DOWNLOAD

DATE

Contact

It is clear to all that COVID-19 has dealt a devastating blow to the aviation industry. However, while the pre-crisis industry was still thriving from the waves of globalization and commoditization of travel, it was already facing threats such as environmental pressures, unbalanced profit sharing along the value chain, and multiple constraints on operational and business agility. The recovery phase will be extremely challenging, and we believe future growth will involve nothing less than reinvention of the industry. Going forward, aviation players should consider four key trends and position themselves to adapt to a number of scenarios involving radically different business models and value-chain relationships.

The challenges facing the aviation industry

The speed and depth of the devastation of the aviation industry from COVID-19 has been breathtaking. The crisis hit the industry at the worst time of the year, the peak season for bookings, causing a severe short-term cash crunch and many likely supplychain casualties. What’s more, the duration of the crisis may be longer than initially predicted: the pandemic is cycling through the regions, and many predict subsequent waves until a vaccinebased solution is fully implemented. Demand is unlikely to recover to current levels for at least a few years, if at all.

Although the industry as a whole was thriving before the crisis, in many ways it was already “dancing on a volcano” in terms of underlying threats:

- Unbalanced profit sharing across the value chain, particularly at the expense of the airlines.

- Rapidly growing challenges to further globalization of economies and unfettered growth of “commoditized” travel due to environmental concerns.

- Fundamental constraints on operational and business agility within and between ecosystem players (airlines, airports, ATC, handling, etc.) due to a patchwork of complex regulations, which have grown over time.

These underlying threats have not gone away. On the contrary, they have been intensified by the crisis.

The “emergency landing” taken by the aviation industry, although brutal, was well conducted by the ecosystem. Today, in the eye of the storm, players in the industry need to focus on two things:

- Succeeding in what will be a very tough and challenging recovery phase.

- Positioning for regrowth against a range of scenarios in a reinvented aviation industry of the future.

Key trends affecting recovery and regrowth

When approaching recovery, companies should already be looking towards their longer-term positions in terms of regrowth. We see four key trends affecting both recovery and regrowth, which have been accentuated by the crisis:

- Demand and consumer behavior: Weaker premium demand due to more remote working; shifts in destinations for leisure travel, e.g., due to perceived safety; lower travelretail demand due to further e-commerce penetration; more digital customer interaction; lower high-yield cargoes as companies seek less vulnerable global supply chains.

- Competition and business models: More consolidation of players; growth of “platform players” moving into new verticals (e.g., airlines expanding into e-retail); growth of asset-light services, including “Aircraft-as-a-Service”.

- Regulatory rebalancing: More consumer/airline protection measures; rebalancing of profit sharing between airlines and infrastructure providers; relaxation of airline/airport ownership limitations to encourage private investment; new sanitary and safety restrictions; acceleration of environmental performance requirements.

- Technology acceleration: New impetus for AI-enabled resource management for faster scale-up/-down; automation everywhere for better operational flexibility and sanitary/ social management; energy-saving tech/circular economy fully leveraged to save OPEX.

Succeeding in the recovery phase

With these trends in mind, the aviation industry will have its main challenge in the recovery phase in finding ways to ramp up over a long period, during which demand will be lower, regulations will be shifting, ecosystem networks will be starting to change, and technology disruptions may be already accelerating.

Successful recovery will therefore require flexibility to respond to different scenarios for resumption of operations, including strategies to mitigate the risks for ramp-ups, which may be slow and highly differentiated by region. Examples include:

- Redefining key contractual relationship models in the context of slowly growing demand. Existing agreements and pricing levels are generally based on 80 percent asset utilization, which will not be achieved.

- Targeted campaigns to retain and rebuild core customer segments. Despite more government intervention, competition will remain intense in an oversupplied market.

- Cooperating and collaborating to ensure precise coordination across all players, from local-station level to national and global levels, with regard to regulation and certification, operations, customer care and trust building, and many other concerns.

- Ensuring that any new regulatory obligations, e.g., for sanitary control, have minimum impact on operations and profitability. Here, smart technology has a key role to play – for example, in Abu Dhabi airport, automatic temperature and heartbeat monitoring at check-in means there is less need for restrictions on passenger density in the terminal.

Looking forward to regrowth in a reinvented industry

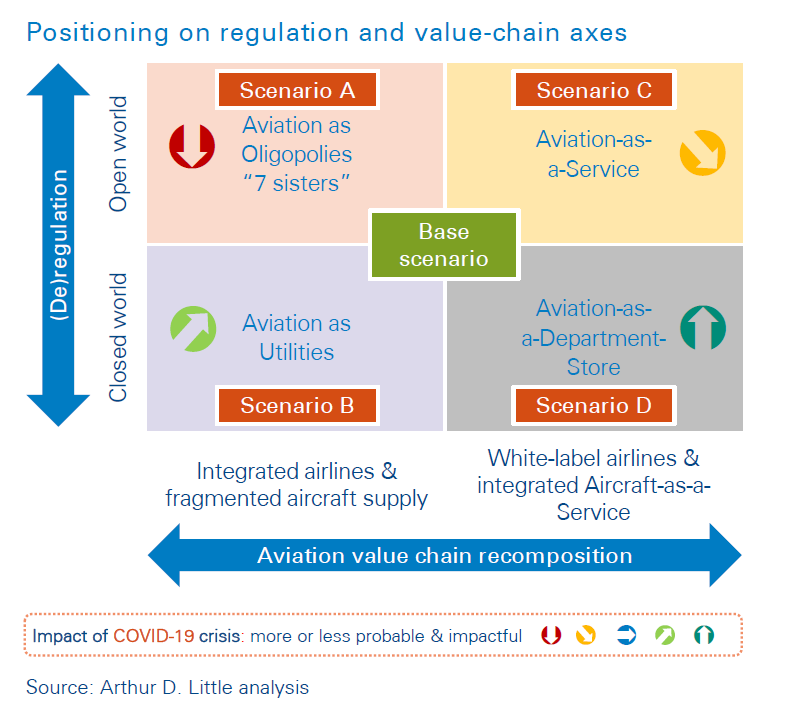

In positioning for regrowth, companies need to consider the likely scenarios for the future of the industry. At the end of 2018, Arthur D. Little conducted a study into the future of the aviation industry, “Aviation 2035”1. In this in-depth study, we built four scenarios for how the industry could evolve, based on identified drivers and trends, and modelled the impact of these on revenues and the profit pool. With the advent of the COVID-19 crisis, we are now in a better position to see which of the four scenarios are more or less likely. The four scenarios are illustrated in the figure below.

In overview, we identified an expected base scenario and four alternative stretch scenarios, which depend on the amount of (de-)regulation and extent of aviation value-chain recomposition.

- Base scenario: Further widespread automation and leveraging of new technologies, including UAVs; consolidated regional, multi-brand airline groups; airline revenue generation models evolving towards media platforms; aircraft OEMs capturing more value-add in the aircraft supply cluster and market for last-mile aviation.

- A: Aviation as Oligopolies: The industry is structured around a set of global airline champions in each cluster of the ecosystem, with large degrees of consolidation and bargaining power; infrastructure providers can diversify profit generation sources thanks to deregulation; aircraft providers are in tougher competition.

- B: Aviation as Utilities: Industry structure is similar to how it is today, but with strong regulation limiting growth and margins; infrastructure service providers are strictly regulated and prevented from diversifying into new profit sources; aircraft providers focus on green and autonomous products to make a difference.

- C: Aviation as a Service: New players (e.g., over -the-top players, luxury brands) own the customer and squeeze airlines into white-label service providers; OEMs concentrate and become total fleet providers and managers group, providing modular assets as a service, including finance and fleet management.

- D: Aviation as Department Stores: Airlines retain customer ownership but become vehicles for third-party media brands; infrastructure service providers are regulated to focus on public service; air transport service providers supply aircraft from total fleet providers and managers, which capture an even greater profit pool.

The advent of COVID-19 has greatly increased the likelihood of Scenarios B (Utilities) and D (Department Stores). This is due to the key trends mentioned above, especially:

- More regulation, both safety/security/health/ environmental and economic, which would reflect greater governmental stakeholding. This is likely to constrain players from greater diversification.

- Weaker and less stable demand, with increased digital customer interaction. This favors asset-light “platform players” and “as-a-service” business models.

How players should respond

Aviation players need to consider carefully how the industry is likely to change as it develops its recovery and regrowth strategies. Despite the damage caused by the crisis, the upside is that it has also accelerated the urgency for more a radical rethink – something that was already needed before the crisis. Companies approaching recovery and regrowth should:

- Develop a forward growth strategy that adequately considers future changes in the industry, especially in terms of demand, consumer behaviors, changes to industry ecosystem roles, new business models, new regulatory requirements and accelerated technology disruptions.

- In the short term, develop scenarios for, and responses to, how the recovery phase will develop, considering different assumptions for the profile (e.g., V/U/bathtub curves), geographical differences, regulatory changes, etc.

- In the medium term, consider how to position to exploit opportunities in a reinvented industry, e.g.:

- Review and update economic and operational relationships with other players across the ecosystem.

- Transform operations and organization, emphasizing collective intelligence and technology.

- Leverage strategic assets to reshape and de-risk the business model.

- Arbitrate investments and devise an M&A strategy accordingly.

- The priorities for different players in the ecosystem vary considerably, depending on the characteristics of their operating and business models. The figure below illustrates the differences.

How Arthur D. Little can help

Arthur D. Little’s team of aviation strategy and operations experts can help you in all aspects of preparing for recovery and regrowth. We have unparalleled depth of insight into the trends, drivers, and constraints across all players in the ecosystem, including detailed forecasts and strategies for each type of player. We can help you:

- Conduct executive workshops: Build external and internal scenarios and kick-start recovery action-plan design.

- Set up your 5F War Room: Establish a virtual war room, assign key roles and reporting lines, and initiate war room actions.

- Scale up digital ways of working: Embed digital collaboration tools and redefine operating models to push digitalization.

- Model scenarios: Establish an analysis framework, simulate the company’s risk exposure, and conduct stress tests on critical areas.

- Develop a future-proof productivity plan: “Brutal truth” assessment, target picture, transformation plan and “Lighthouse” implementation.

- De-risk the path to recovery: Retain critical resources and customers, mitigate disruptions (e.g. supply chain), and prepare for restart.

- Capture opportunities: M&A, horizontal or vertical consolidation of distressed actors, takeover of customers, new offerings.

- Prepare for the “new normal”: Anticipate customerdemand change, redefine the company purpose, outline new offerings and strategy, and define a new operating model.

To learn more about how Arthur D. Little could help, please contact an office near you.