastructure for AVs, particularly if the aim is to achieve commercial operation at SAE Level 4 and Level 5 for AVs. What I mean by readiness here is the readiness of technologies and other necessary requirements in the infrastructure for achieving safe operation and protection of privacy and data. Also, one of the important roadblocks, assuming that the infrastructure in the Kingdom is ready, is the delay in formulating the necessary regulations for these vehicles. Public acceptance may be another roadblock to increasing AVs in the Kingdom, especially if privacy and security issues are not well addressed.

Q: How are you looking to tackle these roadblocks?

A: It is important to note that addressing roadblocks should be participatory work between all stakeholders. We are working with many ministries and agencies, like the Ministry of Transport and Logistic Services; the Ministry of Municipal and Rural Affairs and Housing; the Ministry of Communications and Information Technology; the Saudi Data and Artificial Intelligence Authority; the National Cybersecurity Authority; the royal and development authorities of regions; municipalities; and some other local and international private sectors to improve the readiness of the infrastructure in the Kingdom and formulate the necessary regulations for AVs. We work also with many research bodies, universities, and organizations to set up programs and competitions and develop educational curricula that contribute to raising community awareness and educating the community about what is new in technology.

Q: Most AV players foresee large-scale commercialization of the service by 2024. Do you believe this target is achievable?

A: Yes, it is achievable, but only to a certain extent. Levels 4 and 5 of personal AV may require more study and research to be commercially ready. But if we look around the world, we see that there are other AV technologies that are currently operating in a kind of commercial manner, like the autonomous pod, e-commerce robot, and all other technologies built similarly on the concept of shared mobility. These are what I expect to be commercially operational by 2024 because many organizations and governments have made extensive efforts to develop their requirements and legislation. It is important to note that the readiness of the infrastructure and regulation play an important role in achieving the commercialization of AVs.

Q: Going forward, what will be the next steps for TGA to ensure effective collaboration with the private sector on AVs?

A: The private sector is one of the most important arms in the development and growth of AVs. They possess technical and operational knowledge and have global experiences by the nature of their presence in several countries around the world, and their role with TGA comes through transferring their global knowledge. What I see in our collaboration is that they can strengthen TGA in establishing proof-of-concept piloting and support TGA in drafting the necessary regulation for technologies. Meanwhile, the role of TGA is to create investment opportunities for them and pave the way for new horizons in the local market for AVs. This is what the Public Authority for Investment and Competitiveness at TGA is targeting.

DOWNLOAD THE FULL REPORT