Small and medium-sized enterprises (SMEs) are the engines of economic growth and development in Southeast Asia (SEA) and across the world. They also play a key role in helping to realize sustainability goals. While there are already many government support programs for SMEs across SEA, the business environment has changed radically over the last few years due to factors such as demographics, geopolitics, technology, and climate change. To ensure the SME growth engine stays primed and accelerated, governments must work in new ways with SMEs to bring about a shift in mindset away from risk aversion toward embracing the opportunities arising from uncertainty and disruption as a source of innovation, growth, and entrepreneurship.

THE IMPORTANCE OF SMEs

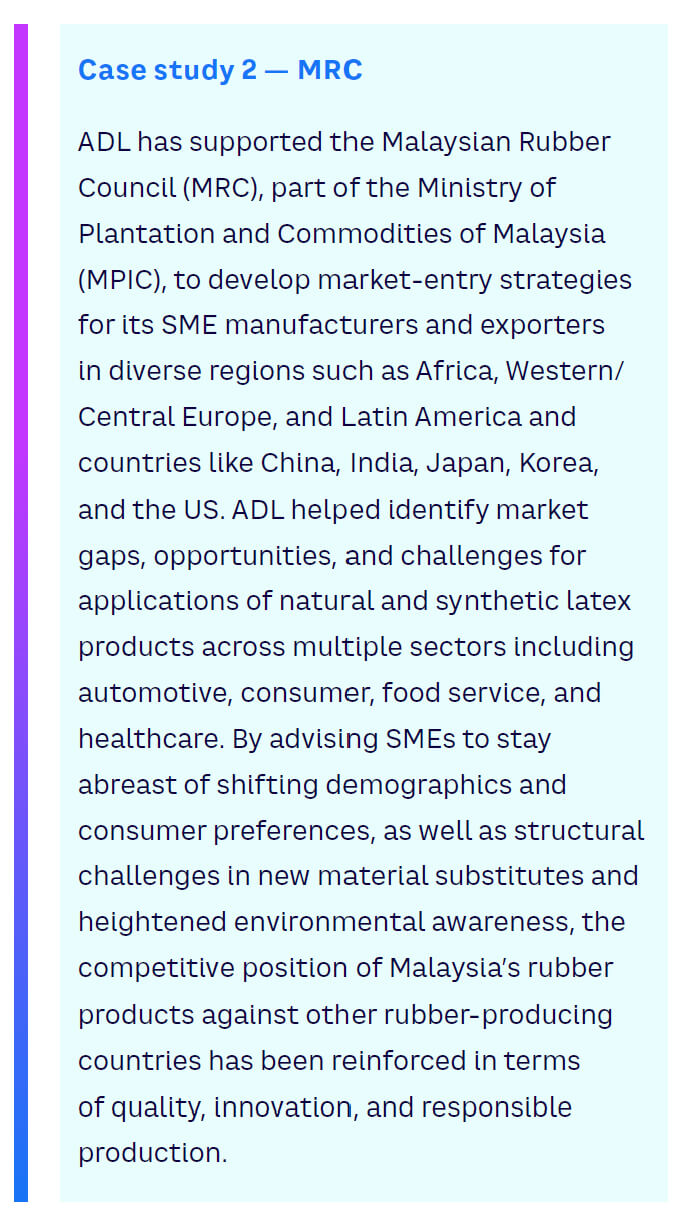

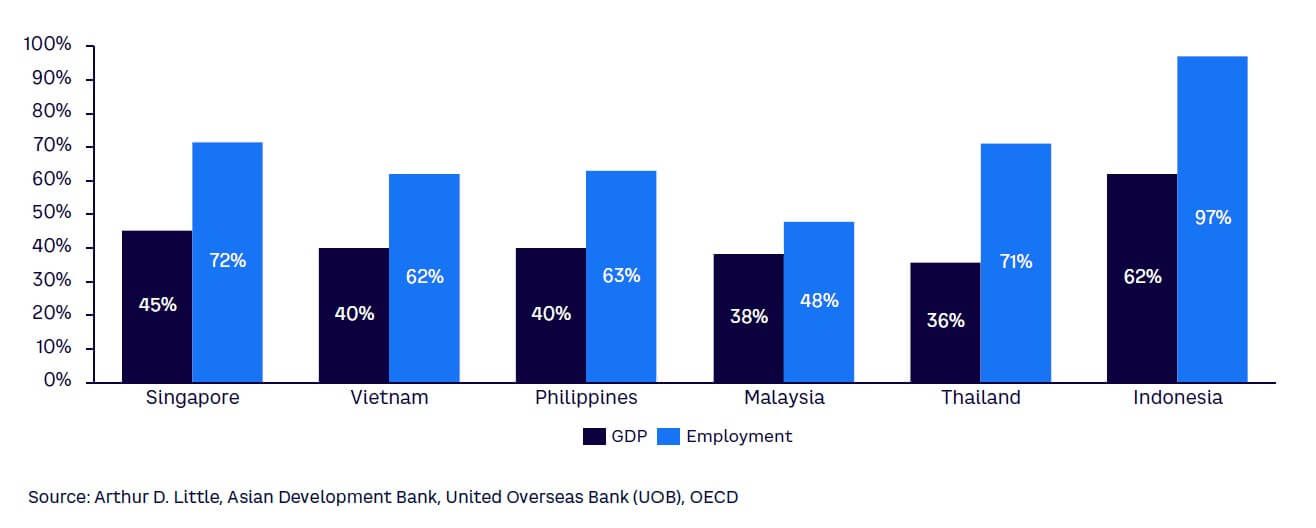

SMEs are the backbone of the global economy. Within six key countries in Southeast Asia, the Organisation for Economic Cooperation and Development (OECD) estimates that SMEs contribute to an average of around 40% of local GDP and 70% of local employment (see Figure 1). Even in countries with strong state-intervened economies like Singapore, SMEs are critical enablers of job creation and livelihoods. In countries with a large and diverse population base (e.g., Indonesia), the World Economic Forum reports that SMEs play an even bigger role, generating 62% of local GDP and 97% of local employment. Not only do SMEs deliver an outsized contribution to wealth and employment, they are also incubators for future innovators and entrepreneurs.

According to the UN Department of Economic and Social Affairs, SMEs also play a direct part in helping realize each of the 17 UN Sustainable Development Goals (SDGs), which aim to eradicate poverty, protect the planet, and ensure prosperity and peace by addressing global challenges like inequality, climate change, environmental degradation, and access to education and healthcare. Beyond facilitating mandates relating to economic development and improving standards of living, SMEs can help drive gender equality and positive climate action to ensure a more environmentally sustainable way of life. To this end, SMEs play a pivotal role not just in achieving economic development targets but also in the holistic long-term development of a country and its residents.

GOVERNMENT’S ROLE IN SME DEVELOPMENT

Given the importance of SMEs to national development, governments across the world have put in place programs and initiatives to support them. Across the SEA region, these include not only fiscal support but also programs geared toward capacity building, digitalization, and internationalization. A non-exhaustive selection of these government support programs includes:

-

Indonesia. The integration of the digital ecosystem to spur SME growth is supported by digital enablement such as MSMEs (micro, small, and medium-sized enterprises) Go Digital program and knowledge transformation sources like KADIN Tech Hub and WIKI WIRAUSAHA.

-

Malaysia. Government agencies and institutions have established knowledge hubs, including the Business Clinic and SME Academy, and business transformation programs like PRESTIGE to encourage technology integration and innovation for SME advancement.

-

Philippines. Mentorship programs, including 3M, Kapatid Mentor Me (KMME), and Go Negosyo’s Kapatid Agri Mentor Me Program (KAMMP), aim to bring together key stakeholders and enablers to help MSMEs scale up.

-

Singapore. Support programs include Scale-Up, Enterprise Leadership for Transformation (ELT), Enterprise Development Grant (EDG), and Capability Development Grant (CDG) to enhance SMEs’ competitiveness globally. SMEs are encouraged to adopt digital solutions for expanded growth under the SMEs Go Digital program.

-

Thailand. The government promotes SME digitalization through the Smart Business Transformation Program (SBTP), alongside capacity building instigated through SME One-Stop Service Center and SMEs Spring Up Initiative.

-

Vietnam. The country facilitates SME growth with improved access to support and funding through initiatives like the SME Development Fund (SMEDF), and National Trade Promotion Programme, while also nurturing an e-commerce ecosystem for enterprise growth under the national E-Commerce Development Master Plan.

Many of these programs have been extremely successful in SME capacity building. For example, OpenGov Asia reports that Indonesia’s MSMEs Go Digital program added digital capabilities to 9.2 million companies in the first two years of the program. In the Philippines, Go Negosyo reported that its KMME program had reached more than 13,000 entrepreneurs by May 2023. Singapore’s Scale-Up program has seen success stories as well, with high-potential SMEs going international, although encouraging a wider range of SMEs to “think bigger” and accelerate growth remains a work in progress. However, some SME development initiatives, such as financing offered by Vietnam’s SME Development Fund, do not experience high demand due to strict eligibility requirements and cumbersome approval processes.

Fortunately, CEOs today look more positively toward state intervention than they would have done several years ago. As highlighted in ADL’s 2024 “CEO Insights” (“Positive in an Uncertain World: Confident CEOs Reskill Companies for AI-Driven Growth”) research study, “the combination of greater protectionism and increased programs and subsidies around decarbonization and other areas is providing new opportunities and changing CEO attitudes toward state intervention [and government support].”

NEW CHALLENGES & OPPORTUNITIES

Despite support from existing government programs, SMEs are facing new challenges from socioeconomic, environmental, geopolitical, and technological megatrends that are increasing the volatility of the business environment and disrupting established ways of working. But as well as challenges, these megatrends also give rise to new opportunities for those SMEs that can respond with the right mindset:

-

Shifting demographics. Global life expectancies are increasing. According to the Economic Research Institute for ASEAN and East Asia (ERIA), the population over 65 years old in SEA countries is expected to triple from 2015 to 2050. At the same time, the SEA middle class is expected to grow to around 55% of the overall population by 2030. Hence, SMEs face risks from a shrinking labor pool, rising labor costs, and potentially declining productivity. However, at the same time, there is an increasing market opportunity to cater to (newly) affluent customers of all ages; hence, SMEs need to be adaptive in how they can best scale their businesses efficiently and effectively.

-

Climate change and environment, social, and governance (ESG) emphasis. With policy mandates and public pressure on climate action, along with diversity, equity, and inclusion initiatives, consumers and governments have rising expectations for ESG accountability. While this poses a degree of additional business complexity for SMEs, it also opens up opportunities for SMEs to differentiate to meet new demands and to grow through offering responsibly produced products and services.

-

Geopolitics and supply chain bifurcation. Long-term territorial disputes, geopolitical tensions, and trade conflicts are likely to be part of the geopolitical scene for the forseeable future. Disruptions to major shipping routes have resulted in surging freight rates, unpredictable delays, and port congestion. Investment and trade flows are bifurcating to political allies (also known as “friend shoring”). Export restrictions and economic sanctions are hindering access to raw materials and technologies essential for manufacturing critical products like microchips and batteries. Potential changes and hurdles in foreign investment policies increase the complexity of conducting business overseas. All this means that SMEs need to reevaluate or modify their business operations to increase their resilience to disruptions in international trade and connectivity. At the same time, friend shoring provides new opportunities for those SMEs adept at navigating the nuances of overseas trade to act as preferred suppliers or neutral brokers.

-

Digitalization and AI. The ongoing digitalization of business — boosted by the rapid development of technologies such as AI, automation, advanced connectivity, and cloud and edge computing — are creating huge demand for data storage, processing, and utility provision. Governments worldwide are accelerating plans for AI development and implementation in their countries and businesses. To respond, SMEs need to build new capabilities, attract new talent, and improve cybersecurity. Those that can do this better and faster than their competitors can expect major benefits.

However, responding to these challenges can be especially difficult for SMEs, given their often limited experience, capabilities, resources, and capacity for investment. Uncertainty in the business environment often results in SMEs resisting change, reducing engagement, and focusing on the established core business as they wait for situations to improve, often leaving them poorly prepared for growth and scale-up. Governments have a key part to play in helping to overcome these barriers.

HELPING SMEs MAKE THE PARADIGM SHIFT

“Sustaining a business is a marathon, and these are particularly difficult times.… But if we change our perspective to proactively identify new growth opportunities, prioritize the development of our people, and renew our efforts to engage the global economy, I am confident we will do well in a post-pandemic world.”

— Singapore’s Minister for Trade & Industry

Gan Kim Yong

The key for governments to help SMEs grow and thrive in today’s uncertain environment is not just to offer traditional support, but also to help them bring about a change in mindset — to shift their paradigm from viewing disruption and volatility as “unavoidable evils” that strain scarce resources to recognizing them as opportunities to change and gain competitive advantage. To do this, governments should focus on helping SMEs holistically across six areas:

-

Venturing into new markets

-

Innovating with new offerings

-

Employing sustainability as a growth lever

-

Using digital as a scale multiplier

-

Seeking resilience against uncertainty

-

Optimizing the financial stack

Venturing into new markets

SMEs often start by operating in small domestic markets and/or niche industries and segments. While some SMEs have shown an increased interest in early international expansion, venturing into new markets is not easy. It requires new market intelligence and new market entry strategies. First-timers often cite finding overseas trading partners, insufficient funding, and insufficient knowledge as key constraints for their overseas expansion. Governments can help promote a more positive mindset toward new market expansion by providing support in some key areas:

-

Network and knowledge to source adequate funding

-

Market intelligence and guidance to leverage insights to select appropriate markets to enter and modes of entry

-

Guidance on identifying and reaching out to local partners to support their market entry

-

Consumer and competitive insights on how to win in the market

-

Guidance on overseas laws and business regulations

Innovating with new offerings

ADL’s “CEO Insights” study found that CEOs view technology innovation as the most critical driver to their company’s future growth; in particular, AI and automation are seen as the most dominant trends to drive growth over the next three years. When asked to list the specific technology areas they were focusing on over the next three to five years in addition to AI & automation, CEOs cited quantum computing, personalized learning platforms, and cognitive smart cities, among other advanced technologies.

SMEs have the advantage of agility and many already have good innovation capabilities. However, they often lack the mindset, expertise, methodology, and financing needed for the successful commercialization and scale-up of innovative concepts. Typical limitations include risk aversion, lack of suitably qualified and experienced talent, inflexible processes, poorly defined governance and, most of all, funding challenges due to the uncertain returns and long payback periods of innovation investments. Governments can greatly help with these limitations; for example, by:

-

Providing access to the right expertise and mentoring

-

Stimulating and strengthening innovation partner ecosystems, including between universities, research institutes, and SMEs

-

Providing risk capping and insurance services

-

Giving direct and indirect financial support

-

Offering in-market intelligence, customer brokerage, and opportunity identification

-

Ensuring an intellectual property regime that is conducive to innovation and entrepreneurship

-

Setting up incubators and venturing funds

Employing sustainability as a growth lever

Governments can work in partnership with SMEs to pursue ESG and sustainability goals in a way that will allow them to gain competitive advantage and accelerate business growth. ADL’s “CEO Insights” study found that CEOs identify sustainability and environmental responsibility as two of the most impactful trends driving growth. Key actions to help SMEs embed sustainability within their operations and governance include:

-

Promoting outcome-based sustainability regulation with adequate compliance time frames to encourage innovation

-

Brokering partnerships with new technology and other service providers beyond traditional value chains to develop new ecosystems and promote new business models based on sustainability

-

Providing guidance on how to integrate sustainability indicators, reporting, and tools at the core of business and incentivize senior management

-

Providing recognition and incentivization for sustainability and ESG excellence in SMEs

-

Offering direct support and/or financial incentives for key sustainable technology development

Using digital as a scale multiplier

While advanced technologies are emerging rapidly, SMEs continue to require support in expertise and strategy to accelerate the digitalization of their business. According to TDCX’s survey of 750 SMEs in SEA, SMEs in SEA generally report digitalization as their top priority, ahead of developing new product lines, talent attraction and development, pivoting to e-commerce, and seeking a new customer base. However, many SMEs in SEA are still in the early stages of their digital transformation journey, with an average of a third or less having digitalized many of their business functions and operations and an average of about half having only digitalized a few business functions and departments.

Governments can help SMEs through, for example:

-

Digital education and capability building programs

-

Ensuring suitable and adequate national digital infrastructure, data regulation, standards, market development, and data security

-

Direct subsidy and support for digital transformation

-

Driving digitalization of government services and providing opportunities for digitally savvy SMEs

Early success stories have shown that SME digitalization can result in increased customer reach, operational excellence, and scale. Joint investment and fiscal support by governments are critical for greater progress in SME digitalization.

Seeking resilience against uncertainty

From extreme weather catastrophes to armed conflict, the increasingly volatile global environment emphasizes the importance of proactive risk management. SEA SMEs have generally fallen behind in adopting robust governance and risk practices, and smaller SMEs are falling behind in adoption of risk management frameworks, increasing their vulnerability. Governments can help SMEs improve their resilience; for example, by providing guidance and training in how to develop fit-for-purpose risk governance, risk management, crisis response, and business continuity approaches.

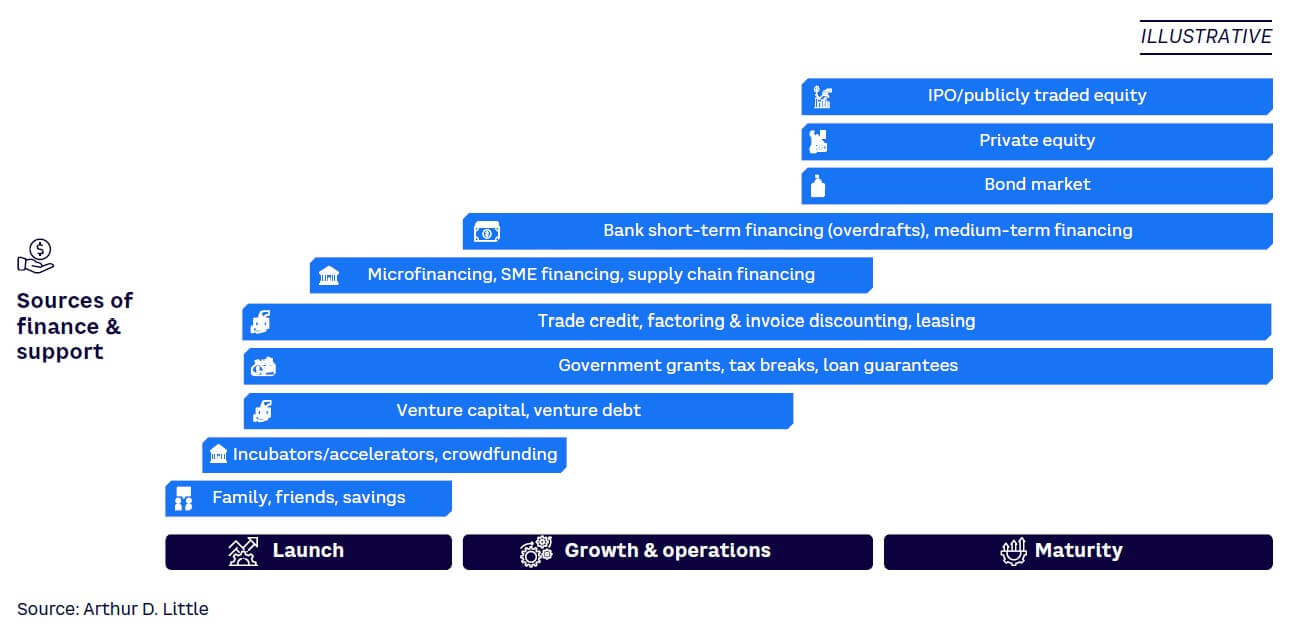

Optimizing the financial stack

Many SMEs face cash and funding challenges, and optimized financial measurement is essential for business growth. According to Mambu’s global survey of 1,000 SMEs, about 70% of all SMEs require additional funding for growth. Those that fail to secure sufficient funding face challenges in cash flow management, expanding their workforce, and upgrading or improving access to technology innovation. In sourcing finance, SMEs should explore financing strategies relevant to each stage of the business lifecycle, from launch through maturity (see Figure 2).

They also should craft their investor story to enhance bankability and facilitate access to broader financing options beyond traditional SME/bank financing and government grants. Governments need to provide a balanced set of financial support measures covering loans, guarantees, tax breaks, inward investment programs, incentives, and subsidies.

Just as important, SMEs need to improve cash flow management; for example:

-

Boosting cash reserves by reducing average collection period and bad debt and implementing cost-saving measures

-

Reducing cash outflow by minimizing nonessential outflows, renegotiating financial terms with suppliers, and phasing investments

-

Improving financial management capabilities by investing in technology for cash flow and foreign exchange monitoring

CONCLUSION

KEEPING THE GROWTH ENGINE PRIMED

The environment for SMEs in SEA and across the world has changed significantly, and increased uncertainty and disruption seems likely to be here to stay in the face of demographic change, geopolitical instability, climate change, and technological innovation. Governments concerned about sustainable economic growth and human capital development need to ensure that SMEs are provided with the right type of support. This means more than just traditional small-company support schemes. Instead, it means helping SMEs make a paradigm shift toward embracing uncertainty and disruption as a source of growth, opportunity, and competitive advantage. This requires a balanced set of programs across areas such as venturing, innovation, sustainability, technology, resilience, and finance. Companies are increasingly open to the right sort of government intervention, and working in partnership can help ensure that the SME growth engine remains primed and accelerated, developing the next generation of innovators and entrepreneurs to suit the years ahead.