DOWNLOAD

DATE

Contact

Many communications service providers (CSPs) struggle to extract value from information and communications technology (ICT). We believe this is strongly due in part to an obsolete business-to-business (B2B) customer-segmentation approach. In this Viewpoint, we propose a refreshed segmentation tactic that better positions telecom operators to capture the promising growth that ICT products and services can deliver.

IS THE ICT PROMISE ACHIEVABLE?

Most CSPs fail at capturing value from ICT market growth. But is this by nature? We think not.

The ICT services market is growing at a CAGR of 8%-15% in most markets and is bigger than the connectivity market in most countries. However, many CSPs have not achieved their aspirations to capture any needle-moving value from this segment. This is because they are struggling with a fundamental set of questions: Is the investment justified in the longer term? Is ICT a “promised land” that’s hard to find? What’s needed to conquer it? Would the fact that CSPs already have a salesforce paid for by connectivity provide a sustainable cost advantage? Or does this promised land not exist, and CSPs should instead focus on efficiency and managing the deflation that software brings to connectivity?

In this Viewpoint, we make the case that the current segmentation used by most CSPs is at the heart of their mistakes. We believe that the way most CSPs segment and approach the market — and consequently tune their value propositions, organize their go-to-market, and eventually invest — directly results in “not winning” in ICT. To date, the wrong segmentation has hindered CSPs’ ability to profitably identify, propose, and close ICT deals.

So, yes, focusing on efficiency in connectivity is a safe bet. It is indeed the strategy to follow if the CSP’s position does not warrant a larger play. If pursued, however, efficiency and automation must be ruthlessly applied. Eventually, though, CSPs will need to accept that an increasing part of their connectivity business will fall prey to software players, disintermediation, and lower-margin wholesale revenues.

But it is absolutely possible for CSPs to capture value in ICT.

To capture ICT growth, many CSPs emulated system integrators with limited success.

When building system integration–like professional services[1] capabilities (which we differentiate from managed services[2]), the competitive disadvantage couldn’t be starker:

- CSPs are usually unable to compete with the reach, scale, cost base, partnerships, and capabilities amassed by system integrators.

- Consequently, CSPs find themselves competing with (or being a channel to) all kinds of players, including industrial system integrators like Siemens, IT system integrators like Accenture, technology providers like Samsung, software vendors like Oracle and SAP, hyperscalers like AWS, equipment manufacturers like Landis+Gyr, and product companies like Bosch.

- CSPs cannot compete on the R&D front.

- CSPs usually cannot compete size-wise.

- CSPs usually have little value-add, so when they take on a general contractor role, they are forced to take high risks, with most customers allowing only little risk coverage.

- Finally, this approach doesn’t work for small and medium-sized enterprises (SMEs), which is why the above-mentioned players don’t target SMEs (except with automated product delivery or managed services).

A few CSPs have been successful as system integrators. Swisscom hosts many core banking platforms, hundreds of SAP installations, and more. Similarly, Magyar Telekom has been successful, as has STC with its subsidiary STC Solutions, Singtel, SoftBank, and others. Success hinges on the convergence of certain market conditions, including:

- An ability to acquire multiple national ICT players, consolidating market capabilities and overcoming the low-value-add problem

- Operating in somewhat closed markets due to cultural, language, or other centrally influenced barriers

- Holding a strong position in (a somewhat closed) home market vis-à-vis the largest companies and governmental institutions in the country

However, most CSPs have experienced significant difficulties in maintaining profitability, as reselling margins are slim and upsides for incremental professional services are limited, while effort and risks are substantial. For some initiatives, the jury is still out. Orange Business, for example, has begun developing professional services that span the Internet of Things (IoT), industrial automation, cybersecurity, and more, focusing on clients globally, including off-footprint clients. However, Orange has yet to manage profitability. In another example, Telia’s Division X has grown beyond Sweden’s footprint into the broader Telia footprint, growing quickly and profitably. However, while there are few examples of ICT successes by CSPs acting as system integrators, we believe that cracking the code of B2B segmentation is the real key to ICT managed services’ success.

WHY SEGMENT?

Many telecom marketing professionals believe size-based segmentation is the best and only approach. We think they are wrong.

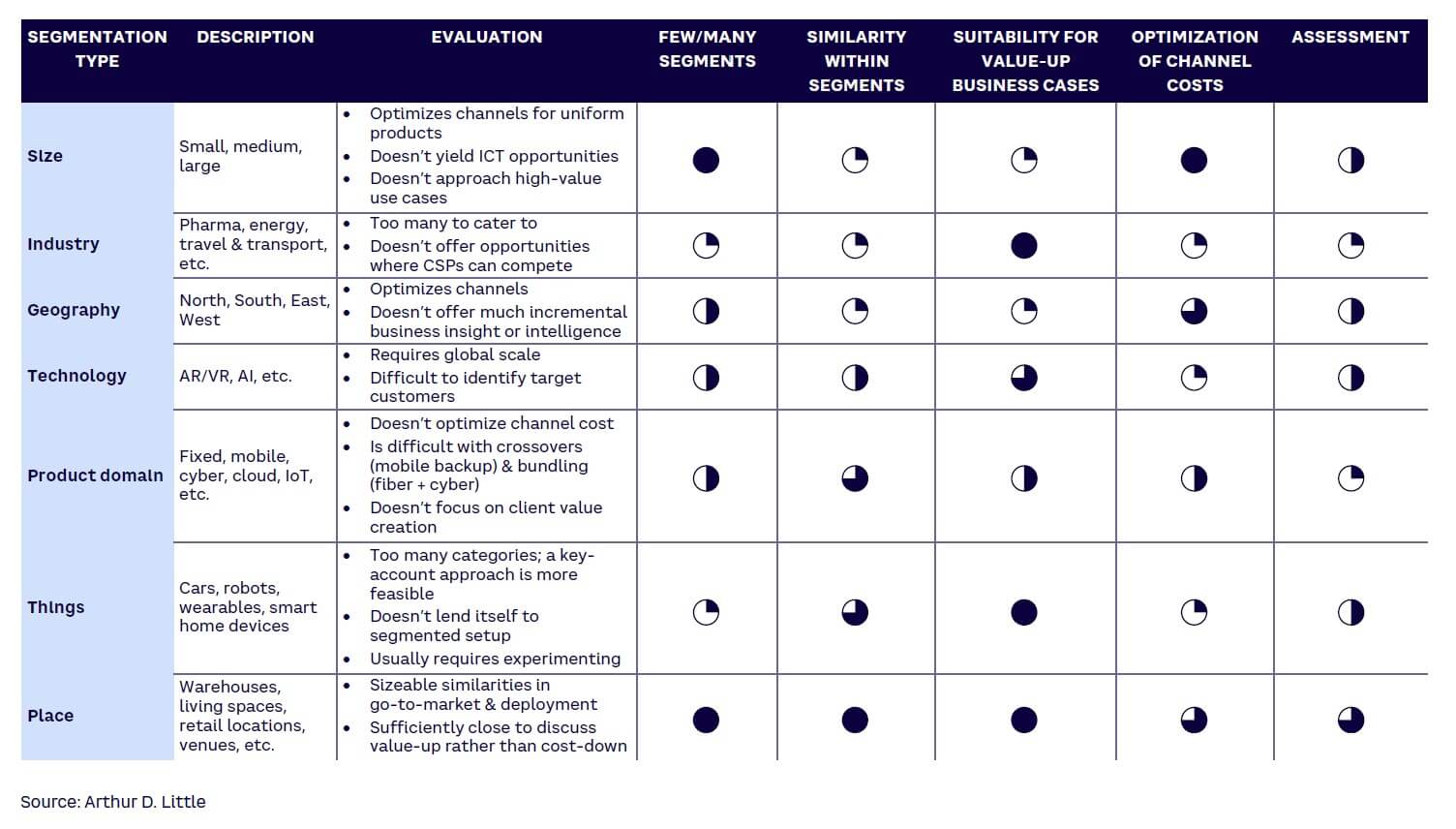

The ideal segmentation for B2B ICT services for CSPs would have a limited number of segments with a high level of similarities in required solutions within the same segment and, to a certain extent, across segments. The segments should optimize for channel costs while being suitable for value-up business cases rather than cost-down ones.

Any ICT-relevant market segmentation must meet the following objectives:

- Identify upcoming CAPEX to OPEX shifts. It’s crucial to understand, anticipate, and drive clients to shift ICT spending to OPEX.

- Pinpoint decision makers within customer organizations who are incentivized not by cost-down, volume-discount business cases but by value-up ones. These people typically prefer an increase in productivity, stock turnover, and health/safety along with a reduction in waste, inventory, power consumption, and so forth, over a reduction in connectivity, compute, or storage costs. These services are typically sold to business units within customer organizations rather than IT departments, or procurement.

- Create value propositions that find a broader audience of decision makers. To win, CSPs need to justify how their offerings can help the business owner improve profit and loss performance and why the CSP is better positioned to address that pain point versus other providers.

Whatever segmentation that CSPs use impacts how channels, value propositions, products, campaigns, organizational structures, targets, key performance indicators (KPIs), and so on, are organized. Thus, changing customer segmentation is fundamental to the why, what, and how CSPs can play bigger in ICT.

HOW NOT TO SEGMENT

Traditional B2B segmentation is unfit.

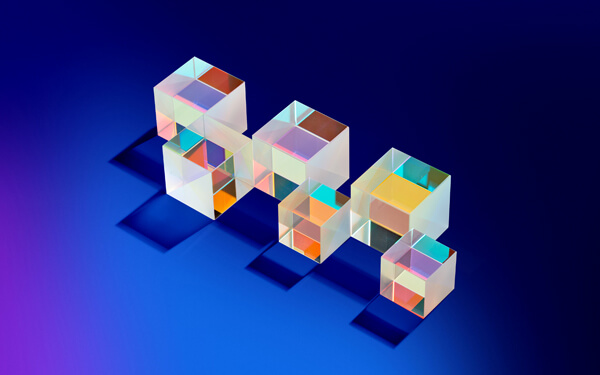

Often, segmentation is based on size, industry, or product (see Figure 1). Each segmentation paradigm shapes organizational mindset. Size-based segmentations are fit for uniform products — not for ICT services, which focus on channel cost optimization.

Size-based segments may be delineated by number of employees, revenues, total spend, and so forth, none of which are perfect, as each has different advantages and drawbacks, but they all give a proxy for size. Any size-based segmentation is suitable for selling common products that fit across segments (e.g., undifferentiated SIM cards, phones, fiber). Such segmentation serves best in managing channel costs. It allows for differentiating care, managing client complexity, handling price-related governance, and so on. However, customers’ digital journeys can’t be clubbed into T-shirt sizes. There is too little similarity between them.

There are three reasons size-based segmentation doesn’t work for ICT businesses:

- It provides no insight into which services or solutions to put into a portfolio and which to stay away from.

- It does not help in understanding or addressing decision makers with a CAPEX-to-OPEX appetite.

- It isn’t suitable for steering ICT sales efforts.

Can vertical segmentation work? No!

The verticals that CSPs usually go after include manufacturing, healthcare (e.g., Telia, DT, BT), mining (e.g., Telstra, ATT), and automotive (e.g., DT, Vodafone AT&T). This helps CSPs better understand the industry but a closer look shows this approach falls short:

- Commonality within verticals emerges only at the very niche level. Verticals do not share commonalities in use cases. Take healthcare: there is no commonality between pharmacies, pharma companies, hospitals, doctors, or health insurers. Even one layer below, commonalities are rare (e.g., public versus private hospitals). Categories are too numerous and specificities are too high to allow for successful vertical segmentation.

- Given that segments’ needs are very specific, spending is hyper-specialized. Consequently, players with a global footprint can adequately service each niche.

- To make it work, CSPs often subcontract delivery bits. Doing so, they take on much larger risks than their margin share should carry. We see this behavior in so-called lighthouse projects (sizeable projects that are not profitable). It seems that sometimes customers buy because they anticipate that CSPs will lose money (see sidebar “Lighthouse project failure.”)

HOW TO SEGMENT

We believe “place type” is appropriate for most CSPs.

CSPs need to deploy a segmentation that allows them to identify, address, and convert opportunities that can fund the go-to-market effort. We want as few segments as possible with as high of similarity as possible that lead to proposition areas suitable for value-up and optimizing channel costs. There are myriad ways of segmenting, but some don’t lend themselves to identifying addressable commonalities. Figure 2 illustrates a rundown of segmentation options.

We believe CSPs can successfully target their new digital products based on place type (see sidebar “Telstra puts the theory to the test”). Here are some examples of places where ICT and connectivity services can be easily interwoven:

- Office buildings. These typically require high-speed Internet, secure networks, collaboration tools, and unified communications. ICT solutions focus on productivity, security, and connectivity.

- Parking garages. These often need IoT solutions, gate automation, surveillance systems, and payment systems. Connectivity for real-time data processing is crucial.

- Manufacturing plants. These require robust, reliable networks for industrial IoT, machine-to-machine communication, automation, and security. Low-latency, high-reliability networks are key.

- Retail spaces. These require point-of-sale systems, inventory management, customer Wi-Fi, and security systems. ICT solutions include customer experience, data analytics, and security.

- Stadiums and event spaces. These require large-scale, high-density connectivity; secure networks for ticketing; broadcasting capabilities; and real-time data processing for crowd management.

- Public buildings. These require secure, often high-availability networks for public services, surveillance, and digital signage. ICT solutions may also support smart building technologies.

- Warehouses. These depend on reliable connectivity for inventory management, automation, IoT, and logistics tracking. Low-latency, durable networks are essential.

Here are several benefits CSPs can reap from place-based segmentation:

- Commonality in connectivity requirements. The buildings/businesses described above typically require multiple connectivity solutions. However, the context surrounding this connectivity demand links to value-up business cases, not cost-down.

- Commonality in use cases. Consider that a grocery store and a clothing retailer both require payment and cash handling, digital signage, loyalty, logistics, inventory, traffic measurement/management, customer experience, surveillance, targeted pricing, and so on. The replicability of such a solution ensures the scalability of the place-specific products offered by CSPs as they build their expertise in one or more domains.

- Marketing clarity. Tying use case to place type provides guidance for CSPs. In general, if a use case relates to place, evaluate. If it doesn’t, don’t. Some questions to consider: Should a CSP focus on SAP transformations? No, if it is not related to a place. Should a CSP focus on a surveillance system that monitors the safety of workers? Yes, as this is specific to a type of place, not industry; this is replicable across similar places.

- Less competition. For example, stadiums are in competition for events, not visitors, and they are all interested in providing a superior visitor experience. This allows CSPs to efficiently target these businesses and offer them a wide variety of services.

CREATING A CANVAS OF OPPORTUNITIES

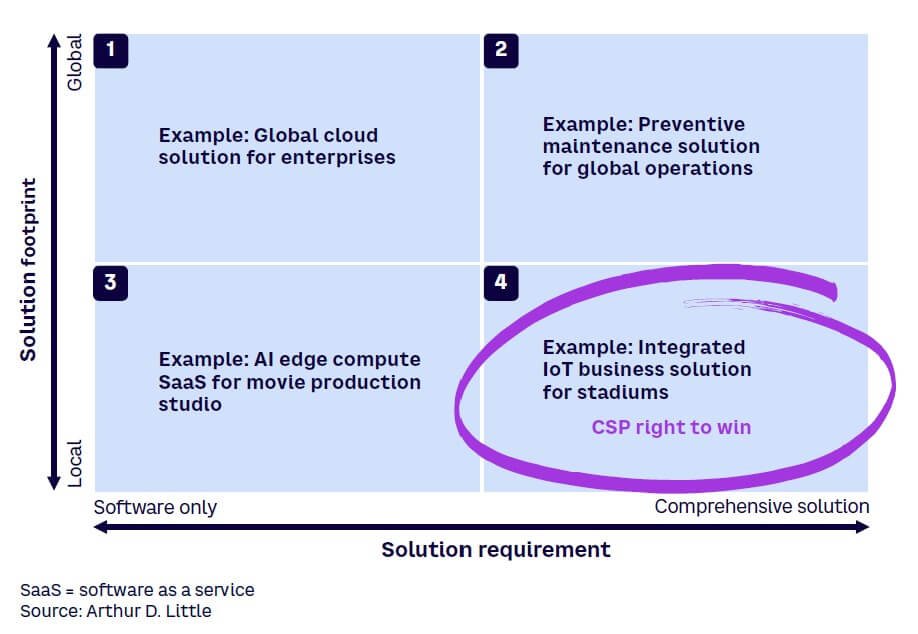

Think local, not software-only.

CSPs usually compete based on local business and operating models. Many solutions require exactly that — a local provider taking care of local specificities (e.g., regulation, site-related needs) for solutions with a strong connectivity requirement. Many use-case providers rely on customers either accepting a certain level of DIY (do it yourself) or employing system integrators and limiting themselves from scaling to SMEs. Plus, having a “local” requirement for a solution that needs to include connectivity equalizes the playing field with global players — and may give CSPs an advantage of local intimacy and proximity. Overall, the canvas of opportunity that CSPs should present to clients needs to be specific to place type and focus on locally specific, non-software-only solution opportunities (see Figure 3).

Case example

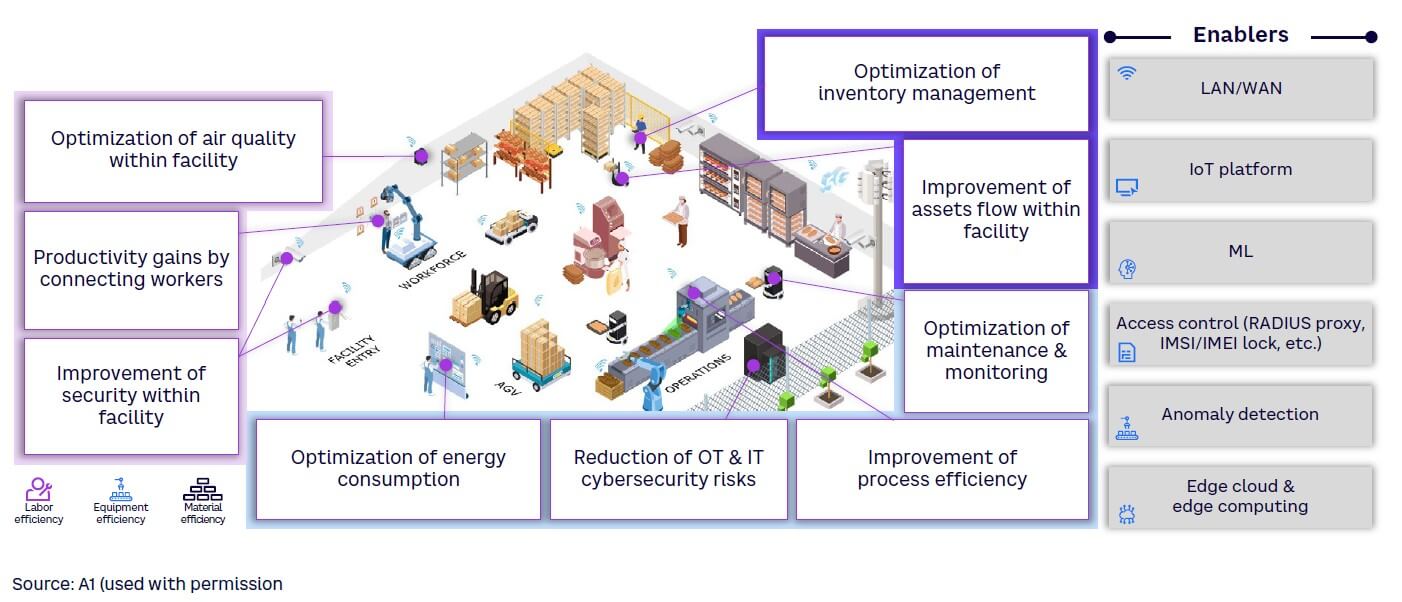

A European incumbent has recently positioned a canvas of opportunities to a manufacturing company — presenting a total of nine value promises or business cases — using its sales effort efficiently (see Figure 4). The value promises center around three benefit categories (and the services all leverage connectivity and technological enablers):

- Increase in labor efficiency:

- Optimization of air quality within facility, including ensuring employee health by controlling air quality and automating compliance with environmental regulations

- Productivity gains by connecting workers, including enhancing productivity through remote maintenance instructions and improving worker safety by displaying safety information and warnings

- Improvement of security within facility, including enhancing on-premises security through protection (leading to fewer sick leaves) and reducing the number of false alarms

- Increase in equipment efficiency:

- Optimization of energy consumption, including improving the bottom line by reducing energy costs for areas with high energy consumption and increasing sustainability in areas where energy is being wasted

- Reduction of operational technology (OT) and information technology (IT) cybersecurity risks, including detecting non-typical behavior in OT & IT environments and simplifying compliance with industry standards and regulations

- Improvement of process efficiency, including machine learning (ML)-based control of production processes, automating production processes, and optimizing product quality control

- Optimization of maintenance and monitoring, including reducing maintenance efforts through predictive maintenance and increasing production line insights and availability

- Increase in material efficiency:

- Improvement of assets flow within facility, including increasing visibility on location/movements of material and assets within facility and increasing efficiency by streamlining production processes

- Optimization of inventory management, including supporting the classification of materials by ML, saving time on error correction and manual classification and improving inventory KPIs through automation

It is evident that these solutions require CSP core services (e.g., WAN, LAN, IoT, edge computing). However, using this approach helped position this CSP to win. Of course, decisions may or may not have been the result of an underlying place-based strategy, but we can see that this approach works well for those who deploy it.

WHAT’S THE WINDFALL?

CSPs’ core enterprise value proposition is based on WAN connectivity services, market segments that are now flat or declining. However, as compute workloads move to the cloud, use cases require technology deployments into formerly non-digital domains, where demand for connectivity is increasing — not only in volume and quality but also in functional capability and security.

Those CSPs that understand when clients are migrating certain use cases to the cloud can better anticipate what services the client will need and when they will need them. These companies will be much better positioned to capture a share of the growing cloud-connectivity business than operators waiting for inbound RFPs (requests for proposal) for wholesale services.

Conclusion

CSPs CAN WIN WITH RIGHT APPROACH

The muted success in capturing value from the ICT market for CSPs is self-inflicted and rooted in a flawed, outdated customer-segmentation approach. In reality, CSPs can win in ICT without becoming a systems integrator. Some valuable points to consider:

- Size-based segmentations, or industry-based segmentations, are the root cause of CSPs missing out on opportunities they could capture. Indeed, such segmentations are very misleading, increase risks, and are usually not profitable.

- The most effective approach is to create a canvas of opportunity that can play on the strengths of CSPs and naturally build on connectivity to sell ICT.

- The opportunities to present on that canvas shall be: place-related, local, and not software-only.

Notes

[1] Professional services are services created for a single customer. Usually, they start with customer-specific requirements engineering. It is a one-to-one business model, where customers need to pay the entire R&D. Supplier efficiency stems from superior access to lower-wage workforce, horizontal capabilities, strong partner networks, etc.

[2] Managed services are services created for many customers. Typically, this begins with some insight into the configuration requirements of multiple customers, and then standardized, customizable services are provided. Over time, there is some degree of automation in buying and managing the service. Efficiency stems from platform economics.