35 min read • Automotive

Chinese electric vehicles: Drag or driver for global markets?

Factual discussion & recommendations based on a global consumer survey

Foreword

China has been a growth driver for Western OEMs for the last two decades, as it has taken advantage of its market size and unbounded desire for Western cars through joint ventures (JVs) with local producers. However, the first signs of an inflection are now visible. A government program initiated a decade ago to promote China’s domestic automotive industry and electrification led to the emergence of new electric vehicle (EV) brands and increased domestic manufacturers’ desire to create their own brands and product portfolios. As a result, China became the largest global car exporter in 2023.

We believe the internationalization of Chinese OEMs will soon accelerate. The drivers are both political and economic, including various regions’ electrification goals and the leveling off of the Chinese economy, forcing domestic OEMs to focus on export activities. Factors such as the global ambitions of Chinese OEMs — particularly in the EV market (both battery-powered and hybrids) — and their competitiveness compared to traditional incumbents play a significant role.

The question is whether this is an opportunity for global EV technologies and markets or just a threat for European/US incumbent manufacturers — as has been posited by many in the public arena.

Arthur D. Little (ADL) believes global automotive players must analyze and discuss the market approach of Chinese brands, global customer perspectives on Chinese EVs, and the profile of customers who will be the first to purchase Chinese EVs to support a fact-based and objective discussion.

This will enable stakeholders in the global automotive industry to make better strategic decisions in the interesting, yet challenging, EV market, where no less than the industry’s future is at stake. This Report provides an overview of the key results of an ADL study involving more than 15,000 respondents across 25 countries, shedding light on how Chinese OEMs are expanding their EVs internationally.

EXECUTIVE SUMMARY & KEY FINDINGS

This Report addresses two crucial gaps for executives in the automotive industry: (1) it provides comprehensive analysis of the positioning strategies of Chinese OEMs, and (2) it describes the results of a first-of-its-kind survey measuring global customer perspectives on Chinese EVs.

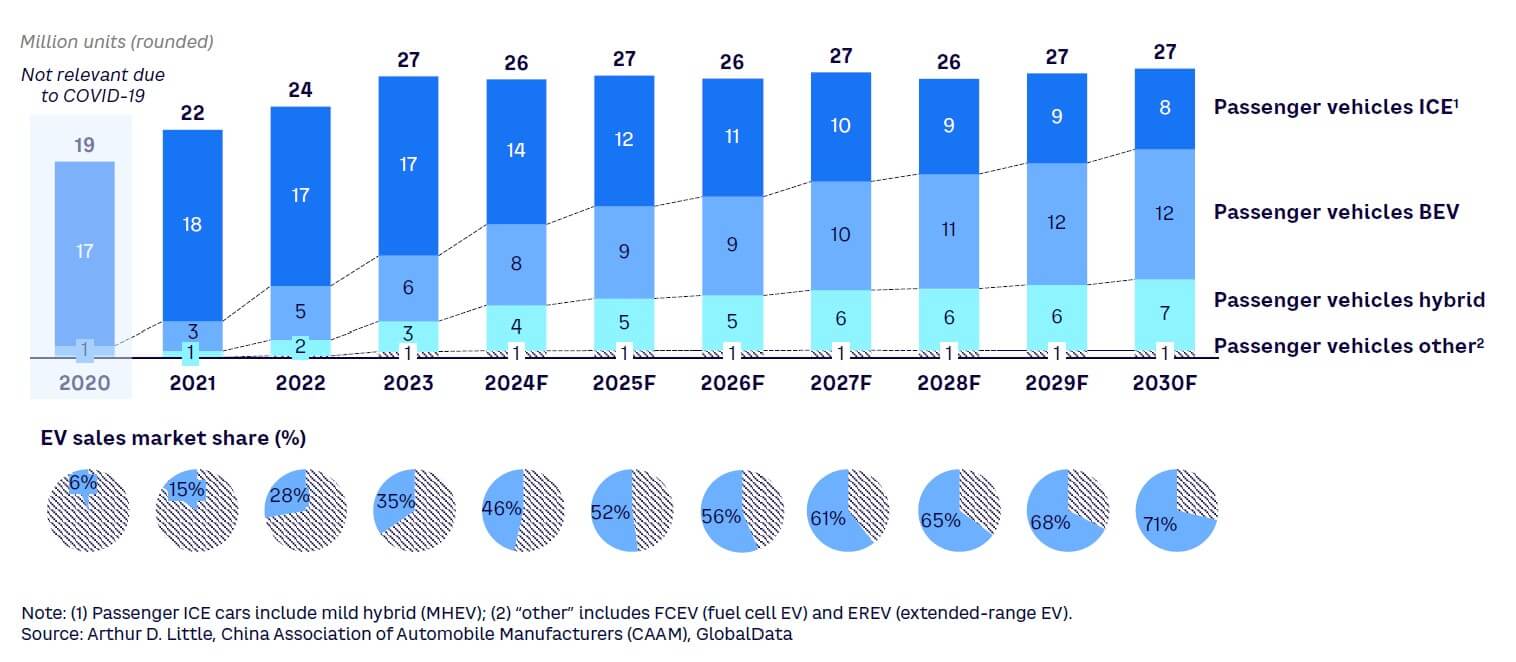

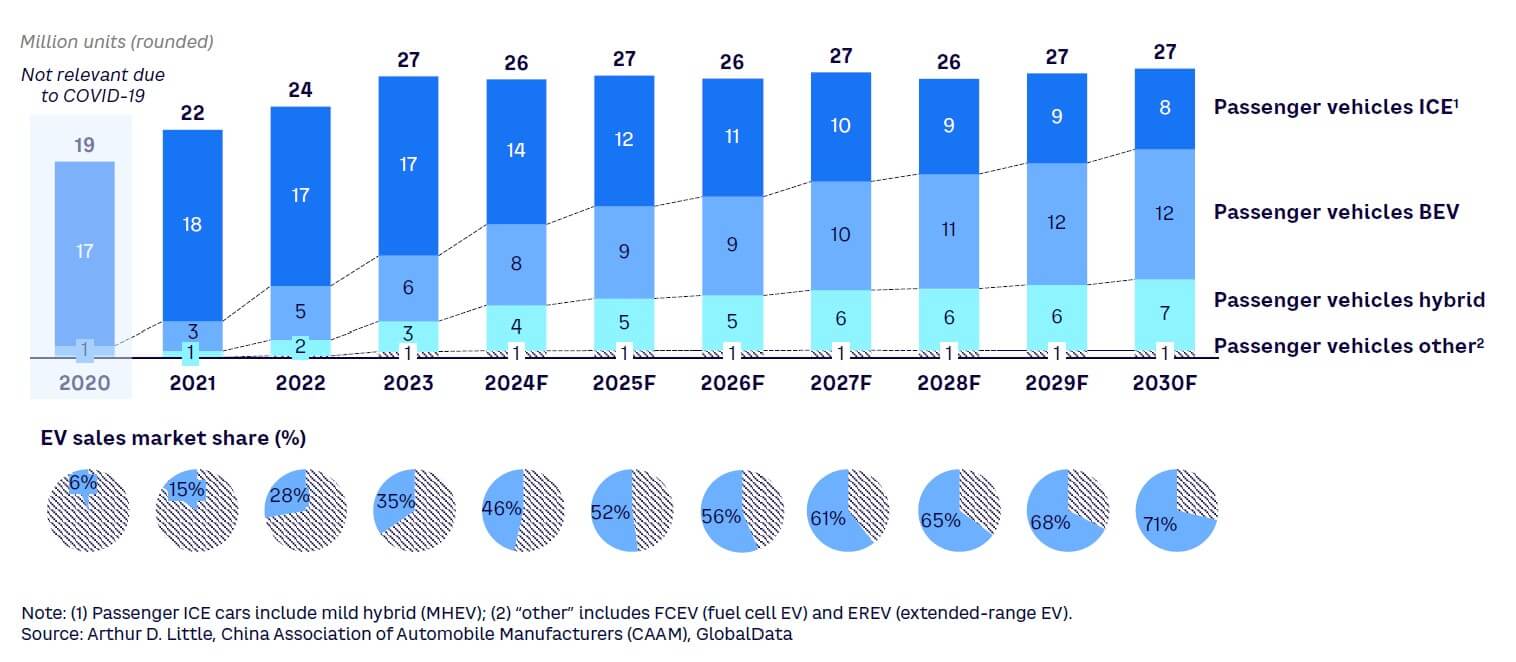

The Chinese passenger vehicle market has been the largest global market in terms of sales since 2009 and has continued to grow with a CAGR of 7%, reaching 26 million vehicles sold in 2023. The market has been a major source of global EV demand, with EVs accounting for 35% of passenger vehicle sales in 2023. Starting in 2025, sales of EV, battery-electric, and hybrid vehicles are expected to surpass those of internal combustion engine (ICE) vehicles in China.

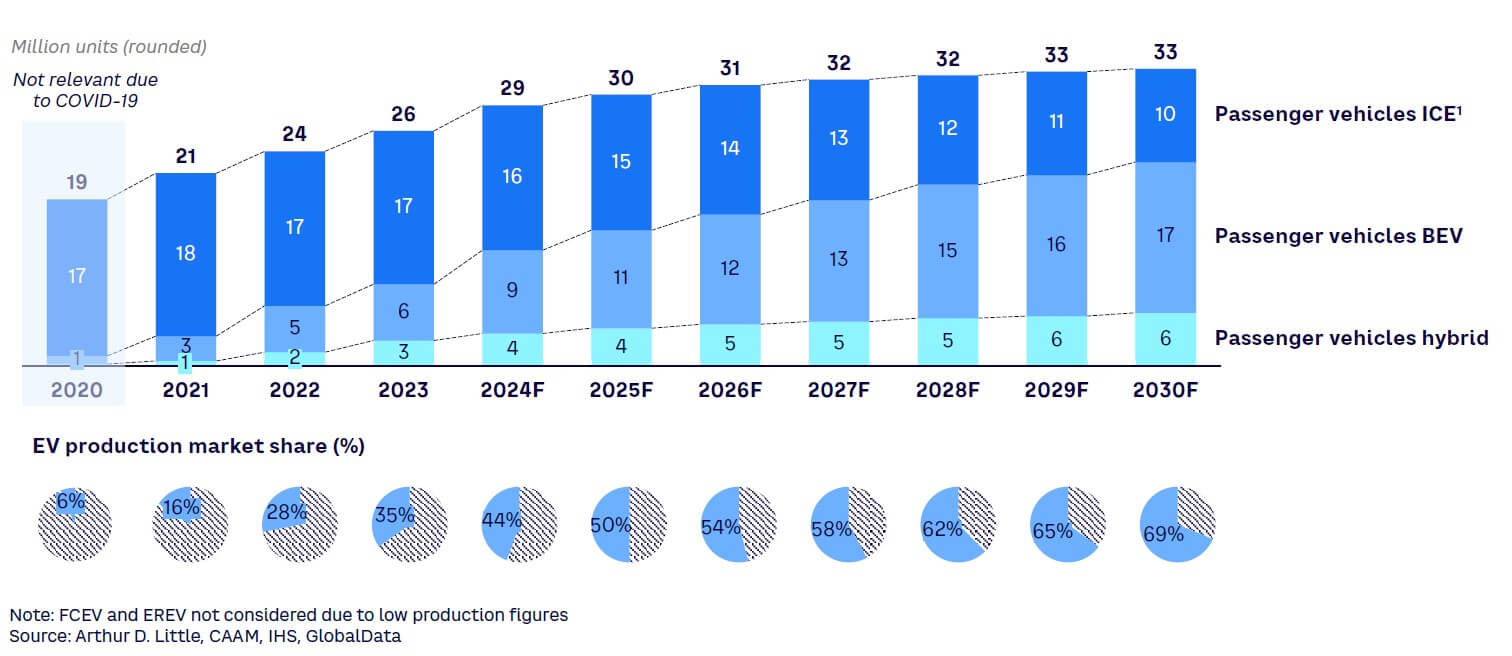

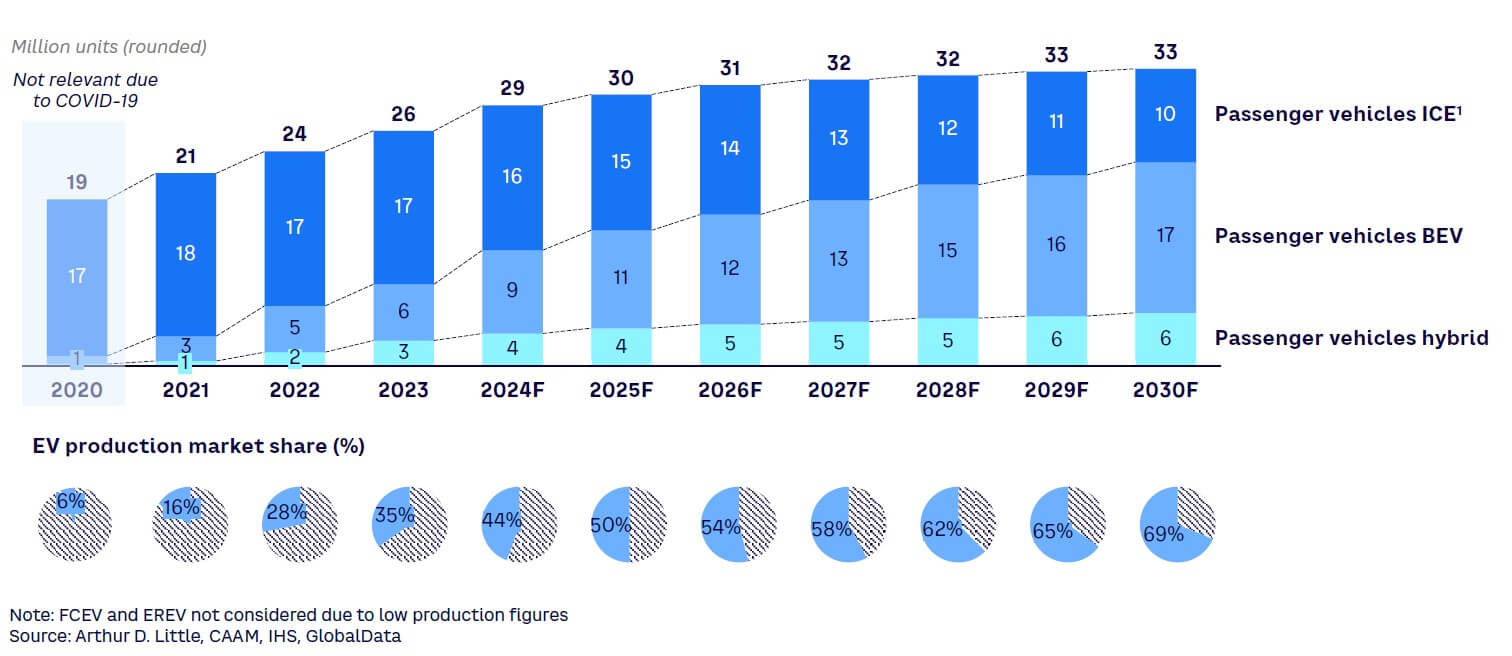

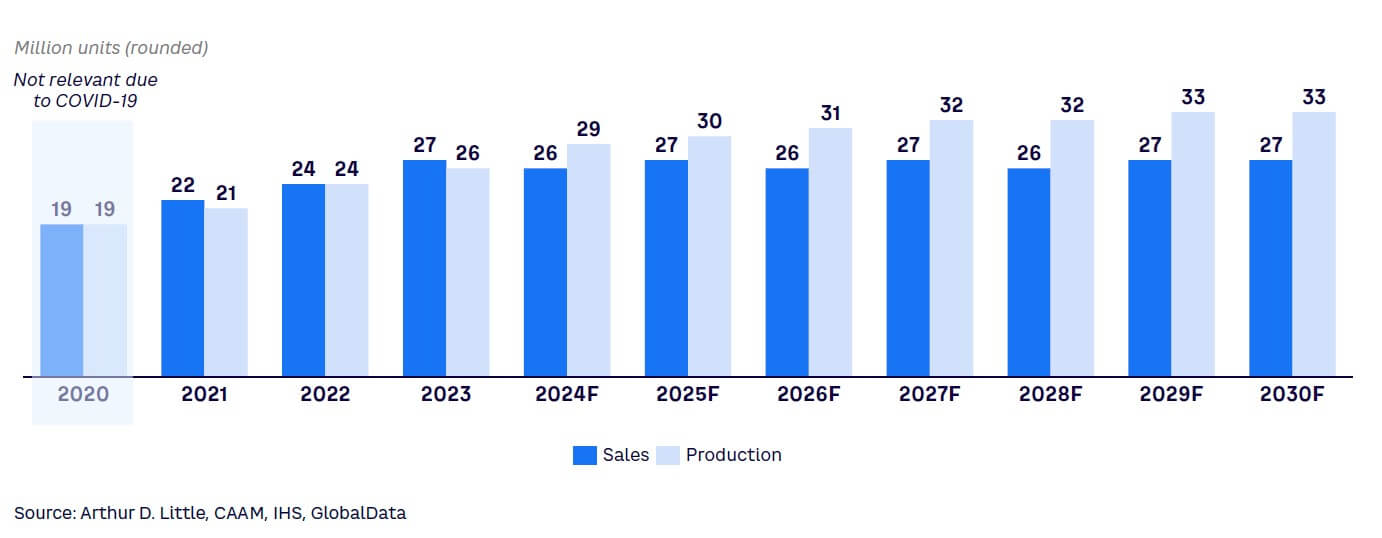

Passenger vehicle production will be driven by EVs in the coming years, projected to grow at 14% annually and comprise 69% of Chinese production by 2030. This production growth has fueled export activities, which increased from 1.5 million passenger vehicles in 2021 to 4 million in 2023, making China the largest exporter of passenger vehicles.

What are the reasons for this robust supply growth? In the past, Chinese production primarily catered to domestic demand. However, a series of policies starting in the mid-2010s led to significant government support for the EV industry. This resulted in strong growth for several brands, ambitious international strategies, and the establishment of substantial production capacities to accommodate potential global demand.

Consequently, Chinese OEMs, especially those with EV models, began exploring internationalization. According to the ADL study, Chinese OEM sales (EV and otherwise) will grow faster than the market in all global regions by 2030, with Europe (+14% annually) and Southeast Asia (+15% annually) experiencing the strongest growth.

In the study, ADL examined three critical aspects that are essential for automotive executives from Chinese OEMs seeking to expand their global presence, as well as those representing Western, Japanese, and South Korean incumbent OEMs:

- Categorization of Chinese OEMs

- Global customer perspectives on factors influencing the decision to purchase (or not purchase) a Chinese EV based on a survey with more than 15,000 respondents across 25 countries

- Profiling of customers most likely to be early adopters of Chinese EVs

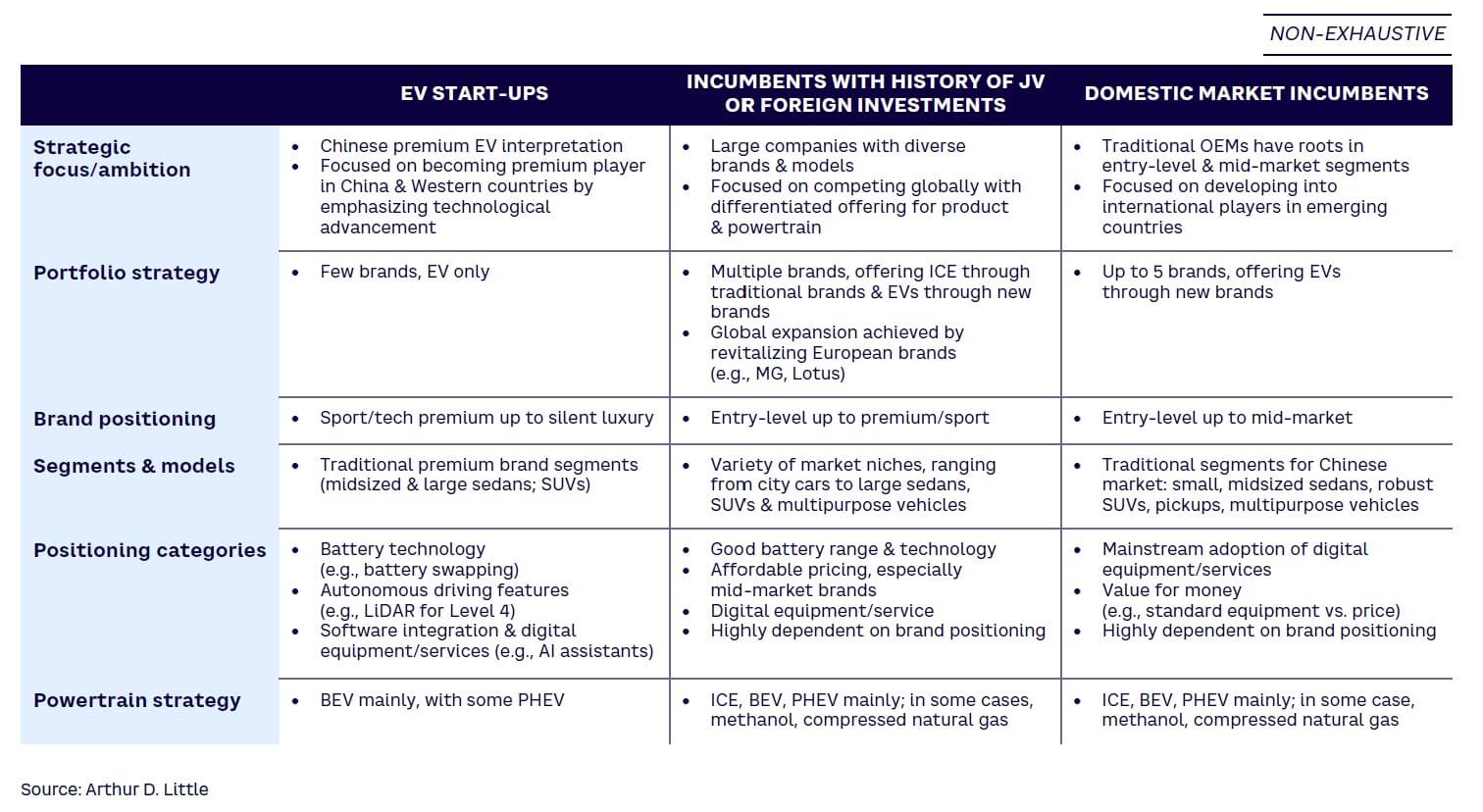

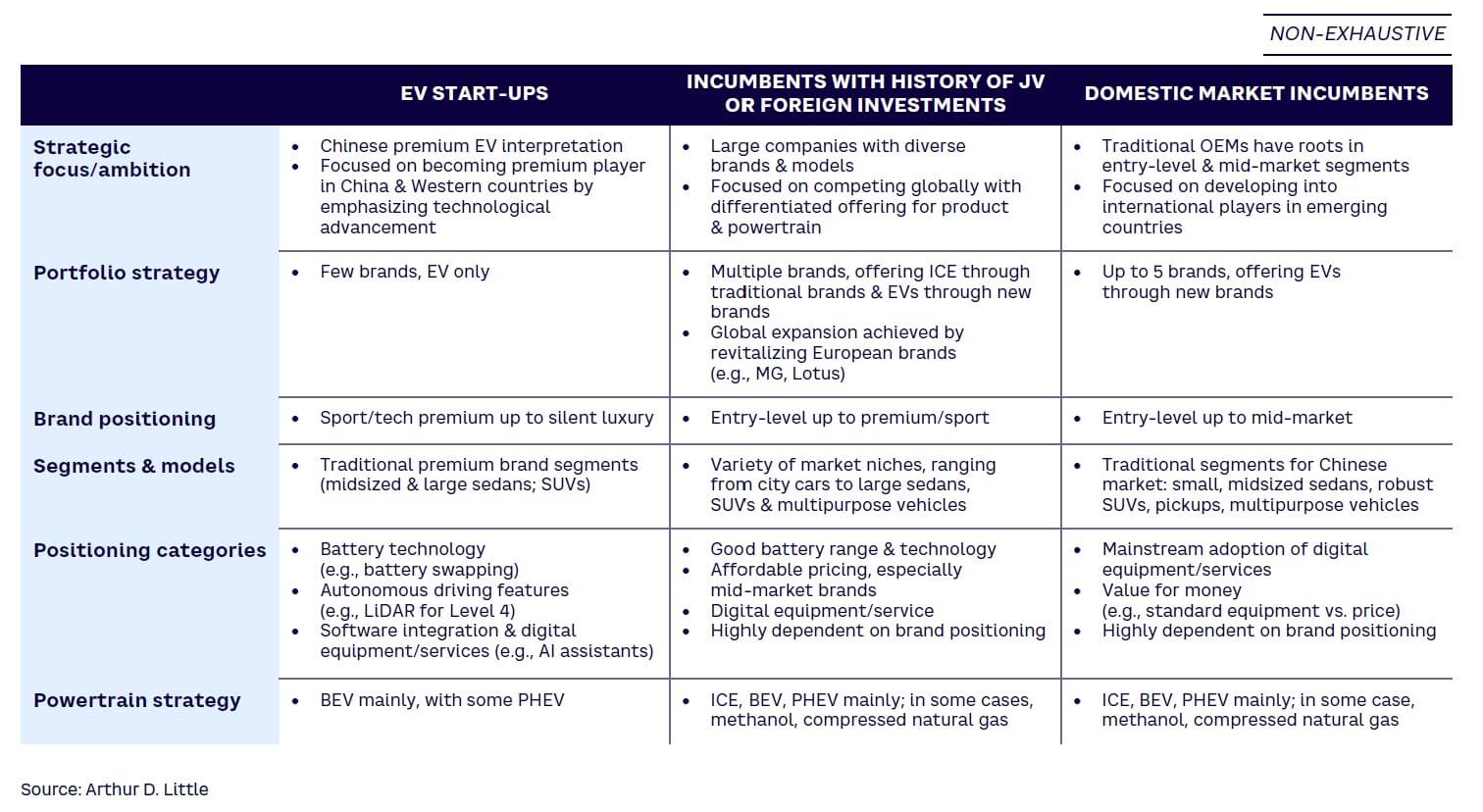

In this Report, we define three categories of Chinese OEMs:

- EV start-ups that aspire to become prominent players in both China and other countries. They emphasize battery and EV powertrain capabilities, software, and autonomous/automated driving technologies. Some players do not have a background in the automotive industry (i.e., they began manufacturing batteries or specialized in digital products).

- Incumbents with a history of international JVs and investments. We differentiate between nongovernmental (e.g., Geely) and state-owned incumbents (e.g., SAIC Motor). These OEMs strive to establish a strong presence in China and globally through diverse brands, focusing on electrification across various segments. We expect these players to achieve the highest sales volume in international markets among the three categories, predominantly in developed automotive markets.

- Domestic market incumbents that target the entry-level and mainstream Chinese market, aiming to penetrate into developing countries by emphasizing value and affordable electrification. We see promising opportunities, particularly in Africa, South America, and states in the Association of Southeast Asian Nations (ASEAN).

ADL aims to offer automotive executives a customer-focused perspective on Chinese EVs by analyzing the factors that influence customer decisions to purchase (or not purchase) a Chinese EV. More than half of survey respondents reported that a Chinese EV is a viable option for them. Notably, respondents in Southeast Asia displayed a high level of openness, exceeding 75%. Consumers in geographically well-established automotive regions (Europe, North America, and Japan/South Korea) showed lower average interest.

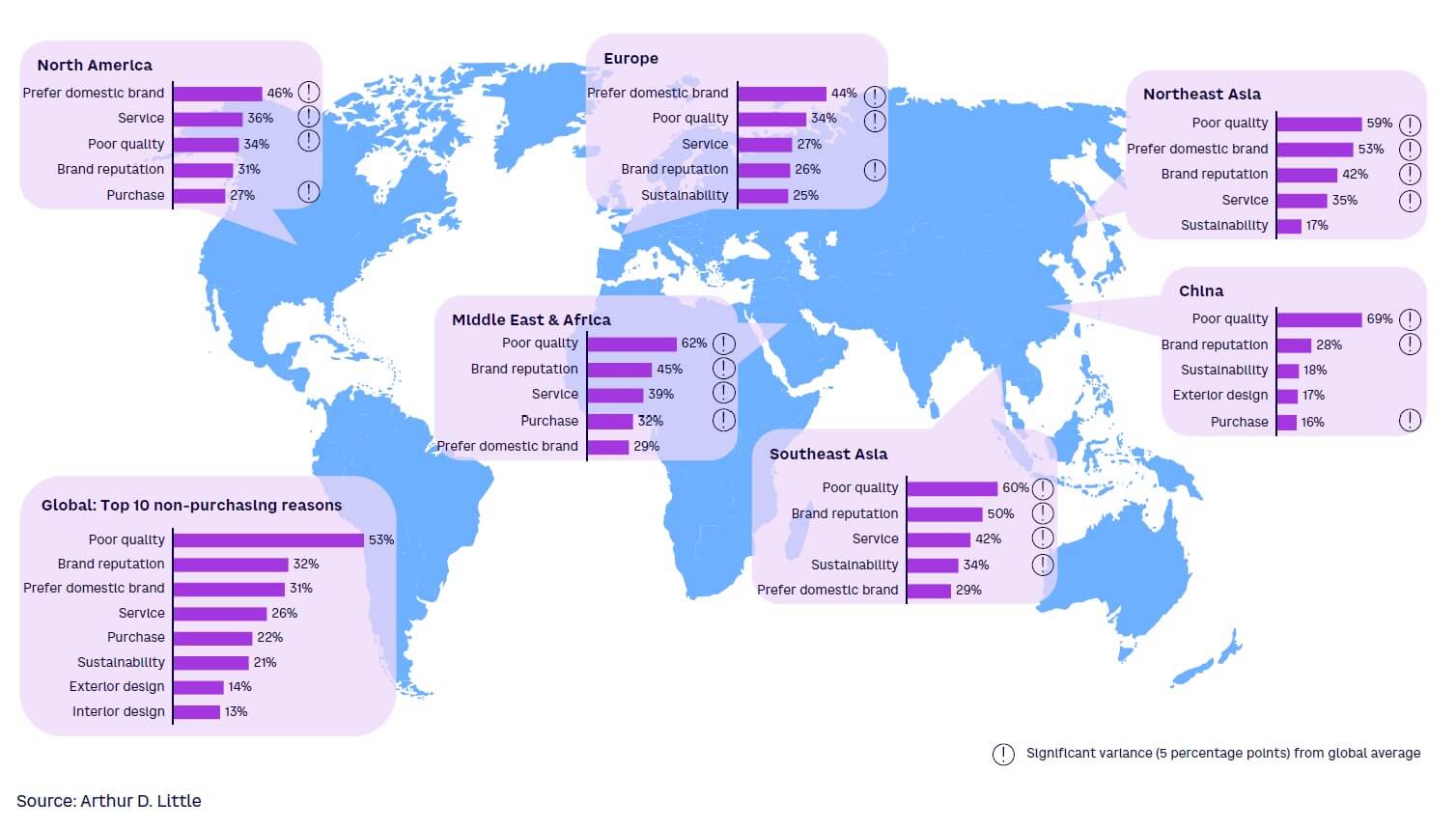

Overall, the primary motivations for purchasing a Chinese EV are value for money (44%) and battery technology (43%). Reasons respondents would not consider purchasing Chinese EVs include concerns about quality (58%), brand reputation (32%), and a preference for national brands (31%).

This Report also presents profiles of likely purchasers of Chinese EVs. We considered the five main European markets (Germany, France, Italy, Spain, and the UK), the North American market, and the Thai market, focusing on three aspects for each country:

- The penetration strategy of Chinese OEMs, the brands driving this, and their current status. For example, we found that in the UK, Chinese OEMs have achieved a market share of 4.4%, while in Thailand they have surpassed 10%.

- The main factors influencing interest and disinterest in purchasing a Chinese EV. These include demographic and automotive profiles (e.g., brand of the current car, annual mileage). We discovered that prospects’ demographic profiles are homogeneous in Italy and Spain; in Germany, there are significant differences between urban and countryside dwellers, premium-brand drivers and non-premium-brand drivers, and company owners and management respondents.

- A forecast for each market of the three defined categories of Chinese OEMs. We found that, all other things being equal, EV start-ups are likely to be successful in Germany and the US; in Spain, domestic market incumbents could aspire to capture market share in the entry-level segments.

RECOMMENDATIONS

Our recommendation contains a call to action for three market players:

- Incumbent OEMs with roots primarily in Europe and North America

- Chinese OEMs interested in globalizing their operations

- Distributors and large dealer groups

Incumbents

After years of sales growth and high profitability (especially post-COVID years), incumbents are finally facing increasing competitive pressure in China and in global markets. After years of sales growth and high profitability (especially post-COVID years), incumbents are finally facing increasing competitive pressure in China and in global markets. For incumbents, ignoring the developing capabilities and ambitions of Chinese EV manufacturers is not an option. Therefore, there is an urgent need to respond, and incumbents should:

- Emphasize brand reputation. In the premium and luxury segments, incumbent OEMs may still benefit from established trust and customers seeking specific product features and qualities. However, that reputation must be supported by superior product quality and substance to be sustainable.

- Emphasize domestic origin and production. OEMs with regional supply chains and strong value creation remain the first choice for many respondents. Local production should be reinforced while creating resilient, sustainable, circular supply chains.

- Leverage dealer networks. Build a trusted, dense, reliable retail network while integrating traditional brick-and-mortar sales and service with a seamless digital approach.

- Create partnerships and JVs with Chinese OEMs. After investing in the development of the Chinese car industry for decades with JVs in China, now is the time for JVs with Chinese OEMs in Europe and the US. This will allow incumbents to capitalize on the speed and cost advantages of the Chinese OEMs, particularly in EV battery technology and entry-level vehicle segments.

- Emphasize customer loyalty. Develop a 360-degree action plan (product, marketing, sales) to capitalize on the customer base accumulated over the past years; this is an incumbent’s most significant asset.

Chinese OEMs

In an effort to globalize their activities, which began in the early 2000s, Chinese OEMs appear to have found a recipe for success thanks to electromobility and integrative activities along the EV value chain. However, this achievement does not come without challenges. Chinese OEMs on their path to globalization should consider the following:

- “Made in China” is not yet synonymous with quality in many large markets. As we learned from Japanese and South Korean OEMs in recent decades, building a reputation for high quality requires time and multiple successful, reliable generations of vehicles. It is essential to prioritize achieving that high quality before launching new products, to refine and differentiate positioning, and to develop clear positioning of brands outside of China.

- Structured sales networks are lacking. It’s important to form partnerships with large, well-established dealership groups, particularly in urban areas where interest in Chinese EVs is high. It is crucial to ensure a clear differentiation from other brands within the sales network — merely adding a new brand to a dealership’s existing portfolio may not suffice.

- Differentiate your go-to-market strategy. Customer requirements vary significantly even within Europe. Focus on targeting early adopters with high purchase interest and adapt your go-to-market strategy accordingly. Consider granting greater autonomy to local management in decision-making for product and volume planning.

- Prioritize business and fleet customers. Especially in Europe, premium Chinese EVs require dedicated programs for business and fleet customers. Owing to favorable tax treatment and corporate environmental, social, and governance (ESG) requirements, these customers play a critical role in gaining relevance within the European market, necessitating used-car programs that effectively maintain high resale values and ensure attractive leasing rates.

Distributors & dealer groups

In recent years, the rise of the online-sales-only approach adopted by some new entrants, along with the agency model, led to questions about the future role of dealers. ADL’s research highlights the continued importance of dealerships, especially in providing service, and reveals that the absence of a service network can deter potential customers from purchasing a specific brand. As Chinese EVs expand internationally, particularly in Europe and Southeast Asia, distributors and dealer groups should react:

- Take the entrepreneurial risk and partner with Chinese OEMs, but conduct thorough due diligence. In the 1990s, dealers participated in the success of Japanese and later Korean brands in the US and Europe. This story can be repeated. However, distributors and dealers should not blindly jump on the Chinese bandwagon. Instead, they should increase their chances of selecting potential winners by understanding the factors that will determine success and conducting a comprehensive, structured assessment of brands seeking partnerships.

- Leverage Chinese brands to address underserved customer segments. With a well-developed product portfolio focused on EVs, selling Chinese vehicles may present an opportunity to target market segments in terms of price and body type that remain unaddressed by traditional OEMs.

- Adapt to new customer segments and test new offerings. Address potential concerns about quality by reducing purchase barriers. This includes exploring new sales models such as subscription-based options.

- Eventually offer service-only for direct sales brands. Revenue reduction from EVs can be offset through the design of a specific service offering for brands that follow an online sales approach or that still lack a well-developed dealer network. Otherwise, incoming Chinese OEMs without a developed service network may seek partnerships with national independent repair chains.

- Prepare for a new used-car market with vehicles from Chinese manufacturers. Chinese OEMs have penetrated several European markets via the rental-sales channel. Rental companies typically hold their cars for a short period before putting them on the used-car market, where, in the absence of a franchise dealer network, they are often sold through auctions to independent dealerships. This group of dealers will be among the first to encounter Chinese used-car stocks. It is crucial for them to analyze which Chinese brands are the best prospects for the used-car market and identify customer groups that may be particularly interested in these vehicles.

1

CHINA’S PASSENGER VEHICLE INDUSTRY

China became the largest passenger vehicle market in the world in 2009 and has grown ever since with a CAGR of 7%. In this Report, we focus on two powertrains: ICE and EVs. The latter can be divided into battery electric vehicles (BEVs) and hybrid vehicles, which include plug-in hybrid electric vehicles (PHEVs) and full hybrid electric vehicles (FHEVs). Fuel cell electric vehicles were not considered. As shown in Figure 1, 27 million ICE and EV passenger vehicles were sold in China in 2023.

In recent years, China has become the lead market for electrification, with EVs experiencing robust sales starting in 2020. Since 2021, hybrid vehicle sales increased by 360%, and BEV sales increased by 129%. EV models reached a market share of 35%, while sales for ICE models decreased by more than 1 million units in the same period.

Car sales in China are expected to remain stable, with a gradual substitution of EVs for ICE vehicles (at an annual rate of around 10%).

At this rate, by 2025, every second new car in China will be either full electric or hybrid, and EVs will have a market share of around 70% by 2030.

As we wrote in last year’s ADL Report “Global Electric Mobility Readiness Index 2023,” the diffusion of EV models has been stimulated by the following three factors:

- Excellent EV infrastructure. China has the most well-developed charging network in the world in terms of density.

- Systematic support for the development of the EV industry through regulation and incentives. These include benefits for both EV OEMs and customers, including exemption from vehicle purchase tax or exemption from license plate restrictions.

- Coercive measures for new ICE vehicles. Local governments have put in place high registration barriers for ICE vehicles, including limiting new license plates.

GLOBAL EXPANSION OF CARS MANUFACTURED IN CHINA HAS JUST BEGUN

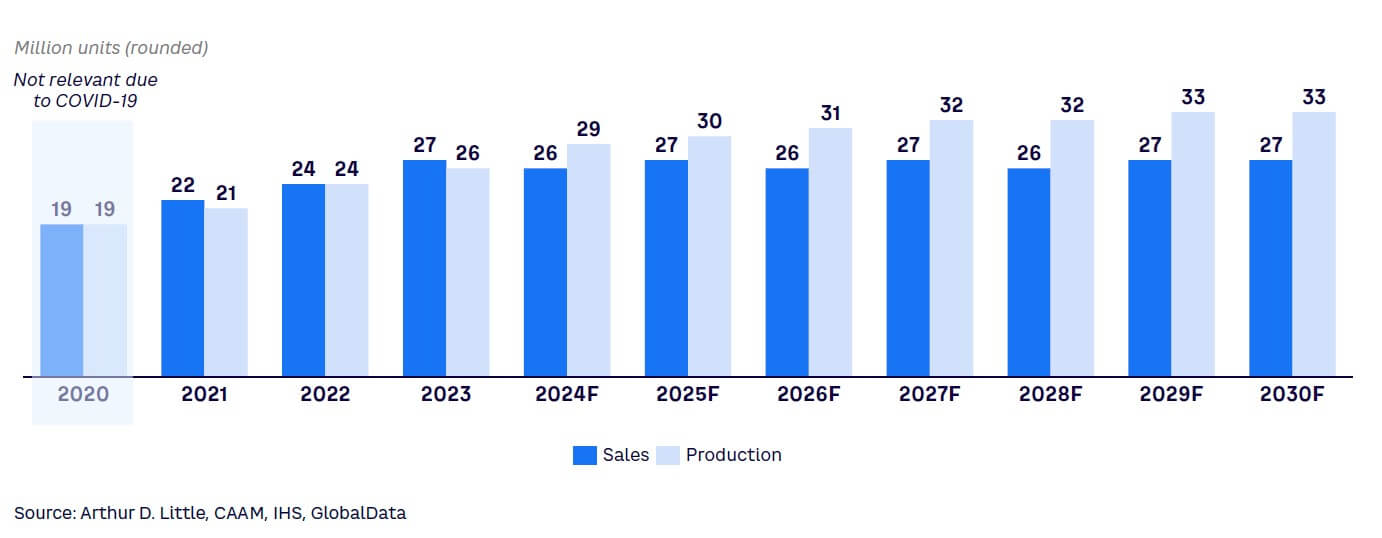

China recently became the world’s largest exporter of passenger vehicles. Until recently, car production in China has primarily catered to domestic demand, with 26 million passenger vehicles produced in 2023. In the future, passenger vehicle production will decouple from domestic sales and grow at an annual rate of 3%. This growth will lead to more than 30 million cars being produced each year by 2025 and almost 33 million by 2030 (see Figure 2).

This growth is due in part to the Chinese car industry’s focus on EVs. Production of ICE vehicles is expected to decrease from 65% in 2023 to just 31% in 2030, while EVs see an annual growth of 14%. By 2030, EVs are expected to represent 69% of total Chinese vehicle production.

The production increase, combined with stable domestic sales and a growing global interest in EVs, will help sustain Chinese OEMs’ push into markets outside China. Indeed, between 2021 and 2023, exports of passenger vehicles rose from 1.5 million in 2021 to 4 million in 2023, with a growth rate of more than 300% for EVs. This underpinned China’s rise to become the world’s largest exporter of cars, surpassing the previous largest car exporter (Japan).

The growth of China’s car exports is driven by the following:

- The “Made in China” Strategy 2014 and its focus on EV powertrains. Since 2014, Chinese OEMs have benefited from substantial subsidies and purchase incentives that fostered the establishment and growth of China’s domestic EV industry. Earlier and more consistently than in other regions, China’s government and industry saw opportunities in the shift to alternative powertrains. Beginning with a requirement to improve air quality in China’s mega-cities, Beijing’s efforts to stimulate electric mobility helped create a highly competitive domestic EV market. In the next year or so, we expect this market to enter a consolidation phase, resulting in a smaller number of strong EV players ready to expand globally.

- China’s large production capacity. Significant government subsidies aimed at incenting the domestic EV segment but with decreased domestic demand, prompting Chinese OEMs to seek markets outside China (see Figure 3).

- The global trend toward electrification. The close proximity and tight control of crucial raw materials (e.g., copper and lithium, which are essential for manufacturing battery cells and modules) allow Chinese OEMs to reduce their dependency on third-party suppliers and cost-effectively offer a wide range of BEVs, including small cars not yet being widely manufactured by Western OEMs.

CHINESE OEM MARKET SHARE SET TO GROW IN MAJOR MARKETS

Sales of Chinese brands are expected to outpace overall car sales in all main global automotive markets (see Figure 4). However, the market share Chinese OEMs are expected to capture varies significantly across regions. In Europe and Southeast Asia, Chinese OEMs will experience annual double-digit growth (14% and 15%, respectively).

Europe (including Türkiye) will see consistent growth in Chinese OEM market share until 2026. Annual sales by Chinese manufacturers are expected to reach 1.6 million vehicles by the end of the decade in those regions, reaching 8% to 10% of the entire European passenger vehicle market, in part due to the planned installation of a local manufacturing base in Europe. In the Russian market, Chinese OEMs will benefit from the country’s isolation from global automotive value streams — but only by exporting low-end, traditionally powered vehicles.

In Southeast Asia (including India and Australia), Chinese OEMs will continue increasing their market share and are expected to reach an annual sales volume of more than 700,000 vehicles by 2030, between 6% and 8% of the entire passenger-vehicle market in the region. Reasons for this growth include the absence of strong local OEM players (aside from India) that can cater to the rising demand for affordable EVs.

The Japanese, South Korean, North American, and South American markets will see much slower growth for Chinese OEMs. Although they’re expected to outgrow overall markets slightly and thus take some market share from established players, Chinese OEMs are expected to play a niche role (under 5% market share). In Japan, Korea, and North America, Chinese cars will likely not gain traction until 2030.

Regarding government support, cost structures, and supply chains, these countries, in particular, have a robust domestic car industry, special customer requirements, and tariffs and non-tariff policies in place. A slower trajectory in transport electrification in those markets will also dampen demand for Chinese car exports.

In the Middle East and Africa, where Chinese OEMs already have a market share of 8%, growth for Chinese cars will be in line with the region’s market growth. We expect the Chinese share to stabilize between 8% and 10%.

DIFFERENTIATED VIEW ON CHINESE CAR OEM IS REQUIRED

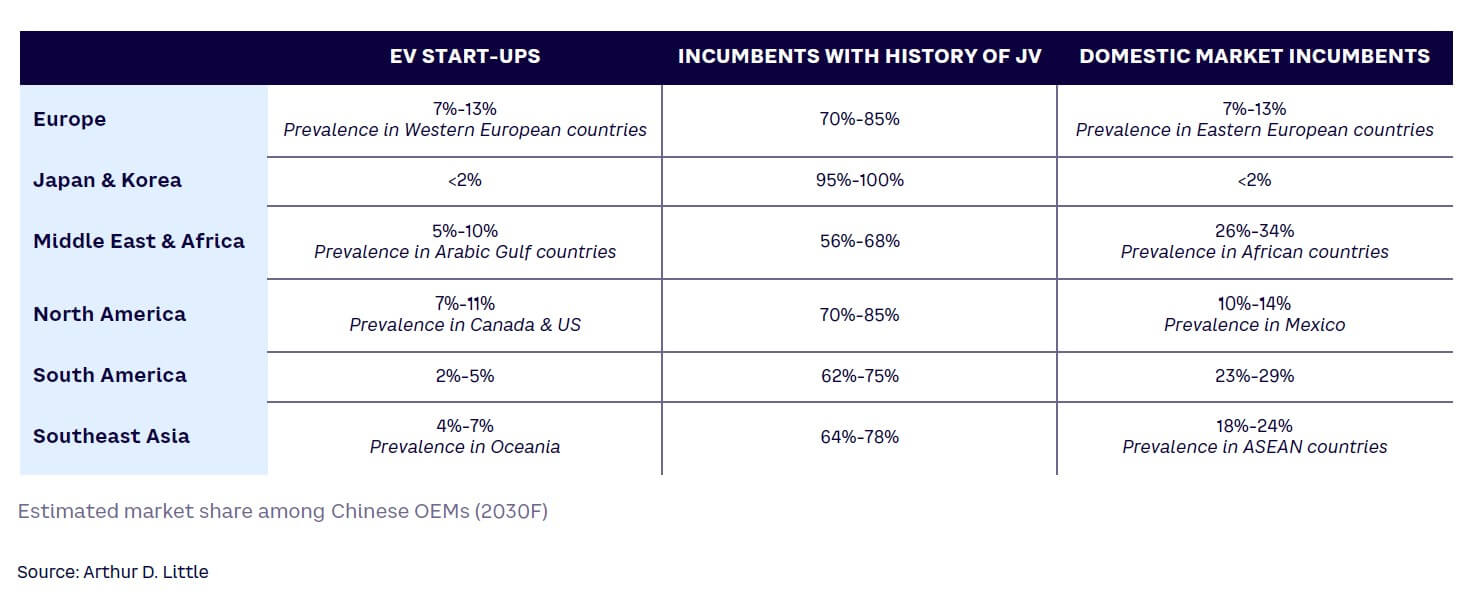

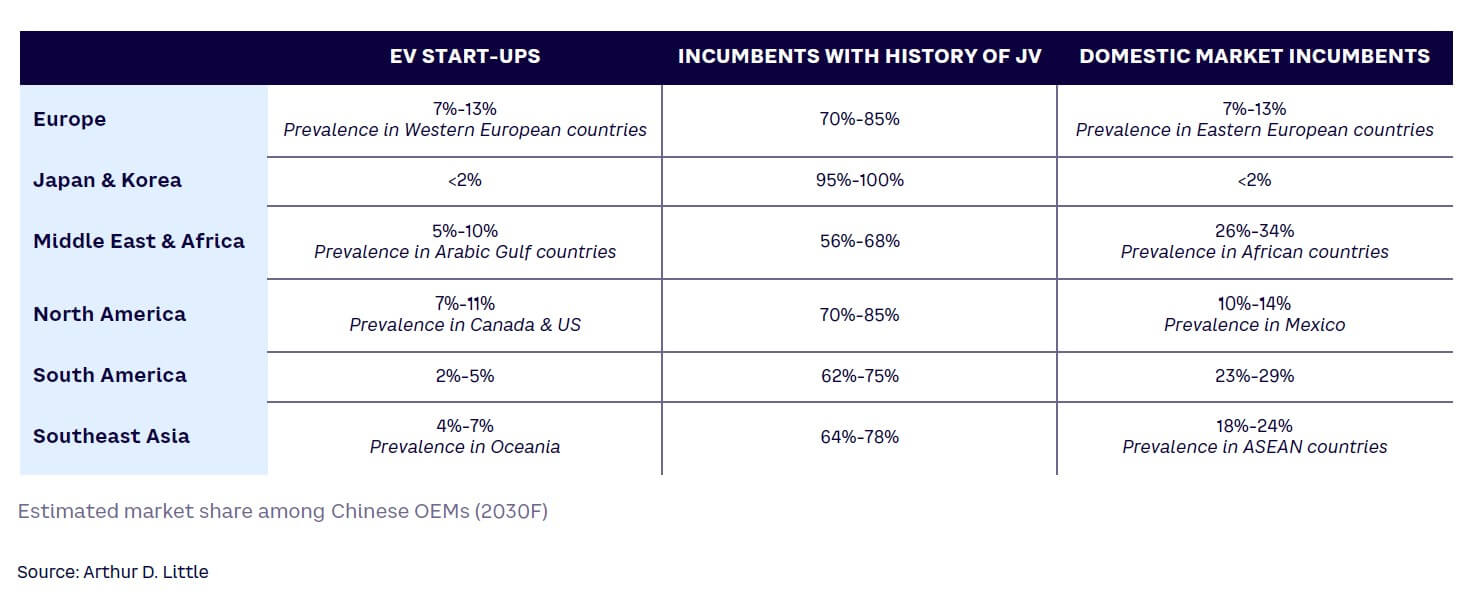

Based on criteria such as history, age/maturity, sales volume, product/powertrain strategy, and partnership strategy, players in the Chinese car industry can be categorized into three main types (see Table 1):

- EV start-ups, launched as result of the Made in China strategy

- Incumbents with a history of international JVs or investments

- Domestic market incumbents

EV start-ups

EV start-ups emerged as a result of the government’s Made in China strategy and the focus on EVs initiated in the mid-2010s. Examples include NIO and XPeng. Several players have backgrounds beyond the traditional automotive industry (e.g., digital products). They aim to establish themselves as premium EV players in both domestic and advanced markets, emphasizing battery technology, in-car software (e.g., AI assistants, virtual reality screens), and autonomous driving features. These brands typically have a premium OEM product portfolio that includes midsized and large sedans and SUVs. They tend to integrate battery technology and software-related activities while outsourcing operations like manufacturing (at least in the initial phase after brand establishment).

This positioning limits EV start-ups’ addressable market share on a global level. ADL expects these players to capture between 7% and 13% of the Chinese passenger vehicle market in advanced economies such as Western Europe, the US, and the Arabian Gulf countries. In emerging countries, including Japan and South Korea, market share will likely remain below 5%.

Incumbents with history of international JVs or investments

Incumbents are large OEM groups and conglomerates that previously served as JV partners for Western OEMs and/or have direct investments in non-Chinese car brands and manufacturers. They can be divided into two categories: nongovernmental-owned incumbents (e.g., Geely and BYD Auto) and governmental-owned incumbents (e.g., SAIC Motor and Beijing Automotive Group [BAIC]). Regardless of ownership, these companies aim to become global players by creating a differentiated product portfolio using various investment and partnership strategies.

Over the last decade, these companies gradually shifted from being junior partners in international JVs to developing their own brands and vehicle portfolios by applying newly acquired skills in R&D and manufacturing.

This resulted in the addition of several new vehicle brands. Investments by these players also revitalized traditional European brands that were floundering (e.g., MG and Lotus). Chinese investors not only injected money into the market, they repositioned brands and revitalized portfolios, mostly based on Chinese EV platforms.

Players in this category cover a wide range of market segments, from entry-level to premium and sports cars, and they use various brands in their portfolio to cater to customer needs (e.g., premium or luxury appeal, futuristic design, affordability). By tapping into shared platforms or components, these brands emphasize EV features in their marketing, particularly range and charging speed. They also stress performance and digital services at relatively low price points compared to European, North American, Japanese, and South Korean competitors.

Incumbents differ from EV start-ups in that they tend to have an asset-heavy business model, integrating key steps of the value chain, including battery manufacturing, software design, and production into their operations. These players are in a position to capture the highest market-share levels among Chinese OEMs abroad, primarily due to their diverse brand and product portfolios. In mature automotive markets, we expect these incumbents to enter with both premium and mainstream brands, capturing between 70% and 85% of local sales (see Table 2). In emerging markets such as ASEAN, Eastern Europe, and North Africa, they will likely offer entry-level products to reach scale. In these markets, we expect them to reach between 50% and 70% of overall local Chinese car sales.

Domestic market incumbents

Domestic market incumbents such as Changan and Great Wall Motor (GWM) have a long history in Chinese entry-level segments. These brands have globalized their business presence over the last few decades, especially in emerging economies. In the last few years, Chinese governmental incentives for manufacturing EVs have encouraged these companies to launch new brands and begin positioning themselves against more traditional brands. Examples include WEY, the upscale brand of GWM.

Despite this new trajectory, these brands remain focused on traditional segments for the Chinese market (i.e., small and midsized sedans, robust, compact SUVs, and pickups) with an entry-level to mid-level positioning. Similar to incumbents with a history of international JVs or investments, these companies’ brand positioning focuses on digital equipment and services such as large screens, smartphone integration, and excellent value for money, especially regarding interior and exterior design and appearance.

Domestic market incumbents can take advantage of their expertise in efficient mass-market vehicle production, integrating most of the traditional activities of an OEM, while high-tech components like batteries, electronics, and software are purchased from third parties. These players will primarily continue to expand in growing and emerging automotive markets. In the Middle East, Africa, South America, and Southeast Asia, they will reach between 18% and 34% market share among Chinese brands (see Table 2). In Europe and North America, we expect these players to be successful in markets like Mexico and Eastern Europe, where they may reach market shares between 7% and 13%.

2

HOW GLOBAL BUYERS LOOK AT CHINESE OEMS

As part of the world’s largest primary consumer survey, ADL asked global car owners, users, and prospective buyers about their perspectives on the products and strategies of Chinese car manufacturers, especially those related to EVs. As indicated earlier, the study involved more than 15,000 respondents in the 25 countries with the largest passenger vehicle markets. Our findings shed light on the following three elements:

- Global interest in Chinese EVs

- Factors influencing the decision to purchase (or not purchase) an EV from a Chinese OEM

- Profiles of early adopters of Chinese EVs in major global markets and overall market potential

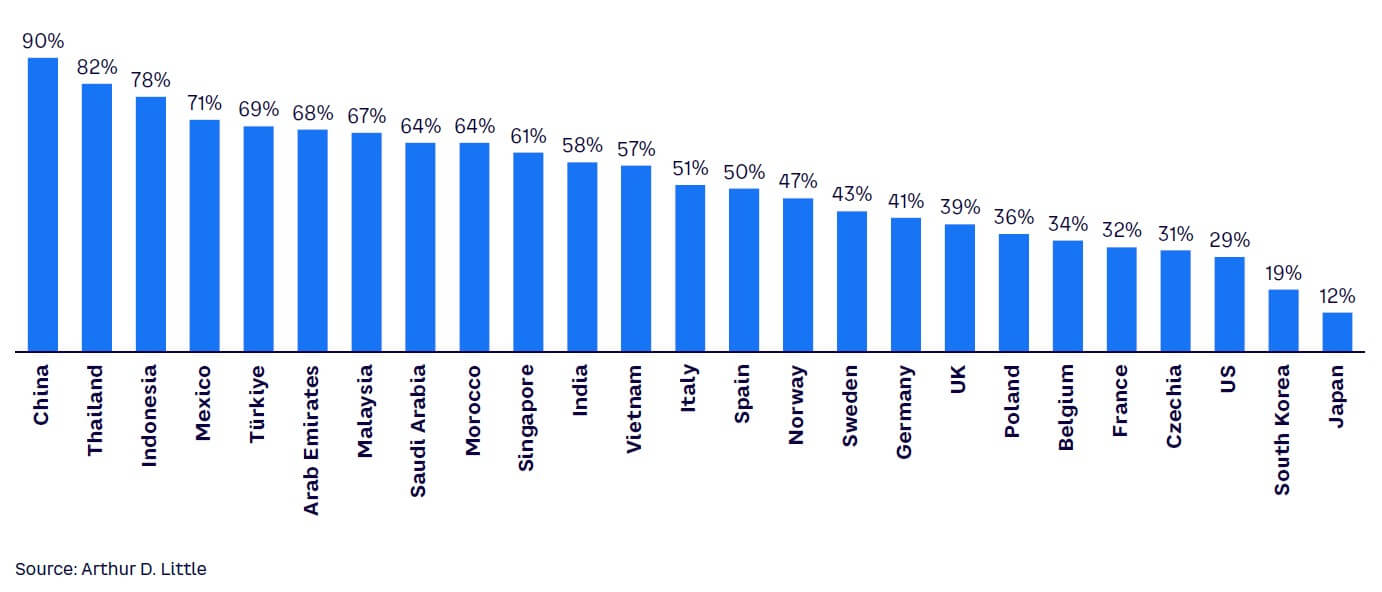

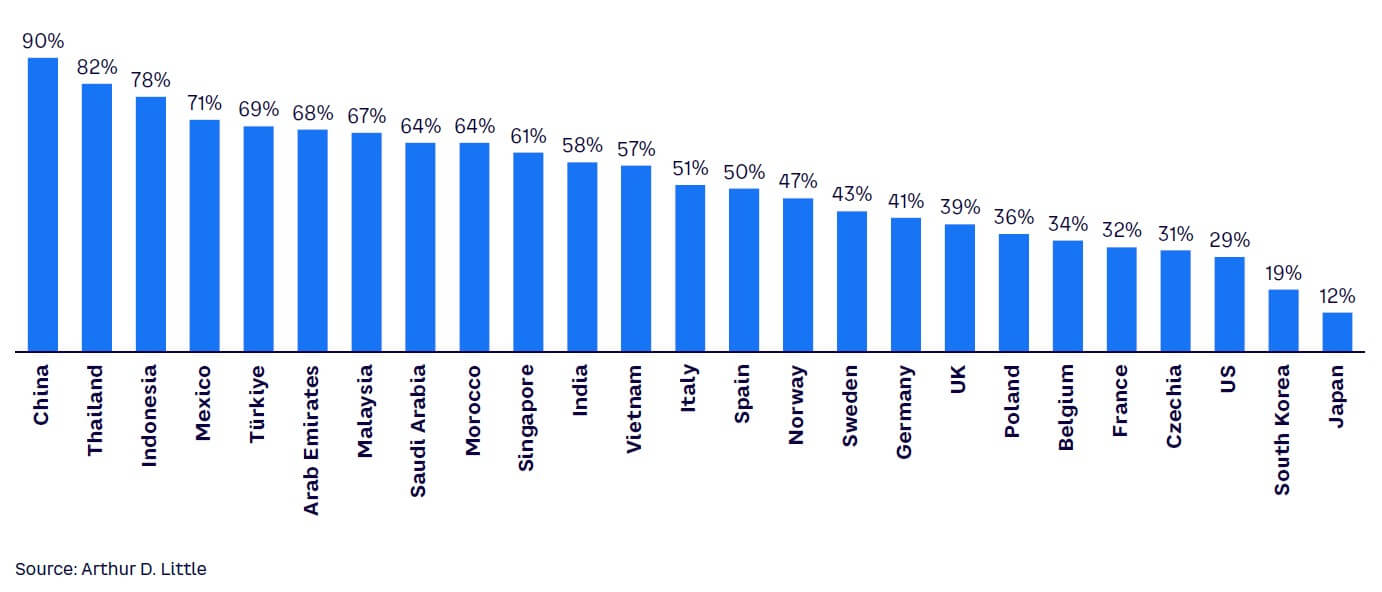

58% OF POTENTIAL BUYERS SAY CHINESE-MADE CAR IS VIABLE OPTION

Our survey revealed that 58% of potential global car buyers are interested in purchasing a Chinese EV. This number includes Chinese respondents who obviously demonstrate a strong propensity to purchase a domestic EV (nearly 90%). Consumers in geographical regions with a historically well-established automotive industry, such as Europe (41%), North America (32%), and Japan/South Korea (14%), show lower interest in Chinese EVs.

These numbers support the low expected sales volume of Chinese OEMs in North America and Northeast Asia (Japan and South Korea) shown in Figure 5. In the Middle East and Southeast Asia, where the level of interest in Chinese EVs is at 66% and 73%, respectively, Chinese OEMs are expected to reach around 10% of the EV market.

We found significant differences within regions. For example, in Europe, half of Italian and Spanish respondents expressed interest in purchasing an EV from a Chinese manufacturer, but only a third of Czech, French, and Belgian respondents would consider it. A similarly fragmented picture emerges in North America, where Mexican respondents demonstrated a high interest in Chinese EVs (71%), fourth-highest in the survey.

Strong differences among individual countries were observed in Southeast Asia. Thai (82%) and Indonesian (78%) respondents displayed a high level of interest in Chinese EVs, which may be attributed to the early presence of Chinese OEMs in both markets. Conversely, Singapore (61%) and Vietnam (57%) showed interest lower than the regional average.

BATTERY TECHNOLOGY & VALUE ATTRACT BUYERS

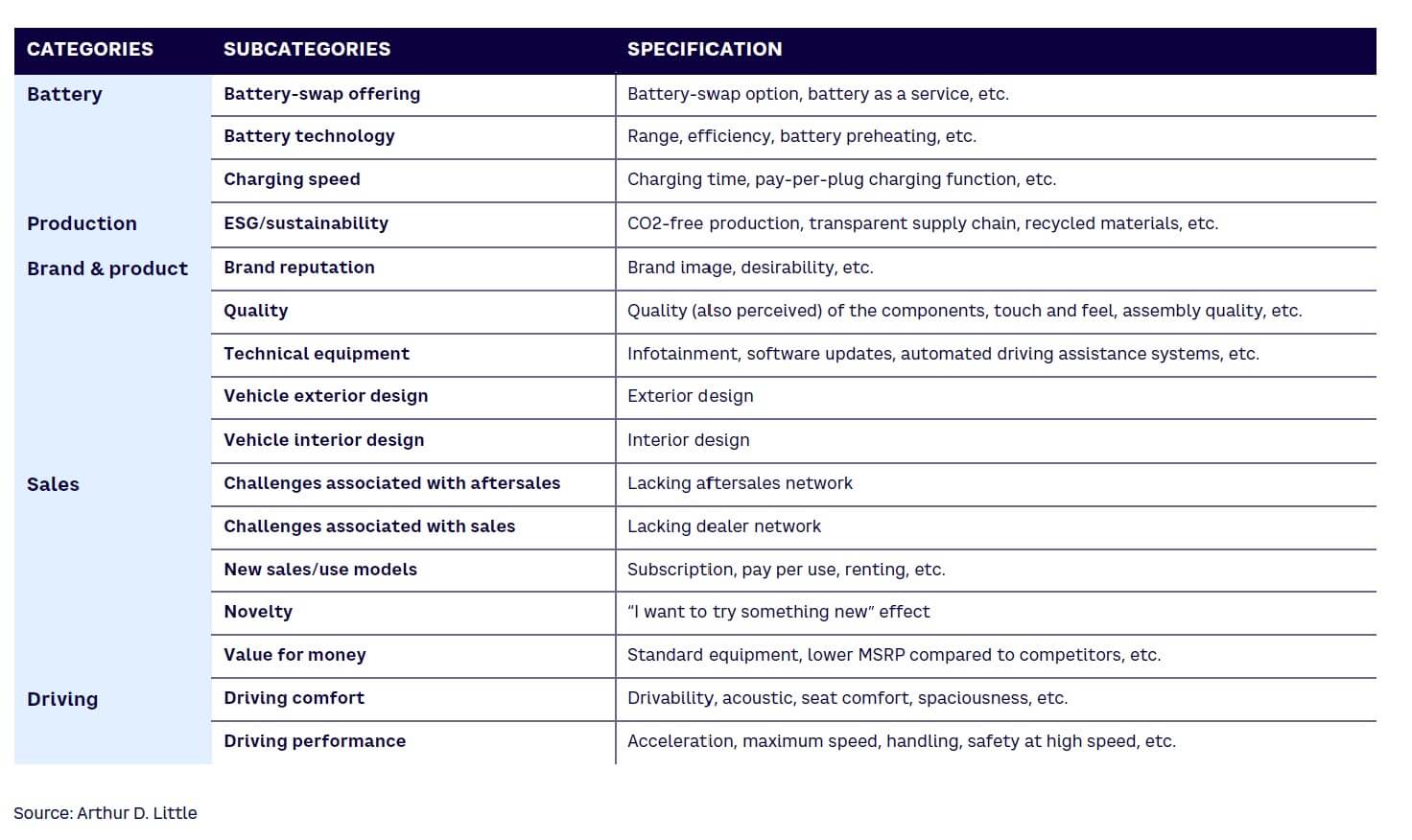

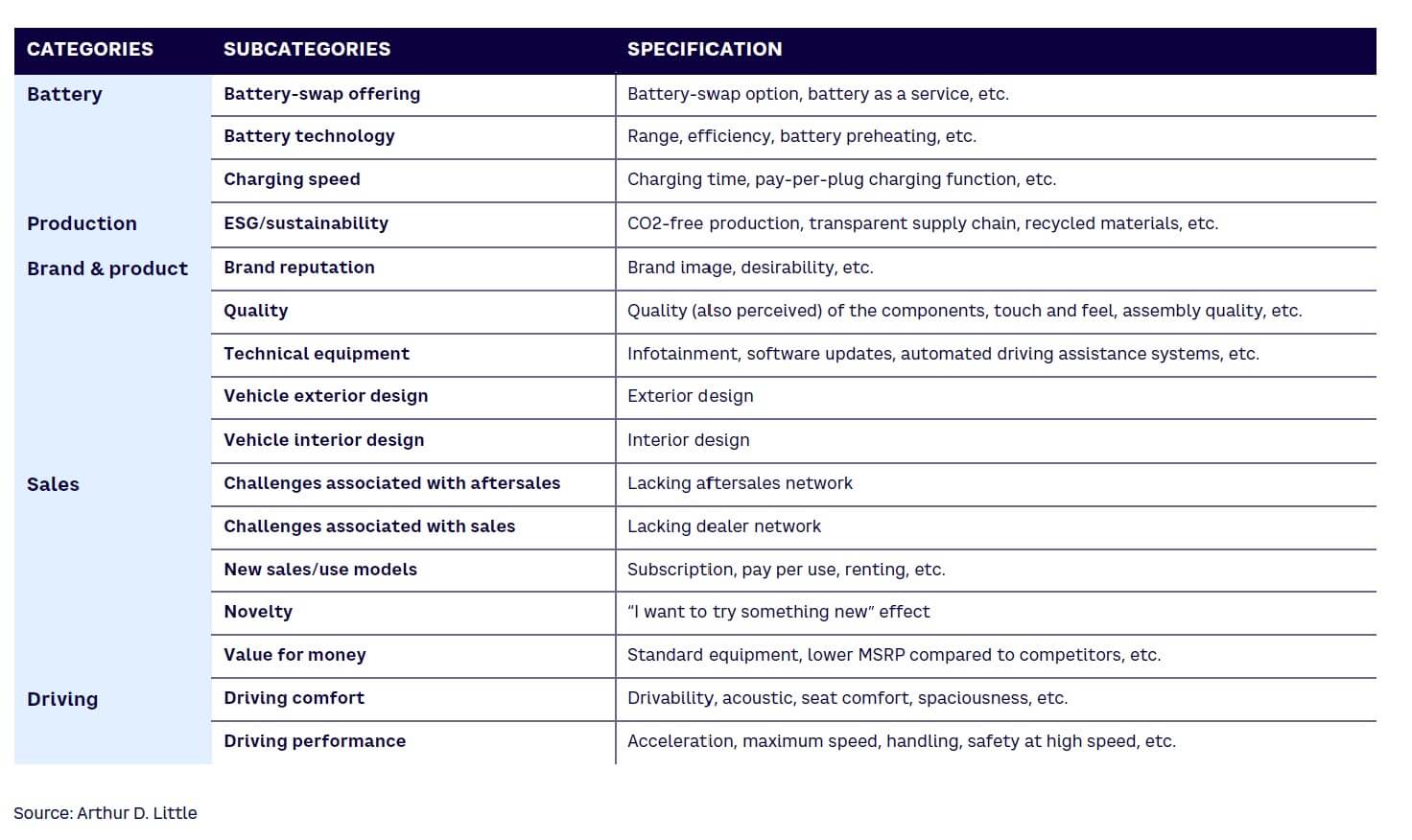

We asked car buyers why they might buy a Chinese EV (and the expectations related to this interest) and their reasons for staying away. These reasons have been categorized into aspects of battery, production, brand/product, sales, and driving — along with corresponding subcategories (see Table 3).

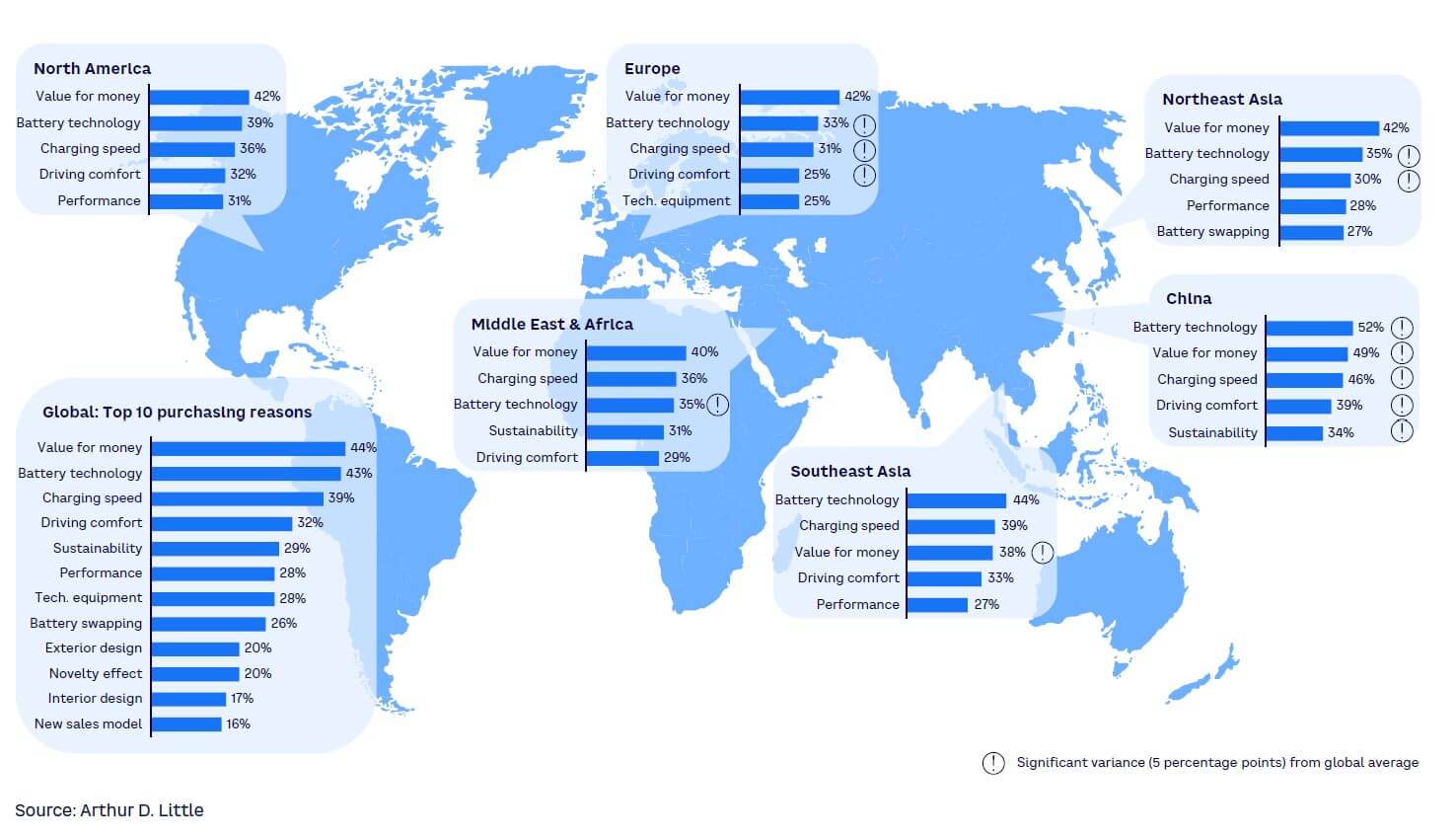

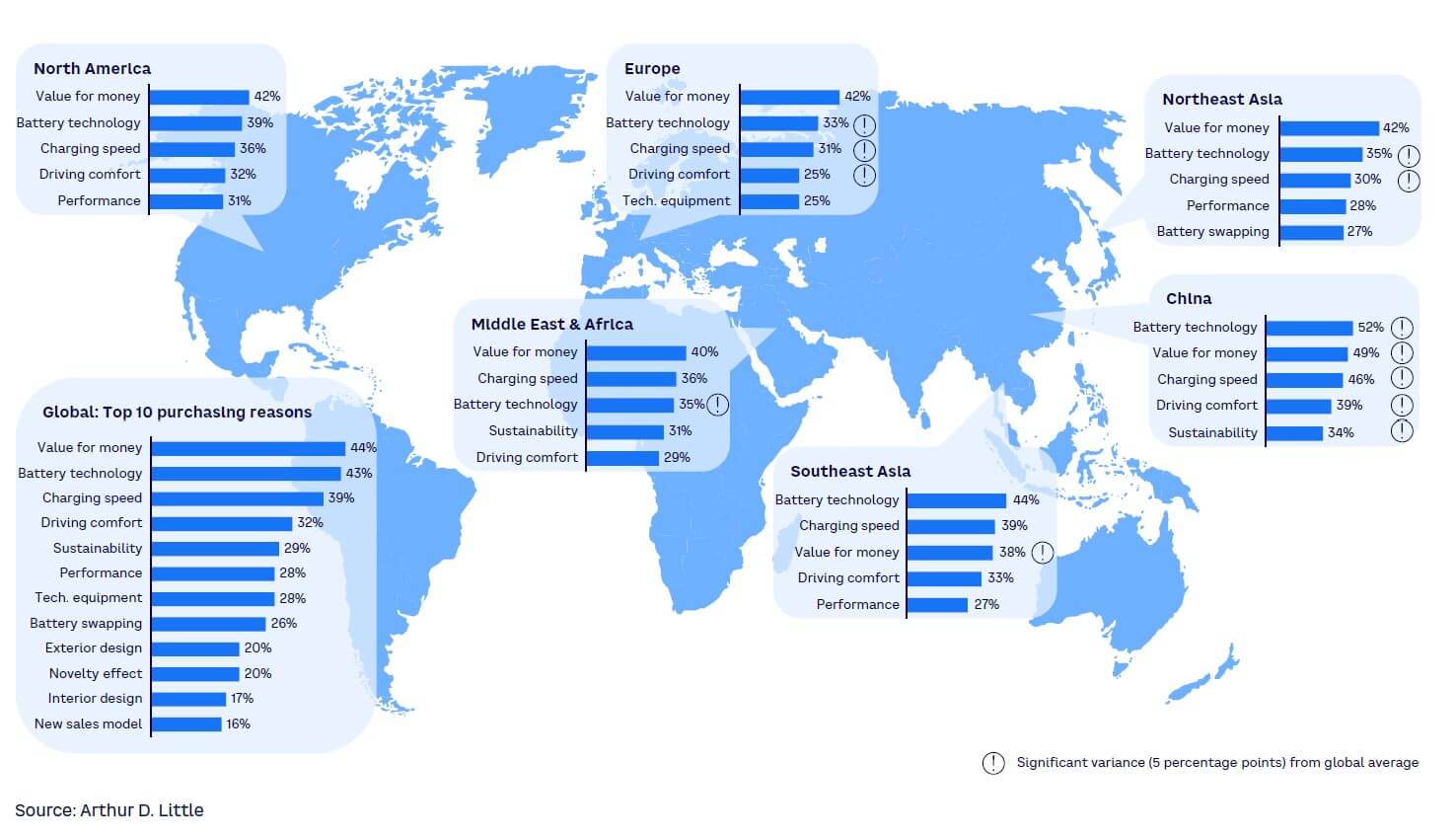

Among the 58% of global respondents who expressed interest in purchasing a Chinese EV, the most prominent reasons relate to costs and battery (see Figure 6). In fact, 44% cited value for money as the main reason for considering a Chinese EV, closely followed by battery technology (43%) and charging speed (39%). These two factors demonstrate trust in Chinese EV-powertrain capabilities.

However, consumers still question product and sales-related characteristics, such as the exterior and interior design of the car. Only 20% of respondents who would purchase a Chinese EV attribute their decision to exterior design, and only 17% cite interior design. New sales and usage models, such as the opportunity to lease or subscribe to a car, are identified as the least influential factors in the decision-making process.

For Chinese respondents, the primary reason for purchasing a domestic EV is battery technology (52%), further emphasizing the trust in domestic technology that Chinese OEMs have established in their home market. Value for money also scored higher than the average. Multiple pricing adjustments by Western OEMs for their EVs in China were required in 2023 but could not effectively change the perception that Chinese EVs are the better bargain. Additionally, Chinese respondents frequently selected driving comfort as a reason for purchase, suggesting that domestic OEMs are particularly adept at meeting customer needs related to seats, legroom, and onboard features.

European respondents are far less enthusiastic about Chinese battery technology (33%), charging speed (31%), and driving performance (20%) than the global average. Interior and exterior design, as well as the novelty effect, which scores higher than average in most regions, have a less positive impact on Europeans. We interpret these results as stemming from a high degree of loyalty to the domestic car industry.

In North America, we find a different situation. Chinese EVs perform higher than the global average regarding expected driving performance (31%), exterior design (24%), and novelty effect (24%).

In the Middle East and North Africa, respondents mostly align with the global average. However, they show greater interest than the global average in purchasing a Chinese EV due to its design (both interior and exterior), novelty effect (24%), and the potential for new sales/use models (22%).

Southeast Asian respondents demonstrate response patterns that closely align with the global average, with percentages above average for technical equipment (31%), interior and exterior design (24% and 23%, respectively), and novelty effect (24%). Most Northeast Asian respondents are not interested in purchasing a Chinese EV, with patterns similar to those seen in Europe.

CHINESE OEM CAN GAIN MARKET SHARE BY IMPROVING PERCEIVED QUALITY

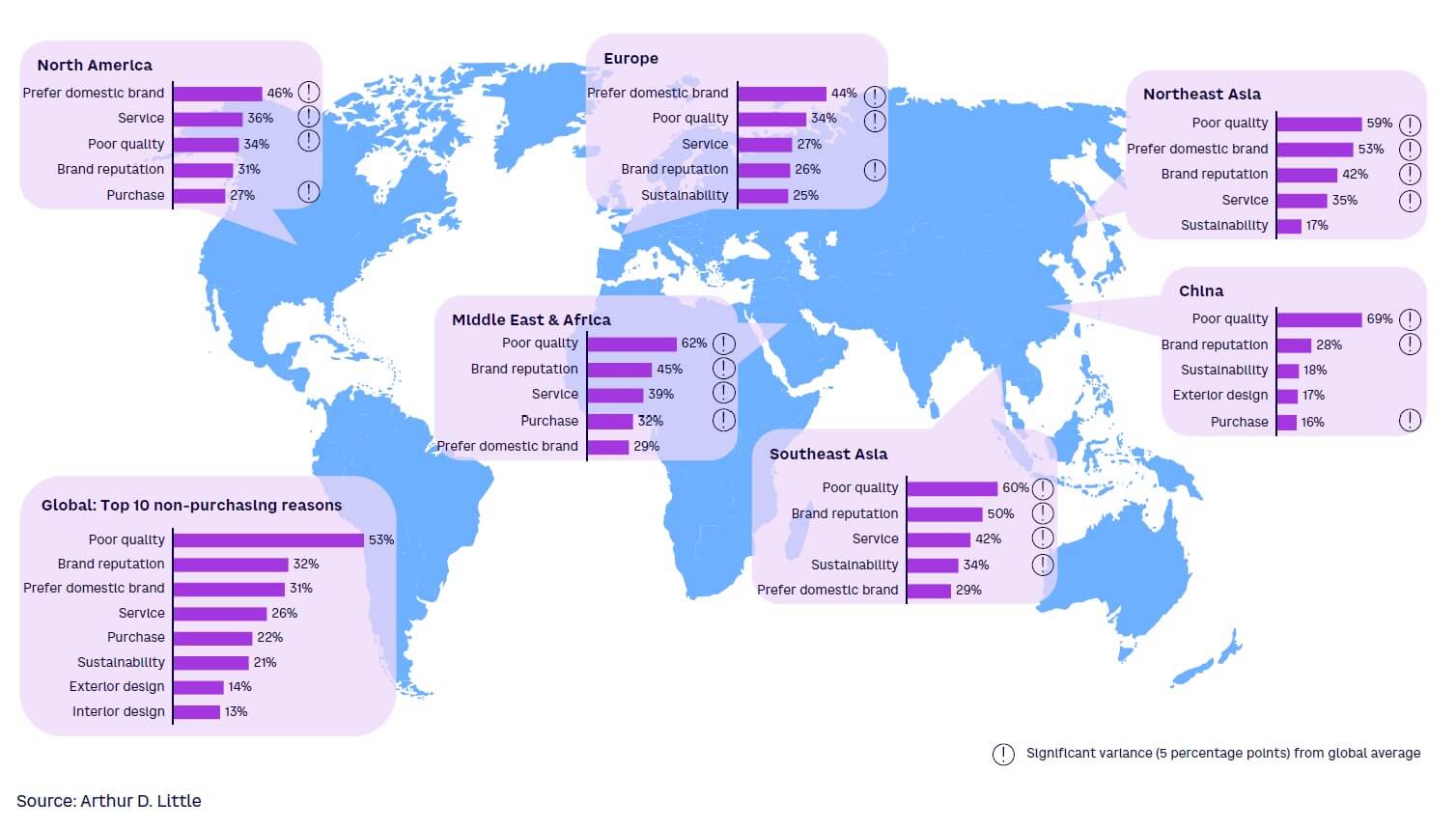

We gathered data on the reasons respondents would not consider purchasing a Chinese EV (see Figure 7). Among the 42% of respondents who would not consider purchasing a Chinese EV, the primary reasons relate to the brand and product category. Major concerns include poor quality (53%), brand reputation (32%), and preference for national brands (31%). Similar to the reasons for purchasing a Chinese EV, exterior and interior design (14% and 13%, respectively) appear to play a less significant role in the decision not to purchase a Chinese EV.

Interestingly, for Chinese respondents, the main reason for not purchasing a domestic EV is still poor quality (69%). This result is surprisingly high (more than 16 percentage points) compared to the global average and to regions like Europe and North America. It is noteworthy that poor quality as a reason against purchasing a Chinese EV is the lowest in Europe and North America (34%).

In Europe, North America, and Northeast Asia, a preference for domestic brands is the primary reason for not purchasing a Chinese EV and is at least 15 percentage points higher than the global average. The question is how long domestic OEMs in those regions can rely on this advantage, given that it’s based mainly on emotions. It’s also unclear whether the perception of brands like MG and Polestar in Europe will change faster than Chinese brands (e.g., XPeng, NIO, and BYD Auto).

In North America, respondents expressed concerns about challenges associated with sales (27%) and after-sales (36%) of Chinese EVs, due to an underdeveloped retail and service network. These two aspects are also reasons for not purchasing a Chinese EV in the Middle East, North Africa, Southeast Asia, and Northeast Asia. For Southeast Asian respondents, brand reputation (50%), challenges associated with service (42%), and ESG standards (34%) negatively influence the purchase decision.

FIRST-ADOPTER PROFILES

To shed light on who might be the first major adopters of Chinese EVs, we analyzed demographics for respondents with the highest interest in Chinese EVs and cross-referenced their responses to other questions in our survey (see Figure 8). This was done in multiple markets, selected by the following two criteria:

- Expected market share of Chinese OEMs by 2030

- Market relevance in terms of sales volume

We examined three aspects for each market:

- Main factors influencing interest and disinterest in purchasing a Chinese EV

- Demographic profile of prospects interested in a Chinese EV

- Automotive profile

Germany

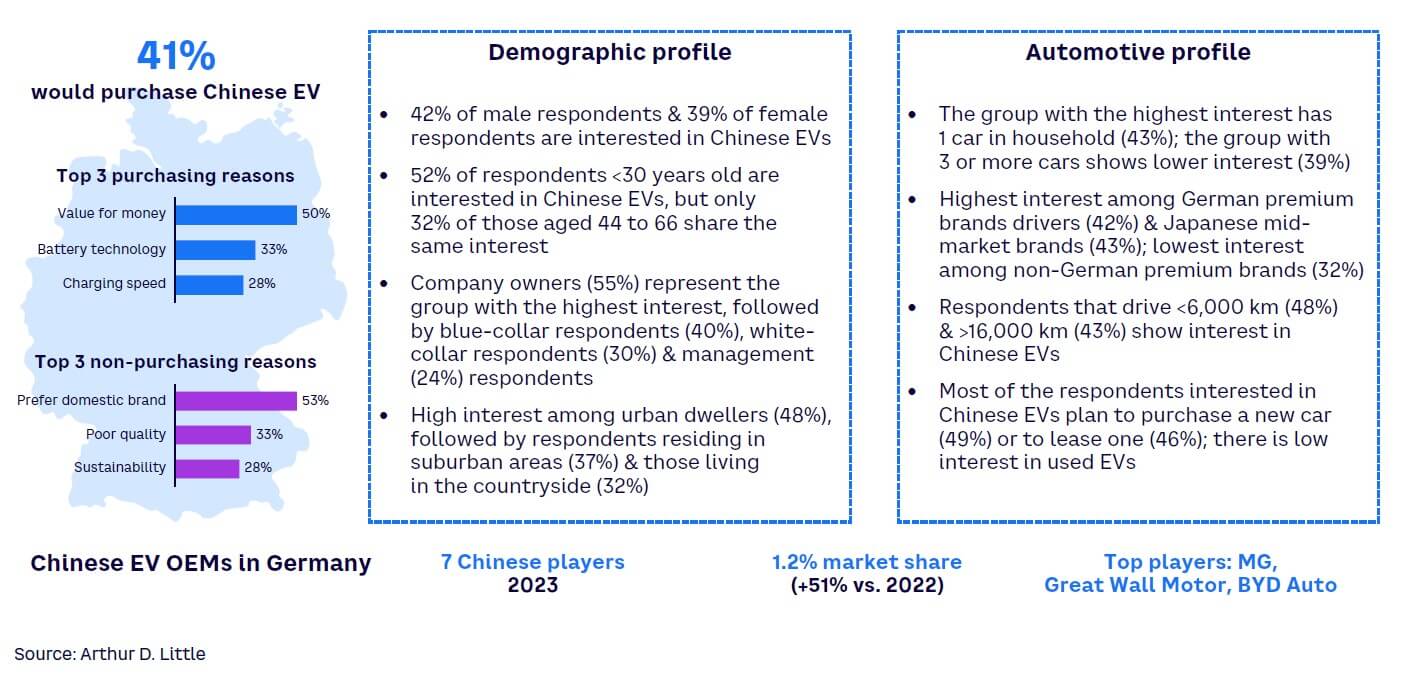

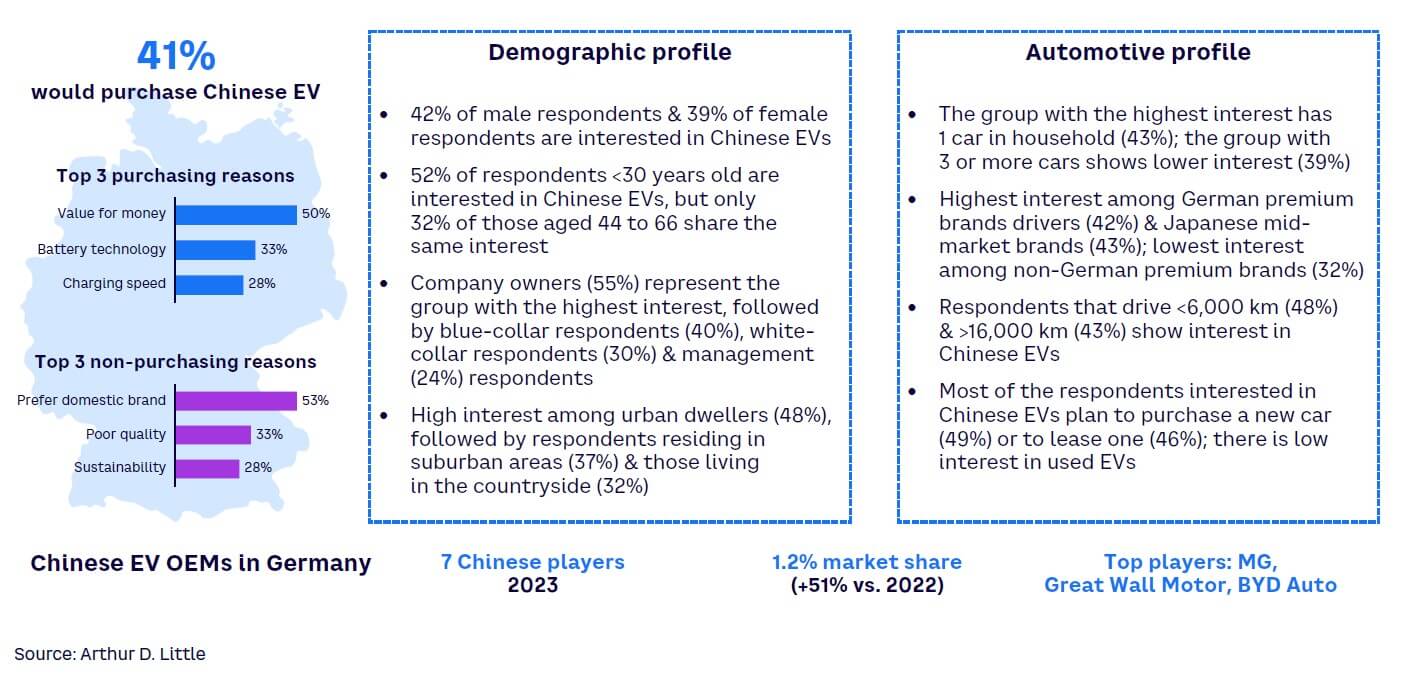

Chinese EVs are currently underrepresented in Germany, but there is a notable interest among young urban dwellers and drivers of German premium brands.

Germany is the largest European passenger vehicle market and home to numerous world-renowned premium brands. Chinese OEMs entered the German market in 2021, with initial entrants Lynk & Co by Geely and MG by SAIC. At the end of 2023, seven Chinese brands were for sale in Germany, capturing a market share of 1.2%. The majority of Chinese brands in Germany offer PHEVs and BEVs. MG led “Team China” in the German market in 2023, selling more than 20,000 cars.

ADL’s research indicates that 41% of Germans would consider purchasing a Chinese EV, motivated by value for money and battery performance (see Figure 9). Notably, most respondents interested in Chinese EVs are under 30 years old and are urban dwellers.

Only a third of older respondents and those living in rural areas showed interest. Among respondents in management positions who typically drive domestically produced company cars, only a fourth would consider a Chinese EV. This data partially contrasts with an interest in Chinese EVs from both German premium-brand and Japanese volume-brand drivers. German premium-brand drivers exhibit a high affinity for technical features (e.g., battery technology and charging speed), while Japanese volume-brand passenger vehicles have long been known for their excellent value for money. Yet both reasons were also reported as main reasons for purchasing a Chinese EV.

We believe the following Chinese OEM categories have the highest sales potential in Germany:

- EV start-ups. Premium brands have consistently maintained high market shares in Germany due to a high proportion of company cars and the number of domestic premium brands. We predict that if premium Chinese EVs can provide competitive offerings for business customers in the D and E segments (large cars), they could capture a market share of 1% to 1.5% by 2030.

- Incumbents with a history of JVs. With the growing trend of electrification and appealing value for money, we expect these brands to attract customers within the B and C EV segments (sub-compacts and compacts), potentially reaching a market share of 6.5% to 7.5% by 2030.

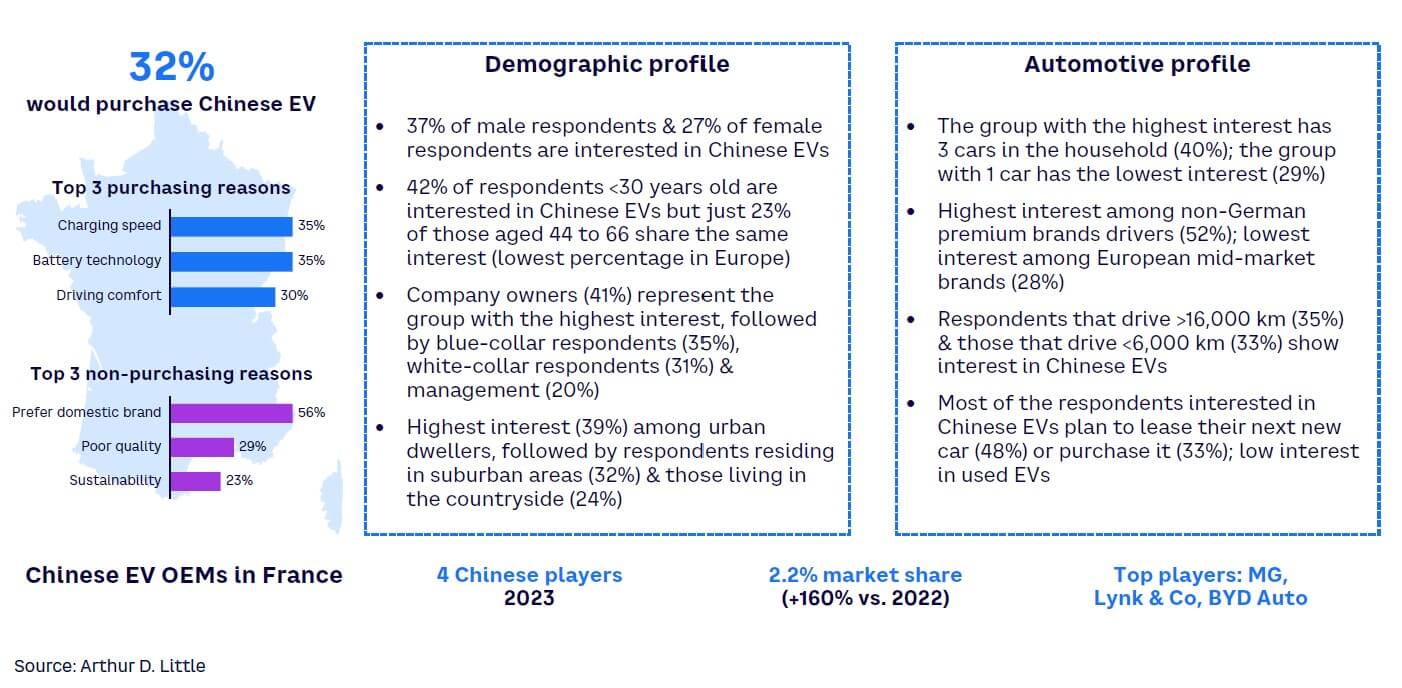

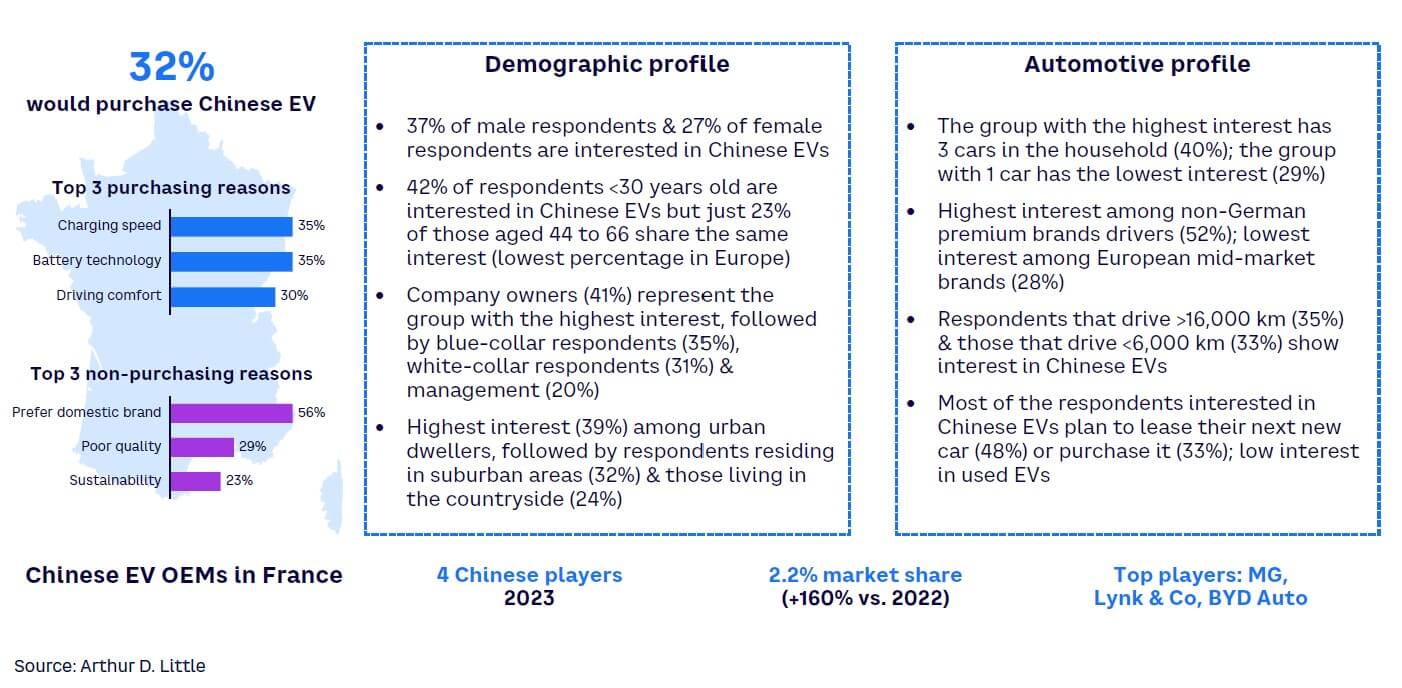

France

In France, strong domestic brands, political factors, and low interest in Chinese EVs may hinder the progress of Chinese EVs.

France’s four top domestic brands (Renault, Peugeot, Citroen, and Dacia) account for nearly 50% of the market, occupying segments that are highly attractive for Chinese EVs (i.e., B and C). In 2021, Chinese EVs entered the French market with MG by SAIC and Lynk & Co by Geely. At the end of 2023, MG had managed to secure 2% of the market, with the MG4 model among the top 30 best-selling vehicles in France. The impact of restrictions on France’s electrification bonus for Chinese EVs will become evident in sales volumes from 2024 onward.

Among the analyzed European markets, France exhibits the lowest willingness to purchase a Chinese EV, with only 32% of respondents expressing interest (see Figure 10). For those considering a purchase, battery-related specifications are the primary motivating factors. Notably, even among respondents under 30 years old (who demonstrate a relatively high degree of openness toward Chinese EVs in other countries), interest in France remains below 50%.

There are some similarities with Germany in terms of professional and living situations, albeit at a much lower level of interest. Respondents with high interest in Chinese EVs tend to have three cars in their household (40%), suggesting that a Chinese EV could replace a second or third vehicle. The highest interest is found among non-German premium-brand drivers (52%), while the lowest interest is among European-brand drivers (28%), indicating that domestic-brand drivers may be hesitant to switch to a Chinese brand and have already found good value for money and appropriate technology.

Despite the weak interest in Chinese EVs, we believe that incumbents with a history of JVs could have success in France, particularly in the B and C EV segments, perhaps achieving a 5% to 6% market share by 2030. The Stellantis stake in Leapmotor and plans to assemble A (city cars) and B segment EVs in Europe could present a volume opportunity for Chinese EVs.

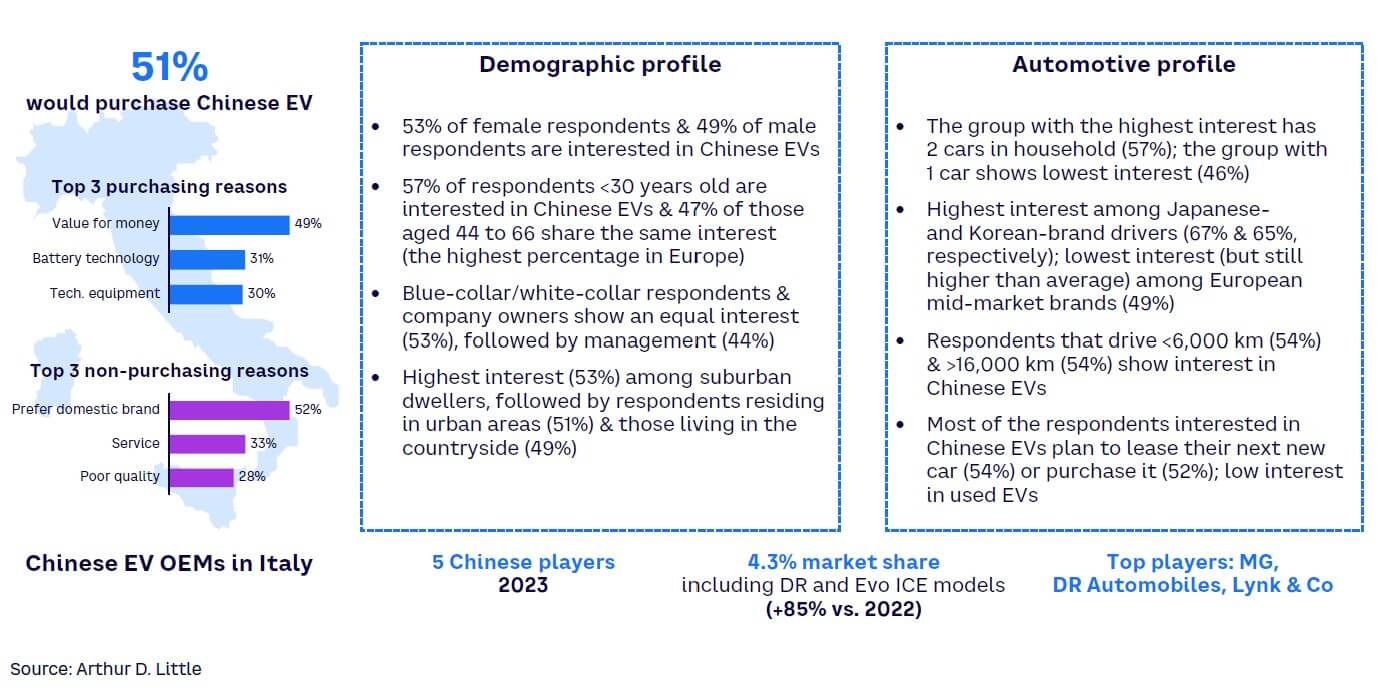

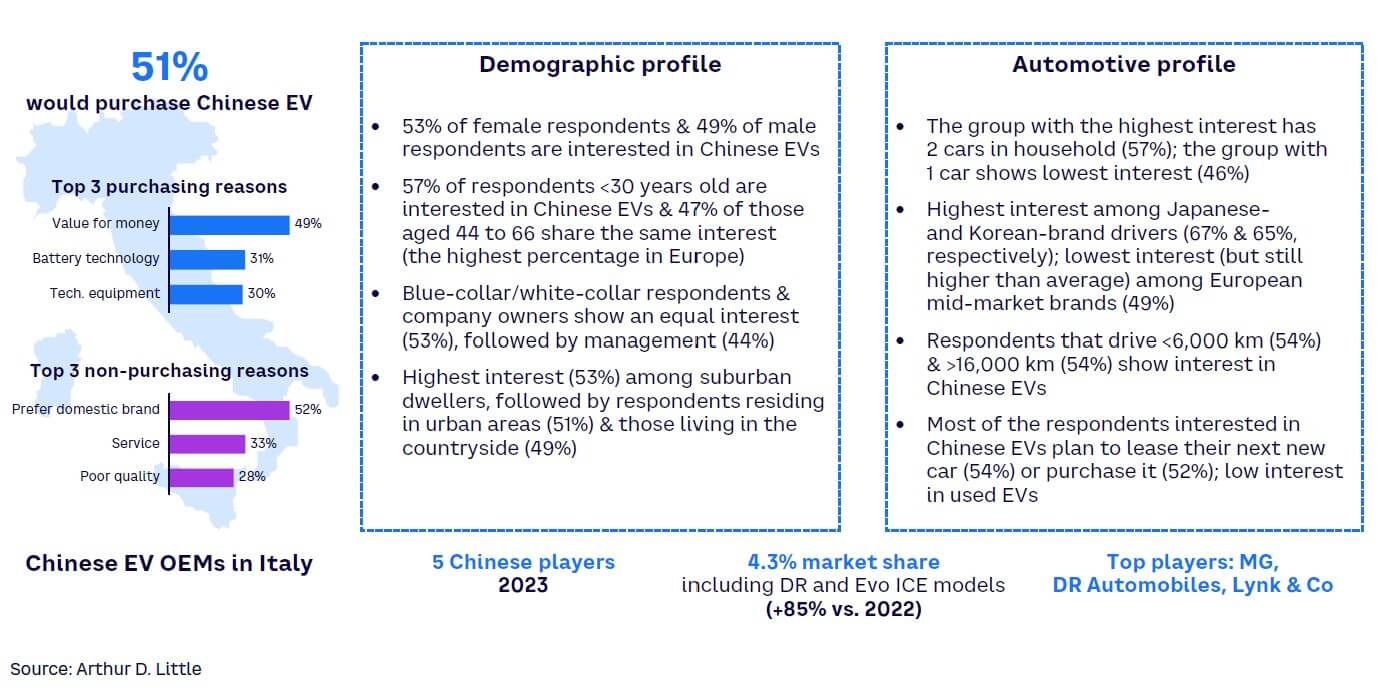

Italy

Italy has the highest interest in Chinese EVs among European countries and has a highly homogeneous customer profile.

Chinese OEM presence in Italy traces back to the mid-2000s, when GWM began importing a robust SUV and pickup through an independent importer, and DR Automobiles (an Italian OEM) started assembling vehicles under a license from Chery Automobile.

Although GWM discontinued its activities after a few years, DR Automobiles began to grow through unconventional sales channels like supermarkets and hypermarkets and an affordable product portfolio (small cars and SUVs). DR Automobiles growth accelerated in 2020 when, through an additional licensing contract with JAC Motors, it diversified its product portfolio, entered new markets, and developed a dealer network.

DR Automobiles is positioned as a volume brand with a cross-segment offering of ICE vehicles and EVs, while the newly launched Evo brand serves the entry-level market. In 2021, similar to other major European markets, MG by SAIC and Lynk & Co from Geely entered the Italian market with EVs.

By the end of 2023, five Chinese brands (including DR Automobiles and Evo) were on sale in Italy, capturing a market share of 4.3%. MG is the best-selling brand, selling more than 30,000 cars per year, followed by DR Automobiles (25,000 cars) and Evo (7,100 cars).

ADL’s analysis indicates that 51% of Italians would consider purchasing a Chinese EV, citing value for money as the main reason (see Figure 11). The majority of respondents interested in Chinese EVs are under 30 years and reside in urban (51%) or suburban (53%) areas. Demographically, Italian respondents appear quite homogeneous, with little variation between age groups, living situations, or professional careers. Notably, respondents with the highest interest in Chinese EVs are those with two cars in their household (57%) and who currently drive a Japanese- or Korean-made vehicle.

We anticipate that incumbents with a history of JVs will play a crucial role in Italy. By offering EVs in the B and C segments, these brands could capture a 5.5%-6.5% market share by 2030.

Spain

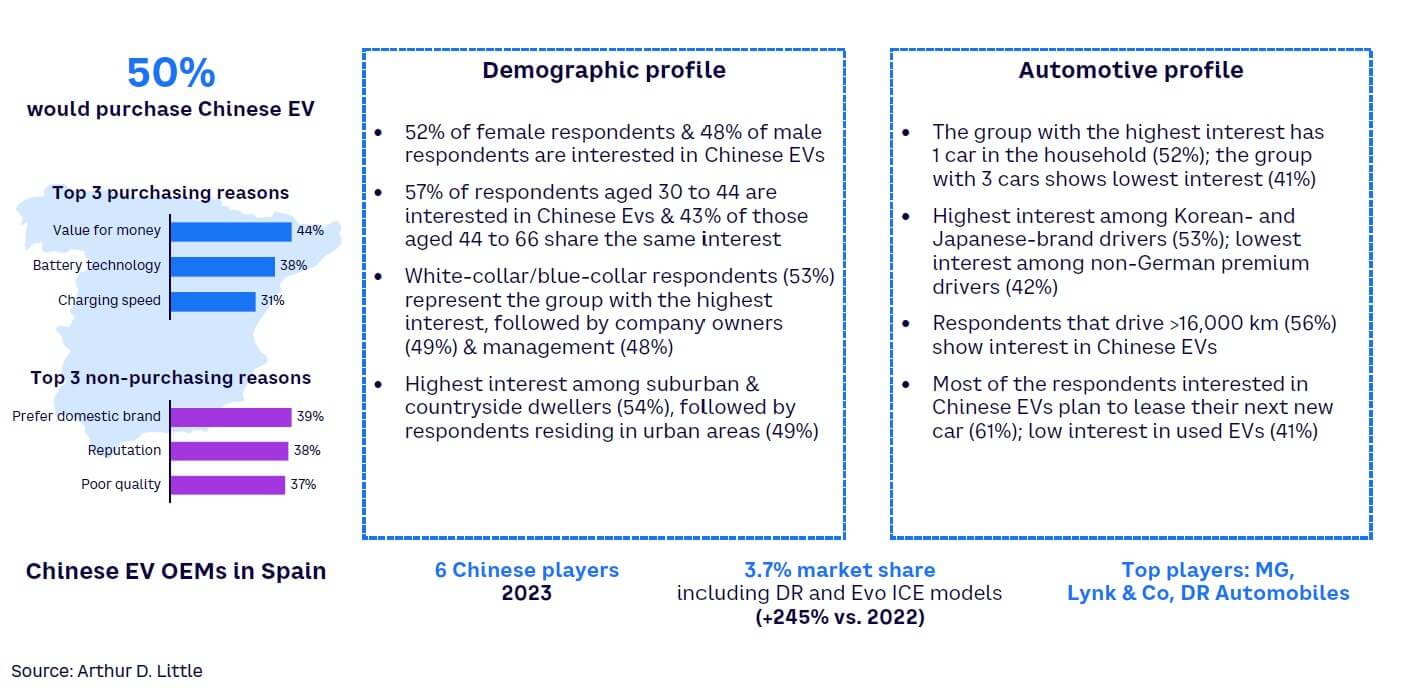

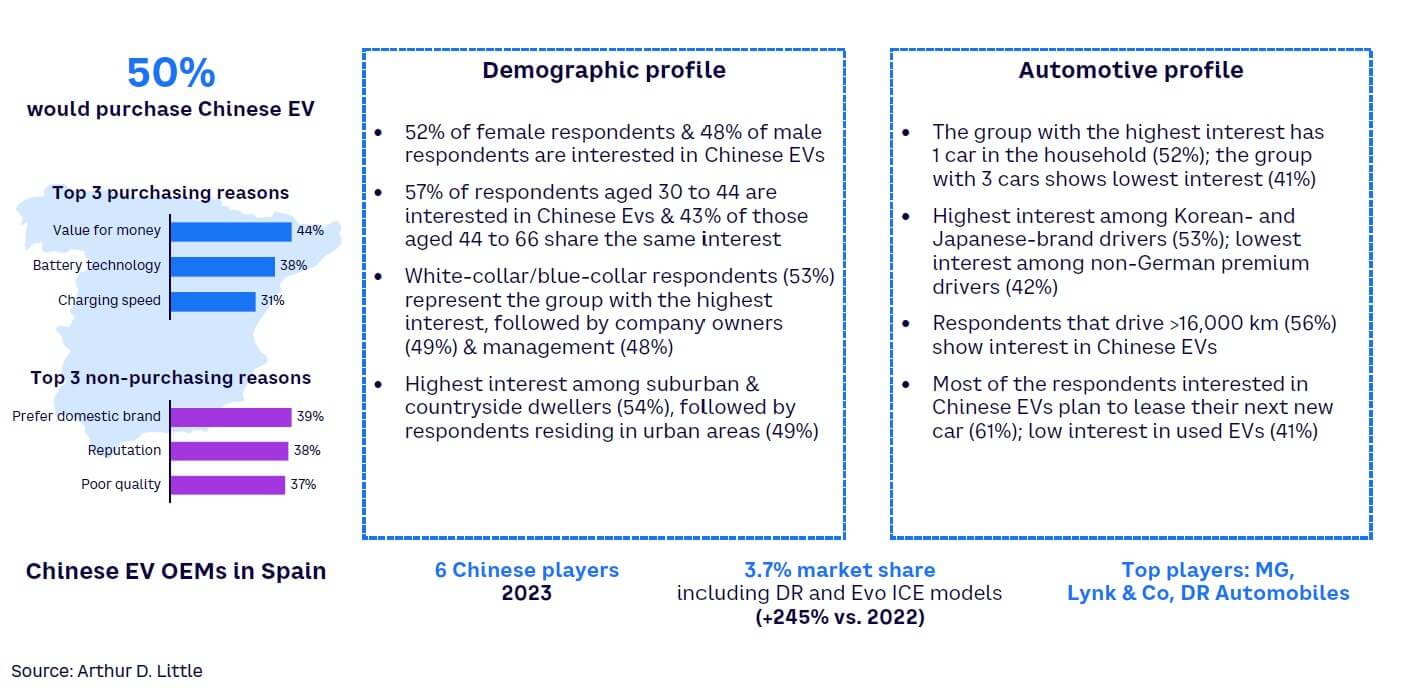

There is notable interest in Chinese EVs in Spain, with a high degree of homogeneity among prospects.

The expansion of Chinese OEMs in Spain began in the late 2010s, when GWM introduced a hatchback model and a robust SUV through an independent distributor. However, these models failed to meet their sales targets and eventually disappeared from the market. Significant growth of Chinese OEMs commenced in 2021 with the entry of MG from SAIC, Lynk & Co, and DR Automobiles into the Spanish market. By the end of 2023, six Chinese players were present in Spain, capturing a 3.7% market share. Except for DR Automobiles, which offers both ICE vehicles and EVs, all other players focus on EVs. MG dominates the Spanish market (29,000 units per year) followed by Lynk & Co and DR Automobiles.

The Spanish market shares several similarities with the Italian market. Fifty percent of respondents willing to purchase a Chinese EV cite value for money as the primary reason (see Figure 12).

Demographically, there are no significant differences in interest for Chinese EVs among Spanish respondents in terms of living or professional situations. Interestingly, the group with the highest interest (57%) in Chinese EVs is between 30 and 44 years old, compared to most other countries where the group with the highest interest is under 30. In Spain, 52% of respondents with only one car in their household said they were inclined to purchase a Chinese EV. Additionally, the highest interest comes from current drivers of Korean and Japanese brands (53%).

We expect two categories of Chinese EVs to play a role in Spain:

- Incumbents with a history of JVs. By offering EVs in the B and C segments (SUVs and hatch), these brands could achieve a total market share between 7% and 8.5% by 2030, primarily driven by private customers.

- Domestic market incumbents. These players could cater to customers seeking functional and affordable A- and B-segment EVs. Due to the gradual reduction of A-segment vehicle offerings by European brands, we expect these brands could capture a total market share of 0.5% to 1% by 2030.

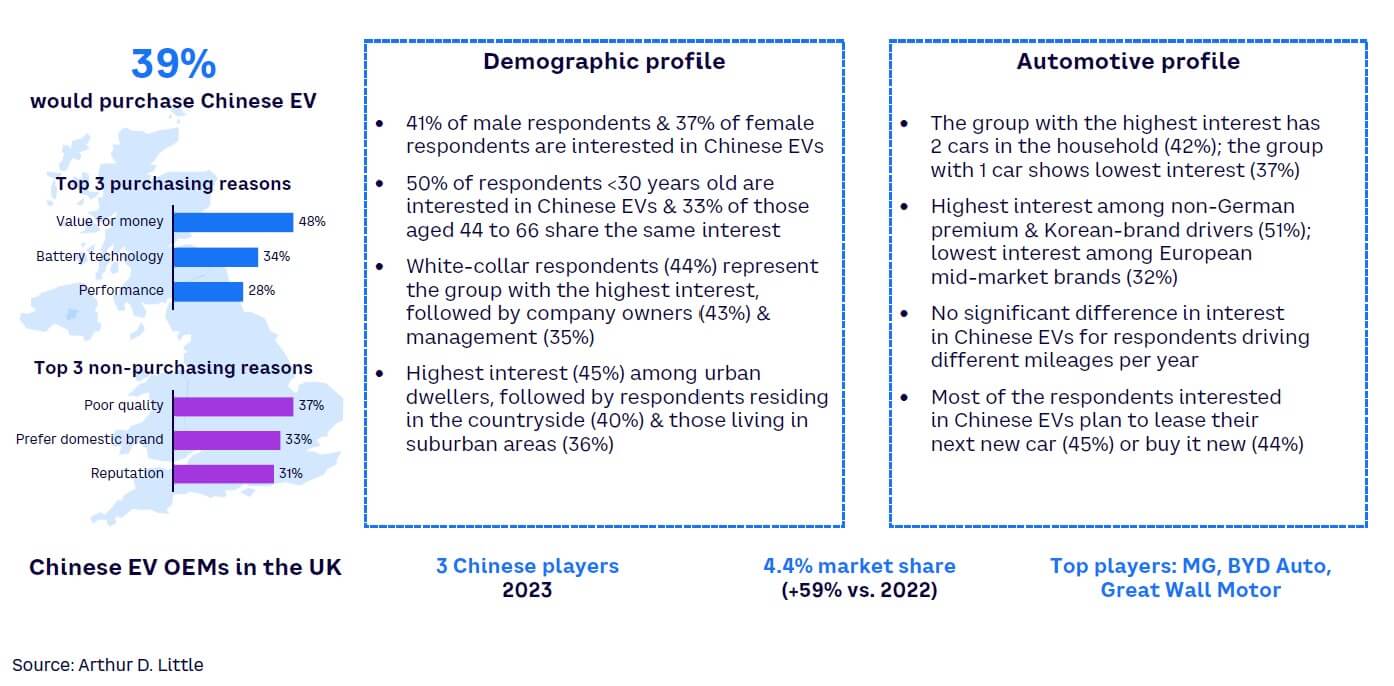

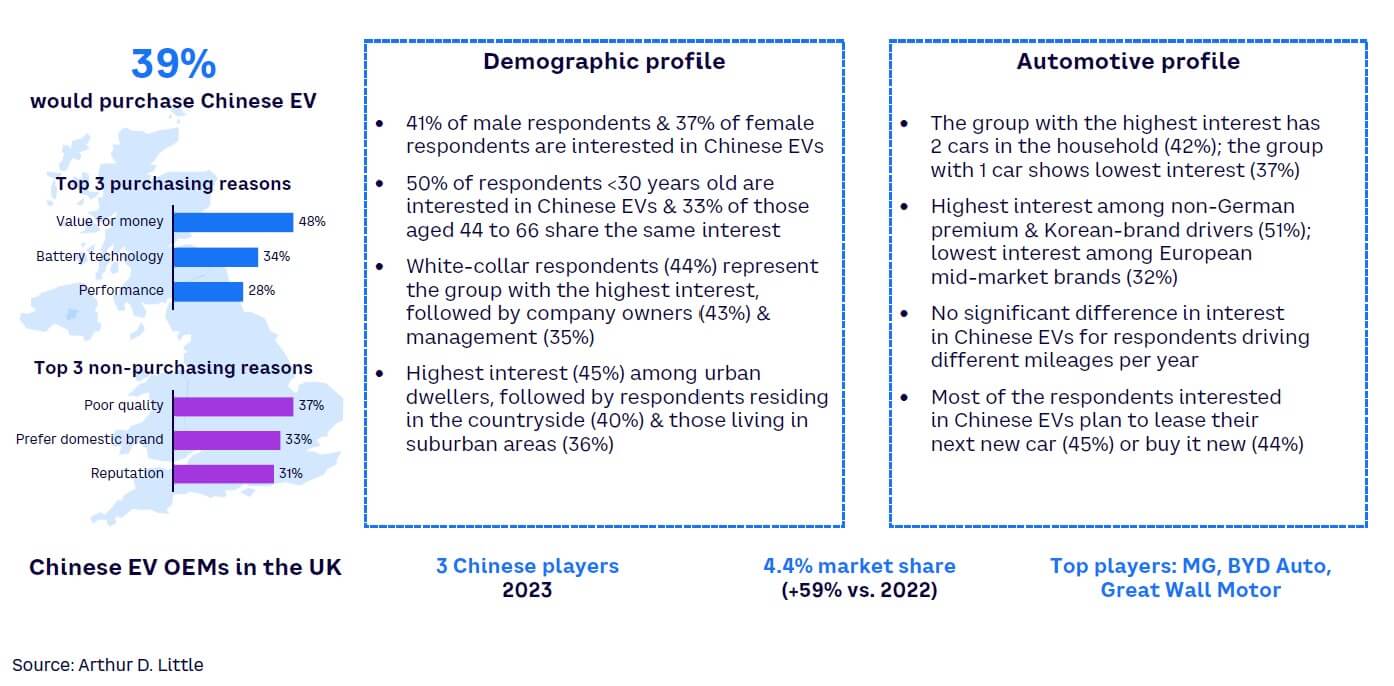

UK

In the UK, the use of the MG brand has supported market share, despite generally low interest in Chinese EVs.

Over the past three decades, the domestic car industry in the UK has experienced significant change, including acquisitions by foreign groups (e.g., Tata acquiring Jaguar, Land Rover, BMW Mini, and Volkswagen Bentley) and the discontinuation of activities by historical brands (e.g., MG and Triumph). MG by SAIC entered the UK market in 2011. However, it was not until the relaunch of its product portfolio in 2021 that the brand began to gain significant traction. By the end of 2023, three Chinese brands were on sale in the UK, capturing a 4.4% market share. It is important to note that 4.3% of the market share captured by Chinese EVs went to MG, which sold more than 80,000 cars in 2023. The success of MG in the UK can be attributed to the brand’s English origin and its presence in the country for more than a decade.

Despite the high market share of Chinese brands, only 39% of respondents said they would consider purchasing a Chinese EV (see Figure 13). Top reasons for interest include value for money (48%) and battery technology (34%). Our research indicates that the majority of respondents interested in Chinese EVs are under 30 years old and reside in urban areas. Company owners and white-collar professionals show the highest interest in Chinese EVs among all professionals. Notably, 51% of drivers of non-German premium and Korean brands expressed interest in purchasing a Chinese EV, while European-brand customers showed lower interest.

Considering the already strong position of MG in the UK and the limitations in terms of additional costs for right-hand driving adjustments, we expect to see fewer Chinese EV brands in the UK than in other European countries. We believe incumbents with a history of JVs will capture the highest segment share (between 8.5% and 10% by 2030).

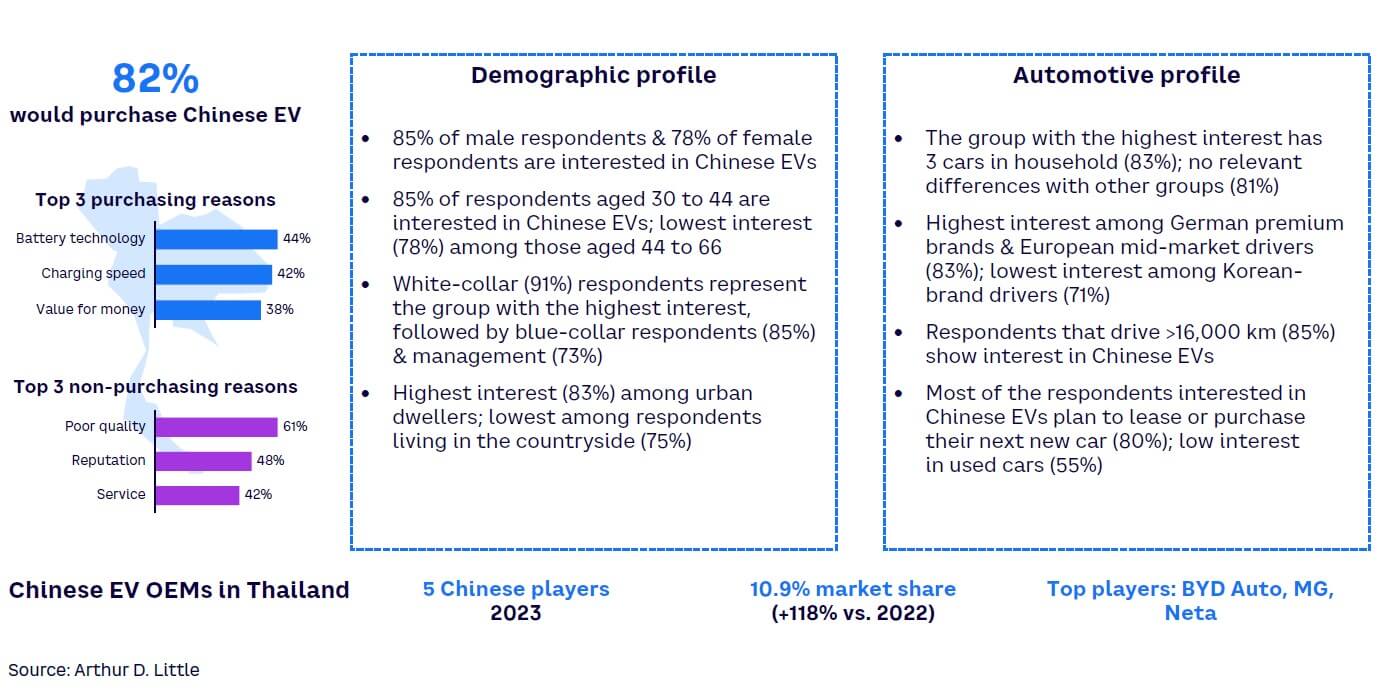

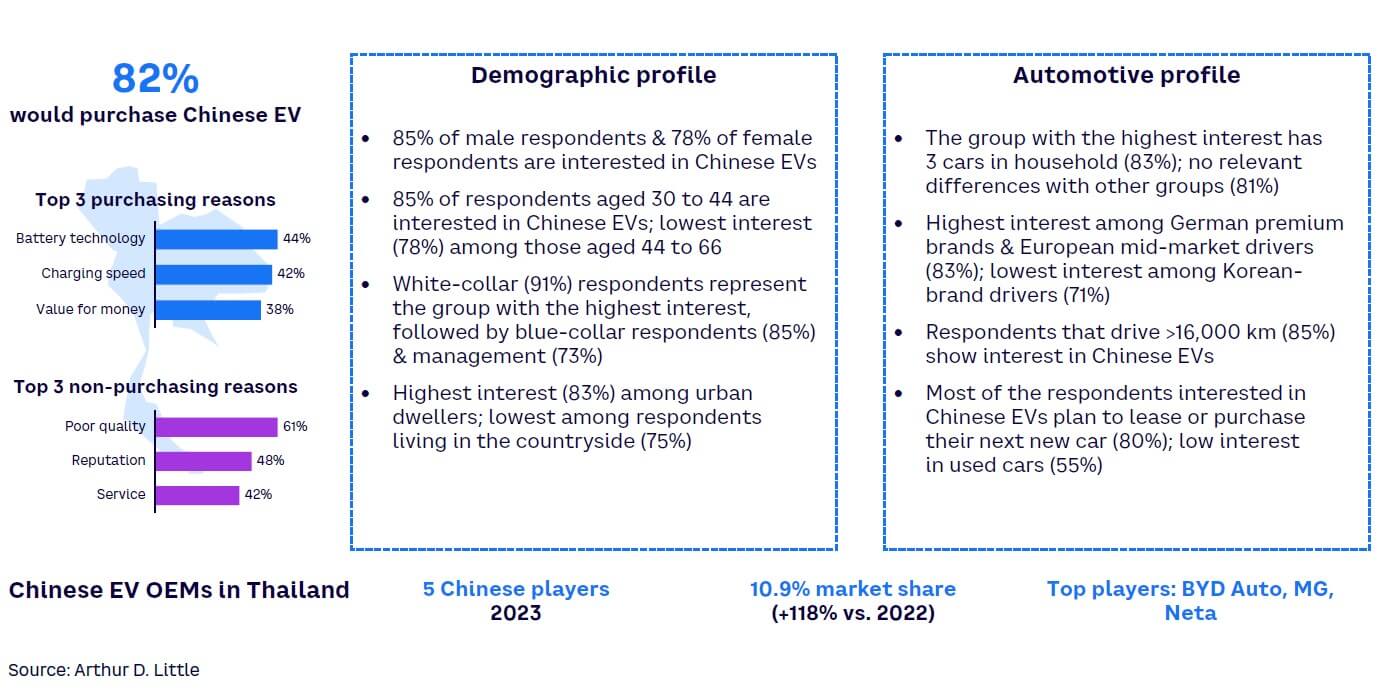

Thailand

Thailand’s strategy to become an EV regional hubis incenting entry of Chinese EVs.

Thailand has the highest interest in Chinese EVs outside China, with an 82% market share (see Figure 14). It has long been considered the automotive hub of Southeast Asia. For decades, Japanese brands have dominated the market, supported by a product portfolio well suited to the Thai market (focusing on pickups and robust SUVs) and an excellent dealer network. As highlighted in the ADL Report “Unleashing Thailand’s Electric Mobility Potential,” the country has embraced the transition to electromobility.

These factors encouraged Chinese EV OEMs to enter the Thai market, underpinning their expansion strategy in two ways: (1) through strong partnerships with well-established local companies (e.g., BYD Auto’s cooperation with Siam Motors Group, one of the largest automotive players in Thailand, giving OEMs access to a well-developed dealer and service network); and (2) through gradual localization of production in the country by Chinese OEMs, with GWM opening two production lines in Thailand in 2021 and beginning EV production in 2024, followed by BYD Auto and SAIC with MG in 2024. In 2023, Chinese OEMs captured an 11% market share in Thailand.

The main reasons for interest in Chinese EVs relate to battery performance (44%) and charging speed (42%). The highest interest is among younger respondents and white-collar workers living in urban areas — the group of respondents most likely to be the first to switch to electromobility. Our research shows that interest in Chinese EVs is highest among German premium-brand drivers (83%), while Korean-brand drivers show the lowest interest (71%). We expect Chinese EVs to stabilize and strengthen their leading position in Thailand, particularly in light of its accommodating policies designed to incent local production.

We believe two categories of Chinese OEMs will be particularly successful in Thailand:

- Incumbents with a history of JVs. By offering EVs in C and D segments (especially SUV and hatchback models), these brands could capture a total market share between 12% and 14% by 2030.

- Domestic market incumbents. These players could address lower market segments (e.g., A and B segments) with affordable EVs. They could also compete in ICE markets for robust SUVs and pickups. We forecast a total market share for these players around 11% by 2030.

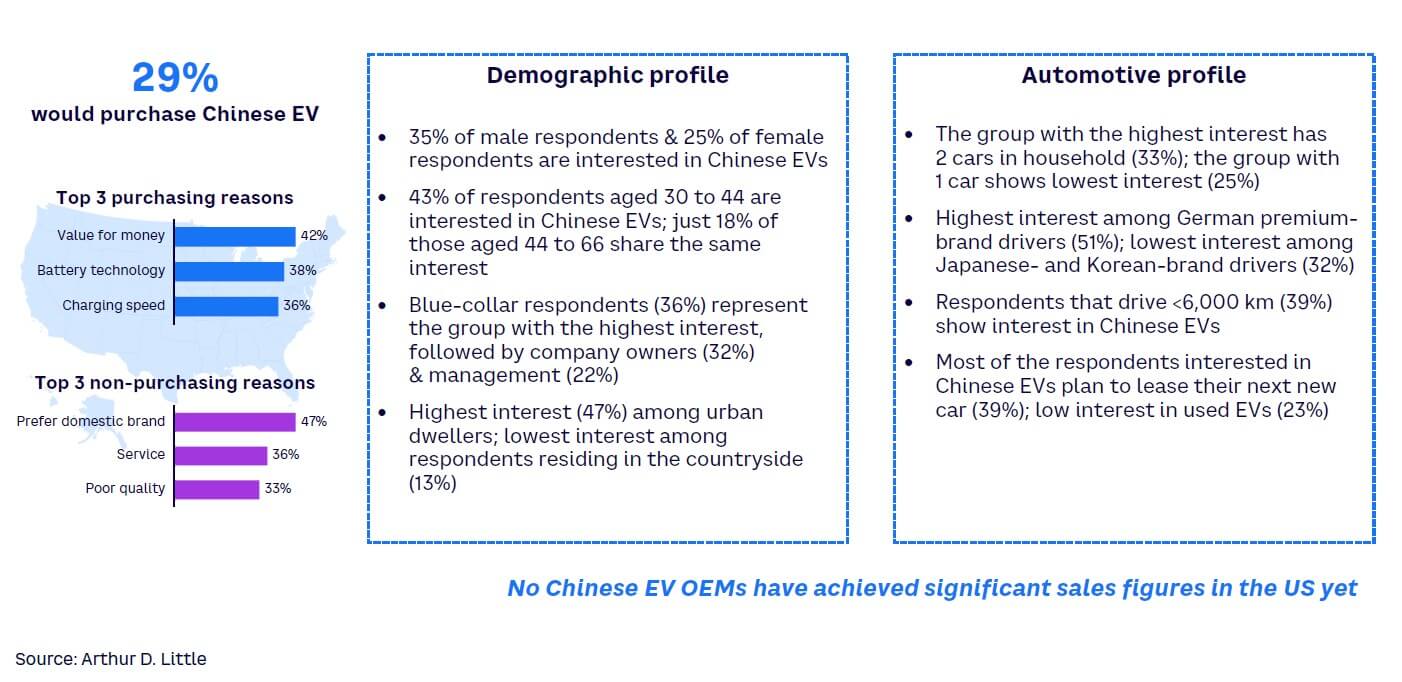

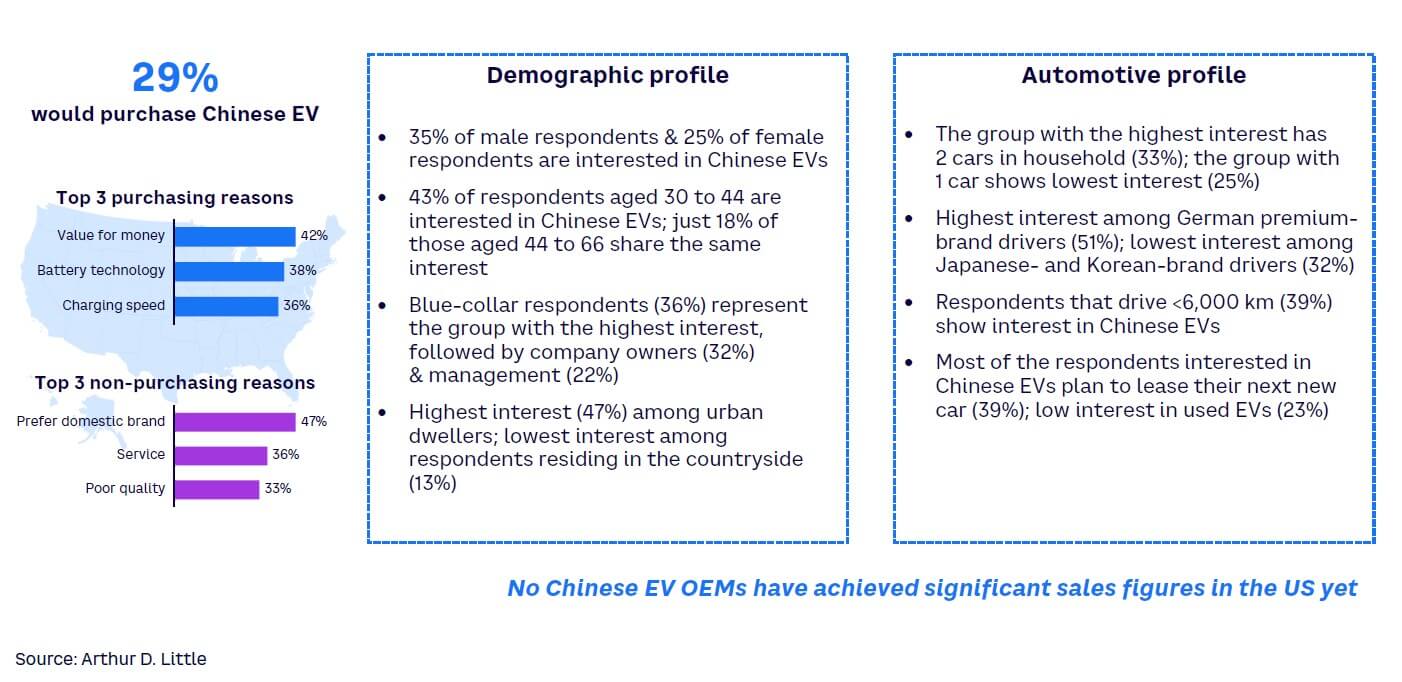

US

In the US, Chinese EVs currently play a minimal role due to trade barriers and low consumer interest. However, market penetration could start soon, beginning in the neighboring market of Mexico.

The US has not been a priority for Chinese brands looking to expand their operations for two main reasons. First, vehicles made in China are subject to a 27.5% import tariff, compared to a 2.5% tariff for other imported vehicles. The US Inflation Reduction Act passed in 2022 includes strict requirements for local sourcing and manufacturing, placing imported EVs at a significant disadvantage.

However, Chinese OEMs have been active in Mexico since the latter half of the 2010s, initially with vehicles built in China and sold under Ford or Dodge brands and since 2021 with MG by SAIC. To circumvent high import tariffs, Chinese OEMs could begin approaching the US by setting up production sites in Mexico and exporting from there.

Enthusiasm for Chinese EVs is relatively low in the US, with only 29% of respondents expressing interest in a Chinese EV (see Figure 15), primarily driven by value for money (42%).

The reasons for not purchasing are similar to those found in European markets: preference for domestic brands (47%) and perceived poor quality (33%). Although the demographic profile of respondents is relatively homogeneous, there are notable differences between urban dwellers (47%) interested in Chinese EVs and those living in rural areas (13%). Most prospects interested in purchasing a Chinese brand currently drive a German premium brand (51%); Japanese- and Korean-brand drivers are less interested in purchasing a Chinese EV (32%).

It is currently unclear when Chinese EVs will begin their expansion in the US market, but we believe two categories could play a role in the US market:

- EV start-ups. Given the high interest among respondents currently driving German premium brands, EV start-ups may have appeal to US customers interested in technology, particularly those in urban areas.

- Incumbents with a history of JVs. These OEMs could target entry-level buyers.

Conclusion

The Chinese passenger vehicle market reached 26 million vehicles sold in 2023 and has become a major source of global EV demand. Production of Chinese passenger vehicles is expected to continue growing in the coming years, fueling export activity (which reached 4 million in 2023) and making China the largest exporter of passenger vehicles.

ADL’s study, based on 15,000 respondents across 25 countries, reveals that for more than half of prospective buyers, a Chinese EV is a viable option. The primary motivations for purchasing a Chinese EV are battery technology and value for money. Quality remains the main barrier to not choosing a Chinese EV.

In a few markets, Chinese EVs have attained considerable market share, but in regions with a strong domestic car industry, the Chinese EV market share remains insignificant. We believe these aspects will be crucial in driving the globalization of Chinese EVs:

- Electrification development in global markets.

- Introduction of import barriers or tariffs for Chinese OEMs, especially in markets with a strong domestic car industry.

- Customer interest in purchasing a Chinese EV translating into a purchase of a Chinese EV.

- Extent to which Chinese EV makers leverage their cost advantage and establish operations in international markets, focusing on brand and product quality.

- Extent to which incumbent OEMs expand their EV product portfolios with more affordable models, leverage their well-known brand reputation, and perhaps engage in partnerships and JVs with Chinese OEMs to lower their production costs.

DOWNLOAD THE FULL REPORT

35 min read • Automotive

Chinese electric vehicles: Drag or driver for global markets?

Factual discussion & recommendations based on a global consumer survey

DATE

Foreword

China has been a growth driver for Western OEMs for the last two decades, as it has taken advantage of its market size and unbounded desire for Western cars through joint ventures (JVs) with local producers. However, the first signs of an inflection are now visible. A government program initiated a decade ago to promote China’s domestic automotive industry and electrification led to the emergence of new electric vehicle (EV) brands and increased domestic manufacturers’ desire to create their own brands and product portfolios. As a result, China became the largest global car exporter in 2023.

We believe the internationalization of Chinese OEMs will soon accelerate. The drivers are both political and economic, including various regions’ electrification goals and the leveling off of the Chinese economy, forcing domestic OEMs to focus on export activities. Factors such as the global ambitions of Chinese OEMs — particularly in the EV market (both battery-powered and hybrids) — and their competitiveness compared to traditional incumbents play a significant role.

The question is whether this is an opportunity for global EV technologies and markets or just a threat for European/US incumbent manufacturers — as has been posited by many in the public arena.

Arthur D. Little (ADL) believes global automotive players must analyze and discuss the market approach of Chinese brands, global customer perspectives on Chinese EVs, and the profile of customers who will be the first to purchase Chinese EVs to support a fact-based and objective discussion.

This will enable stakeholders in the global automotive industry to make better strategic decisions in the interesting, yet challenging, EV market, where no less than the industry’s future is at stake. This Report provides an overview of the key results of an ADL study involving more than 15,000 respondents across 25 countries, shedding light on how Chinese OEMs are expanding their EVs internationally.

EXECUTIVE SUMMARY & KEY FINDINGS

This Report addresses two crucial gaps for executives in the automotive industry: (1) it provides comprehensive analysis of the positioning strategies of Chinese OEMs, and (2) it describes the results of a first-of-its-kind survey measuring global customer perspectives on Chinese EVs.

The Chinese passenger vehicle market has been the largest global market in terms of sales since 2009 and has continued to grow with a CAGR of 7%, reaching 26 million vehicles sold in 2023. The market has been a major source of global EV demand, with EVs accounting for 35% of passenger vehicle sales in 2023. Starting in 2025, sales of EV, battery-electric, and hybrid vehicles are expected to surpass those of internal combustion engine (ICE) vehicles in China.

Passenger vehicle production will be driven by EVs in the coming years, projected to grow at 14% annually and comprise 69% of Chinese production by 2030. This production growth has fueled export activities, which increased from 1.5 million passenger vehicles in 2021 to 4 million in 2023, making China the largest exporter of passenger vehicles.

What are the reasons for this robust supply growth? In the past, Chinese production primarily catered to domestic demand. However, a series of policies starting in the mid-2010s led to significant government support for the EV industry. This resulted in strong growth for several brands, ambitious international strategies, and the establishment of substantial production capacities to accommodate potential global demand.

Consequently, Chinese OEMs, especially those with EV models, began exploring internationalization. According to the ADL study, Chinese OEM sales (EV and otherwise) will grow faster than the market in all global regions by 2030, with Europe (+14% annually) and Southeast Asia (+15% annually) experiencing the strongest growth.

In the study, ADL examined three critical aspects that are essential for automotive executives from Chinese OEMs seeking to expand their global presence, as well as those representing Western, Japanese, and South Korean incumbent OEMs:

- Categorization of Chinese OEMs

- Global customer perspectives on factors influencing the decision to purchase (or not purchase) a Chinese EV based on a survey with more than 15,000 respondents across 25 countries

- Profiling of customers most likely to be early adopters of Chinese EVs

In this Report, we define three categories of Chinese OEMs:

- EV start-ups that aspire to become prominent players in both China and other countries. They emphasize battery and EV powertrain capabilities, software, and autonomous/automated driving technologies. Some players do not have a background in the automotive industry (i.e., they began manufacturing batteries or specialized in digital products).

- Incumbents with a history of international JVs and investments. We differentiate between nongovernmental (e.g., Geely) and state-owned incumbents (e.g., SAIC Motor). These OEMs strive to establish a strong presence in China and globally through diverse brands, focusing on electrification across various segments. We expect these players to achieve the highest sales volume in international markets among the three categories, predominantly in developed automotive markets.

- Domestic market incumbents that target the entry-level and mainstream Chinese market, aiming to penetrate into developing countries by emphasizing value and affordable electrification. We see promising opportunities, particularly in Africa, South America, and states in the Association of Southeast Asian Nations (ASEAN).

ADL aims to offer automotive executives a customer-focused perspective on Chinese EVs by analyzing the factors that influence customer decisions to purchase (or not purchase) a Chinese EV. More than half of survey respondents reported that a Chinese EV is a viable option for them. Notably, respondents in Southeast Asia displayed a high level of openness, exceeding 75%. Consumers in geographically well-established automotive regions (Europe, North America, and Japan/South Korea) showed lower average interest.

Overall, the primary motivations for purchasing a Chinese EV are value for money (44%) and battery technology (43%). Reasons respondents would not consider purchasing Chinese EVs include concerns about quality (58%), brand reputation (32%), and a preference for national brands (31%).

This Report also presents profiles of likely purchasers of Chinese EVs. We considered the five main European markets (Germany, France, Italy, Spain, and the UK), the North American market, and the Thai market, focusing on three aspects for each country:

- The penetration strategy of Chinese OEMs, the brands driving this, and their current status. For example, we found that in the UK, Chinese OEMs have achieved a market share of 4.4%, while in Thailand they have surpassed 10%.

- The main factors influencing interest and disinterest in purchasing a Chinese EV. These include demographic and automotive profiles (e.g., brand of the current car, annual mileage). We discovered that prospects’ demographic profiles are homogeneous in Italy and Spain; in Germany, there are significant differences between urban and countryside dwellers, premium-brand drivers and non-premium-brand drivers, and company owners and management respondents.

- A forecast for each market of the three defined categories of Chinese OEMs. We found that, all other things being equal, EV start-ups are likely to be successful in Germany and the US; in Spain, domestic market incumbents could aspire to capture market share in the entry-level segments.

RECOMMENDATIONS

Our recommendation contains a call to action for three market players:

- Incumbent OEMs with roots primarily in Europe and North America

- Chinese OEMs interested in globalizing their operations

- Distributors and large dealer groups

Incumbents

After years of sales growth and high profitability (especially post-COVID years), incumbents are finally facing increasing competitive pressure in China and in global markets. After years of sales growth and high profitability (especially post-COVID years), incumbents are finally facing increasing competitive pressure in China and in global markets. For incumbents, ignoring the developing capabilities and ambitions of Chinese EV manufacturers is not an option. Therefore, there is an urgent need to respond, and incumbents should:

- Emphasize brand reputation. In the premium and luxury segments, incumbent OEMs may still benefit from established trust and customers seeking specific product features and qualities. However, that reputation must be supported by superior product quality and substance to be sustainable.

- Emphasize domestic origin and production. OEMs with regional supply chains and strong value creation remain the first choice for many respondents. Local production should be reinforced while creating resilient, sustainable, circular supply chains.

- Leverage dealer networks. Build a trusted, dense, reliable retail network while integrating traditional brick-and-mortar sales and service with a seamless digital approach.

- Create partnerships and JVs with Chinese OEMs. After investing in the development of the Chinese car industry for decades with JVs in China, now is the time for JVs with Chinese OEMs in Europe and the US. This will allow incumbents to capitalize on the speed and cost advantages of the Chinese OEMs, particularly in EV battery technology and entry-level vehicle segments.

- Emphasize customer loyalty. Develop a 360-degree action plan (product, marketing, sales) to capitalize on the customer base accumulated over the past years; this is an incumbent’s most significant asset.

Chinese OEMs

In an effort to globalize their activities, which began in the early 2000s, Chinese OEMs appear to have found a recipe for success thanks to electromobility and integrative activities along the EV value chain. However, this achievement does not come without challenges. Chinese OEMs on their path to globalization should consider the following:

- “Made in China” is not yet synonymous with quality in many large markets. As we learned from Japanese and South Korean OEMs in recent decades, building a reputation for high quality requires time and multiple successful, reliable generations of vehicles. It is essential to prioritize achieving that high quality before launching new products, to refine and differentiate positioning, and to develop clear positioning of brands outside of China.

- Structured sales networks are lacking. It’s important to form partnerships with large, well-established dealership groups, particularly in urban areas where interest in Chinese EVs is high. It is crucial to ensure a clear differentiation from other brands within the sales network — merely adding a new brand to a dealership’s existing portfolio may not suffice.

- Differentiate your go-to-market strategy. Customer requirements vary significantly even within Europe. Focus on targeting early adopters with high purchase interest and adapt your go-to-market strategy accordingly. Consider granting greater autonomy to local management in decision-making for product and volume planning.

- Prioritize business and fleet customers. Especially in Europe, premium Chinese EVs require dedicated programs for business and fleet customers. Owing to favorable tax treatment and corporate environmental, social, and governance (ESG) requirements, these customers play a critical role in gaining relevance within the European market, necessitating used-car programs that effectively maintain high resale values and ensure attractive leasing rates.

Distributors & dealer groups

In recent years, the rise of the online-sales-only approach adopted by some new entrants, along with the agency model, led to questions about the future role of dealers. ADL’s research highlights the continued importance of dealerships, especially in providing service, and reveals that the absence of a service network can deter potential customers from purchasing a specific brand. As Chinese EVs expand internationally, particularly in Europe and Southeast Asia, distributors and dealer groups should react:

- Take the entrepreneurial risk and partner with Chinese OEMs, but conduct thorough due diligence. In the 1990s, dealers participated in the success of Japanese and later Korean brands in the US and Europe. This story can be repeated. However, distributors and dealers should not blindly jump on the Chinese bandwagon. Instead, they should increase their chances of selecting potential winners by understanding the factors that will determine success and conducting a comprehensive, structured assessment of brands seeking partnerships.

- Leverage Chinese brands to address underserved customer segments. With a well-developed product portfolio focused on EVs, selling Chinese vehicles may present an opportunity to target market segments in terms of price and body type that remain unaddressed by traditional OEMs.

- Adapt to new customer segments and test new offerings. Address potential concerns about quality by reducing purchase barriers. This includes exploring new sales models such as subscription-based options.

- Eventually offer service-only for direct sales brands. Revenue reduction from EVs can be offset through the design of a specific service offering for brands that follow an online sales approach or that still lack a well-developed dealer network. Otherwise, incoming Chinese OEMs without a developed service network may seek partnerships with national independent repair chains.

- Prepare for a new used-car market with vehicles from Chinese manufacturers. Chinese OEMs have penetrated several European markets via the rental-sales channel. Rental companies typically hold their cars for a short period before putting them on the used-car market, where, in the absence of a franchise dealer network, they are often sold through auctions to independent dealerships. This group of dealers will be among the first to encounter Chinese used-car stocks. It is crucial for them to analyze which Chinese brands are the best prospects for the used-car market and identify customer groups that may be particularly interested in these vehicles.

1

CHINA’S PASSENGER VEHICLE INDUSTRY

China became the largest passenger vehicle market in the world in 2009 and has grown ever since with a CAGR of 7%. In this Report, we focus on two powertrains: ICE and EVs. The latter can be divided into battery electric vehicles (BEVs) and hybrid vehicles, which include plug-in hybrid electric vehicles (PHEVs) and full hybrid electric vehicles (FHEVs). Fuel cell electric vehicles were not considered. As shown in Figure 1, 27 million ICE and EV passenger vehicles were sold in China in 2023.

In recent years, China has become the lead market for electrification, with EVs experiencing robust sales starting in 2020. Since 2021, hybrid vehicle sales increased by 360%, and BEV sales increased by 129%. EV models reached a market share of 35%, while sales for ICE models decreased by more than 1 million units in the same period.

Car sales in China are expected to remain stable, with a gradual substitution of EVs for ICE vehicles (at an annual rate of around 10%).

At this rate, by 2025, every second new car in China will be either full electric or hybrid, and EVs will have a market share of around 70% by 2030.

As we wrote in last year’s ADL Report “Global Electric Mobility Readiness Index 2023,” the diffusion of EV models has been stimulated by the following three factors:

- Excellent EV infrastructure. China has the most well-developed charging network in the world in terms of density.

- Systematic support for the development of the EV industry through regulation and incentives. These include benefits for both EV OEMs and customers, including exemption from vehicle purchase tax or exemption from license plate restrictions.

- Coercive measures for new ICE vehicles. Local governments have put in place high registration barriers for ICE vehicles, including limiting new license plates.

GLOBAL EXPANSION OF CARS MANUFACTURED IN CHINA HAS JUST BEGUN

China recently became the world’s largest exporter of passenger vehicles. Until recently, car production in China has primarily catered to domestic demand, with 26 million passenger vehicles produced in 2023. In the future, passenger vehicle production will decouple from domestic sales and grow at an annual rate of 3%. This growth will lead to more than 30 million cars being produced each year by 2025 and almost 33 million by 2030 (see Figure 2).

This growth is due in part to the Chinese car industry’s focus on EVs. Production of ICE vehicles is expected to decrease from 65% in 2023 to just 31% in 2030, while EVs see an annual growth of 14%. By 2030, EVs are expected to represent 69% of total Chinese vehicle production.

The production increase, combined with stable domestic sales and a growing global interest in EVs, will help sustain Chinese OEMs’ push into markets outside China. Indeed, between 2021 and 2023, exports of passenger vehicles rose from 1.5 million in 2021 to 4 million in 2023, with a growth rate of more than 300% for EVs. This underpinned China’s rise to become the world’s largest exporter of cars, surpassing the previous largest car exporter (Japan).

The growth of China’s car exports is driven by the following:

- The “Made in China” Strategy 2014 and its focus on EV powertrains. Since 2014, Chinese OEMs have benefited from substantial subsidies and purchase incentives that fostered the establishment and growth of China’s domestic EV industry. Earlier and more consistently than in other regions, China’s government and industry saw opportunities in the shift to alternative powertrains. Beginning with a requirement to improve air quality in China’s mega-cities, Beijing’s efforts to stimulate electric mobility helped create a highly competitive domestic EV market. In the next year or so, we expect this market to enter a consolidation phase, resulting in a smaller number of strong EV players ready to expand globally.

- China’s large production capacity. Significant government subsidies aimed at incenting the domestic EV segment but with decreased domestic demand, prompting Chinese OEMs to seek markets outside China (see Figure 3).

- The global trend toward electrification. The close proximity and tight control of crucial raw materials (e.g., copper and lithium, which are essential for manufacturing battery cells and modules) allow Chinese OEMs to reduce their dependency on third-party suppliers and cost-effectively offer a wide range of BEVs, including small cars not yet being widely manufactured by Western OEMs.

CHINESE OEM MARKET SHARE SET TO GROW IN MAJOR MARKETS

Sales of Chinese brands are expected to outpace overall car sales in all main global automotive markets (see Figure 4). However, the market share Chinese OEMs are expected to capture varies significantly across regions. In Europe and Southeast Asia, Chinese OEMs will experience annual double-digit growth (14% and 15%, respectively).

Europe (including Türkiye) will see consistent growth in Chinese OEM market share until 2026. Annual sales by Chinese manufacturers are expected to reach 1.6 million vehicles by the end of the decade in those regions, reaching 8% to 10% of the entire European passenger vehicle market, in part due to the planned installation of a local manufacturing base in Europe. In the Russian market, Chinese OEMs will benefit from the country’s isolation from global automotive value streams — but only by exporting low-end, traditionally powered vehicles.

In Southeast Asia (including India and Australia), Chinese OEMs will continue increasing their market share and are expected to reach an annual sales volume of more than 700,000 vehicles by 2030, between 6% and 8% of the entire passenger-vehicle market in the region. Reasons for this growth include the absence of strong local OEM players (aside from India) that can cater to the rising demand for affordable EVs.

The Japanese, South Korean, North American, and South American markets will see much slower growth for Chinese OEMs. Although they’re expected to outgrow overall markets slightly and thus take some market share from established players, Chinese OEMs are expected to play a niche role (under 5% market share). In Japan, Korea, and North America, Chinese cars will likely not gain traction until 2030.

Regarding government support, cost structures, and supply chains, these countries, in particular, have a robust domestic car industry, special customer requirements, and tariffs and non-tariff policies in place. A slower trajectory in transport electrification in those markets will also dampen demand for Chinese car exports.

In the Middle East and Africa, where Chinese OEMs already have a market share of 8%, growth for Chinese cars will be in line with the region’s market growth. We expect the Chinese share to stabilize between 8% and 10%.

DIFFERENTIATED VIEW ON CHINESE CAR OEM IS REQUIRED

Based on criteria such as history, age/maturity, sales volume, product/powertrain strategy, and partnership strategy, players in the Chinese car industry can be categorized into three main types (see Table 1):

- EV start-ups, launched as result of the Made in China strategy

- Incumbents with a history of international JVs or investments

- Domestic market incumbents

EV start-ups

EV start-ups emerged as a result of the government’s Made in China strategy and the focus on EVs initiated in the mid-2010s. Examples include NIO and XPeng. Several players have backgrounds beyond the traditional automotive industry (e.g., digital products). They aim to establish themselves as premium EV players in both domestic and advanced markets, emphasizing battery technology, in-car software (e.g., AI assistants, virtual reality screens), and autonomous driving features. These brands typically have a premium OEM product portfolio that includes midsized and large sedans and SUVs. They tend to integrate battery technology and software-related activities while outsourcing operations like manufacturing (at least in the initial phase after brand establishment).

This positioning limits EV start-ups’ addressable market share on a global level. ADL expects these players to capture between 7% and 13% of the Chinese passenger vehicle market in advanced economies such as Western Europe, the US, and the Arabian Gulf countries. In emerging countries, including Japan and South Korea, market share will likely remain below 5%.

Incumbents with history of international JVs or investments

Incumbents are large OEM groups and conglomerates that previously served as JV partners for Western OEMs and/or have direct investments in non-Chinese car brands and manufacturers. They can be divided into two categories: nongovernmental-owned incumbents (e.g., Geely and BYD Auto) and governmental-owned incumbents (e.g., SAIC Motor and Beijing Automotive Group [BAIC]). Regardless of ownership, these companies aim to become global players by creating a differentiated product portfolio using various investment and partnership strategies.

Over the last decade, these companies gradually shifted from being junior partners in international JVs to developing their own brands and vehicle portfolios by applying newly acquired skills in R&D and manufacturing.

This resulted in the addition of several new vehicle brands. Investments by these players also revitalized traditional European brands that were floundering (e.g., MG and Lotus). Chinese investors not only injected money into the market, they repositioned brands and revitalized portfolios, mostly based on Chinese EV platforms.

Players in this category cover a wide range of market segments, from entry-level to premium and sports cars, and they use various brands in their portfolio to cater to customer needs (e.g., premium or luxury appeal, futuristic design, affordability). By tapping into shared platforms or components, these brands emphasize EV features in their marketing, particularly range and charging speed. They also stress performance and digital services at relatively low price points compared to European, North American, Japanese, and South Korean competitors.

Incumbents differ from EV start-ups in that they tend to have an asset-heavy business model, integrating key steps of the value chain, including battery manufacturing, software design, and production into their operations. These players are in a position to capture the highest market-share levels among Chinese OEMs abroad, primarily due to their diverse brand and product portfolios. In mature automotive markets, we expect these incumbents to enter with both premium and mainstream brands, capturing between 70% and 85% of local sales (see Table 2). In emerging markets such as ASEAN, Eastern Europe, and North Africa, they will likely offer entry-level products to reach scale. In these markets, we expect them to reach between 50% and 70% of overall local Chinese car sales.

Domestic market incumbents

Domestic market incumbents such as Changan and Great Wall Motor (GWM) have a long history in Chinese entry-level segments. These brands have globalized their business presence over the last few decades, especially in emerging economies. In the last few years, Chinese governmental incentives for manufacturing EVs have encouraged these companies to launch new brands and begin positioning themselves against more traditional brands. Examples include WEY, the upscale brand of GWM.

Despite this new trajectory, these brands remain focused on traditional segments for the Chinese market (i.e., small and midsized sedans, robust, compact SUVs, and pickups) with an entry-level to mid-level positioning. Similar to incumbents with a history of international JVs or investments, these companies’ brand positioning focuses on digital equipment and services such as large screens, smartphone integration, and excellent value for money, especially regarding interior and exterior design and appearance.