Fierce competition for clients and the adoption of new technologies are pushing insurance companies to make bold efforts to improve their sales force and emphasize their most profitable channels. Developing a data-driven strategy to properly dimension sales channels will allow companies to maximize their resources and deploy efficiency initiatives. In this Viewpoint, we define an organized approach to sales dimensioning that can be used by insurance companies and other sectors.

FIRST STEPS

The relationship between customer value and acquisition cost has a direct impact on profitability. The output of each type of channel differs in cost and target segment. For this reason, it is important that channels align with the company’s strategy to optimize ROI. Our experience shows that the right channel dimensioning can improve productivity by 10%-20%. This Viewpoint explores how to define the optimal process for dimensioning sales channels, which focuses on creating optimal configurations of agents in distribution channels. The actions that occur during and after this process are paramount to improving agent performance. The traditional trial-and-error approach can lead to painstaking labor and inadequate results. This outcome is inevitable for any company in almost every sector; our approach avoids these negative outcomes.

Although an insurance company’s sales department usually has the necessary knowledge and reporting tools to identify and track results, roadblocks, and game changers, dimensioning the necessary efforts of each sales channel is often hindered by a lack of resources. The agent configuration in a channel is typically organized by comparing the variation of average performance metrics and ratios impacting a static profit and loss (P&L) statement. It assumes linear behaviors that are a vague representation of the actual constraints faced by the sales force (during the operation) and the sales director (during the sales strategy definition).

A robust and flexible methodology, based on market and internal data, is necessary for properly facing the endgame channel-sizing problem. This data-driven approach has the additional benefit of allowing sales directors to understand the constraints and the best growth direction, while incorporating efficiency improvements that have been vetted and found worthy.

DEFINING THE BEST CONFIGURATION

Data analytics creates the foundation for this stage. For the purpose of dimensioning sales channels, it involves the process of examining raw data to uncover hidden patterns, correlations, market trends, and other relevant information within each type of channel. These analyses are the basis for determining new segmentation models, establishing sources of customer potential value, or identifying value agent drivers. The results establish a foundation for channel modeling in the next phase and provide relevant insights about distribution performance, extraction of actionable insights, and positioning in relation to peers.

Experience has shown that not all channels are suitable for all segments, nor do they have the same cost or offer the same return:

-

Remote channels typically offer a lower acquisition cost but less advisory potential. The cost and effectiveness of the channel depends on the quality of the leads. Internal leads (e.g., former customers) offer better results, but their number is limited. External leads, on the other hand, have a lower impact and can cost three to four times the acquisition cost.

-

An insurance company’s own channels tend to offer average performance at a medium-to-high cost. The risk falls on the company, so it must establish adequate management and control policies. Poor channel management can lead to a degradation of the acquisition cost and liability for the development of new distribution strategies.

-

Intermediated channels offer a medium-to-high, but variable, acquisition cost. These are suitable channels for targeting customer segments where the agents have difficulty initiating a commercial conversation, or conversion is difficult.

New data analytics and the exploration tools used here can process a large amount of information in a short period of time, which is needed to carry out different cross-check analyses and support the three-phase structured approach to dimensioning insurance sales channels.

Three-phase methodology

The Arthur D. Little (ADL) methodology to address endgame channel sizing combines data modeling and business intelligence to design an optimal channel mix to make the sales process more efficient. The methodology is frequently divided into three phases: (1) an exploratory analysis to diagnose the problem, (2) an examination of scenarios to find the optimization model, and (3) an exploration of new initiatives (see Figure 1).

Internal and external analyses are conducted during the Phase 1. The completed internal analysis provides important and useful information, including:

-

Customer characteristics and product tenancy

-

Customer-channel distribution relationships (customer mix per channel, acquisition cost)

-

Customer value and its relationship with the distribution channel

-

Each channel’s contribution to business performance (volume, margin, persistency)

-

Agent dynamic in the channel (rotation)

-

Agent sales performance (ranking, best practices identification)

The external analysis involves benchmarking, and the knowledge it provides can help companies:

-

Understand current insurance market dynamics

-

Analyze roles of each player

-

Identify best practices

-

Discover commercial opportunities (low product penetration in areas or niche markets)

-

Define aspirational commercial objectives (penetration by segments or regions)

Defining different strategic scenarios provides the starting point of the Phase 2, sales channel optimization. It involves forecast modeling and scenario analysis using current and historical data patterns to determine probable future outcomes. Scenario analysis interconnects all elements related to channel performance to show the economic impact of different insurance sales strategies (e.g., being cost-effective, maximizing margins, or focusing on customer segments).

Each scenario seeks to identify the best configuration of agents in the channels to achieve a strategic objective (e.g., maximizing return, cost efficiency, maximizing customer acquisition). The modeling will only work on the configuration of agents in the channels in a ceteris paribus (“other things equal”) environment. Thus, we can identify which configuration drives impact to the different strategic ambitions. Understanding these drivers in the channel configuration in the different strategic ambitions will help select desirable scenarios. The company’s decision makers are responsible for selecting the optimal option to achieve the financial and strategic objectives.

Phase 3 begins once the agent configuration has been selected. The attention shifts to the agents, analyzes how to improve their productivity, and develops initiatives to help them go the extra mile for their customers. Conducting interviews and follow-ups with the top-performing and low-performing commercial agents will identify best practices, pain points, as well as drivers that impact performance. During this phase, it is important to analyze incentive schemas, sales support tools, sales area, or sales monitoring and control. The knowledge gathered during this phase can be implemented later in the form of effective best practices to improve overall agent performance.

BEST PRACTICES FOR IMPROVING CHANNEL PRODUCTIVITY

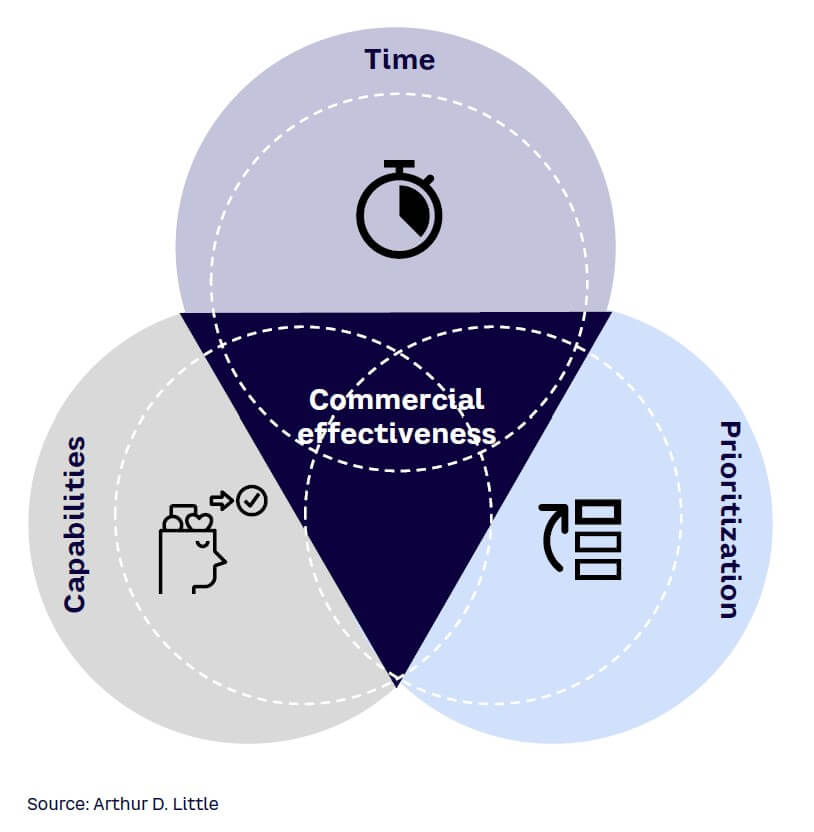

The most common initiatives to improve productivity can be classified into three sets: capabilities, time, and prioritization (see Figure 2).

Another course of action, also with three elements, relies on tools, data, and ongoing training:

-

Volume — reducing the time spent on purely commercial activities by making them simpler, faster, and/or more automatic. Companies can adapt operational processes and provide the necessary tools to increase the time spent on sales and their quality. Systemizing the selling process helps create a standardized and streamlined sales process, which can be easily replicated across a sales team. This will help ensure consistency and provides an opportunity to introduce intelligence into the sales process. Sales support tools simplify the sales process (e.g., a quotation tool), giving an agent time to focus on customer engagement and advisory. It is important to eliminate and reduce administrative tasks (e.g., manual reporting activities) or reduce sales preparation time (e.g., sales pitches and competitor benchmarks can be developed by a commercial intelligence unit instead of agents).

-

Focus — prioritizing commercial actions through enhanced visibility/analysis of the available information. It is increasingly common to use sales support tools that help prioritize the contacts most likely to be successful or to focus the conversation on the most suitable product. These tools rely on the availability of customer information to extract value for sales planning. Implementing tools that focus the agent’s activity on the right leads can improve productivity by 15%-25%. Additionally, the continuous improvement of selection and sales conversion by tracking objective key performance indicators helps develop data-driven funnel management. It increases conversion rates and lowers the chance of early cancellations or churns.

-

Quality — improving or developing commercial skills of the sales force. Developing standardized multichannel lead management with clear roles, responsibilities, and interfaces can help to build a high-sales, process-oriented company. Ongoing training, communications, and side-by-side coaching, using experienced agents and coaches, can create a strong sales culture. These best practices are essential to improving selling by ensuring that agents have the necessary skills, tools, and processes to effectively engage with customers, while maintaining high-quality service standards.

Conclusion

SUMMARIZING THE PROCESS

The expanding competition landscape and the availability of new technology to address myriad issues and tasks have motivated sales forces to revisit their approaches and strategies. Employing a data-driven approach to dimension sales channels allows an insurance company to realize its full potential while minimizing deviations from target results. Ideally, using a strategic process will launch the company toward a strong outcome:

-

Conduct external and internal analyses prior to the optimization exercise to understand the main and hidden blockers that hinder results and to define the constraints and bundles for sales channel dimensioning.

-

Use data analytics models to replicate real challenges present in the sale-dimensioning exercise to find the best configuration for each insurance company and market.

-

Implement efficiency-improvement opportunities after the best configuration is deployed.

-

Prioritize opportunities according to quantitative and qualitative criteria and consider their potential enabling nature.

-

Deploy improvement opportunities, which can lead to a new paradigm for an insurance company, and rerun the analytics model for sales dimensioning to meet and exceed expectations.