DOWNLOAD

DATE

Contact

Within an extremely limited period and without a break, Europe — and the world as a whole — is undergoing the second consecutive major shock spanning geographies and industries. Both businesses and households alike are feeling the depths of the current energy crisis in their energy bills. However, this ongoing crisis will undoubtedly represent opportunities, too. Indeed, much like the COVID-19 pandemic accelerated digitalization, the energy crisis might become a catalyst for the energy flexibility market and demand-side response (DSR) across all segments of the population, including at the level of the individual household.

ENERGY CRISIS HIGHLIGHTS NEED FOR DISTRIBUTED ELECTRICITY FLEXIBILITY

The current geopolitical crisis and the retirement of conventional generating capacity have severely undercut the security of the European energy supply. On top of the supply shortage, a global boost in electrification and increasing intermittency from energy sources are seriously threatening grid stability at all voltage levels in systems that were not designed for such trends. As a result, DSR is gaining momentum and is perceived as an essential additional source of controllable supply to balance the energy equation and partly resolve congestion issues.

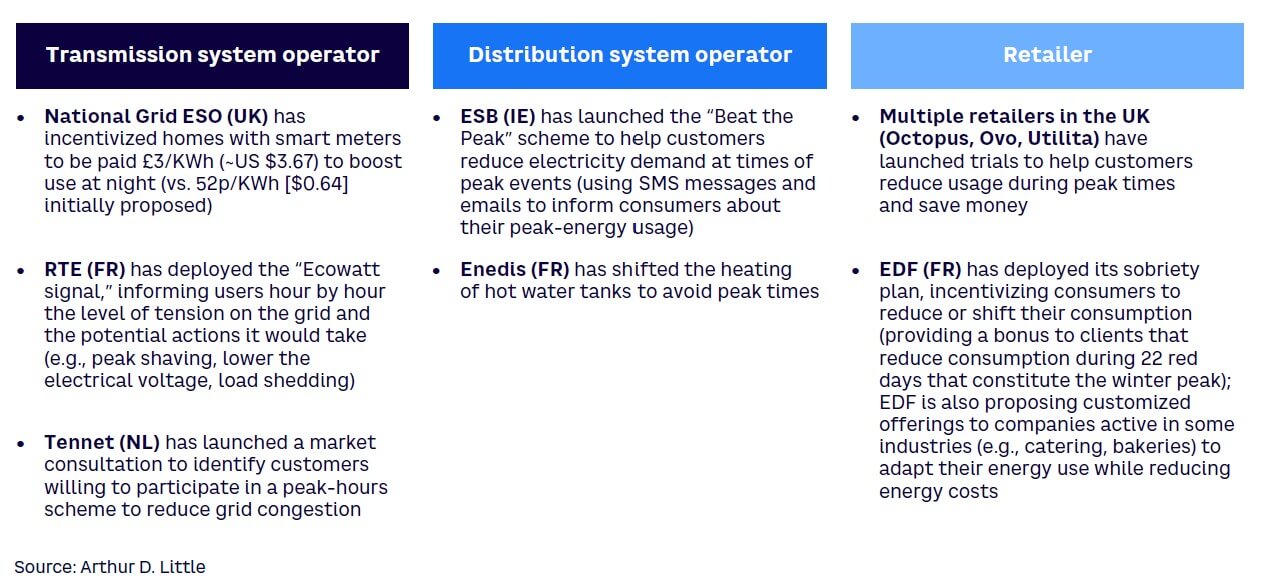

Authorities, governments, network operators, energy retailers — without exception — have shown during these last weeks their ability to suggest and deploy initiatives in record time to unlock flexibility as a response to supply shortage. The market participants naturally reverted to the available levers; from nationwide consumption reduction plans to incentivizing peak load shifting, European network operators and retailers have deployed a series of demand-side management (DSM) measures, as illustrated in Figure 1.

These measures aim largely at residential end-consumer behavior, which is in contrast to the efforts of traditional transmission system operators (TSO) to secure flexibility through power plants and large industrial consumer load shedding. These initiatives could be a glimpse of what is lacking in European energy systems to successfully adapt to the future.

END-USER FLEXIBILITY STILL REMAINS LARGELY UNTAPPED …

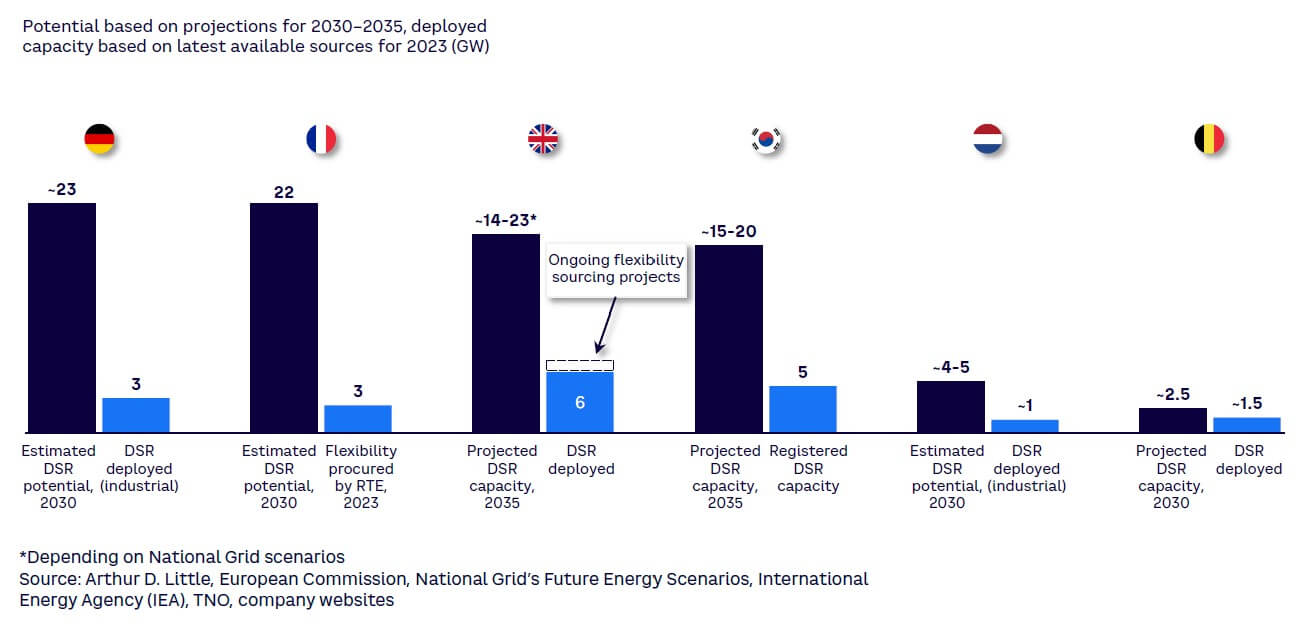

DSR at the individual household level so far has been largely only a topic of discussion rather than being actively deployed. Various projections estimate DSR availability in the range of 130-160 GW for Europe alone by 2030, with 50%-70% of the flexibility coming from households. The same order of magnitude and residential shares apply for US estimations as well.

While the potential of demand-side flexibility is evident, its full-scale deployment is yet to be achieved, as it is unavailable to residential end prosumers (households acting as both consumers and producers) in most countries. An illustration of this is the gap that remains between projected potentials and already-activated DSR capacities. In fact, the leading European economies are not even halfway through to fulfilling their estimated potential (see Figure 2).

As an example, the 2023 procured volume of DSR by France’s RTE (Réseau de Transport d’Electricité) is only around 10%-15% of projections for 2030. At such a low rate, it is clear that system changes must occur to narrow that gap.

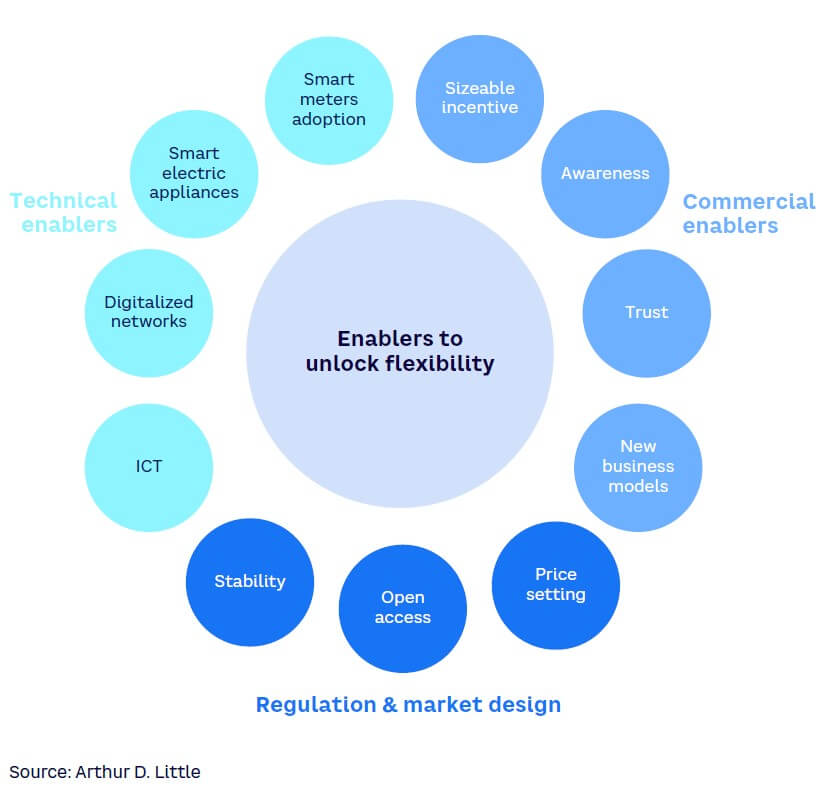

To achieve the full potential of available flexibility, authorities, regulators, network operators, and other utilities must deploy the right technical, commercial, and regulation and market design enablers (see Figure 3).

Technical enablers

Most required enablers are technical, including:

-

Higher rate of smart meters adoption — recording energy consumption data on a quarter-hour or half-hour basis, sharing tariff information with end users, and enabling remote load control are the conditions required to unlock demand response. These features are available via the installation of smart meters. As has been observed in recent DSR initiatives in Europe in response to the crisis, most of the measures are targeted toward home smart meter installations.

-

Proliferation of smart appliances and higher degree of electrification — increasing penetration of smart household equipment capable of generating sufficient flexibility to support the grid as well as to shift the consumption behavior (e.g., EV chargers, heat pumps, home storage).

-

Digitalization of the network — upgrading the network to bring about a near-real-time flow adjustment needed for harnessing the potential of distributed flexibility.

-

Information and communications technology (ICT) — enabling real-time communication sharing between utilities and end users as well as localized decision-making within a grid.

Commercial enablers

In addition to technical enablers, end-customer engagement will be crucial to ensure access to flexibility. Commercial enablers, deployed primarily by energy retailers, might still be missing in most European countries. These include:

-

Unlocked customer participation — creating a compelling incentive for the customer to participate in and stick to the flexibility provision. The customer stickiness for demand response requires at least three conditions:

-

Sizeable monetary incentive. An appropriate price signal is needed to change the behavior (the magnitude of price volatility must be high enough to change end-prosumers’ behavior) and to provide the means to valorize the signal. This can take various forms, ranging from basic time of use (ToU) tariffs to dynamic pricing, peak tariffs, and volume-based tariffs.

-

The balance between a well-developed awareness of DSR and complexity. The traditional way households in Europe engage with energy suppliers is to evolve from the familiar EUR/kWh to a combination of inflows and outflows of benefits and higher price volatility. Despite recent heightened public attention to energy, much effort is still required to educate customers on the benefits and challenges related to DSR. This awareness is required to help customers make informed decisions and eventually build trust in the offerings. Moreover, retailers should offer propositions of various complexities to suit different levels of customer readiness to deal with the inherent intricacy of energy markets.

-

Customer trust and confidence. The trust erosion due to soaring prices has mainly impacted retailers serving as a client interface. Any additional increases in complexity of offerings and price volatility may lead to a deepened unwillingness to participate in new energy programs. This makes value sharing and transparent communication of benefits essential. Just as importantly, privacy of energy consumption data and security of appliance control must be guaranteed by default.

-

DSR incorporated as part of retailers’ commercial offerings and new business models — with offerings adapted in favor of demand response, partly motivated by the attempt to increase customer retention and acquisition.

Regulatory & market design

Regulation should foster both the short-horizon consumer behavior change for a DSR event and the assurance needed for long-term investment decisions. For that to happen, a few enablers are singled out:

-

Price setting — incentivizing a price signal with a high magnitude of price difference between peak and off-peak prices to bring about a behavioral change.

-

Open access to flexibility extraction and consequently to its valorization — guaranteeing flexibility aggregators the equal and technology-agnostic footing at access points of households and wholesale markets at the same time.

-

Stability of subsidies and incentives — providing clearer predictability of payoffs from investing in appliances/equipment.

These in turn require a transition from a system’s setup where TSOs assume full responsibility for the flexibility to the design whereby distribution system operators (DSOs) and retailers are equal participants in securing appropriate residential demand response.

... WHILE BENEFITS EXIST FOR A COUPLE of PLAYERS

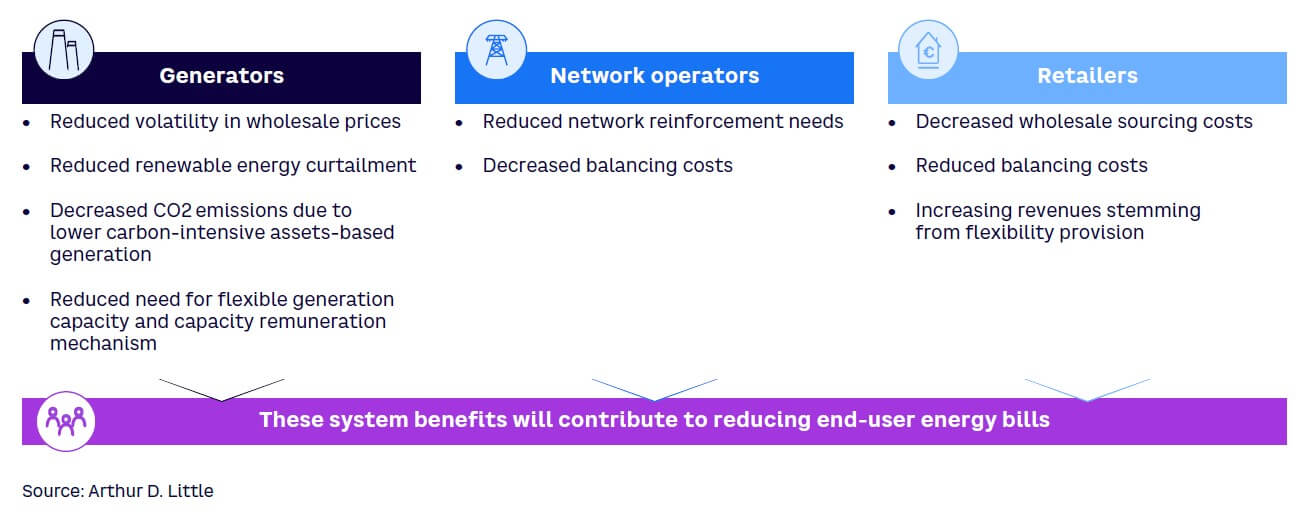

The changes entailed by progressive activation of full-scale DSR will not be confined only to regulatory and technical changes; the major value redistribution throughout the energy value chain is also crucial. This means the impact of DSR proliferation on the current ways of doing business and the solution space for adjusting business models should be assessed for all players, including generators, network operators, and retailers (see Figure 4).

Generation asset owners

Flattening the peaks for electricity consumption by means of DSR events will, eventually, result in decreased requirements for peak generation capacity and related investments. In addition to capacity costs, another outcome of lowered peak consumption is reduced price volatility at the wholesale market. These are direct systemic generation-related benefits of the DSR proliferation, which can be translated into savings in end users’ electricity bills. In addition to the economic benefits, CO2 emissions will decrease with the diminished reliance on carbon-intensive generation assets.

Network operators

Under the development of distributed flexibility in general, network operators need to actively run the increasingly more complex power flows on the grids. To do so requires significant investments in order to meet the rising electrification needs. Given that, the full-scale deployment of DSR flexibility may be an attractive option, delivering better value than traditional grid reinforcement.

An example of grid operators moving toward evening out the peak is Fluvius’s introduction of a dynamic capacity tariff in Flanders, Belgium. Under this new tariff structure, the electricity transportation share of the bill will shift away from being based purely on power offtake to a mix of both offtake and peak capacity used by a household. The aim of the tariff is twofold: decreasing future investment requirements by spreading the demand and reallocating costs to better reflect the main cost driver of the network operator — the capacity provided.

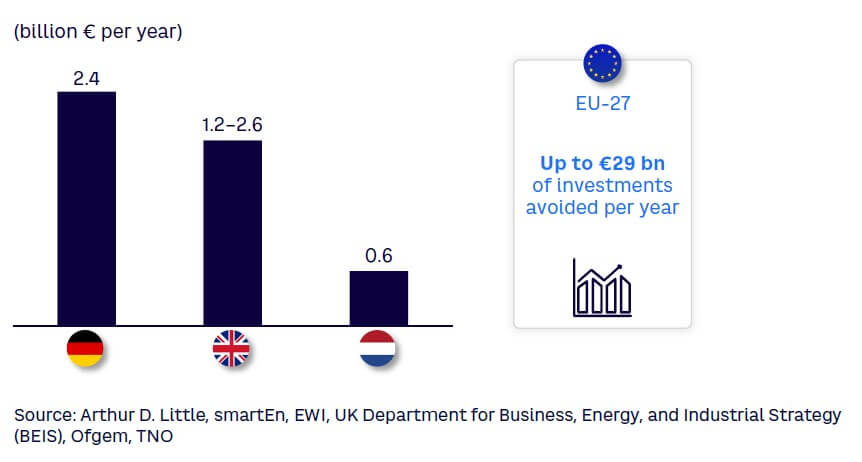

Estimates of the value of avoided investments via the deployment of demand-side flexibility might reach up to €29 billion (approximately US $32.3 billion) per year for the EU alone (see Figure 5).

The sheer size of the value may serve as a basis for a business case for the players down the value chain. However, the example of Fluvius reveals the possibility of a direct link between network operators and households, begging the question: are electricity retailers instrumental in extracting the full value of the DSR?

Retailers

DSR’s penetration is certain to impact the major revenue stream of electricity supply owing to lower consumption. In addition to growing distributed generation, this reduced consumption puts retailers’ financial stability at risk. The value pool of commoditized electricity supply is drying up, while retail operations and technology platforms must increasingly be supported at the retailer’s expense.

At the same time, there is a counterbalance to such a dire outlook. Existing retailers’ access to end customers as well as technological and mental shifts driven by the increase in flexibility will increase retailers’ options regarding revenue streams and business models. For example:

-

Flexibility aggregation and customer load data monetization — bundling distributed DSR at a greater scale that can be valorized on the wholesale market. The DSR aggregation can be coupled with the customer load data collection and can serve as a basis for enhanced load forecasting and more efficient internal process for better wholesale purchase decisions and reduced balancing costs by the retailers.

-

Dynamic pricing and direct load control — designing tariff structures that would reflect (1) increased price volatility and (2) the uptake in flexibility assets (e.g., heat pumps) and electric vehicles (EVs). This presupposes a direct monetary interest for customers in the form of electricity cost savings and requires retailers to manage benefits captured from the overall system’s optimization and outflow of value in terms of savings pass-through and lower prices for the end consumers.

-

Access to flexible assets — supporting users in financing and maintaining their energy-flexible appliances. Pathways of overcoming the investment barrier and creating value vary from “roof renting,” whereby the energy company covers installation costs in exchange for a portion of income generated by the solar panels to more complex “comfort-as-a-service” models and partnerships with construction/manufacturing companies at the development stage. (An illustration of the latter is the partnership of Octopus Energy and ilke Homes to design “zero energy bills” for new housing in the UK.)

Thus, while the evolution of demand response, customers' needs, and technologies may render retailers’ traditional model unaffordable, retailers have some freedom in positioning to secure attractive propositions to end users as well as gain additional value in the changing landscape.

Conclusion

PUTTING A PLAN INTO ACTION

DSR is a concept historically known only by large industrial consumers. However, in today’s context of rising energy bills and the grid’s need for a diversified set of flexibility sources, households represent one of the largest sources of flexible electricity, primarily through EVs and other decentralized assets such as wall batteries and heat pumps. It will now take the entire energy ecosystem — from governments to energy value chain players — to focus on deploying the required commercial, technical, and regulatory enablers.

While network operators are expected to speed up the deployment of smart meters (it is their responsibility in most EU countries, although not in the UK) and provide the right mechanisms and adequate levels of incentives, energy retailers should drive customer engagement in decentralized flexible assets and in unlocking the associated flexibility by extending the right offerings, tariffs, and communications channels. These initiatives should enable new consumer behaviors in line with end-user daily routines to limit disruption and promote active participation in DSR. Now is the time for network operators and retailers to listen to and partner with end consumers to make this happen.