11 min read • Oil, Gas & Other Natural Resources, Strategy

Weathering the perfect storm

COVID-19 and the future of the oil & gas industry

Executive Summary

The oil price war has combined with the COVID-19 crisis to create a perfect storm for the petroleum industry, with oversupply and low prices expected to last for years. Arthur D. Little believes the crisis will have a major impact on the oil industry: decarbonization trends will accelerate and alter the industry’s approach to climate change. Immediate and lasting impacts on the industry are likely to drive a structural transformation, leaving fewer players after the crisis. There is a chance that the market will get “back to normal” sooner than expected – however, it is more likely that the oil industry will continue to lose its appeal to investors.

1

Volatility of the oil & gas industry over the past decade

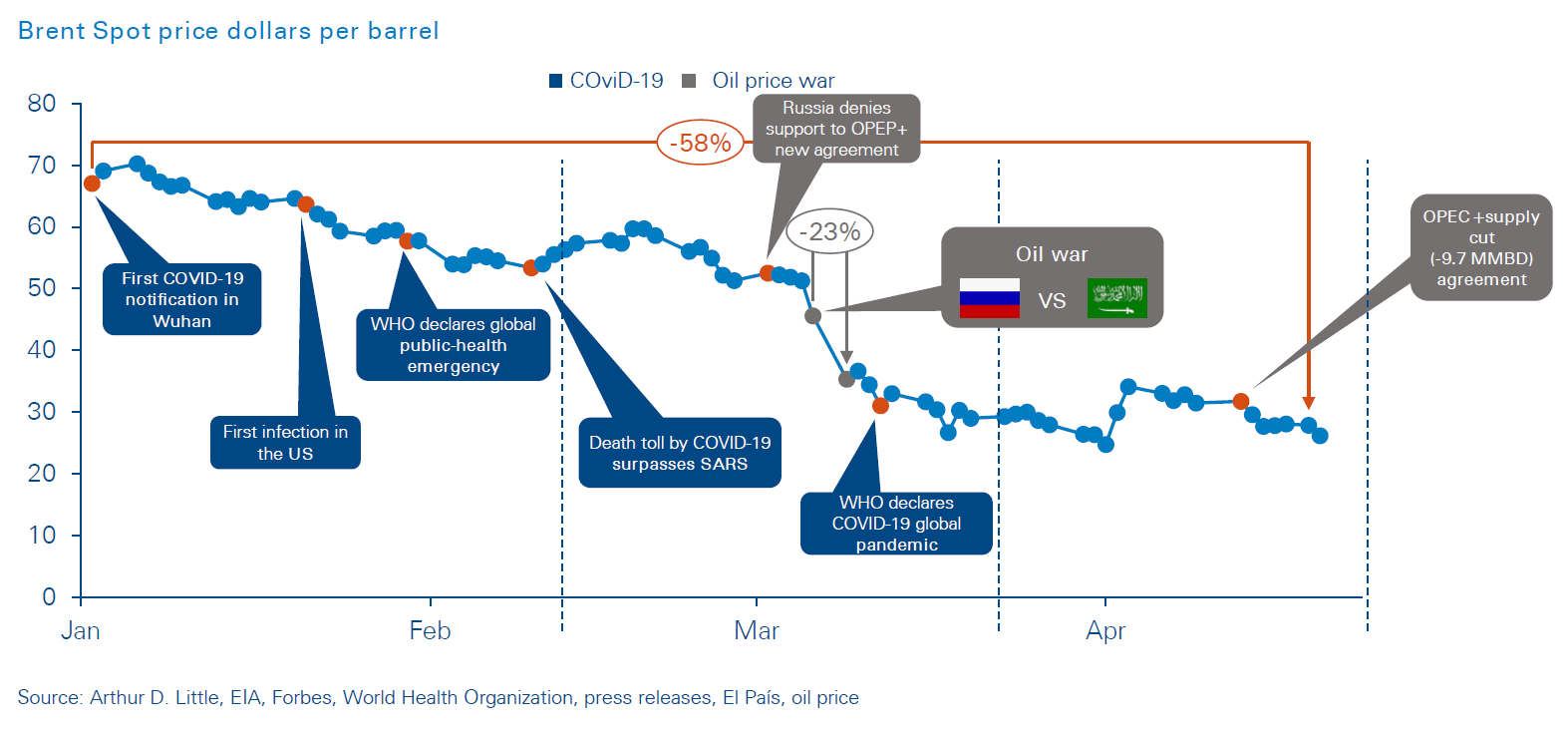

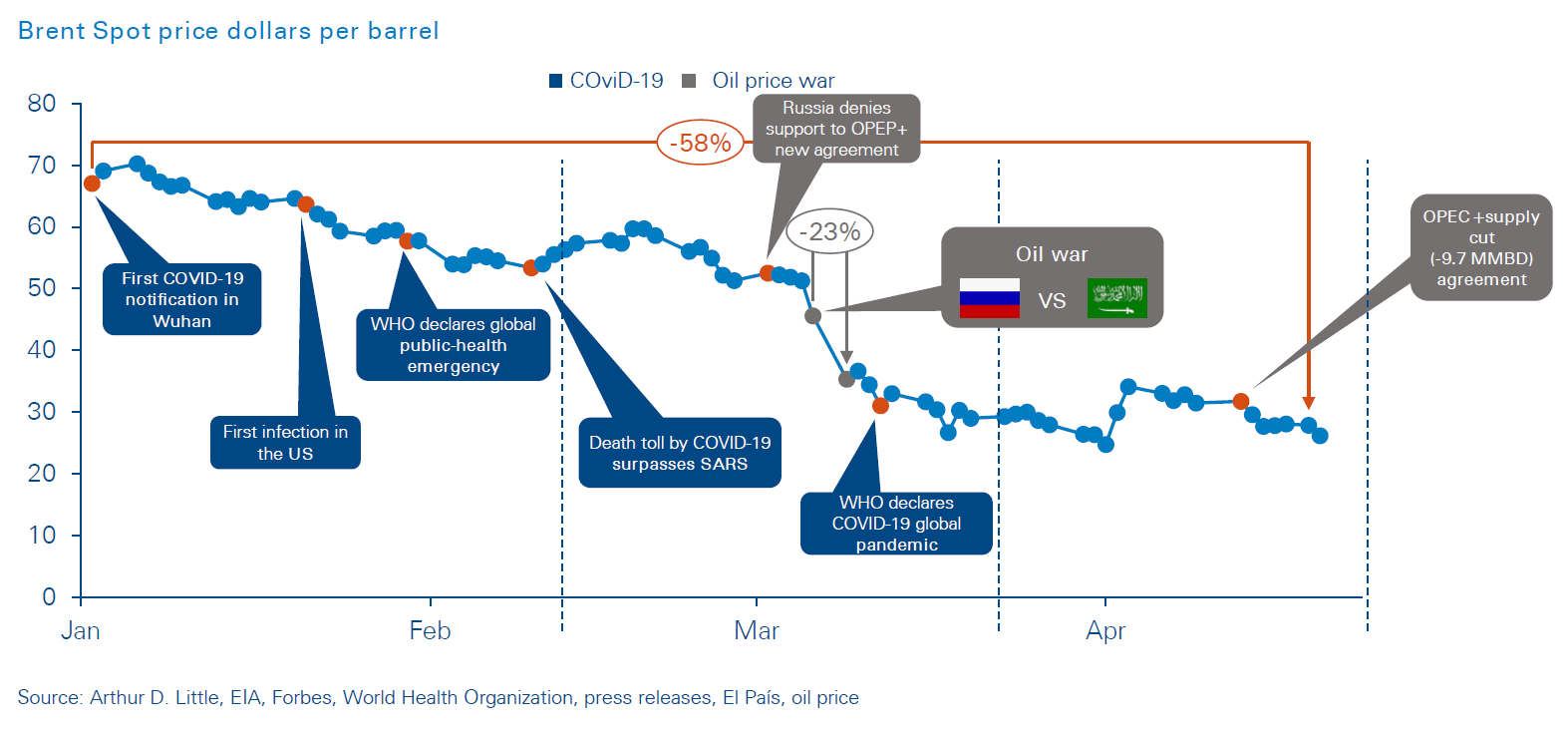

The global lockdown in response to the COVID-19 pandemic has pushed an already-volatile oil & gas market into crisis. On the one hand, the oil & gas industry is already in a major period of transition, with mounting pressure for society to be less reliant on oil and gas in the face of climate change, which has led some companies to diversify into the renewable energy sector. On the other hand, competition for market share within the industry remains fierce, as evidenced by the recent price war between OPEC and Russia.

However, the current situation created by COVID-19 is unprecedented, with the pandemic causing a sudden and dramatic reduction in global energy demand – one which is likely to continue for many months to come, if not longer. This has severely exacerbated the existing problem of oversupply and low prices.

Prior to the COVID-19 lockdown:

- Over the past few years, and following a period of high crude-oil prices, the US has become the world’s top oil producer, a consequence of new extraction technologies, with particular emphasis on shale hydrocarbons.

- After the first signs of demand drop in Asia and before occidental lockdown, Saudi Arabia/OPEC entered a price war with Russia, taking advantage of its own relatively low production costs and high levels of production capacity and reserves to ramp up supply. This pushed crude prices down to levels under $35/bbl.

- For the US and other players with much higher production costs, including those reliant on unconventional methods of oil extraction (such as shale and oil-sands), it is already difficult to operate profitably at this price level.

- As well as challenging the US market share, this poses an existential threat to some independent oil and gas companies, with progressive cancellation of projects and operational shutdown of high-cost oil production.

- The global refining sector is also transforming, with the addition of large-scale, high-complexity facilities in the Middle East and Asia displacing smaller, low-conversion plants, which are no longer able to cover their cash operating costs and annual CAPEX requirements.

- Natural gas prices have also dropped significantly, due to a decrease in demand and excess LNG capacity, with major CAPEX cuts and deferral of multi-billion-dollar projects previously announced.

- In parallel, agreed climate change policies demand that the world reduce its CO2 emissions – notably from hydrocarbon based sources – and embrace greener energy sources, as well as accelerate a sharp transition to a much lower-carbon economy by 2030, at the latest.

- As such, the industry anticipates that peak oil demand will occur within 15 years’ time, with some major players in oil and gas already diversifying into renewable energy sectors.

The COVID-19 effect:

- The global lockdown necessitated by the COVID-19 pandemic has exacerbated these trends, deepening the crisis of oversupply, exaggerating the drop in crude-oil prices and forcing further shutdowns.

- Demand forecasts change every week, but with a drop of over 30 percent in flights and light-vehicle transit to less than half in many regions, average global reductions of more than 10MBD could be expected for 2020.

- The economic slowdown caused by the measures taken to combat COVID-19 is likely to trigger a global recession, which, at the very least, will have a negative impact on oil and gas demand for many months to come, if not longer.

- In the short term, this is likely to drive a number of small and highly leveraged companies to the wall, as they will be unable to operate at this price point because their margins will be eroded – this will also be the case for companies focused solely on high-cost production assets.

- Despite having entered into this price war, the national budgets of the OPEC countries and Russia will be severely impacted by low oil prices, particularly if they continue for more than a few months.

- Depending on the nature of the post-COVID-19 recovery period, peak oil demand may occur sooner than originally predicted.

2

Possible scenarios for the oil & gas industry in a post COVID-19 world

With the oil & gas industry currently locked into a negative cycle of oversupply and price drops, the economic downturn created by the COVID-19 crisis will deal a death blow to a significant number of companies. There will be an economic recovery at some point in the future, but it is highly unlikely that the overall global economy will return to pre-COVID-19 “business as usual”, at least not soon. Instead, the oil & gas sector will be forced to confront a substantial reduction in demand due to both lower economic activity and increased pressures to embrace greener, lower-fossil-fuel energy sources.

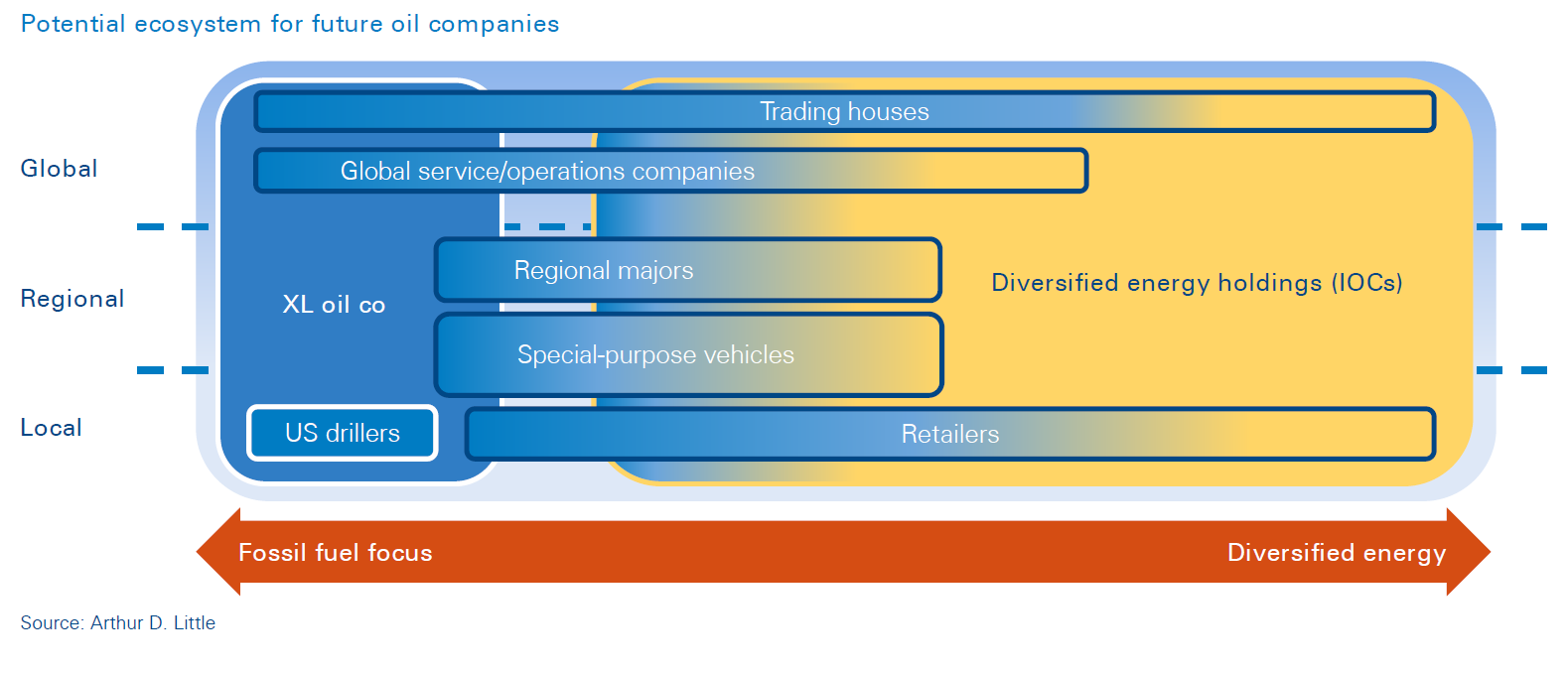

It seems clear that the impact of COVID-19 will push the oil & gas industry even harder towards an earlier structural transformation, which will result in fewer and more agile players. Even in the best-possible scenario, the petroleum industry will continue to lose appeal to investors and shareholders, as has progressively been the case for the past 10 years.

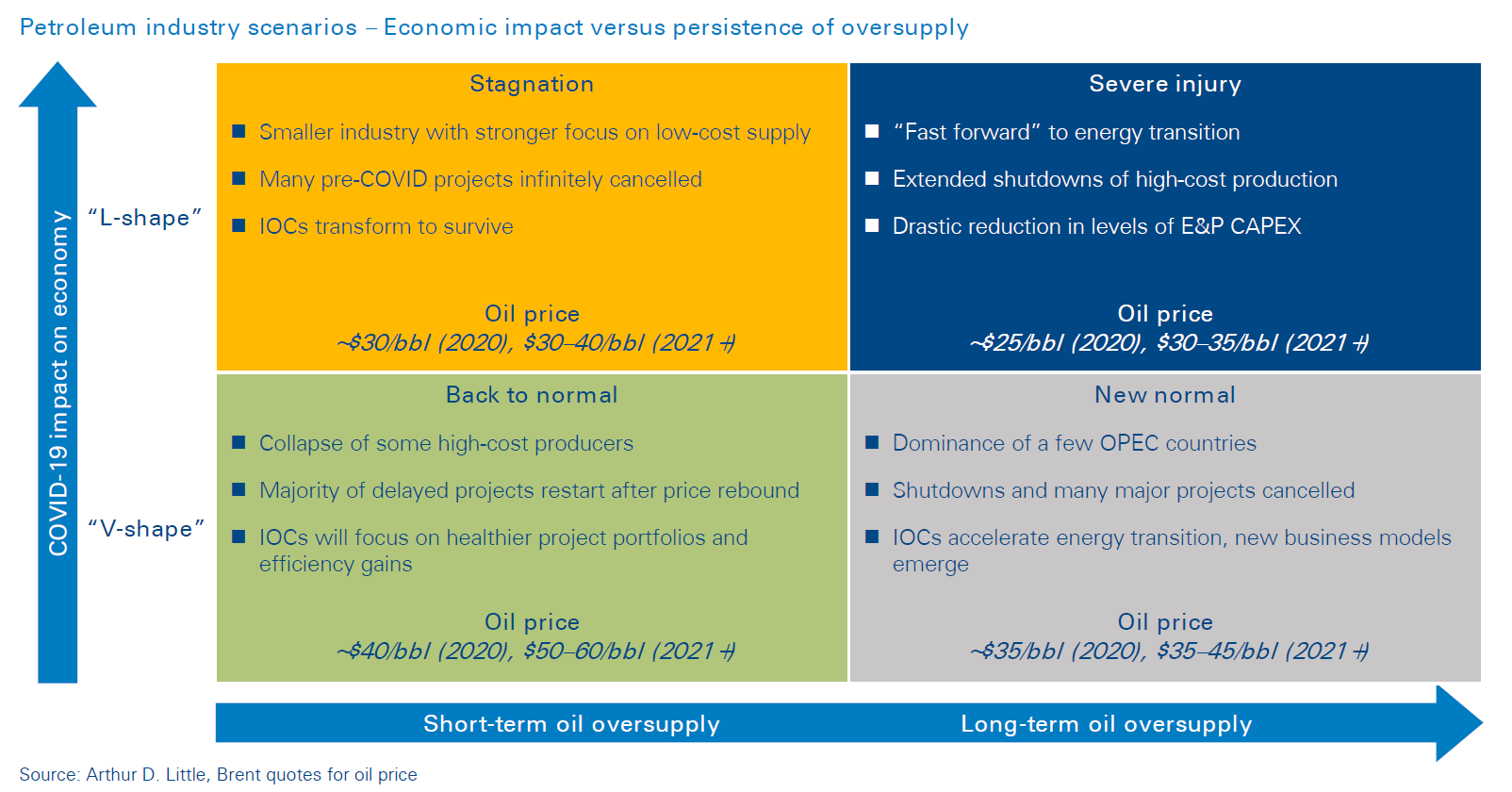

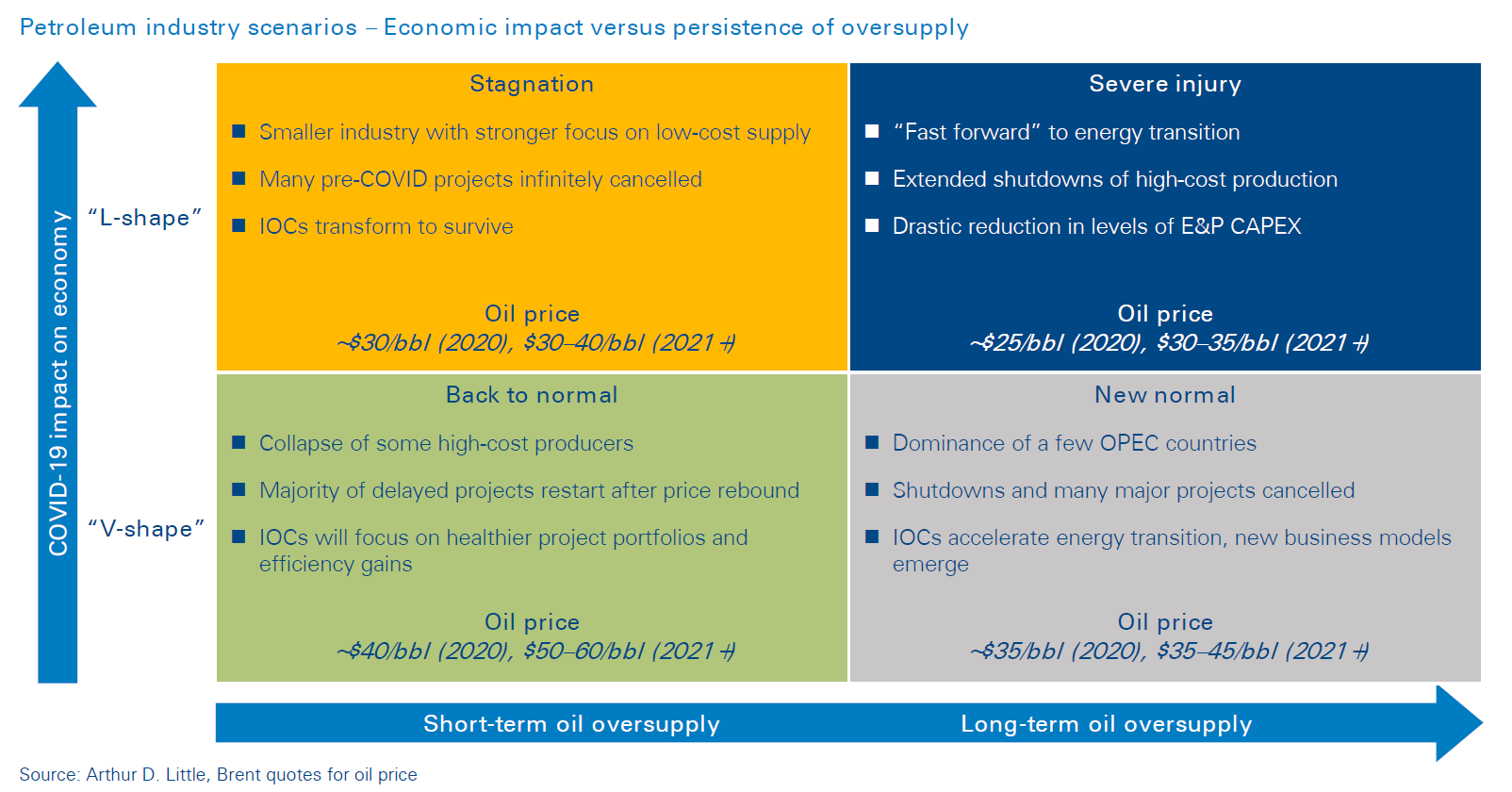

The likelihood of the scenario “Back to Normal” is relatively low, since it strongly depends on a “V-shape” bounce in the economy, as well as the main oil producers deciding – and being able – to cut production significantly to reduce oversupply.

The scenario of “Stagnation” seems more likely, in which economy and demand impact is “L-shaped”, and supply adjusts over time to support prices in the $30–40Bbl range.

If both the economy and demand bounce after a few months, OPEC and other main producing countries will probably lose the sense of urgency to support prices by cutting supply. In this case the industry will face a “New Normal” scenario, with OPEC once again assuming pre-eminent leadership within the market and oil prices remaining relatively low.

The worst scenario for the industry is “Severe Injury”, with both slow economic/demand recovery and persistence of oversupply. We believe this is less probable than the “Stagnation” and “New Normal” scenarios since a lasting demand drop would motivate OPEC and other producers to adjust supply to support prices after a period of time. The level of “injury” to both individual players and the petroleum industry as a whole will depend on whether OPEC commits to supporting prices or leaves the market to make the economic adjustment to balance supply and demand.

International oil company (IOC) reserves have an average production life of just 10 years, and with exploration for new reserves significantly reduced, their share of production (and market power) will progressively shrink. OPEC has over 50 years’ worth of oil reserves, and combined with generally low production costs, will ultimately displace much IOC market access. However, OPEC countries cannot afford to keep oil prices this low indefinitely: petroleum-based economies will need prices to rise in order to support national budgets and spending programs, or they will risk political instability.

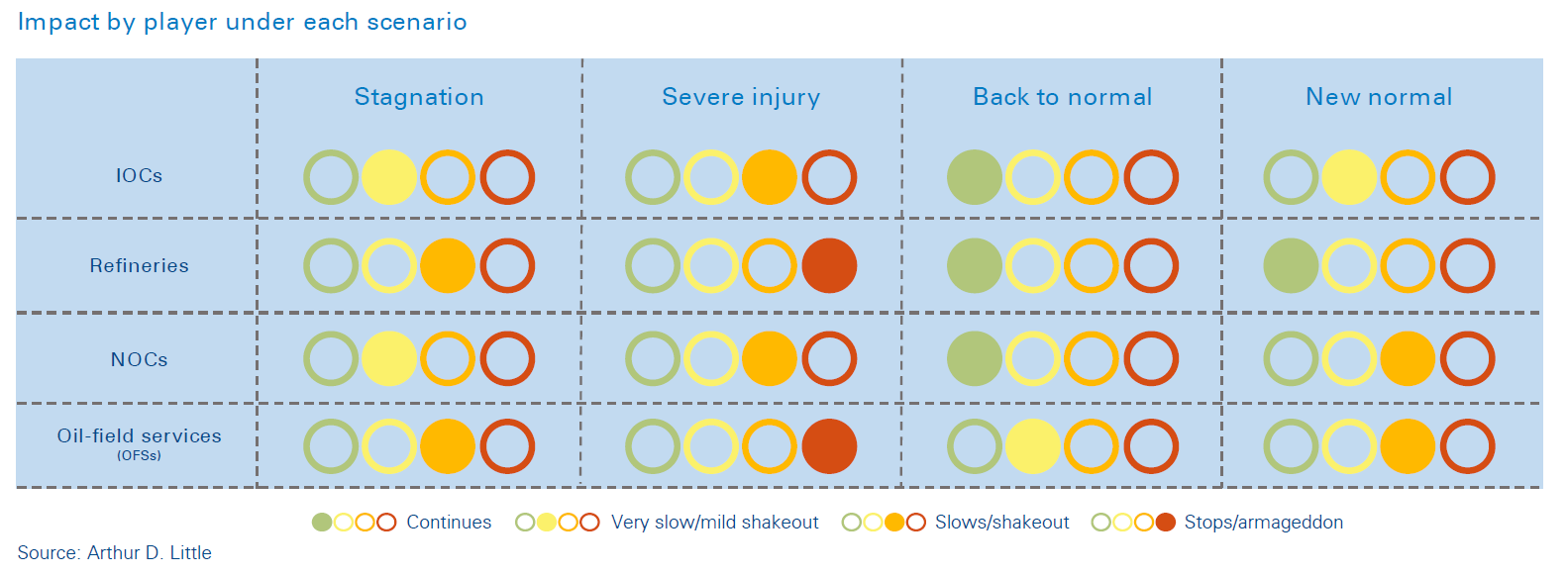

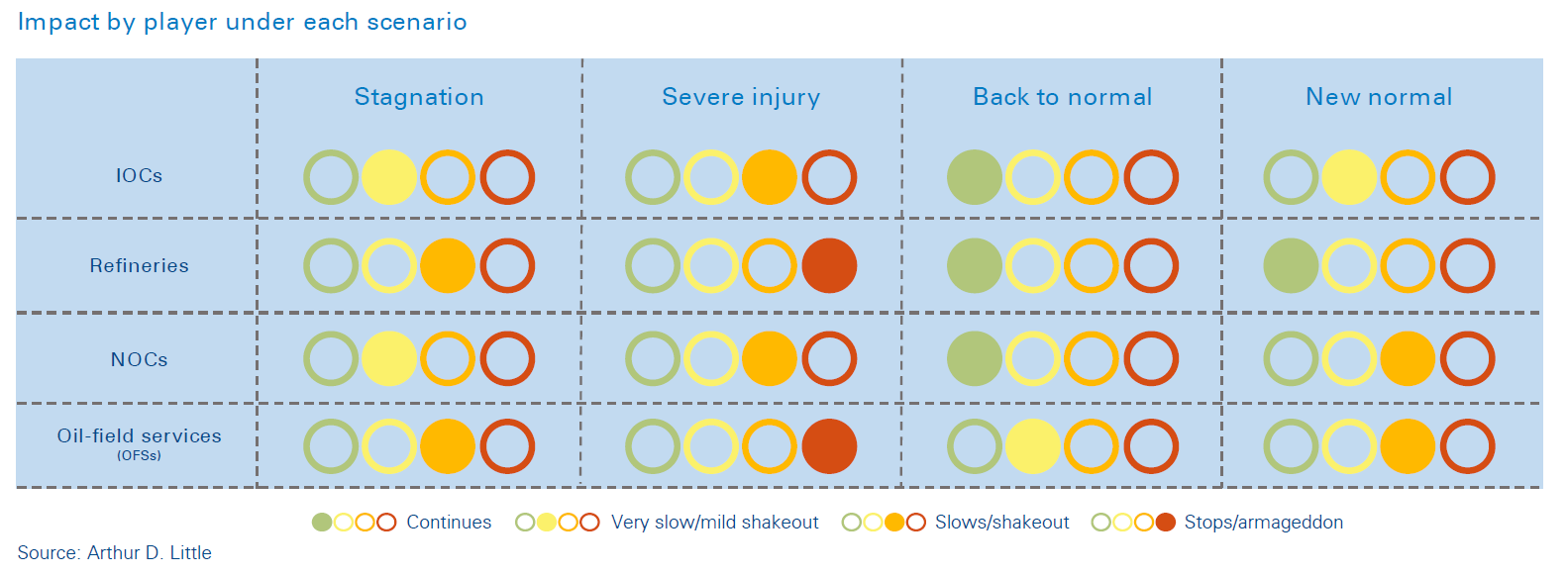

Looking more closely at how the business model of each industry sector will be affected, we predict the following:

- International oil companies will find it increasingly difficult to grow organically, although there may be more M&A opportunities as smaller players struggle to compete. It is also likely that certain high-cost and stranded assets will be written off. However, strategies designed to decarbonize the asset portfolio, and those that favor strengthening renewables and natural gas positions will be much more appealing to stakeholders .

- National oil companies (NOCs) with large, low-cost reserves will push to monetize their value, perhaps over a shorter time period than previously planned – however, NOCs with higher domestic cost structures are likely to shrink. Due to reduced oil and gas revenue, lower national budgets in most of these countries will intensify debate about reinvestment priorities versus pressing social needs, and some governments may use this crisis to spur support for or compel NOCs to adopt energy transition programs.

- Refining players will face low margins for years to come due to structural overcapacity and heterogenous demand evolution by region. In light of this, conversion and quality capital projects will need to be reviewed, while some small-scale assets will not be able to cover their annual maintenance investment needs.

- Oil-field services players face low utilization of assets and staff because of project cancellations and production shutdowns.

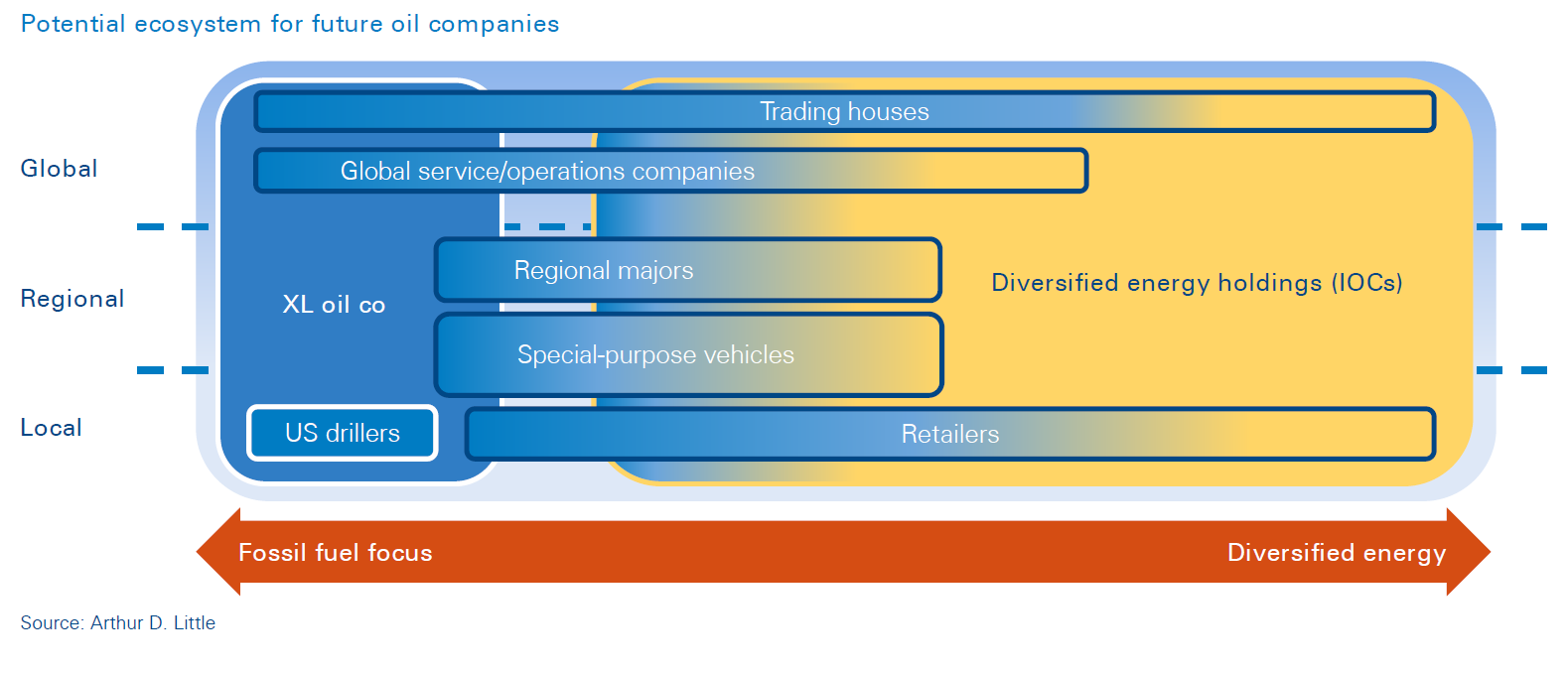

Although a significant number of players in the oil & gas sector may lose market share, there are nevertheless opportunities for companies willing and able to transform their business models. In the short term, this may involve consolidation via acquisition of high-quality assets from failed or collapsing companies. However, with traditional oil margins now fatally eroded for many companies, other energy investments should become more attractive.

Oil and gas are not only increasingly unprofitable to find, produce and industrialize, but also finite resources. Climate change is driving a move to a greener, cleaner-energy economy, with government policies driving increased renewables penetration across the globe. As renewable energy use has become more widespread, infrastructure costs have fallen accordingly, encouraged by financial incentives connected with meeting “green targets”. Oil & gas projects now have lower returns and higher levels of uncertainty than ever before; in contrast, renewables continue to have lower technical risks, and also now have potentially lower commercial risk and relatively higher rates of return.

However, there is a possible flipside to this new energy landscape. While the climate for renewables has never been more favorable, fossil fuels may nevertheless remain more competitive in the short term if oil prices stay low. Although both businesses and consumers are keen to use greener energy sources, they may be swayed to stick with oil and/or gas if it becomes (and remains) significantly cheaper. Similarly, governments may prioritize economy recovery over green subsidies and continue to invest in oil- and gas-fuelled power while there is a plentiful, competitively priced supply. The US and Canada will certainly support their oil & gas sectors and try to prevent their collapse.

3

Accelerating decarbonization trends after COVID-19

The COVID-19 lockdown has thrown the issues facing the oil & gas industry into stark relief. However, while the battle over supply, price and market share could be viewed as a crisis of its own making, the industry ultimately understands that, whatever scenario turns out to be correct, peak demand for oil is going to happen soon – due to COVID-19, perhaps sooner than expected. Companies that have already been far-sighted enough to invest in low-cost assets and the energy transition are in the best position to capitalize on this situation, in which a prolonged run on the price of crude looks set to make the traditional oil & gas model much riskier and less commercially attractive than ever before for most players. And with oil & gas much less of a sure bet, investors will be increasingly persuaded to put their money into the renewables sector instead.

Arthur D. Little believes a post-COVID-19 world will see the oil & gas industry accelerate its transition to a cleaner and more diversified portfolio of energy sources, products and service offerings, promoting higher energy efficiency and decarbonization. COVID-19 has created a perfect storm that, along with the ongoing and urgent need to reduce CO2 emissions in order to fight climate change, should persuade the industry to embrace transformation in faster and smarter ways. For many players, future survival and success depend not only on greater focus on renewable energy, but also turning the industry into a modern, energy-efficient business sector matched by a zeal for intelligent automation and digitalization of working processes.

Conclusions

The COVID-19 lockdown requires an immediate response from all segments of the industry

All oil and gas industry segments – from field operations and services to refining, transport and distribution – have been affected by the COVID-19 slowdown. As already noted, some companies will not survive because their negative margins will inevitably lead to operational shutdowns and financial distress.

In the short term, companies need to focus on two core areas to gain the best-possible chance to weather the COVID-19 storm:

- Asset and CAPEX portfolio review and control Companies need to critically review their existing capital budgets and asset portfolios, and where possible, cut capital expenditure. This will mean cancellation of planned quality/ conversion upgrades, construction of new facilities, and proposed greenfield projects. Costly exploration projects will also need to be reined in, particularly high-risk ones, despite the inevitable knock-on effect as reserves become depleted. As certain asset classes become less profitable, there will also be a need for restructuring: low-cost, short-payback assets are to be prioritized, and high-cost, long-payback assets must be suspended or cancelled.

- Ongoing efficiency optimization This crisis should bring ongoing efficiency initiatives into even sharper focus, with all elements of the supply chain scrutinized and reassessed in pursuit of potential savings. Now is the time to renegotiate contracts with suppliers and partners or cancel them altogether. Similarly, companies should critically examine all aspects of their operations, with manpower kept at minimum levels for the foreseeable future. However, with such processes having been ongoing for most companies since the financial crash of 2008 and the price crash of 2014, significant cost-efficiencies and savings may not be available.

In the medium term, portfolio management and ongoing efficiency optimization are necessary but not sufficient on their own: only true transformation of their business models will ensure long-term viability for most industry players.

For almost every player, it is necessary to rethink objectives, geographic and business scope, and route to market. For companies focused solely on high-cost production assets, such as shale, tar sands and deep water, this may be a major challenge, and a significant proportion of these companies are likely to progressively shrink, collapse or be acquired. For companies already beginning to diversify their energy sources, now is the time to push harder in this direction and invest further in energy efficiency, decarbonization and renewables as such projects become more attractive because of lower technical, commercial and financial risks. There is also likely to be considerable consolidation across the sector as industry portfolios designed for one price point struggle to adjust to life in a new, much harsher environment.

DOWNLOAD THE FULL REPORT

11 min read • Oil, Gas & Other Natural Resources, Strategy

Weathering the perfect storm

COVID-19 and the future of the oil & gas industry

DATE

Executive Summary

The oil price war has combined with the COVID-19 crisis to create a perfect storm for the petroleum industry, with oversupply and low prices expected to last for years. Arthur D. Little believes the crisis will have a major impact on the oil industry: decarbonization trends will accelerate and alter the industry’s approach to climate change. Immediate and lasting impacts on the industry are likely to drive a structural transformation, leaving fewer players after the crisis. There is a chance that the market will get “back to normal” sooner than expected – however, it is more likely that the oil industry will continue to lose its appeal to investors.

1

Volatility of the oil & gas industry over the past decade

The global lockdown in response to the COVID-19 pandemic has pushed an already-volatile oil & gas market into crisis. On the one hand, the oil & gas industry is already in a major period of transition, with mounting pressure for society to be less reliant on oil and gas in the face of climate change, which has led some companies to diversify into the renewable energy sector. On the other hand, competition for market share within the industry remains fierce, as evidenced by the recent price war between OPEC and Russia.

However, the current situation created by COVID-19 is unprecedented, with the pandemic causing a sudden and dramatic reduction in global energy demand – one which is likely to continue for many months to come, if not longer. This has severely exacerbated the existing problem of oversupply and low prices.

Prior to the COVID-19 lockdown:

- Over the past few years, and following a period of high crude-oil prices, the US has become the world’s top oil producer, a consequence of new extraction technologies, with particular emphasis on shale hydrocarbons.

- After the first signs of demand drop in Asia and before occidental lockdown, Saudi Arabia/OPEC entered a price war with Russia, taking advantage of its own relatively low production costs and high levels of production capacity and reserves to ramp up supply. This pushed crude prices down to levels under $35/bbl.

- For the US and other players with much higher production costs, including those reliant on unconventional methods of oil extraction (such as shale and oil-sands), it is already difficult to operate profitably at this price level.

- As well as challenging the US market share, this poses an existential threat to some independent oil and gas companies, with progressive cancellation of projects and operational shutdown of high-cost oil production.

- The global refining sector is also transforming, with the addition of large-scale, high-complexity facilities in the Middle East and Asia displacing smaller, low-conversion plants, which are no longer able to cover their cash operating costs and annual CAPEX requirements.

- Natural gas prices have also dropped significantly, due to a decrease in demand and excess LNG capacity, with major CAPEX cuts and deferral of multi-billion-dollar projects previously announced.

- In parallel, agreed climate change policies demand that the world reduce its CO2 emissions – notably from hydrocarbon based sources – and embrace greener energy sources, as well as accelerate a sharp transition to a much lower-carbon economy by 2030, at the latest.

- As such, the industry anticipates that peak oil demand will occur within 15 years’ time, with some major players in oil and gas already diversifying into renewable energy sectors.

The COVID-19 effect:

- The global lockdown necessitated by the COVID-19 pandemic has exacerbated these trends, deepening the crisis of oversupply, exaggerating the drop in crude-oil prices and forcing further shutdowns.

- Demand forecasts change every week, but with a drop of over 30 percent in flights and light-vehicle transit to less than half in many regions, average global reductions of more than 10MBD could be expected for 2020.

- The economic slowdown caused by the measures taken to combat COVID-19 is likely to trigger a global recession, which, at the very least, will have a negative impact on oil and gas demand for many months to come, if not longer.

- In the short term, this is likely to drive a number of small and highly leveraged companies to the wall, as they will be unable to operate at this price point because their margins will be eroded – this will also be the case for companies focused solely on high-cost production assets.

- Despite having entered into this price war, the national budgets of the OPEC countries and Russia will be severely impacted by low oil prices, particularly if they continue for more than a few months.

- Depending on the nature of the post-COVID-19 recovery period, peak oil demand may occur sooner than originally predicted.

2

Possible scenarios for the oil & gas industry in a post COVID-19 world

With the oil & gas industry currently locked into a negative cycle of oversupply and price drops, the economic downturn created by the COVID-19 crisis will deal a death blow to a significant number of companies. There will be an economic recovery at some point in the future, but it is highly unlikely that the overall global economy will return to pre-COVID-19 “business as usual”, at least not soon. Instead, the oil & gas sector will be forced to confront a substantial reduction in demand due to both lower economic activity and increased pressures to embrace greener, lower-fossil-fuel energy sources.

It seems clear that the impact of COVID-19 will push the oil & gas industry even harder towards an earlier structural transformation, which will result in fewer and more agile players. Even in the best-possible scenario, the petroleum industry will continue to lose appeal to investors and shareholders, as has progressively been the case for the past 10 years.

The likelihood of the scenario “Back to Normal” is relatively low, since it strongly depends on a “V-shape” bounce in the economy, as well as the main oil producers deciding – and being able – to cut production significantly to reduce oversupply.

The scenario of “Stagnation” seems more likely, in which economy and demand impact is “L-shaped”, and supply adjusts over time to support prices in the $30–40Bbl range.

If both the economy and demand bounce after a few months, OPEC and other main producing countries will probably lose the sense of urgency to support prices by cutting supply. In this case the industry will face a “New Normal” scenario, with OPEC once again assuming pre-eminent leadership within the market and oil prices remaining relatively low.

The worst scenario for the industry is “Severe Injury”, with both slow economic/demand recovery and persistence of oversupply. We believe this is less probable than the “Stagnation” and “New Normal” scenarios since a lasting demand drop would motivate OPEC and other producers to adjust supply to support prices after a period of time. The level of “injury” to both individual players and the petroleum industry as a whole will depend on whether OPEC commits to supporting prices or leaves the market to make the economic adjustment to balance supply and demand.

International oil company (IOC) reserves have an average production life of just 10 years, and with exploration for new reserves significantly reduced, their share of production (and market power) will progressively shrink. OPEC has over 50 years’ worth of oil reserves, and combined with generally low production costs, will ultimately displace much IOC market access. However, OPEC countries cannot afford to keep oil prices this low indefinitely: petroleum-based economies will need prices to rise in order to support national budgets and spending programs, or they will risk political instability.

Looking more closely at how the business model of each industry sector will be affected, we predict the following:

- International oil companies will find it increasingly difficult to grow organically, although there may be more M&A opportunities as smaller players struggle to compete. It is also likely that certain high-cost and stranded assets will be written off. However, strategies designed to decarbonize the asset portfolio, and those that favor strengthening renewables and natural gas positions will be much more appealing to stakeholders .

- National oil companies (NOCs) with large, low-cost reserves will push to monetize their value, perhaps over a shorter time period than previously planned – however, NOCs with higher domestic cost structures are likely to shrink. Due to reduced oil and gas revenue, lower national budgets in most of these countries will intensify debate about reinvestment priorities versus pressing social needs, and some governments may use this crisis to spur support for or compel NOCs to adopt energy transition programs.

- Refining players will face low margins for years to come due to structural overcapacity and heterogenous demand evolution by region. In light of this, conversion and quality capital projects will need to be reviewed, while some small-scale assets will not be able to cover their annual maintenance investment needs.

- Oil-field services players face low utilization of assets and staff because of project cancellations and production shutdowns.

Although a significant number of players in the oil & gas sector may lose market share, there are nevertheless opportunities for companies willing and able to transform their business models. In the short term, this may involve consolidation via acquisition of high-quality assets from failed or collapsing companies. However, with traditional oil margins now fatally eroded for many companies, other energy investments should become more attractive.

Oil and gas are not only increasingly unprofitable to find, produce and industrialize, but also finite resources. Climate change is driving a move to a greener, cleaner-energy economy, with government policies driving increased renewables penetration across the globe. As renewable energy use has become more widespread, infrastructure costs have fallen accordingly, encouraged by financial incentives connected with meeting “green targets”. Oil & gas projects now have lower returns and higher levels of uncertainty than ever before; in contrast, renewables continue to have lower technical risks, and also now have potentially lower commercial risk and relatively higher rates of return.

However, there is a possible flipside to this new energy landscape. While the climate for renewables has never been more favorable, fossil fuels may nevertheless remain more competitive in the short term if oil prices stay low. Although both businesses and consumers are keen to use greener energy sources, they may be swayed to stick with oil and/or gas if it becomes (and remains) significantly cheaper. Similarly, governments may prioritize economy recovery over green subsidies and continue to invest in oil- and gas-fuelled power while there is a plentiful, competitively priced supply. The US and Canada will certainly support their oil & gas sectors and try to prevent their collapse.

3

Accelerating decarbonization trends after COVID-19

The COVID-19 lockdown has thrown the issues facing the oil & gas industry into stark relief. However, while the battle over supply, price and market share could be viewed as a crisis of its own making, the industry ultimately understands that, whatever scenario turns out to be correct, peak demand for oil is going to happen soon – due to COVID-19, perhaps sooner than expected. Companies that have already been far-sighted enough to invest in low-cost assets and the energy transition are in the best position to capitalize on this situation, in which a prolonged run on the price of crude looks set to make the traditional oil & gas model much riskier and less commercially attractive than ever before for most players. And with oil & gas much less of a sure bet, investors will be increasingly persuaded to put their money into the renewables sector instead.

Arthur D. Little believes a post-COVID-19 world will see the oil & gas industry accelerate its transition to a cleaner and more diversified portfolio of energy sources, products and service offerings, promoting higher energy efficiency and decarbonization. COVID-19 has created a perfect storm that, along with the ongoing and urgent need to reduce CO2 emissions in order to fight climate change, should persuade the industry to embrace transformation in faster and smarter ways. For many players, future survival and success depend not only on greater focus on renewable energy, but also turning the industry into a modern, energy-efficient business sector matched by a zeal for intelligent automation and digitalization of working processes.

Conclusions

The COVID-19 lockdown requires an immediate response from all segments of the industry

All oil and gas industry segments – from field operations and services to refining, transport and distribution – have been affected by the COVID-19 slowdown. As already noted, some companies will not survive because their negative margins will inevitably lead to operational shutdowns and financial distress.

In the short term, companies need to focus on two core areas to gain the best-possible chance to weather the COVID-19 storm:

- Asset and CAPEX portfolio review and control Companies need to critically review their existing capital budgets and asset portfolios, and where possible, cut capital expenditure. This will mean cancellation of planned quality/ conversion upgrades, construction of new facilities, and proposed greenfield projects. Costly exploration projects will also need to be reined in, particularly high-risk ones, despite the inevitable knock-on effect as reserves become depleted. As certain asset classes become less profitable, there will also be a need for restructuring: low-cost, short-payback assets are to be prioritized, and high-cost, long-payback assets must be suspended or cancelled.

- Ongoing efficiency optimization This crisis should bring ongoing efficiency initiatives into even sharper focus, with all elements of the supply chain scrutinized and reassessed in pursuit of potential savings. Now is the time to renegotiate contracts with suppliers and partners or cancel them altogether. Similarly, companies should critically examine all aspects of their operations, with manpower kept at minimum levels for the foreseeable future. However, with such processes having been ongoing for most companies since the financial crash of 2008 and the price crash of 2014, significant cost-efficiencies and savings may not be available.

In the medium term, portfolio management and ongoing efficiency optimization are necessary but not sufficient on their own: only true transformation of their business models will ensure long-term viability for most industry players.

For almost every player, it is necessary to rethink objectives, geographic and business scope, and route to market. For companies focused solely on high-cost production assets, such as shale, tar sands and deep water, this may be a major challenge, and a significant proportion of these companies are likely to progressively shrink, collapse or be acquired. For companies already beginning to diversify their energy sources, now is the time to push harder in this direction and invest further in energy efficiency, decarbonization and renewables as such projects become more attractive because of lower technical, commercial and financial risks. There is also likely to be considerable consolidation across the sector as industry portfolios designed for one price point struggle to adjust to life in a new, much harsher environment.

DOWNLOAD THE FULL REPORT