The behavior of car buyers has dramatically changed. Nowadays, they spend more than 70 percent of their time in the buying process online, and the number of dealer visits is seldom more than one. Thus, without online-offline integration, customers do not experience a seamless journey, and the dealer and OEM can no longer drive sales success sufficiently. However, online-offline integration is currently only in its infancy for most OEMs and dealerships across industries. OEMs trying to overcome the situation are faced with complex and interdependent legal, network and technological challenges. In this viewpoint, we investigate the challenges and outline a path to integration excellence.

Customers don’t visit dealerships much anymore

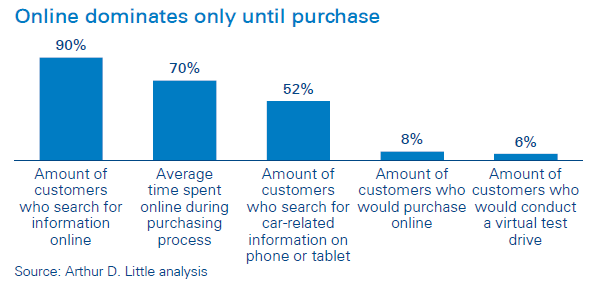

On average, customers nowadays visit dealerships 1.5 times in their purchasing processes. This is shown in the outcome of an Arthur D. Little analysis based on numerous dealership projects. Although numbers differ to a degree across studies and OEMs, without doubt, dealership visits have dramatically declined within the last 10 years. Additionally, buyers spend 70 percent of their purchasing processes online. Moreover, Arthur D. Little’s Future of Automotive Mobility study, which included nearly 10,000 customers in 13 countries, reveals that searching for a new car is becoming mobile-first: already, over half of consumers search for product-related information on their phones or tablets. However, only 8 percent of buyers can imagine purchasing online, while 90 percent search for information on the internet.

Thus, while online is dominant, dealer stores are still a crucial part of the sales process. Given the cost of a new car and the very physical nature of driving, the face-to-face experience will remain important. Our study reveals that only 6 percent of customers would replace a physical test drive with a virtual one. Thus, what customers really want is seamless fusion of the online and offline worlds. If this cannot be provided, the risk is high that customers will drop out of the sales funnel and the OEM and dealer in question will lose revenue.

We can exemplify this change with Ms. Miller, a hypothetical customer who bought her first car 20 years ago, selecting between three brands. She first went to a dealership for each brand to inform herself about the latest models. She decided to take two test drives, and finally returned a third time for negotiation. All interactions happened with the respective dealerships, with the OEMs providing brochures in print, as well as advertising in media. Twenty years later, Ms. Miller undertakes a very different journey. Her interactions with Mr. Schultz, her dealer of choice, are limited to just one or two, down from three or four visits originally. Information and comparison happen online, not only on OEMs’ web pages, but also via social media, third parties such as the motor press, and online advertising. Ms. Miller has very different expectations in terms of communication with Mr. Schultz, as she has already gathered information and configured a prospective car online.

2 The dark side of the moon: Online-offline integration in automotive retail Ms. Miller is much better informed than she was 20 years ago when entering the dealer’s floor. She has specific questions in mind, and a good part of her customer journey has already happened online. This also has implications for the dealer’s role: instead of being the main source of information and providing general advice, Mr. Schultz answers specific questions and supports Ms. Miller with the tools the dealership provides, such as the online configurator. More importantly, the role is to facilitate the last steps in the customer journey. The remaining interactions are very important because they are at the customer journey’s moments of truth.

“Shadows” along the customer journey

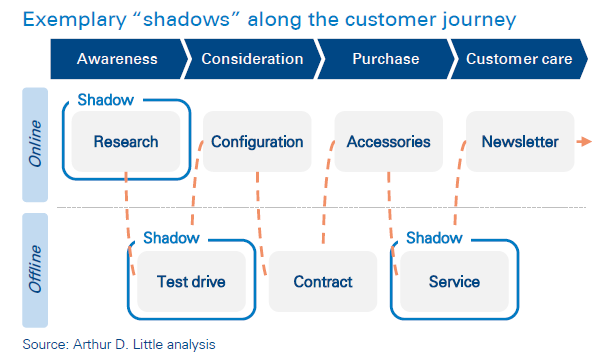

Switching between online and offline is standard for customers, but unfortunately, integrating them is not possible for OEMs and dealerships. Today, much information about the customer is generated online. Yet, this information rarely reaches the relevant salesperson. Mr. Schultz will probably never get to know Ms. Miller’s online activities. Conversely, her interactions with Mr. Schultz will most likely not be reported back to the OEM, which will make it a two-way problem. In other words, customers move freely between the online and offline worlds, but information does not. From the perspective of OEMs and online, what happens at the dealership is like the dark side of the moon. For dealerships, the situation is a mirror image.

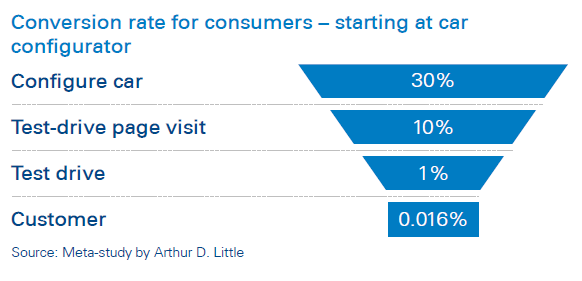

Due to this situation, several “shadows” occur along the customer journey. If the OEM displayed SUV advertisements, the retargeting department would be very pleased to know that Ms. Miller had an unsatisfying test drive with an SUV. Instead, Ms. Miller is annoyed by recurring SUV ads. Therefore, uncovering these “shadows” is helpful in optimizing online targeting. Moreover, the online channel is not designed to be the number-one source of information. Often, the online configuration steps create confusion. Ms. Miller, for instance, is not able to configure a car based on her specific criteria: minimum 400-liter trunk capacity and maximum price of €60,000. The lack of use case-based configuration and the series’ complexity are two major issues. According to our meta-study, only 30 percent of potential customers finish their car configuration, and only one of 6,250 becomes a car buyer.

Therefore, it is crucial for OEMs to control their sales funnels and reduce dropouts.

Online-offline integration is the key success factor

Therefore, HQ, sales regions and dealerships must integrate channels. Data must flow from offline to online, and vice versa. OEMs and dealerships must realize that integrated steps along the customer journey boost conversions, while misaligned steps cause dropouts. Most importantly, information and configuration need to match modern customer needs instead of being simply digitized brochures or complex tools migrated from the dealer to the customer. If OEMs do not master integration, customers will go to the competition because it is very easy to collect information about competitors’ models.

A seamless customer experience matters after all

In practice, integration is achieved when customers can transition between different channels seamlessly. The OEM’s website should include information about the closest dealership and recommend a test drive after a configuration by offering direct appointment booking. Dealers should point out the benefits of having an online account. Mastering this challenge incorporates integration and cross-promotion of channels. Such integration, however, is a few steps ahead because it implies that the offline and online sales processes are already well designed. The reality is different.

The offline side

Due to their experience, a consumer might assume that dealers are already very good at selling cars offline. And, indeed, a lot of dealers do an excellent job. Still, there is dissatisfaction with:

- Pushy salespeople who force fast decisions

- Lack of proactive contacting of customers when they are about to change their vehicles

- Poor communication between sales and service

Dealers need to implement customers’ feedback and work on existing pain points. Implementation carries even more weight, considering that two of the most important steps in the customer journey – the test drive and actual purchase – take place offline. Therefore, it is crucial for the dealer to understand the context of, e.g., the test drive: What happened before booking the test drive? What will the customer do afterwards?

Following up on the physical touchpoints is very important. However, successful tracing and steering of the whole customer journey can only be achieved if the offline side is aligned with the online side.

The online side

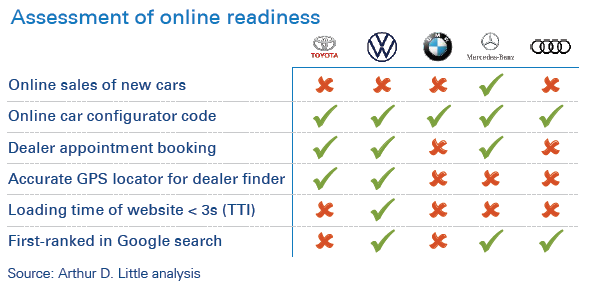

Our omnichannel marketing study highlights the importance of the online side by showing that 70 percent of customers’ time is spent online. Fortunately, many OEMs provide online configurators. Still, basic challenges remain. We checked the German websites of Toyota, VW, BMW, Mercedes-Benz and Audi to assess the online readiness of different OEMs in a short study. We found that all of them performed well at providing retrievable car configuration codes. However, only the Mercedes Benz website offered the possibility to purchase cars online. Booking a dealer appointment directly was only possible for three out of five brands. We also found that two brand websites were not shown as the first organic results in respective Google searches. Moreover, only Toyota and VW had accurate GPS locators for the closest dealers. All brand websites except for VW’s performed poorly in terms of the time it took for the page to become fully interactive (TTI). In total, there is a lot of room for improvement.

Integration

Integrating both channels is the larger challenge, and our study on omnichannel marketing shows that there are four switches from online to offline or vice versa. Accordingly, good integration is a key differentiator and value driver. The main effect of this integration is OEMs’ ability to steer the customer journey. OEMs can shape each customer’s journey and provide the necessary information at the right moments. No OEM has mastered the integration and steering challenge yet, but it offers tremendous potential for sales growth.

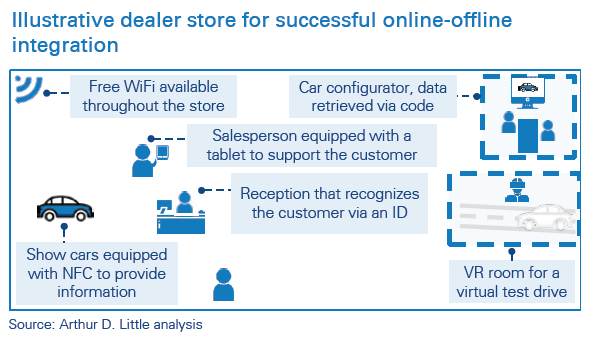

By transferring insight from other industries, we can envision integration at our hypothetical dealership: Ms. Miller configured her dream car and booked a test drive online. On her arrival, her dealer accesses her online profile, which was created during the configuration process and is accessible to both OEM and dealership. After checking the preconfigured car via the online code, they configure a second model on the side. They then step into the virtual reality room for a 3D test drive, which gives Ms. Miller the opportunity to explore both cars. A test vehicle matching important aspects of her configured model is ready for a real test drive. Afterwards, she fills out a short survey about her experience, which is automatically attached to her profile. She is satisfied with the preconfigured model, but wants to reflect upon the car for a couple more days. Mr. Schultz saves the visit information in her profile so retargeting ads can support her decision. Later that week, she returns and buys that exact model.

The key factors for such an excellent journey are a well-equipped dealer store and good interaction between the OEM and dealership. However, there are certain problems that they need to tackle first.

Problems and solutions for effective integration

The dealer

The dealer is crucial for integration as he or she has the only physical contact with the customer. Generally, dealers fear being degraded to agent roles so OEMs can enable direct sales. Hence, many are hesitant to share customer data. The primary task is to explain the advantages of integration, spicing them up with incentives. To achieve a data exchange, the OEM and dealer need to map out their processes and harmonize them. All the information collected on the OEM website should be shared because it enables the dealer to tailor his or her sales approach. The OEM can capitalize on the information gathered offline by improving retargeting. The purchasing information is, again, valuable for the OEM because it can facilitate further services.

Legal

Before measures for online-offline integration can be implemented, all legal challenges must be resolved. Passing on personal data is not possible without further ado. Europe’s General Data Protection Regulation (GDPR) and other laws entail many legal requirements. In the spotlight is central storage of customer data and profiles. To side with caution, customers should sign a declaration of consent to the storage of their data generated both online and offline. In any case, it is necessary to closely align all activities with the corporate legal department.

Technology and systems

Over the past few decades, many IT systems, databases and applications have been added to the landscape of most OEMs, resulting in complex architecture. If an OEM decides to connect different systems, it often faces technical challenges. It is difficult to link customer information because the systems and levels (OEM and dealer) use different identifiers across platforms. One solution is to build a unique identifier for all systems.

The customer

Customers’ expectations for their experiences increase steadily based on interactions with companies such as Amazon. One of our studies revealed that customers had even higher data-privacy demands for car OEMs than they had for, e.g., e-commerce companies. Finding the right balance between insightful data and fulfilling customers’ privacy needs will remain a pivotal challenge. A successful approach is to inform customers about the usage of the data, while only collecting necessary information.

Know-how and skills

Another important factor is the required talents. Integration transforms IT’s role from an internal service provider to an enabler of great customer experience and business value. This role requires a new set of skills and a mind-set shift. Employees with advanced digital skills, such as data scientists, are in particularly high demand in every industry. One way to get access to these skills is to outsource certain activities and rely on external experts. Two other viable options are to hire people with the required skills and to train existing staff. We found that a combination of these options is best.

Three important conclusions

To summarize this discussion, three conclusions become apparent. Firstly, the customers’ behaviors have changed, creating strong demand for online-offline integration and seamless movement between the two. Optimizing the customer journey and delighting buyers need to be at the top of the management agenda. Secondly, nobody is there yet. As of today, no OEM is a true online-offline integration champion. Thirdly, integration mastery can be a game changer, key differentiator and value driver. However, strong alignment between OEMs, regional sales organizations and dealers is necessary on various levels, such as information sharing and systems harmonization, process integration, and centering all actions on the customer. Ultimately, the stereotypical mantra of “the customer is always right” has proven true – and the only way to succeed is to delight the customer. Only then will Ms. Miller, driving her new car, be reflecting on her enjoyable customer journey and happily telling others about it.