With guidance from its Vision 2030 strategy, The Kingdom of Saudi Arabia (KSA) aspires to become one of the world’s 15 largest economies. Unlocking the growth potential outside its urban centers will play a vital role in achieving this ambitious objective, alongside other growth drivers. This Viewpoint analyzes the primary success factors that are available to state and non-state actors to realize the full potential of KSA’s regions.

THE TRANSFORMATIVE PUSH OF VISION 2030

KSA is currently undergoing a major socioeconomic transformation as it strives to meet its Vision 2030 objective. Although a variety of growth drivers will be utilized, such as investing in new industries and strengthening the private sector, unlocking the possibilities beyond the country’s established urban centers will play a critical role. Looking to KSA’s regions shows a real opportunity to deliver growth by leveling up regional development.

The potential impact of regional development on KSA’s GDP is vast. Today, annual GDP per capita in established urban centers including Riyadh, Dammam, and Jeddah averages around SAR 107,000 (US $28,500). In contrast, annual GDP per capita is closer to SAR 73,000 (US $19,500) in regional growth centers such as Aseer, Al-Qaseem, and other provinces. Closing the gap with the urban centers’ annual GDP per capita by only 10% would unlock around SAR 27 billion (US $7.2 billion) of annual GDP contribution.

Case studies — Regional development in Brazil & Spain

Many countries recognize regional development as a growth driver. In Brazil, the government implemented its Growth Acceleration Program, or Programa de Aceleração do Crescimento (PAC), in the early 2000s. PAC aimed to develop infrastructure and improve social services in different regions of the country through investments in transport, housing, sanitation, and energy infrastructure. The outcomes boosted living standards, and research conducted by State University of Bahia estimated that PAC increased GDP growth by as much as 40% when compared to projections that excluded the program. Additionally, the Brazilian Ministry of Planning, Budget and Management highlighted PAC’s contribution to new job creation and increase in incomes. The program guaranteed employment to locals, which helped mitigate the impact of the 2008 financial crisis.

Spain’s regions enjoy significant autonomy, which provides an advantageous climate for economic growth. When developing strategies and plans in the Catalonia region, the focus was on sectors where it has comparative advantages, such as tourism and IT. Catalonia has been developing its regional tourism strategy since 2005; today, the sector accounts for around 12% of its GDP. Showing the benefits, since 2005, Catalonia’s GDP has increased by a CAGR of approximately 2.3%, above Spain’s overall growth of 2.1% in the same period. Regional development in Catalonia has had a significant impact on Spain’s national economy, too, given that it accounts for 20.3% of Spain’s total GDP. Examining the details of these two countries’ approaches offers KSA useful insights. Backed by multi-billion-dollar investments, KSA has begun a journey to develop its regions.

With the establishment of over 10 dedicated regional development entities, initiatives have already moved forward and achieved tangible progress, such as the transformation of the AlUla region into a global tourism destination and the plans for the futuristic NEOM community in northwest Saudi Arabia.

FACTORS FOR SUCCESS

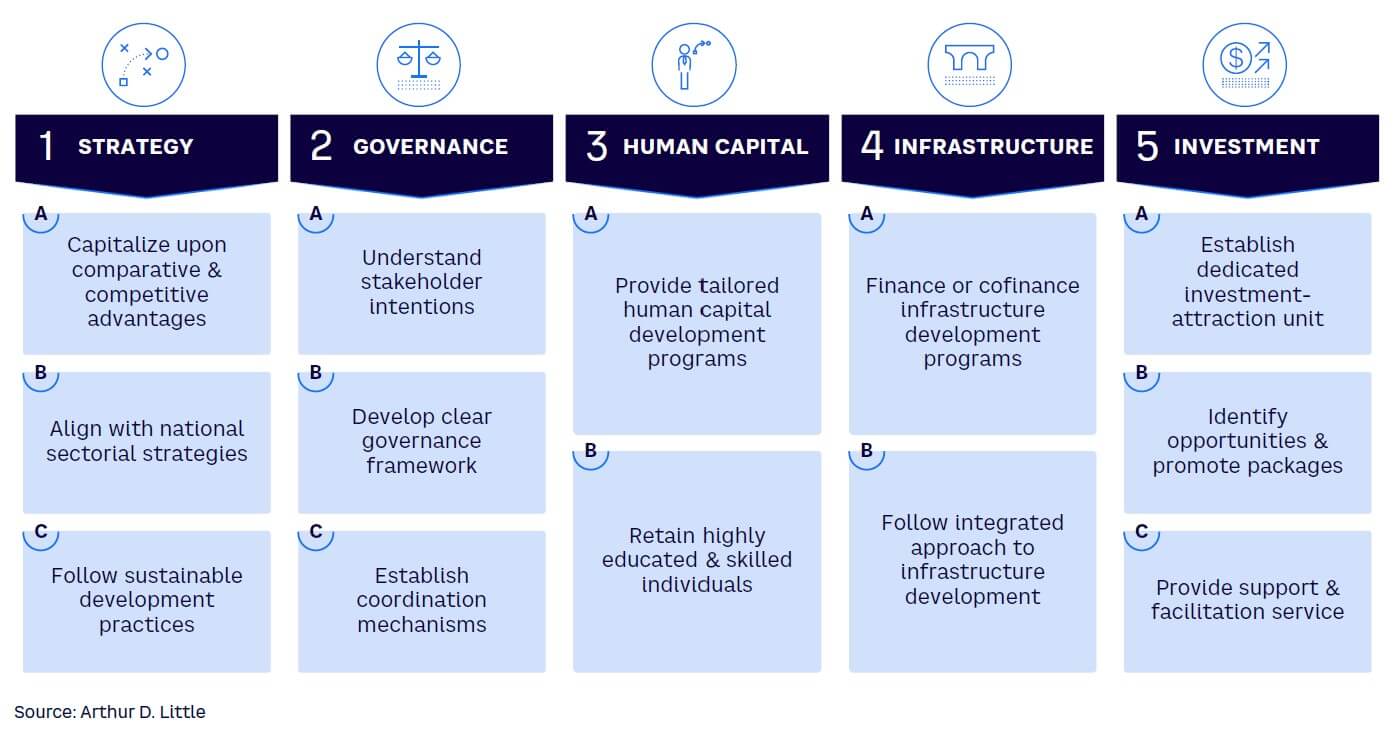

By nature, regional development efforts are multifaceted. Arthur D. Little’s (ADL’s) experience designing and implementing effective programs revealed five specific factors that led to successful outcomes. These factors focus on strategy, governance, human capital, infrastructure, and attracting investment (see Figure 1).

1. Set a visionary strategy

Putting a clear, visionary strategy in place will deliver the necessary focus and enable ongoing, sustainable success. It’s important to tailor the strategy to the region’s comparative and comparable advantages, align it with national priorities, and focus on sustainable development practices. A strong, thoughtful strategy is a crucial element for development and can effectively mobilize stakeholders. Several factors can be considered when formulating a region’s strategy:

-

Capitalize on the region’s comparative and competitive advantages. KSA can leverage its wide range of assets and resources within different regions. Comparative and competitive advantages can be diverse. These include historical sites and natural beauty (e.g., Aseer and AlUla) and religious sites such as Makkah (Mecca) and Madinah (Medina), while provinces like the Northern Borders region possess natural resources and offer an attractive location for logistics.

-

Align with national sectorial strategies. A disjointed approach and the potential for competition among regions could undermine success on the regional and national levels. To avoid these pitfalls, it is important that regional development strategies closely align with both national strategies, such as KSA’s National Tourism Strategy and National Investment Strategy, and with the plans of other regions. Achieving alignment requires regions to begin by studying and analyzing relevant national strategies and gaining input from ministries and other stakeholders.

-

Follow sustainable development practices. Regional strategies have to benefit the local communities and preserve natural assets for generations to come. As KSA embarks on its massive development efforts, it should encourage regions to embed sustainable practices into their strategy to achieve long-term value. KSA has already made commitments to sustainable development, as shown by the example of the recent establishment of the sprawling Imam Faisal bin Turki Royal Reserve, which spans 30,000 square kilometers.

2. Establish clear governance

Regional development programs require buy-in, understanding, and support from a wide range of stakeholders, at both the national and local levels. These entities can include municipalities and dedicated regional development authorities, ministries (e.g., Ministry of Municipal and Rural Affairs and Housing; Ministry of Environment, Water and Agriculture), and infrastructure partners (e.g., Saudi Electricity Company, National Water Company). Best practices for designing the governance process include:

-

Understand stakeholder intentions. Building an in-depth understanding of all key players and their roles in the development of the region is crucial to uncovering synergies and collaborations between them. If there is a dedicated entity for regional development, it can carry out workshops where all relevant stakeholders present their own projects and highlight the support they can provide to others. The Aseer Region Development Authority (ASDA) is a great example for this. ASDA conducts ongoing stakeholder alignment efforts to ensure that the development of Aseer is a joint, coordinated effort.

-

Develop clear governance framework. Because multiple groups are involved and the mandates, roles, and responsibilities of different stakeholders often overlap, a strong governance framework is critical to facilitating successful regional development efforts. The governance framework should include:

-

A clearly defined interaction model that shows interfaces between stakeholders. A visible resource can enable the program to be executed end to end with all entities working together.

-

Signed agreements between stakeholders to ensure their commitment to the program and to delivering assigned projects in the region.

-

-

Establish coordination mechanisms. If there are multiple stakeholders with similar responsibilities, it is important to establish coordination mechanisms. A regional development committee is one potential coordination mechanism. It can be headed and supported by a dedicated entity, if there is one, and should include representatives from each key stakeholder. The committee then orchestrates the planning and implementation of all regional development efforts.

3. Develop regional human capital

Ensuring the availability of well-trained talent is necessary for successful regional development. Without human capital, projects will not deliver economic benefits, and regional populations may potentially feel marginalized and remain underemployed. The World Intellectual Property Organization (WIPO) noted in its Global Innovation Index that KSA invested 7.8% of its GDP in education in 2022. Though KSA has embarked on an impressive upskilling journey, regional availability of well-trained talent remains a main challenge. Overcoming this issue requires measures to:

-

Provide tailored human capital development programs. Regional educational institutes can go beyond delivering the general national curriculum to work with governments, businesses, and industry associations to modify their curricula to meet the needs of priority sectors and industries identified in regional development strategies. This collaboration will support the development of industries with high growth potential by ensuring that the local workforce has the right skills and required knowledge, which will further help attract investment. When it comes to human capital development, AlUla has already achieved impressive results with its approach, which used multiple initiatives to upskill over 5,200 members of its local community in 2021 (against a target of 3,855). The opportunities include scholarship programs, training, and the Hammayah program, which encourages and trains local people to become stewards of the region’s cultural and natural heritage.

-

Retain highly educated and skilled individuals. Rural regions often suffer from the loss of well-educated talent to more developed regions that offer better career opportunities. It is therefore vital to incentivize workers to stay by making the regional environment more appealing. This includes investment in infrastructure and transport and providing access to affordable housing and healthcare. Offering competitive salaries and family-friendly policies, such as flexible work schedules, parental leave, and childcare services, may enhance the appeal for the younger demographic.

4. Develop the region’s infrastructure

Regional infrastructure plays a pivotal role in enabling trade, investment, and social development, thereby promoting economic growth. Although KSA ranks highly globally in terms of infrastructure quality, there are significant variations between major cities and less populated regions where; for example, harsh weather conditions can make it difficult and costly to develop infrastructure networks. To overcome these challenges, success factors to consider include:

-

Finance or cofinance infrastructure development programs. There is considerable potential for further infrastructure development in KSA’s regions, whether through new projects or maintaining or upgrading existing assets. While the majority of required investment will have to be publicly funded, public-private partnerships may offer a solution to avoid the entire burden of investment falling solely on the government, particularly in less developed regions.

-

Follow integrated approach to infrastructure development. Ensuring that different projects work together to create synergies amplifies and maximizes the benefits of new infrastructure. This requires close coordination between stakeholders, built on a holistic, high-level view of all infrastructure project possibilities, combined with an understanding of how they can combine to deliver greater returns together than if implemented in isolation. The benefits of an integrated approach can be seen in linking the expansion of the King Abdulaziz International Airport to Jeddah’s renovation project. The airport was connected to the Haramain High Speed Railway project, which links Jeddah to the holy cities of Mecca and Medina, making it easier for pilgrims to travel to and from the airport and strengthening the airport’s potential as a major transportation hub for other regions.

5. Attract investment from the public & private sectors

KSA aims to raise the contribution of domestic FDI (foreign direct investment) to GDP from 3.8% to 5.7% by 2030. Building an appealing investment environment is crucial to unlocking private sector participation in regional development efforts. Therefore, regional development programs should increase the private sector’s awareness of opportunities and act to remove bottlenecks in the process. These actions can create an attractive environment for investment:

-

Establish dedicated investment-attraction unit. While the Ministry of Investment is spearheading national investment attraction efforts, at the regional level specialized teams play a prominent role in orchestrating the regional investment ecosystem and providing investors with a regional point of contact to showcase and develop opportunities. Establishing these units clarifies the roles of different regional and national stakeholders and provides investors with a 360-degree view of all investment opportunities across the region.

-

Identify opportunities and promote packages. Regional investment opportunities are developed through investment packages, which typically include information about asset location, total land area, total development cost, and internal rate of return. Timing is important for successfully promoting these packages; marketing them too early, before underlying infrastructure is ready, risks dissuading investors over the long term. Promotional tactics include events, private investor dinners, and forums.

-

Provide support and facilitation service. The investment journey can be complex, which means investors require support to overcome any hurdles along the way. Regional development programs should identify any potential issues, resolve those that fall under their remit, and coordinate solutions to overcome future challenges. Services can include supporting investors to obtain government incentives, connecting them to relevant stakeholders, finding opportunities, and conducting site visits, all of which help maintain an investor’s interest.

Multiple entities within KSA, such as the Strategic Office for the Development of Al-Baha region, are establishing dedicated investment-attraction units, as have agencies in other countries like RAKTDA in the UAE and Italy’s Invest in Tuscany. For example, RAKTDA’s investment team attracted hotel and casino group Wynn Resorts to Ras Al Khaimah, the biggest FDI in the emirate. This milestone in turn increased interest from other investors.

Besides attracting private investments, through the Public Investment Fund (PIF), The Kingdom can count on an impressive growth catalyst. Since its inception, PIF has been among the key catalysts of KSA’s regional development efforts. Mainly through its portfolio holdings, PIF channels strategic capital into 13 pivotal sectors with high potential, thereby bolstering Saudi Arabia’s regional growth and economic diversification. In the entertainment, leisure, and sports sector, for example, Saudi Entertainment Ventures (SEVEN), a wholly owned subsidiary of PIF, is investing SAR 50 billion (US $13.3 billion) in developing 21 entertainment destinations across 14 cities in The Kingdom.

One of its landmarks is situated in the Al Madinah region, where SEVEN plans to establish six entertainment zones. These entertainment oases not only enrich the cultural and recreational landscape of each region but create hundreds of direct and indirect jobs for the local community. Overall, SEVEN has signed eight global partnerships with companies such as Warner Bros. Discovery and Mattel and is expecting more than 90 million visitors by 2030.

Conclusion

UNLOCKING REGIONAL GROWTH THROUGH BEST PRACTICES

To meet the goal of becoming a top 15 global economy, one of KSA’s promising growth engines is its regions. Unlocking the regions’ socioeconomic potential requires a holistic development approach. Elements to consider include the following five main dimensions:

-

Strategy. Follow a common national strategic direction, leverage the region’s comparative and competitive advantages, and follow sustainable development principles.

-

Governance. Gain buy-in from all stakeholders, and develop a clear governance framework and coordination mechanisms.

-

Human capital. Ensure the availability of talent with relevant skills through training and retention programs.

-

Infrastructure. Develop the right infrastructure through an integrated approach, and explore direct finance or cofinancing models.

-

Investment. Attract investment with a centralized, dedicated unit, promote opportunities, and provide full support to investors.